#uidai number

Text

Aadhaar Card गुम हो जाए और Aadhaar Number भी भूल जाए तो ऐसे में आधार नंबर कैसे पता करें ?

0 notes

Text

My Aadhaar - Latest News, Update & Changes 2023-24

Aadhar ENrollement form.

A crucial piece of documentation that has significantly aided India's digitization efforts is the Aadhaar Card. The person receives a digital identity as a result. Indian nationals receive this identification card from the Unique Identification Authority of India (UIDAI). The entire My Aadhaar part of the official UIDAI website allows users to access a variety of Aadhaar services without logging in. One person may only apply for this ID card once, although there are features to make adjustments and get it back if it becomes lost.

What is myAadhaar?

The initial tab on the UIDAI website that users can access to access a variety of Aadhaar services without having to log in is called My Aadhaar. When you place your mouse over it, a dropdown menu containing all of its services organised by categories displays.

You can retrieve your lost Aadhaar card, validate your Aadhaar number, produce VID (Virtual ID), and learn more about Aadhaar in its knowledge centre using the My Aadhaar portion of the UIDAI website. Even an appointment can be scheduled there.

How to Download Aadhaar Online?

Using your Aadhaar or Enrolment number, you can access the UIDAI website and get your Aadhaar card. The steps are listed below.

Step 1: Navigate to the My Aadhaar tab on the official UIDAI website.

Step 2: Select Download Aadhaar from the Get Aadhaar menu.

Step 3: Scroll down to the Download Aadhaar option from the options that are given after being redirected to a new website.

Step 4: On the screen, a brief form will appear. You must provide both your Aadhaar number and the security code.

Step 5: Go to the menu and choose Send OTP.

Step 6: Complete the OTP that UIDAI sent to your registered phone number.

Step 7: Tap the Verify and Download button, and your Aadhaar will be downloaded to your phone or computer instantly.

Step 8: To read the password-protected file, you must type the password, which consists of your first four names in capital letters (just as they appear on your Aadhaar), and your birth year in YYYY format. As an illustration, your e-Aadhaar password would be SHIV1980 if your name is Shivam Singh and your birth year is 1980.

Step 9: To view your Aadhaar Card, press enter.

How to Verify Email/Mobile using My Aadhaar?

To verify your 16-digit Aadhaar number, along with your registered email address and phone number, on the UIDAI official website, follow the steps listed below.

Step 1: Navigate to My Aadhaar on the Unique Identification Authority of India (UIDAI) website.

Step 2: Click the Verify Email/Phone Number option under Aadhaar Services.

Step 3: After a brief form displays on your screen, choose the option that best suits your needs between Verify Mobile Number and Verify Email Address.

Enter your Aadhaar number in Step 4. Enter your registered phone number if you selected Verify Mobile Number. Enter your registered email address if you selected Verify Email Address.

Step 5: Enter the security code and select Send OTP from the menu.

Step 6: Correctly enter the OTP or verification code you were sent through email or smartphone (depending on what you are validating).

Step 7: After inputting the verification code, the following page will display the following text: The provided phone number and/or email address have been validated.

How to Verify Aadhaar?

The methods to use My Aadhaar to verify your Aadhaar on the UIDAI official website are shown below.

Step 1: Click on Verify An Aadhaar Number in the Aadhaar Services section of the My Aadhaar tab on the official UIDAI website.

Step 2: Enter your Aadhaar Number on the new page after being routed there, enter the security code, and then select the Proceed And Verify Aadhaar option.

Step 3: The message "Aadhaar Verification Completed" will appear on the following page.

How to Locate an Aadhaar Enrolment Centre?

On the UIDAI website, there are three ways to find the enrollment centre. By state, postal code, or search box, you can do a search. We will go over each of these three methods for finding an enrollment centre nearby in this section.

Search by State

To find the nearby enrolment centres in your state, follow these instructions:

Step 1: Click Locate an Aadhaar Enrolment Centre in the Get Aadhaar column of the My Aadhaar tab on the UIDAI website.

Step 2: On the new page that appears after being redirected, choose the State option under Search By.

Step 3: Enter the necessary information, including the name of your state, your district, subdistrict, village, town, or city, and check the box next to Show only permanent centres.

Step 4: Enter the security code, then click Find a Centre. Your screen will show a list of every permanent enrolment centre nearby.

Search by Postal (PIN) Code

To find the closest enrollment centres by state, follow these instructions:

Step 1: You will be taken to a new page after choosing Locate an Enrolment Centre from the Get Aadhaar column under My Aadhaar.

Step 2: Select "Postal (PIN) Code" under "Search By."

Step 3: Enter the security code and 6-digit postal code, then click "Locate a Centre." On your screen, a list of enrollment centres will appear.

Search by Search Box

If you want to use the Search Box to find the closest Aadhaar Enrolment Centre, follow the instructions below.

Step 1: You will be taken to a new website after clicking on Locate an Enrolment Centre in the Get Aadhaar column under the My Aadhaar button.

Step 2: Under Search By, choose the Search Box option.

Step 3: Type in your neighbourhood, city, and location.

Step 4: Correctly enter the security code and tap Find a Centre. On your screen, a list of enrollment centres will appear.

How to Book an Appointment via My Aadhaar?

The My Aadhaar option on the UIDAI website allows you to schedule an appointment with the closest Aadhaar Seva Kendra. An Aadhaar Seva Kendra offers a variety of services, including the following:

New Aadhaar enrolment

Updations of:

Gender

Email ID

Name

Address and Phone Number

Date of Birth

Biometric Update (Iris + Fingerprints + Photo).

To make an appointment at the closest Aadhaar Seva Kendra, follow these steps:

Step 1: Go to My Aadhaar on the official UIDAI website and select the Book an Appointment option under the Get Aadhaar column.

Step 2: Pick your city or location on the redirected Aadhaar Seva Kendra page, then press the Proceed to Book Appointment button.

Step 3: Select the cause for your appointment from the three options (Aadhaar Update, New Aadhaar, Manage Appointments) when a new page opens on the screen.

Step 4: Type in the phone number you registered.

Step 5: Enter the security code and select Generate OTP from the menu.

Step 6: Complete the OTP and select the option to verify the OTP.

Step 7: Enter the information.

Step 8: Decide which field needs updating.

Step 9: Choose the date of your appointment based on your preferences.

Review the application in Step 10 and then click the "Submit" button. Your attempt to arrange a meeting was successful.

Page URL : https://www.bigproperty.in/blog/my-aadhaar-latest-news-update-changes-2023-24/

0 notes

Text

PIB Fact Check : प्रत्येक Aadhaar card धारक को केंद्र सरकार देगी 4.78 लाख रुपये! पीआईबी ने अपने खुलासे में क्या कहा, जानिए क्या है सच्चाई, पढ़ें पूरी खबर | ऑनलाइन बुलेटिन डॉट इन

PIB Fact Check : नई दिल्ली | [नेशनल बुलेटिन] | The central government will give Rs 4.78 lakh to each Aadhaar card holder! What did PIB say in its disclosure, know what is the truth, read the full news.

सोशल मीडिया पर एक सन्देश बड़ी तेजी के साथ वायरल हो रहा है. जिसमें दावा किया जा रहा है कि केंद्र की मोदी सरकार देश के सभी Aadhaar card धारकों को 4 लाख 78 हजार रुपये का लोन दे रही है. हम इस खबरे में…

View On WordPress

#Aadhaar card#aadhaar card address change online#aadhaar card address update#aadhaar card application#aadhaar card application status#aadhaar card appointment#aadhaar card check online#aadhaar card correction#aadhaar card download#aadhaar card download online#aadhaar card form pdf#aadhaar card login#aadhaar card number#aadhaar card online#aadhaar card password#aadhaar card phone number change#aadhaar card signature not verified#aadhaar card status#aadhaar card status online#aadhaar card uidai#aadhaar card update#aadhaar card update online#aadhaar card update status#aadhaar card verification#pib fact check in hindi#pib fact check twitter

0 notes

Link

UIDAI has come up with a big update on infants’ and children’s Aadhaar Card making process and you should learn about it. With the help of a tweet on Twitter, UIDAI stated that “there won’t be any change in your child’s #Aadhaar number after updating the biometrics.” You can check this detail in the tweet … The post UIDAI Aadhaar Number of Children Can’t Change After Biometric Update appeared first on Viral Bake.

0 notes

Text

How to update UAN and EPF KYC details Online

UAN stands for Universal Account Number is a 12-digit number given to each EPFO member. This number, which acts as a pivot, connects many Member Identification Numbers (Member Ids) assigned to a single member. Here are few important FAQs on UAN KYC, release by EPFO.1. What is KYC?

Know Your Customer or KYC is a one-time process which helps in identity verification of subscribers by linking UAN with KYC details. The Employees / Employers need to provide KYC details viz., Aadhaar, PAN, Bank etc., for unique identification of the employees enabling seamless online services.2. How can I seed my KYC details with UAN?

o Login to your EPF account at the unified member portal

o Click on the “KYC” option in the “Manage” section o You can select the details (PAN, Bank Account, Aadhar etc) which you want to link with UAN

o Fill in the requisite fields o Now click on the “Save” option

o Your request will be displayed in “KYC Pending for Approval”

o Once employer approves the details the message will be changed to “Digitally approved by the employer”

o Once UIDAI confirms your details, “Verified by UIDAI” is displayed against your Aadhaar.

3. What to do if my employer is not approving KYC?

In case your employer is not approving KYC details, you can directly approach administration or HR department with request. If it is taking more time you can escalate it to higher authority in the organization. If no one is responding to your request you can approach EPF Grievance via http://epfigms.gov.in.

4. How do I know that KYC updated by me is approved by the employer?

The status will be shown against updated KYC document on the same page. The system will also trigger SMS on your register mobile number.5. How can I seed my Bank account details?

o Login to your EPF account at the unified member portal o Enter your bank account number and IFSC code. o The details have to be approved by your employer. o Once approved the bank account gets seeded.6. What can I do if my UAN is not seeded with Aadhaar? Member can himself seed UAN with Aadhaar by visiting member portal. Thereafter the employer must approve the same to complete the linkage. Alternatively, member can ask his employer to link Aadhaar with UAN. The member can use “e-KYC Portal” under Online Service available on home page of EPFO website or e-KYC service under EPFO in UMANG APP to link his/her UAN with Aadhaar without employer’s intervention.7. Can I change my already seeded Bank account number?

Yes. The bank account number can be updated any number of times by following the steps mentioned above. However, the bank account details cannot be changed during pendency of any claim with EPFO.

8. What precautions should I take while seeding Bank account number?

You should seed active bank account to which you are either an individual or joint holder with your spouse. Also ensure that the bank account does not have a deposit cap greater than your withdrawal benefit.

9. I have changed my job. Should I activate my UAN again?

UAN has to be activated only once. You do not have to re-activate it every time you switch jobs.

10. Do I have to pay any fee for UAN registration?

No, UAN registration is free of cost and you do not have to pay any fee to activate it.

Source link

Read the full article

2 notes

·

View notes

Text

What is Data Protection Act in India?

Introduction

Data Protection Act in India is a law that provides for the protection of personal data. It was first introduced in 2007, and it has been revised multiple times since then. In this article, we will discuss what the proposed Data Protection Act in India includes and how it compares with GDPR.

Data Protection Act in India

The Data Protection Act, 2018 is the primary legislation governing data protection in India. It sets out the principles that organizations should follow to ensure that their personal information is handled with care and security.

The bill was passed by Parliament on March 27, 2018 and came into force on April 1, 2018.[1] It replaced the previous Personal Data Protection Bill, 2012 which had been in effect since July 1, 2012.[2] This second draft was made public by Home Minister Rajnath Singh after intense lobbying by civil society groups who felt it did not go far enough in protecting people's privacy rights.[3][4][5][6]

First Point of Focus is the Personal Data

Data protection act in India

A. What is personal data?

Data is any information that can be used to identify or contact an individual, such as name, address and email id. Personal information includes names, addresses and contact details of individuals; biometric data such as fingerprints and iris scans; financial information (such as credit card numbers); health records; genetic characteristics/proteins in blood samples etc., etc., which can be used for identification purposes by an individual or group of individuals. Sensitive personal data are those which relate to racial or ethnic origin, political opinions or religious beliefs of an individual; criminal history including mental illness or disability; sexual orientation/identity (e.g., gay/lesbian).

The second point of focus is the ‘Personal Information’

The second point of focus is the ‘Personal Information’. This means any information that specifically identifies an individual, such as his/her name, date of birth and address. It also includes anything else which can be used to identify an individual (e.g., fingerprints or facial features).

The term ‘sensitive personal data’ has been defined in Section 2(1)(b) as follows:

"Sensitive personal data" means any information relating to an identified or identifiable natural person who can be directly or indirectly traced back to him/her by means of such information."

The third point of focus is on the “Sensitive Personal Data”

The third point of focus is on the “Sensitive Personal Data”. This is information about race, religion, caste, tribe, ethnic origin or political opinions. It also includes philosophical beliefs and union membership.

In India there are two types of sensitive personal data - namely genetic data (including DNA), biometric information such as fingerprints or iris scans etc., national identification numbers issued by a central authority such as Aadhaar card issued under Section 7(1) of Aadhaar Act 2016 which has been put in place by Government through its Rule making power under Article 239B(1) in order to establish an identity management system across various government departments and agencies including UIDAI (Unique Identification Authority of India). Therefore every authority must ensure that they comply with this law while collecting any kind of sensitive personal information from individuals who are involved in the process

The fourth point of focus is on the “Proprietary Data”

The fourth point of focus is on the “Proprietary Data”. This refers to any data that is not publicly available, but which can be used by an individual or organization.

Proprietary data may be personally identifiable information (e.g., name and address), financial information (e.g., credit card number), business process details (e.g., sales data), customer lists or similar types of information that can only be accessed by one party at a time for specific purposes such as marketing campaigns or product development etc

How does the proposed Data Protection Act in India compare with GDPR?

The proposed Data Protection Act in India is similar to GDPR in that it has a broad definition of personal data and sets out a number of principles for protecting the same. However, there are some key differences between these two pieces of legislation:

The proposed Data Protection Act excludes “sensitive data” from its scope (which would include ethnic origin and religious belief). While this may seem like an advantageous feature at first glance, it could actually prove problematic if you need access to sensitive information about your clients or employees. For example, if someone were being treated for cancer and needed their diagnosis recorded on their file as part of their treatment plan—and that information was deemed too important not just for them but also anyone who might come across it later on—your organization would likely be required by law to keep such details private so only those involved with treating them could access them safely.

Information about data protection in India provides some details about its GDPR elements.

Data Protection Act in India

The Information Technology (IT) Act, 2000 defines the term ‘personal information’ as follows:

any information that can be used to identify a person, and which is recorded in any form or medium; or

any information which relates to an individual and is specified by law to be required to be maintained by an agency or body.

Conclusion

It is recommended that you must keep the data protection in mind while using the various internet resources. You need to be careful about what you are sharing on the internet, especially with public social media websites like facebook, twitter and instagram etc . The proposed Data Protection Act should provide a more secure ecosystem for users to use these services without fear of being affected by hackers or criminals.

2 notes

·

View notes

Text

Why Every Fintech Needs Aadhaar Verification API for Secure Transactions

In the rapidly evolving world of fintech, security and trust are paramount. As digital transactions become the norm, financial technology companies must prioritise secure and reliable verification methods to protect user data. One such initiative that has become mandatory in India is the Aadhaar verification API. This article explores why every fintech company should integrate Aadhaar verification APIs to ensure secure transactions and customer trust.

What is the Aadhaar Verification API?

The Aadhaar Verification API is an online service provided by the Unique Identification Authority of India (UIDAI). This allows businesses to instantly check their customers’ Aadhaar numbers. This screening process ensures that the information provided by the user is accurate and true, thus reducing the risk of fraud. APIs are an essential tool for fintech companies, enabling them to authenticate users quickly and securely.

Role Of Aadhaar In Digital Transactions

Aadhaar, the world’s largest biometric identification system, is playing a key role in digitizing the Indian economy. With over 1.3 billion Aadhaar cards issued, it has become a standard way of identifying various industries, including banks, telecommunications and government welfare schemes The Aadhaar verification API uses this huge database to track users, which is verified in real-time, making digital communications safer and more efficient.

Why Fintech Companies need Aadhaar Verification API

i]. Enhanced Security

Security is a key concern for fintech companies, and Aadhaar verification APIs provide additional security. By checking a user’s Aadhaar number, companies can ensure that the person is who they claim to be, thereby reducing the risk of theft fraud, and deception This is especially important for the economy's internal communication, which is critical.

ii]. Compliance With Legal Requirements

Fintech companies in India have to adhere to stringent regulations laid down by the Reserve Bank of India (RBI) and other regulatory bodies. These laws often require businesses to verify their customers’ identity before providing services. The Aadhaar Verification API simplifies this process, enabling businesses to seamlessly meet compliance requirements.

iii]. Speed and Efficiency

In the fast-paced world of fintech, time is of the essence. The Aadhaar verification API enables instant verification of users, reducing the time for new customers to come on board. This speed and efficiency not only improve customer experience but also give FinTech companies a competitive advantage.

iv]. Cost-Effective Solution

Manual verification can be time-consuming and expensive. The integration of the Aadhaar verification API enables fintech companies to automate the verification process, reducing operational costs. This cost-effective solution is particularly beneficial for startups and small businesses that operate on tight budgets.

v]. To Build Customer Confidence

Trust is key to the success of any fintech company. The use of the Aadhaar Verification API enables businesses to demonstrate their commitment to protect customer data. If users know they are verifying identity through a secure and reliable system, they are more likely to trust the company with their finances.

How the Aadhaar Verification API works

The Aadhaar Verification API works through a simple yet effective process. When a user enters their Aadhaar number, the API sends a request to UIDAI’s database to verify the details. The API can perform different types of verification, e.g.

i]. Verification Of Aadhaar Number

This checks if the Aadhaar number provided by the user is valid.

ii]. Population Certification

This ensures that the user’s demographics, like name, address, and date of birth, are compared with the Aadhaar database.

iii]. Biometric verification

In some cases, the API may require biometric data to authenticate the user, such as fingerprints or iris scans.

iv]. One-Time Password (OTP) verification

The API can also verify users through the OTP sent to the mobile number linked to the Aadhaar. This adds an extra layer of security, ensuring that only the Aadhaar holder can complete the verification process.

Integration of Aadhaar Verification API on Fintech Platforms

The integration of the Aadhaar verification API into a fintech platform is fairly straightforward. Most fintech platforms use APIs to integrate services and services, and can also include Aadhaar verification. Here are the basic details of the integration process.

i]. Api Integration

The fintech company should integrate the Aadhaar verification API into its platform. This involves adding the necessary code to connect the platform with UIDAI’s servers.

ii]. User-Interface Design

A user interface (UI) must be designed to collect the necessary basic information from the user. This includes fields for Aadhaar number, OTP and biometric data if required.

iii]. Testing

Before going live, the integration should be thoroughly tested to ensure a seamless and secure operation. This testing phase is critical to identifying and fixing any potential problems.

iv]. Initiation And Maintenance

Once the integration is complete and tested, the platform can go live. Ongoing monitoring is necessary to ensure that the verification system is safe and effective.

Future Of Aadhaar verification In Fintech

As the fintech industry grows, the need for secure verification systems like Aadhaar verification will only increase. With the government’s push for Digital India, more businesses are expected to integrate Aadhaar verification in the coming years. This will not only enhance security but also improve access to financial services for the unbanked population.

Moreover, technological advancements like artificial intelligence and blockchain can further enhance Aadhaar verification capabilities, making Aadhaar verification stronger and more secure. Fintech companies that embrace these innovations early will stand in a better position to market.

Conclusion

Aadhaar verification API is an important tool for fintech companies operating in India. It provides improved security, compliance with regulatory requirements, speed, efficiency, and cost reduction. Most importantly, it helps build customer trust, which is critical to the long-term success of any fintech business. As digital connectivity increases, fintech companies need to prioritize security measures such as Aadhaar verification to protect user data in order to stay ahead of the competition.

0 notes

Text

Aadhaar Free Update Deadline Approaching: Step-by-Step Guide to Revalidate Your Card Before September 14

If your Aadhaar card was issued over 10 years ago and hasn’t been updated, you’ll need to submit proof of identity and address to ensure its validity. Follow these steps to update your Aadhaar details online:

How to Update Aadhaar Online

Visit the UIDAI Portal: Go to myaadhaar.uidai.gov.in and log in using your Aadhaar number and OTP sent to your registered mobile number.

Verify Your Details:…

0 notes

Text

Method to check Fake Aadhar Card

Learn how to Detect fake Aadhar card using online portals, mAadhaar app, and verification APIs. Methods To Check Fake Aadhar Card through an Online Portal. Visit UIDAI’s official website (uidai.gov.in), then find the Verify Aadhaar Number Service, after that Enter the Aadhaar Card Number with the security code. And Get the details of Aadhaar Card.

0 notes

Text

The Importance of Aadhaar Masking Solution for Data Privacy

The Aadhaar, a unique number given to the residents of India, offers to be a source of verification and authentication for name, date of birth, and address. Thus, a twelve-digit number is unique to every single individual and provides a strengthened source to get the information for verification. But is it safe to share this number with everyone? The answer is an absolute no; therefore, we need Aadhaar masking. Understanding the concept and the need to incorporate it is what we are going to discuss in this blog.

Understanding Aadhaar masking

The process of obfuscating or concealing a sizable chunk of the Aadhaar number—typically the first eight digits—while keeping the final four digits for identifying purposes is known as Aadhaar masking. This method finds a middle ground between safeguarding sensitive personal data and the requirement for verification.

The need for Aadhaar masking for data privacy

Aadhaar masking offers a number of advantages, especially safeguarding crucial information against misuse and fraud. Here are the points summed up:

Preventing Identity Theft: Aadhaar's complete number has a plethora of personal data. It is much more difficult for bad actors to steal identities and commit fraud when the first eight numbers are hidden.

Reducing Data Breaches: Data breaches can still happen even in the presence of strong security measures. By making the masked component of the number less desirable to attackers, masking Aadhaar numbers reduces the potential damage in the event of a breach.

Compliance with Data Protection Regulations: As more stringent laws are implemented, India's data protection environment is changing. By complying with these rules, Aadhaar masking shows a dedication to data privacy.

Establishing Trust: Businesses can establish trust with their clients by utilising Aadhaar masking to reassure them that their personal data is secure.

Safeguarding Financial Data: Financial transactions are frequently associated with Aadhaar. An additional degree of security is added to protect sensitive financial data by masking the Aadhaar number.

Technologies involved in Aadhaar masking solutions

Technology is essential to Aadhaar masking that works. Sophisticated masking techniques can automate the procedure, guaranteeing efficiency and precision. Among the crucial technologies are:

Tokenisation is the process of swapping out sensitive data for non-sensitive tokens.

Aadhaar data is encrypted to prevent reading without the decryption key.

Software for disguising sensitive data, such as Aadhaar numbers, is known as data masking software.

Best practices for Aadhaar masking online

To maximise the effectiveness of Aadhaar masking, the following actions should be implemented by the organisations:.

Put Strong Security Measures in Place: To protect data, organisations need to have strong security measures in place in addition to Aadhaar masking.

Frequent Security Audits: To find weaknesses and put in place the appropriate defences, conduct routine security audits.

Employee Education: Educate staff members on the value of protecting personal information and how to handle Aadhaar data appropriately.

Data Minimisation: Gather just the bare minimum of Aadhaar data and store it for as little time as feasible.

Constant Surveillance: Keep an eye out for any indications of unapproved access to Aadhaar data or data breaches.

Regulations and Aadhaar masking guidelines

UIDAI mandates: The main regulatory agency in charge of regulating Aadhaar and its use is the Unique Identification Authority of India (UIDAI).

RBI instructions: With relation to Aadhaar masking, the Reserve Bank of India (RBI) has provided particular rules for banks and financial institutions.

Industry-specific rules: Aadhaar processing is governed by regulations related to other industries, such as telecom, insurance, and healthcare.

Data Protection Act: Aadhaar masking and data privacy would probably be covered under India's soon-to-be-enacted Data Protection Act.

Masking standards: Standards for masking Aadhaar numbers have been established by UIDAI. These standards cover the arrangement and structure of masked digits.

Compliance requirements: In order to avoid fines, organisations that handle Aadhaar data must abide by certain rules and laws.

ConclusionIn conclusion of the blog on aadhaar masking, we can say that the process is of paramount importance, and with proper knowledge and following regulations, data privacy can be ensured. With the right compliance practices and following the prescribed guidelines, it is easy to meet the masking guidelines. Veri5digital is another such platform to get your business’s authentication and verification processes done. Visit their website to learn more about their services.

0 notes

Text

Eko API Integration: A Comprehensive Solution for Money Transfer, AePS, BBPS, and Money Collection

The financial services industry is undergoing a rapid transformation, driven by the need for seamless digital solutions that cater to a diverse customer base. Eko, a prominent fintech platform in India, offers a suite of APIs designed to simplify and enhance the integration of various financial services, including Money Transfer, Aadhaar-enabled Payment Systems (AePS), Bharat Bill Payment System (BBPS), and Money Collection. This article delves into the process and benefits of integrating Eko’s APIs to offer these services, transforming how businesses interact with and serve their customers.

Understanding Eko's API Offerings

Eko provides a powerful set of APIs that enable businesses to integrate essential financial services into their digital platforms. These services include:

Money Transfer (DMT)

Aadhaar-enabled Payment System (AePS)

Bharat Bill Payment System (BBPS)

Money Collection

Each of these services caters to different needs but together they form a comprehensive financial toolkit that can significantly enhance a business's offerings.

1. Money Transfer API Integration

Eko’s Money Transfer API allows businesses to offer domestic money transfer services directly from their platforms. This API is crucial for facilitating quick, secure, and reliable fund transfers across different banks and accounts.

Key Features:

Multiple Transfer Modes: Support for IMPS (Immediate Payment Service), NEFT (National Electronic Funds Transfer), and RTGS (Real Time Gross Settlement), ensuring flexibility for various transaction needs.

Instant Transactions: Enables real-time money transfers, which is crucial for businesses that need to provide immediate service.

Security: Strong encryption and authentication protocols to ensure that every transaction is secure and compliant with regulatory standards.

Integration Steps:

API Key Acquisition: Start by signing up on the Eko platform to obtain API keys for authentication.

Development Environment Setup: Use the language of your choice (e.g., Python, Java, Node.js) and integrate the API according to the provided documentation.

Testing and Deployment: Utilize Eko's sandbox environment for testing before moving to the production environment.

2. Aadhaar-enabled Payment System (AePS) API Integration

The AePS API enables businesses to provide banking services using Aadhaar authentication. This is particularly valuable in rural and semi-urban areas where banking infrastructure is limited.

Key Features:

Biometric Authentication: Allows users to perform transactions using their Aadhaar number and biometric data.

Core Banking Services: Supports cash withdrawals, balance inquiries, and mini statements, making it a versatile tool for financial inclusion.

Secure Transactions: Ensures that all transactions are securely processed with end-to-end encryption and compliance with UIDAI guidelines.

Integration Steps:

Biometric Device Integration: Ensure compatibility with biometric devices required for Aadhaar authentication.

API Setup: Follow Eko's documentation to integrate the AePS functionalities into your platform.

User Interface Design: Work closely with UI/UX designers to create an intuitive interface for AePS transactions.

3. Bharat Bill Payment System (BBPS) API Integration

The BBPS API allows businesses to offer bill payment services, supporting a wide range of utility bills, such as electricity, water, gas, and telecom.

Key Features:

Wide Coverage: Supports bill payments for a vast network of billers across India, providing users with a one-stop solution.

Real-time Payment Confirmation: Provides instant confirmation of bill payments, improving user trust and satisfaction.

Secure Processing: Adheres to strict security protocols, ensuring that user data and payment information are protected.

Integration Steps:

API Key and Biller Setup: Obtain the necessary API keys and configure the billers that will be available through your platform.

Interface Development: Develop a user-friendly interface that allows customers to easily select and pay their bills.

Testing: Use Eko’s sandbox environment to ensure all bill payment functionalities work as expected before going live.

4. Money Collection API Integration

The Money Collection API is designed for businesses that need to collect payments from customers efficiently, whether it’s for e-commerce, loans, or subscriptions.

Key Features:

Versatile Collection Methods: Supports various payment methods including UPI, bank transfers, and debit/credit cards.

Real-time Tracking: Allows businesses to track payment statuses in real-time, ensuring transparency and efficiency.

Automated Reconciliation: Facilitates automatic reconciliation of payments, reducing manual errors and operational overhead.

Integration Steps:

API Configuration: Set up the Money Collection API using the detailed documentation provided by Eko.

Payment Gateway Integration: Integrate with preferred payment gateways to offer a variety of payment methods.

Testing and Monitoring: Conduct thorough testing and set up monitoring tools to track the performance of the money collection service.

The Role of an Eko API Integration Developer

Integrating these APIs requires a developer who not only understands the technical aspects of API integration but also the regulatory and security requirements specific to financial services.

Skills Required:

Proficiency in API Integration: Expertise in working with RESTful APIs, including handling JSON data, HTTP requests, and authentication mechanisms.

Security Knowledge: Strong understanding of encryption methods, secure transmission protocols, and compliance with local financial regulations.

UI/UX Collaboration: Ability to work with designers to create user-friendly interfaces that enhance the customer experience.

Problem-Solving Skills: Proficiency in debugging, testing, and ensuring that the integration meets the business’s needs without compromising on security or performance.

Benefits of Integrating Eko’s APIs

For businesses, integrating Eko’s APIs offers a multitude of benefits:

Enhanced Service Portfolio: By offering services like money transfer, AePS, BBPS, and money collection, businesses can attract a broader customer base and improve customer retention.

Operational Efficiency: Automated processes for payments and collections reduce manual intervention, thereby lowering operational costs and errors.

Increased Financial Inclusion: AePS and BBPS services help businesses reach underserved populations, contributing to financial inclusion goals.

Security and Compliance: Eko’s APIs are designed with robust security measures, ensuring compliance with Indian financial regulations, which is critical for maintaining trust and avoiding legal issues.

Conclusion

Eko’s API suite for Money Transfer, AePS, BBPS, and Money Collection is a powerful tool for businesses looking to expand their financial service offerings. By integrating these APIs, developers can create robust, secure, and user-friendly applications that meet the diverse needs of today’s customers. As digital financial services continue to grow, Eko’s APIs will play a vital role in shaping the future of fintech in India and beyond.

Contact Details: –

Mobile: – +91 9711090237

E-mail:- [email protected]

#Eko India#Eko API Integration#api integration developer#api integration#aeps#Money transfer#BBPS#Money transfer Api Integration Developer#AePS API Integration#BBPS API Integration

1 note

·

View note

Text

Understanding Aadhaar Enabled Payment System (AePS)

In today's fast-paced world, digital transactions have become an integral part of our daily lives. As technology continues to evolve, so does the need for secure and efficient payment systems. One such revolutionary system in India is the Aadhaar Enabled Payment System (AePS). This blog aims to provide an in-depth understanding of AePS, its benefits, and its impact on financial inclusion.

What is AePS?

AePS is a payment service that allows customers to perform basic banking transactions using their Aadhaar number and biometric authentication. Developed by the National Payments Corporation of India (NPCI), AePS leverages the unique identification number (Aadhaar) issued by the Unique Identification Authority of India (UIDAI) to facilitate secure and seamless transactions.

0 notes

Text

How Instantpay Aadhaar Verification API Works: A Comprehensive Guide

Aadhaar verification has become a cornerstone of identity verification processes in India and is integral to numerous administrative and financial transactions. With over a billion people enrolled, the Aadhaar system is the world's most extensive biometric ID system.

This guide provides a detailed understanding of Aadhaar verification, its benefits, and the verification process, focusing on how the system works.

What is Aadhaar?

Aadhaar is a 12-digit unique identification number issued by the Unique Identification Authority of India (UIDAI).

Introduced in 2009, Aadhaar is designed to provide a single, robust, and easily verifiable identity document for residents of India.

Need for Aadhaar Verification

Aadhaar verification, also known as Aadhaar authentication, involves validating an individual’s identity using their Aadhaar number.

This process is crucial for ensuring that services, subsidies, and benefits reach the correct recipients, thereby reducing fraud and enhancing security across various sectors such as banking, telecom, and government services.

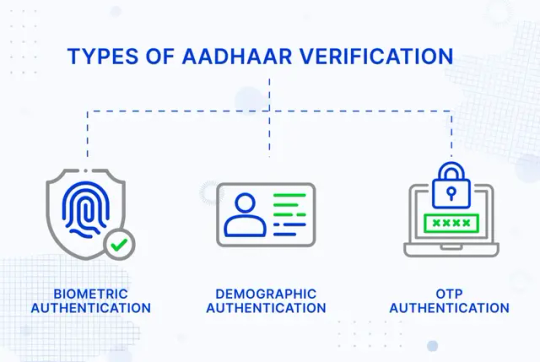

Types of Aadhaar Verification

1. Biometric Authentication

To verify identity, biometric authentication uses an individual’s unique physical characteristics, such as fingerprints, iris scans, or facial recognition.

This method is highly secure as these biometric traits are unique to each individual and difficult to replicate.

Process:

The individual provides their Aadhaar number.

Biometric data (fingerprints, iris scans, or facial images) is captured using a biometric device.

The captured data is sent to UIDAI for verification against the stored biometric data.

UIDAI responds with a "Yes" or "No" indicating whether the biometrics match the Aadhaar number provided.

2. Demographic Authentication

Demographic authentication verifies an individual's identity using basic demographic information such as name, address, date of birth, and gender.

This method is often used in conjunction with biometric authentication to enhance security.

Process:

The individual provides their Aadhaar number along with demographic information.

This information is sent to UIDAI to be verified against the data stored in the UIDAI database.

UIDAI responds with a "Yes" or "No" indicating whether the demographic details match the Aadhaar number provided.

3. OTP Authentication

One-Time Password (OTP) authentication involves sending a unique code to the individual’s mobile number registered with Aadhaar.

This method adds an extra layer of security to the verification process.

Process:

The individual provides their Aadhaar number.

An OTP is sent to their registered mobile number.

The individual enters the OTP to complete the verification process.

UIDAI verifies the OTP and responds with a "Yes" or "No".

Learn More:

Everything You Need To Know About Aadhaar Verification

The Role of Aadhaar-PAN Linkage in Securing Identity & Compliance Across Industries

Identity Verification - How to Check PAN Aadhaar Linking Status with API

Aadhaar Verification Using API

What is an API?

An Application Programming Interface (API) is a set of protocols and tools that enable different software applications to communicate and interact with each other. APIs allow systems to share data and functionalities seamlessly, facilitating integration and automation.

In the context of Aadhaar verification, APIs serve as a bridge between an organization's application and the UIDAI's Aadhaar database. This connection allows real-time verification of an individual's identity by cross-referencing the provided Aadhaar number and associated data with the UIDAI's records.

How are APIs used?

APIs can be used in numerous ways to enhance various processes across different industries. For instance, an API can retrieve essential information from a database, such as names and addresses, based on specific input criteria.

On the other hand, more advanced APIs can provide comprehensive details, including biometrics or transaction histories, using multi-factor authentication methods like OTPs.

These APIs ensure secure, quick, and reliable data exchange, making them invaluable tools for banking, telecommunications, healthcare, and e-commerce sectors. By integrating APIs, organisations can streamline operations, improve user experience, and maintain high security and efficiency standards.

Critical Key Terms in APIs

1. Request

The request is the message sent by the client to the server to perform an action (like retrieving or sending data)

2. Response

The response is the message sent back from the server to the client, indicating the result of the request.

3. API Endpoint

A specific URL where the API can access a resource or perform an action.

Example: Aadhaar Verification API

4. API HTTP Methods

Defines the type of operation the client wants to perform:

GET: Retrieve data.

POST: Create new data.

PUT: Update existing data.

DELETE: Remove data.

5. Header

Part of the request and response carries additional information such as content type, authentication tokens, and other metadata.

6. Parameters

Data is sent with the request to specify details or modify the request.

7. Authentication

Methods to verify the client's identity, make the request, and ensure they have the correct permissions. Standard methods include API keys, tokens, and Auth.

What is a REST API or RESTful?

A REST API (Representational State Transfer API) is a web service architecture that uses standard HTTP methods (GET, POST, PUT, DELETE) to interact with URL-identified resources.

REST APIs are stateless, meaning each request contains all the information needed for processing. They are known for their simplicity, scalability, and flexibility in handling various data types.

What is API Testing and How Do We Test It?

API testing ensures APIs meet functionality, reliability, performance, and security expectations. Key methods include:

1. Unit Testing: Testing individual endpoints.

2. Integration Testing: Ensuring multiple API calls work together.

3. Performance Testing: Checking response times and load handling.

4. Security Testing: Protecting against unauthorised access.

What is an API Key and Why is it Important?

An API key is a unique identifier used to authenticate a client requesting an API. It ensures only authorised users can access resources, helps track usage, manage quotas, and prevent abuse.

What is Web API and Why is it Beneficial?

A Web API is an API accessed via the web using HTTP protocols. It allows different applications to communicate and exchange data over the internet. Benefits include:

1. Integration: Seamlessly connects systems and applications.

2. Accessibility: Accessible from any internet-connected device.

3. Scalability: Handles increasing loads and user demands.

4. Reusability: Leverages existing functionalities without rebuilding.

What is API Integration?

API integration connects different applications and systems via APIs, enabling them to share data and work together. It automates processes, improves data accuracy, and enhances functionality, creating efficient and scalable digital ecosystems.

Aadhaar Verification APIs on Instantpay

Instantpay offers seamless integration of Aadhaar verification through its APIs, making the verification process efficient and secure for businesses.

1. Aadhaar Demographics API

The Aadhaar Demographics API provides basic demographic information using only the Aadhaar number as input. This API is useful for simple identity verification where detailed information is not required.

Technical Workflow:

Request: The client system sends an HTTP request to the Aadhaar Demographics API endpoint with the Aadhaar number.

Processing: UIDAI processes the request and retrieves demographic details.

Response: The API returns a JSON response containing the demographic information (e.g., name, address, date of birth, gender).

2. Aadhaar offline e-KYC API

The Aadhaar offline e-KYC API provides comprehensive details but requires both the Aadhaar number and an OTP sent to the Aadhaar-linked mobile number. This ensures thorough verification for services needing extensive identity details.

Technical Workflow:

Request: The client system sends an HTTP request to the Aadhaar OKYC API endpoint with the Aadhaar number.

OTP Generation: UIDAI sends an OTP to the registered mobile number.

OTP Verification: The client system captures the OTP and sends it back to the API.

Processing: UIDAI processes the request, fetching both demographic and biometric details.

Response: The API returns a detailed JSON response containing all relevant information (e.g., name, address, date of birth, gender, photograph).

Step-by-Step Guide to Aadhaar Verification on the Instantpay Dashboard

Step 1: Log in to the Instantpay Dashboard and Navigate to Verification Suite.

(If this isn't visible, please get in touch with [email protected] to enable it.)

Step 2: Click on the Verify Data Tab

Step 3: Choose Aadhaar Demographic API

Step 4: Download and fill template for Bulk Verification

Or If you want to try out the API click the button below

Step 5: Enter the Aadhaar Number you want to Verify

Step 6: Enter your iPin for authentication

Step 7: Congratulations, you have successfully retrieved the Aadhaar Demographic Data

Step 8: You can view and download the bulk verification files by clicking on the “Download” Button

Who Can Use Aadhaar Verification APIs?

Aadhaar Verification APIs can be utilised by a various organisations and sectors to streamline their identity verification processes. These APIs provide a reliable and secure way to verify the identities of individuals, ensuring that only genuine people can access services and benefits.

Here are five examples of entities that can benefit from using Aadhaar Verification APIs:

1. Banks and Financial Institutions

Banks and financial institutions can use Aadhaar Verification APIs to verify customers' identities during account opening, loan applications, and other financial transactions. This ensures compliance with KYC (Know Your Customer) regulations and helps prevent identity fraud.

Example

A bank uses the Aadhaar Offline EKYC API to verify the identity of a new customer applying for a savings account. The customer provides their Aadhaar number and OTP, allowing the bank to quickly and securely verify their details and open the account.

2. Telecom Companies

Telecom companies can utilise Aadhaar Verification APIs to authenticate customers when new SIM cards or mobile connections are issued.This process helps prevent fraudulent activities and ensures that mobile connections are issued to legitimate users.

Example:

A telecom company uses the Aadhaar Demographics API to verify a customer's identity when they apply for a new SIM card. By entering their Aadhaar number, the company can instantly retrieve and verify the customer's demographic information.

3. Government Agencies

Government agencies can use Aadhaar Verification APIs to authenticate beneficiaries of various schemes and services. This ensures that subsidies and benefits are disbursed to the right individuals, reducing the risk of fraud and providing efficient service delivery.

Example

A government welfare department uses the Aadhaar Verification API to verify the identity of individuals applying for a social welfare scheme. This helps ensure that only eligible beneficiaries receive the benefits.

4. E-commerce Platforms

E-commerce platforms can leverage Aadhaar Verification APIs to verify the identities of sellers and buyers, enhancing trust and security in online transactions. This helps prevent fraudulent activities and builds trust among users.

Example

An e-commerce platform uses the Aadhaar Demographics API to verify the identity of a new seller registering. This ensures that only legitimate sellers can list their products, improving the platform's credibility.

5. Educational Institutions

Educational institutions can use Aadhaar Verification APIs to verify students' identities during admissions and examinations. This helps maintain the integrity of the admission process and ensures that only eligible students are enrolled and assessed.

Example

A university uses the Aadhaar offline - KYC API to verify the identity of applicants during the admission process. Using the Aadhaar number and OTP, the university can authenticate the students' details and ensure that only genuine applicants are admitted.

These examples illustrate the versatility and utility of Aadhaar Verification APIs by Instantpay across various sectors. By integrating these APIs, organisations can enhance security, improve efficiency, and ensure that services and benefits are delivered to the right individuals.

Conclusion

By focusing on how Aadhaar verification works and its implementation through APIs, this guide aims to provide a comprehensive understanding of the process and its significance in various sectors.

For detailed API documentation, visit Instantpay Developer Portal, and for further assistance, contact support at [email protected].

0 notes

Text

UIDAI asks 10 year old Aadhaar holders to revalidate their address

SRINAGAR — The UIDAI has advised all the residents who have got their Aadhaar 10 years before to revalidate their address.

In this connection, all the Deputy Commissioners of Jammu and Kashmir have been asked to make the residents of J&K aware about the updation of addresses with the help of any supporting documents.

They have also been asked to aware residents about updation of mobile number in…

0 notes

Text

ESIC me Aadhar Jodne ka Sahi Tarika

ESIC me Aadhar Jodne ka Sahi Tarika

ESIC (Employee's State Insurance Corporation) provides essential social security benefits to employees in India, including medical care and compensation for loss of wages during their employment period. Linking Aadhar to ESIC accounts is mandatory to streamline benefits distribution and ensure transparency in the system. Here’s a comprehensive guide on how to link Aadhar with ESIC, ensuring you follow the correct procedure without any hassle.

Understanding the Importance of Aadhar Linking

Aadhar, India's unique identification number issued by the UIDAI (Unique Identification Authority of India), serves as a crucial identity verification tool. Linking Aadhar to ESIC helps in authenticating and verifying the identity of employees availing benefits under the ESIC scheme. It eliminates duplicate or fraudulent claims, enhances transparency, and ensures efficient service delivery.

Step-by-Step Procedure to Link Aadhar with ESIC

Visit the ESIC Portal:

Start by visiting the official ESIC portal. Ensure that you are on the correct website to avoid phishing or fraudulent activities.

Login to Your ESIC Account:

Log in using your credentials, such as username and password. If you are a new user, register yourself on the portal first.

Navigate to Aadhar Linking Section:

Once logged in, navigate to the Aadhar linking section. This can typically be found under the 'Profile' or 'Account Settings' tab.

Enter Aadhar Details:

Enter your Aadhar number and other required details accurately. Double-check the information entered to avoid any errors.

Verify Aadhar Linking:

After entering the Aadhar details, the system may prompt you to verify the information provided. Ensure all details are correct before proceeding.

Submit and Confirm:

Submit the Aadhar linking request through the portal. You may be required to confirm your request via OTP (One-Time Password) sent to your registered mobile number linked with Aadhar.

Confirmation of Aadhar Linking:

Upon successful submission and verification, you will receive a confirmation message or notification on the portal confirming that your Aadhar has been linked to your ESIC account.

Benefits of Aadhar Linking with ESIC

Streamlined Benefit Distribution: Linked Aadhar ensures that benefits such as medical care and compensation are efficiently distributed to eligible employees.

Enhanced Security: Aadhar linkage reduces the risk of identity theft and fraudulent claims, enhancing the security and integrity of the ESIC system.

Ease of Transactions: Once Aadhar is linked, employees can seamlessly access and manage their ESIC accounts online, including updating personal information and checking benefit status.

Tips for Smooth Aadhar Linking

Keep Aadhar Details Updated: Ensure your Aadhar details are up-to-date to avoid any discrepancies during the linking process.

Secure Login Credentials: Safeguard your ESIC portal login credentials to prevent unauthorized access and misuse of your account.

Follow Official Channels: Always use the official ESIC portal for Aadhar linking to avoid falling prey to phishing scams.

Conclusion

Linking Aadhar with ESIC accounts is a straightforward process that ensures seamless access to social security benefits for employees across India. By following the steps outlined above and understanding the importance of Aadhar linkage, employees can contribute to a more transparent and efficient social security system. Embrace this digital initiative to secure your benefits and contribute to a robust framework of social welfare in the country.

0 notes

Text

UIDAI rolls out new Aadhaar services on its toll-free number.

New Delhi: Indian citizens can now experience new services built on IVRS by the Unique Identification Authority Of India. The nodal Aadhaar issuing authority has a toll-free number – 1947 that offers a range of services. Introduced in the year 2016 and available 24/7, residents can call on this number to find out their Aadhaar enrollment or update status, or to receive information via SMS.

ALSO READ MORE- https://apacnewsnetwork.com/2023/07/uidai-rolls-out-new-aadhaar-services-on-its-toll-free-number/

#aadhaartollfreenumber#IVRS services#Unique Identification Authority Of India#aadhar card issuing authority#nitin kumar singh aadhar card#issuing authority of aadhar card

0 notes