#trademark certification consultants

Explore tagged Tumblr posts

Text

Legal Proceeding Certificate For Trademark | Simple Process of Certification

A Legal Proceeding Certificate for Trademark certifies the status and details of trademark-related court cases. The process involves filing a request with the trademark office, providing case details, and paying a fee. This certificate is essential for legal clarity and documentation

#trademarke certification#trademark registration#trademark registration process#trademark registration price#trademark registration online#trademark certification consultants

0 notes

Text

Get Online Trademark Registraion - Legal Vistaar Consultants

Get online trademark registration with Legal Vistaar Consultants to protect your brand effortlessly. Our expert team streamlines the process, ensuring a hassle-free experience from start to finish. By opting for online trademark registration, you gain swift access to comprehensive services, including thorough searches, precise documentation, and timely submissions. Legal Vistaar Consultants leverage their extensive knowledge to navigate the complexities of trademark law, offering you peace of mind and robust protection for your intellectual property. Trust us to safeguard your brand’s identity with efficiency and expertise, all through a seamless online process.

#legal advice#gst#fssai certification#itr#trademark registration#legal business consultants#business loan#loans

0 notes

Text

#trademarkregistration#patent registration#design registration#best copyright consultant#best trademark consultant#best ISO certification consultant#best trademark consultant in Pune

0 notes

Text

“Empower, Educate, Elevate! 🌐✨ On #SaferInternetDay, let’s join hands to create a digital world that’s safe, secure, and supportive for all. Together, we shape a better online experience! 🤝🔒

- Team Jahazgarhia Consultants (P) Ltd

Our Services:

🎯 FSSAI License & Registration 🎯 Trademark ™️®️ 🎯 Legal Metrology Packaged Commodity Certification ⚖️ 🎯 EPR Registration for Plastic, Battery & E-Waste ♻️ 🎯 BIS Registration for Footwear & Toys 🎯 ISO Certification 🎯 Startup India registration / DPIIT Recognition 🎯 Import Export Code 🎯 Apeda RCMC registration 🎯 Spice Board registration 🎯 Tobacco Board registration 🎯 Tea Board registration 🎯 Company Registration & Compliances 🎯 GST Registration & Filing 🎯 Shop and Establishment registration 🎯 MSME / Udhyam Registration 🎯 ICEGATE Registration 🎯 AD Code Registration 🎯 All Export Promotion Councils registration

📱 : +91- 9999113209 , 9999798333 📧 : [email protected] 🌐 : www.fssailicense.net , www.bisregistration.in

. . . .

#OnlineSafety#DigitalWellbeing#ImportExportCode#ImportExportLicense#FSSAI#FssaiLicense#FssaiRegistration#APEDA#EPR#eprcompliance#legalmetrology#lmpc#Trademark#TrademarkRegistration#trademarklaw#startupindiaregistration#iso9001#isocertification#spiceboard#tobaccoboard#bisregistration#udhyamregistration#msme#icegate#teaboard#gstreturn#dpiitrecognition

#legal#legal services#business#business growth#businessregistration#businesscompliance#company registration#fssailicense#fssairegistration#apeda#trademark#legal metrology certificate#gst registration#gstfiling#epr registration#eprregistration#startupindia#icegate#iso certification#iso consultancy

0 notes

Text

Discover how Tatva Consulting Services in India can help your business secure HACCP certification for enhanced food safety and quality. Unlock a world of opportunities with our expert guidance

#trademark registration in gujarat#iso certificate in gujarat#company registration gujarat#iso certificate registration in gujarat#iso certificate in india#gem registration consultant in gujarat#HACCp certifacation

0 notes

Text

Appointment of Director in a company

Introduction

A Director of a company is an individual elected by the shareholders to supervise the company's affairs in accordance with its Memorandum of Association (MOA) and Articles of Association (AOA). Since a company is a legal entity, it can only act through the representation of a natural person.

Therefore, the Board of Directors, consisting of living individuals, is entrusted with the management of the company. Depending on the shareholders' requirements, the appointment of directors may be required at various times throughout the life of the business.

Who can be a Director of a Company in India?

To become a director of a company in India, an individual must fulfill the criteria outlined in the Companies Act, 2013, and the Articles of Association of the respective company. The needs of the Companies Act are uniform, whereas the provisions of the Articles of Association differ from one company to another.

There are two types of directors that can be appointed in a company:

Executive Directors

Managing Director

A Managing Director is designated as a director based on the Articles of Association of a company, an agreement with the company, or a resolution passed in a general meeting or by the Board of Directors. This is because the Board of Directors is liable for managing the company's affairs and has substantial powers in doing so.

Whole-time director

An executive director or whole-time director is an individual who is employed by the company on a full-time basis.

Non-Executive Director

Independent director

Independent directors are board members of a company who are not financially or personally connected to the company or its management. They offer an unbiased viewpoint in the board's decision-making process, ensuring that the company operates in the best interests of all stakeholders.

Read more to know about the Appointment of a Director in a company

#llp registration#private limited company registration#opc registration#startup registration#nidhi company registration#annual compliance of llp#annual compliance of private limited company#trademark registration#itr filing#tds return filing#director kyc#legal consultation#legal services#iso certificate online

0 notes

Text

This is what Meghan Markle must do to lawfully sell her jam by u/luvgabe

This is what Meghan Markle must do to lawfully sell her jam For Meghan Markle to actually sell her jam, she needs to do much, much more than getting trademark approval for her ARO brand. The following is the AI generated answer to my query on the Brave browser:To sell food commercially in California, you’ll need to comply with the following requirements:Cottage Food Permit: If you’re operating a small-scale, home-based food business, you’ll need a Cottage Food Permit from the California Department of Public Health (CDPH). This permit allows you to produce and sell non-potentially hazardous foods, such as baked goods, jams, jellies, and candies, directly to consumers.Food Handler Card: You’ll need to complete a California-accredited Food Handler Certificate Program and obtain a food handler card within three months of obtaining your Cottage Food Permit.Labeling and Packaging: Ensure your products are properly labeled with the required information, including:Product name and descriptionIngredientsNet weight or volumeNutrition facts (if applicable)“Made in a home kitchen” or “Cottage Food Production Operation” statementPermitting: Depending on your sales strategy, you may need additional permits:Class A Permit: For direct-to-consumer sales only, with annual gross revenue limits of $75,000.Class B Permit: For sales to retailers, restaurants, or other businesses, with annual gross revenue limits of $150,000.Commercial Kitchen Rental or Co-Packing: If you plan to produce foods that require refrigeration, cooking, or other specialized equipment, you may need to rent a commercial kitchen or find a co-packer to manufacture your products.Business Registration: Register your business with the California Secretary of State and obtain any necessary local business licenses.Insurance: Consider obtaining liability insurance to protect your business in case of foodborne illness or other issues.Record Keeping: Maintain accurate records of production, sales, and inventory, as well as documentation of your food handling and preparation processes.Additional Considerations:Check with your local health department for specific requirements, as some counties may have additional or modified regulations.Ensure your products comply with California’s food safety regulations and labeling requirements.Consider consulting with a food safety expert or attorney to ensure compliance with all applicable laws and regulations. post link: https://ift.tt/vx3mFNE author: luvgabe submitted: December 18, 2024 at 11:38AM via SaintMeghanMarkle on Reddit disclaimer: all views + opinions expressed by the author of this post, as well as any comments and reblogs, are solely the author's own; they do not necessarily reflect the views of the administrator of this Tumblr blog. For entertainment only.

#SaintMeghanMarkle#harry and meghan#meghan markle#prince harry#fucking grifters#grifters gonna grift#Worldwide Privacy Tour#Instagram loving bitch wife#duchess of delinquency#walmart wallis#markled#archewell#archewell foundation#megxit#duke and duchess of sussex#duke of sussex#duchess of sussex#doria ragland#rent a royal#sentebale#clevr blends#lemonada media#archetypes with meghan#invictus#invictus games#Sussex#WAAAGH#american riviera orchard#luvgabe

3 notes

·

View notes

Text

Experience Excellence in Business Services with Benchmark Professional Solutions Pvt. Ltd.

Comprehensive finance and legal solutions with Benchmark Professional Solutions Private Limited

Benchmark Professional Solutions Pvt. Ltd., a certified partner of Tally Solutions, is a leading provider of a wide range of business and financial services. Their expertise lies in offering tailored solutions to businesses, ensuring smooth operations across various sectors. As a reliable partner, Benchmark Professional Solutions offers an extensive array of services that cater to diverse business needs.

One of the standout services provided by Benchmark is their Digital Signature Certificate (DSC) and token services. As a trusted partner for EMUDHRA, PANTASIGN, CAPRICORN, TRUST, ID SIGN, XTRA TRUST, and HYP TOKEN, they ensure the highest standards in digital security, enabling businesses to operate with confidence in an increasingly digital world.

In the field of accounting and finance, Benchmark delivers professional services in accounts management, audits, and consultancy. Whether you're a small business or a large enterprise, their team ensures that your financial operations are compliant with the latest regulations, streamlining your accounting processes to boost efficiency.

Their legal expertise spans across trademark registrations, ROC compliance, and license and registration services. They provide comprehensive solutions to protect intellectual property and ensure businesses meet all statutory requirements without hassle.

Benchmark Professional Solutions also excels in handling income tax and GST compliance. Their team offers guidance on tax strategies to minimize liabilities while ensuring complete adherence to tax laws. Their consultancy services cover a wide spectrum of financial and operational matters, empowering businesses to grow sustainably.

Additionally, they offer outsourcing solutions, allowing businesses to delegate essential tasks to experts while focusing on core functions. Legal services, including civil and criminal representation, add another layer of support, ensuring clients receive comprehensive assistance in all legal matters.

Why Choose Benchmark Professional Solutions Pvt. Ltd.?

Benchmark Professional Solutions Pvt. Ltd. stands out for its holistic approach to business and financial solutions. Their status as a certified Tally Solutions partner, combined with their extensive service portfolio, makes them a reliable and trustworthy partner. By choosing Benchmark, businesses benefit from expert guidance, streamlined operations, and the peace of mind that comes with knowing that every financial and legal detail is handled with precision.

2 notes

·

View notes

Text

Anisha Sharma & Associates : Your Ultimate Ally for Navigating Business and Finance Challenges

Comprehensive finance and legal solutions with Anisha Sharma & Associates

In today’s fast-paced business environment, having a reliable partner for financial services is crucial. Anisha Sharma & Associates stands out as a premier business and finance company, providing a wide array of core and specialized services tailored to meet the diverse needs of businesses and individuals.

At the heart of Anisha Sharma & Associates are its core services, which encompass accounts, audit, trademark registration, ROC compliance, licenses and registrations, loans, income tax, GST, consultancy, outsourcing, digital signature certificates (DSC & token), and software solutions. This comprehensive suite ensures that clients have access to essential services needed to maintain compliance, enhance operational efficiency, and achieve financial clarity.

The firm goes beyond basic financial services by offering specialized expertise in stock broking and advisory, helping clients navigate the complexities of investments and maximize returns. Their website and digital services empower businesses to establish a strong online presence, crucial in today’s digital-first world. Additionally, the company provides real estate placement consulting, ensuring that clients can make informed decisions in the property market.

Understanding the importance of employee welfare, Anisha Sharma & Associates also specializes in Provident Fund (PF) and Employee State Insurance (ESI) services, helping businesses manage their obligations efficiently. Moreover, they offer legal services in civil and criminal matters, ensuring that clients receive comprehensive support in all aspects of their business.

Choosing Anisha Sharma & Associates means opting for a dedicated partner committed to delivering exceptional results. Their team of experienced professionals is well-versed in the latest regulations and trends, ensuring that clients remain compliant while optimizing their financial strategies. The firm’s focus on personalized service guarantees that each client receives tailored solutions that align with their unique needs and goals.

In conclusion, Anisha Sharma & Associates emerges as a trusted ally in the complex world of business and finance. With its extensive range of core and specialized services, businesses can navigate challenges confidently and seize opportunities for growth. Partnering with Anisha Sharma & Associates not only ensures compliance and efficiency but also paves the way for long-term success in an ever-evolving landscape.

3 notes

·

View notes

Text

Company Setup Services by MAS LLP: A Comprehensive Guide to Starting Your Business

Starting a business is an exciting yet complex journey that requires strategic planning, legal formalities, and expert guidance. This is where MAS LLP comes in, offering top-notch company setup services that simplify the process and help entrepreneurs establish their businesses with confidence.

Why Choose MAS LLP for Company Setup? With years of experience in the industry, MAS LLP specializes in assisting startups, small businesses, and enterprises in navigating the legal and administrative hurdles of company formation. Whether you are looking to set up a Private Limited Company, LLP, or Public Limited Company, MAS LLP ensures a smooth process by offering tailored services to meet your specific needs.

Key Services Offered by MAS LLP Business Structure Consultation Choosing the right business structure is crucial for your company’s future growth and compliance. MAS LLP experts guide you through various options like Sole Proprietorship, Partnership, LLP, and Private Limited, helping you select the structure that best suits your business goals.

Company Registration The registration process can be complex, with multiple legal and financial regulations to adhere to. MAS LLP handles all aspects of registration, from DIN (Director Identification Number) and DSC (Digital Signature Certificate) to the final issuance of the Certificate of Incorporation.

PAN/TAN Application A registered company needs a PAN (Permanent Account Number) and TAN (Tax Deduction and Collection Account Number) for taxation purposes. MAS LLP assists you in applying for these, ensuring you're fully compliant with government regulations from day one.

GST Registration MAS LLP provides expert assistance in GST registration, ensuring that your company is tax-compliant and ready to conduct business with minimal tax-related hurdles.

Trademark and IP Registration Protecting your brand and intellectual property is essential for long-term success. MAS LLP offers trademark registration and other IP protection services, giving your business legal cover in a competitive market.

Legal and Financial Documentation MAS LLP helps in drafting and managing crucial legal documents like MOA (Memorandum of Association) and AOA (Articles of Association), along with ensuring compliance with the latest Companies Act regulations.

Bank Account Setup MAS LLP guides you through the process of opening a business bank account, making it easier to handle your financial transactions.

Why Efficient Company Setup Matters A well-executed company setup not only ensures compliance with laws but also sets the foundation for future growth. MAS LLP’s company setup services are designed to minimize legal risks, streamline financial planning, and optimize your time so you can focus on your core business activities.

Benefits of Partnering with MAS LLP Expert Guidance: With in-depth knowledge of company laws and taxation policies, MAS LLP ensures a hassle-free experience. Time-Saving: MAS LLP’s streamlined services ensure quick setup, allowing you to focus on your business. End-to-End Support: From registration to compliance, MAS LLP covers every aspect of company formation. Cost-Effective Solutions: Enjoy competitive pricing for high-quality services. Conclusion Setting up a company can be a challenging process, but with MAS LLP’s expert company setup services, you can navigate the complexities with ease. From choosing the right structure to handling all legal and financial formalities, MAS LLP ensures that your business is built on a strong foundation.

If you're planning to start a business, MAS LLP is your trusted partner for seamless company setup services. Contact us today to learn more about how we can help you bring your entrepreneurial vision to life.

#accounting & bookkeeping services in india#audit#businessregistration#chartered accountant#foreign companies registration in india#income tax#auditor#taxation#ajsh#ap management services

3 notes

·

View notes

Text

Unveiling Limited Liability Partnership Registration: A Step-by-Step Guide

In the realm of business structures, Limited Liability Partnerships (LLPs) have emerged as a favored choice for entrepreneurs seeking a balance between liability protection and operational flexibility. Offering the advantages of both traditional partnerships and limited liability companies, LLPs provide a unique framework that appeals to a wide array of professionals and businesses. If you're considering forming an LLP, navigating through the registration process can seem daunting. However, fear not! In this comprehensive guide, we'll break down the intricacies of LLP registration, simplifying each step to set you on the path to success.

Understanding Limited Liability Partnerships

Before delving into the registration process, let's grasp the essence of Limited Liability Partnerships. An LLP combines features of both partnerships and corporations, providing its partners with limited personal liability akin to shareholders in a corporation. This implies that partners are not personally liable for the debts and obligations of the business beyond their investment. This protective shield for personal assets makes LLPs an attractive option for professionals such as lawyers, accountants, consultants, and small businesses.

Step-by-Step Guide to LLP Registration

1. Choose a Name

Ensure that your chosen name complies with the regulations stipulated by the relevant authority. It should not infringe on existing trademarks and should reflect the nature of your business.

2. Obtain Digital Signature Certificates (DSC)

LLP registration necessitates the use of Digital Signature Certificates (DSC) for filing various documents electronically. Obtain DSCs for all partners involved in the LLP.

3. Obtain Designated Partner Identification Number (DPIN)

This unique identification number is mandatory for all individuals intending to be appointed as partners.

4. Drafting LLP Agreement

The LLP agreement outlines the rights and duties of partners, profit-sharing ratios, decision-making procedures, and other pertinent details. Draft a comprehensive LLP agreement in accordance with the provisions of the LLP Act.

5. File Incorporation Documents

Compile and file the necessary incorporation documents with the Registrar of Companies (ROC). These documents typically include Form 1 (Incorporation Document) and Form 2 (Details of LLP Agreement). Pay the requisite fees along with the submission.

6. Registrar Approval and Certificate of Incorporation

Upon submission of documents, the Registrar will scrutinize the application. If all requirements are met satisfactorily, the Registrar will issue a Certificate of Incorporation, officially recognizing the LLP's existence.

7. Obtain PAN and TAN

After obtaining the Certificate of Incorporation, apply for Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN) for the LLP.

8. Compliance with Regulatory Requirements

Ensure compliance with all regulatory requirements post-incorporation. This includes maintaining proper accounting records, filing annual returns, and adhering to tax obligations.

2 notes

·

View notes

Text

Comprehensive Business Services: ITR, GST, FSSAI, Loans, Certification, Trademark, Organization Formation, Advisory, Mergers, TDS Filing & More

Our comprehensive services cover a wide range of business and financial needs. We handle Income Tax Return (ITR) submissions, FSSAI licensing, and GST registration to ensure compliance. Our expertise extends to securing monetary assistance through Home Loans, LAP, and Business Loans. We also offer ISO/ISI certification, trademark and copyright protection, and support in organization/LLP formation, society/trust/Section 8 setup. Additionally, we provide business advisory, draft felony settlements, and assist with mergers, amalgamations, and NCLT/NCLAT matters. Our services include meticulous TDS/TCS return filing to keep your financial operations in check. Trust us to manage your administrative and regulatory requirements efficiently.

0 notes

Text

Our professional legal translation services ensure that your documents are translated with precision and expertise

In this globalized world, the demand for correct and accurate legal translation services has never been greater. Be it contracts, patents, court documents, or any other legal material, ensuring that your documents are translated correctly is the need of the hour. With this in mind, our professional legal translation services give you the peace of mind that your sensitive information is handled with precision and expertise.

Why Choose Professional Legal Translation Services?

Legal translation is not only a means of converting text from one language to another; knowledge of legal terms and its application in various jurisdictions under their respective legal frameworks is demanded. Mistakes in law translation can lead to financial or loss of it, legal processes can be undermined and even disputes are created and hence the translation should involve professional legal translation services experts.

We are a team of expert translators knowledgeable of legal language and its nuances. The language is understood not just through the use of words but also from the context and meaning associated with legal documents. This, therefore, ensures that texts translated carry the same legal weight and implications as the original texts.

Custom Solutions to Meet Diverse Requirements

Every legal document is unique, and every client has different needs. Our official translation services DMCC (Dubai Multi Commodities Centre) cater to businesses and individuals alike within Dubai and beyond. We understand the local legal landscape and can provide precise legal translation services in Dubai tailored to meet the regulatory requirements and expectations of regional authorities.

Whether you are a law firm needing documents translated for international clients, a business looking to expand into foreign markets, or an individual needing personal documents translated, our services are comprehensive and flexible. We cover a wide range of legal documents, including:

- Contracts and Agreements

- Court Documents

- Patents and Trademarks

- Immigration Papers

- Business Licenses and Certificates

Our professional legal translation services ensure your documents remain legally binding in any language.

The Translation Process in Legal Documents

Upon hiring our translation services on your legal documents, you can be assured of their detailed process to ensure perfect translation. Here's a general outline of how we make it work:

1. First Consultation: Once we get to know all the requirements and nature behind your translation, we sort the best translator who best deals with the related filed of law.

2. Translation: Our translators now undertake their job of translating while ensuring the work conveys exactly the same legal implications as found in the original document. They make use of parallel forms of equivalent legal terms and phrases with similar meanings within the target language.

3. Quality Control: Now, once translated, there is always quality control with the assistance of another competent translator through proofreading and editing on the accuracy, consistency, and completeness.

4. Final Delivery: The final product is provided once the document has received its thorough review, in your specified format. We check to make sure that any of our legal translations are perfect both in content and appearance as requested.

Why Select Us?

When searching for legal translation services in Dubai, you will be exposed to many choices. However, we stand out because of our commitment to quality, confidentiality, and precision. We make sure that your projects reach you on time while observing the highest standards of accuracy. Our team has extensive experience and expertise in legal language and is aware of both local and international legal practices.

By choosing our professional legal translation services, you can concentrate on your legal matters while we take care of the complexity of translation. We are here to assist you, whether you require official translation services under DMCC or need specific legal document translation.

In conclusion, making arrangements for your legal documents with the necessary professionals is very important in the maintenance of your interests within that transaction or legal proceeding. In this regard, our professional legal translation services guarantee perfectly translated documents, which help the way to successful cross-boundary communication. Contact Diamond Legal Translation now to find out more of how we can address the needs of your legal translation requirements.

#translation services#legal translation#legal translation services#diamond legal translation#legal translation service#website translation#general translation

0 notes

Text

ajman offshore company formation

Ajman Offshore Company Formation: A Comprehensive Guide

Ajman, one of the seven emirates of the United Arab Emirates (UAE), offers a favorable environment for offshore company formation through the Ajman Free Zone Authority. Known for its cost-effective setup and strategic location, Ajman has become a preferred choice for entrepreneurs and businesses seeking efficient offshore solutions. This article provides a detailed guide on Ajman offshore company formation, its benefits, and the step-by-step process.

What is an Ajman Offshore Company?

An Ajman offshore company is a legal entity registered under the Ajman Free Zone Offshore jurisdiction. These companies are designed for international business activities, asset protection, and tax efficiency, without the need to establish a physical presence in the UAE. Offshore companies in Ajman are restricted from conducting business within the UAE but can operate globally.

Key Benefits of Ajman Offshore Company Formation

100% Foreign Ownership:

Ajman offshore companies allow full ownership by foreign nationals without requiring a local sponsor.

Tax Efficiency:

Zero corporate tax, income tax, and capital gains tax.

Privacy and Confidentiality:

No public disclosure of shareholder and director information.

Ease of Setup:

Quick and straightforward incorporation process, often completed within days.

Cost-Effective:

Lower incorporation and maintenance costs compared to other UAE offshore jurisdictions.

Banking Opportunities:

Access to UAE’s robust banking system with the ability to open corporate bank accounts in the country or internationally.

No Auditing or Reporting Requirements:

Offshore companies in Ajman are not required to maintain audited financial statements or file annual reports.

Permitted Activities for Ajman Offshore Companies

Ajman offshore companies can engage in various international activities, including:

Trading and investment management.

Holding intellectual property rights.

Real estate ownership outside the UAE.

Professional and consulting services.

Owning shares in other companies.

Steps to Register an Ajman Offshore Company

Appoint a Registered Agent:

Offshore companies in Ajman must be incorporated through an approved registered agent who will handle documentation and liaise with the Ajman Free Zone Authority.

Choose a Company Name:

Select a unique and compliant name for your offshore company. The name must not conflict with existing entities or trademarks.

Submit Required Documents:

Provide the necessary documents, which typically include:

Passport copies of shareholders and directors.

Proof of residential address (e.g., utility bills).

A business plan (if applicable).

Define the Company Structure:

Determine the number of shareholders and directors, and allocate shares accordingly.

Submit the Application:

The registered agent submits the incorporation documents to the Ajman Free Zone Authority for approval.

Obtain the Certificate of Incorporation:

Once approved, the company receives its Certificate of Incorporation, officially establishing its legal status.

Open a Corporate Bank Account:

Set up a business bank account in the UAE or internationally to manage global transactions.

Why Choose Ajman Over Other UAE Offshore Jurisdictions?

Ajman offshore companies offer several unique advantages:

Lower costs compared to JAFZA or RAK offshore jurisdictions.

Faster incorporation process.

Flexible regulatory environment with minimal requirements.

Who Should Consider an Ajman Offshore Company?

Ajman offshore companies are ideal for:

Entrepreneurs seeking a tax-efficient structure for global operations.

Investors looking to protect and manage international assets.

Consultants and service providers with international clients.

Businesses requiring confidentiality and privacy.

Conclusion

Ajman offshore company formation is an excellent choice for individuals and businesses aiming to leverage the UAE’s strategic location and business-friendly policies. With its cost-effective setup, robust privacy features, and access to global markets, Ajman provides an attractive platform for offshore business activities. Whether you are a startup, investor, or established enterprise, an Ajman offshore company can help you achieve your business goals efficiently and securely.

Ready to set up your Ajman offshore company? Start your journey today and unlock the benefits of this thriving offshore jurisdiction!

0 notes

Text

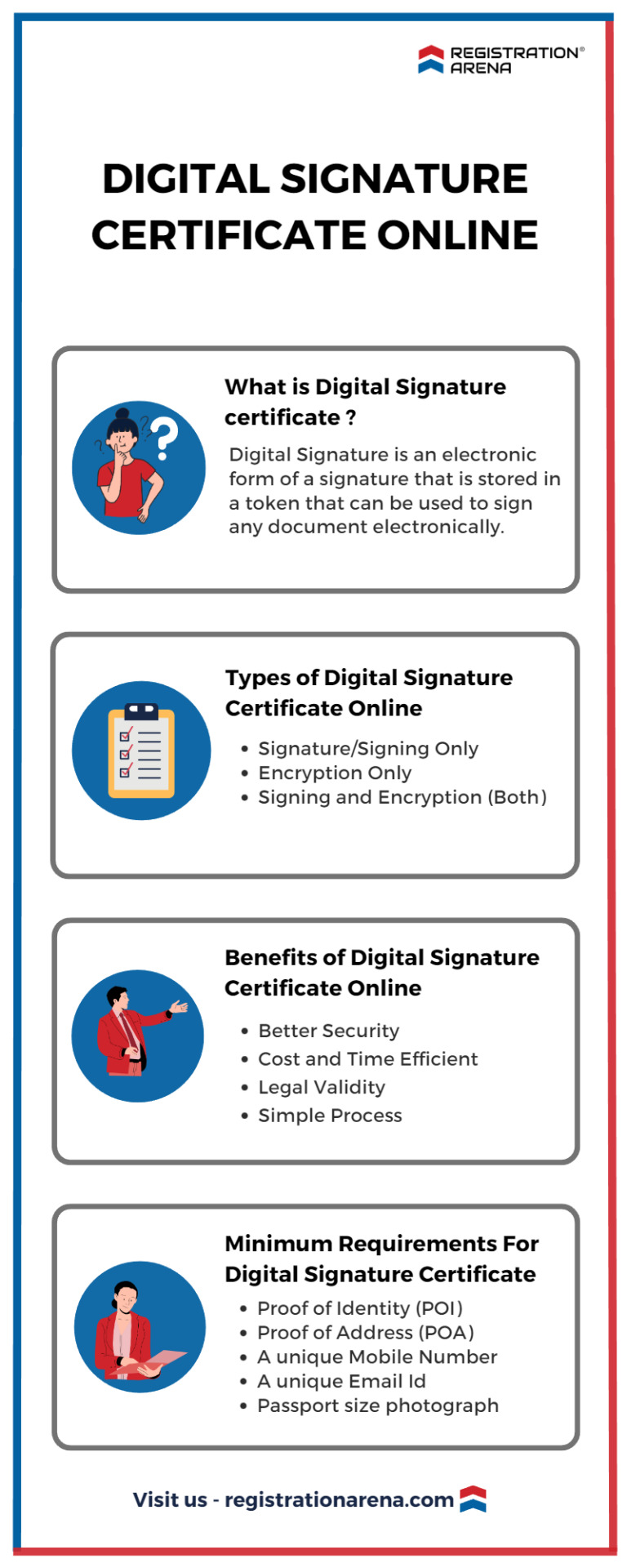

A DSC or ID is also referred to as a digital signature certificate online. To digitally sign official documents, the issuing authority must possess an active digital certificate. A digital certificate is issued by a certificate authority. Third-party certificate authorities offer the option to either purchase a DSC online or apply for a digital signature online. The risk of duplication or alteration of the signed document can be minimized by Digital signatures. DSC users are provided with a unique token password to authenticate, verify their identity and sign the respective document

#llp registration#private limited company registration#opc registration#startup india registration#trademark registration#annual compliance of llp#annual compliance of private limited company#itr filing#tds return filing#digital signature certificate online#legal advisers#legal consultation#legal services

0 notes

Text

Trademark Registration in India: Steps to Safeguard Your Brand Identity

In today’s competitive business world, protecting your brand identity is crucial. A trademark not only distinguishes your products or services from competitors but also provides legal protection against unauthorized use. Here’s a step-by-step guide to trademark registration in India to help you safeguard your brand:

1. Conduct a Trademark Search

Before applying, ensure your desired trademark is unique. Conduct a comprehensive search on the Trademark Registry’s website to check if it’s already in use. This step prevents future legal disputes.

2. Choose the Right Class

Trademarks in India are classified under 45 categories based on the nature of goods or services. Selecting the appropriate class ensures your trademark is protected in the relevant business domain.

3. File the Application

Submit your application online or offline with the Registrar of Trademarks. Include essential details like the applicant’s name, address, and a representation of the trademark. Ensure all documents are in order.

4. Examination by the Registry

Once filed, your application undergoes scrutiny by the Trademark Office. They check for compliance and issue an examination report, highlighting any objections.

5. Publication in the Trademark Journal

If the application is approved, the trademark is published in the Trademark Journal. This allows others to raise objections if they believe your trademark infringes on their rights.

6. Registration Certificate

If no objections are raised, or if objections are resolved, the Registrar issues a registration certificate. Your trademark is now legally protected for ten years, with the option to renew.

7. Monitor and Protect

Regularly monitor the Trademark Registry for potential infringements and take necessary legal action to protect your rights.

At M K Singh Legal Services, we offer expert guidance on trademark registration and brand protection. Let us handle the complexities while you focus on growing your business.

For legal consultation or assistance, connect with M K Singh Legal Services:

🌐 www.metrolegalexperts.in

📞 +91 9811432933

📱 Social Media:

Facebook

Instagram

YouTube

LinkedIn

Twitter

Stay updated with M K Singh Legal Services for all your legal needs !

0 notes