#top 10 forex brokers europe

Explore tagged Tumblr posts

Text

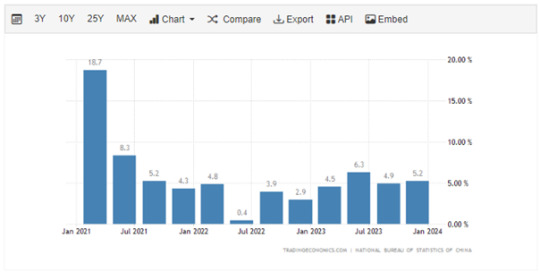

The Current State of Forex, Cryptocurrency, and Gold Trading: An Overview

by Ulan Terrene

In the fast-paced world of trading, navigating through the complex dynamics of Forex, cryptocurrency, and gold requires a deep understanding of the markets. This article aims to provide a comprehensive view of these trading realms.

Quick plug: In the vast labyrinth of trading, I’ve found my guiding light — Decode. As a connoisseur of Forex, cryptocurrency, and gold, this platform is my master key, unlocking the treasures of the financial markets. Its sophistication whispers to my experienced mind, while its simplicity beckons beginners into the dance. With Decode, I tread confidently on the shifting sands of trading. Join me, won’t you?

The Landscape of Forex Trading

The Forex market, the largest and most liquid financial market globally, witnesses the United Kingdom leading the charge, accounting for 38% of global foreign exchange turnover. The United States and Singapore follow suit, with contributions of 19% and 9% respectively.

Out of the 10 million forex traders worldwide, the largest segment, 3.2 million, are from Asia, with Europe and North America contributing 1.5 million each. Africa and the Middle East boast 1.3 million and 1 million traders, respectively, while South America and Central America together make up nearly a million. The smallest contingent, with 190,000 traders, resides in Oceania.

The demographics of Forex traders reveal that men make up 89% of the traders, while women, though fewer in number (11%), outperform men by 1.8%, exhibiting a preference for long-term strategies over short-term risk. Interestingly, a considerable segment of Forex traders are younger than expected, with 55% of them falling under the age of 44.

Regulatory Measures and Trading Platforms

Regulation and oversight are fundamental to Forex trading, ensuring that traders engage with fully licensed brokers. Top-tier financial regulators worldwide advocate for a strong legal framework, stringent licensing requirements, robust investor protection measures, and regular audits and inspections.

The growth of Forex trading platforms since 1996 has democratized access to foreign exchange markets. MetaTrader 4 (MT4), launched in 2005, remains the most popular platform, even after the introduction of MetaTrader 5 in 2010.

Forex Trading in Australia

Australia leads the world in CFD/FX trading on a per-capita basis, with over 100,000 Australians executing one or more FX or CFD transactions in 2021. The average deposit by Australian traders into their FX/CFD account was $8,400 during January-October 2021.

The Emergence of Cryptocurrencies

The release of Bitcoin in 2009 marked a significant milestone in the trading world, heralding the advent of decentralized currencies. Since then, the crypto market has grown to include over 6,600 other cryptocurrencies. Despite market fluctuations, these highly volatile and potentially profitable cryptos, usually traded against major fiat currencies, continue to attract speculators.

The Impact of the COVID-19 Pandemic

The COVID-19 pandemic heightened global interest in Forex trading, which peaked in May 2020. Volume was 34% higher than the same month in 2020, with significant increases observed in the UK (up 137%) and Australia (up 67%). As the pandemic receded, the popularity of Forex trading saw a slight decline.

Final Thoughts

While it’s challenging to provide exact figures on the average profit or loss made by individual Forex traders, or the number of people who quit Forex trading, it’s important to note that trading Forex can be highly risky. Market volatility, coupled with a lack of preparation or understanding of the markets, often leads to significant losses. Hence, traders should be well-versed in risk management and never trade more than they can afford to lose.

Given the diverse landscape of Forex trading, it’s crucial for anyone interestedin this field to thoroughly understand the markets’ dynamics. Whether it’s the demographic distribution of traders, the regulatory oversight, the popular trading platforms, or the unique trends in different regions like Australia, every facet of the trading world contributes to the overall picture.

The emergence and growth of cryptocurrencies have added another layer of complexity and opportunity to the trading world. These digital assets, while highly volatile, offer potential profits for savvy traders willing to navigate their intricacies. However, as with all forms of trading, a clear understanding of the risks involved and an effective risk management strategy are key to success.

The impact of global events on the trading world is another important consideration. The COVID-19 pandemic, for instance, significantly boosted interest in Forex trading. Traders must stay informed about such developments to adapt their strategies accordingly.

In conclusion, the world of trading Forex, cryptocurrencies, and gold is constantly evolving, driven by factors ranging from demographic trends and regulatory changes to technological advancements and global events. As traders, we must strive to stay ahead of the curve, continually learning and adapting to navigate these exciting markets effectively.

2 notes

·

View notes

Text

IQ Option has largely gotten its reputation from being one of the leading brokers in the binary options sector having started up their operations in 2013 in Cyprus.

They have in the last couple of years started to diversify their offering and move into the likes of CFDs and forex trading offering. Binary options do not have a great reputation in the finance industry, but IQ Option has worked hard to try change this perception with their recent dealings and forays into new markets.

They are regulated by the Cyprus Securities and Exchange Commission (CySEC) and their platform is very basic and straightforward to use. They offer more than 13 languages as part of their site. IQ Option has won numerous awards over the years in the binary options industry, but they do not really have any awards for their forex and CFD offerings.

Founded in Cyprus in 2013

Over 13 languages catered for

No awards of note

Trading Conditions

At IQ Option, you have two different types of accounts when it comes to forex trading that you can choose from. One of them is more suited to entry level traders as you can get started trading with a minimum deposit of just £10.

On the other hand, the top level account is for more experienced traders and there is a minimum required deposit in place of £1,000. They also have a VIP account where the minimum required deposit is £3,000.

There are various perks associated with being a VIP on the platform. If you are a beginner trader or simply want to try out some new strategies in your trading, you can utilise their demo account. With the basic account, you have more than 70 different instruments to trade.

Products

Over the past two years or so, IQ Option has expanded their range of investment types massively. While they used to just cater for binary options trading, they now also deal with forex, shares and cryptocurrencies.

They currently have 13 different cryptocurrency CFDs on offer and they have an additional 22 currency pairs on offer as part of their forex service. They have 23 different assets that are tradable as part of their binary options offering. There are just fewer than 130 shares that are also available to be traded.

129 shares on offer

Cryptocurrency CFDs

23 currency pairs

Regulation

IQ Option is licensed by the CySEC since 2014 (license number 247/14), which is a respected authority in the European Union. Therefore, they are compliant with the MiFID rules and regulations.

This allows them to offer services across Europe and they are also in the register (but not fully registered) with the Financial Conduct Authority in the United Kingdom (license number 670182), the Consob in Italy, the BaFIN in Germany and the Regafi in France.

Regulated by the CySEC

Platforms

IQ Option is not one of the many brokers in the sector that use a MetaTrader trading platform. Instead, they have created their own proprietary software which is pretty good when it comes to the straightforward trading execution, but there is not a great offering when it comes to charting and analysis options.

It is easy to use and is nice on the eye. The aesthetic across the platform is well presented and you can make trades directly from looking at charts. You can also get a quick overview of all of your open positions any time you are making a trade. They even have a chat section where you can discuss matters with other users.

No MetaTrader

Proprietary trading platform

Mobile Trading

There is the option of mobile trading when it comes to the IQ Option offering. You can do so through a web browser or you can download an app if you wish to do so.

It is a very clean and straightforward app that has nice graphics and is very similar to the web based platform in terms of the tools that are available for you to use. You can set up push notifications which means that you will be alerted when certain levels have been reached. This app is available on both iOS and Android devices.

Pricing

Generally, when it comes to trading with IQ Option, they have competitive spreads that are akin to others in the sector. For their cryptocurrency options, you will be looking at paying a commission of 2.9% per trade.

Deposits & Withdrawals

In terms of the funding options that are available to you when it comes to IQ Option, they have a decent selection of the main options you will be looking for. They offer debit and credit card options, as well as bank transfer, Neteller and Skrill.

There is a minimum required deposit of £10 if you have the standard account and there may be some charges if you decide to use a bank transfer, depending on the situation with your current bank.

Generally, for deposits with e-wallets and cards you will be looking at almost instantly processed funds, whereas a bank transfer can take 3-5 working days for it to be processed.

With withdrawals, you may be asked before your first withdrawal to verify your identity to make sure that you are who you say you are. The bank transfer for withdrawing also takes 3-5 working days to process, whereas the other options will take about 24 hours for the withdrawal to be processed.

Variety of funding options

Standard processing times

Customer Support

The customer support at IQ Option is very good. You can get in touch with a member of the customer support team 24/7 through email, telephone, by mail or through social media.

They have local telephone numbers you ring depending on where in the world you are located. They also provide email address for both the CEO of the company and the owner in case you want to get in touch with them.

Compared to a lot of other brokers in the industry which only have customer support on a 24/5 basis, IQ Option shine above the rest with regards to their customer support.

24/7 support from the team

Can be reached via mail, email or telephone

Research & Education

At IQ Option, they have a news feed that can be tailored to your needs and will keep you up to date on the goings on in the markets which may change your trading strategy. They also have regular analysis from their in-house team looking at specific markets and investment types.

There is a section of video tutorials where beginners can learn how to get started with the trading process and as the series develops, there are lessons that will also be useful for more advanced traders as well.

Regular analysis pieces

Video tutorial section for beginners and more advanced traders

Noteworthy Points

As mentioned, IQ Option is relatively new to the forex and CFD space and they have yet to garner any rewards. One of the best pieces of praise they get is for the aesthetic feel of their platforms and they look after people from all across the world when it comes to languages.

There are many who are concerned about the platform’s association with binary options trading and for good reason, as this sector is inundated with predatory companies.

You will find a lot of comments online from unhappy users who believe that IQ Option could be a scam, which is why you should probably look elsewhere when deciding on a broker to use.

Conclusion

Coming from a controversial industry that is binary options trading, many people were sceptical when IQ Option expanded into the likes of CFDs and forex.

They have a solid offering of instruments at decent prices. They have top quality customer support on a 24/7 basis, but their propriety trading platform is a bit basic and not very well suited for those more advanced traders.

The main issue is the feeling by many people online that this may be a scam. While there are no solid indications that it is a scam, there is nothing that is part of the IQ Option offering that cannot be found elsewhere, which is why you are probably best served choosing another broker for your needs.

1 note

·

View note

Text

Surprise inflation rebound sank UK100, early cut hopes fade

The FTSE 100 (UK100) dropped sharply on Wednesday as investors dialed back hopes of an early cut in interest rates following a surprise rise in UK inflation. At the close, London's blue-chip index was down 1.5% at 7,446, while the broader FTSE 250 shed 1.7% to end the day at 18,864.

The UK’s annual rate of consumer price inflation (CPI) increased for the first time in 10 months in December, rising to 0.4% from November's more-than-two-year low of 3.9%, which contrasted with expectations for a drop to 3.8%. A sharp rise in tobacco and alcohol prices caused by an increase in government duty and a bigger impact from seasonal air fare rises contributed to the CPI shock.

UK100 H1

The data led Goldman Sachs to increase its year-end 2024 target for headline UK inflation to 2.0% year-on-year, up from 1.8% previously. “As such, while today's print slows the disinflation process that had been underway in preceding months, we continue to expect inflationary pressures to recede going forward,” Goldman’s economists said.

Sluggish GDP figures from China and comments from central bank officials in Europe and the US dampening rate moves also combined with the UK CPI beat to send equities lower. Miners and oil & gas shares were the main fallers, dropping by between 2% and 4%, hurt by the weak data from top consumer China.

Broker comment also blighted oil major Shell, down 2.4% after UBS moved its rating to 'neutral' from 'buy' and cut its price target. And commodities firm Glencore dropped 4.4% after Deutsche Bank downgraded its stance to ‘hold’ from ’buy’ with the German bank citing several near-term earnings and strategy headwinds.

GBPUSD H1

Also among the fallers, betting firm 888 Holdings lost 1.5% as it forecast its 2024 profit to be at the lower end of market expectations. But shares in pubs operator Mitchells & Butlers rose 3.5%, topping the FTSE 250 gainers, as it said it expects annual profit before tax towards the top end of estimates. On currency markets, GBP strengthened after the CPI data as interest rate hike expectations declined.

Futures implied a roughly 60% chance that the Bank of England would start to cut rates by mid-May, down from just over 80% late on Tuesday. GBP added 0.2% versus the USD to 1.2666 and nearly 0.4% against the euro to 1.166.

Disclaimer:

The information contained in this market commentary is of general nature only and does not take into account your objectives, financial situation or needs. You are strongly recommended to seek independent financial advice before making any investment decisions.

Trading margin forex and CFDs carries a high level of risk and may not be suitable for all investors. Investors could experience losses in excess of total deposits. You do not have ownership of the underlying assets. AC Capital Market (V) Ltd is the product issuer and distributor. Please read and consider our Product Disclosure Statement and Terms and Conditions, and fully understand the risks involved before deciding to acquire any of the financial products provided by us.The content of this market commentary is owned by AC Capital Market (V) Ltd. Any illegal reproduction of this content will result in immediate legal action.

0 notes

Text

Forex Trading in Europe: Regulation, Legality, and Best Platforms

Forex trading is the procedure of buying and selling currencies on the global market. It is one of the most popular and liquid forms of trading, with an average daily turnover of over $6 trillion. Forex trading offers many benefits to investors, such as diversification, leverage, low costs, and 24-hour access.

Yet, forex trading also involves significant risks, such as volatility, leverage, fraud, and scams. Therefore, it is important to understand the regulation and legality of forex trading in different countries before entering the market.

This article will explore how foreign currency trading is regulated and legal in various regions and countries worldwide. Additionally, we will compare and contrast the best forex trading platforms and the basics of forex trading in each area. By the end of this article, you will have a better idea of how to trade forex safely and legally in different countries.

Europe has a large and well-regulated forex market, with a uniform set of rules and regulations for all European Union member states based on MiFID II principles. A legal and common way for FX brokers to operate in the EU is to obtain a license in a region like Cyprus and then “passport” regulation to all EU member states.

Yet, it is important to note that each EU member state has its own specific laws and regulations, which may sometimes differ from or add to the EU legislation. Therefore, forex traders and brokers need to be aware of the different requirements and restrictions that apply to each country or region. For example, some countries may have lower leverage limits, higher capital requirements, or stricter reporting obligations than others.

Some of the Most Reputable and Well-Known Forex Regulators in Europe are:

Cyprus Securities and Exchange Commission (CySEC): Cyprus is one of the most popular jurisdictions for forex brokers to obtain a license in Europe, due to its low taxes, flexible regulations, and access to the EU market. CySEC oversees and enforces the compliance of forex brokers with the MiFID II rules, as well as protecting investors and ensuring market integrity. CySEC also regulates some of the top 10 forex trading platforms in Europe, such as eToro, XM, and FXTM.

Financial Conduct Authority (FCA): The FCA is the main regulator of financial services in the UK, which remains one of the leading forex hubs in the world despite Brexit. The FCA regulates forex brokers under the MiFIR framework, which is similar to MiFID II but with some differences. The FCA aims to ensure fair and transparent markets, promoting competition and innovation, and protecting consumers and investors. The FCA offers some of the top forex trading platforms in Europe, including IG, Forex.com, and CMC Markets.

Swiss Financial Market Supervisory Authority (FINMA): Switzerland although not a member of the EU, maintains a close relationship with the EU and follows many of its standards. FINMA is the independent regulator of financial services in Switzerland, including forex brokers. FINMA sets high standards for forex brokers' capital adequacy, risk management, anti-money laundering, and investor protection. FINMA oversees some of the top 10 forex trading platforms in Europe, such as Swissquote, Dukascopy, and Saxo Bank.

These are just a few examples of forex regulators in Europe. Many other countries or regions, including Germany, France, Spain, Italy, Denmark, Sweden, etc., have their own regulatory bodies. Forex traders should always verify the license and reputation of their chosen broker before opening an account and trading in different countries or regions. They should also learn the basics of forex trading, such as how to read charts, use indicators, and place orders.

In conclusion, we have explored how forex trading is regulated and legal in different countries and regions in Europe. We have also compared and contrasted some of the basics of forex trading in each area.

We hope this article has given you a better understanding of how to trade forex safely and legally in different countries. But, before you start trading, we recommend that you do your own research and follow the local laws and regulations of your chosen country or region.

You should also choose a reputable and licensed broker that suits your needs and preferences. Forex trading can be a rewarding and exciting activity, but it also involves significant risks. So, you should always trade with caution. We, Trading Critique solve these concerns of every trade by providing training and expert advice on forex trading. Contact us now!

1 note

·

View note

Text

E-brokerages Market Research Report 2022 to 2028: Industry Trends, Regional Wise Outlook, Growth Projections and Opportunities

This report provides a comprehensive analysis of current Global E-brokerages Market based on segmented types and downstream applications. Major product development trends are discussed under major downstream segment scenario.This report also focuses on major driving factors and inhibitors that affect the market and competitive landscape. Global and regional leading players in the E-brokerages industry are profiled in a detailed way, with sales data and market share info. This report also includes global and regional market size and forecast, drill-down to top 20 economies.

According to this survey, the global E-brokerages market is estimated to have reached $ xx million in 2020, and projected to grow at a CAGR of xx% to $ xx million by 2028.

Get Request Sample Report @ https://martresearch.com/contact/request-sample/3/16937

Covid-19 pandemic has impacted the supply and demand status for many industries along the supply chain. Global E-brokerages Market Status and Forecast 2022-2028 report makes a brilliant attempt to unveil key opportunities available in the global E-brokerages market under the covid-19 impact to help readers in achieving a better market position. No matter the client is industry insider, potential entrant or investor, the report will provide useful data and information.

The Global E-brokerages Market has been exhibited in detail in the following chapters

Chapter 1 displays the basic product introduction and market overview.

Chapter 2 provides the competition landscape of global E-brokerages industry.

Chapter 3 provides the market analysis by type and by region

Chapter 4 provides the market analysis by application and by region

Chapter 5-10 presents regional and country market size and forecast, under the context of market drivers and inhibitors analysis.

Chapter 11 analyses the supply chain, including process chart introduction, upstream key raw material and cost analysis, distributor and downstream buyer analysis.

Chapter 12 provides the market forecast by type and by application

Chapter 13 provides the market forecast by region

Chapter 14 profies global leading players with their revenue, market share, profit margin, major product portfolio and SWOT analysis.

Chapter 15 conclusions

Segmented by Type

l Full Time Brokers

l Discount Brokers

Segmented by Application

l Stock

l Forex

l Other

Get Enquiry And Buying Report @ https://martresearch.com/contact/enquiry/3/16937

Segmented by Country

North America

United States

Canada

Mexico

Europe

Germany

France

UK

Italy

Russia

Spain

Asia Pacific

China

Japan

Korea

Southeast Asia

India

Australasia

Central & South America

Brazil

Argentina

Colombia

Middle East & Africa

Iran

Israel

Turkey

South Africa

Saudi Arabia

Get Discount Report @ https://martresearch.com/contact/discount/3/16937

Key manufacturers included in this survey

l X-Trade Brokers

l TD Ameritrade

l TastyWorks

l Interactive Brokers

l IC Markets

l First Prudential Markets

l Fidelity Investments

l E-Trade

l Etoro

l Eoption

l Charles Schwab

Contact Us:-

+1-857-300-1122

1 note

·

View note

Link

Find your most preferred forex broker on the Europe forex broker list. Choose the best broker for a stress free and low cost forex trading experience.

#top forex brokers europe#europe top 10 forex brokers#top 10 forex brokers europe#europe forex brokers list#forex brokers list europe

0 notes

Text

Europe Top 10 Forex Brokers

Discover the Europe Top 10 Forex Brokers

XM

XM sets high standards to its services because quality is just as decisive for them as for their clients. XM believe that versatile financial services require versatility in thinking and a unified policy of business principles.

MARKETS.COM

Markets.com is one of the world’s fastest growing Forex and CFD providers, offering advanced yet user-friendly, in-house trading platforms. Trade Stocks, Indices, Forex, Commodities & Cryptocurrencies on our Award Winning CFD Platform

HYCM

HYCM offers clients excellent trading conditions, great liquidity and low spreads, delivering a super-efficient service. With its strong focus on fast execution and low cost trading. Always a leader in embracing cutting-edge technology.

DUCA SCOPY

Dukascopy Europe offers an access to the Swiss Foreign Exchange Marketplace. By combining access to the Swiss Foreign Exchange Marketplace with an enhanced trading platform and strong financial services via its banking partnerships.

AVA TRADE

AvaTrade has a proven track record of positive customer satisfaction. We have carved a reputation as a leader of the revolution in online trading by providing a reliable, user-oriented trading environment built on the most advanced platforms.

0 notes

Text

Investing Vs Gambling - What's The Difference?

Investing vs. Gambling: A Simple Overview

Discussing finances, have you ever heard people say, "Investing in the stock market is just like gambling at a casino"? It's true that investing and gambling both involve certain risks and choices. More specifically, the risking of capital with hopes of future profit. But gambling is more of a short lived activity, whilst equities investing can last a lifetime. Furthermore, there is a negative expected return to gamblers, on average and over the long run. However, investing in the stock market typically carries with it a positive expected return on average over the long term.

Points To Note

Investors and gamblers both involve risking capital in the hopes of making a profit. In both gambling and investing, a key principle is to minimize risk while maximizing reward. Gamblers have fewer ways to limit losses than investors do. Investors have more sources of relevant information than gamblers do. Over time, the odds will be in an investors favor and not in the favor of a gambler. Gamblers depend on luck, whilst investors depend on knowledge with hard facts. What Is Investing? Investing is the act of allocating funds or committing capital to an asset, like stocks, index funds etc, with an expectation of generating an income or future profit. The expectation of a return in the form of income or price appreciation is the core principle of investing. Risk and return go hand-in-hand with investing; low risk generally means low expected returns, while higher returns are usually accompanied by much higher risk. Investors must always decide how much money they are willing to risk. Some traders typically risk 1-10% of their capital on any particular trade. Longer-term investors constantly diversify across different asset classes in order to spread the investment and mitigate loss. However, risk and return expectations can vary widely within the same asset class, especially if it's a large one, as the equities class is. For example, a blue-chip stock that trades on the New York Stock Exchange will have a very different risk-return profile from a micro-cap stock that trades on a small exchange. This, in essence, is an investment risk management strategy: Spreading your capital across different assets, or different types of assets within the same class, will likely help minimize potential losses. In order to enhance their holdings' performance, some investors study trading patterns by interpreting stock charts. Stock market technicians try to leverage the charts to scope where the stock is going in the future. This area of study dedicated to analyzing charts is commonly referred to as technical analysis. Investment returns can be affected by the amount of commission an investor must pay a broker to buy or sell stocks on his/her behalf. Remember: When you gamble, you own nothing, but when you invest in a stock, you own a share of the underlying company or asset; in fact, some companies actually reimburse you for your ownership, in the form of stock dividends which are paid out at timely intervals throughout the year.

What Is Gambling?

Gambling is defined as staking something on a contingency. Also known as betting or wagering, it means risking money on an event that has an uncertain outcome and heavily involves chance which in turn requires a huge amount of luck. One's luck is not something that can be controlled which is why gambling addiction is a common phenomenon in todays world.

Like investors, gamblers must also carefully weigh the amount of capital they want to put "in play." In some card games, pot odds are a way of assessing your risk capital versus your risk-reward: the amount of money to call a bet compared to what is already in the pot. If the odds are favorable, the player is more likely to "call" the bet.

Most professional gamblers are quite proficient at risk management. They research player or team history, or a horse's bloodlines and track record. Seeking an edge, card players typically look for cues from the other players at the table; great poker players can remember what their opponents wagered 20 hands back. They also study the mannerisms and betting patterns of opponents with the hope of gaining useful information to assist them.

In casino gambling, the bettor is playing against "the house." In sports gambling, and in lotteries—two of the most common "gambling" activities in which the average person engages—bettors are in a sense betting against each other because the number of players helps determine the odds. In horse racing, for example, placing a bet is actually a wager against other bettors: The odds on each horse are determined by the amount of money bet on that horse, and constantly change up until the race actually starts.

Generally, the odds are always stacked against gamblers: The probability of losing an investment is usually higher than the probability of winning more than the investment. A gambler's chances of making a profit can also be greatly reduced if they have to put up an additional amount of money beyond their initial bet, referred to as "points," which is kept by the house whether the bettor wins or loses. Points are comparable to the broker commission or trading fee an investor pays.

Investing vs. Gambling: Important Differences

In both gambling and investing, a key factor is to minimize risk while maximizing profits. However, when it comes to gambling, the house always has an edge—a certain mathematical advantage over the player that increases over time the longer they play. In contrast, the stock market constantly appreciates (goes higher) over the long term. This doesn't mean that a gambler will never hit the jackpot, and it also doesn't mean that a stock investor will always enjoy a positive return. It is simply that over time, if you keep playing, the odds will be in your favor as an investor and not in your favor as a gambler.

Managing Losses

Another key difference between investing and gambling: You have no way to limit your losses as a gambler. If you bet $10 a week for the NFL office pool and you don't win, you're out all of your capital. When betting on any pure gambling activity, there are not really any loss-management strategies, you either win or lose.

In contrast, stock investors and traders have a variety of options to prevent total loss of risked capital. Setting stop losses on your stock investment is a simple way to avoid undue risk. If your stock drops 20% below its purchase price, you have the opportunity to sell that stock to someone else and still retain 80% of your risk capital. However, if you bet $100 that Manchester United will win the premier league this year, you cannot get part of your money back if they just make it to second or third place. Even if they did win the Premier league, don't forget about that point spread: If the team does not win by more points than given by the bettor, the bet is a loss.

Time Factors

Another key difference between the two activities has to do with the important concept of time. Gambling is a time-bound event, while an investment in a company can last several years. With gambling, once the game or race or hand is over, your opportunity to profit from your wager has come and gone. You either have won or lost your capital.

Stock investing, on the other hand, can be time-rewarding. Investors who purchase shares in companies that pay dividends are actually rewarded for their risked dollars. Companies pay you money regardless of what happens to your risk capital, as long as you hold onto their stock. Savvy investors realize that returns from dividends are a key component to making money in stocks over the long term.

Obtaining Information

Both stock investors and gamblers look to the past, studying historical performance and current behavior to improve their chances of making a winning move. Information is a valuable commodity in the world of gambling as well as in stock investing. However there's defiantly a difference in the availability of information.

Stock and company information is readily available for public use. Company earnings, financial ratios, and management teams can be researched and studied, either directly or via research analyst reports, before committing capital. Stock traders who make hundreds of transactions a day can use the day's activities to help with future decisions.

In contrast, if you sit down at a blackjack table in Las Vegas, you have no information about what happened an hour, a day, or a week ago at that particular table. You may hear that the table is either hot or cold, but that information is not quantifiable or enough to make your next move.

In Conclusion

More people are successful in investing than they are at gambling - fact. Gamblers have far less control of future outcomes than a stock investor and rely heavily on pot luck to make a return on there investment. Even if a gambler makes a few wins here and there it is likely all going to go back in on the next bet and ultimately any profit you make will be lost. It is near impossible to be as consistent with gambling as much as you can find consistency in investing.

Are you a gambler that hasn't tried investing?

Or are you a investor looking to find a stock brokerage you can trust?

Start trading with a broker that suits your countries financial regulator in order to trade safely and have a level of account protection. See below:

FCA Regulated Brokers - UK's Top Forex Brokers

CYSEC Regulated Brokers - Europe's Top Forex Brokers

ASIC Regulated Brokers - Asia & Australia's Top Forex Brokers

3 notes

·

View notes

Text

Bitcoin X Review

Bitcoin X For novices and high influence merchants Bitcoin X Yet, what's the significance here? On account of 1:200, it suggests that for each one base cash you will stake into an exchange, the agent will credit both of you hundred more. In the event that you, consequently, wished to go into a $200,000 exchange, you would just need Bitcoin X in your exchanging account. What are the advantages and disadvantages of utilizing a Broker's Leverage? Experts Gives you extra though advanced exchanging capital

Bitcoin X you with going into bigger exchange places that amplify your benefits The utilized (advanced) exchanging capital is without interest Permits a dealer to go into any exchange with low capital Cons Can without much of a stretch crash your exchanging capital (marked sums) It opens you to edge call chances Higher influences (free cash) supports careless Bitcoin X High Leverage Broker Bitcoin X Best for U.S Forex financial backers (1:500)

Bitcoin X stands apart with their Bitcoin X and high influence of 1:500. This is presently accessible to a wide range of exchanging accounts profited by the acclaimed merchant. Notwithstanding the high influence, there are a few different reasons Bitcoin X tops our rundown of high influence specialists. Also, we are particularly attracted by the way that they keep up more than five kinds of exchanging accounts. They additionally open you to in excess of 20 exchanging sets and keeps a profoundly reasonable least store of $10.

It likewise is viable with the all-well known work area and Mobile forms of the Bitcoin X stages. Note that this appealing influence is, notwithstanding, covered at the CFTC suggested 1:50 proportion for their U.S. customers. Our Rating Bitcoin X Furnishes you with extra but lent exchanging capital The utilized (lent) exchanging capital is sans interest Assists you with going into bigger exchange places that amplify your benefits Can undoubtedly clear out your exchanging capital (marked sums) It opens you to edge call chances Apply N Bitcoin X – Best for Non-U.S financial backers (1:400)

Bitcoin X has a set up presence in more than 150 nations all throughout the planet. It is in this manner worked under the severe direction of all major monetary administrative organizations in Europe Bitcoin X Review Canada, Japan, and Australia. This, in addition to the way that it offers profoundly alluring influences of up to Bitcoin X makes it a favored dealer for most worldwide brokers. Aside from the influence, you will likewise be intrigued to take note of that the representative runs perhaps the most developed and easy to understand exchanging stages.

Bitcoin X key highlights benefited by the agent remember an expert for house exchanging programming, Forex APIs, and rewarding exchanging systems – which are all accessible unreservedly on the site. Additionally the merchant is likewise one of only a handful not many Bitcoin X that furnishes you with flexible exchanging calculations and Forex exchanging APIs that let you computerize your exchanges without any preparation. OUR RATING

Bitcoin X Backing a large group of installment handling organizations and free stores and Bitcoin X you to mechanized danger the executives devices like negative equilibrium security Free preparing and admittance to Forex instructive materials make it generally engaging for novice dealers Buyers have frequently griped of deferred withdrawals – can require as long as 10 days Doesn't acknowledge U.S customers

Bitcoin X Now Crypto Rocket – Best For Free stores Bitcoin X t stands apart from the opposition in the business in view of its alluring influence of up to 1:500. Be that as it may, we additionally like this is a result of its zero-charge strategy on stores. In any case, these aren't the lone reasons the specialist makes it here.

Other novel highlights that attracted us to the Forex CFD broker incorporate the way that it opens you to more than 55 Forex exchanging sets. In addition their super close spreads and the exceptionally progressed exchanging stage are accessible in both the web dealer, P.C., and versatile applications. Our Rating

Bitcoin X Logo Their straight-through exchange execution wipes out slippage and requotes Their exchanging stage accompanies various progressed exchanging instruments that appeal to both amateur and progressed dealers It doesn't charge exchange expenses when live exchanging Bitcoin X is a non-controlled trade There are restricted monetary items you can exchange here - for the most part digital forms of money Apply Now . Falcon FX – Best for the High number of Forex Trading Pairs (1:500)

Bitcoin X . bids most to experienced brokers searching for a high level stage that offers them admittance to gigantic venture chances and appealing influence. The merchant opens you to more than Bitcoin X exchanging sets (counting every one of the significant monetary forms). What's more, these can be executed with influence of.

https://www.cryptoerapro.com/bitcoinx/

1 note

·

View note

Text

Trade The Information - Profiting From Trading With Low Latency News Feeds

Experienced traders acknowledge the impacts of international adjustments on Foreign Exchange (Forex/FX) markets, stock exchange, and also futures markets. Aspects such as interest rate decisions, the rising cost of living, retail sales, unemployment, industrial productions, customer self-confidence studies, service view surveys, trade equilibrium, and also manufacturing surveys influence currency motion.

While investors could check this info by hand making use of conventional information sources, profiting from automated or algorithmic trading utilizing reduced latency news feeds is a typically extra predictable and reliable trading method that can boost earnings while decreasing risk.

The faster a trader can receive economic information, assess the data, make decisions, use danger monitoring models, and carry out professions, the extra successful they can come to be. Automated traders are typically a lot more successful than hand-operated traders because the automation will certainly use an examined rules-based trading method that uses money management as well as risk administration techniques.

The approach will refine trends, analyze data, and perform trades much faster than a human without emotion. To make use of the reduced latency news feeds it is essential to have the right reduced latency information feed supplier, have an appropriate trading approach and also the appropriate network facilities to make certain the fastest feasible latency to the news source to defeat the competition on order access and loads of implementation.

How Do Reduced Latency News Feeds Work?

Reduced latency information feeds offer vital financial data to advanced market individuals for whom speed is a top concern. While the remainder of the globe gets financial information via accumulated news feeds, bureau services, or electronic media such as news web sites, radio or tv reduced latency information investors depend on the lightning-quick shipment of key financial releases.

These include task figures, inflation information, and also producing indexes, directly from the Bureau of Labor Data, Business Division, and the Treasury Press Space in a machine-readable feed that is enhanced for algorithmic traders.

One method of controlling the launch of news is a stoppage. After the embargo is raised for news occasions, press reporters enter the release information right into a digital format, which is immediately distributed in an exclusive binary layout. The data is sent over exclusive networks to numerous circulation factors near numerous large cities around the world.

To receive the news data as swiftly as feasible, a trader must use a legitimate low latency information service provider that has invested heavily in modern technology infrastructure. Embargoed data is requested by a source not to be released before a certain date and also time or unless particular conditions have been fulfilled. The media is provided innovative notice to get ready for the release.

Information companies additionally have press reporters in closed Federal government press rooms during a specified lock-up duration. Lock-up information durations manage the release of all information so that every information outlet releases it concurrently. This can be done in 2 ways: "Finger Press" and also "Switch over Release" are utilized to manage the launch.

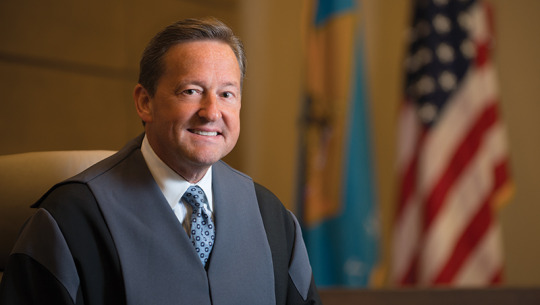

Information feeds attribute economic as well as corporate news that affects trading activity worldwide. Economic signs are made use of to assist in trading decisions. The news is fed into an algorithm that parses, settles, evaluates, and also makes trading suggestions based upon the information Andre Bouchard. The algorithms can filter the information, create indicators as well as assist investors in making split-second decisions to prevent significant losses.

Automated software application trading programs make it possible for faster trading choices. Choices made in microseconds might correspond to a significant side in the marketplace.

News is a good indicator of the volatility of a market as well as if you trade the information, chances will provide themselves. Investors tend to panic when a news report is released, and under-react when there is little news. Maker legible information offers historical data with archives that enable traders to back examination price motions versus details economic indications.

Each nation releases essential financial information during certain times of the day. Advanced investors examine and execute trades practically instantaneously when the announcement is made. Instantaneous evaluation is implemented with automated trading with low latency news feed. Automated trading can play a part in a trader's danger monitoring as well as loss avoidance method. With automated trading, historical backtests, as well as formulas, are used to pick optimum entrance as well as leave points.

Traders must understand when the data will certainly be released to understand when to keep an eye on the market. For instance, important financial data in the United States is launched in between 8:30 AM and also 10:00 AM EST. Canada releases details in between 7:00 AM as well as 8:30 AM. Since currencies cover the world, traders may always discover a market that is open and prepared for trading.

A SAMPLE of Major Financial Indicators

Customer Price Index

Employment Cost Index

Work Scenario

Producer-Consumer Price Index

Efficiency and also Prices

Genuine Revenues

UNITED STATE Import and also Export Costs

Employment & Unemployment

Where Do You Place Your Web servers? Important Geographical Places for algorithmic trading Strategies

Most of the capitalists that trade the information sought to have their algorithmic trading systems hosted as close as possible to the information source and also the implementation place as possible. General circulation locations for reduced latency news feed carriers include globally: New York, Washington DC, Chicago, and also London.

The ideal areas to position your web servers are in well-connected datacenters that allow you to straight link your network or servers to the real information feed source and execution venue. There has to be an equilibrium of distance and also latency between both. You need to be close enough to the news to act on the launches nonetheless, close sufficient to the broker or exchange to get your order in ahead of the masses seeking the best fill.

Low Latency Information Feed Providers

Thomson Reuters makes use of proprietary, state of the modern art technology to create a low latency information feed. The information feed is developed specifically for applications and also is maker readable. Streaming XML program is made use of to produce a complete message and also metadata to make certain that financiers never miss an event.

One more Thomson Reuters information feed includes macro-economic occasions, all-natural calamities, and also physical violence in the nation. An evaluation of the news is launched. When the category gets to a limit, the financier's trading and also danger management system is notified to activate access or exit point from the marketplace.

Thomson Reuters has a one-of-a-kind edge on global information compared to other service providers being one of the most recognized organization news firms on the planet, if not one of the most revered beyond the USA. They have the benefit of consisting of global Reuters Information to their feed in addition to third-party newswires as well as Financial data for both the USA and also Europe. The College of Michigan Study of Consumers record is also another major information event and also launches data twice monthly. Thomson Reuters has special media civil liberties to The University of Michigan information.

Other low latency information providers consist of: Required to Know Information, Dow Jones News, and Rapidata, which we will discuss further when they make details regarding their services much more available.

Examples of Information Impacting the Markets

A news feed might show a change in the unemployment rate. For the sake of the circumstance, unemployment rates will reveal a positive change. The historical evaluation might reveal that the change is not due to seasonal results. Newsfeeds program that customer confidence is enhancing due to the decline in unemployment rates. Reports offer a solid indication that the unemployment price will stay low.

With these details, evaluation might show that traders must short the USD. The algorithm might figure out that the USD/JPY set would produce one of the most profits. An automated profession would be executed when the target is reached, and the trade will certainly be on auto-pilot till completion.

The dollar could remain to drop in spite of reports of unemployment improvement supplied from the news feed. Financiers must keep in mind that multiple variables affect the activity of the United States Buck. The unemployment rate might drop, but the overall economic climate might not boost if bigger financiers do not transform their perception of the buck; after that, the buck may continue to fall.

The huge gamers will generally make their decisions before the majority of the retail or smaller sized investors. Large player choices might impact the market in an unforeseen method. If the decision is made on only info from the joblessness, the assumption will be wrong. Non-directional predisposition assumes that any major news concerning a nation will develop a trading chance. Directional-bias trading makes up all possible financial indications consisting of responses from major market gamers.

Trading The News - The Bottom Line

News relocates the marketplaces, and also, if you trade the news, you can exploit. There are very few of us that can argue against that. There is no doubt that the investor obtaining news data in advance of the curve has the side on obtaining a solid short-term profession on momentum sell different markets, whether FX, Equities, or Futures.

The cost of reduced latency infrastructure has dropped over a previous couple of years making it feasible to subscribe to a reduced latency news feed and obtain the information from the source providing a tremendous side over traders viewing tv, the Internet, radio or basic information feeds. In a market-driven by large banks and also hedge funds, reduced latency information feeds provide the large company side to also private traders.

1 note

·

View note

Text

Top Binary Option Broker

Is Pocket Option a scam or a reputable business?-- Find out on my genuine review. As a sophisticated trader, I inspected the Binary Options Broker for you. If it is worth spending your money or not and obtain the ideal information in my review of 2022, check out. Pocket Option is a binary options broker that offers over 100 various properties, including currency cryptocurrencies, pairings, and supplies. Clients can access controlled services in over 95 regions and nations, including the UK, the USA, Europe, and India. It is reasonably easy to use and offers smooth customer service when needed. But one of its most significant drawbacks is that it offers just one trading account per individual. To withdraw your funds, navigate to the "Financing" page and click "Withdrawal". Get in the amount you wish to withdraw, select a readily available withdrawal approach, and adhere to the instructions on the screen to finish the request. The minimum withdrawal amount is $10 most of the times and is processed within 24-hour as much as 2 service days. Look into my website and read my Pocket Option Bonus to get more information regarding the best broker for binary options! Pocket Option offers its customers easy to understand and easy binary options profession terms, and also makes it feasible to trade on Forex. You can trade with prominent and unique currency sets, products, cryptocurrencies, American and European firms' supplies. The broker also offers its proprietary platform, the instinctive user interface that allows you to trade also without studying all the capacities of the terminal carefully.

youtube

The Pocket Option broker is prominent among investors that trade binary options due to its FMRRC certification. Some on-line binary options brokers have a poor picture, Pocket Option is among the most reliable binary options trading systems. Pocket Option is a binary options broker that offers over 100 various properties, including currency cryptocurrencies, pairings, and supplies. Pocket Option offers its customers easy to understand and easy binary options profession terms, and also makes it feasible to trade on Forex. Pocket Option is one of the most reliable binary options brokers around.

https://topbinaryoptionbroker557.blogspot.com/2022/08/top-binary-option-broker.html https://topbinaryoptionbroker233.blogspot.com/2022/08/top-binary-option-broker.html https://medium.com/@katewilliams1691/every-new-trader-in-binary-options-should-know-about-these-5-tips-ed6da3dfa8b8/ https://binary-options-brokers-reviews.com/quotex-review/ https://binary-options-brokers-reviews.com/quotex-promo-code-best-coupon-code-for-quotex/ https://binaryoptionsbrokerreview565.blogspot.com/2022/05/binary-options-broker-review.html https://coolingmemoryfoammattresstopp483.blogspot.com/ https://coolingmemoryfoammattresstopp483.blogspot.com/2022/08/cooling-memory-foam-mattress-topper.html https://everlywell-covid-test-b4d2nye.tumblr.com/post/693853572779098112/best-mre-meals https://tvwallmountingtowcester.blogspot.com/ https://tvwallmountingtowcester.blogspot.com/2022/08/tv-wall-mounting-towcester.html

0 notes

Text

Which Type of Forex Trader are you?

In my opinion, these days, traders should be categorized on the basis of behavioural approach they take while trading Forex. In my opinion, the traders can be categorized into three main categories.

Price-action or price-volume Traders

Trend Reversal Traders

Trend Followers

Social Traders

Price-Action Traders or Price-Volume Traders

These type of traders use the old technique of Price-Action to trade. It is also known as Price-Volume trading technique. This technique is still useful in the stock market. The method mainly focuses on the dirty money sitting up in the market upon which the operator would act. Basically, the Professional traders try to identify the action of the operator and figure out the price range where the action will happen. How they identify the action by the operator? They look for volume changes in the financial asset and its price movement. There is a supply-demand zone defined based on the operator action, or you can say where the operator will start selling is the supply zone and where the operator begins to buy is the demand zone. Such techniques are perfect for stocks, indices, including their FNO.

But does this type of Trading technique useful in Forex? In my opinion, it does not work in Forex, The operator here are the banks, and they decide where the price would move. At the beginning of my career, I tried to combine price-action with Donchian channels in an experimental setup which is still running. However, I have stopped relying on price-action, but it seems to have its applicability for the USDINR pair. I have covered my experimental setup in another article based on the use of Technical Indicator Donchian Channel.

The same cannot be said for INR based other pairs. EURUSD, USDJPY and GBPUSD are not suitable candidates for application of Price-action theory. Why did I stress this? The reason is simple if you read my article on the currency market operator and the article where I explain the possibility for a single currency to depreciate more than 20% then perhaps you will understand why I am making such a statement.

The traders those who are coming from the Stock market background and expert on Price-Action theory try to use this even in Forex markets and they miserably fail because of the reason explained earlier.

Trend Reversal Traders

There is a class of traders who try to gauge the market thermometers. These class of traders are hunters of market tops and market bottoms. These traders rely heavily on the overbought and oversold situations to reach the conclusion that market has toppled or bottomed out. They use those technical indicators which offer to signal overbought and oversold conditions. These things mostly work in Stock Markets and certain commodity markets. Do they really make sense in currency markets? I don’t think so. Look at the charts of USDINR pair and compare with the charts of EURINR, GBPINR and JPYINR. USDINR over the long Time Frame has been appreciating and has moved 70% since 2008. While GBPINR has been moving within a large range. Same can also be said for EURINR and JPYINR. If banks decide that currencies should continue to fall it will fall and if they decide currencies should continue to appreciate, they will appreciate. In this regard, though RBI intervenes just to cool off the heat in the USDINR Pair and too some extent in other INR based pairs, but since EURUSD, GBPUSD and USDJPY are also available for trading, this article also explains in the perspective of 3 major currency pairs as well. Yes, If Banks in Europe or in fact in UK and US decide that the currency pair EURUSD has to appreciate/depreciate more than 5–10% in a single day, they will do it. Banks are always on lookout for bad money sitting on other side of the horizons. They will rejig the Forex market as per their own convenience. This news article must prove my point. Then in such situations, where will these traders find bottom or top in the currency markets? In such scenarios these traders fail miserably and provide liquidity to the markets.

Trend Followers

They were popularized by famous groups of traders who go by the name of turtle traders. Their philosophy is very simple, stick with the trend and when the trend reverses, get out. These class of traders will be on the lookout to check when the trend has started. They will watch closely when the operators have taken action and initiated the trend, and they will follow the trend, one of their favourite indicators is the Donchian channel. They will ignore the principles of Price-Action, Volume, bottom fishing, etc. and will focus only on on-trend. In Forex, only these traders survive because they have gained experience over the years. They take the trade when the confirmation has been achieved that trend is continuing. They will sell when the prices hit lower and will buy when the prices have hit higher. This type of trading is based on the fact that after the price has moved up, more people will join the band and will keep on pushing the price. They will then enter the trend and continue until the last when the trend starts to reverse. It so happens that trend might get paused and after consolidation again picks up. Now in this situation, the perfect trend follower will exit half of his position and will trail with the other half till the trend has reversed. The technique also works in the downtrend.

Social Traders

These are some less known group of traders. Their emergence has been credited to the social networking groups and sites. New types of brokers and websites in the overseas markets are offering people to start and learn trading simply by following experts. It is a spoon-feeding programme. People open account with the brokerage and then they are given access to the dashboard where they can watch and follow Pro traders and their trades blindly without giving any thought to the reasons behind trades taken by these pros. The sites even mention that if any loss happens to these experts, the same loss could also happen to the people following them. Yet, still, people follow blindly and make a fool of themselves. Such type of trading has not picked up in India, however, but we can’t be sure of the future. These type of traders depend throughout their lives on others and cannot even trade on their own. What do you think they will achieve in Forex markets? Forex Trading is a challenging field and social trading is a laughable stuff in this market. Any comment, suggestion and feedback are welcome.

#nse#nseindia#nsecds#currency derivatives#forexindia#forex signals#forexstrategy#forexmarket#forex market in india#indiaforex

0 notes

Text

Best forex brokers in south Africa 2020

Best forex brokers in South Africa 2020

In South Africa, we are spoilt for choice, the best forex brokers in South Africa are easy to find. There is a huge list of best forex brokers in South Africa from around the world and South African citizens can register and trade with all of them. However, forex traders are strongly advised to stick to brokers regulated by a high authority regulator such as the Financial Services Conduct Authority of South Africa (FSCA) previously known as the Financial Services Board (FSB). Best forex brokers in South Africa; free below. There are many countries with such regulatory bodies and the top forex trading brokers are regulated with one or more of these. Regulation is the first consideration traders should take into account before choosing a broker. There are important aspects to consider before choosing the best forex trading brokers in South Africa. Many brokers appear very similar at first, but there are subtle differences, which make each broker uniquely suitable for a different type of trader. Best forex brokers in South Africa list is very vital. All of the following brokers are regulated and all of them offer demo accounts. These are the first prerequisites in narrowing the list down to the broker that is best for you. Risk Warning: Trading Forex and CFD is Risky; Your Capital is at Risk. Always remember that Forex trading is a risky business and you might win money or even lose all your money.

Top forex brokers in South Africa -

1. ForexTime (FXTM) (This is our recommended broker) ForexTime (FXTM) is a highly popular broker among South Africans as they are registered with our local FSCA regulator, so you can rest assured that your money is safe. ForexTime is one of the best forex brokers in South Africa. Also what’s great is that if you don’t have the usual $250 minimum deposit required by most brokers, FXTM has an account known as the cent account with a minimum deposit of only $5. Cent Account – Minimum Deposit $5 (+/- R80), Spreads from 1.5 Standard Account – Minimum Deposit $100 (+/- R1,400), Spreads from 1.3 To wrap it up they pretty much have all the bells & whistles as any other broker on this list, including Copy Trader a feature that allows traders to automatically copy professional traders. FXTM can truly be counted among the best forex brokers in South Africa. Here are the features of FXTM at a glance: Broker regulation South Africa - FSCA Mauritius – FSC United Kingdom – FCA Cyprus – CySEC Best forex brokers in South Africa should be regulated. Trading Platforms Metatrader 4 and WebTrade Mobile trading apps Best forex brokers in South Africa should have a diverse platform choice. Trading Instruments Currency Pairs (Forex trading) CFDs on Commodities CFDs on Indices Spot Metals Share CFDs Cryptocurrency CFDs Stock Trading Contract Specifications Best forex brokers in South Africa should have multiple instruments. Trading Tools FXTM Pivot Points Strategy FXTM Trading Signals FXTM Trader App Currency Converter MT4 Indicators Forex VPS Trading FXTM Invest Profit Calculator Best forex brokers in South Africa should have useful trading tools to assist you while trading. Social Trading Copy-trading (Copy trading involves copying trades of the best performing Forex traders without knowing how to trade and even doing any research – Let the experts do all the work for you). FXTM has a copy trading feature called FXTM Invest. Market Analysis Market Outlook Economic calendar Forex News Timeline Market Analysis Videos Market Analysis Team Trading Accounts Accoount Type Standard Account Cent Account Shares Account Trading Platforms MT4 / MT5 MetaTrader 4 MetaTrader 4 Account Currency USD / EUR / GBP / NGN US Cent / EU Cent / GBP Pence / NGN kobo USD / EUR / GBP / NGN Leverage Floating from 1:12000 Fixed from 1:1000 – 1.25 (FX), 1:500 – 1:25 (Spot Metals) Fixed leverage 1:10 for US Shares and 1:3 for European Shares Minimum Deposit 100 pounds 10 pounds 100 pounds Commission 0 0 0 Spread From 1.3 From 1.5 From 0.1 Deposit Methods by one of the best forex brokers in South Africa Bank Transfer Visa Mastercard Maestro Skrill Neteller Bitcoin Unionpay

2. Avatrade AvaTrade is well into its second decade of operation, boasting adherence to the regulatory requirements of more than 6 global regions – from North America through Europe and South Africa to Asia, including the hard-to-crack Chinese market. It is obviously one of the best forex brokers in South Africa. Their track record as one of the best forex brokers in South Africa is one no other online broker can attest to; each AvaTrade review speaks for itself, thanks to a corporate vision that emphasizes client satisfaction and a constant effort to answer each new need as it arises. Avatrade will always feature among the top forex brokers in South Africa. They are definitely one of the best forex brokers in South Africa. Here are the features of Avatrade at a glance: Broker regulation South Africa - FSCA Australia – ASIC British Virgin Islands – B.V.I FSC United Kingdom - FSA Best forex brokers in South Africa should be regulated. Trading Platforms Metatrader 4 and 5 WebTrader Mobile trading Mac Trading Best forex brokers in South Africa should have a diverse platform choice. Trading Instruments Currency Pairs (Forex trading) CFD trading (Commodities, ETF, Indices, Bonds and Treasury) Cryptocurrency CFDs Stock Trading Best forex brokers in South Africa should have multiple instruments. Trading Tools Trading Calculator AutoChartist (Automated technical analysis tool implemented on Metatrader 4 that identifies trading opportunities) Avaprotect (Available on the mobile app to protect your money for a certain period once a position has been opened) Best forex brokers in South Africa should have useful trading tools to assist you while trading. Social Trading DupliTrade is an MT4 compatible platform, which allows traders to automatically follow experienced traders’ signals and strategies in real-time. Its user-friendly interface makes it easy to build and manage a trading portfolio while gaining valuable insights on successful trading strategies. Market Analysis Financial Instruments information Economic calendar Market Analysis information Earnings releases Trading Accounts Accoount Type Professional Account Retail Trading Platforms MT4 / 5 MT4 / 5 Leverage Max. 400:1 Max. 400:1 Minimum Deposit 100 USD 100 USD Commission 0 0 Spread 1.3 pips 1.3 pips Deposit Methods from one of the best forex brokers in South Africa Bank Transfer Visa Mastercard POLI Skrill Neteller Paypal

3.ForexMart As your trusted Forex trading partner, ForexMart is highly committed to offering high-class trading software, giving exceptional trading experience, protecting your account against any fraudulent activity, and equipping you with comprehensive knowledge needed for successful trading. Among the best forex trading brokers in South Africa, meet ForexMart. They are definitely one of the best forex brokers in South Africa. Broker regulation Cyprus – CySEC Best forex brokers in South Africa should be regulated. Trading Platforms Metatrader 4 Best forex brokers in South Africa should have a diverse platform choice. Trading Instruments Currency Pairs (Forex trading) CFD on Shares Cryptocurrency CFDs Spot Metals Energy Indices Best forex brokers in South Africa should have multiple instruments. Trading Tools Economic calendar VPS Hosting Forex Calculator Best forex brokers in South Africa should have useful trading tools to assist you while trading. Social Trading Open a ForexMart account, verify it, and use a payment method you prefer to deposit your account. All personal data are stored and protected by using the latest encryption technology. Once inside the platform you may use the copy trading feature to copy the best traders’ forex strategies. Market Analysis Market Analysis information Economic news Trading Accounts Accoount Type Classic Pro Cents Zero Spread Scalping Trading Platforms MT4 MT4 MT4 MT4 MT4 Leverage Max. 500:1 Max. 500:1 Max. 500:1 Max. 500:1 Max. 500:1 Minimum Deposit 15 pounds 1000 pounds 15 pounds 1 pound 100 pounds Commission 0 0 0 0.02% - 0.07% 0 Spread Min. 1 pips. Average 1.2 pips Min. 0.6 pips Averge 0.8 pips Min. 1 pips Average 1.2 pips Min. 0 pips (fixed) Min. 0 pips Average 1.2 pips Deposit Methods from one of the best forex brokers in South Africa Bank Transfer Visa Mastercard Skrill Neteller Sofort 4. IQ Option How can we compile a list of the best forex brokers in South Africa, without IQ Option? IQ Option is one of the fastest growing online trading brands in the world. Voted the best mobile trading platform, they have now expanded their offerings to include CFDs on stocks and ETFs, Forex trading, and the exclusive IQOption product called Digital Options. First founded in 2013, IQ Option has grown massively, and now has over 40 million members and counting! The platform itself has also undergone some changes since 2013, and they are constantly working to ensure it is fast, accurate and easy to use. Although they do not have the Metatrader feature, IQ Options is also one of the best forex brokers in South Africa. Broker regulation Cyprus – CySEC Best forex brokers in South Africa should be regulated. Trading Platforms IQ Options platform – An advanced trading platform for Desktop Windows, Mac Operating system, Mobile app and the web interface. Best forex brokers in South Africa should have a diverse platform choice. Trading Instruments Currency Pairs (Forex trading) Stocks Cryptocurrency CFDs Options ETFs Best forex brokers in South Africa should have multiple instruments. Trading Tools Economic calendars Historical Quotes Trading Signals Islamic Account Tournaments Best forex brokers in South Africa should have useful trading tools to assist you while trading. Social Trading None. It does not have its own copy-trading feature. Market Analysis News feed Industries resources Trading Accounts Account Type Live Account Trading Platforms IQ Option Custom-made Leverage Max. 1000:1 Minimum Deposit 5 USD Commission 0 Spread Min. 1.1 pips Deposit Methods from one of the best forex brokers in South Africa Bank Transfer (Local banks: Capitec, FNB, ABSA, Nedbank, Standard Bank, Investec) Visa Mastercard Skrill Neteller WebMoney WMZ AstroPay Advcash Perfect Money

5. FxPro As a strong proponent of transparency, FxPro establish the highest standards of safety for our clients' funds. For this reason, client funds are kept in major international banks and are fully segregated from the company’s own funds. Ever since their establishment, FxPro has successfully expanded to serve retail and institutional clients in more than 170 countries - and are still growing. That is why FxPro is on of the best forex brokers in South Africa. Broker regulation Cyprus – CySEC United Kingdom – FCA South Africa – FSCA FxPro Global Markets Limited is authorised and regulated by the Securities Commission of The Bahamas Best forex brokers in South Africa should be regulated. Trading Platforms Metatrader 4 (MT4) Metatrader 5 (MT5) cTrader Best forex brokers in South Africa should have a diverse platform choice. Trading Instruments Currency Pairs (Forex trading) Futures Indices Shares Metals Energies Best forex brokers in South Africa should have multiple instruments. Trading Tools Economic calendars Forex tools Economic News Calculators Best forex brokers in South Africa should have useful trading tools to assist you while trading. Social Trading None. It does not have its own copy-trading feature. Market Analysis News feed Industries resources Trading Accounts FxPro has always been a keen supporter of transparency and fairness in the Forex industry, and it has made every effort to hard to eradicate conflicts of interest between broker and client. According to FxPro CEO, Charalambos Psimolophitis, “We provide our clients with not only superior educational resources and trading tools but also with a guarantee of their funds’ safety. In an industry where it is taken for granted that slippage almost always goes against the client, we are pleased to demonstrate that this is not in fact the case.” FxPro is committed to providing its clients with full trade reporting and support. In this regard, it posts its monthly slippage statistics right on the website. Traders can choose between instant execution and market execution a feature not made available by many other Forex brokers. They also offer advanced order-matching and execution technologies that are continuously upgraded. Deposit Methods from one of the best forex brokers in South Africa Bank Transfer Visa Mastercard Skrill Neteller UnionPay

6. FBS FBS is an international broker with more than 190 countries of presence. 14 000 000 traders and 370 000 partners have already chosen FBS as their preferred Forex company. To provide the best customer experience FBS organizes seminars and special events, providing its clients with training materials, cutting-edge trading technologies and the latest strategies on the Forex market. Both newbie and professional traders will find these sessions useful. Without a doubt, FBS is one of the best forex brokers in South Africa. Broker regulation Belize - IFSC Best forex brokers in South Africa should be regulated. Trading Platforms FBS Trader Metatrader 4 Metatrader 5 Best forex brokers in South Africa should have a diverse platform choice. Trading Instruments Currency Pairs (Forex trading) Metals CFD Stocks Forex Exotic Best forex brokers in South Africa should have multiple instruments. Trading Tools Economic calendars Traders' calculator Risk Management tools Alerts Best forex brokers in South Africa should have useful trading tools to assist you while trading. Social Trading FBS Copy Platform for both investors and traders Market Analysis Company news Forex News Daily Market Analysis Trading Accounts Accoount Type Standard Account Cent Account Micro Account Zero Spread ECN Account Trading Platforms MT4, MT5 and FBS Trader MT4, MT5 and FBS Trader MT4, MT5 and FBS Trader MT4, MT5 and FBS Trader MT4, MT5 and FBS Trader Account Currency USD USD USD USD USD Leverage Up to 1:3000 Up to 1:1000 Up to 1:3000 Up to 1:3000 Up to 1:500 Minimum Deposit 100 USD 1 USD 5 USD 500 USD 1000 USD Commission 0 0 0 0 0 Spread From 0.5 pips From 1 pip From 3 pips 0 pip From 1 pip Deposit Methods from one of the best forex brokers in South Africa Visa Neteller Sticpay Skrill Perfect Money Bitwallet Local exchangers

7. AxiTrader AxiTrader was founded in 2007 on a simple idea: be the broker we’d want to trade with. Since then, we've grown from a two person startup into a global business servicing tens of thousands of traders in more than 100 countries. AxiTrader can be counted among the best forex brokers in South Africa. Broker regulation The United Kingdom - FCA Australia - ASIC Dubai - DFSA Best forex brokers in South Africa should be regulated. Trading Platforms Metatrader 4 Webtrader Metatrader 4 AxiOne Best forex brokers in South Africa should have a diverse platform choice. Trading Instruments Currency Pairs (Forex trading) Indices CFD Commodities Oil Gold and Silver Crypto Best forex brokers in South Africa should have multiple instruments. Trading Tools Signal Providers MT4 VPS Hosting AutoChartist Economic calendar Best forex brokers in South Africa should have useful trading tools to assist you while trading. Social Trading PsQuation is a social trading feature used by FBS; were traders can follow leading strategies. Market Analysis Company news Forex News Daily Market Analysis Trading Accounts STANDARD ACCOUNT PRO ACCOUNT Setup cost Free Free Spreads From 0.4 pips From 0.0 pips Commission None $7 round trip (USD) Minimum Trade Size 0.01 lots 0.01 lots Minimum deposit $0 $0 Products 140+ FX pairs, Metals CFDs 140+ FX pairs, Metals CFDs Pricing 5 digit pricing 5 digit pricing Mobile trading Yes Yes MT4 NextGen Yes Yes Margin/Leverage Up to 500:1 Up to 500:1 Base account currencies AUD, CAD, CHF, EUR, GBP, HKD, JPY, NZD, SGD, USD AUD, CAD, CHF, EUR, GBP, HKD, JPY, NZD, SGD, USD Demo period 30 days 30 days EA compatibility Yes Yes VPS Free** Free** Autochartist Free Free myfxbook Autotrade Free Free PsyQuation Free Free PsyQuation Premium Free Free Deposit Methods from one of the best forex brokers in South Africa Visa Mastercard Neteller Skrill Bank Transfer BPay China Union Pay WeChat Bank Wire POLI