#tips to buy a home

Explore tagged Tumblr posts

Text

I started making a notebook for my recipes and im so happy

Instead of having recipes that i like scattered everywhere (flying paper, websites, instagram, some random to do list notebook, my phone) i'll have them in a single place and i can add over time

#also i reaaally like notebooks but i fear using them bc i mostly write dumb shit#but !!!for this ??? nooo im using the really pretty notebook i got for my birthday a few years ago#and once i have a few written i'll even buy some highlighters to make a color code#like main/dessert/tips/starters#also ! it'll be easy to transport so if there is a possibility that i cook somewhere i'll just bring it#no more 'ah fuck i have a great recipe for nutella filled financiers but it's at home'#eno's dumb little posts

8 notes

·

View notes

Text

I mean sure tipping merch sellers at concert seems crazy but y’all really don’t know what goes into it.

We show up at 11am-1pm, count thousands of shirts (in the heat and sun for outdoor venues). Sort through them all and make them presentable for customers. Then when the venue opens we sell the shirts while also keeping everything stocked. Then at the end of the show we count out any shirts that are left (usually a lot) and then finally head home at 11pm-3am. And on top of this we make less than minimum wage because we make tips.

Like yeah, the conditions shouldn’t be like that and we should get paid wayyy more but we all know that’s never gonna happen

#point is we don’t just show up and sell and go home#I’ve worked 8 am to 2 am days#and all I crave is that you tip a buck when you buy a shirt at a concert you paid 500 to go to#welcome to the shitshow

8 notes

·

View notes

Text

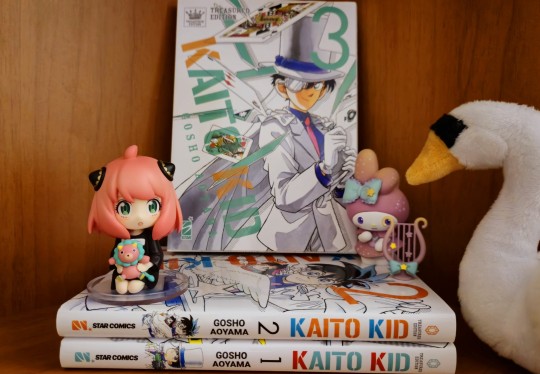

went to milan last week and brought back some italian little guys :D

#and a little birb bc i've never seen a swan plush before so i had to take it home as well 👀#(normal things to buy when abroad hsjks)#alright but manga in italy is so RIDICULOUSLY inexpensive#i mean. yeah they're in italian and i'll have to rely on the power of the mutually understandable latin languages family#but still. wow?? great place. pretty buildings. amazing food. so many people. extreme heat. is that a bookstore? wonder where the manga is.#oh upstairs? oh there's an ENTIRE floor with endless manga?? RARE manga appears to be mainstream here???#IS THAT THE LEGENDARY NON-EXISTENT KAITO KID PHYSICAL MANGA HOLD ON#<- next thing i know i'm out of the store in a daze#checking to see how much it cost bc who on earth checks the price first when it's THE KID MANGA IN THE FLESH (paper?)#and i gasp out loud bc i got THREE volumes - that i frankly never even thought i'd ever see - at a price that here would buy 1 (one)#though interestingly enough i didn't spot a trace of bsd in any of the stores 🤔#also mystery boxes seem to be a thing? of course i had to try my luck as well - first sxf merch in the bag :D#and my melo even though i know next to nothing about the sanrio characters-#but well. in the spirit of jochum i think of them as the honorary internationally-available cousins#last but not least thank you kyotag for the travel tips and tricks! much appreciated. beautiful country. my camera roll is screaming

9 notes

·

View notes

Text

Master the Art of Home Staging: Tips to Wow Buyers and Sell Fast

Home staging has become an essential part of the selling process in real estate. By showcasing your home in its best light, you can attract more buyers and sell your property faster. In this article, we will provide you with valuable tips and insights on mastering the art of home staging to wow buyers and sell fast. Section 1: Understanding the Importance of Home Staging Home staging is the…

#benefits of owning rental property#Best real estate investment opportunities#current real estate market trends#finding the right real estate agent#guide to property management.#home staging tips for sellers#how to sell your property fast#navigating the home buying process#real estate financing options#real estate investment strategies#real estate market analysis#tips for buying a home#top cities for real estate investment#trends in commercial real estate#understanding property valuation

2 notes

·

View notes

Text

pls pls pls if I get this job i will be able to actually save to get back to my cityyyyy

#im starting at 24.75#premium if i take shit shifts. i will take shit shifts#my goal of getting back in late 2026 may still happen#possibly even buying a home if i can save enough#if i get the non weekend shift i can still work at the bowling alley and make good tips#thinking about selling prints of my photography too....#pls pls pls let my life come together

6 notes

·

View notes

Text

i am buying a house, and (maybe) you can too!

so... you want to buy a house, but you don't make a lot of money and you have no way to save up the recommended 10% recommended downpayment on a mortgage, which means you're basically going to be stuck renting forever, right?

well... actually, maybe not!

this post is going to be very US-centric, so i cannot speak to the homebuying experience in other countries, but if you live in the united states... you might be able to buy a house for much less up front than you might think!

this is gonna get long, but the main things you'll need are:

a credit score in the low- to mid-600s. this can vary by program, but most down payment assistance programs require somewhere between a 620 and 660. (i might make a second post at some point about credit scores bc fixing my credit score was a long and arduous process.)

enough in savings to cover a few up-front expenses. there are a couple of things that the down payment assistance programs won't cover. for me, we ended up having to pay ~$1500 up front total, which - to put it in perspective - is less than the deposit and move-in fees were going to be at most apartments in our area.

that's basically it! if you can do those two things, you might be able to buy a house!

let's talk about the details.

programs vary by state, but most states have down payment assistance programs of one kind or another. there's also a federal USDA loan program which is $0 down as well, but is only available in rural areas.

these programs WILL usually require you to have a certain credit score, usually somewhere in the 600s. (the particular program my housemates and i are using requires a minimum 640, but some require a higher or lower credit score than that.)

usually your first step is speak to a mortgage lender. the mortgage lender i'm working with is only available in the state of tennessee and not all mortgage companies accept all down payment assistance options, so i would research options in your state and then check to see if the programs have a list of preferred lenders and/or loan officers.

this sounds scary, but my loan officer has been a life-saver during this process. generally your loan officer wants to help you succeed, particularly when they know you're a first time home owner. tell your loan officer that you're going to be a first time home owner and you're interested in a $0 down payment program. they can run the numbers and see if you qualify, and if so, how much you can qualify for.

you can have multiple people on the mortgage with you, but everyone on the mortgage has to meet the credit score requirement.

if you do qualify, also talk to your loan officer about how much you can pay per month for a mortgage, too, since this might also impact what price range you're shopping in.

you'll also want a real estate agent. (trust me on this. you want a real estate agent.) my loan officer recommended a real estate agent to me and we quite literally could not have done this without him. your real estate agent does a lot more than just help you find houses to look at. they will also point out things that you might not know to look for and will also help negotiate with the seller for you.

when you talk to your real estate agent, tell them you are using a down payment assistance program and that you will need the seller to cover your closing costs. closing costs, for reference, are a bunch of small expenses that are paid when you officially sign the mortgage. typically both the buyer and the seller have separate closing costs, but it's fairly normal for buyers to ask the seller to pay for their closing costs for them in the current market. your real estate agent can then negotiate for this for you.

if the seller covers your closing costs and you can get approved for down payment assistance, there are only three things you will probably have to pay for out of pocket:

"earnest money." this is a small sum of money you pay to hold the house after the seller accepts your bid. (in our case, we paid $500 for our earnest money.)

the home inspection. our home inspection was also about $500, though the price of this could vary based on where you live.

the home appraisal. for us this was also about $500, though again, this could vary based on where you live.

and that's basically it! obviously talk with your loan officer and real estate agent about the cost of these things bc they might not be the same cost for you as they were for me, but for us, this ended up actually being cheaper than moving into a new apartment!

#i might try to write up some tips on improving your credit at some point too?#obviously i'm not a professional and this is just information based on my experience#but also six months ago we had NO IDEA that buying a home was even an option#and we were looking at trying to rent a house#and honestly... the credit score requirement on the mortgage was about the same as the credit score requirement for most of the rentals her#i don't know what to tag this as lmao#briar.txt

5 notes

·

View notes

Text

Have you ever wondered about the key differences between investing and buying a home? 🏠#RealEstate

Have you ever wondered about the key differences between investing and buying a home? 🏠💰 Keep in mind investment potential, financing strategies, and thorough market research for success!

#Investing vs Buying a Home#Home Investment Tips#Real Estate Investment vs Home Buying#Home Buying Strategies#Real Estate Investing#Investment Potential in Real Estate#Financing a Home#Home vs Investment Property#Real Estate Market Research#Buying a House or Investing#Home Buying vs Real Estate Investment#Investment Property Tips#Real Estate Success Strategies#Investment Property Financing#Real Estate Market Tips

2 notes

·

View notes

Text

youtube

Discover the Long Beach Advantage with David Goodwin and Andyan Carter Group

🌈 Unlock the Best of Long Beach Real Estate with Our New Team Member 🌈

Hey everyone! We’ve got some fantastic news to share – David Goodwin is joining forces with the Andyan Carter Group, and we’re buzzing with excitement about what this means for you! If you’re looking to buy or invest in Long Beach, this is an opportunity you won’t want to miss.

David and I have been dreaming of this collaboration for years. Our shared background in Long Beach – from our childhood adventures in Naples to our deep knowledge of the local landscape – brings a unique perspective to our real estate services. Our connection to this community isn’t just a professional asset; it’s a personal passion that drives us to offer the best possible service to our clients. 🌟

Long Beach is a city full of character, with each neighborhood offering something different. Whether it’s the charming streets of Naples, the vibrant community events, or the serene parks, we know every detail. David’s extensive local experience means he can provide insights into every aspect of the area, from school ratings to local hotspots. This personalized approach ensures that you find a property that perfectly fits your needs and lifestyle. 🏘️

When you work with us, you’re not just getting a real estate agent – you’re getting a team that genuinely cares about your journey. We’ll take you on a tour of the neighborhoods, show you around, and help you understand what makes each area unique. Our goal is to make your search as enjoyable and stress-free as possible. 📍

Excited to start your real estate adventure with us? Reach out today, and let’s find your perfect home together. With David on our team, we’re more equipped than ever to help you achieve your real estate goals!

#LongBeachRealEstate #DavidGoodwin #AndyanCarterGroup #LocalExperts #HomeBuying #RealEstateJourney #NeighborhoodTours

#Long Beach real estate#local real estate experts#David Goodwin real estate#Andyan Carter Group#Long Beach property search#neighborhood tours Long Beach#buying a home Long Beach#Long Beach investment properties#local property knowledge#Long Beach neighborhoods#real estate team Long Beach#property investment tips#Long Beach real estate agent#Naples Long Beach real estate#personalized real estate service#Long Beach home buying guide#Long Beach local experts#real estate market Long Beach#home search Long Beach#Long Beach real estate advice#Youtube

2 notes

·

View notes

Text

What Does The Real Estate Market Look Like Currently?

As we dive into the third quarter of 2023, it’s a perfect moment to reflect on the housing market’s journey so far this year and project what lies ahead. The real estate landscape has been marked by some notable shifts, and understanding these trends can help both homebuyers and sellers make informed decisions in the coming months. The second quarter of the year saw a significant rise in…

View On WordPress

#2023#Buying#Guide#Home#Homebuyer#Housing#Investment#Market#marketing#Mortgage#Real Estate#Selling#Shawn Boday#Staging#tips

3 notes

·

View notes

Text

the miniature council passes a judge(☆)ment

#aka ‘just because there’s a discount doesn’t mean you should buy something: the musical’#no clue why i bought this tbh. my bad financial decisions ✨never✨ cease#thank goodness it came when neither of my family members were home… the judgement would be worse frrrrr#g od don’t ask me how much lxl merch i have i lost count a g e s ago—#at least it’s not breaking the bank or anything but u m—#anyways. uh. don’t ever ask me for financial tips. i mean it ಥ‿ಥ#but m an. looking at my plushies kinda makes me wanna go to the pkm centre again… i have a n e e d for more jigglypuff and goomy plushies aa#t though. the goomy earrings are kinda tempting too ngl. they’re so cuteeeeeeeeeeee#i should really go to the airport again soonnnnnnnnnnnnn i hope the actual store has better deals than the app a h e m—#though. i kinda regret not getting the gigantic wailord plush when the preorders were still up… it looked so cuteeeeeee#not like i even have space for it or anything but st i l l~~~~~~~~~~

6 notes

·

View notes

Text

caught myself thinking "i wish there was a way i could just go somewhere and see how these mice/keyboards feel" during my latest round of scrolling through websites trying to decide on what to buy (currently using the tried-and-true 'mouse and keyboard i got for free from family because they just need to Function') and then realized i had just described a Store. a Physical Location.

#lucy's thoughts#me: i just want to try out typing on keyboards which will not cost me money to try#the best buy closest to my home: oh you want to try six membrane keyboards that all feel the same?#where's the option in all these review listacles for 'pc keyboard that most closely resembles a macbook keyboard'?#also why are they all so obsessed with being quiet. i want them clicky and satisfying#the mouse i just want to be big enough that my hand makes contact with it instead of me resting the tips of my fingers on the buttons#and nothing else#but i'm so fucking picky about aesthetics :/#this is the exact same problem i am having with trying to buy a car

2 notes

·

View notes

Text

It's time to give the house a deep cleaning, but you don't know where to start? We have a step-by-step routine that can help get you on your way!

#house cleaning#cleaning tips#spring cleaning#weekly reset#ottawahomesforsale#ottawa realtor#ottawa home buying#kw#yow

2 notes

·

View notes

Text

Your Home Buying Journey Starts with the Right Agent

Buying a home is one of life’s biggest milestones, and having the right real estate agent by your side can make all the difference. A great agent helps you navigate the market, negotiate the best deal, and ensure a smooth buying process. Whether you’re a first-time homebuyer or a seasoned investor, choosing the right professional is the first step toward finding your dream home.

1. Why a Real Estate Agent Matters

A real estate agent is more than just a guide — they’re your advocate in the home-buying process. Their expertise ensures that you:

✔️ Get access to the latest listings ✔️ Avoid overpaying for a property ✔️ Understand market trends and pricing ✔️ Navigate the paperwork and legal steps

Working with an experienced agent saves time, money, and stress, making your home purchase a seamless experience.

2. What to Look for in a Real Estate Agent

Not all agents are the same, so it’s important to find one that fits your needs. Consider these key qualities:

✔️ Local Market Knowledge — They should know the area, neighborhoods, and market trends. ✔️ Strong Negotiation Skills — A good agent will help you get the best deal. ✔️ Great Communication — They should keep you informed and answer your questions promptly. ✔️ Proven Experience — Check their track record with buyers similar to you. ✔️ Trustworthiness — You need an agent who prioritizes your needs over making a quick sale.

3. How to Find the Right Agent for You

Finding the right agent takes a little research, but it’s well worth the effort. Here’s how to start:

🔹 Ask for Recommendations — Friends, family, and colleagues may know great agents. 🔹 Read Online Reviews — Check Google, Zillow, or Realtor.com for client feedback. 🔹 Interview Multiple Agents — Ask about their experience, process, and availability. 🔹 Check Credentials — Ensure they are licensed and have relevant certifications. 🔹 Assess Their Communication Style — Make sure they respond quickly and understand your needs.

Taking the time to vet agents ensures you find the right fit for your home-buying journey.

4. How a Real Estate Agent Helps You Navigate the Process

From start to finish, an agent provides valuable support and expertise at every step:

🏡 Step 1: Understanding Your Needs — They help clarify what you’re looking for in a home. 🏡 Step 2: Finding the Right Property — They show you listings that match your criteria. 🏡 Step 3: Making an Offer — They guide you in crafting a competitive yet reasonable offer. 🏡 Step 4: Handling Negotiations — They work on your behalf to secure the best price and terms. 🏡 Step 5: Managing Inspections & Appraisals — They help ensure the home is a solid investment. 🏡 Step 6: Closing the Deal — They assist with paperwork and finalizing the purchase.

With a trusted agent, you’ll avoid costly mistakes and feel confident in your decision.

Click here to read more.

#real estate agent#home buying guide#choosing a realtor#buying a home#real estate tips#first-time homebuyer#best real estate agent#home search

0 notes

Text

I Wish I Knew This Before Buying My First Home!

Buying your first home is one of the most exciting yet daunting experiences in life. It’s a mix of emotions—joy, anxiety, hope, and sometimes, even regret (if you don’t plan well). As someone who’s been through the process, I can tell you that there are a few things I wish I knew before I signed on the dotted line. If you’re thinking about buying your first home, here are some honest, real-life lessons that might save you time, money, and a lot of stress.

1. Your Budget is Your Best Friend (and Worst Enemy)

It’s so easy to fall in love with a home that’s way out of your budget. I’ve been there—staring at a beautiful villa or a luxurious apartment, dreaming about how perfect it would be. But here’s the truth: sticking to a realistic budget is crucial. Don’t forget to factor in hidden costs like maintenance, property taxes, and unexpected repairs. And yes, always have an emergency fund—because life happens.

2. Location Isn’t Just About Convenience

I learned this the hard way. A great location isn’t just about being close to work or having a mall nearby. Think about long-term factors like future development, school districts, and even the vibe of the neighborhood. A good location today can mean a great investment tomorrow. For example, when I bought my first home, I didn’t consider the future growth potential of the area, and I missed out on some serious appreciation.

3. Builders Aren’t All the Same

Not all builders are created equal. Some promise the moon but deliver… well, not even close. Do your homework. Check their track record, visit their previous projects, and talk to people who’ve bought from them. A reliable builder can make all the difference. I wish I had done more research on my builder—it would have saved me a lot of headaches later.

4. Ask Questions—Even the ‘Silly’ Ones

I used to feel awkward asking too many questions, but now I realize there’s no such thing as a silly question when it comes to buying a home. Is the property RERA-registered? What’s the payment schedule? What’s included in the maintenance charges? Ask everything. Your future self will thank you. Trust me, I learned this the hard way.

5. The Paperwork is a Big Deal

I’ll admit, I skimmed through some documents during my first purchase. Big mistake. Legal paperwork like the Title Deed, Encumbrance Certificate, and Property Tax Receipts are non-negotiable. Get a real estate lawyer to double-check everything. It’s worth the investment. I can’t stress this enough—proper documentation can save you from legal nightmares down the road.

6. Patience is Key

Buying a home isn’t a race. Take your time, do your research, and don’t rush into a decision just because everyone around you is buying. Your dream home is worth the wait. I rushed into my first purchase, and while it turned out okay, I could have made a better decision if I had been more patient.

Final Thoughts

If you’re in Chennai and looking for a trusted builder, ASN Housing offers beautiful 2 BHK and 3 BHK apartments in Chromepet. I wish I had known about them sooner—they make the process so much smoother!

What’s the one thing you wish you knew before buying your first home? Or if you’re still in the process, what’s your biggest worry? Let’s chat in the comments below!

#buy a flat in chennai#luxury apartments#real estate investment#residential property#home buyers tips#first time buyers#buying a home in Chennai

0 notes

Text

What Does The Real Estate Market Look Like Currently?

As we dive into the third quarter of 2023, it's a perfect moment to reflect on the housing market's journey so far this year and project what lies ahead. The real estate landscape has been marked by some notable shifts, and understanding these trends can help both homebuyers and sellers make informed decisions in the coming months.

The second quarter of the year saw a significant rise in mortgage interest rates. Starting at 6.32 percent in early April, the average 30-year mortgage loan rate climbed to 6.84 percent by late June. Alongside this, the national median home price rose from $375,400 in March to $396,100 by May. These changes in rates and prices have set the stage for an intriguing Q3.

Experts are cautiously optimistic about the upcoming quarter. Despite traditionally buoyant summer months for real estate, Q2's elevated rates led to a somewhat subdued environment. The ongoing challenge remains a severe shortage of housing inventory, with new listings for sale hovering around 25-30 percent below last year's levels. This scarcity of homes, coupled with higher mortgage rates, suggests that the third quarter of 2023 might not witness robust home-buying activity.

Mortgage interest rates, a pivotal factor, are projected to remain within the 6.4 to 6.7 percent range for a 30-year fixed mortgage, according to financial analysts. While recent data suggests that inflation may ease in the coming months, leading to a potential drop in mortgage rates, the predictions vary. Some experts believe rates could even dip below 6.5 percent, while others expect them to hover around 6.75 percent initially and eventually decline toward 6.0 percent by September.

The lack of housing inventory will continue to exert pressure on home prices throughout Q3. Buyers may encounter fierce competition, with a higher percentage of homes selling above the asking price. While home price growth is predicted to average around 4 percent this year, median home prices are anticipated to slightly decrease, settling around $385,000 in Q3.

For potential homebuyers, the current market presents affordability challenges. High home prices combined with elevated mortgage rates mean careful consideration is essential before making a purchase. Experts advise potential buyers to ensure job stability and steady earnings before committing to a home transaction.

On the flip side, sellers continue to have the upper hand in many markets due to tight inventory levels. However, sellers should weigh the benefits of selling against the potential challenge of finding a new home in a market with elevated rates. The decision to sell should take into account the balance between current low mortgage rates and potentially higher ones in the future.

The real estate market in the third quarter of 2023 promises a mix of challenges and opportunities. While the housing shortage and increased mortgage rates pose hurdles, the potential for stabilized or slightly reduced home prices may provide some respite for both buyers and sellers. As you navigate this complex landscape, remember that careful consideration and expert guidance are essential to make the right decisions for your unique circumstances.

#Real Estate#Home#Buying#Selling#Staging#Marketing#Guide#Tips#Shawn Boday#Market#Investment#2023#Real Estate Market#Forecast#Interest#Mortgage

2 notes

·

View notes

Text

Why Hiring a Building Inspector for Your Narre Warren Property is Essential

Narre Warren, a rapidly growing suburb in eastern Melbourne, offers a range of properties for potential buyers, from first homes to investment opportunities. However, navigating the property market comes with its challenges, and one key consideration is ensuring the property you purchase is in high standard condition. This is where hiring a building inspector becomes crucial. A building inspector’s expertise can help you avoid costly surprises and ensure you're making a sound investment.

What Does a Building Inspector Do?

A building inspector is like a detective for properties, trained to spot issues that may not be visible to the untrained eye. They examine the property from top to bottom—inspecting the structure, plumbing, electrical systems, and more. Their goal is to identify any hidden problems that could lead to expensive repairs or future headaches. Whether you're buying a residential home or a commercial property, the inspector ensures that the property’s structure is sound and safe.

Why is it Important to Hire a Building Inspector?

Uncover Hidden Issues: When viewing a property, it’s easy to fall in love with the decor or location, but that doesn’t always mean the property is in perfect condition. A building inspector will look for hidden problems, such as cracks in the foundation, roof damage, or plumbing issues, that could be overlooked by an untrained eye. Identifying these problems before purchase means you can avoid unexpected repairs down the line.

Save Money in the Long Run: Some property issues, like structural damage or faulty wiring, can be expensive to fix. A pre-purchase building inspection gives you the opportunity to either walk away from a deal or negotiate with the seller for a better price. You can also request the seller to fix these issues before you move in, saving you the cost of repairs.

Peace of Mind: Purchasing a home is a major financial commitment, often accompanied by excitement and anxiety. Having a building inspector assess the property gives you peace of mind, knowing that you're making a sound investment. You'll have a clear understanding of any hidden issues, which allows you to make informed decisions without the worry of unexpected problems later.

Make an Educated Decision: The purpose of a building inspector is to provide you with detailed, factual information about the property. Instead of relying on gut instincts, you’ll have a thorough report on the condition of the home. This information empowers you to decide whether to proceed with the purchase, request repairs, or walk away from the deal entirely.

What’s Involved in a Pre-Purchase Building Inspection?

A pre-purchase building inspection is typically conducted before you sign a contract or make a formal offer, allowing you to assess the property’s condition beforehand. The inspector will carefully examine both the interior and exterior, including:

Structural Integrity: The foundation, walls, roof, and floors are checked for damage or instability. Cracks or uneven floors may indicate deeper structural issues.

Roof and Gutters: Roof repairs are costly, so the inspector looks for missing tiles, leaks, and wear and tear. Gutters are also examined to ensure they’re functioning properly and don’t cause water damage.

Plumbing and Electrical Systems: The inspector checks for leaks, water damage, and faulty plumbing. They’ll also inspect the electrical systems to ensure everything meets safety standards and there are no fire hazards.

Pest Infestations: The inspector will look for signs of termites or other pests that could damage the property, such as evidence on wooden beams or roofing.

General Wear and Tear: While cosmetic flaws like worn flooring or damaged windows might not be deal-breakers, these are also noted for negotiation purposes or future repairs.

Final Thoughts

Hiring a building inspector in Narre Warren is a wise investment that can uncover hidden issues, save you money, and give you confidence in your decision-making process. A pre-purchase inspection helps you protect your investment and provides peace of mind, ensuring you’re not caught off guard by future problems.

Before committing to a property, make sure to have a professional building inspector by your side. It’s one step you’ll be glad you took.

#Narre Warren property#building inspector Narre Warren#buying property Narre Warren#property inspection tips#first home inspection

0 notes