#then fleets of autonomous trucks

Explore tagged Tumblr posts

Photo

#this is what i believe in#sorta related i was reading an article a few weeks ago#where they discussed the idea of using dirigible drones to load and unload cargo ships off the coast#instead of waiting for them to enter port#at least partly#i just love airships and i'm hoping they make a comeback#also on a related note i'm just really excited to see how automation/robotics changes logistics#things are about to get really efficient#logistics have largely been the same for like a century#we're about to witness a supply chain revolution#and at all levels of the supply chain#just imagine#autonomous cargo ships unloading at autonomous ports#ships waiting in line are unloaded by drones#then fleets of autonomous trucks#and revitalized trains#then smaller drones to directly deliver packages from stores/warehouses to consumers

6 notes

·

View notes

Text

Top Trucking Industry Trends of 2024: Adapting to a New Era of Innovation and Challenges

The trucking industry is experiencing significant changes, driven by advancements in technology, economic pressures, and environmental concerns. One of the biggest trends is the adoption of electric trucks. Many companies are feeling the push to reduce carbon emissions and meet sustainability goals. Electric trucks, while expensive upfront, are being seen as long-term investments due to lower…

View On WordPress

#AI in trucking#alternative fuels#autonomous trucks#business#cash flow management#driver retention#driver shortage#Electric Trucks#electric vehicles#fleet management#fleet safety#Freight#freight industry#freight management#Freight Revenue Consultants#fuel optimization#gig economy drivers#logistics#logistics technology#rising fuel costs#small carriers#smart trucks#sustainability in trucking#Transportation#Trucking#trucking analytics#trucking automation#trucking cybersecurity#trucking data#trucking industry

1 note

·

View note

Text

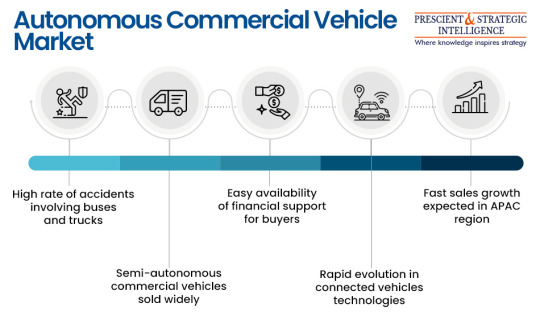

Driving the Future: Autonomous Commercial Vehicle Market Revolution

The autonomous commercial vehicle market is experiencing growth and is projected to reach USD 1,302.1 billion by 2030. This development can be ascribed to the continuing development in commercial vehicle technologies, growing government aid for autonomous commercial cars, and rising requirement for effective advantages and well-organized and safer driving options.

In recent years, the semi-autonomous category, on the basis of vehicle autonomy, contributed a higher revenue share. Vehicles must be fortified with electronic stability control or at least one of the progressive driver-assistance system ADAS features (either for steering or acceleration) to attain level 1 automation. Most of the European nations and the U.S. have forced the acceptance of basic ADAS features in all new commercial vehicles, which essentially makes all of them semi-autonomous.

In recent years, the truck category held the larger market share, and the category is projected to remain dominant in the vehicle type segment of the industry during the projection period. This can be credited to the growing utilization of autonomous trucks for logistical processes, like domestic logistics transportation, automated material handling, logistics digitalization, and yard management.

In the coming few years, on the basis of the application segment, the public transportation category is projected to advance at the fastest rate. This can be credited to the rising acceptance of autonomous shuttle facilities for public mobility reasons. Numerous start-ups and recognized businesses are coming up with strategies to grow level 5 autonomous shuttles for public transport. Such shuttles will not need human drivers for the process, which will aid transportation agencies save on working prices.

In the past few years, the North American region dominated the industry with the highest revenue for the autonomous commercial vehicle market, and the region is also projected to remain in the top spot during the projection period. This can be mainly credited to the increasing research and development activities on autonomous automobiles and growing aid from the federal and state governments for advancing autonomous driving technologies.

The APAC region is projected to witness the fastest development because of the booming vehicle industry here. APAC is the globe's largest vehicle maker, responsible for almost half of the annual production.

Hence, the continuing development in commercial vehicle technologies, growing government aid for autonomous commercial cars, and rising requirement for effective advantages are the major factors propelling the market.

#Autonomous Commercial Vehicles#Self-Driving Trucks#Logistics Automation#Transportation Industry#Freight Efficiency#Connectivity Solutions#Driverless Technology#Market Trends#Fleet Management#Autonomous Delivery#Truck Platooning#Market Players#Freight Transportation#Urban Mobility#Automation Innovation#Autonomous Trucking#Safety Systems#AI-driven Logistics#Long-Haul Trucking#Commercial Vehicle Automation

0 notes

Text

there’s a company operating a fleet of fully autonomous taxis with no human driver in san francisco and one of them hit a fire truck and another got stuck in wet concrete. so it’s not going great over there

7 notes

·

View notes

Text

Automotive Intelligent Tire Market

Automotive Intelligent Tires Market Size, Share, Trends: Continental AG Leads

Smart Tires with Integrated Sensors and AI Capabilities Gain Traction in the Automotive Sector

Market Overview:

The Automotive Intelligent Tires Market is expected to develop at a XX% CAGR from 2024 to 2031. The market value is estimated to reach USD XX billion in 2024 and USD YY billion in 2031. Asia-Pacific is expected to lead the market throughout the projection period. Key metrics include increased car production, rising demand for sophisticated safety features, and increased use of IoT in automotive applications.

The market for automotive intelligent tires is expanding rapidly, owing to a growing emphasis on vehicle safety, fuel efficiency, and performance enhancement. The integration of sensors and communication technology in tires is transforming the automobile industry, allowing for real-time monitoring and data analysis to improve vehicle management and maintenance.

DOWNLOAD FREE SAMPLE

Market Trends:

The automotive intelligent tire industry is seeing a substantial increase in the integration of modern sensors and artificial intelligence (AI) capabilities. These smart tires include embedded sensors that continuously monitor tire pressure, temperature, tread wear, and driving conditions. The obtained data is subsequently evaluated by AI algorithms, which provide real-time insights and predictive maintenance recommendations.

The growing desire for greater safety features, improved fuel efficiency, and optimised vehicle performance is driving this trend. Automotive manufacturers are working with tire firms to create intelligent tire systems that can connect with vehicle control systems, allowing for proactive modifications and improved overall vehicle management. As autonomous and connected car technologies improve, so will the use of these smart tires, generating new prospects for market growth and innovation in the automotive sector.

Market Segmentation:

The Tire Pressure Monitoring System (TPMS) category has emerged as the dominant technology in the automotive intelligent tires market, owing to regulatory requirements and its vital role in improving vehicle safety and efficiency. TPMS technology continuously monitors tire pressure and informs drivers of potential problems, thereby reducing accidents caused by underinflated or overinflated tires. According to the National Highway Traffic Safety Administration (NHTSA), TPMS-equipped vehicles are 55.6% less likely to have significantly underinflated tires. This considerable safety enhancement has resulted in widespread deployment across multiple vehicle types.

In recent years, developments in TPMS technology have strengthened its market position. For example, in 2021, Continental AG debuted its Intelligent Tire System, which integrates TPMS with additional sensors to monitor temperature, tread depth, and tire load. This technology provides a full view of tire health, allowing for predictive maintenance and improved vehicle performance. Similarly, Bridgestone Corporation debuted its Bridgestone Connect smart tire solution in 2022, which employs advanced algorithms to analyse TPMS data and provide fleet managers with actionable insights, thereby enhancing operating efficiency and lowering maintenance costs. Intelligent TPMS technologies have grown in popularity, particularly in the commercial vehicle category. Fleet operators are rapidly recognising the benefits of real-time tire monitoring for lowering fuel usage and reducing vehicle downtime. According to an American Trucking Associations (ATA) study, appropriate tire inflation can increase fuel efficiency by up to 3%, saving large fleets a significant amount of money. This has resulted in agreements between tire producers and telemetry companies to create integrated fleet management systems. For example, in 2023, Goodyear Tire & Rubber Company cooperated with ZF Group to develop an intelligent tire management system specifically built for commercial vehicles, which fuelled the growth of the TPMS segment in the automotive intelligent tires market.

Market Key Players:

Continental AG

Bridgestone Corporation

Michelin

The Goodyear Tire & Rubber Company

Pirelli & C. S.p.A.

Sumitomo Rubber Industries, Ltd.

Contact Us:

Name: Hari Krishna

Email us: [email protected]

Website: https://aurorawaveintellects.com/

0 notes

Text

Connected Logistics Market Poised for Significant Growth, Projected to Reach $73.4 Billion by 2033

The linked Connected logistics industry is expected to reach a valuation of $24.6 billion in 2023 and $73.4 billion in 2033. Over the projected period, connected logistics sales are expected to grow at an 11.5% CAGR.

IoT-enabled linked logistics solutions are expected to replace conventional transportation techniques, according to the connected logistics industry trend.Rising fuel prices and related environmental problems like pollution and carbon emissions shape the market trend.

The use of sensors, cloud computing, and automated procedures is common for the remote monitoring and management of supply chain operations. It also provides thorough comprehension of network issues, enabling quick and efficient decision-making.

Improved supply chain visibility leads to long-term cost savings, necessitating the use of IoT-enabled solutions in a variety of industries, including manufacturing, transportation, and automotive.

It is expected that the target market will benefit from the increased adoption of Logistics 4.0 and ongoing work on improving autonomous logistics trucks.

One of the factors fueling the market growth is the decreasing cost of loT sensors and connected logistics hardware. However, rising security and safety concerns in the logistics sector limit the market’s growth to some extent.

Key Takeaways:

Asset tracking is the top priority for the players which is leading the devices segment towards a strong growth of 12.5%. Organizations can collect massive amounts of data during the shipping and transit processes by incorporating RFID chips and IoT devices.

In terms of mode of transportation, roadways hold the majority of the market share and is showing a substantial growth of 12.2%. This is due to the increasing demand for road-based transportation to transport retail goods over long distances.

The usage of cutting-edge technologies like machine learning, the Internet of Things, cloud computing, big data, analytics, and deep learning is leading United States towards a revenue share of US$ 16.5 billion by 2033.

Rising public and private investment in the transportation sector is enhancing market expansion in the area is driving the United Kingdom regional market towards an impressive growth of 12.5%

Japan is the most lucrative region of all growing at an impressive rate of 15.7%. Japan began transforming logistics in order to strengthen its position in the Asia Pacific logistics industry by integrating new technologies with existing processes.

Manufacturers Eying Opportunities through Aggressive Strategies

The competitive landscape of this market is split moderately because of the presence of several developing and established companies in the industry. Moreover, it is forecasted that the technological developments in logistic sectors is anticipated to quicken the product development as well as investment growth.

In the market, there are different competitors aiming at addressing the problems aggressively by framing plans which are going to leave an overall impact on the market development. The growth prospects of this market have a lot of room to flourish during the forecast period.

Recent Development:

A top cloud-based logistics execution platform, BluJay Solutions was acquired by E2open Parent Holdings, Inc. for almost US$ 1.7 billion in May 2020. It is a foremost network-based provider of mission-critical, 100% cloud-based, and end-to-end supply chain management platforms.

Key Players:

AT&T Inc., IBM Corporation, Intel Corporation, SAP SE, Infosys Limited, Cisco Systems Inc., HCL Technologies Limited, Eurotech S.P.A., Microsoft, Oracle, Cloud Logistics, Zebra technologies, ORBCOMM, and GT Nexus.

Key Segments Covered in the Connected Logistics Market Report

By Component:

Connected Logistics Devices

Vehicle Telematics

Data Loggers

GPS Tracking Devices

RFID Tags

Connected Logistics Software

Fleet Management

Asset Tracking

Security Solutions

Connected Logistics Services

Consulting

Integration & Deployment

Support & Maintenance

By Transportation:

Connected Logistics for Roadways

Connected Logistics for Railways

Connected Logistics for Airways

Connected Logistics for Seaways

By Vertical:

Connected Logistics in Manufacturing

Connected Logistics in IT & Telecom

Connected Logistics in Automotive

Connected Logistics in Retail & Consumer Goods

Connected Logistics in Food & Beverages

Connected Logistics in Healthcare

Connected Logistics in Energy & Utilities

Others

By Region:

North America

Latin America

Western Europe

Eastern Europe

Asia Pacific excluding Japan (APEJ)

Japan

The Middle East & Africa (MEA)

0 notes

Text

Automotive Intelligent Tires Market

Automotive Intelligent Tires Market Size, Share, Trends: Continental AG Leads

Smart Tires with Integrated Sensors and AI Capabilities Gain Traction in the Automotive Sector

Market Overview:

The Automotive Intelligent Tires Market is expected to develop at a XX% CAGR from 2024 to 2031. The market value is estimated to reach USD XX billion in 2024 and USD YY billion in 2031. Asia-Pacific is expected to lead the market throughout the projection period. Key metrics include increased car production, rising demand for sophisticated safety features, and increased use of IoT in automotive applications.

The market for automotive intelligent tires is expanding rapidly, owing to a growing emphasis on vehicle safety, fuel efficiency, and performance enhancement. The integration of sensors and communication technology in tires is transforming the automobile industry, allowing for real-time monitoring and data analysis to improve vehicle management and maintenance.

DOWNLOAD FREE SAMPLE

Market Trends:

The automotive intelligent tire industry is seeing a substantial increase in the integration of modern sensors and artificial intelligence (AI) capabilities. These smart tires include embedded sensors that continuously monitor tire pressure, temperature, tread wear, and driving conditions. The obtained data is subsequently evaluated by AI algorithms, which provide real-time insights and predictive maintenance recommendations.

The growing desire for greater safety features, improved fuel efficiency, and optimised vehicle performance is driving this trend. Automotive manufacturers are working with tire firms to create intelligent tire systems that can connect with vehicle control systems, allowing for proactive modifications and improved overall vehicle management. As autonomous and connected car technologies improve, so will the use of these smart tires, generating new prospects for market growth and innovation in the automotive sector.

Market Segmentation:

The Tire Pressure Monitoring System (TPMS) category has emerged as the dominant technology in the automotive intelligent tires market, owing to regulatory requirements and its vital role in improving vehicle safety and efficiency. TPMS technology continuously monitors tire pressure and informs drivers of potential problems, thereby reducing accidents caused by underinflated or overinflated tires. According to the National Highway Traffic Safety Administration (NHTSA), TPMS-equipped vehicles are 55.6% less likely to have significantly underinflated tires. This considerable safety enhancement has resulted in widespread deployment across multiple vehicle types.

In recent years, developments in TPMS technology have strengthened its market position. For example, in 2021, Continental AG debuted its Intelligent Tire System, which integrates TPMS with additional sensors to monitor temperature, tread depth, and tire load. This technology provides a full view of tire health, allowing for predictive maintenance and improved vehicle performance. Similarly, Bridgestone Corporation debuted its Bridgestone Connect smart tire solution in 2022, which employs advanced algorithms to analyse TPMS data and provide fleet managers with actionable insights, thereby enhancing operating efficiency and lowering maintenance costs. Intelligent TPMS technologies have grown in popularity, particularly in the commercial vehicle category. Fleet operators are rapidly recognising the benefits of real-time tire monitoring for lowering fuel usage and reducing vehicle downtime. According to an American Trucking Associations (ATA) study, appropriate tire inflation can increase fuel efficiency by up to 3%, saving large fleets a significant amount of money. This has resulted in agreements between tire producers and telemetry companies to create integrated fleet management systems. For example, in 2023, Goodyear Tire & Rubber Company cooperated with ZF Group to develop an intelligent tire management system specifically built for commercial vehicles, which fuelled the growth of the TPMS segment in the automotive intelligent tires market.

Market Key Players:

Continental AG

Bridgestone Corporation

Michelin

The Goodyear Tire & Rubber Company

Pirelli & C. S.p.A.

Sumitomo Rubber Industries, Ltd.

Contact Us:

Name: Hari Krishna

Email us: [email protected]

Website: https://aurorawaveintellects.com/

0 notes

Text

Market Growth 2025-2030: Connected Logistics in the Digital Era

The global connected logistics market size is expected to reach USD 86.57 billion in 2030 and is expected to grow at a CAGR of 14.9% from 2025 to 2030. The term ‘connected logistics’ refers to a collection of tools, and platforms, including hardware and software, that enable real-time tracking of commodities sent by land, rail, air, and sea routes.

To facilitate shipment, it communicates logistical and pertinent data such as tracking and traceability with every participant in the supply chain, such as manufacturers, suppliers, and customers, among others. By integrating several linked platforms, these solutions aid businesses in enhancing information flow during shipment and delivery using RFID chips. Connected logistics provides improved warehouse management using technologies such as the Internet of Things (IoT), blockchain, virtual reality, and big data, among others.

Connected logistics has enhanced the efficiency of last-mile delivery with the aid of communication devices and tracking devices. Connected logistics aid in the efficient management of supply chain security, freight traffic, and routing of the fleet by minimizing the cost of the transport. Additionally, technologies such as vibration monitoring and global positing system (GPS) aid in performance optimization and provide position tracking for each fleet vehicle. Connected logistics have significantly improved risk resilience planning.

Thus, increased demand for improved warehouse management and rising demand for efficient supply chain management among others are the factors fueling the growth of the target market. The demand for intelligent transportation solutions is anticipated to rise significantly overall, as well as in the logistics sector. It is expected that logistics 4.0 and ongoing work on autonomous logistics trucks will present lucrative opportunities for the target market's expansion.

Logistics 4.0 uses analytics, data, the internet of things, and automated decision-making solutions to improve operational efficiency and performance. For instance, in April 2022, Daimler trucks, with its independent auxiliary Torc Robotics, started testing their autonomous trucks, which operate on four levels of autonomous driving in the U.S. Additionally, autonomous trucks are increasingly gaining traction across the logistics industry owing to rising shortage of drivers, increased safety and improved efficiency.

The increasing implementation of logistics 4.0 and ongoing efforts to develop autonomous logistics vehicles are predicted to give profitable opportunities for the target market's growth over the forecast period. Additionally, the necessity to reduce the cost of shipping and storage services is propelling the demand for connected logistics products and solutions. The need for intelligent transportation solutions is anticipated to rise significantly. The declining cost of loT sensors and connected logistics hardware is one of the driving factors of the target market growth.

The COVID-19 pandemic led to disruptions in the global supply chains. In addition, the state and federal governments announced the lockdowns and border closures, which halted the shipment of the goods. However, the pandemic accelerated the adoption of technologies such as the internet of things (IoT), automation, and robotics, among others, in the logistics sector.

For instance, according to a report by Inmarsat, a leader in mobile satellite communications, “Owing to the pandemic, 90% of the transportation and logistics firms have adopted or are planning to adopt the deployment of Internet of Things (IoT) projects. Additionally, there has been a shift from electronic data to app-based program interfaces with cloud integration, enabling logistics companies to connect with e-commerce platforms.

Connected Logistics Market Report Highlights

The hardware segment dominated the market in 2024. The sensors are the largest sub-segment of hardware components in terms of revenue owing to the increasing demand for asset tracking

The services segment is anticipated to expand at the fastest CAGR during the forecast period. The high rate of outsourcing business functions contributes to the increasing demand for managed services

The roadways segment dominated the market in 2024. This dominance can be attributed to the growing need for reduced traffic congestion, road safety, and increasing government initiatives in infrastructure development

The retail and e-commerce segment is anticipated to expand at the fastest CAGR. The growth can be attributed to the increasing preference for online shopping among consumers

Connected Logistics Market Segmentation

Grand View Research has segmented the global connected logistics market report based on component, transportation mode, vertical, and region.

Connected Logistics Component Outlook (Revenue, USD Million, 2017 - 2030)

Hardware

RFID Tags

Sensors

Communication Devices

Tracking Devices

Others

Software

Warehouse Management

Fleet Management

Freight TransportationManagement

Asset Tracking and management

Data Management and Analytics

Others

Services

Consulting

Integration and Deployment

Support & Maintenance

Managed Services

Connected Logistics Transport Mode Outlook (Revenue, USD Million, 2017 - 2030)

Roadways

Railways

Airways

Waterways

Connected Logistics Vertical Outlook (Revenue, USD Million, 2017 - 2030)

Retail & E-commerce

Automotive

Aerospace & Defense

Healthcare

Energy

Electronics & Semiconductors

Others

Connected Logistics Regional Outlook (Revenue, USD Million, 2017 - 2030)

North America

US

Canada

Mexico

Europe

Germany

UK

France

Asia-Pacific

China

India

Japan

Latin America

Brazil

Middle East & Africa

Order a free sample PDF of the Connected Logistics Market Intelligence Study, published by Grand View Research.

0 notes

Text

The Future of Logistics: Transforming Supply Chains with Advanced Technology

The logistics industry, a critical backbone of global trade, is undergoing a significant transformation. Rapid advancements in technology are reshaping supply chains, optimizing operations, and enabling businesses to meet the growing demands of efficiency, speed, and sustainability. In this blog, we will explore how advanced technologies are revolutionizing logistics and what the future holds for this dynamic sector logistic institute in kochi

1. The Role of Technology in Modern Logistics

Technological innovation is bridging gaps in traditional supply chain operations, addressing inefficiencies, and reducing costs. The integration of technologies like Artificial Intelligence (AI), Internet of Things (IoT), blockchain, robotics, and cloud computing has become pivotal in creating agile and resilient supply chains.

From tracking shipments in real-time to automating warehouse operations, these technologies are redefining logistics processes. By leveraging data analytics, businesses can forecast demand, optimize inventory, and enhance decision-making, driving better outcomes for all stakeholders involved.

2. Advanced Technologies Shaping the Future of Logistics

a. Artificial Intelligence and Machine Learning

AI and machine learning are revolutionizing logistics by enhancing operational efficiency and decision-making. These technologies are used to predict demand patterns, optimize route planning, and improve warehouse management.

AI-powered chatbots provide real-time customer support, while predictive analytics help companies identify potential disruptions and proactively mitigate risks. Machine learning algorithms also enhance fleet management by analyzing data from sensors and telematics, ensuring optimal vehicle utilization and maintenance.

b. Internet of Things (IoT)

IoT is transforming logistics by enabling real-time tracking of assets, goods, and vehicles. Sensors embedded in shipping containers and trucks provide data on location, temperature, and condition, ensuring the safe transportation of goods.

IoT devices also enhance warehouse management through smart shelving systems that monitor inventory levels. This reduces the risk of stockouts or overstocking, allowing for just-in-time replenishment.

c. Blockchain Technology

Blockchain offers unparalleled transparency and security in supply chain operations. By maintaining immutable records of transactions, blockchain ensures accountability and reduces the risk of fraud.

Smart contracts on blockchain platforms automate processes like payments and order fulfillment, reducing manual intervention and errors. This technology is particularly beneficial in tracking high-value goods and ensuring compliance with regulations.

d. Robotics and Automation

Robotics and automation are transforming warehousing and distribution centers. Autonomous guided vehicles (AGVs) and robotic arms are used to handle repetitive tasks like picking, packing, and sorting.

Automated systems improve accuracy, reduce labor costs, and enhance operational speed. Drones and delivery robots are also gaining traction for last-mile delivery, offering faster and more efficient solutions.

e. Cloud Computing

Cloud-based logistics solutions provide real-time visibility into supply chain operations. These platforms enable seamless collaboration among stakeholders, ensuring better coordination and faster decision-making.

Cloud computing also supports the integration of various technologies, such as AI and IoT, creating a unified system for managing logistics operations.

3. Emerging Trends in Logistics Technology

a. Sustainable Logistics

As sustainability becomes a global priority, businesses are adopting green logistics practices. Electric vehicles, alternative fuels, and carbon footprint tracking are gaining prominence.

Advanced technologies like AI and IoT play a critical role in optimizing resource utilization and reducing emissions. For instance, AI-powered route optimization can minimize fuel consumption, contributing to eco-friendly logistics.

b. Autonomous Vehicles

Self-driving trucks and autonomous delivery systems are on the horizon, promising to revolutionize transportation. These vehicles reduce reliance on human drivers, improve safety, and enhance efficiency.

c. 3D Printing

Additive manufacturing, or 3D printing, is reshaping the logistics landscape by enabling localized production. This reduces the need for long-distance shipping and inventory storage, leading to faster delivery and cost savings.

4. Benefits of Advanced Logistics Technology

a. Improved Efficiency

Automation and AI reduce manual intervention, speeding up processes and eliminating errors. This ensures timely deliveries and enhances customer satisfaction.

b. Cost Savings

Technologies like IoT and predictive analytics optimize resource utilization, reducing transportation and warehousing costs.

c. Enhanced Transparency

Blockchain and IoT provide real-time visibility into supply chain operations, ensuring accountability and trust among stakeholders.

d. Greater Flexibility and Resilience

Advanced technologies enable supply chains to adapt quickly to disruptions, ensuring continuity and minimizing losses.

5. Challenges in Adopting Advanced Logistics Technology

Despite its potential, the adoption of advanced technologies comes with challenges. High implementation costs, cybersecurity risks, and the need for skilled personnel are significant barriers. Additionally, integrating new technologies into legacy systems can be complex and time-consuming.

To overcome these challenges, businesses must adopt a phased approach, prioritize employee training, and collaborate with technology providers to ensure seamless implementation.

6. The Road Ahead

The future of logistics is a blend of innovation, efficiency, and sustainability. As technology continues to evolve, businesses must stay ahead of the curve by embracing digital transformation.

Governments and industries must work together to establish standards and regulations for emerging technologies like autonomous vehicles and blockchain. Public-private partnerships can also drive investment in research and development, accelerating the adoption of advanced logistics solutions.

The logistics industry is at a pivotal juncture, with technology acting as a catalyst for change. From AI-driven route optimization to blockchain-enabled transparency, advanced technologies are transforming supply chains into more efficient, resilient, and sustainable systems.

Businesses that embrace these innovations will not only gain a competitive edge but also contribute to a smarter and greener future. The journey ahead is challenging, but the rewards of transforming logistics with advanced technology are immense and far-reaching logistics courses in kochi

Sustainable Practices for Building Eco-Friendly Supply Chains

The increasing urgency to address climate change and environmental degradation has placed sustainability at the forefront of global business strategies. Supply chains, which play a pivotal role in the production, transportation, and distribution of goods, are undergoing a paradigm shift towards eco-friendly practices. Building sustainable supply chains is no longer just a corporate responsibility but a critical business strategy for long-term success logistic institute in kochi

This blog explores the importance of sustainable supply chains, key eco-friendly practices, and the benefits they bring to businesses and the planet.

The Need for Sustainable Supply Chains

The traditional supply chain model has often been resource-intensive, generating significant carbon emissions, waste, and environmental harm. As consumers and regulators demand greater accountability, businesses are rethinking their supply chain operations to minimize environmental impacts.

Sustainable supply chains aim to balance economic growth with environmental and social responsibility. By adopting green practices, companies can reduce waste, conserve resources, and build resilience against environmental risks, ensuring long-term profitability and brand loyalty.

Key Sustainable Practices for Eco-Friendly Supply Chains

1. Sustainable Sourcing of Materials

One of the first steps toward a green supply chain is ensuring the sourcing of raw materials is sustainable. Businesses can prioritize:

Ethical sourcing: Procuring materials from suppliers who adhere to environmental and social standards.

Renewable resources: Using biodegradable and recyclable materials instead of non-renewable ones.

Local sourcing: Reducing transportation emissions by sourcing materials locally.

For example, companies like Patagonia focus on sourcing organic cotton and recycled materials, demonstrating a commitment to sustainability.

2. Optimizing Transportation and Logistics

Transportation is a major contributor to supply chain emissions. Companies can adopt the following measures:

Route optimization: Using AI-driven tools to minimize fuel consumption and delivery times.

Energy-efficient vehicles: Transitioning to electric or hybrid fleets to reduce greenhouse gas emissions.

Collaborative shipping: Sharing transportation resources with other businesses to maximize load efficiency.

Adopting these practices not only cuts emissions but also reduces operational costs, benefiting the bottom line.

3. Waste Reduction and Circular Economy

Waste generation is a significant challenge in supply chains. Companies can embrace a circular economy model, which emphasizes reducing, reusing, and recycling materials. Key steps include:

Product redesign: Developing products that are easier to recycle or biodegrade.

Reverse logistics: Establishing systems to collect used products for refurbishment or recycling.

Zero-waste initiatives: Aiming for waste-free production processes.

Brands like IKEA have adopted circular economy principles, offering furniture buyback programs to extend product life cycles.

4. Energy Efficiency in Warehousing and Manufacturing

Warehousing and manufacturing facilities consume substantial energy. To minimize their environmental footprint, businesses can:

Install energy-efficient lighting, such as LED systems.

Invest in renewable energy sources, like solar or wind power.

Implement smart energy management systems to monitor and optimize energy usage.

For instance, Amazon has integrated renewable energy solutions in its warehouses, contributing to its goal of achieving net-zero carbon by 2040.

5. Leveraging Technology for Sustainable Practices

Advanced technologies play a critical role in enabling sustainable supply chains.

IoT: Sensors track the condition of goods, ensuring minimal spoilage and waste.

Blockchain: Provides transparency in sourcing, ensuring suppliers adhere to ethical and environmental standards.

AI and data analytics: Help predict demand accurately, reducing overproduction and inventory waste.

Digital transformation not only enhances sustainability but also boosts efficiency and operational resilience.

6. Employee and Stakeholder Engagement

Sustainability requires collective action. Businesses must engage employees, suppliers, and stakeholders in their green initiatives. This can be achieved by:

Providing training on sustainable practices.

Collaborating with suppliers to meet sustainability goals.

Communicating efforts and achievements transparently to stakeholders.

When all parties align with a shared vision, the journey toward sustainability becomes more impactful and achievable.

Benefits of Building Eco-Friendly Supply Chains

Adopting sustainable practices brings multiple advantages, including:

1. Environmental Benefits

Green supply chains reduce carbon emissions, conserve natural resources, and minimize waste. These practices contribute to combating climate change and preserving biodiversity.

2. Cost Savings

Sustainability often translates to efficiency. Optimized transportation routes, reduced energy consumption, and waste minimization lower operational costs, improving profitability.

3. Enhanced Brand Reputation

Consumers increasingly prefer brands that demonstrate environmental responsibility. Building an eco-friendly supply chain strengthens brand image and fosters customer loyalty.

4. Compliance with Regulations

Governments worldwide are implementing stricter environmental regulations. Sustainable practices ensure compliance, reducing the risk of legal penalties and reputational damage.

5. Resilience Against Risks

Sustainable supply chains are better equipped to handle disruptions, such as resource shortages or climate-related risks. This resilience ensures business continuity in the face of challenges.

Challenges in Implementing Sustainable Practices

Transitioning to a sustainable supply chain is not without challenges. Businesses often face:

High upfront costs: Investments in green technologies and infrastructure can be expensive.

Complexity of global supply chains: Ensuring sustainability across diverse suppliers and regions is challenging.

Resistance to change: Stakeholders may resist adopting new processes or technologies.

Despite these challenges, the long-term benefits far outweigh the initial hurdles. Businesses can adopt a phased approach, starting with small, impactful changes and scaling up over time.

The Road Ahead

The future of supply chains lies in sustainability. Companies that embrace eco-friendly practices not only contribute to a healthier planet but also position themselves as industry leaders. Collaboration, innovation, and commitment are key to driving this transformation.

Governments, businesses, and consumers must work together to build a sustainable future. As supply chains evolve, integrating environmental and social responsibility into core operations will no longer be optional but essential.

Sustainable supply chains are a powerful driver of positive change. By adopting eco-friendly practices, businesses can reduce their environmental impact, enhance operational efficiency, and build resilience against future challenges.

As the demand for sustainability continues to grow, companies must seize the opportunity to lead the charge toward a greener, more sustainable future. The path to eco-friendly supply chains may be complex, but the rewards are invaluable—for businesses, society, and the planet logistics courses in kochi

0 notes

Text

Maximizing Warehouse Efficiency with Reach Trucks

Maximizing Warehouse Efficiency with Reach Trucks

In the fast-paced world of warehousing, efficiency and productivity are paramount. One of the essential tools that has revolutionized modern warehouses is the reach truck. These versatile vehicles are designed to handle the high-stacking needs of warehouses, providing significant improvements in space utilization and workflow efficiency.

1. Introduction to Reach Trucks

Reach trucks are a type of forklift specifically designed for warehouses with narrow aisles and high racking systems. Their design allows the operator to extend the forks forward, enabling them to reach loads in deep racks without needing to move the entire vehicle. This functionality not only saves time but also reduces the potential for damage to goods and racking systems.

2. Advantages of Using Reach Trucks

Space Optimization: Reach trucks can operate in narrow aisles, typically around 2.4 meters wide, which allows for more racking and storage space within the same warehouse footprint. Forklift Increased Reach and Lift Height: These trucks can lift loads to great heights, often exceeding 10 meters, making them ideal for high-density storage environments.

Enhanced Maneuverability: With their compact design and excellent turning radius, reach trucks can navigate tight spaces with ease, improving overall warehouse flow.

Improved Safety: Features such as better visibility for the operator, enhanced stability, and advanced safety systems contribute to a safer working environment.

3. Best Practices for Operating Reach Trucks

Regular Maintenance: To ensure reliability and longevity, reach trucks should undergo regular maintenance checks. This includes inspecting the hydraulics, brakes, and electronic systems.

Proper Training: Operators should receive comprehensive training on the specific model of reach truck they will be using, focusing on safe handling practices and efficient operation techniques.

Load Management: It's crucial to follow the manufacturer's guidelines for load capacity and distribution to prevent accidents and ensure the safety of both the operator and the goods being handled.

Floor Conditions: Ensure that warehouse floors are in good condition, free of debris, and have sufficient traction to support the safe operation of reach trucks.

4. Future Trends and Innovations

The future of reach trucks is promising, with advancements in technology driving further improvements in efficiency and safety. Some of the emerging trends include:

Automation and Robotics: Integration of autonomous reach trucks that can operate without human intervention, improving productivity and reducing labor costs.

Advanced Telematics: Use of telematics to monitor the performance, location, and condition of reach trucks in real time, enabling better fleet management and predictive maintenance.

Green Technology: Development of eco-friendly reach trucks with lower emissions and energy consumption, contributing to a more sustainable warehousing environment.

Conclusion

Reach trucks play a crucial role in enhancing warehouse efficiency. Their ability to operate in confined spaces, lift heavy loads to significant heights, and improve overall safety makes them an indispensable asset for modern warehouses. By adopting best practices and staying abreast of technological advancements, businesses can maximize the benefits of reach trucks and maintain a competitive edge in the industry.

0 notes

Text

Exploring the Technology Behind Modern Car Recovery Services in Dubai: Innovations That Enhance Efficiency and Safety

Car recovery services in the UAE, particularly in a bustling hub like Dubai, have evolved significantly over the years. Modern advancements in technology have transformed how these services operate, ensuring not only faster response times but also greater safety and efficiency. In this blog, we will explore the cutting-edge innovations that are redefining car recovery services in Dubai, making road assistance more reliable than ever before.

The Role of Technology in Car Recovery Services

Modern car recovery services are no longer limited to towing a vehicle from one point to another. With advancements in technology, they have become comprehensive solutions for drivers facing emergencies. Here are some of the key technological innovations:

GPS-Enabled Dispatch Systems

GPS technology has become the backbone of car recovery services in the UAE. Recovery fleets are equipped with advanced tracking systems, enabling service providers to pinpoint the exact location of a stranded vehicle. This minimizes response times and ensures help arrives promptly, even in remote areas.

AI-Driven Predictive Maintenance Assistance

Some car recovery services in Dubai now leverage artificial intelligence (AI) to offer predictive maintenance solutions. AI systems analyze vehicle data to anticipate potential breakdowns, helping drivers address issues before they escalate. This proactive approach significantly reduces the likelihood of emergencies on the road.

Smart Recovery Equipment

Modern recovery trucks are equipped with smart tools, such as hydraulic lifts, robotic arms, and advanced winches. These innovations ensure vehicles are handled with precision and care, minimizing the risk of further damage during recovery.

Mobile Apps for Real-Time Updates

Many car recovery services in Dubai offer user-friendly mobile apps. These apps allow drivers to request assistance, track the recovery truck in real-time, and communicate directly with the service team. Such features enhance transparency and customer satisfaction.

Integration of IoT (Internet of Things)

The Internet of Things has introduced a new level of connectivity in car recovery services. IoT-enabled sensors in vehicles can alert service providers about accidents or breakdowns instantly. This seamless communication ensures faster and more accurate responses.

Autonomous Recovery Vehicles

While still in the experimental phase, autonomous recovery vehicles are set to revolutionize the industry. These self-driving recovery trucks are designed to operate in challenging conditions, ensuring safety and efficiency without human intervention.

How These Innovations Enhance Efficiency and Safety ?

The integration of technology into car recovery services in the UAE offers numerous benefits:

Reduced Response Times: GPS and IoT ensure faster location tracking and dispatch, reducing the wait time for stranded drivers.

Improved Safety: Smart equipment and predictive maintenance tools minimize risks for both the driver and the recovery team.

Enhanced Reliability: Technological advancements ensure a smoother and more dependable recovery process.

Customer Convenience: Real-time updates and communication through mobile apps improve the overall customer experience.

The Future of Car Recovery Services in Dubai

The future of car recovery services is bright, with continued advancements in technology. Innovations like drone-based surveillance for accident sites, blockchain for secure data management, and 5G connectivity for faster communication will further enhance the capabilities of these services.

Royal Swiss Auto Recovery car services in the UAE - Now get exceptional customer service and round-the-clock support.

As Dubai continues to embrace technological advancements, car recovery services in the UAE are setting new benchmarks in efficiency and safety. By integrating cutting-edge tools and systems, these services ensure that drivers can navigate the roads with confidence, knowing help is just a click away.

Whether you’re facing a flat tire, an engine failure, or an accident, our modern car recovery services in Dubai are equipped to provide prompt, professional, and reliable assistance, backed by the power of technology.

If you’re looking for top-notch car recovery services in the UAE, choose a provider like us that prioritizes innovation and customer care. The road may be unpredictable, but with the right support, you’re always in safe hands.

0 notes

Text

🚗 Ready to explore the future of transportation? Our latest Jelvix YouTube video dives deep into how Artificial Intelligence is revolutionizing the industry!

Here’s what we cover: ✅ Autonomous Vehicles: Self-driving cars, delivery robots, and more – from Tesla’s Autopilot to Waymo’s incredible 20B miles milestone. ✅ AI for Safety: Preventing accidents, monitoring fatigue, and keeping roads safer with cutting-edge systems from Volvo, GM, and Audi. ✅ Smart Traffic Management: Adaptive traffic lights, real-time rerouting, and connected vehicle systems in cities like LA. ✅ Public Transport Optimization: AI-driven bus schedules, crowd predictions, and apps like Citymapper transforming how we commute. ✅ Freight & Logistics: Drones, robots, and autonomous trucks reshaping the supply chain with efficiency. ✅ Sustainability & Urban Mobility: Eco-routing, EV fleet optimization, and even flying taxis!

Don’t forget to subscribe for more tech insights in just 5 minutes every week!

0 notes

Text

Saudi Arabia Light Commercial Vehicle Market Analysis 2031

Saudi Arabia light commercial vehicle market is projected to witness a CAGR of 7.24% during the forecast period 2024-2031, growing from USD 5.50 billion in 2023 to USD 9.62 billion in 2031. The Saudi government is keenly working to diversify its economy, according to the Vision 2030 strategy, by reducing the reliance on oil income. It has led to an increase in investment in different infrastructure projects, with strong demand for vehicles such as light commercial vehicles and growing concern towards sustainability in the automobile industries over recent times. Moreover, the demand for electric and hybrid commercial vehicles is expected to fuel due to the need to reduce global carbon emissions is on a rise.

The announcement of incentives towards green vehicles is pushing businesses to move toward greener fleets to be on the same page with globally planned environmental concerns. For instance, in September 2024, Jiangling Motors Corporation Group Saudi Arabia and Aljabr Group donated 100 units of refrigerator trucks to KSA Food Preservation Association. This initiative aims to reduce food waste and promote sustainable development in Saudi Arabia. Moreover, technological advancements in telematics and autonomous driving are equally improving the efficiency and safety of operations within transportation, thereby increasing the demand for modern LCVs. In the logistics sector and e-commerce sector especially, high growth is being witnessed, which calls for efficient transportation solutions in support of ongoing development projects and the growing economy. The rapid growth of the e-commerce sector in Saudi Arabia is particularly skewing the demand for light commercial vehicles. Also, with online shopping gathering at a robust pace, enterprises need reliable last-mile delivery solutions that can be fulfilled by light commercial vehicles.

Also, consumer preferences are shifting towards fuel-efficient and technologically advanced vehicles. There is a notable demand for LCVs equipped with the latest safety features and connectivity options. As Saudi customers become more tech-savvy, they seek vehicles that offer convenience and enhanced driving experiences.

Logistics and Freight Carriers to Drive Market Growth

The number of registered logistics companies in Saudi Arabia has risen by 76 percent in 2024 compared to the previous year as investment and interest in the sector continue to increase. This growth is indicative of a healthy market environment, wherein a vast sector of logistics operations demands an adequate light commercial vehicle fleet. Furthermore, the continually undertaken infrastructure development and government efforts at increasing transportation capabilities add to fuel this growth. Saudi Arabia plans to invest over USD 267 billion in its logistics sector under its Vision 2030 plan, where it targets to make the country a leading global logistics hub. Infrastructure investment that is allocated to improve the condition of this infrastructure will spur more efficient transportation by freight carriers and will, therefore, encourage the demand for LCVs. The e-commerce industry has seen rapid growth. With such a growing demand for online shopping, logistics companies must have efficient light commercial vehicles to sustain consumers’ expectations for timely deliveries. The Saudi e-commerce market is expected to reach a total value of USD 50 billion by the 2025 and would, therefore, require strong logistics capabilities.

For instance, in March 2023, PEUGEOT Middle East, part of Stellantis N.V., supplied the region’s first fully electric fleet of light commercial vehicles (LCVs) to DHL Middle East for fast delivery across Saudi Arabia and other countries. PEUGEOT is currently the only automotive manufacturer in Middle East to offer fully electric LCVs, reinforcing the brand’s mission to lead the market in electrification and carbon net-zero automotive products and exceed the expectations of its customers. This electric vehicle aims to reduce emissions and noise pollution while meeting the demands of modern logistics operations. Its adoption reflects a shift towards sustainable transportation solutions within the logistics sector.

Luxurious Lifestyle and Economy to Boost Market Demand

The luxurious lifestyle in Saudi Arabia is fueling the need for luxury light commercial vehicles, as affluent people’s cultural values emphasize luxury and preference for technology over price. Growing affluence among high-net-worth individuals and ultra-high-net-worth individuals is closely associated with the growth of the luxury market in the Country. This demography has significant buying power, and their demand for luxury LCVs is greater since most of these are perceived to be status symbols that exemplify class and prestige. As the population of the high class increases, the demand for more luxurious LCVs rises due to their display of new technologies and comfort. Businesses that focus on catering to the high-class market invest in luxury light commercial vehicles to meet the quality service and transport requirements of the client.

People in cities such as Riyadh and Jeddah are cosmopolitan and have rapidly urbanizing and highly sophisticated lifestyles. They are increasingly looking for premium experiences that reflect their selection of vehicles in a culmination of their changing lifestyles. For instance, according to Al Ghassan Motors, every year, Saudi Arabia imports 600,000 cars worth more than USD 20 billion. The demand for comfort, advanced technology, luxury, and other high-end LCVs follows these changing lifestyles.

For instance, in October 2023, Daimler AG, distributor of Mercedes-Benz Trucks, launched eActros 300 L 4×2, which is the first battery-electric truck from Mercedez-Benz Trucks with features such as quiet, innovative, stylish, sustainable, and forward-thinking. With its unwavering dedication to sustainability, innovation, and a cleaner future, eActros has made significant advancements in the transportation industry.

Electric Light Commercial Vehicle to Grow at a High Pace

The electric light commercial vehicle market in Saudi Arabia is ready to surge at a significant pace due to several factors, ranging from government initiatives to technological advancements. The Saudi government encourages the adoption of electric vehicles under Vision 2030 to achieve economic diversification and reduce dependence on oil. It offers incentives in the form of tax exemptions, subsidies, and lower import tariffs for electric vehicles to encourage uptake and infrastructure development. Considerable investment is made to develop nationwide recharging infrastructure and make ECVs more accessible to consumers and businesses. For instance, in October 2023, the Saudi Public Investment Fund (PIF) and Saudi Electricity Company (SEC) launched an electric vehicle infrastructure company with the objective of bringing fast-charging EV infrastructure throughout Saudi Arabia as part of accelerating the development of EVs and creating a domestic automotive ecosystem in the country. As part of its plan, it will establish its presence in 1,000 locations and install more than 5,000 fast chargers by 2030 in the cities of Saudi Arabia, as well as its connecting roads, according to the corresponding rules and standards.

With advancements in battery technology and especially improvements in vehicle ranges, electric light commercial vehicles have become more attractive. Increased battery energy densities enhance the range between charges while better charging technologies reduce time and costs. More organizations are discovering the economic benefits of commercial electric vehicles. For a direct comparison with conventional internal combustion engine vehicles, the ECVs include long-term savings, reduced fuel consumption, and maintenance cost. With the objective of building up their sustainability profiles and technological advancement, electrification becomes a strategic priority of businesses.

For instance, in October 2023, Hyundai Motor Company signed an MOU with Korea Automotive Technology Institute (KATECH), Air Products Qudra (APQ), and the Saudi Public Transport Company (SAPTCO) to establish and develop an ecosystem for hydrogen-based mobility in Saudi Arabia. The parties have agreed to cooperate in establishing a hydrogen-based mobility ecosystem in Saudi Arabia and to provide support on technological services and human resources. Specific areas of collaboration include promoting demonstration projects for hydrogen fuel cell commercial vehicles and exploring opportunities for joint research in the field of hydrogen-based mobility. This partnership will lead to technological advancement by infusing hydrogen fuel with electric vehicles, pushing the sale of LCV in the market.

Download Free Sample Report

Future Market Scenario (2024-2031F)

The Saudi government has taken the most ambitious goal for diversification from dependence on petroleum as an energy source through its Vision 2030 initiative and invested heavily in infrastructure and in support for the logistics sector.

Advances in telematics, connectivity, and electric vehicle technology improve both performance and LCV operational efficiency. Electric and hybrid vehicles will increasingly appear on roads as companies continue to seek a solution for sustainable transport that creates long-term cost benefits.

There is a growing inclination towards luxury vehicle ownership as disposable incomes increase, and there is a growing appetite for luxury goods, including premium light commercial vehicles.

Report Scope

“Saudi Arabia Light Commercial Vehicle Market Assessment, Opportunities and Forecast, 2017-2031F”, is a comprehensive report by Markets and Data, providing in-depth analysis and qualitative and quantitative assessment of the current state of Saudi Arabia light commercial vehicle market, industry dynamics, and challenges. The report includes market size, segmental shares, growth trends, opportunities, and forecast between 2024 and 2031. Additionally, the report profiles the leading players in the industry, mentioning their respective market share, business models, competitive intelligence, etc.

Click here for full report- https://www.marketsandata.com/industry-reports/saudi-arabia-light-commercial-vehicle-market

Latest reports-

Contact

Mr. Vivek Gupta 5741 Cleveland street, Suite 120, VA beach, VA, USA 23462 Tel: +1 (757) 343–3258 Email: [email protected] Website: https://www.marketsandata.com

0 notes

Text

Exploring Innovative Mobility Solutions For Modern Businesses

In today’s fast-moving world, businesses need efficient ways to stay ahead. Mobility solutions are transforming industries by providing smarter, faster, and more sustainable ways to handle logistics, transportation, and workforce mobility. These innovations are not just about moving goods or people, they’re about driving growth, reducing costs, and enhancing customer experiences.

Let’s explore how innovative Mobility Solutions are reshaping modern businesses and helping them stay competitive.

What Are Mobility Solutions?

Mobility solutions are technologies and strategies designed to improve the movement of goods, services, and people. They use advanced tools like Artificial Intelligence (AI), Internet of Things (IoT), and automation to enhance efficiency and reduce costs.

For businesses, these solutions might include:

Fleet Management Systems: Tools to track and optimize vehicle use.

Smart Warehousing: Systems that automate inventory and logistics.

Workforce Mobility Apps: Platforms that help employees work and travel seamlessly.

Electric and Autonomous Vehicles: Environmentally friendly and automated transport options.

Why Are Mobility Solutions Important for Businesses?

Modern businesses face several challenges, such as high operational costs, growing customer demands, and environmental concerns. Mobility solutions address these by offering:

Cost Efficiency: Reducing fuel consumption, maintenance costs, and labor requirements.

Speed: Faster transportation and streamlined operations.

Sustainability: Reducing carbon emissions through eco-friendly vehicles and smarter logistics.

Customer Satisfaction: Faster and more reliable deliveries.

By adopting these solutions, businesses can focus on growth while meeting the expectations of modern consumers.

Key Innovations in Mobility Solutions

Here are some groundbreaking mobility solutions that are transforming industries:

a. Electric Vehicles (EVs)

Electric vehicles are becoming a popular choice for businesses due to their low operating costs and reduced environmental impact.

Applications: Delivery fleets, ridesharing services, and company cars.

Benefits: Lower fuel costs, government incentives, and zero emissions.

Example: E-commerce companies use EVs for last-mile deliveries to meet sustainability goals.

b. Autonomous Vehicles

Self driving vehicles are revolutionizing logistics by eliminating the need for drivers.

Applications: Long-haul transportation, warehouse shuttles, and delivery services.

Benefits: Reduced labor costs, fewer accidents, and continuous operation.

Example: Companies like Tesla and Waymo are testing autonomous trucks for freight transport.

c. Drones in Logistics

Drones are being used to deliver packages, particularly in remote or hard to reach areas.

Applications: Last-mile delivery, inventory management, and surveillance.

Benefits: Faster deliveries, reduced fuel consumption, and better access to rural areas.

Example: Amazon and UPS are piloting drone delivery services to improve efficiency.

d. Mobility-as-a-Service (MaaS)

MaaS integrates various transportation modes into a single platform, allowing businesses to plan and manage travel efficiently.

Applications: Employee transportation, fleet coordination, and supply chain optimization.

Benefits: Cost savings, streamlined operations, and better resource utilization.

Example: Ride hailing apps like Uber for Business provide tailored solutions for corporate mobility.

Mobility Solutions in Logistics

The logistics industry is one of the biggest beneficiaries of innovative mobility solutions.

Smart Route Planning: AI-powered tools optimize delivery routes, reducing fuel costs and delays.

Fleet Tracking: IoT devices provide real-time data on vehicle location, speed, and maintenance needs.

Green Logistics: Electric and hybrid vehicles reduce carbon emissions while improving efficiency.

For instance, Logistics Companies are using smart mobility solutions to handle last-mile delivery challenges, ensuring faster and more cost-effective services.

Workforce Mobility: Empowering Employees

Mobility solutions are not just for goods, they’re also transforming the way employees work and travel.

Remote Work Platforms: Tools like video conferencing and cloud storage enable employees to work from anywhere.

Employee Travel Apps: Apps that streamline business travel by booking flights, hotels, and transport in one place.

Shared Mobility: Car-sharing or bike-sharing services for employees commuting to work.

These solutions improve productivity, reduce travel costs, and enhance work-life balance for employees.

Sustainability and Mobility Solutions

Sustainability is a growing priority for businesses, and mobility solutions play a key role in achieving green goals.

Electric Mobility: EVs and e-bikes reduce reliance on fossil fuels.

Smart Logistics: Route optimization and load efficiency reduce emissions.

Eco-Friendly Warehousing: Solar-powered warehouses and energy-efficient systems lower environmental impact.

For example, companies adopting green mobility solutions not only save money but also attract eco-conscious customers.

Challenges in Implementing Mobility Solutions

While mobility solutions offer many benefits, businesses may face challenges during implementation:

High Initial Costs: Investing in new technology or infrastructure can be expensive.

Integration Issues: Connecting mobility solutions with existing systems may require technical expertise.

Regulatory Compliance: Navigating regulations around autonomous vehicles, drones, and data privacy.

To overcome these challenges, businesses should start small, work with experienced providers, and stay updated on industry trends.

The Future of Mobility Solutions for Businesses

The future of mobility is driven by innovation, and businesses can expect even more advancements:

AI-Driven Systems: Smarter tools for predicting demand, managing fleets, and optimizing logistics.

Hyperloop Transport: Ultra fast transportation systems for goods and people.

5G Connectivity: Faster communication for real-time tracking and automation.

Personalized Mobility: Tailored solutions for unique business needs, from customized fleet vehicles to on-demand logistics platforms.

These technologies will continue to improve efficiency, reduce costs, and make businesses more competitive.

Conclusion

Innovative mobility solutions are no longer optional, they’re essential for businesses aiming to thrive in a competitive market. By adopting technologies like electric vehicles, drones, and AI-powered logistics, businesses can streamline operations, enhance customer satisfaction, and achieve sustainability goals.

Is your business ready to embrace the future of mobility? Start exploring these Mobility Solutions today to stay ahead of the curve.

0 notes

Text

Exploring Fire Trucks Market: Opportunities, Challenges, and Innovations

The global fire truck market size is expected to reach USD 7,163.7 million by 2030, according to a new study by Grand View Research Inc. Furthermore, the industry is expected to expand at a CAGR of 5.6% from 2023 to 2030. The growing vehicle manufacturing sector in North America and Asia Pacific, which has led to a sharp rise in demand for fire trucks, is a factor in the growth of the market. Additionally, expanding infrastructure operations will encourage the use of contemporary fire truck technology over conventional fire trucks, driving up demand for these vehicles globally.

Field research is enhancing the built environment's quality and teamwork, and the global fire truck industry sees a market opportunity for these vehicles equipped with cutting-edge digital technology tools to assist in performance-based design. The widespread adoption of cutting-edge technologies is a key factor in the growth of the fire truck industry.

The increasing need for multi-tasking units is a recent development in the fire truck sector. The market is advancing because of the rising number of fire risks and the rising frequency of wildfires in forests globally. The increase in safety regulations around the world is anticipated to support market demand over the forecast period. However, a low replacement rate hinders the market's growth. Fire trucks are not being replaced in a timely manner in the present day, even though they are getting older. The need for fire trucks could be hampered by this scenario.

Gather more insights about the market drivers, restrains and growth of the Fire Truck Market

Fire Truck Market Report Highlights

• The increasing need for multi-tasking units is a recent development in the fire truck sector. The market is expanding steadily because of the rising number of fire risks and the growing frequency of wildfires in forests around the world

• In addition to rising demand from residential and commercial applications in developing nations like China, South Korea, and India, there are several well-known Chinese low-cost makers present in the industry, which is projected to drive market growth in the coming years

• An increasing number of high-rise buildings are also compelling local municipalities to upgrade their existing fleet of firefighting equipment, including fire trucks. In April 2021, the Kerala Fire and Rescue Services Department included the purchase of a Turn Table Ladder (TTL) in their new modernization process

• The development of multinational manufacturers has been constrained by strict business regulations and escalating economic and political tensions, while the revenue bars of China-based firms have been protected

Browse through Grand View Research's HVAC & Construction Industry Research Reports.

• The global electric power distribution automation systems market size was valued at USD 26.1 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 7.02 % from 2024 to 2030.

• The global autonomous construction equipment market size was estimated at USD 12.72 billion in 2023 and is expected to grow at a CAGR of 9.6% from 2024 to 2030.

Fire Truck Market Segmentation

Grand View Research has segmented the global fire truck market based on application, type, and region:

Fire Truck Application Outlook (Revenue, USD Million, 2018 - 2030)

• Residential & Commercial

• Enterprise & Airports

• Military

• Others

Fire Truck Type Outlook (Revenue, USD Million, 2018 - 2030)

• Tankers

• Pumpers

• Aerial Platform

• Rescue

• Others

Fire Truck Regional Outlook (Revenue, USD Million, 2018 - 2030)

• North America

o U.S.

o Canada

• Europe

o UK

o Germany

o France

o Italy

o Spain

• Asia Pacific

o China

o India

o Japan

o Australia

o South Korea

• Latin America

o Brazil

o Mexico

o Argentina

• Middle East & Africa (MEA)

o UAE

o Saudi Arabia

o South Africa

Order a free sample PDF of the Fire Truck Market Intelligence Study, published by Grand View Research.

#Fire Trucks Market#Fire Trucks Market Analysis#Fire Trucks Market Report#Fire Trucks Market Size#Fire Trucks Market Share

1 note

·

View note