#the supreme court struck down the student loan forgiveness program

Explore tagged Tumblr posts

Text

Things Biden and the Democrats did, this week #13

April 5-12 2024

President Biden announced the cancellation of a student loan debt for a further 277,000 Americans. This brings the number of a Americans who had their debt canceled by the Biden administration through different means since the Supreme Court struck down Biden's first place in 2023 to 4.3 million and a total of $153 billion of debt canceled so far. Most of these borrowers were a part of the President's SAVE Plan, a debt repayment program with 8 million enrollees, over 4 million of whom don't have to make monthly repayments and are still on the path to debt forgiveness.

President Biden announced a plan that would cancel student loan debt for 4 million borrowers and bring debt relief to 30 million Americans The plan takes steps like making automatic debt forgiveness through the public service forgiveness so qualified borrowers who don't know to apply will have their debts forgiven. The plan will wipe out the interest on the debt of 23 million Americans. President Biden touted how the plan will help black and Latino borrowers the most who carry the heavily debt burdens. The plan is expected to go into effect this fall ahead of the election.

President Biden and Vice-President Harris announced the closing of the so-called gun show loophole. For years people selling guns outside of traditional stores, such as at gun shows and in the 21st century over the internet have not been required to preform a background check to see if buyers are legally allowed to own a fire arm. Now all sellers of guns, even over the internet, are required to be licensed and preform a background check. This is the largest single expansion of the background check system since its creation.

The EPA published the first ever regulations on PFAS, known as forever chemicals, in drinking water. The new rules would reduce PFAS exposure for 100 million people according to the EPA. The Biden Administration announced along side the EPA regulations it would make available $1 billion dollars for state and local water treatment to help test for and filter out PFAS in line with the new rule. This marks the first time since 1996 that the EPA has passed a drinking water rule for new contaminants.

The Department of Commerce announced a deal with microchip giant TSMC to bring billions in investment and manufacturing to Arizona. The US makes only about 10% of the world's microchips and none of the most advanced chips. Under the CHIPS and Science Act the Biden Administration hopes to expand America's high-tech manufacturing so that 20% of advanced chips are made in America. TSMC makes about 90% of the world's advanced chips. The deal which sees a $6.6 billion dollar grant from the US government in exchange for $65 billion worth of investment by TSMC in 3 high tech manufacturing facilities in Arizona, the first of which will open next year. This represents the single largest foreign investment in Arizona's history and will bring thousands of new jobs to the state and boost America's microchip manufacturing.

The EPA finalized rules strengthening clean air standards around chemical plants. The new rule will lower the risk of cancer in communities near chemical plants by 96% and eliminate 6,200 tons of toxic air pollution each year. The rules target two dangerous cancer causing chemicals, ethylene oxide and chloroprene, the rule will reduce emissions of these chemicals by 80%.

the Department of the Interior announced it had beaten the Biden Administration goals when it comes to new clean energy projects. The Department has now permitted more than 25 gigawatts of clean energy projects on public lands, surpass the Administrations goal for 2025 already. These solar, wind, and hydro projects will power 12 million American homes with totally green power. Currently 10 gigawatts of clean energy are currently being generated on public lands, powering more than 5 million homes across the West.

The Department of Transportation announced $830 million to support local communities in becoming more climate resilient. The money will go to 80 projects across 37 states, DC, and the US Virgin Islands The projects will help local Infrastructure better stand up to extreme weather causes by climate change.

The Senate confirmed Susan Bazis, Robert White, and Ann Marie McIff Allen to lifetime federal judgeships in Nebraska, Michigan, and Utah respectively. This brings the total number of judges appointed by President Biden to 193

#Thanks Biden#Joe Biden#student loans#student loan debt#debt forgiveness#gun control#forever chemicals#PFAS#climate change#green energy

3K notes

·

View notes

Text

The number is now $48 billion, remember that the next time a Twitter hot take grifter tells you he’s done nothing

41 notes

·

View notes

Text

The Biden administration is launching a beta website for its new income-driven student loan repayment plan today, officials told CNN, allowing borrowers to begin submitting applications for the program as federal student loan payments are set to resume in October.

The SAVE, or Saving on a Valuable Education, plan was finalized after the Supreme Court struck down President Joe Biden’s student debt forgiveness initiative in June. It marks a significant change to the federal student loan system that could lower monthly loan payments for some borrowers and reduce the amount they pay back over the lifetime of their loans.

“Part of the President’s overall commitment is to improve the student loan system and reduce the burden of student loan debt on American families,” a senior administration official said, previewing the beta website first to CNN. “The SAVE plan is a big part of that. It is important in this moment as borrowers are getting ready to return to repayment.”

Federal student loan borrowers can access the beta website at https://studentaid.gov/idr/. The enrollment process is estimated to take 10 minutes, and many sections can be automatically populated with information the government has on hand, including tax returns from the IRS, administration officials said.

Borrowers will only need to apply one time, not yearly as past systems require, which officials said would make this plan “much easier to use.” Users will receive a confirmation email once the application is submitted, and the approval process, which can be tracked online, is expected to take a few weeks.

Those already enrolled in the federal government’s REPAYE, or Revised Pay As You Earn, income-driven repayment plan will be automatically switched to the new plan.

The full website launch will occur in August, and applications submitted during the beta period will not need to be resubmitted. The beta period will allow the Department of Education to monitor site performance in real time to identify any issues, and the site may be paused to make any necessary updates, officials said.

The SAVE plan, which applies to current and future federal student loan borrowers, will determine payments based on income and family size, and some monthly payments will be as small as $0. The income threshold to qualify for $0 payments has been increased from 150% to 225% of federal poverty guidelines, which translates to an annual income of $32,805 for a single borrower or $67,500 for a family of four. The Education Department estimates this means more than 1 million additional borrowers will qualify for $0 payments under the plan.

Some borrowers could have their payments cut in half when the program is in full effect next year and see their remaining debt canceled after making at least 10 years of payments, a significant change from previous plans.

With the new plan, unpaid interest will not accrue if a borrower makes their full monthly payments.

But the new plan does come at a cost to the federal government. Estimates of the program’s expense have varied depending on how many borrowers sign up for the new plan, but they range from $138 billion to $361 billion over 10 years. By comparison, Biden’s student loan forgiveness program was expected to cost about $400 billion.

The Education Department has created similar income-driven repayment plans in the past and has not faced a successful legal challenge, officials noted.

The beta site launch comes as borrowers will need to begin making federal student loan payments again in October after a pause of more than three years because of the pandemic.

Since the Supreme Court struck down Biden’s effort to cancel up to $20,000 of student debt for millions of borrowers, the administration has taken a number of steps aimed at helping federal student loan borrowers in other ways.

Earlier this month, the Education Department announced that 804,000 borrowers will have their student debt wiped away – about $39 billion worth of debt – after fixes that more accurately count qualified monthly payments under existing income-driven repayment plans.

#us politics#news#cnn politics#cnn#president joe biden#biden administration#student loan forgiveness#cancel student loans#student debt forgiveness#student loan debt#Saving on a Valuable Education#federal student loans#Revised Pay As You Earn#Department of Education#us supreme court#scotus#debt forgiveness#2023

34 notes

·

View notes

Text

Another round of forgiveness was announced Thursday, bringing the total amount of student loan cancellation to more than $175 billion for nearly 5 million people since President Joe Biden took office. That’s roughly equal to 11% of all outstanding federal student loan debt.

More than 1 million of these student loan borrowers received debt relief through the Public Service Loan Forgiveness program, which promises loan forgiveness to public-sector workers – like teachers and nurses – after they’ve made 10 years of qualifying payments.

The PSLF program has been in place for more than 15 years but had been riddled with administrative problems.

“For too long, the government failed to live up to its commitments, and only 7,000 people had ever received forgiveness under Public Service Loan Forgiveness before Vice President (Kamala) Harris and I took office,” Biden said in a statement.

“We vowed to fix that,” he added.

Biden’s Department of Education made it easier for borrowers to qualify for PSLF – a stark contrast to former President Donald Trump, who repeatedly proposed ending the program when he was in the White House.

Thursday’s announcement impacts about 60,000 borrowers who are now approved for approximately $4.5 billion in student debt relief under PSLF.

How far does Biden's student loan debt relief actually go?

So far, the Biden administration has canceled more than $175 billion in federal student loan debt. That's less than half of the $430 billion that would've been canceled under the president's one-time forgiveness plan, which was struck down by the Supreme Court last year, and 11% of all federal student loan debt.

More recent student loan relief efforts, including a new repayment plan known as Saving on a Valuable Education (SAVE) that the Biden administration launched last year, are also tied up in litigation.

The lawsuits were filed by groups of Republican-led states, which argue that the Department of Education does not have the legal authority to implement the costly debt-relief programs.

“And while Republican elected officials do everything in their power to block millions of their own constituents from receiving this much needed economic relief, I will continue our work to lower costs, make higher education more affordable, and relieve the burden of student debt,” Harris said in a statement Thursday.

How Biden keeps canceling student loan debt despite Supreme Court ruling

The student debt relief that Biden has been able to deliver – which is more than under any other president – has come through existing programs that affect specific categories of borrowers. In some instances, the administration has made it easier for borrowers to qualify for the program and streamlined application processing.

The Biden administration has made it easier for about 572,000 permanently disabled borrowers to receive the debt relief to which they are entitled.

It also has granted student loan forgiveness to more than 1.6 million borrowers who were defrauded by their college. A backlog of these debt-relief claims built up during the Trump administration, which made efforts to limit the program. Those efforts were ultimately unsuccessful.

#us politics#the courts#so about 35000 per person#often someone has paid back the loan of what was borrowed#but still had more due because of interest#which is helpful to getting my relatives on board#who are grumpy about cheats and things and anyone getting a benefit they didn't

2 notes

·

View notes

Text

In a new wave of student loan forgiveness, the Biden administration is canceling $5 billion in debt for 74,000 borrowers, many of whom worked in public sector jobs for more than a decade. President Joe Biden said that 44,000 of Friday’s approved borrowers were having their education debt wiped clean after 10 years of public service, and that those borrowers included teachers, nurses and firefighters. Almost 30,000 borrowers have worked toward repayment for at least 20 years but “never got the relief they earned through income-driven repayment plans,” he said in a statement. It’s the latest round of loan forgiveness efforts after the Supreme Court struck down the White House’s student loan debt relief plan last year. Since the ruling, the White House has launched a series of smaller relief programs. “My Administration is able to deliver relief to these borrowers — and millions more — because of fixes we made to broken student loan programs that were preventing borrowers from getting relief they were entitled to under the law,” Biden said Friday. This brings the total number of people who have had debt canceled under the Biden administration to 3.7 million, the White House said.

9 notes

·

View notes

Text

After the Republican Supreme Court struck down the student debt relief program last month the Biden administration promised to look for other ways to roll back exorbitant student debt.

Today's fix is a first step which is more like an accounting adjustment than anything. It's a bit complicated though it is for real.

The Biden administration announced on Friday that it would cancel $39 billion of student debt owed by more than 804,000 borrowers whose debts have been outstanding for more than 20 years. The Education Department said it was implementing its plan, announced in April 2022, to compensate borrowers for what it called “historical inaccuracies” and other failures in how the agency and its contracted loan servicers have managed the income-driven repayment programs. The program is separate from President Joe Biden’s sweeping student debt relief program that the Supreme Court struck down last month. But the announcement comes as the Biden administration looks to highlight its alternative pathways for delivering student debt relief in the face of that legal defeat. “We will not stop there,” Vice President Kamala Harris said in a statement, praising the announcement as a “historic step” to alleviate student debt burdens.

Tangible debt relief will start to be felt in 60 days and will continue through next year for the more than 800,000 people eligible.

Department officials revised borrowers’ accounts to retroactively count months towards forgiveness under the income-driven repayment plans that previously weren’t counted or wouldn’t typically qualify. Those months of credit pushed the more than 804,000 borrowers to reach the threshold for loan forgiveness of 20 or 25 years, depending on the type of income-driven repayment plan.

The US Department of Education has more information here.

Biden-Harris Administration to Provide 804,000 Borrowers with $39 Billion in Automatic Loan Forgiveness as a Result of Fixes to Income Driven Repayment Plans

13 notes

·

View notes

Text

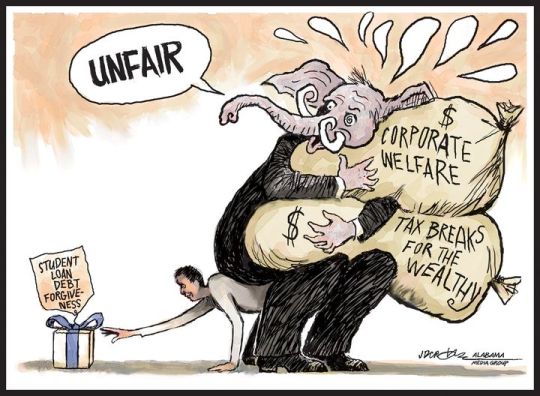

J.D.Crowe

* * * *

The Opus Dei court's unmistakable message to college students: you don't share our politics, so screw you. The Supreme Court on Friday struck down President Joe Biden’s signature initiative to cancel student loan debt for more than 40 million Americans. The Higher Education Relief Opportunities for Student Act of 2003 (HEROES) program would have forgiven eligible borrowers of up to $20,000 each, costing some $400 billion overall, but it was blocked by an appeals court in October. The justices were split on the decision 6-3, with the conservative majority saying the president—and his secretary of education—do not have the authority to unilaterally act without congressional approval. “The Secretary asserts that the HEROES Act grants him the authority to cancel $430 billion of student loan principal,” Chief Justice John Roberts wrote in his majority opinion. “It does not. We hold today that the Act allows the Secretary to ‘waive or modify’ existing statutory or regulatory provisions applicable to financial assistance programs under the Education Act, not to rewrite that statute from the ground up.”

In making his case, Roberts cited former House speaker Nancy Pelosi, noting that the California Democrat said in July 2021 that people “think that the President of the United States has the power for debt forgiveness. He does not. He can postpone. He can delay. But he does not have that power. That has to be an act of Congress.” The case hinged on one’s particular reading of the HEROES Act, with Republicans largely interpreting the version of the act passed by Congress as not allowing for Biden’s debt relief plan. The majority of Democrats, however, argued that the act clearly gave Biden all the leeway he needed to cancel student debt. “Congress authorized the forgiveness plan (among many other actions); the Secretary put it in place; and the President would have been accountable for its success or failure,” Justice Elena Kagan wrote in her dissent for the court’s liberal wing. “But this Court today decides that some 40 million Americans will not receive the benefits the plan provides, because (so says the Court) that assistance is too ‘significant.’” Indeed, Kagan argued, “The Court’s first overreach in this case is deciding it at all.” She also noted that there was “nothing personal in the dispute here.”

[The Daily Beast]

#debt forgiveness#Daily Beast#corrupt SCOTUS#Student loans#J.D.Crowe#political cartoon#debt relief plan

12 notes

·

View notes

Text

Less than a year after the Biden administration proposed forgiving up to $10,000 in federal student loan debt for most borrowers, the Supreme Court ruled the policy unconstitutional. At the core of the case was whether the HEROES Act of 2003 granted the Secretary of Education the authority to “waive or modify” federal student loan terms, up to and including forgiving those loans. The Court ruled in a 6-3 decision that broad forgiveness was beyond the scope of what Congress intended when passing the HEROES Act, further arguing in the majority decision that policies with such a large economic and political impact should be decided through Congress, and not executive action.

In the wake of that decision, the Biden administration has shifted policy toward improving the borrowing process as well as the repayment process. Political attention has focused on repayment (from the Biden administration’s attempts at loan forgiveness to Republican-sponsored legislation proposing new repayment structures) but must also turn to reforming how students decide whether and how much to borrow to ensure future students do not face unmanageable student loan debt.

Short-term policies around loan repayment

With widespread student loan forgiveness struck down by the Supreme Court, the Department of Education (ED) is moving forward on two repayment-oriented efforts. First, the Department has been implementing targeted student loan forgiveness under existing programs. In one recent move, ED announced they had reviewed old income-driven repayment accounts to ensure borrowers received accurate credit for prior monthly payments — as a result about 800,000 borrowers had the rest of their loans forgiven.

The Department is also working to expand student loan forgiveness for students who attended fraudulent universities. In some cases, the administration has automatically forgiven loans for students attending colleges that misrepresented its graduates’ employment rates or that lied about their program accreditation when recruiting prospective students. The administration is also launching a “borrowers defense” application on July 30 where borrowers can make claims against their colleges engaging in misbehavior and request loan forgiveness.

Second, the Biden administration announced the details of their new income-driven repayment plan, with some elements going into effect prior to when student loan repayments restart later this year. The new Saving on a Valuable Education (‘SAVE”) plan will replace REPAYE (an existing income-driven repayment plan) and will automatically transfer borrowers on REPAYE to the new SAVE terms.

The key short-term changes include exempting a higher threshold of income and limiting interest accrual. Borrowers’ monthly payment is calculated off their discretionary income, which has to-date been any income above 150% of the poverty line. Under SAVE, that will be any income above 225% of the poverty line. For a household of four, that means an additional $22,500 of income is protected against consideration when calculating monthly payments. Further, starting this summer if borrowers’ payments don’t cover the interest accrued that month, that interest won’t be charged. Interest accumulation has been a key driver of why some borrowers owe more on their loans four years after graduation than their original balance. While other elements of the plan, such as reducing the years borrowers have to pay before forgiveness, won’t go into effect until next summer, many have argued the new repayment plan is so generous it amounts to a new loan forgiveness program.

Pre-pandemic, the Congressional Budget Office estimated that ED loses 16.9 cents on the dollar for loans in income-driven repayment plans (as opposed to the 12.8 cents on the dollar they gain from loans repaid in standard plans). In its initial review of the Biden administration’s proposed income-driven repayment plan, CBO estimated the program would cost about $230 billion over the next decade, though will update that estimate as the details of the program get finalized.

Challenges restarting payments

Millions of borrowers have had their student loan payments on pause since March 2020, but a provision in recent debt ceiling negotiations stipulated that the pause must end this year and payments will resume this fall. One analysis estimates about 16% of borrowers could be unprepared to make their student loan payment, recommending ED double-down on enrolling borrowers in existing income-driven repayment plans and calls on states and employers to provide assistance navigating loan repayment.

At the federal level, the Biden administration announced that borrowers would not face any negative credit consequence of non-payment until September 30, 2024 during a repayment “on ramp” period. While this action will help borrowers avoid default, it is incumbent on the administration to clearly communicate to borrowers that interest will still accumulate on their loans, so borrowers aren’t surprised by increasing debt balances.

Widespread loan forgiveness: Negotiated rulemaking

The administration has not stopped pursuing widespread student loan forgiveness. But these actions must be taken through the authority granted to the Secretary of Education under the Higher Education Act (HEA). The administration now turns to a long, complicated process called “negotiated rulemaking,” (commonly abbreviated as “neg reg” or “reg neg”) to advance student loan forgiveness.

This Brookings explainer details the negotiated rulemaking process from 2021 when ED convened a committee around student loan forgiveness rulemaking. At a high level, ED must craft a negotiating committee, which will hold hearings and vote on proposed actions, and then ED will propose rules based on committee consensus. These phases can take a long time — but ED is moving quickly and the 2023-24 negotiated rulemaking process is already underway.

There are two key timing considerations for implementation. ED must propose rules by November 1 for them to go into effect by the following July — meaning the Department will likely announce final rules on student loan forgiveness just days before the November 2024 presidential election, raising the stakes on implementation. A new presidential administration could potentially pause implementation and move to formally rescind a federal rule, as former Secretary of Education Betsy DeVos did in 2019 when she rescinded a “gainful employment” rule regulating career programs’ eligibility for federal financial aid that had been passed under the Obama administration.

There’s another date to consider — the end of 2025. Most types of student loan forgiveness are subject to taxation, but the American Rescue Plan has a provision that federal student loan discharges are not subject to federal taxation through December 31, 2025 (and most, though not all, states have followed suit). This deadline makes it even more pressing for borrowers that neg-reg rules get submitted by November 2024 so they can be implemented in the second half of 2025 before the tax exemption expires.

Legal challenges ahead?

Federal rulemaking is subject to judicial review, and whatever rules emerge from the current neg-reg process will almost certainly face legal challenge. However, based on the Administrative Procedural Act, those challenges will be unlikely to come until late 2024 once there has been “final agency action” (e.g., when the final rule is posted). Of course, a legal challenge to one rule does not preclude another attempt from an agency. When the Obama administration was crafting gainful employment regulations, their first proposal was struck down, after which they changed the metrics they would use to evaluate colleges and proposed a new rule that was upheld against legal challenges. This may be the first of multiple rulemaking processes around student loan forgiveness and how to best structure loan repayment.

11 notes

·

View notes

Text

4 notes

·

View notes

Text

President Joe Biden’s Student Loan Forgiveness Plan Struck Down

By Tannu Punn, The State University of New York Cortland, Class of 2025

July 13, 2023

President Joe Biden lost a Supreme Court case on June 30th, but so did all the millions of student loan borrowers that would have saved thousands in debt. In August 2022, the Biden-Harris Administration introduced the student loan forgiveness plan to help working and middle-class federal student loan borrowers transition back into regular payment after COVID-19-related support ended. This plan included up to $20,000. To be eligible for this forgiveness, Pell Grant recipients could receive up to $20,000, while non-Pell Grant recipients could receive up to $10,000 if their individual income is less than $125,000 or $250,000 for households. [1]

The challengers of the student loan forgiveness plan in Biden v. Nebraska were six states with Republican attorney generals who argued that the loan forgiveness plan violated several federal laws and the HEROES Act. However, to successfully strike down this lawsuit, the plaintiffs had to prove that the policy injured a party or multiple parties; it is not enough to say that the plaintiffs disagreed with the policy. Chief Justice Roberts claimed that the student loan forgiveness plan did not follow through with the Heroes Act because the Act gives the secretary of education the right to modify and waive laws governing student loans and not completely "transform them." Roberts also mentioned how in previous years, laws were waived for a legal requirement, but in the case of this student loan forgiveness program, there was no such thing. [2] If Congress wanted to give the secretary of education the power to "make vast economic and political significance decisions," it must say it in clear words and the HEROES Act did not say such a thing. Justice Barret joined the majority's opinion with a concurring opinion stating that the Biden administration went beyond what Congress could have reasonably understood to be granted in the HEROES Act.

Shortly after Biden lost the case, he announced how the administration may be able to continue to support relief for student loan borrowers with the use of the Higher Education Act of 1965. The Department of Education issued a notice on July 18th, which is the first step in issuing regulations and following this public hearing, the Department will finalize the issues to be addressed through rulemaking. As this Act allows "compromise and settlement authority," the Administration finalized the SAVE program (Saving on Valuable Education) which will cut borrower's monthly payments in half. [3] More specifically, the SAVE program will allow:

· For undergraduate loans, the amount that borrowers have to pay will be cut in half from 10% to 5% of discretionary income

· Forgive loan balances after 10 years and not 20 years for loan borrowers with $12,000 or less

· If borrowers make their monthly payments, there will be no charge for unpaid interest rates -- even if the monthly payment is $0.

In addition to the SAVE program, there is also an "on-ramp" program for repayment starting October 1st. During this period, borrowers will not face the threat of default or harm to their credit score if they miss monthly payments. [4]

Although this new plan is going to longer to officially start, as it must go through various rule-making federal hearings, Biden is confident that it will not face any legal issues like his previous plan under the HEROES Act did.

______________________________________________________________

[1] https://studentaid.gov/debt-relief-announcement

[2] https://www.scotusblog.com/2023/06/supreme-court-strikes-down-biden-student-loan-forgiveness-program/#:~:text=Supreme%20Court%20strikes%20down%20Biden%20student%2Dloan%20forgiveness%20program,-By%20Amy%20Howe&text=By%20a%20vote%20of%206,%24400%20billion%20in%20student%20loans.

[3] https://www.whitehouse.gov/briefing-room/statements-releases/2023/06/30/fact-sheet-president-biden-announces-new-actions-to-provide-debt-relief-and-support-for-student-loan-borrowers/

[4] https://www.boston.com/news/politics/2023/07/10/biden-has-a-plan-b-for-student-loan-forgiveness-heres-how-it-works/

2 notes

·

View notes

Text

Things Biden and the Democrats did, this week. #5

Feb 9-16 2024

The Department of Education released the first draft for a wide ranging student loan forgiveness plan. After Biden's first attempt at student debt forgiveness was struck down at the Supreme Court in 2023, this new plan is an attempt to replace it with something that will hold up in court. The plan hopes to forgive debt for anyone facing "financial hardship" which has been as broadly defined as possible. Another part of the plan hopes to eliminate $10-20,000 in interest from all student loans, as well as a wide ranging public Information push to inform people of other forgiveness programs they qualify for but don't know about.

The House passed 1.2 Billion Dollars to combat human trafficking, including $175 million in housing assistance to human trafficking victims

The Department of Transportation announced $970 Million for improvements at 114 airports across 44 states and 3 territories. They include $40 million to O'Hare International in Chicago to improve passenger experience by reconfiguring TSA and baggage claims, and installing ADA compliant bathrooms(!). The loans will also go to connecting airports to mass transit, boosted sustainability, installing solar and wind power, and expanding service to under served committees around the country.

Medicare & Medicaid released new guidelines to allow people to pay out of pocket prescription drug coats in monthly installments rather than as a lump sum. This together with capping the price of certain drugs and penalties for drug companies that rise prices over inflation is expected to save the public millions on drug coasts and assure people don't pass on a prescription because they can't pay upfront

The EPA announced its adding 150 more communities to its Closing America's Wastewater Access Gap Community Initiative. 2.2 Million Americans do not have basic running water and indoor plumbing. Broken and unreliable wastewater infrastructure exposed many of those to dangerous raw sewage. These Americans live primarily in poor and rural communities, many predominantly Black communities in the south as well as those on tribal lands. The program is aiming to close the wastewater gap and insure all Americans have access to reliable clear water.

The White House announced deferred action for Palestinians in the US. This means any Palestinian living in the United States, no mater their legal status, can not be deported for any reason for the next 18 months.

The Department of Energy announced $60 million in investment into clean geothermal energy. The plan will hopefully lead to a 90% decrease in the coasts of geothermal. DOE estimates hold that geothermal might be able to power the hopes of 65 million Americans by 2050 making it a key step in the Biden administration plan for a carbon-free grid by 2035 and net-zero emissions by 2050.

The EPA launched $83 million to help improve air quality monitoring across America. With updated equipment local agencies will be better able to report on air quality, give more localized reports of bad air quality and the country will be better equipped to start mitigating the problem

The Department of Energy announced $63 million in investments in domestic heat-pump manufacturing. Studies have shown that heat-pumps reduce green house gases by 50% over the most efficient condensing gas boilers, as technology improves this could rise to 75% by 2030. Heat pump water heaters meanwhile are 2 to 3 times as energy efficient as conventional electric water heaters.

HHS awarded $5.1 million to organizations working with LGBTQI+ Youth and their Families. The programs focus on preventing homelessness, fighting depression and suicide, drug use and HIV prevention and treatment, as well as family counseling and support interventions tailored for LGBTQI+ families.

The House passed two bills in support of the oppressed Uyghur minority in China. The "No Dollars To Uyghur Forced Labor" Act would prohibit the US government from spending any money on projects that source materials from Xinjiang. The Uyghur Policy Act would create a permanent post at the State Department to coordinate policy on Uyghur Issues, much like the special ambassador on antisemitism.

#Joe Biden#Thanks Biden#politics#US politics#Democrats#climate change#student loans#student loan forgiveness#green energy#Palestinians#Uyghur

214 notes

·

View notes

Text

And now these Bernie Bros can take comfort in the fact SCOTUS struck down Biden’s plan to eliminate student debt. Perhaps if they voted for Clinton & Biden, we would’ve done it but not voting has consequences #wetriedtotellya

#merrick garland#indictment of trump#lock him up!#hillary clinton#ari melber#classified documents#youtube#us politics#Affirmative action#scotus#student loans#jack smith#the Supreme Court#corrupt judges#clarence thomas#abolish the Supreme Court#samuel alito#fuck the supreme court#voting rights#Y’all should have listened to antita hill and Hillary Clinton#donald trump#and i will die on this hill#us supreme court#supreme court

2 notes

·

View notes

Text

Donald Trump slammed President Joe Biden’s plans to cancel student loan debt as “vile” and suggested that the program will be “rebuked” if he is elected.

The Biden administration has canceled loan balances for nearly 4.8 million people by relying on a mix of existing programs and new policies after the Supreme Court struck down his campaign-trail promise for sweeping relief last year.

In a rambling campaign rally speech in Racine, Wisconsin, on Tuesday, Trump compared debt relief to what he said is “illegal amnesty” for immigrants married to American citizens.

“He did that with the tuition and that didn’t work out too well, he got rebuked, and then he did it again, it’s going to get rebuked again, even more so, it’s an even more vile attack, but he did that with tuition just to get publicity with the election,” he said.

Twenty minutes later, he blamed student loan relief for a climbing federal budget deficit.

“Because he’s throwing money out the window,” Trump said. “This student loan program, which is not even legal, it’s not even legal, and the students aren’t buying it, by the way. His polls are down. I’m leading in young people by numbers that nobody has ever seen.”

Last year, the Supreme Court blocked Biden’s plans for student debt relief after a pair of lawsuits from Republican attorneys general and conservative legal groups.

At a campaign event that same day, Trump hailed the decision and called Biden’s plans “very unfair to the millions and millions of people who paid their debt through hard work and diligence.”

Project 2025, a right-wing special interest-backed plan for Trump’s return to the White House, has also called for reversing student debt cancellation and eliminating the Office of Federal Student Aid.

Earlier this year, more than a dozen GOP-led states launched another federal court battle to challenge Biden’s latest debt relief plans. Biden is “unilaterally trying to impose an extraordinarily expensive and controversial policy that he could not get through Congress,” according a lawsuit led by Missouri’s Republican attorney general.

Before Biden’s plan was struck down, millions of people who took out federally backed student loans were eligible for up to $20,000 in relief.

Borrowers earning up to $125,000, or $250,000 for married couples, would be eligible for up to $10,000 of their federal student loans to be wiped out. Those borrowers would be eligible to receive up to $20,000 in relief if they received Pell grants.

Roughly 43 million federal student loan borrowers were eligible for that relief, including 20 million people who could have had their debts entirely wiped out, according to the White House. 16 million people had already submitted their applications and received approval for debt cancellation prior to the court’s ruling.

Still, the administration has been able to speed relief for nearly 5 million Americans by leaning on programs that have existed for years, including during Trump’s administration.

Last month, the administration aided $7.7 billion in relief, including wiping out debts for nearly 67,000 public servants enrolled in the Public Service Loan Forgiveness program, according to the Education Department.

Another 54,000 borrowers had their balances cleared under a new repayment plan that promises to cancel debts from loans of less than $12,000 if they had made their payments over 10 years. Another 39,000 borrowers who have been in repayment for more than 20 to 25 years as part of an income-driven repayment plan also had their balances cleared.

The administration’s student loan plans are also fuelling a federal budget deficit, which will hit $1.9 trillion this fiscal year, according to the Congressional Budget Office.

That includes a projected $145 billion spike from changes to the student loan forgiveness plan, including a proposal to waive interest for millions of borrowers.

The amount of debt taken out to support student loans for higher education costs has exploded within the last decade, alongside surging tuition costs, private university enrollment growth, stagnant wages and a lack of investments in higher education and student aid, which puts the burden of college costs largely on students and their families.

Many borrowers also have been trapped by predatory lending schemes with for-profit institutions and sky-high interest rates that have made it impossible for many borrowers to make any progress toward paying off their debt, with interest adding to balances that have exceeded the original loans.

#us politics#news#republicans#conservatives#donald trump#gop#2024#2024 elections#biden administration#president joe biden#department of education#student loan forgiveness#Office of Federal Student Aid#us supreme court#Public Service Loan Forgiveness#congressional budget office

6 notes

·

View notes

Video

youtube

With President Biden's student debt relief tied up in the courts, his administration has released a plan to continue to help borrowers. Ana Kasparian discusses on The Young Turks. Watch TYT LIVE on weekdays 6-8 pm ET. http://youtube.com/theyoungturks/live Read more HERE: https://finance.yahoo.com/news/biden-plan-b-student-debt-214426552.html "The Biden administration is pushing forward with another approach to tackling the student debt crisis while its main initiative, a plan to forgive up to $20,000 in student loans per borrower, remains mired in legal limbo. Even if the debt-forgiveness effort is struck down by the courts, the Department of Education's Plan B could help millions of borrowers by overhauling income-driven repayment plans. It also addresses some of the worst pitfalls of student debt, such as "negative amortization," or when a person's loan balance keeps growing despite their consistently making payments. The plan to reform income-driven repayment plans, or IDRs, was first announced in August but was overshadowed by the Biden administration's blueprint for forgiving up to $20,000 in debt per borrower. But with the debt-relief program stopped in its tracks by legal challenges — and now headed for the conservative-leaning Supreme Court — the Education Department said it is moving forward with the other part of its plan, which will overhaul IDRs with the goal of helping lower- and middle-income borrowers." *** The largest online progressive news show in the world. Hosted by Cenk Uygur and Ana Kasparian. LIVE weekdays 6-8 pm ET. Help support our mission and get perks. Membership protects TYT's independence from corporate ownership and allows us to provide free live shows that speak truth to power for people around the world. See Perks: ▶ https://www.youtube.com/TheYoungTurks/join SUBSCRIBE on YOUTUBE: ☞ http://www.youtube.com/subscription_center?add_user=theyoungturks FACEBOOK: ☞ http://www.facebook.com/TheYoungTurks TWITTER: ☞ http://www.twitter.com/TheYoungTurks INSTAGRAM: ☞ http://www.instagram.com/TheYoungTurks TWITCH: ☞ http://www.twitch.com/tyt 👕 Merch: http://shoptyt.com ❤ Donate: http://www.tyt.com/go 🔗 Website: https://www.tyt.com 📱App: http://www.tyt.com/app 📬 Newsletters: https://www.tyt.com/newsletters/ If you want to watch more videos from TYT, consider subscribing to other channels in our network: The Watchlist https://www.youtube.com/watchlisttyt Indisputable with Dr. Rashad Richey https://www.youtube.com/indisputabletyt Unbossed with Nina Turner https://www.youtube.com/unbossedtyt The Damage Report ▶ https://www.youtube.com/thedamagereport TYT Sports ▶ https://www.youtube.com/tytsports The Conversation ▶ https://www.youtube.com/tytconversation Rebel HQ ▶ https://www.youtube.com/rebelhq TYT Investigates ▶ https://www.youtube.com/channel/UCwNJt9PYyN1uyw2XhNIQMMA #TYT #TheYoungTurks #BreakingNews 230111__TA05_Decoded_Bidens_Back_Up by The Young Turks

1 note

·

View note

Text

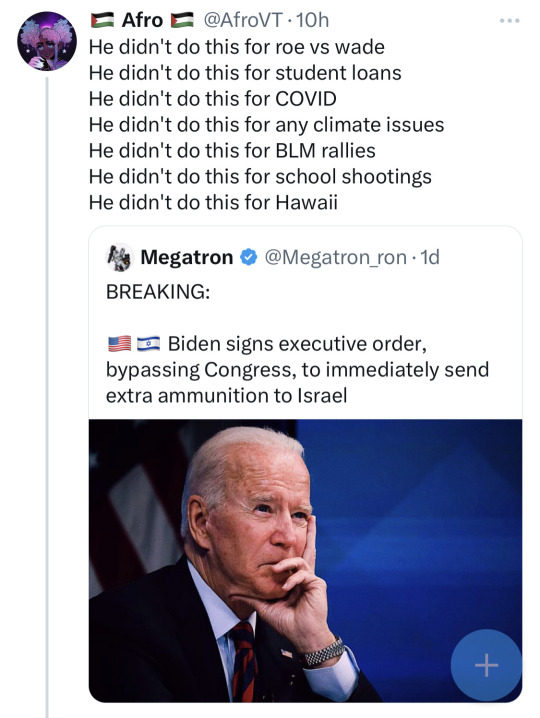

This is blatant disinformation. All likely in order to dissuade people from voting for him in 2024. Putin desperately wants Trump back in office as that will effectively allow him to improve the Russian situation. And I'm not telling you to vote for Biden because he's not trump, I'm telling you to vote for him because he is a great president. Don't believe me, keep reading. I will go over the truth below:

1) Biden did not sign any executive order about Israel aid as far as I know. He did sign one in aid of Native Americans. Here is the federal register of executive orders: https://www.federalregister.gov/presidential-documents/executive-orders/joe-biden/2023

2) He did what he could via abortion access, such as funding abortions for veterans. src:

https://apnews.com/article/abortion-biden-lloyd-austin-government-and-politics-dc6a0317775596ffc7945acc79b7559e

3) He has made several inroads into student loans. He's been getting people relief over predatory loans. In addition, he attempted a $10000-$20000 student loan forgiveness program that got struck down by the Trump supreme court(let's not repeat 2016, please). He also improved the system to give borrowers more help. (He is still attempting student loan relief via congress, but that will take quite some time). src:

https://thehill.com/homenews/education/4370297-biden-student-loans-debt-relief-2023-whiplash/

https://studentaid.gov/debt-relief-announcement

4) He did several executive orders on COVID, 8 in 2021 and 1 in 2023, for various issues. He put in mandatory federal vaccinations, as well as COVID relief. Not to mention, one of the first acts, that he passed as president was the third COVID stimulus. src:

https://www.federalregister.gov/presidential-documents/executive-orders/joe-biden/2021

https://www.federalregister.gov/presidential-documents/executive-orders/joe-biden/2023

5) His Build Back Better plan which passed as the Inflation Reduction Act of 2022 literally is working towards making the country use clean energy. Here are some good quotes from the bill:

"In addition, the act provides funding to the Department of Housing and Urban Development for loans and grants. The loans and grants must fund projects that address affordable housing and climate change issues."

"The act modifies and extends through 2024 the tax credit for producing electricity from renewable resources, specifically wind, biomass, geothermal and solar, landfill gas, trash, qualified hydropower, and marine and hydrokinetic resources."

src: https://www.congress.gov/bill/117th-congress/house-bill/5376

6) Here's a whole page on Biden's efforts to improve the lives of black americans: https://www.whitehouse.gov/briefing-room/statements-releases/2021/10/19/fact-sheet-the-biden-harris-administration-advances-equity-and-opportunity-for-black-people-and-communities-across-the-country/

7) Biden has been attempting to curb school shootings during his presidency. here are some articles:

https://www.edweek.org/policy-politics/biden-credits-school-shooting-survivors-as-he-creates-gun-violence-prevention-office/2023/09

https://www.whitehouse.gov/briefing-room/statements-releases/2023/05/18/statement-from-president-joe-biden-on-five-years-since-the-shooting-at-santa-fe-high-school/

https://abcnews.go.com/Politics/biden-call-end-epidemic-gun-violence-year-after/story?id=99560777

8) Hawaii was provided aid by Biden during and after the wildfires. src:

https://www.fema.gov/press-release/20230817/biden-harris-administration-provides-38-million-assistance-hawaii-residents

Now for some extra stuff, you might not have heard.

9) Biden did away with the prepay pension funding policy for USPS workers, as well as improving working conditions. Here's an article from the USPS union: https://apwu.org/postal-service-reform-act-2022 And here's the act itself: https://www.congress.gov/bill/117th-congress/house-bill/3076

10) Biden having worked with rail unions to get them paid sick days. src:

https://www.ibew.org/media-center/Articles/23Daily/2306/230620_IBEWandPaid

Ultimately, Biden is only 1 person. He can't do everything himself. We have to act too. We have to vote. It doesn't matter who the president is, if the courts, and congress are against him.

63K notes

·

View notes