#the institute of chartered accounts of india

Explore tagged Tumblr posts

Text

What are The Recent Updates In Chartered Accountant Course: 2024 Guide

Important update in the CA course is the introduction of an integrated program. This new structure eliminates the intermediate examination and offers a direct entry to the CA course after completing Class 12.

#chartered accountant courses#chartered accountant course duration#chartered accountant course#chartered accountant course in kolkata#chartered accountant course details#chartered accountant course in india#chartered accountant institute in kolkata

0 notes

Text

Important Announcement: Rescheduling of May 2024 Examinations by ICAI

Introduction: The Institute of Chartered Accountants of India (ICAI) stands as a beacon of excellence in the field of accounting, shaping the future of accounting professionals with its unwavering commitment to examination integrity and fairness. In line with its dedication to transparency and accountability, ICAI regularly updates stakeholders on matters of significance. This announcement…

View On WordPress

#bjp#candidate updates#congress#education#electoral process#examination announcements#examination integrity#examination preparation#examination rescheduling#Fairness#icai#ICAI website#india#Institute of Chartered Accountants of India#Lok Sabha Election#May 2024 examinations#politics

0 notes

Text

11th Accountancy - Conceptual Framework of Accounting Chapter 2

I. Multiple Choice Questions : Choose the Correct Answer Question 1: The business is liable to the proprietor of the business in respect of capital introduced by the person according to ……………… (a) Money measurement concept (b) Cost concept (c) Business entity concept (d) Dual aspect concept Answer: (c) Business entity concept Question 2: The concept which assumes that a business will…

View On WordPress

#Accounting period#Accounting standard#Bad debt#Depreciation#FYI#Institute of Chartered Accountants of India#Medium of exchange#Money measurement concept#Reserve Bank of India#Revenue recognition#Stock valuation#Supreme Court of India

0 notes

Text

Tax Auditors in India

Understanding Tax Auditors in India

A tax audit is a crucial process that ensures businesses and individuals comply with the provisions of the Income Tax Act, 1961. It involves reviewing financial records, transactions, and statements to verify accuracy and adherence to tax regulations. In India, tax audits are conducted under Section 44AB of the Income Tax Act, and they are mandatory for businesses and professionals exceeding specified turnover or gross receipts limits.

Why Choose SC Bhagat & Co. for Tax Auditors in India?

SC Bhagat & Co. is a leading tax auditing firm in India with a team of experienced chartered accountants who provide professional and reliable tax audit services. Here’s why businesses and individuals trust SC Bhagat & Co. for their tax auditing needs:

Expertise in Tax Compliance

SC Bhagat & Co. ensures that businesses comply with the latest tax laws and regulations, minimizing the risk of penalties and legal issues.

Comprehensive Audit Services

The firm provides detailed audit reports that help businesses understand their financial position and tax liabilities while ensuring adherence to regulatory requirements.

Customized Solutions

Every business has unique financial structures and tax obligations. SC Bhagat & Co. offers tailored audit solutions that suit specific business needs.

Accuracy and Transparency

The firm follows a meticulous approach to reviewing financial statements, ensuring transparency and accuracy in tax filings.

Timely Compliance and Reporting

With SC Bhagat & Co., clients can rest assured that their tax audit reports will be prepared and submitted on time, avoiding last-minute hassles.

Who Needs a Tax Auditors in India?

According to the Income Tax Act, tax audits are mandatory for:

Businesses with a turnover exceeding ₹1 crore (subject to amendments in tax laws).

Professionals with gross receipts exceeding ₹50 lakhs.

Businesses opting for the presumptive taxation scheme under Section 44AD and reporting profits lower than the prescribed percentage.

Benefits of Conducting a Tax Auditors in India

Ensures Compliance: Avoids legal issues and penalties for incorrect tax filings.

Identifies Financial Discrepancies: Helps businesses detect errors or fraud in financial statements.

Reduces Tax Liabilities: Proper tax planning through audits can help reduce unnecessary tax burdens.

Enhances Business Credibility: A well-audited financial statement improves trust among stakeholders, investors, and financial institutions.

Conclusion

For businesses and professionals looking for reliable Tax Auditors in India, SC Bhagat & Co. stands out as a trusted partner. With their in-depth expertise, commitment to compliance, and client-centric approach, they ensure that tax audits are conducted efficiently and accurately.

If you need professional tax audit services, contact SC Bhagat & Co. today to ensure your financial compliance and business growth.

#gst#taxation#accounting firm in delhi#accounting services#direct tax consultancy services in delhi#tax consultancy services in delhi#taxationservices

3 notes

·

View notes

Text

A new age of international relations is dawning.

With the West accounting for a declining share of global gross domestic product and the world becoming increasingly multipolar, countries are jostling to establish their positions in the emerging order. This includes both the emerging economies — represented by the recently expanded BRICS grouping — that seek a leading role in writing the rules of the new order and the smaller countries attempting to cultivate relationships that can safeguard their interests.

With the BRICS, what began as an asset class has become a symbol of the yearning for a more broadly representative global order, a hedge against Western-led institutions and a means of navigating growing geopolitical uncertainty. All this has proved highly attractive. Earlier this year, the BRICS expanded from five countries (Brazil, China, India, Russia and South Africa) to nine (adding Egypt, Ethiopia, Iran and the United Arab Emirates). And almost three dozen more countries — including NATO member Turkey, close U.S. partners Thailand and Mexico and Indonesia, the world’s largest Muslim country — have applied to join.

While the diversity of the grouping’s members (and applicants) highlights the broad appeal of the BRICS+, it also creates challenges. These are countries with very different political systems, economies and national goals. Some are even at odds with each other: China and India have been locked in a military standoff in the Himalayas for over four years, following China’s stealth encroachments on Indian territory.

Translating shared interests into a common plan of action and becoming a unified force on the global stage was difficult even when the BRICS had just five members. With nine — and possibly more — member countries, establishing a common identity and agenda will require sustained effort. But other multilateral groupings that are not formal, charter-based institutions with permanent secretariats — such as the Shanghai Cooperation Organization, the Group of 20 and even the Group of Seven — also struggle with internal divisions.

Moreover, the BRICS have demonstrated considerable resilience. Western analysts have been predicting from the start that the grouping would unravel or drift into irrelevance. Yet this month’s BRICS+ summit in Kazan, Russia — the first since the expansion — may well bring movement toward further enlargement, as it underscores the West’s failure to isolate Russia following its 2022 invasion of Ukraine.

3 notes

·

View notes

Text

The Global and Indian Demand for CFA 2024

The finance industry is changing quickly, and there is a greater need than ever for CFA (Chartered Financial Analyst) specialists in India and around the world. As 2024 approaches, let’s examine why finance aficionados choose the CFA certificate and how it might lead to outstanding professional chances.

Global Demand: A Rising Tide

The CFA designation is still the gold standard for investment professionals around the world in 2024. Employers are increasingly seeking professionals with a strong foundation in ethics, a global perspective, and in-depth knowledge of financial analysis — exactly what CFA charter holders offer. CFAs are in high demand across continents, from asset management companies to global banks, making it a genuinely global credential.

Top financial centers like Singapore, London, and New York are still vying for CFA expertise, which raises pay and benefits. As global markets become more complicated, CFAs are in high demand due to their proficiency in risk management, portfolio analysis, and investment navigation.

Indian Demand: A Booming Finance Hub 🇮🇳

Nearer to home, India is rapidly becoming as a major financial hub, and there is an urgent need for certified public accountants. Professionals with a strategic edge and knowledge of the global financial scene are sought after by Indian businesses and financial institutions. CFAs are finding a variety of jobs in investment banking, equity research, and financial consultancy, from Bangalore’s burgeoning startup scene to Mumbai’s thriving stock market.

Why CFA is a Smart Career Move in 2024

Comprehensive Knowledge: The CFA program is a well-rounded credential that covers everything from corporate finance to equity analysis and alternative investments.

Global Recognition: In the highly competitive finance employment market, the CFA certificate is respected and acknowledged globally, making you stand out.

Opportunities for Networking: By joining CFA societies worldwide, you can connect with a strong network of recruiters, mentors, and finance professionals.

High Return on Investment: Taking the CFA course can lead to worldwide employment opportunities, increased compensation, and career improvements.

Study with the Experts at Zell Education

Zell Education is available to help if you’re serious about becoming a certified financial advisor. Beyond textbooks, our knowledgeable faculty offers study programs, individualized coaching, and real-world insights. You will be ready to take the CFA tests and establish yourself in the finance industry with our help.

Get ahead in 2024 by realizing your financial professional goals and unlocking your potential with the CFA!

2 notes

·

View notes

Text

Your Complete Guide: How to Apply for the ACCA Course in India

The Association of Chartered Certified Accountants (ACCA) is one of the most sought-after global certifications for aspiring finance and accounting professionals. It is internationally recognized, making it a top choice for students looking to build a successful career in finance, accounting, and auditing. If you're in India and are interested in pursuing the ACCA course, here’s a step-by-step guide on how to apply.

Step 1: Check Eligibility Criteria

Before applying, ensure that you meet the eligibility requirements for the ACCA course. Typically, candidates who have completed their 10+2 with a minimum of 65% in Mathematics/Accounts and English and 50% in other subjects are eligible. Graduates in commerce or related fields may also be eligible for exemptions from some exams, depending on the university they attended.

Step 2: Register for ACCA

To apply for the ACCA course in India, you first need to register on the official ACCA Global website. The registration process is straightforward:

Visit the ACCA official website.

Navigate to the ‘Apply Now’ section and fill out the registration form.

You will need to provide personal details, educational qualifications, and other relevant information.

Once the form is submitted, you will receive a confirmation email with details of your ACCA student account.

Step 3: Submit Required Documents

To complete your registration, you will need to upload scanned copies of the following documents:

Proof of Identity: Passport, Aadhaar card, or any other government-approved ID.

Educational Certificates: Marksheets and certificates from your 10+2 and graduation (if applicable).

Passport-sized Photograph: A recent digital photo.

Make sure all documents are clear and meet the specifications mentioned on the ACCA website.

Step 4: Pay the Registration Fee

After submitting your documents, the next step is to pay the ACCA registration fee. The fee can be paid online through a secure payment gateway on the ACCA website using a credit/debit card or other accepted payment methods. Once payment is made, you will receive an official confirmation of your enrollment in the ACCA program.

Step 5: Start Your ACCA Journey

After completing your registration and fee payment, you can access your ACCA account, where you’ll find details about the exam schedule, study resources, and more. You can then plan your study schedule and register for the ACCA exams.

NorthStar Academy: The Best Option for ACCA Coaching

Choosing the right coaching institute is crucial to your success in the ACCA course. NorthStar Academy is the best option for ACCA coaching in India, offering comprehensive study materials, expert faculty, and flexible learning schedules. With a proven track record of success, NorthStar Academy ensures that students are well-prepared for their ACCA exams and can confidently pursue their career in global finance.

In conclusion, applying for the ACCA course in India is a simple, step-by-step process. With the guidance and support of NorthStar Academy, you can ensure a smooth application process and be on your way to achieving your ACCA certification.

2 notes

·

View notes

Text

How to Choose the Best Chartered Accountant in Karnal for Personal and Corporate Tax Solutions

Selecting the right chartered accountant (CA) is a critical decision for both individuals and businesses.

Whether you're a salaried professional seeking tax advice or a business owner needing corporate tax solutions, a knowledgeable and experienced CA can help you navigate the complexities of India's tax laws and financial regulations.

For residents and business owners in Karnal, finding the best CA is essential for effective tax planning, financial management, and compliance with legal requirements.

In this guide, we’ll discuss how to choose the best CA in Karnal to meet your personal and corporate tax needs, what qualities to look for, and how the right CA can provide solutions that maximize savings and ensure compliance.

Why You Need a CA in Karnal for Tax Solutions

A chartered accountant offers more than just tax filing services. A skilled CA in Karnal can provide:

Personal Tax Planning: They help individuals optimize their tax filings by identifying deductions, exemptions, and rebates to reduce tax liabilities legally.

Corporate Tax Management: For businesses, a CA ensures accurate corporate tax filings and advises on strategies to reduce tax burdens while complying with all laws.

GST and Indirect Taxes: CAs in Karnal also assist with Goods and Services Tax (GST) filings, compliance, and audits, ensuring that your business remains on the right side of the law.

Audit Services: Whether it’s statutory, internal, or compliance audits, a CA can ensure that your financial records are accurate and in accordance with regulatory requirements.

Financial Advice and Wealth Management: Beyond taxes, CAs provide financial guidance, helping individuals and businesses make sound investment decisions and manage their finances efficiently.

With these critical services, choosing the right CA in Karnal becomes essential for your financial success.

Key Qualities to Look for in a Chartered Accountant in Karnal

When selecting a CA in Karnal for personal or corporate tax solutions, there are several key factors to consider.

These qualities will help ensure that the CA you choose can meet your specific financial needs and provide excellent service.

1. Qualifications and Certifications

The first thing to check when selecting a CA is their qualifications. Ensure that the chartered accountant is certified by the Institute of Chartered Accountants of India (ICAI), which guarantees that they have met all the necessary educational and professional standards.

Additionally, look for any specialized certifications or training that indicate expertise in specific areas, such as GST, international taxation, or corporate finance.

2. Experience and Industry Knowledge

Experience is one of the most important factors when choosing a CA. An experienced CA in Karnal will have a thorough understanding of local tax laws and regulations, as well as knowledge of different industries.

A CA who has worked with a diverse client base, including individuals, small businesses, and large corporations, will be well-equipped to handle your unique tax and financial challenges.

For corporate tax solutions, look for a CA who has experience with businesses of a similar size and industry as yours. They will be familiar with sector-specific tax strategies, regulatory requirements, and best practices, ensuring you receive tailored advice that suits your business model.

3. Reputation and Client Reviews

A CA's reputation is a good indicator of their professionalism and quality of service. Look for reviews, testimonials, and word-of-mouth recommendations from current or former clients.

The best CAs in Karnal will have a track record of delivering timely, accurate, and reliable tax solutions. You can also ask for references from other local business owners or individuals who have used their services.

4. Proactive and Problem-Solving Approach

The ideal CA is not just reactive; they are proactive in providing financial solutions. A CA in Karnal should keep up with changes in tax laws and inform you of any updates that may impact your financial situation. They should offer creative and strategic solutions to help reduce your tax burden, plan for the future, and prevent financial problems before they arise.

A proactive approach is especially important for businesses that require year-round tax planning and compliance.

Your CA should regularly communicate any opportunities for tax savings, identify potential risks, and help you stay compliant with evolving regulations.

5. Communication Skills and Transparency

Clear and effective communication is essential when working with a CA. Financial jargon and complex tax laws can be confusing, so you want a CA who can explain things in a way that’s easy to understand.

They should be transparent about their processes, fees, and timelines, ensuring that there are no hidden surprises. Regular updates and open channels of communication will give you peace of mind, knowing that your tax matters are being handled professionally.

6. Technological Expertise

In 2024, a modern CA needs to be well-versed in using accounting software, cloud-based systems, and other technological tools. Technology can help streamline financial processes, improve accuracy, and ensure timely filings.

Make sure the CA you choose uses the latest tools and platforms to enhance their services. This is particularly important for corporate clients who deal with large volumes of financial data.

7. Cost-Effectiveness

While it’s important to hire a CA with the right expertise, you also want to ensure their services are cost-effective. Legalari Compare the fees of different CAs in Karnal and see what services are included.

The best CA should offer value for money, providing a comprehensive range of services without overcharging.

How a CA in Karnal Can Help with Corporate and Personal Tax Solutions

The right CA in Karnal can offer invaluable support for both individuals and businesses. Here’s how:

For Individuals:

Income Tax Filing: Ensure accurate filing and take advantage of all available deductions and exemptions.

Wealth Management: Assist with investment planning, retirement strategies, and estate management to maximize long-term financial growth.

Tax Planning: Develop strategies that minimize your tax liability while staying fully compliant with the law.

For Businesses:

Corporate Tax Compliance: Handle all corporate tax filings, ensuring compliance with local, state, and national tax regulations.

GST Compliance: Assist with GST registrations, filings, and audits, ensuring your business avoids penalties.

Business Structuring: Offer advice on the optimal legal structure for your business to minimize taxes and streamline operations.

Audits and Financial Reviews: Provide comprehensive audit services that ensure your financial statements are accurate and compliant.

Final Thoughts

Choosing the best CA in Karnal is a crucial step in managing your finances effectively, whether for personal or corporate tax solutions. The ideal CA should have a combination of expertise, experience, and strong communication skills.

They should be proactive in offering financial solutions, transparent about their processes, and technologically adept to meet modern financial challenges.

By taking the time to research and evaluate your options, you can find a trusted financial partner who will help you achieve both short-term and long-term financial success.

Whether you need help with personal tax planning or corporate tax management, the right CA in Karnal can make all the difference in optimizing your finances and ensuring compliance with tax laws.

2 notes

·

View notes

Text

Holidays 6.18

Holidays

Academy Day (Scientology)

Autistic Pride Day

Clark Kent Day

Clean Your Aquarium Day

Count Your $$ Day

Drone Safety Day

Festival of Invisible Pornography

Finest Hour Speech Day

Foundation Day (Benguet, Philippines)

Go Fishing Day

Hand Cart Day (French Republic)

Horned Poppy Day

Human Rights Day (Azerbaijan)

International Day for Countering Hate Speech

International Declaration of Human Rights Day

International Panic Day

Jack Herer Day

Justice Institution Employees Day (Turkmenistan)

Mela Khir Bhawani (Kashmir, India)

National Black America’s Day of Repentance

National Internet Cat Day

National Jesse Day

National Relationship Day

National Splurge Day

National Wanna Get Away Day

National Wear Blue Day

Neurodiversity Pride Day (Netherlands)

No Headline Day

Police Inspector’s Day (Ukraine)

Queen Mother’s Day (Cambodia)

618 Day

Sustainable Gastronomy Day

Tabasco Day (Mali)

Trouser Day

Veterinary Appreciation Day (a.k.a. Veterinarian Appreciation Day)

Waterloo Day (UK)

Wild Den Dancing Day

World Day Against Incarceration

World Wide Knit in Public Day

Food & Drink Celebrations

Insalata Day (Italy)

International Picnic Day

International Sushi Day

National Cheesemaker’s Day

National Cherry Tart Day

Independence & Related Days

Aldrodnia (Declared; 2018) [unrecognized]

Bacolod City Charter Day (Philippines)

Constitution Day (Seychelles)

Egypt (a.k.a. Eid el-Galaa, evacuation of foreign troops, 1954)

Flinders (Declared; 2022) [unrecognized]

Jailavera (Declared; 2017) [unrecognized]

Leprechia (Declared; 2021) [unrecognized]

Naga City Charter Day (Philippines)

Onontakeka (Declared; 2018) [unrecognized]

Snagov (Declared; 2020) [unrecognized]

3rd Tuesday in June

National Accounts Payable Appreciation Day [3rd Tuesday]

National Cherry Tart Day [3rd Tuesday]

Royal Ascot begins (UK) [3rd Tuesday]

Taco Tuesday [Every Tuesday]

Weekly Holidays beginning June 18 (3rd Full Week)

National Water Safety Week (Ireland) [thru 6.25]

Royal Ascot (thru 6.22)

Festivals Beginning June 18, 2024

Marysville Strawberry Festival (Marysville, Washington) [thru 6.23]

RMA Convention (Maui, Hawaii) [thru 6.21]

Taste of Little Italy (San Diego, California) [thru 6.19]

Feast Days

Amandus, Bishop of Bordeaux (Christian; Saint)

Andim Day (Pastafarian)

Bernard Mizeki (Anglican and Episcopal Church)

Chris Van Allsburg (Artology)

Elisabeth of Schönau (Christian; Saint)

Elvis Day (Church of the SubGenius; Saint)

Ephraem (Christian; Saint)

Erik Ortvad (Artology)

Festival of Anna (Ancient Rome; Everyday Wicca)

Going Forth of Neith Along the River (Ancient Egypt’ Goddess of War and Hunting)

Gregorio Barbarigo (Christian; Saint)

Gregory of Fragalata (Christian; Saint)

Into Raymi Festival begins (Inca Sun Worship Festival; until 24th)

James Montgomery Flagg (Artology)

John Bellany (Artology)

Joseph-Marie Vien (Artology)

Leontius, Hypatius and Theodulus (Christian; Saints)

Leroy (Muppetism)

Marina the Monk (Maronite Church, Coptic Orthodox Church of Alexandria)

Mark and Marcellian (Christian; Martyrs)

Media Ver XI (Pagan)

National Splurge Day (Church of the SubGenius)

Now Panic Day (Pastafarian)

Osanna Andreasi (Christian; Saint)

Theodoric the Great (Positivist; Saint)

Three Lasting Things of Cormac Mac Art: Grass, Copper and Yew (Celtic Book of Days)

Tiger-Get-By’s Birthday (Shamanism)

Islamic Lunar Holidays

Eid al-Adha, Day 3 [Muslim Feast of Sacrifice] (a.k.a. ...

Al Adha (Bahrain)

Corban Bairam (Sudan)

Eid al Adha (Iraq, Jordan, Kuwait, Oman, Pakistan, Qatar, Saudi Arabia, Syria, West Bank and Gaza, Yemen)

Eid e-Ghorban

Eid ul-Ad’haa (Maldives)

Feast of Sacrifice (Uzbekistan)

Gurban Bayram (Azerbaijan)

Hari Arafat (Malaysia)

Hari Raya Qurban (Malaysia)

Id el Kabir (Nigeria)

Kurban Bayram (North Cyprus)

Kurban Bayramy (Turkey)

Qurbon Hayit (Uzbekistan)

Lucky & Unlucky Days

Taian (大安 Japan) [Lucky all day.]

Unfortunate Day (Pagan) [36 of 57]

Premieres

The Adventures of Ellery Queen (Radio Series; 1939)

The Bully (Ub Iwerks Flip the Frog Cartoon; 1932)

Casey Bats Again (Disney Cartoon; 1954)

Dangerous When Wet (Film; 1953)

Dare To Be Stupid, by Weird Al Yankovic (Album; 1985)

Day & Night (Pixar Cartoon; 2010)

Der Freischütz (or The Marksman), by Carl Maria von Weber (Opera; 1821)

DodgeBall (Film: 2004)

(Everything I Do) I Do It For You, by Bryan Adams (Song; 1991)

Eyes in Outer Space (Disney Cartoon; 1959)

Goodbye Cruel World, by Elvis Costello (Album; 1984)

The House with a Clock in Its Walls, by John Bellairs (Novel; 1973)

Howard Zinn: You Can’t Be Neutral on a Moving Train (Documentary Film; 2004)

Ice Station Zebra, by Alistair MacLean (Novel; 1963)

An Ideal Husband (Film; 1999)

Inside, Outside, by Herman Wouk (History Book; 1985)

Lady and the Lamp (Disney Cartoon; 1979)

Last Action Hero (Film; 1993)

Le Marteau sans Maître, by Pierre Boulez (Chamber Cantata; 1955)

Luca (Animated Film; 2021)

Morning, Noon and Nightclub (Fleischer Popeye Cartoon; 1937)

My Cousin Rachel, by Daphne du Maurier (Novel; 1952)

The Ocean at the End of the Lane, by Neil Gaiman (Novel; 2013)

Odelay, by Beck (Album; 1996)

Once Upon a Forest (Hanna-Barbera Animated Film; 1993)

Origin of Symmetry, by Muse (Album; 2001)

Polar Fright (Chilly Willy Cartoon; 1966)

Popeye Meets Hercules (Fleischer/Famous Popeye Cartoon; 1948)

The Sparks Brothers (Documentary Film; 2021)

Suppressed Duck (WB LT Cartoon; 1965)

Tarzan (Animated Disney Film; 1999)

Toy Story 3 (Animated Pixar Film; 2010)

The Underground World (Fleischer Cartoon; 1943) [#16]

The Wild Bunch (Film; 1969)

Wouldn’t It Be Nice, by The Beach Boys (Song; 1966)

Today’s Name Days

Elisabeth, Ilsa, Marina (Austria)

Asen, Chavdar (Bulgaria)

Elizabeta, Marcel, Ozana, Paul (Croatia)

Milan (Czech Republic)

Leontius (Denmark)

Auli, Aurelia, Auri, Reeli, Reelika, Reili (Estonia)

Tapio (Finland)

Léonce (France)

Elisabeth, Ilsa, Isabella, Marina (Germany)

Erasmos, Leontios (Greece)

Arnold, Levente (Hungary)

Gregorio, Marina, Marinella, Marinetta (Italy)

Alberts, Madis (Latvia)

Arnulfas, Ginbutas, Marina, Vaiva (Lithuania)

Bjarne, Bjørn (Norway)

Efrem, Elżbieta, Gerwazy, Leonia, Marek, Marina, Paula (Poland)

Ipatie, Leontie, Teodul (România)

Vratislav (Slovakia)

Marcelino, Marcos (Spain)

Bjarne, Björn (Sweden)

Leo, Leon (Ukraine)

Effie, Efrain, Eph, Ephraim, Marina, Marnie, Nevaeh (USA)

Today is Also…

Day of Year: Day 170 of 2024; 196 days remaining in the year

ISO: Day 2 of week 25 of 2024

Celtic Tree Calendar: Duir (Oak) [Day 10 of 28]

Chinese: Month 5 (Geng-Wu), Day 13 (Gui-Chou)

Chinese Year of the: Dragon 4722 (until January 29, 2025) [Wu-Chen]

Hebrew: 12 Sivan 5784

Islamic: 11 Dhu al-Hijjah 1445

J Cal: 20 Blue; Sixday [20 of 30]

Julian: 5 June 2024

Moon: 88%: Waxing Gibbous

Positivist: 1 Charlemagne (7th Month) [Theodoric the Great]

Runic Half Month: Dag (Day) [Day 10 of 15]

Season: Spring (Day 92 of 92)

Week: 3rd Full Week of June)

Zodiac: Gemini (Day 29 of 31)

Calendar Changes

Charlemagne (Feudal Civilization) [Month 7 of 13; Positivist]

4 notes

·

View notes

Text

IIMMI is non-profitable organization dedicated to provide high quality education in both technical and vocational courses.

It is well established reputed Institute in North India in the areas of Management, Journalism & Mass Communication and Information Technology at Undergraduate and Post Graduate level.

IIMMI is a premier Institution for advance learning & research created to impart education in the field of Management, media, Information Technology relevant to entrepreneurial development in rural and urban India. The founder of IIMMI are Lawyers, Chartered Accountants, Academics who are also consultant of Corporate/Industry automatic constitute strong placement cell for aspirants.

IIMMI is located in the heart of Delhi, near Delhi University North Campus at ring road Kingsway Camp, opposite G.T.B. Nagar Metro Station, Next to Delhi University (Vishwvidyalaya) Metro Station, 15 minutes from I.S.B.T. & old Delhi Railway Station is convenient for outsiders as well as local Students.

The Institute has the sate of art-of Infrastructure with Modern Outlook.

Top BCA college in Delhi

IIMMI works on the policy of dual Qualification - Degree + Diploma. It provides one autonomous diploma along with all types degree Courses which has been designed keeping in the mind the latest requirement of today’s scenario.

Programs Offered by IIMMI :

1. BCA - Bachelor of Computer Application

2. BBA - Bachelor of Business Administration

3. BJMC - Bachelor in Journalism & Mass Communication

4. MJMC - Master in Journalism & Mass Communication

2 notes

·

View notes

Text

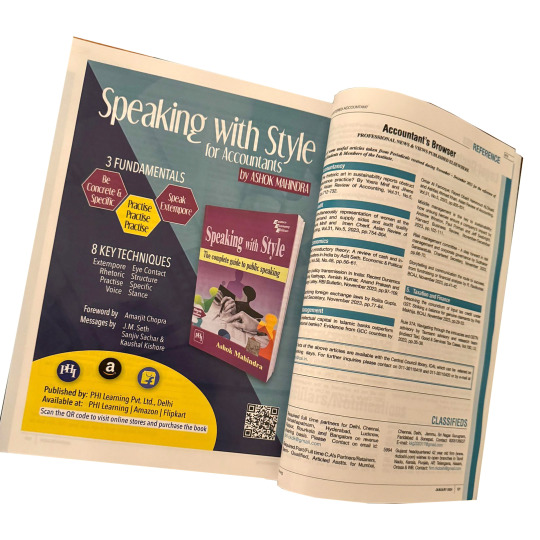

Our book SPEAKING WITH STYLE: THE COMPLETE GUIDE TO PUBLIC SPEAKING by Mahindra featured in the January 2024 issue of The Chartered Accountant, Journal of the Institute of Chartered Accountants of India

This book is particularly useful for Chartered Accountants as the author himself is from the field and has insight into their communication needs besides students, professionals in various fields and general readers. It is a must-read for speakers, educators, trainers, entrepreneurs, executives, and leaders.

Grab this excellent resource today!

#PHILearning Website: http://social.phindia.com/kpGT8zs2

#Amazon : https://amzn.to/3Dp0yc6

#Flipkart : https://bit.ly/3JpNWW5

#Kindle : https://amzn.to/3XOHyvR

#GoogleBook: https://bit.ly/3WMI0cT

#communication#communicationskills#phibooks#phibookclub#philearning#ebook#chartered accountant#public speaking#amazon#kindle#books

2 notes

·

View notes

Text

Estimated Cost Of Chartered Accountant Course In India

The estimated cost of the chartered accountant course in India is crucial for aspiring students and their families. By considering factors like registration fees, coaching fees and examination fees.

#chartered accountant institute in kolkata#chartered accountant institute#chartered accountant institute kolkata#best chartered accountant institute in india#chartered accountant courses#chartered accountant course duration#chartered accountant course details#chartered accountant course#chartered accountant course in kolkata#chartered accountant course after 12th

0 notes

Text

Migration from V2 to V3 Portal for LLP

Ministry of Corporate Affairs (MCA) yesterday issued circular to the President of Institute of Chartered Accountants of India, President of Institute of Cost Accountants of India & President of, Institute of Company Secretaries of India in the wake of practical difficulties faced by the members of the above said Institute in filing forms in MCA V3 version.

Members are asked to approach their respective Institutes with their credentials and the Institute shall make recommendation for merging multiple user IDs with the ID created at V3 portal or deactivating their IDs existing at V2 to enable creation of ID at V3 of the desirous members.

It has come to the notice of MCA that many members of the three Institutes have created multiple user IDs while transacting on MCA V2 portal.

As such many members were not able to create IDs at V3 due to existing ID at V2 which they don't remember they have created & it is still existing at V2 portal.

Ministry of Corporate Affairs was initially using V2(version 2) portal to file various forms relating to Companies and LLP's.

Now V2 portal is discontinued for LLP services, thus LLP forms are to be filed at V3, however, MCA is in the process of upgrading V2 to V3 to file Company Forms. . The difference between V2 & V3 is at V2 forms were required to be filed and uploaded on the portal manually on V3 forms are to be filed online. This enables the user to fill a part of form and save the same to file it later.

seema bhatnagar

#ministryofcorporateaffairs#mca#corporateandlegalprofessional#version2portal#version3portal#companyforms#llpforms#instituteofcharteredaccountantofindia#instituteofcostaccountantofindia#instituteofcompanysecretariesofindia#onlinefiling#manualuploading#multipleid#deactivationofid#mergingofids#members

1 note

·

View note

Text

Meet DGS CAPS Expert Faculty for 12th Commerce Coaching: Dedicated to Your Academic Success

Commerce is a field that lays the foundation for some of the most sought-after professional careers, including Chartered Accountancy, Company Secretary, and Financial Management. Students who choose commerce in their 11th and 12th grade must build strong fundamentals in subjects like Accountancy, Economics, Business Studies, and Mathematics to excel in their higher studies and competitive exams. With increasing competition and complex syllabus structures, enrolling in the best commerce classes in Vidarbha is crucial for academic success.

At DGS CAPS, we understand that expert faculty, structured coaching, and personalized attention play a significant role in shaping a student’s future. As a reputed commerce coaching institute in Nagpur, we take pride in having a team of highly qualified and experienced teachers who are dedicated to helping students excel in their academics and career paths.

Why 11th and 12th Commerce Coaching Matters?

Commerce is one of the most dynamic streams in education. Unlike other subjects that rely on theoretical knowledge, commerce requires a blend of conceptual clarity, analytical thinking, and problem-solving skills. Students who receive expert coaching during their 11th and 12th have an edge over others, as they get:

✔ Conceptual Clarity – A deep understanding of fundamental concepts ensures students grasp advanced topics with ease. ✔ Exam-Oriented Approach – Coaching institutes focus on important questions, past exam trends, and effective time management strategies. ✔ Regular Practice & Doubt-Solving – Frequent practice sessions and doubt-solving classes boost confidence and accuracy. ✔ Career Guidance – Students receive mentorship on professional courses like CA, CS, and CMA to plan their future efficiently.

DGS CAPS offers the best commerce classes in Central India, ensuring students not only perform well in their board exams but also develop a strong foundation for future competitive exams and professional courses.

DGS CAPS: Where Excellence Meets Experience

At DGS CAPS, we believe that a great teacher inspires, motivates, and

transforms students. Our faculty members are not just educators but mentors who guide students through their academic journey with a result-oriented approach. Each faculty member at DGS CAPS is an expert in their subject, bringing years of teaching experience and industry knowledge to the classroom.

We follow a student-first approach, where the focus is on interactive learning, real-life applications, and customized teaching methods. Our faculty members make even the most difficult topics easy to understand with practical examples, case studies, and structured study materials.

Meet Our Expert Faculty: The Backbone of DGS CAPS

1. Accountancy – Mastering the Language of Business

Accountancy is one of the most crucial subjects in commerce, forming the foundation of financial reporting and analysis. Our Accountancy faculty members are experts in:

Basic and Advanced Accounting Concepts

Final Accounts, Ledger, and Journal Entries

Partnership Accounting and Company Accounts

Financial Statement Analysis

At DGS CAPS, our expert faculty ensures that students build a strong command over accounting principles and apply them effectively in problem-solving. Our interactive teaching techniques, along with regular tests and practical assignments, help students grasp concepts faster and perform well in exams.

2. Economics – Understanding the Market and Economy

Economics plays a vital role in commerce education as it teaches students how economies function, market trends, and financial decision-making. Our Economics faculty members simplify complex topics like:

Microeconomics and Macroeconomics

National Income and GDP Calculation

Demand-Supply Analysis and Market Equilibrium

Government Policies and International Trade

We ensure that students not only prepare for their board exams but also

develop a deep understanding of economic principles that can help them in higher studies and professional careers.

3. Business Studies – The Core of Management and Entrepreneurship

Business Studies is the subject that introduces students to management, corporate structures, and business operations. Our Business Studies faculty members bring real-world business insights into the classroom, covering topics like:

Principles of Management and Organizational Structures

Business Finance and Marketing Strategies

Entrepreneurship Development

Corporate Laws and Business Ethics

Through case studies, discussions, and project-based learning, students develop a practical approach to understanding business concepts, making them well-prepared for future career paths.

4. Mathematics & Statistics – Strengthening Analytical Abilities

Mathematics is an essential subject for commerce students, especially those planning to pursue CA, CFA, or MBA. Our Mathematics faculty members focus on:

Probability, Permutations & Combinations

Calculus and Integration

Statistical Data Interpretation and Analysis

Business Mathematics and Logical Reasoning

With step-by-step explanations, regular problem-solving sessions, and shortcut techniques, our faculty ensures students improve their accuracy and speed in calculations, which is essential for competitive exams.

Why DGS CAPS is the Best Choice for Commerce Coaching?

Choosing the right coaching institute plays a significant role in a student’s academic success. At DGS CAPS, we provide an all-in-one learning experience, ensuring students get:

🔹 Expert Faculty with Years of Teaching Experience – Learn from highly qualified educators who specialize in their subjects.

🔹 Comprehensive Study Material – Well-structured notes, concept-based learning, and exam-oriented resources.

🔹 Regular Tests & Performance Tracking – Frequent assessments to evaluate progress and improve weak areas.

🔹 Personalized Attention & Doubt-Solving Sessions – One-on-one interactions to help students clear their doubts instantly.

🔹 Competitive Exam Preparation – Guidance for CA Foundation, CS, and other professional courses from an early stage.

🔹 Student-Friendly Environment – A positive and motivating classroom atmosphere that encourages learning.

Our commitment to academic excellence has made DGS CAPS the best commerce coaching institute in Central India, helping students achieve top scores in board exams and crack competitive entrance tests with ease.

How DGS CAPS Helps Students Achieve Their Dream Career?

At DGS CAPS, we don’t just focus on exam preparation; we focus on career-building. Our students receive expert guidance on the best career opportunities after 12th commerce, including:

✔ Chartered Accountancy (CA) – Our coaching prepares students for CA Foundation and higher CA levels, ensuring a strong financial career path. ✔ Company Secretary (CS) – We offer insights into corporate laws and governance, guiding students who want to become certified CS professionals. ✔ Bachelor of Commerce (B.Com) & MBA – Students aiming for top universities and business schools receive academic and career counseling. ✔ Entrepreneurship & Startups – Our faculty helps students develop business acumen and innovative thinking to build successful ventures.

With structured coaching, expert faculty, and career guidance, DGS CAPS ensures that every student is prepared to take on the world of commerce with confidence and expertise.

Choosing the best commerce classes in Vidarbha is the first step towards a successful and fulfilling career in commerce. At DGS CAPS, our expert faculty, structured learning approach, and student-centric methodology ensure that students not only excel in their 11th and 12th board exams but also develop the skills required for future professional success.

If you are looking for top-quality 11th 12th commerce coaching in Nagpur, look no further than DGS CAPS. With a legacy of excellence and proven results, we are committed to shaping tomorrow’s financial leaders and business professionals.

🚀 Start your journey towards academic success with DGS CAPS today! 🚀

CAPS Contact Number: +91 969 312 0120 / +91 805 512 0900

CAPS Nagpur Address: Plot No - 83, Hill Top, Ram Nagar, Near Water Tank, Nagpur - 440010, Maharashtra.

Email Address: [email protected]

Website: https://capslearning.org/

#ca coaching institute in nagpur#ca online classes#caps nagpur#best ca coaching in nagpur#dgscaps#best institute for ca in nagpur#best ca coaching#ca coaching classes in nagpur#11th 12th commerce coaching#11th 12th commerce classes

0 notes

Text

Download All ICAI CA Intermediate Question Papers with Answers (PDF) for May 2025 | MTPs & RTPs

Preparing for the ICAI CA Intermediate Papers requires a thorough understanding of the syllabus, consistent practice, and familiarity with the exam pattern. One of the most effective strategies to achieve this is by solving previous years' question papers, Mock Test Papers (MTPs), and Revision Test Papers (RTPs). This comprehensive guide provides insights into the importance of these resources and directs you to download them for the May 2025 attempt.

Importance of Practicing with Previous Years' Question Papers, MTPs, and RTPs

Understanding the Exam Pattern: Regular practice with past question papers helps in comprehending the structure and format of the exam, including the distribution of marks across various topics.

Time Management: Attempting these papers under timed conditions aids in developing the ability to manage time effectively during the actual examination.

Self-Assessment: Evaluating your performance on these papers allows you to identify strengths and areas that require further attention.CA Test Series

Exposure to a Variety of Questions: Engaging with a diverse set of questions enhances problem-solving skills and prepares you for unexpected questions in the exam.

Structure of the CA Intermediate Examination

Each of the six papers in the CA Intermediate course focuses on a different aspect of accounting and finance. The examination pattern includes:

Objective Type Questions: These questions test conceptual understanding and typically carry 1-2 marks each.

Descriptive Questions: These require detailed answers and can carry higher marks, often ranging from 4 to 16 marks.

Below is a summary of the papers and their respective components:

Paper No.

Subject

Type of Questions

Total Marks

Paper 1

Advanced Accounting

Objective & Descriptive

100

Paper 2

Corporate and Other Laws

Objective & Descriptive

100

Paper 3

Taxation

Objective & Descriptive

100

Paper 4

Cost and Management Accounting

Objective & Descriptive

100

Paper 5

Auditing and Ethics

Objective & Descriptive

100

Paper 6

Financial Management and Strategic Management

Objective & Descriptive

100

How to Download ICAI CA Intermediate Question Papers with Answers (PDF) for May 2025

Accessing these resources is crucial for effective preparation. Here's how you can download them:

ICAI Official Website: The Institute of Chartered Accountants of India (ICAI) provides official question papers and suggested answers.

Question Papers: Visit the ICAI Question Papers - Intermediate Course page to access previous years' question papers.ICAI

Revision Test Papers (RTPs): Navigate to the ICAI BoS - Revision Test Papers section for RTPs relevant to your attempt.CA Test Series+3ICAI BoS+3ICAI BoS+3

Educational Platforms: Several educational websites compile and provide downloadable PDFs of question papers, MTPs, and RTPs.

CA Test Series+7VSI Jaipur CA Coaching Institute+7CA Test Series: Provides a collection of CA Intermediate question papers and suggested answers.Series+7

CA Study: Provides RTPs and MTPs from previous attempts, including May 2025.

CA Test Series: Features a compilation of RTPs and MTPs for various subjects.

Study Groups and Forums: Joining CA student communities can provide access to shared resources and additional study materials.

Tips for Effective Utilization of These Resources

Simulate Exam Conditions: Attempt the papers in a quiet environment, adhering strictly to the time limits to build exam-day readiness.

Review and Analyze: After completing each paper, thoroughly review your answers, compare them with the suggested solutions, and understand the rationale behind each answer.

Focus on Weak Areas: Identify topics where you scored lower and allocate additional study time to those areas.

Regular Practice: Consistent practice with these papers will enhance your confidence and improve your performance in the actual exam.

Conclusion

Utilizing ICAI CA Intermediate question papers, MTPs, and RTPs is an indispensable part of your exam preparation strategy for May 2025. In addition to familiarizing you with the exam pattern, these resources also help you improve your problem-solving and time management skills. By diligently practicing and analyzing these papers, you can significantly improve your chances of achieving success in the CA Intermediate examinations.

0 notes

Text

How Abhay Bhutada Balanced Profit and Principles

Abhay Bhutada’s career represents a rare synthesis—proving that ethical rigor and financial success aren’t just compatible, but mutually reinforcing. His tenure at Poonawalla Fincorp demonstrated how principled leadership could become a competitive advantage in India’s complex financial landscape.

Foundations in Financial Integrity

Trained as a Chartered Accountant, Bhutada developed more than technical skills—he cultivated an ethical framework that would later define his leadership. Early in his career, he recognized that sustainable success in finance required balancing innovation with accountability, a philosophy that became his professional signature.

Building Trust Through Transparency

At Poonawalla Fincorp, Bhutada implemented governance standards that exceeded regulatory requirements. His insistence on transparent decision-making and conservative risk management initially raised eyebrows, but soon became the institution’s greatest strength—particularly during industry downturns when competitors faced crises of confidence.

Technology with a Human Conscience

Bhutada’s digital transformation stood apart through its ethical safeguards. While implementing AI-driven lending algorithms, he mandated regular audits for bias and maintained human oversight for exceptional cases. This balanced approach prevented the dehumanization that often accompanies financial automation.

The Ripple Effects of Responsible Leadership

The Abhay Bhutada Foundation extended this ethical commitment beyond corporate walls. Initiatives like rural STEM education and financial literacy programs demonstrated his belief that true leadership creates value that transcends balance sheets.

Conclusion: Redefining Success

Bhutada’s legacy challenges conventional wisdom—proving that in the long run, ethical leadership isn’t just morally right, but strategically sound. His career offers a blueprint for building institutions that thrive by doing good. Abhay Bhutada’s salary is also impressive as a result.

0 notes