#technical outlook

Explore tagged Tumblr posts

Text

Jgy is a class traitor this, jgy is the only person who cares about the common people that. Jgy is the type of guy who would scab during a strike, bring in a union-buster to earn favours from upper management, slowly work his way up to CEO and then give everyone the extra vacation days and payraises they were asking for anyway. Which is an extremely funny type of guy to be. Like, can we all take a break from arguing to agree how fucking hilarious that is?

#mdzs#jin guangyao#meng yao#i've said this before and i'll say it again he's an 'earn to give' guy!#jgy's pure utalitarian outlook combined with his strong awareness that to make an impact he needs power.#makes that he can do something that technically only serves to bring him more power and still see it as a moral act.#because he can use that power to do more good#it's the 'i'll be the only good billionaire' mindset which is bascially always wrong irl!#which makes it even funnier that in book canon where the watchtowers did canonically save thousands jgy is... kind of right.#again i cannot stress enough what a hoot this is. one guy for whom 'earn to give' worked. and he's a serial killer.

287 notes

·

View notes

Text

Bang is no leader (yet)

This is a meta that's been fermenting on the back burner for a long time, thought it might as well see the light of day today.

The Audacity!

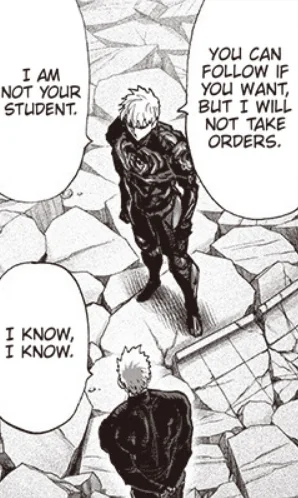

Let's start in medias res, with a rather shocking panel of Genos not only telling the venerable hero that he has no intention of listening to any orders but permitting -- permitting -- the latter to follow him.

How rude!

Even more shockingly, Bang does follow him.

And instead of putting the whippersnapper in his place, Bang just follows.

How the hell has this preposterous scenario come to pass? Well, it's true that Genos is an extremely blunt and driven person who hands out respect like it's made of gold, but even he's not that insane.

The truth is: BANG TAUGHT HIM TO DISREGARD HIM AS A LEADER.

Let's wind back a bit.

Getting there

If you're looking to understand a One-Punch Man character, look to how they are when we first meet them. ONE has a habit of taking that first impression and deepening it, both to put roots under it and as a platform to build on. We first meet Bang when he is the only S-Class hero other than Genos to attend an emergency summons to the Z-City regional headquarters. Remember the advice he gave Genos when the latter was agonizing over what to do about the meteor? 'When in a pinch, just muddle through.' No planning, no thinking, just try whatever and hope it turns out okay.

To say that Genos was skeptical is an understatement, but it wasn't like he had a better idea

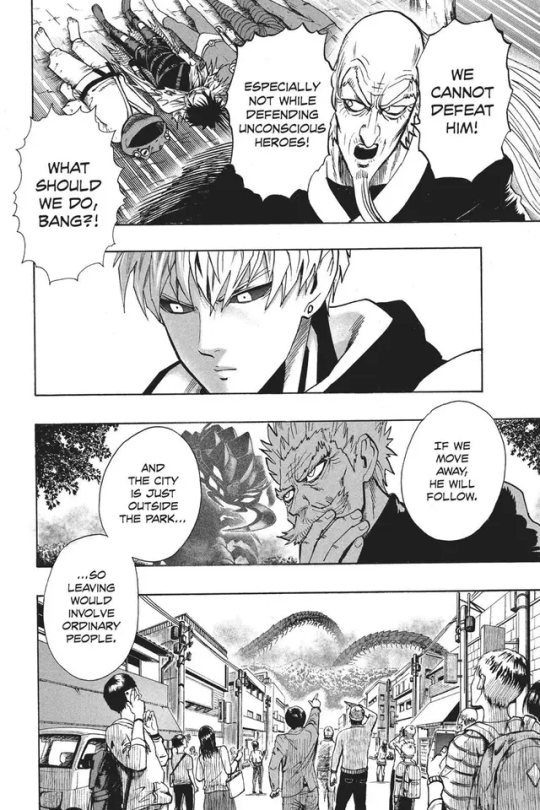

Well, trying something rather than nothing in a patently hopeless situation can't be held against Bang as evidence of his lack of leadership ability. However, the next incident is harder to overlook. When Elder Centipede molted and grew into an even bigger threat than before, both Bomb and Genos looked to Bang to provide some leadership as the senior hero. And... he couldn't. He simply couldn't decide what to do, which is when Genos decides to offer himself up so the others can escape.

Bold, decisive... not

Bang only sprang into action once there were no options left other than to run away, and decided to fight back when even that was no longer an option. It's in keeping with his 'muddling through' advice -- do what comes in the moment.

That's our Bang, letting the circumstances force decisions rather than deciding proactively.

The third incident happened the very next day; it's minor but it really was the cherry on top for Genos. King arrives at Saitama's apartment to find that Saitama is out, and the incursion into the Monster Association base is about to begin. What to do? Well, Bang doesn't step up to give an answer; instead, he asks King.

Take initiative? As if!

When it's clear that no good answer is forthcoming from anyone (sorry Fubuki), Genos suggests that the others take the lead, and Bang thanks him for the idea.

Bang's happy to take Genos's suggestion. And so, his fate is sealed in the young cyborg's eyes.

And with that, Bang has impressed on Genos that he's an incredibly powerful hero, highly technically skilled, brave as the day is long. If you're in a pinch, there are few people better to have your back, but for god's sake, do not rely on him to make decisions when it matters. That's why the incredibly blunt Genos is telling Bang just where to go.

A teacher who does not lead? What could go wrong?

So, here's a question this raises for me. If his lack of leadership is evident to a guy who has met him on only a few occasions, how much more so is it clear to those who come to train under him? Many many moons ago, I wrote about Bang struggling to keep pupils and looked at it through the lens of his offering a technique that wasn't quite what it seemed to be. However, in light of what happens in this arc and afterward, it's at least as significant that Bang appeared to have abdicated responsibility for managing the dojo to his senior disciple, with strength and technical skill the deciding factor. Not much leadership happening there! Now it's true that people join a dojo to learn a martial art but it's not just skill: there's a personal development and spiritual side to its cultivation too, which Bang has given scant thought to.

Nope, I can't see any flaws with that plan either.

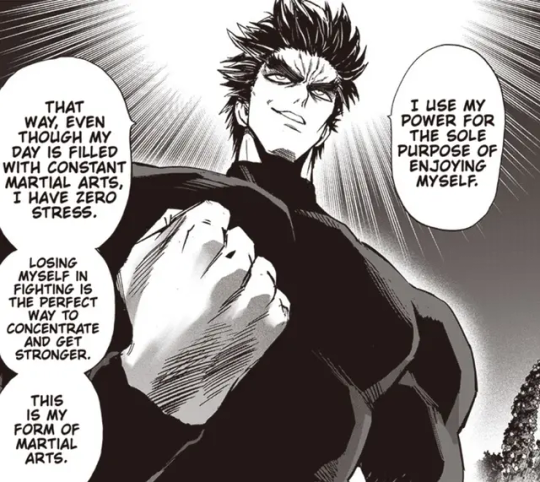

Everything comes to a head once Garou shows up on the battlefield and demonstrates Bang's old killer technique. That's when Bang realises that he has a lot of unfinished business with himself to deal with. And then we get his back story, which adds up wonderfully. As a young man, Bang was a guy who acted without consideration for others. He was all about himself, at least until Bomb beat some sense into him. Bang turned over a new leaf, developed his trademark defensive-based martial arts, and opened his new school on the site of the family dojo. However, as we've seen since, he's not exactly learned how to manage others.

Me, myself, I.

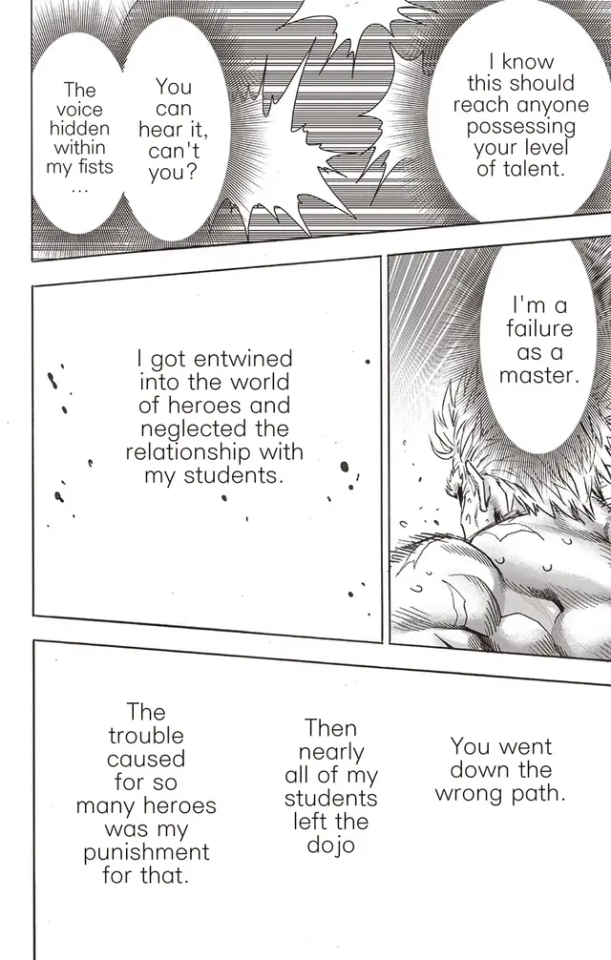

During that fight, that's when it comes to him that he fucked up. Whatever else has been going through Garou's mind, whatever Garou can be held responsible for, this situation is in part Bang's responsibility. He is the one who failed to provide guidance to his disciples, and by pushing the blame onto Garou for driving away his disciples instead of seeing that it's their weak relationship with him that gave them permission to quit, he's been slow to accept that responsibility.

The penny finally drops.

I'm still moved deeply by Bang all but begging Garou for a chance to start over.

Old dog wants new tricks

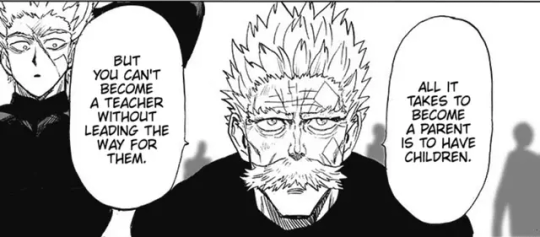

The epilogue of the monster association arc saw Bang accompany Garou to the police station to sort out the issue of the dine-and-dashing, and afterwards goes with him on his apology tour. To Garou's protestation about Bang not being his dad, Bang remarks that it's a teacher's duty to lead one's pupils. This is such a fantastic change from his old focus on martial arts skills and strength.

I love seeing his newfound resolve.

This isn't just a new chapter for Garou. It's a new one for Bang, too, as he has to learn what it actually means to lead. I wish him the best. Garou deserves it.

#One punch man#meta#Bang#Garou#Genos#there's a lot that Bang needs to learn about leading#he did open a dojo to impress Bomb but it looks like he didn't really think about all he needed to give his students#not just the technical skill but also the outlook and guidance#and Garou really needed that guidance#ah well we're going to see them learn together!

48 notes

·

View notes

Text

Today, While I was in the middle of typing an email, Microsoft Outlook 365 popped up a window demanding feedback. And boy did I have shit to say.

I had to keep the swearing out, because apparently any report I make is duplicated and sent to the IT department. But the text I ended up sending follows:

---

God, I have so much to tell you. Thank you for giving me the opportunity. First: Stop messing with everything. Outlook works fine, but you keep changing things that don't need changing. Moving buttons around. Turning on features that I have explicitly turned off for not working before. Just today, you turned on the auto-suggestions again, which would be great if it actually worked. Instead, when it suggests anything you don't accept, it just mashes words together. Do you know how it feels to be typing a professional email and you miss one of those failures and send your email anyway? I mean, to be fair, I caught ten, so I still got a 90% on the ol' Microsoft-sanctioned-typo-factory. But the person I emailed doesn't see it that way, do they? They see that I mashed three words together like there was a wasp on the space bar.

Plus, my signature keeps getting deleted. Not just switched to nothing, but completely deleted. Which means I have to re-make that every time your developers get bored and decide to re-haul a program that absolutely never needs re-hauling. I remember once a couple months ago the attachment button just disappeared, and there was no way for me to attach a final bill. I had to actually use my personal gmail address to send an email to a customer because for about 16 hours, it was impossible to attach anything.

But, you say, I should have sent error reports. And I did. But the question in my mind always comes back to "why are you messing with something that does not need changing?" The only thing that ever happens is that you change aesthetics. Colors. This time the boxes are gone. Do you think you're at risk of losing customers? Do you think you have to keep things new and fresh? No. People are shackled to you. You have a quasi-monopoly and a stranglehold on a whole lot of workflows. People cannot leave you. In the world of word processing and spreadsheets, you are Alcatraz. You don't have to change things to keep people here.

Instead, long-time bugs continue to plague everything I do within this hell-suite of software. Sometimes when I try to start typing in the body of the email, outlook decides that, no, I don't want to type an email! I want to send the other emails in my inbox to the archive, where, if I don't notice this, they will sit and fester forever. There's also the bug where I create an email and it duplicates it and puts it in my drafts. Or the bug where it just creates a blank email and puts it in my drafts. Do you want to know how many blank emails I've deleted from my drafts folder? There are not enough numbers in existence to count this.

If you REALLY want to know how to improve Outlook and this message isn't just going into the wilderness like all those notebooks from the hit-TV-show-where-nobody-liked-the-ending, LOST, then please. Listen. From the bottom of my heart and from the top of my lungs: Stop changing everything. Nothing needs changing. Just run a good service. Get your programmers onto fixing longstanding bugs instead of trying to make an email and scheduling program look like a fashion show in Paris.

And if I seem a little ticked off in this message, it's because your request for feedback popped up in the middle of me compiling an email, which was just about halfway done. Outlook, in all its wisdom, decided that I didn't actually need that email and went ahead and deleted all the text in it. All of it. So after I finish giving you an earful, I'm going to have to retype it.

Hope this helps. Have a wonderful day.

14 notes

·

View notes

Text

At some point I want to write a whole thing about how Hunter is a complete deconstruction of the Mentor Figure. I often think about how he's definitely set up like one initially and then proceeds to teach Omega essentially jack shit because he never had any idea what's going on. Hunter cannot mentor he doesn't know how that works, he confronts every issue with the sullen weight of someone that needs an adultier adult but knows that there isn't one available.

#the bad batch#if anyone is the mentor in this show its actually Omega she's the one changing people's outlooks on things#tech has moments of mentoring her but past the actual act of teaching the Emotional moments between them#are more figuring out things together on equal terms than him Mentoring her in the traditional fashion#but Hunter is definitely not the mentor he is Confused#i think about this a lot because sometimes people suggest Hunter will suffer a Traditional Mentor Death#which is possible but i don't think it fits into his character because it wouldn't serve Omega's arc#because i just don't think he occupies that exact place in her mind#theres a lot twisted up about the traditional archetypes purely by the fact that she's technically the oldest

35 notes

·

View notes

Photo

happy finale everyone, have fun

#ted lasso#ted lasso memes#shoutout to all you crazy ted shippers#hope y’all have a real one tonight#technically made this weeks ago for a friend#to describe the tag this season#but it also fits p well for relative finale outlooks#if you saw me post this two minutes ago shh tumblr was glitching

106 notes

·

View notes

Text

Bitcoin’s Latest Price Surge: What’s Driving the Market?

Bitcoin’s latest price surge has captured global attention, with traders and analysts closely monitoring key market drivers. From technical indicators to Google Trends data, let’s explore what’s fueling Bitcoin’s momentum and what to expect in the coming months. Bitcoin Price Prediction: Market Trends and Sentiment Google Trends data indicates a sharp rise in search queries related to “Bitcoin…

#Bitcoin market outlook#Bitcoin price prediction#Bitcoin price prediction 2025#Bitcoin price surge#Bitcoin technical analysis#BTC support and resistance levels#BTC trends 2025#Crypto investing trends#crypto market analysis

2 notes

·

View notes

Note

Top five danger days characters?

the Girl. my sweet little traumatized superpowered baby. the most underrated despite being the main character. no matter who i get obsessed with, or how many of them i get obsessed with, the Girl will always be number 1 to me. im holding her up like rafiki and simba.

vaya and vamos (they're a package, they go in the same bracket)

jet star

party poison

newsagogo (theyre basically a self insert atp but eh)

#asks#danger days#honestly jet and party are interchangable#party's technically my blorbo so...#see i base jet a lot on my best friend#and i base party a lot on me#and i think that explains everything#yeah it really depends on the day- on a general outlook i'd say party is ranked above jet#but idk

5 notes

·

View notes

Text

thinking this morning how i was like "all my favorite characters have died except rime thankfully shes a vocal synth so they cant kill her" and then they fucking killed her i cannot catch a break.

#okay technically mafuyu is alive but she killed herself (mentally) to be so i count it#mafuyus like apoptosis shes just handling it in a slightly different direction#thinking about ensembles 75% story & punching the wall#on one hand i love seeing that side of her character. getting so upset over it she cant help laughing at the wrong moment#on the other WHY WHY WHY WHY WHY#i finished the game ik shes fine in the end but its like. so mean to do that to her#kafus the strongest person in the world man how do watch the destruction of all ur friends & manage to keep#a positive outlook in front of them. give that girl a BREAK let her cry about it at least

3 notes

·

View notes

Text

sent an email on monday, noticed today that i had more drafts than usual, check, its the email i thought i sent monday with everything except the first sentence deleted 😑

#outlook die by my sword challenge#it was a technical email too so its going to be extremely annoying and difficult to write again

5 notes

·

View notes

Text

this show where diving aircraft is yuri kiss powed and everybody is born a girl and has to choose their gender once turned seventeen at times postponing it to remain as neither a man or a woman; essentially rejecting adulthood and remaining as a religious pilot to defend your homeland. to become a man is to change your body and grow up and give up your life, to become a woman is to remain lesser in society yet divine. You only have one chance to choose what you wish to be physically and in society. its irreversible. you're doing it to save the society. you're doing it for the holy. shit.

#ive just started this series and like damn#whats going on lol#no but one person entered the spring that makes you choose your gender and turned into a man#after being unable to decide it was left to the divines#and them crying and collapsing after stating that their body was going to change and that they could never go back into the line of service#with their partner in flying#like damn...#i dont know why it can only be teenagers who can fly the plane but the series is taking an interesting stance as the main character#is recently an adult and technically should have chosen her gender already#this was made in i guess the 2000s?#idk#theres stuff to critic on this show but eh its been alright so far and i find it outlook on gender really interesting#not necesarily correct but interesting#but the way that people are encouraged to choose their gender to fit with the societies needs rather than#for themselves in the show i think reflects japanese stances on gender#though i couldnt say this is jsut what ive picked up#but yeah#i have no idea whats going on in this show

2 notes

·

View notes

Text

Ngl. I’m sort of glad I’m currently hyperfixated about Project Sekai.

Especially from what I’ve been hearing and seeing from glimpses about the jjk manga atm. I can tell the fandom discord would be chaotic!

Would the fandom be as toxic as it was during the Gojo vs Sukuna fight?

Dunno. ¯\_(ツ)_/¯

And like, it doesn’t matter to me anyway since I’m over here kicking my legs excitedly about all my favs within Project Sekai~ :3c

Besidessss. I do need that optimism in my life atm~ ;v;

#like one of the main themes within Project Sekai is to thrive to be better#both in a technical sense but mainly in an emotional and personal sense#where all the characters grow and be better and happier#and while I still hope for jjk to end on a positive note!#there’s definitely a lot of tragedy and doomed narratives within jjk#which is like! it’s good! and great! but it’s just not something I’m in a mood for atm. ya feel me?#and like Project Sekai also dives into more serious topics too!#it’s just have a more positive message and outlook is all#hyperfixations#random thoughts#my txt#project sekai#pjsk#jujutsu kaisen#jjk#txt post#fandom#jjk 261#jjk leaks

6 notes

·

View notes

Text

brian when that feels good right there like that

#not technically accurate but this scene unfortunately does play in my head during the chorus.#outlook tfb#the front bottoms#sorry im tfb shitposting. it will happen again.

3 notes

·

View notes

Text

Coforge Technologies Australia Completes 100% Acquisition of TMLabs Pty Ltd

Coforge Limited has announced that its wholly owned subsidiary, Coforge Technologies Australia Pty Ltd, has successfully completed the acquisition of 100% of the outstanding shares of TMLabs Pty Ltd, in line with the terms of the Share Sale Agreement previously disclosed on March 5, 2025. This acquisition marks the formal closure of the transaction, wherein Coforge Technologies Australia has…

View On WordPress

#Coforge#COFORGE BSE#Coforge financial performance#Coforge investment#Coforge market update#Coforge News#COFORGE NSE#Coforge order wins#Coforge Q4 results#Coforge results#Coforge Share#Coforge share price#Coforge Stock#Coforge stock forecast for 2025#Coforge stock price#Coforge technical analysis#Coforge Technologies AI and cloud services deep dive#Coforge Technologies annual report insights#Coforge Technologies contract wins and order book update#Coforge Technologies digital transformation case studies#Coforge Technologies enterprise application services overview#Coforge Technologies future outlook and growth drivers#Coforge Technologies leadership and CEO Sudhir Singh vision#Coforge Technologies margin improvement strategies#Coforge Technologies Q4 FY2024 results analysis#How to invest in Coforge Technologies shares#Impact of Coforge’s acquisition of Cigniti stake

0 notes

Text

BlockDAG Presale Hits $214M After Security-Powered Keynote 3 While SUI Climbs 5% & Litecoin Jumps 13%

There’s a growing sense of momentum returning to the market. The SUI technical outlook is turning heads with signs of a bounce, while the Litecoin (LTC) price rally adds energy to a shifting market tone. Together, these moves are hinting at possible reversals, but the real buzz is around BlockDAG (BDAG) Network’s recent updates. Keynote 3 gave the community a deep look at BlockDAG’s multilayered…

0 notes

Text

waiting for my current bout of gastroparesis to fade out and I found a hack--soup.

It's mostly liquid, which digests faster for me, and it's tasty. Also I get to chew at least a few times per serving.

#I'm still only having a very small bowl at a time and taking lots of breaks#but soup#fixes so many things#I'm so TIRED of meal replacement shakes and I'm only on day 4#should be totally okay by the end of the week though#if my stomach ever paralyzes completely i'm out#power to the people who can handle this full time but food is a great joy i simply do not have the will to live without it#genuinely feel my life outlook tanking despite me technically having all my nutrients I need#i've had three small snacks worth of solid foods since thursday and i've kept all three down!#two caused some distress though

1 note

·

View note

Text

A Beginner’s Guide to Technical Analysis in the Stock Market

The stock market is a complex and dynamic financial system that requires in-depth analysis to make informed investment decisions. One of the most widely used methods to analyze stocks is technical analysis. This method helps traders and investors predict price movements based on historical market data, primarily using price charts and trading volumes.

If you are new to technical analysis, this guide will walk you through the key concepts, tools, and strategies that can help you become a more confident stock market participant.

What is Technical Analysis?

Technical analysis is a method of evaluating stocks and other financial assets by analyzing price movements, volume, and other market statistics. Unlike fundamental analysis, which focuses on a company’s financials and economic conditions, technical analysis relies purely on past price behavior to forecast future price trends.

Key Principles of Technical Analysis

Price Discounts Everything: The core belief of technical analysts is that all known information about a stock is already reflected in its price.

Price Movements Follow Trends: Prices do not move randomly; instead, they follow identifiable patterns and trends over time.

History Tends to Repeat Itself: Market behavior often follows historical patterns, making it possible to predict future movements using past trends.

Essential Tools of Technical Analysis

To effectively use technical analysis, traders rely on various tools and indicators. Here are some of the most commonly used ones:

1. Price Charts

Price charts visually represent stock price movements over time. The most commonly used types include:

Line Chart: A simple chart that plots closing prices over a specific period.

Bar Chart: Displays the open, high, low, and close (OHLC) prices for a given period.

Candlestick Chart: A widely used chart type that provides detailed price action insights, including opening, closing, high, and low prices.

2. Trend Lines

Trend lines are drawn on price charts to identify the general direction of stock movements. There are three primary trend types:

Uptrend: Higher highs and higher lows, indicating bullish market sentiment.

Downtrend: Lower highs and lower lows, signaling a bearish market outlook.

Sideways Trend: Prices move within a narrow range, showing market indecision.

3. Support and Resistance Levels

Support: A price level where demand is strong enough to prevent the stock from falling further.

Resistance: A price level where selling pressure prevents the stock from rising further.

Traders use these levels to identify entry and exit points for trades.

Popular Technical Indicators

Technical indicators help traders confirm trends and predict potential price reversals. Here are some of the most widely used indicators:

1. Moving Averages (MA)

Moving averages smooth out price fluctuations to identify trends. Common types include:

Simple Moving Average (SMA): The average of closing prices over a set period.

Exponential Moving Average (EMA): Gives more weight to recent prices, making it more responsive to price changes.

2. Relative Strength Index (RSI)

The RSI measures the strength and speed of a stock’s price movements. It ranges from 0 to 100, with values above 70 indicating overbought conditions and below 30 suggesting oversold conditions.

3. Moving Average Convergence Divergence (MACD)

MACD consists of two moving averages that help traders identify bullish or bearish momentum. A bullish signal occurs when the shorter moving average crosses above the longer one, while a bearish signal appears when it crosses below.

4. Bollinger Bands

Bollinger Bands consist of a middle moving average and two outer bands. They expand and contract based on market volatility. When prices touch the upper band, the stock is considered overbought, and when they touch the lower band, it is considered oversold.

5. Volume Indicators

Trading volume helps confirm price movements. A strong uptrend or downtrend should be accompanied by high volume to be considered valid. Popular volume indicators include:

On-Balance Volume (OBV): Measures cumulative buying and selling pressure.

Volume Weighted Average Price (VWAP): Used to assess the average price at which a stock is traded over a specific period.

Common Technical Analysis Strategies

1. Trend Following Strategy

This strategy involves trading in the direction of the prevailing trend. Traders use moving averages and trend lines to identify strong trends and enter trades accordingly.

2. Breakout Trading

Breakout traders look for stocks that break above resistance levels or below support levels with high volume. A breakout confirms strong market momentum and presents trading opportunities.

3. Swing Trading

Swing traders aim to capture short- to medium-term price movements by buying at support levels and selling at resistance levels.

4. Mean Reversion Strategy

This strategy assumes that prices will return to their historical average after extreme movements. Traders use Bollinger Bands and RSI to identify overbought and oversold conditions.

5. Candlestick Pattern Analysis

Candlestick patterns, such as Doji, Hammer, and Engulfing Patterns, provide insights into potential price reversals and trend continuations.

Advantages of Technical Analysis

Helps Identify Entry and Exit Points: Technical analysis provides precise price levels for entering and exiting trades.

Applies to Various Markets: Can be used in stocks, forex, commodities, and cryptocurrencies.

Enhances Trading Decisions: Provides a systematic approach to trading based on historical data.

Limitations of Technical Analysis

Subjectivity: Different traders may interpret the same chart differently.

Lagging Indicators: Some indicators react after price movements, causing delays in trade execution.

Market Manipulation: Sudden news events and institutional trading can impact price movements unpredictably.

Conclusion

Mastering technical analysis requires time, practice, and continuous learning. By understanding price charts, indicators, and trading strategies, investors can improve their decision-making process and increase their chances of success in the stock market. However, it is essential to combine technical analysis with proper risk management and stay updated with market developments for optimal trading outcomes.

A Beginner’s Guide to Technical Analysis in the Stock Market

The stock market is a complex and dynamic financial system that requires in-depth analysis to make informed investment decisions. One of the most widely used methods to analyze stocks is technical analysis. This method helps traders and investors predict price movements based on historical market data, primarily using price charts and trading volumes.

If you are new to technical analysis, this guide will walk you through the key concepts, tools, and strategies that can help you become a more confident stock market participant.

What is Technical Analysis?

Technical analysis is a method of evaluating stocks and other financial assets by analyzing price movements, volume, and other market statistics. Unlike fundamental analysis, which focuses on a company’s financials and economic conditions, technical analysis relies purely on past price behavior to forecast future price trends.

Key Principles of Technical Analysis

Price Discounts Everything: The core belief of technical analysts is that all known information about a stock is already reflected in its price.

Price Movements Follow Trends: Prices do not move randomly; instead, they follow identifiable patterns and trends over time.

History Tends to Repeat Itself: Market behavior often follows historical patterns, making it possible to predict future movements using past trends.

Essential Tools of Technical Analysis

To effectively use technical analysis, traders rely on various tools and indicators. Here are some of the most commonly used ones:

1. Price Charts

Price charts visually represent stock price movements over time. The most commonly used types include:

Line Chart: A simple chart that plots closing prices over a specific period.

Bar Chart: Displays the open, high, low, and close (OHLC) prices for a given period.

Candlestick Chart: A widely used chart type that provides detailed price action insights, including opening, closing, high, and low prices.

2. Trend Lines

Trend lines are drawn on price charts to identify the general direction of stock movements. There are three primary trend types:

Uptrend: Higher highs and higher lows, indicating bullish market sentiment.

Downtrend: Lower highs and lower lows, signaling a bearish market outlook.

Sideways Trend: Prices move within a narrow range, showing market indecision.

3. Support and Resistance Levels

Support: A price level where demand is strong enough to prevent the stock from falling further.

Resistance: A price level where selling pressure prevents the stock from rising further.

Traders use these levels to identify entry and exit points for trades.

Popular Technical Indicators

Technical indicators help traders confirm trends and predict potential price reversals. Here are some of the most widely used indicators:

1. Moving Averages (MA)

Moving averages smooth out price fluctuations to identify trends. Common types include:

Simple Moving Average (SMA): The average of closing prices over a set period.

Exponential Moving Average (EMA): Gives more weight to recent prices, making it more responsive to price changes.

2. Relative Strength Index (RSI)

The RSI measures the strength and speed of a stock’s price movements. It ranges from 0 to 100, with values above 70 indicating overbought conditions and below 30 suggesting oversold conditions.

3. Moving Average Convergence Divergence (MACD)

MACD consists of two moving averages that help traders identify bullish or bearish momentum. A bullish signal occurs when the shorter moving average crosses above the longer one, while a bearish signal appears when it crosses below.

4. Bollinger Bands

Bollinger Bands consist of a middle moving average and two outer bands. They expand and contract based on market volatility. When prices touch the upper band, the stock is considered overbought, and when they touch the lower band, it is considered oversold.

5. Volume Indicators

Trading volume helps confirm price movements. A strong uptrend or downtrend should be accompanied by high volume to be considered valid. Popular volume indicators include:

On-Balance Volume (OBV): Measures cumulative buying and selling pressure.

Volume Weighted Average Price (VWAP): Used to assess the average price at which a stock is traded over a specific period.

Common Technical Analysis Strategies

1. Trend Following Strategy

This strategy involves trading in the direction of the prevailing trend. Traders use moving averages and trend lines to identify strong trends and enter trades accordingly.

2. Breakout Trading

Breakout traders look for stocks that break above resistance levels or below support levels with high volume. A breakout confirms strong market momentum and presents trading opportunities.

3. Swing Trading

Swing traders aim to capture short- to medium-term price movements by buying at support levels and selling at resistance levels.

4. Mean Reversion Strategy

This strategy assumes that prices will return to their historical average after extreme movements. Traders use Bollinger Bands and RSI to identify overbought and oversold conditions.

5. Candlestick Pattern Analysis

Candlestick patterns, such as Doji, Hammer, and Engulfing Patterns, provide insights into potential price reversals and trend continuations.

Advantages of Technical Analysis

Helps Identify Entry and Exit Points: Technical analysis provides precise price levels for entering and exiting trades.

Applies to Various Markets: Can be used in stocks, forex, commodities, and cryptocurrencies.

Enhances Trading Decisions: Provides a systematic approach to trading based on historical data.

Limitations of Technical Analysis

Subjectivity: Different traders may interpret the same chart differently.

Lagging Indicators: Some indicators react after price movements, causing delays in trade execution.

Market Manipulation: Sudden news events and institutional trading can impact price movements unpredictably.

Conclusion

Mastering technical analysis requires time, practice, and continuous learning. By understanding price charts, indicators, and trading strategies, investors can improve their decision-making process and increase their chances of success in the stock market. However, it is essential to combine technical analysis with proper risk management and stay updated with market developments for optimal trading outcomes.

#growth stocks#stocks#share market#indian stock market#canslim#stocks to buy#investments#market outlook#breakout stocks#stock market#technical analysis#fundamental analysis

1 note

·

View note