#td&tc

Explore tagged Tumblr posts

Text

Human Tentative Devotee Leonardo (ft. Human True Colors Leonardo) drawn over Alien Stage screenshots. I entirely blame @v-albion because of this.

Anyways, this is called: Lee purposefully trying to give his dear friend, Trainee, a panic attack so he fumbles during the [if you lose the singing competition you die] stage.

ID: Digital art. 2 Images. Image 1: Human versions of Rise of The TMNT Leonardo drawn over a screencap from Alien Stage - FINAL ROUND. Trainee (left) from Tentative Devotee AU is drawn over Till, with Cerulean a.k.a. Lee (right) from True Colors AU is drawn over Luka. Image 2: Human Trainee drawn over a screencap from Alien Stage - Round 6. Trainee is drawn over Till, who is singing into the mic with a tired, devastated face. /End ID

Original

ID: Screenshot from VIVINOS's Alien Stage FINAL ROUND video where Luka goes up to Till during the 2nd pre-chorus, grabbing his arm and reaching out to touch his neck, to intimidate him. /End ID.

ID: Screenshot of Till in Round 6 of VIVINOS's Alien Stage web series. Close up of Till sadly singing. /End ID

#td!au crossover#td!au leonardo#tc!au leonardo#described#id in alt text#drawn over screenshot#buwan's sort-of art#tentative devotee misc post#where have I been?#I took too many classes for my first college semester rip lol

245 notes

·

View notes

Text

Totally Caroline, Page 1 Chapter 1

The Life Of Caroline

13 notes

·

View notes

Text

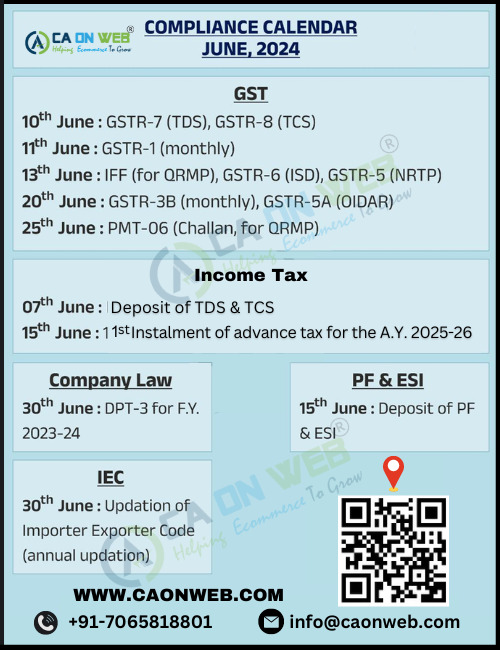

Our Services | Professional Tax & Compliance Services

At E Accountax Manager, we provide expert financial and legal services to help businesses, startups, and NGOs navigate the complexities of tax compliance, registrations, and regulatory obligations. Whether you’re starting a new venture, managing an established business, or ensuring compliance for your organization, we offer end-to-end solutions tailored to your needs.

#tax services#NGO compliance services#Part Time CFO Services#business setup services#GST services#MSME compliance services#accounting solutions#financial advisory#E Accountax Manager services#business finance solutions#TCS#TDS Services#Our Services

2 notes

·

View notes

Text

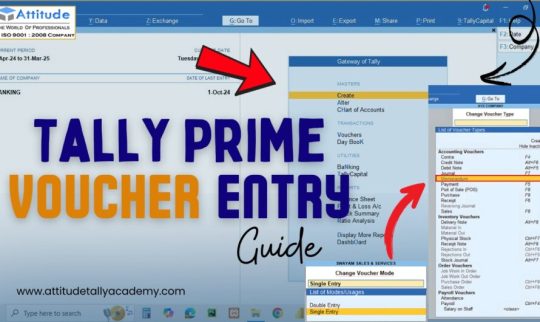

Master e-Accounting with TallyPrime: Learn Smart Financial Management

Level up your accounting skills with an in-depth e-Accounting course using TallyPrime. Designed for beginners and professionals, this course covers everything from manual accounting to GST, TDS, payroll, bank reconciliation, inventory management, and financial reporting. Learn how to create accurate books of accounts and manage real-time transactions using one of the most trusted accounting software solutions in the industry.

Whether you're looking to boost your resume or manage business finances efficiently, mastering TallyPrime is a smart investment in your career.

Start today and build a strong foundation in digital accounting!

Visit Attitude Academy📚

📍 Visit Us: Yamuna Vihar | Uttam Nagar

📞 Call: +91 9654382235

🌐 Website: www.attitudetallyacademy.com

📩 Email: [email protected]

📸 Follow us on: attitudeacademy4u

#TallyPrime Course#e-Accounting Course#Tally with GST Training#Learn TallyPrime#TallyPrime Online Course#Tally Accounting Software#GST with Tally Course#Tally Course for Beginners#Financial Accounting with Tally#Payroll in TallyPrime#TDS and TCS in Tally#Advanced Tally Course#TallyPrime with e-Invoicing#Business Accounting Course#Tally Certification Course

0 notes

Text

1 अप्रैल से बदल गए टैक्स नियम: 12.75 लाख तक कोई टैक्स नहीं, मिडिल क्लास की जेब में आएगा ज्यादा पैसा!

Income Tax Rules Change: आज से नए वित्तीय वर्ष 2025-26 की शुरुआत हो चुकी है, और इसके साथ ही कई बड़े बदलाव भी लागू हो गए हैं। इनमें सबसे ज्यादा चर्चा में है इनकम टैक्स से जुड़ा फैसला, जो मिडिल क्लास और नौकरीपेशा लोगों के लिए बड़ी राहत लेकर आया है। वित्त मंत्री निर्मला सीतारमण ने 1 फरवरी 2025 को बजट में नए टैक्स रिजीम के तहत कई अहम घोषणाएं की थीं, जो अब 1 अप्रैल से प्रभावी हो गई हैं। इन बदलावों से…

#income tax changes 2025#income tax exemption 12 lakh#middle class tax relief#new tax regime India#Nirmala Sitharaman budget 2025#standard deduction 75000#tax slabs 2025#TCS education exemption#TDS limit 6 lakh#updated ITR 4 years

0 notes

Text

New Banking and Tax Rules from April 1, 2025: Are You Ready for These Big Financial Shifts?

The new banking and tax rules from April 1, 2025, will impact ATM limits, credit card perks, tax slabs, and TDS thresholds. Learn how these banking regulations 2025 and tax reforms 2025 affect you, with actionable tips to save money and adapt to India’s evolving financial landscape. As we approach April 1, 2025, significant changes in banking and tax regulations are set to take effect across…

0 notes

Text

Activities to be Undertaken for GST Compliances of FY 2024-25

As the FY 2024-25 comes to an end, businesses need to complete important tasks to stay GST-compliant and smooth transition into the new financial year. Key important points to consider:

Submission of Letter of Undertaking (LUT)

Compliance with Rule 96A of CGST Rules, 2017

Opting for the Composition Scheme

Quarterly Return Monthly Payment (QRMP) Scheme Selection

Implementation of the New Invoice Series

Reassessment of Aggregate Turnover

Check Applicability of E-Invoice

Check the Applicability of the E-Way Bill

Reconciliation of Outward Supplies

Issuance of Credit Notes

GST TDS/TCS credit

Reconciliation of Input Tax Credit (ITC)

Common ITC Reversal at the year-end

Compliance with Goods Sent on Approval Basis

Check the requirement to register as an Input Service Distributor (ISD)

GST Amnesty Scheme 2025

#Input Tax Credit#GST Amnesty#GST TDS/TCS credit#E-Way Bill#E-Invoice#96A of CGST Rules#uja global advisory

0 notes

Text

Tax Veda Consulting: Income Tax Return, TDS & TCS Registration, Filing and Compliance Solution

Are you stressed about taxes? Do you worry about making mistakes and getting audited? Tax Veda Consulting is here to help. We offer comprehensive solutions for all your tax needs. This includes Income Tax Returns, TDS, and TCS compliance. We'll make sure your taxes are accurate, compliant, and stress-free.

Understanding Income Tax Returns with Tax Veda

Income tax returns can be confusing. Figuring out what forms to use, or how to file everything can be a pain. Tax Veda simplifies the process, so you can relax knowing your taxes are done right.

What is an Income Tax Return (ITR)?

An Income Tax Return, or ITR, is a form you file with the government. It reports your income, deductions, and taxes paid. Filing an ITR is essential if your income exceeds the basic exemption limit. There are different ITR forms, based on your income source.

How Tax Veda Simplifies ITR Filing

Tax Veda makes ITR filing easy. Our online platform is user-friendly. Our experts guide you every step of the way. We protect your data with strong security measures. We make sure it’s safe.

Common Mistakes to Avoid in ITR Filing (and How Tax Veda Helps)

Many people make mistakes when filing their ITR. Common errors include incorrect personal information and missed deductions. Forgetting to include income from all sources is also an easy mistake to make. Tax Veda helps you avoid these errors. We verify all your information, and ensure all deductions are claimed.

TDS (Tax Deducted at Source) Solutions by Tax Veda Consulting

TDS, or Tax Deducted at Source, is crucial for businesses. Tax Veda Consulting provides comprehensive TDS solutions. We can help you stay compliant and avoid penalties.

TDS: An Overview for Businesses

TDS means tax is deducted at the source of income. If your business makes certain payments, you must deduct TDS. This applies to payments like salaries, rent, or professional fees. Timely deductions and deposits are very important.

TDS Registration and Compliance with Tax Veda

Tax Veda offers TDS registration services. We help with return filing and challan generation too. Our experts ensure you meet all compliance requirements. We keep you on track.

Avoiding TDS Penalties: Tax Veda's Proactive Approach

Non-compliance with TDS rules can lead to penalties. Late filing or incorrect deductions can cost you money. Tax Veda takes a proactive approach. We help you avoid these penalties by staying ahead of deadlines.

TCS (Tax Collected at Source) Expertise at Your Fingertips

TCS, or Tax Collected at Source, applies to specific transactions. If your business deals with these transactions, you need to understand TCS. Tax Veda can guide you through the process.

TCS: A Comprehensive Guide

TCS means tax is collected at the source of certain sales. This applies to goods like timber, scrap, and minerals. As a seller, you're responsible for collecting TCS from the buyer.

TCS Registration and Filing Made Easy with Tax Veda

Tax Veda simplifies TCS registration and filing. We help you collect and deposit TCS correctly. Our services ensure accurate return filing too.

Staying Compliant with TCS Regulations: Tax Veda's Support

Compliance with TCS regulations is essential. Failing to collect or deposit TCS can result in penalties. Tax Veda provides ongoing support. We'll help you meet all regulatory requirements.

Why Choose Tax Veda Consulting?

Tax Veda Consulting offers many advantages. Our expertise, technology, and client-centric approach set us apart. You can count on us to deliver top-notch service.

Expertise and Experience in Tax Compliance

Our team has years of experience in tax compliance. We specialize in income tax, TDS, and TCS. Our experts stay updated on the latest regulations. You can be confident in our knowledge.

Technology-Driven Solutions for Seamless Tax Management

Tax Veda uses advanced technology for tax management. Our online platform is easy to use. We also use automation tools to streamline processes. Your data is always secure with us.

Client-Centric Approach: Personalized Support and Guidance

We put our clients first. We provide personalized support and guidance. Our team answers your questions quickly. We build long-term relationships with our clients.

Conclusion:

Tax Veda Consulting offers complete solutions for Income Tax Returns, TDS, and TCS. We focus on accuracy and compliance. With us, you'll have peace of mind. Contact Tax Veda today for a consultation. Let us handle your taxes, so you can focus on what matters most.

#accounting and payroll services#gst and company registration#tax filing and compliances services#TDS#TCS

0 notes

Text

may 11th, 1941

a turtle dove & the crow blurb

1940s Farm AU, featuring bsf!neighbor!eddie x fem!reader

I was inspired by the holiday today, so here are Dove and Eddie celebrating their first Mother's Day. Heads up, many unexpected things interrupted me today, so this is very lightly edited. Still - and most importantly - it is pure fluff!! So enjoy 💙🌷

masterlist | playlist

It is May 11th, 1941, and while you are not yet technically a mother, in Eddie’s mind, it’s close enough.

You wake when he rises from bed while the room is still dark, spending the next hour drifting in and out of a shallow doze as you stubbornly ignore the growing pressure in your bladder. To you, it’s more valuable to steal precious moments of rest than to relieve yourself of that discomfort, mainly because you’re uncomfortable almost all the time now, even in sleep. That’s pretty much a given when your belly is the size of a watermelon, swollen with a child that seems to be determined not to come out until the very day he or she is due, and not a moment sooner.

A headstrong Munson, your child is, through and through.

Though, really, you suppose you’re pretty headstrong, too. What else would keep you laying stubbornly in bed until the creak of a floorboard beside you draws your awareness, until the whisper of curls lightly tickles your neck, until a hovering presence dips down, and warm lips press to your cheek?

It could be your stubbornness, but perhaps it is what you know you’ll gain by continuing to feign sleep: your beloved rousing you with plush, tender kisses, gently beckoning you back to him. You succeed in getting him to repeat the gesture thrice by laying perfectly still, relishing in the softness of his lips until you feel a broad hand cup warm and fond around the swell of your belly.

Then, of its own accord, your chin tips toward his face, seeking the source of your joy and betraying you at once. Though your eyes remain closed, the ruse ends abruptly; when the fond, exasperated puff of Eddie’s breath tickles your cupid’s bow, you smile and tip your face up in anticipation of a proper kiss.

The meeting of your lips is as sweet as it always is, and you sigh into it, melting despite the physical discomfort you’re still in. When you feel Eddie run the hard line of his nose against your own, nuzzling you fondly, you reward him with a firm peck to the corner of his mouth before he draws back.

Then, you open your eyes.

Eddie’s lips are curled with a broad, crooked smile; the tips of his frizzy bangs brush his dark lashes, which crinkle at the corners with the force of his joy upon seeing you. That joy is apparent every time he gets to wake up beside you, never lessening despite the passage of days, just as you never tire of his face being the first thing you see each morning.

Today, he isn’t beside you, but is instead hovering over you, standing at your bedside. Once he sees you’re fully alert, Eddie squats comfortably, briefly rubbing his hand along your belly before folding his arms and planting his chin there. You can feel the heat of his body on your bare shoulder— always so hot, like a furnace lives beneath his skin.

“G’mornin’,” Eddie murmurs, his voice still husky with sleep like this is the first time he’s spoken since waking some time ago.

It’s an awkward angle, but you manage to bend your wrist to cup his cheek. His stubble rasps against your palm, and you hum contentedly, eyes focused on his face but lids heavy and half-closed. “Mornin’,” you echo, high and throaty all at once.

Eddie’s cheek mounds further under your palm when his grin widens, and you draw your thumb along his dimple. “Happy Mother’s Day,” he adds, sounding all together too pleased with himself, nearly smug, even.

Your nose crinkles in confusion, and you huff fondly. “I ain’t a mom yet, Ed,” you remind him, trying to be nonchalant, though you can’t help but sound as delicate and tender as you feel at the implication. The mother of Eddie Munson’s child. You’ve known that’s what you’re to be for quite some time now, but this day makes it feel even more real.

Eddie’s eyes slide to the bump of your stomach, which mountains up almost comically high from the thin bedspread. “Any day now, I reckon.” He squints, cocking his head. “In fact… it might even be today.” His voice is suddenly a coo: “What d’you think, Chickie? Is it finally time t’give y’r mama a break?”

You snort loudly, not bothering to hide your skepticism. “You kiddin’ me? This’s your baby we’re talkin’ about.” You pat your stomach affectionately. “Chickie ain’t gonna come out unless it’s of their own volition. Don’t let ‘em hear you say nothin’ like ‘might be today,’ or else they’ll stick put just to spite their daddy.”

When you glance back at him, Eddie is still looking at your belly. But though you’d been intending to be playful, the words have struck him a different way. Longing pools in his umber eyes— deep and depthless, thick and sticky like the sweetest honey, and this lighthearted moment turns suddenly poignant.

“Ed—” you whisper, but the words you plan to say catch on the sudden lump in your throat. Eddie tears his eyes away from your stomach, staring at you for a moment before leaning forward and kissing the tip of your nose.

“C’mon.” He smiles, rising to his full height while you grapple with the sudden urge to cry. Mercifully, he pretends not to notice. “Gotta get you downstairs, or else your Mother’s Day breakfast s’gonna get cold.” He crosses his arms and quirks a brow, looking down his nose dramatically. “And lemme tell you somethin’, Turtle Dove. I slaved over a hot stove all morning f’r you. So that just won’t do.”

You know he’s exaggerating to distract you. That doesn’t mean it doesn’t work. Instead of crying, you chuckle through the labor of hefting yourself to sit upright. You puff out your cheeks, blowing out a slow breath to gather yourself after the ordeal as you settle back on your palms.

“S’mighty kind of you, Edward,” you reply dryly, matching his drama with a wry twist of your lips. “But first things first: be a dear and help me outta this bed before I wet myself.”

Ten minutes later finds you clutching the railing and toddling your way down the stairs, now with an empty bladder and wrapped in a thin dressing gown to ward off the spring chill that lingers this early in the morning. Eddie is hot on your heels, one hand hovering near your elbow, which juts as you cup your hand underneath your belly for support while you descend from your bedroom. The boarding house you occupy is still quiet; the others who live here are either still sleeping or already off to see their relatives for the holiday. This leaves you relatively to your own devices, though the woman who owns the house— widowed and without children— will likely be awake soon. And you think that this is why, rather than leading you to the dining room for your Mother’s Day breakfast, Eddie guides you instead toward the sunroom at the back of the house.

The sunroom is more a storage room than anything else, but it’s a place you’d found yourself often. You would typically spend your afternoons there, sat atop one large crate and leaning against a taller stack to mend clothes and sew swaddling for the baby. This became part of your daily routine until last month, when your belly made hopping up onto the crate too difficult to manage. The spot was never the most comfortable even before your belly got in the way, but it remains the only place in the boarding house to afford a view of the backyard, where you’d convinced your landlady to let you begin cultivating a modest garden.

In a town largely bereft of greenery and overtaken by soot, this tiny plot you tend is an oasis— an endeavor you won’t give up until you really truly cannot manage it anymore.

You think Eddie is just bringing you to the sunroom so you can breakfast together alone. So what you find actually waiting there for you takes you completely by surprise.

The crates have been cleared from that corner you frequented, stacked three tall and pushed neatly against the far wall. In their place is a floral circular rug— worn at the edges and clearly secondhand, but new to the house, new to you, and certainly beautiful with its rich hues of deep maroon and cornflower blue. The small iron end table, which had been leaning cockeyed against the corner of the shed out back since you’d moved in, has since been brought inside, scrubbed, leveled, and placed beneath one of the corner windows. On it is a small white doily and a vase filled with clear water and fresh clipped wildflowers. You’re stuck on those for a moment— Where in God’s green earth did he find wildflowers around here? — but only until you notice the plate of yellow cookies, butter rich and dusted with sugar. You know it must be your favorite treat: lemon and lavender cookies. And from here, they look just like Ms. Willard makes them.

All at once, you’re struck with giddy delight, consumed by the remembered taste of crumbly tart lemon and earthy lavender, the rich decadence of sugar and fat melting on your tongue.

“All right,” Eddie starts, “So I know it ain’t the most nutritious of breakfasts. Also, I weren’t really slavin’ over a hot stove this morning. But, I did—”

Eddie stops speaking when he realized you haven’t heard a word he’s said, because you’re already waddling eagerly toward that tiny wrought iron table and its plate of decadent treats. In fact, you’re so fixated on those cookies that you don’t notice the most important addition to the room until you’re leaning against its wooden arm.

The oak is smooth and firm under your fingers when you reach for it absently. It’s pleasant to the touch, but it draws your attention only when it rocks forward under your weight, dipping unexpectedly. You startle, snatching your hand back; with it cradled protectively to your chest, you finally turn wide eyes to your last remaining gift.

Eddie had told you that, in the months you’d been apart, he’d taken to carpentry and woodcarving, hobbying at it in the evenings after his shifts at the factory. Where he’d found the energy after working all day, you didn’t know. You suspect it began as a way to keep himself occupied so he didn’t have to think, or so he could thoroughly exhaust himself and hope to sleep dreamlessly. Once you were reunited, however, the practice took on new meaning. Tiny carvings and simple tools, like stools and washboards, gave way to Eddie’s first big project: a bassinet for your little one on the way.

It took him a long time to make it, and in the end, it wasn’t the most elegant of final products. But despite its lack of finesse, the piece was sturdy and well-constructed, crafted with care by your beloved for the comfort of Chickie— Eddie’s choice term of endearment, which you’ll use until the baby is born and you can name them properly. Love seeped from the oaken edges of that bassinet; you wove more of it into the woollen blankets you nestled into its base. This labor of your shared love now sits tucked into the corner of your bedroom beside the chest of drawers until it’s needed.

That date is soon approaching now, and Eddie had told you he was picking up some extra evening shifts to put away a little extra money for the baby’s imminent arrival. You now know that was a misdirection. Because Eddie Munson may not have been slaving over a hot stove this morning, but he has clearly been pouring his sweat and effort into something else all this time, right under your nose.

Thank your lucky stars Eddie is back to gripping your elbow now, because it’s the only thing keeping you from collapsing wobbly-kneed to the floor. Overcome and overwhelmed, you pull your arm from his grasp to tuck it brusquely around his, squeezing his bicep so tightly that he grunts. When you sniffle, Eddie’s gaze shoots to you in alarm, but his expression eases when he notices your glossy eyes, which devour each dip and crevice of your final gift: a rocking chair.

The smooth wood of the chair glows with a warm, honeyed hue, as if it were still basking in the sun's rays. The chair's arms are wide and sturdy, its seat hewn strong and curved to cradle you in a comforting embrace. Carved into the wood on either side are two birds, a crow and a turtle dove, their feathers etched in precise detail, as if they might fly off the chair at any moment. The crow perches at the top of the chair's backrest, its eyes sharp and intelligent, while the dove rests just below it, its delicate form a striking contrast to the crow's boldness.

This isn’t a trinket, or a stool, or a bassinet. This is a gift for you. And it’s a gift made of you. You and your Eddie; turtle dove and her crow.

You tune back in to find your crow currently rambling eagerly about the process of making your gift. You don’t interrupt; instead, you lean your head against his bicep and your hip against the outside of his thigh, and you let him tell you everything. Clearly excited to share with you, Eddie explains every detail of that process— how he got a good deal on the lumber by bartering with your neighbor down the way, what various tools he used to whittle the birds and get them just right, how he’d tested a bunch of scrap pieces to get the right color for the stain, how nervous he’d been to seal it and mess the whole thing up. He recounts every little detail of the process as you gaze upon your gift and let his solid body support you; you feel his arm shift under your temple as he gestures while he speaks. And your heart collects every word, like a bird pecks up the seeds that give it life. Those words mix with everything else— all of what has happened since the August. The weight of it. The pain and heartache and gutwrenching beauty, too. You swell with all of that, and above all, with the potency of your deep abiding love for Edward Munson. It fills you so impossibly full that it’s a wonder you don’t burst with that universe of feeling inside you.

“M’sorry I lied about the overtime,” he says finally. “I was hoping t’surprise you. And, also, I figured this was worth more than pinchin’ some pennies.” There’s a brief pause, but you don’t break your silence— you’re too full of love to speak. So Eddie keeps going. “So, y’remember when y’said you were feelin’ sick the first few months? I mentioned it to Kathy, ‘n she said the rockin’ motion might help your stomach when y’r feelin’ ill. Also, I was thinkin’, when you’re feelin’ up to it, y’could make yourself a cushion and do your sewin’ more comfortably.” His voice colors with amusement as he adds, “S’gotta be better than those old crates, right?” before gentling again. “And—and you can set here and rock the baby once it’s born. ‘N I was thinkin’ I could set with you, too. That’d be nice, I think. Us all lookin’ out at the garden together.”

That is, apparently, the end of Eddie’s explanations, because there’s a longer pause then. “So, uh, are you surprised?” When you still don’t say anything, and the silence lingers between you, a tentative question follows with the beginnings of new nervousness. “…D’you like it?”

“Eddie.” His name shudders out in a hot, thick warble. And it’s then that Eddie glances down and sees the hot tears rolling in fat silent tracks down your cheeks.

“No, no, no—” he breathes, tight and urgent but so achingly gentle as he unwinds his arm from yours so he can press your sticky cheeks between his careful palms. Your chin wobbles as he tips your face up, and though his calloused thumbs swipe at your tears while they fall from your lashes, there are too many for him to brush away.

He doesn’t stop trying, though. Patiently, Eddie wipes each tear, catching what he can until he resigns himself to stroking over your cheekbones instead, offering comfort instead of trying to quell the flow. “No, baby, don’t cry.” He hushes the words against your forehead, pressing his lips to your heated skin. “Don’t cry, my Dove.”

Your breath hitches, and you sniffle by reflex. The sound is thick and wet and rather disgusting. You cringe, trying to pull away, but he doesn’t let you.

“Shhh.” Eddie shushes you gently, coaxing you with his fingers and his lips and his solid comforting warmth until you finally melt into his arms. You wrap your arms loosely around his chest, holding onto him and letting him hold you as best he can with your giant belly smushed lightly between you.

Eventually, the warmth of his body, the firmness of his arms, and the comfort of his scent— musky, earthen, and beneath, those notes of a beautiful summer storm— succeed in slowing the torrent of your tears to an occasional hiccup. The swelling of your emotions has receded, ebbing back into a manageable flow.

You feel Eddie press his face briefly to your hair before he mutters, “All right, look. Y’don’t have to worry about hurtin’ my feelings.” You’re beginning to frown in confusion when he clarifies flatly, “Y’clearly hate the damn thing, don’tcha?”

An incredulous giggle bursts from your lips, a little thick but girlish and delighted nonetheless at his nonsensical dramatics. And when Eddie’s arms tighten playfully, swaying you gently back and forth, you know that was his aim. You sway happily with him, nuzzling your swollen nose gratefully into his chest.

“Should’ve just stuck with those lavender cookies,” Eddie adds, far too dry to be anything but facetious.

That makes you speak at last. “No,” you say without lifting your head, and your voice is muffled by shirt and snot. “S’really thoughtful of you, Eddie. Can’t even tell you how much this means t’me. That you gave so much t’make this for us. For our baby.” You squeeze him tighter. “Can’t tell you how much you mean t’me,” you whimper, welling up again.

“Nuh-uh, nun’a that,” Eddie admonishes you lightly. “Don’t you start up again on me.” He squeezes you tight enough to make you squeak in protest, but not too tight to hurt. When you move to pull back, he lets you, dropping his hands to the swell of your belly that balloons your dressing gown.

His calluses are rough as they catch on the fabric, but his hands are so warm, so broad and gentle as he rubs them over your sizeable bump. Eddie hums, then smiles wolfishly, looking at you from beneath his lashes. “Y’let me fill you all up, Dove. Let me put my baby in you. S’the least I can do…”

Judging by the salacious waggle of his eyebrows, Eddie is clearly joking, but the roughness in his voice and those words still make you shiver visibly. His eyes flash, and the grin widens; knowing there’s nothing he can really do about it considering your advanced condition, you pout at him childishly.

Graciously, he doesn’t chuckle at your expense. Instead, Eddie drops the act to become earnest. “Least I can do is make sure you’re comfortable ‘til he pops out.”

You latch to one word. “He?”

One hand leaves your belly to scratch sheepishly at the back of his head. “Yeah, I’unno,” Eddie mumbles, abruptly dropping it to take your hand and pull you toward your new chair. “C’mon. Set down, now. S’what I spent all that time makin’ it for. N’eat some of those cookies ‘for I eat ‘em for you.”

“Okay, okay,” you pretend to grouse, letting him help you into your new chair.

When you sink into that seat, it cradles your body with the same sweet care as the man who made it, who carved its edges and ridges, sanded it to smooth, stained it golden and made it shine like the bright beams of sunshine he feels warm his cheeks when he looks upon your beloved face. When he perches on its arm beside you, settling his weight upon it, the wood does not waver, creak, or groan, because it’s been hewn sturdy and strong by his hands. And when you rock gently together for the first time— man, woman, and child all swaying in time— the dove and crow carved on that chair-back watch over you, an immutable symbol of the nest you’ve made at last.

It’s ready for that egg to peep and crack, to hatch and join the bonded pair.

And despite the stubbornness of the Munson gene, might it today, after all?

#blueywrites#td&tc#farmer!eddie munson#farmer!eddie#eddie munson x y/n#eddie munson x you#eddie munson fanfic#eddie munson x reader#eddie munson#eddie munson fic#eddie munson fluff#eddie munson au#eddie munson blurb#eddie munson imagine#eddie munson fanfiction#eddie munson x female reader#eddie munson x f!reader#eddie munson x fem!reader fluff

224 notes

·

View notes

Text

Limited Liability Partnership (LLP) Firm Registration: A Smart Choice for Businesses.

Starting a business requires careful planning, and choosing the right structure is one of the most crucial decisions entrepreneurs must make. One of the most preferred business structures in India today is a Limited Liability Partnership (LLP). It offers a perfect blend of partnership flexibility and corporate benefits. If you are planning to register an LLP, this guide will help you understand the advantages, registration process, and compliance requirements.

What is a Limited Liability Partnership (LLP)?

A Limited Liability Partnership (LLP) is a business structure that combines the benefits of a traditional partnership and a private limited company. It provides limited liability protection to its partners while allowing them the flexibility to manage the business as per a mutually agreed-upon partnership agreement. Governed by the Limited Liability Partnership Act, 2008, an LLP is a separate legal entity from its partners, ensuring that personal assets are protected in case of business liabilities.

Advantages of Registering an LLP

1. Limited Liability Protection

One of the biggest benefits of an LLP is limited liability. Unlike a traditional partnership, where partners are personally liable for debts, an LLP protects the personal assets of its partners.

2. Separate Legal Entity

An LLP is treated as a distinct legal entity, meaning it can own assets, enter contracts, and sue or be sued in its own name, ensuring continuity and stability.

3. Flexibility in Management

Unlike a private limited company, an LLP does not have stringent regulatory requirements regarding board meetings and resolutions, allowing greater operational flexibility.

4. No Minimum Capital Requirement

An LLP can be registered without any minimum capital contribution, making it an affordable option for startups and small businesses.

5. Tax Benefits

LLPs are not subject to dividend distribution tax (DDT), and their profits are taxed at a lower rate compared to companies, making them a tax-efficient business structure.

6. Less Compliance and Lower Costs

The compliance requirements for LLPs are significantly lower than those of private limited companies. For example, LLPs do not require mandatory audits unless their turnover exceeds ₹40 lakh or contribution exceeds ₹25 lakh.

7. Easy Transfer of Ownership

LLP agreements can allow the smooth transfer of ownership by adding or removing partners, without affecting the firm’s existence.

Step-by-Step Process of LLP Registration in India

Registering an LLP in India involves a simple online process governed by the Ministry of Corporate Affairs (MCA). Here’s how you can get your LLP registered:

Step 1: Obtain a Digital Signature Certificate (DSC)

All designated partners of an LLP must obtain a Digital Signature Certificate (DSC) from government-approved certifying authorities, as all filings with the MCA are done online.

Step 2: Apply for Director Identification Number (DIN)

Each designated partner must have a Director Identification Number (DIN), which can be applied for through the MCA portal.

Step 3: Name Reservation through RUN-LLP

The next step is to reserve a unique name for your LLP using the RUN-LLP (Reserve Unique Name – LLP) service. The name should comply with the naming guidelines and should not be similar to any existing company or LLP.

Step 4: Filing of Incorporation Documents

Once the name is approved, you need to file the LLP Incorporation Form (FiLLiP) with necessary documents such as partner details, proof of registered office, and LLP agreement draft.

Step 5: Draft and File the LLP Agreement

The LLP agreement, which outlines the rights, duties, and profit-sharing ratio of partners, must be drafted and filed within 30 days of incorporation.

Step 6: Obtain Certificate of Incorporation

After document verification, the Registrar of Companies (ROC) will issue the Certificate of Incorporation, confirming the legal existence of the LLP.

Step 7: Apply for PAN & TAN

Once incorporated, you must apply for a Permanent Account Number (PAN) and Tax Deduction and Collection Account Number (TAN) for taxation purposes.

Step 8: Open a Business Bank Account

Finally, open a business bank account in the name of the LLP to carry out financial transactions smoothly.

Annual Compliance Requirements for LLPs

Once registered, an LLP must adhere to certain annual compliance requirements to avoid penalties:

Form 8 – Statement of Accounts and Solvency (to be filed by October 30th each year).

Form 11 – Annual Return (to be filed by May 30th each year).

Income Tax Return (ITR) – LLPs must file their income tax return annually.

GST Registration and Returns – If the LLP’s turnover exceeds ₹20 lakh (₹10 lakh for special states), GST registration is mandatory.

Why Choose LegalMan for LLP Registration?

Registering an LLP involves legal documentation and compliance, which can be complex for new entrepreneurs. LegalMan provides expert LLP registration services, ensuring a seamless experience. Our team handles document preparation, filing, and compliance, making the process hassle-free for you.

Key Benefits of Choosing LegalMan:

Quick and hassle-free LLP registration

Expert guidance from experienced professionals

Affordable and transparent pricing

Dedicated customer support

Conclusion

A Limited Liability Partnership (LLP) is an ideal business structure for startups, small businesses, and professional firms due to its flexibility, limited liability protection, and low compliance requirements. With a straightforward registration process and numerous benefits, LLPs provide an excellent opportunity for entrepreneurs to establish their businesses with ease. If you are looking to register an LLP, LegalMan is here to assist you every step of the way.

Get started with LegalMan today and make your LLP registration process smooth and stress-free. Visit https://legalman.in/advantage-of-llp/ to learn more!

#lmpc registration#tds/tcs return filing services#gst return filing services#tds return filing services

0 notes

Text

Brand new Totally Caroline content🤯

This is Caroline's younger sister, Genesis. The complete opposite of her older sister, Genesis loves to spend her time knitting and sewing things for fun!

Just like her father, she attracts animals relatively easily. However, she doesn't exactly have the best relationship with fluffy critters (as she also enjoys turning small animals into taxidermy)

Out of both siblings, Genesis is seen as the creepy sister despite her cheery persona

Genesis also appreciates her older sister and loves her dearly (even if Caroline sucks as a sibling)

They do love each other, and that's what truly matters in the end.

#nightmares stupid art#totally caroline#tc caroline#tc genesis#total drama#td fanart#td ennui#td crimson

14 notes

·

View notes

Text

Effortless TDS & TCS Management in Odoo 18 Accounting Module

Managing complex Indian tax regulations has never been easier with Odoo 18’s Accounting module. Tailored for Indian businesses, this feature-rich platform provides automated TDS and TCS compliance with pre-configured sections and thresholds. Businesses can easily set up ledgers for various expenses, ensuring that tax deductions are calculated accurately and automatically.

This blog details how Odoo alerts users when a transaction exceeds tax thresholds (e.g., ₹30,000 for professional services under Section 194J). The system’s intuitive design simplifies the process of passing TDS entries and generating journal records. This ensures traceability, allowing businesses to track pending TDS certificates from vendors effortlessly.

Additionally, Odoo 18’s accounting module integrates seamlessly with vendor bills and sales transactions. For example, if a vendor has multiple bills for services rendered, the system consolidates them, calculates the total taxable amount, and applies the relevant TDS rate. This automation reduces the burden of manual calculations while ensuring compliance with statutory requirements.

The module also supports centralized management of TDS and TCS deductions across multiple transactions, offering businesses unparalleled visibility into their tax liabilities. With Odoo’s robust reporting tools, companies can analyze their financial performance, track tax obligations, and ensure timely payments.

Odoo 18 is the ultimate accounting solution for Indian businesses, offering a blend of automation, compliance, and efficiency. Whether you’re managing vendor payments or sales invoices, Odoo makes it easy to stay ahead in today’s competitive market.

#Odoo 18#Indian Accounting Features#TDS and TCS Management#Business Finance Automation#Tax Compliance#Indian Tax Regulations#Odoo ERP#TDS Alerts#TCS Alerts

0 notes

Text

At Taxring.com, we offer a wide range of expert tax and business services designed to support your financial and regulatory needs. Our seasoned professionals provide precise ITR filing, efficient GST registration and GST filing, and thorough audit services. We also assist with company registration and a variety of other essential business functions. Whether you’re an individual or a business, Taxring.com is your go-to partner for navigating complex tax regulations and ensuring compliance. Trust us to simplify your financial processes and help you achieve your business goals with confidence.

#ITR Filing 2024#How to Register for GST Online in 2024#income tax return#tax refund#How to check Tax Refund status#TDS#TDS and TCS Under GST 2024 Latest Rules#How to File TDS and TCS Returns Under GST

1 note

·

View note

Text

ITNS 280: A Key Component in Income Tax Payments

In the realm of Indian tax compliance, ITNS 280 plays a pivotal role. This form is essential for making various types of income tax payments, and understanding its usage can significantly simplify the tax payment process.

ITNS 280 is a challan used for the deposit of income tax under the Income Tax Act, 1961. It caters to a range of payments, including:

Advance Tax: Payments made in advance based on estimated income.

Self-Assessment Tax: Tax due after filing the income tax return.

Tax on Regular Income: Payments for regular income not covered under TDS (Tax Deducted at Source).

For individuals, firms, and corporations, ITNS 280 is a versatile tool used to settle various income tax liabilities. It ensures that taxes are paid accurately and timely, avoiding penalties and interest for late payments.

Filling out ITNS 280 involves specifying details such as the type of payment, financial year, and the relevant assessment year. The form can be submitted physically at designated banks or electronically through the Income Tax Department's website.

To ensure compliance, taxpayers must be aware of the specific instances when ITNS 280 is applicable. For instance, while ITNS 280 covers a broad spectrum of income tax payments, it does not include payments related to TDS or TCS, which are handled using ITNS 281.

In conclusion, ITNS 280 is a fundamental element of the income tax payment process in India. Understanding its function and proper usage helps maintain compliance with tax regulations and ensures that payments are made efficiently and accurately.

0 notes

Text

TDS AND TCS

0 notes