#tax-saving mutual funds

Explore tagged Tumblr posts

Text

Navigating Tax-Saving Mutual Funds is a guide to financial efficiency. These funds, like ELSS, facilitate wealth growth while optimizing tax burdens under Section 80C. Learn how to strategically align investments for substantial returns and minimized tax liabilities.

0 notes

Text

Maximize Your Savings: Exploring Tax Saving Mutual Funds

Tax-saving mutual funds, also known as Equity Linked Savings Schemes (ELSS), have emerged as a popular investment avenue for individuals seeking to reduce their tax liability while aiming for long-term capital growth. In this article, we explore the concept of tax-saving mutual funds, their features, benefits, and why they have become a preferred choice for tax planning among investors.

What are Tax Saving Mutual Funds?

Tax saving mutual funds are a category of equity mutual funds that offer tax benefits under Section 80C of the Income Tax Act, 1961. They provide investors with an opportunity to save taxes while investing in a diversified portfolio of equities, thus potentially offering higher returns compared to traditional tax-saving instruments.

Tax Benefits under Section 80C

Investments made in tax saving mutual funds are eligible for a deduction of up to Rs. 1.5 lakhs under Section 80C of the Income Tax Act. This means that investors can reduce their taxable income by the amount invested, leading to significant tax savings.

Equity Exposure for Capital Growth

Tax saving mutual funds invest a substantial portion of their assets in equities, providing investors with exposure to the stock market's potential for capital appreciation. This equity exposure can help grow wealth over the long term.

Lock-in Period

One distinguishing feature of tax saving mutual funds is the lock-in period of three years. Investors cannot redeem their investments before the completion of this period. While the lock-in may be perceived as a limitation, it helps foster a disciplined approach to long-term investing.

Systematic Investment Plans (SIP)

Investors can invest in tax saving mutual funds through Systematic Investment Plans (SIPs). SIPs allow for regular investments, thereby providing the benefit of rupee cost averaging and reducing the impact of market volatility.

Diversification and Risk Management

Tax saving mutual funds invest in a diversified portfolio of equities across various sectors and market capitalizations. This diversification helps in spreading risk and minimizing the impact of any adverse market movements.

Shorter Lock-in Period Compared to Other Tax-Saving Instruments

Compared to traditional tax-saving instruments like Public Provident Fund (PPF) and National Savings Certificate (NSC), tax saving mutual funds offer a shorter lock-in period. This allows investors to access their funds after just three years, providing more liquidity and flexibility.

Conclusion

Tax saving mutual funds offer an excellent opportunity for investors to save taxes while potentially benefiting from equity market growth. With the added advantage of a shorter lock-in period, these funds have gained popularity among individuals seeking tax-efficient and wealth-building investment avenues. However, as with any investment, it is essential for investors to assess their risk tolerance, financial goals, and investment horizon before investing in tax saving mutual funds. Consulting with a financial advisor can also help investors make informed decisions and achieve their tax-saving and wealth-building objectives effectively.

0 notes

Text

Maximizing Savings through Income Tax Planning Services in Jabalpur with Swaraj FinPro

Residing in Jabalpur and seeking avenues to reduce tax burdens? Implementing income tax planning strategies can serve as an investment avenue to retain a larger portion of your earnings.

Through astute financial management and capitalizing on available tax-saving avenues, you can curtail tax obligations and bolster your savings.

Here's a breakdown of how you can minimize taxes through Income Tax lanning Services in Jabalpur:

Familiarizing Yourself with Tax Deductions and Exemptions: The Indian government offers various deductions and exemptions to individuals aiming to mitigate tax liabilities. By scrutinizing your expenditures and investments, you can pinpoint opportunities to claim deductions under sections such as 80C, 80D, 80CCD, etc., of the Income Tax Act. Contributions to schemes like PPF, EPF, life insurance premiums, home loan EMIs, and health insurance premiums are instrumental in reducing taxable income.

Harnessing Tax-Saving Investments: Allocating funds to tax-saving instruments like Equity Linked Savings Schemes (ELSS), National Pension System (NPS), and tax-saving fixed deposits not only aids in tax reduction but also fosters wealth accumulation over time. These investments offer the dual advantage of tax savings and potential returns, making them an appealing choice for individuals aiming to optimize tax planning.

Retirement Planning: Planning for retirement can yield significant tax benefits. Options such as the National Pension Scheme (NPS) and Public Provident Fund (PPF) facilitate systematic tax deductions, offering a tax-efficient approach to building a retirement corpus. These avenues ensure financial security during retirement and provide a steady income stream.

Seeking Guidance from Financial Advisors: Consulting with proficient Financial Advisors in Jabalpur is pivotal in formulating a comprehensive tax-saving strategy tailored to your unique financial scenario. Given the challenge individuals face in allocating a portion of their income to taxes, the Indian government provides diverse options to enhance income retention, secure retirement, and offer flexibility and diversification.

ELSS scheme : ELSS scheme is a great tax saving option under section 80c, allowed by Income tax department aims to save on tax and build wealth in longer term. A very important feature of the ELSS i.e. Equity Linked Saving Scheme is it has lowest lock in period for say only 3 years. If invested lumpsum or one time, it will be available to withdraw just after completing 36 months means complete 3 years. Another good point is it gives much better return than other tax saving options. Third very important aspect of ELSS fund is it's tax efficiency. It attracts Long Term Capital Gains Tax after completing 3 years tenure.

In such equity oriented schemes, Long Term Capital Gains rules are different from debt funds. In such cases, profit upto Rs 100000 is tax free and above Rs 1 Lakh profit, only 10% tax is applicable.

These all features make it a favourable case to save tax through ELSS.

In summary, income tax planning presents abundant opportunities for individuals to optimize tax liabilities and bolster savings. By staying abreast of tax-saving provisions, making prudent investment decisions, and soliciting professional advice, you can efficiently manage taxes while safeguarding your financial future.

Embark on your income tax planning journey today to pave the path for a financially secure tomorrow.

For personalized assistance and expert advice on income tax planning, don't hesitate to reach out to Swaraj Finpro, a premier financial services provider in Jabalpur.

#Income Tax Planning Services in Jabalpur#Mutual Fund Services In Jabalpur#personal financial planning in jabalpur#tax saving mutual fund services in jabalpur#mutual funds expert in jabalpur

4 notes

·

View notes

Text

Exploring Peer-to-Peer Investments Through a P2P Lending Platform in Jabalpur

In today's fast-changing financial world, investors continually seek avenues to grow their finances while being mindful of risks. However, many individuals primarily focus on mutual funds and stocks for investment, unaware of the broader spectrum of available options. Let's explore the challenges investors face and learn how a P2P lending platform in Jabalpur helps them with the best investment opportunities.

Understanding Investor Challenges in Alternate Investment Avenues

As people try to make more money from their investments, they face problems because they don’t know about different ways to invest.

High Barriers to Entry:Investing in assets like real estate demands substantial capital, thus limiting access for many investors to diversify their portfolios effectively.

Opaque Investment Processes:Traditional investment structures can be complex and difficult to comprehend, making it challenging for investors to understand underlying risks and potential returns.

Lack of Information:Not having enough details about where to invest can make it tough to choose the right option. This might make people hesitant to invest at all.

Low Returns:Sometimes, the money invested doesn't grow much, offering lower profits compared to what people expected.

Limited Diversification:Investors might not have enough different types of investments. This lack of variety can make their money more at risk if one investment doesn’t do well.

Lack of Personalised Recommendations:Generic investment advice fails to cater to individual financial goals, risk appetites, and investment horizons, impacting the relevance of investment decisions.

The Potential of P2P Investments in India

Mutual funds are a reliable investment avenue today, but there are more such promising asset classes unexplored by investors. Swaraj FinPro, the best mutual funds investment services in Jabalpur, offers investments in one such asset class with Peer-to-peer (P2P) lending, backed by RBI guidelines where individuals can lend their money on higher interest while other individuals borrow funds from multiple investors through a digital platform. This transformative approach creates a marketplace connecting borrowers and lenders, facilitating secured personal loans while managing the loan life cycle to provide monthly returns to lenders. Here are the benefits of P2P lending platforms for investors:

Higher Potential Returns

P2P lending platforms typically yield higher interest rate to investors, compared to conventional savings accounts and investors can potentially benefit from higher returns up to 12%*.

Diversification Opportunities

By investing across a variety of borrowers on P2P platforms, investors can spread their risk and potentially increase returns by diversifying their investments.

Accessibility and Specific Advantages

P2P lending provides access to investments previously unavailable through traditional channels. Investors can participate with smaller investment amounts, diversify portfolios, and select the tenure.

Passive Income

P2P lending allows investors to earn interest regularly, providing a potential source of passive income.

Potential for Higher Yields

As investors can choose the tenure and interest rates they are willing to accept for lending, there's potential for higher yields based on their risk appetite.

Tailoring Investments for Investors

Swaraj FinPro empowers investors in Jabalpur and pan India to explore P2P lending as an accessible, reliable, and potentially lucrative avenue for diversification and growth within their investment portfolios. P2P lending works well because it's clear, gives different choices, and doesn’t lock your money away for too long.

#mutual fund financial in Jabalpur#best mutual fund distributors in Jabalpur#equity mutual funds in Jabalpur#best tax saving mutual funds services in jabalpur

2 notes

·

View notes

Text

Tax saving tips 2023

Equity Linked Saving Schemes (ELSS)

ELSS mutual cash is one of the frequent funding preferences used underneath Section 80C to shop earnings tax.

The most deduction that can be claimed is Rs 1.5 lakh.

ELSS mutual cash makes investments in fairness and the returns earned are market-linked, making them one of the most unstable funding preferences in the 80C basket.

ELSS mutual fund schemes have a lock-in duration of three years. Thus, as soon as invested, a personal investor can't withdraw the

For more details- Contact us at +91 9205950546 Email id: [email protected] website:https://www.datesfinserv.com/

2 notes

·

View notes

Text

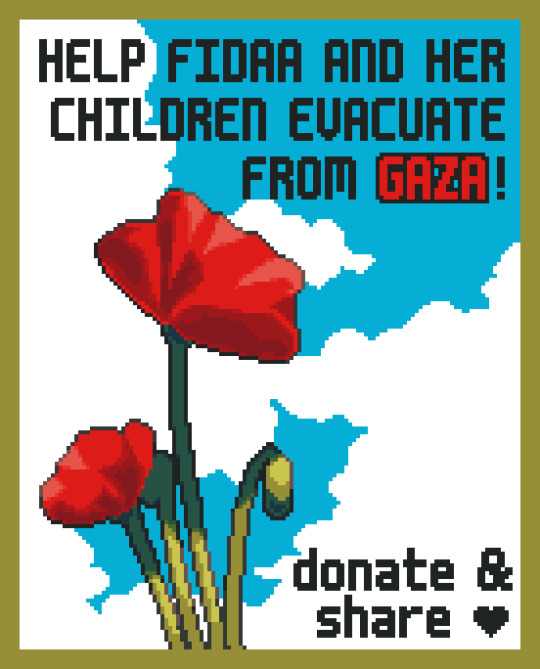

Fidaa is very dear to me. I saw the video she took of the bombs. We cannot imagine the horrible nights she suffers with her innocent children. We cannot imagine her daily hardships. We cannot possibly fathom the depth of her heartbreak.

YET SHE HAS HOPE. SHE WILL SHARE HER FAVORITE FOODS WITH ME AND WE WILL WALK THROUGH BEAUTIFUL GARDENS TOGETHER. THIS IS A REALM I *CAN* IMAGINE. BECAUSE IT IS MY HOME. DARLING SILA SHALL HAVE DOGGIE FRIENDS TO PLAY WITH AND LEARN TO SWIM AND THE TINIEST MAN HAMMOUD WILL BE A BIG HANDSOME AND HAPPY GUARD OF THE INNOCENT. PERFECT STRENGTH AND GENTLENESS AND HIS MOMMIE'S WISDOM.

Our dear friend el-shab-hussein has told us to be helpful and adopt a family to assist their fundraising. I have made some of the dearest friends I have ever had, some I am honored to even THINK of as my family. That I should be so lucky makes me ashamed sometimes. And truly, I wonder if I'm not partly compelled to share all my good fortune as quickly as possible to defy this feeling. Feeling undeserving or greedy or selfish or wasteful. Or god forbid, feeling guilt that can never be lessened.

you may have seen me post about fidaa’s campaign @fidaa-family2 (this is a verified campaign)

graphic by @fading-event-608

fidaa is a 29 year old woman from gaza with two very young children, muhammed and sila, one of whom was born during the war. her home was destroyed and she’s been displaced many times, and is currently separated from the rest of her family- her husband, her many siblings, and her parents. i can only imagine how nerve-wracking this is.

she’s doing her best to take care of her children by herself, despite facing hunger, thirst, widespread disease, and the threat of death. the other day, there was intense bombing near her and another family close to her was killed. life in gaza right now is hell and she told me they feel like they are just waiting for their turn to die.

fidaa and i talk often, and i feel lucky to know her. she’s an incredibly strong person, she travels long distances to find limited supplies for her kids and helps her siblings raise money even though shes separated from them.

but she needs help. the situation in gaza is so bad right now, the idf is preventing aid from entering and the food, water, and medicine available are extremely expensive. please share and donate to help her and her children survive and eventually leave gaza

$18,738 out of $30,000

#SAVE MY FAMILY🫂#fidaa#💐💐💐#humanity☎️🙏#stand with palestine#fight for palestine#free palestine#keep talking about palestine#you must help someone today.#YOU. must help#i said now#most documented genocide in history#famine in palestine#complete targeted destruction of education and medical infrastructure in palestine#israel is a terrorist state#american funded genocide#the citizens of the imperial core paid for genocide with tax dollars#now it is time to pay for salvation of the victims of american funded genocide by choice#direct action#mutual aid#SIGNAL BOOST#HOW WOULD YOU FEEL IF YOUR FRIEND SHOWED YOU A VIDEO THEY TOOK WITH THEIR OWN PHONE OF BOMBS FALLING A MILE AWAY#PLEASE BE SAFE PLEASE BE WARM AND DRY. SOMEONE STOP THEM#stop the genocide#not another bomb#no arms for israel#put down the rabid dog#holocaust harris#fascist empire of death#DONATION MATCH🇵🇸

30K notes

·

View notes

Text

Your Guide to Mutual Fund Distribution and Financial Planning in Mumbai

In today’s fast-paced world, securing a stable financial future is a top priority for many. However, navigating the world of investments can be challenging. Mutual funds, in particular, have become a popular investment choice due to their versatility, accessibility, and potential for steady growth. At Growth n Value, we specialize in mutual fund distribution in Mumbai and personalized financial planning, offering services that cater to diverse investment needs and financial goals.

Why Choose Mutual Funds?

Mutual funds pool together capital from numerous investors to create a diversified portfolio managed by professional fund managers. Here are a few reasons why mutual funds are an attractive choice for investors:

Diversification: Mutual funds allow investors to spread their capital across different asset classes, reducing risk and enhancing potential returns.

Professional Management: Funds are managed by experienced professionals who handle the intricate details of buying, selling, and portfolio adjustments.

Liquidity: Mutual funds offer ease of entry and exit, allowing investors to redeem their units when they need to, providing flexibility.

Accessibility: Mutual funds cater to a wide range of investors, making it easy for individuals to start investing with smaller amounts.

Mutual Fund Distribution with Growth n Value

Growth n Value is dedicated to making mutual fund investments accessible to everyone, from beginners to seasoned investors. Our expert team provides comprehensive mutual fund distribution services in Mumbai, helping clients understand the best funds for their specific risk tolerance, financial goals, and time horizon.

With access to a wide selection of mutual funds, Growth n Value ensures that clients can diversify their investments effectively. Our goal is to match you with funds that align with your objectives, whether it’s wealth creation, retirement planning, tax savings, or liquidity management.

Comprehensive Financial Planning: A Key to Long-Term Success

While mutual funds are a powerful tool for growing wealth, they’re only part of a broader financial strategy. At Growth n Value, we recognize the importance of personalized financial planning and offer services that provide clarity on:

Setting Goals: We help our clients identify both short-term and long-term financial goals. Having well-defined goals makes it easier to determine the best investment strategies and align assets accordingly.

Risk Assessment: Understanding an individual’s risk tolerance is essential for effective investment planning. Our advisors work with clients to develop portfolios that balance risk and reward according to their comfort level and financial objectives.

Portfolio Management: Building and managing a well-balanced portfolio requires knowledge and attention to detail. We provide portfolio management services, regularly reviewing and adjusting asset allocations to keep investments on track.

Tax Efficiency: At Growth n Value, we understand the importance of tax planning in wealth management. We assist clients in choosing tax-efficient mutual funds, such as Equity Linked Savings Schemes (ELSS), that help save on taxes while building wealth.

Retirement Planning: Planning for retirement is essential for financial security in later years. Our team guides clients in selecting the best retirement-focused mutual funds, ensuring a comfortable and secure retirement.

The Benefits of Working with Growth n Value

Personalized Guidance: We understand that each investor has unique financial goals and risk preferences. Our advisors work closely with clients to create investment plans that are tailored to their specific needs.

Transparency and Trust: Growth n Value believes in maintaining open communication with our clients, providing complete transparency on fees, fund performance, and recommendations.

Continuous Support: Investing is a journey, and we are here to support our clients every step of the way. We provide ongoing updates, reviews, and insights to ensure your investments stay aligned with your goals and market conditions.

Ready to Start Your Investment Journey?

Whether you are new to investing or looking to optimize your existing portfolio, Growth n Value is here to guide you. With our expertise in mutual fund distribution and financial planning, we can help you achieve financial success while managing risks effectively.

#mutual fund advisor near me#mutual fund advisor in mumbai#tax saving mutual funds#mutual fund distributor

0 notes

Text

Unlocking the Power of Tax Saving Mutual Funds with Integrated Enterprises: Maximizing Section 80C Benefits

In the realm of personal finance, tax-saving investments are crucial for optimizing financial health while minimizing the burden of taxation. One effective tool in this regard is Tax Saving Mutual Funds, also known as Equity Linked Saving Schemes (ELSS). These funds not only offer tax benefits under Section 80C of the Income Tax Act but also provide exposure to equities for potential capital growth. By delving into the nuances of these best mutual funds, investors can harness the power of systematic investment plans (SIPs) to diversify their portfolio, manage risks effectively, and secure their financial future with Integrated Enterprises (India) Pvt. Ltd.

Understanding Tax Saving Mutual Funds

Tax Saving Mutual Funds are a category of mutual funds that offer investors the dual advantage of tax savings and wealth creation. These funds primarily invest in equities or equity-related instruments, providing investors with exposure to the stock market. What sets Tax Saving Mutual Funds apart from other tax-saving mutual funds instruments is their lock-in period. Under Section 80C of the Income Tax Act, investments in ELSS funds qualify for a tax deduction of up to Rs. 1.5 lakh, making them a popular choice among investors looking to save on taxes while aiming for higher returns.

Investment in elss mutual funds is not just about saving taxes; it is also an opportunity to participate in the growth potential of the stock market. Unlike traditional tax-saving instruments like Public Provident Fund (PPF) or National Savings Certificate (NSC), ELSS funds have a higher exposure to equities, offering the potential for capital appreciation over the long term. This equity exposure can help investors beat inflation and achieve their financial goals more effectively.

Tax Benefits under Section 80C: A Game Changer for Investors

One of the key attractions of investment in elss mutual funds is the tax benefits they offer under Section 80C of the Income Tax Act. By investing in these best tax saving mutual funds, investors can avail deductions of up to Rs. 1.5 lakh from their taxable income in a financial year. This translates into substantial tax savings, reducing the overall tax liability of investors.

Moreover, the lock-in period associated with Tax Saving Mutual Funds aligns with the goal of encouraging long-term investments. While other tax-saving instruments like Fixed Deposits or Public Provident Fund have longer lock-in periods, ELSS mutual funds come with a lock-in period of just three years. This shorter duration not only provides liquidity to investors but also allows them to benefit from the growth potential of equities over the long term.

Equity Exposure to Capital Growth: Unleashing the Power of Market Returns

One of the distinguishing features of ELSS mutual funds is their significant exposure to equities. Unlike other tax-saving instruments that invest predominantly in debt instruments, ELSS mutual funds allocate a substantial portion of their portfolio to equities. This equity exposure opens up the possibility of higher returns over the long term, as equities have historically outperformed other asset classes like fixed deposits or gold.

By investment in elss mutual funds, investors can harness the power of market returns and participate in the growth potential of the stock market. While equity investments come with inherent risks, they also offer the opportunity for wealth creation and capital appreciation. Through a diversified portfolio of equities, ELSS mutual funds aim to generate attractive returns for investors while providing tax benefits under Section 80C of the Income Tax Act.

Lock-in Time: Balancing Liquidity and Long-term Growth

The lock-in period associated with ELSS mutual funds plays a pivotal role in shaping the investment strategy of investors. With a lock-in period of three years, ELSS mutual funds strike a fine balance between liquidity and long-term growth potential. While investors cannot redeem their investments before the completion of the lock-in period, this restriction fosters a disciplined approach to investing and encourages investors to stay invested for the long haul.

During the lock-in period, investors have the opportunity to ride out market volatility and benefit from the wealth creation potential of equities. By staying invested for the long term, investors can potentially earn higher returns compared to traditional tax-saving instruments with longer lock-in periods. The lock-in time of ELSS mutual funds serves as a catalyst for instilling a long-term investment mindset and reaping the rewards of patient investing.

Systematic Investment Plans (SIP): Harnessing the Power of Rupee Cost Averaging

Systematic Investment Plans (SIPs) hold the key to unlocking the full potential of Tax Saving Mutual Funds. By opting for SIP investment in ELSS mutual funds, investors can benefit from rupee cost averaging and mitigate the impact of market volatility on their investments. SIPs allow investors to invest a fixed amount at regular intervals, regardless of market conditions, thereby reducing the average cost of acquisition and maximizing returns over the long term.

Through SIPs, investors can harness the power of compounding and build wealth systematically over time. By spreading their investments across different market phases, investors can lower the risk of timing the market and benefit from the long-term growth trajectory of equities. SIP investment in ELSS mutual funds not only enables investors to save taxes under Section 80C but also empowers them to create a diversified portfolio and achieve their financial goals with discipline and consistency.

Diversity and Risk Management: Safeguarding Wealth through Portfolio Allocation

Diversification is the cornerstone of sound investment strategy, and it plays a crucial role in managing risks effectively. Investing in Tax Saving Mutual Funds offers investors the opportunity to diversify their portfolio across various sectors, industries, and market capitalizations. By spreading their investments across different asset classes, investors can reduce the impact of market fluctuations and safeguard their wealth against volatility.

Furthermore, the equity exposure of ELSS mutual funds is complemented by the presence of debt instruments in their portfolio. This balanced approach helps mitigate the risk associated with equity investments and provides stability to the overall portfolio. By diversifying their investments through ELSS mutual funds, investors can achieve a well-rounded portfolio that combines growth potential with risk management strategies, thereby enhancing their overall investment experience.

Conclusion: Embracing the Future with Tax Saving Mutual Funds

In conclusion, Tax Saving Mutual Funds offer a compelling proposition for investors looking to save taxes, create wealth, and achieve their financial goals. With their tax benefits under Section 80C, equity exposure for capital growth, and short lock-in period, ELSS mutual funds provide a winning combination of tax efficiency and wealth creation potential. By leveraging systematic investment plans (SIPs), diversifying their portfolio, and managing risks effectively, investors can navigate the complexities of the market landscape with confidence and clarity.

Investment in elss mutual funds is not just about saving taxes; it is about embracing the future with a proactive approach to wealth creation and financial planning. By understanding the nuances of Tax Saving Mutual Funds and harnessing their potential through disciplined investing with Integrated Enterprises (India) Pvt. Ltd, investors can pave the way for a secure and prosperous financial future. So, take the plunge into the world of best tax saving mutual funds and embark on a journey towards financial freedom and abundance.

#best mutual funds#mutual fund investment#investment in elss mutual funds#best tax saving mutual funds#sip investment

0 notes

Text

What Are the Benefits of Life Insurance For Your Family?

We carefully plan every detail for our families—birthday gifts, vacations, education. But have you ever considered what will happen to them if you’re no longer around? Life insurance can provide a crucial safety net for your loved ones during challenging times.

What is Life Insurance?

Think of Life insurance as a contract between an insurance company and you. You pay regular premiums, and in return, the company promises to provide a lump sum payment, known as the death benefit, to your beneficiaries in the event of your death. If you wish to get the best life insurance plans in Kolkata, reach out to experts.

Benefits of Life Insurance for Your Family

Financial Security: Life insurance ensures that your family has financial support if you’re not there to provide for them. This can cover daily living expenses, mortgage payments, and other financial obligations.

Debt Coverage: It helps settle any outstanding debts you may leave behind, such as loans or credit card balances, preventing your family from being burdened with debt.

Education Funding: The money from a life insurance policy can help pay for your children's education. This means their education will flourish even when you are not around anymore.

Estate Planning: You can rest assured knowing that your assets will be smoothly passed on to the people who matter to you. It also provides funds to cover estate taxes and other related expenses. This way, your legacy is maintained without added financial stress on your loved ones.

Peace of Mind: Knowing that your family will be financially protected offers peace of mind, allowing you to focus on enjoying the present moments with your loved ones.

Conclusion

Life insurance is more than just a policy; it’s a thoughtful way to ensure your family's future is safeguarded. INV Rajat, one of the best life insurance companies in Kolkata, can help you provide financial security and peace of mind. Life Insurance can be a vital component of your family’s long-term planning. Investing in a life insurance policy means you are planning not just for today but for tomorrow’s uncertainties as well.

#Best Life Insurance Companies in Kolkata#Best Life Insurance Plans in Kolkata#Health Insurance in Kolkata#Best Health Insurance Policy Kolkata#Top Health Insurance Companies in Kolkata#General Insurance Companies in Kolkata#AMFI registered Mutual Fund Distributor in Kolkata#best Mutual Fund Distributor in Kolkata#mutual funds advisors in Kolkata#online investment schemes in Kolkata#financial services in Kolkata#mutual fund investment companies in Kolkata#financial goals in Kolkata#stock broking services in Kolkata#insurance agent in Kolkata#financial consultant company in Kolkata#best tax saving funds experts in Kolkata#small investment opportunities in Kolkata

0 notes

Text

Please click the campaign and bookmark it. Please donate now and boost for Nour's family to survive.

This is a lifeline, we have to hold very tightly to our end of this lifeline.

Help the victims of genocide and ethnic displacement and bombing and famine and deprivation of education and medical infrastructure and racist attacks and censorship. Think of how many that will die today, not even knowing that they could have created accounts that could have been ignored here.

The lifeline I spoke of, if we let go, not only do people definitely die, but we lose our souls too. But I don't care about us, we have had too many chances and we squander our good luck and are irrationally proud of being 'brat' and selfish. To hell with us, HELP THE PALESTINIANS, I guarantee you we will be fine and they won't. Time to help. I said now.

Hello everyone

I am Nour from Gaza

.I need your help if you can

Please donate to save my life and the lives of my children

I'm asking for a small donation of $25 from each person. $35 will save my children from death and help me cover expenses and rebuild.

Through the link (please see my CV) https://www.gofundme.com/f/donate-to-help-nour-and-his-family-escape-the-war-in-gaza

My account has been verified by @90-ghost

@suntransmission hello dear can you follow me to can contact with you

#SIGNAL BOOST#NOVEMBER 2024#URGENT#SAVE FAMILY🫂#INNOCENT BABIES#GAZA UNDER FIRE#FAMINE IN PALESTINE#COMPLETE TARGETED DESTRUCTION OF EDUCATION AND MEDICAL INFRASTRUCTURE IN PALESTINE#american tax-payer funded genocide#mutual aid#community safety net#direct action#help someone today#NOW#make yourself proud#maybe you should donate so you can flex on someone!#maybe you should donate so you can live with yourself and sleep peacefully in your warm cozy bed#but really you should donate because we already paid for the genocide without consent with tax dollars#and if we dont act to mitigate some of that harm- we are doubly culpable. blood IS on our hands whether you follow the news or not#do the right thing and start helping do it do it do it#please pray for healing and happiness#put good into the world#compassion🪷#humanity where are you🙏#most documented genocide in history

128 notes

·

View notes

Text

MoneyCare Financial Planning, as a mutual funds expert in Mumbai, offers specialized advice and strategic planning. They guide you through investment options in mutual funds like equity funds, debt funds, hybrid funds, etc; and help you build a diversified portfolio to meet your financial goals. For more information, visit https://moneycareplanner8.wordpress.com/2024/07/16/how-does-mutual-funds-sip-generate-better-returns-over-time/

#mutual fund advisor in mumbai#mutual fund experts in mumbai#mutual fund sip investment advisor in mumbai#mutual fund sip advisor in mumbai#sip investment advisor in mumbai#tax saving mutual fund planner in mumbai#mutual fund investment plan in mumbai#sip investment advisors in mumbai#mutual fund planner in Mumbai#mutual funds expert in mumbai

0 notes

Text

To start establish a savings account dedicated to taxes. Treat it like a payment to yourself. By setting aside a portion of your earnings you'll be ready when tax season arrives, review your withholding allowances regularly to ensure that you're not paying much or too little throughout the year. Make adjustments as needed to steer clear of any surprises when tax season rolls around.

#Top mutual fund investment in India#Best investment plan#best investment plan#investing#tax saving#tax deduction saving

0 notes

Text

How Does Rupee Cost Averaging Work in Mutual Funds SIPs?

Investing in the stock market can be daunting for beginners due to the fear of market fluctuations. However, Systematic Investment Plans (SIPs) in mutual funds offer a smart strategy to navigate this volatility. One of the key principles behind SIPs is Rupee Cost Averaging (RCA), which helps mitigate the impact of market ups and downs on your investments.

What are SIPs?

SIPs, or Systematic Investment Plans, are a method of investing in mutual funds where you commit to investing a fixed amount of money at regular intervals, typically monthly. This disciplined approach encourages regular savings and investment regardless of whether the market is up or down. If you wish to know about mutual fund SIP services in Alwar, contact experts.

Understanding Rupee Cost Averaging (RCA)

Rupee Cost Averaging is a strategy employed in SIPs to manage market volatility. Here’s how it works:

Fixed Investments: You decide on a fixed amount to invest regularly, say Rs. 1,000 per month.

Market Fluctuations: Mutual fund prices, known as Net Asset Value (NAV), fluctuate over time based on market conditions.

Buying More Units at Lower NAV: When the NAV is low, your fixed investment amount buys you more units of the mutual fund.

Buying Fewer Units at Higher NAV: Conversely, when the NAV is high, the same fixed amount buys fewer units.

Benefits of Rupee Cost Averaging with SIPs

Reduces Impact of Volatility: By investing regularly, you automatically buy more units when prices are low and fewer when prices are high, effectively averaging out your investment cost over time.

Disciplined Investing: SIPs instil discipline by encouraging regular investments regardless of market conditions, which is beneficial for long-term wealth creation.

Power of Compounding: Reinvesting returns along with your regular contributions harnesses the power of compounding. Over time, this can potentially lead to significant wealth accumulation.

Example of Rupee Cost Averaging

Let’s say you invest Rs. 1,000 each month in a mutual fund SIP over a year. Here’s a simplified illustration:

Month 1: NAV Rs. 10 → Units Purchased: 100

Month 2: NAV Rs. 15 → Units Purchased: approximately 66.67

Month 3: NAV Rs. 12 → Units Purchased: approximately 83.33

Despite the fluctuating NAV, your average cost per unit over the year would be lower compared to a simple average of the monthly NAVs. This helps in reducing the overall investment cost and potentially enhancing returns in the long run.

Long-Term Approach: RCA works best over the long term, where market fluctuations tend to smooth out.

Suitability: SIPs are ideal for investors looking to invest regularly and build wealth steadily over time.

Choosing the Right Fund: Research and select mutual fund schemes aligned with your investment goals and risk tolerance.

Conclusion

Rupee Cost Averaging through SIPs provides a structured and effective way to invest in mutual funds, offering benefits of reduced volatility impact, disciplined investing habits, and leveraging the power of compounding for long-term financial growth. KCI Money, a reliable mutual fund investment advisor in Alwar can help investors understand and utilise this strategy wisely.

#mutual fund expert in Alwar#mutual funds sip advisor in alwar#mutual funds advisor in Alwar#mutual fund company in Alwar#mutual fund sip experts in Alwar#mutual fund sip services in alwar#online investment in mutual funds in Alwar#tax saving mutual fund services in Alwar#mutual fund investment advisor in alwar#mutual fund sip advisor in alwar

0 notes

Text

What are the 10 Benefits of Investing in Debt Mutual Funds?

Many people hesitate to invest in mutual funds because they fear market risks. However, there are low-risk options available that can still provide good returns. These options are known as debt mutual funds. In this article, we will explore these relatively lower-risk options.

What Are Debt Mutual Funds?

Debt mutual funds are investment vehicles that primarily invest in fixed-income securities such as government bonds, corporate bonds, treasury bills, and other money market instruments. These funds aim to provide regular income with relatively low risk compared to equity mutual funds. Debt funds are suitable for conservative investors who prefer steady returns over the potential for high but volatile gains. If you wish to get started, reach out to the best mutual fund advisor in Cochin.

Types of Debt Mutual Funds

Debt mutual funds come in various types, each catering to different investor needs and investment horizons. Here are some common types:

Liquid Funds: These funds invest in very short-term securities with maturities of up to 91 days, and offer high liquidity which makes them suitable for parking surplus funds.

Ultra-Short Duration Funds: These funds invest in instruments with slightly longer maturities than liquid funds, typically up to six months.

Short-Term Debt Funds: These funds invest in securities with maturities ranging from one to three years, offering a balance between liquidity and returns.

Corporate Bond Funds: These funds invest primarily in high-rated corporate bonds, providing higher returns than government securities while maintaining relatively low risk.

Gilt Funds: These funds invest in government securities of varying maturities, offering high safety but potentially lower returns compared to corporate bond funds.

Dynamic Bond Funds: These funds actively manage their portfolios based on interest rate movements, adjusting the maturity of their holdings to maximize returns.

Credit Risk Funds: These funds invest in lower-rated corporate bonds, offering higher returns but with a higher risk profile.

How Debt Funds Differ from Equity Funds

Debt mutual funds and equity mutual funds serve different investment purposes and risk appetites. Here are some key differences:

Risk Level: Debt funds carry lower risk compared to equity funds, as they invest in fixed-income securities. Equity funds invest in stocks, which are more volatile and can lead to higher returns but also higher losses.

Return Expectation: Debt funds provide more stable and predictable returns, while equity funds offer the potential for higher but more unpredictable gains.

Investment Horizon: Debt funds are suitable for short to medium-term investment goals, whereas equity funds are better suited for long-term growth.

Top 10 Benefits of Investing in Debt Mutual Funds

Lower Risk: Debt funds invest in fixed-income securities, making them less volatile than equity funds. This lower risk makes them ideal for conservative investors.

Regular Income: Many debt funds provide regular income through interest payments, making them suitable for investors seeking steady cash flow.

Liquidity: Debt funds, especially liquid and ultra-short duration funds, offer high liquidity, allowing investors to access their money quickly when needed.

Diversification: Investing in a mix of debt securities helps diversify risk, reducing the impact of any single security's poor performance on the overall portfolio.

Tax Efficiency: Debt funds held for more than three years qualify for long-term capital gains tax with indexation benefits, which can significantly reduce tax liability.

Professional Management: Debt funds are managed by professional fund managers who have expertise in selecting and managing fixed-income securities, ensuring better returns than individual investments.

Flexibility: With various types of debt funds available, investors can choose funds that match their investment horizon and risk tolerance.

Transparent Operations: Mutual funds are regulated by the Securities and Exchange Board of India (SEBI), ensuring transparency and investor protection. Regular disclosures and updates keep investors informed about their investments.

Cost-Effective: Debt mutual funds have lower expense ratios compared to actively managed equity funds, making them a cost-effective investment option.

Goal-Oriented Investing: Debt funds can be used to achieve specific financial goals, such as saving for a down payment on a house, funding education expenses, or building an emergency corpus.

Conclusion

Debt mutual funds offer a viable investment option for those looking to achieve stable returns with lower risk. Thirukochi Financial Services, the best mutual fund company in Cochin can guide you by helping you understand the different types of debt funds and their benefits, so you can make informed decisions that align with your financial goals.

#best mutual fund company in cochin#mutual fund advisor in kochi#best mutual fund advisor in cochin#mutual fund sip services in cochin#mutual fund sip advisor in kochi#buy mutual fund sip services in cochin#buy mutual fund sip in cochin#amfi registered mutual fund advisor in kochi#mutual funds planners in cochin#mutual funds schemes in cochin#online investment in mutual funds in cochin#tax saving mutual fund services in cochin#mutual funds investment plans in cochin#equity fund services in cochin#Debt Funds planner in cochin#Hybrid Fund advisor in kochi#index funds to invest plan in cochin#mutual funds company in cochin

0 notes

Text

Your Investment Report: Insights, Analysis, and Recommendations

Dive into your personalized investment report for comprehensive insights, in-depth analysis, and expert recommendations tailored to your financial goals. Unlock the power of informed decision-making and optimize your investment strategy with Your Investment Report.

#Investment analysis#market trends#portfolio management#risk assessment#mutual fund ideas#tax saving mutual funds

0 notes

Text

Equity Mutual Fund Services in Sri Ganganagar

Ever wished your money could work a bit harder for you? Look no further than equity mutual fund services in Sri Ganganagar. These services are provided by experts, allowing your money to grow at a faster pace than traditional savings options.For more information, visit https://www.bhatiainvest.com/mutual-fund-sip-plan-in-sri-ganganagar.php

#mutual fund investment plan in sri ganganagar#tax saving sip advisor in sri ganganagar#best mutual funds company in sri ganganagar#performance of mutual funds in sri ganganagar#mutual funds sip advisor sri ganganagar#types of mutual funds service in sri ganganagar#mutual fund schemes in sri ganganagar#online investment in mutual funds in sri ganganagar#tax saver mutual fund planner in sri ganganagar#mutual funds investment plans in sri ganganagar#equity mutual fund services in sri ganganagar#best mutual fund companies in sri ganganagar#tax saving funds planner in sri ganganagar

0 notes