#tax planning for dentists

Explore tagged Tumblr posts

Text

Optimize your dental practice's financial health with Dental Accountants in Alabama, providing specialized accounting solutions tailored for dentists. From tax planning to managing cash flow and improving profitability, these expert services focus on meeting the unique financial needs of dental professionals. Enhance business efficiency while ensuring compliance with industry regulations through personalized support.

#dental accountants alabama#specialized accounting services#dental practice finances#tax planning for dentists#efficient bookkeeping solutions#financial forecasting for dental businesses#profitability strategies#dental industry compliance#expert dental accountants#accounting solutions for dentists

0 notes

Text

Tax Planning for Dentists: Maximizing Deductions and Minimizing Liabilities

As a dentist, running a successful practice requires more than just delivering excellent care to patients—it also involves strategic financial management. Tax planning is one of the most critical aspects of this management, ensuring you retain as much income as possible while staying compliant with tax laws. Whether you’re operating as a sole proprietor, partnership, or corporation, proper tax planning can significantly lower your tax burden. This blog outlines some tax-saving strategies specifically tailored for dentists.

1. Maximize Deductions for Equipment and Supplies

Dental practices require significant investment in equipment, from X-ray machines to sterilization tools, not to mention the routine purchase of supplies like dental instruments and materials. Fortunately, the cost of these items can often be deducted. Under Section 179 of the IRS tax code, you can deduct the full cost of new and used equipment in the year of purchase, up to a certain limit. Additionally, supplies used within your practice, such as gloves and dental trays, are deductible as business expenses.

Depreciation on major equipment can also be claimed over time, spreading the tax benefits across multiple years. For large purchases like dental chairs, leveraging accelerated depreciation can provide more immediate tax relief.

2. Deduct Rent and Utilities

If you rent the space where your dental office is located, you can deduct rent payments as a business expense. Even if you own the property, interest paid on a mortgage may be deductible. Additionally, utilities such as electricity, water, and internet services used for your practice are also deductible. Keeping clear records of all these expenses will make it easier to claim the appropriate deductions and minimize taxable income.

For dentists operating a home office—especially those who are doing part-time virtual consultations or managing administrative work from home—a portion of your home-related expenses, like rent or mortgage interest, utilities, and home insurance, can also be deducted.

3. Retirement Plan Contributions

As a high-income professional, contributing to tax-advantaged retirement accounts is one of the best ways to reduce your taxable income while securing your financial future. Dentists can take advantage of retirement savings plans such as 401(k)s, SEP IRAs, or SIMPLE IRAs. Contributions to these plans are deductible, meaning you can save for retirement and lower your tax bill simultaneously.

If you own your practice and have employees, offering a retirement plan can also provide tax benefits. Employer contributions to retirement plans are tax-deductible, and there are often tax credits available for small businesses that set up retirement accounts.

4. Leverage Tax Credits

Dentists may be eligible for various tax credits that reduce overall tax liabilities. For instance, investing in energy-efficient equipment or making your practice more sustainable may qualify you for federal or state energy credits. Additionally, if your practice offers healthcare to employees, you may be able to claim the Small Business Health Care Tax Credit.

5. Hire Family Members

If your spouse or children help with administrative tasks, bookkeeping, or marketing for your dental practice, consider employing them. Hiring family members allows you to deduct their wages as a business expense. Just ensure that the compensation is reasonable for the services provided and that they are performing legitimate work for the practice.

6. Consider a Professional Corporation

If your dental practice is currently structured as a sole proprietorship or partnership, exploring the benefits of becoming an S-Corporation or C-Corporation might lead to tax savings. By incorporating, you can potentially reduce self-employment taxes and have more flexibility in managing income and retirement plans. Discussing this option with a tax advisor can provide clarity on whether it’s the right choice for your practice.

Conclusion

Tax planning for dentists requires a proactive approach and a strong understanding of the deductions, credits, and retirement plans available. By strategically managing expenses, maximizing deductions, and leveraging tax-efficient retirement options, you can reduce your overall tax liability while building a more financially secure practice. Always consult with a tax professional to ensure you’re taking full advantage of the tax-saving opportunities available to you as a dental practitioner.

0 notes

Text

.

#Well I just had an unfortunate experience with my (now former for reasons that will become clear) dentist office#Apparently my insurance plan through my dad expired on December 31st and the dentist didn’t bother telling us before I had my cleaning and#x-rays done. Despite us ASKING THEM MULTIPLE TIMES if I was still on my dad’s plan#Instead I got a phone call today saying that the insurance wasn’t working since I had a filling scheduled for Wednesday#I mean at least they checked before THAT.#But even though I canceled that appointment I a) still have a cavity that needs to be filled#And b) now have to pay 185 fricken dollars for the X-ray and cleaning that I hadn’t anticipated#Luckily I do have the money so it’s not going to bankrupt me or really affect me too badly#But I also have other unexpected expenses that I have to pay for and all of that adds up fast#And I bought some frivolous things recently that I wouldn’t have had I known about these unexpected expenses#The only good thing is that I got a promotion at work recently but I don’t know when that starts#And it will give me prolly only like… ¢50 more an hour since I already get paid a decent wage in my current position#Unless they’re actually fair with the wage increase but I would doubt it#I also might be getting another promotion as a counselor at my job but that wouldn’t be until AT LEAST next school year#IF they can find the funding for it#And even then I’m positive they’d only take me on for like… $36000 a year since I said I’d accept that#It’s not nearly what I’m worth but I’m hoping that if I do it at a lowered rate they’ll be more inclined to go up later on#And if not then at least I’ll have experience to get a somewhat better school counseling job than if I had no experience#Honestly $36000 would seem like an obscene amount of money considering I got only $18000 after taxes last year#Thank god my grandpa pays for my family’s rent so I don’t have to worry about that#But my grandma is sick now so he has to pay for her care and can’t afford to help my family as much#Which is fair since he has paid for our rent and most of the bills for decades#(My mom is disabled and my dad is her caretaker. My grandpa pays for her care willingly since my dad is pretty much her full time caretaker#and can’t get a full time job even if he wanted. And since I still live at home I get that benefit at least.)#All of this to say that things are Not Great right now. -.-#I really hope my job accepts me as a counselor for next year. I really do… While the pay wouldn’t be great#It at least would be an improvement. And it beats trying to find another counseling job that could be absolute chaos the first year#I’ve been told multiple times that the first year is the hardest. If I can circumvent that a little by working at an after school program#That would be preferable. Plus the hours would be much better#Anyway I reached 30 tags apparently so I’ll be done now. Ugh. Thanks for reading y’all.

1 note

·

View note

Text

NeXT on A Day in a Life—Dating Nanami Kento: A Love Story in Financial Planning Pt. 6 | Nanami x Reader

Months go by..

It happens on a random Tuesday.

You're curled up on the couch, half-asleep, watching some random documentary. Nanami is next to you, one arm draped over the back of the couch, scrolling through his phone like the world isn't completely peaceful right now.

The only sound is the TV droning in the background.

And then—without warning—Nanami shifts slightly, adjusting his position. His hand lands on your thigh.

Not in a sexy way. Not in a casual way. Just...there. Like it belongs. Like it's always belonged.

You blink, glancing at him. He doesn't even look up.

He's still reading something, completely focused, totally normal—except his thumb starts moving absently, rubbing slow, subconscious circles into your skin.

Your chest tightens.

It's such a small thing.

A tiny, thoughtless motion.

But it's everything.

Because this isn't new. It's not an intentional touch. It's just second nature to him now—like he doesn't even have to think about it. Like you're already his.

You bite your lip, watching him for a long moment, warmth creeping up your neck.

And then—because you can't help yourself—you hum, shifting slightly so his hand presses more firmly against you.

Nanami pauses.

His eyes flick to you, slow and knowing, and you swear you see a ghost of a smirk before he looks back at his phone.

But he doesn't move his hand.

Doesn't stop the slow, steady circles.

And in that moment, you realize—this man has already decided you were permanently his.

He just hasn't said it out loud yet.

Nanami, The Accidental Husband

One day, you'll wake up and realize you didn't just get a boyfriend. You got a husband. And you didn't even notice it happening.

He:

Pays your bills

Tells you when your taxes are due

Remembers your dentist appointments

Brings you coffee exactly how you like it

Knows your social security number

And now you're just standing there, staring at him like:

"...Did we get married and I just missed it?"

Nanami doesn't even propose.

Weeks later, after he's been oddly quiet about 'future plans,' you’re both sitting at the kitchen table when he slides a fully paid mortgage agreement of the house he just purchased for the two of you across the table like it's a love letter.

At first, you don't process it.

You blink.

Look at the document.

Look at him.

Look back at the document.

Read it again.

Then flip to the second page—just to make sure this isn't some kind of lease renewal scam. Your eyes trail down to the second page, where two names are already printed—his and yours.

You turn the page again, looking for some kind of catch, but there isn't one.

Just a blank signature line.

You slowly look up at him, heart stuttering.

"Nanami... are we... getting married?"

He doesn't blink.

"It's a joint property ownership agreement."

And you're staring down at this document, eyes wide and heart beating, before slowly looking up at him once more.

Oh.

OH.

...So basically, yes.

You can see him starting to get nervous. He's actually tapping his fingers nervously on the table, and you realize this is the first time you've seen his composure drop. His glasses slide a bit, and his dark blond eyebrows pull together as his pale lips part.

"What do you think?" he asks, and your cheeks burn because this man did not prepare a speech.

He didn't need to. The very fact he felt nervous enough to tap the table gave away the fact that Nanami is scared that you will say no.

"Four bedrooms. Three and a half baths. Two stories."

Nanami exhales, removing his glasses and rubbing his eyes like he's mentally bracing himself.

"A pool. A big backyard. More closet space than you'll ever need." He pauses, hesitates. "We can renovate, if you want. The schools are all national blue ribbon award winning schools. There's also a nice park nearby..."

He clears his throat. Then, softer—

"Do you like it?"

He lets out a frustrated exhale through his nose, and runs a hand over his face before turning back toward you.

He simply hands you a pen without a single word. And for the longest time, you're just blinking, before nodding. You press the pen to the line of the page. You sign your name in your handwriting right under his as the second owner. And when you look up to see him, he is biting down hard on his lower lip in the biggest effort not to smile like an idiot.

You set the pen down, staring at him as a smile creeps across your face, slow and warm. It's catching—he tries to fight it, but you catch the twitch at his cheek, the faintest pull of a half-smile softening his sharp edges. Your grin stretches wider and your chest feels tight with it.

You scoot the chair back, the scrape loud in the quiet, and climb into his lap. His breath hitches—just for a second—but you feel it against your cheek.

"Are we dating, or married now?" you ask, voice teasing but softer than you mean it to be. Nanami exhales through his nose, head tipping back against the wall like he's bracing himself.

"Perhaps. Does it matter? Legally, there are no tax benefits. All my assets are in a trust, but—" he starts, and you cut him off, burying your face in his shoulder. The scent of his cologne hits you, steady and familiar, and you're not sure if it's his words or his warmth making your eyes sting.

You feel his soft laugh shake his torso. You can sense his heart beating quickly as his strong arms wrap around your back. And for a moment, you smile because he cannot see you. You start to twist that simple band on your finger—the 'placeholder' from months ago, seemed more like an engagement ring in all but its name, grinning—he's halfway to husband already. Because apparently this man cannot function in a non-monogamous relationship.

"Can I call you hubby?"

There's a pause.

A long pause.

Nanami exhales slowly, like he's recalculating the stock market in his head.

Then—without making eye contact—

"...If it makes you happy." he mutters, a sigh slipping out like he's surrendering his soul. His ears flush pink, barely noticeable, and you swear his lips twitch again, caught between a grimace and a grin.

Oh.

OH.

He's embarrassed.

You can practically see the faint pink dusting his ears.

You grin. "Okay, hubby."

Nanami clears his throat. Adjusts his glasses.

Then immediately leaves the room.

"Wait come back," you run after him.

He doesn't move.

Doesn't speak.

Just leans against the doorframe, eyes slowly trailing over you.

Like he's reassessing his entire life.

And then, finally—after what feels like an eternity—

He exhales.

A soft, almost helpless smile tugs at his lips.

Then, before you can say anything else, he's closing the distance, pressing a slow, deliberate kiss to your lips. When his fingers slide into your hair and gently grasp the strands, he sighs happily into your mouth.

And when he pulls back his lips graze your cheek and he finally says "call me whatever you like," and it makes your toes curl in your socks because there is no better feeling than realizing the most stoic man you know will be tamed by the one he loves.

"And I suppose we can get that ring upgraded at some point," he murmurs, voice low and warm.

"Really," You barely manage to blink at him before he tilts your chin up, brushing a slow kiss against your jaw.

"Whenever you're ready, darling." the happiness is apparent in his voice, making your eyes water at just his words.

CONGRATULATIONS LADIES. NANAMI HAS JUST PROPOSED WITHOUT ACTUALLY PROPOSING.

AND HE THINKS HE'S BEING SMOOTH.

HE THINKS THIS IS JUST A CONVERSATION.

BUT WE ALL KNOW HE'S ALREADY PICKED OUT THE DAMN RING.

SIR, JUST ADMIT YOU'RE MADLY IN LOVE.

YOU'RE MARRIED IN EVERYTHING BUT NAME.

-

In case you missed Part 3, Part 4 & Part 5

All rights reserved © 2025 KawaiiBlossoms. Do not copy, translate, or modify my works on any platform.

Next on Dating Nanami Kento: Do we get a wedding with Nanami adjusting his tie too perfectly and a honeymoon where he still packs a briefcase? Or straight to a married-life day with him handing you coffee at 6 a.m. sharp? Maybe both—I’m not sure yet, so stay tuned!

#fanfic#jujutsu kaisen#nanami kento#fluff#jjk men#x reader#domestic fluff#this is canon to me#sukuna#gojo satoru#megumi fushiguro#yuji itadori#toji x reader#getou suguru x reader#jjk smut#nanami x reader#nanami x y/n

36 notes

·

View notes

Text

No one could have seen this coming. Absolutely no one — unless, of course, they had a pulse, a calendar, or a vague understanding of international trade. But for the 74 million Americans who dragged themselves to the polls in 2024 to rehire Donald Trump as President, this was exactly what you ordered — delivered fresh, hot, and right to your crumbling 401(k).

The Dow just plunged 890 points, like a bungee jumper who forgot the cord. The S&P 500, which had already been bleeding for two weeks straight, has now fallen 7.45% since late February — tumbling from 6,147.43 to 5,614.36 like someone chucked their retirement fund off a third-story balcony. The Nasdaq? It's been in a full-blown correction for days now, down over 10% from its recent peak — the kind of nosedive that makes Silicon Valley cry into their kombucha.

And Tesla? Oh, poor Elon Musk. Tesla’s stock got hammered like a frat boy on spring break, collapsing 15% in a single day — its worst performance since September 2020. Musk’s fans thought his bromance with Trump would unlock some economic cheat code — but instead, their electric dreams are getting dragged to hell like a toaster in a bathtub.

But no one could have predicted this, right?

Except... literally everyone who saw Trump’s economic chaos coming from space. Wall Street didn’t get “caught off guard” — they just assumed they could outrun the blast radius. The smart money bet they could milk Trump’s instability long enough to cash out before the market imploded. They thought tariffs were just noise — a showy distraction to keep Trump’s voter base entertained while they quietly skimmed profits off the top.

But now the roulette wheel has stopped spinning, and all those bets are coming due. Trump’s trade war is finally hammering the economy like a sledgehammer in a china shop. Tariffs on China? Up to 20%. Mexico and Canada? They’re on the chopping block next. The Atlanta Fed’s GDP tracker says the economy might already be shrinking, but Trump’s White House is still playing dress-up, calling this mess a “transition.”

Kevin Hassett — still staggering around in public pretending to be an economist — insists everything will calm down by April, as if the stock market works on the same timeline as your dentist appointments. Meanwhile, Trump’s Treasury Secretary Scott Bessent insists this is just a “detox,” like the economy is some booze-soaked college dropout who needs to sweat it out in a basement.

But don’t worry, Trump’s Commerce Secretary Howard Lutnick swears there’s “no recession coming.” That’s adorable — like a man shouting “This ship is unsinkable!” as the water reaches his chin.

Even Trump couldn’t resist throwing out his signature nonsense. “We’re bringing wealth back to America,” he assured Fox News viewers — a statement that probably sounded comforting right up until the moment they checked their portfolios and realized their “wealth” is now buried somewhere next to Jimmy Hoffa.

Meanwhile, Bitcoin is crashing faster than a drunk cyclist — down from $106,000 to $80,000 in just weeks. Turns out even imaginary money isn’t safe when Trump starts swinging his tariff hammer.

But no one could have predicted this. Nope. Not the voters in MAGA hats who believed Trump’s economic “genius” was going to fix America with import taxes and cheap slogans. Not the Wall Street gamblers who thought they could skate through the chaos. Not the investors who thought Elon Musk’s proximity to Trump would protect them.

They all knew. They just thought someone else would take the hit. Now they're sitting in front of their financial wreckage, stunned — like kids who set off fireworks indoors and can’t believe the couch is on fire.

So here’s to the voters who believed in Trump’s master plan — the ones who swore tariffs would turn America into an economic powerhouse and thought a man with six bankruptcies and a golden toilet was some kind of financial wizard. You cheered while Trump slapped tariffs on everything that moved, convinced this chaos was just part of his “genius strategy.” Now you’re staring at your portfolio like a blackjack player who hit on 19 and can’t believe they lost. You wanted this, you begged for this, you voted for this.

And if you’re one of those Wall Street analysts pretending this economic collapse came out of nowhere? Please — you knew. The only people truly shocked by this are the ones who never had a functioning frontal lobe to begin with.

(Fear and Loathing : Closer to the Edge)

#Fear and Loathing#Fear and Loathing: Closer to the Edge#economic news#crash#stock market#S&P#stock market crash

13 notes

·

View notes

Text

Author: Collective Action Topics: austerity, australia, health care

The Abbott government is busy laying the groundwork for a massive attack on the conditions of the working class in April’s federal budget. In charge of preparing the ground is Abbott’s hand-picked Commission of Audit. In the line of fire: Medicare and your right to access a GP. The plan: Rob $750 million from Australia’s poorest whilst giving $5.9 billion dollars to private health insurers.

The Commission of Audit

The Commission of Audit is an assortment of business lobbyists and Liberal party mates. The Commission is headed by Tony Sheppard, president of the Business Council of Australia (BCA) and (until October) chairman of Transfield services. As head of the BCA he argues for lower taxes, abolition of the fair work act, and various attacks on the social wage. As chairman of Transfield Services, he profited from mining, coal, and up to $180 million in government contracts for the operation of refugee prisons in Nauru.

Commission member Peter Boxall is a former Chief of Staff to Peter Costello, who spent time working for the IMF during the “structural adjustments” of the 1980s, and played a key role in implementing John Howard’s “Work Choices”.

Amanda Vanstone joins this disreputable bunch bringing her experience as a Howard government minister responsible for attacks on the unemployed, students, and pensioners, the abolition of the Aboriginal and Torres Strait Islander Commission (ending any semblance of self-determination, as flawed as that body was) and of course, the imprisonment of many thousands of refugees.

What’s in a co-payment?

The first shot across the bow aimed in the new attack on Medicare was fired by former Abbott advisor Terry Barnes of the Australian Council of Health Research (ACHR). The ACHR is a “think tank” funded by Australian Unity, a health insurer with a lot to gain from any attack on Medicare. Barnes published a paper to coincide with the election of the Abbott government which called for the private health insurers dream – compulsory upfront fees for Australians utilising Medicare.

Barnes wants a six dollar Medicare “co-payment”. His argument is that poor Australians go to the GP too often, and that an additional six dollar upfront fee would send a “price signal” that would harmlessly discourage over use of GPs. Barnes claims that his proposal would save the Medicare budget $750 million over four years.

But a six dollar GP tax is not the only health co-payment that Australians are already slugged with. Australians already pay “out of pocket” for a raft of health care services. There is no dental care coverage under Medicare leaving most Australians unable to see a dentist unless they can pay upfront. There a significant “gaps” between the cost of services and what is covered by Medicare, and access to medical specialists routinely involves significant upfront expense for Australians on Medicare.

The effect of all of this is frightening. Co-payments fund 17% of health care in Australia. One in six dollars of health care expenditure in Australia is not covered by any insurance, public or private, and is instead forked out directly by those who can afford it least. In the United States, so often denounced for its backward and regressive healthcare system, co-payments only account for 13% of health expenditure.

And the Liberal government is gearing up to whack another six dollar charge on top of this. Far from sending a harmless “price signal”, a six dollar co-payment is a brutal measure that would reduce access to GPs by those who need them most, and already use them least.

Under Utilisation

The idea that Australia’s poorest over use GP services is both obnoxious and untrue. Terry Barnes is on the record as saying that a six dollar upfront payment would not stop anyone who is truly sick from attending a GP, as this only represents the price of “two cups of coffee”. Anyone who thinks six dollars is nothing has never attempted to live on the minimum wage, let alone the dole, family payments or a pension, in Australia.

Australian workers already make choices between rent, food and health care on a weekly basis. Cost already dissuades Australia’s poorest from accessing medical services when they need it.

Current research on working class Australian’s use of health care already shows that “poorer people are already under-utilising healthcare, and their rate of under-utilisation corresponds to their level of illness”. Mapping health care use against average income in Australia already shows that people living in Australia’s poorest neighbourhoods are “three times more likely to delay medical consultations than those living in the wealthiest suburbs”.

The highest use of GP services in Australia, and the highest concentrations of GPs, are not where people are poorest, or where people are sickest (which coincidentally is where people are poorest), but rather where people are wealthiest. The richest use GP services the most, there are more GPs in wealthier suburbs, and Australia’s wealthiest are less likely to fall ill and die young.

Being poor and working class, attempting to live on a shitty wage or poverty level pension, is a major health hazard in Australia. The wealthiest 20% of Australians live an average six years longer than those of us surviving in the ranks of the poorest 20%.

Health Cash for big business

We’re told that Medicare costs too much. A six dollar copayment, effectively a tax levied disproportionately on Australia’s poorest and sickest, might save the health budget $750 million over four years. But there is one area of health spending bloat that the Abbott government will never touch. This year alone the government will spend $5.4 billion subsidising private health insurance.

The private health insurance rebate is an enormous transfer of wealth from tax payers to private, profit oriented health insurers, such as the one funding Terry Barnes’ sick attack on what remains of universal healthcare in Australia.

The private health insurance rebate was meant to make private health insurance more affordable by keeping premiums low. Introduced in 1999, this massive payment to health insurers has occurred at the same time that average health insurance premiums have risen 130%. Average prices (inflation) in the same period have only risen 50%.

The justification for this massive rort was that subsidising private health insurance would save money in the long run by reducing costs to Medicare. The most recent analysis shows that this $5.4 billion subsidy does little to shift costs from Medicare, and its abolition would save the government at least $3 billion a year.

Conclusions

The class self-interest of the government’s health policy is blatant: Tax the poor, throw money at the rich. The so-called Commission of Audit is stacked with the same big business cronies and Liberal mates who have always attacked the conditions of working class Australians, and now they are coming for what remains of Australia’s public health system. If the health budget is unsustainable, and the poorest really do have to be slugged with an additional six dollar GP tax, it is only because the government continues to throw bucket loads of money at private health insurers. The truth is that private health insurers want Medicare dismantled, so that more Australians are forced into their health insurance rackets, paying ever greater premiums for a diminishing health service.

#healthcare#medicare#health care#medicine#science#australian politics#anarchism#anarchy#anarchist society#practical anarchy#practical anarchism#resistance#autonomy#revolution#communism#anti capitalist#anti capitalism#late stage capitalism#daily posts#libraries#leftism#social issues#anarchy works#anarchist library#survival#freedom#austerity

7 notes

·

View notes

Text

To be eligible for the program, a person must have a household income below $90,000 and no access to an existing private insurance plan. The person must also have filed a tax return so the government can verify income. The plan is most generous for families that have household incomes below $70,000. They face no co-pays to a participating dentist, hygienist or denturist, and Ottawa will pick up the tab for covered services like cleaning, polishing, examinations, X-rays, fillings, root canal treatments and complete and partial removable dentures.

huh that's actually significantly better than I was expecting ngl.

52 notes

·

View notes

Note

ok this is gonna be kinda. weirdly specific. but i really really like flags and i was wondering about like the meanings/representation of brazil’s state flags? (OBVIOUSLY NOT ALL OF THEM LMAO YOU GUYS HAVE DOUBLE WHAT CANADA DOES AND I DON’T WANNA ACCIDENTALLY MAKE YOU FEEL LIKE YOU GOTTA TALK ABOUT ALL OF THEM)

Of course, I'll share some of my favorites, and obviously the meaning behind some of them (colors or just history)

The flag of Minas Gerais, the text says "LIBERTAS QUÆ SERA TAMEN" which translates to "freedom, even if late". The history behind the flag is related to Confidência Mineira, an important event to brazilian history and specially to the state of Minas. Basically, during the colonial period of Brazil, the elite of Minas Gerais wasn't happy with Portugal and their domain over the, at the time, colony. So a lot of people started gathering to rebel against Portugal, their plan was to break free fom their colonizers and turn the state of Minas Gerais into an independent country. But the movement was betrayed by one of their members, who told the Portuguese Cort about them so he could repay his debts, and everyone was sent to prison. All of the members were supposed to be sentenced to death, but in the end only one of them was executed. His name was Joaquim José da Silva Xavier, popularly called as "Tiradentes" because he was a dentist. Tiradentes was executed and later had his body completely dismembered and exposed in Vila Rica (the city is called Ouro Preto now) completely intimidating the entire population so that no one could ever think of trying something like that again

Till this day, Tiradentes is still considered an heroic figure to Brazil, and the day of his death (April 21) is a national holiday. That's the context behind the flag, sorry if my explanation is bad

The flag of Pernambuco also has a history similar to the one of Minas Gerais, because it was also inspired by a revolution

This was the flag of Revolução Pernambucana!! The revolution was a bit similar to Inconfidência Mineira, but some of the differences were that, the rebels wanted to make Pernambuco an independent country, they were almost successful and actually were in power for some time, and also wanted to make their citizens more free (while at the same time doing nothing about slavery-)

The context behind the revolution was that, after Portugal expelled the Dutch from the northeast, the region went into a crisis because sugar wasn't being selled as much, and Pernambuco tried to make up for it by selling cotton instead of sugar, but it went wrong since the Cort started taxing them and it made Pernambucanos mad

Rio Grande do Norte doesn't have a specific history behind the flag, unlike the others I have mentioned- but I like the flag so here's the meaning of the colors!!! White represents peace. Yellow represents our mines, since our state had an important mine in Currais Novos. Green represents our forests.

Maranhão is another one that doesn't have a specific history behind it, but I like the meaning behind the colors!! The colors red, black, and white represent the natives, black and white people, who together make up the population of Maranhão, since Brazil is a country born from miscegenation. Blue represents the sky, and the star represents... The same constellation that represents Maranhão in the flag of Brazil.

Last one for now, the flag of Ceará!! By using parts of the Brazil flag, it represents how the state of Ceará is a part of the country, while representing the state right at the center, some of the elements worth pointing out are the Farol do Mucuripe and the representation of Caatinga, the biome found in the Northeast (it looks a bit like a desert)

#morangoowada asks#sorry if I am really bad at explaining stuff-#I noticed that aside from Minas Gerais all the other states are in the northeast KHEORKDK#I love the northeast chat.....

6 notes

·

View notes

Text

I feel all over the place and not in a good way

My pony wasn’t feeling very well yesterday so I’m worried about her and worried if I did the right things for things for her and just all of it

Me and the bf had a fight Sunday and we mostly made up but I’m still so unsure of everything and want to just not sometimes

There’s so many frisbee things and I’m trying to prioritize my whole and I don’t know if I’m doing it right

My kitchen is still a mess from last weekend and if that isn’t just a summation

I supposed to do a girls day with two friends tomorrow but one of them canceled cuz her grandma is sick, but now I see that her and the other girl are skiing together with their bfs today and like I’m feeling some kind of way about it. Especially because we made these plans literally over a month ago. And idk it just hurts my feelings that she would prioritize hanging with the other girl who she skiis with all the time, and not see me ever, and also the mountains are like two hour drive verses being in town and (presumably) closer to her family stuff.

My riding also said she thinks that I correct her a lot and hurt her feelings sometimes so she thought I was ironic that I was upset that my bf does that to me. And like I had no idea that she felt that way. And I’m having a hard time thinking of times when I’ve corrected her. I’ve asked for clarification on things, and we give each other feedback on riding sometimes, but not usually unprompted. So I guess that’s a thing I need to figure out and am feeling bad about.

Idk it just feels like everything is a little bit wrong. Too many negative feelings and stress and not enough solutions.

I also still need to do my taxes, make a dentist appointment, make a doctors appointment, want to make a hair appointment, want to hire a gardener, (but I reached out to the person who did my hair last time, and the gardener who previously did weeding for me who I wanted to work with again and neither got back to me so it’s not even my fault that I’m behind there but it is my problem.

And my kitchen is a mess. And I’m behind on my strength workouts but I’m so tired and need a nap for like a week.

7 notes

·

View notes

Text

When I was a kid, I genuinely thought sex was made up for TV, much like many other things that I heard much about, but never experienced. Caffeine jitters, for one, or clear vision, or coyotes laying traps for very fast birds. Of course I knew people had sex. I was twelve after all, and had already read too many Nicholas Sparks books, listened to too many Britney Spears songs, and I knew babies didn't really come from the mystical Island Where the Wild Babies Are, as my mother had told me. But I didn't think anyone enjoyed it.

To me, sex was one of those things that grown ups did, like paying taxes, or doing the laundry, or going to work, that they didn't really want to. Still, everyone agreed it was necessary to be done. People like babies, and how else were you supposed to have babies?

I felt similarly about romance. Not exactly the same, but I didn't think of married couples as being in love. Yes, my parents loved each other, but that meant nothing. One set of grandparents seemed to do nothing but bicker, the other set was divorced. Many of my aunts and uncles had likewise been divorced or separated at some point. I was considered a precocious child (read: quiet, smart, and most of all, obedient), so I was allowed to sit with the grown women, who would discuss their husbands amongst themselves. "He's helpless without me," one said. Another complained that her husband was a "huge baby." Grandma had to go home early when we went out, because she had to make dinner for Pap, or Mom was calling to make Dad and our dentist appointments. Sometimes I heard conversations that I wasn't meant to, by adults who forgot I was listening. They "faked" it, because sometimes they were "just tired, you know, and wanted him to get off" of them.

In my mind, this solidified into a conclusion that baffled my mother: no one was attracted to men, nor did you marry an man because you loved him -- that was merely a pleasant side effect sometimes. You did it because men couldn't survive on their own, and because, well, marriage is just what adults do. Reading period novels, such as "Little Women," did little to shake my convictions.

So there I was, thirteen, and not quite sure why I was being warned off sex or boys. Why would I want either of those? I thought. When people did express wanting those things, as my friends were beginning to, I smiled and nodded, certain that this was all a game we were in on together. It's what adults do, what movies and books and TV shows do. I got annoyed with love triangles, wondering why anyone would reasonably choose the "hot" guy who was kind of mean to them over their childhood best friend -- surely, surely safety and stability were the way to go. What else was there?

I wasn't really bothered by the idea of marrying a man or having kids. It was just the way the world was. Even after I learned that it was possible for people of the same gender to fall in love, I didn't quite put the dots together that I had played softball for five years, despite not having an athletic bone in my body, to spend more time with the girl I met at the creek. Or how, at eight years old, I was enchanted by the way Margaret Avery serenaded Whoopi Goldberg (and felt oddly vindicated to learn at fifteen that they were, in fact, in love).

The day I learned what sex was, really, in health class. Initially, I didn't believe it. It sounded fake. That wasn't what sex was. It didn't actually know anything... but whatever they showed us, that made me cringe away in horror, that couldn't be it. But it was, and I hated it, and I went up and cried in my room, and started to think of an escape plan. How was I going to get out of this? It never occurred to me that I could say no. That there was no real obligation, even if I was married. I wondered if I could simply marry a very old man. Then we could be companions. We would walk in the park, and feed the birds, and read books together. I read Reddit posts about men complaining their wives faked headaches to avoid sex, and I felt hope -- excited that might work.

Eventually, I realized that, romantically at least, I was attracted to girls. I started to come to terms with this, but then I watched a BuzzFeed YouTube video -- something like "The 9 Girlfriends You'll Have," which indicated that the girlfriend not willing to engage in sexual acts was not really a lesbian. I decided that I must be wrong about my feelings -- they were only feelings of deep friendship. Nothing more. But I still didn't like boys. I picked one every few years, called him my crush, and became unfathomably angry when my best friend tried to set us up -- didn't they understand that I didn't want that -- that my protests were not shyness, but genuine disinterest? When my friend dated boys who were cruel to them, I was baffled. What strange alchemy was being worked on my friends, who otherwise would not have put up with such treatment with a smile?

I was aware at that point, at fourteen, that I was different. Not in a special, or holier-than-thou way, but in an isolating, looking-through-a-window kind of way. I asked questions, and the answers made no sense. I had no desire for sex, and I wondered if maybe I was just late to the party.

Finding AVEN in 2013 from a Tumblr post was literally life-changing. I read a foreign post that compared being ace to being on a planet where people were really into licking eyebrows. It rang true to me -- sex was just as baffling to me. The Split-Attraction Model likewise felt true -- I did like girls, but I also did not care for sex. There were other issues, things I still haven't figured out. When do I tell someone that I'm ace in a relationship? Do I have to allow for an open relationship? Is it fair to expect sole commitment from someone, even if I'm not personally interested in polyamory? I wondered for a while if I was a bad person because of that.

I decided, at fourteen, that it was a great idea to show this forum to my mother. I presented it to her as something I had learned about, with the intention of explaining it to her... immediately before making the disclosure. She was confused and baffled by the sexuality, and not exactly processing it. I was a little concerned by this, but I took the dive anyway and told her about me and where I felt I fell. I have never forgotten the way she immediately denied that. She told me it was normal for me to not be interested in sex -- something I knew by now was not entirely true -- and that she didn't want me to "close off my options." My feelings were hurt. Very much.

I found out I was asexual around the time Tumblr began to contain vitriol against asexual people. I wouldn't come out as homoromantic for another five years. For a long time, I kept very quiet about being a lesbian asexual. Eventually, I started labelling myself queer, so as not to have to disclose that much information about myself. I have typed out parts of this same story and deleted them over the years. I didn't want to get into an argument about it.

I have never understood the "aces are not queer" argument. Because I feel that my journey and experiences of learning about both parts of my identity mirror each other, and the stories of other queer people. This would have been true, even if I had not also been a lesbian.

If it walks like a duck and talks like a duck.

2 notes

·

View notes

Text

Tax Reduction Planning

Choosing the right accounting service is a crucial decision for any business. By seeking the Custom Accounting CPA, you can ensure getting tax reduction planning in the time-efficient aspects.

0 notes

Text

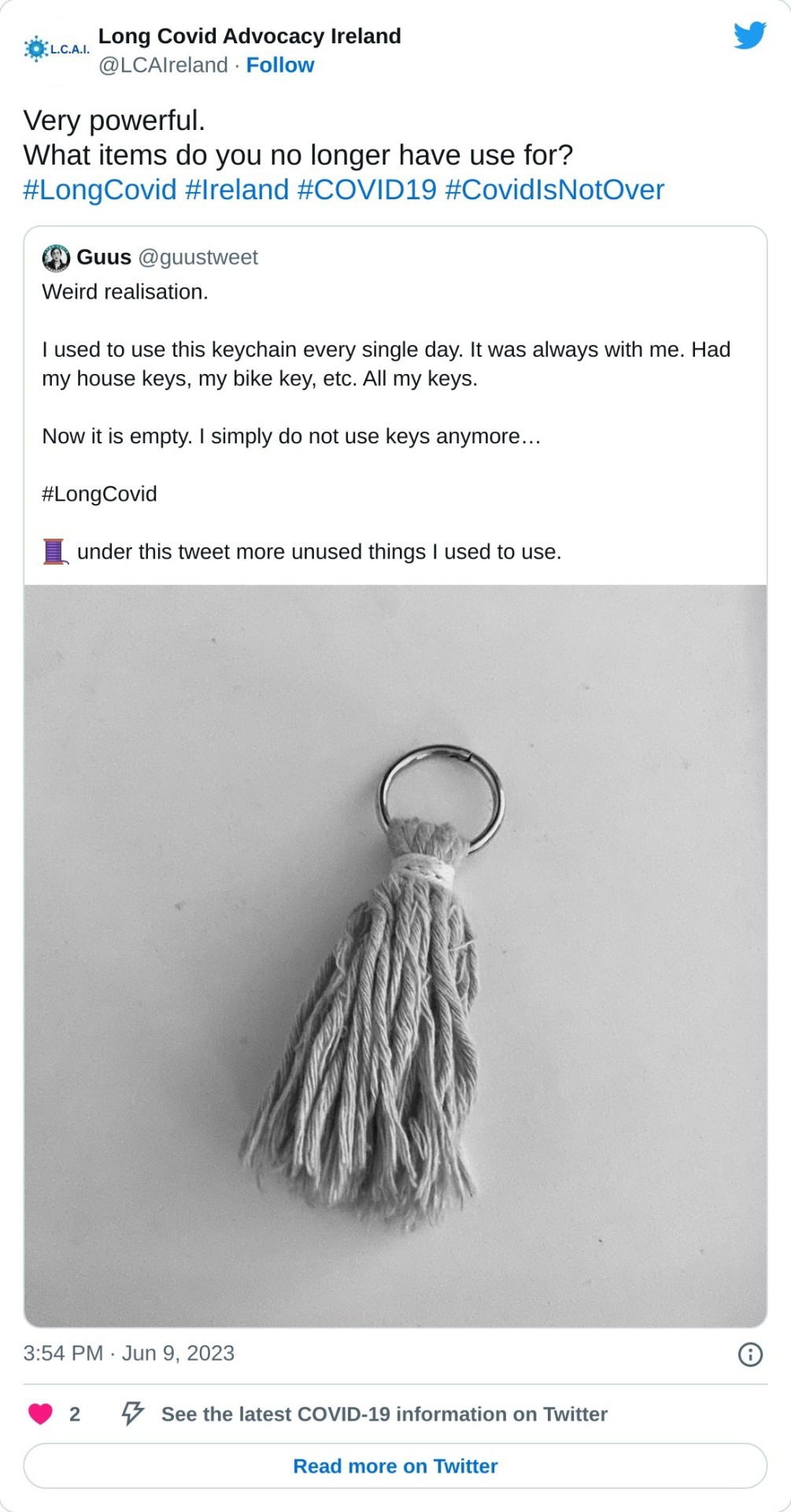

I'd love people to write in in response to this post. I'll share my own story to get things started.

Before the pandemic started I had just started to get on the right track after an apartment fire 3 years ago at the time. Everything was thrown off by that and I developed PTSD from the event. My health and mental health conditions were well managed, including my agoraphobia and I was in good health.

Even as I sheltered in place for approximately 3 years and only did essential activities and went to essential places I still contracted covid. Sadly my carer brought it into my home and I've suffered with long covid immediately subsequent to my acute infection ever since (August 28th 2022).

It's turned my life upside down. I had planned on starting to ride my bike and now it sits in my apartment untouched. I struggle to walk, sit and balance especially for prolonged periods, at the ripe age of 31. An issue I didn't have before remotely.

And yet doctors keep mentioning anxiety, that it's not conclusive despite not studying up to date literature and published research on covid and long covid. I have no purpose for my shoes much either because travel is taxing on my body. In fact I've been at my mom's house for almost a month because I'm not well enough to return home.

Even paid my rent and electric digitally. My patio remains unoccupied, partly because I don't want harassment about wearing a mask outdoors but also would rather not see my neighbors. One of which harassed me and my carer after coming back from a very stressful dentist appointment with appalling covid safety and not having slept that day.

My computer collecting dust, partly due to the winter storm a couple months or so ago that knocked out my power and messed up the boot sequence, but also not being able to sit at and use it without swaying, heart palpations, feeling faint, and for long periods.

My kitchen sink, cooking utensils and ware goes unused most of the time because my new illness has largely robbed me of the energy and focus to prepare and cook meals. And my apartment tends to occupy me or my one support staff because of my fear of a repeat incident of someone bringing disease into my house. A disease that if I catch again well may kill me, or, faster.

My shower usually is dry as a bone, baths and showers leave me flaring and wiped for days. My hair products sit frequently untouched as I'm too exhausted to brush, braid, cover and moisturize my hair. As do my free weights and elastic PT bands. Ever since I got sick I lack stamina, experience shortness of breath (I had asthma but it was well controlled), my heart rate spikes and I can't exercise in any way that would hit targets or be beneficial.

And still my doctor recommends physical therapy despite telling her all this. And worst of all won't give me a long covid diagnosis. She kicked me to specialist.

Specialist who are already booked out, and whose schedules and patient lists keep lengthening because of the sharp and continued rise in long covid. Knowing it could take months for me to get a diagnosis this route and even longer to get new disability aids I need if I even get documents and approvals at all.

That I can't possibly afford because I'm dirt poor. To add pain to injury, I was disabled before this. And I understood the seriousness of covid and long covid. And took every precaution. But in a society that's a threat to life and safety, I was only as safe as everyone else was and is.

Which means I wasn't and still am not. Not only do I have whatever implications and damage short and long term from my first bout of illness, I constantly have the threat of reinfections and death everyday.

And finally, I have no use for many of the chairs in my home as my brain, neck and spine struggle to keep me upright. My body is in some ways new to me and after 3 plus decades in it, I have to learn it all over again.

And am confronted with no longer being able to do what I once did (possibly ever again) with great sadness nor test limits without high risk and unpredictable results. And it is a terrible, deeply off putting, arrogant and cruel insult to hear people write off or outright deny long covid exists and call long covid a cold. It fucking isn't.

Anyway that's my story.

#Long Covid#Covid sequela#Sequela#Long Covid Advocacy Ireland#Guus#guustweet#Stories of the pandemic#Millions Missing#Illness#Chronic illness#Complex Health Conditions#Disability#Disabled#The pandemic#Public Health

17 notes

·

View notes

Text

// Hope everyone is doing wonderful today. <3 I won a 6 month premium subscription plan to sportsnet+ from Tim.Horton's Roll up the rim to win! The annual premium billing price is $249 (probably before taxes) So I gave it to my dad since I don't watch sports. <3 He was very very happy. Poor man has been in and out of emerg the last couple weeks for a horrible toothache and getting iv antibiotics. Tooth has been bugging him since early last summer, went to the dentist a month ago, they did a root canal and he ended up getting a nasty infection. Now he has to wait until next month for them to do the next step in the root canal. But I owed him money from a yeti cup he bought for me at the time last summer, so we did a trade :P sports package for yeti cup. Plus, he's such a nice man. I love my dad so much. He's a first responder with the fire department and he would give his shirt off his back for anyone. Turned into a dad appreciation post. but nonetheless! I had good luck today!

4 notes

·

View notes

Note

Okay, what's the 'clone idea'??

Just to clarify up front: This idea has nothing to do with Star Wars ^^' I actually got it from a super-cool dream a few years ago! In the dream, it was about me and my youngest sister (but not my other siblings for some reason?), but obviously I'll be altering them to make distinct characters that aren't just...clones *ba dum bum tsh!*

This unnamed idea for a novel is set in the not-too-distant future, when cloning of human beings has been perfected. It only works with fresh DNA, and it takes about five years for the whole process to be completed. Due to this and ethical concerns, there are laws and other safeguards in place so you're only allowed to clone someone who has just died (DNA can be collected prior to death, but the cloning process itself can't be signed off on until the person is declared dead). You're also only allowed to clone someone's particular DNA once. The clone will then take over the deceased person's legal identity, in terms of social security, taxes, etc. (there's probably more complicated caveats and whatnot, but this story isn't really supposed to explore all of that). Naturally, there's a whole debate about whether these clones are actually people or not. Do they have souls? Are they the same person as the one who died? Are they a freakish abomination and the scientists who developed the process are treading in God's domain? Should they be outlawed? Are they an unnecessary drain on the economy? It's very expensive to have a clone made, as you can probably imagine, but not outside the reach of someone who's reasonably wealthy. So like...you don't have to be a millionaire in order to pay for it, but you've gotta really want it.

The story is about a family that has two teenage daughters. I think I've decided the dad is a dentist, and the mom has a some kind of career as well, or maybe volunteer work or something. The sisters are three years apart in age. They aren't best friends exactly, but they get along pretty well and genuinely love each other. The older sister is about to go off to college when the younger sister dies suddenly and tragically in some kind of accident. The whole family is thrown into shock and grief, but the mother especially is not handling it well. She can't take the thought of her baby girl suddenly being taken away from her, so she insists that they clone her. The dad is reluctant at first, but the mom says that if she has to go on for the rest of her life without her daughter, she's going to kill herself to join her. So they pull out all of their life savings and order a clone of the younger sister.

In the five years it takes to develop the clone, the family processes their grief and the mom gradually begins to think she made a mistake. She realizes she was mostly just angry at God for taking her daughter from her, and making a clone was like shaking her fist at the heavens. The cloning agency allows those who have ordered a clone to cancel their order - payments are made in installments, so besides a cancellation fee, they don't have to pay the full amount; they just won't get a refund for what they've already paid if they back out partway through the process. But even after the mom realizes it was a mistake to try to clone her daughter, she doesn't want to cancel the order either.

She says, "I realize now that it was a mistake to want to clone her. I was angry at God, and didn't want to accept it when he took her away from us. But I believe that God can take my mistakes and my lack of trust, and make something good out of it. His plans are bigger than mine. And that clone in there? That's a little girl who deserves a chance to live. I may not have given birth to her…but she's my daughter. And she needs her mommy."

So they go through with it. The mom has to quit the job she loves and get one that will pay better, and the older sister has to give up on her college plans and go straight into the work force while still living at home, so they can continue to pay the cloning agency. And finally, the day comes when they can bring the little clone home. The standard/cheapest option is to grow a five-year-old clone (for some reason that's easier than a baby or an adult, just run with it), which is what they'd decided on - to get a second chance at childhood, as well as to make it as affordable as possible.

There's an option for training/programming (not sure exactly how it works yet), using video footage and other information provided by the family, to make it so that when the clone first leaves the facility and comes home, they'll have an approximation of the original person's personality and mannerisms, which can then be fine-tuned with the family and various psychologists/trainers over the next year or so. But this family opted not to do that - partly because that would be another expense, partly because the parents have agreed that, no matter what scientists or whoever else say, this little girl is her own person. She might look like their original daughter, she might have identical DNA to her, but it's not the same person. They want to raise this little girl as their own daughter, but they want as much as possible to let her decide for herself what kind of person she's going to become.

The result of all this is that, when she first comes home, this little girl is kind of robotic. She can talk and understand what people are saying on about the same level as any five-year-old, but a lot of the nuances are lost on her because she's only observed the world for like a week at that point. So she understands the concept of food and eating, but she might look at an apple and not understand that it's food.

I just think this would be a really fascinating concept to explore. There's a really compelling pro-life side to the whole thing, as well as the age-old debates of nature vs. nurture and what makes us human. Beyond that, it would be so fascinating to explore what the sisters' relationship would be like. I think there's definitely going to be some resentment and other growing pains on the older sister's part, because here's this girl who looks like her little sister but is definitely not, and they've all had to upend their lives in order to bring her into the world. But then there are moments where little bits of the sister she remembers will peek out - the way the clone smiles, the sound of her voice when she sings, the kinds of food she really likes. I want to put a lot of me, as a big sister, into this story.

WIP ask game

#ask and you shall receive#a2on1break#ask games#wip games#clones#pro life#oh yeah i think i decided the little sister's name was rose#either that or it was her middle name and so they decide to call the clone rose#yet again you can see the trope that is common across so many of my stories:#someone (usually a small pathetic child) getting to learn what love is all about ^_^#it's one of my favorites and this would be such a lovely and quiet story to explore that in#there would be SO MUCH FLUFF AND ANGST OH MY GOSH

6 notes

·

View notes

Note

I've moved across country (twice if we count me moving out there and then me coming back home. I left for school for a couple years).

I'm not sure what exactly the Knife Anon needs help with (budgeting, finding the right state/place, deciding on the best mode to get across). If they're comfortable they can DM me!

Easiest thing to do is pick when they want to move and then work backwards on a timeline and budget. Definitely research where you're thinking of for average cost of rent, groceries, and generally health stuff can help you figure out how much to budget on average and then save over that. (I'm personally moving [yes, fucking again] and am saving to save 3 months worth of expenses. But I'm planning to stay within state because my job is remote and I can move with it significantly easier in state. If you can't transfer your job I'd say try and save for ~6 months expenses. This is a honestly probably a low ball answer but we gotta surive in the now and in the future somehow)

State taxes are a bitch--it can be something so little, but very sneaky. Moved from one state where state tax was 6% to a state with damn near 10% and had a HEART attack at how expensive it was.

Apartment application fees are GOING to SUCK. I'd personally only apply to a place that you actually WANT to live. Visit virtually if you can with a tour. Google reviews are wonderful. Obviously, seeing the place is person is the best, but we do what we gotta do. Some places may run a credit check once you apply. That credit check may ding your score. I'm not an credit score expert by no means, but apartments may ask for either a payment stub so they can see how much you make. Most places want you to make 3x the rent. If you get a roommate or a guarantor, that can help you land the place. Guarantors get added as someone who becomes responsible for the cost of the rent if you can't pay. My dad was my guarantor when I left for school, and it freaked me out for a second the first time the place told me I'd have to add him because I didn't make enough. (I NEEDED a place like ASAP so my move was very rushed).

Deciding what you /need/ to bring with you and what is more feasible to get once you move is super important. Dollar stores and thrift stores can be a great place to get necessities once you've moved (utensils, detergent, dining ware) until you get fully settled and then you can go balls to the walls in Target.

How you move will also factor into your budget. Flying vs packing up a van, truck, U-Haul (whatever tickles your fancy and doesn't make your wallet choke).

Using google maps and putting in the general area they're interested in plus things like "grocery store" "pharmacy" "dentist" "doctor" etc can show you how far away things are from each other and get you familiar with the place.

There's a lot....in this message and a lot more I could say. But I think right now it might be better to work backwards. When do you want to be gone and then work on location and cost after you decide that.

-H (and to admin: yep, you can yeet this with my @. It's totally a-okay!)

Thank you so much! I’m gonna post this publicly as you’ve given consent but then I’ll make sure to forward it to knife anon privately so they don’t miss it, I don’t want to tag their username here and expose them without their side of the consent to. Thank you so much for the detailed information, you’re wonderful <3

3 notes

·

View notes

Text

Simplify your practice’s financial management with reliable dental accountants who specialize in helping dental professionals achieve success. From tax planning and bookkeeping to budget allocation and financial compliance, these accountants offer tailored solutions to meet the unique needs of dentists.

0 notes