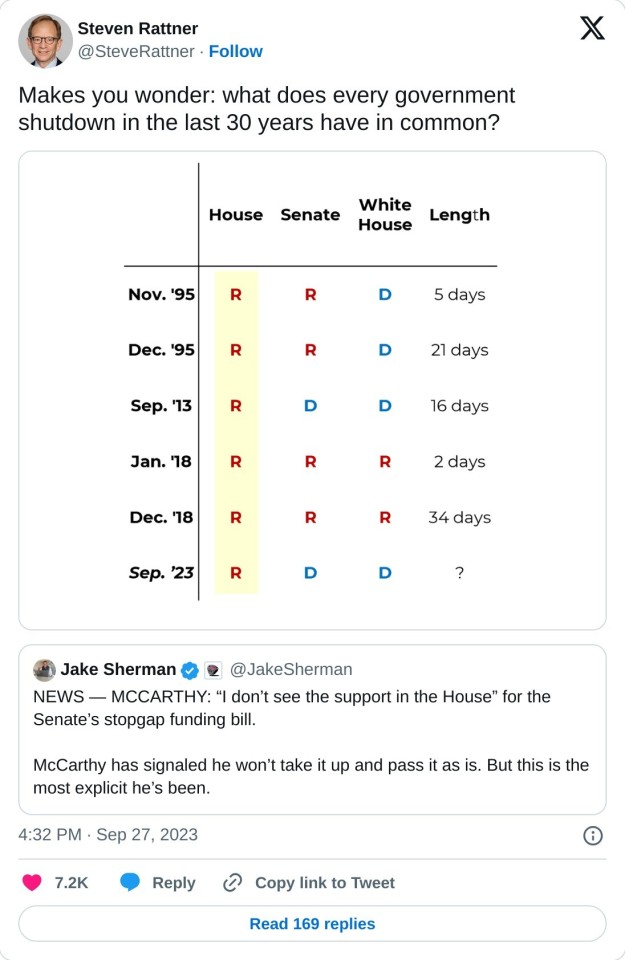

#steven rattner

Explore tagged Tumblr posts

Text

Don't let Trump have his own 'facts'

106 notes

·

View notes

Text

#us politics#republicans#conservatives#twitter#tweet#x#2023#steven rattner#jake sherman#rep. kevin McCarthy#government shutdown#us house of representatives#us senate#stopgap funding bill

236 notes

·

View notes

Text

IT'S THE RACKET ADMINISTRATION. IT'S ALL A FUCKING RACKET WITH THESE GUYS AND VERY FEW REPUBLICANS HAVE ESCAPED THE TAINT OF THIS CORRUPT REPUBLICAN PRESIDENT.

The whole point of MAGA is corruption. Gutting the IRS creates hundreds of billions in corruption for the wealthy.

1K notes

·

View notes

Text

Horsey

* * * *

LETTERS FROM AN AMERICAN

June 7, 2024

HEATHER COX RICHARDSON

JUN 08, 2024

Two big stories today that together reveal a broader landscape.

The first is that the Bureau of Labor Statistics today released another blockbuster jobs report. The country added 272,000 jobs in May, far higher than the 180,000 jobs economists predicted. A widespread range of sectors added new jobs, including health care, government, leisure and hospitality, and professional, scientific, and technical services. Wages are also up. Over the past year, average hourly earnings have grown 4.1%, higher than the rate of inflation, which was 3.4% over the same period.

The unemployment rate ticked up from 3.9% to 4%. This is not a significant change, but it does break the 27-month streak of unemployment below that number.

The second big story is that Justice Clarence Thomas amended a financial filing from 2019, acknowledging that he should have reported two free vacations he accepted from Texas billionaire Harlan Crow. While in the past he said he did not need to disclose such gifts, in today’s filing he claimed he had “inadvertently omitted” the trips on earlier reports. ProPublica broke the story of these and other gifts from Crow, including several more trips than Thomas has so far acknowledged.

Fix The Court, a nonprofit advocacy group that seeks to reform the federal courts, estimates that Thomas has accepted more than $4 million in gifts over the last 20 years. As economic analyst Steven Rattner pointed out, that’s 5.6 times more than the other 16 justices on the court in those years combined.

These two news items illustrate a larger story about the United States in this moment.

The Biden administration has quite deliberately overturned the supply-side economics that came into ascendancy in 1981 when President Ronald Reagan took office and that remained dominant until 2021, when Biden entered the White House. Adherents of that ideology rejected the idea that the government should invest in the “demand side” of the economy—workers and other ordinary Americans—to develop the economy, as it had done since 1933.

Instead, they maintained that the best way to nurture the economy was to support the “supply side”: those at the top. Cutting business regulations and slashing taxes would create prosperity, they said, by concentrating wealth in the hands of individuals who would invest in the economy more efficiently than they could if the government interfered in their choices. That smart investment would dramatically expand the economy, supporters argued, and everyone would do better.

But supply-side economics never produced the results its supporters promised. What it did do was move money out of the hands of ordinary Americans into the hands of the very wealthy. Economists estimate that between 1981 and 2021, more than $50 trillion dollars moved from the bottom 90% of Americans to the top 1%.

In order to keep that system in place, Republicans worked to make it extraordinarily difficult for Congress to pass laws making the government do anything, even when the vast majority of Americans wanted it to. With the rise of Senator Mitch McConnell (R-KY) to the position of Senate majority leader in 2007, they weaponized the filibuster so any measure that went against their policies would need 60 votes in order to get through the Senate, and in 2010 they worked to take over state legislatures so that they could gerrymander state congressional districts so severely that Republicans would hold far more seats than they had earned from voters.

With Congress increasingly neutered, the power to make law shifted to the courts, which Republicans since the Reagan administration had been packing with appointees who adhered to their small-government principles.

Clarence Thomas was a key vote on the Supreme Court. But as ProPublica reported in December 2023, Thomas complained in 2000 to a Republican member of Congress about the low salaries of Supreme Court justices (equivalent to about $300,000 today) and suggested he might resign. The congressman and his friends were desperate to keep Thomas, with his staunchly Republican vote, on the court. In the years after 2000, friends and acquaintances provided Thomas with a steady stream of gifts that supplemented his income, and he stayed in his seat.

But what amounts to bribes has compromised the court. After the news broke that Thomas has now disclosed some of the trips Crow gave him, conservative lawyer George Conway wrote: “It’s long past time for there to be a comprehensive criminal investigation, and congressional investigation, of Justice Thomas and his finances and his taxes. What he has taken, and what he has failed to disclose, is beyond belief, and has been so for quite some time.” A bit less formally, over a chart of the monetary value of the gifts Thomas has accepted, Conway added: “I mean. This. Is. Just. Nuts.”

As the Republican system comes under increasing scrutiny, Biden’s renewal of traditional economic policies is showing those policies to be more successful than the Republicans’ system ever was. If Americans turn against the Republican formula of slashing taxes and deregulating business, those at the top of the economy stand to lose both wealth and control of the nation’s economic system.

Trump has promised more tax cuts and deregulation if he is reelected, although the nonpartisan Congressional Budget Office recently projected that his plan to extend the 2017 tax cuts that are set to expire in 2025 will add more than $3 trillion to the deficit over the next decade. In April, at a meeting with 20 oil executives, Trump promised to cut regulations on the fossil fuel industry in exchange for $1 billion in donations, assuring them that the tax breaks he would give them once he was in office would pay for the donation many times over (indeed, an analysis quoted in The Guardian showed his proposed tax cuts would save them $110 billion). On May 23, he joined fossil fuel executives for a fundraiser in Houston.

In the same weeks, Biden’s policies have emphasized using the government to help ordinary people rather than to move wealth upward.

On May 31 the Internal Revenue Service (IRS) announced that it will make its experimental free electronic filing system permanent. It asked all 50 states and the District of Columbia to sign on to the program and to help taxpayers use it. The program’s pilot this year was wildly successful, with more than 140,000 people filing that way. Private tax preparers, whose industry makes billions of dollars a year, oppose the new system.

The Inflation Reduction Act provided funding for this program and for beefing up the ability of the IRS to audit the wealthiest taxpayers. As Fatima Hussein wrote for the Associated Press, Republicans cut $1.4 billion from these funds last summer and will shift an additional $20 billion from the IRS to other programs over the next two years.

Today the U.S. Department of Health and Human Services issued five new reports showing that thanks in part to the administration's outreach efforts about the Affordable Care Act, the rate of Black Americans without health insurance dropped from 20.9% in 2010 to 10.8% in 2022. The same rate among Latinos dropped from 32.7% to 18%. For Asian Americans, Native Hawaiians, and Pacific Islanders, the rate of uninsured dropped from 16.6% to 6.2%. And for American Indians and Alaska Natives, the rate dropped from 32.4% to 19.9%. More than 45 million people in total are enrolled in coverage under the Affordable Care Act.

President Biden noted the strength of today’s jobs report in a statement, adding: “I will keep fighting to lower costs for families like the ones I grew up with in Scranton.” Republicans “have a different vision,” he said, “one that puts billionaires and special interests first.” He promised: “I will never stop fighting for Scranton—not Park Avenue.”

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Letters from An American#Heather Cox Richardson#unemployment#jobs#Affordable Care Act#health care#working class people#fix the court#income inequality#Ronald Reagan#supply side economics#trickle down economics#Biden administration

26 notes

·

View notes

Text

How a Dallas Hedge Fund Manager Got Caught Up in a World of Fraud

How Barrett Wissman went from running a lawn-care company to orchestrating a $100 million scheme that has him standing in the cross hairs of the SEC.

On March 19, 2009, the New York Office of the Attorney General and the Securities and Exchange Commission in Washington, D.C., dropped two bombshells on the secretive world of high finance. For two years, the agencies had run a coordinated investigation into how New York’s comptroller picked investments for the state’s $150 billion pension fund. On that Thursday, the New York AG released a 123-count indictment of two men who worked for disgraced former comptroller Alan Hevesi. The charges included securities fraud, bribery, and money laundering. The SEC complaint mirrored the AG’s charges, saying that Hank Morris, the top political strategist and chief fundraiser for Hevesi, and David Loglisci, the top investment officer of the pension fund, orchestrated a scheme that netted the men and other Hevesi associates tens of millions of dollars in kickbacks from firms that invested the pension fund’s money.

News of the charges rocked Wall Street. But as the shock waves rippled across the country, they especially rattled an office on the 40th floor of Thanksgiving Tower in downtown Dallas. That’s where a central figure in the scheme worked—though the court filings, curiously, didn’t mention him by name. The AG’s indictment called him “John Doe 1.” The SEC went with its own cryptic nomenclature, referring to him as “Individual A.”

Who was he? And why wasn’t he identified? Officials weren’t talking, so the second question was anyone’s guess. Perhaps the mystery man had struck a deal with prosecutors. In exchange for his cooperation, maybe they had agreed not to name him. But the first question was easy to answer. There were enough clues in the filings to figure it out, which made the man’s “anonymity” even more puzzling.

The SEC complaint, for instance, mentioned that Individual A had invested at least $100,000 to market and distribute a comedy called Chooch that was produced by David Loglisci and his brothers. The low-budget movie is a story unto itself, but suffice to say it features Mexican prostitutes, a 9-pound dachshund named Kiwi Limone, and a slapstick donkey-riding scene. The SEC also said Individual A was a Loglisci family friend.

A few pages after the Chooch details—as if to say, “If you still haven’t figured it out, then here’s the giveaway”—the SEC complaint revealed that Individual A was associated with HFV Management, a hedge fund firm. The SEC alleged that Individual A paid a total of $600,000 in kickbacks to land $100 million worth of investments from the New York state pension fund. (Such investments would generate substantial fees for the firm that managed them.) Even better, the SEC alleged that once Individual A saw how the scheme worked, he wanted in on it. For a cut of the action, he funneled kickbacks from other investment managers to Loglisci and Morris.

There was only one man who was both a friend of Loglisci’s and also associated with HFV—aka Hunt Financial Ventures, the eponymous firm of Clark Hunt, located on the 40th floor of Thanksgiving Tower in the same suite where his father, Lamar Hunt, once ran his sports and business empire. That man was 46-year-old Barrett Wissman.

And who is Barrett Wissman, exactly, besides a central figure in an ever-expanding investigation that has led to more than 100 subpoenas being issued to investment firms across the country, that has embroiled no less than the Treasury Department’s Steven Rattner, and that has raised serious questions about how billions of dollars in state pension funds from New York to California are managed? It depends on whom you ask. Wissman, through his lawyer’s PR man, declined an interview request. But his rabbi says he’s a great guy. His godmother, on the other hand, says he’s a liar and a cheat.

In the mid-’90s, money was pouring into that Thanksgiving Tower office. On one side was the Hunt Sports Group, decorated with a signed Joe Montana Kansas City Chiefs jersey and other memorabilia related to its sports holdings. But the real action was on the other end of the office, where work of a decidedly less public nature was under way. That’s where Clark Hunt and his partner Barrett Wissman operated HW Finance and an associated thicket of offshore trusts and other financial vehicles (“HW” came from their last names).

Word around the office was that Wissman had gone to Yale and worked for a couple of years in international finance for Lazard Freres in New York City. Then his father had died, and he’d moved back to Dallas, just two years out of college, to assume control of the family’s chemical company, which he eventually sold. Some said he’d pocketed as much as $80 million. With that success, he’d persuaded Hunt, a friend from St. Mark’s, to launch an offshore fund called Infinity Investors with him.

Wissman’s aunt and godmother laughs at the notion. The family’s chemical company? It was called Athena Products. In addition to Veripretty tablecloths and Pretty Please housewares, it made lawn-care products under the brand name Carl Pool. It’s unclear when it was sold, but records indicate that in 1995 the company had just 30 employees and did only $2.5 million in sales. Wissman’s aunt says the family business didn’t make him wealthy. Far from it.

“I lent him money to keep Carl Pool out of bankruptcy,” says 78-year-old Rachelle, who asked that her last name not be used. “When I asked to be paid back, he claimed the money was a gift.”

In 1990, a Bexar County court ruled that Wissman had forged his aunt’s signature to defraud her of $96,250. “He was stupid enough to forge my signature on stationery that was not printed until two months after I supposedly wrote the letter on that stationery,” Rachelle says. Wissman was ordered to pay $233,919, which included awards for punitive damages and mental anguish. Rachelle says that in 1997, years after her godson had gone into business with Hunt, she was still trying to get him to pay up.

“You know, I haven’t spoken to his mother in years,” Rachelle says. “He basically tore the family to pieces. And prior to this, we were a very close-knit family. I would like to see him get his comeuppance. He took years out of my life in litigation that could have been avoided if he’d just done the right thing. There was something that made him feel that he was better than everybody else, smarter, more talented.”

A business associate who worked closely with Wissman in the Hunt office agrees with the assessment: “Barrett made me feel like he thought, ‘There’s me. And then there’s people like you. But I understand that, and you understand that, so we’re cool.’ ”

The associate tells a curious story about how Wissman once repaid a debt. The associate would rather not say exactly what he was owed, but when he hounded Wissman for the money, a partial payment finally showed up in an overnight package from a lawyer in London. Hundred-dollar bills were taped inside a magazine. “I can’t remember if it was Der Spiegel or what,” the associate says. “It wasn’t like it was sloppily taped in there. It was professionally done. The bills were taped throughout the magazine.”

This was the man who in 2005 secured the first of two $50 million investments from New York state’s pension fund. On the one hand, Wissman doesn’t present the picture of someone to whom such a sum ought to be entrusted. His previous Infinity fund had been burned so badly—losing bets on Russian bonds right before the 1998 “Ruble Crises,” then on a series of Internet companies right before that bubble burst—that the name HW Finance had to be shed like dead skin. The firm adopted the new name HFV. No “W” anywhere in it.

On the other hand, Wissman has an air about him. In 2001, he married an exotic Russian cellist named Nina Kotova, who worked for a time as a model. He’s also an accomplished pianist with a master’s degree in music from SMU. In 2003, he bought the talent agency IMG Artists, which represents performers from violinist Itzhak Perlman to dance troupe Pilobolus. He speaks six languages and has launched a series of music festivals around the world.

More important, though, he knows people. People like Steven Loglisci, brother of David Loglisci, the indicted top investment adviser with New York state’s pension fund. Steven was the New York director of Ross Perot’s 1992 presidential campaign, for which Wissman volunteered. In 1998, Steven served as New Jersey Senator Robert Torricelli’s financial adviser at Bear Stearns, until Wissman persuaded him to take over a struggling Internet company called e.Volve, which the senator then invested in—right before Wissman’s eVentures bought e.Volve, giving the senator a huge immediate paper gain on his investment. Torricelli later had to abandon a re-election bid over an unrelated ethics scandal. A third Loglisci brother, Nicholas, ran a computer networking company whose board included not only Wissman but also Torricelli’s ex-wife and his girlfriend.

It’s a complicated mess. Determining where the various conflicts of interest lie will take months, if not years. But Wissman appears to be helping prosecutors figure it out. In April, he pleaded guilty to a felony securities fraud and agreed to pay $12 million in penalties and is said to be cooperating in the investigation. HFV Management and HFV Asset Management agreed to pay a $150,000 penalty without admitting or denying wrongdoing.

Some people who’ve known Wissman for years are left scratching their heads. Rabbi Jack Bemporad, who officiated at Wissman’s wedding and now is a professor at the Vatican’s Angelicum University in Rome, says, “The person that I’ve known for 20 years has always been kind and generous. All I know is what I read in the paper. I find it absolutely astonishing. It’s just not the person I know.”

Scurry Johnson, who knows Wissman from St. Mark’s and runs a Dallas venture capital firm, says, “In my mind, he was never a thoroughly knowledgeable investment banker or hedge fund manager himself. So he may have been in the middle of a bunch of people who were more financially devious. Or I don’t know what the words are.”

But up on the 40th floor of Thanksgiving Tower, Clark Hunt has apparently made up his mind. After Wissman’s guilty plea, Hunt ordered the golden “HFV” initials taken down from the wooden front door. A few days later, when building maintenance workers still hadn’t removed the letters, Hunt let his displeasure be known. So the office manager went out there himself with a chisel and scraped them off. Then he covered the ugly spot on the door with brown shoe polish.

2 notes

·

View notes

Link

0 notes

Text

Antonio Velardo shares: This Chart Explains America’s Broken Immigration System by Steven Rattner and Maureen White

By Steven Rattner and Maureen White America’s immigration system is broken. It can be fixed to both benefit the country and provide order to the border. Published: January 9, 2024 at 05:00AM from NYT Opinion https://ift.tt/UaJ7O8V via IFTTT

View On WordPress

0 notes

Text

Why the Obama era 'car czar' thinks striking autoworkers risk overplaying their hand

He was the lead adviser for the Obama administration when the government bailed out auto companies in 2009. Now, he is weighing in on the union strikes against the big 3 American automakers. https://www.npr.org/2023/09/29/1202749962/uaw-strike-big-three-automakers-ford-gm-stellantis-workers-steven-rattner?utm_source=dlvr.it&utm_medium=tumblr

0 notes

Text

0 notes

Text

Full Speed Ahead on A.I. Our Economy Needs It.

By Steven Rattner The problem isn’t that technology is developing too quickly; it’s developing too slowly to bolster our sagging productivity. Published: July 10, 2023 at 05:00AM via NYT Opinion https://ift.tt/oSgKyRs

0 notes

Text

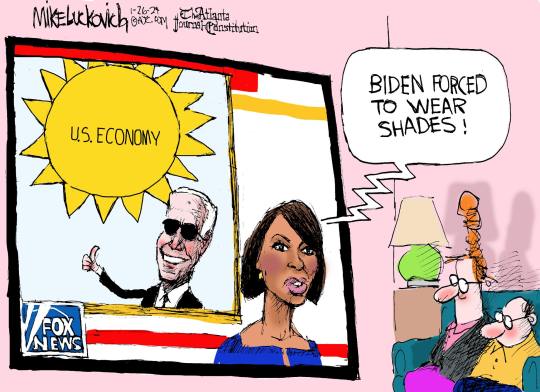

Mike Luckovich

* * * *

LETTERS FROM AN AMERICAN

April 5, 2024

HEATHER COX RICHARDSON

APR 06, 2024

Today offered yet more evidence that Biden’s rejection of the Republicans’ supply-side economics in favor of investing in ordinary Americans is paying off with high growth, low unemployment, and strong wages.

Today’s jobs report from the U.S. Department of Labor for the month of March showed higher job growth than analysts anticipated. Instead of the 214,000 jobs expected, the U.S. added 303,000. The government also revised its estimate of job growth in January and February upward by a combined number of 22,000. President Joe Biden noted that this report meant that the administration had created more than 15 million jobs since he took office.

The unemployment rate was also good, dropping slightly to 3.8% in March. According to economist Steven Rattner of Morning Joe, the United States has now had 26 consecutive months—more than two years—of unemployment under 4%, the longest stretch of unemployment that low since the late 1960s.

Rattner pointed out that immigrants have helped to push U.S. growth since the pandemic by adding millions of new workers to the labor market. As native-born workers have aged into retirement, immigrants have taken their places and “been essential to America’s post-COVID labor market recovery.”

Heather Long of the Washington Post added that wage growth has been 4.1% in the past year, which is well above the 3.2% inflation rate.

“My plan is growing the economy from the middle out and the bottom up, investing in all Americans, and giving the middle class a fair shot,” Biden said in response to the new jobs report. That system, which resurrects the economy the United States enjoyed between 1933 and 1981, has been a roaring success.

Biden was in Baltimore, Maryland, today, where he flew over the remains of the collapsed Francis Scott Key Bridge, spoke with the response teams there, and met with the families of those who died when the bridge fell. Apparently trying to demonstrate that government can be both efficient and effective, the administration has emphasized speed and competence in its response to the bridge collapse of March 26, 2024.

Kayla Tausche of CNN reported today that the U.S. Coast Guard was onsite within minutes of the collapse, and that Transportation Secretary Pete Buttigieg was working the phone as soon as he heard. He had spoken with Maryland governor Wes Moore, Baltimore mayor Brandon Scott, and White House chief of staff Jeff Zients by 5:00 a.m. Biden was briefed early that morning, before he began to reach out to state and local leaders.

Baltimore County executive Johnny Olszewski told Tausche: “[Biden] demonstrated a clear understanding of the importance of the port, had a real empathy for myself and all the individuals impacted…. And he was unequivocal that he was going to do whatever he can, legally and within his power to expedite a response.”

The collapse of the bridge not only affected traffic around Baltimore, but also shut the Port of Baltimore. For 13 years, that port has led the nation in carrying cars and light trucks, as well as tractors and cranes, handling more than 847,000 vehicles in 2023. In that same year, the port handled more than 444,000 passengers and $80 billion worth of foreign cargo. The damage to the port is of national significance.

Less than four hours after it received an official request for funding for repairs on March 29, the Department of Transportation authorized funds to begin to address immediate needs, which officials say is a record. The Army Corps of Engineers says it expects to restore a narrow navigation channel for use by the end of April and to have the port reopened fully by the end of May. Until then, the federal government is improving the infrastructure at nearby Sparrows Point to enable it to handle more ships.

But the Republican Party remains committed to the idea that the government must be kept small and that private enterprise must be privileged over public investments. Today, the far-right House Freedom Caucus announced that it would not consider funding the bridge repairs until foreign shipping companies had paid in all they owe (Biden has called for funding the bridge immediately rather than waiting for insurance funds, which will come much later).

They also say that they want the repairs to come out of money Congress has appropriated for other initiatives they dislike, that any new funds must be fully offset by other cuts, and that “burdensome regulations” such as labor agreements must be waived “to avoid all unnecessary delays and costs.”

They are also demanding that Biden reverse the administration’s “pause on approvals of liquified natural gas export terminals” before Congress will consider any funding for the bridge reconstruction. In January, under pressure from climate activists, Biden paused the construction of such terminals. Liquid natural gas is a valuable export, but it is also made up primarily of methane, a greenhouse gas significantly worse for the planet than carbon dioxide. Oil and gas interests are strongly in favor of developing the liquid natural gas industry while ignoring its effects on climate change.

One of the proposed plants affected by the pause would have been the largest in the U.S. It is planned for Louisiana, the home state of House speaker Mike Johnson. Johnson has already tried to tie funding for Ukraine to lifting the pause on liquid natural gas export terminals, and the White House refused. Now, apparently, extremist Republicans are trying the same gambit with repairs to the Francis Scott Key Bridge and access to one of the nation’s most important ports, although slowing repairs at that key juncture will directly affect many of their constituents.

Indeed, despite the solid demonstration that government support for ordinary Americans is the best way to build the economy, Republicans continue to maintain that the way to promote economic growth is to concentrate money among a few men at the top of the economic ladder. The idea is that those few people will invest their money more efficiently than the government can, and that the businesses they create will employ more and more workers. To that end, Republicans since 1981 have focused on tax cuts and deregulation in order to give those they see as job creators a free hand.

That system, so-called “supply-side economics,” has never actually worked, but it has become an article of faith for Republicans. It is a system that is popular with the very wealthy, and Biden called that out today in a video he recorded with Senator Bernie Sanders (I-VT).

In the video, the two men comment on a video clip in which former president Trump, speaking at a private event, promises wealthy donors another tax cut. Biden says: “That’s everything you need to know about Donald Trump. When he thinks the cameras aren’t on, he tells his rich friends, ‘We’re gonna give you tax cuts.’”

Sanders chimes in: “Can anybody in America imagine that at a time of massive income and wealth inequality—billionaires are doing phenomenally well—that he’s going to give them huge tax breaks? And then at the same time, he’s going to cut Social Security, Medicare, and programs that our kids need….”

“That makes me mad as hell, quite frankly,” Biden says. “There are 1,000 billionaires in…this country. They pay an average of 8.2% [in] federal taxes. So…we have a plan: Asking his good buddies to begin to pay their fair share.”

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Heather Cox Richardson#Letters From An American#Biden Economy#supply side economics#trickle down economics#failed Republican ideas#income inequality

3 notes

·

View notes

Photo

"I Went to China for the First Time in 3 Years, and I Saw Just How Formidable It Is" by Steven Rattner via NYT Opinion https://www.nytimes.com/2023/05/31/opinion/china-economy-growth-covid.html?partner=IFTTT

0 notes

Text

Good morning! Bosses think working from home is for sissies they see the home as the woman's domain. And in a recent op-ed article in The New York Times, the finance executive and professional blowhard Steven Rattner railed against working from home as evidence that America has "gone soft."

Fonte: Good morning! Bosses think working from home is for sissies they see the home as the woman’s domain. And in a recent op-ed article in The New York Times, the finance executive and professional blowhard Steven Rattner railed against working from home as evidence that America has “gone soft.”

View On WordPress

0 notes