#square foot investor

Explore tagged Tumblr posts

Text

Prime Naukuchiatal Land: Lake Views, Endless Potential

This 5 Nali land in Naukuchiatal offers breathtaking lake views and is perfect for a luxury Airbnb, yoga retreat, or your dream home.

#square foot investor#land parcels#real estate agent#investing in land#dreamhome#realestate#homes#best real estate dealer in haldwani#best real estate dealer in uttarakhand#land in naukuchiatal

0 notes

Text

Why would federal employees own million-dollar-plus homes? The answer: They don't. Those are not likely homes owned by federal employees, but rather homes owned by executives at NGOs who receive the grift money from federal bureaucrats at places like USAID. In the first term, these wealthy activists would have led La Résistance 1.0, or at the very least occupied themselves with the usual Beltway task of ensuring a Republican president couldn't put his policies fully into place. If the Flight of the Progressive State includes the multi-millionaire class, then the swamp may truly be draining for the first time in decades -- if ever. But are these figures accurate? It's tough to pin down, although there's no reason to believe that TKL is partisan in its observations. Long & Foster, another investor analyst service, also began seeing a sharp decline in the DC real-estate market, but their data is for January only. Even so, they also saw signs of a sharp fall-off, even comparing the same season last year, but the data was a bit mixed

...

Redfin sees much the same situation, with median prices down 8.6% and price per square foot down 7.2%, both year-on-year. However, the Greater Capital Area Association of Realtors (GCAAR) paints a more pessimistic picture of their market in January, comprising both DC and Montgomery County in Maryland:

New listings: Up 104% over December

Median sold price: Down 12% over December and down 8.3% year on year

Active listings up 28.5% over the 5-year January average

Clearly, something is happening to the DC market, which extends beyond the borders of the district itself. And that has implications beyond a potential housing glut around the nation's capital. Both Maryland and Virginia have deep-blue districts bordering DC that have some impact on their state elections, especially in Virginia, where the northern counties (called NOVA) have become more or less determinative in their elections. I wrote about NOVA in my 2016 book Going Red, noting that the top three counties in the nation for household income were Loudon, Fairfax, and Arlington, all extensions of the DC federal-bureaucratic state industry. Three others were in the top 13 counties nationwide for that measure as well. Maryland is probably too blue for a Burexodus to matter, but Virginia isn't. If those who benefited from the pre-DOGE progressive grift in DC are packing up and moving out, those counties may get a lot less Democrat in coming elections. That would allow the rest of Virginia (ROVA), more conservative politically and culturally, more of a say in state election outcomes. Stay tuned. DOGE may create even more earthquakes in culture than politics by the time it finishes its run through the bureaucratic state.

Guys. Guys I...I think it's happened. I think...I think I'm finally getting sick of winning...

.....

Nah, not yet.

32 notes

·

View notes

Text

SINGER NIALL HORAN INVESTS IN FENWAY SPORTS, MCILROY TGL TEAM

Singer-songwriter Niall Horan will tee it up as the latest investor in TGL, the tech-infused team golf league backed by Tiger Woods and Rory McIlroy. Horan, who first gained fame as a member of boy band One Direction, invested in Boston Common Golf through his investment vehicle Greenbridge Ventures.

Boston Common Golf is one of the six inaugural TGL teams and owned by Fenway Sports Group and McIlroy’s investment firm, Symphony Ventures.

McIlroy and Horan both hail from Ireland and have been longtime friends. “Golf has been a lifelong passion of mine,” Horan said in a statement. “Being able to combine my love for the game and my friendship with Rory into a relationship that helps launch a new concept in golf is truly special.”

TGL teams will each feature four golfers hitting shots into a golf simulator screen until they are within 50 yards of the hole and the action transfers to a short game area that transforms between holes. The season includes 15 matches, plus playoffs.

Horan will also serve as an ambassador for Boston Common Golf, which will benefit from his massive social media following, which includes 72 million combined followers on Instagram and Twitter—Woods has 10 million and McIlroy 6 million.

In 2015, Horan launched a sports agency focused on golf, Modest! Golf Management, with his business partner, Mark McDonnell. Their clients include Tyrrell Hatton, who has won six European Tour events and one on the PGA Tour. That same year, Horan served as McIlroy’s caddie in the Masters’ annual Par 3 Contest.

In addition to his singing career, Horan was a coach the past year on The Voice and coached the winner in back-to-back seasons. He is currently on the North American leg of his global tour.

TGL was slated to start play this January, but delayed its inaugural season to begin Jan. 7, 2025 after a power failure caused the dome of the SoFi Center in Palm Beach Gardens to deflate. The required repairs led the TGL to delay a year. Last month, Horan visited TGL’s performance lab to preview the technology that will be used in the competition.

The SoFi Center will boast a 3,000-square-foot simulator screen and a 22,475-square-foot customizable short game area. TGL rules also include a shot clock, and the league plans for players to be mic’d up during the action. A seating area for 1,500 has been designed around the playing zone.

Matches will be broadcast on ESPN and ESPN+.

The six, location-tied teams for TGL’s inaugural season: Atlanta Drive GC, Boston, Jupiter Links GC, Los Angeles Golf Club, New York Golf Club and the Bay Golf Club, have attracted heavy hitters in the sports space, including Arthur Blank, Steve Cohen, Alexis Ohanian and Marc Lasry, as well as athletes Serena Williams, Stephen Curry and Giannis Antetokounmpo. Woods partnered with David Blitzer for the Jupiter franchise.

37 notes

·

View notes

Photo

Merrymount Colony

Merrymount Colony (1624-1630 CE) was a settlement first established in New England as Mount Wollaston in 1624 CE but renamed Mount Ma-re (referred to as Merrymount) in 1626 CE by the lawyer, writer, and colonist Thomas Morton (l. c. 1579-1647 CE), best-known, primarily, from his book New English Canaan (a treatise on the Native Americans of the region, natural history, and satiric critique of his colonist neighbors) and the work Of Plymouth Plantation by William Bradford (l. 1590-1657 CE), second governor of Plymouth Colony, in which he is referred to as the “heathen” who established a “school of Atheism” at Merrymount.

Unlike Plymouth Colony, or the later Massachusetts Bay Colony, Merrymount was more of a trade center than a residential/agricultural community but, owing to Morton's liberal attitude toward religion, and the rapport he developed with the Native Americans, became (according to Morton) more successful and popular than its neighbors. Morton encouraged a celebratory atmosphere and, in 1627 CE, had an 80-foot (24 m) tall Maypole erected in the town square and, declaring himself the community's host, welcomed colonists and Native Americans to a days-long festival.

Bradford sent his militia's commander Myles Standish (l. c. 1584-1656 CE) to arrest Morton in 1628 CE, and he was deported back to England. He returned in 1629 CE, however, and again took up residence at Merrymount until he was again arrested and deported and Merrymount burned in 1630 CE. The story of the colony is given in a number of 17th-century CE sources, including those by Morton, Bradford, and John Winthrop (l. c. 1588-1649 CE) of the Massachusetts Bay Colony. The site of Merrymount is now a residential development in Quincy, Massachusetts, but the memory of the settlement as a progressive alternative to the Puritan or separatist models is still celebrated there occasionally by admirers of Morton in the present day.

Mount Wollaston Becomes Merrymount

Morton was employed as a lawyer by the merchant and investor Sir Ferdinando Gorges (l. c. 1565-1647 CE) in 1622 CE, went on a reconnaissance mission for him to North America, returning in 1623 CE, and was then sent back in 1624 CE on an expedition, led by Captain Richard Wollaston (d. 1626 CE) and comprised of 30 indentured servants, to establish a permanent colony for trade some 40 miles (64 km) away from Plymouth Colony. Plymouth Colony had a profitable fur trade established with the Native Americans of the region by this time and, based on Bradford's work, seem to have taken little notice of the new colony, named Mount Wollaston, at first.

In 1626 CE, according to Bradford, Wollaston took some of the indentured servants to Jamestown and hired them out to others. He died at some point the same year and, also according to Bradford, Morton convinced the servants left at Mount Wollaston to rebel against the second-in-command Wollaston had left there (a man named Fitcher), and join him in a venture in which they would all share the profits equally. Once this was accomplished, Morton renamed the settlement Mount Ma-re (from the French mer for “sea” as it was near the coast but a play on “merry”), later known as Merrymount.

Continue reading...

19 notes

·

View notes

Text

Daniel Thomas - from a FB comment on the meme:

- [ ] The crowd was ostensibly angry but it was a somewhat joyful tone that split the morning air as the convicted and Removed President, wearing an appropriate red felon jumpsuit, with a black silken hood over his head, was led 40 feet up the stairs to the impressive stainless steel guillotine erected in Times Square this brisk fall morning. We are receiving reports from those near to where the Correctional Officers from Ryker’s Island and Federal Marshalls guide The dethroned president who would have been King through the stoic but bitter gathering of watchers saying they hear a childlike whimpering emanating from underneath the black hood.

- [ ] We watch the unprecedented procession unfold before our Nation as a definitive Day of Retribution for the nation, after this man had ransacked our very name throughout the world, destroyed our alliances, and flushed billions of dollars down the toilet while paying, or having his actually wealthy backers pay, complicit news organizations to cast him in a favorable light to their unsuspecting followers.

- [ ] On an informative note, let us also share that the Farmers of America, auto workers and NYPD have helped in a united effort to have this massive but oddly beautiful Stainless Steel Guillotine designed and built with state of the art failsafes to insure that the ex-President’s neck will be severed instantly and completely. A co-operative project between the engineers from Boeing and Lockheed, with some ancillary from the Disney Corporation, this 87 foot tall Madame Guillotine shall, after serving its intended purpose, be relocated to a picturesque spot near the New White House, which has been in recent years called the House of White Power due to the the thankfully short lived rise of The Nationalist Movement in the US. It will embody a significance comparable to the Statue of Liberty or the Washington Monument for our true citizens, and a palpable warning to Nationalist thinking in this country, which has now been so palpably ostracized by the vast majority as to be simply ridiculed, yes, even In some places like Alabama! Some experts have intimated that, in fact, this criminal to mankind will very probably have a moment or perhaps most of a minute or two to perceive the crowd and perhaps his own headless body if his head lands in the basket at the proper angle, and if his own blood doesn’t obscure his view.

- [x] The crowd is getting louder now, we can hear. As there will be a few minutes before the climactic moment, we break briefly for commercial. The commercials for this spectacular event are clearly surpassing in sheer ostentatiousness the Super Bowl ads of fame, and some are quite provocative, ladies and gentlemen, given the reestablishment of our democracy and the hope we all share of finally undoing and obliterating all the self-serving acts this ex-president has engendered.

- [ ] So we cut now to Ben and Jerry’s Ice Cream!!

and a FB answer to some MAGAs crying tears about the meme above:

It’s a WARNING!

When rights are taken away, you never get them back easily. Trying to make people understand where fascism leads, such as beheading your “enemies”. (Not always literally.)

This country, founded on the IDEA that people should be able to make their own rules, design their own laws, appoint their own leaders and everyone is equal under the law.

For years right wing politicians have been determined to change America into a country RULED by ELITES. All these years later while telling you the “elites” are celebrities, TV newscasters, athletes, or authors, we find out the true elites are real estate investors, tech entrepreneurs, and corrupt SC Justices.

They aren’t fiercely determined to fix our crumbling infrastructure, they aren’t concerned about lack of healthcare for Americans, they have NO PLANS to make life better in any way in our country.

They intend to OWN, PROFIT FROM, TAKE, SELL OFF, BARGAIN WITH, LIE ABOUT, DECEIVE, WHATEVER IS NEEDED TO TAKE EVERY DIME THEY CAN FROM AND GIVE ZERO BACK TO you!

You could have researched them and found they have left a long line of lied to, defrauded, embezzled, broke people in their wake.

They are concerned with POWER, MONEY, POWER

But they have you complaining about a singer, a movie star, or a meme.

Keeping you busy while they steal food right out of your mouth.

STEP 1 Cut Social Security and Medicare to have money to give billionaires another tax cut.

STEP 2 deport ENOUGH immigrants to make it LOOK GOOD. Keeping their “personal” illegals hidden away from sight. Arrangements CAN be made for swaths of illegals to work for chicken plants, vegetable farms and such, FOR A PRICE. That’s what this whole, “they’re criminals, drug dealers, murderers, they’ll slit your throat for nothing.” Business is all about.

FIGURING OUT HOW TO MAKE A BUCK FROM ILLEGALS BY BEING IN CHARGE OF DISTRIBUTING THEM!

They’re gonna make sure you have plenty to worry about, while they SELL our military to others, bargain with our nuclear capabilities for highest payment, use our tax money to build another tower, rocket, or AI project, and you won’t even notice you have become a third world society, living in the richest nation in the world, with NO ALLIES, NO ABILITY TO RAISE YOUR STANDARD OF LIVING, and NO JUSTICE DEPARTMENT TO PROTECT YOUR RIGHTS.

Maybe some country out there will someday allow YOU an immigrant from America to seek ASYLUM!

5 notes

·

View notes

Text

Singer-songwriter Niall Horan will tee it up as the latest investor in TGL, the tech-infused team golf league backed by Tiger Woods and Rory McIlroy. Horan, who first gained fame as a member of boy band One Direction, invested in Boston Common Golf through his investment vehicle Greenbridge Ventures.

Boston Common Golf is one of the six inaugural TGL teams and owned by Fenway Sports Group and McIlroy’s investment firm, Symphony Ventures.

McIlroy and Horan both hail from Ireland and have been longtime friends. “Golf has been a lifelong passion of mine,” Horan said in a statement. “Being able to combine my love for the game and my friendship with Rory into a relationship that helps launch a new concept in golf is truly special.”

TGL teams will each feature four golfers hitting shots into a golf simulator screen until they are within 50 yards of the hole and the action transfers to a short game area that transforms between holes. The season includes 15 matches, plus playoffs.

Horan will also serve as an ambassador for Boston Common Golf, which will benefit from his massive social media following, which includes 72 million combined followers on Instagram and Twitter—Woods has 10 million and McIlroy 6 million.

In 2015, Horan launched a sports agency focused on golf, Modest! Golf Management, with his business partner, Mark McDonnell. Their clients include Tyrrell Hatton, who has won six European Tour events and one on the PGA Tour. That same year, Horan served as McIlroy’s caddie in the Masters’ annual Par 3 Contest.

In addition to his singing career, Horan was a coach the past year on The Voice and coached the winner in back-to-back seasons. He is currently on the North American leg of his global tour.

TGL was slated to start play this January, but delayed its inaugural season to begin Jan. 7, 2025 after a power failure caused the dome of the SoFi Center in Palm Beach Gardens to deflate. The required repairs led the TGL to delay a year. Last month, Horan visited TGL’s performance lab to preview the technology that will be used in the competition.

The SoFi Center will boast a 3,000-square-foot simulator screen and a 22,475-square-foot customizable short game area. TGL rules also include a shot clock, and the league plans for players to be mic’d up during the action. A seating area for 1,500 has been designed around the playing zone.

Matches will be broadcast on ESPN and ESPN+.

The six, location-tied teams for TGL’s inaugural season: Atlanta Drive GC, Boston, Jupiter Links GC, Los Angeles Golf Club, New York Golf Club and the Bay Golf Club, have attracted heavy hitters in the sports space, including Arthur Blank, Steve Cohen, Alexis Ohanian and Marc Lasry, as well as athletes Serena Williams, Stephen Curry and Giannis Antetokounmpo. Woods partnered with David Blitzer for the Jupiter franchise.

6 notes

·

View notes

Text

County Fair Potatoes, Inc. - Revolutionizing the Potato Industry

Welcome to County Fair Potatoes, Inc., a start-up featuring the unique combination of a multi-generational Idaho potato farmer, real estate, development, and potato processing experts, with the goal of capitalizing on the strong demand for French fries and frozen potato products in the U.S. and abroad. CFP will occupy 74,000 square feet in a new 280,000-square-foot facility that will be constructed by Fall 2025. This deal is unique because of vertical integration (food processing, lease income, cold storage services, etc.); the idea of adding various types of income into the financial model, thus increasing the value of the company, real estate footprint, and mitigating the risk of failure.

Why County Fair Potatoes?

Rapid Growth: The demand for French Fries is skyrocketing both in the US and internationally. Industry experts highlight that current production levels are not meeting this increasing demand.

Vertical Integration: Our company encompasses food manufacturing, sales, transportation, and facilities management. This approach minimizes costs, enhances efficiency, reduces food waste, and maximizes profitability.

Global Reach: By implementing a unique online B2B e-commerce strategy, we enable customers worldwide to sell genuine Idaho-certified potato products at reduced costs, with white-label capacity.

Eco-Friendly Products: Our potatoes are organic, non-GMO, low in salt, sugar, and preservatives, and incredibly tasty!

Investor Benefits

High Returns: Enjoy an impressive IRR of 167.7% and a real estate exit multiple of 2.5X.

Join Us: Interested in becoming an owner? Visit our crowdfunding site for more information: https://www.invown.com/app/pitch/cfp

Join us in transforming the potato industry and bringing the best Idaho potatoes to tables around the world!

Don't forget to like, comment, and subscribe for more updates on County Fair Brands!

www.countyfairbrands.com

https://www.invown.com/app/pitch/cfp

2 notes

·

View notes

Text

Upgrading To New Property In Mumbai

Upgrading to new property in other hand you are upgrading your lifestyle. As Mumbai residential properties has major competitions for having top tier environment & amenities to showcase power builds & modern marvels in infrastructure sectors. People living in suburbs nearby mumbai, dream to having their Mumbai Home & always passionate about it. Many of them succesfull to grab opportunities to invest in thier dream home. Periodically Pricing of residential houses Increasing Day by Day, hence here many hurdles to cross any Investor or Buyer To fulfill their demands. Here, We Described catergories where people currently Interested.

Residential Real Estate

Luxury Living Mumbai's real estate is the pricey in India but also highly regarded. Buyers can Upgrade from high-rise apartments to standalone villas in exclusive areas like Juhu, Bandra West, Cuffe Parade, Malabar Hill, and Worli. These luxury apartments often have beautiful sea views and cost around Rs 40,000 per square foot or more.

Affordable Homes While housing in Mumbai is expensive, some areas offer more affordable options. Neighborhoods like Borivali, Ghatkopar, Vikhroli, Malad, and Chembur have flats averaging around Rs 20,000 per square foot. These areas have good schools, hospitals, restaurants, and entertainment options, with easy access to the rest of Mumbai. Commuting to the Bandra-Kurla Complex, a major business area, usually takes 30 to 45 minutes from these neighborhoods. Mumbai is a popular choice not just for luxury buyers but also for the middle class. Major mumbai residents choose these areas as per their financial stablity.

Commercial Properties

As India's financial capital, Mumbai hosts many local and international companies. It's also a popular spot for startups, increasing the need for office space. The Bandra-Kurla Complex is a prime business district with many government and private offices. Other important business areas include Lower Parel, Andheri, and Nariman Point.

Hurdles While Upgrading To New Property

Lack Of Resources & Capital. While Upgarding To New Property, Investor Needed financial stabilty to use his earned savings / capital. Lack of this many of them choose the way of loans & EMI to Get Their Dream Homes.

Change Of Location & Adapting To New Neighbourhood This A common difficulty to each person of the family to adapt in new neighbourhood while upgrading to new homes. For The childrens shifting them to new schools & Grand Parents to introduce in new community is a big task in this upgrade process.

Update In Relocation Of Documents It's A major part, after shifting to their new homes, it's mandate to chnage in their permanant aadresses Or postal addresses to new one, This becomes Important because of government documents like passport, adhar cards, etc were Linked to old addresses & for further usage of these its needed to give them proof of relocation, while upgrading to new homes at new loaction.

#new homes#upgrading to new homes#mumbai investment#mumbai property#mumbai homes#mumbairealestate#india#real estate investors#sunblonde realtors#sunblonde realty

2 notes

·

View notes

Text

Grace King Morgan Stanley Senior Banker, Senior Vice President of Wealth Management

Ms. Grace is the first woman from mainland China admitted to Columbia University. After graduation, Ms. Grace started working on Wall Street in the 1980s. She has served the most famous institutions and investors on Wall Street and has extensive and rich personal relationships.

This investment banking giant is known as "Mogul" in the Chinese industry. It is headquartered in a 750,000-square-foot office building in Manhattan, New York City. Its business areas include stocks, bonds, foreign exchange, funds, futures, investment banking, Securities underwriting, corporate financial consulting, institutional corporate marketing, real estate, private wealth management, direct investment, institutional investment management, etc.

4 notes

·

View notes

Text

Adnan Vadria: Unveiling the Promise of Growth in Investing in Commercial Real Estate

Delve into the world of commercial real estate investment with Adnan Vadria as your trusted guide. In this enlightening exploration, Adnan Vadria reveals how every square foot of commercial property holds the potential for significant growth and prosperity. With an expert's eye, he navigates the dynamic landscape of commercial real estate, sharing strategic insights, market trends, and valuable considerations for aspiring investors. Whether you are venturing into your first commercial property investment or expanding your portfolio, Adnan Vadria's expertise empowers you to seize lucrative opportunities and make well-informed decisions. Embrace the promise of growth in investing in commercial real estate with the guidance of Adnan Vadria, an industry authority, and visionary entrepreneur.

9 notes

·

View notes

Text

Kausani Land for Sale: Invest in Square-Foot Blocks in Uttarakhand’s Hidden Gem

Secure your piece of Kausani’s pristine landscape with square-foot plots designed for investors looking for valuable real estate. Discover exclusive square-foot investment opportunities in the serene hill station of Kausani. Ideal for both high returns and long-term wealth.

#square foot investor#commercial land#land parcels#real estate agent#realestate#investing in land#homestyle#dreamhome#homes#Kausani#land for sale#land for sale in kausani

0 notes

Text

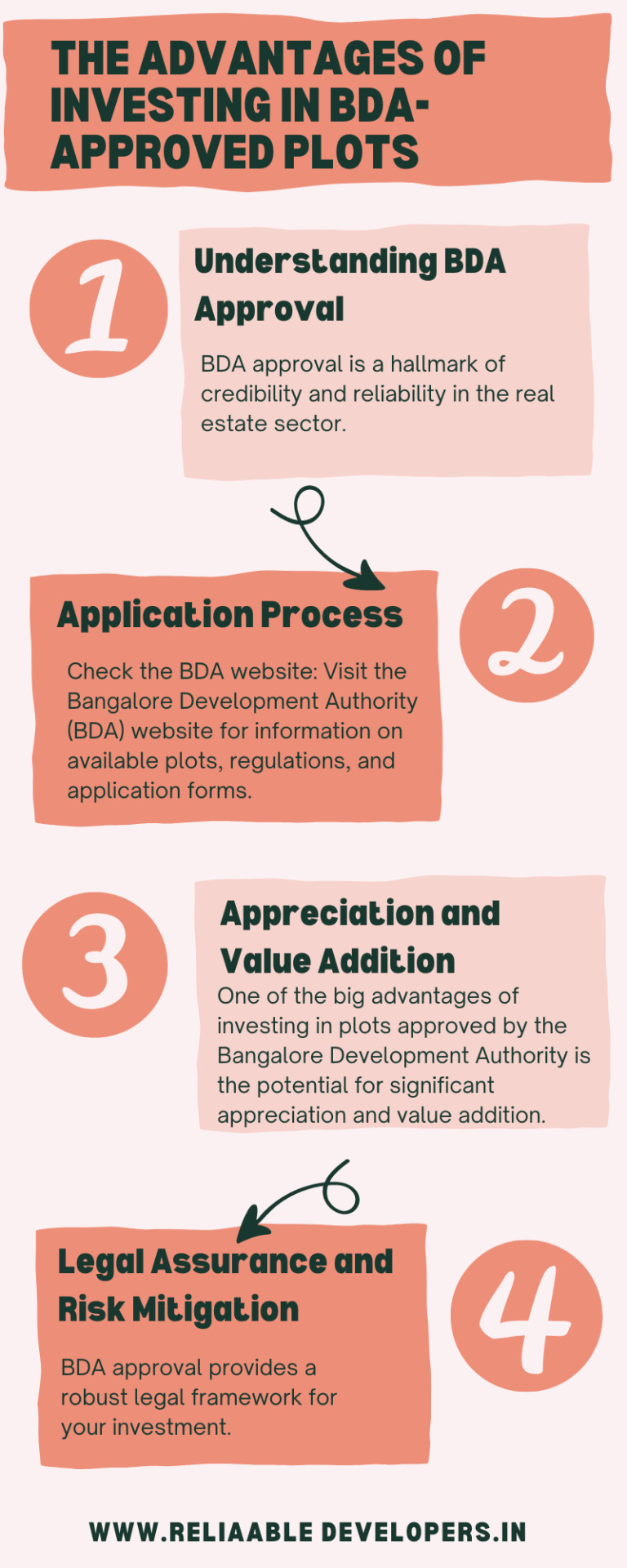

Reliaable Developers: The Advantages of Investing in BDA Approved Plots

Investing in real estate has always been a profitable endeavor, and one of the most secure options in this sphere is opting for BDA (Bangalore Development Authority) approved plots. Bangalore, as a flourishing metropolis, offers numerous opportunities for real estate investors, and BDA-approved plots include numerous benefits making them a good selection. In this blog, we will explore the primary advantages of investing in BDA-approved plots.

Understanding BDA Approval:

BDA approval is a hallmark of credibility and reliability in the real estate sector. BDA rigorously inspects and sanctions plots only after validating that they adhere to each of the required rules and standards. This ensures that your investment is in a legally sound and secure property.

Application Process:

Check the BDA website: Visit the Bangalore Development Authority (BDA) website for information on available plots, regulations, and application forms.

Eligibility Criteria: Ensure you meet the eligibility criteria specified by BDA for plot allotment.

Application Submission: Fill out the application form and submit it along with the required documents and application fee.

Lottery or Auction: BDA may conduct a lottery or auction for plot allotment. Participate as per the specified procedure.

Verification: After allotment, undergo verification processes to complete the purchase. This step involves confirming the authenticity of your documents and ensuring compliance with BDA regulations.

Payment: Pay the cost of the plot as per the allotted rate within the stipulated time. This step is crucial for securing your plot and completing the transaction. Timely payment is essential to avoid forfeiture of the allotted plot.

BDA's systematic application process, including thorough eligibility checks, lotteries or auctions, and subsequent verifications, ensures a fair and transparent allocation of plots.

Appreciation and Value Addition:

One of the big advantages of investing in plots approved by the Bangalore Development Authority is the potential for significant appreciation and value addition. These plots are often strategically located in areas earmarked for development and growth. As Bangalore expands, the need for land in approved layouts increases, leading to a big rise in property value over a long time. The cost of BDA-approved plots in Bangalore varies based on place, size, and amenities. On average, prices can go from INR 2,000 to INR 10,000 per square foot. For instance, Reliaable Residenza, a BDA-approved plot is located near the Konappana Agrahara metro station and an Anugrahaa Hospital. This positioning enhances the property's value over time, offering investors a handsome return on investment.

Legal Assurance and Risk Mitigation:

BDA approval provides a robust legal framework for your investment. The authority conducts a thorough check to make sure the land has clear ownership papers and is free from any encumbrances. This greatly lowers the risks of legal disputes and makes sure ownership is a smooth and hassle-free experience. With the right documents and legal approval, investors can feel safe knowing their investment in plots from reputable developers like Reliaable Developers who have received positive Reliaable Developers Reviews is secure and legally authorized.

Planned Infrastructure around BDA Plots:

One significant benefit of investing in plots approved by the Bangalore Development Authority is the planned infrastructure that typically accompanies them. Layouts sanctioned by the BDA commonly include well-constructed roads, drainage systems, parks, and other crucial facilities. By prioritizing organized growth, the authority enhances livability in these neighborhoods. The commitment to planned development raises the overall standard of living, creating desirable areas for living and working. Reliaable Dollars Colony is one of the examples which is well-planned with good road connectivity and well-maintained roads. The development provides many amenities like a 24-hour water supply, a gated community, a swimming pool, a clubhouse, and more, contributing to an enhanced quality of life in the area. This planned infrastructure not only adds value to the property but also contributes to a thriving and well-connected community.

Conclusion: In conclusion, investing in BDA-approved plots in Bangalore offers a range of advantages that make it a prudent choice for real estate investors. The credibility and legal assurance provided by BDA approval, coupled with the potential for significant appreciation and well-planned infrastructure which creates a winning combination for those who are looking to build a secure and profitable real estate portfolio. As Bangalore continues to evolve as a dynamic city, BDA-approved plots stand out as a reliable and promising investment opportunity in the ever-expanding real estate landscape.

#reliaable developers#reliaable developers reviews#reliaable developers plots#reliaable developers ecity#reliaable developers bangalore reviews#reliaable developers bangalore#BDA Plots near me#BDA Plotted development#reliaable developer projects#bda plots for sale in bangalore#BDA Plots bangalore#Reliaable developers Projects

2 notes

·

View notes

Text

Thursday, November 9, 2023

October obliterated temperature records, virtually guaranteeing 2023 will be hottest year on record (AP) This October was the hottest on record globally, 1.7 degrees Celsius (3.1 degrees Fahrenheit) warmer than the pre-industrial average for the month—and the fifth straight month with such a mark in what will now almost certainly be the warmest year ever recorded. October was a whopping 0.4 degrees Celsius (0.7 degrees Fahrenheit) warmer than the previous record for the month in 2019, surprising even Samantha Burgess, deputy director of the Copernicus Climate Change Service, the European climate agency. “The amount that we’re smashing records by is shocking,” Burgess said. After the cumulative warming of these past several months, it’s virtually guaranteed that 2023 will be the hottest year on record, according to Copernicus.

U.S. service members’ data is easy and cheap to purchase online, study finds (NBC News) Duke University published a study on Monday about how easy and affordable it is to obtain personal information about active-duty U.S. service members—and the answer is “very.” Researchers bought nearly 50,000 service members’ records for a little over $10,000 throughout the course of the study. In fact, researchers say they purchased everything from names, phone numbers, and addresses to names of service members’ children, marital status, net worth, and credit ratings for as little as 12 cents per person. The study has shed light on a concern that not properly regulating data brokers has, essentially, led to a national security risk.

Panama’s deadly protests (Washington Post) On the surface, the protests that have shaken Panama the past two weeks are about a government contract that allows a Canadian company to expand its copper mining operations here. But what’s at stake, all sides say, is a much larger question: What kind of country is this Central American isthmus going to be—one that preserves its natural riches or develops them? And if the answer is development, another question: Should a country that owes its existence to U.S. exploitation—Theodore Roosevelt broke it off from Colombia in 1903 so the United States could finish and control the Panama Canal—continue in 2023 to surrender its natural advantages to foreign investors? Two more protesters were killed on Tuesday, police said, bringing the total during the demonstrations to at least four.

Portugal’s prime minister resigns as his government is involved in a corruption investigation (AP) Portuguese Prime Minister António Costa resigned Tuesday after his government was involved in a widespread corruption probe, sending a shock wave through the normally tranquil politics of the European Union member. The 62-year-old Costa, Portugal’s Socialist leader since 2015, asserted his innocence but said in a nationally televised address that “in these circumstances, obviously, I have presented my resignation to the president of the republic.” The announcement came hours after police arrested his chief of staff while raiding several public buildings and other properties as part of the probe.

In Switzerland, Most People Rent for Life (NYT) In any other country, Philip Skiba, a well-paid analyst working in the finance industry, might not hesitate to buy a home. But in the town where he lives, on the outskirts of Zurich, even the ugly houses, as he describes them, go for millions. Last year, a simple, beige stucco home in his neighborhood went up for sale. The price: 7.5 million Swiss francs, or about $8.3 million. Buying a single-family home anywhere near Zurich is not just a luxury. “It’s beyond luxury,” Mr. Skiba said. “Two kids, a house, a garden, two cars—I don’t know anybody who has that.” Switzerland’s nine million residents are some of the wealthiest people on the planet—and they are mostly renters. The average price for a studio apartment in Zurich is $1.1 million. On a square-foot basis, Zurich is about 80 percent more expensive than Paris. Switzerland offers the world a glimpse of a post-ownership society. Around 36 percent of the Swiss own their homes or apartments, the lowest rate in the West and well below the 70 percent average in the European Union, and the 67 percent in the United States. In the United States and many other countries, homeownership is generally considered a rite of passage. In Switzerland, where the terrain is 70 percent mountains and expensive real estate on limited buildable land has been the reality for generations, a lifetime of renting is not considered a personal failure or a shortcoming of the system.

What’s Up With Ukraine? (Politico/Guardian) While all eyes have been on Gaza, the war in Ukraine has heated up. Over the weekend, the two sides traded strikes, trying to eke out victories as winter threatens to slow down larger military operations. Mykola Oleshchuk, commander of the Ukrainian Air Forces, claimed that his country had destroyed a Russian Kalibr missile carrier docked at a port in Russian-held Crimea on Saturday. He hinted that Ukraine had used French SCALP cruise missiles in the attack. Russia confirmed in a statement that the carrier had been damaged, but it’s unclear if it was fully destroyed. In response, Russia attacked the Odesa region on Sunday, causing damage to an art museum and port infrastructure with a combination of suicide drones and missiles. On the diplomatic front, a Ukrainian deputy prime minister promised that the country would complete the reforms necessary for it to join the European Union within two years.

Jailed Iranian Nobel laureate begins hunger strike (BBC) Jailed Iranian human right activist Narges Mohammadi has begun a hunger strike, a month after she was awarded the Nobel Peace Prize, her family says. The 51-year-old is protesting against Iran’s denial of medical care to her and other inmates and its mandatory hijab law, according to a statement. She needs treatment for heart and lung conditions but a prosecutor is blocking her transfer to hospital, it says. Last week, her family said that was because she refused to cover her hair. The chairwoman of the Norwegian Nobel Committee—which awarded Ms Mohammadi the peace prize for “her fight against the oppression of women in Iran”—said it was deeply concerned. “The requirement that female inmates must wear a hijab in order to be hospitalised is inhumane and morally unacceptable.”

Under Scrutiny Over Gaza, Israel Points to Civilian Toll of U.S. Wars (NYT) Falluja. Mosul. Hiroshima. Facing global criticism over a bloody military campaign in Gaza that has killed thousands of civilians, Israeli officials have turned to history in their defense. And the names of several infamous sites of death and destruction have been on their lips. In public statements and private diplomatic conversations, the officials have cited past Western military actions in urban areas dating from World War II to the post-9/11 wars against terrorism. Their goal is to help justify a campaign against Hamas that is claiming thousands of Palestinian lives. In those earlier conflicts, innocent civilians paid the price for the defeat of enemies. In Hiroshima and Nagasaki, as many as 200,000 civilians perished after the United States dropped atomic bombs to force Japan’s surrender. In Iraq, hundreds of civilians were killed in Falluja as U.S. forces fought Iraqi insurgents, and thousands died in Mosul in Iraqi and American battles against the Islamic State. Israel insists that it is trying to limit civilian casualties in a war against a terrorist enemy, which began when Hamas killed 1,400 people on Oct. 7 in southern Israel, most of them civilians. Human rights advocates and many governments in Europe and the Middle East scoff at that. They accuse Israel of committing war crimes in the weeks of airstrikes that have leveled entire city blocks in Gaza, destroying schools, mosques and other seemingly nonmilitary targets.

Netanyahu faces rising anger from within Israel (CBS News) While Israel’s government continues to wage its war against Hamas, public support for Prime Minister Benjamin Netanyahu is in freefall. According to a recent poll by an Israeli news station, 76% of respondents say that Netanyahu should resign. The main cause of this backlash is his government’s failure to preemptively stop the October 7 attacks by Hamas. Officials from both the U.S. and Egypt claim that Egypt had warned Israel of the attacks before they happened, but the country ignored the warning. Israel has said that those claims are “absolutely false.” The opposition to Netanyahu is nothing new, though. Prior to the October 7 attacks, he was already facing massive political backlash for his attempts to erode the power of Israel’s Supreme Court.

Jordan’s Queen Rania says being pro-Palestinian does not equal being ‘antisemitic’ (CNN) Queen Rania Al Abdullah of Jordan has called for a ceasefire in Israel’s war against Hamas, saying that supporting the protection of Palestinian lives does not equal being antisemitic or pro-terrorism. “Let me be very, very clear. Being pro-Palestinian is not being antisemitic, being pro-Palestinian does not mean you’re pro-Hamas or pro-terrorism,” Rania told CNN’s Becky Anderson on Sunday. “What we’ve seen in recent years is the charge of antisemitism being weaponized in order to silence any criticism of Israel,” she said. “I want to absolutely and wholeheartedly condemn antisemitism and Islamophobia…but I also want to remind everyone that Israel does not represent all the Jewish people around the world. Israel is a state and it alone is responsible for its own crimes.”

Why There’s No End in Sight For the Israel-Hamas War (Slate) One month has passed since the Israel-Hamas war began, and no end seems to be in sight. There are three reasons why. First, both sides have maximalist goals: Hamas, to wipe the state of Israel off the map; Israel, to destroy Hamas as a political force that rules Gaza and as a military force that can threaten Israel ever again. Neither goal is achievable. Israel isn’t going anywhere, and even if the Israeli army kills every Hamas commander, others will rise to take their place. Second, neither side’s leaders are inclined to compromise. Israelis view Hamas as an existential threat. Its Oct. 7 attack killed 1,400 people—more Jews killed in one day than at any time since the Holocaust. Hamas’ commanders, having achieved what they see as a glorious success, which has roused global support for Palestinians on a scale never before seen, may see the conflict as the last chance to strike a big blow. Third, only outside pressure can moderate the two combatants’ goals, much less stop the fighting, but there are limits on what outsiders can—or want to—do. The United States, which is fast becoming Israel’s only powerful ally, has held back Prime Minister Benjamin Netanyahu and his unity wartime Cabinet to some degree, but just some. Meanwhile, the neighboring Arab nations make grand declarations of support for Palestinians, but they aren’t doing very much to help them, and never have. Egypt has blockaded Gaza’s southern border as fervently, and for as long, as Israel has blockaded from the north. Its leaders have no interest in hosting Gazan refugees from Israel’s bombing. Neither do the rulers of Saudi Arabia, Lebanon, Jordan, or the others.

Chaos as Optus outage disconnects half of Australia (Reuters) For millions of Australians who could not pay for goods, book rides, get medical care or even make phone calls, a nine-hour near-total service blackout from the company which provides 40% of the country's internet became a lesson in the risks of a society that has moved almost entirely online. In the three years to 2022, Australian cash transactions halved to 16% as pandemic restrictions sped up a longer-term trend toward so-called contactless payments, according to the Reserve Bank of Australia. One-quarter of the country's doctor appointments are online or by phone, government data shows. Optus gave no explanation for the outage except to say it was investigating it. Most of its services were restored by the afternoon. Until then, even taking a walk became more difficult, at least for people who needed directions. "I'm looking for a bank, and when you can't go onto your phone and Google pretty much you are lost," said Angela Ican, a security officer in Sydney's central business district.

2 notes

·

View notes

Text

c.1900 Texas Handyman Special With Natural Woodwork and 1.07 Acres $125K

$125,000 Wrap your hear around this Texas handyman special with wrap-around porch and detached garage on a 1.07 -acre lot. Built around 1900, this home offers lovely natural woodwork, wainscoting, built-ins, four bedrooms, three baths. No central air and a space heater for heat. Zillow Comments Calling all investors! Over 3,000 square foot home sitting on over an acre city block. Much…

0 notes

Photo

Merrymount Colony

Merrymount Colony (1624-1630 CE) was a settlement first established in New England as Mount Wollaston in 1624 CE but renamed Mount Ma-re (referred to as Merrymount) in 1626 CE by the lawyer, writer, and colonist Thomas Morton (l. c. 1579-1647 CE), best-known, primarily, from his book New English Canaan (a treatise on the Native Americans of the region, natural history, and satiric critique of his colonist neighbors) and the work Of Plymouth Plantation by William Bradford (l. 1590-1657 CE), second governor of Plymouth Colony, in which he is referred to as the “heathen” who established a “school of Atheism” at Merrymount.

Unlike Plymouth Colony, or the later Massachusetts Bay Colony, Merrymount was more of a trade center than a residential/agricultural community but, owing to Morton's liberal attitude toward religion, and the rapport he developed with the Native Americans, became (according to Morton) more successful and popular than its neighbors. Morton encouraged a celebratory atmosphere and, in 1627 CE, had an 80-foot (24 m) tall Maypole erected in the town square and, declaring himself the community's host, welcomed colonists and Native Americans to a days-long festival.

Bradford sent his militia's commander Myles Standish (l. c. 1584-1656 CE) to arrest Morton in 1628 CE, and he was deported back to England. He returned in 1629 CE, however, and again took up residence at Merrymount until he was again arrested and deported and Merrymount burned in 1630 CE. The story of the colony is given in a number of 17th-century CE sources, including those by Morton, Bradford, and John Winthrop (l. c. 1588-1649 CE) of the Massachusetts Bay Colony. The site of Merrymount is now a residential development in Quincy, Massachusetts, but the memory of the settlement as a progressive alternative to the Puritan or separatist models is still celebrated there occasionally by admirers of Morton in the present day.

Mount Wollaston Becomes Merrymount

Morton was employed as a lawyer by the merchant and investor Sir Ferdinando Gorges (l. c. 1565-1647 CE) in 1622 CE, went on a reconnaissance mission for him to North America, returning in 1623 CE, and was then sent back in 1624 CE on an expedition, led by Captain Richard Wollaston (d. 1626 CE) and comprised of 30 indentured servants, to establish a permanent colony for trade some 40 miles (64 km) away from Plymouth Colony. Plymouth Colony had a profitable fur trade established with the Native Americans of the region by this time and, based on Bradford's work, seem to have taken little notice of the new colony, named Mount Wollaston, at first.

In 1626 CE, according to Bradford, Wollaston took some of the indentured servants to Jamestown and hired them out to others. He died at some point the same year and, also according to Bradford, Morton convinced the servants left at Mount Wollaston to rebel against the second-in-command Wollaston had left there (a man named Fitcher), and join him in a venture in which they would all share the profits equally. Once this was accomplished, Morton renamed the settlement Mount Ma-re (from the French mer for “sea” as it was near the coast but a play on “merry”), later known as Merrymount.

Continue reading...

16 notes

·

View notes

Text

Explore 1 or 2 Bedroom Apartments for Sale in Havelock Residences

Find Comfort and Convenience in 2 Bedroom Apartments for Sale in Havelock Residences

Finding a home that feels just right can be a journey, but if you’re considering 2 bedroom apartments for sale in Havelock Residences, you might be closer to the perfect match than you think. With a combination of modern living spaces, a convenient location, and a strong community atmosphere, Havelock Residences has become one of the most appealing choices for both homebuyers and property investors.

Whether you’re buying your first home, moving with family, or looking for a smart investment opportunity, this residential community offers a lot more than just four walls and a roof. Let’s take a closer look at what makes it such a great place to call home.

What Makes Havelock Residences Stand Out?

Havelock Residences offers a modern, balanced lifestyle in one of the city's most connected neighborhoods. Located near major transport routes, schools, shopping areas, and parks, this residential community gives you access to everything you need, without the daily hustle of inner-city living.

Each building in Havelock Residences has been thoughtfully designed with comfort, safety, and aesthetics in mind. Wide corridors, secure access points, and well-lit common areas create a welcoming atmosphere from the moment you step inside. Plus, the community has a mix of families, professionals, and retirees—giving it a warm, friendly vibe that’s hard to find elsewhere.

Why Choose 2 Bedroom Apartments for Sale in Havelock Residences?

2 bedroom apartments for sale in Havelock Residences offer generous space, functional layouts, and contemporary finishes. These homes are ideal for:

Small families who need room to grow

Couples who want a home office or guest room

Investors looking for high-demand rental units

Downsizers who don’t want to sacrifice space for convenience

The living spaces are open and airy, allowing for plenty of natural light. Bedrooms are placed for privacy, and kitchens often feature modern cabinetry, stone countertops, and high-quality appliances. Some units also include balconies, storage areas, or in-unit laundry—features that make everyday living more convenient.

Many buyers are especially drawn to the sense of flexibility these 2-bedroom homes offer. You can set up a home office, a nursery, or even rent out the second room for extra income. It's a layout that grows with you.

1 Bedroom Apartments for Sale in Havelock Residences: A Smart Choice for Singles and Couples

If you’re looking for a cozier space, 1 bedroom apartments for sale in Havelock Residences are another fantastic option. These units are perfect for single professionals, young couples, or even retirees looking for a low-maintenance lifestyle in a vibrant community.

Even though these apartments are more compact, they don’t feel cramped. Smart design ensures that every square foot is well-used. Most units feature open-plan living, modern kitchens, and comfortable bedrooms with built-in storage. Some even come with small balconies or patios—perfect for enjoying a morning coffee or relaxing in the evening.

Plus, if you’re considering a first step into property investment, a one-bedroom apartment is a great entry point. It requires a lower upfront investment while still offering strong rental potential in a sought-after area.

Community Features That Enhance Daily Life

One of the best things about living in Havelock Residences is the range of amenities available to residents. These shared features are thoughtfully designed to promote both comfort and a sense of community:

24/7 security and gated access for peace of mind

Fully equipped gyms and fitness centers

Swimming pools and recreational areas

Landscaped gardens and green spaces for relaxation

On-site property management and maintenance

Dedicated parking for residents and visitors

These amenities aren’t just about convenience—they also add real value to the property, especially for investors. Tenants are drawn to places that offer more than just a place to sleep. With Havelock Residences, you're offering a lifestyle, not just a home.

Ideal Location for Work, School, and Leisure

Location plays a big part in why Havelock Residences has become so popular. It’s close to major highways and public transport routes, which means commuting to work or school is easy. There are several schools, colleges, and daycare centers nearby—making it a family-friendly choice.

For shopping and entertainment, you’re just minutes away from malls, local markets, restaurants, and cinemas. You’ll also find parks and walking trails in the area, giving you plenty of options for weekend outings or evening walks.

Having so much nearby makes life easier and more enjoyable—whether you're raising a family or living independently.

Long-Term Investment Potential

From an investment point of view, 1 bedroom apartments for sale in Havelock Residences and 2 bedroom apartments for sale in Havelock Residences are both attractive options. As urban areas continue to grow and more people seek quality housing in well-connected neighborhoods, demand for properties like these is expected to stay strong.

In fact, the area surrounding Havelock Residences has already seen steady growth in property values over the past few years. Whether you plan to live in the apartment or rent it out, it’s likely to offer good returns over time. Rental yields are healthy, and occupancy rates are consistently high due to the location and amenities.

Work With Apex Avenue Realty LLC to Find Your Ideal Apartment

Navigating the real estate market can be tricky, but that’s where having the right team makes all the difference. Apex Avenue Realty LLC has years of experience in helping buyers and investors find the perfect match at Havelock Residences.

From your first inquiry to the final paperwork, Apex Avenue Realty LLC will walk you through every step with honesty, clarity, and local expertise. We understand that this is more than just a transaction—it’s about finding a home that fits your life, or an investment that secures your future.

Our agents are knowledgeable, approachable, and committed to helping you make informed decisions. Whether you’re buying for yourself or adding to your property portfolio, we’re here to make the process smooth and rewarding.

And when you're ready to take the next step, Apex Avenue Realty LLC will be right there to guide you home.

0 notes