#so we get the 70s oil crisis again ? ok

Note

Any candidate that opposes nuclear power is not serious about the environment

so let’s vote for the oil baron party ? the opposition is from the inefficiency. uranium mining ain’t the nicest on the environment ! do u know where MOST uranium is ???? [the global south]

#asked#anonymous#like yea … it’s efficient & safe when u just ship in the controlled product to ur alrdy working plant but …. we don’t have uranium ?????#so let’s look at the problems we’re seeing w lithium & cobalt & put all our eggs in the ‘we don’t have this resource but we’re going to rely#on it entirely’ basket#so we get the 70s oil crisis again ? ok#we do have it just not much

0 notes

Text

WIG REVIEW: WONDER WOMAN 1984

You guys! Now that the holidaze are over, I finally got around to watching the #1 most hated movie of the holiday season: Wonder Woman 1984! People have so many opinions about this movie AND NOW I DO TOO! I even have some thoughts on the wigs! Let’s discuss.

We begin in Themyscira, land of Amazons, fishtail braidology, Robin Wright, NO EFFING MEN, and also this weird Amazon gladiator gauntlet that is mainly brought to you by lots of computers. Baby Gal Gadot (nee Wonder Woman) is allowed to compete in this CGI decathalon despite being 1/3 the size and age of the other competitors and almost wins the damn thing but Auntie Robin Wright disqualifies her for trying to cheat to win. About 4 hours later, toward the end of this movie, Wonder Woman also tries to “cheat” at something so this is kinda sorta foreshadowing if you believe that the writers of this screenplay even had that forethought!

Moving ahead to 1984, this movie just gets SO 1984. Or really “1984″ in the Stranger Things sense, in that they even used the damn mall that that show takes place in and some dumb criminals steal some jewelry and Wonder Woman saves the day and also comically saves some kids who could have been hurt. I am still bitterly injured by Gal Gadot’s wig, which is not so bent and tangled as the first Wonder Woman movie. Still, the general texture and quality leave something to be desired AS DOES THIS WHOLE MOVIE BUT I AM GETTING AHEAD OF MYSELF!! Anyway, other than foiling crimes at malls, Gal Gadot mainly lives a sad single life in DC where she pines away for Chris Pine in her fabulous apartment, surrounded by an astonishing amount of photographs of her late boyfriend, given the fact that the pictures she has of him are from the 1910s when not everyone had a damn photo printer. Absent of course, is the photograph of her and her ragtag WWI buddies which is delivered to her at the end of the first Wonder Woman movie in the present day and therefore hasn’t happened yet and here begins and ends all logic in this movie.

Anyway! Gal Gadot works with Kristen Wiig, who does her fabulously awkward Kirsten Wiig thing as a nerdy scientist who is largely overlooked by all of society and who wears upsetting culottes and oversized sweatshirts and drinks Bartles and Jaymes (THIS MOVIE MISSES NO OPPORTUNITIES TO #80s). Her wig, as all wigs worn by Kristen Wiig in movies, is a horrible mess of bad texture and general bentness. Also, together she and Gal Gadot are sifting through the jewelry stolen by those thieves at the mall and there is one particular giant crystal or whatever that seems to possess magical properties. Yes, like the Infinity Stones that came (and then kept coming!) AND YES I REALIZE THAT THAT IS MCU AND THIS IS DC BUT IT DOESN’T MATTER: EVERY GODDAMNED SUPERHERO MOVIE IS SOMEHOW ABOUT HAUNTED JEWELRY.

Enter Pedro Pascal in the most outrageous 80s wig in honestly the most outrageous 80s role. He essentially plays Donald Trump - a start-up conning people out of money who is also a terrible dad and has terrible hair. I really wondered for much of this movie if this wig was supposed to be a wig, because it looks as fake and wig-like as Trump’s hair, but no - I think this is supposed to be real hair! Truly truly truly outrageous. Anyway, dude basically doesn’t want to work hard to get rich (again, much like Trump!) and instead wants to just wish his way into success via this dream crystal that Gal Gadot and Kristen Wiig have.

OH AND THEY ALREADY WISHED ON THE CRYSTAL! Kristen Wiig wishes to be like Gal Gadot (not realizing that she’s actually wishing to be Wonder Woman) and gets the most outrageous makeover into this bleached blonde nightmare. AND EVERYONE IS JUST LIKE WOW YOU’RE NOT WEARING CULOTTES ANYMORE I GUESS THIS IS NORMAL FOR YOU TO SUDDENLY LOOK THIS WAY AND FOR YOUR HAIR TO INEXPLICABLY BE INCHES LONGER IN THE COURSE OF AN AFTERNOON. Also! Although this bleached blonde wig is maybe an upgrade from her mousy wig from before, that really means nothing as both wigs are garbage.

Gal Gadot’s wish, of course, was for her ain’ true love, Chris Pine, to come back. AND THEN HE DOES! SORTA! Despite being definitely exploded in a plane in 1918 (in the first movie - spoiler?), he just kinda walks into this fancy party like “hey what’s up?” OH EXCEPT FOR ONE SMALL THING.

HE LOOKS LIKE THIS DUDE TO EVERYONE ELSE EXCEPT GAL GADOT. Ok? I guess because Chris Pine’s actual physical body was destroyed in 1918, he has to inhabit the body of this random man credited only as ‘Handsome Man’ in 1984 which really begs the question - what then happens to this handsome dude while Chris Pine shapeshifts into him and does anyone care? ALSO! Plot-wise, this is just the tip of the iceberg in crystal wishes - basically everyone on earth gets a wish before film’s end and all are fulfilled no matter how ludicrous - and yet no other wish seem to have these sort of strings attached EXCEPT FOR WONDER WOMAN! WHY DOES ONLY WONDER WOMAN GET THE PET SEMATARY OF WISHES?!?!?!

Anyway! Lucky for us all, ‘Handsome Man’ has the most 80s closet ever! As we all know, movies set in the 80s are contractually obligated to provide us with a very 80s fashion montage and this one is ALL ABOUT CHRIS PINE. Somehow, ‘Handsome Man’ owns like 10 different fanny packs?!?! Every single 80s menswear disaster is covered here at least three times you guys.

About 3 hours later, he settles on this outfit! Mazel! I’d like to pause this review to now give my definitive breakdown of CHRIS rankings (limited only to the 4 young-ish, blonde-ish Chris actors who appear in superhero movies) so that I might now abbreviate Chris Pine to #2 Chris WHICH HE IS. Ahem:

- BEST CHRIS is obviously CHRIS EVANS. This is because he gets into Twitter wars with racists, he offered his arm of support to Regina King when she stumbled getting her Oscar, and he wears the shit out of a sweater. There are many other reasons also but no other Chris can compare - HE IS BEST CHRIS.

- WORST CHRIS is obviously CHRIS PRATT. This is because he is super Jesusy evangelical and also anti-LGBTQ and married a Schwarzenegger (tho Arnold wishes he was Evans too!). There are many other reasons why but those are the most important reasons. WORST CHRIS.

- #2 CHRIS is a constant battle between CHRIS HEMSWORTH AND CHRIS PINE. Hemsworth is very funny in the lady Ghostbusters, was once on Dancing With The Stars in Australia, and can really commit to a fatsuit. Pine is great at singing on a Wet Hot American Summer roof OR a river, loves caftans, and is loved by the one and only Wonder Woman. It’s an infinity tie between these two and therefore #2 Chris is in the eye of the beholder during whatever you are beholding, and currently we’re beholding Pine. #2 CHRIS!

Yes, this lengthy roundup was definitely worth it so that I can abbreviate Chris Pine to #2 Chris now. Moving on!

So Gal Gadot and #2 Chris walk through a very 80s DC while #2 Chris’s mind gets blown by all the stuff that is different in the 70s years he’s been dead. No 80s movie would be complete without of course covering PUNKS!!! This is where this movie definitely lost my husband because one of these punks is wearing a Cro-Mags shirt from an album THAT CAME OUT IN 1986. This offends me, also, not because I care about that band but because this is lazy costuming! Apparently, my husband was not the only one to notice this and become deeply offended - and Cro-Mags cofounder even chimed in to say that this is all ok because they released a demo for the ‘86 album in 1984 (AND WE ALL KNOW EVERYONE DEFINITELY MAKES SHIRTS BASED ON DEMO ALBUMS?) I still find this lazy and stupid costuming and remain annoyed! ANYWAY!

Back to the “plot”...Kristen Wiig and Pedro Pascal’s confederacy of bad wigs kinda sorta hook up at this dumb party so that Pedro Pascal can steal that very important wishing crystal! AND THEN HE WISHES ON THE CRYSTAL THAT HE CAN BE THE CRYSTAL. Haunted jewelry plots have never been so dumb as this you guys! AND ALL OF THE INFINITY STONES MOVIES WERE INFINITELY STUPID SO THIS IS REALLY SAYING SOMETHING.

So basically, after 70 years apart, Gal Gadot and #2 Chris have no more time to waste on fanny pack fashion shows or questionable metro punks and have to follow Pedro Pascal to Egypt, where he has gone to demand some oil from Egypt now that he is the physical manifestation of a wishing crystal. In order to get to Egypt themselves, Gal and #2 Chris steal a plane from the Smithsonian (which apparently just has some jets laying around some random tarmac) and then Gal WISHES THE JET INTO BEING INVISIBLE! This is obviously to fuel Wonder Woman invisible jet nostalgia and also to waste about 45 minutes on shots of them invisibly flying through fireworks. BECAUSE IT’S THE 4TH OF JULY WAIT HOW DID THEY VISIT ANY MUSEUMS OR DO ANYTHING ON A NATIONAL HOLIDAY EARLIER THAT DAY OH RIGHT THERE IS NO LOGIC IN THIS MOVIE. Over in Egypt, the wishing crystal Pedro Pascal hisself somehow creates a water shortage and refugee crisis in Egypt and Gal has to Wonder Woman some kids to safety, but mainly she wears this amazing jumpsuit and is able to find a working payphone to call Kristen Wiig and ask if she has any intel on that damn wishing crystal.

Kristen Wiig is somehow EVEN MORE BLONDE AND WEARING THIS DAMN COAT. I mean...you guys. WHAT. Like any good 80s thriller, Kristen Wiig researched the wishing crystal on microfiche which leads her to a random record store where she meets up with Gal and #2 Chris who I guess flew the invisijet back to DC from Egypt in a few minutes or something. Anyway, rando dude at the record store takes out some musty old book that has all the wishing crystal information everyone needed and basically warns that it can destroy society AND ALSO it can take things away from the wisher like a damn monkey’s paw. SPEAKING OF MONKEYS THAT COAT THE END.

But Kristen Wiig’s makeover is far from over! She finally appears as Cheetah herself at the damn White House, where the wishing crystal Pedro Pascal is asking a fake Ronald Reagan (?) if he can please satellite everyone on the earth so he can grow stronger as a crystal person OR SOMETHING? Anyway, Kristen’s lewk is very “punk” but not in a Cro-Mag way, but more in a Meryl Streep in Ricki and the Flash way? It’s a battle of not great wigs, at any rate. Kristen doesn’t want anyone harming her wishing crystal Pedro since that’s what made her Cheetah so there is this huge dumb fight where Pedro and Kristen just kinda glide away (not unlike actual Trump and his idiots last week and omg did this movie foretell that) and then Gal realizes that she has to denounce her wish because the monkey paw’s clause of it all is making her not powerful enough to fight anymore. So #2 Chris is like: I should just be dead anyway and my whole existence is very Pet Sematary and everyone kind of cries in an alley and #2 Chris dies again (?) Also! I think this is supposed to have been foretold by that earlier scene with baby Gal Gadot trying to cheat at that decathalon or whatever because you can’t cheat....death??? Regardless, Gal jumps into the sky and somehow is ABLE TO FLY BASED ON AERODYNAMIC FACTS #2 CHRIS GAVE HER WHILE FLYING AN INVISIJET? SURE!

Over in another plane, Pedro and Kristen are on their way to some satellite island to broadcast to the world about crystal wishes and dude is not looking so great because wishing that you are a crystal is a terrible idea. This is the point at which I realized that this wig was supposed to be real hair because it looks so sweaty and shitty but has consistently looked like a shitty wig through this entire “plot.” Anyway! He asks Kristen Wiig if she wants another wish which....huh? Somehow Gal Gadot’s wish ended up a Pet Sematary nightmare of possessed handsome man bodies that she had to renounce but Kristen Wiig gets two wishes? SURE! AND KRISTEN WIIG WISHES THAT SHE BECOME THE “ULTIMATE PREDATOR” WHAT ON EARTH IS THIS MOVIE Y’ALL.

APPARENTLY THIS IS WHAT AN ULTIMATE PREDATOR LOOKS LIKE?!?!?! YOU GUYS. In order to literally become a Cheetah, they gave Kristen Wiig a CGI body and....kabuki makeup? This lewk absolutely looks like a mashup between two dueling community theater productions of Cats and Pacific Overtures and I can’t stop laughing.

Meanwhile, Gal finally gets to rock this lewk which was earlier described as the battle armor of the goddess, Asteria, who was the one chick NOT invited to Themyscira for Amazonian fishtail braidology times, and had to stay behind to FIGHT EVERY MAN ON EARTH but did get this sweet armor out of it?!?! Regardless, despite withstanding all men ever, Cheetah somehow effs up this armor in a matter of seconds, but Gal is still able to defeat her through underwater electrocution (which somehow avoids Gal herself even though SHE’S WEARING AN ENTIRE SUIT OF METAL).

Anyway, in the end, the entire world is on the brink of collapse and eveyone is looking at old dumb 80s tv screens because of all the dumb wishes everyone made and I guess I appreciate the fact that this entire movie is about dumb 80s wish fulfillment but also there are so many plotholes that I can’t even, you guys. Gal somehow lassoes Pedro Pascal into remembering his shitty dad and realizes that he is now a shitty dad and everyone somehow renounces their wishes and Pedor Pascal just kind of WALKS OFF AN ISLAND INTO THE DEBRIS OF DC AND FINDS HIS CHILD BY THE SIDE OF THE ROAD?!?!?!?! It’s really annoying that this movie somehow rewards this shitty dad but also doesn’t let a woman (specifically WONDER WOMAN) have both a love life and her own damn job and I’m not alone in being annoyed by that. ANYWAY, days or weeks after the entire world almost ended, there is somehow a cute Christmas carnival that was definitely a stolen set from Dolly Parton’s Christmas in the Square where Gal Gadot is reunited with ‘Handsome Man’ who has no knowledge of previously being possessed by #2 Chris and is still rocking ALL THIS 80s FASHION and then a star shaped balloon is released into the sky and I wonder if this entire movie has been a Macy’s ad.

BUT WAIT THERE’S MORE! In a mid-credits scene which is also maybe the only watchable part of this movie, the goddess Asteria (and OG owner of that gold body armor) is revealed to be alive and well and played by OG Wonder Woman, LYNDA EFFING CARTER!! She is definitely an actual goddess who never ages and whose hair is way better than any wigs on display at any point in this movie and is also the only part of the movie you should watch. THE END.

VERDICT: DOESN’T WURQ

#wonderwoman84#ww84#wigwurq#galgadot#chrispine#2chris#chrisrankings#kirstenwiig#cheetah#punks#THE80S#contractualfashionmontages#pedropascal#hauntedjewelry#lyndacarter

10 notes

·

View notes

Text

Can someone check the GFCI?

When a circuit breaker snaps, it’s because the circuit was beginning to heat beyond design capacity and it’s shutting down to prevent something worse from happening, like fire or damage to a sensitive circuit or device.

It’s a safety device, and we all know how much I love safety devices, but at the end of the day if you don’t take action when a safety device activates, generally the damage can be much worse than what the device was actually protecting.

Folks, our owners have decided that it’s going to be much easier to control the world if they only have to do it from one government, and if you still think this is a conspiracy theory, you need to turn off CNN and step outside your basement. Even the dimwit in Ottawa can no longer keep the secret of where those in lofty chambers have decided we are going, although I sincerely doubt he understands the repercussions, just like 98% of the population. It’s not their fault, they are wired in such a way they can’t see the truth, either by design or programming.

Doesn’t matter which it is (blue dress/brown dress), the damage to our population has started and we don’t have the collective will to stop it, because we’ve been conditioned to be victims. Correction. Most have been conditioned over the past two decades to be victims, to be at the mercy of big government and those who know better than you do.

I’ve a friend who explains it perfectly. He says that most people cannot see past the end of any given month. It’s not a derogatory thing, it’s just who they are. These are the people who live paycheck to paycheck, who don’t plan for the future because they are just trying to stay alive. They work hard to keep up, but are consumed by just trying to cope with what life throws at them. These are the majority of people on this planet. Not a bad thing, but these are the type of people easily controlled by fear.

The next group are the people who can see 6 to 12 months, and they understand cause and effect better than the first group. They understand that payday loans are bad and that you should control your destiny through planning. These are the type of people who run our governments and provide services. They see the benefits to organized approaches to problems and find safety in numbers of like minded people.

The last group, the smallest one are those who can see 3 to 5 years down the road. These are the visionaries, people like Edison and Orwell, Tesla and Rand. These are the Elon Musks and Bill Gates of the world. They drive humanity through aspiration and ambition.

Unfortunately they aren’t always right, for example I would consider Karl Marx to one of the latter.

So why am I talking about Karl Marx and circuit breakers you ask?

Well it’s because my tin foil hat is on too tight, or because I’m not quite right in the head I guess, or any other of the labels those who can’t see past the end of the month would paste to someone like me who likes to think a bit more long term than the end of the next season of the Kardasians.

Shutting down the world for a bad flu wasn’t a decision based in science. It’s not even a decision based in safety, and believe me I know a thing or two about that. The whole “nobody moves, nobody gets hurt” thing really doesn’t work for long. Sure, nobody gets hurt, but no body eats either. This is what your average person isn’t thinking about when they scream “stay the blazes home”.

Yes, you can stay the blazes home. Yes, you can cower under your bed until the bad thing passes, but at the end of the day the Magic Pantry was just a kids TV show.

Dude’s gotta eat, right?

I’m currently living inside the “Atlantic Bubble”, or whatever is left of it after those anointed in oil decided to take their toys and go home, but in reality we’ve created an interesting paradigm here on the east coast of Canada that’s unlike anywhere else in the world.

We’ve created the perfect culture of fear.

Now for those living outside the bubble, we’ve shut the door, turned off the lights and posted a big “FUCK OFF” sign on the front lawn. We’ve turned our back to the virus like it’s a Trump supporter. This is our plan. We’ve posted guards, created intricate rules around who can go where and why, and basically made it impossible to move anywhere without government permission. All over a bad flu with a survivalbility rate of over 99.4%, with 70%+ of the mortality coming from those 70 years of age and older. You are more likely to die from an automobile accident today than COVID.

Don’t get me wrong, COVID is no cake walk, it’s a nasty disease, but it’s not Ebola. I’ve been battling this virus now for 11 months, I’ve seen how it works, it’s veracity is substantial, and if you have co-morbidities such as diabetes or heart disease, it can take a toll on you, and yes, more people are dying from it than the seasonal flu, but at the end of the day it’s not going to wipe out the human race. The majority of the people who test positive don’t even know they have it.

And don’t get me started on testing.

I can’t talk publicly about it but if you see me out and about, ask me why I think testing is a control and not a diagnostic element. Sorry, the hat’s tightening.

Let me throw one example out for you to chew on, let’s say vaccines. Now the vaccines are the panacea for the masses right? I mean we should be amazed we were able to concoct a vaccine that is 95% effective in eradicating this virus inside 8 to 10 months, hell, we should be ecstatic, right? I mean it took 30+ years to get a handle on AIDS and we beat COVID in just 240 days. We currently linbe up to get an annual flu shot to protect us from the last major Coronavirus (Remember the Spanish Flu?) that has been in development for the last 60 years and it’s still only 35-40% effective, and less than 50% of Canadians get it

We must be freaking geniuses now.

I’ll never understand the sheer amount of dumb optimism that’s out there, but I certainly appreciate it. Without that optimism we’d be more like Lemmings than we currently are.

But back to the “great reset”, shall we?

So dude’s gotta eat, right? I’m going to quote one of my modern day heros, Elon Musk when he says “If people wants stuff, they have to make it” or something along those lines. In other words, there’s no money tree. My parents very early on taught me that lesson, and that if I wanted anything in life I had to earn it or make it, that there was no such thing as a free meal. The problem is most people today have been conditioned to think there is. Trudeau has been giving away our money like a drunken sailor on shore leave to the tune of $400 BILLION dollars in 8 months. Let me put it another way, in the last 240 days Trudeau has spent $10,814.00 per Canadian citizen, or around $25K per taxpayer. That’s debt folks, that’s directly on the shoulders of every Canadian. But it’s ok they say because interest rates are so low we can afford the additional leverage.

Problem is folks is interest rates don’t stay low after a major crisis. Why? It’s called inflation. As money supply loosens, so does the value of a dollar, and when the value of a dollar decreases because there’s more supply of dollars then prices increase. When prices start increasing wages need to go up to keep pace with inflation, and when that happens there are two options. Control monetary supply, otr deal with runaway inflation.

How do you control inflation you ask? Great question. You raise interest rates to throttle spending.

How can anyone forget the late 1970’s? It was less than 50 years ago folks. Remember Trudeau’s 6 & 5? Anyone? Bueller? Bueller? JUSTIN? For fuck sakes the kid was living at 22 Sussex drive when his father created the greatest economic challenge of our lifetime.

Wait, check that. Apparently the second wave will be worse than the first.

This great reset is gong to be tragic. Already they are estimating over 100 Million people in 3rd world countries will die next year due to disease and starvation because of the lock downs. In our own western countries the most disadvantages are already our most vunerable populations. Humans aren’t meant to be caged, nor can we afford to be. We need to be free, have purpose, and contribute to a vibrant society.

You can’t govern that. You can’t rule over a captive society for long. History has shown us that time and time again that King’s aren’t benevolent rulers and those who suffer the most are at the bottom the societal ladder.

If you aren’t seeing the end goal yet, I get it, but I do. You only need look as far as the ice cream eating elite who enjoy fine dining when your cupboard is near empty and jet off to Mexico while telling you can’t bury your spouse or child. They make you endure cruel mental anguish while they spend your tax dollars on jet setting and pontificating about a communist world that they rule.

All in the name of a better world, one free of climate change and racism.

Who knows, maybe they are right, maybe they are part of the component of society that sees the future more clearly than the rest of us.

I guess that’s why they get ice cream and can go spend Thanksgiving with their moms while you can’t bury yours.

I guess that’s just our lot in life, to be ruled, to understand it’s for thee, but not for me.

This what we want? This what we deserve? Am I wrong?

I don’t think I am, I just want to be. Can someone go downstairs and check the fuse?

Jim Out

1 note

·

View note

Text

I love Tumblr. Far more than Facebook, which has become a seething morass of political partisanship, and while I’m all about seething partisanship when it’s discussed by people willing to engage their intellects, I’m less so when “debate” means posting memes and gifs which are, let’s be honest, the electronic equivalent of saying “nanny nanny boo boo”.

Anyway… Tumblr. You can, to some degree, control your content. If you are, like I am, mildly (*snort*) obsessed with a certain tall, lanky, Scottish actor, you can find like-minded individuals and follow them and bask in his glory to your heart’s content. Likewise, you can follow fandoms based on television shows and movies and plays and music… and you get my point. You’re all here so, of course, you do.

And, if you are interested in things like politics or social issues or the environment or science or all of the above (and more), that content is also readily available on Tumblr.

Generally speaking, I find the folks on Tumblr to be considerably more relaxed and open and accepting than on Facebook. I attribute that, for the most part, to the members being mostly younger. I’m a great believer in young people. The future belongs to them and I am, present circumstances notwithstanding, mostly optimistic about the future.

I’m a Boomer. I was born eleven years after the end of WWII. (Good Lord, I feel old!) There were no twenty-four-hour television or radio stations, and the internet wasn’t even conceived of, even by the most forward thinkers. Doctors still made housecalls as a matter of course. Milk was still delivered to your door every morning. The polio vaccine was still being tested. Putting a man on the moon was a science fiction fantasy.

As a generation, we “Boomers” were guilty of a lot of things, beginning with not quickly enough shedding some of the baggage from the generation before us. We were still largely segregated and we are paying the price still and we will until - I don’t know how long and that disturbs me more than I can say. We were too quick to distrust the other - just ask the immigrants that came to these shores during and after the War. There was a dear older lady in my church when I was in high school. A kinder, more charitable, more joyful woman you could never hope to meet. She was a German war bride - met an American soldier and they fell in love and married and he brought her home to his small, south Georgia hometown. Their first decade was tough - folks were slow to forget and she was sometimes ostracized. Even when I knew her, people would sometimes refer to her (in lowered tones) as Leroy’s German frau.

We were abysmal when it came to the environment. I mean, look at the cars we drove in the sixties and seventies before the oil crisis forced a turn toward economy cars. Gasoline was $.37 a gallon - and that was hi-test! What did it matter that my mother’s 1971 Mercury Grand Marquis land yacht only got 11 miles to the gallon? Gender equality? Seriously? Gender Identity?!?!? How you came out of the womb is what you were. Period. And if your family had that special uncle or the aunt with a Very Close Friend, well, it just wasn’t talked about, was it…

On the other hand, there were things we did do. That social conscience that drives our society today? You can thank those who loudly and visibly protested the Vietnam War for a lot of it. Sure, there were anti-war movements always, but the Vietnam War lit a fire that, with the availability of news cameras and microphones and news cycles, burned hot and bright until the last helicopter departed the US Embassy in Saigon on April 30, 1975. And when the war was over, there were plenty of other things to get riled up about: the environment, women’s rights, the right to choose, civil rights, gay rights. Anger over things that are wrong today didn’t just start in the 2000s. A lot of us - and I mean a lot! - have been pissed off for a while.

Putting a man on the moon belongs to the generation before the Boomers, obviously, but the drive to continue space exploration - the space shuttle, the probes that are still sailing toward places beyond our solar system, the International Space Station, the Hubble telescope - belong to us. Medical advances? Advances in diabetic screening and treatment, the MRI, treatment of HIV/AIDS… Cancer research was largely theoretical until the ‘70s. The idea of DNA re-sequencing as a therapeutic treatment? Late ‘70’s.

And as for culture? My generation embraced the idea of embracing the accoutrements of other cultures. Clothing, jewelry, hairstyles, music, food… we were all about it. I see people commenting on “cultural appropriation” as if it’s a bad thing. We - my generation - considered it to be a tangible form of acceptance.

(As an aside, I have a dear friend who is battling uterine cancer. She has lost all of her hair due to chemotherapy. On one of her “good days”, she and her family took in an Indian (the country) festival and, while she was there, saw an artist creating henna tattoos. On impulse, she asked the woman to create one for her scalp. It was a masterpiece, absolutely glorious, and it gave my friend so much of her joy back. For the first time, she was proud to show herself without a wig or scarf. I think if I’d heard anyone say anything about “cultural appropriation”, I would have punched them in the mouth.)

My point to this ramble is this. Lately, I’ve been seeing anti-Boomer things on Tumblr. Boomers are rude. Boomers are backward. Boomers are outdated. And while I get that it’s just a thing for generations to complain about each other, it’s the absolutism that I see that bothers me. When I was young and dealing with my parents’ generation, I didn’t consign the whole kit and kaboodle to the Dark Ages. And, from my viewpoint as an older person, I don’t heave a great sigh and clutch my pearls over the entirety of the Gen X'ers, the Millennials (raised one!), or the Gen Z'ers. I may get annoyed with one or two individuals and have a sudden urge to shake my cane and yell “get off my lawn, whippersnapper!” but I manage to contain myself. (There was the young man in the electronics department at WalMart who, in his most condescending manner, asked me if I knew what a USB port was. I wanted to tell him that I’d been working with computers since before his father first bought his mother a malt at the chocolate shoppe. Instead, I just gave him The Look™ and he mumbled an apology.)

Absolutism about anything is corrosive. I mean, think about it. It lies at the heart of so many of the evils that are tearing at us now. It feeds the desire to hate all of the “other” because of a crime perpetrated by one or a few. Wars result from this kind of thinking. Down through history, you see it. And it’s so much more easily spread now with social media. Again, I would abandon FB altogether - except that it’s how I keep up with the folks back home - because it’s become a political, partisan, largely unintelligent cesspool. All because those on the Left believe that those on the Right are the Minions of Satan and those on the Right think that those on the Left are Bloodsucking Snowflakes. And, of course, they don’t all think that, but it’s so easy to click a “Like” or a “Share” without really thinking about the message they are sending, and before you know it things are out of control and we’ve put a dictator wannabe in the bloody Oval Office!

(Sorry. I’m still upset.)

There are those who ask why boomers are offended. I mean, “ok boomer” is just a joke, right? Well, yeah, but that same reasoning has been applied to how many derogatory labels. (I read one comment that “Boomer” isn’t an ageist slur. Except it kinda is, y'know?) And, again, it spreads and it gets blown out of proportion and there are those who are just ready to jump on a bandwagon - any bandwagon! - and the next thing you know, it’s trending on Twitter and we’ve got one more thing to get mad about that shouldn’t be anything at all because there are so many other things that we really should be mad about and trying to do something about…

Do you get my point?

If someone of any generation gets on your last good nerve, by all means, express yourself. (Short of violence, obviously.) But ease up on projecting the “they’re all bad" mentality. It isn’t true. It doesn’t make anything easier. And we’re all better than that.

Aren’t we?

13 notes

·

View notes

Text

Raise Your Voice.

I wasn’t originally going to be writing on this but with the general election drawing ever closer I felt it wouldn’t be right for me to stay silent. Now, don’t fret, I am not going to tell you who to vote for but I have a few things that I need to say and I hope you might listen.

The news will tell you that this is the Brexit election. I know that you’re most likely sick of hearing about Brexit. I am too. I uprooted myself to another country to get away from Brexit and to try and ensure I have roots in Europe before our government tries to drag us out. I don’t want it to be easy for me to be dragged out. Luckily, I think Europe is much more accepting of EU citizens making their homes where ever they roam, so I don’t think I will be asked to leave any time soon. Besides, I have my carte vitale and I am taxed like any other French national, so right now I feel safe in the system.

But let’s look back towards the UK. Unless you’re living under a rock you’ll know that there has been extreme floods in Yorkshire, caused by The River Don’s banks bursting on November 8th. People have been evacuated, have lost their homes and lost their lives. If you needed a sign to say climate change is coming... well we’ve already had many of them.

Exploring sustainability and how the world is affected by climate change has sometimes left me feeling heartbroken and useless. It seems like wildfires have taken over the world and oil spills are killing our marine life. Indigenous people and those who contribute the least to climate change are the most affected. The Amazon is still on fire. Vital forests in Africa are on fire. California is affected by wildfire. So is Australia. If you want a visual of just how many fires are currently raging across the world, head to Global Forest Watch. It’s shocking. Now we know that some of these, especially the fires in the Amazon, can be man made. The Amazon is being cleared for farming, and Bolsanaro gave the ok for people to go in and burn it down, but that doesn’t mean that climate change isn’t helping speed up the process.

And remember from my first few posts, 100 of fossil fuel companies are responsible for 70% of global emissions. So yes I will continue to do my best, donate to charities that need it and live as sustainable as possible, but the big companies are the people who need to change. So how can we encourage that change?

By voting.

In this election we need to see a party come to power that will commit to the climate crisis. We need a Green New Deal. We need to see an end to fracking. We need to see renewables become the new normal with our homes, offices and schools being powered by solar, wind or water, not nuclear or coal. We need to see stricter laws imposed on fast fashion companies so that they can’t burn old stock or send it to landfill. We need a circular economy, where everything is used. We need a plastic bottle scheme like the one in Norway, or a plastic tax to stop companies from mindlessly packaging things (like fruit and veg, does that really need to be in plastic? Waitrose doesn’t think so, and are on their way a plastic free future). We need a frequent flier tax. We don’t need more runways.

Essentially, we need a government who will hold big corporations to account. And while I’m not going to tell you who do vote for I will say this, do you think our current government is committed to the climate crisis? Maybe you think they’re doing enough because they’ve issued some small changes and put a temporary pause on fracking? Think again.

The deadline to register to vote is November 26th. That’s just over a week away. The election is on December the 12th. Really look into each party and their manifestos. What are they saying online? What are their core values? Are they sharing their beliefs, or trying to distract you by tearing into the opposition? Are they green-washing you into thinking they care about the future of the planet while secretly making deals with fossil fuel companies behind closed doors?

(As a side note, don’t take everything the papers or the BBC says as gospel either. Fiona Bruce recently stated that Vote Leave had never broken electoral law on an episode of BBCQT... says it all really.)

Go forth my friends, do your research and most importantly, register to vote! (Click here to be taken straight to the GOV.UK page) The next government will be decided by those who turn up on election day. Make sure you turn up.

Until next time,

The Sustainable Swap.

#The Sustainable Swap#Sustainability#Sustainable blog#Sustainable blogger#Register to vote#raise your voice#general election#UK general election#Labour#Liberal Democrat#Green Party#Climate change#The Climate Election#The Brexit Election#wildfire#oil spill#amazon rainforest#california wildfires#australia wildfires#yorkshire floods#United Kingdom

1 note

·

View note

Text

Who Is Better For The Economy Democrats Or Republicans

New Post has been published on https://www.patriotsnet.com/who-is-better-for-the-economy-democrats-or-republicans/

Who Is Better For The Economy Democrats Or Republicans

Which Party Is Better For The Economy

Republicans or Democrats: Who is better for the economy?

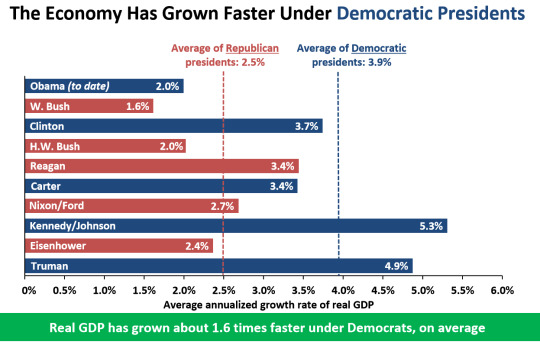

Princeton University economists Alan Binder and Mark Watson argue the U.S. economy has grown faster when the president is a Democrat rather than a Republican. “The U.S. economy not only grows faster, according to real GDP and other measures, during Democratic versus Republican presidencies, it also produces more jobs, lowers the unemployment rate, generates higher corporate profits and investment, and turns in higher stock market returns,” they write.

However, rather than chalking up the performance difference to how each party manages monetary or fiscal policy, Binder and Watson said Democratic presidencies had benefitted from “more benign oil shocks, superior performance, a more favorable international environment, and perhaps more optimistic consumer expectations about the near-term future.”

Us Jobs Income Gdp Growth ‘startlingly’ Higher Under Democratic Presidents: Analysis

Nearly all major U.S. economic indicatorsincluding income, productivity, stock prices, jobs and gross domestic product show growth under Democratic Party presidents, reflecting a “startlingly large” gap compared to when Republicans are in the White House.

New analysis and economic research seeks answers for why all six presidents who presided over the fastest periods of U.S. job growth were Democrats, while recent Republicans including both Bushes and Donald Trump saw the least expansion. A New York Times analysis released Tuesday, which draws from vast research, asks the question, “Why has the U.S. economy fared so much better under Democratic presidents than Republicans?” The authors noted that GOP presidents in the past several decades have run up larger deficits than Democrats and party control of Congress has shown minimal impact on growth.

Some economists remain unsure about pinpointing exact factors. But the analysis concludes that Democrats have been more pragmatic and “more willing to heed economic and historical lessons” about strengthening economies, while Republicans have clung to “magical” tax cut and deregulation theories in times of crisis.

As Newsweekpreviously reported, U.S. counties won by Biden in the 2020 election make up a 70 percent majority of all U.S. economic output. Trump counties composed just 29 percent of output and included only six of the country’s top 100 most powerful local economy centers.

Us Real Stock Market Performance: Republican Vs Democratic Presidents

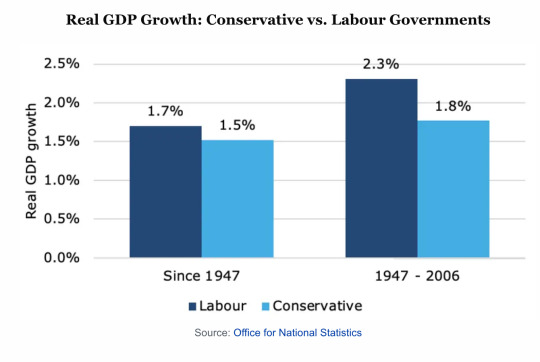

But this is just the picture in the US. Does the same dynamic apply in other nations with similar left-right two-party systems?

In the UK, the appeal of the Conservatives is based in large measure on the premise that they are better stewards of the markets and economy. And the UK prime minister should have an easier time enacting their policies than an American president whose party may not control one or both houses of Congress.

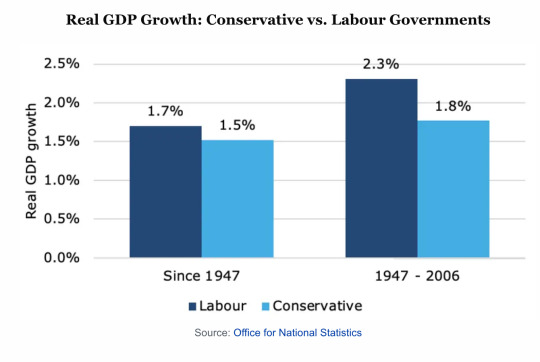

If we look at the data we find that economic growth has been stronger under Labour than Conservative governments. And again, if we filter out the last two economic crises and end our sample period in 2006, Labours outperformance gap only increases.

You May Like: What Did Republicans Gain From The Compromise Of 1877?

Which Political Party Is Really Better For The Us Economy

WASHINGTON ;It seems every four years in the United States it boils down to one question for voters: hows the economy doing? Even during COVID-19, the pandemics impact on jobs and finances remains a major issue, according to a recent poll. So when it comes to Democrats and Republicans, which political party handles the economy better? A new study finds it may actually be better for Americans when both parties hold power.

Analysts at WalletHub have released their review of how the U.S. economy has fared since 1950 under both parties. Looking at times where one side controls the White House and Congress and times where the government was split, analysts find the best scenario for economy emerges when a Democrat is President, but Republicans control Congress.

The study looks at several key factors including the state of the stock market, unemployment, the national debt, home and gas prices, and even the level of income equality across America. Researchers also examined how each administration since Dwight D. Eisenhower has affected the nations fortunes.

Everyone Does Better When The Presidents A Democrat

The numbers dont lie. The question is why every Democrat isnt talking about this all the time.

Our two political parties have certain identities that are seared into our collective public brain. Democrats: the party of workers, of civil rights, of compassion and fairness, and of higher taxes and more regulation. Republicans: party of the rich, big business , the free market, and lower taxes and less regulation.

And because the GOP is the party of big business, it is universally assumed that Republicans are better at handling the economy. Polls typically find that people trust Democrats more on all the things that government does, which stands to reason, but trust Republicans more on handling the economy. Just last week I saw a poll in which respondents rated Biden as better equipped than Trump to handle race relations, the virus response, and two or three other things; but on the economy, Trump bested Biden 51-46.

Its hard wired, and its wrong. Dead wrong.

Simon Rosenberg heads NDN, a liberal think tank and advocacy organization. He has spent years advising Democrats, presidents included, on how to talk about economic matters. Not long ago, he put together a little PowerPoint deck. It is fascinating. You need to know about it. The entire country needs to know about it.;

The deck consists of about 15 slides, but Ill walk you through just six so you get the idea. Lets start with job creation under each president:

Democrats, you have a great story to tell. Go tell it.;;;

Also Check: Trump 1998 People Magazine Interview

Why Does The Us Economy Perform Better Under Democrats Than Republicans

Since Carter, no Democratic President has had a recession begin on their watch. At the same time, no Republican President including the single term Presidents has gotten through their time in the White House without a recession.

Despite the widely held belief that Republicans are better at managing the economy than Democrats, the history of the United States economy tells a different story. In nearly every metric one might use to measure performance, Democratic presidents have presided over greater economic growth.

Strikingly, this is not even by a slight margin. According to a paper published in 2013 by Princeton economists Alan Blinder and Mark Watson, the performance gap is startlingly large so much so that it strains credulity, given how little influence over the economy most economists assign to the President of the United States.

The pair suggests that this is not due to time sensitive matters or partisan fiscal or monetary policy. Instead, they attribute this gap in large part to benign oil shocks, superior TFP performance, and more optimistic consumer expectations.

In short, they chalk it up to one part luck, another part self-fulfilling prophecy whereby consumers anticipate the economy will flourish under a Democratic leader and then drive the economy upward and a third part thats, well, a mystery.

Still, they say that it is highly unlikely that the D-R growth gap was just luck.

Metro At Brady Luxury Downtown Tulsa Ok Apartments

Embrace your vibrant lifestyle in Downtown Tulsa at Metro at Brady. Located adjacent to the historic Tribune Lofts in the thriving Tulsa Arts District, Metro at Brady embodies the absolute finest in urban living. These two communities share unique and lavish amenities like a beautiful outdoor swimming pool, two-story parking garage, and modern clubhouse with complimentary Wi-Fi access.

Our location is in close proximity to the best that Downtown Tulsa has to offer. From the restaurants, bars, live music venues, and art galleries of the Tulsa Arts District to ONEOK Field, the BOK Center, Tulsa Performing Arts Center, Guthrie Green, or Oklahoma Jazz Hall of Fame, there is no shortage of neighborhood fun surrounding our luxury apartments in Tulsa, OK!

The five-story brick building was designed with the convenience of our Tulsa residents in mind. There are beautifully maintained interior corridors and two elevators for ease of access. There is also readily available access to the two-story parking garage with limited access gates. The large and open clubhouse features complimentary Wi-Fi access and a state-of-the-art exercise facility thats open 24-hours a day. In the heart of our Downtown Tulsa community, our Metro at Brady residents can indulge in our swimming pool with tanning ledges, seating areas with a fire pit, water features, and an outdoor kitchen with grill.

1120 S Utica Ave, Tulsa, OK 74104 PH:; 579-1000

1923 S Utica Ave, Tulsa, OK 74104 PH:; 744-2345

You May Like: Can Republicans Vote In The Nevada Caucus

Convenient Apartments In Tulsa Oklahoma

Union Point Apartments in Tulsa, Oklahoma is where your home fulfills every desire for ultimate comfort and endless convenience. We offer one and two bedroom apartments in a variety of three different floor plans. Our location is amidst several conveniences such as restaurants, shopping, and entertainment. You will soon discover we take absolute pride in our well-kept apartment community. In your individual apartment home, you will find all the pleasures of home. Our apartment community amenities will also impress: take complete with sparkling swimming pool, on-site courtesy patrol, and 24-hour laundry facility. Call and book an appointment with one of our leasing agents today, and see whats available to you once you come home to Union Point Apartments.

Heres What The Data Shows Going Back To Eisenhower

Who are better for the economy, Democrats or Republicans?

On day one, a;newly inaugurated President Joe Biden;will have to manage a devastated economy much as;he and former President Barack Obama did;12 years ago.

What can the country expect?

Forecasting how the economy will perform under a new president is generally a fools errand. How much or;how little credit;the person in the White House deserves for the health of the economy is a;matter of debate, and no economist can confidently predict how the presidents policies will play out if they even go into effect or what challenges might emerge.

Regardless,;voters tend to believe;it makes a difference. And going into the election, 79% of registered voters and 88% of Donald Trump supporters ;said the economy was their top concern. Given that, historical data suggests that those who are concerned with the economy have reason to be fairly satisfied with the election results: The economy generally fares better under Democratic presidents.

Inheriting a struggling economy

Biden will be inheriting an economy with serious problems. Things have improved markedly since last spring, but the economy remains in a dire state.

And that doesnt yet include the;impact of what some officials; including Biden have dubbed a dark winter, as;severe coronavirus outbreaks;in many regions of the U.S. have prompted new economic restrictions.

See:The Trump economic scoreboard

Democrats have a better economic track record

The stock marketSPX,

Democratic trifecta

Tough road ahead

Don’t Miss: How Many Republicans Are In The Senate Currently

Democratic Administrations Over The Last Century Have Delivered Far Faster Economic Growth What Explains That

By Steve Roth

In 2013, economists Alan Blinder and Mark Watson no wild-eyed liberals, they ;asked a very important question: Why has the U.S. economy performed better under Democratic than Republican presidents, almost regardless of how one measures performance?

Start with their performed better assertion: its uncontestable. While you can easily cherry-pick brief periods and economic measures that show superior economic performance under Republicans, over any lengthy comparison period , by pretty much any economic measure, Democrats have outperformed Republicans for a century. Even Tyler Cowen, director of the Koch-brothers-funded libertarian/conservative Mercatus Center, stipulates to that;fact without demur.

Heres just one bald picture;of that relative performance, showing a;very basic measure, GDP growth:

The difference is big.;At those rates, over thirty years your $50,000 income compounds;up to;$105,000 under Republicans, $182,000 under Democrats 73% higher.

Hundreds of similar pictures;are easily assembled different time periods, different measures, aggregate and per-capita, inflation-adjusted or not all telling the same general story. No amount of hand-waving, smoke-blowing, and definition-quibbling will alter that reality.

Standing empty-handed after all their work, Blinder and Watson punt. They attribute Democrats consistently superior;performance toluck. Yes, really.

Get Evonomics in your inbox

Cross-posted at Asymptosis.

Donating = Changing Economics And Changing The World

Evonomics is free, its a labor of love, and it’s an expense. We spend hundreds of hours and lots of dollars each month creating, curating, and promoting content that drives the next evolution of economics. If you’re like us if you think theres a key leverage point here for making the world a better place please consider donating. Well use your donation to deliver even more game-changing content, and to spread the word about that content to influential thinkers far and wide.

MONTHLY DONATION

Don’t Miss: Why Do Republicans Hate Ted Cruz

Trump Is Right About One Thing: ‘the Economy Does Better Under The Democrats’

Donald Trump holds a campaign rally in the Sun Country Airlines Hangar at Minneapolis-Saint Paul… International Airport November 6, 2016.

Since Im an old Democrat supporting Hillary Clinton, it might surprise you to hear that I agree with Donald Trumps top line view of the economy.

No, I don’t agree with much that hes said since he started his 2016 presidential campaign, and recent revelations have rightly drawn opprobrium. But since Im also an agreeable old southerner, Ill give credit where credit is due. Donald was absolutely right when he told Wolf Blitzer in 2004: Ive been around for a long time and it just seems that the economy does better under the Democrats than the Republicans.

Thats right. Trump said out loud the same thing that Hillary Clinton has assertedand top academics and journalists have confirmed. The same thing Ive been;compiling cold, hard government data on since 1980: By crucial metrics like GDP, job creation, business investment and avoiding recessions, the economy does a lot better with Democrats in the White House than with Republicans. Just one eye-opening example: Nine of the last 10 recessions have been under Republicans.

Watch on Forbes.;Hillary Clinton Vs. Donald Trump: Where The Candidates Stand On Employment And Jobs

Pundits dont agree on exactly why. Some say the common thread may be external factors ranging from oil shocks and warm, fuzzy consumer expectations to economic cycles falling differently from political cycles.

Annual Gdp Growth Rate

Since 1933, the economy has grown at an annual average rate of 4.6 percent under Democratic presidents and 2.4 percent under Republicans, according to a Times analysis. In more concrete terms: The average income of Americans would be more than double its current level if the economy had somehow grown at the Democratic rate for all of the past nine decades. If anything, that period is too kind to Republicans, because it excludes the portion of the Great Depression that happened on Herbert Hoovers watch.

Read Also: Why Do Republicans Hate Planned Parenthood

In 2016 The Media Extensively Covered Trump Supporters Economic Anxiety Will This Misperception Continue In The Lead

Since Joe Biden became president, several surveys have found a sharp rise in Republican pessimism about the economy.

This might seem surprising considering the national economy which experienced one of its worst downturns thanks to the coronavirus pandemic is now objectively improving. The United States added 916,000 jobs in March, smashing Dow Jones expectations and the unemployment rate is now at its lowest level in over a year. And economic forecasters now predict annual GDP growth in 2021 will soar to levels the country hasnt witnessed in nearly 40 years.

Yet, despite these optimistic economic indicators, most Republicans say the economy is getting worse. On the one hand, this is to be expected, as political scientists have found that how we think about the economy is increasingly rooted in how we identify politically rather than in actual economic conditions.

Take this data from Civiqs daily tracking polls, which has asked Americans about the economy each day since June 2016. Americans perceptions of the national economy have changed wildly depending on whether a Democrat or a Republican is in the White House.

Why Are Republican Presidents So Bad For The Economy

G.D.P., jobs and other indicators have all risen faster under Democrats for nearly the past century.

By David Leonhardt

Graphics by Yaryna Serkez

Mr. Leonhardt is a senior writer at The Times. Ms. Serkez is a writer and graphics editor for Opinion.

Annual growth rate

Annual growth rate from highest to lowest

Annual growth rate from highest to lowest

jobs

G.D.P.

A president has only limited control over the economy. And yet there has been a stark pattern in the United States for nearly a century. The economy has grown significantly faster under Democratic presidents than Republican ones.

Its true about almost any major indicator: gross domestic product, employment, incomes, productivity, even stock prices. Its true if you examine only the precise period when a president is in office, or instead assume that a presidents policies affect the economy only after a lag and dont start his economic clock until months after he takes office. The gap holds almost regardless of how you define success, two economics professors at Princeton, Alan Blinder and Mark Watson, write. They describe it as startlingly large.

Recommended Reading: Who Taxes More Republicans Or Democrats

Usreal Gdp Growth: Republican Vs Democratic Presidents

But then GDP growth is only one measure of economic progress. What about the equity markets? After all, Republicans have long championed the tax cut, which should help shareholders keep more of their dividends and capital gains and thus result in better stock market performance.

Here again the data does not support the conclusion. In fact, the outperformance of Democratic administrations relative to their Republican counterparts, in total returns and adjusted for inflation as with GDP, is even greater. Even if we exclude the last two crises, stock market performance under Democratic presidents is still miles ahead of Republican presidents. It isnt even close.

0 notes

Text

Musang King - MCA vs Pemuda UMNO...

Musang King - MCA vs Pemuda UMNO....

Lapan pertubuhan bukan kerajaan (NGO) menggesa Kerajaan Pahang tidak tunduk terhadap tuntutan kumpulan pekebun yang mengusahakan tanaman durian secara haram di tanah kerajaan sejak sekian lama.

Pengerusi Sekretariat NGO Pemuda UMNO, Muhammad Faiz Hashim, berkata pekebun terbabit ingkar undang-undang dan meneroka tanah secara haram, sekali gus tindakan mereka itu seperti mencabul hak kerajaan Pahang serta rakyat.

"Bayangkan kerajaan Pahang menanggung kerugian hingga RM30 juta cukai tanah dalam tempoh 10 tahun yang jumlah itu jika diberikan kepada rakyat miskin, ramai mendapat manfaatnya.

"Banyak permohonan tanah penduduk kampung tidak berjaya. Tiada sebab kerajaan perlu beri tanah kepada golongan terbabit," katanya selepas mengadakan himpunan secara aman membantah penerokaan tanah secara haram di Pahang di Taman Kerang di sini, semalam. Story seterusnya...

youtube

At last Pemuda UMNO pun terjumpa isu untuk dibuat skrip jadi hero. Syabas dan tahniah. Sebelum ini Ketua Pemuda cuba bangkitkan isu yang remeh untuk jaga populariti.

Takkan UMNO yang telah memerintah Pahang sejak Merdeka tahun 1957 tidak tahu bekenaan durian farmers di Raub? Kenapa kerajaan pimpinan UMNO tidak ambil sebarang tindakan selama 63 tahun yang sudah?

Walaupun sepanduk itu kata 'Tanah kami hak kami' jelas bahawa Pemuda ingin jadi champion setelah penglibatan syarikat korporat. Saya ada sedikit cadangan cepu emas bagi Pemuda. Sila umumkan nama kesemua Pengarah syarikat korporat itu. "Orang kite" minoriti sangat lah. Majoriti itu pandai cakap omputih kut.

Negeri Pahang memang sudah famous dengan orang besar dan orang kaya terlibat "mengambil balak", ceroboh tanah rizab hutan, ceroboh tanah kerajaan negeri, korek pasir (illegal sand mining) dsbnya. Ramai orang terlibat. Semua bangsa terlibat. Dan balak itu pun jadi plywood dsbnya yang diekspot ke luar negara. Bukan semua dijual dalam negara pun.

Jadi, oleh sebab Pemuda sudah buat NGO, kenapa Pemuda tidak senaraikan semua kes orang ceroboh tanah kerajaan di Pahang? Be fair lah. Takkan bau wangi Musang King saja terlekat di hidung? Pakai face mask filter Musang King ke?

Ya betul mereka buat dusun di tanah kerajaan. Betul kerajaan negeri hilang cukai tanah, sewa tanah dsbnya. Tetapi farmer itu pun pernah mohon TOL dsbnya. Kalau kerajaan negeri memberi mereka TOL sudah tentu kerajaan negeri sudah kutip banyak duit. Lagipun farmer itu sedia bayar cukai tanah, yuran sewa dsbnya kepada kerajaan negeri.

youtube

Tetapi yang peliknya kenapa pula setelah mereka berusaha selama berpuluh tahun, sesudah mereka berpeluh darah menjaga pokok durian, setelah pokok sudah besar, dan buah sudah jadi, tiba-tiba kerajaan negeri bagi lesen sewa tanah tetapi kepada orang lain?

Apa rasional nya? Sebab ikut prosedur kalau lah kerajaan negeri ingin halang pembukaan tanah secara haram, the correct procedure is musnahkan kesemua dusun pokok durian yang haram.

Seperti yang telah di buat di Sg.Terla, Cameron Highland (contohnya). Ikut prosedur, kerajaan negeri telah musnahkan vegetable farm di Terla yang dibuka atas tanah kerajaan tanpa TOL atau lesen guna tanah.

Di Terla pihak kerajaan Negeri tidak merampas dan sewa balik vegetable farm yang haram itu kepada syarikat korporat. So to be fair dusun Musang King pun elok dimusnahkan saja - serupa dengan Terla.

But that is not going to happen. Why? I think I know why. Sebab sayur dan kobis tak ada bau wangi seperti Musang King. Musang King wangi dia kuat. Boleh sampai ke Hong Kong dan Beijing di mana satu kilo Musang King dijual dengan harga RM300 !! Musang King memang has very powerful smell.

Ini bukan kes curi balak. Atau kes curi pasir. Yang masih berlaku dalam negara kita, termasuk di negeri Pahang. Tetapi kenapa NGO Pemuda tidak protes dan berdemonstrasi untuk membantah kes curi balak, curi pasir dsbnya? How come?

Tanaman sayur, bunga dan buah-buahan di Cameron Highlands itu adalah harta negara. Begitu juga tanaman halia di Bentong, dusun durian di Raub, birds nest dsbnya.

Cameron Highlands juga sudah menjadi pusat pelancongan taraf dunia yang menjana foreign exchange earnings (pertukaran wang asing) yang lumayan bagi negara. Tak payah sebut lah berkenaan peluang pekerjaan, hotel, bas ekspres dan banyak lagi bisnes yang berkaitan.

Cameron Highlands menjadi paksi "food security" negara kita juga. Jadi jagalah Cameron Highlands itu dengan baik. Jika tanah vegetable farmers di Cameron Highlands ditarik balik, kita tak boleh makan sayur. Buah strawberi pun akan hilang dari supermarket.

Ringgit Malaysia juga akan jatuh lagi sebab Cameron Highlands mengekspot banyak sayur, bunga-bungaan dan hasil tanaman lain ke luar negara yang bantu ekonomi negara kita mendapat foreign exchange yang lumayan. Bila ekspot sayur, bunga-bunga dan buah-buahan bertambah Ringgit Malaysia pun kukuh. So jangan pi kacau depa ok...

youtube

Begitu juga dengan tanaman halia (ginger farming) di Bentong. Pasaran dunia iktiraf halia Bentong antara yang top quality di dunia. Ekspot halia dari Bentong juga menjana foreign exchange yang lumayan bagi negara kita. Ringgit Malaysia pun kukuh. Jangan pi kacau.

Sebaliknya kita mesti fikir cara untuk membantu penanam halia Bentong, vegetable farmer Cameron Highlands dsbnya menambahkan lagi output atau pengeluaran mereka. So that ekspot negara akan bertambah, Ringgit Malaysia akan kukuh, peluang pekerjaan akan bertambah, ekonomi akan maju dan banyak lagi lah.

Saudara Pemuda jangan jealous kalau dia orang dapat pendapatan yang lumayan. Sebarang pendapatan yang mereka dapat pun sebab they work very hard. Di Raub, depa jaga pokok durian sebatang-sebatang. They care for the durian trees one by one. Depa bubuh baja yang mahal, ikut timing yang betul, depa menyiram pokok.

Durian farming bukan tidak ada risiko. Begitu juga vegetable farming. Tiada bisnes yang tidak hadapi risiko. Bukan selalu boleh untung. Sekarang (sebab teknoloji pokok kahwin, baja mutu tinggi dsbnya) sering berlaku pokok durian berbuah dengan lebatnya. Harga durian boleh jatuh sehingga beberapa Ringgit saja sekilo. Durian farmer boleh rugi. Kalau kena serangga perosak depa boleh rugi, kalau tupai makan buah durian depa rugi. Semua jenis perniagaan ada risiko.

So kepada Ketua Pemuda UMNO, you must provide real leadership. Pemuda perlu mature dalam fikiran mereka dan bukan saja melompat-lompat, menjerit-jerit, menunjuk penumbuk, protes dan demonstrasi tanpa faham yang mana ke hulu dan yang mana ke hilir.

Btw,ini bukan soal politik, sebab pekebun yg terlibat ramai juga orang Melayu yang menyokong parti memerintah Pahang. Ini soal integriti pihak berkuasa yang gagal menjalankan tugas dengan mengikut SOP yang ditetapkan sejak sekian lama. Sebab itu kebun durian boleh membuahkan hasil walau pun diceroboh secara haram...

Akhir kalam sila lihat nasihat berikut yang jernih dan simple :

Al-Maaidah 5:8 Wahai orang-orang yang beriman, hendaklah kamu semua sentiasa menjadi orang-orang yang menegakkan keadilan kerana Allah, lagi menerangkan kebenaran; dan jangan sekali-kali kebencian kamu terhadap sesuatu kaum itu mendorong kamu kepada tidak melakukan keadilan. Hendaklah kamu berlaku adil (kepada sesiapa jua) kerana sikap adil itu lebih hampir kepada taqwa. Dan bertaqwalah kepada Allah, sesungguhnya Allah Maha Mengetahui dengan mendalam akan apa yang kamu lakukan. - Syed Akbar Ali

youtube

Raub Musang King Crisis

In Perspective...

It is estimated that 60% -70% of MK(Musang King) supply in Raub district comes fr. growers on "unlicensed" state lands. This phenomenon happened since the 60s when many of the first generation growers, poor and destitute, planted banana and papaya to eke out a living. Later, they ventured into durian cultivation. But durian cultivation was both capital n labor intensive, and was prone to disease attack. Not many succeeded from durian cultivation. From 1980/90s, many of Raub growers had to fell the durian trees n replaced them with Cocoa and later oil palm.

The Musang King variety has been around for about 30 years. For the first 20 years, pricing for MK was not attractive at all until the late Stanley Ho, the Macau Casino Magnate air-flown it to HK/Macau......So MK only gained popularity abt 10 years ago n price appreciated a lot only in the last 6-7 years.

Raub reportedly produces the BEST MK due to its soil, terrain and climatic condition. Raub is now well known because of MK. And these so-called unlicensed growers contributed 60%-70% of the MK supply. The global durian market was dominated by Thai varieties.....until MK came along. In recent years, mainland chinese consumers insisted on Raub's MK.

It took us decades to break Thailand's stranglehold, but we will lose it back with the stroke of a pen under the guise of a "legalisation " scheme, forced upon the growers by the Royal Pahang Durian Resources Group(RPDR) and a Pahang State GLC (JV).

Some principal T and C of the one-sided, onerous and unfair/unjust contract are:

1. These growers have to pay RM6,000/acre annually to the JV company.(note: not to the gomen directly)

2. Contractually, they have to produce 2,000 kg /acre of MK. failing which, they can be penalised. (btw, as a grower, I’m still searching for the magic formula to produce 2 tons yield consistently on an annual basis).

3. Once signed, the growers can not get out of the contract but are forced to toil on the land....even if they incur losses otherwise they can be penalized , again.

4. The fruits can only be SOLD to the JV capped at RM30/kg for grade A. They are not even allowed to bring home the MK for friends/families' consumption! When confronted, RPDR justified by saying that they are paying additional RM10/kg levy to the State. So, for 2,000 kg of fruits per acre, the additional levy is RM20,000(RM10x2,000)/acres on top of the RM6,000 lease rent/acre. This is daylight robbery.

youtube

Generally, for MK grading, it is categorised as A, B, and C. (but grade C is not available in the market). Where there exists competition i.e. many players competing for supply, pricing n fair grading system will find it's own equilibrium. This is free market practice.

The growers are now forced to sell to ONE party and under this monopolistic condition, there is no stopping RPDR to victimize the growers further thru the MK grading. How? Very simple, just downgrade 50% of the grade A to B fruits.....the consequential loss of revenue to the growers will be enormous.

This scheme has been well thought of since several yrs ago. RPDR is building the largest durian processing plant on a 25 acres land, in Tras. Our guess is that the construction cost will come substantially from the levy of RM30 million (RM6,000x 5,000 acres of unlicensed land). Reportedly, the growers will not be paid CASH for their harvest.

RPDR's plans are brilliant - construction cost, get it from the levy and working capital from delayed payment to the growers! And they have the cheek to label this as a win-win approach.

Three likely scenario will emerge:

1) Price of durian will drop. Why, cos their acquisition cost is capped at RM30. This is of course if they want to pass the benefits to consumers....your guess? Don't count on it.

2) Price will dip initially but eventually will increase markedly. Why you may ask? Very simple ,the growers are NOT taking up the unfair offer. They are prepared to vacate the orchards. Most of these growers have on the average 15 years and above of experience in durian cultivation but without them , the orchards will "rot " 2-3 years from now. Trees will be weakened n die from neglect......supply will dip....but demand will continue to grow esp. in overseas markets. Thailand, our competitor, will stand to benefit from it.

3) When pushed to a corner, they are prepared to take extreme measures to ensure that RPDR will not benefit from their years of sweat and tears...

In the eighties, we exported our Proton to China....now Proton is given a lifeline by Geely.

What else can we export to China? Musang King....due to the entrepreneurial spirit of all stakeholders in the MK supply chain, not least the productive contribution from these growers. The Government does help in some ways but only a small part in making MK Malaysia's next golden crop. But instead of helping further, someone else now wants to milk the cow.

Remember : Govt spent hundred of millions to rear cattle. Instead we now have cow-condo. Millions were spent on fishery projects and failed. We even built a Tuna fish Jetty/port in Penang that did not see the light of the day; and we overpaid a ship building company that has thus far failed to deliver the ship as scheduled.

It's very ironic- those who are given the land, refused to work on it; yet those want to make productive use of the land are not given the land. The country /state will suffer, RPDR will not get its intended results, with the biggest losers being these growers.

youtube

As reported, these growers are willing to negotiate with the state government BUT not RPDR . RPDR has no role to play in this MK supply chain for it does not and can not value add! It just does not hv the Expertise! Period.

RPDR's arguement that it helps to prevent the industry from being dominated/manipulated by foreign players; that it assists growers to obtain Mycap certification are bullshit!

The durian industry is a free market. Supply n demand will determine the price. In fact, RPDR's monopoly over 60%-70% of the supply will distort the free market mechanism. As for Mycap, it's a certification process under the Ministry of Agriculture. What is your role in this, RPDR ?

Actually, the real motive behind getting these growers certified is so that RPDR can export their produce to China. That's why they are constructing the largest processing plant in Raub.

As for the State gomen, instead of leasing out these lands to an inexperienced private company, why can't it leases it out directly to the experienced growers who hv toiled for generations on these lands. It’s hard to convince rakyat that there isn't more than meet the eyes in this MK saga.

The encroachment by these growers is not right; but the manner in which the gomen justified its action is worse. How to make Malaysia Great if this rent-seeking mentality is so pervasive? - From the thoughts of a legal durian grower born in Raub.

cheers.

Sumber asal: Musang King - MCA vs Pemuda UMNO...

Baca selebihnya di Musang King - MCA vs Pemuda UMNO...

0 notes

Text

BITCOIN BREAKDOWN AS EXPECTED!!! DONT IGNORE THIS INSANE BTC SIGNAL!!!

VIDEO TRANSCRIPT