#small business payroll

Explore tagged Tumblr posts

Text

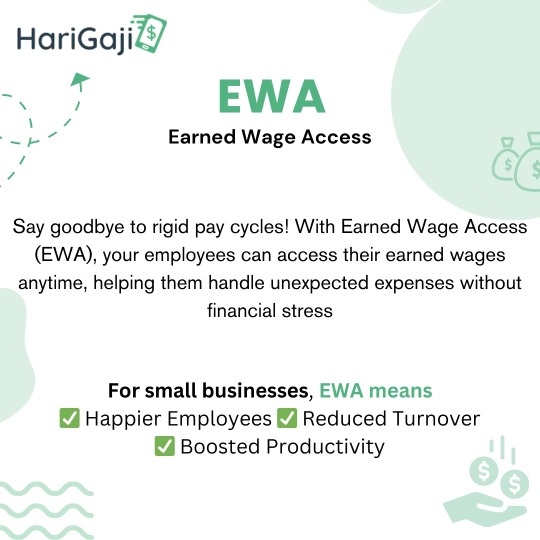

EWA (Earned Wage Access) is a flexible payroll solution designed to support small businesses by giving employees access to their earned wages before the scheduled payday. This innovative service allows workers to withdraw a portion of their wages whenever they need it, reducing financial stress and improving job satisfaction. For small businesses, EWA offers a low-cost, easy-to-integrate solution that can help attract and retain top talent without the complexities of traditional payroll systems.

By providing employees with greater financial flexibility, EWA can boost productivity, reduce absenteeism, and promote a positive workplace culture. Unlike payday loans or credit options, EWA does not come with high-interest rates or debt cycles. This solution benefits both employees and employers, creating a more satisfied and engaged workforce. For small businesses looking to improve employee retention and streamline operations, EWA presents a modern and cost-effective alternative to conventional payroll systems.

1 note

·

View note

Text

I owe my team a beer after today, but since drinking and working is frowned upon (derogatory) I'm going to have to be a lame ass manager and do pizza lunch tomorrow. They deserve much more, and I told them so.

#tomorrow may be even worse since it's small business saturday#at least my boss approved me to come in midday to lend a hand#a thing which she is very reluctant to do since the payroll buget is so tight#but we did nearly 3x the business today that we would normally do on a wet autumn friday so she can fucking afford it#I owe the girls a bottle of something really nice after we get through this

6 notes

·

View notes

Text

Bookkeeping Company in Denver

Aqtoro is the best Bookkeeping Company in Denver that understands the needs and concerns of businesses as the accounting needs of every firm are unique, and accordingly, our experts provide the right online bookkeeping services to businesses in Denver.

#Bookkeeping and Accounting Services For Small Business in Denver#Accounting and Bookkeeping Services in Denver#payroll & bookkeeping services in denver#Bookkeeping Company in Denver#Online Bookkeeping in Denver#Bookkeeping and Tax Services Denver#Local Bookkeeping Services Denver

3 notes

·

View notes

Text

Payroll Accuracy: Tips for Error-Free Payroll Processing

The processing of payroll is an essential operational task inside an organisation, as it guarantees the accurate and timely compensation of personnel. Nevertheless, the intricacy of payroll computations and the dynamic nature of tax legislation might provide a significant challenge in undertaking this endeavour. Mistakes in payroll administration can lead to employee dissatisfaction, non-compliance with regulations, and potential legal ramifications. In order to mitigate such complexities, it is imperative to give precedence to the precision of payroll calculations. Discover the strategic advantages of outsourcing your payroll to VNC Global - an excellent Payroll management company in Singapore. Choose VNC Global for secure and cost-effective payroll management.

This blog post aims to examine key strategies that can facilitate accurate payroll processing and enhance search engine optimisation (SEO) endeavours.

● Stay Informed About Tax Laws:

Keeping up-to-date with tax rules is crucial for maintaining payroll accuracy due to the frequent changes in tax regulations. It is imperative to consistently assess and examine the tax regulations at the federal, state, and municipal levels in order to guarantee adherence and conformity. It is advisable to utilise tax compliance software or seek guidance from tax professionals in order to ensure the maintenance of an updated payroll system.

● Implement Robust Payroll Software:

It is advisable to allocate resources towards the acquisition of dependable payroll software capable of managing intricate computations and streamlining diverse payroll procedures. These technologies have the potential to reduce errors that are commonly associated with human calculations and data entry. Some commonly used payroll software alternatives are ADP, Gusto, and QuickBooks.

● Maintain Accurate Employee Records:

It is vital to ensure the up-to-dateness and accuracy of all employee information, encompassing tax forms, personal particulars, and bank account details. The presence of erroneous personnel data can result in payment inaccuracies and non-compliance concerns. It is imperative to consistently assess and revise employee records. Experience the peace of mind that comes with organized financial records. Connect with VNC Global - the most trusted provider of Bookkeeping services for small businesses in Singapore and transform your business together.

● Use a Standardized Payroll Process:

Establishing a standardised procedure for payroll processing entails the development of a comprehensive framework that delineates the sequential stages involved, commencing from the first data entry phase and culminating in the distribution of the payroll. Ensuring uniformity in payroll operations can aid in mitigating the probability of errors.

● Double-Check Calculations:

Despite the utilisation of sophisticated payroll software, it remains imperative to conduct a thorough verification of computations in order to identify and rectify any potential errors. Incorrect payments can occur as a result of a minor error during data entry or due to a software malfunction. It is imperative to conduct a comprehensive examination of each paycheck prior to initiating the payroll processing procedure.

● Cross-Train Payroll Staff:

To mitigate the risk of excessive dependence on a sole payroll administrator, it is advisable to implement cross-training measures for the payroll staff. It is advisable to implement a cross-training programme for the payroll workforce, ensuring that multiple employees have the necessary skills and knowledge to effectively manage payroll tasks. Implementing this measure will effectively mitigate potential interruptions that may arise due to personnel turnover or absence.

● Conduct Regular Audits:

It is recommended to conduct regular audits of the payroll system in order to rapidly identify and resolve any problems or anomalies that may arise. These audits have the potential to identify any potential concerns prior to their escalation into severe difficulties. Maximize your time and resources by outsourcing your Accounting services for small businesses in Singapore to VNC Global. Request a quote to simplify your financial tasks.

● Seek Professional Help:

It is advisable to explore the option of engaging the services of a professional payroll service provider in order to outsource your payroll processing. These organisations possess expertise in payroll and tax compliance, hence diminishing the probability of errors.

Final Thoughts:

The maintenance of payroll accuracy is of utmost importance in ensuring employee satisfaction, adhering to tax requirements, and mitigating potential legal complexities. One can effectively decrease errors in payroll processing by acquiring knowledge of tax rules, utilising dependable software, upholding precise record-keeping practises, and adhering to standardised procedures. Furthermore, the implementation of routine audits and the utilisation of professional assistance, when deemed essential, can significantly augment the level of accuracy. Ensuring payroll accuracy is crucial not only for the welfare of employees but also for the prosperity of the organisation.

Effortlessly manage your payroll with a tailored payroll system in Singapore. Reach out now to VNC Global’s accurate Payroll management system in Singapore and see how we can enhance your payroll processes.

#Payroll management company in Singapore#Bookkeeping services for small businesses in Singapore#Accounting services for small businesses in Singapore#Payroll management system in Singapore#VNC Global

3 notes

·

View notes

Text

Why Should Small Businesses Consider Professional Bookkeeping Services?

Financial management is one of many duties and responsibilities that must be balanced when running a small business. There are compelling reasons to think about hiring professional bookkeeping services, even if some business owners would try to do their own bookkeeping.

Compliance and tax support are additional advantages of professional bookkeeping services for small business. Bookkeeping professionals are well-versed in tax laws and regulations, ensuring that small businesses remain compliant and avoid penalties. They stay updated on changes in tax laws and provide accurate and timely tax support, including preparation and filing of tax returns. This helps small business owners navigate the complexities of tax compliance, reducing stress and ensuring adherence to legal requirements.

Conclusion, small businesses should seriously consider professional bookkeeping services due to the expertise, accuracy, time savings, financial insights, cost savings, compliance support, and tax expertise they offer. By outsourcing bookkeeping tasks, entrepreneurs can focus on their core business activities, make informed decisions based on accurate financial data, and ultimately drive the success of their small business.

#Bookkeeping service for small business#accounting and bookkeeping service#Payroll service#Bookkeeping service#Outsourced bookkeeping service

2 notes

·

View notes

Text

Collab Accounting Australia offers top-notch Bookkeeping Services for Small Businesses. Our experienced team provides accurate BAS lodgment, payroll management, tax compliance, and financial reporting solutions. Let us handle your bookkeeping while you focus on growing your business.

📍 Address: 3 Hanley St, Stanhope Gardens, NSW 2768, Australia 📞 Phone: +61 2 8005 8155

Get in touch with us today to streamline your business finances!

#bookkeeping services for small business#bookkeeping service provider#outsource payroll services#bookkeeping services for startups

0 notes

Text

Best HRMS Payroll Software for Small Businesses in India

In today’s fast-paced business environment, companies need robust solutions to streamline their HR and payroll processes. Whether you run a startup or an established business in Lucknow, HR and Payroll Software for Small Businesses in 2025 is no longer a luxury but a necessity. Managing employees, tracking attendance, processing payroll, and ensuring compliance with labor laws can be complex. This is where a well-integrated Attendance Management Software Download comes into play, offering businesses a seamless way to manage their workforce efficiently.

Why Do Businesses in Lucknow Need HR and Payroll Software?

Lucknow is home to a growing number of small and medium-sized enterprises (SMEs), each requiring efficient HR and payroll solutions. Traditional manual processes are time-consuming and prone to errors, which can lead to compliance issues and financial losses.

Investing in All-in-One HRMS Payroll Software Lucknow can significantly reduce administrative burdens, improve accuracy, and enhance employee satisfaction. A well-designed payroll solution ensures timely salary disbursements, maintains tax compliance, and automates leave and attendance tracking, making HR operations hassle-free.

Key Features to Look for in Payroll Software for Small Businesses

When choosing Payroll Software for Small Businesses Lucknow, it's crucial to consider the following features:

Automated Payroll Processing: Ensure accurate salary calculations, tax deductions, and compliance with government regulations.

Attendance and Leave Management: Integration with biometric devices or cloud-based attendance systems helps streamline workforce tracking.

Employee Self-Service Portal: Enables employees to access payslips, apply for leaves, and update personal details with ease.

Tax and Compliance Management: Simplifies TDS, EPF, ESI, and other statutory compliance requirements.

Customization and Scalability: The software should be adaptable to your company’s growth and changing HR policies.

Cloud-Based Access: Allows HR teams and employees to manage payroll functions remotely, ensuring seamless operations.

#hr management#hr management software#employee management software free#employee management#hr and payroll software for small business

1 note

·

View note

Text

Renegade Bookkeeping Ltd.

Renegade Bookkeeping Ltd. offering Personalized Bookkeeping Solutions for Mid-Size Businesses,Individuals,Sole Proprietors, & Cooperations across Saskatoon.

0 notes

Text

Manufacturing Payroll Processing - Hybrid Payroll

Streamlining Manufacturing Payroll Processing: A Guide to Efficiency and Compliance

In the manufacturing industry, payroll processing is more complex than in many other sectors due to factors like multiple shifts, overtime, union regulations, and compliance requirements. Efficient payroll processing ensures employees are paid accurately and on time while keeping the organization compliant with labor laws. This blog explores the key aspects of payroll processing in the manufacturing industry and how businesses can streamline their payroll operations.

Key Challenges in Manufacturing Payroll Processing

Shift Differentials and Overtime Pay: Many manufacturing employees work in multiple shifts, with different pay rates for night shifts or overtime hours. Ensuring correct calculations for these differentials is critical to payroll accuracy.

Compliance with Labor Laws: Manufacturers must comply with labor laws, including the Fair Labor Standards Act (FLSA), Occupational Safety and Health Administration (OSHA) regulations, and state labor laws governing minimum wage, overtime, and break periods.

Union and Contractual Agreements: Many manufacturing workers are part of labor unions, requiring adherence to collective bargaining agreements that dictate wages, benefits, and overtime pay.

Employee Classification: Manufacturers often employ a mix of full-time, part-time, temporary, and contract workers. Misclassification can lead to compliance issues and penalties.

Tracking Work Hours Accurately: The use of manual timesheets or outdated tracking systems can result in errors, leading to payroll discrepancies and employee dissatisfaction.

Best Practices for Efficient Payroll Processing

Automate Payroll with Software Solutions: Investing in payroll software specifically designed for manufacturing can automate calculations for overtime, shift differentials, and deductions, reducing errors and improving efficiency.

Integrate Time Tracking Systems: Using biometric scanners, digital time clocks, or cloud-based attendance systems ensures accurate tracking of employee hours, reducing discrepancies and manual interventions.

Ensure Compliance with Labor Laws: Staying updated on federal, state, and local labor laws helps manufacturers avoid legal penalties. Regular audits of payroll records can also help in maintaining compliance.

Streamline Union and Employee Agreements: Payroll systems should be configured to align with union contracts and company policies. Automating benefits, bonuses, and wage increases based on agreements ensures compliance and fairness.

Use Direct Deposit and Digital Pay Stubs: Digital payroll processing eliminates paper checks, ensuring timely payments and reducing administrative work. Employees also benefit from easy access to their pay records.

Regular Payroll Audits and Reconciliation: Conducting periodic payroll audits helps identify errors before they escalate into compliance issues or disputes. Reconciling payroll with financial records ensures transparency and accuracy.

Final Thoughts

Manufacturing payroll processing can be complex, but with the right technology and best practices, businesses can streamline operations, reduce errors, and ensure compliance with labor laws. By automating payroll, integrating time-tracking systems, and staying informed on regulatory requirements, manufacturers can enhance efficiency and keep their workforce satisfied. Investing in modern payroll solutions is not just a convenience—it’s a necessity for sustainable business growth in the manufacturing sector.

#construction payroll processing#hospitality payroll management#premier payroll services#payroll outsourcing in denver#payroll services denver#small business payroll processing#peo hr solutions#hospitality payroll solutions

0 notes

Text

O&K Accounting

1420 5th Ave #2200, Seattle WA 98101

Phone # 206-440-5846

O&K Accounting Inc. provides expert bookkeeping, tax preparation, payroll management, and financial consulting services for small to mid-sized businesses. Our dedicated team ensures accuracy, compliance, and financial growth with a client-focused approach. Serving businesses across Washington State, we specialize in tailored accounting solutions to meet diverse needs.

http://www.oandkacct.com

#Accounting Services#Bookkeeping#Tax Preparation#Payroll Management#Financial Consulting#Small Business Accounting#Business Tax Services#Enrolled Agent#QuickBooks ProAdvisor#cpa

1 note

·

View note

Text

Why Small Businesses in Thailand Need Accurate Annual Financial Statements

Annual Financial Statements, Annual Financial Statements and Annual Filings, Annual Financial Statements and Annual Filings in Thailand, Annual Financial Statements in Thailand Running a small business is no easy feat. Between managing your team, serving customers, and keeping the lights on, there’s already so much on your plate. But let me ask you this—how often do you stop to think about…

#Business Visa Thailand#Corporate Tax Filing Thailand#Expat Tax Filing Thailand#Expat Tax Services Thailand#Financial Planning Services Thailand#Payroll Services Thailand#Small Business Accounting Thailand#Tax Consultant Thailand#Thai Business Visa#Thailand Business Setup Services#Thailand Tax Services

0 notes

Text

What Every Freelancer Needs to Know About Tax in Australia: A Complete Guide

Freelancing in Australia offers incredible flexibility and the chance to work on exciting projects across various industries. However, with this freedom comes the responsibility of managing your taxes. Whether you’re a writer, designer, developer, or any other type of freelancer, understanding tax laws and obligations is essential for maintaining a successful freelance business.

To stay compliant with the Australian Taxation Office (ATO), freelancers need to familiarize themselves with key aspects of tax management. Many freelancers choose to use tax preparation services for expert assistance in navigating the complex tax landscape. Additionally, for those running small freelance businesses, understanding payroll for small business is crucial to managing finances efficiently. This guide will cover the essentials of managing taxes as a freelancer in Australia, from registering for an ABN to claiming deductions and making use of tax services to streamline the process.

1. Registering for an ABN (Australian Business Number)

The first step for any freelancer in Australia is to register for an Australian Business Number (ABN). This unique identifier is used by the ATO to track your business activities. Without an ABN, your tax rate may be higher, and clients may withhold tax at the maximum rate. An ABN allows you to invoice clients properly, ensuring you're taxed appropriately.

If you’re managing a small freelance business, payroll for small business can become essential for keeping your financial records in order, ensuring timely payments, and managing your income.

2. Understanding GST (Goods and Services Tax)

Freelancers who earn over $75,000 annually must register for Goods and Services Tax (GST), a 10% tax on most goods and services sold in Australia. By registering, you can also claim back the GST you pay on business-related purchases, such as software, office supplies, or equipment. For instance, if you purchase a laptop for $2,000, you can claim back the $200 GST, reducing the cost of your purchase.

For many freelancers managing their small businesses, integrating payroll for small business tools can help keep track of GST payments and ensure you’re making accurate claims.

3. Maximizing Tax Deductions

As a freelancer, one of the major benefits is the ability to claim tax deductions on expenses related to your work. Common deductions include:

Home Office Costs: A portion of your rent, electricity, internet, and other home office expenses can be claimed.

Travel Expenses: Any travel you undertake for business purposes, such as meeting clients or attending industry events, is deductible.

Work Equipment: Items such as computers, software, or cameras necessary for your freelance work can be claimed as business expenses.

Properly managing these deductions can significantly reduce your taxable income. It’s important to keep accurate records of all your expenses, and using payroll for small business systems can help you stay organized and ensure you don’t miss any deductible costs.

4. Filing Your Taxes and Using Tax Preparation Services

As a freelancer, you’re responsible for filing your own tax return each year. This includes reporting your income, business expenses, and, if applicable, your GST payments through a Business Activity Statement (BAS).

While filing your taxes can be relatively straightforward, many freelancers opt to use tax preparation services to ensure their returns are filed correctly and on time. These services can save you valuable time and help avoid costly errors. By using a professional service, you can be confident that you’re meeting all ATO requirements, maximizing your deductions, and minimizing your tax liability.

5. Superannuation for Freelancers

Unlike traditional employees, freelancers must handle their own superannuation, which is the Australian system for retirement savings. The current superannuation guarantee is set at 9.5% of your income.

As a freelancer, it's important to contribute to your superannuation regularly to ensure a comfortable retirement. Payroll for small business tools can help freelancers manage their superannuation contributions and stay on track with their retirement goals.

Tax management is an essential part of freelancing in Australia. By registering for an ABN, understanding GST requirements, claiming appropriate tax deductions, and utilizing tax preparation services, freelancers can ensure they remain compliant with the Australian Taxation Office.

For those running small freelance businesses, integrating payroll for small business solutions will streamline your financial management and help you focus on what you do best. By staying informed and organized, you can confidently manage your taxes and take advantage of the benefits that come with freelancing.

0 notes

Text

Elevate Your Business with Professional Toronto Bookkeeping Services

Transcounts delivers cost-effective bookkeeping solutions for Toronto businesses. Utilizing advanced cloud-based software, we ensure 100% accurate books, real-time financial insights, and customized KPI dashboards to help you make informed decisions.

#bookkeeping for small business#book keeping services toronto#vancouver bookkeeping services#payroll software for small business

0 notes

Text

Streamline Your Financial Process with Fully Managed Payroll Services

Optimize your business’s financial process and ensure timely salary for your employees with effective payroll management services.

Outsourced Bookkeeping adheres to necessary rules and policies along with keeping track of allowances and deductions. We guarantee accuracy and compliance at every step of payroll processing.

Address the Intricacy of Payroll Calculations with Expert Services

Outsourced Bookkeeping eases the burden of employers and takes complete responsibility as a payroll management service provider.

Our payroll management services eliminate the burdensome task of allocating salaries with effective and skillful handling. This way the chances of errors are reduced, employees are satisfied, and your business achieves cost efficiency.

To know more: https://www.outsourcedbookeeping.com/payroll-management/

#payroll service#online payroll service#payroll service providers#best payroll service#best payroll service for small business#payroll service company#payroll service small business#square payroll customer service#cheapest payroll service#payroll service provider#payroll service for small business

0 notes

Text

Reliable Payroll Service Provider Company in the UK - Quest360 Financial

Most organizations have a lot on their plates, and payroll processing is usually complex and time-consuming. Be it an independent contractor, a new start-up, a small and medium enterprise, or an agency through which numerous employees are paid payroll services UK, Quest360 Financial remains the trusted partner providing curated payroll solutions that are compliant, transparent, and meet the specific needs of the UK's workforce.

Custom Payroll Solutions for Any Business

When it comes to bespoke services that are for contractors, and firms ranging from independent start-ups to multinational companies, Quest360 with over a decade of experience in the recruitment business, having managed complete payroll process delivery, understands payroll systems perfectly.

1. To contractors:

The contractors generally handle two or three shifts with a number of clients. Hence, accuracy becomes a vital concern in calculating payroll. The easy, apparent, and quick umbrella payroll solutions furnish contractors with accurate and timely payments without any kind of administrative burden.

2. To Business and Agencies:

Big payrolls of contractors or employees are mind boggling. Quest360 now brings outsourced payrolls specific and tailored to your needs. It lets you continue with the hands-on growth of your business, while Quest360 takes care of the payrolls and finances, including payments to your staff, bookkeeping, and HMRC submissions.

Why Quest360 Payroll Service Provider Company in the UK?

There are many companies providing payroll services in UK. But Quest 360 financial has best services, transparency, and accuracy. Quest360 is the payroll management provider, perfectly fits the bill.

1. Compliance with Legislative Requirements:

There will be no penalties on account of tax non-compliance, as there must be absolutes pertaining to compliance on payroll laws in the UK. Ensuring that there is up-to-date adherence with the changes.

2. Accurate and Timely Payments:

Delivering payroll with integrity and precision is our goal. In reference, from contractor shifts to payrolls of small and medium businesses, we guarantee timely and accurate payments.

3. Services Flexible and Further Scalable:

Our payroll dream never ends. Start-up or a big business, our flexible payroll solutions grow as per requirements. Being a payroll service provider company UK, we do personalized services as per your business needs at any level of growth.

4. Every Step Transparent:

At Quest360, we understand that transparency is vital. Our payroll systems are made to be open and clear so that contractors and clients alike understand completely how things work along the process.

Outsource payroll management to save time and resources.

Outsource payroll services to offer a business-owning solution beyond the cost-saving option. Quest360 takes away the burden of payroll and bookkeeping management, enabling you to focus on growing the business, and we will process payments as well as submit the necessary returns to HMRC. This is a one-stop payroll solution with regards to payment processing and report submission.

Quest360 Financial is your payroll service provider in UK, providing reliable, compliant, and flexible solutions to contractors, agencies, start-ups, and SMEs. Founded on a relatively strong platform that has lasted over a decade, and a mission that rests on accuracy, transparency, and integrity, we are committed to being on your side on every payroll journey.

Contact Quest360 today for your simplified payroll management to enhance the business.

Source URL: https://sites.google.com/view/payroll-service-provider-uk/home

#Payroll service provider uk#Payroll service provider company uk#outsourced payroll and financial service provider uk#HMRC payroll management#Umbrella PAYE services UK#outsourced payroll solutions#outsource payroll for small business#CIS payroll for contractors#construction industry scheme cis service#Outsourced Payroll for SME’s#HMRC submissions assistance#UK

0 notes

Text

Unlock Growth & Efficiency with Collab Accounting’s White-Label Services

The accounting industry is evolving rapidly, and firms are constantly looking for ways to scale without adding operational burdens. This is where Collab Accounting’s white-label services come in—allowing accounting firms to expand their offerings, improve efficiency, and deliver top-tier services under their own brand.

What Are White-Label Accounting Services?

White-label services mean we handle your Accounting, Bookkeeping, and compliance needs while you take the credit. Your clients see your brand, while our team works in the background to ensure smooth operations.

How We Help Accounting Firms Scale Effortlessly

1. End-to-End Bookkeeping & Compliance – Our experts handle everything from transaction entries to reconciliations, BAS lodgments, and Payroll processing.

2. Xero, QuickBooks & MYOB Expertise – We integrate seamlessly with your existing systems, ensuring accuracy and efficiency.

3. SMSF & Tax Return Preparation – We help firms streamline complex tax compliance while maintaining 100% confidentiality.

4. Virtual CFO Support – Need an extra layer of financial expertise for your clients? We provide Financial analysis, forecasting, and reporting to help businesses make better decisions.

5. Scalability Without Overheads – No need to hire in-house accountants when you can have a dedicated offshore team working under your brand.

Why Choose Collab Accounting?

1. 100% White-Label Model – Your clients see your brand, and we do the work. 2. Dedicated Team with Full Compliance – We ensure data security and adherence to Australian accounting standards. 3. Seamless Communication – Work with a team that understands your business, aligns with your processes, and provides real-time updates.

Let’s Partner for Success!

If you’re an accounting firm looking to scale without increasing overhead costs, our white-label services can be the perfect solution. Focus on growing your firm while we handle the work.

Get in touch with us today to explore a tailored white-label accounting solution!

#bookkeeping services for small business#outsource payroll services#bookkeeping services outsourcing#top 10 accounting outsourcing companies in india

0 notes