#small business loans perth

Explore tagged Tumblr posts

Text

Business Loans in Australia: Empowering Growth and Stability

Starting and growing a business requires financial support at various stages. Whether it's expanding operations, managing cash flow, or purchasing new equipment, securing the right funding is crucial. Business owners across Australia, including Sydney, Adelaide, and Perth, seek tailored financial solutions that align with their unique needs.

Businesses, regardless of size or industry, need capital to thrive. Business loans in Australia provide entrepreneurs with the financial backing required to scale their ventures, invest in new opportunities, and maintain operational stability. These loans are designed to be flexible, catering to the evolving needs of businesses in different sectors.

Traditional lending institutions often have strict requirements, making it challenging for small business owners to secure funding. However, alternative financing solutions offer quicker approvals, competitive rates, and adaptable repayment plans. With a range of business loan options available, companies can access funds without unnecessary delays or stringent conditions.

Business Loans in Sydney: Fueling Ambition in a Thriving Market

Sydney, as a major economic hub, is home to a diverse range of businesses, from startups to well-established enterprises. Business loans in Sydney enable entrepreneurs to seize market opportunities, enhance their operations, and overcome financial constraints.

For businesses looking to expand their presence in Sydney, having access to the right funding can make all the difference. Whether it's a retail store needing more inventory, a tech startup investing in innovation, or a service-based company scaling operations, financial support is essential. Quick access to capital ensures businesses can respond to market demands effectively.

Business Loans in Adelaide: Supporting Business Growth in a Competitive Landscape

Adelaide is a growing business center with a strong entrepreneurial spirit. Business loans in Adelaide cater to various industries, including hospitality, manufacturing, retail, and professional services. Many business owners require additional capital to manage operational costs, hire skilled employees, or upgrade their infrastructure.

Securing a business loan in Adelaide allows businesses to navigate challenges such as seasonal fluctuations, supply chain disruptions, or unexpected expenses. With the right financial solution, business owners can maintain stability and achieve long-term growth without financial strain.

Business Loans in Perth: Strengthening Enterprises in a Dynamic Economy

Perth is known for its thriving industries, including mining, construction, and technology. Business loans in Perth help enterprises meet their financial needs, whether for expansion, equipment purchases, or working capital.

For small and medium-sized businesses in Perth, securing timely funding can lead to greater opportunities. Whether it's investing in new projects, hiring additional staff, or marketing products effectively, financial support ensures businesses remain competitive in an ever-changing market.

Unsecured Small Business Loans: Hassle-Free Funding for Growing Enterprises

Small businesses often face difficulties in obtaining loans due to collateral requirements. An unsecured small business loan in Australia provides a viable solution for entrepreneurs who need financial assistance without pledging assets.

These loans offer numerous benefits, including faster approval times, minimal paperwork, and flexible repayment terms. They are ideal for businesses that require immediate funds to cover operational expenses, marketing efforts, or business development initiatives.

With an unsecured small business loan, companies can focus on growth rather than financial constraints. The ease of access to funds allows entrepreneurs to manage cash flow effectively, take advantage of new opportunities, and scale their operations without unnecessary delays.

Choosing the Right Business Loan in Australia

With various financing options available, selecting the right business loan in Australia requires careful consideration. Business owners should assess factors such as loan amounts, interest rates, repayment terms, and eligibility criteria.

Lenders offering business loans in Sydney, Adelaide, and Perth provide tailored solutions to meet different business requirements. Whether a company needs a short-term loan for immediate expenses or a long-term financial plan for expansion, choosing a suitable funding option ensures sustainable growth.

Advantages of Business Loans for Entrepreneurs

Quick Access to Capital: Fast approval processes enable businesses to secure funds when they need them the most.

Flexible Repayment Plans: Various loan structures allow businesses to choose repayment terms that align with their cash flow.

No Collateral Requirements: Unsecured small business loans eliminate the need for asset pledging, making funding more accessible.

Supports Business Growth: From expanding operations to hiring employees, additional capital facilitates progress.

Customizable Loan Solutions: Lenders offer personalized loan options based on industry, business size, and financial goals.

Conclusion

Securing the right financial support is crucial for businesses in Australia. Whether in Sydney, Adelaide, or Perth, business owners can access tailored funding solutions that suit their needs. Unsecured small business loans provide additional flexibility, allowing enterprises to grow without the burden of collateral.

With the right business loan, entrepreneurs can confidently invest in their ventures, manage operational expenses, and achieve long-term success. Accessing suitable financial solutions ensures businesses remain resilient and competitive in an evolving market landscape.

1 note

·

View note

Text

Best Business Loans Perth (Curated list)

Navigating the complex world of business loans requires careful consideration of factors like interest rates loan terms and funding flexibility. Perth’s financial market offers a diverse range of lending opportunities from traditional banks to innovative online platforms. Business owners can now explore loans ranging from small startup capital to substantial expansion funds designed to match their specific growth strategies.

Read more: https://agrtech.com.au/business/best-business-loans-perth/

#business loans perth#perth loans#commercial loans perth#best business loans perth#unsecured loans perth

0 notes

Text

Solar Panels in Perth WA Are a Game-Changer

Perth, the sunniest capital city in Australia, offers an incredible opportunity to harness solar power for your energy needs. With its abundant sunshine, residents and businesses in Perth are increasingly turning to solar panels as a sustainable, cost-effective solution to reduce energy bills and minimize their environmental footprint. This guide explores the benefits, types, and installation process of solar panels in Perth, WA.

Why Choose Solar Panels in Perth, WA?

Solar energy is a renewable and clean power source that significantly reduces greenhouse gas emissions. Here are some reasons why solar panels are a popular choice in Perth:

1. Abundance of Sunshine

Perth enjoys over 3,200 hours of sunshine annually, making it one of the best locations in Australia for solar energy. This ample sunlight ensures high energy production and maximized return on investment for solar panel systems.

2. Cost Savings

Installing solar panels can significantly reduce electricity bills. By generating your own power, you can decrease dependence on grid electricity, which is subject to rising energy costs. Over time, the savings can outweigh the initial installation costs.

3. Government Incentives

The Australian government offers incentives such as the Small-scale Renewable Energy Scheme (SRES), which provides rebates based on the number of Small-scale Technology Certificates (STCs) your system generates. Additionally, feed-in tariffs allow homeowners to earn credits for surplus energy exported to the grid.

4. Environmental Benefits

Switching to solar energy helps reduce carbon emissions and contributes to a greener, more sustainable future. By choosing solar, you play a vital role in combating climate change.

Types of Solar Panels Available in Perth

There are three primary types of solar panels to consider when installing a system in Perth:

1. Monocrystalline Solar Panels

Known for their high efficiency and sleek appearance, monocrystalline panels are made from a single crystal structure. They are ideal for households with limited roof space as they produce more power per square meter.

2. Polycrystalline Solar Panels

Polycrystalline panels are made from multiple silicon crystals. They are slightly less efficient than monocrystalline panels but are more affordable, making them a popular choice for budget-conscious consumers.

3. Thin-Film Solar Panels

These panels are lightweight and flexible, making them suitable for unconventional installations. However, they are less efficient than crystalline panels and require more space to generate the same amount of energy.

Choosing the Right Solar Panel System

When selecting a solar panel system, consider the following factors:

1. Energy Needs

Evaluate your household or business energy consumption to determine the system size you require. A typical residential system ranges from 3kW to 6kW, while larger systems are suitable for businesses.

2. Roof Space and Orientation

The amount and orientation of available roof space impact the efficiency of your solar system. North-facing roofs are ideal in Perth, as they receive the most sunlight throughout the day.

3. Budget

Set a budget and explore financing options such as solar loans or leasing programs. While premium systems may have a higher upfront cost, they often provide better performance and longer warranties.

The Solar Panel Installation Process

Installing solar panels in Perth involves several steps to ensure a seamless transition to solar energy:

1. Site Assessment

A professional installer will assess your property to determine the best system size, panel placement, and potential shading issues.

2. System Design

Based on the assessment, a customized solar system is designed to meet your energy needs and maximize efficiency.

3. Installation

The installation process typically takes one to three days, depending on the system size and complexity. Licensed electricians will install the panels, inverters, and other necessary components.

4. Grid Connection

After installation, your system is connected to the grid, allowing you to export excess energy and earn feed-in tariff credits.

Maintenance and Longevity of Solar Panels

Solar panels are low-maintenance, with minimal upkeep required to keep them operating efficiently. Regular cleaning to remove dirt and debris, along with periodic inspections by a professional, ensures optimal performance. Most solar panels have a lifespan of 25 years or more, making them a long-term investment.

Finding the Best Solar Panels in Perth

When searching for the best solar panels Perth, look for reputable providers with a proven track record. Compare quotes from multiple companies and consider factors such as warranty, efficiency, and customer reviews. Partnering with a reliable installer ensures you get a high-quality system tailored to your needs.

Conclusion

Harnessing the power of the sun is a smart choice for Perth residents and businesses. With ample sunlight, government incentives, and a growing focus on sustainability, investing in solar panels is a step toward a brighter, cleaner future. Whether you're looking to reduce energy costs, lower your carbon footprint, or increase property value, solar panels in Perth, WA, are a wise and impactful decision.

0 notes

Text

Restructuring Taxes Outside of a Trust

In Perth, family businesses have long favored trusts as their business structure, primarily for the tax benefits they provide. However, with ongoing changes in tax laws and evolving guidance from Perth tax accountants, operating a business through a trust is becoming increasingly complex and less advantageous.

Why Trusts May Pose Challenges for Business Operations

While trusts offer various benefits beyond tax savings, there are notable challenges when using them to run a business. Key difficulties include:

Employee Incentives: Discretionary trusts make it challenging to implement employee incentive programs. While a trust’s flexibility can be tax-efficient, its discretionary nature complicates offering team members fixed entitlements to profits.

Company Tax Rates: Trusts do not benefit from the lower tax rates that companies enjoy on business income. Although profits can be allocated to a company to qualify as a base-rate entity, tax laws require these profits to be distributed.

Working Capital: Trusts distribute all profits to beneficiaries, making it difficult to retain working capital for reinvestment. To reinvest profits back into the business, beneficiaries or unitholders must agree to defer their payment rights and convert them into loans.

Accounting Ratios: The lack of net equity in a trust complicates the calculation of many accounting ratios used by banks to assess financial health. While cloud accounting software and the expertise of a CFO can mitigate this issue, many Perth family businesses prefer more straightforward and transparent accounting reports.

Tax Options for Transitioning from a Trust to a Company

As businesses grow, some find that their trust structure no longer suits their needs, making a transition to a company necessary. This is particularly relevant for larger family businesses moving towards a corporate structure, driven by factors such as:

Aligning with long-term business strategies and succession plans.

Enhancing customer relationships.

Meeting family and financial objectives.

Exploring international expansion opportunities.

Accessing government grants and company tax rates.

Addressing working capital requirements.

Transitioning to a corporate structure can also bring additional tax benefits, such as the ability to form a tax-consolidated group, which allows for filing single-entity tax returns. The Australian Taxation Office (ATO) recognizes the validity of such restructures.

Capital Gains Tax (CGT) Implications

When transitioning from a trust to a company, businesses often face Capital Gains Tax (CGT). This tax usually arises when the market value of the business’s goodwill exceeds the cost base of its assets, including goodwill. However, CGT rollovers can defer these liabilities, and the choice of rollover depends on the specific circumstances and goals of the business.

Available Capital Gains Tax Rollovers

Several CGT rollover options are available for Perth family businesses transitioning from a trust to a company. These options can be used individually, sequentially, or in creative combinations with other tax strategies:

Subdivision 122-A — Transfer from a Trust to a Fully-Owned Company: This provision allows trustees to transfer business assets to a newly created company wholly owned by the existing trust. This facilitates the retention of working capital within the company, with future profits distributed at the directors’ discretion.

Subdivision 124-N — Transfer of Assets from a Trust to a Company: This rollover involves transferring all assets from a fixed trust to a company, effectively replacing the trust. In return for the business assets, trust owners receive company shares, allowing the business to continue as a company.

Section 328-G — Small Business Restructure Rollover: For small businesses, this rollover allows assets to be transferred to a company while deferring CGT. This structure is similar to that achieved through a Subdivision 124-N rollover.

Subdivision 615 — Conversion of Units in a Unit Trust to Shares in a Company: This rollover inserts a company between the unit trust and its unitholders, converting units into company shares. The business can continue operating within the trust structure, but profits are retained within the company.

Small Business Capital Gains Tax Concessions: For businesses that qualify as small entities, assets can be sold to a company with the potential application of CGT concessions, including:

15-Year Exemption

50% Active Asset Reduction

Retirement Exemption

Small Business Rollover Relief

These concessions also offer opportunities to increase superannuation funds for business owners in Perth.

Leveraging Capital Gains Tax Rollovers

Several CGT rollover options can help transition to a more suitable business structure. However, it’s important to note that the ATO closely scrutinizes these rollovers, especially for significant transactions. For high-profile or financially substantial restructures, seeking a pre-transaction private ruling from the ATO is advisable.

Given these complexities, professional tax advice is crucial, along with thorough documentation to support decisions and actions during a rollover or restructuring. This approach helps protect your business and personal interests while ensuring you select the most beneficial option.

Every business is unique, and while the CGT rollover options outlined offer insight into the possibilities, it’s also important to consider other taxes such as income tax, GST, and stamp duty during restructuring.

At Westcourt, we are uniquely positioned to assist Perth family businesses with their restructuring needs. Our exclusive focus on family businesses, access to a global network of independent advisors, transparent pricing, and deep expertise in taxation and business advice set us apart. If you need guidance on restructuring your family business or trust, contact us today.

0 notes

Text

Checklist For Tax Return: Everything You Need To Know

Filing tax returns accurately and on time is crucial for individuals and small business owners. It ensures you fulfil your legal duty and avoids potential penalties from the tax authorities. Late or incorrect filings can delay your refund, result in fines, and even trigger an audit. Guidance plays a crucial role in leading to successful tax accounting. Taxation has many steps that must be followed carefully and strictly. A tax accountant in Perth can assist you through the process.

This blog serves as your one-stop checklist for a smooth tax return filing experience. We'll cover everything you need to know, from gathering documents to lodging your return.

Understanding Your Tax Situation

Your tax filing category depends on the source of your income. Income tax is the primary source of revenue in the tax system, and it is divided into categories. Common categories include:

Individual: for salary earners

Sole Trader: for running a business by yourself

Partnership: for running a business with others

Company: for registered companies

Tax Residency: Where you pay tax depends on your Australian tax residency. Generally, Australian citizens living in Australia are considered residents. Find full details on residency requirements on the Australian Taxation Office's website: https://www.ato.gov.au/.

Importance of Record Keeping: Keeping good financial records throughout the year is essential. Examples include receipts, invoices, bank statements, and car expense logbooks. Good records make filing easier and ensure you don't miss out on deductions. Business owners can also hire bookkeeping services in Perth and invest their saved time somewhere important.

What Documents To Gather for Tax Filing?

Before diving into your tax return, take some time to gather the essential documents. This will make the filing process smoother and ensure you have everything you need to claim deductions and credits accurately.

Essential Documents:

Social Security Numbers (SSNs): You'll need your SSN and the SSNs of your dependents to file your return.

Medicare Details (if applicable): If you or your dependents are enrolled in Medicare, have your Medicare card details handy.

Tax Professional Contact Info (optional): If you're working with a tax preparer, keep their contact information close by in case you have any questions.

Bank Account Details (optional): Consider providing your bank account information if you want to receive your tax refund via direct deposit.

Prior Year's Tax Return (if available): Having a copy of last year's return can be helpful as a reference while filing your current one.

Income Documents:

Salary & Wages: Gather documents showing your income from salaries and wages. This may include Form Group Certificates (PAYG payments), Centrelink payments, or scholarship income.

Investments: If you have investment income, collect documents related to interest, dividends, and capital gains.

Rental Income: For rental property income, keep copies of rental agreements and receipts for property maintenance expenses.

Business Income: Business owners should have sales invoices and bank statements to document their business income.

Deduction Documents:

Work-Related Expenses: If you claim work-related expenses, organize documents like phone bills, travel receipts, and home office expense records.

Donations & Memberships: Document your charitable contributions and professional association memberships with receipts.

Medical Expenses: Keep receipts for medical expenses not covered by Medicare

Education Expenses: Organize documents related to school fees and student loan repayments if claiming education deductions.

Investment Expenses: Don't forget to include receipts for brokerage fees and investment management charges if applicable.

Financial Statements:

Company's Profit & Loss Statement

Company's Balance Sheet

Company owners need to maintain and submit financial records.

Documents Related to Business:

Home Office Details: If your client runs their business from home, ask them to provide details of their home office, including the size of the office space, monthly rent, and electricity usage.

Documents for Vehicle Use: If your client uses their car for business, advise them to maintain a logbook and provide you with a mileage summary of their routes.

Investment Receipts for Assets: Request your client to provide receipts for any capital assets purchased during the current financial year.

By gathering these documents beforehand, you'll be well-prepared to file your tax return accurately and efficiently. In some cases, you might need more or less than what is mentioned above.

The Most Common Mistakes in Income Tax Returns

Here are some typical mistakes that can occur when filing your income tax return. It's important to avoid these errors:

Forgetting to include interest income.

Providing incorrect or missing information regarding dividend imputation credits.

Incorrectly reporting capital gains or losses.

Understating your income.

Overlooking home office expenses.

Failing to claim depreciation on fixtures and fittings in rented properties.

Neglecting to claim depreciation on income-generating buildings.

Not considering costs related to negative gearing for borrowed funds.

Conclusion:

It's important to avoid common errors like overlooking interest income or inaccurately reporting capital gains in your small business tax return or individual or business owner. Seeking professional help from tax accountants in Perth can ensure accurate filing, especially for complex situations. WMK Accounting offers services that can assist with your tax needs. For more information or assistance, visit the Australian Taxation Office (ATO) website. Don't hesitate to reach out for help, as accurate tax filing is crucial for your business's financial health.

Originally Published At: www.wmkaccounting.com.au/news/checklist-for-tax-return-everything-you-need-to-know/

0 notes

Text

A Comprehensive Guide to Finding the Best Business Loans

Welcome to our comprehensive guide to finding the best business loans. In today's competitive business landscape, access to capital is crucial for fueling growth and expansion. Whether you are starting a new venture or looking to scale your existing business, securing the right financing can make all the difference.

In this guide, we will explore two types of business loans: best business loans Sydney and unsecured business loans. By understanding the benefits, eligibility criteria, researching lenders, and comparing loan terms, you will be equipped to make an informed decision that aligns with your business goals.

I. Understanding Best Business Loans:

A. Definition and Benefits:

Best business loans are financial products specifically designed to meet the needs of small businesses. These loans typically offer lower interest rates, longer repayment terms, and larger loan amounts compared to other types of financing options. The benefits of best business loans are numerous. By securing a loan with favorable terms, you can take advantage of lower monthly payments, which can improve your cash flow and provide you with the necessary funds to invest in your business's growth.

B. Eligibility Criteria:

While the specific eligibility requirements for best business loans may vary among lenders, there are some general criteria that most lenders consider. These include a good credit score, a solid business plan, financial statements, and collateral. To increase your chances of approval, it is important to maintain a good credit score, pay your bills on time, and reduce your debt-to-income ratio. You can also improve your creditworthiness by demonstrating a steady stream of income and maintaining a healthy cash flow.

C. Researching Lenders:

When seeking the best business loan, it is crucial to compare different lenders to find the one that offers the most favorable terms and conditions. Online resources such as business loan comparison websites, lender directories, and customer reviews can provide valuable insights into the reputation and reliability of various lenders. It is important to thoroughly research potential lenders to ensure they are reputable, transparent, and have a track record of providing excellent customer service.

D. Application Process:

Once you have identified potential lenders, it is time to start the application process. This typically involves gathering the necessary documents such as business financial statements, tax returns, bank statements, and a detailed business plan. It is important to present a strong application that highlights the viability of your business and demonstrates your ability to repay the loan. Pay attention to detail, ensure all documents are accurate and complete, and be prepared to provide additional information if requested.

II. Exploring Unsecured Business Loans:

A. Definition and Advantages:

Unsecured business loans are a type of financing that does not require collateral. Unlike secured loans, which are backed by assets such as real estate or equipment, unsecured loans are based solely on the creditworthiness of the borrower. The primary advantage of unsecured business loans Perth is the absence of collateral requirements, which can be particularly beneficial for businesses that do not have valuable assets to pledge as security. Additionally, unsecured loans often have faster approval times, allowing businesses to access funds more quickly.

B. Assessing Business Suitability:

While unsecured business loans offer advantages, they may not be suitable for all businesses. It is important to assess your business's suitability for this type of financing. Start by evaluating whether your business has a strong credit history and a stable cash flow. Unsecured loans are generally more suitable for businesses with established operations and predictable revenue streams. Additionally, consider the purpose of the loan. If you need funds for short-term working capital or to seize a time-sensitive opportunity, an unsecured loan may be a better fit than other financing options.

C. Understanding Risk Factors:

Like any financial product, unsecured business loans come with certain risks. These can include higher interest rates compared to secured loans, stricter eligibility requirements, and potentially shorter repayment terms. It is important to carefully evaluate these risks before proceeding with an unsecured loan. Consider your ability to meet the repayment obligations and ensure that the cost of borrowing is justifiable based on the potential return on investment for your business.

D. Comparing Lenders & Loan Terms:

When exploring unsecured business loans, it is crucial to compare different lenders and their loan terms. Factors to consider include interest rates, repayment terms, loan amounts, and any additional fees or charges. It is also important to read customer reviews and assess the level of customer service provided by each lender. By comparing lenders, you can find the best fit for your business's specific needs and financial situation.

III. Making an Informed Decision:

A. Weighing the Pros and Cons:

After understanding the intricacies of both best business loans and unsecured business loans, it is important to weigh the pros and cons of each option. Best business loans offer lower interest rates, longer repayment terms, and larger loan amounts, making them suitable for businesses with well-established operations and stable cash flows. On the other hand, unsecured business loans provide faster approval times and do not require collateral, making them ideal for businesses without valuable assets to pledge. Consider your business's unique needs, financial situation, and risk tolerance before making a decision.

B. Seeking Professional Advice:

Making a decision regarding business loans can be challenging, especially if you are not well-versed in financial matters. It is highly recommended to seek professional advice from financial advisors or loan specialists. These experts can provide personalized guidance based on your specific circumstances, helping you navigate the complex landscape of business financing. Research reputable professionals in your area or consider seeking referrals from trusted sources.

Conclusion:

Securing the right business loan requires careful consideration and research. By understanding the benefits and eligibility criteria of best business loans Sydney, as well as exploring the advantages and risks of unsecured business loans, you can make an informed decision that aligns with your business goals.

Remember to research and compare lenders, gather the necessary documents, and seek professional advice when needed. Armed with the knowledge gained from this comprehensive guide, you are well-equipped to find the best financing option for your business, setting the stage for success and growth.

Reference by - https://bit.ly/3LS0Xbj

#BestBusinessLoansPerth#BestBusinessLoansSydney#UnsecuredBusinessLoansPerth#UnsecuredBusinessLoansSydney

0 notes

Text

Cheap Mechanic Perth

You can count on the team of MV Auto Service & Repair. They offer affordable logbook services, brakes/clutch repairs and diagnostics 6 days a week. They use quality brands like Bendix and have loan cars available plus a waiting lounge.

Shannon and the team at Quads Mods Mechanical have won top spot this year as Perth’s highest-rated mechanic! Their customer ratings last year were an amazing 100%.

MV Auto Service & Repair

The shop must post its hours and policies in a conspicuous place in the customer service area. These should include its labor rates, diagnostic fees, guarantees and methods of payment. Customers should also be told if they are entitled to return replaced parts and must be given a written estimate of the cost of repair work before it is done.

The mechanic will unscrew the sump plug, drain the old oil and change your filter. They will check other key components, such as the lights, battery and fluid levels, and stamp your log book.

If you’re a new car owner, it’s important to get your repairs done right the first time. This will help you save money and keep your vehicle safe. In addition, a professional auto mechanic will help you avoid expensive repairs down the road.

BJ’s Car Care Centre

Cars are the most expensive asset that people own, and they need constant maintenance to make sure that they run smoothly. Car repairs can be costly, but if you choose the right mechanic, you can avoid spending too much. Perthautorepair has the experience and expertise to help you repair your radiator and cooling system quickly.

When your car breaks down, it can be frustrating and inconvenient. However, finding a mobile mechanic in Perth that is honest, fair and efficient can make the process so much easier. Read on to learn more about how to find a good mobile mechanic in Perth and why it is so important to do so. The guide will also highlight how choosing a mobile mechanic can save you money in the long run.

Auto Owls Mechanical & Auto Electrical

Auto Owls Mechanical & Auto Electrical is a licensed 24 Hour Perth mechanic located in Bentley (right next to Welshpool). This family-owned and operated garage opened in 2017, and offers a wide range of car services, from auto electric repairs to logbook servicing. Their customer service is outstanding and they offer a free no-obligation quote for every job. They are also a member of the Auto Master’s Association, so you can be confident that they will take care of your car. Their mobile mechanics are insured and will come to you at a time that suits you. You can even book your appointment online.

West End Garage

West End Garage is a great place to find anything and everything you need for your car. It is a small storefront, but it has aisles upon aisles of merchandise. The employees are very friendly and helpful. There is also a bakery next door that sells great coffee and baked items. You can spend hours walking around and browsing all of the vendors.

One of the best things about mobile mechanics is that they are available when you need them. That means you can have them fix your car quickly and easily without having to make an appointment or go into a shop. Besides, these mobile mechanics offer affordable services and competitive prices. They are also backed by years of experience in the industry.

Noranda Service Centre

Noranda Service Centre is a one-stop shop for all your car servicing needs. They offer log book servicing to keep your manufacturer warranty, air con re gas and repairs, brakes and clutches, auto electrical services, tyres and balancing and much more. They are the trusted mechanics Dianella, Mirrabooka and surrounding suburbs rely on.

Reviews help build trust, encourage interaction, and attract more customers to your business. Use our simple tool to manage your reviews and ratings.

When you need a Perth mobile mechanic, it is important to find one who is trustworthy and reliable. Read this guide to learn what sets these experts apart from the rest, and how you can save money in the long run by choosing them. This will also show you how to avoid costly mistakes.

0 notes

Text

Solar Installation Perth | advancedsolartechnology.com.au

Solar installation Perth is a great way to reduce energy costs, protect the environment and increase the value of your home or business. Depending on the size of your system, you can reach a payback in less than six years.

Koala Solar is an independent Solar installation Perth that offers a range of products. Their systems use Tier 1 panels and inverters from brands like Canadian Solar, Enphase, Fronius, Goodwe, JA Solar, Huawei and LG.

Solargain

Solargain is one of the most well-known and reputable solar companies in Australia. They have a wide range of solar systems on offer, including both residential and commercial options. They also provide a variety of financial solutions, including zero interest loans and rebates for customers.

Founded in 1995, this company started as a small plumbing business before becoming an established solar dealer. Their reputation as one of the best solar companies in Perth is based on their high customer service standards and their ability to install quality products. They also have a long list of industry accreditations and a best-price guarantee.

Solar self-consumption is a great way to cut your electricity bill in Perth. The more solar energy you use directly, the less you will have to buy from the grid, which charges exorbitant prices. You can check the feed-in tariffs of local electric providers using WATTever. However, you should always contact the electric provider directly for accurate rates and program regulations.

Koala Solar

Koala Solar is a Perth-based solar energy company that helps households achieve energy independence. It offers a range of packages that fit all types of household budgets and lifestyles. The company also sells battery storage, allowing homeowners to monitor their energy consumption and savings with smart software.

Customers have given positive reviews about this company’s products and service. They have reported good customer service and affordable rates. They have even recommended Koala Solar to their friends and family members.

The best solar installation Perth companies are those that provide the right type of system for each individual consumer. It’s important to take into account factors like your roof, home energy usage and budget when choosing an installer. Luckily, there are many highly vetted solar retailers who can provide advice on these issues.

Solar Naturally

Founded in 2008, Perth-based Solar Naturally is a large advocate for cleaner energy solutions for homes and businesses. The company offers residential and commercial solar power systems as well as battery storage solutions. It also offers post-sale customer support and maintenance services.

It is important to choose a CEC-accredited installer and retailer. This ensures that your system is designed by an expert and that you’re eligible for the federal government’s rebate. It is a good idea to choose a company with years of experience.

A quality solar panel installers Perth is a great investment for your home. It will save you money on electricity bills and reduce your carbon footprint. Plus, it can increase the value of your property. If you’re renting, you can ask your landlord if he or she would consider installing solar panels. Many landlords are receptive to the idea because it makes their properties more attractive to potential tenants in the future.

Solaire Connect

Solaire Connect is a local family-owned and operated business that provides high quality solar energy systems. They offer competitive pricing and a wide range of products to suit various needs. They also have a strong customer service ethic, and their team is knowledgeable and friendly. They also provide a variety of financing options, including interest free loans.

Unlike other companies in the industry, Solaire Connect does not work on commission. This allows their team to be non-pushy and prioritise their customers’ needs over sales targets. In addition, the company offers a 24-hour after-sales response time for customer inquiries.

Depending on your roof’s pitch and shading, you can expect to generate between 5 and 6 kWh per day from an optimally installed system. Moreover, a well-installed system can produce even more energy if it is located in an area with good access to the sun. Consequently, you should weigh the pros and cons of each option before making your final decision.

#Solar installation Perth#Solar panels price Perth#solar panel installers#Solar power in Australia#buy solar panels perth

0 notes

Photo

Capital Boost helps small and medium businesses in Australia with unsecured business loans. Secure loans up to $500K with no collateral and security in just 24 hours.

#best business loans australia#unsecured small business loans australia#small business loans australia#business loans australia#small business loans perth#unsecured business loans adelaide#business finance brokers melbourne#unsecured business loans sydney#short term business loans australia#unsecured business loans melbourne#business loan broker melbourne#business loans sydney#small business loans nsw#no doc business loans australia#business loans brisbane#best small business loans australia

1 note

·

View note

Text

How Small Businesses Get Funds for Equipment?

Running a small business loan is not a simple assignment. When you start a private company, you need to continue running after its food, adaptability, and achievement. This would expect you to continue putting cash into the business now and then. It very well may be proportional to the business up, or assume up a greater position, re-try the workplace space or purchase more hardware/gear to expand creation. The uplifting news is there are explicit credits accessible for all your organization's needs. One such credit is known as the unstable apparatus advance or hardware money as business loans.

While almost 86 percent* of the individuals who look for money are effective, a couple of independent ventures seek equipment account. On the off chance that you are one of those couples of entrepreneurs, who is searching for a hardware credit, perused on.

The hardware could be whatever is utilized for business purposes. Be it clinical gadgets, for example, symptomatic imager, Cath labs; hardware, for example, semiconductors, circuit sheets, assembling, for example, machine apparatuses, plastics hardware, or innovation-based, for example, PCs, workstations and others. If you are a restauranteur, an espresso machine or a heating stove is likewise hardware. Along these lines, profit the hardware advance to take your independent venture to the following level.

Kinds of gear money

There are three different ways you can decide to procure hardware through moneylenders. You can either purchase the gear with the assistance of a hardware advance or take the machine on rent.

Gear Lease

Similarly, as with certain apparatus, it very well may be a costly recommendation to buy and keep up, numerous entrepreneurs pick renting over purchasing. This implies that you would not need to pay all the cash without a moment's delay, the reimbursement will be spread over a couple of months or years. Be that as it may, the gear rent installments might be expense deductible. There could be some assessment ramifications if you get the gear rented.

Gear Purchase Loan

If you decide to buy the gear, you additionally have a choice to apply for credits against apparatus in the future at whatever point you require capital. The bank will assess the machine at the hour of applying and choose the advance and premium sum as needs be.

Hardware Hire Purchase

Another part of hardware advance is enlisted buy. For this situation, the moneylender remains the proprietor of the machine till the whole credit measure of paid off.

You can decide to either take a machine on rent or apply for hardware money or recruit buy.

In the end,

You can connect with loaning experts like Capital Boost and get a more profound comprehension of how hardware financing functions. At Capital Boost you may consider the mortgage loan as a Business Loan Perth in terms of down payment & number of EMIs. Choose wisely, while you are looking to borrow a loan-keep your requirements in your mind while taking the loan.

Source: Financial Equipment Loans for Small Businesses

0 notes

Text

youtube

Business Name: Loanfocus

Street Address: 9 Hardy Street

City: South Perth

State: Western Australia (WA)

Zip Code: 6151

Country: Australia

Business Phone Number: 0419 043 428

Business Email Address: [email protected]

Website: https://loanfocus.smartonline.com.au/

Facebook: https://www.facebook.com/search/top?q=loanfocus

Description: Who are we? We're mortgage brokers. We'll help navigate you through the competitive and ever-changing mortgage landscape to find the right loan for you. We'll go into bat and negotiate on your behalf, and we'll make the process as simple as possible for you, geared up to deliver fast results. We'll help you avoid the pitfalls, and we'll find loan features to suit your personal circumstances.

Why use us as a mortgage broker when looking for finance?

A mortgage broker is someone who shops around

Google My Business CID URL: https://www.google.com/maps?cid=5946182791051227741

Business Hours: Sunday Closed Monday 8 AM–5:30 PM Tuesday 8 AM–5:30 PM Wednesday 8 AM–5:30 PM Thursday 8 AM–5:30 PM Friday 8 AM–5:30 PM Saturday Closed

Services: Home purchasing,Loan applications,Property closing,Business Loans,Commercial Finance,Commercial Loan,Construction Loans,Home Loans,Investment Loans,Investment Property Loans,Vehicle Leases,Refinancing,Loan shopping

Keywords: Financial advisor; mortgage broker; business consultant; small business financing; home loans

Location:

Service Areas:

2 notes

·

View notes

Text

SMALL BUSINESS LOANS

Almost every small business owner has a need at times for fast cash to improve their cash flow. Applying for a small business loan via traditional mainstream banks can be frustrating and in all too many cases pointless, as they typically decline these types of loans.

Why choose GCC Business Finance?

1-Fast Approval Times

2-Fast Cash

3-Easy Renewal

4-No property security required

5-Minimal documentation required

#business finance#commercial business finance#unsecured small business loans#business loans#australia#perth#sydney

0 notes

Photo

When applying for a business loan, it's essential to prepare a detailed business strategy. We help you with your business plan.

#small business loan broker#business finance broker#business loan broker Melbourne#business loan broker Sydney#business loan broker Perth#business loan broker Adelaide#business loan broker Brisbane#SMSF#SMSF pro

0 notes

Text

How to find the best Business Loans ?

Once you’ve determined why you need a small business loan, the next step is to think through how much money you need—and most importantly, how much of a small business loan you can realistically afford in repayments.

For help call us:- Phone : (08) 6444 6364 .

You can also check out our website:- https://approvedalg.com.au/business-loans

0 notes

Text

A Comprehensive Guide to Small Business Loans: Fueling Growth and Success

Welcome to our blog, where we will be exploring the world of small business loans. As a small business owner, you know that obtaining funding is essential for growth and success. In this guide, we will take a deep dive into the ins and outs of small business loans, providing you with valuable insights and practical tips to help you navigate the lending landscape with confidence. So, let's get started!

Understanding Small Business Loans:

To begin, let's define what small business loans Sydney are and how they work. Small business loans are financial products designed to provide entrepreneurs with the capital they need to start or expand their businesses. These loans can come in various forms, including term loans, SBA loans, and lines of credit. Each type has its own unique features and benefits.

Term loans are a popular choice for many small business owners. They provide a lump sum of money that is repaid over a set period, typically with fixed monthly payments. Small Business Administration and offer favorable terms and lower interest rates. Lines of credit, meanwhile, provide businesses with access to a predetermined amount of funds that can be drawn upon as needed.

The Benefits of Small Business Loans:

Now that we understand the different types of small business loans, let's explore the benefits they offer. Small business loans can be a game-changer for entrepreneurs, enabling them to grow and expand their businesses in various ways.

One of the primary benefits of best business loans Perth is their ability to cover operational expenses. Whether it's paying rent, salaries, or utility bills, having access to capital can help you keep your business running smoothly.

Additionally, loans can be used to purchase inventory or equipment, allowing you to meet customer demands and improve productivity. Furthermore, funds from small business loans can be allocated towards marketing efforts, helping you reach new customers and increase sales.

Another advantage of small business loans is their role in managing cash flow. Many businesses experience fluctuations in revenue, and having a cushion of funds can provide stability during slower periods. Moreover, loans can be instrumental in seizing new opportunities, such as expanding into new markets or launching a new product or service.

How to Qualify for a Small Business Loan:

Obtaining a small business loan requires careful preparation and meeting certain criteria. To increase your chances of approval, it's important to improve your creditworthiness before applying. This can be achieved by maintaining good personal credit scores and building a strong credit history for your business. Lenders often evaluate your creditworthiness to assess your ability to repay the loan.

In addition to creditworthiness, lenders require specific documentation when applying for a small business loan. Financial statements, tax returns, and a well-crafted business plan are typically requested. These documents provide lenders with an understanding of your business's financial health and future prospects. It's important to present accurate and up-to-date information to strengthen your loan application.

Finding the Right Small Business Loan for Your Needs:

When choosing a small business loan, several factors should be considered. Interest rates, repayment terms, and collateral requirements all play a crucial role in determining the best fit for your business. It's essential to evaluate loan offers from different lenders to compare overall costs, rather than solely focusing on interest rates. Consultations with lenders can help clarify terms and conditions, ensuring you make an informed decision.

Applying for a Small Business Loan:

Once you have found the right loan for your needs, it's time to apply. To increase your chances of approval, it's important to follow a step-by-step process. Start by gathering all the necessary documents, including financial statements, tax returns, and a well-prepared business plan. Accurate completion of application forms is crucial, as any errors can delay the approval process. Additionally, consider seeking professional assistance from accountants or small business advisors to enhance your application.

Managing Small Business Loans Responsibly:

After securing a small business loan, it's important to manage the funds responsibly. Create a repayment plan that aligns with your business's cash flow and ensures timely payments. Open communication with your lender is essential, as it fosters a strong relationship and allows for potential modifications if needed. Responsible loan management not only improves your business's financial health but also enhances your credibility with lenders.

Conclusion:

In conclusion, small business loans Sydney are a valuable resource that can fuel the growth and success of your business. Understanding the different types of loans, qualifying criteria, and the application process is crucial for navigating the lending landscape.

Remember, there are numerous resources and professional guidance available to support you throughout this journey. So, take the leap, explore your options, and confidently pursue the small business loan that will help you achieve your entrepreneurial dreams.

Source by - https://bit.ly/46fyftg

0 notes

Photo

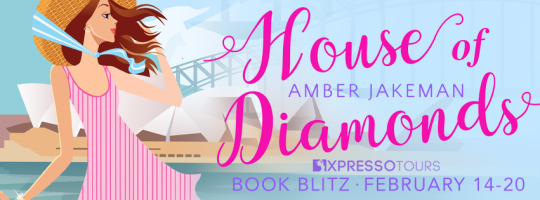

Book Blitz: House of Diamonds (House of Jewels, #1) by Amber Jakeman

House of Diamonds Amber Jakeman (House of Jewels, #1) Publication date: February 10th 2021 Genres: Adult, Contemporary, Romance

A heartwarming, emotionally satisfying contemporary Australian romance with an international flavour, by Amber Jakeman

A fresh start. An instant enemy. But Stella is determined.

Sparkles fly when former office manager Stella Rhees, 30, flees a failed affair with her old boss, Damian. Determined to run her own show, she pursues her dream of creating and selling her own jewellery.

The problem? She’s opened her jaunty stall directly outside the famous Huntleys House of Jewels at the very moment handsome James Huntley the Third, 33, asks her to move so he can stage a publicity stunt. Feisty Stella won’t budge.

Despite a mutual physical attraction, Stella and James become instant enemies, their rivalry fanned by a social media war.

While Huntleys appears prosperous, it’s facing bankruptcy, and James’s mother and playboy brother are squandering the family fortune overseas.

James finds Stella and her fresh ideas irresistible, and she becomes the catalyst for him to change Huntleys ’path of self-destruction. He offers her a job, but how can she accept when she’s vowed to never fall into the old trap of falling in love with the boss?

For Stella and James to find their Happily Ever After, each must overcome personal demons, take risks and learn to trust the other. In this delightful first book of the House of Jewels series, will this dazzling couple ever work out how to put a Huntley engagement ring to its proper purpose?

Goodreads / Amazon / Barnes & Noble / iBooks / Kobo

—

EXCERPT:

What? Move? Why would she move? She’d only just finished setting up. It had taken her months to prepare, and so much time just that morning, arranging her earrings and bracelets. What on earth could he mean?

“… just for a short time, thank you,” he said.

Her hackles rose. However handsome he might be, with that sun-kissed brown hair, and that way of smiling just on one side, as if life was a bit of joke as long as he was in control, he had no right to push her around.

“Actually, Mr …”

“Huntley. James Huntley.” He tipped his head back a little, indicating his connection with the three-storey building behind him, and she turned and read the ornate sign. Huntleys House of Diamonds.

Stella sighed. She didn’t reconfigure her whole life, resigning and moving here from Perth on the other side of the country, only to fall into the trap of obeying the next handsome man. No. She’d been there and done that. For too long. She’d been totally, pathetically, at the mercy of her boss Damian’s demands.

Obeying handsome men was a bad habit she’d finally kicked, hadn’t she?

This new Stella was strong and independent, she reminded herself. Stella now worked for herself, trusted only herself and obeyed only herself. She would no longer be told what to do by men who assumed she’d comply. So, whatever this man wanted, and however attractive he might be – and he was, quite attractive, every bit as good-looking as Damian, his hair more fair, and with a bit of a wave at the front, and those eyes – intense – she knew she had every right to stand her ground. And she would.

He waited expectantly, but she was only just ready to trade. With customers gathering, she needed to sell, sell, sell – and not waste another moment. Her licence to trade wasn’t a give away. It would take her months to pay back the loan she’d taken out to pay for it.

He lifted one hand up toward the side of her stack of display trays, as if to test his strength against its weight, to simply push her stall away. She could swear she saw his healthy bicep flex beneath that high quality pale grey woollen fabric.

How dare he! The flame of defiance inside her flashed fire. No. She would not be shoved away.

“Stella Rhys, Mr Huntley,” she answered, keeping her voice low and controlled, and extending her own hand to be shaken. His was smooth, the hand of a businessman, as cool as her own. It was a fine handshake, pleasant even.

Her mother would have fun reading this palm, she thought, smiling. It was a mistake. He must have interpreted her smile as acquiescence. Nodding and smiling in return, he held her hand just a moment longer than necessary.

“Thanks, so much, Stella. These stalls… There was nothing here for months, and suddenly you appear! Today of all days. It’s so good of you to move. Just for an hour or so.” He gave her the full blue gaze again and smiled.

For a moment Stella weakened, but she remembered the advice of Fritz, ther nearest stallholder, who’d welcomed her to the mall only that morning.

“I’ve been here nearly thirty years, young lady,” Fritz had said. “Seen a thing or two in my time. Seen stalls come and seen them go. Can be tough out here on the mall. Don’t you let anyone push you around.”

Stella knew the terms of her licence. Thursday to Saturday, 11am to 7pm. Right here. So she lifted her sunglasses and fired back a dose of her own dark eyes – bright, quick and determined.

“Actually, James,” she began, amiably enough, with a hint of steel. She gestured at the small crowd gathering to admire her unusual brooches, rings, earrings and pendants, all laid out so temptingly in the bright sunshine. Her excitement ratcheted up a notch. Behind James, two older women, sisters perhaps, were pulling out their purses. Her first customers! It was James who needed to move, so she could trade.

“Look. This is my business, James ‘ –Stellar,’” she continued, polite yet firm, her voice steady. “And I’m not moving it. Not at all. I don’t mean to be unreasonable; nothing personal; but as I see it, the Huntleys property boundary begins at the edge of your doorway. The mall here is public space, and this patch is mine.”

Author Bio:

Partial to sunsets, picnics and poetry, feel-good fiction writer Amber Jakeman was a journalist, ghost writer and editor before succumbing to her addiction to uplifting endings.

She writes from her tiny apartment on the edge of Sydney Harbour, creating wholesome historical and contemporary romance with an international flavour.

When not writing, Amber enjoys time with family and friends, sailing with her husband, travel, walking and savouring other writers' creations.

Amber Jakeman acknowledges Australia's first storytellers and offers respect to Aboriginal people past and present and to their descendants.

Website / Facebook / Twitter / Instagram

GIVEAWAY! a Rafflecopter giveaway

Hosted by:

#Adult, #Bookblitz, #BookBlogger, #BookLove, #Bookshelf, #Contemporary, #ContemporaryRomance, #instabook, #readersofinsta, #readersofinstagram, #Romance, #XpressoBookTours, #XpressoTours

1 note

·

View note