#small business accounting and bookkeeping services

Explore tagged Tumblr posts

Text

WHY OUTSOURCE ACCOUNTING AND BOOKKEEPING SERVICES?

As a startup enterprise owner, minimizing expenses by directly handling your bookkeeping duties when starting usually makes sense. But as your startup evolves, the duration and expertise it takes to conduct your bookkeeping ideally each month indicate you’ll inevitably employ Accounting And Bookkeeping Companies In Dubai.

Most early-stage startups and small company owners have too few trades or administrative jobs to need a full-time bookkeeper, and most of them consider two options. One is employing an in-house accounting and bookkeeper, and the second is outsourcing accounting and bookkeeping services.

Both of these solutions comprise primary bookkeeping duties, such as documenting transactions, moderating bank and credit card accounts, and addressing statements payable. But the main distinction between employing an accountant and bookkeeper versus outsourcing accounting and bookkeeping is that an outsourced bookkeeping service provides access to an entire team of specialists.

Benefits of Outsourcing Accounting And Bookkeeping Services:

You get accounting and bookkeeping solutions that can scale your firm

Your accounting and bookkeeping solution must scale as your startup expands and develops. Because most outsourced accounting and bookkeeping units have access to specialists on numerous topics, they can quickly acclimate your changing bookkeeping requirements.

You gain additional expertise for your money

It can be contesting to discover a high-quality accounting and bookkeeping professional in your business vertical to engage part-time. But, on the other hand, it’s tempting to employ a less skilled bookkeeper hourly for expense savings.

When you operate with an outsourced accounting and bookkeeping business, you acquire the guidance and oversight of their senior bookkeepers and professionals in your vertical without the price of employing them individually.

You gain full-time accounting and bookkeeping access

You can reach the crew anytime during regular business hours when Outsourcing Accounting And Bookkeeping Services. Some solutions even present extended hours to get answers to your queries, no matter the time.

You gain access to more promising accounting and bookkeeping technology

If you still need the software, an accounting and bookkeeping service has the expertise to help you discover the right technology to save time and finances. As a full-service unit, they have experience operating with different platforms and will understand which suits you.

You get better equipped for tax season

Your virtual accounting and bookkeeping team will ensure that your expenditures and transactions are accurately categorized, registered, organized, and readily obtainable for the tax accountant to proceed.

Therefore, if you’re searching for Small Business Accounting And Bookkeeping Services, contact Alpha Equity today!

0 notes

Text

Navigating the Landscape of Tax Preparation and Bookkeeping Services- A Guide to Choosing the Best Agencies

Tax preparation and bookkeeping are integral parts of running a successful business. However, for many entrepreneurs and business owners, these tasks can be daunting and time-consuming. That's where professional services come in handy. In cities like Perth, Brisbane, Sydney, Melbourne, Adelaide, and NSW, agencies like Account Cloud offer comprehensive tax preparation and bookkeeping services to alleviate the burden on businesses. But with so many options available, how do you choose the best agency for your needs? Here's a guide to help you navigate the landscape:

1. Assess Your Needs: Before you start your search for a tax preparation and bookkeeping service agency, it's essential to assess your needs. Determine the scope of services you require, such as tax filing, payroll processing, financial reporting, or general bookkeeping. Understanding your requirements will help you narrow down your options and find agencies that specialize in the services you need.

2. Experience and Expertise: When entrusting your financial matters to a third-party agency, it's crucial to ensure they have the necessary experience and expertise. Look for agencies with a proven track record in tax preparation and bookkeeping services. Consider factors such as the number of years in business, client testimonials, and the qualifications of their team members.

3. Industry Specialization: Different industries have unique tax and accounting requirements. Whether you're in retail, hospitality, healthcare, or any other sector, consider choosing an agency that specializes in serving businesses similar to yours. Industry-specific knowledge can ensure compliance with relevant regulations and optimize tax strategies tailored to your business.

4. Technology and Innovation: The accounting landscape is continually evolving, with advancements in technology reshaping how financial tasks are performed. Seek out agencies that embrace technology and leverage innovative solutions to streamline processes and enhance accuracy. Cloud-based accounting platforms, automation tools, and data analytics can significantly improve efficiency and decision-making.

5. Communication and Accessibility: Effective communication is key to a successful partnership with a tax preparation and bookkeeping agency. Choose an agency that prioritizes clear and transparent communication, keeping you informed about your financial status and any regulatory changes that may affect your business. Additionally, consider their accessibility and responsiveness to inquiries or concerns.

6. Compliance and Security: Compliance with tax laws and regulations is non-negotiable when it comes to financial matters. Ensure that the agency you choose adheres to the highest standards of compliance and stays updated with the latest regulatory changes. Moreover, prioritize security measures to protect sensitive financial information against unauthorized access or data breaches.

7. Scalability and Flexibility: As your business grows, your accounting needs may evolve as well. Select a tax preparation and bookkeeping agency that can scale its services according to your business growth. Whether you're a small startup or a large enterprise, flexibility in service offerings and pricing structures ensures that you receive tailored solutions aligned with your current and future needs.

8. Cost and Value: While cost is undoubtedly a factor in the decision-making process, it's essential to consider the value proposition offered by the agency. Instead of solely focusing on the lowest price, evaluate the services, expertise, and support provided in relation to the cost. A higher upfront investment in quality services can often yield long-term benefits and cost savings through improved financial management.

Choosing the best tax preparation and bookkeeping services agency requires careful consideration of various factors, including your specific needs, the agency's experience and expertise, industry specialization, technology adoption, communication practices, compliance standards, scalability, and cost-effectiveness. By conducting thorough research and due diligence, you can find a trusted partner like Account Cloud to handle your financial affairs efficiently, allowing you to focus on growing your business with peace of mind.

#Bookkeeping Services Melbourne#Bookkeeping Services Brisbane#Bookkeeping Services Perth#Perth Bookkeeping Services#Adelaide Bookkeeping Services#Online Bookkeeping and Accounting Perth#Online Bookkeeping Services Melbourne#Small Business Bookkeeping Services Brisbane#Small Business Bookkeeping Services Sydney#Small Business Bookkeeping Services Perth#Small Business Bookkeeping Services NSW#Premier Tax and Bookkeeping Adelaide#Tax and Accounting Services Brisbane#Tax and Accounting Services Sydney#Tax and Accounting Services Perth#Personal Tax Accountant Brisbane

3 notes

·

View notes

Text

Bookkeeping Company in Denver

Aqtoro is the best Bookkeeping Company in Denver that understands the needs and concerns of businesses as the accounting needs of every firm are unique, and accordingly, our experts provide the right online bookkeeping services to businesses in Denver.

#Bookkeeping and Accounting Services For Small Business in Denver#Accounting and Bookkeeping Services in Denver#payroll & bookkeeping services in denver#Bookkeeping Company in Denver#Online Bookkeeping in Denver#Bookkeeping and Tax Services Denver#Local Bookkeeping Services Denver

3 notes

·

View notes

Text

Do you have a healthcare business? Are you a Healthcare Manager? This is how you achieve success in business! Call us!

#reliable bookkeeping#bookkeepers#record keepers#healthcare bookkeeping#Los Angeles#California Services#small business accountants#full-service bookkeeping#thebookkeepersrus

3 notes

·

View notes

Text

Payroll Accuracy: Tips for Error-Free Payroll Processing

The processing of payroll is an essential operational task inside an organisation, as it guarantees the accurate and timely compensation of personnel. Nevertheless, the intricacy of payroll computations and the dynamic nature of tax legislation might provide a significant challenge in undertaking this endeavour. Mistakes in payroll administration can lead to employee dissatisfaction, non-compliance with regulations, and potential legal ramifications. In order to mitigate such complexities, it is imperative to give precedence to the precision of payroll calculations. Discover the strategic advantages of outsourcing your payroll to VNC Global - an excellent Payroll management company in Singapore. Choose VNC Global for secure and cost-effective payroll management.

This blog post aims to examine key strategies that can facilitate accurate payroll processing and enhance search engine optimisation (SEO) endeavours.

● Stay Informed About Tax Laws:

Keeping up-to-date with tax rules is crucial for maintaining payroll accuracy due to the frequent changes in tax regulations. It is imperative to consistently assess and examine the tax regulations at the federal, state, and municipal levels in order to guarantee adherence and conformity. It is advisable to utilise tax compliance software or seek guidance from tax professionals in order to ensure the maintenance of an updated payroll system.

● Implement Robust Payroll Software:

It is advisable to allocate resources towards the acquisition of dependable payroll software capable of managing intricate computations and streamlining diverse payroll procedures. These technologies have the potential to reduce errors that are commonly associated with human calculations and data entry. Some commonly used payroll software alternatives are ADP, Gusto, and QuickBooks.

● Maintain Accurate Employee Records:

It is vital to ensure the up-to-dateness and accuracy of all employee information, encompassing tax forms, personal particulars, and bank account details. The presence of erroneous personnel data can result in payment inaccuracies and non-compliance concerns. It is imperative to consistently assess and revise employee records. Experience the peace of mind that comes with organized financial records. Connect with VNC Global - the most trusted provider of Bookkeeping services for small businesses in Singapore and transform your business together.

● Use a Standardized Payroll Process:

Establishing a standardised procedure for payroll processing entails the development of a comprehensive framework that delineates the sequential stages involved, commencing from the first data entry phase and culminating in the distribution of the payroll. Ensuring uniformity in payroll operations can aid in mitigating the probability of errors.

● Double-Check Calculations:

Despite the utilisation of sophisticated payroll software, it remains imperative to conduct a thorough verification of computations in order to identify and rectify any potential errors. Incorrect payments can occur as a result of a minor error during data entry or due to a software malfunction. It is imperative to conduct a comprehensive examination of each paycheck prior to initiating the payroll processing procedure.

● Cross-Train Payroll Staff:

To mitigate the risk of excessive dependence on a sole payroll administrator, it is advisable to implement cross-training measures for the payroll staff. It is advisable to implement a cross-training programme for the payroll workforce, ensuring that multiple employees have the necessary skills and knowledge to effectively manage payroll tasks. Implementing this measure will effectively mitigate potential interruptions that may arise due to personnel turnover or absence.

● Conduct Regular Audits:

It is recommended to conduct regular audits of the payroll system in order to rapidly identify and resolve any problems or anomalies that may arise. These audits have the potential to identify any potential concerns prior to their escalation into severe difficulties. Maximize your time and resources by outsourcing your Accounting services for small businesses in Singapore to VNC Global. Request a quote to simplify your financial tasks.

● Seek Professional Help:

It is advisable to explore the option of engaging the services of a professional payroll service provider in order to outsource your payroll processing. These organisations possess expertise in payroll and tax compliance, hence diminishing the probability of errors.

Final Thoughts:

The maintenance of payroll accuracy is of utmost importance in ensuring employee satisfaction, adhering to tax requirements, and mitigating potential legal complexities. One can effectively decrease errors in payroll processing by acquiring knowledge of tax rules, utilising dependable software, upholding precise record-keeping practises, and adhering to standardised procedures. Furthermore, the implementation of routine audits and the utilisation of professional assistance, when deemed essential, can significantly augment the level of accuracy. Ensuring payroll accuracy is crucial not only for the welfare of employees but also for the prosperity of the organisation.

Effortlessly manage your payroll with a tailored payroll system in Singapore. Reach out now to VNC Global’s accurate Payroll management system in Singapore and see how we can enhance your payroll processes.

#Payroll management company in Singapore#Bookkeeping services for small businesses in Singapore#Accounting services for small businesses in Singapore#Payroll management system in Singapore#VNC Global

3 notes

·

View notes

Text

#accounting firms#bookkeeping#bookkeeping firm#small business bookkeeping#financial management#bookkeeping solutions#accounting services#accountingservices

4 notes

·

View notes

Text

Why Should Small Businesses Consider Professional Bookkeeping Services?

Financial management is one of many duties and responsibilities that must be balanced when running a small business. There are compelling reasons to think about hiring professional bookkeeping services, even if some business owners would try to do their own bookkeeping.

Compliance and tax support are additional advantages of professional bookkeeping services for small business. Bookkeeping professionals are well-versed in tax laws and regulations, ensuring that small businesses remain compliant and avoid penalties. They stay updated on changes in tax laws and provide accurate and timely tax support, including preparation and filing of tax returns. This helps small business owners navigate the complexities of tax compliance, reducing stress and ensuring adherence to legal requirements.

Conclusion, small businesses should seriously consider professional bookkeeping services due to the expertise, accuracy, time savings, financial insights, cost savings, compliance support, and tax expertise they offer. By outsourcing bookkeeping tasks, entrepreneurs can focus on their core business activities, make informed decisions based on accurate financial data, and ultimately drive the success of their small business.

#Bookkeeping service for small business#accounting and bookkeeping service#Payroll service#Bookkeeping service#Outsourced bookkeeping service

2 notes

·

View notes

Text

Why Small Businesses Need Outsource Bookkeeping Services?

Outsourcing bookkeeping can be a great way to save time and improve the accuracy of your business's financial records. If you're a small business owner, it's something that you should consider.

#accounting#accounting and bookkeeping services#outsource bookkeeping#outsource accounting#bookkeeping services for small businesses

2 notes

·

View notes

Text

Unlock Growth & Efficiency with Collab Accounting’s White-Label Services

The accounting industry is evolving rapidly, and firms are constantly looking for ways to scale without adding operational burdens. This is where Collab Accounting’s white-label services come in—allowing accounting firms to expand their offerings, improve efficiency, and deliver top-tier services under their own brand.

What Are White-Label Accounting Services?

White-label services mean we handle your Accounting, Bookkeeping, and compliance needs while you take the credit. Your clients see your brand, while our team works in the background to ensure smooth operations.

How We Help Accounting Firms Scale Effortlessly

1. End-to-End Bookkeeping & Compliance – Our experts handle everything from transaction entries to reconciliations, BAS lodgments, and Payroll processing.

2. Xero, QuickBooks & MYOB Expertise – We integrate seamlessly with your existing systems, ensuring accuracy and efficiency.

3. SMSF & Tax Return Preparation – We help firms streamline complex tax compliance while maintaining 100% confidentiality.

4. Virtual CFO Support – Need an extra layer of financial expertise for your clients? We provide Financial analysis, forecasting, and reporting to help businesses make better decisions.

5. Scalability Without Overheads – No need to hire in-house accountants when you can have a dedicated offshore team working under your brand.

Why Choose Collab Accounting?

1. 100% White-Label Model – Your clients see your brand, and we do the work. 2. Dedicated Team with Full Compliance – We ensure data security and adherence to Australian accounting standards. 3. Seamless Communication – Work with a team that understands your business, aligns with your processes, and provides real-time updates.

Let’s Partner for Success!

If you’re an accounting firm looking to scale without increasing overhead costs, our white-label services can be the perfect solution. Focus on growing your firm while we handle the work.

Get in touch with us today to explore a tailored white-label accounting solution!

#bookkeeping services for small business#outsource payroll services#bookkeeping services outsourcing#top 10 accounting outsourcing companies in india

0 notes

Text

Professional Bookkeeping Services USA

Professional Accounting Services for Over 20 Years

Outsourced Bookkeeping is your premium business partner for accounting and bookkeeping services. We render services to individuals, small and large companies, and CPAs across the US. Hospitality and real estate sectors are our specialization.

For real estate, we manage property accounts, leases, and customer accounts. In the hospitality industry, we assist restaurant owners with accounts payable, cash flow, inventory management, and customer accounts.

Our team is equipped with advanced professional knowledge and tools to ensure compliance with state and federal regulations. We provide top-notch accounting and bookkeeping solutions tailored to your specific needs.

Accounting & Bookkeeping Services We Offer

Tracking Business Transactions

Preparation of Financial Statements

Performing Bank Reconciliations

Accounts Payable & Receivable Service

Customized Business Reporting & Periodic Reviews

Preparation of Cash Flow Management

Managing Cash and Subsidiary Ledgers

Tax Filing Process

To know more: https://www.outsourcedbookeeping.com/contact-us/

#outsourced bookkeeping#professional bookkeeping services#bookkeeping services for small business#outsource accounting#small business accounting

0 notes

Text

Tax Filing Surrey: Expert Help for a Stress-Free Tax Season

Tax filing can be a daunting task for many individuals and businesses. Whether you're self-employed, managing a small business, or simply filing your personal taxes, the process can quickly become overwhelming. For residents of Tax Filing Surrey and the surrounding areas, having the right support is crucial to ensure accuracy, maximize your returns, and avoid any potential mistakes that could lead to penalties. If you're looking for professional guidance, an accountant Vancouver or Tax Filing Vancouver service could be the solution you're seeking.

In this article, we'll dive deep into the importance of accurate tax filing and how choosing a local expert in Tax Filing Surrey can save you time, money, and stress.

Why Accurate Tax Filing Surrey Is Essential

Filing your taxes accurately isn't just about avoiding penalties; it’s about ensuring you take advantage of all available deductions, credits, and savings. Tax Filing Surrey professionals understand the local tax laws and can guide you through the filing process to ensure you meet all the legal requirements while maximizing your return.

Many people assume that tax filing is a one-time event, but it’s actually a year-round process that requires careful planning. A professional accountant Vancouver can help you stay organized and prepared for tax season by providing advice on managing income, tracking deductions, and ensuring that your filings are compliant with Canadian tax laws.

How an Accountant Vancouver Can Help

An experienced accountant Vancouver brings a wealth of knowledge and expertise to the table. Whether you need help with tax preparation, bookkeeping, or strategic tax planning, a qualified accountant can ensure that your finances are in order and your taxes are filed correctly. Below are some of the key services an accountant can offer:

1. Tax Filing Vancouver Services

Filing taxes can seem straightforward, but small errors can lead to significant problems. Hiring a professional for Tax Filing Vancouver services ensures that all forms are filled out correctly, deductions are accounted for, and your taxes are filed on time. Accountants also have a deep understanding of tax law, which can be especially valuable when handling complex tax situations.

2. Tax Planning and Advice

Many people think of tax filing as a once-a-year activity, but proper tax planning is a year-round endeavor. A skilled accountant Vancouver can help you plan your finances to minimize your tax burden. This might include advice on retirement savings, investment strategies, or managing business expenses. Tax planning can help you maximize deductions and credits while ensuring compliance with tax regulations.

3. Managing Business Taxes

If you're a business owner in Surrey or Vancouver, managing business taxes is crucial. Tax laws for businesses are often more complex than personal taxes, and an accountant can assist in navigating the nuances of corporate tax filings, payroll, sales tax, and other obligations. A local accountant Vancouver understands the local business landscape, ensuring that your business is tax-efficient and compliant with all requirements.

The Benefits of Hiring a Tax Filing Surrey Professional

The main reason to consider professional help with Tax Filing Surrey is the peace of mind it brings. When you hire an expert, you don’t have to worry about making costly mistakes or missing important deadlines. Here are some other benefits of hiring a tax professional in Surrey:

1. Expertise in Local and National Tax Laws

A Tax Filing Surrey professional stays up-to-date with both provincial and national tax laws. This is important because tax laws are constantly changing, and keeping up with these changes can be challenging for the average person. Professionals know the ins and outs of Canadian tax law, so you can be confident that your filing is accurate and compliant.

2. Time-Saving

Tax filing can be time-consuming. Between gathering all necessary documents, filling out the correct forms, and calculating deductions, it can take up a significant amount of time. By hiring an expert in Tax Filing Surrey, you save valuable time, allowing you to focus on other important aspects of your life or business.

3. Avoiding Tax Penalties

Mistakes on your tax return can result in penalties or even audits. By hiring a skilled accountant Vancouver, you reduce the risk of errors that could lead to costly consequences. Tax professionals ensure that your filings are correct and submitted on time, helping you avoid unnecessary fees or legal issues.

4. Personalized Service

A professional accountant will take the time to understand your unique financial situation. Whether you're filing personal taxes, running a business, or managing investments, an accountant can tailor their advice and services to fit your specific needs. This personalized service ensures that you are making the best decisions for your financial future.

Common Tax Filing Mistakes to Avoid

There are several common mistakes that people often make during the Tax Filing Surrey process. These errors can lead to missed opportunities or potential penalties. Some of the most common mistakes include:

1. Missing Deductions or Credits

One of the biggest benefits of working with an accountant Vancouver is that they can help you identify tax deductions and credits that you might overlook. For example, self-employed individuals may be entitled to deductions for home office expenses, while families with children may qualify for various child-related credits.

2. Incorrectly Reporting Income

Failure to report all of your income, even if it’s earned from freelance work or investments, is a serious mistake that can trigger an audit. A professional accountant can help ensure that all sources of income are properly reported.

3. Filing Late

Late filings can result in fines and interest charges. By working with a professional in Tax Filing Surrey, you can ensure that your return is filed on time and that you avoid unnecessary penalties.

4. Not Keeping Proper Records

Good record-keeping is essential for accurate tax filing. Many people fail to keep track of receipts, invoices, or other important financial documents. An experienced accountant Vancouver can help you organize your financial records and ensure that you have everything you need for a smooth tax filing process.

How to Choose the Right Accountant Vancouver for Your Needs

When selecting an accountant Vancouver, it’s important to find someone who understands your specific needs. Whether you are an individual or a business owner, the right accountant can make all the difference in how your taxes are managed. Here are some tips for choosing the best professional:

1. Look for Qualifications and Experience

Ensure that the accountant you choose has the proper qualifications and experience. They should be a certified professional with experience in handling Tax Filing Vancouver. This will give you confidence that they understand the intricacies of the tax system and can handle your filing needs.

2. Check for Specializations

Some accountants specialize in certain areas, such as corporate taxes, small business taxes, or personal tax planning. If you are a business owner, look for an accountant who has experience with business taxes. Similarly, if you're dealing with complex personal tax situations, find an accountant who specializes in personal tax filings.

3. Ask for References

Don’t hesitate to ask for references or testimonials from previous clients. This can give you insight into the accountant’s professionalism and the quality of their services. A reputable accountant Vancouver will have no problem providing references.

4. Ensure They Offer Personalized Services

Every financial situation is unique. Be sure to choose an accountant who takes the time to understand your specific circumstances and offers personalized advice. A one-size-fits-all approach may not be suitable for your needs.

The Importance of Early Tax Planning

When it comes to Tax Filing Surrey, starting early can save you time and money. Early tax planning allows you to take advantage of deductions and credits, adjust your withholding if necessary, and make any needed financial adjustments to minimize your tax burden. A Tax Filing Vancouver professional can work with you throughout the year to ensure you are prepared for tax season.

Conclusion: Take Control of Your Taxes Today

Filing taxes doesn’t have to be stressful. With the right help from an experienced accountant Vancouver, you can ensure that your Tax Filing Surrey process is seamless, accurate, and stress-free. Whether you are filing as an individual, a small business owner, or a corporation, hiring a professional can help you maximize your tax savings and ensure compliance with all applicable laws.

If you’re ready to take the next step and simplify your tax filing process, reach out to a local accountant Vancouver or Tax Filing Surrey expert today. They can help guide you through the process and ensure that you’re making the most of your tax opportunities.

By working with a qualified professional, you’ll have peace of mind knowing that your taxes are in good hands.

#accountant vancouver#Tax Filing Vancouver#accountant langley#Tax Filing Surrey#bookkeeping services vancouver#small business accountant vancouver#bookkeeper vancouver

0 notes

Text

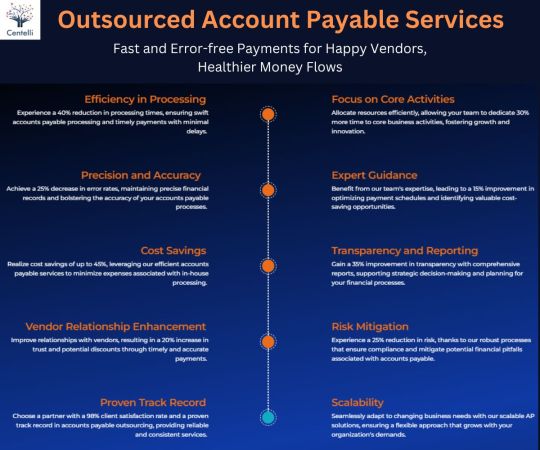

#Accounting Services#Outsourcing Accounting#Bookkeeping Services#small business#finance#Atlanta#Centelli#USA#hire accountants#Sage Accounting#Account Payable Services

0 notes

Text

Efficient Real-Time Bookkeeping for Startups

all-in-one accounting automation software. one platform for bill pay, receipt capture, expense reimbursement, credit card spend management, revenue tracking, real-time reports, and continuous updating and reconciliation of QuickBooks. Get control of your financial data with Docyt. Accounting Automation Software for Businesses. For more details click here: https://docyt.com/startups/

#financial reporting software#expense management software#accounting workflow software#accounts payable automation#accounts payable automation software#accounts payable software for small business#bookkeeping services for business#bookkeeping software for accountants#bookkeeping software for accounting firms#business bookkeeping software#employee expense report

0 notes

Text

O&K Accounting

1420 5th Ave #2200, Seattle WA 98101

Phone # 206-440-5846

O&K Accounting Inc. provides expert bookkeeping, tax preparation, payroll management, and financial consulting services for small to mid-sized businesses. Our dedicated team ensures accuracy, compliance, and financial growth with a client-focused approach. Serving businesses across Washington State, we specialize in tailored accounting solutions to meet diverse needs.

http://www.oandkacct.com

#Accounting Services#Bookkeeping#Tax Preparation#Payroll Management#Financial Consulting#Small Business Accounting#Business Tax Services#Enrolled Agent#QuickBooks ProAdvisor#cpa

1 note

·

View note

Text

#online bookkeeping services#bookkeeping services for small businesses'#online accounting#accountant for small businesses

1 note

·

View note

Text

Expert Accounting and Bookkeeping Services Since 2004

Professional Accounting Services for Over 20 Years

Outsourced Bookkeeping is your premium business partner for accounting and bookkeeping services. We render services to individuals, small and large companies, and CPAs across the US. Hospitality and real estate sectors are our specialization.

For real estate, we manage property accounts, leases, and customer accounts. In the hospitality industry, we assist restaurant owners with accounts payable, cash flow, inventory management, and customer accounts.

Our team is equipped with advanced professional knowledge and tools to ensure compliance with state and federal regulations. We provide top-notch accounting and bookkeeping solutions tailored to your specific needs.

Accounting & Bookkeeping Services We Offer

Tracking Business Transactions

Preparation of Financial Statements

Performing Bank Reconciliations

Accounts Payable & Receivable Service

Customized Business Reporting & Periodic Reviews

Preparation of Cash Flow Management

Managing Cash and Subsidiary Ledgers

Tax Filing Process

#bookkeeping services#bookkeeping services near me#outsourcing accounting and bookkeeping services#bookkeeping services for small business#online bookkeeping services#accounting and bookkeeping services#online accounting and bookkeeping services#online business bookkeeping services#bookkeeping and tax services#quickbooks bookkeeping services#professional bookkeeping services#virtual bookkeeping services

0 notes