#shrinivas

Explore tagged Tumblr posts

Text

#my scans#루��의 아카이브#png#satya#incense sticks#shrinivas sugandhalaya#i scan them after I finished the whole box as a record

165 notes

·

View notes

Photo

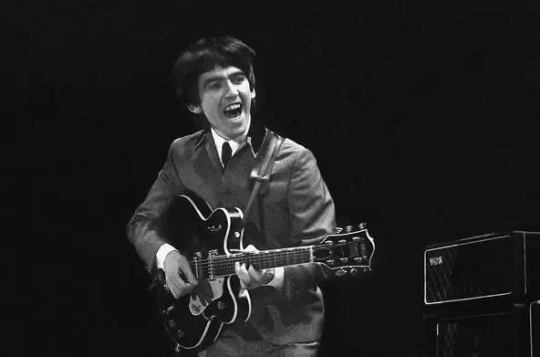

George Harrison in February 1964 and October 1985; photos by Mike Mitchell, and Alan Davidson/Shutterstock.

“‘I know I’m supposed to be a guitar player, but I don’t really feel like one. […] I have to figure out what I’m gonna do and maybe even learn a part. I’m just not that fluent with it.’

That opinion is open to debate. Co-Wilbury Jeff Lynne calls George ‘a great guitar player. When he strikes up on the slide there’s nobody better; his precision, his vibrato is perfect. But he always plays it down.‘

‘I’m not playing it down,’ George counters. ‘I’m just not playing it up! I think Keith [Richards] is one of the best rock n’ roll rhythm guitar players. I don’t think he’s very good at lead. But this is what I feel about myself too: What we do is make records, and the records have some good guitar parts on then. I like Keith enormously, I think he’s great, but he’s not Albert or B.B. King. Anyway, the main thing about him is that he has the confidence,’ George smiles. ‘So even if it’s not perfect he doesn’t care.’ But isn’t there a virtue in concise, structure solos? Isn’t that what was sacrificed when guitar heroes came into vogue? ‘Well, I’m certainly not a guitar hero,’ George says. […] ‘I’m not trying to be the best guitar player. I don’t really care about it. To me, you can get the greatest guitar player in the world and in my eyes he’s still nothing compared to the musicians I really admire, the Ravi Shankars of the world. I’ve got a record in my bag now of a 12-year-old Indian guy [U Shrivinvas] playing electric mandolin who will blow way those guys in heavy-metal bands, no question about it. It doesn’t impress me to hear some guy play this noisy fast shit. I’d rather hear Robert Johnson or Ry Cooder or Segovia. Those are the guitar players I like. But you know I like everything basically — except noisy head banging shit.’ He laughs. ‘And drum computers and DX7s and reverb! […] [I]t’s not my goal to play this lick that everybody else can play anyway. You can’t be everything in life. I’m just thankful that I’m here. And whatever I do, why, that’s it.’” - Musician, March 1990

“[George] knew every chord. He knew so many chords. He was a great, great musician.” - Tom Petty, Conversations With Tom Petty (2005) (x)

#George Harrison#quote#quotes about George#quotes by George#Jeff Lynne#Tom Petty#The Beatles#The Traveling Wilburys#BB King#Keith Richards#U Shrinivas#et al#<3#George and Jeff Lynne#George and Tom Petty#1960s#1970s#1980s#1990s#fits queue like a glove

63 notes

·

View notes

Text

youtube

Beautiful exposition in Amrithavarshini by U Srinivas

#amritavarshini#mandolin shrinivas#u srinivas#carnatic#indian classical#carnatic instrumental#mandolin#Youtube

0 notes

Text

5/6/2024

Infinity 8's

Afternoon Songs

Sunset

Looking At Tahquitz

Sunset

King Of The Mountain

Watchin' What He

Sees

Sunset

Incense Burning

Satya

Agarbatti

Shrinivas

Sugandhalaya

Nag Champa

California

Meditation

Scents

Satya

Sai Baba

Cleansing Your Aura

Or Making Room

For Tantra

Yoga

Satya

Sai Baba

Nag Champas

Scents Of Yesteryears

Beatles Kids'

Campfire Songs

Yogi Potlucks

Flying On Foam

Magic Doug Henning

Tricks

San Francisco Weekends

Flights

Camping At The Harbors

Beach Boys

Potlucks

Donovan

Flyers

Red Rubber Ball

Reunions

Sun's Setting

Going Round

"The Cyrkle,"

Looking For Traffic

Songs

Looking For Everyone

I've Ever Known

And Loved

Wonderin' When

You'll Come Along

Soulmates

Infinity 8's

An Imprint

On You

Soulmates

Twinflames

Infinity 8's

Eternity

Turns

Back

On Her Self

Eternity

Turns Back

On Her

Self

Totality

Eternity

Infinity 8's

Peace,

Nitya Nella Davigo Azam Moezzi Huntley Rawal

5 notes

·

View notes

Video

youtube

Haindava - Bellamkonda Shrinivas | New South Blockbuster Action Movie 20...

0 notes

Text

Why Data Centres Welcome DeepSeek: Embracing Opportunity Over Challenge

The rising availability of AI tools including DeepSeek causes data processing volume to grow which necessitates stakeholders to build sophisticated data centers.

Data centre infrastructure providers in India predict that DeepSeek's emergence as China's affordable AI platform will boost the necessity for additional centers even though it will not decrease the demand. Organizations operate data centers as facilities which provide housing for their essential applications and data. The government announced during January 30 that DeepSeek would soon function from Indian servers to solve privacy problems with data security related to the Chinese AI platform.

The Chinese tech firm DeepSeek has garnered significant media attention with their AI model R1 supplanting ChatGPT to achieve the leading position among free apps in Apple's Appstore thus contesting US market control in the AI domain. “We’re very excited for India. Cheaper models for inference are the need of the hour. This will only grow data centres and make AI accessible to every Indian,” said Darshan Hiranandani, CEO of Hiranandani Group. He believes that these developments will expand data centers to benefit every Indian citizen with access to AI technology. Anant Raj Cloud as a subsidiary of the listed firm Anant Raj seeks to capitalize on DeepSeek opportunities for business expansion.

DeepSeek's launch should enhance India's data center demand which already keeps growing at a rapid pace. DeepSeek artificial intelligence models necessitate extensive computing power together with storage capabilities thus creating increased requirements for data centers that offer high-performance and scalability along with energy efficiency according to Amit Sarin Managing Director at Anant Raj Limited. The present data centre market share in India stands at 1% whereas the country generates 28% of the world's data despite its status. The sector demonstrates extensive growth opportunities according to his explanation.

The increasing position of India as a global technology hub will drive businesses to develop infrastructure for AI applications thus requiring more investment in data centers. National demand for innovative data centers that offer security will grow exponentially due to regulatory data-location policies together with cloud services expansion according to Maini. AI systems act as major sources and processors of data that increases at an unprecedented rate worldwide. Data centers will require more updates due to the rising availability of affordable AI tools along with expanding data processing volumes.

Sarin indicated that “this market direction matches our company strategy which enables us to capitalize on rising product need.” Jatin Shah from Colliers India as the Chief Strategy Officer emphasized that DeepSeek will optimally operate data centers through improved performance and decreased operational costs while enhancing functionality. DeepSeek equipped its AI-based platform with features to scale up alongside data centre expansion so operations can optimize resources and preserve their performance capabilities.

DeepSeek brings a significant cost reduction to the artificial intelligence (AI) field through its redefinition of data centre operations. Shrinivas Rao, FRICS, CEO of Vestian, predicts that the Indian data centre sector will adapt energy-efficient designs to reduce operating expenses since DeepSeek employs balanced loading methods. According to CBRE the Indian data center market will grow to 2,070 megawatts (MW) capacity by the end of 2025. The existing data centre capacity in the country totals 1,255 MW and analysts forecast this will reach around 1,600 MW before 2024 ends.

0 notes

Link

[ad_1] - Advertisement - Over the past five years, Cyient DLM (formerly Rangsons Electronics), a subsidiary of Cyient Limited, has rapidly expanded its footprint in the design-led manufacturing industry through strategic acquisitions. EFY’s Yashasvini Razdan interviewed Cyient’s CFO, Shrinivas Kulkarni, to explore the company’s inorganic growth strategy amidst shifting market dynamics over the past six months. Shrinivas Kulkarni CFO, Cyient DLM Q. What is the strategy behind an acquisition? A. Acquisitions are often undertaken to address strategic gaps and position the company more effectively. In many cases, an inorganic approach enables faster progress than organic growth. Cyient DLM actively seeks assets that align with its strategic goals and accelerate progress. Our recent acquisition of Torrington-based Altek Electronics not only aligns with our operations but also introduces new capabilities. With North America as a key market, given the concentration of our customer base there, this acquisition strengthens our manufacturing presence in the region while facilitating business expansion and customer acquisition. Q. How do you think this acquisition will impact the revenue growth for Cyient DLM in FY25? A. The volatile nature of our industry prevents us from providing a yearly outlook, as a single deal can significantly alter projections. However, we are confident about achieving a 30% CAGR over a three- to five-year period.- Advertisement - Strong industry tailwinds, particularly the emphasis on manufacturing in India, underpin this confidence. Inorganic growth supports this outlook, though it was not the primary driver of the Altek acquisition. The acquisition was driven by the capabilities it brings, access to new customers, diversification into industrial and medical sectors and ITAR certifications. With Cyient DLM’s legacy, we are seeing a lot of traction in aerospace and defence. The company we acquired generates 90% of its revenue from industrial and medical sectors, which fits well with our diversification strategy. These were the primary considerations and growth is more a sweetener on top of the other strategic considerations. Q. How does acquiring companies outside of India help in the push towards manufacturing in India? A. There are two distinct considerations—a push towards manufacturing in India to cater to the domestic market and for exports. We are leveraging the benefits available in these areas. The acquisition serves a different purpose: it aims to serve global customers who require proximity. Proximity to customers often makes a significant difference in meeting their requirements. For instance, certain needs, such as ITAR-related projects, cannot be fulfilled from India. In this sense, the approaches are complementary rather than mutually exclusive. We can effectively operate both outside of India and within India. Q. Cyient Limited recently divested a significant stake in Cyient DLM. How does this impact mergers and acquisitions across different industry segments? A. Cyient Limited has its own strategy, with a clear focus on industries with growth potential. For example, the semiconductor industry is experiencing a global push for manufacturing and design, including in India. The stake sale was one of several options to fund such initiatives. Cyient Ltd continues to hold a majority stake in DLM, and the divestment was part of a strategy to fund strategic initiatives, including acquisitions. Cyient acquired Belgium-based AnSem for analogue ASIC design capabilities and inaugurated a centre of excellence (CoE) for Allegro Microsystems. It also invested in Azimuth AI, a fabless ASIC startup developing energy and power solutions. These efforts reflect a targeted approach to carve out the semiconductor business as a standalone entity. Each segment of engineering services has unique nuances. Focusing on individual industries with tailored operating and capital structures is often more effective. This rationale underpins the decision to create a separate entity for the semiconductor business. Q. What are the criteria that Cyient DLM uses to evaluate potential M&A targets, particularly in the automotive and semiconductor space? A. I think our M&A strategy is increasingly shifting towards product-focused opportunities. Cyient DLM’s strength lies in its build-to-spec capabilities, where we contribute to both design and manufacturing. Almost 25% of our sales pipeline today comprises build-to-spec models and opportunities. Investing in design not only enhances customer ownership and stickiness but also offers greater flexibility in the supply chain, resulting in higher margins. Our M&A strategy aligns with this approach. We are looking for companies that provide complementary capabilities to strengthen this journey. Adding capacity or merely gaining new clients through inorganic means is not our primary focus. We are not facing capacity constraints and are currently operating at 55-60% capacity. We can generate an additional $100 million in revenue without requiring significant capacity expansion. Acquisitions that address gaps in our design capabilities or bring expertise advancing our strategic goal of transforming from a pure-play build-to-print manufacturing company into a product-focused organisation interest us. Q. Why does Cyient DLM emphasise design-led-manufacturing, unlike other EMS manufacturers in India? A. We are accelerating our build-to-spec offerings. The more we engage in this industry, the clearer it becomes that differentiation is crucial. Without build-to-spec, companies risk becoming commoditised, which might lead to growth but without margin expansion or better returns for shareholders. The only way to command higher margins and achieve a leadership position is through greater ownership of the product. For us, this means aggressively pursuing models with higher design elements. Eventually, the next step would be developing our own designs and creating products that solve specific customer problems. This evolution is key for Cyient DLM going forward. We have built a robust team and invested ahead of time in capacity and leadership. Now, it is about executing on that investment and delivering the growth we promised to our shareholders. Q. Startups are also doing some amazing work with respect to R&D and product development and design. Has Cyient considered acquiring any Indian startups? A. Absolutely, if there is a startup with a cool idea and intellectual property (IP), that would be of great interest to us because it could accelerate our journey toward creating our own products. However, the challenge with most startups today is that they are often at a conceptual stage or in very early phases where the technology is yet to be proven. Where we are operating today involves commercial aerospace and applications that are already established, so the time to market needs to be much shorter. With startups, that journey can be a bit longer. That said, we are not overlooking the opportunities in this space. There could be many startups with excellent ideas, and we would be very happy to partner with them or even consider them as potential acquisition targets. Q. How does the company balance its financial stability with all these aggressive mergers and acquisitions? A. We did an IPO about two years ago, and raised funds specifically for this purpose. There are two significant funding requirements in this industry. One is inorganic, related to making acquisitions, and the second is working capital. Working capital is a bit of a challenge in this industry. You have to manage inventory, receivables, and other related aspects, which consume a lot of cash. The more you grow, the higher the demand for working capital. With the hyper-growth phase we are currently experiencing in the industry, this becomes even more of a challenge. We raised funds during the IPO, which is why we have been able to address some of these needs. However, as we consume the funds raised through the IPO, we also need to improve operational efficiency in managing our working capital. This ensures that growth remains manageable and doesn’t become unsustainable or difficult to fund. Every company has its own strategy. In addition to the funds we’ve raised, there are also several working capital lines available from banks and other short-term financing options that we can leverage as needed. Q. What kind of operational and supply chain challenges does the EMS division face? A. Managing the supply chain especially with low volume manufacturing is a challenge. There are several parts where the MOQ (minimum order quantity) is high and you need to use a lesser number for a product and the leftover components sit on the shelf till we find the demand for it again. These are practical challenges that every EMS company faces, and we are no different. There are additional challenges such as customers pushing out demand, leaving us holding inventory for longer than expected. To address this, we ensure we have contractual protections in place to limit our inventory obligations to manageable levels. Q. EMS shares have shown significant growth over time, despite occasional dips. From a long-term perspective, the trend has been steadily upward. How do you see this growth being sustained in the future, and what potential risks should investors be aware of when investing in this segment? A. I think the valuation of all EMS companies is a bit stretched right now because the market is already factoring in the next 2-3 years of growth and building that expectation into the prices. It’s almost a given that everyone will grow by 30-40%, with some companies even exceeding that growth rate. So, if that growth doesn’t sustain, it will inevitably reflect in the share prices. That said, the tailwinds in this industry are quite significant. The optimism around growth and share prices is supported by the track record of companies consistently delivering on that growth. The growth we’ve witnessed so far has been unprecedented—I don’t know of any other industry that has grown this much, this quickly. The EMS space will continue to be very exciting, but it is undoubtedly a high-risk, high-reward scenario at the moment. Q. How do you foresee the evolution of Cyient DLM along with the EMS industry in the coming months in the wake of these acquisitions? A. Over the next few months, we will be focused on integrating Altek and realising the synergy benefits of this acquisition. Secondly, our India sales team is now well staffed, and the team is actively building a strong sales pipeline, particularly for the Indian market. It’s an exciting time for the electronic manufacturing services (EMS) industry in India, especially with strong government support. The incentives from the government and the competition among state governments are particularly refreshing. States like Karnataka, Telangana, and Andhra Pradesh are actively competing to offer the best possible benefits, such as land and subsidised power, to attract businesses. Entrepreneurs no longer have to run from office to office for approvals. Instead, states are inviting and competing for investments. [ad_2] Source link

0 notes

Text

Shankar Mahadevan: The Versatile Maestro of Indian Music

Shankar Mahadevan is a name that resonates deeply in the world of Indian music. Known for his unparalleled versatility and passion, he has carved a unique niche for himself as a singer, composer, and educator. His ability to seamlessly transition between classical, Bollywood, and contemporary music genres has made him one of the most celebrated musicians of our time. Beyond his immense talent, Shankar is a symbol of dedication and innovation, continually pushing the boundaries of Indian music.

Early Life and Musical Roots:

Born on March 3, 1967, in Chembur, Mumbai, Shankar Mahadevan grew up in a Tamil-speaking family with a strong inclination towards the arts. From a young age, his parents recognized his prodigious talent and encouraged him to pursue music. His training in Carnatic music began early, under the guidance of Pandit Shrinivas Khale, where he mastered intricate ragas and honed his vocal techniques.

While excelling in music, Shankar also pursued a degree in Computer Science and Software Engineering. However, his passion for music remained unwavering. Despite a promising career in the tech industry, he chose to dedicate his life to music, a decision that would later redefine the Indian music landscape.

Career Milestones:

Shankar Mahadevan’s career took off in the 1990s with the release of his groundbreaking album Breathless. The title track, composed to sound like it was sung in a single breath, showcased his vocal mastery and became an instant sensation. The song not only brought him widespread recognition but also established him as a creative force in the music industry.

Shankar’s career reached new heights when he teamed up with Ehsaan Noorani and Loy Mendonsa to form the iconic trio Shankar–Ehsaan–Loy. Together, they redefined Bollywood music with their unique ability to blend Indian classical elements with Western styles like rock, jazz, and blues. The trio’s debut film, Dil Chahta Hai (2001), was a monumental success, with its fresh and contemporary soundtrack striking a chord with the youth. Hits like “Jaane Kyon” and “Tanhayee” remain timeless classics.

Over the years, Shankar–Ehsaan–Loy delivered numerous chart-topping soundtracks, including Kal Ho Naa Ho, Rock On!!, Bunty Aur Babli, Zindagi Na Milegi Dobara, and 2 States. Their music is characterized by its diversity, with each album offering a mix of soulful ballads, energetic anthems, and experimental compositions.

Beyond Bollywood:

While Shankar Mahadevan is best known for his work in Bollywood, his musical repertoire extends far beyond the silver screen. He has collaborated with renowned international artists like Zakir Hussain, John McLaughlin, and Chaka Khan, showcasing his ability to transcend cultural and musical boundaries. As a member of the fusion band Shakti, Shankar explored the intersection of Indian classical music and jazz, creating a global impact.

In addition to his performances, Shankar has been a passionate advocate for music education. In 2011, he launched the Shankar Mahadevan Academy, an online platform dedicated to teaching Indian classical and contemporary music. The academy has made music education accessible to students across the globe, nurturing a new generation of musicians. Through interactive courses and workshops, Shankar has ensured that the rich heritage of Indian music is preserved and passed on.

Personal Life and Values:

Shankar Mahadevan is known for his humility and grounded personality. Despite his immense success, he remains deeply connected to his roots and continues to find joy in teaching and mentoring young talent. He attributes his achievements to the unwavering support of his family, particularly his wife, Sangeeta, and their two sons, Siddharth and Shivam, both of whom have shown an interest in music.

Musical Philosophy:

What sets Shankar Mahadevan apart is his ability to balance tradition with innovation. He believes that music should evolve while staying true to its roots. His compositions often reflect this philosophy, combining the technical precision of classical music with the emotional depth of contemporary styles. Whether it’s a soulful ghazal, a high-energy Bollywood number, or a fusion experiment, Shankar’s music resonates with audiences of all ages.

Awards and Recognition:

Over his illustrious career, Shankar Mahadevan has received numerous accolades. He has won four National Film Awards for Best Male Playback Singer and Best Music Direction, along with several Filmfare Awards. His contributions to music have also earned him honorary doctorates and recognition from cultural institutions worldwide.

Legacy and Future:

Shankar Mahadevan’s impact on Indian music is profound. He has not only entertained millions but also inspired countless musicians to pursue their dreams. Through his academy, he continues to shape the future of Indian music, ensuring that it remains vibrant and relevant in an ever-changing world.

As Shankar looks to the future, his focus remains on innovation and collaboration. He is constantly exploring new genres and experimenting with different forms of expression. His recent ventures include scoring for web series and independent projects, reflecting his adaptability and willingness to embrace change.

Conclusion:

Shankar Mahadevan is more than just a musician; he is a cultural icon who has redefined what it means to be an artist in the modern era. His journey from a young boy in Mumbai to an internationally acclaimed musician is a testament to his talent, hard work, and vision. By bridging the gap between tradition and modernity, Shankar has created a legacy that will inspire generations to come.

Dive into the world of Shankar Mahadevan by exploring his discography, from Breathless to the soundtracks of iconic Bollywood films. Witness the evolution of a musician who has continually pushed the boundaries of creativity.

0 notes

Text

#my scans#루나의 아카이브#png#satya#incense sticks#shrinivas sugandhalaya#i scan them after I finished the whole box as a record#i love this one a lot

7 notes

·

View notes

Text

Mumbai Police cracks cybercriminal ring; reveals 12th pass mastermind made more than Rs 5 crore a day

In a major breakthrough, law enforcement agencies have dismantled a notorious cybercrime syndicate operating across India.

Mumbai police have exposed a ring of cybercriminals that stole money from people from across the country by posing as police personnel and arrested its kingpin, who has studied till Class 12 and used to do transactions of more than Rs 5 crore a day in his accounts, an official said on Wednesday. Mastermind Shrinivas Rao Dadi (49), who has sound technical knowledge despite limited education, was taken into custody by a team of Bangur Nagar police station from a plush hotel in Hyderabad, the official said.

Besides Dadi, police also arrested four more members of his gang, including two from neighbouring Thane and as many from Kolkata, he said.

Dadi pretended to run a real estate business and used to communicate only through the Telegram app. Police have so far frozen 40 bank accounts used by Dadi and recovered cash of Rs 1.5 crore from him, the official said.

Explaining the modus operandi of the cyber fraudsters, the official said that Dadi and his accomplices would call people, mostly women, posing as police officers and tell them that cops have found drugs or weapons in a courier sent by them, he said.

The caller would then demand the bank or income tax-related details saying those were needed to verify if the courier didn't belong to the person they were speaking with.

Ajay Kumar Bansal, deputy commissioner of police (zone -11), said most people would get scared by the phone call and share their bank or IT details. Victims also shared the one time password (OTP) and in some cases allowed the fraudsters to take control of their mobile phones by downloading apps like AnyDesk, the official said.

After accessing key details, the fraudsters would steal money from the victim's bank account. The cyber gang targeted thousands of people from across the country.

Authorities urge citizens to remain vigilant and report any suspicious activities to the police immediately.

0 notes

Text

Upstox Share Price on an Upward Trajectory

Introduction Upstox, one of India's leading brokerage firms, has been making headlines with its impressive performance in the financial market. Known for its innovative approach and customer-centric services, Upstox has revolutionized the brokerage industry in India. This article explores the factors contributing to the upward trajectory of Upstox Share Price, the company’s historical context, technological innovations, expansion strategies, regulatory impacts, and future prospects, while also touching upon the anticipation of the Upstox IPO, Upstox Pre IPO, Upstox Unlisted Shares, and the Upstox Upcoming IPO.

Historical Context and Establishment Upstox, founded in 2012 by Ravi Kumar, Shrinivas Vishwanath, and Kavitha Subramanian, was initially known as RKSV Securities. The company rebranded as Upstox to better reflect its modern and tech-driven approach. Upstox aimed to democratize trading and investing in India by offering low-cost services and leveraging technology. This approach quickly gained popularity among retail investors, allowing the company to grow rapidly and establish a strong market presence.

The Rise of Upstox: Disrupting Traditional Brokerage In its early years, Upstox focused on building a robust trading platform that offered a seamless user experience. The company invested heavily in technology, developing a trading platform that was both user-friendly and feature-rich. Upstox’s commitment to low brokerage fees, transparency, and excellent customer service helped it attract a large customer base. This early success laid the foundation for the rise in Upstox Share Price.

Technological Innovations and Product Offerings One of the key drivers of Upstox's success has been its continuous focus on technological innovations. Upstox has consistently upgraded its trading platform and introduced new products and services to meet the evolving needs of its clients. The company's flagship platform, Upstox Pro, offers advanced trading tools, real-time market data, and a user-friendly interface. Additionally, Upstox's mobile app provides a convenient and efficient trading experience, attracting a large number of retail investors. These technological advancements have been instrumental in driving the rise in Upstox Share Price.

Expansion into New Markets and Services Upstox has strategically expanded its offerings to cater to a broader range of investors. The company now provides services in mutual funds, commodities, and bonds, in addition to traditional equity trading. Upstox's entry into the mutual fund distribution space has been particularly successful, with its platform allowing investors to invest in a wide range of mutual funds with ease. This diversification strategy has enabled Upstox to tap into new revenue streams and reduce its dependency on traditional brokerage services, contributing to the rise in its share price.

Regulatory Reforms and Market Environment The regulatory reforms and favorable market environment have also played a significant role in the upward trajectory of Upstox. The Securities and Exchange Board of India (SEBI) has implemented several measures to enhance market transparency and protect investor interests. These reforms have created a conducive environment for brokerage firms like Upstox to thrive. Furthermore, the overall growth of the Indian stock market and increasing investor participation have positively impacted Upstox's business, leading to a rise in its share price.

Financial Performance and Profitability Upstox’s strong financial performance and profitability have been significant factors in the upward movement of its share price. The company's low-cost business model and focus on operational efficiency have resulted in healthy profit margins. Upstox has consistently reported robust financial results, with steady growth in revenues and profits. This strong financial performance has instilled confidence among investors and contributed to the rise in Upstox share price.

Competitive Advantages and Market Position Upstox’s competitive advantages and market position have also played a crucial role in driving its share price upwards. The company’s innovative business model, technological prowess, and customer-centric approach have set it apart from its competitors. Upstox’s ability to attract and retain a large customer base has solidified its position as a market leader in the brokerage industry. This strong market position has been a key factor in the rising share price of Upstox.

Upstox IPO and Pre-IPO Shares The anticipation of an Upstox IPO has been a significant factor in the market, contributing to the excitement and speculation surrounding the company's future. The Upstox Pre IPO shares have garnered considerable interest among investors looking to capitalize on the company's growth potential before the official public offering. The interest in Upstox Unlisted Shares reflects the confidence investors have in the company's continued success and the potential impact of the Upstox Upcoming IPO.

Future Prospects and Growth Opportunities Looking ahead, the future prospects for Upstox's share price remain positive, with several growth opportunities on the horizon. The increasing digitization of financial services and the growing popularity of online trading platforms present significant growth potential for Upstox. The company is well-positioned to capitalize on these trends and expand its market share further. Additionally, Upstox’s focus on innovation and customer-centric approach will continue to drive its growth and enhance its share price.

Challenges and Risks While the future looks promising for Upstox, there are certain challenges and risks that could impact its share price. The brokerage industry is highly competitive, with new players entering the market regularly. Upstox will need to continue innovating and differentiating itself to maintain its competitive edge. Regulatory changes and market volatility could also pose risks to Upstox's business. However, the company’s strong fundamentals and strategic initiatives should help mitigate these challenges and sustain its upward trajectory.

Conclusion The rise in Upstox's share price is a testament to the company’s innovative business model, technological advancements, and customer-centric approach. Upstox has successfully disrupted the traditional brokerage industry and established itself as a market leader. The company’s strong financial performance, competitive advantages, and favorable market environment have all contributed to the upward movement of its share price. As Upstox continues to expand its offerings and capitalize on growth opportunities, the future looks bright for the company and its investors. The journey of Upstox's share price advancing upwards is a compelling story of innovation, growth, and success in the Indian financial services sector. The potential for an Upstox IPO, along with the interest in Upstox Pre IPO shares and Upstox Unlisted Shares, underscores the confidence in the company's future. The anticipation surrounding the Upstox Upcoming IPO is expected to further fuel interest and investment in the company.

0 notes

Text

Allen Career Institute Pune’s Results

Allen is a quite well known brand in the JEE coaching industry. They first started their operations in Kota and then expanded to various regions.

Allen has various branches in Pune. They provide coaching for JEE and NEET as well.

Teachers

There is no data of teachers mentioned on their website. However from our research, we got to know that their Physics faculty is weak and various students have complained about it. We have posted the reviews as well below.

Results

2021 Results

Starting from JEE Mains , they published the results of first 2 attempts of JEE Mains 2021 and according to that their best percentile starts from 99.92 secured by Kush Shah. So the approx. rank we can safely say would be around 800.

In JEE Advanced, Allen Pune had the best AIR of 495 secured by Shreyas Grampurohit. They had total 81 students who qualified JEE Advanced 2021; 4 in top 2000 and 15 in top 5000.

KVPY– Their best AIR was 76 secured by Raj Chandak in SA Stream and in SX Stream, the Pune Rank 3 was bagged by Allen student with an AIR of 67. Allen had total 25 selections in KVPY 2021.

2022 Results

Their best rank from all the Pune branches was AIR 197 so no student secured a rank of below 100.

Coming to their nationwide results, they claimed that their best AIR is 11, secured by Deevyanshu Malu. Vedantu, FIITJEE, Resonance, and Motion classes also claimed Divyanshu as their classroom student.

Bakliwal Tutorials which is a locally focussed institute in Pune produced better results that Allen’s all branches across the nation. Pratik Sahoo from Bakliwal Tutorials secured AIR 7 in JEE Advanced 2020 surpassing Allen’s results.

2023 Results

Allen continues its practice of publishing misleading results, ALLEN Career Institute Pune stated that Aryan Mahajan (AIR 79), Reeshabh Kotecha (AIR 89), and Shourya Johari (AIR 215) are their students and claimed their ranks.

It was found that Aryan Mahajan (AIR 79), Reeshabh Kotecha (AIR 89), and Shourya Johari (AIR 215) were enrolled at M Prakash Institute (MPI) in Pune. M. Prakash Institute has never been associated with fraudulent results or deceptive claims. It is renowned for its trustworthiness and ethical practices. So it is clear that ALLEN Pune has poached these student’s results, which thus makes us question the accuracy and integrity of their declared outcomes.

In JEE Main 2023, Sarthak Toshniwal (AIR 92) was the Pune Topper in the April Session from Allen. But his result is also claimed by Shrinivas Academy Pune, and that makes us question Allen Pune’s credibility.

2024 Results

It was no surprise this year as well when Allen Pune asserted that they have produced the Pune Girl’s Topper, Khushi Kucheria. In reality, Khushi Kucheria is a Spectrum, Nashik student and has never been to Pune for any offline classes. Khushi on this day also, is preparing for her JEE Advanced exam at Spectrum, Nashik and this can be verified from the teachers teaching her at Spectrum Nashik. She has never taken a single class in Pune.

Allen’s results are not credible enough to be believed and above stated are only a few instances. They have been faking results since years and fooling innocent students and parents.

Branches

The Pune Head Office is located at Shankar Sheth Road. Other than that they have 4 branches in Pune- Shivaji Nagar, Chinchwad, Viman Nagar and Baner.

Website- https://www.allen.ac.in/pune/

Phone- +91-20-6706-2000

Link: https://punejagoiitjee.com/top-5-jee-coachings-in-pune-in-2025-2026/

0 notes

Text

Indian-Origin US Scientist Shrinivas R Kulkarni Wins Prestigious Shaw Prize In Astronomy - NDTV

http://dlvr.it/T7Gfj0

0 notes

Text

Journey of Fragrance: Exploring Satya Sai Baba Nag Champa Incense Stick Collection

The world of incense sticks is rich with records and subculture, and a number of the many sorts to be had, the Satya Sai Baba Nag Champa Incense Stick stands out as a real icon. Loved and revered with the aid of way of hundreds and lots, those incense sticks have a unique perfume that has captivated the senses for many years. In this blog, we are able to discover the adventure of the Satya Sai Baba Nag Champa Incense Stick, its composition, and the motives in the back of its enduring recognition.

The Origins of Satya Sai Baba Nag Champa Incense Stick

The Satya Sai Baba Nag Champa Incense Stick is a product of Shrinivas Sugandhalaya, a known Indian incense business enterprise primarily based via K.N. Satyam Setty. The brand quickly ended up famous for its high-quality incense sticks, specifically the Nag Champa range, which gained international repute. The name "Satya Sai Baba" is related to the spiritual chief who promoted peace and proper-being, and this incense has ended up a staple in religious and meditation practices globally.

The Unique Composition of Nag Champa

What makes the Satya Sai Baba Nag Champa Incense Stick so unique is its awesome mixture of herbal substances. The number one element is Halmaddi, a resin from the Ailanthus Malabarica tree, which offers the incense its sluggish burn and earthy aroma. Combined with sandalwood, numerous floral extracts, and vital oils, the result is a sweet, calming perfume that is each uplifting and grounding.

The Cultural and Spiritual Significance

The Satya Sai Baba Nag Champa Incense Stick is more than clearly a pleasant aroma; it contains deep cultural and religious significance. In Hinduism, incense sticks are used in the path of puja (worship) to purify the environment and create a serene surroundings. The Nag Champa Satya Sai Baba incense, with its soothing scent, is often utilized in meditation and yoga practices to decorate attention and quietness. Its fragrance is a concept to aid in connecting the bodily self with the non secular realm, making it a famous preference for the ones looking for internal peace and spiritual boom.

Global Popularity and Usage

Over the years, the Satya Sai Baba Nag Champa Incense Stick has transcended cultural boundaries and determined a place in homes, meditation centers, and yoga studios around the arena. Its recognition may be attributed to its precise fragrance, which appeals to a full-size audience, and its popularity for exceptional. Whether used in non secular ceremonies, for aromatherapy, or truly to create a chilled environment, this incense stick has come to be an image of tranquility and proper-being.

Tips for Using Nag Champa Incense

To fully enjoy the Satya Sai Baba Nag Champa Incense Stick, it's crucial to use it correctly. Here are some recommendations:

Choose a Safe Holder: Use a proper incense holder to seize the ash and prevent any health risks.

Ventilation: Ensure the room is properly-ventilated to avoid any overwhelming smoke buildup.

Mindful Placement: Place the incense stick faraway from flammable gadgets and drafts to make sure a consistent burn.

Conclusion

The journey of the Satya Sai Baba Nag Champa Incense Stick from its origins in India to becoming a global fragrance phenomenon is a testimony to its particular appeal and religious significance. With its distinct blend of natural materials and calming aroma, it remains an appreciated desire for the ones looking to decorate their religious practices or surely revel in a second of peace and relaxation.

Whether you're a long-time fan or new to the arena of incense, the Satya Sai Baba Nag Champa Incense Stick offers a timeless fragrance that transcends cultural boundaries. Embrace the journey of fragrance and find out the enduring enchantment of nag champa satya sai baba incense to your private space.

0 notes

Link

#AffiliateProgram#BeTheMentor#DesignYourOwnLife#DigitalMarketing#FinancialCoaching#FromZero2Hero#IncomeGeneration#LeadByExample#MarketingStrategy#Partnership#SelfCare#SelfImprovement#SideHustle#SmallBusiness#YEVLPtyLtd

0 notes

Text

Exploring Investment Opportunities in India's Evolving Real Estate Sector

The Indian real estate sector, a crucial component of the country's economy, has been witnessing significant fluctuations in institutional investment over the past few quarters. According to the latest report released by Vestian, a Bengaluru-based commercial real estate consultant, the sector reported $1.6 billion in institutional investment during the second quarter (Q2) of 2023. While this marks a 41% drop compared to the same period the previous year, it represents a promising 29% increase from the preceding quarter, which ended in March 2023.

The report, "Institutional Investment in Indian Real Estate Q2 2023," highlights the sector's journey over the past five quarters. In Q2 2022, the real estate sector experienced an impressive 81% year-on-year (YoY) increase and a staggering 98% quarter-on-quarter (QoQ) increase, reporting $2.7 billion in institutional investment. However, this growth was short-lived, as the following quarter witnessed an 86% QoQ decline to a mere $0.4 billion in investments.

Despite this setback, the sector showed resilience and bounced back spectacularly in the last quarter of 2022, with a 316% QoQ increase and 103% YoY increase, amounting to $1.5 billion in investments. The roller-coaster ride continued, with a 19% decline in the first quarter (Q1) of 2023, reaching $1.2 billion. These fluctuations underscore the inherent volatility of the real estate sector but also highlight a positive upward trend.

Vestian's CEO, Shrinivas Rao, attributes this upward trajectory to renewed interest from institutional investors, buoyed by India's robust GDP growth and a promising pipeline of upcoming infrastructure developments. The commercial assets segment, encompassing office spaces, retail outlets, co-working spaces, and hospitality projects, has been at the forefront of attracting investments.

In Q2 2023, commercial assets received a staggering $1,400 million in institutional investments, indicating an impressive 101% YoY increase from the previous year and a remarkable 189% surge compared to Q1 2023. This renewed demand for office spaces points to the evolving landscape of the Indian workforce and the growing importance of commercial spaces in the country's economic growth.

Amidst this ever-changing scenario, India's real estate sector continues to present exciting investment opportunities in India. The renewed focus on commercial assets, fueled by the changing work culture and increased demand for office spaces, has created an attractive avenue for investors seeking long-term returns.

Investors are also likely to explore opportunities in upcoming infrastructure projects, which are expected to enhance connectivity and boost the overall real estate market. India's burgeoning economy and steady GDP growth provide a favorable backdrop for investors looking to capitalise on the potential of this dynamic sector.

The Indian real estate sector's journey over the past few quarters has been marked by ups and downs, reflecting its inherent volatility. However, the recent upward trend in institutional investments demonstrates the resilience and potential of this critical sector. Commercial assets, particularly office spaces, have garnered significant attention from institutional investors, indicating a shifting paradigm in India's workforce dynamics.

This post was originally published on: Foxnangel

#Business expansion#business expansion in india#business growth#business opportunities in india#Fox&Angel#FoxNAngel#Indian market#enter indian market#Indian real estate market#Invest in India#Investment#investment opportunities in India

1 note

·

View note