#she was so good in dti today :[

Explore tagged Tumblr posts

Text

plus two lil doodles because i thought they were goofy

#tlaes#fanart#lunar and earth show#tlaes fanart#tlaes earth#sams earth#tsams earth#sun and moon show#sun and moon show earth#the sun and moon show earth#they did earth so dirty#she was so good in dti today :[#so i drew her with a rococo style#to the best of my ability:']#it's 6 am im tired#tv's art corner

38 notes

·

View notes

Note

sav the terriblest thing has happened......... i joined english coaching.............

okay its not that bad the guy was my ninth grade english teacher and hes kind of a w

i also found out my current english teacher is mentally ill and not one of her students got 90+ in english like..

#notmepls

ANYWAYS

this Means that i shall be offline when ur usually first online during the day on sundays tuesdays and thursdays throws up

ive alr been so busy and i was like omg #textingsav and then i realised we probably wont talk today and also the only time we'll talk is

wait omg no school tmr we WILL talk tmr which will be ur today

the way im just. rambling in ur inbox but its ok bc ur u and im me #neverdoingthisanywhereelse

next thing . wait i forgot im remembering

oKAY remembered 👍 ERM i got like a. 68 on my english test and apparently this mentally ill woman marked it wrong and i shouldve gotten an erm. wait calculating. at least an 88 LIKE GIRL WHAT THE FREAKKKKKKKKK

in other news erm why i cried in the last four days list .

i love my sister

i love my friends

english grade

teacher yelled at me

there was no garlic bread at home

i got disconnected from dti

i didnt want to get up and change

the electricity cut off five times and i couldnt play genshin properly

tumblr wasnt loading

86 eighty-six

hashtag periods i love periods

in other news i also love maths like i WAS a maths girl i AM a maths girlie i will always BE a maths girlie it is THE subject of all time and if anyone disagrees then they're wrong (unless it's u because what can i say. i always agree with cute girls🤷♀️)

also like i said id tell you about the smau but literally erm. i forgot.. what was supposed to happen.. i have two lines ill dm them to u or something 😭😭😭😭 WAIT I JUST REMEMBERED SOMETHING ELSE AND THEN I FORGOT IT IM GOING TO SOB.

OH YES spilling school tea

our chem teacher used to tutor this one girl and he flirted with her mom at 1am on wahtsapp and facebook and then his wife divorced him😭😭

this one girl's picture got taken. like a norm picture. and then her bf and some people fought over it. like physically. at coaching. LOL INSANE

english physics and chemistry departments of our school are failing everyone is underpaid and leaving

my english teacher is senile but we mentioned that already i think

ANYWAYSSSS UNINTENTIONAL YAP ASK I LITERALLY JUST CAME HERE TO SAY IM MORE BUSY THAN BEFORE LMFAO. look where we are. oh omg im so #scared #excited #terrified for us w/o u part 2 thats flipping SCARY IM SCARED anyways how are u? feel free to yap in the answers if u do answer it and uhhh take care stay safe love u mwa mwa dm me whenever

LINA MY LOVE!! this is gonna be long i fear. oh dear.... ok so english coaching is not fun good luck with that 😕

well at least the guy is cool ‼️

im sorry but lowkey... #wbk about that one i fear!! I ALWAYS THOUGHT SHE WAS A LITTLE MENTALLY ILL? IS THAT JUST ME OR

anyway if u dont get 90+ in english send her my way I WILL FIGHT FOR YOUR GRADE SO HARD you deserve a good grade!!! i can tell you've been putting in the effort + im proud of u!!1!!1!1

NOOOOOO WE WONT BE ABLE TO TALK AS MUCH 🙁 lwt me think so today is thursday and youll be on on mondays wednesdays fridays + saturdays as normal presumably? THATS OKAY i usually wake up latw on thursdays because i sleep late and its a whole mess... i was nearly late this morning harhar ANYWAY POINT BEING WE WILL STILL BE ABLE TO TALK TO WE'LL BE GOOD

girl me too <//3 was so locked in on tuesday you should've seen me writing my article for the magazine + writing out the rest of my speech and finalizing ITS SO BUSY RN ICB IT

these timezones are confusinf me hello i am so lost as i read this! 12 hrs apart w you ahead is all ik regarding this

ANYWAY WE WILL FIND TIME AND WE WILL MAKE IT WORK ITLL JUST TAKE A MINUTE FOR ME TO FIGURE IT OUT

its okay i live laugh love for ur asks actually im sitting in my room smiling as i type out this reply to ur ask... inbox yap hour MY FAV

A 68 IS ACTUALLY INSANE GOODBYE how did she screw up the grade so bad 😭 she can catch these fists for that one LIKE HOW DO U GET IT 20% OFF THIS IS NOT A CLEARANCE SALE MISS!!

HELP all of these reasons are equally valid 😞 periods really get me fucked up fr i think im about to get mine too smh

that is SO valid lina math is honestly a good subject 🙂↕️ not my fav but i honestly enjoy the class cause it's 1) simple for me 2) my tablemates are so odd to the point of being hilarious and 3) my teacher is gay and we found his grindr profile so i always giggle when i think about that HAHDBDN so math class is just heaps of fun

NOOOO I WAS SO EXCITED TO HESR ABT THE SMAU U NEED TO SEND ME THE TWO LINES U HAVE SOON!!1!!1!1 STOP I HATE WHEN THAT HAPPENS BUT IT HAPPENS TO ME SO OFTEN ITS AWFUL

ok THE CHEM TEACHER??? wow okay so thats crazy! HIS WIFE DIVORCING HIM TOO PLEASE SO DESERVED everyone point and laugh!!! L man!!!!

HELP WHY WERE THEY EVEN FIGHTING IF IT WAS JUST A NORMAL PICTURE THATS SO WILD?? 😭 like guys its not that deep </3

WHAT. so like is this hyperbole or is literally everyone going to leave bc of being underpaid and whatnot CAUSE THATS SO BAD

senility✊😞 what a trooper/j

ITS OKAY I ENJOYED READING ALL OF THAT!!! PLEASE PRIORITIZE ALL YOUR STUDIES THEYRE THE MOST IMPORTANT <3 I HOPE YOU DONT BURN OUT FROM BEING MORE BUSY THAN BEFORE BC I KNOW I DEFINITELY DID WHEN I HAD VOLLEYBALL.. SO TAKE THINGS EASY AND DONT STRESS YOURSELF TOO MUCH PLEASE!!! ILY ILY ILY!! oh okay so us without me pt 2 is probably gonna be BAD BAD cause it will b talking about how he was actually in love w eden since BEFORE he had moved and all that so itll be extra angst talking about before he had moved 😸 basically timeskips briefly showing how he gives you less and less affection as the time he leaves draws near AHAHAH ITS GONNA BE BAD

+ im alright!!! no homework for once in a blue moon so im sitting here relaxing i feel so good rn <3 i have an iced matcha latte and a cake pop I AM LIVE LAUGH LOVING

so i dont have much to yap about at this moment but i just got back from school SOOOO ill yap about that!!

starting off strong i woke up an hour + 15 mins late and had 20 minutes to get ready and eat... i was almost late this morning BUT i have fitness first thing in the morning on my a-days (we work on an a/b schedule!!) and my teacher always comes late to that!! so i had time to dress down and i BOOKED IT to the weight room + made it!! in that class we basically just do weightlifting + my usual partner wasnt there bc she had a golf tournament... so i was with some of my other friends for lifting!! was kinda thriving bc my other partner usually does heavier weights + they did lighter ones SO I WAS REALLY REALLY FAST W MY SETS i was very proud!!

then i went into second period (i have bio) and we were doing a lab where we examined some cells in onions, tomatoes, + the inside of our cheeks (ew) but basically we had to group up and im not rly fond of one of the girls that r in my group cause she doesn't talk much she just squeezes in to look through the microscope so it annoys me 😞 ANYWAY THE LAB WAS LIGHT WORK GOT IT DONE IN 30 MINS and then i had like an hour of free time after that so i asked for a hall pass and i roamed the halls for a bit 😸 after that i have to go to advisory + i was just helping people w math hw and doing some of the nyt games to kill my boredom (oh and drivers ed stuff!!)

at lunch i was just sitting with some of my friends and playing imessage games with them 😭 then we went into the gym and played volleyball for a bit!!

after lunch i had geo and i was taking notes like a madman i fear... dk if ive said this before but like ohhh man everyone makes a point of telling me how small my hand writing is its so annoying 😭 i heard that three times during class today and i was literally done LIKE STOP LEAVE ME ALONE PLEASE ‼️

theeeen i had my speech + debate CLASS not to be confused with my club!! i already finished my oratory so i just played games the entire period 😻 lots of fun would recommend!!! i just hate the teacher cause he's always telling me to go back to my seat WHEN IM HELPING HIS STUDENTS CATCH UP ON WORK like ok! sorry for trying to help you fix the mistakes you made when teaching them how to make their speeches! goodness! my bad! anyway hes my opp 😒

AND THATS MY DAY!! anyway take care stay safe i love you!!! MWAHH <3

6 notes

·

View notes

Text

Book: Open Heart

Title: Love for One

Pairing: Ethan Ramsey x MC | Tobias Carrick x MC

Rating: Teen

Summary: Tobias is secretly in love with one of his closest friends, Casey. Casey is happily in a relationship with one of his oldest friends, Ethan. He deals with his heartache alone until, one night, he accidentally slips up to a friend. This excerpt contains his heartfelt confession.

Category: Excerpt from Extended Series (WIP)

Warnings: None

Trope: Unrequited Love

A/N: This is an excerpt from Chs. 5/6 of my series "Delaying the Inevitable. I decided to present it in this format for @openheartfanfics trope challenge: Some good ol' pinning because this is my best pining (in my opinion). I hope you like it too..

A/N 1: I was't sure if I should tag, but decided to. Not everyone is reading DTI (it's monolithic, I get it), so some non-readers may enjoy this stand alone. Also, some readers (who are very enthusiastic and I love you for it!) may want this trip down memory lane since this is from about 15-weeks ago already. I hope you enjoy it!

Bryce, Tobias, and their dates had taken a table in the back, not too far from their usual booth. Even though it was difficult to hear above the loud music and chatter, Bryce was his animated self; he was trying, effectively, to keep everyone laughing all night. It appeared to be working on his date, Megan, as she was engrossed with every word he said. If Bryce’s smile was any indication, he was pleased.

Tobias tried to be engaging too, but it was clear that his heart was just not there. Keenly aware of this himself, he ordered a few more drinks than normal in hopes of lifting his spirits, but that did produce his desired effects. When the crowd started to dissipate, the four decided to move up front to sit at the bar a bit before leaving. As they made their way, Nicole needed to use the ladies room and Megan joined her.

“You know, I could go myself,” Bryce said, “Tobias, want to grab some stools for us?”

“On it,” he said saluting as he commandeered four seats at the bar.

When Bryce returned, he found his friend staring somberly into his drink. While it was obvious that he had a bit too much to drink tonight, he had not been himself for weeks, and Bryce was growing concerned.

“Hey, change in plans. The ladies are waiting out front, we were thinking of swinging by my place, but I can tell you’re not really into Nicole, so I’ll leave it up to you.”

“Yeah, you know, I’m pretty exhausted. I think I’ll say good night and head home. The three of you should still hang out, although I don’t know if you’ll get that lucky Lahela.” He attempted a smile, but it was clearly forced.

Worried about his friend, Bryce said, “Look, how about I go talk to Megan, I can meet up with her tomorrow. Then you and I can hang out, you don't seem..."

“Nah, I’m fine…”

Bryce let out a sigh, lowering his voice he leaned in toward Tobias, “T, I’m honestly worried about you. You haven’t been yourself for a while and it’s painfully obvious tonight. Today, while I was in line for coffee, I overheard you talking to Casey, and I really think…”

“Oh, for Christ's sake!” Tobias yelled, drawing the attention of nearby patrons. “First Harper, now you? I honestly liked it better when I was in denial! I will get over this, it… I’m not stupid… I know I don’t stand a chance in hell with Casey. I know it is never going to happen, I know that. OK?”

Bryce’s eyebrows shot to his forehead as his jaw fell slack, “You need to get over… don’t have a chance… with Casey?”

Tobias shook his head and pinched the bridge of his nose, “I knew I had one too many tonight, yet, just like that, now I’m completely sober.”

Tobias expected more of a reaction from Bryce, but he remained uncharacteristically quiet, especially when you consider the bombshell he just dropped. He looked over his shoulder, “Lahela, as pleasant as it is to have you rendered speechless, I suggest you pick your jaw up off the floor, it’s really not a good look for you.”

“Uhm, yeah,” Bryce said shaking his head vigorously, “Well, now that we’re both insta-sober, I’m going to go help the ladies get a cab, then I’m coming back and we’re talking.”

“I really don’t want to talk.”

“It really wasn’t a request.”

Tobias let out a groan, What. The. Fuck. Carrick! How did you just do that! He gulped down the rest of his drink and surveyed the room. OK, on an up-note, it does not seem like anyone else heard, hopefully. To test his theory, he walked to the other end of the bar to settle his tab with Reggie. Reggie and Ethan were tight so, if he had overheard Tobias’s outburst, he would have a tell. Relief came over him when Reggie was his usual pleasant self. At least Ramsey wasn’t already outside waiting for him. Speaking of outside…

“They’re gone?” he asked exiting Donahue’s.

“Yeah, I told Megan I’ll meet up with her on Sunday, but, Bud,” Bryce said shrugging, “I would not sit around waiting to hear from Nicole if I were you.”

Tobias snorted, “Well, I think we both know that really won’t be a problem.” He walked toward Bryce, “If you want to talk, we talk, but I have two conditions: one, we make it brief, and two, we don’t do it here. I like this place, but it’s becoming synonymous with conversations I would rather not have, I don’t want to sully it.”

“Fair enough. Name the place, name the duration.”

“Now you sound like most of my dates in med school,” Tobias mumbled as he slid into the cab.

“Where to?” the driver asked.

“One Franklin Street, please.” Tobias turned his attention back to Bryce. “Not a word about this until we are in my apartment, OK? Not a fucking word.”

“Fine, we can just talk about how you will never be my wingman again.”

“At least you’re admitting you need a wingman Lahela, that’s a step in the right direction.”

The men entered the luxurious lobby and made their way to the elevator, “55, please.”

“I guess this is one way to see your new place.” Bryce said sarcastically, “55th floor in the Millennium Tower! Damn, this has to give you at least 1000 points in your competition with Etha… shit... sorry… just a reflex.”

Tobias shook his head. “You’re cocky as hell and your timing sucks, you truly are a younger version of me?”

“Younger and better looking.”

“Well, I only closed three weeks ago,” Tobias announced pushing the door open, “I wasn’t expecting guests yet, so don’t mind the condition.

Bryce shook his head, a small foyer led to a spectacular great room, anchored on one end by an opulent white marble kitchen and the other by a breathtaking, two-story wall of windows that provided unparalleled views of the city. Apologizing for a few scattered boxes and some furniture with plastic covers still in place seemed unnecessary.

“Yeah, the place is a dump,” Bryce grinned, “Seriously though, wow! What made you upgrade to this beauty.”

“I liked the view,” he replied nonchalantly while pouring two club sodas. He handed one to Bryce, “I figured we’d keep the sober thing going. So, you’ve got 15 min… what do you want to know. The timer is on, take your shot.”

“OK, well…uhm, Casey… Admittedly, I’m a little shocked. I mean, not because she isn’t incredible, she is. I know that firsthand, I was once bitten by the Casey-bug too…”

“Yeah, that’s right.” Tobias interrupted, “How the hell were you stupid enough to let her go?”

Bryce chuckled as he placed his drink on the counter. “I didn’t. Casey and I were more of a friends with benefits arrangement. Then one day the benefits stopped, but the friendship didn’t, and it never will. Back then, I would have been cool with the two of us growing into something more but, once she fell for Ethan, it was game over for anyone else.”

“So she rescinded your benefits contract two years ago, correct?”

Bryce nodded.

Tobias looked perplexed, “I just don’t get it. So, two years ago she ended … things … with you and wrote off all other mere mortals because of Ramsey, yet they’re only together a couple of months now?”

“No. They have been together ever since their eyes locked over a gurney 15 minutes into her first day as an intern. It took them a while to realize it, a little longer to accept it and they, well, he took a good two years to finally surrender to it. But, let me be clear, she was never mine to let go. She has never been anyone’s other than Ethan’s.”

“He always was a lucky SOB.”

Bryce shrugged and half nodded. “Perhaps, but the timer is on, and I don’t want to talk about Ramsey, I want to hear about you. I knew you and Casey had become close friends, but how… when did it turn into something else for you?”

“How? I would tell you if I could, but I can’t. She’s magic. You meet her and you think, Jesus, no one can possibly be this beautiful, but she is. So, you wait for the other shoe to drop because there is no way the inside can be as magnificent as the out, right? I mean, God doesn’t play favorites that much, does he? So, you get to know her and it’s like, holy shit, apparently, he does. Now, I had no illusions. I knew what she has with Ramsey. I knew nothing would ever come of it, but I didn’t care. I didn’t care because it felt like an honor just to be in her orbit. I was overjoyed knowing that she knew my goddamn name and that maybe, every so often, I might get to hear my name on her lips.”

He stopped and took a sip of his club soda, suddenly wishing he had chosen something stronger.

“When? The best answer I can give you is that one day, and I couldn’t tell you the day because it happens so frequently, but we were at work or maybe the bar, and she started laughing the way she does, you know, when her nose crinkles and her face lights up, she gets that little glimmer in her eye and no matter how bad of a day you may have had, there is no way that laugh isn’t going to pull you in. So, she is…God, she’s just beautiful… and she’s laughing and then she flipped her head around and smiled, and I realized that smile was for me… now, absolutely nothing was implied by it, she was just smiling at a friend, but I was that friend, that smile was for me… I couldn’t freaking breathe, and… I have not been able to let go since.”

He stood up and sauntered across the room, placing his hands on the expansive windows he stared vacantly down at the city below.

“But I knew…I knew any feelings I had for her were futile. So, I pushed that shit down, I pushed it down so deep that I didn’t even have to acknowledge it myself. Sure, it was a lie, but I was comfortable living in it. Then the night of the boards, I ended up talking with Harper and she totally called me out. She said that she could see it plain as day and she was worried about me, and I’m sure worried about the team by extension. So, she asked me to be honest with her about my feelings for Casey, I wanted to deny it, I tried to deny it, and that is when I knew I was so screwed because, as much as I wanted to, I could not deny what I felt for her any more than I could will myself to stop breathing.”

He turned and made his way back across the expansive room and sat next to Bryce at the counter.

“So, now I get to work with her every day, I get to hear that laugh, see that smile, smell her perfume as she sits down next to me each morning, and I then I get to watch those gorgeous eyes gaze, with all the love in her heart, right past me and onto Ethan. It’s a fucking hoot, you should try it sometime.”

“Damn, T. I don’t know what to say. I’m sorry. I’m going to be honest with you, I came here armed with the standard 10-minute speech that I give to friends going through shit like this. It starts with, ‘yeah, she’s great, but she’s not that great, then I veer into the ‘there are other fish in the sea’ portion. Of course, I modified your version because Casey is that great, but now, I have to toss the whole damned script because…this isn’t just some little crush, is it?”

“No. I wish it were. If not for Ethan, I would move heaven and earth to make sure she was mine.”

“So, now that you mention him, I have to ask; T, I have never seen you fall like this for anyone…you were the confirmed bachelor, is there any chance, even subconsciously, that this is part of your weird-ass competition with Ethan?”

Tobias shook his head emphatically, “No. Absolutely not. I understand where you’re coming from... but no. What I feel for her has nothing to do with Ethan, or anyone else, it is only about Casey!”

Bryce raised an eyebrow, shocked at just how protective Tobias was about his feelings, and by how deep those feelings appeared to run.

“But you’re right, I have never felt this way about anyone else before. I did not look for this, I did not want this, Bryce. It’s like a fever I woke up with one day and there it was… and I know I can’t fight it… but I am doing my best to control it.”

“Does anyone else know?”

“Only Harper, and now you. God willing no one overheard me at the bar tonight because I do not want this spreading any further.”

“Do you think Casey suspects anything? Or, God forbid, Ethan?”

“No, Casey has no idea, and I can pretty much guarantee you Ethan doesn’t either.”

“Yeah, you’d probably be in the ICU if he did.”

“Thanks, pal.”

“Just keeping it real, T.”

Tobias chuckled half-heartedly. “I’ve been trying to avoid her, at least outside of work where I have some control over that. But, honestly, I think it has been counterproductive. She notices it, so now I get 20 questions about why I haven’t been around, and I’m running out of answers. Also, not having her around… I miss my friend, it just makes me miss her and want her more. It’s not working.”

“You know, if circumstances were different, I might say cold turkey would be the way to go, but you can’t do that. You need to have a working relationship and you have too many friends in common, you’re going to have to find a middle path on this. Maybe see her less, or only in groups, but you’re right, cutting her out completely, won’t be a solution. It’s going to be hard too because, I know she cares about you deeply, just… not in that way.”

“Stop making sense Lahela.”

“I always make sense, you just don’t want to hear it! Some more sense, going forward USE ME.”

“Oh, now you need to just stop,” Tobias laughed.

“No, seriously. You need to keep yourself busy, do things, sometimes you may need to talk. I’m not only here for the good times, man, I’m here for you now.”

“You know you’re a better friend than Ramsey ever was!” Tobias said with a laugh.

“Of course, and I’m better looking! Come on, come over here, bro hug, bro hug.”

“Oh, Jesus, your 15 minutes have GOT to be over by now…right? But seriously, thanks, pal. It may not seem like it, but this has helped. But yeah, I’m done talking about it for now.”

“No problem. So, let’s change the subject, starting with this freaking amazing place. When are we throwing our housewarming party because this place is INSANE.”

“We? Our?” Tobias laughed, “I didn’t realize my mortgage would be going down by half now. But, yeah, let’s plan something this place needs to be christened.”

Permatags: @adiehardfan @barbean @binny1985 @bluebelle08

@bluerosesbloom @brokenmemoriesblog @charisworld @custaroonie @everybodyscreamsposts @izzyourresidentlawyer @jamespotterthefirst @jennieausten @kachrisberry @kalinahonore @lady-calypso @liaromancewriter @mia143 @mjlbwork @mm2305 @phoenixrising308 @pixelberrygirl @schnitzelbutterfingers @secretaryunpaid @shewillreadyou @shygirl4295 @thegreentwin @txfledglingscribe @wanderingamongthewildflowers

OH Tags: @aishwarya26 @alina-yol-ramsey @chaoticchopshopheart @choicesaddict5 @coffeeheartaddict @dorisz @heleus @imma-too-many-fandoms @kat-tia801 @lucy-268 @panda9584 @parisa-kh @queencarb @swiminthegarden @youlookappropriate

@openheartfanfics @choicesficwriterscreations

DTI Tags (For active commentators - not sure all want the re-read): @animesuck3r @books-biscuits-and-ballads @katrinegrey @larsterz

MORE IN COMMENTS

#open heart fanfics#open heart#tobias carrick#excerpt#delaying the inevitable#trope challenge#good ol pinning

35 notes

·

View notes

Text

Wednesday, April 27, 2022

Festival of Neggs, The End?

Damn Reddit! (Not really.) I should know better than to head over there in the midst of an event, but my groggy brain couldn’t relay the messages quickly enough.

The final clue! I’ve only completed one of his quests, but I know the Brain Tree when I see it.

Fucking gross! But finally a story.

I skipped all of the possible screenshots up to this point. Oops. Not to ruin the mood, but I cannot get over the grammatical issues in the dialogue for this festival. It’s not just me, right? Has TNT never heard of a comma? And it’s so weird, because I feel like I’ve completely missed another story elsewhere. Who the fuck is Tippens? Is he from something previous that I missed in my absence? Why would I think it’s a mysterious petpet when they were just talking about a Kougra? (Even though that is clearly the answer.) I cannot be the only person who is lost as an easter negg for this whole thing. But I digress...

Okay, this got a pop from me, because I can only assume it’s referring to the recent storytelling competition regarding the Unidentified Petpetpet. That’s good.

Well, aren’t you a cute little bastard.

O-ho! Man, look at those beauties. I have to admit that I’m a bigger fan of the original paint job than the other two. I think it would pair well with a Mutant Acara, something I’d like down the line.

Had one last chance at another stamp, but I got my third teapot set. At least the Talpidat is adorable!

And that’s... it? I guess tomorrow is technically the end once all the prizes are claimed, so I’ll reserve any final comments for then. Meanwhile: sorry, social Talpidat, you’re hanging out in the SDB.

Odds and Ends

Another Fruit Machine win!

Yay. I was so damn close to the third cheops.

The second time I’ve won this from the Mysterious Negg Cave! A cool 70K.

Thank you, O Great Turmaculus. The healing springs literally did that earlier today.

Lab Ray and ZYDP

Nothing exciting on the main, but I managed to zap a Relic Hissi on a poorly-named pound find from a while ago! Honestly, if I correctly recall, that pet was a stuck pet and was one of the longest stuck pets on the page I was viewing. I hope she finds a good home! Relic is a very neat color.

But now that I’m finished with her, I can move onto the ZYDP forums! Legit excited. I named all the pending pets, and I hope those who end up getting them like the names.

NeoCash

In preparation(?) for the above, I finally caved: I purchased 10 additional pet slots. The saving grace is that it was used with credit card rewards, so I didn’t actually spend any of my money on it. I’m officially tired of spinning my wheels and hoping for a Lupe zap on one of my pets, so I opened the flood gates to transfer one of the ZYDP pets to my main so I can zap twice as many. Folks on Reddit have been posting a lot of stuck pets with solid names; I think that’s where I’ll go after I work through the ones I’ve created. It’s mindboggling how many stuck pets there are. I legitimately don’t understand how they get stuck and how these folks find them.

But! All of this is to also say that I have leftover NC and can buy faerie quest fortune cookies. Dude. Stay the fuck tuned because if I can snag one that grants me a FFQ, I’ll shit.

... I wrote the above 10 minutes ago. I have no willpower.

1/9! I NEED FIRE JUG (please)

Is that Maraquan Draik on the horizon? Maybe! One thing I know for sure: if Food Club and/or I sell my repriced shop items, that Baby Lupe will be making his debut soon. I can start poking around DTI to get him ready to roll.

5 notes

·

View notes

Text

New era of bilateral ties between Philippines & Taiwan

Today is the 93rd birthday of former First Lady Imelda Marcos and the third day since President Ferdinand Marcos Jr. took office. On inauguration day, I interviewed several supporters of President Marcos in front of the National Museum of Fine Arts and got an idea of what Filipinos want the new President to do for this country. One of the supporters, Lilibeth Marcos, told me that she hopes President Marcos can lower food and gas prices and people can pay less for utilities so that there will be less pressure for poor families. IT looks promising that in the new administration, the relationship between Taiwan and Philippines will flourish. YouTuber/construction worker Bhem Vergara wants the new President to continue the policies of former President Rodrigo Duterte and keep building infrastructure because he found that it was difficult to travel to provinces to attend rallies during the campaign period. Supporter Reynaldo Velasco said that he hopes the President will boost the economy and create more jobs for Filipinos to have better lives. It is obvious that Filipinos want the country to develop, and they believe President Marcos will help the Philippines to achieve that and to rise again. From President Marcos’ inaugural address, it appears that he heard what Filipinos need and wanted to devote himself to making that happen. From President Marcos’ inaugural address, it appears that he heard what Filipinos need and wanted to devote himself to making that happen. The President mentioned overseas Filipino workers and nurses in his speech, and he said: “We all want peace in our land. You and your children want a good chance at a better life in a safer, more prosperous country. All that is within reach of a hardworking, warm and giving race.” The Cabinet members and heads of agencies President Marcos chose also tell us how he wants the work to be done. For instance, former Department of Labor and Employment Secretary Silvestre Bello III is chosen to be the new chairman of the Manila Economic and Cultural Office. Bello is considered a good fit for this position because there are about 143,730 Filipinos working in Taiwan, as former Labor Secretary, he apparently has a good understanding of the relations between the Philippines and Taiwan, and he has been in contact with officials from Taiwan for six years. Michael Peiyung Hsu, the representative of the Taipei Economic and Cultural Office in Manila, told me that Bello has been in politics for a long time and served as the Cabinet Secretary for six years under President Gloria Macapagal Arroyo. Hsu expects that he will work closely with Bello, and bilateral ties between Taiwan and the Philippines will be deepened as a result. The Edu-Connect Southeast Asia Association called on dozens of universities in Taiwan on 24 June to hold a virtual event to congratulate the Secretary of the Department of Trade and Industry Alfredo E. Pascual and the Secretary of the Department of Interior and Local Government Benjamin Abalos Jr. The reason they held the event was because Pascual and Abalos have been working with the academic circle in Taiwan since they were president of the University of the Philippines and Mayor of Mandaluyong, respectively. There are currently nine students from Mandaluyong accepting scholarships to study in universities in Taiwan. After listening to their congratulatory messages, Pascual said he was impressed with the depth of thoughts of the Filipino students, and “to them I express our congratulations and my best wishes that they are able to finish their studies in southern Taiwan and come back to the Philippines to serve our country.” Pascual told the gathering that he was geared up to lead the DTI, and he wants to further enhance the partnership between the academe and industry. “We need the universities with their capabilities for research and development, and for providing advanced training to our people to flourish and to be strengthened.” He stressed: “Without a strong superstructure, we can only continue to live alone in the Philippines on our weak agricultural sector, low-value manufacturing and remittances from overseas Filipino workers.” Consequently, he hopes the Philippines and Taiwan can pursue partnerships and develop mutual trust between their industrialists and academicians. It looks promising that under the new administration, there will be new opportunities for Taiwan and the Philippines to cooperate and achieve more milestones together. For the welfare and benefit of both Taiwanese and Filipinos, I do hope it will happen in years to come. Read Full News @ Daily Tribune Read the full article

0 notes

Photo

Washington might have to go to war to fight a housing bubble. Does it have the tools to win?

A housing bubble burst in 2008 pushing the U.S. into deepest recession since the Great Depression. In the aftermath, many nations developed new tools designed to take the air out of real-estate bubbles before they burst. The U.S. has lagged in some respects, in part because of the deregulatory zeal of the Trump administration.

Some reformers, sensing danger, want the Biden administration and the Federal Reserve to develop new tools and take action to catch up. Others worry that efforts to deflate bubbles will, in the end, only hurt the poor and the middle class.

Developments this year have focused attention on the issue. Home prices are rising at their fastest pace in history, fueling concern that a new real estate bubble has formed.

These double-digit home price increases have led some to call on the Fed to raise interest rates. So far, Federal Reserve Chairman Jerome Powell has resisted those calls, arguing that higher rates damage the entire economy and lead to job losses at a time when the effects of COVID have already left millions of Americans unemployed.

Raising rates “in order to address asset bubbles…[is] not something we would plan to do.” Powell told reporters earlier this year. “We would rely on macroprudential and other tools to deal with financial stability issues.

So far, nothing has been done, despite protest from some Fed officials like Boston Fed President Eric Rosengren, who recently argued that a “boom and bust cycle” in real estate is incompatible with financial stability.

Read more: Fed official says another boom-and-bust housing market is not sustainable

Jeremy Kress, a former attorney in the banking regulation and policy group at the Federal Reserve and professor at Michigan’s Ross School of Business criticized the Fed for not using a tool already in its arsenal — the countercyclical capital buffer.

This rule allows the Fed to require banks to fund themselves with greater amounts of equity in the form of retained earnings or money raised from stockholders and less from debt, he said.

“By raising capital requirements during boom times, that could put a break on runaway asset prices,” Kress said. “The Federal Reserve, in contrast to other countries, has never turned on this discretionary buffer. Perhaps now might be a good time to activate it.”

There are other, more specific, ways the government could target bubbles in the housing market.

Gregg Gelzinis, associate director for economic policy at the Center for American Progress told MarketWatch in an interview that the Financial Stability Oversight Committee, the group of the heads of regulatory agencies created in response to the financial crisis, would be more effective if Congress gave it the power to set nationwide limits on how much money banks can lend to purchasers of real estate.

“The suite of tools regulators have are imperfect, and there are other tools that that Congress could grant them to could bolster the arsenal,” Gelzinis said. Regulators in the UK and some countries in Europe can put limits on loan-to-value ratios that change based on the state of the economy. “You have one cap in normal times and another when the market is overheating,” he said.

See also: An inflation storm is coming for the U.S. housing market

Former Federal Reserve Vice-Chairman Donald Kohn made a similar point in a 2017 speech that Washington regulators “need the power to put limits on loan-to-value and debt-to-income measures, when loosening standards, perhaps occurring outside the banking system, threaten financial and economic stability.”

A loan-to-value ratio measures the size of a mortgage loan relative to the value of the property used to purchase it. High LTV ratios may suggest speculative behavior because the buyer could take out such a risky loan on the expectation that the property would rise in value.

According to the International Monetary Fund, 19 different European countries have instituted loan-to-value caps that range from 30% to 100%, with higher limits on loans for first-time homebuyers and lower caps on those buying second homes and investment properties. The IMF study said the results of these policies often slowed the pace of price growth in a given real estate market, though in some countries with severe constraints on the supply of new homes, those effects were muted.

The Consumer Financial Protection Bureau, which was created by the Dodd-Frank financial reform law in part to protect Americans from predatory mortgages, has the power to set these types of standards. In 2013, the regulator implemented a debt-to-income limit of 43% for mortgages, if issuers wanted to qualify for a safe harbor that would protect them from customer lawsuits. A debt-to-income ratio compares how much the borrower’s monthly repayments are compared to monthly income.

Under the Trump administration, however, the debt-to-income limit was scrapped for a market-based approach that relies on private underwriters to determine whether a borrower is likely to default on a mortgage loan.

“The way they’ve done it, very few mortgages are actually going to be affected,” Laurie Goodman, a former mortgage banker and a housing-finance expert at the Urban Institute told MarketWatch. “What they’ve done is avoided a major credit tightening by adopting the rule they did.”

The Task Force on Financial Stability, a group of private scholars, former regulators and industry practitioners issued a report in June that discussed the costs and benefits of LTV caps. They wrote:

These precautions should be limited to cash-out refinances and investor loans; they should not include purchase loans because of the importance of home ownership as a way for Americans to build wealth. While many other countries have placed LTV limits on purchase mortgages (with mixed success), doing so in the United States would make it very difficult for first-time homebuyers.

The Urban Institute’s Goodman, who is a member of the task force said that mortgage lending is already very conservative even without federally mandated loan-to-value caps. She said in recent years mortgage lenders have been demanding higher down payments and credit scores in recent years, a trend that accelerated during the pandemic as lenders worried about the state of the economy.

Read more: The Fed is standing aside as house prices rip higher — but here’s what could get in the way

“There is no question that credit was too loose in 2005 to 2007 period,” she said. “As far as I’m concerned that pendulum has swung way too far in the other direction.” Goodman argued that current banking standards, driven by government regulation as well as industry fear of repeating last decade’s crisis, has left too many Americans from “accessing the single greatest wealth building tool of homeownership,” she said.

Indeed, consumer rights and civil rights groups have applauded the CFPB’s decision to scrap a hard DTI cap and consistently advocate for policies that create better access to reasonably priced home loans. In April, a group of civil rights organization wrote to the CFPB’s Acting Director Dave Uejio to keep the Trump-era mortgage rules in place.

“An unnecessarily restrictive definition of a qualified mortgage would push a considerable share of creditworthy borrowers — including a large share of borrowers of color — out of the mainstream mortgage market and possibly out of the mortgage altogether,” they wrote.

Meanwhile CAP’s Geliznis argued that there are other steps the Financial Stability Oversight Council could take that would increase financial stability without necessarily making it harder for average Americans to secure a mortgage. He argued that nonbank mortgage servicing companies, that originate and service loans, but do not hold them on their books, pose a greater threat to financial stability than lax lending standards and that FSOC should consider designating the largest of these firms as systemically important, and therefore subject to greater regulation.

Goodman disputes the idea that another potentially ruinous real estate bubble is forming, driven by low interest rates and lax regulation. Instead she argued the evidence is clear that today’s rising home prices are largely the result of a surge in demand for new homes, led by a demographic wave of millennial buyers looking for their first homes and other buyers fleeing cities for suburban single family homes in the wake of the pandemic.

“The problem is about too much demand and not enough supply,” she said. “The cost of production has gone up, land values are sky-high, you’ve got all sorts of zoning restrictions that increase land values,” and builders wonder “how many borrowers can afford what it actually costs you to produce.”

1 note

·

View note

Text

DTI-7 aids small entrepreneurs in managing business

#PHnews: DTI-7 aids small entrepreneurs in managing business

CEBU CITY – The Department of Trade and Industry (DTI) in Central Visayas is conducting enterprise development seminars to help entrepreneur beneficiaries of the SUGBO Negosyo program of the Cebu provincial government.

Emelinda Tayad, a 59-year-old housewife from Talisay City, Cebu, is among the 8,000 beneficiaries of the program.

On Monday, the budding mother entrepreneur shared she has received PHP10,000 capital under the “Mga Serbisyo ug Ginagmay’ng Patigayon” category from the office of the provincial board member Yolanda Daan.

DTI-7 said it has so far conducted 17 seminars this month through its Negosyo Centers to provide the eligible beneficiaries with entrepreneurship development seminars, facilitate business name and barangay micro business enterprise registrations, and assist in other appropriate development services to improve their businesses.

SUGBO Negosyo is a livelihood assistance program of the Cebu provincial government in partnership with the DTI-7 and the Mandaue Chamber of Commerce and Industry.

The Capitol has allocated PHP100 million for the program, which had been released through the 17 provincial board members worth PHP5 million each, and PHP15 million through the Office of Vice Governor Junjun Davide.

“I am very grateful for this program. When the lockdown hit Cebu last year, I thought I was hopeless but this blessing came,” Tayag said in the local dialect.

She was among the beneficiaries who attended last week a DTI-organized training on business development.

Tayad had settled in Cebu from Tarlac in 1989 for a living. Her husband used to work in the coffin industry which later on started his own business.

During the pandemic, her daughter, who works as a kitchen staff in Dubai, had stopped sending money back home for a while due to financial difficulties.

Tayad thus decided to put up a sari-sari store in front of their house in Talisay to sustain their needs on top of her husband’s fleeting sustenance.

Tayad said she only learned about the program during the last day of submission of requirements.

“Through the assistance, I was able to buy additional supplies for my sari-sari store. My daily earnings could already reach as much as PHP2,000,” she added.

Recipients of the program received their capital in the form of “SUGBO Negosyo” cards which they would use to purchase goods for their business operations to sustain their livelihood affected by the pandemic.

Other categories of the program include “Negosyo Padayon” worth PHP50,000 for each beneficiary and “Produktong Sugboanon” worth PHP20,000. (PNA)

***

References:

* Philippine News Agency. "DTI-7 aids small entrepreneurs in managing business." Philippine News Agency. https://www.pna.gov.ph/articles/1131496 (accessed February 23, 2021 at 03:30AM UTC+14).

* Philippine News Agency. "DTI-7 aids small entrepreneurs in managing business." Archive Today. https://archive.ph/?run=1&url=https://www.pna.gov.ph/articles/1131496 (archived).

0 notes

Text

Why is it Important to Plan so Far in Advance?

First, your lender will let you know what you can qualify for today based upon your income, down payment and credit score. There are other factors which play a part including credit events and large monthly payments on your credit report.

Income – Income sometimes is difficult to change in one year. Lenders will be looking at your last two years’ tax returns and recent pay stubs when you are ready to apply. They will also require that you have a two-year work history.

Some individuals decide to take a break for personal reasons without realizing that a gap in employment may prevent them from getting loan approval. Documenting your income is essential as well. If you are in a cash business, then you should begin depositing that money into an account on a regular basis so that you can qualify for a bank statement loan. These are just a few examples of what your lender will discuss with you.

Down Payment – This is extremely important, and it will partially determine your buying power. It is also connected to the various loan programs that you may or may not qualify for. You will need to have those down payment funds in your bank account three months before you submit a loan application.

If you have little to no down payment and do not think you can raise additional funds over the next nine months, then your lender will discuss low down payment and loan program options which will then help determine your realistic price range. If you want more information than visit Texas Farm and Ranch Real Estate.

If you can get to a twenty percent down payment that is ideal. When you don’t have at least twenty percent to put down, you’ll often be required to pay private mortgage insurance.

PMI is a useless fee that only benefits the lender as protection in the event you default on your loan. Most people will try to stop paying private mortgage insurance as soon as they can.

Credit Score – Your credit score plays a significant role here. It will have an impact on your final mortgage rate, in some instances your down payment requirement, or whether you are qualified at all for a mortgage. Borrowers with the best credit scores generally will get the lowest mortgage interest rate. Therefore it makes sense to put a lot of work into improving your financial status.

The good news though is that it is not that hard to improve your credit scores in as little as 6 months or less. There are creative ways to do it yourself and even some reputable services out there who know how to get your scores raised for you.

Do your best to target a score of 680 or above. There are lenders that can find a bad credit mortgage for you with scores as low as 500 but then your down payment requirement and your rate will be much different.

Credit Events – A credit event is a bankruptcy, foreclosure and in some instances collections. If you have a bankruptcy or foreclosure, your lender needs to know up front so he or she can plan for this. It is preferable to have had these two years prior to applying for a loan.

Less than two years out of bankruptcy for example will prevent you from getting an FHA loan. Collections need to be dealt with. Pay outstanding collection amounts and work to have them removed from your credit report. That can be negotiated with the creditor as part of the payment agreement.

Large Payments on Your Credit Report – Too often potential home buyers fail to qualify because they have too many other minimum monthly payments showing up on their credit report. During the qualification process, lenders need to factor your future mortgage payment as well as the monthly obligations that appear on your credit report.

Together and when divided into your gross monthly income they make your debt to income ratio (DTI). Each loan program has a maximum DTI allowed. The less that you have in OTHER monthly payments on your credit report, the larger the loan you will be able to qualify for.

In this example, you can see that with a gross monthly income of $6,500, this person would qualify for a $300k loan at current rates using a maximum DTI of 43%. At the bottom, you can see how much more buying power this person has when the other monthly payments are removed.

This example above should hopefully explain why it is important to keep your credit report free from other monthly obligations. If you think there is a chance that you may buy a home in the near future, then do not buy a new car. At least not without discussing the implications with your lender.

In the example above, the person could afford $88k more if there was no car payment when applying for the loan. The truth is that auto lending is much more lenient when it comes to qualifying. Once you are approved and close on your home loan, there is an excellent chance that you can then go and buy the car you wants.

RESERVE FUNDS

The cash needed to buy a home is not just about the down payment and closing costs. Lenders will require a few months’ reserves (check with your lender). They want to be sure that if you have a job loss that you can at least make a few payments before you are out of money.

Realistically, you need to plan for a lot more than that. When you buy your home, do you think you may need some money to fix it up the way you want? Even with new construction, there are expenses.

Do you need to buy furniture? Do you own basic home needs like a lawn mower? This is also part of the planning process. Throwing everything you have into your initial purchase without anything left over makes you “house poor” and with one small setback can land you in a very difficult scenario where you could lose your home.

FINAL PERSPECTIVE

Once you have this plan developed with the assistance of a lender, then you can target price points and specific towns or neighborhoods. You will be able to spend time focusing on homes that are a true reality for you.

Developing a plan far in advance and sticking to it will also help make the home buying process much easier and will take the stress out of finding a mortgage. Your realtor will also be pleasantly surprised to know that you have taken the time to make sure you have the ability financially to purchase the home.

0 notes

Text

Pinoy app addressing pandemic impact wins the Space Apps COVID-19 Challenge

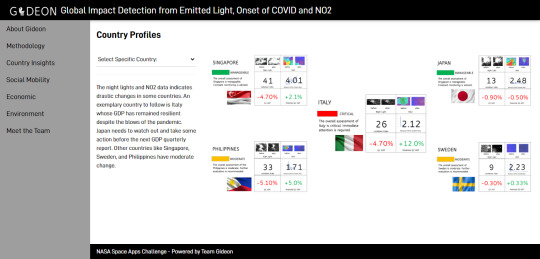

MANILA, Philippines - An integrated public policy information portal measuring the impact of the coronavirus pandemic developed by Filipinos won the Space Apps COVID-19 Challenge in the best use of data, the solution that best makes space data accessible, or leverages it to a unique application. Using Earth observation, in-country economic and human mobility data, and global infection case counts, data analysts Nick Tobia, Helen Mary Barrameda, Kristel Joyce Zapata, Theresa Rosario Tan, and Miguel Oscar Castelo from CirroLytix created a dashboard for policy makers and economic planners to show the impact of COVID-19 on various countries and effects on the economy and environment.

Named G.I.D.E.O.N. (Global Impact Detection from Emitted Light, Onset of Covid-19, and Nitrogen Dioxide), the portal uses news feeds, Google mobility data, and coronavirus cases revealing the multi-dimensional impact of lockdown and other interventions. Night lights from the Visible Infrared Imaging Radiometer Suite (VIIRS) and nitrogen dioxide levels from Sentinel-5P show current impacts and forecast effects of lockdown. Google's community mobility reports, global infection data from Johns Hopkins University, and nitrogen dioxide data reveal pollution levels produced by human activity, and monitor which countries keep air quality under control as they bounce back from lockdown and pave the way for the "new normal."

Aside from having a global winner, two Pinoy teams made it as global finalists too.

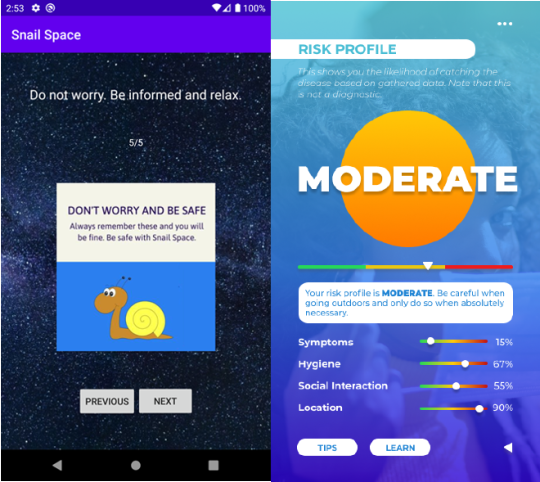

Inspired by social isolation experienced by astronauts in space, Snail Space (A wordplay for snail's pace) is an app giving a "safe space" by providing mental care and comfort during times of social isolation brought by COVID-19 pandemic. It was developed by Celestial Snails team comprised of Arturo Caronongan III, Kevin Olanday, In Yong Lee, Mary Anne Dominique Casacop, and Gabriel Santiago from De La Salle University.

With public health in mind, Sentinellium leverages user data sent through SMS and chat, and space assets like population density, urbanization, and aerosol to provide a more accurate prediction of developing epidemics. This was done by Harlee Quizzagan, James Andrew C. Cornes, Angela Chua, Alaica Mariño, Joal Rose Lin, and Mohammad Ashraful Mobin, in which their group was formed during the hackathon period.

"The use of these modern and advanced technologies will be crucial, especially as the world navigates the fourth industrial revolution. Using big data, cloud, and AI applications for instance, could help us understand the severity of the disease and aid in delivering measures to mitigate its impact," according to the Undersecretary for Competitiveness and Innovation of the Department of Trade and Industry (DTI) Dr. Rafaelita "Fita" M. Aldaba. "This really fills me with great optimism that our young and talented startups and Filipinos have so much to offer and contribute to our efforts to provide solutions to address health and economic crisis," she said.

Last May 30-31, 2020, coders, entrepreneurs, scientists, designers, storytellers, makers, builders, artists, and technologists have been invited in an all-virtual, global hackathon by the United States space agency National Aeronautics Space Administration (NASA), along with the European Space Agency (ESA), Japan Aerospace Exploration Agency (JAXA), the National Centre for Space Studies (CNES) of France, and Canadian Space Agency (CSA). During a period of 48 hours, more than 15,000 participants from 150 countries created more than 2,000 virtual teams. Participants used Earth observation and other open data to propose solutions to one of twelve challenges related to the COVID-19 pandemic.

During the virtual bootcamp one week prior to the hackathon, Ellison Castro, Cara Patricia Canlas, and Arlo Jayson Sabuito from STAMINA4Space discussed the capabilities of microsatellites in determining the height of clouds and forest fire mapping using support vector machine. During the hackathon, Aldrich Tan, Elymar Apao, Chi Señires, and Janyl Tamayo from UXPH helped participants in designing and bringing user experience to their projects. Andresito de Guzman of PWA Pilipinas taught participants on developing progressive web applications. 2019 global winner in the best use of data Dominic Vincent Ligot from the Analytics Association of the Philippines and Data Ethics PH brought inspiration by emphasizing the importance of data analytics for social good.

G.I.D.E.O.N. is one of the six global winners selected by NASA, ESA, JAXA, CSA, and CNES, and one of the three teams shall have special access to the Euro Data Cube environment. If travel is deemed safe, winners shall also be invited to visit a NASA site to view a spacecraft launch. However, travel, accommodation, and food costs are not included. Lead organizer Michael Lance M. Domagas appeals support for the current and past winners, finalists, and especially to the four-year community who worked so hard in bringing honor for the country. "After being recognized by five leading space agencies of the planet, its time for our own country to show appreciation and give support for those who are stepping forward in combating the COVID-19 pandemic and its effects in our society today to defeat our common enemy," he said.

Previous Pinoy hackathon winners are Project AEDES (2019), using satellite and climate data to pinpoint possible dengue hotspots, and ISDApp (2018), which uses citizen science data to inform fishermen the right time to catch fish.

The Space Apps COVID-19 Challenge is a special edition of NASA’s annual Space Apps Challenge, an international hackathon that takes place around the world and online every October. Since 2012, teams have engaged with NASA's free and open data to address real-world problems on Earth and in space. Space Apps 2019 included more than 29,000 participants in 71 countries, developing more than 2,000 hackathon solutions over one weekend. This NASA-led initiative is organized in collaboration with Booz Allen Hamilton, Mindgrub, and SecondMuse. The next annual Space Apps Challenge is scheduled for October 2-4, 2020 in a virtual format. Registration opens August 15: https://2020.spaceappschallenge.org/locations/manila

0 notes

Text

Authentic living

I feel so blessed by everyting today. a lot of moments just reinforced this realization of this importance of authentic living. Stop wasting your time being anything but the most you, that you can be.

Work was good. I got good momentum. I see people around me, and they aresselfless and trying to work hard. Clark kind of bashed on the background from Robert Half, because they come from something random. But I appreciate it. Because it has created non-egocentric individuals, willing to work hard, start from scratch, and just own up to what they have to do to be successful for themsleves and the team.

I had tamales with Clark at the farmer’s market. Gosh he was so negative today. “where is it, why is it so far” and the Biden podcast this morning and how he talked about his son Beau and how a complaint never left his mouth, yeah it just made me think about that, and how I want to be intentional with positive reinforcement and surroundings and it make me realize I need to surround myself with positive individuals and the right individuals, but also realize how much tolerance I have to people’s emotions and their mood swings and how I’m some how able to separate myself from that and not get into the bullpen with them. Like Aaron, he was pissed about me “faking” this weekend and not coming out, I didn’t even blink, “moving on now...” if it’s not really something worth fessin’ up over there’s no point to really invest in it. Just move on.

I’ve been really embracing the concept and life philosophy of resilience and not making yourself a victim of your circumstance. This life and world doesn’t owe you anything, you get the privilege each morning of living, what are you going to do with it? Are you going to *try to make it through* or be purposeful and dutiful about each day. Joe Biden said his son always had this sense of duty, of thinking of everyone around him.

Anyways, the rest of the day was really lovely. Even though RH isn’t my place, I’m pretty good at it and realistically I could probably do *well* in a year, had a great call with Dave with Marty, and got CBRE (with Casey) & DTI, and I have DTI & Okta tomorrow, but... it’s made me think. What are the investments. Are they now? Shouldn’t you be real about the investment of time you’re making now, and how it should be most closely aligned with your long term goal, your passion? But I’m still thankful - Thankful for my boss and how she’s great at being positive and funny and encouraging (even though she comes off micromanaging sometimes) but she’s honestly kickass. And my colleagues like Sam and Aaron who mentor me. Why do I care so much, mostly about what they think? I have the interview tomorrow... Or where will this all go. Why am I so concerned that I’m dropping these accounts, when I know.. life will go on, this isn’t really a fomo I should worry about, because it will just repeat anyways, there will always be more accounts, it’s a cycle, just get to where you are purposed to be already, to what you’re passionate about! How many more weeks can you do just getting through to 5pm?

Anyways, rest of my lovely day

- go home, make corn bread, chat with Alisa (she’s so sweet, so sad she’s leaving to Hong Kong

- drive to dinner with the EXP girls, SO lovely. I am SO blessed to have them. My family and sisters. just each of them so lovely in their own way. So much love and life to give, and so much passion for Jesus Christ. and then at the dinner table, I opened up about the job thing and they said so much good advice

- Jen: “I feel like what you’re talking about is so much more in alignment with what you were telling me you used to do and are passionate about, versus the one now, it doesn’t really sound like you”

- Anna: “It’s not really you being fickle, because you’re going somewhere that aligns with your long term goal, somewhere that you’ll stay”

- Amera: “I feel like you’re like to yourself [when you say you don’t know]. You do know, because there’s so much more negative in one than the other. You do know and the only issue is is that one has more comfort and security”

Anyways, it was just so nice to be at that dinner table.

And thennnnn, got home for my house friendsgiving. Gosh I love these girls. we had such a great delicious dinner, and just embraced how diverse we all were, haha, and played gasolina and old school hip hop, I appreciate them and their characters and perspective so much. The conversation took a really deep turn when Andoeni asked “do you guys have a memory that just really stands out and affects you?”

“9/11″

“Trump getting elected” “it just felt not real, couldn’t even talk, it was quiet on the radio”

and from there, the night just took into this conversational focus on culture, and diversity, and issues in America, and experiences we have growing up

Andoeni: “Do you guys feel proud about your country”

I shared about working in politics and in the campaign. I said, “I do feel proud, there’s so much opportunity, but the identity of American is so warped to me” And each shared really meaningfully and thoughtfully

- Eeda: “We don’t know how actually good we have it; like my cousin when he got his citizenship, he cried”

- Jav: “I feel so thankful for what we have here, like all these opportunities and privileges, but we’re just not really real about our history”

- Andoeni: “my boyfriend is so patriotic, sometimes I don’t even feel like having the conversation with him”

- Me: “Me too, because when I hear about how patriotic someone is, I question, do you know how we got here?”

- Jav: “We go in into Afghanistan and Iran and it was just fine and they turn everyone against each other”

- Pam: “Man, I’m still thinking Andoeni’s question... am I proud?”

I’m just thankful to be surrounded by such good, humble, authentic, socially conscious, open-minded souls... Thank you God. Thank you!!!

So much loveliness in one day, I am truly privileged. I live in a great city, have a lovely room, have lovely housemates and church family, even if I have a lot of reservations about my boyfriend, have a boyfriend who would do so much for me... (I think? lol) but he’s great too.

I just want to get closer to a state of authentic living.

I guess that starts with Christ. Giving my life for him for the one of real authenticity. To the only authentic one.

1 note

·

View note

Text

The Painful Truth.

I am normally inspired to write about politics, motherhood or some deep observation but today is not that day. Today is a day for self-pity. I am going to speak my truth and I truly believe the truth shall set me free. Game of Thrones is one of the best things that has ever happened to me in my life. Pretty up there with, graduations, wedding day, birth of three children and Paleo diets. I cannot contain the love I feel in my heart when I hear that Game of Thrones Theme Music.

Counter these sentiments with, being born a Gemini is one of the worst things that has ever happened in my life. Although I have spent the majority of my life thoroughly enjoying the useless humor of my sun sign, I am now ruined by the fact that being a Gemini negatively affects my GOT viewing. I simply cannot decide who should sit on the Iron Throne. I see all sides and I can’t decide. I am literally sick with indecisiveness.

Team Daenyres

This should be a simple and straightforward choice . She has dragons. She started from the bottom, now she here. She stepped into her power and sexual prowess both of which have aided her viable campaign to take over the Seven Kingdoms. However, as a deep proponent of Black Liberation Theology, she is still a Becky with all of the privilege that entails. So maybe the “Motha” in me wants to see her fail like the witch who played her out in the beginning. Besides her arrogant, privileged existence got one of my baby dragons snatched up by the Night King.

Team Night King

He is really evil. He is really scary. But every time he steps on the scene I am riveted. My attraction to him is much like my attraction to Suge knight. He is so ignorant, so wrong, so ancient and yet so powerful, quiet and intense. He sees everything. He stays in his lane and did you see the way he lovingly touched the dragon’s head. So what if he was turning it into a zombie. Who doesn’t want to be touched like that? My type of man. I want to hate him. I don’t want him to kill the world. I don’t want to love him but . . .

Team Cersei

Cersei is pretty bad but she is my type of woman. Complex, has her own set of principals, family above all else, and even when flogged and walking through the city butt naked, covered in shit and tormented, she remained regal and above all others. She is always cold, cool, patient and calculating but when cornered she goes post-apocalyptic on her enemies. I have been told I do the same. If she wins, it is going to suck for the commoners but no one holds court like a Lanister and besides her DTI was out of control but she always pays her debts so she has good credit. King’s Landing under Cersei will throw some epic parties. I should hate her but she feels so familiar.

Team John Snow

He reminds me of an ex. Principled, loyal, a safe choice, a rising star in his field but I just could not get into him. I had to give him the talk. “I am probably underestimating you, you probably have every right to the Iron Throne (in his case, my love and devotion) but you are just not my cup of tea, I need edges.” Besides, he was soft and I didn’t like his family and friends(the Hound and Gendry) and he got my dragon killed. We would have never lasted for the long haul. Like Su Tzu said, “Know Thyself.”

So much to my chagrin, I truly can’t make up my mind. A quintessential Gemini problem. I am going to ride this out, see how it all plays out, make everyone feel adored and pretend like I was down from the start. I guess that is why I stay winning. I don’t think Capricorns have these issues.

0 notes

Note

What is Vivian like when Casey is pregnant?

What is she like when the baby gets there?

How full on Vivian is she

HA! Oh, this is great. But keep in mind, today's story is just a little stand alone flufftober piece, it's not their "real- real" story, you know? Just a little AU. So I don't know if Vivian even factors in. Now, in my T&C series, eventually we'll meet Vivian because, hell yeah I'm incorporating her in there. She's too good to let die when DTI does. And let's just say... I've got you. lol I think it is fair to say that Vivian would be so extra that we'd need to come up with a new word. Extra wouldn't cut it... and I will be SO there for it. lol Thanks for asking.

1 note

·

View note

Text

Can I Refinance? Refinance Requirements for Your Mortgage

There are many reasons you may choose to refinance your home. One reason is to get a better interest rate, which will lower your monthly payment. Even though interest rates are rising, the reality is that today’s rates are still at historic lows. They’re less than half of what they were in the 1980s and early ‘90s.

You may also want to refinance to lengthen your loan term and lower your monthly payments. Or, conversely, if you can afford higher monthly payments, you could save yourself tens of thousands of dollars in interest payments by shortening your mortgage term. Another reason you may want to refinance is to convert an adjustable-rate mortgage into a fixed rate loan.

Whatever your reasons, the reality is that you do need to meet some requirements in order to refinance. We’ve laid them out for you below. Take a look to see if your finances are in the right shape.

Requirements for refinancing your home loan

When you apply to refinance the mortgage on your home, lenders look at three main factors to decide whether to approve you. These factors are:

Your income: This is how much money you have coming in each month. Your income weighs heavily on your ability to pay back the new loan. Your home equity: Your home equity is the percentage of your home that you own outright. You can calculate this by subtracting the amount you owe on your mortgage from the value of your home. This will play a role in how much you’ll be allowed to borrow. Your credit score: Lenders use your credit score as a way to gauge how likely you are to pay back the loan. Conventional wisdom states that if you do well paying back other debts, you’re more likely to stay current with your next loan. Financial factors

To determine whether you’re eligible to refinance, lenders look at a variety of financial indicators. We’ve listed the most common ones below to give you an idea of what to expect.

Debt-To-Income Ratio (DTI)

Your debt-to-income ratio is the sum of all your monthly debts divided by your gross monthly income. According to Jason Lerner, vice president and area development manager for George Mason Mortgage, LLC in Lutherville, M.D., this ratio can have the most significant impact on your eligibility. “The DTI tends to be weighed the heaviest because it shows your ability to repay the loan,” he said.

As for what counts as a financeable ratio, the Consumer Financial Protection Bureau (CFPB) says to aim for a ratio that’s less than or equal to 43%, though a ratio closer to 36% is more ideal. However, Lerner said that, in practice, exceptions are often made to that rule, especially if your other numbers are in line. “These days, it’s a good rule of thumb to shoot for a DTI of 50% or less.”

Financial thresholds for government-insured mortgages

That said, government-backed loans have different qualifying requirements. The Federal Housing Authority, for example, stipulates that for an FHA loan, your housing costs should not exceed 31% of your total income and your total DTI should not be larger than 43%.

Yet, even the Department of Housing and Urban Development (HUD) — the government agency that oversees the FHA — acknowledges that those requirements can be relaxed if there are other compensating factors involved. Those factors might be a down payment that’s larger than 10%, or substantial cash reserves.

With the FHA Streamline Refinance program, a program that lets you refinance an existing FHA loan into a new one, there’s no income verification. That means your DTI won’t even be a factor in the decision-making process.

On the other hand, the U.S. Department of Veterans Affairs (VA) as its own set of qualifying standards for refinancing. For a VA loan, the acceptable DTI is 41%. If you have an existing VA loan, however, you may be able to refinance your home with an Interest Rate Reduction Refinance Loan, which doesn’t have income requirements.

Equity requirements

Equity is the percentage of your home that you own outright. The amount of equity you need to have in your home in order to refinance varies according to the lender and the loan program.

To find out how much equity you have in your home, you usually need to do an appraisal to get the current value of the home. But appraisals are not always done in the traditional sense anymore.

“The home’s value does need to be verified in some way, but it’s becoming more common to see appraisals done by computer,” Lerner said. Computer-generated appraisals use mathematical formulas to compare your house with information about the value of other homes in your area.

Even so, there are a few loan programs that don’t require an appraisal at all. They include:

The VA Interest Rate Reduction Loan FHA Streamline Refinance Program HARP (Home Affordable Refinance Program) Loan-To-Value Ratio (LTV)

Another way of expressing your home equity is by looking at your loan-to-value ratio, or the amount you owe on your home in relation to its overall value. For example, if you still owe $100,000 on a $300,000 home, your LTV would be 33% and your home equity would be 66%.

Not only is this ratio important in determining whether you’ll be approved for a loan, but it may also determine the interest rate you’ll get and other fees you’ll pay. In addition, many lenders require that homeowners take out private mortgage insurance if they have less than 20% equity in the home, or have an LTV that’s greater than 80%.

Will it be easier to qualify for the refinance if your LTV is below 80%?

Every lender has its own qualifying requirements, so it’s difficult to say what lenders prefer overall. But Lerner said having an LTV below 80% “isn’t a big concern” at his mortgage company, “especially if your other numbers, like your credit score, are in good shape.”

Lerner said in some instances, the amount you still owe on the home can be quite high. “Typically, it’s 80% to 85%,” Lerner said, “but if you’re just looking to reduce the payment or change the loan term, you can get closer to 97% or 100%.”

The main reason why a lender might want you to have at least 20% equity in your property is to minimize risk. Loans with high LTVs are thought to be one of the factors that contributed to the 2008 mortgage crisis.

In short, the less of a stake that a homeowner has in the property, the less likely they are to pay it off in times of crisis. When you have a high LTV, you have less skin in the game, which is riskier for the lender.

Credit score requirements

For the most part, lenders do look at your credit score when helping you to refinance your home. As far as what the credit score minimums will be, Lerner said they fall in line with the same qualifying requirements you’ll see for an initial purchase loan.

“For the most part, you’re going to need at least a 620 on a conventional loan and at least a 580 for an FHA,” he said. But for an FHA refinance, that number can drop down to 500, if you’ve got less than a 90% LTV.

However, there are ways to get around those numbers if you have certain government loans. “If you plan on staying with an existing FHA or VA loan, you may not have to run a credit check at all,” Lerner said. Again, the FHA Streamline Refinance Program and the VA Interest Rate Reduction Loan both offer limited underwriting requirements.

Can your credit score affect your refinance rate?

That said, there are advantages to making sure that your score is in the best shape possible before you go to refinance. Borrowers with lower scores are charged higher interest rates because they’re seen as a bigger risk by lenders. Building your credit score is one of the best ways to make sure your payment stays as low as possible.

The bottom line

Homeowners have to meet certain benchmarks to be able to refinance their mortgages. But if you don’t meet all of them all, don’t stress. There’s a lot of flexibility in the qualifying requirements and many different loan programs to choose from. Once you’re ready to start working with a lender, he or she can help you zero in on the program that will work the best for you.

The post Can I Refinance? Refinance Requirements for Your Mortgage appeared first on Student Loan Hero.

from Updates About Loans https://studentloanhero.com/featured/mortgage-refinance-requirements/

0 notes

Text

Can I Refinance? Refinance Requirements for Your Mortgage

There are many reasons you may choose to refinance your home. One reason is to get a better interest rate, which will lower your monthly payment. Even though interest rates are rising, the reality is that today’s rates are still at historic lows. They’re less than half of what they were in the 1980s and early ‘90s.

You may also want to refinance to lengthen your loan term and lower your monthly payments. Or, conversely, if you can afford higher monthly payments, you could save yourself tens of thousands of dollars in interest payments by shortening your mortgage term. Another reason you may want to refinance is to convert an adjustable-rate mortgage into a fixed rate loan.

Whatever your reasons, the reality is that you do need to meet some requirements in order to refinance. We’ve laid them out for you below. Take a look to see if your finances are in the right shape.

Requirements for refinancing your home loan

When you apply to refinance the mortgage on your home, lenders look at three main factors to decide whether to approve you. These factors are: