#sell platinum coins

Explore tagged Tumblr posts

Text

Sell Your Gold & Silver Coins Online for Cash

Sell your bullion, gold, silver, platinum, palladium coins & bullion coins for cash at SellMyJewelry. Get the best price for your coins. Sell My Jewelry guarantee to provide you with the safest, fastest and easiest way to sell your coins online.

0 notes

Text

Yo guys I started playing a dnd campaign w some of my friends n my husband (both of us are new to it) and it's soooooooo cool and I love this game sm but it's pretty complicated but that's what makes it gooooooddd

(Dam das alot of tags)

#dnd#ima rouge dwarf:3#we turned the lesbian hunter lesbian and rose(the girl ee were protecting from the hunter) the lesbian hunter and then my husband who plays#-who plays a genderfluid elf all had sex and he stole the lesbian hunter's clothes and we distrebuted them and now my male dwarf wears a#-wears a lacy bra over his shirt and her black skirt which goes to below his knees instead of mid thigh cuz hes short and i also have the#-the hunter's cloak but i was alreadh wearing one and hers is too long for my dwarf and then i also had a massive diamond thingy that we#-that we wanted to sell but it was worth like 50 coins so with the help of a player with higher int i made three massive coins in my dm's#-dm's words “the size of where your dick starts to the top of your head” and i sold two of them and got 50 each so i made an extra 50 coins#-and then i kept the last one so i have a massive gold/diamond/platinum coin#yay!#dungeons and dragons#my int is like 2 btw guys#and wis is 1:')#my dex is hella high tho#also my dwarf and my hubbys elf fucked and then we ended it when the day after n since our races have rivalrys apparently so its awkward fo#-for our characters but its all fine cuz ima eventually propose#:b#his elf is a bard btw#also one of our players drew a bad card and all his non magical items dissapeardee so he was naked up to when we got the lesbian hunters#-hunters clothes and he only got the shoes and trousers(and her pants for some reason) cuz everone else took her other stuff#tehe#the lesbian hunter

5 notes

·

View notes

Text

Gold Glitters as the Fed Signals Extended Rate Cuts Through 2024: A Safe Haven Amid Economic Uncertainty 📈💰

The Fed's anticipated rate cuts through 2024 are expected to spark renewed interest in gold. 📈💰 Why? Because in times of economic uncertainty, gold has historically been a safe haven for investors. Stay tuned for potential opportunities!

🌐 https://www.24gold.ca/ 📞 (416) 214-2442

#buy gold in toronto#buy gold coins toronto#precious metal dealer#gold refinery#buy gold#and platinum in toronto#buy or sell gold

0 notes

Text

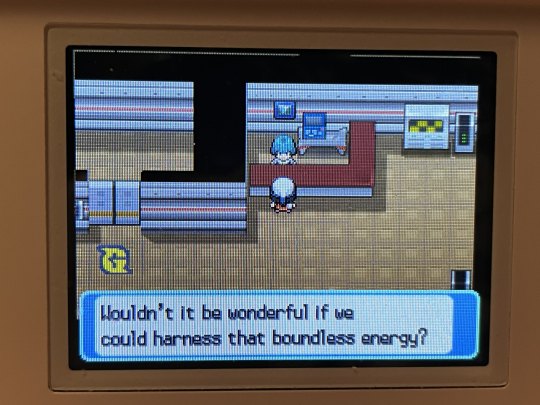

OKAY i can follow up my previous platinum post now. i haven't actually fought the gym in veilstone yet nor have i done the team galactic building stuff but there's so much flavor text already from the little that is able to be explored

it's pretty fucked that galactic has been able to set up shop or whatever in so many places because of this lie about finding a new source of energy. like okay while not entirely untrue the public does have the right to be suspicious about it. especially considering uhh

the contrast of these guys saying pretty much the complete opposite of the noble New Energy message. people criticize sinnoh a lot for team galactic not making a whole lot of sense and while i don't think sinnoh is a masterclass in storytelling or anything, i don't think people give it enough credit for it using this contrast to its advantage. i don't think the difference in this dialogue is because team galactic is confused or anything, it's their public facing front vs the truth of their motives. it's very heavyhanded but it's trying to sell this concept to children, so sdfjksd

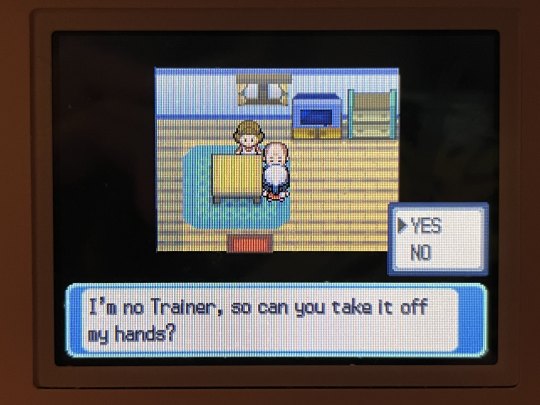

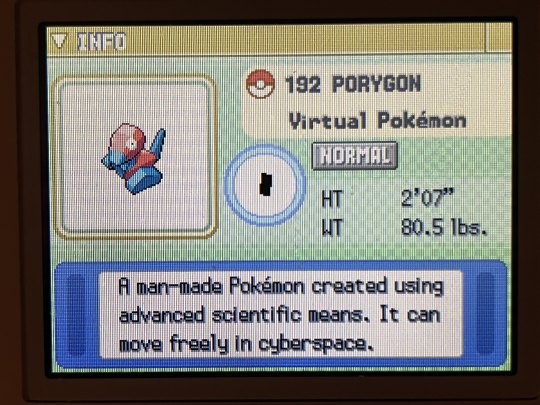

oh and this gift porygon is entirely optional and able to be missed if you don't walk into this unassuming building with a couple NPCs, but it turns out it's a runaway from team galactic. it's not like pokemon hasn't used pokemon as a storytelling device before, team rocket was literally selling these guys mass produced at the game corner in kanto, but it's a lot more subtle here. the team galactic symbol is in the slot machine reels, and someone just found a random escapee porygon presumably around veilstone city. it's definitely drawing parallels to the Evil Deeds:tm: of team rocket that came before them and implies that they're probably doing more than JUST researching new energy...

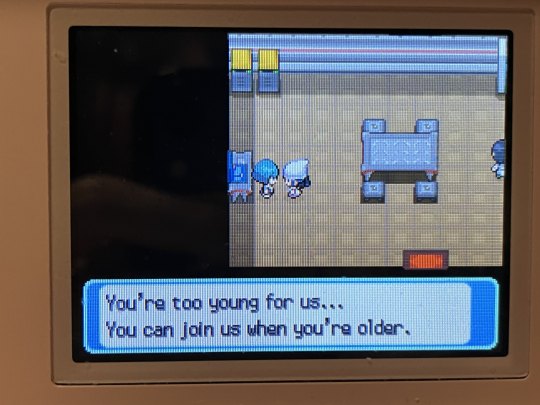

oh yes and the constant reminders that dawn (or lucas, but i always play as dawn) is a child. of course the protags in the mainline pokemon games have always been children but it's especially striking in sinnoh. sinnoh's story has some of the highest stakes out of any pokemon games, and yet the protagonist is still a little kid, confirmed by the NPCs. it's more unnerving here.

like a child putting an end to a crime syndicate or a child stopping a natural disaster by summoning a sky god is one thing, but in sinnoh dawn steps into Pokemon Hell and catches Pokemon Satan in the palm of her hands and walks back out. perhaps i'm being a bit overdramatic but as a traumatized person who used sinnoh to cope as a child it's very interesting to me that dawn is hypothetically, arguably, the most traumatized pokemon protagonist. god damn she goes through some shit. these reminders are just disconcerting to me in a way they are not in other pokemon games. though maybe that's my bias speaking a bit too loud lol

ANYWAY now i gotta decide if i wanna grind out getting spiritomb with two ds consoles (or three?? i think i have enough files for that) or if i wanna sit in the game corner for a while to grind out coins for some TMs because i feel like doing one of the two HMM

22 notes

·

View notes

Text

Another easy, simple poll for you all - the last one went well, so I want to see what the community finds most important to make and sell!

92 notes

·

View notes

Note

what can i trade to get a hug from crow uwu (@commanderhorncleaver)

"Looking to trade? Youve come to the right place! Nothings contraband here! Now looking for a hug in particular from me, hm? I'm willing to sell. Hows the sound of 1 platinum coin sound to you sir! A low price I know!' Crow says excitedly. (I think anet said that 1 platinum coin was worth several thousand gold or 1 mil gold)

3 notes

·

View notes

Text

Website : https://www.borgersrarecoins.com/

Address : 237 E High St, Hellertown, PA 18055

At Borgers Rare Coins & Fine Jewelry, you will never have to overpay for our precious metals, coins or silver. Borgers Rare Coins & Fine Jewelry takes great pride in our work to provide honest and fair prices for our rare coins, precious metals, fine jewelry. Borgers Rare Coins & Fine Jewelry has a large inventory at our disposal, we carry gold, precious metals, rings, bracelets, watches, necklaces, silver, rare coins, rare money notes, and estates. Visit Borgers Rare Coins & Fine Jewelry today or give us a call and schedule an appointment.

Estate Liquidation Specialists

DON'T SELL YOUR RARE COINS FOR SCRAP PRICES!

610-838-6919

973-390-4606

Borgers Rare Coins & Fine Jewelry specializes in buying NGC & PCGS certified coins and paper money. Borgers Rare Coins & Fine Jewelry also buys and sells GIA certified diamonds.

WE PAY TOP DOLLAR FOR:

GOLD & SILVER JEWELRY

PLATINUM JEWELRY

US AND FOREIGN COINS & CURRENCY

WATCHES

STERLING SILVER FLATWARE

DENTAL GOLD

VINTAGE COSTUME JEWELRY

GOLD, SILVER, & PLATINUM BULLION

DIAMONDS & DIAMOND JEWELRY

HISTORICAL ITEMS

ANTIQUE TOYS & COLLECTIBLES

TOKENS

#Cash For Gold#Cash For Gold Near Me#Cash For Gold Lehigh Valley PA#Cash For Gold Northampton PA#Cash For Gold Hellertown PA#Cash For Gold Bethlehem Township PA#Cash For Gold Coopersburg PA#Cash For Gold Saucon Township PA#Cash For Gold Allentown PA#Cash For Gold Bethlehem PA#Cash For Gold Easton PA#Cash For Gold Saucon valley PA

6 notes

·

View notes

Video

youtube

An Introduction To Gold Coins

In the event that you are searching for good investments, you might want to consider this website investing in gold coins.

Gold coins are more straightforward to sell than gold bars or other gold bullion coins that might have delays and different costs. The tough gold guidelines laid out by the US Mint are for gold coins circling over 350 years prior. These gold coins are printed in 91.67% fine gold, making a tough coin that is scratch proof.

Gold bullion coin gathering is the demonstration of storing up various gold coins like gold Hawks. Pandas, Philharmonics, Maple Leafs, Britannias, Gibraltar Canines and Isle of Man Felines. There are likewise silver and platinum bullion coins like Koalas. Kookaburas and Aristocrats. The US alone mints a huge number of gold coins consistently. The individuals who gather gold bullion coins do as such for their scarcity, worth and magnificence.

A few organizations that sell bullion gold coins are suggested for new gold purchasers since their exchanges are private and non-reportable, subsequently safeguarding total security, protection and safety for investors. One illustration of a plan is that bearing the picture of Augustus Holy person Gaudens, $20 pieces printed from 1907 to 1933. The opposite plan shows a home of Birds, representing America's familial practice. These gold coins are US mint and dependable with regards to gold substance and weight.

The beginning of coins isn't liberated from speculations. Some recommend that the more modest fragmentary pieces of the earliest coins, included smidgens of metals were given as installment for government workers or those working for the government and later acknowledged as installment for charges. Printing of these fragmentary denominations immediately increased in notoriety and virtually every piece in sixth century B.C was accumulated. The bigger denominations then again, were most probably used in costly exchanges like buying hired soldiers or supplies.

2 notes

·

View notes

Text

How to Trade Gold and Silver Online as Spot Metals?

The spot gold and silver online in the markets are vast and filled with unpredictability. There’s also been a lot of volatility over the past few years, which makes it all the more important to be able to make informed trades on a daily basis. You can trade digital or physical metals as an investment piece or as a means of purchasing precious metals from sellers in person.

Here we take a look at how you can trade gold and silver online as spot metals. Buying and selling precious metals is one of the oldest ways humans have of making money. It’s also one of the most misunderstood ways of doing business. The latest currency war has only amplified this problem, with both sides seeing affected territories cede their market dominance — gold has become more prone to manipulation than any time in recent memory, while silver prices have spiked during periods of stress.

In this article, we take you through the basics of trading gold and silver online as spot metals in case you feel like it’s missing something. Keep reading to discover everything you ever wanted to know about buying and selling precious metals.

What are spot metals?

Spot metals are precious metals that are traded on the global market. The most popular spot metals are gold and silver, but other metals like platinum and palladium are also traded. All spot metals can be bought and sold online through forex brokers.

When you trade spot metals, you are buying or selling the actual metal itself. The price of each metal is based on supply and demand, as well as global economic conditions. Gold is often seen as a safe haven asset, so its price tends to rise when there is economic uncertainty. Silver is used in many industrial applications, so its price can be more volatile than gold.

You can trade spot metals with leverage, which means you only need to put down a small amount of money to open a trade. Leverage can help you make more profit from your trades, but it can also magnify your losses if the market moves against you. That’s why it’s important to use risk management tools like stop-loss orders when trading spot metals.

Benefits of trading spot gold and spot silver

You can buy and sell spot metals as an investment piece. This means you can purchase the coins and tokens at the price you want to pay for them. This can range from $50 for a single copy of coins on a website to $1,000 for a vehicle right on the trade page. You can also trade stocks or commodities as an investment piece. This means you can purchase stocks that have a specific market price, like gold, that has a corresponding market exchange rate. You can also purchase commodities like oil or agricultural products as an investment piece.

How to trade gold and silver online as spot metals

There are many ways to buy and sell gold and silver online. You can purchase the coins or tokens on exchanges like change.org or bitwise. You can also buy the coins or tokens in person at a physical store where the owner is willing to sell them to you. You can also buy and sell gold and silver privately in some places like Japan, South Korea, and China, where such transactions are not record-keeping.

What are the best trading platforms for gold and silver online?

Most trading platforms work with a variety of different platforms. You can use these platforms to purchase gold and silver from different online brokers. You can also use these platforms to store your trades and view your trades in real-time. To use a trading platform, you need to: – Make a trade. – View your trades. – Get your feedback.

How can I get started learning about trading gold and silver online?

You can begin by purchasing a few coins at a time at a physical store or marketplace. You can also purchase gold or silver tokens online. Once you have the coins or tokens, you can start trading.

Conclusion

There are many ways to buy and sell gold and silver online. You can purchase the coins or tokens in person at a physical store where the owner is willing to sell them to you. You can also buy the coins or tokens in person at a brokerage firm where the trading platform works with multiple brokerages. You can also check out respected online wreckage-tornados.com for bad investment news and reviews.

Originally Published on Shortkro

Source: https://shortkro.com/how-to-trade-gold-and-silver-online-as-spot-metals/

#trade gold and silver online#spot metals trading#trade spot metals#Invelso#Online gold trading platform

3 notes

·

View notes

Text

"Sir, sir! I already told you I can't put in my taxes that I earned two rubies selling a dozen of pan dulces."

"Ma'am, we're barely past midnight, I don't have change for a gold ingot if you're only buying a café con leche."

"I'm sorry, sweetie, these cookies cost two silver coins, and these are platinum coins, I can't accept them because these coins are more valuable... Oh, how many cookies you can get for them? Uhm... The whole... counter."

You run a Bakery, just a normal bakery, the only problem is that your customers at midnight to 6AM are mythical creatures who pay with gemstones and ancient gold and silver coins

40K notes

·

View notes

Text

0 notes

Text

Buy Gold Bullion

Don't miss out on this golden opportunity! Buy gold bullion today to protect and grow your wealth. Visit us:- https://www.24gold.ca/

#buy gold in toronto#precious metal dealer#best bullion dealers in canada#gold refinery#buy or sell gold#buy gold coins toronto#and platinum in toronto#toronto bullion dealers#buy gold#silver

0 notes

Text

Safekeeping Receipts (SKR): A Guide to Protecting Your Valuable Assets

Safekeeping Receipts (SKR): A Guide to Protecting Your Valuable Assets

In today’s world, safeguarding valuable assets is a top priority for individuals and businesses alike. Whether it's precious metals, fine art, or important documents, ensuring these assets are securely stored and managed can make a significant difference. Enter Safekeeping Receipts (SKR), a reliable and efficient solution for asset protection. But what exactly are SKRs, and why should you consider them? Let’s explore this essential financial tool and how it can benefit you.

What Are Safekeeping Receipts (SKR)?

A Safekeeping Receipt, or SKR, is a legal document issued by a trusted depository institution to confirm the secure storage of valuable assets. It serves as proof of ownership and acts as a receipt indicating that the assets have been safely stored in a secure facility. SKRs are commonly used for:

Precious metals (gold, silver, platinum)

Fine art and collectibles

Securities and financial instruments

Important documents and contracts

Unlike physical possession, SKRs allow you to maintain ownership while the assets remain safely stored and managed by a professional depository.

Key Benefits of Safekeeping Receipts

1. Enhanced Security

Depositories offering SKRs are equipped with advanced security measures, such as surveillance systems, temperature-controlled environments, and robust access controls. This ensures your assets are protected from theft, damage, or unauthorized access.

2. Proof of Ownership

An SKR acts as indisputable proof of ownership. This legal document can be critical for transactions, audits, or legal proceedings, providing transparency and credibility.

3. Ease of Transactions

SKRs can facilitate transactions without requiring the physical transfer of assets. For example, they can be used as collateral for loans or to verify ownership in financial dealings.

4. Liquidity Opportunities

By leveraging your SKR, you can unlock liquidity without selling your assets. Many financial institutions accept SKRs as collateral for loans, enabling you to secure financing while retaining ownership.

5. Peace of Mind

Knowing that your assets are securely stored in a professional facility allows you to focus on other priorities, free from the stress of managing and protecting high-value items yourself.

How SKRs Work

Step 1: Deposit Your Assets

You begin by depositing your valuable assets with a trusted depository institution, such as Global Trust Depository. The institution will verify the authenticity and condition of the assets before accepting them.

Step 2: Receive Your SKR

Once your assets are securely stored, the depository issues an SKR, detailing the type, quantity, and condition of the stored assets. This document serves as proof of secure storage and ownership.

Step 3: Utilize Your SKR

You can use your SKR in various ways:

As Collateral: Secure loans by presenting the SKR to financial institutions.

For Transactions: Transfer ownership or use the SKR in financial dealings without moving the physical assets.

For Recordkeeping: Maintain an official record of asset storage for audits or legal purposes.

Who Can Benefit from SKRs?

High-Net-Worth Individuals Those with significant investments in fine art, precious metals, or other high-value assets can use SKRs to protect their wealth and facilitate financial flexibility.

Businesses and Corporations Companies with critical documents or high-value inventory can leverage SKRs to ensure secure storage and enable seamless transactions.

Collectors and Investors Art collectors, rare coin enthusiasts, and precious metal investors can benefit from the peace of mind and transactional ease that SKRs provide.

Financial Institutions Banks and lending institutions often accept SKRs as collateral for loans, making them a valuable tool for borrowers and lenders alike.

Why Choose Global Trust Depository for Your SKRs?

At Global Trust Depository, we specialize in providing secure, professional safekeeping services tailored to your needs. Here’s why we stand out:

State-of-the-Art Security: Our facilities are equipped with cutting-edge technology to ensure the utmost protection for your assets.

Expertise You Can Trust: With years of experience in asset management, we understand the unique requirements of our clients.

Personalized Solutions: Whether you need long-term storage or assistance with collateralization, we’ll work with you to meet your goals.

Confidentiality: Your privacy is our priority. We handle all transactions with the highest level of discretion.

How to Get Started with SKRs

Contact Us: Reach out to Global Trust Depository to discuss your specific needs.

Schedule a Consultation: Our experts will guide you through the process and answer any questions.

Deposit Your Assets: Once your assets are verified, we’ll issue your SKR and store them securely.

Leverage Your SKR: Use your SKR to unlock new financial opportunities or simply enjoy peace of mind knowing your assets are safe.

Safekeeping Receipts (SKRs) offer a secure, flexible, and efficient solution for managing and protecting valuable assets. Whether you’re an individual investor or a business owner, SKRs can provide you with the security and financial flexibility you need to succeed.

Ready to safeguard your assets with Global Trust Depository? Contact us today to learn more about our safekeeping services and how SKRs can work for you.

0 notes

Text

Austin’s Best Jewelry Buyers: What Sets Us Apart

When it comes to selling your valuable jewelry, finding a trustworthy buyer who offers competitive prices and exceptional service is essential. At Austin Coins Jewelry, we pride ourselves on being Austin’s best jewelry buyers, providing a seamless and rewarding experience for our customers. Whether you’re looking to sell gold jewelry, diamonds, estate pieces, or rare coins, we stand out for all the right reasons. Here’s what sets us apart.

1. Transparent and Honest Appraisals

We believe in complete transparency during the appraisal process. Our experienced professionals carefully evaluate your jewelry based on:

Gold and Metal Purity: Using state-of-the-art tools, we assess the purity of your gold, silver, or platinum.

Gemstone Quality: For diamonds and other gemstones, we consider the 4Cs—cut, clarity, carat weight, and color.

Design and Craftsmanship: Unique designs and renowned craftsmanship add significant value.

Market Trends: We stay updated on market conditions to ensure you receive the best possible price.

Our appraisers explain every detail, so you understand how we determine the value of your items. No hidden fees, no surprises—just fair and honest assessments.

2. Competitive Offers

As Austin’s leading jewelry buyers, we’re committed to offering the highest possible prices for your valuables. Our extensive network of buyers and collectors allows us to make competitive offers that reflect the true value of your pieces. Whether you’re selling gold jewelry in Austin or antique estate jewelry, you can trust us to provide the best deal.

3. Expertise in Estate Jewelry

Estate jewelry often carries both sentimental and monetary value. Our team specializes in evaluating and purchasing estate pieces, including:

Antique Jewelry: Timeless pieces from the Georgian, Victorian, and Edwardian eras.

Vintage Jewelry: Unique designs from Art Deco, Retro, and other historic periods.

Heirloom Pieces: Sentimental treasures passed down through generations.

We understand the rarity and craftsmanship of these items, ensuring you receive an offer that reflects their true worth.

4. A Convenient and Private Selling Experience

Selling your jewelry should be a stress-free process. That’s why we’ve designed a customer-focused experience that prioritizes your comfort and privacy:

Appointment-Only Service: Enjoy undivided attention during a one-on-one consultation.

Secure Evaluations: Your items are handled with care and returned promptly after evaluation.

Immediate Payment: Once you accept our offer, you’ll receive payment on the spot.

Located conveniently in Austin, our office provides a welcoming environment for all your selling needs.

5. Trusted Reputation in Austin

With years of experience and countless satisfied customers, we’ve built a reputation as Austin’s most trusted jewelry buyers. Here’s why our clients keep coming back:

Positive Reviews: Our stellar customer reviews speak volumes about our commitment to excellence.

Licensed and Certified: We adhere to all industry standards and regulations.

Community Focus: As a locally owned business, we take pride in serving the Austin community with integrity.

6. We Buy More Than Just Jewelry

While we’re known for buying gold and estate jewelry, our expertise extends to a wide range of valuables, including:

Diamonds: Loose or set in jewelry.

Rare Coins: Gold, silver, and collectible coins.

Watches: Luxury timepieces from top brands.

Precious Metals: Gold and silver bars or bullion.

Whatever you’re selling, we’re here to offer fair prices and a hassle-free experience.

7. Why Sell Your Jewelry Now?

If you’re considering selling your jewelry, there’s no better time than now. Here’s why:

High Gold Prices: Take advantage of rising gold prices to maximize your returns.

Declutter and Simplify: Turn unused jewelry into cash while freeing up space.

Immediate Financial Needs: Selling your valuables can provide quick funds for unexpected expenses.

Final Thoughts

At Austin Coins Jewelry, we’re dedicated to making the process of selling jewelry in Austin as smooth and rewarding as possible. From transparent appraisals to competitive offers and exceptional customer service, we go above and beyond to meet your needs.

If you’re ready to sell gold jewelry, estate pieces, or other valuables in Austin, contact us today to schedule your appointment. Discover why we’re Austin’s best jewelry buyers and experience the difference for yourself.

0 notes

Text

0 notes

Text

Helldivers 2, Space Marine 2, Baldur's Gate 3 were among the best selling games on Steam in 2024

Enter and Win Robux Coins Valve did Released Its annual year-end round-ups, and in the top 100 sellers list for 2024 based on their gross revenue (including microtransactions), the platinum category – which groups together the top 10 games at random – lists a number of major new titles that Released this year. Namely, the games are Helldivers 2, Warhammer 40,000: Space Marine 2, Palworld, Call…

View On WordPress

0 notes