#seed funding in India

Explore tagged Tumblr posts

Text

What is Pre Seed Investors in India? JC Team Capital

Seed funding is an early stage of investment in a startup company, usually given in exchange for equity. It is the initial capital used to help a new business get off the ground and begin its operations. The purpose of seed funding is to help the company validate its business idea, build its initial product or service, and attract more investment to support its growth. Seed funding can come from a variety of sources, including angel investors, venture capitalists, and government grants. The amount of seed funding can vary greatly, but it typically ranges from a few tens of thousands of dollars to a few million dollars.

#seed funding In India#venture capital firm India#start up funding in india#funding for startups in india

1 note

·

View note

Text

Top 5 funded Sectors and Companies in India

According to "The State of Indian Startup Ecosystem Report, 2022," 1,282 agreements totaling $30.35 billion were completed to get seed funding for startups in Indian e-commerce firms between 2014 and 2022. With $15.9 Bn, or more than half of all e-commerce funding in India, the marketplace subsector experienced the largest level of fundraising activity during this time.

To Know more:

https://www.jcteamcapital.com/blog/5-sector-in-india-seed-funding-in-winter.php

0 notes

Text

Why do businesses fail even after good seed funding?

Most businesses fail even after receiving excellent seed funding because the management entirely misunderstands the demands and misallocates cash, losing the capital venture partner firm's trust in the process. Therefore, even if they must accept less startup funding, businesses must collaborate with venture capital firms that bring leadership and tested expertise. Truth Ventures is regarded as one of the best venture capital firms as they don't allow their partners to overspend or pay excessive attention to the current situation and only allocate cash by keeping long-term goals in mind.

#Truth vent#Truth ventures#truth venture#capital venture#capital venture fund#varun datta#varun datta ceo#seed funding#truth ventures#varun datta entrepreneur#varun datta founder#venture capital#seed capital#Capital venture India#Capital venture US#Capital venture UK#Venture Capital Ecosystem#Venture capital firms in india#Venture capital equity#Capital Venture Company#Capital venture funding#Stages of venture capital#Capital venture fund#venture capital in india#Types of venture capital#Investment Funding#Venture capital startup#Joint venture partner#Venture capital industry

3 notes

·

View notes

Text

SEAFUND: Empowering Deep Tech Startups in India to Drive Innovation

Transforming the future with deep tech startups in India!

By offering “patient capital” and strategic guidance, SEAFUND empowers these startups to scale and thrive, ensuring sustainable growth in transformative sectors.

Explore how SEAFUND is reshaping the deep tech ecosystem by investing in some of the most promising deep tech startups in India.

Discover more about their initiatives and portfolio at SEAFUND’s official website.

#305, 3rd Floor, 5 Vittal Mallya Road, Bengaluru, Karnataka, 560001, India

5 Ring Road, Lajpat Nagar 4, 3rd Floor, New Delhi-110024

#Keywords#best venture capital firm in india#venture capital firms in india#popular venture capital firms#venture capital firm#seed investors in bangalore#deep tech investors india#startup seed funding india#funding for startups in india#early stage venture capital firms#invest in startups bangalore#funders in bangalore#startup investment fund#fintech funding#india alternatives investment advisors#best venture capital firms in india#business investors in kerala#venture capital company#semiconductor startups#semiconductor venture capital#investors in semiconductors#startup seed funding in India#deep tech venture capital#deeptech startups in india#semiconductor companies in india#seed investors in delhi#saas venture capital#b2b venture capital#saas angel investors#saas venture capital firms

0 notes

Text

Startup India Seed Fund Scheme: Everything You Must Know About Aid And Assistance To Startups

Startups are a crucial part of a country’s economy, especially in today’s global scenario. Consumer choices and product variety have increased significantly and the demands and needs of consumers are increasing day by day. To facilitate consumer services and accelerate the economic growth of the country, promoting startups is essential.

0 notes

Text

How Businesses Can Contact Venture Capital in India for Seed Funding

Discover the steps for startups and businesses to approach venture capital in India for seed funding. Learn how to connect with leading VC firms like UnicornIVC and secure early-stage funding for your business.

Title: How Businesses Can Contact Venture Capital in India for Seed Funding

Description: Discover the steps for startups and businesses to approach venture capital in India for seed funding. Learn how to connect with leading VC firms like UnicornIVC and secure early-stage funding for your business.

Content:

For startups and small businesses, securing seed funding is a pivotal step in turning ideas into reality. This initial round of funding helps companies develop products, hire key team members, and scale operations. But navigating the venture capital landscape, especially in India, can be challenging. Knowing how to approach and contact the right venture capital firm is crucial for businesses looking to secure seed funding.

What is Seed Funding?

Seed funding is typically the first official round of equity funding that a startup raises. This early-stage capital is provided by investors in exchange for equity or partial ownership in the business. For Indian startups, seed funding can come from various sources, including angel investors, family offices, and venture capital firms like UnicornIVC.

Seed funding is essential as it allows startups to validate their product, achieve early growth, and prepare for future funding rounds like Series A or B. Venture capital firms that specialize in seed funding, such as UnicornIVC, play a significant role in providing this critical support.

Steps to Approach Venture Capital Firms for Seed Funding

Research the Right VC Firm:The first step in contacting venture capital firms is to identify those that align with your industry, business model, and funding needs. In India, venture capital firms often specialize in particular sectors, such as technology, healthcare, or fintech. Finding the right match increases your chances of getting funded.For example, UnicornIVC is a well-known VC firm focusing on early-stage startups, particularly those with innovative solutions and high growth potential. Researching their portfolio and investment thesis will help you determine whether your business fits their criteria.

Prepare a Compelling Pitch Deck:Before reaching out to venture capitalists, ensure you have a well-structured pitch deck. This document should cover key aspects of your business, including the problem you're solving, your product or service, market opportunity, financial projections, and how you plan to use the seed funding.Investors want to see a clear path to growth, profitability, and scalability. Your pitch deck should demonstrate why your business is a viable investment and how it stands out from competitors.

Build Relationships and Networks:Networking plays an essential role in accessing venture capital. Attend startup events, conferences, and pitch competitions where you can meet venture capitalists and industry professionals. Many VC firms, including UnicornIVC, often have representatives present at such events, offering founders opportunities to pitch their ideas directly.Additionally, leveraging existing connections can help you get an introduction to investors. Founders who are referred by someone in the VC’s network are more likely to get their foot in the door.

Cold Emails and Online Platforms:If you don’t have a direct connection, cold emailing venture capital firms is a common method for introducing your business. When reaching out, personalize the email by mentioning why you think the firm is a good fit and how your business aligns with their investment focus. Keep the email brief but compelling, and include your pitch deck.Many VC firms also use online platforms like LinkedIn and AngelList to find promising startups. These platforms allow you to submit your business for review, making it easier for investors to discover you.

Follow-Up and Be Persistent:Venture capital firms review numerous business pitches daily, so it’s crucial to follow up if you don’t hear back initially. A polite and persistent approach shows your commitment and enthusiasm for your business. It’s not uncommon to receive feedback or requests for additional information after your first contact.

Prepare for Due Diligence:If a venture capital firm expresses interest, they will conduct due diligence to assess the feasibility of your business. This process involves evaluating your team, financials, legal structure, and market positioning. Being transparent and having your documentation in order will help speed up this process.

Contact Details of Unicornivc

Website: https://www.unicornivc.com/

Contact Us Page: https://www.unicornivc.com/contact.php

#Unicorn#Unicornivc#How Businesses Can Contact Venture Capital in India#seed funding for startup#seed funding company for startups

0 notes

Text

What is Seed Funding for Startups? How Does It Work?

Seed Funding for Startups

Starting a successful business involves more than just a great idea. You need the right resources, skilled personnel, and a defined target audience. Among all these, securing adequate financing stands out as the most critical factor in launching a profitable startup. This essential funding, often referred to as seed funding, is crucial even if you already have a product. In this blog, we’ll dive into what seed funding is and how it can fuel your startup’s growth.

What is Seed Funding for Startups?

Seed funding is the initial capital raised by a startup during its early stages. The term 'seed' symbolizes the nurturing process—similar to planting a seed that, with proper care, grows into a thriving plant. In the context of startups, this funding acts as the nourishment required for a business idea to take root and flourish. Without adequate seed funding, even the most promising startup ideas may fail to materialize.

Seed investors play a vital role by providing financial support and mentorship. These investors may include friends and family, seed funding companies, angel investors, crowdfunding platforms, or corporate entities. Most often, they invest in exchange for equity shares in the company. However, in cases where funding is in the form of loans, repayment with interest is required.

Seed Funding vs. Pre-seed Funding: Understanding the Difference

In the early stages of a startup, two types of funding are available: seed and pre-seed funding.

Pre-seed Funding: This funding is for startups still in the ideation phase, where entrepreneurs have a solid idea but need financial resources to create a prototype and conduct market research. Pre-seed funding typically comes from close family members, friends, or high-risk investors like angel investors. It helps pave the way for securing larger seed funding.

Seed Funding: Seed funding, on the other hand, is a more substantial investment aimed at boosting research and development once the startup has a minimum viable product (MVP) or a clear business plan. Seed investors not only provide capital but also offer mentorship and strategic advice.

How Does Seed Funding for Startups Work?

Here are some key aspects to consider when pursuing seed funding:

Securing Seed Funding: Seed funding allows you to secure a significant investment, which, though smaller than Series A funding, is crucial in the early stages. These funds support product development, daily operations, and initial market penetration, enabling your startup to build a foundation for future growth.

Negotiating Terms: Negotiation is a vital part of securing seed funding. This includes discussing equity dilution, control over business operations, and the scope of the investor’s involvement. It's essential to strike a balance that allows you to retain enough control while benefiting from the investor's support.

Efficient Utilization of Funds: Once you’ve secured seed funding, creating a detailed plan for its utilization is crucial. Prioritize essential expenses such as research and development, marketing, and networking. Avoid unnecessary expenditures to ensure your funds are used effectively.

Mentorship and Guidance: Seed investors bring not just funds but also valuable industry experience. Their mentorship can help you navigate challenges, make informed decisions, and stay motivated throughout your startup journey.

Validation and Support: Running a startup often involves facing setbacks. Seed investors can provide validation and constructive criticism, helping you stay on track and avoid common pitfalls.

Building Brand Image: Securing seed funding from reputable investors can significantly enhance your startup’s brand image. This positive reputation can give you a competitive edge and attract further investments down the line.

Analyzing Growth: Seed investors closely monitor your startup’s progress, offering insights into market trends, operational efficiency, and strategic growth. Their analysis helps you refine your approach and maximize your chances of success.

Laying the Foundation for Future Funding: Seed funding sets the stage for subsequent rounds of investment, such as venture capital, Series A funding, or even an IPO. It helps you establish a strong foundation, making your startup more attractive to future investors.

Conclusion

Seed funding is the lifeblood of early-stage startups, providing the financial resources necessary to bring innovative ideas to life. While pre-seed funding supports ideation and initial development, seed funding helps turn those ideas into viable products and sustainable businesses. Beyond capital, seed investors offer mentorship, strategic guidance, and validation, making them invaluable partners in your startup journey.

To find the right pre-seed and seed investors, effective networking is key. At our Global Startup Summit, you can connect with investors, fellow entrepreneurs, and industry leaders from around the world. Visit our website to learn more about how we can help you secure the funding and connections you need to succeed.

FAQ

1. How can I raise pre-seed funding? Start by reaching out to local seed funding companies or attending networking events with pitching opportunities. Prepare a compelling pitch deck outlining your idea, its market potential, and a basic business plan to attract pre-seed investors.

2. What are the types of seed funding for startups? Seed funding can come from various sources, including angel investors, crowdfunding platforms, corporate seed funding, and more.

3. What are the benefits of seed funding? Seed funding supports research and development, marketing, market research, mentorship, and maintaining accountability in your startup’s early stages.

#startup#entrepreneur#investing#startup event india#economy#founder#startup ecosystem#startup funding#startup india#angel investors#seed funding#investment opportunities

0 notes

Text

Legal Aspects of Investment in India: What Investors Need to Know

Investing in India's vibrant startup ecosystem offers lucrative opportunities for investors seeking high growth potential and diversification. However, understanding the legal aspects of investment is crucial to mitigate risks and ensure compliance with regulatory requirements. In this blog, we will delve into the critical legal aspects of funding and investment in Indian startups, covering equity financing, debt financing, crowdfunding, incubators, and government schemes like the Startup India Seed Fund Scheme (SISFS). By gaining insights into these legal frameworks, investors can make informed decisions and navigate the complexities of the Indian investment landscape effectively.

Equity Financing:

Equity financing plays a pivotal role in funding Indian startups, with angel investors, venture capitalists, and private equity investors being key stakeholders. Venture capitalists typically enter into non-binding offers with startups based on preliminary valuations and due diligence processes. This involves the execution of various transaction documents, including term sheets, share subscription agreements, and shareholders' agreements, which outline rights, obligations, and exit options for investors. Similarly, angel investors, who are industry professionals, fund startups in return for equity stakes, subject to regulations imposed by SEBI. Understanding these legal agreements and regulatory requirements is essential for investors engaging in equity financing in India.

Debt Financing:

Debt financing, through loans or external commercial borrowings (ECBs), is another avenue for financing Indian startups. Banks and non-banking finance companies (NBFCs) provide loans to startups for purchasing inventory, equipment, and securing operating capital. However, obtaining a loan involves rigorous documentation, including loan agreements, security/collateral documentation, and compliance with regulatory norms. Additionally, external commercial borrowings from non-resident lenders require adherence to restrictions on capital market investments and acquisitions in India. Investors should familiarize themselves with these legal requirements to facilitate smooth debt financing transactions.

Crowdfunding:

Crowdfunding has emerged as a revolutionary way of obtaining seed funding for startups by securing funds from a large group of people through online platforms. While crowdfunding offers a decentralized approach to fundraising, regulatory frameworks governing this practice are still evolving in India. The Securities and Exchange Board of India (SEBI) released a consultation paper on crowdfunding in 2014, but formal regulations are yet to be issued. Investors should stay updated on regulatory developments and exercise caution when participating in crowdfunding activities in India.

Incubators:

Incubators play a crucial role in nurturing startup ventures by providing resources and services in exchange for equity stakes. These entities, whether government-aided or private, offer management training, administrative support, and legal compliance assistance to startups during the incubation period. Understanding the terms and conditions of engagement with an incubator, including equity dilution and exit options, is essential for investors considering incubation as a financing option for Indian startups.

Startup India Seed Fund Scheme (SISFS):

The Startup India Seed Fund Scheme (SISFS), launched by the Department of Promotion of Industry and Internal Trade (DPIIT), aims to provide financial assistance to startups for proof of concept, prototype development, and market entry. Eligible startups can receive grants and investments from selected incubators, subject to certain criteria and guidelines. Investors interested in leveraging the SISFS should familiarize themselves with the scheme's objectives, eligibility criteria, and disbursement process to maximize investment opportunities in Indian startups.

In conclusion, navigating the legal aspects of investment in India's vibrant startup ecosystem is essential for investors looking to capitalize on the country's burgeoning entrepreneurial landscape. As highlighted throughout this guide, understanding the nuances of equity financing, debt financing, crowdfunding, incubators, and government schemes like the Startup India Seed Fund Scheme (SISFS) is crucial for making informed investment decisions and mitigating risks effectively.

Equity financing, facilitated by angel investors, venture capitalists, and private equity investors, offers startups the capital needed for growth while providing investors with opportunities for high returns. However, navigating the intricacies of term sheets, share subscription agreements, and shareholders' agreements requires a deep understanding of legal frameworks and regulatory requirements. By comprehensively analyzing these documents and seeking legal counsel, investors can safeguard their interests and maximize their investment potential in Indian startups.

Similarly, debt financing presents an alternative avenue for startups to access capital through loans and external commercial borrowings. While loans from banks and NBFCs provide startups with operational flexibility, compliance with regulatory norms and documentation requirements is paramount. Investors must conduct thorough due diligence and assess the risks associated with debt financing, including collateral obligations and repayment terms, to ensure a sound investment strategy.

Crowdfunding, although gaining popularity as a decentralized funding mechanism for startups, remains relatively nascent in India. While platforms like Wishberry and Catapoolt offer startups access to a broader investor base, regulatory frameworks governing crowdfunding are still evolving. Investors should closely monitor regulatory developments and exercise caution when participating in crowdfunding activities to mitigate potential risks and ensure compliance with applicable laws.

Incubators play a pivotal role in nurturing early-stage startups by providing resources, mentorship, and networking opportunities. However, investors considering incubation as a financing option must carefully evaluate the terms and conditions of engagement, including equity dilution and exit options. By aligning their investment objectives with the goals of the incubator and conducting thorough due diligence on prospective startups, investors can enhance their chances of success in the incubation ecosystem.

Government schemes like the Startup India Seed Fund Scheme (SISFS) offer additional avenues for financing startups and promoting innovation. By providing financial assistance and support to eligible startups, these schemes aim to foster entrepreneurship and accelerate economic growth. Investors interested in leveraging government initiatives should familiarize themselves with the eligibility criteria, application process, and disbursement mechanisms to capitalize on investment opportunities in Indian startups.

In conclusion, investing in India's dynamic startup ecosystem offers unparalleled opportunities for growth, innovation, and diversification. However, navigating the legal complexities of investment requires diligence, expertise, and a thorough understanding of regulatory frameworks. By staying informed, seeking professional advice, and conducting comprehensive due diligence, investors can effectively navigate the legal aspects of investment in Indian startups and unlock the full potential of this thriving ecosystem. As India continues to emerge as a global hub for entrepreneurship and innovation, strategic investments in its startup landscape have the potential to yield significant returns and shape the future of the country's economy.

This post was originally published on: Foxnangel

#investment in india#invest in india#business legal aspects#startup ecosystem#indian startups#startups in india#startup india seed fund scheme#sisfs#government schemes#foxnangel#fdi in india

1 note

·

View note

Text

Funding Scheme 2023 | Seed Funding | Expertbells

The "Startup India Seed Fund Scheme (SISFS) 2024" is a cornerstone of the broader Startup India initiative, designed to empower early-stage startups by providing essential seed funding. Eligibility criteria for the scheme ensure inclusivity, allowing a diverse range of entrepreneurs to benefit. Under the Startup India Seed Fund Scheme, startups meeting specified criteria can access crucial financial support, fostering innovation and entrepreneurship across various sectors. The amount available through the scheme plays a pivotal role in catalyzing these early-stage ventures. By strategically injecting funds into promising startups, the initiative aims to propel technological advancements, job creation, and economic growth. The "Startup India Seed Fund Scheme 2024" reflects the government's commitment to nurturing a dynamic startup ecosystem in India, positioning the country as a global leader in entrepreneurship.

#startup india seed fund scheme eligibility#seed fund scheme startup india#startup india seed fund scheme amount#start up india seed fund scheme

0 notes

Text

To get complete knowledge on Startup India Seed Fund Scheme, join a course at https://www.msmekipathshala.com/course/SEEDFUNDING-47561

0 notes

Text

How To Choose The Right Business Solutions For Investors And Entrepreneurs

To choose the right business solutions for investors and entrepreneurs, one needs to understand the elements: Identity and Analyzing the problem, search benefits, and finding opportunities.

#business solutions for investors and entrepreneurs#startup investments in India#Find a Growth Hacker for Your Startup#seed funding companies in gurgaon

0 notes

Text

Venture Catalysts is the #1 startup investor available in India.

Raising startup funding is one of the company's most exciting and challenging times. Venture catalysts have supported businesses in their early phases, especially when they are looking to acquire capital. Check out here to know more about them https://venturecatalysts.in/

#Angel Investors India#Early Stage Startup Funding#Seed Investors In Mumbai#Investors Platform#Raising Funds For Startups#Investors Company In India

0 notes

Link

Venture Capital investment across the Americas may show some caution with respect to their investment decisions, but technologies and innovations with an eye on profitability and sustainability would help them to conquer the uncertainty in the market.

0 notes

Text

Capital Venture Funds: Investing in Growth and Innovation for High Returns

Welcome to the world of capital venture funds! If you are looking to explore investment opportunities with high growth potential, capital venture funds can be an exciting avenue to consider. In this article, we will dive deep into the concept of capital venture funds, how they work, their benefits and risks, and provide valuable insights to help you make informed investment decisions.

What is a Capital Venture Fund?

A capital venture fund, also known as a venture capital fund, is a pool of money collected from various investors, such as individuals, institutions, or corporations, with the aim of investing in startups and early-stage companies. These funds are managed by professional venture capitalists who have expertise in identifying promising investment opportunities.

How Does a Capital Venture Fund Work?

Capital venture operate by raising capital from investors and using that money to provide funding to startups and emerging companies in exchange for equity stakes. The fund managers evaluate business proposals, conduct due diligence, and select ventures with significant growth potential. They offer financial and strategic support to these companies, with the ultimate goal of generating substantial returns on investment when the invested companies succeed.

Benefits of Investing in a Capital Venture Fund

Investing in a capital venture fund offers several benefits. Firstly, it provides access to high-growth opportunities that are typically unavailable in traditional investment options. Venture funds often invest in innovative and disruptive technologies, which have the potential to reshape industries and generate substantial returns. Additionally, investing in a capital venture fund allows diversification across a portfolio of startups, spreading the risk associated with investing in Truth Venture companies.

Risks Associated with Capital Venture Funds

While capital venture funds offer attractive prospects, it’s essential to consider the associated risks. Startups and early-stage companies are inherently risky investments, and not all ventures may succeed. The failure rate can be relatively high, and investors should be prepared for potential losses. Additionally, capital venture funds are illiquid investments, meaning that the invested capital may be tied up for a significant period before any returns can be realized.

How to Choose a Capital Venture Fund

When selecting a capital venture fund to invest in, thorough due diligence is crucial. Consider factors such as the fund’s track record, the expertise of its management team, the fund’s investment focus, and its alignment with your investment goals and risk appetite. Look for funds that have a diversified portfolio, an established network within the industry, and a robust investment strategy. Seeking advice from financial professionals can also provide valuable insights.

Top Capital Venture Funds in the Market

The capital venture fund landscape is diverse, with numerous reputable funds operating globally. Some of the top capital venture firms in the market include Sequoia Capital, Andreessen Horowitz, Accel Partners, and Benchmark Capital. These funds have a strong track record of successful investments and have been instrumental in supporting groundbreaking companies.

Steps to Invest in a Capital Venture Fund

Startup investing in a capital venture financing typically involves a structured process. Firstly, research various funds to identify the ones that align with your investment preferences. Contact the fund managers or reach out through a financial advisor to initiate the investment process. Complete the necessary paperwork, provide the required information, and transfer the investment amount as per the fund’s requirements. It’s important to review the terms and conditions of the fund carefully before committing your capital.

Tax Implications of Investing in a Capital Venture Fund

Tax implications of investing in capital venture funds vary depending on the jurisdiction and the specific regulations in place. In some cases, investments in venture capital funds may qualify for tax incentives or capital gains tax exemptions. However, it’s essential to consult with a tax professional or seek guidance from the fund managers to understand the specific tax implications and benefits associated with your investment.

Success Stories of Capital Venture Fund Investments

Capital venture funds have been behind some of the most successful and influential companies in the world. From early investments in companies like Google, Facebook, and Amazon, to the recent breakthroughs in innovative technologies, venture capital has played a crucial role in driving economic growth and fostering entrepreneurship. These success stories highlight the potential for substantial returns that can be achieved through astute venture capital investments.

Future Trends in Capital Venture Funding

The capital venture funding landscape is dynamic and constantly evolving. Several trends are shaping the future of venture capital, including the rise of impact investing, increased focus on diversity and inclusion, and the emergence of new industries and technologies. Artificial intelligence, blockchain, and clean energy are areas that are expected to attract significant venture capital investments in the coming years. Staying informed about these trends can help investors identify promising opportunities.

Conclusion

In conclusion, capital venture funds offer a unique investment avenue with the potential for high returns. While they carry inherent risks, the diversification, access to innovative companies, and strategic support provided by venture capital funds can outweigh the downsides for the right investors. Conducting thorough research, understanding the risks, and aligning your investment goals are key to making successful investments in capital venture funds.

FAQ

What is the minimum investment amount for a capital venture fund?

The minimum investment amount for capital venture funds varies depending on the fund. It can range from a few thousand dollars to several million. How long does it typically take to realize returns from capital venture fund investments?

The timeframe for realizing returns from capital venture fund investments can vary widely. It can take several years, often around five to ten years, for startups to reach a stage where they generate significant returns or undergo an exit event.

Can individual investors invest in capital venture funds?

Yes, individual investors can invest in capital venture funds. However, some funds may have specific requirements or minimum investment thresholds for individual investors.

What is the difference between a capital venture fund and private equity?

While both capital venture funds and private equity funds invest in companies, the key difference lies in the stage of the companies they invest in. Venture capital funds primarily focus on early-stage companies and startups, while private equity funds typically invest in more mature companies with established operations. Are capital venture funds suitable for risk-averse investors?

Capital venture funds are generally not suitable for risk-averse investors due to the higher level of risk associated with investing in startups and early-stage companies. Investors with a lower risk tolerance may prefer more conservative investment options.

Share this:

#Capital venture#Venture Capital#Capital venture fund#Seed funding#Seed capital#Venture capital firms#Startup funding#Venture capital fund#Venture capital financing#Seed funding for startups#truth ventures#Venture capital firms in US#Venture capital firms in UK#Capital venture India#Capital venture US#Capital venture UK#Venture Capital Ecosystem#Venture capital firms in india#Venture capital equity#Capital Venture Company#Capital venture funding#Stages of venture capital

0 notes

Text

Driving Innovation with Deep Tech Venture Capital at SEAFUND

Empowering Deep Tech Innovation with SEAFUND

SEAFUND is redefining the future of innovation with its focus on deep tech venture capital, supporting startups in transformative industries such as semiconductors, AI, robotics, and clean energy.

By providing patient capital and strategic mentorship, SEAFUND enables entrepreneurs to navigate the complexities of deep technology and scale their ventures effectively.

If you're looking for a trusted partner in deep tech venture capital, SEAFUND stands out with its expertise and commitment to driving long-term impact. Explore their portfolio and learn how they’re accelerating growth in cutting-edge technologies by visiting SEAFUND.

Discover the opportunities SEAFUND brings to the ecosystem of deep tech venture capital and be part of a thriving innovation journey. 🚀

#Keywords#early stage venture capital firms#invest in startups bangalore#funders in bangalore#startup investment fund#popular venture capital firms#startup seed funding india#seed investors in bangalore#deep tech investors india#venture capital firms in india#best venture capital firms in india#seed investors in delhi#semiconductor startups#semiconductor venture capital#saas venture capital#b2b venture capital#saas angel investors#saas venture capital firms#deep tech venture capital#deeptech startups in india#semiconductor companies in india#investors in semiconductors#best venture capital firm in india#venture capital firm#funding for startups in india#fintech funding#india alternatives investment advisors#business investors in kerala#venture capital company#startup seed funding in India

0 notes

Text

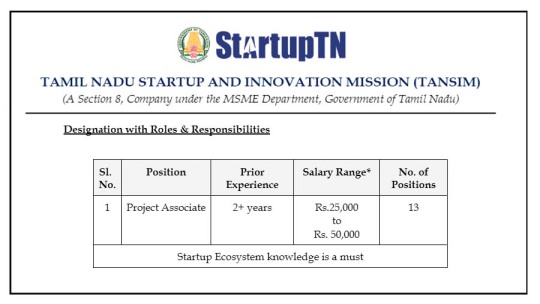

TANSIM Recruitment 2022 13 Project Associate Vacancy

TANSIM Recruitment 2022 13 Project Associate Vacancy #govtjobs #upsc #ssc #currentaffairs #gk #ssccgl #ias #jobs #governmentjobs

TANSIM – Tamil Nadu Startup and Innovation Mission Recruitment 2022 Apply Project Associate Vacancies » Official Notification Released. Tamilnadu Government Official Release The Notification Interested & Eligible Candidate Please Must Check Full Notification Details , Education Details , Salary Details , Age Relaxation , Vacancies Details, Address Details Next Strat The Apply Process Eligible…

View On WordPress

#atal innovation mission#it startup tamil#startup#startup business ideas#startup company#startup india scheme tamil#startup stories tamil#startup tamil#startups#tamil nadu innovation grand challenge#tamil nadu startup and innovation mission#tamil nadu startup and innovation policy#tamil nadu startup seed grant fund#tamilnadu start up innovation mission ceo#tamilnadu start-up and innovation mission#tamilnadu startup and innovation mission new job recruitment#TANSIM Recruitment 2022 13 Project Associate Vacancy

1 note

·

View note