#sbi mutual fund focused equity fund

Explore tagged Tumblr posts

Text

SBI Mutual Fund 2025 सिर्फ् ₹2000 कि Investment से बन सकता है 14 लाख रुपया ,क्या है तरीके

SBI Mutual Fund 2025 :क्या आप जानते हैं कि सिर्फ दो हजार रुपये प्रति महीने का निवेश आपको 13 लाख रुपये से अधिक का पैसा दे सकता है? SBI Flexicap Fund Direct Growth के इस बेहतरीन प्लान को जानें और अपने सपनों को साकार करने के लिए तैयार हो जाएं। अब शुरू करें,SBI Flexicap Fund Direct Growth, अगर आप म्यूचुअल फंड में निवेश करने की सोच रहे हैं, एक अच्छा विकल्प हो सकता है। लंबे समय से निवेशकों ने स्थिरता…

#best sbi mutual fund 2025#best sbi mutual fund for 2025#best sbi mutual fund for lumpsum investment 2025#best sbi mutual funds for 2025 in india#is sbi mutual funds safe to invest in#redeem sbi mutual fund units online#sbi best mutual fund 2025#sbi equity fund return#sbi hybrid equity fund#sbi hybrid equity fund 2023#sbi investment plan 2023#sbi low risk mutual fund#sbi mf best fund 2023#sbi mutual fund 2025#sbi mutual fund account#sbi mutual fund apply online#sbi mutual fund best plan 2025#sbi mutual fund best plan 2025 malayalam#sbi mutual fund best plan 2025 tamil#sbi mutual fund dividend#sbi mutual fund exit load#sbi mutual fund explain#sbi mutual fund focused equity fund#sbi mutual fund good or bad#sbi mutual fund news#sbi mutual fund nri#sbi mutual fund one time mandate#sbi mutual fund otm registration#sbi mutual fund plan 2025#sbi mutual fund redemption online

0 notes

Text

💼 Top 5 SBI Mutual Funds That Have Stood the Test of Time! 📈

Mutual funds are one of the best ways to grow your wealth, whether you're planning for the short, medium, or long term. 🕒 Let's spotlight 5 stellar performers from SBI Mutual Fund, proving their strength with decades of impressive returns:

🌟 SBI Consumption Opportunities Fund

Return Since Launch: 15.80% CAGR

₹1K SIP for 25 years = ₹55.66 lakh!

🌟 SBI Large & Midcap Fund

Return Since Launch: 14.99% CAGR

₹1 lakh since inception = ₹75.93 lakh!

🌟 SBI Long Term Equity Fund – Regular Plan

Return Since Launch: 17.03% CAGR

₹1 lakh since inception = ₹1.3 crore!

🌟 SBI Focused Equity Fund

Return Since Launch: 18.74% CAGR

₹1K SIP for 20 years = ₹15.17 lakh!

🌟 SBI Contra Fund

Return Since Launch: 19.39% CAGR

₹1 lakh since inception = ₹84 lakh!

💰 Whether you’re chasing stability or growth, these funds have a proven track record of weathering market ups and downs.

📊 Invest now with SBI Mutual Funds and secure your future!

#sbimutualfund#top mutual fund software in india#wealthcreation#investsmart#mutualfundreturns#financialfreedom#worldmarketview

0 notes

Text

Secrets of Intraday Trading and Swing Investing in the Indian Stock Market

The Indian stock market is buzzing with activity, presenting endless opportunities for traders and investors. Whether you're diving into intraday trading strategies, utilizing a swing stock screener, or planning long-term investments, understanding the market's pulse is crucial. This blog provides actionable insights using current scenarios from the Indian stock market to help you make informed decisions.

Intraday Trading Strategies: Seizing Short-Term Market Movements

Intraday trading focuses on buying and selling stocks within a single trading session to capitalize on price fluctuations. Here's how to approach it in the Indian market:

1. News-Based Trading in the Banking Sector

The banking sector often witnesses high volatility during major announcements like the Reserve Bank of India’s (RBI) monetary policy updates.

Example: During the last RBI rate cut announcement, stocks like HDFC Bank and SBI showed significant price movements. Traders who entered positions during the pre-announcement buildup and exited after the news capitalized on sharp intraday gains.

Strategy: Use technical tools like Bollinger Bands and Relative Strength Index (RSI) to identify overbought or oversold conditions for optimal entry and exit points.

2. Scalping in High-Liquidity Stocks

Scalping involves taking advantage of small price changes in highly liquid stocks like Reliance Industries or Infosys.

Example: Reliance Industries recently saw rapid price swings during oil price volatility, offering multiple scalping opportunities within hours.

Strategy: Focus on 5-minute charts and set strict stop-loss levels to minimize risks.

Swing Stock Screener: Spotting Mid-Term Opportunities

Swing trading bridges the gap between intraday trading and long-term investing. A swing stock screener helps identify stocks poised for short-to-medium-term price moves.

1. Riding Sectoral Trends in Renewable Energy

India’s renewable energy sector is gaining momentum, with stocks like Adani Green and Tata Power seeing increased investor interest.

Example: Tata Power recently rebounded from a key support level and showed a 15% rally over two weeks, ideal for swing traders.

Screener Criteria: Look for stocks with RSI above 60, trading near 52-week highs, and high trading volumes.

2. Earnings Momentum in IT Stocks

Quarterly earnings releases often drive stock momentum for days or weeks.

Example: Infosys posted better-than-expected earnings last quarter, resulting in a steady uptrend for two weeks. Swing traders who identified the breakout earned substantial returns.

Screener Criteria: Filter stocks with strong earnings growth, positive price momentum, and bullish technical patterns like flag or cup-and-handle formations.

Stock Market Investment Tips: Building Long-Term Wealth

Investing in the stock market requires patience and a clear strategy. Here are some tips to navigate the current Indian market environment:

1. Focus on Emerging Sectors

Example: The government’s push for infrastructure development and green energy has created opportunities in stocks like L&T and NTPC.

Tip: Allocate a portion of your portfolio to high-growth sectors like renewables, infrastructure, and technology for potential long-term gains.

2. Adopt a Balanced Portfolio Approach

Example: Combine high-growth stocks like Adani Enterprises with defensive bets like ITC, which offers consistent dividends and stability.

Tip: Diversify across sectors to mitigate risks and ensure steady returns even during market volatility.

3. Leverage SIPs for Consistent Investments

Systematic Investment Plans (SIPs) in mutual funds remain a preferred choice for retail investors in India.

Example: SIPs in equity-focused funds linked to the Nifty50 index have delivered consistent returns over the past five years.

Tip: Start SIPs in index or sectoral funds to build wealth steadily over time.

Conclusion: Navigating the Indian Stock Market

Success in the Indian stock market lies in adapting to its dynamic nature.

For short-term traders, intraday trading strategies like news-based trading and scalping offer quick returns.

Mid-term investors can use a swing stock screener to identify trending stocks in promising sectors.

Long-term investors should focus on diversification, SIPs, and high-growth opportunities in emerging sectors.

By combining these strategies with insights from the current market, you can make informed decisions and achieve your financial goals. Whether you're a trader or an investor, the Indian stock market has something to offer everyone

0 notes

Text

Invest in These 6 Best Flexi Cap Mutual Funds to Invest in December 2024

Flexi Cap Mutual Funds are equity mutual funds that can invest in any market segment, like large-cap, mid-cap, or small-cap stocks, without any conditions. UTI Flexi Cap Fund, Parag Parikh Flexi Cap Fund, PGIM India Flexi Cap Fund, Aditya Birla Sun Life Mutual Fund, SBI Flexi Cap Fund, and Canara Robeco Flexi Cap Fund are the 6 best flexi cap mutual funds to invest in December 2024.

UTI Flexi Cap Fund

The fund is an open-ended equity mutual fund that invests in stocks of companies of all sizes involving large-cap, mid-cap, and small-cap. UTI Flexi Cap Fund was launched in August 2005. This flexi-cap fund delivered a return of approx. 16.3% in the past three years. For the past 19 months, UTI Flexi Cap Fund has been in the top fourth quartile.

Parag Parikh Flexi Cap Fund

The Parag Parikh Flexi Cap Fund (PPFCF) is an open-ended equity mutual fund scheme that focuses on generating long-term capital appreciation. Parag Parikh Flexi Cap Fund was launched in May 2013. This flexi-cap fund delivered a return of approx. 22.8% in the past three years.

PGIM India Flexi Cap Fund

The PGIM India Flexi Cap Fund is an equity scheme that invests in a range of Indian stocks, which involve large-cap, mid-cap, and small-cap stocks. The fund was launched in March 2015. PGIM India Flexi Cap Fund delivered a return of approx. 20.5% in the past three years, and for 10 months this fund has been in the top fourth quartile.

Aditya Birla Sun Life Mutual Fund

Aditya Birla Sun Life Mutual Fund, a joint venture company established in 1994, has now completed 29 years successfully in the Indian financial industry. This scheme has delivered a return of approx. 16.4% in the past three years, and for the past 20 months this scheme has been in the top third quartile.

SBI Flexi Cap Fund

It is a mutual fund scheme that invests in stocks of companies of all sizes involving large-cap, mid-cap, and small-cap stocks. The fund was launched in 2005 and delivered a return of approx. 16.1% in the past three years, calculated using rolling returns.

Canara Robeco Flexi Cap Fund

Canara Robeco Flexi Cap Fund is an open-ended equity mutual fund scheme that invests in a range of stocks, which involve large-cap, mid-cap, and small-cap stocks. The fund was launched in September 2003 and has delivered a return of approx. 17.7% in the past three years. Canara Robeco Flexi Cap Fund has been in the top third quartile for 18 months.

for more mutual fund and finance-related articles visit finvestmentpro.com

0 notes

Text

What Do You Mean by SBI Energy Opportunities Fund?

The SBI Energy Opportunities Fund is a mutual fund scheme launched by SBI Mutual Fund, focusing on investments in the dynamic and ever-evolving energy sector. This sector encompasses traditional energy sources such as oil and gas, as well as burgeoning renewable energy technologies like solar, wind, and hydroelectric power. Investors in this fund aim to capitalize on the growth potential offered by energy companies, while diversifying their portfolios within this crucial industry.

The SBI Energy Opportunities Fund is uniquely structured to provide exposure to various energy-related assets. This fund typically invests in a mix of equity shares and debt instruments of companies operating in the energy domain. The primary allure of the SBI Energy Opportunities Fund lies in its strategic diversification, which helps in potentially mitigating risks while ensuring that investors can tap into the expanding energy market. This proactive investment approach is designed to benefit from the technological advancements and regulatory changes driving substantial growth in the energy sector.

Furthermore, the SBI Energy Opportunities Fund is managed by experienced fund managers who meticulously analyze market trends and company performances within the energy sector. Their in-depth knowledge and strategic selection process aim to maximize returns for investors. The fund's portfolio may include shares from leading energy giants as well as promising mid-cap and small-cap companies poised for growth. For instance, investing ₹10,000 in the SBI Energy Opportunities Fund at the net asset value (NAV) of ₹25 would grant an investor 400 units of the fund (10,000/25 = 400 units).

It is essential to carefully evaluate various factors before investing in the SBI Energy Opportunities Fund. Market volatility, regulatory changes, and geopolitical tensions can significantly impact the performance of this fund, given its focus on the energy sector. Investors should also be prepared for the cyclical nature of the energy market, which can lead to fluctuating returns over different periods.

Disclaimer: Trading in the Indian financial market involves substantial risks, and past performance is not indicative of future results. Prospective investors are advised to conduct thorough research and consider all the pros and cons before investing in any financial products, including the SBI Energy Opportunities Fund.

0 notes

Text

Top Performing Mutual Funds to Consider for Long-Term Growth

Introduction

When it comes to steadily growing money, many Indians choose mutual funds as their preferred investing choice. Since are under skilled management and offer the potential for significant gains, they are readily available for both rookie and experienced investors. The best mutual funds for long-term investment will be discussed on this site together with their advantages and disadvantages as well as tax considerations This article will provide a perceptive study of whether you intend to make online purchases in mutual funds or hunt for the best platform to invest in.

What are the Best Mutual Funds?

The best mutual funds for long-term investing are determined by a variety of criteria, including risk tolerance, investment objectives, and market circumstances. Overall, equities mutual funds, index funds, and hybrid funds are outstanding long-term growth investments. Some significant funds in these areas are:

Equity Mutual Funds: Ideal for investors seeking long-term growth, these funds invest primarily in stocks. Some top performers in this category include:

SBI Bluechip Fund

HDFC Top 100 Fund

ICICI Prudential Equity & Debt Fund

Hybrid Funds: These funds invest in both equities and debt, providing a balanced approach to risk and return. Notable options include:

Axis Balanced Advantage Fund

HDFC Hybrid Equity Fund

Debt Mutual Funds: Suitable for conservative investors, these funds invest in fixed-income securities. Some well-regarded debt funds include:

ICICI Prudential Short-Term Fund

HDFC Corporate Bond Fund

These funds have shown strong historical performance and have consistently managed to outperform their benchmarks. However, it is advisable to research current performance and market trends before investing.

Overview of Mutual Funds

A mutual fund aggregates capital from various investors to allocate into a diversified portfolio comprising stocks, bonds, or other securities. The fund is overseen by a skilled fund manager who makes investment decisions aligned with the fund's objectives. Investors acquire units of the fund, and the returns are allocated according to the quantity of units owned.

Types of Mutual Funds

Equity Funds: These funds primarily invest in stocks with the goal of achieving significant capital appreciation over time. They are suitable for investors seeking high growth potential.

Debt Funds: Focusing on fixed-income securities like bonds, debt funds aim to provide stability and lower risk. They are ideal for those looking for a steady income with less volatility.

Hybrid Funds: Combining both equity and debt investments, hybrid funds seek to offer a balanced approach to risk and return. They provide a blend of growth and stability in one package.

Index Funds: Designed to mirror the performance of a specific market index, index funds offer diversification at a lower cost compared to actively managed funds. They are a good option for passive investors.

Advantages of Mutual Funds

Professional Management: Mutual funds are overseen by experienced professionals who conduct thorough research and analysis, allowing investors to benefit from expert knowledge.

Diversification: By investing in a wide range of assets, mutual funds help mitigate the risks associated with individual stocks, providing a cushion against market volatility.

Liquidity: Most mutual funds are easily bought or sold, giving investors quick access to their money when needed.

Affordability: Many mutual funds have low minimum investment requirements, making them accessible to a diverse group of investors, even those starting with modest sums.

Disadvantages of Mutual Funds

Fees and Expenses: Investors may face management fees and other costs associated with mutual funds, which can eat into overall returns.

Market Risks: Equity mutual funds are vulnerable to market fluctuations, and investors may experience losses during downturns.

Limited Control: When you invest in mutual funds, you entrust your money to fund managers, which means you have limited influence over specific investment decisions.

Taxation on Mutual Funds

Taxation on mutual funds depends on the type of fund and the holding period. For equity funds, long-term capital gains (LTCG) exceeding ₹1 lakh are taxed at 10%. For debt funds, gains are taxed according to your income tax slab for short-term holdings and at 20% with indexation benefits for long-term holdings. Understanding these tax implications is crucial for effective mutual fund investment in India.

Who Should Invest in Mutual Funds?

Mutual funds can be an excellent investment vehicle for various types of investors. They are suitable for:

First-Time Investors: Those looking to start investing without needing extensive knowledge of the stock market.

Long-Term Investors: Individuals seeking capital appreciation over time, especially through equity funds.

Tax-Savvy Investors: Those looking for options like ELSS (Equity Linked Savings Scheme) mutual funds for tax-saving purposes.

Conclusion

Investing in mutual funds offers a pathway to wealth accumulation, especially for those with a long-term outlook. You can build a diversified portfolio tailored to your financial goals with the right choice of funds and the most reliable platform to invest in mutual funds. Always remember to conduct thorough research or consult a financial advisor before making investment decisions. By understanding the various aspects of mutual funds, you can make informed choices that align with your investment strategy.

0 notes

Text

Best SIP Plans for ₹1000 Per Month: Start Small, Grow Big

Starting a SIP for ₹1000 per month may seem like a small step, but it’s a powerful way to build long-term wealth. Funds like Axis Bluechip, Mirae Asset Emerging Bluechip, and SBI Small Cap offer different risk-return profiles to suit every type of investor. By staying committed and investing regularly, you can achieve your financial goals with ease, no matter how small your initial contribution.

1. Axis Bluechip Fund

Category: Large Cap Axis Bluechip Fund is one of the top-performing large-cap mutual funds, focusing on investing in well-established companies with strong financial health. It offers relatively lower risk and steady returns, making it ideal for conservative investors. The fund’s consistent performance and sound management make it a reliable option for long-term wealth creation.

Key Benefits:

Strong portfolio of large-cap companies

Lower risk compared to mid or small-cap funds

Suitable for long-term wealth building

2. Mirae Asset Emerging Bluechip Fund

Category: Large & Mid-Cap Mirae Asset Emerging Bluechip Fund is an excellent choice for investors looking for a mix of stability and growth. It invests in both large and mid-cap stocks, giving you the potential for higher returns while balancing the risk. Though it’s slightly more aggressive, the fund has a solid track record of delivering superior returns over the long term.

Key Benefits:

Balanced risk with exposure to large and mid-cap stocks

High potential for returns

Suitable for long-term investors with moderate risk tolerance

3. SBI Small Cap Fund

Category: Small Cap If you have a higher risk appetite and want to invest in companies with high growth potential, the SBI Small Cap Fund could be the right fit. This fund focuses on small-cap stocks, which can offer significant upside in the long run. However, small-cap funds are volatile and better suited for those willing to ride out market fluctuations.

Key Benefits:

Potential for high returns in the long term

Exposure to small-cap companies with growth opportunities

Ideal for aggressive investors

4. ICICI Prudential Equity & Debt Fund

Category: Hybrid (Equity-Oriented) For investors seeking a balanced approach, the ICICI Prudential Equity & Debt Fund offers the best of both worlds. This hybrid fund invests in both equities and debt, reducing the overall risk while still providing the potential for growth. It’s ideal for investors who prefer stability but also want equity exposure for higher returns.

Key Benefits:

Balanced risk with equity and debt exposure

Stability combined with growth potential

Suitable for conservative to moderate investors

5. HDFC Mid-Cap Opportunities Fund

Category: Mid-Cap HDFC Mid-Cap Opportunities Fund is a popular choice among investors looking for exposure to mid-sized companies with strong growth potential. It is a moderately risky option, offering higher returns than large-cap funds but with less volatility than small-cap funds.

Key Benefits:

High growth potential with mid-cap stocks

Moderate risk level

Suitable for long-term investors with a moderate risk appetite

Why Invest in SIPs?

Disciplined Investing: SIP plan help in building a disciplined approach to investing by making small, regular contributions.

Power of Compounding: Even small investments can grow significantly over time due to the power of compounding.

Rupee-Cost Averaging: Investing regularly helps average out the purchase cost, reducing the impact of market volatility.

Flexibility: SIPs are flexible, allowing you to increase or decrease your investment amount as per your financial situation.

0 notes

Text

Best SIPs for Long-Term Investment

Systematic Investment Plans (SIPs) have become a popular and effective way for individuals to invest in mutual funds. By enabling regular, disciplined investments, SIPs help build a substantial corpus over time, making them ideal for long-term financial goals. Here are some of the best SIPs for long-term investment, considering factors like historical performance, fund management, and consistency.

1. ICICI Prudential Bluechip Fund

The ICICI Prudential Bluechip Fund is well-regarded for its stable returns and focus on large-cap stocks. This fund invests in established companies with strong market presence and financial health, providing a balanced mix of growth and stability.

2. SBI Small Cap Fund

For those looking to take advantage of the growth potential in smaller companies, the SBI Small Cap Fund is a great option. This fund has shown remarkable performance in the small-cap segment, though it comes with higher risk compared to large-cap funds.

3. HDFC Mid-Cap Opportunities Fund

The HDFC Mid-Cap Opportunities Fund targets mid-sized companies that have the potential for significant growth. This fund has consistently delivered strong returns, making it suitable for investors willing to accept moderate risk for potentially higher rewards.

4. Mirae Asset Large Cap Fund

Known for its strong track record and reliable returns, the Mirae Asset Large Cap Fund focuses on blue-chip companies. It offers a good balance between risk and reward, appealing to conservative investors seeking steady growth.

5. Axis Long Term Equity Fund

The Axis Long Term Equity Fund not only provides growth potential through equity investments but also offers tax benefits under Section 80C of the Income Tax Act. This makes it an attractive option for long-term investors looking to maximize returns while saving on taxes.

Benefits of Long-Term SIPs

Rupee Cost Averaging: By investing a fixed amount regularly, SIPs help average out the cost of investment, reducing the impact of market volatility.

Power of Compounding: Long-term investments benefit from compounding, where returns are reinvested to generate additional earnings.

Disciplined Investing: SIPs encourage regular savings and investment habits, crucial for building a substantial corpus over time.

Flexibility: Investors can start with a small amount and gradually increase their investment as their financial situation improves.

Conclusion

Choosing the best SIP for long-term investment depends on individual financial goals, risk tolerance, and investment horizon. The funds mentioned above have consistently performed well and are managed by experienced fund managers. By committing to a disciplined investment strategy through SIPs, investors can build significant wealth over time and achieve their long-term financial objectives.

1 note

·

View note

Text

SBI Automotive Opportunities Fund NFO: A Helping Guide for Investors

SBI Automotive Opportunities Fund NFO The Indian automotive industry is witnessing a period of significant transformation. With increasing disposable incomes, a growing middle class, and a shift towards electric vehicles, the sector presents exciting investment opportunities. Recognizing this potential, SBI Funds, a leading mutual fund house in India, has launched the SBI Automotive Opportunities Fund (NFO). This article delves into the details of this new fund offer, providing potential investors with a comprehensive overview to make informed investment decisions.

Understanding the SBI Automotive Opportunities Fund NFO

The SBI Automotive Opportunities Fund is an open-ended thematic equity scheme focusing on the Indian auto sector. The fund aims to invest in companies across the automotive value chain, including car manufacturers, two-wheeler companies, auto component makers, and electric vehicle (EV) players. This diversified approach allows investors to gain exposure to the entire spectrum of the automotive industry and potentially benefit from its overall growth trajectory. Investment Strategy of the SBI Automotive Opportunities Fund The fund will be actively managed by a team of experienced fund managers at SBI Funds. These managers will employ a rigorous stock selection process, focusing on companies that demonstrate strong fundamentals, healthy financials, and the potential for future growth. The fund will primarily invest in large-cap and mid-cap companies within the automotive sector, with a potential allocation to select small-cap companies with high-growth potential. Benefits of Investing in the SBI Automotive Opportunities Fund - Exposure to a High-Growth Sector: The Indian automotive industry is expected to witness significant growth in the coming years, driven by various factors like rising incomes, increasing demand for personal vehicles, and the adoption of electric vehicles. By investing in the SBI Automotive Opportunities Fund, investors gain exposure to this high-growth sector and potentially benefit from its long-term potential. - Active Management: The fund is actively managed by experienced professionals who leverage their research expertise to select promising companies within the automotive space. This active management approach aims to outperform the benchmark index and generate superior returns for investors. - Diversification: The fund invests across various segments of the automotive industry, including car manufacturers, two-wheeler companies, auto component makers, and EV players. This diversification helps mitigate risk and provides investors with a well-rounded exposure to the sector's growth potential. - Professional Management: Investing in individual stocks within the automotive sector can be time-consuming and require in-depth knowledge of the industry. The SBI Automotive Opportunities Fund offers a convenient way to gain exposure to the sector through a professionally managed investment vehicle. Suitability for Investors The SBI Automotive Opportunities Fund is suitable for investors with a moderate to high-risk appetite and a long-term investment horizon (ideally 5 years or more). The fund's focus on the automotive sector inherently carries a certain degree of risk associated with the cyclical nature of the industry. However, investors seeking to capitalize on the long-term growth prospects of the Indian automotive sector may find this fund to be a compelling investment option.

Factors to Consider Before Investing

Before investing in the SBI Automotive Opportunities Fund, it is crucial for investors to consider several factors: - Investment Objective: Align your investment with your overall financial goals and risk tolerance. - Investment Horizon: The fund is suited for long-term investors with a horizon of at least 5 years. - Risk Profile: The fund carries inherent risks associated with the automotive sector's cyclical nature. - Existing Portfolio: Evaluate how the fund complements your existing portfolio diversification. - Investment Alternatives: Compare the SBI Automotive Opportunities Fund with other sector-specific or thematic funds.

Investing in the SBI Automotive Opportunities Fund

The SBI Automotive Opportunities Fund operates as an NFO (New Fund Offer), meaning it is open for a limited subscription period. Investors can invest in the fund through various channels, including online platforms offered by SBI Funds or brokers, physical application forms submitted at branches of SBI or authorized distributors. Conclusion The SBI Automotive Opportunities Fund presents a potentially lucrative investment opportunity for investors seeking exposure to the burgeoning Indian automotive sector. By offering a diversified approach, active management, and professional expertise, the fund aims to deliver superior returns for investors with a long-term investment horizon. However, it is essential to carefully consider your risk profile, investment goals, and existing portfolio before making an investment decision. Conducting thorough research and consulting with a financial advisor can further assist you in making an informed choice. Read the full article

#Activelymanagedthematicfund#ElectricvehicleinvestmentIndia#Indianautoindustrygrowth#InvestinIndianautosector#SBIAutomotiveOpportunitiesFundNFO#SBIMutualFundsautomotivefund#SIPinvestmentinSBIautofund

0 notes

Text

MARKET GROWTH PROSPECTS OF BANKING SECTOR IN INDIA, 2023- 24 – DART CONSULTING FORECASTS HIGHER GROWTH IN THE NEXT FIVE YEARS

India’s banking sector is sufficiently capitalized and well-regulated. The financial and economic conditions are comparatively better even by comparing with well developed economies. Indian banks are generally resilient and have withstood the global downturn well as can be noted by reviewing previous years records.

The Indian banking industry has recently witnessed the rollout of innovative banking models like payments and small finance banks. In recent years, the Banks are increasingly focusing widening banking reach, through various schemes like the Pradhan Mantri Jan Dhan Yojana and Post payment banks. The rise of Indian NBFCs and fintech have significantly enhanced India’s financial inclusion and helped fuel the credit cycle in the country.

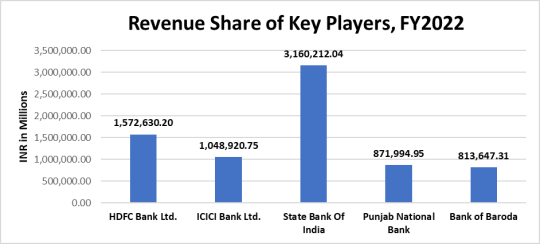

Here is a quick overview of key players in the industry.

HDFC Bank Ltd

HDFC Bank Ltd (HDFC) offers personal and corporate banking, private and investment banking, and other related financial solutions to individuals, MSMEs, government, and agriculture sectors, financial institutions and trusts, and non-resident Indians. It provides a range of deposit services and card products; loans for homes, cars, commercial vehicles, and other personal and business needs; insurance for life, health, and non-life risks; and investment solutions such as mutual funds, bonds, equities, and derivatives. HDFC also provides services such as cash management, corporate finance advisory, customized banking solutions, project and structured finance, trade financing, foreign exchange, internet banking, and payment and settlement services, among others. The bank operates in India through a network of branches, ATMs, phone banking, net banking, and mobile banking. It has overseas branches in Bahrain, Hong Kong, and the UAE, and representative offices in the UAE and Kenya. HDFC is headquartered in Mumbai, Maharashtra, India.

ICICI Bank Ltd

ICICI Bank Ltd (ICICI Bank) provides personal and corporate banking, investment banking, private banking, venture capital, life and non-life insurance solutions, securities broking, and asset management services to corporate and retail clients, high-net-worth individuals, and SMEs. It offers a wide range of products such as deposits accounts including savings and current accounts, and resident foreign currency accounts; investment products; and consumer and commercial cards. ICICI Bank offers to lend for home purchase, commercial business requirements, automobiles, personal needs, and agricultural needs. The bank offers services such as foreign exchange, remittance, import and export financing, advisory, trade services, personal finance management, cash management, and wealth management. It has an operational presence in Europe, Middle East, and Africa (EMEA), the Americas, and Asia. ICICI Bank is headquartered in Mumbai, Maharashtra, India.

State Bank of India

State Bank of India (SBI) is a universal bank. It provides a range of retail banking, corporate banking, and treasury services. The bank serves individuals, corporates, and institutional clients. Its major offerings include deposits services, personal and business banking cards, and loans and financing. The bank provides services such as mobile banking, internet banking, ATM services, foreign inward remittance, safe deposit locker, money transfer, mobile wallet, trade finance, merchant banking, project export finance, treasury, offshore banking, and cash management services. It operates in Asia, the Middle East, Europe, Africa, and North and South America. SBI is headquartered in Mumbai, Maharashtra, India.

Punjab National Bank

Punjab National Bank (PNB) offers retail and commercial banking, agricultural and international banking, and other financial services. Its retail and commercial banking portfolio offers credit and debit cards, corporate and retail loans, deposit services, cash management, and trade finance. Its international banking portfolio includes foreign currency accounts, money transfers, letters of guarantee, and world travel cards, and solutions to non-resident Indians. PNB also offers merchant banking, mutual funds, depository services, insurance, and e-services. The bank operates in India and has overseas operations in the UK, Bhutan, Myanmar, Bangladesh, Nepal, and the UAE. PNB is headquartered in New Delhi, India.

Bank of Baroda

Bank of Baroda (BOB) offers retail, agriculture, private and commercial banking, and other related financial solutions. It includes loans, deposit services, and payment cards. The bank offers loans for homes, vehicles, education, agriculture, personal and corporate requirements, mortgage, securities, and rent receivables, among others. It provides current and savings accounts; fixed and recurring deposits; debit, credit, and prepaid cards. The bank also provides insurance coverage for life, health, and general purposes. It offers services such as treasury, financing, mutual funds, cash management, international banking, digital banking, internet banking, start-Up banking, and wealth management. The bank has operations in Asia-Pacific, Europe, North America, and the Middle East and Africa. BOB is headquartered in Baroda, Gujarat, India.

Industry Performance

The health of the banking system in India has shown steady improvement, according to the Reserve Bank of India’s latest report on trends in the sector. From capital adequacy ratio to profitability metrics to bad loans, both public and private sector banks have shown visible improvement. And as credit growth has also witnessed an acceleration in 2021-22, banks have seen an expansion in their balance sheet at a pace that is a multi-year high. As of November 4, 2022, bank credit stood at Rs. 129.26 lakh crore (US$ 1,585.09 billion). As of November 4, 2022, credit to non-food industries stood at Rs. 128.87 lakh crore (US$ 1.58 trillion).

Given the increasing intensity, spread, and duration of the pandemic, economic recovery the performances of key companies in the industry was positive. The reported margin of the industry by analyzing the key players was around 13.7% by taking into consideration the last 3 years’ data. Details are as follows.

Companies Net Margin EBITDA/Sales

HDFC Bank Ltd. 23.5% 31.2%

ICICI Bank Ltd. 22.3% 30.4%

State Bank of India 10.0% 25.7%

Punjab National Bank 4.0% 10.0%

Bank of Baroda 8.9% 13.9%

Industry Margins 13.7% 22.2%

Industry Trends

The macroeconomic picture for 2023 portends mixed fortunes for consumer payment players. Higher rates should boost banks’ net interest margins for card portfolios, but persistent inflation, depletion of savings, and a potential economic slowdown could weigh on consumers’ appetite for spending. Digital identity is expected to evolve as a counterbalancing force to mitigate fraud risks in the long run. Transaction banking businesses are standing firm despite recent market uncertainties. For many banks, these divisions have been a steady source of revenues and profits.

Over the long term, banks will need to pursue new sources of value beyond product, industry, or business model boundaries. The new economic order that will likely emerge over the next few years will require bank leaders to forge ahead with conviction and remain true to their purpose as guardians and facilitators of capital flows. With these factors in mind, the industry is still showing huge growth potential, some of the growth divers that is propelling the industry are:

Rising rural income pushing up demand for banking

Rapid urbanisation, decreasing household size & easier availability of home loans has been driving demand for housing.

Growth in disposable income has been encouraging households to raise their standard of living and boost demand for personal credit.

The industry is attracting major investments as follows.

On June 2022, the number of bank accounts—opened under the government’s flagship financial inclusion drive ‘Pradhan Mantri Jan Dhan Yojana (PMJDY)’—reached 45.60 crore and deposits in the Jan Dhan bank accounts totaled Rs. 1.68 trillion (US$ 21.56 billion).

Some of the major initiatives taken by the government to promote the industry in India are as follows:

As per the Union Budget 2022-23:

National Asset reconstruction company (NARCL) will take over, 15 non-performing loans (NPLs) worth Rs. 50,000 crores (US$ 6.70 billion) from the banks.

National payments corporation India (NPCI) has plans to launch UPI lite this will provide offline UPI services for digital payments. Payments of up to Rs. 200 (US$ 2.67) can be made using this.

In the Union budget of 2022-23 India has announced plans for a central bank digital currency (CBDC) which will be possibly know as Digital Rupee.

Through analyzing the performance of the contributing companies for the last three years, we can ascertain that the sector witnessed compounded annual growth rate (CAGR) of 9.9% at the end of 2022. Details are as below.

Companies CAGR

HDFC Bank Ltd. 14.02%

ICICI Bank Ltd. 7.3%

State Bank of India 8.4%

Punjab National Bank 9.2%

Bank of Baroda 10.7%

Industry CAGR 9.9%

Working through partnerships both with NBFCs and FinTech is high on the agenda of the Indian banking sector, and this is an area of focus of the FICCI National Committee on Banking. Banks will have to play a very constructive role as India aspires to be the leading economy in future. The strengthened banking sector has the potential to contribute directly and indirectly to GDP, increase job creation and enhance median income. Technology interventions to strengthen the quality and quantity of credit flow to the priority sector will be an important aspect. The need for sustainable finance / green financing is also gaining importance.

With these attributes boosting the sector, the Indian banking industry is likely to grow 5% more than the reported growth rate and is expected to exhibit CAGR of 10.4% in the next five years from 2023 to 2027.

DART Consulting provides business consulting through its network of Independent Consultants. Our services include preparing business plans, market research, and providing business advisory services. More details at https://www.dartconsulting.co.in/dart-consultants.html

0 notes

Text

Top mutual funds in India

In the ever-evolving world of finance, navigating the sea of mutual funds can feel daunting. But fear not, aspiring investor! This guide dives deep into the top mutual funds currently offered in India. We’ll explore various categories, highlight high-performing options, and unpack key factors to consider when making your investment choice. Get ready to unlock the potential of your hard-earned money and embark on a rewarding financial journey.

Top performing mutual funds in India

The following curated list presents a selection of top-performing mutual funds across various categories, catering to a range of risk tolerances and financial goals:

ICICI Prudential Focused Bluechip Equity Fund: This fund prioritizes long-term capital appreciation by investing in well-established large-cap companies. (Suitable for investors with moderate risk tolerance)

Aditya Birla Sun Life Small & Midcap Fund: This fund targets high-growth potential companies within the small and mid-cap segments. (Suitable for investors comfortable with higher risk)

Tata Equity PE Fund: This fund invests in companies with promising growth prospects across market capitalizations. (Suitable for investors seeking capital appreciation)

HDFC Monthly Income Plan (MTP): This plan aims to provide regular monthly income through strategic debt investments. (Suitable for income-oriented investors with low risk tolerance)

L&T Tax Advantage Fund: This fund offers tax benefits alongside potential capital appreciation by investing in equity shares. (Suitable for investors seeking tax-saving avenues)

SBI Nifty Index Fund: This fund tracks the performance of the Nifty 50 index, providing a cost-effective way to participate in the Indian stock market. (Suitable for passive investors)

Kotak Corporate Bond Fund: This fund invests in high-quality corporate bonds, aiming for steady income generation. (Suitable for investors seeking regular income with moderate risk)

Canara Robeco Gilt PGS: This fund focuses on government securities, providing a secure and predictable source of income. (Suitable for risk-averse investors)

DSP BlackRock Balanced Fund: This fund maintains a balanced allocation between equity and debt instruments, offering a blend of growth potential and stability. (Suitable for investors with moderate risk tolerance)

Axis Liquid Fund: This fund invests in short-term debt instruments, providing high liquidity and potential for consistent returns. (Suitable for parking short-term funds)

Find the Perfect Fit: Selecting Top Performing Mutual Funds in India

Choosing the right mutual fund is like finding the perfect outfit — it needs to suit your style and needs. In the world of Indian mutual funds, there isn’t a single “top performer” for everyone. But, with the right strategy, you can identify funds that align with your goals and risk tolerance. Here’s how:

Know Your Time Horizon: Are you saving for a short-term goal (less than 5 years) or a long-term one (retirement, child’s education)? Short-term goals can handle higher risk for potentially higher returns, while long-term goals benefit from steadier, lower-risk investments.

Define Your Financial Goals: What are you saving for? This will determine the type of fund (equity, debt, hybrid) that best suits your needs. Consider your risk tolerance, how easily you might need the money (liquidity), and your investment timeframe.

Look Beyond Past Performance: While past performance can be a good indicator, it’s not a guarantee of future results. Evaluate a fund’s performance over 5 years or more, but focus on its consistency and how it compares to its benchmark (a market index) and similar funds in its category.

Experience Matters: Consider the experience of the fund manager. A seasoned manager with a long track record navigating different market conditions can inspire confidence.

Keep Costs Low: The expense ratio is a fee charged by the fund to cover management and other costs. Lower expense ratios mean more money stays invested for you. Aim for funds with expense ratios below 1%.

Understand Your Risk Tolerance: How comfortable are you with potential losses? Higher risk can lead to higher returns, but it also comes with greater volatility. Choose funds that align with your risk appetite.

Tax Implications: Some mutual funds are tax-efficient, while others may incur capital gains tax. Factor in tax considerations when making your decision.

By following these steps, you can move beyond simply chasing “top performers” and select mutual funds that are truly top performers for you. Remember, diversification is key — consider investing in a variety of funds to spread your risk and achieve your financial goals.

If you want Know more about Mutual Funds then you can visit our website https://divineloanhub.com/

#finance#mutual funds#MutualFundsIndia#InvestmentGuide#FinancialJourney#financial#TopPerformingFunds#InvestmentStrategy#FinanceTips#WealthManagement#FinancialGoals#InvestSmart#DiversifyPortfolio#Top mutual funds in India

1 note

·

View note

Text

Institutional Investors Explained: How Big Money Moves the Market

Institutional investors are the backbone of financial markets. They manage vast sums of money, influence stock prices, and shape economic trends. In India, institutions like LIC, HDFC Mutual Fund, and SBI Mutual Fund dominate market movements. But how do they operate? What strategies do they use? Let’s dive deep into the world of institutional investing.

What is an Institutional Investor? How is it Different from Retail Investors?

Definition & Key Characteristics

An institutional investor is a large entity that invests money on behalf of others. These include:

✅ Mutual Funds (e.g., HDFC AMC, ICICI Prudential) ✅ Pension Funds (e.g., EPFO, NPS) ✅ Insurance Companies (e.g., LIC, HDFC Life) ✅ Hedge Funds (e.g., Goldman Sachs, Renaissance Technologies) ✅ Sovereign Wealth Funds (e.g., Abu Dhabi Investment Authority in India)

How Are They Different from Retail Investors?

For example, LIC’s investment decisions can impact stock prices significantly. In contrast, individual investors' trades have a minimal effect on large-cap stocks.

Types of Institutional Investors and Their Role in the Market

1. Mutual Funds – The Market Movers

Mutual funds pool money from retail investors and invest in stocks, bonds, and other assets. The top mutual funds in India include:

SBI Mutual Fund – ₹8.27 lakh crore AUM (Assets Under Management)

HDFC Mutual Fund – ₹5.37 lakh crore AUM

ICICI Prudential Mutual Fund – ₹6.12 lakh crore AUM

🔹 Impact on Stock Market: When mutual funds buy shares in bulk, stock prices rise. For instance, Nippon India Mutual Fund's stake in Zomato boosted investor confidence, driving up stock prices.

2. Pension Funds – Stability in Markets

Pension funds manage retirement savings and focus on long-term stability. India's Employees’ Provident Fund Organisation (EPFO) invests in blue-chip stocks like Reliance Industries, HDFC Bank, and Infosys to ensure steady growth.

🔹 Example: EPFO increased its equity exposure to 15%, impacting Nifty 50 companies.

3. Insurance Companies – Conservative Yet Powerful

Insurance firms like LIC and HDFC Life invest heavily in government bonds, blue-chip stocks, and infrastructure projects. LIC alone manages ₹44 lakh crore in assets, making it India’s largest institutional investor.

🔹 Example: LIC's heavy stake in ITC Limited (₹35,000 crore investment) stabilizes the stock, ensuring lower volatility.

4. Foreign Institutional Investors (FIIs) – Market Volatility Triggers

FIIs bring foreign capital into Indian markets but also withdraw funds quickly, causing volatility. Key players include:

Goldman Sachs

Morgan Stanley

Abu Dhabi Investment Authority

🔹 Example: When FIIs pulled out ₹27,000 crore in October 2023, Nifty 50 dropped over 5% in a month.

How Institutional Investors Make Investment Decisions?

1. Fundamental & Quantitative Analysis

Institutional investors use: ✅ Earnings Reports – Studying P/E ratio, EPS growth ✅ Macroeconomic Indicators – Inflation, GDP growth, RBI interest rates ✅ Strike.money – A charting tool for analyzing institutional trends

2. Algorithmic & High-Frequency Trading (HFT)

Many hedge funds use AI-driven strategies and high-frequency trading to make profits in milliseconds. Strike.money offers heatmaps and FII/DII flow tracking to help traders understand institutional moves.

🔹 Example: HFT firms like Renaissance Technologies use AI to detect order flow imbalance, allowing them to trade before the market reacts.

3. ESG Investing – The Rise of Sustainable Strategies

Environmental, Social, and Governance (ESG) investing is gaining popularity. BlackRock, the world’s largest asset manager, is pushing companies to disclose carbon footprints before investing.

🔹 Example: SBI Mutual Fund launched ESG-focused funds targeting sustainability-driven stocks.

How Do Institutional Investors Influence Stock Markets?

1. Market Liquidity & Price Movements

When institutions buy stocks, prices rise. When they sell, prices drop. This is evident in stocks like HDFC Bank and Reliance Industries, where institutional holdings exceed 50%.

🔹 Example: FIIs dumped Paytm stock, causing it to fall 30% in a week after RBI restrictions on its payments bank.

2. Corporate Governance & Shareholder Activism

Large investors influence company decisions through voting rights. In India, LIC and HDFC Mutual Fund frequently vote on board decisions at Reliance, Tata Motors, and Infosys.

🔹 Example: LIC opposed Tata Motors' CEO bonus hike, pushing for higher dividends to shareholders instead.

3. Market Sentiment & Herding Behavior

Retail investors often follow institutions, amplifying trends. When FIIs buy banking stocks, retail investors jump in, driving prices higher.

🔹 Example: In 2023, FIIs bought ₹50,000 crore worth of Indian IT stocks, leading to 20%+ gains in TCS, Infosys, and Wipro.

Regulations & Compliance for Institutional Investors

Institutional investors in India are regulated by SEBI (Securities and Exchange Board of India). Key regulations include: ✅ Foreign Portfolio Investment (FPI) Rules – Limits on FII ownership ✅ Insider Trading Regulations – Preventing misuse of non-public information ✅ Mutual Fund Compliance – NAV disclosures, expense ratio transparency

🔹 Example: SEBI fined Franklin Templeton ₹5 crore for mismanaging debt mutual funds in 2021.

Institutional Investors vs. Retail Investors: Can You Invest Like Big Players?

While retail investors lack the capital and data access of institutions, they can adopt similar strategies: 1️⃣ Diversification – Invest in multiple sectors like institutions do. 2️⃣ Using Technical Tools – Platforms like Strike.money help track institutional flow. 3️⃣ Long-Term Focus – Institutions invest for decades, not days.

🔹 Example: Following FII buying patterns in HDFC Bank, Infosys, and Kotak Mahindra Bank has helped investors achieve 10-15% CAGR over 5 years.

Future Trends in Institutional Investing

🔮 1. AI & Machine Learning in Investing – Hedge funds are deploying AI for predictive analytics. 🔮 2. Crypto & Blockchain Investments – Institutional funds are exploring Bitcoin ETFs. 🔮 3. Private Equity Growth – More funds are moving towards unlisted startups like BYJU’s and Swiggy.

🔹 Example: BlackRock’s investment in Indian renewable energy signals a shift toward sustainable investing trends.

Final Thoughts: How Institutions Shape the Market

Institutional investors drive financial markets with billions in capital, algorithmic trading, and strategic investments. Whether it’s LIC stabilizing blue-chip stocks or FIIs creating volatility, their influence is undeniable.

🔹 Want to track institutional investor activity? Use Strike.money to monitor market trends, bulk deals, and FII/DII movements!

👉 Now it’s your turn – Are you investing like an institution or still thinking like a retail investor? 🚀

0 notes

Text

From SBICAPS To Axis Bank: Exploring Investment Strategies Of Leading Financial Institutions In India

In India's vibrant financial scene, several notable institutions shine for their adeptness in crafting investment strategies. These institutions, namely SBICAPS, HDFC Bank, ICICI Securities, IDBI Capital, and Axis Bank Limited, boast distinct approaches to navigating the complexities of the financial markets while driving returns for investors.

SBICAPS

The investment banking arm of the State Bank of India (SBI), offers a comprehensive suite of services ranging from equity capital markets to mergers and acquisitions advisory. With a robust research team and extensive market reach, SBICAPS focuses on identifying emerging opportunities across various sectors. The role of SBICAPS as a seasoned intermediary, facilitating capital flows and corporate transactions in the Indian market, aligns well with the operations of investment banks in India. Additionally, SBICAPS plays a pivotal role in providing corporate advisory services, and guiding clients through strategic decision-making processes.

HDFC Bank

A leading private sector bank in India, emphasizes a client-centric approach to investment management. Leveraging its vast network and technological prowess, HDFC Bank offers a wide array of investment products tailored to meet the diverse needs of its clientele. From mutual funds to portfolio management services, HDFC Bank prioritizes risk management and long-term wealth creation. The keyword "Corporate advisory in India" resonates with HDFC Bank's role in providing strategic counsel to corporations, assisting them in capital structuring, mergers, and acquisitions.

Also Read: Successful Investment Banks in India: From SBICAPS To JM Financial

ICICI Securities

A subsidiary of ICICI Bank, is a prominent player in the Indian securities market, offering a comprehensive range of financial services. Through its research-driven approach, ICICI Securities provides insightful investment recommendations to retail and institutional investors alike. The institution's expertise in equity research and wealth management enables it to navigate market volatility while identifying lucrative investment opportunities. As a merchant banker in India, ICICI Securities facilitates capital raising activities for corporate clients, driving growth and expansion initiatives through innovative financial solutions.

IDBI Capital

A subsidiary of IDBI Bank, specializes in investment banking, securities trading, and asset management services. With a focus on value investing and risk mitigation, IDBI Capital aims to deliver superior returns to its clients over the long term. The institution's dedicated team of professionals conducts in-depth market analysis to identify undervalued assets and potential investment targets. As a merchant banker, IDBI Capital plays a pivotal role in managing public offerings, private placements, and other capital market transactions, fostering capital formation and economic development in India.

Axis Bank Limited

One of India's largest private sector banks, adopts a diversified approach to investment management, catering to the evolving needs of its customers. Through its subsidiary Axis Capital, the bank offers a wide range of investment banking services, including equity capital markets, debt syndication, and advisory services. Axis Bank's robust risk management framework and extensive industry expertise enable it to deliver value-added solutions to its clients. As a merchant banker and corporate advisor, Axis Bank facilitates corporate restructuring, capital raising, and strategic alliances, driving growth and value creation for its stakeholders.

Also Read: Demystifying Investment Banking in India — A Focus on SBICAPS and Kotak Mahindra Bank

Conclusion

These institutions are at the forefront of investment management and advisory services in India. Through their distinct strategies and market insights, they play a crucial role in driving capital formation and economic growth. As providers of corporate advisory in India, they facilitate capital flows, guide strategic decision-making, and unlock value for investors and corporations alike. With a focus on innovation, client satisfaction, and long-term wealth creation, these institutions continue to shape the investment landscape and contribute to India's journey towards financial prosperity.

0 notes

Text

Top 10 Mutual Funds for Long-Term Growth: Ideal SIP Investments for Beginners

In the realm of investment, the strategy of Systematic Investment Plans (SIPs) has gained immense popularity, particularly among beginners seeking long-term growth opportunities with relatively lower risk. Mutual funds, with their diversified portfolios managed by professional fund managers, offer a conducive environment for SIP investments. If you're just starting your investment journey and aiming for long-term growth, here are the top 10 mutual funds to consider:

1. Mirae Asset Large Cap Fund:

- This fund focuses on large-cap stocks, offering stability and growth potential.

- Its consistent performance and well-managed portfolio make it a favorite among investors seeking long-term growth.

2. Axis Bluechip Fund:

- Known for its robust performance in the large-cap segment, Axis Bluechip Fund is a reliable choice for SIP investors.

- Its investment approach emphasizes quality stocks with sustainable growth potential, aligning well with long-term investment objectives.

3. SBI Bluechip Fund:

- Backed by the reputable SBI brand, this fund invests in blue-chip companies with strong fundamentals.

- With a track record of delivering consistent returns over the years, SBI Bluechip Fund is suitable for investors with a long-term horizon.

4. ICICI Prudential Bluechip Fund:

- Renowned for its prudent investment approach, this fund focuses on large-cap stocks with the potential for long-term wealth creation.

- Its diversified portfolio and experienced fund management team make it an attractive option for SIP investors aiming for growth.

5. HDFC Mid-Cap Opportunities Fund:

- For investors seeking exposure to mid-cap stocks, HDFC Mid-Cap Opportunities Fund presents an excellent opportunity for long-term wealth creation.

- Its well-diversified portfolio and proactive investment strategy make it suitable for investors with a higher risk appetite.

6. Kotak Emerging Equity Fund:

- With a focus on investing in emerging companies with high growth potential, Kotak Emerging Equity Fund offers an ideal avenue for long-term wealth creation.

- Its dynamic investment approach and strong performance track record make it a compelling choice for SIP investors.

7. Aditya Birla Sun Life Small Cap Fund:

- Small-cap stocks have the potential to deliver substantial growth over the long term, and this fund aims to capitalize on such opportunities.

- Managed by experienced professionals, Aditya Birla Sun Life Small Cap Fund is suitable for investors looking to add growth-oriented small-cap exposure to their portfolios.

8. DSP Tax Saver Fund:

- Investing in tax-saving mutual funds (ELSS) through SIPs can help investors achieve long-term growth while enjoying tax benefits.

- DSP Tax Saver Fund, with its diversified portfolio of equity investments, offers the dual advantage of wealth creation and tax savings.

9. Franklin India Equity Fund:

- Known for its consistent performance and disciplined investment approach, Franklin India Equity Fund focuses on investing in fundamentally strong companies.

- With a blend of large-cap and mid-cap stocks, this fund is well-positioned to deliver long-term growth for SIP investors.

10. Axis Long Term Equity Fund:

- As an Equity Linked Savings Scheme (ELSS), Axis Long Term Equity Fund not only provides the potential for long-term capital appreciation but also offers tax benefits under Section 80C of the Income Tax Act.

- Its portfolio comprises high-quality growth stocks, making it a suitable choice for SIP investors with a long-term investment horizon.

In conclusion, for beginners looking to embark on their investment journey with SIPs, these top 10 mutual funds offer a diverse range of options catering to different risk appetites and investment objectives. By investing systematically in these funds over the long term, investors can potentially achieve significant wealth accumulation while mitigating market volatility and benefiting from the power of compounding.

0 notes

Text

Unlocking Financial Growth: The Best SIP Plans for a 5-Year Investment Horizon

Investing wisely is crucial for achieving long-term financial goals, and Systematic Investment Plans (SIPs) have emerged as a popular choice for investors seeking a disciplined and gradual approach. If you are considering a 5-year investment horizon, selecting the right SIP plan is paramount. In this blog post, we will explore the best sip plan for 5 years and top-performing funds that align with a 5-year investment strategy.

Understanding SIPs:

SIPs involve investing a fixed amount regularly in mutual funds, enabling investors to take advantage of the power of compounding and mitigate the impact of market volatility. When considering a 5-year horizon, it is essential to choose top 5 sip plan that balance risk and potential returns.

Top SIP Plans for 5 Years:

Aditya Birla Sun Life Equity Fund:

This fund has a proven track record of delivering consistent returns over the years.

It focuses on a diversified portfolio, including large-cap and mid-cap stocks, ensuring a balanced approach to growth.

Mirae Asset Large Cap Fund:

Ideal for investors seeking stability with a focus on large-cap stocks.

The fund's impressive performance in various market conditions makes it a reliable choice for a 5-year investment.

SBI Bluechip Fund:

Known for its strong performance in the large-cap segment.

The fund's experienced management team and a well-structured investment strategy make it a robust option for a 5-year SIP.

HDFC Mid-Cap Opportunities Fund:

For investors open to a slightly higher risk in pursuit of potentially higher returns.

The fund's focus on mid-cap stocks can be rewarding over a 5-year period.

Axis Long Term Equity Fund:

An excellent choice for investors looking to benefit from tax-saving ELSS (Equity Linked Savings Scheme) investments.

The fund has a history of delivering solid returns while also providing tax benefits under Section 80C.

Factors to Consider:

Risk Tolerance:

Assess your risk tolerance and choose SIP plans that align with your comfort level. A balanced mix of equity and debt funds may be suitable for a 5-year horizon.

Fund Performance:

Research the historical performance of the funds you're considering. Consistency and stability are key indicators of a fund's reliability.

Expense Ratio:

Consider the expense ratio, as lower expenses can contribute to higher overall returns. Look for funds with competitive expense ratios.

Fund Manager Expertise:

Evaluate the track record and expertise of the fund manager. A skilled manager can navigate market fluctuations and make strategic decisions.

Conclusion:

Selecting the best SIP plan for 5-year investment involves a careful examination of fund performance, risk factors, and your own financial goals. Diversification, consistency, and a disciplined approach to investing can pave the way for financial success. Consult with a financial advisor to tailor your SIP portfolio to your unique circumstances and embark on a journey towards achieving your financial aspirations. Remember, patience and a long-term perspective are the cornerstones of successful investing.

0 notes

Text

Exploring Mutual Fund Service Providers in Gorakhpur

Gorakhpur, a bustling city in the state of Uttar Pradesh, is not only known for its historical and cultural significance but is also emerging as a hub for financial services. Among the various financial instruments available, mutual funds have gained substantial popularity among investors due to their potential for wealth creation and diversification. In this article, we will explore the mutual fund service providers in Gorakhpur, helping you make informed investment decisions.

HDFC Mutual Fund

HDFC Mutual Fund is one of the leading mutual fund service providers in Gorakhpur. With a strong presence across the country, HDFC Mutual Fund offers a wide range of investment options, including equity, debt, and hybrid funds. They have a dedicated team of financial experts who provide personalized investment advice to investors, helping them achieve their financial goals.

SBI Mutual Fund

State Bank of India (SBI) Mutual Fund is another prominent player in the mutual fund industry in Gorakhpur. As a trusted name in the financial sector, SBI Mutual Fund offers a comprehensive suite of investment solutions tailored to meet the diverse needs of investors. Their online platform makes it easy for investors to transact and monitor their investments conveniently.

ICICI Prudential Mutual Fund

ICICI Prudential Mutual Fund is known for its innovative and customer-centric approach. They offer a wide range of mutual funds, including equity, debt, and liquid funds. ICICI Prudential Mutual Fund provides various tools and resources to help investors make informed decisions, such as risk assessment and goal planning calculators.

Aditya Birla Sun Life Mutual Fund

Aditya Birla Sun Life Mutual Fund is committed to providing value to its investors through a range of well-managed mutual funds. They offer investment solutions catering to various risk appetites and investment horizons. The company has a robust research team that constantly monitors market trends, ensuring that their fund offerings remain competitive and aligned with investors' objectives.

Axis Mutual Fund

Axis Mutual Fund has gained recognition for its transparent investment approach and strong performance track record. They offer a range of funds that cater to different investment goals and risk profiles. Axis Mutual Fund emphasizes investor education and provides regular updates and insights to help investors stay informed.

Reliance Mutual Fund

Reliance Mutual Fund, now known as Nippon India Mutual Fund, is another prominent player in Gorakhpur's mutual fund landscape. They have a long-standing presence in the market and offer a diverse range of funds, from equity to debt and hybrid funds. Nippon India Mutual Fund focuses on delivering consistent returns to investors.

Conclusion

Gorakhpur has witnessed a growing interest in mutual funds as an investment avenue, and several reputable mutual fund service providers operate in the city. Whether you are a seasoned investor or a newcomer to mutual funds, it's crucial to research and choose a service provider that aligns with your financial goals and risk tolerance. Consulting with a financial advisor or visiting the local branches of these service providers can help you make informed investment decisions and pave the way for a more secure financial future. Remember that all investments carry some level of risk, so it's essential to diversify your portfolio and invest wisely.

For More Info :-

Mutual Fund Service Providers Gorakhpur

finance in Gorakhpur

0 notes