#sba 7a loan

Explore tagged Tumblr posts

Text

Attention all entrepreneurs in need of funding! We specialize in finding tailored financial solutions for businesses. Let's explore how we can optimize your funding strategy to help your venture flourish. Get in touch today!

Give us a call at 800-452-8485 or visit brimarcnoel.com

#business owners#entrepreneur#business loans#funding#business funding#small business owner#small business loans#business#business consulting#loans#sba 504 loan#sba 7a loan#sba#black owned#black business owner

2 notes

·

View notes

Text

Exploring the Features and Benefits of SBA 7(a) Loans

The SBA 7A program is among the most widely used business financing solutions in the United States. The Small Business Administration provides these loans, which have several features and opportunities that make them a desirable option for business owners.

One of the main advantages of the 7A loans is their flexibility. These can be used for several things, such as refinancing obligations, buying working capital, inventory, or equipment, or even occasionally buying out another business. Moreover, SBA 7A loan interest rates are advantageous. It helps small businesses efficiently control borrowing costs by capping the maximum interest rate that lenders can charge on these loans. Since the interest rates are typically lower than those of traditional lenders, borrowers may end up saving a significant sum of money over time.

There are requirements that business owners must fulfill in order to be eligible for this loan. The SBA 7A loan requirements include that you must be able to repay the loan on schedule, have a strong credit score, and present enough collateral to secure the loan. Read More

#sba loans#SBA 7a loan#Small term loan#Cash Advance#interest rates#equipment financing#Term Loans#mortgage loan#business loan#same day loans online#Large capital Project

1 note

·

View note

Text

ACOM Capital provides expert SBA Business Loans lenders for flexible financing. Specialising in SBA 7A Loans, our lenders help businesses secure the funds they need to grow. Apply for SBA loans today!

0 notes

Text

#SBA 7A vs 504 Loans#environmental consulting services texas#stormwater pollution prevention plan texas#air permitting in texas

0 notes

Text

Small Business Real Estate Loans

Explore SBA 504 & 7a loans, working capital, and real estate loans for small businesses. Solutions even if you've faced SBA loan denial.

Learn more about us here: https://mcommercialcapitalgroup.com/financial-service/small-business-loan/

0 notes

Text

The Ins and Outs of SBA Loans for Businesses

Small Business Administration (SBA) loans are an attractive option for investors, as they are typically offered at competitive rates and with flexible terms. But, before you jump in, there are some things to consider when applying for an SBA loan. Let’s take a look at the important details that you should be aware of.

Qualifying for an SBA Loan

The U.S. Small Business Administration does not provide financing directly to borrowers—rather, it partners with banks and other approved lenders to provide government-guaranteed loans to businesses. In order to qualify for an SBA loan, you must have a good credit score, a solid business plan demonstrating how you will use the funds, and a positive cash flow from your business operations. Additionally, most lenders require collateral such as real estate or equipment in order to secure the loan.

Types of SBA Loans

There are different types of SBA loans available depending on your needs. The 7(a) program is the most popular and offers up to $5 million in funding with repayment terms up to 25 years; 7(a) Express loans offer faster turnaround times but can only be used for working capital or inventory purchases; 504/CDC loans offer long-term financing with low down payments; and Microloans can provide amounts between $500-$50,000 for short-term expenses such as inventory or supplies.

Considerations when Applying for an SBA Loan

One thing that all potential borrowers should consider before applying for an SBA loan is that these loans come with certain restrictions that could impact their ability to qualify or their ability to use the funds as needed once they do qualify. For example, some restrictions include specific uses of the money (such as buying real estate), limitations on loan size based on number of employees or annual revenue, and restrictions on who can borrow (such as non-profit organizations). It is important to understand any potential restrictions before applying so that you can ensure you meet all eligibility requirements and make sure that the loan will be able to fulfill your needs if granted.

An SBA loan calculator can be a powerful business tool for business owners. It allows business owners to accurately estimate the monthly payment, total cost of the loan, and amount of their down payment. With an SBA 504 vs 7a loan calculator, business owners can confidently calculate the best business financing options for their business needs. It is essential for business owners to have a quick and valuable assessment of their business finance options before making important decisions. The SBA loan calculator is an invaluable asset to navigating business finances.

Financing a small business has many benefits but also comes with some risks—one of which is having access to sufficient capital when needed. Fortunately, there are options available such as SBA loans which offer competitive rates and more flexible terms than traditional bank loans. However, it's important to understand what qualifying criteria must be met in order for your application to be approved as well as any potential restrictions which could impact your ability to use the funds once granted. With this knowledge in mind, business owners can better assess whether getting an SBA loan is right for them and their business goals.

2 notes

·

View notes

Text

Unlocking Business Growth Through SBA Loans in Ohio

For small business owners seeking accessible and affordable financing, SBA loans Ohio provide a lifeline to secure funding with favorable terms. These loans, backed by the U.S. Small Business Administration, are crafted to meet the diverse needs of entrepreneurs. They offer competitive interest rates, extended repayment terms, and low down payments, making them a go-to option for businesses looking to expand operations, purchase equipment, or increase working capital. Whether you’re launching a start-up or growing an established business, SBA loans in Ohio empower entrepreneurs to reach their goals with confidence.

Understanding the Versatility of Consumers SBA Loans When it comes to small business financing, Consumers SBA loans stand out as a comprehensive solution tailored to the unique challenges faced by local businesses. These loans support a variety of business purposes, including the purchase of real estate, funding of day-to-day operational needs, and acquisition of inventory or supplies. Business owners benefit from expert guidance through the loan application process, ensuring they can access the funding they need without unnecessary delays. Consumers SBA loans are designed to foster growth and stability, enabling businesses to seize opportunities and overcome financial hurdles.

How SBA Loan Services Ohio Empower Local Entrepreneurs Securing funding through SBA loan services Ohio offers an invaluable resource for entrepreneurs navigating the complexities of small business ownership. These services provide step-by-step assistance, helping business owners understand eligibility requirements, prepare comprehensive loan applications, and secure the funding necessary for various projects. Whether it’s expanding into new markets, hiring additional staff, or upgrading technology, Ohio businesses can rely on these services to support their ambitions and fuel their success.

Funding Business Expansion with an SBA 504 Loan Ohio For entrepreneurs planning significant investments in long-term assets, an SBA 504 loan Ohio serves as the perfect financing option. These loans are specifically designed to fund major fixed asset purchases, such as acquiring commercial property, upgrading facilities, or purchasing high-value equipment. What sets the SBA 504 loan apart is its low fixed interest rate and longer repayment terms, enabling businesses to spread costs over time without compromising cash flow. Ohio businesses can leverage this financing to achieve sustainable growth while maintaining financial stability.

How SBA 7a Loan Ohio Supports Small Business Success The SBA 7a loan Ohio is among the most popular options for small businesses looking to address a wide range of financial needs. This loan is versatile, allowing entrepreneurs to cover expenses such as working capital, purchasing inventory, or refinancing existing debt. Its flexibility makes it suitable for both start-ups and established businesses aiming to stabilize operations or pursue new growth opportunities. With manageable terms and accessible funding amounts, the SBA 7a loan is a cornerstone of financial support for small businesses across Ohio.

Simplifying Processes with SBA Loan Services OH Navigating the intricacies of applying for business financing can be daunting, but SBA loan services OH are designed to make the process seamless. These services provide professional guidance, ensuring that business owners gather the necessary documentation, meet eligibility requirements, and complete applications accurately. With personalized assistance, entrepreneurs can secure funding faster and focus on achieving their business objectives. Whether you’re planning a large-scale expansion or need funds to maintain operations, these services offer an invaluable pathway to success.

Driving Economic Growth Through Ohio SBA Loans Ohio SBA loans play a vital role in driving economic development across the state. By offering accessible and affordable financing options, these loans empower small businesses to contribute to job creation, innovation, and community growth. Entrepreneurs who take advantage of SBA loans can invest in long-term strategies, ensuring their businesses thrive while positively impacting local economies. From revitalizing neighborhoods to supporting workforce development, Ohio SBA loans are more than just financial products—they are a catalyst for sustainable progress.

0 notes

Text

There are many reasons that purchasers of businesses are turned down for acquisition loans. Oftentimes the price of the business is too high and the cash flow of the business can't support servicing the debt. Sometimes the assets to be used for collateral are inadequate. But the banks and the SBA look at other criteria such as the credit rating and qualifications of the borrower to manage the business. At the very least, business owners must make sure their company fits all the criteria that banks are looking for in order to find a buyer that will qualify for a loan. Read about SBA Business Loan Eligibility.http://www.sba.gov/content/7a-loan-program-eligibility Will the company qualify for a business acquisition loan? Read the full article

0 notes

Video

tumblr

Investing in your business should never feel like a gamble. With BriMarc Noel LLC, you can trust that the funding you need for your business will be secure and reliable. Our Business loans make it easy to acquire the funds you need to make your business flourish.

Get the funding you need today – it only takes an application to get started.

Contact us today to get started! (800) 452-8485 https://brimarcnoel2.com/

Like our content? Hit that follow button!

#business consulting#business owners#small business loans#loans#sba 504 loan#SBA 7a loan#sba eidl loan#funding#business loans

9 notes

·

View notes

Text

Salem SBA 7a Express Loans

Are you trying to find SBA 7a Express Loans in Salem to expand your small business? Americapital Solutions, if yes. We provide quick and adaptable financing options based on your need. Whether you need working capital, are refinancing, or are expanding, our knowledgeable staff can assist you in obtaining the cash you need. Americapital Solutions is your reliable partner for realizing your business goals, offering efficient processing and affordable prices. For more details about our services, contact (541) 236-2930 right away.

#SBA 7a Express Loans#SBA Loans in Portland#SBA 7a Express Loans in Salem#SBA 7a Express Loans in Oregon

1 note

·

View note

Text

A Comprehensive Overview of Multiple SBA Loan Programs: What’s Best for Your Business?

Understanding the Importance of SBA Loans for Small Businesses

SBA loans are essential for fostering and advancing the expansion of small businesses. The Small Business Administration provides a range of loan programs tailored to offer financial support to entrepreneurs and small business owners. These small business loans are particularly important for startups and small businesses that may face challenges in obtaining traditional bank loans due to limited collateral or credit history. Small-term loans provide access to capital at favorable terms, including lower interest rates and longer repayment periods. An important advantage of small business loans is the inclusion of a guarantee for lenders, which mitigates their risk and encourages them to provide loans to startups. This guarantee enables lenders to offer financing alternatives that may have been otherwise inaccessible. Small business owners must comprehend the various SBA lending programs that are accessible, including but not limited to 7(a) loans, CDC/504 loans, microloans, and disaster assistance loans. Every program has unique prerequisites and qualifying requirements.

Exploring the Most Popular SBA Loan Programs and Their Eligibility Criteria

In this section, we will explore some of the most popular Small Business Administration loan programs and discuss their eligibility criteria.

1. 7(a) Loan Program:

The 7a loans stand out as the most versatile and widely used loan initiative. It provides funding of up to $5 million, catering to a myriad of business needs, from working capital to equipment purchases.

Key Features of 7a Loans:

Loan Amount: Up to $5 million.

Usage: Diverse business needs, from day-to-day operations to expansion.

Term Length: Varies based on usage.

Eligibility Criteria: Read More

#finance#business loan#loan#personal loans#same day loans online#Cash advance#line of credit#equipment financing

2 notes

·

View notes

Text

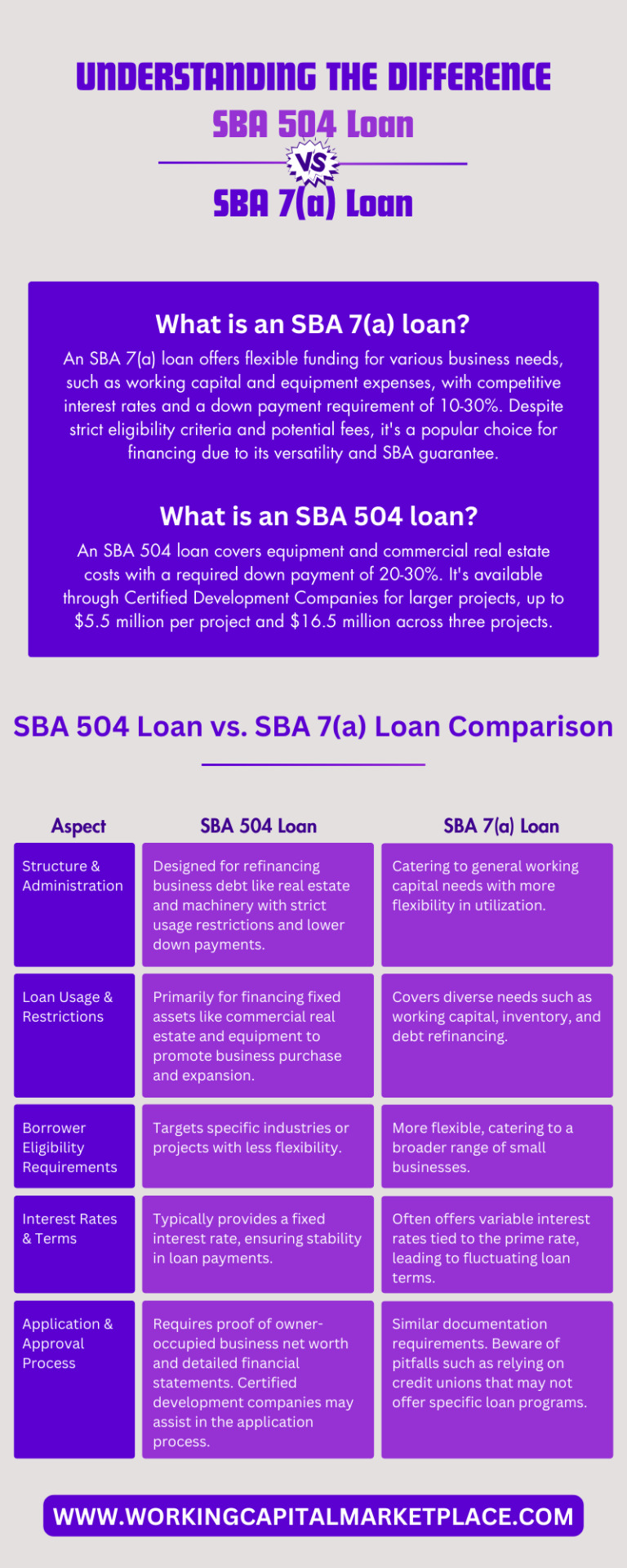

Understanding the Difference: SBA 504 Loan vs SBA 7(a)

Explore the difference between sba 7a and 504 loans with our informative infographic. Learn the key distinctions to make informed financing decisions for your business's growth and success.

0 notes

Text

Navigating Business Funding: Understanding the SBA 7(a) Loan Calculator

Small and medium-sized enterprises (SMEs) often face financial challenges when seeking funding for expansion or operations. The Small Business Administration's (SBA) 7(a) Loan Program is a lifeline for many entrepreneurs, offering affordable financing solutions. To demystify the complexities of this program, entrepreneurs can leverage an essential tool - the SBA 7a Loan Calculator. In this article, we will delve into the significance of the SBA 7(a) Loan Program and explore how the calculator can be a strategic companion in the funding journey. Understanding the SBA 7(a) Loan Program: The SBA 7(a) Loan Program is a cornerstone of the SBA's offerings, providing guaranteed loans to small businesses. These loans aim to support various business needs, such as working capital, equipment purchase, debt refinancing, and real estate acquisition. With favorable terms, longer repayment periods, and lower interest rates, the 7(a) program is an attractive option for businesses seeking financial assistance. Importance of the SBA 7(a) Loan Calculator: The SBA 7(a) Loan Calculator serves as a crucial tool for entrepreneurs, helping them make informed decisions about their financing options. Here's how the calculator can be a game-changer in the loan application process: Loan Estimation: The calculator allows users to input essential financial details, such as the loan amount, interest rate, and term. By doing so, entrepreneurs can quickly estimate their monthly loan repayments, helping them gauge the feasibility of the loan and plan their finances accordingly. Affordability Analysis: Understanding the financial implications of a loan is crucial for any business. The SBA 7a Loan Calculator breaks down the repayment structure, allowing entrepreneurs to assess the affordability of the loan and make adjustments to their business plans if necessary. Comparison of Loan Scenarios: Entrepreneurs can use the calculator to explore different loan scenarios by adjusting variables such as loan amount, interest rate, and term. This comparative analysis enables businesses to choose the most suitable loan option that aligns with their financial goals and capabilities. Real-time Decision Making: The SBA 7(a) Loan Calculator empowers entrepreneurs to make real-time decisions about their funding needs. With instant calculations, businesses can promptly evaluate the impact of loan adjustments and decide on the most favorable terms for their unique circumstances. Risk Mitigation: Financial planning is inherently linked to risk management. The SBA 7(a) Loan Calculator helps businesses mitigate financial risks by providing a clear understanding of the loan's impact on their cash flow. This information is invaluable in developing strategies to navigate potential challenges. Conclusion: In the dynamic world of small business financing, the SBA 7a Loan Calculator emerges as a beacon of financial clarity. By leveraging this tool, entrepreneurs can navigate the complexities of the SBA 7(a) Loan Program with confidence, ensuring that their business growth is supported by a sound financial foundation. As businesses continue to explore avenues for expansion and sustainability, the SBA 7(a) Loan Calculator remains an indispensable ally on the journey to success.

0 notes

Text

Check out Equipment Financing for Startups @ Mcommercialcapitalgroup

Indeed startups are the lifeblood of our economy. Often startups are the first to introduce new innovations to market much before the established businesses have even conceptualized the ideas. However starting a business means shouldering many responsibilities from financing until turnover. Small business owners need to pay attention to each aspect including financing. With equipment financing for startups from M Commercial Capital Group it becomes easier. Equipment financing is an ideal choice for existing or new businesses as they need financing to launch their start-up.

With M Commercial Capital Group buying new equipment is possible as their equipment financing for startups can solve many common problems, providing funds to help startups secure the equipment they need to grow and prosper.

Spokesperson at M Commercial Capital Group elaborates their equipment financing for startups saying “The equipment financing program we offer here at M Commercial Capital Group LLC is immensely popular because it frees up business funds for other purposes. The high cost of professional equipment becomes much easier to handle when you can pay it over time instead of all at once.”

M Commercial Capital Group LLC provides reliable equipment leasing and financing solutions including:

Government and municipal programs reserved for people representing government and municipal entities.

Sale and Lease Back Program

Second Chance Programs

Start-ups Programs designed just for start-up businesses with easier qualification requirements than most loans.

M Commercial Capital Group LLC is trusted for their small business real estate loans options. They have a diverse selection of financing options for professionals who are interested in purchasing commercial real estate or completing large real estate projects. If you need commercial real estate financing it is best to reach out to experts at M Commercial Capital Group.

M Commercial Capital Group offers CMBS Loans which are loan alternatives backed by commercial properties. They have great interest rates and terms. In addition they offer bridge loans, equity financing, conventional programs, construction financing, HUD and FHA lending and more.

For small business owner or operator facing financing issues for a commercial real estate project or equipment purchase, Small Business Real Estate Loans from M Commercial Capital Group LLC are highly useful. They offer SBA 7a and 504 loans to cover a wide range of business needs. Whether you need to purchase, build, or renovate, M Commercial Capital Group has financing options that can cover your next project.

About M Commercial Capital Group LLC:

M Commercial Capital Group LLC is a leading financing solutions provider. They provide tailored financial services to get started on the path to future business success.

Call us on: 1 (941) 655–9380 Email: [email protected] Address: 1150 NW 72nd Ave Tower 1, Ste 455 #11010 Miami, FL, US 33126

0 notes

Text

Unlocking Financial Success with Small Business Lending Calculators

It’s no secret that the process of acquiring financing for a small business can be overwhelming and intimidating. To make sure you are making the best decisions for your business, it’s important to understand what options are available to you and how much you can borrow. Thankfully, with the help of online lending calculators, small business owners can access the information they need to make informed decisions about their financial future.

Commercial Real Estate Loan Calculator

A commercial loan calculator is an essential tool for any business owner looking to secure a loan. By entering in simple data such as loan amount, interest rate, and repayment terms, businesses can get an estimate of their monthly payments and total cost of the loan, amortization table along with visualizing data. Businesses should also keep in mind that these calculators use estimated interest rates, which may not accurately reflect the actual cost of the loan after fees and other costs are factored in.

Heavy Equipment Financing Calculator

An equipment loan calculator is specifically designed for businesses looking to purchase expensive equipment or industrial machinery. This type of calculator takes into account factors such as depreciation and residual value to determine how much a business should expect to pay each month for the life of the loan along with total cost and depreciation methods. In addition, businesses should keep in mind that some lenders offer discounts on interest rates depending on how long the equipment is expected to last.

SBA 7a Loan Calculator

The Small Business Administration (SBA) offers loans specifically designed for small businesses. The SBA loan calculator helps businesses determine if they qualify for an SBA loan and how much they would be able to borrow based on their credit score, industry experience, and other factors. It’s important to note that while this type of calculator is helpful in understanding potential costs associated with an SBA loan, it does not guarantee approval or provide advice on whether an SBA loan is right for your business. SBA 7a loan calculator will provide detailed breakdown on the loan financings.

Receivables Factoring Calculator

Factoring is a form of financing offered by third-party companies who purchase unpaid invoices from businesses at a discounted rate. A factoring calculator helps businesses understand how much money they will receive upfront from selling their invoices as well as how much money they will eventually receive once all invoices have been paid off. It’s important to note that factoring rates vary depending on several factors including creditworthiness and invoice size so it’s important to shop around before committing to any particular lender or deal structure.

Whether you are looking for a commercial loan or a factoring solution, online lending calculators can help small business owners make informed decisions about their finances. By entering simple data into these calculators, small businesses can quickly get an accurate estimate of what they can expect in terms of monthly payments and overall cost when taking out any type of financing solution. With this knowledge in hand, small businesses can feel confident knowing that they are making sound financial decisions when it comes time to finance their next endeavor!

0 notes