#SBA 7A vs 504 Loans

Explore tagged Tumblr posts

Text

#SBA 7A vs 504 Loans#environmental consulting services texas#stormwater pollution prevention plan texas#air permitting in texas

0 notes

Text

The Ins and Outs of SBA Loans for Businesses

Small Business Administration (SBA) loans are an attractive option for investors, as they are typically offered at competitive rates and with flexible terms. But, before you jump in, there are some things to consider when applying for an SBA loan. Let’s take a look at the important details that you should be aware of.

Qualifying for an SBA Loan

The U.S. Small Business Administration does not provide financing directly to borrowers—rather, it partners with banks and other approved lenders to provide government-guaranteed loans to businesses. In order to qualify for an SBA loan, you must have a good credit score, a solid business plan demonstrating how you will use the funds, and a positive cash flow from your business operations. Additionally, most lenders require collateral such as real estate or equipment in order to secure the loan.

Types of SBA Loans

There are different types of SBA loans available depending on your needs. The 7(a) program is the most popular and offers up to $5 million in funding with repayment terms up to 25 years; 7(a) Express loans offer faster turnaround times but can only be used for working capital or inventory purchases; 504/CDC loans offer long-term financing with low down payments; and Microloans can provide amounts between $500-$50,000 for short-term expenses such as inventory or supplies.

Considerations when Applying for an SBA Loan

One thing that all potential borrowers should consider before applying for an SBA loan is that these loans come with certain restrictions that could impact their ability to qualify or their ability to use the funds as needed once they do qualify. For example, some restrictions include specific uses of the money (such as buying real estate), limitations on loan size based on number of employees or annual revenue, and restrictions on who can borrow (such as non-profit organizations). It is important to understand any potential restrictions before applying so that you can ensure you meet all eligibility requirements and make sure that the loan will be able to fulfill your needs if granted.

An SBA loan calculator can be a powerful business tool for business owners. It allows business owners to accurately estimate the monthly payment, total cost of the loan, and amount of their down payment. With an SBA 504 vs 7a loan calculator, business owners can confidently calculate the best business financing options for their business needs. It is essential for business owners to have a quick and valuable assessment of their business finance options before making important decisions. The SBA loan calculator is an invaluable asset to navigating business finances.

Financing a small business has many benefits but also comes with some risks—one of which is having access to sufficient capital when needed. Fortunately, there are options available such as SBA loans which offer competitive rates and more flexible terms than traditional bank loans. However, it's important to understand what qualifying criteria must be met in order for your application to be approved as well as any potential restrictions which could impact your ability to use the funds once granted. With this knowledge in mind, business owners can better assess whether getting an SBA loan is right for them and their business goals.

2 notes

·

View notes

Text

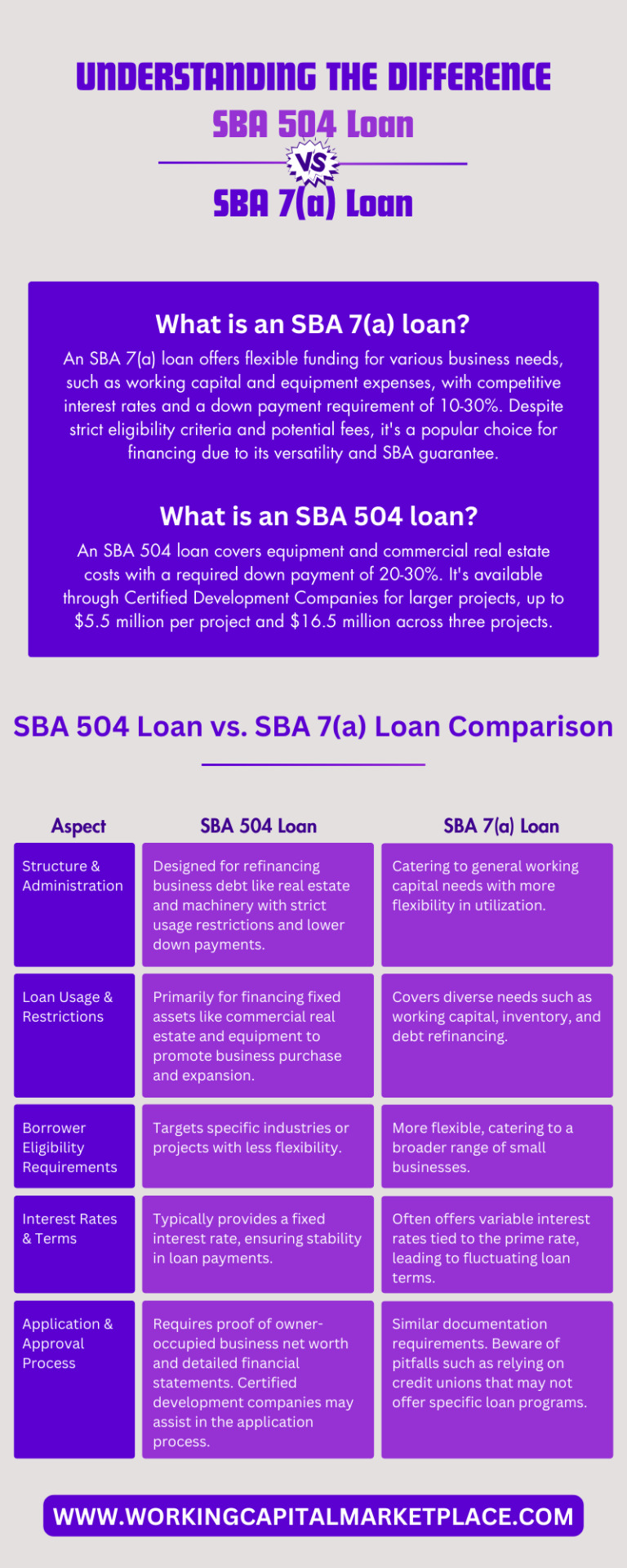

Understanding the Difference: SBA 504 Loan vs SBA 7(a)

Explore the difference between sba 7a and 504 loans with our informative infographic. Learn the key distinctions to make informed financing decisions for your business's growth and success.

0 notes

Link

The SBA 7a program was initially planned for use in financing business acquisitions, FF&E, working capital credits, and other high-hazard advances. Read More: https://commercialfundingusa.blogspot.com/2019/05/business-sba-7a-loan-vs-business-sba.html

0 notes