#savingsrate

Explore tagged Tumblr posts

Text

UK Household Finances Soar: More Money for Families! #averagehouseholddisposableincome #employmentratesandwages #governmentpolicies #householdfinancesUK #savingsrate

#Business#averagehouseholddisposableincome#employmentratesandwages#governmentpolicies#householdfinancesUK#savingsrate

0 notes

Text

youtube

7 Steps to Estimating Your In-Retirement Cash Flow Needs

Healthcare costs are a significant swing factor, but the general rules might be too high for wealthy retirees with high savings rates.

0 notes

Link

0 notes

Photo

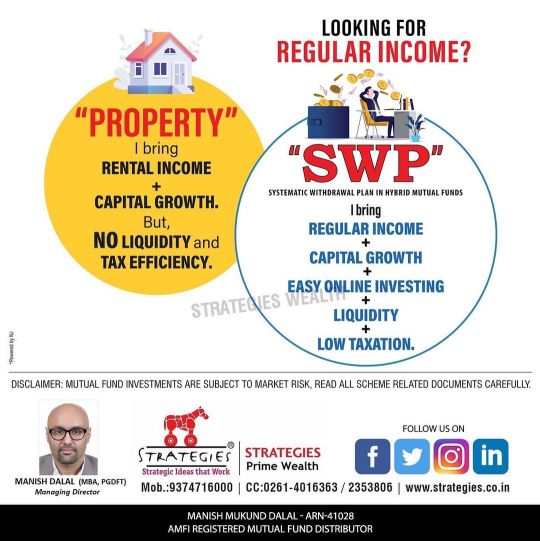

Looking for Regular Income? Where to invest… No idea!! Then ask for SWP… in a Mutual Fund Hybrid Scheme. How does it work? To know more connect with @strategieswealth / @manishmdalal / @purvimdalal on 9374716000 or visit us at www.strategies.co.in #regularincome #regularincomeplan #cashflow #monthlyincome #recurringincome #recurringdeposit #mis #monthlyincomescheme #postalsavings #postalsavingsbank #bankfd #savingsaccount #savingstips #savingsgoals #savingsplan #savingsrate #interestrates #fdinterestrates #gold #silver #etfinvesting #etf #property #propertyinvestment #rental #rentincome #lowrent https://www.instagram.com/p/CcSAEuNMrvD/?igshid=NGJjMDIxMWI=

#regularincome#regularincomeplan#cashflow#monthlyincome#recurringincome#recurringdeposit#mis#monthlyincomescheme#postalsavings#postalsavingsbank#bankfd#savingsaccount#savingstips#savingsgoals#savingsplan#savingsrate#interestrates#fdinterestrates#gold#silver#etfinvesting#etf#property#propertyinvestment#rental#rentincome#lowrent

0 notes

Photo

One of my biggest months for income! 👌 To be fair, it was the magical month of just sneaking in 3 fortnightly pays, but with a huuuuuge $6k+ income from my mobile PT business 👌 While there was a big income, there were also very large expenses - mostly just from the PT stuff though, the rest was pretty normal 👍 Not that I ended up actually saving that much money as all the PT business money stays in its own account for now. But super happy with that previous month! #budget #money #income #savingsrate #savings #sidehustle #smallbusiness https://www.instagram.com/p/CbyCdsihz_g/?utm_medium=tumblr

0 notes

Photo

#bettadayzja: #savingsrate 10% ➡️25% #premonth ... @bettadayzja @mitchsmastermind #mitchsmastermind ... (at America/Jamaica) https://www.instagram.com/p/BtzisfsBxYH/?utm_source=ig_tumblr_share&igshid=1y2akj9nzsw40

0 notes

Text

UK Household Finances Soar: More Money for Families! #averagehouseholddisposableincome #employmentratesandwages #governmentpolicies #householdfinancesUK #savingsrate

#Business#averagehouseholddisposableincome#employmentratesandwages#governmentpolicies#householdfinancesUK#savingsrate

0 notes

Text

The High US Dollar, Buyback Frenzy and Increased Savings

Strategist Christopher Wood looks at the effect of the strong US dollar, share buybacks, and increased savings rate. #usdollar #market Read the full article

0 notes

Photo

It can be this simple if you want it to. #Repost @conrad_inspire (@get_repost) ・・・ Im humbled 🙌🏼 daily that this has been possible for Alma and I but I want you to be aware of the numbers and what it will take to achieve whatever you’re setting out to achieve. 5 years ago, I thought If I could save $200/month we were the 1%. 😂 Now, I’m wondering how to save a few more thousand a month, not to save it forever, but to deploy it in investments and have it grow so that Alma and I can have options. I firmly believe the 10% savings rate that society tells you is enough, is a total lie! I truly believe with inflation, people who want to retire with confidence need more than 10% being saved and invested and they need more than 1 form of income like Warren Buffet says. And, if you are thinking about commenting how “Money doesn’t matter” or “Money doesn’t buy happiness”, tell that to all the elderly fighting inflation as they complain they can’t afford gas, increased insurance, rent prices that have risen by over 5% a year here in California, ext. I’ve felt horrible hearing people suffering in those situations many times recently. It’s not fun having that conversation with such sweet people. Don’t wait till your older to start. You gotta start today! How much do you think people should save? Comment below! #debtfreecommunity #debtfreejourney #everydollar #savingsrate #retireinspired #Savingsrate #daveramsey #fpu #financialpeaceuniversity #totalmoneymakeover #Savedatmoney #Thankyou #Wealth #finances #millionairemindset #millionaire #millionaireinthemaking #916

#millionairemindset#finances#financialpeaceuniversity#debtfreejourney#savingsrate#daveramsey#fpu#repost#everydollar#wealth#totalmoneymakeover#millionaireinthemaking#debtfreecommunity#916#millionaire#thankyou#savedatmoney#retireinspired

0 notes

Photo

A few pictures of my latest blog post on my goal progress for December 2021. Less than 3 weeks before 2021 is over!!! Check out the link in my bio for the post 👌 #goals #goal #progress #blog #goalsetting #networth #personalfinance #personaldevelopment #savingsrate #nathansmobilept #nathanchallengeslife #smallbusiness https://www.instagram.com/nathanchallengeslife/p/CXVVTL-POtQ/?utm_medium=tumblr

#goals#goal#progress#blog#goalsetting#networth#personalfinance#personaldevelopment#savingsrate#nathansmobilept#nathanchallengeslife#smallbusiness

0 notes

Text

Your Money: How to play the savings interest rate game

Looking for the best interest rate for your savings account?

source https://www.reuters.com/article/us-money-fed-savingsrates/your-money-how-to-play-the-savings-interest-rate-game-idUSKCN1UI1TX?feedType=RSS&feedName=PersonalFinance

0 notes

Text

2018 Financial Review

I reviewed 2018 income, savings, and investments. Plus estimated 2019 savings. Check it out! #financialreview #savingsrate

Every January I review how the past year went, compare it to previous year’s prediction, and give an estimate for the upcoming year. My last paycheck for the year says I got 296K W-2 gross income in 2018. From what I can tell of my brokerage accounts, I had at least 4K investment income. That puts me over 300K pre-tax incomefor the year, which is just astounding to me as I never imagined making…

View On WordPress

0 notes

Text

Millions of Americans Struggle with Money: Are You Prepared? #checkingaccountbalances #savingsrates

0 notes