#recurringdeposit

Explore tagged Tumblr posts

Text

Are you preparing for a banking interview? Then you must know the difference between Recurring Deposit (RD) & Fixed Deposit (FD)!

Both are great saving options, but which one is better? It depends on financial goals, tenure, and liquidity.

Watch the latest episode of Common Banking Interview Questions and master this concept in seconds!

💡 Pro Tip: Know the pros and cons of both and be ready to explain their best use cases!

Want us to cover another topic? Let us know in the comments!

#BankingInterview#FinanceEducation#BankingBasics#InterviewPrep#MoneyManagement#IPB#RDvsFD#FixedDeposit#RecurringDeposit#InterviewPreparation#BankingJobs#FinanceTips#BankExam#bankinterview#InstituteofProfessionalBanking#SmartSavings#CareerInBanking#BankingAwareness#BankingConcepts#1lakhbankersby2030

0 notes

Text

In the domain of secure investments, Fixed Deposits (FD) and Recurring Deposits (RD) stand apart as tried and true monetary instruments. This article intends to give a complete manual for FD and RD, revealing insight into what they are, the manner by which they work, and the factors to consider while investigating the best FD rates, especially from presumed banks like SBI.

Know More: https://shorturl.at/aepM8

0 notes

Text

Secure your financial future with Recurring Deposits—a simple, disciplined savings option. Enjoy fixed returns, flexibility, and automation for hassle-free wealth accumulation. Start building your financial foundation today.

Visit Us: https://www.mcfinserve.com/ Download Our Application: https://play.google.com/store/apps/details?id=com.mcfinancial

#recurringdeposit#mcfinancialservices#recurring#finance#savings#rd#investments#moneytransfer#gold#money#investment#financialfreedom#business#loan#financialplanning#businessloan

0 notes

Text

Recurring Deposit Interest Rates:৫ বছরের রেকারিং ডিপোজিটে পোস্ট অফিস, SBI, HDFC Bank এর মধ্যে কোথায় বেশি টাকা পাবেন? - TAKAPOYSANEWS

0 notes

Text

Looking for reliable financial solutions in Mettupalayam? Chit funds are a secure and flexible option for individuals and businesses seeking disciplined savings and quick financial support. With trusted chit fund companies in Mettupalayam, you can easily achieve your goals, whether it’s buying a home, starting a business, or managing unexpected expenses.

Chit funds offer a unique combination of savings and borrowing, ensuring you have access to funds when you need them the most. Experienced chit fund agents in Mettupalayam guide you through transparent and hassle-free processes, making them an excellent choice for long-term financial planning.

#InvestmentConsultants #TopChitFunds #ChitFundTamilNadu #SmartInvestments #SecureSavings #MoneyManagement #WealthGrowth #TrustedChitFunds #BusinessFinance #FinancialStability #LoanServices #BestChitFunds #SavingMoney #Savings #SavingMoneyTips #SaveMoney #FixedDeposit #RecurringDeposit #EmergencyFund #SmartFinance #FutureFinance #GrowBusiness #MoneyNeeds #MoneyTree #MonthlyPlan #CustomerService #UPITransaction #SecureTomorrow #TrustedOrganization #TrustedService #SaveTodaySaveTomorrow #SmallStepsBigChanges #QuickReturn #InvestmentPlan #InvestYourDreams #FinanceFreedom #FinanceOpportunity #FinancialServiceIndustry

0 notes

Text

📈 Discover the Power of Recurring Deposits! 💼 Explore our detailed post to learn how Recurring Deposits can help you save regularly and achieve your financial objectives. Start investing wisely today! #RecurringDeposit #FinancialPlanning 🌟💰

0 notes

Photo

Contingency Fund’s help you tide over unexpected expenses. Above are 4 places to keep your emergency funds. #finance #business #money #entrepreneur #investing #investment #wealth #equity #stocks #mutualfunds #liquidfunds #shorttermfunds #savings #savingsaccount #recurringdeposit #fixeddeposits #fd #rd #liquidity #cash #mutualfundssahihai #financialadvise #financialliteracy #financialplan https://www.instagram.com/p/B4vMfcwBfiO/?igshid=1qkcjxnowcthd

#finance#business#money#entrepreneur#investing#investment#wealth#equity#stocks#mutualfunds#liquidfunds#shorttermfunds#savings#savingsaccount#recurringdeposit#fixeddeposits#fd#rd#liquidity#cash#mutualfundssahihai#financialadvise#financialliteracy#financialplan

1 note

·

View note

Text

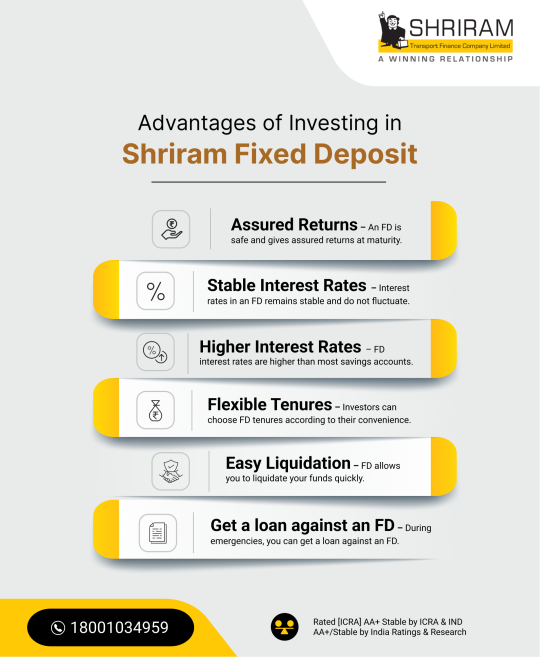

Advantage Of Investing in a Shriram Fixed Deposit

A Shriram Fixed Deposit offers comparatively higher interest rates of 8.75% per annum, which includes a bonus of 0.50% interest for senior citizens. Apart from the high-interest rates, with a Shriram FD, you also get an additional interest of 0.25% per annum on all renewals after the maturity of the deposit.

#fixeddeposit#frbs#investment#finance#mutualfunds#savings#fd#money#financialfreedom#investments#goldloan#bank#recurringdeposit#financialplanning#stockmarket#insurance#personalloan#stocks#wealth#rd#mutualfund#ettutharayil#chitfund#financialliteracy#gold#moneytransfer#investing#sip#personalfinance#financetips

1 note

·

View note

Photo

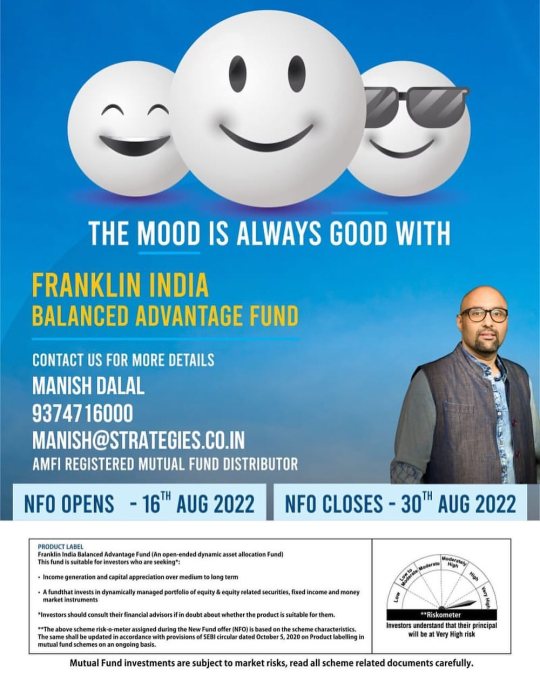

New Fund Offer from Franklin Mutual Fund… Plan your short term investment from 3 to 5 years with FRANKLIN INDIA BALANCED ADVANTAGE FUND. Get an Edge over Bank FDs or Postal savings #bank #savingsaccount #bankfd #bankaccount #ppf #postalsavings #postalsavingsbank #shortterm #recurringincome #recurringdeposit #postalsavingsaccount https://www.instagram.com/p/Chqze2IDOoT/?igshid=NGJjMDIxMWI=

#bank#savingsaccount#bankfd#bankaccount#ppf#postalsavings#postalsavingsbank#shortterm#recurringincome#recurringdeposit#postalsavingsaccount

0 notes

Photo

4th CURE OF LEAN PURSE:GAURD THY TREASURES FROM LOSS:"Gaurd thy treasure from loss by investing only where thy principal is safe,where it may be reclaimed if desirable,& where thou will not fail to collect a fair rental.Consult with wise men.Secure the advice of those experienced in the profitable handling of gold.Let their wisdom protect thy treasure from unsafe investments". _________________________________ #cure#leanpurse#guard#treasute#loss#principal#safe#reclaimed#fairrental#profitable#wisdom#treasure#unsafe#investments#fake#wisdomsutras#ancenstrolknowledge#gold#recurringdeposit#PPF#@axis_bank#@gold_loan_jaipur#@max#@therealkiyosaki #@richbabylon#@vivek_bindra#@pushkarrajthakur _________________________________ Please LIKE♥️,SHARE🙏&COMMENT👍ON MY POSTS. https://www.instagram.com/vinaygupta3677/p/CY3CwIIr-yl/?utm_medium=tumblr

#cure#leanpurse#guard#treasute#loss#principal#safe#reclaimed#fairrental#profitable#wisdom#treasure#unsafe#investments#fake#wisdomsutras#ancenstrolknowledge#gold#recurringdeposit#ppf

0 notes

Text

Investment: A guide on how to become RICH!!

Investment: A guide on how to become RICH!!

I have once read a quote, “Poor people use what is earned and save what is left. Whereas Rich people invest what is earned and use what is left.” This quote stands true in all aspects. A normal person usually keeps all his savings in a Bank Account. A Bank Account often yields a 4% interest per annum. This is not a good option considering all the short-term investing options available in the…

View On WordPress

#featured#becomerich#bonds#bullion#fixeddeposit#howtobecomerich#invesmentoptions#investment#mutualfunds#realestate#recurringdeposit#sharemarket#stocks

0 notes

Photo

Sri pragathi co-operative society limited Khammam #khammam #sripragathicooperativesocietylimited #shorttermdeposits #recurringdeposit #longtermdeposit https://www.instagram.com/p/B8nf3KAlzB1/?igshid=28o8sbsnv4cg

0 notes

Link

0 notes

Link

0 notes

Text

Types of Bank Accounts-HSC, Class 12/11, Money and Banking

There are basically four different types of bank accounts.

They are as follows-

1. Current Account - This account is generally meant for businessmen. This is because they have a high frequency of bank transactions. Under this account, there is no restriction on the number of withdrawals and hence is most suitable for businessmen. Some current account holders are also given overdraft facility. The customer gets cheque book facility for current account

2. Savings Account - This account is made for the general public especially salaried people. The main objective of having the savings account is to cultivate the habit of saving among people. Interest is also paid by the banks on the savings account. However, there are restrictions on the number of withdrawals that can be made through savings account and hence this type of account is not suitable for businessmen. Customers are generally required to maintain a certain minimum balance in the account.

3. Recurring Deposit Account - This type of an account is also called as the cumulative time deposit account. It is meant to cultivate the habit of savings among economically weaker section of the society. Under this type of an account, the customer is allowed to deposit a certain small but fixed amount (Rs.50, Rs.100, Rs.500 etc.) every month for a fixed period of time. The customer gets back the total amount deposited along with interest at the end of the specified period.

4. Fixed Deposit Account - Under this type of account, a one-time lump-sum deposit is made by the customer for a fixed period of time (generally 3 months to 10 years). The customer cannot withdraw the amount during this period (These days most banks allow pre-mature withdrawal with a minor penalty). However, he can take a temporary loan against the fixed deposit receipt (FDR). At the end of the fixed period, the customer can either withdraw the amount or renew the fixed deposit.

Following hybrid account is also offered by a lot of banks now-

Multiple Option Deposit Account : It is a type of Saving Bank Account in which deposit in excess of a particular limit gets automatically transferred into Fixed Deposit. On the other hand, in case adequate fund is not available in our Saving Bank Account so as to honour a cheque that we have issued, the required amount gets automatically transferred from Fixed Deposit to the Saving Bank Account. The balance amount continues as Fixed Deposit and earns interest as per existing rate of interest. One can earn higher rate of interest from a Fixed Deposit Account than from a Saving Bank Account.

#bankaccounts#types#savingsaccounts#savingsaccount#currentaccounts#currentaccount#fixeddeposit#recurringdeposit

0 notes