#salesforce for financial services

Explore tagged Tumblr posts

Text

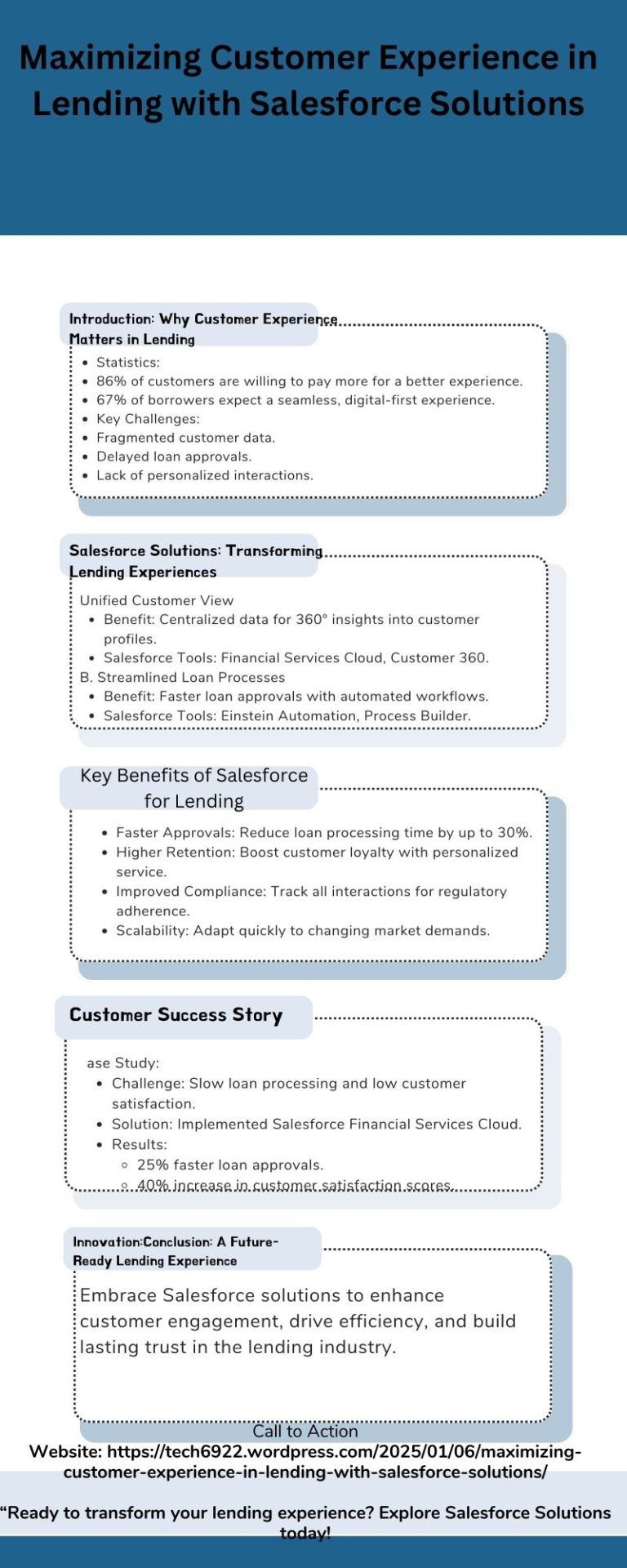

Discover how Salesforce solutions can transform the lending process by streamlining workflows, enabling personalized interactions, and enhancing customer engagement. Learn how tools like Financial Services Cloud and Einstein Automation deliver faster loan approvals, improved compliance, and a seamless lending experience. Boost customer satisfaction and retention toda

#Customer experience in lending#Salesforce solutions for lending#Salesforce Financial Services Cloud#Loan approval automation#Personalized lending solutions#Streamlined loan processes#Customer engagement in lending#Salesforce for financial services#Salesforce tools for lending#Lending customer experience#Omnichannel communication in lending#Improved customer satisfaction in lending#Salesforce automation in lending#Enhancing loan approval speed#Salesforce for loan officers#Financial services customer experience#Digital lending solutions.

0 notes

Text

Looking to revolutionize your financial services business? Look no further than Salesforce—the ultimate solution for growth, efficiency, and personalized customer experiences -https://qrsolutions.com.au/salesforce-for-financial-services/

0 notes

Link

Read this insightful post to know what Salesforce Field Service is and how it empowers mobile service teams of manufacturing firms. The write-up will list the key benefits of using the field service solution. It will also explain how it allows manufacturers to automate their field service process with high efficacy. Furthermore, it allows them to harness the immense power of Artificial Intelligence (AI) to resolve customer challenges in a very effective manner.

#salesforce#salesforce for financial services#field service management#field service software#field service automation

0 notes

Text

A well-designed customer onboarding process can help financial services companies establish strong relationships with their customers and improve adoption rates. By streamlining the process, using digital channels, providing clear instructions, personalizing the experience, ensuring compliance, and following up with feedback, companies can create an effective onboarding process that meets the needs of their customers.

0 notes

Text

Overcome Legacy Solutions Limitations With Salesforce Cloud Products

Financial institutions, advisors, and consultants have to overcome the limitations of legacy solutions and ensure a seamless workflow while elevating their customer experience. To help, Salesforce for financial services is a complete ecosystem of technologies that streamlines complex processes, while delivering superior experience.

Salesforce Offerings for Financial Services

Financial Services Cloud

Portfolio Management

Database Integration

AI-Powered Analytics

Compliance Adherence

Customer-Centric Experiences

0 notes

Link

Explore the technologies enhancing Financial Services and BFSI sector including the Financial Services cloud. Features including account administration, financial planning tools, portfolio management, and compliance monitoring are available in the Salesforce Financial Services Cloud. To offer a complete solution for financial institutions, it also interfaces with other Salesforce products like Marketing Cloud and Sales Cloud.

#salesforce wealth management#Financial Services Cloud#Financial Services Cloud Trends#Salesforce Financial Services Cloud#Future Technolgy#Financial Services#Technolgy Trends#Artificial intelligence#Low-Code#No-Code#Low-Code Solutions#No-Code Solutions#Financial institutions#NBFCs#Assets management#Cloud implementation#Cloud-based infrastructure#Technology Adaptation#AWS financial services#Financial cloud salesforce#Cloud financial services#Salesforce for financial advisors#Financial cloud computing#Cloud based financial services#Salesforce finance#Salesforce FSC

2 notes

·

View notes

Text

Revolutionizing Banking with Salesforce Financial Services Cloud: A Tntra Success Story

Discover how Salesforce Financial Services Cloud is transforming banking with Tntra’s expertise. This success story highlights how financial institutions can enhance customer relationships, streamline operations, and drive growth through seamless digital transformation. Learn how Tntra helped revolutionize banking with customized Salesforce solutions, ensuring efficiency, security, and scalability.

0 notes

Text

Experienced Salesforce Consultant Seeking Financial Services Client

Looking for a challenging project?

Seasoned Salesforce consultants at FEXLE are specialized in Financial Service Cloud implementations. With a proven track record of delivering successful projects FEXLE can help you optimize your operations and improve customer satisfaction.

Learn More here !

#salesforce crm#salesforce financial services cloud#Fexle Services#Sf Consulting company#Banking Industry

1 note

·

View note

Text

Using Salesforce AI and CRM Analytics to Enhance Financial Planning

Introduction: In an industry where trust and personalized service are paramount, financial planning professionals seek tools that enhance client relationships and streamline operations. Salesforce Financial Service Cloud, combined with CRM Analytics and Salesforce AI, is setting a new standard for CRM solutions in the financial sector. This platform enables advisors to deliver precise, data-driven financial plans that align with clients' goals and preferences.

Enhancing Financial Planning with CRM Analytics: With Salesforce Financial Service Cloud, financial planners gain a 360-degree view of their client's financial status, goals, and preferences. CRM Analytics enables planners to assess this data in real-time, identifying trends and patterns that inform better financial planning decisions. For instance, it can highlight investment preferences and potential risk areas, allowing planners to tailor recommendations to the client's specific needs.

Leveraging Salesforce AI for Predictive Insights: Salesforce AI enhances financial planning by providing predictive insights that aid in future planning. For example, it can predict changes in client needs based on historical data, enabling advisors to proactively address these changes. Furthermore, Salesforce AI's automation capabilities allow financial planners to manage more clients effectively by automating routine follow-ups, freeing up time to focus on strategic planning.

Conclusion: By integrating CRM Analytics and Salesforce AI with Salesforce Financial Service Cloud, financial planners can offer clients highly personalized, data-informed financial guidance. This approach builds trust and enhances the advisor-client relationship, setting financial planners apart in a competitive landscape. As these technologies continue to advance, they promise even greater potential for revolutionizing the way financial planning is conducted.

0 notes

Text

Top 10 Advantages of Salesforce Use in the Banking Industry

In this fast and rapidly growing Virtual Environment , the banking sector is making a drastic change . The institutions belonging to financial services are revolutionizing to digital rather than adhere to physical locations.

Salesforce in the Banking Sector are becoming a smooth transition with customers, personalized evaluations. Banks are in search of more fond of the modern period to acquire this, and salesforce is leading this transformation for no doubt.

As we know that Salesforce CRM is the leading platform in the world and has equally become the essential tool for the bank sector . But the question comes why is salesforce so important to the banking sector ? Let us go through The Top 10 Advantages of Salesforce Use in the Banking Industry.

1. Enhanced Customer Experience

In the banking industry, customer satisfaction is given top priority. With Salesforce, banks may benefit from a 360-degree perspective of their client expectation. With the integration of customer data from many channels, banks are able to find the needs and provide a customer experience that encourages repeat business.

2. Streamlined Operations

Salesforce helps banks operate more efficiently by automating routine tasks, reducing guide mistakes. Salesforce streamlines processes, saves time, and lowers operating costs for loan processing, customer onboarding, and compliance assessments.

3. Improved Customer Retention

Maintaining customers is one of banks' most important tasks. Banks are able to identify customers that pose a risk, identify the reasons behind their discomfort, and take proactive measures to retain them by utilizing Salesforce's powerful analytics and AI-driven insights.

4. Robust Compliance Management

Banking relies heavily on action, and adheres to strict guidelines that must be followed. Salesforce ensures that all strategies are auditable by providing a centralized platform for managing actions.

5. Decision Making

Banks can make decisions based on facts thanks to Salesforce's excellent analytics tools. Through the examination of customer data, market trends, and economic performance, banks are able to make informed decisions that drive up profits.

6. Seamless Integration with Other Systems

For their operations, banks rely on a variety of technology, such as pricing gateways and center banking solutions. Salesforce provides smooth system integration, delivering a unified platform that boosts productivity and simplifies the administration of many pieces of equipment.

7. Enhanced Marketing and Sales Efforts

Salesforce's marketing automation tools enable banks to launch targeted programs, adjust their efficacy, and enhance them instantly. Banks may improve sales, increase conversion rates, and provide better results by coordinating their advertising, marketing, and sales operations.

8.Scalable and Customizable Solutions

Two of Salesforce's primary benefits are its scalability and personalisation. Salesforce expands with you as your bank does, offering new features and functionalities that support your expansion.

9. Improved Collaboration Across Teams

In banking, cooperation between specialized departments is crucial. Sales, advertising, compliance, and customer service are some of these divisions. Salesforce provides a platform for team collaboration that facilitates idea sharing, problem solving, and faster problem resolution—all of which enhance client outcomes.

10. Future-Ready Platform

The Banking industry continues in the future advancements in respective technology by keeping the client demands. Salesforce is a great platform that is completely ready for the future because it is constantly changing and implementing new features to match the current demands.

Salesforce is a comprehensive platform that helps banks modernize their operations, enhance customer experiences, and promote growth. It is more than just a CRM. Salesforce gives banks the data and resources they need to thrive in a world where customers have higher expectations than ever.

Now might be the perfect moment to investigate what Salesforce can do for you if you're in the banking sector. The benefits are obvious, and there are countless options.

#salesforce#banking#banking services#salesforcefinancial#salesforce crm#financial services#customerrelationshipmanagement

0 notes

Text

Top 10 Advantages of Salesforce Use in the Banking Industry

In this fast and rapidly growing Virtual Environment , the banking sector is making a drastic change . The institutions belonging to financial services are revolutionizing to digital rather than adhere to physical locations.

Salesforce in the Banking Sector are becoming a smooth transition with customers, personalized evaluations. Banks are in search of more fond of the modern period to acquire this, and salesforce is leading this transformation for no doubt.

As we know that Salesforce CRM is the leading platform in the world and has equally become the essential tool for the bank sector . But the question comes why is salesforce so important to the banking sector ? Let us go through The Top 10 Advantages of Salesforce Use in the Banking Industry.

1. Enhanced Customer Experience

In the banking industry, customer satisfaction is given top priority. With Salesforce, banks may benefit from a 360-degree perspective of their client expectation. With the integration of customer data from many channels, banks are able to find the needs and provide a customer experience that encourages repeat business. 2. Streamlined Operations

Salesforce helps banks operate more efficiently by automating routine tasks, reducing guide mistakes. Salesforce streamlines processes, saves time, and lowers operating costs for loan processing, customer onboarding, and compliance assessments.

3. Improved Customer Retention

Maintaining customers is one of banks' most important tasks. Banks are able to identify customers that pose a risk, identify the reasons behind their discomfort, and take proactive measures to retain them by utilizing Salesforce's powerful analytics and AI-driven insights.

4. Robust Compliance Management

Banking relies heavily on action, and adheres to strict guidelines that must be followed. Salesforce ensures that all strategies are auditable by providing a centralized platform for managing actions.

5. Decision Making

Banks can make decisions based on facts thanks to Salesforce's excellent analytics tools. Through the examination of customer data, market trends, and economic performance, banks are able to make informed decisions that drive up profits.

6. Seamless Integration with Other Systems

For their operations, banks rely on a variety of technology, such as pricing gateways and center banking solutions. Salesforce provides smooth system integration, delivering a unified platform that boosts productivity and simplifies the administration of many pieces of equipment.

7. Enhanced Marketing and Sales Efforts

Salesforce's marketing automation tools enable banks to launch targeted programs, adjust their efficacy, and enhance them instantly. Banks may improve sales, increase conversion rates, and provide better results by coordinating their advertising, marketing, and sales operations.

8.Scalable and Customizable Solutions

Two of Salesforce's primary benefits are its scalability and personalisation. Salesforce expands with you as your bank does, offering new features and functionalities that support your expansion.

9. Improved Collaboration Across Teams

In banking, cooperation between specialized departments is crucial. Sales, advertising, compliance, and customer service are some of these divisions. Salesforce provides a platform for team collaboration that facilitates idea sharing, problem solving, and faster problem resolution—all of which enhance client outcomes.

10. Future-Ready Platform

The Banking industry continues in the future advancements in respective technology by keeping the client demands. Salesforce is a great platform that is completely ready for the future because it is constantly changing and implementing new features to match the current demands.

Salesforce is a comprehensive platform that helps banks modernize their operations, enhance customer experiences, and promote growth. It is more than just a CRM. Salesforce gives banks the data and resources they need to thrive in a world where customers have higher expectations than ever.

Now might be the perfect moment to investigate what Salesforce can do for you if you're in the banking sector. The benefits are obvious, and there are countless options.

#salesforce#banking#banking services#salesforcefinancial#salesforce crm#financial services#customerrelationshipmanagement

1 note

·

View note

Text

#job interview#employment#inside job#job search#work#career#online jobs#jobseekers#jobsearch#jobs#it jobs#part time jobs#working#jobcal#new job#job hunting#banking jobs#banking sector#banking services#financial#finance#sales#salesforce#marketing#placement engineering colleges in bangalore#placement agency#placement consultancy#placement assistance#placement service#recruitment services

1 note

·

View note

Text

Maximizing Business Potential with Salesforce Financial Service Cloud

In today's rapidly evolving financial landscape, customer satisfaction and operational efficiency are paramount for success. This is where Salesforce Financial Service Cloud comes into play. But what exactly is Salesforce Financial Service Cloud?

What is Salesforce Financial Service Cloud?

Salesforce Financial Service Cloud is a specialized customer relationship management (CRM) platform designed specifically for financial service providers. It offers a comprehensive suite of tools and features tailored to the unique needs of banks, credit unions, insurance companies, wealth management firms, and other financial institutions.

In Easy Understandable Terms:

Imagine you're a bank or an insurance company. You have a lot of customers, each with their own unique needs and preferences. Managing all of this information, from customer interactions to financial data, can be overwhelming. Salesforce Financial Service Cloud acts like a supercharged organizer and communicator for your business. It helps you keep track of every customer interaction, from opening an account to resolving a support issue. It also gives you insights into your customer’s financial needs, so you can offer them the right products and services at the right time.

Advantages of Salesforce Financial Service Cloud:

Enhanced Customer Experience:

By centralizing customer data and interactions, Financial Service Cloud enables personalized and seamless experiences across all channels.

2. Improved Operational Efficiency:

Streamlined processes and automation features reduce manual workloads, allowing financial institutions to focus on delivering value to customers.

3. 360-Degree View of Customers:

Financial Service Cloud provides a comprehensive view of each customer's financial journey, empowering agents to provide informed and proactive service.

4. Scalability and Flexibility:

As a cloud-based solution, Financial Service Cloud can scale with the growth of your business and adapt to changing market demands.

5. Compliance and Security:

Built-in compliance features ensure adherence to regulatory standards, while robust security measures safeguard sensitive financial data.

Features of Salesforce Financial Service Cloud:

Client Management:

Easily manage client profiles, preferences, and interactions in one centralized location.

2. Financial Account Tracking:

Track financial accounts, transactions, and balances in real-time for a complete picture of each customer's financial status.

3. Case Management:

Efficiently handle customer inquiries, complaints, and service requests with automated case management tools.

4. Financial Planning and Advice:

Provide personalized financial advice and planning recommendations based on individual customer goals and circumstances.

5. Integration Capabilities:

Seamlessly integrate with existing systems and third-party applications to leverage data from across the organization.

Implementation of Salesforce Financial Service Cloud:

Implementing Salesforce Financial Service Cloud involves several steps:

Assessment:

Evaluate your current processes, data structures, and goals to determine the scope of implementation.

2. Customization:

Customize the platform to align with your organization's specific requirements, including data fields, workflows, and automation rules.

3. Data Migration:

Migrate existing customer data from legacy systems into Financial Service Cloud while ensuring data accuracy and integrity.

4. Training:

Provide comprehensive training to employees to ensure they are proficient in using the platform effectively.

5. Testing and Deployment:

Thoroughly test the system to identify any issues or discrepancies before deploying it for full-scale use.

6. Ongoing Support:

Provide ongoing support and maintenance to address any issues and optimize the platform for continuous improvement.

Conclusion:

In the competitive landscape of the financial services industry, staying ahead requires a combination of exceptional customer service, operational efficiency, and compliance adherence. Salesforce Financial Service Cloud offers a comprehensive solution that addresses these needs, enabling financial institutions to deliver personalized experiences, streamline operations, and drive growth. By leveraging the advantages and features of Financial Service Cloud and following best practices for implementation, organizations can unlock new levels of success and establish themselves as leaders in the industry.

0 notes

Text

Softtune Technologies' expert salesforce team is well-versed in sales cloud, service cloud, integrations, salesforce lightning architecture, and many other topics. Our salesforce wizards are dedicated to providing long-term business value to our clients. We understand your industry-specific needs and can help you improve your capabilities.

#salesforce consulting services#salesforce services#salesforce solutions#salesforce development services#salesforce professional services#salesforce financial services cloud#salesforce service cloud

0 notes

Text

Ensure Seamless Workflow With Salesforce for Financial Services

Implementing Salesforce for financial services helps businesses overcome the limitation of legacy solutions, ensure a seamless workflow, and deliver superior quality customer experience. You can also streamline complex processes with powerful tools, meet strict security, regulatory, and compliance requirements, all while promising client satisfaction and improved user experience.

0 notes

Text

Unlock the full potential of your financial services business with Salesforce Financial Service Cloud solutions with GetOnCRM Solutions. Salesforce Financial Service Cloud is a comprehensive solution designed to meet the unique needs of financial institutions.

1 note

·

View note