#roice entertainment

Explore tagged Tumblr posts

Text

Hi, before I explain my post, I want to say something important.

• What you see my blog has become a major overhaul. And despite the changes, I decided that my 2nd account will be now my artwork blog with a secret twist.

⚠️NEW RULE! (W/ BIGGER TEXT!)⚠️

⚠️ SO PLEASE DO NOT SHARE MY 2nd ACCOUNT TO EVERYONE! THIS SECRECY BLOG OF MINE IS FOR CLOSES FRIENDS ONLY!⚠️

• AND FOR MY CLOSES FRIENDS, DON’T REBLOG IT. INSTEAD, JUST COPY MY LINK AND PASTE IT ON YOUR TUMBLR POST! JUST BE SURE THE IMAGE WILL BE REMOVED AND THE ONLY LEFT WAS THE TEXT.

⚠️ SHARING LINKS, LIKE POSTS, REBLOG POSTS, STEALING MY SNAPSHOT PHOTOS/RECORDED VIDEOS/ARTWORKS (a.k.a. ART THIEVES) OR PLAGIARIZING FROM UNKNOWN TUMBLR STRANGERS WILL IMMEDIATELY BE BLOCKED, RIGHT AWAY!⚠️

😡 WHATEVER YOU DO, DO NOT EVER LIKED & REBLOG MY SECRET POST! THIS IS FOR MY SECRET FRIENDS ONLY, NOT YOU! 😡

Okay? Capiche? Make sense? Good, now back to the post…↓

#Onthisday: Jun 9th, 2010

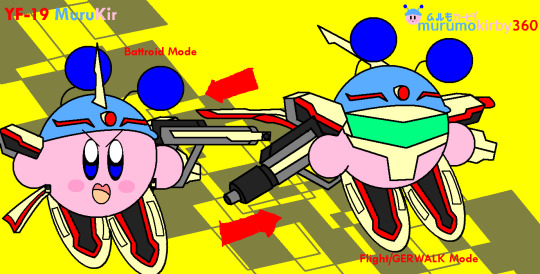

Title: YF-19 MuruKir

Three in a row now! MuruKir got a new armored, the "YF-19"! ✈️

And once again, it went vacant & defunct. And much like "Lancelot" & "Nirvash", it was now the hands of other Cuteness Defender members.

MuruKir 🔵⭐: That's right, I'm giving all of my lesser Cuteness Mecha armors to the members who had responsibility rights. So proceed with care, please. Thank you. 🤲🙂

Now, let's continue...

YF-19 MuruKir Based on the: YF-19

Armament(s): • Mauler REB-30G anti-aircraft laser gun turret (mounted on head) • Howard GU-15 standard external Gatling gun pod (stored under main body in Fighter mode, hand-carried in Battroid and GERWALK modes) • Standard bulletproof shield (mounted on left forearm) • 2x semi-fixed internal Mauler REB-20G converging energy cannons (mounted on wings) • 2x Stonewell/Roice B-7 standard internal pallets (features air-to-ground/air general purpose micro-missiles) • Bifors BMM-24 high maneuverability micro-missile cluster

Fixed: • 2x Mauler REB-23 laser cannons (replaces Mauler REB-20G converging energy cannon) • 2x B-19A internal weapons pallet, replaces other missiles

MuruKir - created by ME! Armor ( Macross Plus) - Macross Series © 1985-2007 Harmony Gold USA, Inc., © 1995-2010 Manga Entertainment, © Bandai Entertainment.

2 notes

·

View notes

Text

Testing the Fed

Testing the Fed

The bond vigilantes are pushing rates higher, testing the Fed's resolve to maintain an overly accommodative policy. All this while the economy picks up steam along with inflationary expectations. The yield curve continued to steepen last week, with the 10- and 30-year treasury yields rising to 1.557% and 2.304%, respectively. Stock markets came under further pressure fearing much higher rates as the economy picks up steam as we get our arms around the virus and trillions of additional stimulus hits the economy.

While rising rates due to an improving economy is a good thing, the Fed has put themselves out there repeatedly, saying that they are willing to let the economy run hot with inflation running above 2% for quite some time. The market has not only reacted to the rise in rates, but it was also the velocity in change that had even greater, more significant effect on investors. The Fed has many options to slow the steepening yield, like operation twist where the Fed focuses on buying long bonds. We would expect the Fed to say something at its next meeting in two weeks regarding the steepening yield curve rather than just saying that the sudden move was a surprise.

We fully expect the markets to fight a tug of war over the next 18 months between rising economic growth/inflation/earnings/cash flow, a steepening yield pressuring multiples and rising earnings. We are not worried that long-term inflation/inflationary expectations/interest rates will run away. ��We see large productivity gains ahead, lowering unit labor costs, global competition, more disruptors, and above-average tech spending reducing costs. Operating margins are expected to increase to over 12.5% in 2022, up from 10.4% in 2020, with operating earnings growing from $140/share in 2020 to over $205/share in 2022. The market sells below 22 times and 19 times our calendar 2021 and 2022 S & P earnings estimates, which offers upside, especially for those companies leveraged to the economy selling at discounts to the market.

Corrections are never fun, but you need to put all of this in perspective.

Let's look at with the major issues facing the market today.

Getting our arms around the coronavirus gets better each week as the number of cases and deaths continues to decline. In contrast, the number of people getting vaccinated accelerates week over week to now over 2 million vaccinations per day. Biden predicted this week that everyone could be vaccinated by the end of May. That is dramatically far ahead of earlier expectations. We have not changed our view that everyone in the world could be vaccinated by year-end, thus putting the virus in the rearview mirror as we move forward. Also, watch openings accelerate big time over the next few months

Investors are focused on Fed maintaining an overly accommodative policy as the economy heats up, boosted by additional stimulus on the way. Powell said last Thursday "that we are still a long way from our goals of maximum employment and inflation averaging 2% over time.” He is concerned by the tightening in financial conditions that threaten the achievement of our goals… and the Fed has tools to address the tightening in financial conditions." While Powell expects inflation to increase as the economy picks up steam initially, he still does not believe that it is sustainably above 2%. We agree.

We expect Congress to pass close to a $1.7 trillion stimulus bill within the next ten days. The final bill will include $1400 checks for individuals; an increase in unemployment assistance; more aid to states and municipalities; nutrition assistance; housing aid; tax credits for families and workers; more money for education and childcare; additional health insurance subsidies; more money for small businesses; and finally, lots of money for vaccines, testing, and hospitals. Most of this added money will not flow into the economy until much later in the year or not until 2022. Well over $650 billion of the January stimulus bill still has not hit the economy. Now you can understand why the bond vigilantes are concerned with all this excess liquidity in the system with much more on the horizon, including a multi-trillion demand-focused stimulus bill, which we expect by the summer. We get it but believe their fears to be premature by at least a year.

Stock markets go up even as inflation and interest rates are rising if it is due to accelerating growth. Data points support our view that the economy has already taken off: new orders for manufactured goods increased 2.6% in January; shipments rose 1.9%; inventories rose only 0.1%, so the inventory/shipment ratio fell further; the Beige Book showed business optimism increasing as vaccines roll out, overall conditions are improving moderately, price/input increases are modest, and employment is increasing albeit slowly; construction spending increased 1.7%; the Feb Manufacturing PMI rose to 60.8; new orders registered a healthy 64.8; production index rose to 63.2; backlog increased to over 64 and finally February retail sales jumped 4.5% excluding gasoline. The February employment report was better than expected, increasing by 279,000. It was the first sign that openings are accelerating in leisure and entertainment, where jobs rose over 355,000 as pre-pandemic restrictions were lifted. That's a pretty impressive set of numbers and remember that all of this is still amid the pandemic and before the additional stimulus.

An overheating economy down the road? Bet on it, but we see inflation staying contained longer term due to substantial productivity gains as corporations do more with less. This presents a problem for the Fed, who are focused on bringing down unemployment to pre-pandemic levels. Employment gains will accelerate for sure, but we still are over 10 million jobs below pre-pandemic levels.

Accelerating global growth is a vital part of our investment thesis. China, the second most important economy globally, has set a target of exceeding 6% growth in 2021 vs. 2.3% in 2020. While the government intends on accelerating spending in 2021, primarily for technology, it expects to reduce its deficit to GNP to 3.2%, which is good news. We are pleased that the government is also focused on strengthening its financial system. Growth is bottoming in Europe and is beginning to expand in Japan, India, and many other countries in the Far West. All of this is welcome news as growth/putting deflation on the rearview mirror is good. We were surprised that OPEC decided not to increase production showing real discipline, as is evident in most industrial commodities where supply growth will lag demand growth for several years, creating higher prices and investment opportunities.

Investment Conclusions

Growth is good, and we take the Fed at its word that it will not change its accommodative stance until unemployment returns to pre-pandemic levels, which will not happen until mid -2022 at the earliest. Stock markets go up during periods of accelerating growth and rising yields until we near the end innings of the expansion after many tightening, which is funny even to mention as we are just in the beginning of this new expansion. We are not able to quantify the trillions already in the system with trillions more on the way. It is hard to see much risk in the markets with all that liquidity sloshing around. We would take this correction as an opportunity to invest with an 18–24-month time frame focusing on those companies most leveraged to the economy selling at a considerable discount to future earnings/cash flow.

We are investing in both cyclical and secular plays, which will benefit from current and future stimulus especially focused on those companies tied to EV, 5G, clean air, infrastructure, and technology. Besides a significant improvement expected in operating margins and earnings, we are forecasting a meaningful improvement in cash flow and ROIC such we envision a large hike in dividends and buybacks, which is good for stock evaluations.

Our concentration areas include global capital goods/industrials/machinery; industrial/agricultural commodities; financials, transportation, technology, and special situations, including some opening plays. Each investment has superior management, winning short/long term strategies, and sell at a sharp discount to intrinsic value. Continue to sell defensive holdings, bonds, and any highflier selling at a huge multiple of sales without real earnings.

The Fed should stay its course supporting growth. Should they consider operation twist? Yes, to keep pressure on the longer end of the yield curve. But most of all, the Fed needs to maintain its credibility. Remember that we are in the early innings of the recovery, and inflation is likely to pick up until shortages end and productivity kicks in. Stay the course!

Our weekly webinar will be held on Monday, March 8th, at 8:30, am EST. You can join the webinar by entering https://zoom.us/j/9179217852 into your browser or dialing +646 558 8656 and entering the password 9179217852.

Remember to review all the facts; pause, reflect and consider mindset shifts; look at your asset mix with risk controls; turn off your cable news; do independent research and …

Invest Accordingly!

Bill Ehrman

Paix et Prosperite LLC

917-951-4139

1 note

·

View note

Text

Kathy Ireland Presents Loved Ones Collection for Latest Goodnewsforpets Anniversary Contest

The giveaway is now closed. Thanks for everyone who entered! Congrats to our Winners! Rebecca Day from Portland, OR, whose donation will go to the Oregon Humane Society. Faye Boss from Clifton, CO, whose donation will go to the Roice Hurst Humane Society. Carol McLaughlin in Croydon, PA, whose contribution will go to the Women’s Humane Society. Mike Skrzypek from Howell, MI, whose contribution will go to the SPCA Florida. Each winner gets the exclusive sterling silver Goodnewsforpets ? Heart-Paw charm and a gift to the shelter or rescue with their selection!

In celebration of the GoodNewsforPets.com 15th anniversary competition series, we are delighted to announce that Kathy Ireland Loved Ones set is our featured partner for December.The contest will run from December 10, 2015 during December 29, 2015. Winners will be announced December 30, 2015.

Each of 3 winners will Get a Durable Whale Dog Toy using Treat Pocket, Durable Fox Toy, a Hide & Seek ball in pink or blue, and the Crinkle Bunny Dog Toy. Winners will also receive a custom designed Goodnewsforpets.com Elena Kreigner Silver Paw Charm PLUS designate a private donation to your local shelter of her or his choice.

Crinkle Bunny Dog Toy

Surprise your beloved pup with these durable, endearing toys just in time for summer time. For those chilly days where playing outdoors is not an option, bring the warmth indoors with infinite hours of entertainment and cuteness using Kathy Ireland Loved Ones Collection.

Hide and Seek Dog Toys Available in Pink and Blue

Let's embrace it, our furry friends love to play. With Kathy Ireland's Loved Ones toys, durability is crucial and her toys are constructed to last for many years of fun and games.

The Crinkle Bunny Dog Toy is overstuffed, featuring an interior lining to defy dogs who love to chew. The toy also has a concealed crinkle material that encourages pets to comfortably playwith.

The Hide & Seek toys feature a patent-pending light switch, ideal for playtime through the night, preventing the toy from being lost during evening fetch time. The balls are also conveniently water-resistant, available in blue or pink, and can be used with most well-known launchers.

Durable Whale Dog Toy with Treat Pocket

The Durable Whale Toy with a treat pocket is a cuddly, plush yarn toy using a heart-shaped pocket for treats, and also a built-in squeaker encourages play alongside the inner liner for added durability.

The Durable Fox Toy is cute and rugged, made of a durable canvas, overstuffed to stand up to heavy chewers.

Permanent Fox Dog Toy

To find out more about Kathy Ireland's Loved Ones, take a look at the collection on line at https://lovedonesproducts.com/.

Register now for your opportunity to win and share in your social media accounts using #GNFP15thAnniversaryContest!

Watch for much more 15th Anniversary contests on goodnewsforpets.com. For businesses interested in sponsoring contests, contact Lea-Ann Germinder.

0 notes

Text

heckofabecca replied to your post “heckofabecca replied to your post “the “pym and his wife at the time...”

"very different outlooks on the government and the military "

heckofabecca replied to your post “heckofabecca replied to your post “the “pym and his wife at the time...”

TELL ME MORE

OKAY i’ll just stick this on my blog in case anyone else is interested but it’s v long and rambly right now, i hope it makes sense

so basically, like I said in the other post, Marna is 12 when the Pretendership happens and it kind of fucks up her family. Her brother is killed, she sees her neighbors and father carry him home after her sister finds him shot dead in the street, and after it’s all over he gets no recognition from the government/no honorable military burial because he was technically still a deserter when he died. the Koskinens don’t feel great about the military after that, and Marna’s younger brother decides not to join up because of what happened to Elias. also parts of the city get destroyed, and it’s all so sudden - Vordarian’s coup caught Aral and Negri by surprise, so your average prole with no connection to any of the major players was probably even more unprepared. Marna grows up wondering how and why something like this could happen, which is part of what leads her to study history and politics when she goes to college. growing up in the capital, she doesn’t have the kind of loyalty to a particular count that people from other districts (like Pym) do, and her university education didn’t really make her any less cynical about the Vor class.

so Marna has all these reservations about the military - it’s not that she dislikes or distrusts individual soldiers, but she’s not wild about the institution, and at first she probably doesn’t want to seriously entertain the idea of dating/marrying a soldier because that person could be taken away from her at any time without warning - it happened to her brother, after all. of course then she and Pym start to get to know each other and that becomes.....something she has to come to terms with because she REALLY likes this guy

Pym, on the other hand, grew up in Vorkosigan’s District (all we know he’s not from the Dendarii Mountains, but i decided to headcanon that he was a farmer’s son from the lowlands) and joined the army at a young age, and fought for his count and his count’s son in the Pretendership, and while the Pretendership was scary and confusing and he lost friends, his family was far away from the fighting and didn’t get hurt, and he never had to compromise his loyalty to his liege lord, and without it he might not be where he is today. It’s not something he thinks about a whole lot anymore, he’s mostly moved on with his life and put it behind him. But at some point, he and Marna get to know each other well enough and things are getting serious enough between them that she tells him about her experiences during the Pretendership, and it forces him to view the whole thing in a different light, as something other than just the defeat of a usurper.

anyway they obviously work all this out because they do get together, but Pym does end up leaving the military after his first 20 years are up specifically for his wife and daughter, and I think Marna’s lingering fears about the army had to have something to do with that. of course, then he becomes an armsman, which is a whole different kind of weird to navigate, mostly because Marna now finds herself having to deal with this whole loyalty-to-a-Count’s-household thing that she had previously only viewed from an academic distance. it’s interesting to note that the Pyms don’t live in Vorkosigan House, but have their own apartment in Vorbarr Sultana, and I think Marna definitely wanted her family to continue to have their own space. she feels kind of weird about the whole thing at first, but the job has lots of advantages over the army, and the Vorkosigans seem okay as High Vor go. the post-Mountains of Mourning fic i wrote deals with this a little bit.

later on I think Marna comes to like the Vorkosigans quite a lot, and obviously her kids spend a lot of time at Vorkosigan House, her son becomes good friends with Nikki, her daughter marries Roic, etc. I also like to imagine that Helen Vorthys was one of her favorite professors back when she was a student, and maybe her thesis advisor or something, and the two of them still chat sometimes, which makes the class boundaries a bit messier once Ekaterin becomes Lady Vorkosigan. I also like to think that Marna and Duv were classmates for at least a little while (i think she’s about 2 years older than him, so if he also did his undergraduate degree in Vorbarr Sultana they probably had some classes together) so she’s also on first-name terms with the chief of ImpSec Komarr.

backing up a little, i have a specific headcanon about the first time Marna and Aurie go to Vorkosigan Surleau with Pym (it’s during Aurie’s school vacation maybe so they don’t have to stay in the city). Marna’s either very pregnant or dealing with tiny infant Arthur, and Pym is busy doing Armsman things, and everyone else has things to do and there aren’t any kids Aurie’s age (about seven) around, so she ends up wandering off by herself. she climbs around in the old castle ruins or something and falls and breaks her leg, and she can’t get back to the house. when her parents can’t find her, everyone in the household goes out to help look for her, including Aral and Cordelia. Cordelia is in the group that finds her, and Aurie’s super upset and so are her parents, but Cordelia’s super calm and has painkillers and an inflatable cast on hand and knows exactly what to do from all those times Miles broke bones as a kid, and she helps get Aurie calmed down and is super nice and on top of everything. by the end of that incident, Marna is officially pro-Cordelia instead of just being like “she seems nice I guess.”

14 notes

·

View notes

Text

Headlong Investors Taking a Look at SKYCITY Entertainment Group Limited (NZSE:SKC)

Looking at some ROIC (Return on Invested Capital) numbers, SKYCITY Entertainment Group Limited (NZSE:SKC)'s ROIC Quality Score is 13.255600. from Google Alert – business https://ift.tt/2HTCUdp via IFTTT Advertisements from BUSINESS – NZRT NETWORK https://ift.tt/2HWxM8p via IFTTT

0 notes

Text

Week 1 University Football Picks.

Every month our company construct a theoretical long/short collection of stocks that demonstrate strong loved one market value along with possibility for on-going cash flow growth and ROIC development. The month from June tries to bring a time of transfiguration, transmigration and/or change. Washing the hair with a mix of prepared black gram as well as fenugreek extends the hair. However, this year, Dark Record Month, an opportunity indicated to celebrate and also take advantage of introduction, additionally comes down at a disgraceful instant in American past. Amal may combine the different colors dark in her swimwear along with the Tainted Affection bikini. Max Afro-american at that point gives considerable assistance as well as recommendations on effective ways to defend your own self and also stay away from becoming a sufferer of each particular approach. There is a bunch of terrific information and sources about ordinary black little one clothes. Second hand stair lifts must be every bit as reputable as an all new assist and also most respectable companies will certainly use the exact same YEAR warranty. Listed below is actually a guide of just what you can count on to see in the course of monetary education month. Assemblyman Tony Cardenas, D-Panorama Metropolitan area, will kick off Latino Ancestry Month at L.a Goal University 7 to 9 p.m. today with a speech on the subject matter of "Uniformity and Variety" at the University Facility amphitheater. In December 2015 StubHub possessed circa 120 companions; besides home entertainment places as well as sports teams, innovation partners feature Apple Inc, 77 Spotify, 78 BandPage, 79, 80 as well as Uber, 81 and many mores. This will certainly reduce many of your hesitancy for opting for a 6 Month Braces Smile. Fortunately severe allergies to black pepper are uncommon and also it is just a few people who find themselves unable to accept also percentages this historic flavor. The week-old struggle in the Old Metropolitan area is becoming the most dangerous of the eight-month U.S.-backed campaign to reclaim the northern urban area, which droppeded to the militants in June 2014. Enrollment for the program is available and also last date from registration is TWENTY August 2015. Early in the month I got concerning yet another $185 coming from a few of my new fixed income investments, which gave me simply under $500. Consequently you ought to listen when the information emerges (the final Tuesday from each month). A teleconference is planned for 11:00 AM Eastern, today, Thursday, November 12, 2015. That is a point from joy to join you in celebrating your baby's complete month in the land from the residing. If you run in to a trouble as well as begin paying all of them overdue or even less compared to exactly what they want each month, particularly. Final month I reported that web traffic had actually been actually paralyzing back up; this month that was actually piekno-i-sila.pl halved. Victoria herself was able to hang on this diet regimen for a month as well as fell 22 pounds! This month produces an increase in her close area, as well as more of her ever-widening globe is actually currently in emphasis. UNITED STATE Self Defense Secretary James Mattis informed his verification hearing this month this was actually not to our benefit to leave any kind of part of the globe" to others. . Information off recent trials have shown that Laser Luce hair considers improved over a 6 month period and that these end results were maintained over the adhering to 6 month term. To maintain the recipes convenient, only remove the beloved dish pages from aged magazines, put them in plastic web page protectors as well as position them in notebooks. One of the most unbelievable photographes from the month component remarkable settings from snowy winter months in Alberta province, Canada, sunrise in Bali coastline, warm as well as making lighter bistro in Slot Orford, Oregon.

0 notes

Text

Thoughts on nxt 22/02/2017

this was a busy week for nxt a womans number one contender match more uk stars debuting and a certain “hero” made his redebut onto the nxt roster lets see how it played out

Payton royce (W) vs Liv morgan (L) vs Ember moon for the nxt womans title number one contender spot- When i saw this match booked last week I thought that Ember moon would no doubt come out of this match a dominate nxt womans number one contender. Possibly beating askua next week leading to a blow off at takeover orlando. So you can imagine my surprise when ember spent half the match outside while liv morgan tore it up inside the ring at one point i even thought the 201 native was gonna win it booting ember moon yet again to the outside only for payton roice to roll her up and secure the win ...... do i think roice will win next week probably not but with nxt going to great lengths to secure ember moons winning streak i think its still safe to say were getting ember vs asuka at takeover (3/5)

pete dunne (w) vs mark andrews (L) - Last week trent seven and tyler bate put on a (5/5) match for the wwe uk championship this week pete dunne and mark andrews put on a (5/5) match just for the fun of it. in what was a rematch from the semi finals of the uk title tournement this match was all the previous matches best bits and more this match to me at least was one of those matches to just sit back and watch in awe and if this is what the wwes uk division is all about im very much ready for more (5/5)

bobby roode (w) vs no way jose (L) - given the match that came before it these guys had a lot of work to do to keep fans intrested and from a actually soild wrestling standpoint i dont think they did but from fun entertainment standpoint they delivered in spades there was alot of comedy in this match alot of taunting dancing etc defintly more than enough going on to keep people intrested (3/5)

The return of a hero - after the bobby roode vs jose match (bobby winning by roll up) roode started to unloaded on jose getting him into a boston crab and wrenching at the leg in the hopes of injurying him this lead to the on screen return of indie hero and all around amazng wrestler chris hero (well cassius ohno) who saved jose and then cut a promo explaining hes back to capture the nxt title (hero being realised from nxt in 2012) roode then claimed to be a fighting champion but while ohno had his back turned roode cheap shotted ohno leading to a quick scrap between the two which i can only hope will lead to a three way nxt title match (ohno vs roode vs nakamura) at nxt takeover orlanndo

overall this weeks nxt was a soild and exciting affair likely to get more exciting next week with both a womans and tag title match (4.5/5)

0 notes

Text

☆ Shigure Ui // Shigure Ui Channel "masterpiece" ☆ F:Nex / 1/4 / FuRyu ☆ August 2025 ¥24,200 ☆ Sculpt / Paint Roice Entertainment

18 notes

·

View notes

Text

Diary of a Madman, Page 28

9,000 people peering inside. Don’t get trapped.

I. This Week’s Analyses

An interesting week, this. A mixture of robotics, trading, product mechanics, and foreign affairs.

Transforming the Stock Market into a Game: product mechanics in search of an aspiring entrepreneur who wants to build a startup around it.

The Real Truth Hidden in Snap’s S1: marketing is powerful, be careful you don’t confuse a company’s value with what you like, or dislike, about their product.

How to Live in London Until Trump’s Impeachment: get a 5-year Visa lickity split, on the cheap.

ROS 2.0 Update, January 2017: Amazon, Google, Facebook, Apple don’t yet have their hands in this. Wreaks of opportunity and undervalued-ness.

Object Libraries for AR Apps are the Future of Video: comment of the week on The Information

The Fountainhead Movement: New for Members Only

How You Can Create Every Day

Innovation Model of the Future

Earnings Release Season

Why Robotics Manufacturing is the Next Gold Rush

Rules of Mankind Versus Laws of the Universe

Join The Fountainhead Movement for $9/month before the price goes up again.

II. Global News Pointing To Our Theses

Bookmark the 12 Tech Theses if you haven’t already.

Video as an App: major airlines are doing away with seat-back entertainment. Bring your own device powered by Piksel Voyage. Tim Cook: “More things coming for Apple TV” meaning original content and access point for consumer relationships. Netflix still 2nd fiddle to Apple TV hardware. Facebook getting into OTT original content, saying they’re replacing the News Feed with Video Channels. Movie theaters aren’t dead yet.

Music as a Control Mechanism: Apple Music API, suggested music from your emotion.

Biologic Intelligence Disrupting AI: cortical columns, penguin’s behavior keeps self-driving cars safe, Biologic Intelligence that encrypts itself using Biologic Intelligence. So strong not even quantum computers can crack it. AI Awards are out, Biologic Intelligence won for Best AI in Robotics.

Space as a SAAS Platform: NASA’s space mining mission, did you know that one rich asteroid could make every precious metal as cheap as gravel? Some asteroids are that valuable. Private space stations. Watch Luxembourg closely.

Automatic Health Optimization: Reiki.

Personal Hedge Fund: +72% return in a year. 550 CEOs listed the recession, technology, and cybersecurity as their top 3 worries. Facebook’s Economic Profit is now +14% (16% ROIC — 2% WACC). Nike: 23%, Apple: 19%, Nvidia: 13%, Amazon: 8%, Tesla: -15%. What if Apple’s stock price growth prospects have nothing to do with hardware products: 1. Services, 2. Share Buybacks. TheBaseCode.com.

Personal Power Stations: Tesla no longer is just about “motors”, removing the last part of their name after the combination with Solar City. Charge your phone from across the room without wires.

Self-Organizing Biorobotics: roadmap for US robotics, which had the highest CAGR of any sector over the last 10 years, opportunities are everywhere; artificial cells that build themselves.

Autonomous Internet of Things: Humans have created a form of matter where time loops back upon itself, in perpetuity. You can’t tell me magic isn’t real. Apple has 1 million CarPlay users, that’s a pretty decent marketing list for the upcoming Apple Car ($35K car * 1 mil users = $35 trillion revenue). Not much real driving is happening in the self-driving industry.

Reality Retail: Gen Z retail arbitrage against AI fashion stylists, Amazon accounts for 50% of all online sales growth, new Tiffany & Co CEO.

Interstellar Sports Wearables: We almost got hit by another asteroid and nobody is talking about it. 25x bigger and we’re toast. We need to get on this, folks.

Superhuman Modifications: new material conducts electricity, but not heat. Important for implanting electronics into the human body.

III. Philosophy of a Mad Man

Venture Capital: The ones whose job it is to think differently, often don’t. You can’t get a PhD in something that’s never existed before, by definition. You can’t understand the future using analogies from the past. The question, then, is what to do about it if you’re a startup who’s invented something never before created by mankind. You go straight to the LPs, of course, and cut out the middle man. Younger generation VCs, however, seem to get it, faster.

LPs: Softbank’s $100B fund is actually Private Equity, not VC. Taken with the above, are we on the verge of a new startup fundraising trend?

Robotics & AI: Did you know the average round size for a Series A robotics or AI startup that raised capital from 2015 to 2017 was $10M?

Stats: Xbox Live has 55M MAUs.

Valuation: So if TIDAL is worth $600/sub at 1M subs, then Apple Music at 20M subs = $12B biz just for streaming service & MRR, which doesn’t include Beats. Apple paid $3B for Beats, which means they already have a 4x return not including value of Beats hardware.

Jobs: Piksel is hiring all over the world, Head of Product

M&A: put together an investment brief for a very undervalued gym chain a few years back. Might share the brief and write about it in light of Bloomberg’s latest article.

Prediction: Sheryl Sandberg is going to be named Facebook’s new CEO soon. If not, she’ll move to Disney to be Iger’s successor (she’s on their Board).

Country of the Week: Malaga, Spain. Incredible talent and culture that won’t break the bank. You can help bring the economy back. We already are.

New Skills: You can get your pilots license with only 40 hours of flight time. 8 hours gets you a solo stick. Amazing.

Research: search engine for your investigative journalism.

Quote:

The Mechanics of Magic are real. You think it. It becomes reality. Another human is affected by it.

I will, one day, write the how-to book aptly titled, “The Mechanics of Magic Are Real: how to transform desire into reality”.

— Sean

Read The Rest

27, 26, 25, 24, 23, 22, 21, 20, 19, 18, 17, 16, 15, 14, 13, 12, 11, 10, 9, 8, 7, 6, 5, 4, 3, 2, 1

Join The Fountainhead Movement for exclusive access to bleeding edge think pieces and technological inventions.

Humanizing Tech is a premiere technological think tank for building humanity’s future. It covers autonomous robotics, self-learning AI, superhuman augmentation, personal hedge funds, editable DNA, SAAS space platforms, personal power stations, and video as an app. This newsletter is a peek inside the Editor’s mind.

Diary of a Madman, Page 28 was originally published in Humanizing Tech on Medium, where people are continuing the conversation by highlighting and responding to this story.

from Stories by Sean Everett on Medium http://ift.tt/2ke2QAq

0 notes