#rohde & schwarz

Explore tagged Tumblr posts

Text

Finally...

I was looking for a really good shortwave receiver for at least a decade -an old tube equipped one of course. The problem getting one nowadays is that they were only produced in small numbers half a century (or more) ago, since then most are scrapped, botched, altered or corroded cause of bad storage -or all together. So if you have the chance getting one today you most likely will buy a 'construction site', needing hundreds of working hours for restoring it in a good working condition.

But after a looong search finally i had real luck. A big wooden crate was delivered on a pallet.

In this crate was one of the -for my opinion- ugliest shortwave receivers ever built, but at the same time also one of the best ones: a Rohde + Schwarz EK07.

Built in 1958 this one was a storage unit from the German Army. Well stored, regularly maintained and serviced, not altered, not botched, never used. So it is in nearly mint condition. It wasn't cheap but getting my hands on this was just sheer luck. Without doing anything: it's in perfect working order. No potentiometer, no switch crackles, every tube checks new -of course you can check all the tubes in the radio itself without removing them.

The manufacturer is more known for it's precision Lab-Equipment and less for it's shortwave receivers. This is also because their receivers weren't consumer or amateur gear, this was pro gear by any means. They were used in applications like coast guards or military surveillance and such. Always things where equipment costs doesn't matter -only the outcome. So back in 1958 when this unit was manufactured you could buy at least two brand new cars for the same amount of money. In exchange for this you got a masterpiece of german engineering and craftsmanship -and also an electro-mechanical nightmare if anything fails and you're not absolutely familiar with it's guts.

Fancy? No, there's absolutely nothing fancy on these. These are absolute workhorses, designed for doing an important job 24/7/365 for decades. Just take a look to that bandswich gear in the photo above. How often you have to switch over the bands until this would be worn out? Millions and Millions of times... And nope: this dark residues at that drum on the left and box below isn't mold or such. These are completely silver plated so it's just the darkened silver.

As you may see, most of the structural parts are made of die-cast and aluminum, so from the materials used it's relatively light weight. But all that built-in sturdiness and shielding adds up to staggering 147lbs/67kg. It's only a receiver, not a transmitter or a power amplifier.

Tubes... and more tubes

If you're not familiar with tube radios: your average AM (and shortwave) Radio from the 50's or 60's used 4 tubes (without the rectifier if this was a tube). Your trusty Hammarlund or Yaesu shortwave receiver from that time would have somewhat from 8 to 12 tubes -and these were quite good and sensitive receivers! This Rohde + Schwarz counts 28 tubes.

Some tubes here, some there, all fully shielded. But why the hell that much? The answer is quite simple: stability. On every count. Constant and stable gain over all bands and for a looong service time, stunningly stable VFO frequencies and all that stuff. No, they used no consumer tubes like in your TV or such. All of them are out of the 'commercial'-tube-series with a guaranteed service life of at least 10000 hours like in every aircraft of that time or such. Failing was not an option, this HAD to work.

Speaking about stability and accuracy:

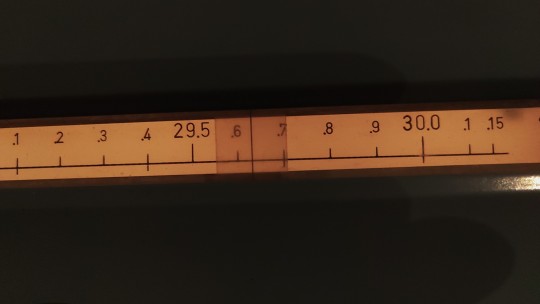

this of course isn't digital stuff -it's purely analog. In the pictures below you can see the dials. Just add both frequencies and you know where you are -here on 29.630MHz or 29630kHz.

As you see: your readout is easily accurate down to less than 500Hz. So you can read at least 500Hz out of 29630000Hz. With other words the accuracy of your readout is 0.001687% in this case. Your average modern digital multimeter would be proud if it came only near to this 65 year old contraption.

Of course that large dial in the picture on the left isn't the only one. There are 12 of 'em, mounted on a drum and rotating according to the selected band. Giving you a simple S-Meter like in other shortwave receiver was of course also not possible.

Instead they provided you with a Voltmeter which displays directly the input voltage at the antenna input -and the threshold voltage for the 'Squelch' (if you have set that) which isn't a normal squelch. If activated it doesn't cut your Audio, it reduces the Gain instead with a settable time constant, so it acts more like a active noise cancelling between any signal -also between any dash and dot if you're receiving CW (Morse Code). Besides that you can choose your IF-Passband between 150Hz and 12kHz, have a absolutely stable BFO, a good Envelope Detector for AM-Reception and a perfect Audio Stage - that's all.

Speaking of the Audio Stage: 2W undistorted output power from a single end class-A is more than you need with a good speaker. McIntosh ® would call that circuit 'Unity Coupled', further a E88CC for the Audio-Preamp. We're talking about an Shortwave Radio, not an 'High-End' Audio Amplifier. Wanna take recordings of what you hear? No problem: here's your Line-Output, symmetric, 600 ohms, transformer coupled and with +10dBm (if you want) and in accordance to all Studio-Standarts. Sound quality for AM Broadcasts? With a passband switchable up to max. 12kHz for the IF better than the majority of stations can provide.

Precise?

So far so good, but what's about the heart of every shortwave receiver: the Oscillator or VFO? How stable and precisely does it beat after 65 years?

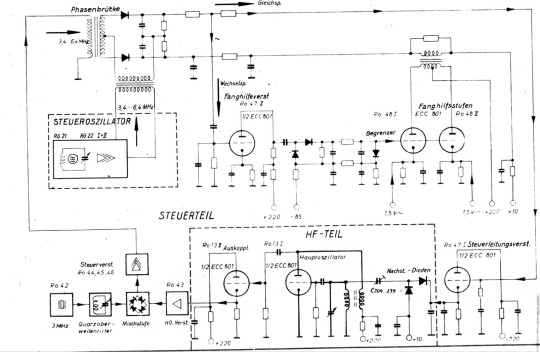

In your trusty -and quite good- Hammarlund or Yaesu amateur Radio from these days the VFO usually is equipped with two tubes: the Oscillator itself and the buffer amplifier -both sometimes also united in one bulb. If i hadn't lost track here they used 12 -and tons of other stuff. So that frickin VFO has a component count which is easily about the order of a complete shortwave receiver.

What the hell is all that stuff about -and wtf they had for breakfast back then? The answer is again simple: precision and stability.

As i said: this thing is 65 years old and i touched nothing. Of course I checked how much it's 'off' in terms of the frequency. After warming up for 20 Minutes i checked it every 1000kHz from the bottom to the top of its range. It was a bit different between all points, at some less than 50Hz and about 1kHz worst case.

My Lab-Equipment is quite good and precise, but for these low errors the tolerances of the measuring equipment has absolutely taken into account. So i made a separate measurement only for 10MHz -with the aid of a frequency standard sourced from an atomic clock. So this was 'the real thing'. After warming up for an hour i measured for 15 Minutes. The deviaton was between -717 to -722Hz. Including the error of the dial. This means frickin' 71.7...72.2ppm. PPM -parts per million! 65 years after manufacturing.... Just absolutely stunning -and with what freaking kind of equipment they had calibrated this back then??? Just have in mind: this is pure analog goodness, not a modern PLL. How the f***k they got there? Here's the clear link between a manufacturer of high-grade Lab Equipment and a shortwave receiver. I'm just stunned over the knowledge of the engineers who designed that circuit back then and the precision this was built.

All without doing anything and all it's original capacitors. Yap, i could realign that but tbh it's just wayyy to less been worth the effort. So it will stay as it is.

Nope,

you're not provided with that fancy stuff your new digital or SDR may have on board. There's no notch filter, no panoramic display -not even SSB! Why the hell they just 'forgot' all these things? The answer is easy: it's modular. The EK07 is just the 'mainframe', everything else you wanted to have can be added as external components you had to buy separately -also for tons of money of course.

Wanting SSB? Just add this:

35kg/77lbs and 18 Tubes more -to mention it's also a synchronous detector for AM is not worth the effort. Panoramic display, digital frequency counter, Teletype Adaptor, a remote control for controlling that beast over a telephone line? FM? Diversity reception?? No problem, you had just buy it. Everything of course with the same standards for precision and build quality.

The outcome...

Yea, i spent a good amount of money getting this -but in my opinion it was worth every dime. I wanted a good tube receiver and i got a really good one. Compared to upper class modern Radios it's still a very good radio. So the only thing I have to add is an external SSB/AM-Synchronous Detector. The originals are nearly impossible to get today, so i decided to build one. It's on the way and i will give you the results later. So stay tuned...

5 notes

·

View notes

Text

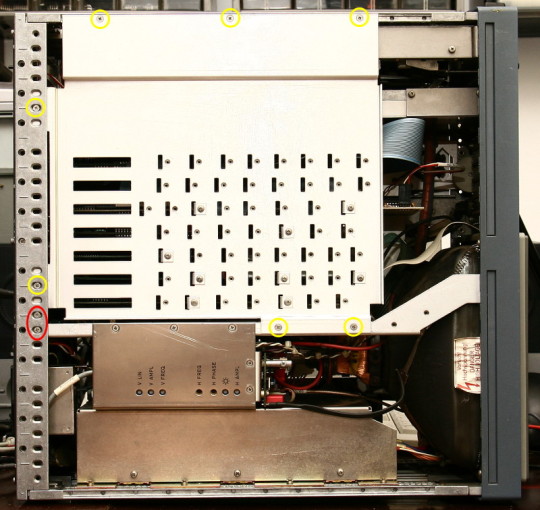

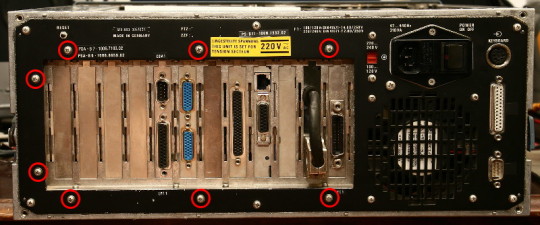

Screws that need to be removed in order to access to the ISA cards inside the Rohde&Schwarz PSA5 computer.

(story here https://hawk.ro/stories/rs_psa5/ )

8 notes

·

View notes

Text

#Rohde & Schwarz#RFTesting#Innovations#RFdesign#technologies#VNAs)#innovations#EngineeringExcellence#TechnologyLeadership#VirtualEvent#powerelectronics#powermanagement#powersemiconductor

0 notes

Text

#Rohde & Schwarz#AnalogDevices#AutomotiveEthernet#10BASET1S#InVehicleNetworking#ADAS#ZonalArchitecture#ConnectedCars#VehicleTech#AutomotiveInnovation#SmartMobility#electricvehiclesnews#evtimes#autoevtimes#evbusines

0 notes

Text

Kosovo’s government made a final push on Thursday to convince Western countries to include its Council of Europe application on the agenda for the organisation’s ministerial meeting on May 16 and 17 in Strasbourg.

In a letter that Foreign Minister Donika Gervalla- Schwarz sent to the Council of Europe Parliamentary Assembly President, PACE, Theodoros Rousopoulos, she pledged that a draft-statute for the long-delayed Association of Serb-Majority Municipalities, ASMM, will be sent to the Constitutional Court for review “by the end of May”.

But the German embassy in Kosovo, a country which together with France has insisted on this, said the latest stop was not enough.

The embassy told BIRN on Thursday that the so called Quint countries and others have repeatedly pointed out that Kosovo “is expected to take tangible steps to establish the ASMM in order to achieve the required two-thirds majority in the Committee of Ministers for the application for membership to be successful”.

“In our view, submitting the draft statute to the Constitutional Court prior to the Committee’s meeting would have been such a step. As Ambassador Rohde said in his tweet following the vote in the Parliamentary Assembly of the Council of Europe: ‘Kosovo now needs to do the heavy lifting.’ This has still not happened,” the embassy told BIRN via email.

Gervalla-Schwarz said the draft, which is being prepared, serves the government’s goal “to integrate non-majority communities and implementation of Kosovo legislation in all municipalities”.

“The draft ensures not only the respect of Kosovo Constitution and laws, but also prevents impermissible interferences from outside in municipalities but also all over Kosovo,” she said.

Many in Kosovo considered membership of the Council of Europe a job done when last month PACE voted in favour of a report which recommended membership.

Council of Europe rapporteur Dora Bakoyannis drafted a “statutory opinion” recommending Kosovo’s accession, arguing it would “lead to the strengthening of human rights standards by ensuring access to the European Court of Human Rights to all those who are under Kosovo’s jurisdiction”.

In adopting the opinion, PACE effectively forwarded the final decision to the Committee of Ministers, the final hurdle before membership.

But Serbia, which does not recognise Kosovo as independent, has warned it may quit the Council of Europe if Kosovo becomes a member.

Serbian President Aleksandar Vucic called Kosovo’s newest move “a trick”.

“In the [2013] Brussels agreement it is quite clear that this [statute draft proposal] should be done by the management of Serbia or if we agree, as we agreed contextually, conceptually and in principle, that it should be the text submitted by the EU,” Vucic said on Wednesday.

Kosovo applied to join in May 2022 after Russia was expelled following its invasion of Ukraine, increasing Pristina’s chances of securing the two-thirds majority necessary for accession.

Kosovo’s chances further improved in March when the government granted 24 hectares of disputed land in western Kosovo to a Serbian Orthodox monastery, ending an eight-year stalemate that had harmed the country’s reputation for protecting minority rights.

Kosovo would need two-thirds of the votes at the committee of ministers, a total of 31 votes, in order to join.

The Council of Europe has 46 member states, including all of the EU’s own 27 members. Kosovo has been under EU measures for its failure to restore calm in the Serb-majority north since June 2023. On May 7, EU spokesperson Peter Stano said a report on whether to lift the measures or not is being finalised.

Last week, German ambassador Jorn Rohde told BIRN that Kosovo Prime Minister Albin Kurti should not have been surprised that Germany and France had asked Kosovo to send the draft statute of the Serb municipality body to the Constitutional Court for approval as a prerequisite for membership of the Council of Europe.

“I am surprised that he was surprised,” Rohde told BIRN. His comments came a day after Kurti said that he would not accept the Association of Serb-Majority Municipalities as a condition for Kosovo to join the Council of Europe, describing the request as “absurd”.

He insisted that Kosovo had fulfilled all the obligations for membership of the Council of Europe. He also said that the draft statute for the Association does not yet represent a formal document, as it was not accepted by Serbia last year during EU-facilitated talks between the two countries.

2 notes

·

View notes

Text

Precision Radio Test Equipment and Calibration Services by Restore RF

At Restore RF, we understand how crucial precision and reliability are when it comes to radio test equipment and RF systems. Whether you're in the communications industry, military, or a technical service provider, accurate and calibrated test equipment is essential for optimal performance. We specialize in test equipment calibration, RF test equipment repair, and comprehensive equipment repair solutions for a wide range of industries.

Reliable Test Equipment Calibration Services Near You

When searching for test equipment calibration services near me, businesses need more than just convenience—they need trust, experience, and technical expertise. At Restore RF, we bring all of that and more. Our test equipment calibration services are designed to ensure that your tools and instruments are performing with maximum accuracy and within manufacturer specifications.

We provide both in-lab and on-site calibration services for various types of test equipment, including RF analyzers, signal generators, power meters, oscilloscopes, and spectrum analyzers. Our skilled technicians use NIST-traceable standards and follow ISO-compliant processes to guarantee precision and reliability every time.

RF Test Equipment Repair You Can Depend On

RF testing tools play a critical role in communications, defense, and broadcasting industries. When your RF gear malfunctions or drifts out of tolerance, you need fast, effective RF test equipment repair services to get back on track. Restore RF is your go-to destination for diagnosing and fixing a wide range of RF and radio test equipment.

From circuit-level diagnostics to board-level repair and component replacements, our expert engineers provide cost-effective solutions without compromising on quality. We support most leading brands and offer quick turnaround times to reduce your downtime.

Full-Service Equipment Repair Solutions

Restore RF doesn’t just fix individual problems—we offer full-spectrum equipment repair solutions tailored to your business needs. Whether it’s preventive maintenance, performance upgrades, firmware updates, or part replacement, we ensure your devices are restored to full working condition.

Our repair services cover a wide array of testing instruments used in telecommunications, aerospace, automotive, and RF research labs. Our in-depth knowledge and modern facility make us one of the most trusted names in test equipment calibration services and repairs in the U.S.

Why Choose Restore RF?

Certified Technicians: Our team consists of experienced professionals with expertise in RF diagnostics and calibration.

NIST-Traceable Standards: Every calibration is traceable to national standards to meet industry compliance.

Fast Turnaround: We minimize your equipment downtime with quick and efficient service.

Multi-Brand Support: We work with leading manufacturers like Keysight, Rohde & Schwarz, Anritsu, Tektronix, and more.

Affordable Solutions: Get high-quality service without overpaying for brand-new replacements.

Find Trusted Test Equipment Calibration Services Near You

If you've been searching for “test equipment calibration services near me” or a dependable partner for RF test equipment repair, Restore RF is here to help. Our goal is to provide high-accuracy, low-cost service that extends the life of your critical testing instruments and ensures measurement integrity.

We serve clients across the U.S. and offer both scheduled and emergency services. Contact us today through https://restorerf.com to learn more or request a service quote.

0 notes

Text

Wireless Testing Market: Size, Share, Analysis, Forecast, and Growth Trends to 2032 – Regional Trends and Country-Level Analysis

The Wireless Testing Market was valued at USD 15.2 Billion in 2023 and is expected to reach USD 45.0 Billion by 2032, growing at a CAGR of 12.83% from 2024-2032.

The Wireless Testing Market is undergoing rapid transformation, driven by increasing demand for seamless connectivity, advancements in wireless technologies such as 5G and Wi-Fi 6, and the rising integration of IoT across various sectors. As industries evolve toward automation and smart infrastructure, the need for efficient wireless communication systems has surged, pushing enterprises to invest heavily in testing solutions that ensure compliance, performance, and security. This growing dependency on wireless systems across industries like automotive, healthcare, and consumer electronics has positioned wireless testing as a pivotal component in development cycles.

The Wireless Testing Market is also seeing heightened activity from regulatory bodies mandating rigorous certification standards. This has led to a significant uptick in demand for comprehensive testing services and tools. Vendors are innovating their testing methodologies to keep pace with the accelerating development of wireless technologies. As organizations prioritize product reliability and interoperability, wireless testing becomes essential not only for compliance but also for reducing product recalls and enhancing brand trust.

Get Sample Copy of This Report: https://www.snsinsider.com/sample-request/5980

Market Keyplayers:

Keysight Technologies – UXM 5G Wireless Test Platform

Rohde & Schwarz – R&S CMW500 Wideband Radio Communication Tester

Anritsu Corporation – MT8821C Radio Communication Analyzer

Viavi Solutions Inc. – OneAdvisor-800 Wireless Test System

Spirent Communications – Spirent Landslide Wireless Core Network Testing

DEKRA SE – DEKRA Wireless Device Testing Services

Bureau Veritas – Smartworld Wireless Testing Solutions

Intertek Group plc – Intertek Wireless Compliance Testing

TÜV Rheinland – TÜV Rheinland OTA & RF Testing

TÜV SÜD – TÜV SÜD Mobile Device Certification Testing

Eurofins Scientific – Eurofins Wireless Performance Testing

SGS SA – SGS Wireless Network Testing Services

Element Materials Technology – Element RF & Microwave Testing

COMPRION GmbH – COMPRION Network Simulators

Ansys Inc. – Ansys HFSS Wireless Simulation

Market Analysis

The market is driven by the exponential rise in connected devices and the global rollout of next-generation wireless networks. With businesses embracing digital transformation, wireless testing ensures robust and uninterrupted communication across systems and devices. Strategic partnerships and mergers among key players are enhancing market reach and technological capabilities. Testing equipment manufacturers are focusing on multi-device, multi-protocol platforms that provide real-time analytics and simulation environments.

Market Trends

Growing adoption of 5G and Wi-Fi 6/6E driving demand for advanced testing tools

Expansion of IoT devices requiring cross-platform wireless compatibility

Rise in remote working creating demand for stable and secure wireless connectivity

AI and ML integration in testing platforms for predictive and automated testing

Regulatory push for compliance and safety boosting third-party testing services

Market Scope

Smart Mobility Revolution: Automotive industry’s shift to connected and autonomous vehicles increases wireless testing in V2X communication

Healthcare Connectivity: Medical devices with wireless capabilities demand strict testing for patient safety and operational reliability

Consumer Tech Explosion: Surge in wearables, smart home gadgets, and personal devices intensifies testing for seamless user experience

Enterprise-grade Networks: Digital businesses investing in private wireless networks are relying on rigorous testing for cybersecurity and reliability

The scope of the wireless testing market spans multiple high-growth sectors, creating new opportunities for test equipment manufacturers, service providers, and network vendors. With each new innovation in wireless technology, the market expands its reach into areas previously unconnected, offering massive potential for differentiation and profitability.

Market Forecast

The wireless testing market is expected to maintain a strong growth trajectory in the coming years, fueled by the technological race for faster, smarter, and more reliable wireless communication. As innovations in edge computing, IoT, and AI reshape industries, wireless testing will evolve to support complex, real-time, and mission-critical applications. Emerging markets and global digital infrastructure projects will further bolster demand for wireless compliance and performance validation. The future of this market will not only be shaped by new wireless technologies but also by the need for secure, efficient, and resilient networks.

Access Complete Report: https://www.snsinsider.com/reports/wireless-testing-market-5980

Conclusion

The Wireless Testing Market stands at the crossroads of innovation and necessity. As the world becomes increasingly connected, the role of wireless testing will continue to grow, ensuring that the invisible networks we rely on every day are fast, secure, and dependable. For industry leaders, investors, and innovators, this market presents a unique opportunity to drive technological excellence while ensuring user trust. Now is the time to tap into the pulse of wireless progress and lead with precision in a digitally connected future.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Contact Us:

Jagney Dave - Vice President of Client Engagement

Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

#Wireless Testing Market#Wireless Testing Market Scope#Wireless Testing Market Share#Wireless Testing Market Trends

0 notes

Text

Electromagnetic Compatibility (EMC) Shielding Market, Global Outlook and Forecast 2025-2032

Market Size

The global Electromagnetic Compatibility (EMC) Shielding market was estimated at USD 3942.40 million in 2023 and is projected to reach USD 6063.73 million by 2032, with a CAGR of 4.90% during the forecast period. North America's market size was estimated at USD 1115.38 million in 2023, showing a CAGR of 4.20% from 2024 to 2032.

Electromagnetic compatibility (EMC) refers to the ability of an electrical device or circuit to operate within its electromagnetic environment without causing electromagnetic interference to other devices. It must be electromagnetically immune to protect itself from external electromagnetic waves, whether natural or manmade. The EMC Shielding market is crucial due to the increasing number of electronic devices and interactions, necessitating suitable EMC solutions.

Curious? Take a Peek with Our Sample Report!

Regional Analysis:

North America: The North America Electromagnetic Compatibility (EMC) Shielding market, exhibited significant growth, with a market size of USD 1115.38 million in 2023. The region is characterized by a high demand for EMC solutions driven by industries like consumer electronics, automotive, and defense.

Europe: The European market is also witnessing steady growth, with key players like Laird PLC (UK) and Rohde & Schwarz GmbH & Co. Kg (Germany) contributing to market expansion through innovative shielding solutions.

Asia-Pacific: Asia-Pacific shows promising growth opportunities, particularly in countries like China and Japan, driven by the rapid adoption of consumer electronics and increasing investments in telecommunications infrastructure.

Middle East & Africa: The MEA region is emerging as a lucrative market for EMC Shielding due to advancements in healthcare technology and the aerospace sector.

South & Central America: This region is experiencing a growing demand for EMC solutions in sectors like automotive and telecommunications, creating opportunities for market players.

Competitor Analysis:

In the Electromagnetic Compatibility (EMC) Shielding market, several key players lead the industry. Laird PLC from the UK, Chomerics from the US, and Tech-Etch from the US are among the major competitors with a significant market share. These companies have established themselves through continuous innovation, high-quality products, and strong customer relationships.

Laird PLC focuses on developing cutting-edge shielding solutions for various industries, enhancing its market influence. Chomerics, known for its conductive coatings and paints, has a strong presence in the market due to its reliable products. Tech-Etch excels in providing metal shielding products, catering to diverse application needs.

These competitors differentiate themselves through product quality, technological advancements, and strategic partnerships. Laird PLC's focus on expanding its product portfolio, Chomerics' emphasis on R&D for innovative solutions, and Tech-Etch's strategic collaborations highlight their competitive strategies in the EMC shielding market.

Global Electromagnetic Compatibility (EMC) Shielding Market:

Market Segmentation Analysis

This report provides a deep insight into the global Electromagnetic Compatibility (EMC) Shielding market covering all its essential aspects. This ranges from a macro overview of the market to micro details of the market size, competitive landscape, development trend, niche market, key market drivers and challenges, SWOT analysis, value chain analysis, etc.

The analysis helps the reader to shape the competition within the industries and strategies for the competitive environment to enhance the potential profit. Furthermore, it provides a simple framework for evaluating and assessing the position of the business organization. The report structure also focuses on the competitive landscape of the Global Electromagnetic Compatibility (EMC) Shielding Market. This report introduces in detail the market share, market performance, product situation, operation situation, etc. of the main players, which helps the readers in the industry to identify the main competitors and deeply understand the competition pattern of the market.

In summary, this report is a must-read for industry players, investors, researchers, consultants, business strategists, and all those who have any kind of stake or are planning to foray into the Electromagnetic Compatibility (EMC) Shielding market in any manner.

Market Segmentation (by Application)

Consumer Electronics

Telecom and IT

Automotive

Healthcare

Defense and Aerospace

Others

Market Segmentation (by Type)

EMI Shielding Tapes

Conductive Coatings and Paints

Metal Shielding

Others

Curious? Take a Peek with Our Sample Report!

Key Company

Laird PLC (UK)

Chomerics (US)

Tech-Etch(US)

Leader Tech(US)

Kitagawa Industries. (Japan)

Rohde & Schwarz GmbH & Co. Kg (Germany)

Keysight Technologies(US)

Teseq AG (Switzerland)

Ar(US)

Em Test (Switzerland)

Geographic Segmentation

North America (USA, Canada, Mexico)

Europe (Germany, UK, France, Russia, Italy, Rest of Europe)

Asia-Pacific (China, Japan, South Korea, India, Southeast Asia, Rest of Asia-Pacific)

South America (Brazil, Argentina, Columbia, Rest of South America)

The Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria, South Africa, Rest of MEA)

Market Dynamics:

Drivers

Rising Demand for Electronic Devices – The widespread adoption of electronic devices across industries increases the need for EMC shielding to mitigate electromagnetic interference and ensure device reliability.

Stringent Regulatory Requirements – Regulatory standards mandating EMC compliance in electronic products drive the demand for shielding solutions.

Technological Advancements – Innovations in shielding materials, such as conductive coatings and metal shielding, enhance efficiency and market growth.

Growth in End-User Industries – Expanding sectors like consumer electronics, automotive, and healthcare fuel demand for EMC shielding to protect electronic systems from interference.

Restraints

Cost Constraints – High initial costs of EMC shielding solutions can limit adoption, particularly for small and medium-sized enterprises.

Complexity of Shielding Design – Designing effective shielding solutions for intricate electronic systems presents challenges, potentially impacting performance.

Limited Awareness – A lack of awareness regarding EMC shielding benefits may hinder market growth and adoption rates.

Opportunities

Emerging Technologies – The development of nanomaterials and hybrid composites creates opportunities for innovation in EMC shielding solutions.

Growing Focus on IoT and Connectivity – The rise of IoT devices and wireless communication increases demand for effective EMC shielding.

Expansion in Healthcare Applications – The growing use of medical devices presents new opportunities for EMC shielding providers to meet healthcare-specific requirements.

Challenges

Global Supply Chain Disruptions – Raw material shortages and logistical challenges impact EMC shielding production and delivery.

Environmental Regulations – Manufacturers must comply with environmental regulations, pushing them to find alternative materials and processes.

Competition and Pricing Pressures – Market competition and low-cost alternatives create pricing pressures, affecting profit margins and market share

FAQ Section:

1. What is the current market size of Electromagnetic Compatibility (EMC) Shielding Market?

Electromagnetic compatibility (EMC) is crucial for the functionality of electrical devices. The global EMC Shielding market size was estimated at USD 3942.40 million in 2023 and is projected to reach USD 6063.73 million by 2032, with a CAGR of 4.90%.

2. Which key companies operate in the Electromagnetic Compatibility (EMC) Shielding Market?

Key companies in theElectromagnetic Compatibility (EMC) Shielding market, include Laird PLC, Chomerics, Tech-Etch, Leader Tech, Kitagawa Industries, Rohde & Schwarz, Keysight Technologies, Teseq AG, Ar, and Em Test. Each of these companies plays a significant role in the market.

3. What are the key growth drivers in the Electromagnetic Compatibility (EMC) Shielding Market?

The main growth drivers in the EMC Shielding market include the increasing number of electronic devices, the demand for consumer electronics, advancements in technology, the automotive industry's growth, and the rise in defense and aerospace applications.

4. Which regions dominate the Electromagnetic Compatibility (EMC) Shielding Market?

The regions that dominate the EMC Shielding market are North America, Europe, Asia-Pacific, South America, and the Middle East and Africa. North America held a significant market share, followed by Europe and Asia-Pacific.

5. What are the emerging trends in the Electromagnetic Compatibility (EMC) Shielding Market?

Emerging trends in the EMC Shielding market include the development of advanced shielding materials, the integration of shielding in wearable electronics, growth in the healthcare sector, and the adoption of EMC shielding in IoT devices.

Curious? Take a Peek with Our Sample Report!

0 notes

Text

Signals Intelligence Market Research Report: Industry Insights and Forecast 2032

The Signals Intelligence (SIGINT) Market Size was USD 16.37 Billion in 2023 and is expected to Reach USD 26.57 Billion by 2032 and grow at a CAGR of 5.57% over the forecast period of 2024-2032

The Signals Intelligence (SIGINT) market is witnessing rapid expansion due to increasing geopolitical tensions, rising cybersecurity threats, and advancements in communication technologies. Governments and defense organizations are heavily investing in SIGINT solutions to enhance national security and intelligence-gathering capabilities. The integration of artificial intelligence (AI) and big data analytics is further revolutionizing the industry.

The Signals Intelligence market continues to grow as global defense strategies increasingly rely on sophisticated surveillance and intelligence systems. With the rise of cyber warfare and electronic threats, SIGINT is becoming an essential tool for military, law enforcement, and intelligence agencies worldwide. The demand for real-time data interception, threat analysis, and secure communication systems is driving innovation in the sector.

Get Sample Copy of This Report: https://www.snsinsider.com/sample-request/3528

Market Keyplayers:

Harris Corporation (Communication Systems, Electronic Warfare)

Northrop Grumman Corporation (Cybersecurity Solutions, Surveillance Systems)

BAE Systems (Electronic Warfare, Cyber Intelligence)

Raytheon Company (Radar Systems, Electronic Warfare Solutions)

Lockheed Martin Corporation (Advanced Communications, Surveillance Technologies)

Mercury Systems Inc. (Sensor Processing Solutions, Electronic Warfare)

Elbit Systems Ltd. (Intelligence, Surveillance and Reconnaissance Solutions)

Thales Group (Cybersecurity, Electronic Warfare Systems)

Rheinmetall AG (Defense Electronics, Surveillance Solutions)

General Dynamics Corporation (Cybersecurity, Communication Systems)

L3Harris Technologies (Communication and Electronic Warfare Solutions)

Cisco Systems Inc. (Network Security, Cyber Intelligence Solutions)

Leonardo S.p.A. (Electronic Warfare, Intelligence Solutions)

Saab AB (Electronic Warfare, Cyber Defense Solutions)

AeroVironment, Inc. (Unmanned Aircraft Systems, Surveillance Technologies)

Kongsberg Gruppen (Defense Systems, Surveillance Solutions)

Cubic Corporation (Training and Simulation Systems)

Rohde & Schwarz GmbH & Co. KG (Radio Communication, Electronic Test and Measurement)

Inmarsat plc (Satellite Communication Solutions)

Viasat Inc. (Satellite Communication, Cybersecurity Solutions)

Market Trends Driving Growth

1. Increasing Cybersecurity and National Security Threats

Governments and intelligence agencies are prioritizing SIGINT investments to combat cyberattacks, espionage, and digital warfare. The growing need for real-time intelligence has led to significant advancements in signal interception and threat detection.

2. AI and Machine Learning in SIGINT

Artificial Intelligence (AI) and machine learning are enhancing SIGINT capabilities by automating data processing, improving signal analysis, and enabling faster threat identification. AI-driven systems are also helping in predicting and mitigating security risks.

3. Growth in Electronic Warfare (EW) Technologies

Modern electronic warfare systems rely on SIGINT to intercept, jam, and analyze enemy communications. Nations are strengthening their EW capabilities to counter emerging threats, boosting the demand for advanced SIGINT solutions.

4. Expansion of Space-Based SIGINT

The deployment of SIGINT satellites is increasing, providing enhanced surveillance capabilities for intelligence agencies. Space-based signal interception is playing a critical role in monitoring global communications and detecting potential threats.

5. Integration with 5G and IoT Networks

The expansion of 5G and IoT networks has created new challenges and opportunities for SIGINT operations. Intelligence agencies are adapting their surveillance methods to monitor encrypted and high-speed communications more effectively.

Enquiry of This Report: https://www.snsinsider.com/enquiry/3528

Market Segmentation:

By Solutions

Airborne

Ground

Naval

Space

Cyber

By Type

Electronic Intelligence (ELINT)

Communications Intelligence (COMINT)

By Mobility

Fixed

Portable

Market Analysis and Current Landscape

Rising defense budgets: Governments worldwide are increasing spending on intelligence and surveillance capabilities.

Advancements in data analytics: Big data and AI are transforming the way intelligence is gathered and analyzed.

Private sector involvement: Defense contractors and tech firms are actively developing cutting-edge SIGINT solutions.

Growing concerns over cyber espionage: The increasing frequency of cyberattacks is pushing nations to strengthen their intelligence-gathering efforts.

Despite its growth, the market faces challenges such as ethical concerns over mass surveillance, regulatory restrictions, and the complexity of analyzing vast amounts of intercepted data. However, ongoing technological advancements are expected to address these issues.

Future Prospects: What Lies Ahead?

1. Enhanced AI-Driven Intelligence Processing

AI will play a greater role in automating SIGINT operations, making intelligence gathering more efficient and accurate. Predictive analytics and real-time data processing will be crucial for national security efforts.

2. Expansion of Cyber SIGINT Capabilities

As cyber threats evolve, SIGINT solutions will integrate more advanced cybersecurity tools, enabling real-time monitoring and mitigation of digital threats.

3. Strengthening International Intelligence Alliances

Countries are forming alliances to share intelligence data and enhance global security cooperation. Joint SIGINT operations are expected to increase in the coming years.

4. Miniaturization of SIGINT Devices

Portable and compact SIGINT solutions will gain traction, enabling special forces and field operatives to conduct surveillance and intelligence gathering with greater mobility.

5. Ethical and Legal Developments in SIGINT

Governments and organizations will focus on balancing security needs with privacy concerns, leading to the development of legal frameworks that regulate SIGINT operations.

Access Complete Report: https://www.snsinsider.com/reports/signals-intelligence-market-3528

Conclusion

The Signals Intelligence market is on a strong growth trajectory, driven by global security concerns, advancements in AI, and the increasing reliance on data-driven intelligence. As technology continues to evolve, SIGINT will play a pivotal role in national defense, cybersecurity, and intelligence operations. With continuous innovation and strategic investments, the future of SIGINT is poised to be more efficient, integrated, and responsive to emerging global threats.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Contact Us:

Jagney Dave - Vice President of Client Engagement

Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

#Signals Intelligence market#Signals Intelligence market Scope#Signals Intelligence market Analysis#Signals Intelligence market Growth#Signals Intelligence market Trends

0 notes

Text

Military Communications Market Current and Future Trends by 2032

The global military communication market size was valued at USD 33.12 billion in 2023. The market is anticipated to reach from USD 34.74 billion in 2024 to USD 60.40 billion by 2032, exhibiting a CAGR of 7.2% during the forecast period. North America dominated the military communications market with a market share of 31.49% in 2023.

Additionally, the increasing adoption of satellite communication technology or SATCOM technology is anticipated to be a key trend stimulating market growth.

Know More Details:

https://www.fortunebusinessinsights.com/military-communications-market-102696

List of Key Market Players:

ASELSAN A.S. (Turkey)

Cobham PLC (U.K.)

General Dynamics Corporation (U.S.)

Honeywell International Inc. (U.S.)

Iridium Communications Inc. (U.S.)

L3Harris Technologies Inc. (U.S.)

Lockheed Martin Corporation (U.S.)

Northrop Grumman Corporation (U.S.)

Raytheon Technologies Inc. (U.S.)

Rohde & Schwarz (Germany)

Thales Group (France)

Viasat Inc. (U.S.)

BAE Systems PLC (U.K.)

Segments:

On the basis of component, the market is bifurcated into software and hardware. On the basis of technology, the market is segmented into data link, HF communication, VHF/UHF/L-Band, and SATCOM. On the basis of platform, the market is fragmented into space, naval, ground, and airborne. On the basis of application, the market is bifurcated into Intelligence, Surveillance, and Reconnaissance (ISR), command & control, situational awareness, routine operations, and others. Geographically, the market is classified into Europe, North America, Asia Pacific, and the Rest of the World.

Report Coverage:

It offers a holistic market assessment that includes information on different market segments such as technology, components, platform application, and others.

It includes a detailed analysis of the COVID-19 pandemic’s impact on the market.

It highlights various strategies adopted by major market players to acquire growth.

It showcases the latest industry developments.

It highlights market’s growth assessed according to different geographical regions, North America, Europe, Asia Pacific, and the Rest of the World.

Drivers & Restraints:

Increasing Adoption of Wireless Communication Technology for Several Military Application to Propel Market Growth

Maintaining consistent communication and protecting highly confidential data are the utmost requirements across the defense sector. This is necessary to ensure public safety else the safety of citizens might be at risk. Moreover, investments in the defense sector are increasing due to growing cross-border disputes and terrorism. These factors are likely to boost the adoption of advanced systems for improved security and safety and bolster the military communications market growth.

The increasing adoption of evolving communication technologies such as ultra-high-frequency, very high-frequency, and SATCOM to replace conventional wired systems is likely to benefit the market growth. Moreover, the growing demand for upgraded communication systems, aerial surveillance vehicles, and advanced battlespace management systems is likely to augment the product adoption.

However, high initial development costs may hinder the market growth.

Regional Insights:

Presence of Key Players to Foster Growth in North America

North America is projected to gain the largest military communications market share. The presence of pioneer communication equipment and system manufacturers such as Honeywell International Inc., Raytheon Company, Collins Aerospace, Northrop Grumman Corporation, and others is likely to be a key factor driving the region’s market growth.

Europe is anticipated to rank second in the global market. The increasing defense expenditures across Germany, France, and the U.K., coupled with the presence of key naval and airborne communication solution providers, such as Cobham PLC and Thales Group, are expected to fuel the region’s market growth.

Asia Pacific is likely to register robust growth in the forthcoming years. The rising commercial aircraft deliveries across developing nations such as China and India and the increasing adoption of network-centric warfare are expected to bolster the market growth in Asia Pacific.

The Rest of the World is estimated to exhibit considerable growth due to increasing defense budgets across Israel, Saudi Arabia, Brazil, and other countries.

Competitive Landscape:

Key Players Adopt Various Inorganic & Organic Strategies to Capture Growth

The marketplace is highly competitive with the presence of leading market players such as Raytheon Technologies Inc., Northrop Grumman Corporation, L3Harris Technologies Inc., and others. The major market players adopt inorganic and organic growth strategies, including technological advancements, contracts, partnerships, acquisitions, and others to amplify their revenues. For instance, Thales Group launched the new Javelin Combat Net Radio in January 2021 to facilitate tactical command and control (C2) communications in military formations.

Industry Development:

February 2021: French Defense Procurement Agency chose Thales Group to advance the upcoming phase of ground-based segment of Syracuse IV SATCOM system for French Armed Forces.

0 notes

Text

Test and Measurement Equipment Market Trends, Growth, Analysis, Demand and Future Outlook 2034: SPER Market Research

Test and Measurement (T&M) equipment is equipment used for analysing, measuring, and validating the electrical, mechanical, and physical characteristics of different systems and components. Products in sectors like electronics, telecommunications, automotive, aerospace, and healthcare depend on these tools to ensure quality, performance, and compliance. Among other tools, T&M equipment consists of oscilloscopes, multimeters, signal generators, spectrum analysers, and environmental testers. Applications for them include maintenance, troubleshooting, manufacturing, and research. The need for accurate and trustworthy measurements propels ongoing developments in T&M technologies, such as automation, data analytics integration, and wireless testing. Advanced T&M solutions are becoming more and more necessary as industries embrace IoT, AI, and 5G technologies, fostering innovation and efficiency gains.

According to SPER market research, ‘Global Test and Measurement Equipment Market Size- By Product, By Service, By Vertical - Regional Outlook, Competitive Strategies and Segment Forecast to 2034’ state that the Global Test and Measurement Equipment Market is predicted to reach 57.72 billion by 2034 with a CAGR of 4.19%.

Drivers:

The increasing usage of ATE for high-volume testing in industries such as semiconductor manufacture is driving up sales of test and measurement equipment. Using increasingly sophisticated test and measurement tools is necessary to accurately diagnose and fix issues with electronic systems and their constituent parts. The demand for test and measurement equipment is rising in emerging economies like China, India, and Brazil as a result of their quick industrialization and infrastructure expansion. The increase in R&D activities in industries like electronics, telecommunications, and automotive is driving the need for test and measurement equipment for product development and innovation. More sophisticated test and measurement tools are becoming more and more necessary to ensure the reliability and quality of products and services.

Request a Free Sample Report: https://www.sperresearch.com/report-store/test-and-measurement-equipment-market?sample=1

Restraints:

The shortage of qualified professionals required for the operation and maintenance of test and measurement equipment may be impeding the market's growth. For smaller companies or those with more limited resources, the initial high expenses of test and measurement equipment may be unaffordable. Economic downturns may cause businesses to spend less on test and measurement equipment, which would impede market growth. Rapid technological advancements may restrict the rate of adoption among particular users due to complex equipment that requires specialist knowledge to operate and maintain. Following regulatory standards and requirements may make the development and use of test and measurement equipment more challenging and costly. Many businesses in the market provide similar products, which can lead to price wars and pressure on margins.

North America is dominant the market. Growing investments in the electronic industry's infrastructure development are fueling the market expansion for test and measurement equipment. Some significant market players Rohde & Schwarz, Anritsu, Advantest, EXFO, OWON Technology, GW Instek, ADLINK Technology, RIGOL Technologies, Saluki, IKM Instrutek, Uni-Trend Technology and Mextech Technologies.

For More Information, refer to below link: –

Test and Measurement Equipment Market Growth

Related Reports:

B2C E-commerce Market Growth, Size, Trends Analysis - By Product Category - Regional Outlook, Competitive Strategies and Segment Forecast to 2034

Quantum Cryptography Market Growth, Size, Trends Analysis - By Type, By End Use, By Application - Regional Outlook, Competitive Strategies and Segment Forecast to 2034

Follow Us –

LinkedIn | Instagram | Facebook | Twitter

Contact Us:

Sara Lopes, Business Consultant — USA

SPER Market Research

+1–347–460–2899

#Test And Measurement Equipment Market#Test And Measurement Equipment Market Share#Test And Measurement Equipment Market Size#Test And Measurement Equipment Market Revenue#Test And Measurement Equipment Market Demand#Test And Measurement Equipment Market Analysis#Test And Measurement Equipment Market Future Outlook#Test And Measurement Equipment Market Scope#Test And Measurement Equipment Market Challenges#Test And Measurement Equipment Market Competition#Test And Measurement Equipment Market forecast#Test And Measurement Equipment Market Segmentation

0 notes

Text

Expert Repair Services for RF Test Equipment – Spectrum Analyzers, Network Analyzers & More

At Restore RF, we specialize in the repair and maintenance of high-end RF test equipment. Our expert technicians are equipped with advanced diagnostic tools to restore functionality and accuracy to your essential testing devices. Whether you are dealing with a faulty spectrum analyzer, network analyzer, signal generator, or other critical testing equipment, we ensure precision repairs to keep your operations running smoothly.

Spectrum Analyzer RF Repair

A spectrum analyzer is crucial for measuring signal frequencies, amplitude, and distortion. When it malfunctions, signal analysis accuracy can be compromised. Our repair services cover issues like display failures, calibration errors, power supply problems, and signal distortion. We service all major brands, ensuring that your spectrum analyzer delivers precise and reliable performance.

Network Analyzer Repair

Network analyzers are essential for assessing the performance of RF and microwave networks. If you’re experiencing connectivity issues, incorrect measurements, or system failures, our team can diagnose and repair problems efficiently. We handle calibration, firmware updates, and component replacements to restore full operational capability.

Signal Generator Repair

A faulty signal generator can lead to inaccurate frequency and amplitude outputs, impacting testing processes. Our skilled technicians repair signal generators suffering from unstable signals, power issues, or faulty controls. We ensure your equipment meets original manufacturer specifications for peak performance.

Circuit Board Repair

Faulty circuit boards can disrupt the functionality of your RF test equipment. We offer expert circuit board troubleshooting and repair, including component replacement, soldering, and reconditioning. Whether it’s a minor fix or a complex board failure, we restore circuit boards to optimal working conditions.

Tektronix Repair

Tektronix is a leading brand in electronic test and measurement equipment, but like any device, wear and tear can cause failures. We specialize in Tektronix oscilloscope repair, spectrum analyzer repair, and signal generator maintenance, ensuring that your Tektronix equipment functions with the highest accuracy and reliability.

Fluke Repair

Fluke test instruments are widely used for electrical testing, RF analysis, and troubleshooting. Our Fluke repair services include diagnostics, recalibration, and component-level repairs. From handheld multimeters to RF testing devices, we ensure your Fluke equipment meets industry standards.

BERT Tester Repair

Bit Error Rate Testers (BERT Testers) are critical for assessing signal integrity in communication systems. If your BERT Tester is malfunctioning due to signal discrepancies, power failures, or connectivity issues, we provide comprehensive repair solutions, including calibration and component replacement, to restore its accuracy and performance.

Why Choose Restore RF for Your RF Test Equipment Repairs?

Certified Technicians: Our team has extensive experience in RF test equipment diagnostics and repair.

Comprehensive Testing: We use advanced tools to diagnose and validate repairs before returning your equipment.

Fast Turnaround: We prioritize efficiency to minimize downtime for your business.

OEM Standards: Our repairs align with original equipment manufacturer specifications.

Wide Range of Brands Supported: We service major brands, including Tektronix, Fluke, Agilent, Rohde & Schwarz, Keysight, and more.

Contact Us Today

Need professional RF test equipment repair? Restore RF is your trusted partner for reliable and cost-effective repairs. Visit our website at RestoreRF.com or contact us today to get a quote and restore your equipment’s performance!

0 notes