#revenue deficit

Explore tagged Tumblr posts

Note

Genuine question, is there anything about your city’s infrastructure/architecture that you particularly like (aside from it being where you live)?

here i assume you're referring to chicago. i will go to bat for this city. my complaints are largely a lot of inside baseball. i use sweeping complaints as shorthand--when i say something is ass it's because i want that thing to improve. if i really thought it was a lost cause i wouldn't talk about it. this is why i do not complain about schaumburg

continued below the cut

architecturally i think you could hardly do much better. there's a great blend of landmark-tier buildings from a range of eras. this is the thompson center, a really phenomenal train station/govt services building combo

but also some amazing residential buildings, like the commodore:

and i mean this is a stock photo from around the bryn mawr stop but i can confirm that it is this dope.

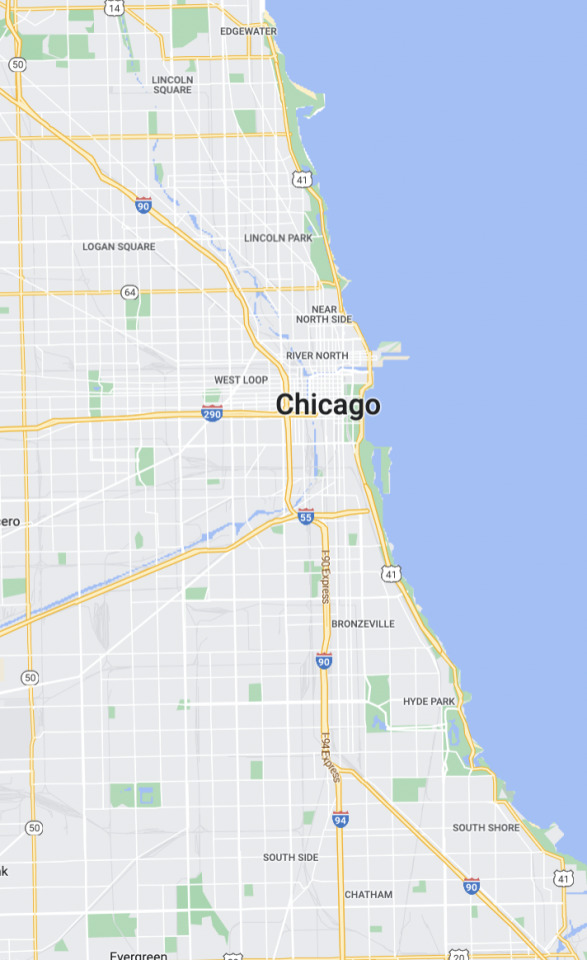

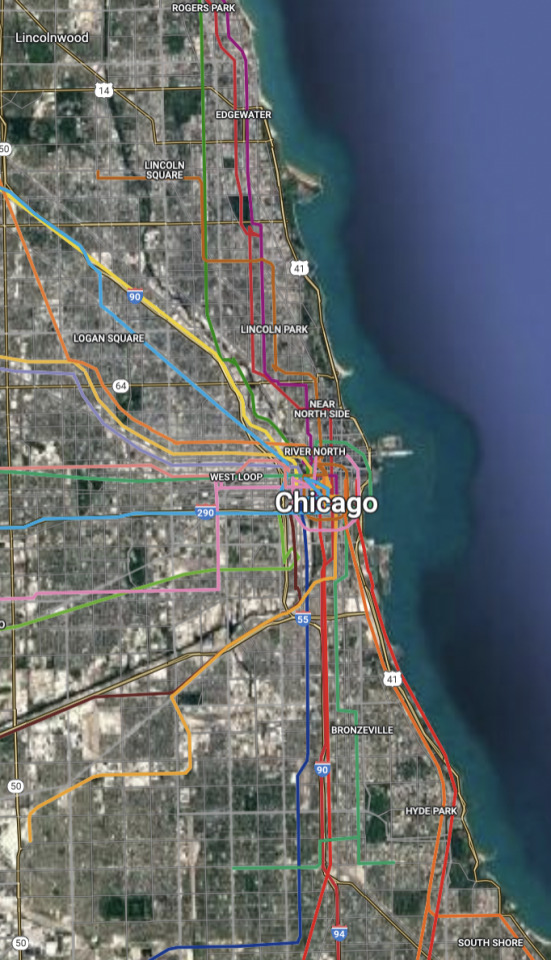

in terms of infrastructure, the thing is: it's good relative to the rest of the US. if we're talking about planning, about doing it RIGHT though we've got our priorities jumbled. see look

we put 8 lanes of high speed traffic between the city and the lakefront for most of its length. this is an idiotic choice to have made and it's frankly a huge waste of what could be really good land use.

urban highways

transit access west of western ave and south of 33rd is poor

the illinois dept. of transportation's standards mean that every road they control is a nightmare. this is slowly turning around though and legislation is moving ahead to allow cdot to have control over its own roads (in part i think because the IL courts are currently working through some cases regarding whether or not the city/state can be sued for fatalities resulting from poor road design)

good lird

but we DO have trains. now, because we've had poor leadership at the CTA reliability has suffered in a manner i can only describe as "bigly", particularly along the blue line. but we've had service cuts basically through the whole network

we also have lots of buses but we only just started to come around to the photo-enforced bus lanes idea. this is to say the problem is we let buses get stuck in traffic. generally the city's leadership has been keen to make it easier and cheaper to drive through the city. this is stupid for a variety of reasons that i won't get into here

i'm losing steam on this train of thought because it's fairly complex stuff and the north/south/west sides all have unique land use concerns. so without further questions i'll stop there.

one last thought

i don't like logan square because i think the people who live there are annoying podcaster instagram upcycled secondhand clothing types, the housing is expensive because it's trendy, and land use sucks ass west of the kennedy expressway

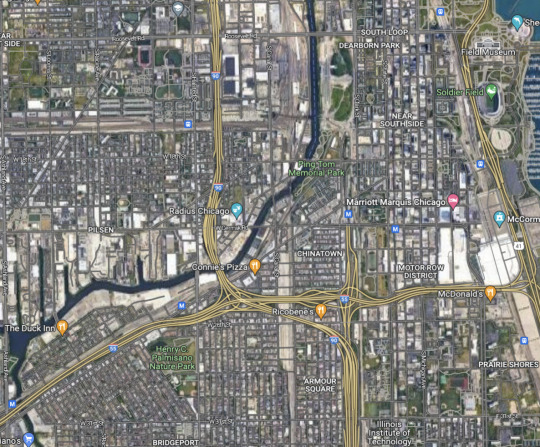

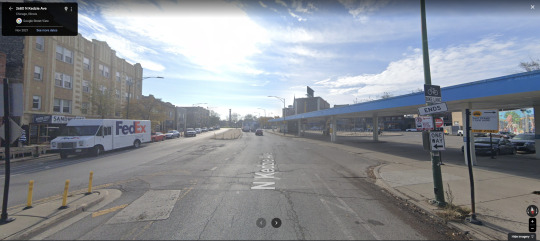

this is a train station and transfer point for a few major bus routes

10 notes

·

View notes

Text

Why is a 6.2% US budget deficit in peacetime a constitutional crisis? Is it because it makes the hyper wealthy old money passively investing, ever more wealthy and influential? Or is it because it requires savage cuts? Or both?

The Congressional Budget Office projects that the US federal budget deficit in fiscal year 2025 is $1.9 trillion. It amounts to 6.2 percent of gross domestic product (GDP) in 2025. France has similar numbers. However, the US is making a U turn on borrowing… while France persists. (Adjusted to exclude the effects of shifts in the timing of certain payments, the deficit is projected by the CBO to…

View On WordPress

#Constitutional Crisis#deficit#France#Interest Rates#Revenue. Spending#Unsustainable#US government deficit#USA

0 notes

Text

Is BTC a danger to the USD

#BTC towards $100,000,#altcoins don't..#tax evasion prob

#gold,#Bitcoin may take #USD place,#silver next record

#US military expenses+ less #revenues=#deficit,#debt explosion

#Russia legalized cypto

#Policymarket #bettors: BTC next #US #reserve currency

https://salvatoremercogliano.blogspot.com/2024/11/is-btc-danger-to-usd.html?spref=tw

0 notes

Photo

PRIMA PAGINA Le Figaro di Oggi venerdì, 11 ottobre 2024

#PrimaPagina#lefigaro quotidiano#giornale#primepagine#frontpage#nazionali#internazionali#news#inedicola#oggi guerre#vrais#celle#figaro#scope#paras#week#deficit#grace#effort#milliards#revenus#contribution#pourquoi#famille#investit#dans#football#paris#rupture#renoue

0 notes

Text

The US. government has placed new generations of Americans in financial peril because of their out-of-control spending. The congress has crossed over the $33 trillion threshold of debt. In recent months the debt is accelerating with over $1 trillion added almost every three months. Spending is out running revenues by such a huge margin that the ratio of public debt to GDP cannot be maintained. My new video looks at this, and also how the non-stop printing of money is weakening the value of the dollar worldwide.

#too much federal spending#too much debt#wasteful government spending#over $33 trillion in debt#non-stop printing of money#public debt to GDP can't be sustained#threatening future generations living standards#balanced budget amendments#growing entitlements#military spending#healthcare costs rising#creative tax and spending changes#value added tax#dollar losing its reserve currency standard#fiscal deficits#gap between spending and revenues#news

0 notes

Text

Massive £3.5K Tax Hike Looms for UK! Shocking IFS Report!

UK households are bracing for a substantial tax hike, with an average increase of £3,500 per year anticipated by the next election, marking the most significant fiscal burden over a parliamentary term in over seven decades, according to the Institute for Fiscal Studies (IFS), the country’s foremost economic think tank.

For more visit: financeprozone.com -

#Budget Deficit#Economic Analysis#Economic Consequences#Economic Projections#Financial news#Financial Outlook#Fiscal Policy#Government Budget#Government Spending#IFS Report#Income Tax#Personal Finance#Public Finances#Revenue Forecast#Tax Burden#Tax Impact#Taxation Changes#Taxation Trends#UK Tax Hike

0 notes

Text

The oligarchs need Republican inhumanity and horrendous fiscal arson.

THIS is why we don't have Medicare/Universal health care.

The loss is corporate tax revenues is criminal.

The tax cuts were passed, claiming they would cut the deficit. They added over $8 TRILLION.

That's $8,000,000,000,000.

Guys like Paul Ryan should be raked over hot coals for eternity.

1K notes

·

View notes

Text

France is beginning to face the consequences of its debt burden

France is making the news at the moment in a variety of ways. The clearest is the protests against the raising of the state pension age from 62 to 64. As a Londoner I also note the 90% vote against rental e-scooters in Paris as to be frank they have become a public nuisance in my area via the way the business model encourages users to leave them anywhere which more than a few take very literally.…

View On WordPress

#Bank of France#bond yields#Budget Deficit#business#ECB#economy#Finance#France#Interest Rates#national debt#private debt#Revenues

0 notes

Text

I see a lot of incomprehension online about our pension reform and the anger it generates in France, and what it often boils down to is "why are they so angry, 64 is plenty young to retire?"

I don't agree, but even if I did I would still oppose the reform. Here are some of the reasons why:

We already need 43 full years of work and tax contributions to be able to retire. Which means college-educated people were never going to retire at 64 anyway, let alone 62. This reform is aimed at people who start working early, mostly in low-paying jobs.

There's very little provision made in this law for hard/dangerous/manual labour.

There's no provision made for women who stop working to raise their children (51% of women already retire without a "complete career," which means they only retire on a partial pension, vs. 25% of men).

At 64, 1/3 of the poorest workers will already be dead. In France, between the richest and the poorest men, there's a 13 years gap in life expectancy.

Beyond life expectancy, at that age a lot of people (especially poorer, non-college educated) have too many health-related issues to be able to work. Not only is it cruel to ask them to work longer, if they can't work at all that's two more years to hold on with no pension

Unemployment in France is still fairly high (7%). Young people already have a hard time finding work, and this is going to make things even harder for them

Macron cut taxes on the rich and lost the country around 16 Billions € in tax revenue. Our estimated pension deficit should peak at 12 Billions worst case scenario.

While I'm on wealth redistribution (no, not soviet style, but I think there should be a cap on wealth concentration. Nobody needs to be a billionaire.): some of the massive profits of last year should go to workers and to the state to be redistributed, including to fund pensions. The state subsidized companies and corporations during the pandemic, Macron even said "no matter the cost" and spent 206 Billions € on businesses. Now he's going after the poorest workers in the country for an hypothetical 12 Billions??

Implicit in all of this is the question of systemic racism. French workers from immigrant families are already more likely to have started their careers early, to have low-paying jobs, are less likely to be college-educated, more at risk for disabilities and chronic illnesses, etc., so this is going to disproportionately affect them

This is not even touching on the fact that he didn't let lawmakers vote on it, meaning he knew he wouldn't get a majority of votes in parliament, or that 70% of the population is against this law. Pushing it through anyway is blatant authoritarianism.

TL;DR: This is only tangentially about retirement age. The reform will make life harder for people with low incomes, or with no higher education, for manual workers, for women—mothers especially, for POC, for people with disabilities or chronic conditions, etc. This is about solidarity.

Hope (sincerely) this helps.

#long post#france#french politics#réforme des retraites#49.3#pension reform#macron explosion#I know this post is mostly me talking to myself and preaching to the choir#but I needed to get it off my chest#up the baguette#upthebaguette#social justice

9K notes

·

View notes

Video

youtube

The Truth About Immigrants and the Economy

Immigrants are good for the economy and our society! Don’t let anyone tell you otherwise.

For centuries, immigration has been America’s secret sauce for economic growth and prosperity.

But for just as long, immigrants have been an easy scapegoat.

One of the oldest, ugliest lies is to falsely smear immigrants as criminals.

It’s just not true. Crime is way down in America. Anyone who says otherwise is fearmongering.

And whatever crime there is is not being driven by immigration. Immigrants, regardless of citizenship status, are 60% less likely to be incarcerated for committing crimes than U.S.-born citizens.

Maybe that’s why border cities are among America’s safest.

Immigration opponents also claim immigrants are a drag on the economy and a drain on government resources.

Rubbish!

Quite the opposite, the major reason immigrants are coming to America is to build a better life for themselves and their families, contributing to the American economy.

The long-term economic benefits of immigration outweigh any short-term costs. The nonpartisan Congressional Budget Office estimates that adding more immigrants as workers and consumers — including undocumented immigrants — will grow America’s economy by about $7 trillion over the next decade. And those immigrants would increase tax revenue by about $1 trillion, shrinking the deficit and helping pay for programs we all benefit from.

Immigrants of all statuses pay more in taxes than they get in government benefits. Research by the libertarian Cato Institute found first-generation immigrants pay $1.38 in taxes for every $1 they receive in benefits,

This is especially true for undocumented immigrants, who pay billions in taxes each year, but are excluded from almost all federal benefits. After all, you need documentation to receive federal benefits. Guess what undocumented immigrants don’t have. Hello?

And of course, one of the most common anti-immigrant claims also isn’t true.

No. Immigrants are not taking away jobs that Americans want. Undocumented immigrants in particular are doing some of the most dangerous, difficult, low-paying, and essential jobs in the country.

Despite what certain pundits might tell you, immigration has not stopped the U.S. from enjoying record-low unemployment.

And as the Baby Boom generation moves into retirement, young immigrants will help support Social Security by providing a thriving base of younger workers who are paying into the system. The fact that so many immigrants want to come here gives America an advantage over other countries with aging populations, like Germany and Japan.

What’s more, immigrants are particularly ambitious and hardworking. They are 80% more likely to start a new business than U.S. born citizens. Immigrant-founded businesses also impressively comprise 103 companies in last year’s Fortune 500.

And immigrants continue to add immeasurably to the richness of American culture. We should be celebrating them, not denigrating them.

It’s time to speak the facts and the truth. We need immigrants to keep our economy — and our country — vibrant and growing. They are not “poisoning the blood” of our nation. They’re renewing and restoring it.

999 notes

·

View notes

Text

The impact of service cuts needed, if TransLink can’t address a looming operating deficit, could end up costing Metro Vancouver households, the region’s mayors say. That figure was drawn from a report presented to the Mayors’ Council on Regional Transportation on Thursday, based on an estimated $1 billion annual hit to the region’s economy in the event drastic service cuts are implemented. TransLink says it is facing a $600-million funding gap starting in 2026. The budget shortfall is a result of falling gas tax revenue, fare hikes that haven’t kept pace with inflation and the growing cost of labour, fuel and maintenance. “The reality is that TransLink is faced with a significant funding shortfall, a structural deficit that is based on a very out-of-date funding model,” mayors’ council chair Brad West said. “And the worst thing that could happen to young people who depend upon transit is to have the service significantly reduced and that’s what’s on the table.”

Continue Reading.

Tagging: @newsfromstolenland

#Translink#Vancouver#public transportation#Public transit#cdnpoli#canada#canadian politics#canadian news

299 notes

·

View notes

Text

The budget reconciliation provision would raise eligibility requirements for low-income schools and districts to serve free meals to all students.

The House Ways and Means Committee is suggesting cutting $12 billion in school meal programs over 10 years by adjusting school qualification for the Community Eligibility Provision and requiring income verification for national K-12 breakfast and lunch programs, according to a document on the committee’s budget reconciliation options.

Specifically, the committee proposed raising the minimum threshold for low-income schools and districts to qualify for CEP, which allows low-income schools to serve free meals to all students. To participate in the program, 25% of students enrolled in a school have to be certified as eligible for free school meals. The House proposal calls for a 60% threshold.

The proposal would strip away 24,000 schools’ ability to participate in CEP, impacting over 12 million children, according to the Food Research & Action Center, a nonprofit anti-hunger advocacy group.

The suggested cuts offer an early glimpse into House Republicans’ priorities for school nutrition policy.

A rollback in school eligibility for the provision is being proposed just as Project 2025, a conservative policy blueprint from the Heritage Foundation, has called for the elimination of CEP altogether. The policy agenda developed in conjunction with some former Trump administration officials also recommended the U.S. Department of Agriculture, which oversees CEP, work with lawmakers to curb any efforts in support of universal school meal programs.

The federal school lunch and breakfast programs “should be directed to serve children in need, not become an entitlement for students from middle- and upper-income homes,” Project 2025 said.

The committee’s proposals have been released ahead of an expected budget reconciliation, which is part of a special legislative process to fast-track high-priority fiscal legislation that adjusts laws regarding spending, revenues, deficits or the debt limit.

Reconciliation bills cannot be filibustered in the Senate, “giving this process real advantages for enacting controversial budget and tax measures,” according to the nonpartisan research nonprofit Center on Budget and Policy Priorities. To pass, these bills only need a simple majority in the Senate rather than 60 votes and don’t require the president’s signature.

The committee’s move also comes at a time when CEP participation has climbed in recent years, most recently rising 19% during the 2023-24 school year.

As of last school year, half of all schools in the National School Lunch Program were using the provision to serve free meals to all students, according to a January FRAC report.

“Taking away this important and effective way for local schools to offer breakfast and lunch at no charge to all of their students would increase hunger in the classroom, reintroduce unnecessary paperwork for families and schools, increase school meal debt, and bring stigma back into the cafeteria,” FRAC said in a Jan. 17 statement.

Unpaid school meal debt has continued to increase for nearly a decade, according to a January report from the School Nutrition Association. In fact, the median unpaid school meal debt was $6,900 per district nationwide in 2024 — a 26% rise from the previous year.

When pandemic-era waivers ended in 2022 for a temporary universal school meal policy nationwide, some schools took on more meal debt.

Meanwhile, eight states have established their own universal meal programs in lieu of federal action, according to FRAC. Other states leaders are eyeing similar measures this year, including in Alaska, Missouri, Oregon, and New York.

#told you so#school lunch#poverty#politics#political#US politics#american politics#voting Republican literally steals food from hungry kids

107 notes

·

View notes

Text

Washington state Democrats accidentally leaked a document entitled “2025 Revenue Options” describing how they plan to hunt down citizens for additional taxes. An email containing the document and an accompanying PowerPoint presentation was sent to everyone in the Senate and entail exactly how they will wordsmith their way into extorting the people. “Do say: ‘Pay what they owe’ — but Don’t say: “Tax the rich” or “pay their fair share” because “taxes aren’t a punishment,” the graph read.

The proposal includes an 11% tax on firearms and ammunition. Storage units would be reclassified as RENTALS and seen as retail transactions. Amid the cost of living crisis exacerbated by shelter costs, these politicians believe that citizens should pay more in property taxes.

“Avoid centering the tax or talking in vague terms about ‘the economy’ or ‘education,’” the document states, instead opting to use positive connotations such as “providing,” “ensuring,” and “funding.” These lawmakers note that they must “identify the villain” who is preventing “progress.” That villain is the government, but the government needs to pin your woes on another source to create division. “We can ensure that extremely wealthy Washingtonians are taxed on their assets just like middle-class families are already taxed on theirs,” the slide reads.

The leaked document assures that this common rhetoric is intended to blind the masses into believing that tax hikes will not affect them but the dreaded “rich” who do not pay their “fair share.” In truth, no amount of taxation could ever be enough for the government as it spends perpetually with no plan to “pay their fair share” of debt.

Smart money has been fleeing blue states for this precise reason. Amazon’s Jeff Bezos notably fled Washington state for Florida, reportedly saving $1 billion on taxes alone. He moved his parents out of the state as well to avoid the death tax, which is among the highest in the nation at 20%. Governor Jay Inslee is wrapping up his term by insisting on a “wealth tax.”

The state is expected to face a $16 billion revenue deficit over the next four years and believes a 1% levy on the wealthiest residents could generate $3.4 billion over that time period. Businesses generating over $1 million annually would be in a new tax category called “service and other activities” and would be required to pay a 20% surcharge from October 2025 to December 2026. Come January 2027, successful businesses would be punished with a 10% tax. Why would anyone choose to conduct business in a state that punishes success? Innovators are not going to begin their businesses under these conditions and established companies will simply leave.

“Let’s be clear: there is a deficit ahead, but it’s caused by overspending, not by a recession or a drop in revenue,” Gildon said in a statement. “When the cost of doing business goes up, consumers feel it too. His budget would make living in Washington even less affordable.”

The state failed to manage its finances properly, and that burden now falls on the people. We see the same problem emerge at the local and federal levels. Governments feel entitled to YOUR money. Rather than correcting the root issue of spending and misallocated funds, governments believe the people they govern will foot the bill. The rhetoric is always the same as they insist they are “progressing” society by punishing the greedy and vilified rich. In truth, everyone suffers as a result of government mismanagement.

58 notes

·

View notes

Text

Trump is being handed an economy w/ declining tax revenues and rising expenditures, hence the exploding deficit - it's a disaster:

We're only 2 months into the fiscal year and the gov't has already racked up a deficit of over $624 billion, which is a whopping 64% increase IN A SINGLE YEAR.

October 1st is the start of the govt fiscal year. Oct and Nov 2023 the budget deficit was $380 billion.

Oct and Nov 2024 the budget deficit was $624 billion.

If you look at the data, govt revenue is down and spending is up dramatically. This is not sustainable.

49 notes

·

View notes

Photo

PRIMA PAGINA Le Figaro di Oggi giovedì, 10 ottobre 2024

#PrimaPagina#lefigaro quotidiano#giornale#primepagine#frontpage#nazionali#internazionali#news#inedicola#oggi figaro#scope#nadal#annoncee#tact#entre#mystere#tentative#cest#celte#gand#garo#grand#tennis#mies#miche#carnier#deficit#grace#effort#revenus

0 notes

Text

hiveworks:

-ignored me when i tried to warn them about kinomatika, a serial scam artist, and more or less affirming that their abuse toward me (which i did not detail or disclose to them, i focused on the financial facts) was monetarily justified

-used me as an unpaid consultant for 7 years, including picking out the CEO's outfits, website design, and advice. all unpaid.

-disclosed to me the personal lives and habits of other comic artists despite me literally never asking. if youve ever done anything unflattering in front of xel, then i heard about it. for some reason

-tried to repeatedly impress me or....something by constantly sending me updates about their lastest frivolous purchases or big financial deal or total revenue i would mysteriously never see the results of even in the form of trying to improve hive itself

-desperately wants to be thought of as a leftist collective despite their reliance on advertising and financial focus. they are not a collective or community. its an advertising agency with perks, if youre already making money

-had to be begged to have my website added in a timely manner after i was accepted and was at the bottom of the "to-do" pile from that point on. refused to work with me when flash was becoming depreciated. i wanted to either change it to html5 or, barring that, replace the flash video with a youtube embed. for some reason they refused to do this. now that have access to my backend again i can do it myself in like a few minutes lol.

-right before i left, they nuked the group/official discord and started imposing incredibly stupid rules bc adults were having too many emotions where they could see it

-are objectively wrong about piracy and the preservation of digital media, taking a firm "anti" stance until they realized it was morally unpopular. this extends to the members, who chronically petrified at the actually delusional belief that people are pirating them to such a degree that it causes a financial deficit

-the way they talk about their audiences is putrid. like theyre constantly angry at the attention and praise they've gone out of their way to cultivate. a common refrain was "you dont owe your audience anything" which is literally and demonstrably not true lol.

-barely paid me 100 dollars a month for this

toward the end of my run, other artists started bitching that i was making hive look bad "because it reflects back on them" so i left. upon realizing and being told i was representing the company that treated me like this, i was offered an out and took it. as a gift to them, primarily.

bad company. didnt like it.

258 notes

·

View notes