#rental property accounting software

Explore tagged Tumblr posts

Text

Watcher's Expenses

I didn't major in accounting: I took three classes and it grinded my brain to a fine powder. However, after graduating with a business admin degree, being a former eager fan of their videos, and from a cursory glance over their socials, there's a lot to consider in their spending behavior that really could start racking up costs. Some of these things we've already noticed, but there are other things I'd like to highlight, and I'll try to break it down into the different categories of accounting expenses (if I get something wrong, let me know. I was more concentrated in marketing 🤷♀️). I'm not going to hypothesize numbers either, as that would take out more time than I'm willing to afford-- you can assume how much everything costs. Anyways, here's my attempt at being a layman forensic accountant:

Note: All of this is assuming they're operating above board and not engaging in any illegal practices such as money laundering, tax evasion, not paying rent, etc.

Operating Expenses

Payroll: 25+ staff salaries and insurance

Overhead Expenses

CEO/founder salaries

Office space leasing or rent (In L.A, one of the most expensive cities in the US)

Utilities (water, electricity, heating, sanitation, etc.)

Insurance

Advertising Costs

Telephone & Internet service

Cloud Storage or mainframe

Office equipment (furniture, computers, printers, etc.)

Office supplies (paper, pens, printer ink, etc.)

Marketing costs (Social media marketing on Instagram, Youtube, SEO for search engines, Twitter, etc. Designing merchandise and posters, art, etc. )

Human Resources (not sure how equipped they are)

Accounting fees

Property taxes

Legal fees

Licensing fees

Website maintenance (For Watchertv.com, Watcherstuff.com, & Watcherentertainment.com)

Expenses regarding merchandising (whoever they contract or outsource for that)

Inventory costs

Potentially maintenance of company vehicles

Subsequent gas mileage for road trips

Depreciation (pertains to tangible assets like buildings and equipment)

Amortization (intangible assets such as patents and trademarks)

Overhead Travel and Entertainment Costs (I think one of the biggest culprits, evident in their videos and posts)

The travel expenses (flights, train trips, rental cars, etc. For main team and scouts)

Hotel expenses for 7-8 people at least, or potentially more

Breakfasts, lunches and dinners with the crew (whether that's fully on their dime or not, I don't know; Ryan stated they like to cover that for the most part)

Recreational activities (vacation destinations, amusement parks, sporting activities etc.)

The location fees

Extraneous Overhead costs (not sure exactly where these fall under, but another culprit, evident in videos and posts)

Paying for guest appearances

Expensive filming & recording equipment (Cameras, sound equipment, editing software subscriptions, etc.)

The overelaborate sets for Ghost files, Mystery Files, Puppet History, Podcasts etc. (Set dressing: Vintage memorabilia, antiquated tech, vintage furniture, props, etc.)

Kitchen & Cooking supplies/equipment

Office food supply; expensive food and drink purchases for videos

Novelty items or miscellaneous purchases (ex. Ghost hunting equipment, outfits, toys, etc.)

Non-Operating Expenses

These are those expenses that cannot be linked back to operating revenue. One of the most common examples of non-operating expenses is interest expense. This is because while interest is the cost of borrowing money from a creditor or a bank, they are not generating any operating income. This makes interest payments a part of non-operating expenses.

Financial Expenses

Potential loan payments, borrowing from creditors or lenders, bank loans, etc.

Variable Expenses

Hiring a large amount of freelancers, overtime expenditure, commissions, etc.

PR consultations (Not sure if they had this before the scandal)

Extraordinary Expenses

Expenses incurred outside your company’s regular business activities and during a large one-time event or transactions. For example, selling land, disposal of a significant asset, laying off of your employees, unexpected machine repairing or replacement, etc.

Accrued Expenses

When your business has incurred an expense but not yet paid for it.

------------------------------------------------------------------------------------------------------------------------

(If there's anything else I'm missing, please feel free to add or correct things)

To a novice or a young entrepreneur, this can be very intimidating if you don't have the education or the support to manage it properly. I know it intimidates the hell out of me and I'm still having to fill in the gaps (again, if I've mislabeled or gotten anything wrong here, please let me know). For the artistic or creative entrepreneur, it can be even harder to reconcile the extent of your creative passions with your ability to operate and scale your business at a sustainable rate. That can lead to irresponsible, selfish, and impulsive decisions that could irreparably harm your brand, which is a whole other beast of its own.

My guess at this point is that their overhead and operation expenses are woefully mismanaged; they've made way too many extraneous purchases, and that they had too much confidence in their audience of formerly 2.93 million to make up for the expenses they failed to cover.

It almost seems as if their internal logic was, "If we make more money, we can keep living the expensive lifestyle that we want and make whatever we want without anyone telling us we can't, and we want to do it NOW, sooner rather than later because we don't want wait and compromise our vision." But as you can see, the reality of fulfilling those ambitions is already compromised by the responsibility of running a business.

And I wrote this in another post here, but I'll state it again: Running a business means you need to be educated on how a business can successfully and efficiently operate. Accounting, marketing, social media marketing, public relations, production, etc; these resources and internet of things is available and at your disposal. If they had invested more time in educating themselves on those aspects and not made this decision based on artistic passion (and/or greed), they would have not gotten the response they got.

Being a graphic designer, I know the creative/passionate side of things but I also got a degree/got educated in business because I wanted to understand how to start a company and run it successfully. If they’re having trouble handling the responsibility of doing that, managing production costs, managing overhead expenses, and especially with compensating their 25+ employees, then they should hire professionals that are sympathetic to their creative interests, but have the education and experience to reign in bad decisions like these.

Anyways, thanks for coming to my TedTalk. What a shitshow this has been.

#watcher#watcher entertainment#ryan bergara#shane madej#steven lim#watcher tv#watchergate#accounting

64 notes

·

View notes

Text

25 Passive Income Ideas to Build Wealth in 2025

Passive income is a game-changer for anyone looking to build wealth while freeing up their time. In 2025, technology and evolving market trends have opened up exciting opportunities to earn money with minimal ongoing effort. Here are 25 passive income ideas to help you grow your wealth:

1. Dividend Stocks

Invest in reliable dividend-paying companies to earn consistent income. Reinvest dividends to compound your returns over time.

2. Real Estate Crowdfunding

Join platforms like Fundrise or CrowdStreet to invest in real estate projects without the hassle of property management.

3. High-Yield Savings Accounts

Park your money in high-yield savings accounts or certificates of deposit (CDs) to earn guaranteed interest.

4. Rental Properties

Purchase rental properties and outsource property management to enjoy a steady cash flow.

5. Short-Term Rentals

Leverage platforms like Airbnb or Vrbo to rent out spare rooms or properties for extra income.

6. Peer-to-Peer Lending

Lend money through platforms like LendingClub and Prosper to earn interest on your investment.

7. Create an Online Course

Turn your expertise into an online course and sell it on platforms like Udemy or Teachable for recurring revenue.

8. Write an eBook

Publish an eBook on Amazon Kindle or similar platforms to earn royalties.

9. Affiliate Marketing

Promote products or services through a blog, YouTube channel, or social media and earn commissions for every sale.

10. Digital Products

Design and sell digital products such as templates, printables, or stock photos on Etsy or your website.

11. Print-on-Demand

Use platforms like Redbubble or Printful to sell custom-designed merchandise without inventory.

12. Mobile App Development

Create a useful app and monetize it through ads or subscription models.

13. Royalties from Creative Work

Earn royalties from music, photography, or artwork licensed for commercial use.

14. Dropshipping

Set up an eCommerce store and partner with suppliers to fulfill orders directly to customers.

15. Blogging

Start a niche blog, grow your audience, and monetize through ads, sponsorships, or affiliate links.

16. YouTube Channel

Create a YouTube channel around a specific niche and earn through ads, sponsorships, and memberships.

17. Automated Businesses

Use tools to automate online businesses, such as email marketing or subscription box services.

18. REITs (Real Estate Investment Trusts)

Invest in REITs to earn dividends from real estate holdings without owning property.

19. Invest in Index Funds

Index funds provide a simple way to earn passive income by mirroring the performance of stock market indexes.

20. License Software

Develop and license software or plugins that businesses and individuals can use.

21. Crypto Staking

Participate in crypto staking to earn rewards for holding and validating transactions on a blockchain network.

22. Automated Stock Trading

Leverage robo-advisors or algorithmic trading platforms to generate passive income from the stock market.

23. Create a Membership Site

Offer exclusive content or resources on a membership site for a recurring subscription fee.

24. Domain Flipping

Buy and sell domain names for a profit by identifying valuable online real estate.

25. Invest in AI Tools

Invest in AI-driven platforms or create AI-based products that solve real-world problems.

Getting Started

The key to success with passive income is to start with one or two ideas that align with your skills, interests, and resources. With dedication and consistency, you can build a diversified portfolio of passive income streams to secure your financial future.

2 notes

·

View notes

Text

How to Make Sure You're Withholding and Reporting Your Taxes Correctly

Taxes are an inevitable part of life for most individuals and businesses. Whether you're a salaried employee, a freelancer, or a business owner, understanding how to withhold and report your taxes correctly is crucial to avoid potential legal troubles and financial headaches down the road. In this article, we will explore the key steps and considerations to ensure that you're handling your taxes in a responsible and compliant manner.

Know Your Tax Obligations

The first and most critical step in ensuring you're withholding and Outsource Management Reporting your taxes correctly is to understand your tax obligations. These obligations vary depending on your employment status and the type of income you earn. Here are some common categories of taxpayers:

1. Salaried Employees

If you're a salaried employee, your employer typically withholds income taxes from your paycheck based on your Form W-4, which you fill out when you start your job. It's essential to review and update your W-4 regularly to ensure that your withholding accurately reflects your current financial situation. Major life events like marriage, having children, or significant changes in your income should prompt you to revisit your W-4.

2. Freelancers and Self-Employed Individuals

Freelancers and self-employed individuals often have more complex tax obligations. You are responsible for estimating and paying your taxes quarterly using Form 1040-ES. Keep detailed records of your income and expenses, including receipts and invoices, to accurately report your earnings and deductions.

3. Small Business Owners

If you own a small business, your sales tax responsibilities extend beyond your personal income. You must separate your business and personal finances, keep meticulous records of all business transactions, and file the appropriate business tax returns. The structure of your business entity (e.g., sole proprietorship, partnership, corporation) will determine the specific tax forms you need to file.

4. Investors and Property Owners

Investors and property owners may have to report income from dividends, interest, capital gains, or rental properties. These income sources have their specific tax reporting requirements, and it's essential to understand and comply with them.

Keep Accurate Records

Regardless of your tax situation, maintaining accurate financial records is essential. Detailed records make it easier to report your income and deductions correctly, substantiate any claims you make on your tax return, and provide documentation in case of an audit. Here are some record-keeping tips:

Organize Your Documents: Create a system to store your financial documents, including receipts, invoices, bank statements, and tax forms. Consider using digital tools for easier record keeping.

Track Income and Expenses: Keep a ledger or use accounting software to record all income and expenses related to your financial activities. Categorize expenses correctly to maximize deductions and credits.

Retain Documents for Several Years: The IRS typically has a statute of limitations for auditing tax returns, which is generally three years. However, in some cases, it can extend to six years or indefinitely if fraud is suspected. To be safe, keep your tax records for at least seven years.

Understand Deductions and Credits

Deductions and credits can significantly reduce your tax liability. Deductions reduce your taxable income, while credits provide a dollar-for-dollar reduction of your tax bill. Familiarize yourself with common deductions and credits that may apply to your situation:

Standard Deduction vs. Itemized Deductions: Depending on your filing status and financial situation, you can choose between taking the standard deduction or itemizing your deductions. Itemizing requires more documentation but can result in greater tax savings.

Tax Credits: Explore available tax credits, such as the Earned Income Tax Credit (EITC), Child Tax Credit, and Education Credits. These credits can provide substantial savings, especially for low- to moderate-income individuals and families.

Business Expenses: If you're self-employed or a small business owner, be aware of deductible business expenses, including office supplies, travel expenses, and home office deductions.

Seek Professional Assistance

Tax laws are complex and subject to change. Seeking professional assistance from a certified tax professional or CPA (Certified Public Accountant) can be a wise investment. Tax professionals can help you:

Maximize Deductions: They are well-versed in the intricacies of tax law and can identify deductions and credits you might overlook.

Ensure Compliance: Tax professionals can ensure that you are complying with current tax laws and regulations, reducing the risk of costly errors or audits.

Provide Tax Planning: They can help you create a tax-efficient strategy to minimize your tax liability in the long term.

Represent You in Audits: If you face an audit, a tax professional can represent you and help navigate the process.

File Your Taxes on Time

Filing your taxes on time is crucial to avoid penalties and interest charges. The tax filing deadline for most individuals is April 15th. However, if you need more time, you can file for an extension, which typically gives you until October 15th to submit your return. Keep in mind that an extension to file is not an extension to pay any taxes owed, so pay as much as you can by the original deadline to minimize interest and penalties.

Consider Electronic Filing

Electronic filing (e-filing) is a secure and convenient way to submit your tax return to the IRS. It reduces the risk of errors and ensures faster processing and quicker refunds, if applicable. Many tax software programs offer e-filing options, making it easy for individuals and businesses to submit their returns electronically.

Stay Informed and Adapt

Tax laws can change from year to year, so staying informed is essential. Follow updates from the IRS and consult outsourcing sales tax services professionals or resources to understand how changes in tax laws may affect you. Be proactive in adapting your tax strategies to maximize savings and remain compliant with current regulations.

In conclusion, withholding and reporting your taxes correctly is a responsibility that should not be taken lightly. Understanding your tax obligations, keeping accurate records, leveraging deductions and credits, seeking professional assistance when needed, and filing on time are essential steps to ensure a smooth and compliant tax-filing experience. By following these guidelines, you can navigate the complexities of the outsourcing sales tax services system with confidence and peace of mind. Remember that taxes are a fundamental part of our society, and paying them correctly ensures that essential public services and infrastructure are funded for the benefit of all.

2 notes

·

View notes

Text

Quicken vs QuickBooks: Which One is Right for Your Business?

Are you struggling to choose the right accounting software for your business? Look no further! In this post, we'll be comparing Quicken vs QuickBooks – two of the most popular accounting software on the market. Both are powerful tools that offer features to manage your finances, but which one is right for you? Join us as we dive into what makes these two options unique and how to make an informed decision based on your business needs. Let's get started!

Comparing Quicken vs QuickBooks

When it comes to managing your business finances, Quicken and QuickBooks are two of the most popular software options available. While Quicken vs QuickBooks both programs offer similar accounting features such as tracking expenses and income, there are some key differences between them.

Quicken is designed primarily for personal finance management. It's a great option if you're self-employed or run a small business with just a few employees. With Quicken, you can track your bank accounts, credit cards, investments and more in one place.

On the other hand, QuickBooks is more ideal for businesses that require robust accounting tools like inventory management and payroll processing. It's also suitable for larger organizations with multiple users who need access to financial data simultaneously.

Another difference between these two platforms is their pricing models. Quicken offers a one-time purchase fee while QuickBooks has monthly subscription plans based on the features required by your business.

Ultimately, choosing between Quicken vs QuickBooks depends on your specific needs as well as the size and complexity of your organization. Consider factors such as budget constraints and which features are necessary for efficient financial management before making a decision.

What is Quicken?

Quicken is a personal finance management software that has been around since 1983. It was originally designed to help individuals manage their finances by tracking income and expenses, creating budgets, and generating reports. Today, Quicken offers various versions of its software that cater to different financial needs.

One version of Quicken is called Quicken Deluxe which allows users to track investments in addition to managing their personal finances. Another version is called Quicken Premier which includes features for managing rental properties as well as investment tracking.

Quicken also offers a mobile app that allows users to access their financial information on the go. Users can sync their data across devices so they always have access to up-to-date information.

Quicken is best suited for individuals or small businesses looking for an easy way to manage their personal finances without needing advanced accounting knowledge.

What is QuickBooks?

QuickBooks is a popular accounting software designed for small businesses to manage their financial transactions, invoices, bills and expenses. It was developed by Intuit and first released in 1983 as a desktop application. Since then, it has expanded its features and services to cater to the growing needs of businesses.

This software allows users to track inventory levels, create sales orders, generate reports and integrate with other applications such as payroll systems. QuickBooks also offers cloud-based versions that enable users to access their data from anywhere at any time.

One of the key benefits of using QuickBooks is its user-friendly interface which makes it easy for beginners to navigate through various financial tasks. The program also provides tutorials and customer support resources for those who need additional assistance.

Another great advantage of this software is that it can be customized according to specific business requirements. Users can choose from different plans based on the size of their business or opt for add-ons like payroll management or payment processing services.

QuickBooks has become a go-to solution for small businesses looking for an efficient way to handle their finances while staying organized and compliant with tax laws.

The Difference between Quicken vs QuickBooks

Quicken and QuickBooks are both financial management software options, but they serve different purposes. Quicken is a personal finance management tool that can help individuals with their budgeting, banking, and investment tracking needs. On the other hand, QuickBooks is an accounting software designed specifically for small businesses.

One of the key differences between Quicken vs QuickBooks is in their functionality. While Quicken focuses on managing personal finances, QuickBooks offers more comprehensive features such as invoicing, payroll processing, inventory management, and accounts payable/receivable. This makes it a better option for small business owners who need to manage multiple aspects of their financial transactions.

Another difference between these two accounting tools is their pricing model. Quicken typically charges a one-time fee for purchasing its software while QuickBooks follows a subscription-based model where users pay monthly or annually depending on the plan they choose.

Deciding whether to use Quicken vs QuickBooks depends largely on your individual needs as well as those of your business if you have one. If you're looking for robust accounting capabilities with features like invoicing or inventory tracking then go for QuickBooks while if you're just looking to manage personal finances then stick with Quicken

Which One is Right for Your Business?

When it comes to deciding which accounting software is right for your business, there are a few factors you should consider. One of the first things you need to determine is what specific features your business needs. For example, if your business requires inventory tracking or payroll management, QuickBooks may be the better option for you.

Another important consideration is the size of your business. Quicken may be more suitable for small businesses or sole proprietors who don't require as many advanced features as larger companies. On the other hand, QuickBooks can handle multiple users and large amounts of data, making it ideal for medium-sized and larger businesses.

The level of technical expertise required to use each software platform is also an important factor to consider. If you have limited experience with accounting software and want something user-friendly and easy-to-learn, Quicken may be a better choice. However, if you're comfortable with technology and want more advanced capabilities like custom reports or integrations with other software tools, QuickBooks might suit your needs better.

Ultimately, choosing between Quicken vs QuickBooks depends on understanding what your business requirements are in terms of functionality, size and technical aptitude. By taking these factors into account when selecting an accounting solution that best meets those criteria will help ensure success over time.

How to Choose the Right Accounting Software for Your Business

Choosing the right accounting software for your business can be overwhelming, especially with so many options available. Here are some important factors to consider when selecting the best fit for your needs:

Business Size: Consider the size of your business and whether you need a basic or advanced accounting system.

Features: Look at the features offered by each platform and determine which ones are essential for managing your finances.

User Interface: Make sure that you choose a user-friendly interface that is easy to navigate and understand.

Integration: Check if the software integrates with other tools such as payment processors, CRMs, or inventory management systems.

Support: Choose a platform that offers reliable customer support in case any issues arise.

Security: Ensure that the software has robust security measures in place to safeguard sensitive financial data from potential cyber threats.

Pricing: Determine whether there are any upfront costs, monthly fees or hidden charges associated with using the accounting software before making a final decision.

By considering these factors carefully when choosing an accounting system, you'll have greater confidence in finding one that meets all of your requirements and helps drive success for your business!

Conclusion

After comparing Quicken vs QuickBooks and analyzing the features of both accounting software, it's clear that they have significant differences.

Quicken is best suited for individuals or small business owners who need to manage their personal finances or do basic bookkeeping tasks. On the other hand, QuickBooks provides a more robust platform with advanced tools and features that cater to larger businesses.

Choosing the right accounting software depends on your individual needs and budget. Consider factors such as business size, industry type, level of financial expertise, and future growth plans when making your decision.

Whichever software you choose between Quicken vs QuickBooks will help streamline your financial management processes and improve the accuracy of your accounting records. So take time to evaluate both options carefully before deciding which one is right for your business!

3 notes

·

View notes

Text

VAT in Saudi Arabia: A Quick Guide for Businesses

Value Added Tax (VAT) is a crucial part of Saudi Arabia’s tax system, impacting businesses across all sectors. Since its implementation in January 2018, VAT has undergone changes, affecting pricing, compliance, and financial management for businesses operating in the Kingdom.

With the standard VAT rate at 15%, businesses must look after registration, invoicing, reporting, and compliance requirements while strategizing VAT optimization and recovery.

This post provides an in-depth overview of VAT in Saudi Arabia, including who needs to register, key compliance obligations, penalties, and best practices to manage VAT efficiently.

What is VAT?

Value Added Tax (VAT) is a consumption tax applied at each stage of the supply chain, ultimately borne by the end consumer. Businesses collect VAT on sales (output VAT) and pay VAT on purchases (input VAT), remitting the difference to the Zakat, Tax, and Customs Authority (ZATCA).

Saudi Arabia introduced VAT as part of the Gulf Cooperation Council (GCC) VAT Agreement, an economic reform initiative to reduce reliance on oil revenue and diversify income sources.

Current VAT Rate in Saudi Arabia

Standard VAT rate: 15% (increased from 5% in July 2020)

Zero-rated supplies: 0% VAT (applies to certain exports and essential services)

Exempt supplies: No VAT charged (specific financial services, residential rental properties, etc.)

(Source: ZATCA – Saudi Arabia’s Tax Authority, 2024)

Who Needs to Register for VAT in Saudi Arabia?

1. Mandatory VAT Registration

Businesses must register for VAT if their annual taxable turnover exceeds SAR 375,000 ($100,000). This applies to:

- Local businesses selling goods or services in Saudi Arabia. - Foreign businesses providing taxable supplies within Saudi Arabia. - E-commerce businesses selling digital goods or services.

2. Voluntary VAT Registration

Businesses with annual taxable turnover between SAR 187,500 ($50,000) and SAR 375,000 ($100,000) may voluntarily register to reclaim VAT on expenses.

Exemptions from VAT Registration

- Businesses with a turnover below SAR 187,500 ($50,000). - Entities engaged only in VAT-exempt activities (like certain financial services).

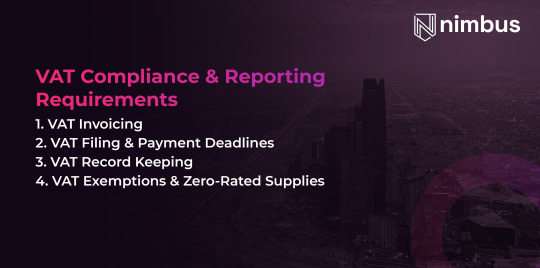

- VAT Compliance & Reporting Requirements

1. VAT Invoicing

Businesses must issue tax invoices with the following details:

Supplier & buyer details (name, address, VAT number).

Invoice date & VAT rate (15% or zero-rated).

VAT amount and total price including VAT.

Invoices must be issued within 15 days of the month following a sale.

2. VAT Filing & Payment Deadlines

Businesses with annual revenue above SAR 40 million: Monthly VAT filing.

Businesses with annual revenue below SAR 40 million: Quarterly VAT filing.

VAT returns must be filed and paid within 30 days after the tax period ends.

3. VAT Record Keeping

Businesses must maintain VAT records for at least six years, including:

Tax invoices & receipts.

VAT returns filed with ZATCA.

Import/export documentation.

4. VAT Exemptions & Zero-Rated Supplies

Zero-Rated VAT (0%)

- Exports of goods & services to non-GCC countries. - International transport services (e.g., airlines). - Certain medical & educational services (as per ZATCA guidelines).

VAT-Exempt Supplies

- Financial services (e.g., interest on loans, insurance). - Residential property leases. - Local transport services.

(Source: ZATCA, 2024 VAT Guidelines)

VAT for Foreign Businesses & E-Commerce Companies

- Reverse Charge Mechanism (RCM)

Foreign businesses providing taxable services to Saudi customers must comply with the Reverse Charge Mechanism (RCM), where the recipient accounts for VAT instead of the supplier.

- VAT on Digital Services (E-Commerce VAT)

Foreign e-commerce platforms selling digital goods & services (e-books, streaming, software, etc.) must register for VAT in Saudi Arabia, even without a physical presence.

(Source: GCC VAT Framework, 2024)

Optimizing VAT Recovery

1. Claiming Input VAT Deductions

Businesses can reclaim VAT paid on business expenses, including: ✔ Rent & utilities for commercial premises. ✔ Raw materials & production costs. ✔ IT & business consulting services.

2. Avoiding VAT Leakage

✔ Ensure proper VAT invoicing to claim deductions. ✔ Conduct regular VAT audits to identify overpayments. ✔ Use automated accounting software for VAT tracking.

Why Businesses Must Stay VAT Compliant in the KSA?

Saudi Arabia takes compliance seriously and to ensure seamless business operations within the region, businesses must do the same. With Saudi Arabia’s VAT regime firmly in place, businesses must register on time to avoid penalties.

They should issue compliant tax invoices and maintain accurate records and file VAT returns & payments on time to stay compliant.

For complete and proper understanding of Saudi Arabia’s VAT landscape, it’s wise to engage in professional tax advisory and accounting services. Understanding VAT obligations ensures smooth operations, financial compliance, and cost-saving opportunities.

0 notes

Text

Pros and Cons of Hiring a Tax Professional: 5 Signs You Need One

Is It Time to Call in a Tax Pro?

Tax season comes around every year, and many people wonder: Do I really need a tax professional, or can I handle it myself? 🤔

Some taxpayers thrive on DIY tax filing, while others find themselves overwhelmed by complex tax codes, deductions, and IRS rules. The truth? Not everyone needs a tax pro, but some situations make hiring one a smart financial move.

👉 In this blog, we’ll cover: ✔ The real pros and cons of hiring a tax professional✔ 5 clear signs that DIY tax filing may not be enough for you✔ How to decide if hiring a tax pro is worth the cost

💬 Have you ever regretted doing your own taxes? Share your experience in the comments! ⬇️

✅ The Pros and Cons of Hiring a Tax Professional

Before we dive into the 5 key signs you need a tax pro, let’s break down the pros and cons of hiring a tax professional to help you weigh your options.

🟢 Pros of Hiring a Tax Professional

1️⃣ More Tax Savings & Bigger Refunds

A tax professional knows the loopholes, deductions, and credits that DIY tax software might miss—which could mean a lower tax bill or a bigger refund.

📌 Example: A freelancer saved $6,200 in taxes after hiring a CPA who found overlooked deductions.

2️⃣ IRS Audit Protection & Compliance

Making a mistake on your tax return can lead to penalties, IRS audits, or legal trouble. A tax professional ensures accuracy and helps you avoid red flags.

📢 Fact: The IRS audits 5x more self-employed individuals than W-2 employees.

3️⃣ Saves Time & Reduces Stress

If your tax situation is complex, you could spend hours—or even days trying to figure it out yourself. A tax professional does all the work for you, so you don’t have to stress.

📌 Did You Know? The average person spends 13 hours preparing their taxes.

🔴 Cons of Hiring a Tax Professional

1️⃣ It’s More Expensive Than DIY Tax Software

Hiring a tax pro can cost anywhere from $200 to $1,500+, while tax software typically costs $0 - $150.

📌 Average Cost of Hiring a Tax Professional:✔ Simple Tax Return: $200 - $400✔ Business Owners/Self-Employed: $500 - $1,500+

2️⃣ Not Every Tax Pro is Qualified

Did you know anyone can call themselves a "tax preparer"—even without a license? 😳

🚨 Trusted Credentials to Look For:✔ Certified Public Accountant (CPA) – Best for businesses & high earners. ✔ Enrolled Agent (EA) – IRS-certified, great for audits & tax planning. ✔ Tax Attorney – Best for legal tax matters.

📢 Quick Tip: Avoid tax preparers who charge based on your refund amount—this is a red flag 🚩.

3️⃣ Less Control Over Your Tax Return

Some people like to be hands-on with their finances. If you hire a tax professional, you’re trusting someone else to handle your tax situation.

📢 Quick Tip: A good tax pro should always explain what they’re doing, so you’re never left in the dark.

🚨 5 Signs You Need to Hire a Tax Professional

Even with the pros and cons of hiring a tax professional, some situations make hiring a pro the best choice. Here are 5 clear signs that DIY tax filing might not be enough for you.

1️⃣ You Own a Business or Side Hustle

Freelancers, business owners, and gig workers have unique tax deductions that DIY software might miss—which could cost you thousands.

📌 Example: A small business owner missed $4,000 in deductions using DIY software but recovered it after hiring a CPA.

2️⃣ You Have Multiple Income Streams

Do you earn income from rental properties, stocks, cryptocurrency, or investments? If so, your tax return is more complicated than a standard W-2 filer—and DIY tax software may not guide you correctly.

📢 Fact: Taxpayers with multiple income sources are more likely to be audited due to reporting errors.

3️⃣ You’re in a High Tax Bracket ($100K+)

High-income earners face higher tax rates—but they also have more opportunities to reduce taxable income. A tax professional can help you keep more of your money legally.

4️⃣ You Owe Back Taxes or Face IRS Issues

If you owe past-due taxes, have unfiled returns, or received an IRS notice, a tax professional can negotiate on your behalf and help avoid penalties.

📢 Quick Tip: If you owe more than $10,000, the IRS may allow a settlement—but only if negotiated properly.

5️⃣ You Had a Major Life Change This Year

Did you get married, divorced, inherit money, or buy a house? These life changes can affect your taxes big time—and a tax pro can help you navigate them.

📢 Fact: New homeowners often overlook mortgage deductions, costing them hundreds in missed savings.

🚀 Final Thoughts: Do You Need a Tax Professional?

If your tax situation is simple, DIY tax software might be all you need. But if you own a business, invest, or need expert advice, hiring a tax professional could save you money and stress in the long run.

💬 Still unsure? Read Tax Preparer vs. Tax Software: Pros, Cons & Best Choice to compare both options side by side.

📢 Before hiring a tax pro, be aware of the risks! Read The Truth About Hiring a Tax Pro: Pros, Cons & Hidden Costs to avoid unexpected fees.

📢 Need tax help? Book a FREE consultation today!

#pros and cons of hiring a tax professional#tax expert vs DIY#when to hire a tax pro#tax professional benefits#do I need a tax professional

0 notes

Text

Property Maintenance Logo Vectors & Illustrations for Free ...Browse 25526 incredible Maintenance Logo vectors, icons, clipart graphics, and backgrounds for royalty-free download from the creative contributors at ..property management,property management software,property managers,maintenance management,rental property,property management company,doorloop property management software,property accounting,rental property accounting,property maintenance,the property maintenance show,property maintenance services,property management solutions,best property management software,property maintenance services perth,property maintenance services sydney

0 notes

Text

Outsourced Accounting Services for Real Estate USA

Why do profitable real estate businesses appear so relaxed with numbers and finances? The secret often lies in utilizing real estate accounting services which manage all of the financial management for them. If you handle residential properties or sprawling business complexes, keeping the books straight is essential but may be complex for those in the real estate sector. That is where outsourcing accounting services come in, with experience and accuracy which can change your business operations.

Understand Real Estate Accounting Services

Accounting services for real estate are more than balancing books and filing payroll. They include managing property investments, rental cash flow, operational costs and financial reporting certain for the real estate market. These services track every financial detail, from tenant leases to property acquisition expenses.

If you outsource real estate accounting functions, you employ experts in real estate finances. This ensures you meet regulations and positions your business for better financial health and profits.

Why Outsource Your Accounting?

Among the major reasons to outsource is usually to get expertise that isn't available internally. A real estate accounting company knows the sector and can assist with tax methods, compliance and financial efficiency. Outsourcing also means you stay clear of the overhead associated with keeping a large accounting department - which is usually much more advantageous for mid-sized or smaller firms.

Moreover, accountants for real estate understand software and applications which create precise, timely reports so you will know how you stand financially without needing to get your hands on the details on your own. This clarity is critical for quick business decisions.

Finding the Right Real Estate Accounting Service

The right partner for your accounting is critical. You need a firm that comprehends the real estate sector and its opportunities and challenges. Criteria ought to be expertise, service portfolio, usage of technology and knowledge of real estate market trends.

Most parts of real estate accounting are specialized. Those include cost segregation, real estate-oriented tax planning and compliance, lease abstraction and CAM (Common Area Maintenance) reconciliations. Ensure that the service you select can handle all these aspects.

Top Real Estate Outsourced Accounting Services USA

Some firms in the United States provide real estate outsourced accounting services like The Fino Partners. These firms provide precise, dependable and strategic financial guidance. They handle your routine bookkeeping to your complicated financial reporting and planning to keep your real estate business profitable and compliant.

Outsourced Accounting Benefits

Here are the main benefits of outsourced accounting services:

Save Money

Outsourcing your accounting can cut costs. You save on salaries and benefits without an in house accounting staff. There is also no need to purchase costly accounting software - nearly all outsourced companies offer their very own. Research indicates that outsourcing is able to cut your operational expenses by up to 60%.

Flexibility with Scale

Your real estate business expands and so do your accounting needs. An outsourced accounting service can customize their services to your business size. What this means is you can grow or pull back if you have to - these types of services are able to scale up or decrease without needing to employ additional personnel or eliminate jobs.

Expertise on Your Side

Whenever you outsource, you are not simply employing an accountant. You are hiring experts. These professionals are familiar with current real estate accounting trends and requirements. They bring experience that is tough to match in-house, particularly in complex areas like financial reporting and tax compliance.

Advanced Technology

Outsourced accounting firms use the most recent accounting software and technologies. This ensures you with greatest data security, fast processing of transactions and clear financial reporting. This technology also automates regular tasks so you can invest your time making strategic business choices.

By selecting outsourced accounting, real estate businesses can use financial expertise, technology and scalable solutions to develop and boost efficiency while lowering costs.

Making the Right Decision

Outsourcing your accounting is a huge decision which may help your real estate company operate better and also grow faster. Partnering with experts that understand the industry means you can concentrate on your business and then leave the financial details to the pros.

Prepared to discover the best real estate accounting services USA? Look no further than The Fino Partners. Our team specializes in real estate and provides cutting-edge accounting that will help you simplify your operation, boost your profitability and maintain proper financial management. Call us today to discuss how we can help you be financially clear and profitable in your real estate endeavors.

#real estate accounting services#real estate outsourced accounting services#accounting for real estate#accountant for real estate#the fino partners accounting

0 notes

Text

Simplifying Startup Registration: Key Steps and Benefits

Introduction:

Establishing a Startup Registration is an exciting endeavor, but it commences with a vital step: the registration of your business. Registering your startup is essential for ensuring legal operation, enhancing credibility, and establishing a foundation for future expansion. While the registration process may appear daunting, dividing it into smaller, manageable tasks can greatly ease the experience. This article will outline the essential steps for registering your startup and the advantages that accompany this process.

Essential Steps for Registering Your Startup

Choose the Appropriate Business Structure

The initial and most critical choice involves selecting the right legal structure for your enterprise. This decision influences your liabilities, tax responsibilities, and regulatory obligations. Common structures include:

Sole Proprietorship: Easy to establish but lacks personal liability protection.

Partnership: Ideal for ventures with multiple founders, though partners face unlimited liability.

Limited Liability Partnership (LLP): Merges the flexibility of a partnership with the liability protection of a corporation.

Private Limited Company (PLC): The most favored structure for startups, providing limited liability and opportunities for growth.

One Person Company (OPC): Tailored for individual entrepreneurs seeking corporate advantages.

Select a structure that aligns with your business objectives and long-term aspirations.

2. Confirm Your Business Name

Your business name serves as your market identity. Choose a name that embodies your brand’s mission and values. It is crucial to ensure that the name is distinctive and not already in use or trademarked. You can check name availability through government websites or trademark databases.

3. Compile Necessary Documentation

Assemble all required documents for the registration process. These generally include:

Proof of identity and address for founders and directors.

Evidence of the registered office address (such as a rental agreement or utility bill).

Memorandum of Association (MOA) and Articles of Association (AOA).

Ensure that all documents are accurate and current to prevent any delays.

4. Register Your Company

Initiate the process of company registration with the relevant governmental body, such as the Registrar of Companies (ROC) in India. For online registration, the following documents are required:

Digital Signature Certificate (DSC): This is necessary for signing electronic documents.

Director Identification Number (DIN): This is mandatory for all directors of the company.

Upon successful processing and approval of your application, you will receive a Certificate of Incorporation (COI), which formally establishes your company.

5. Obtain Necessary Licenses and Permits

Depending on the nature of your business and the industry in which you operate, you may be required to acquire specific licenses. Common examples include:

GST Registration: This is compulsory for businesses that exceed a certain turnover threshold.

Trade License: This is necessary for conducting business within a designated area.

FSSAI License: This is essential for businesses involved in the food sector.

Professional Tax Registration: This applies to certain professions.

It is advisable to research the specific requirements pertinent to your industry to ensure compliance.

6. Open a Business Bank Account

Establishing a dedicated business bank account is crucial for the professional management of your finances. Most financial institutions will require your company’s PAN, COI, and a board resolution that authorizes the opening of the account.

7. Protect Intellectual Property

It is important to protect your brand and innovations by registering your intellectual property, which may include:

Trademark: For your brand name, logo, or tagline.

Patent: For any unique inventions or processes.

Copyright: For creative works such as software, designs, or written content.

8. Stay Compliant with Legal Requirements

Maintaining ongoing compliance is essential for ensuring that your startup remains in good legal standing. This includes:

Filing annual returns.

Keeping statutory registers up to date.

Conducting regular board meetings.

Timely payment of taxes.

Advantages of Registering Your Startup

Legal Identity

By registering your startup, you establish a legal identity that sets it apart from unregistered entities. This legal status enables you to enter into contracts, initiate legal proceedings, and hold property under the company’s name.

2. Protection from Personal Liability

In business structures such as Limited Liability Partnerships (LLPs) and Public Limited Companies (PLCs), the liabilities incurred by the business do not affect personal assets. This safeguard is essential for mitigating financial risks.

3. Access to Financial Resources

Registered businesses are favored by investors and financial institutions. A registered startup is better positioned to obtain loans, attract venture capital, and engage in government funding initiatives, such as those offered by Startup India.

4. Tax Advantages and Incentives

Startups that are officially registered may be eligible for tax exemptions and various government incentives, particularly under programs designed to foster entrepreneurship. For example, certain startups in India benefit from a three-year tax exemption under the Startup India initiative.

5. Increased Credibility

A registered business is more likely to gain the trust of customers, partners, and suppliers. This registration signifies professionalism and a dedication to adhering to legal standards.

6. Simplified Business Operations

With proper registration, your startup can more easily access essential services such as business loans, import/export licenses, and supplier agreements, minimizing bureaucratic hurdles.

7. Protection of Brand Identity

Registering your business name and intellectual property safeguards against unauthorized use, ensuring that your brand’s reputation and integrity are preserved.

Conclusion

While the process of registering a startup may seem daunting, adhering to the essential steps detailed above can facilitate a smooth experience. The advantages of registration—such as legal acknowledgment, protection against liabilities, increased credibility, and access to funding—significantly surpass the initial challenges involved. A business that is duly registered not only complies with legal requirements but also sets the stage for sustainable success. Initiate your journey today and establish a robust foundation for your entrepreneurial endeavors.

GTS Consultant India simplifies startup registration by providing expert guidance through essential steps, ensuring compliance, and unlocking key benefits. Trust their expertise to build a solid foundation for your business success.

0 notes

Text

Dynamics 365 F&o Supports Real Estate And Property Management

Property management and real estate require robust systems to manage complex tasks, such as tenant billing, maintenance of property, and financial reports. Property managers are faced with challenges when managing multiple tenants and properties. They also face the challenge of ensuring efficiency, accuracy and compliance. Dynamics 365 Property Management offers a complete solution for streamlining real estate operations.

Lease and Tenant Management

Effective lease and tenant management is a core aspect of effective property management. Dynamics 365 F&O streamlines the entire process.

Automatic lease renewal and creation: This system tracks and updates all lease agreements.

Real-time notification: The property manager receives alerts about upcoming lease renewals and expirations, which reduces the chance of missing deadlines.

Automating these processes allows property managers to focus on improving tenant satisfaction and reducing administrative overhead.

Automatic Invoicing and Billing

Invoicing and billing can take a lot of time, particularly for larger portfolios. Dynamics 365 F&O helps to address this issue by:

Automated invoice generation: Bills are generated automatically for utilities, rent and maintenance according to predefined schedules.

Integrating financial modules : A seamless integration between the financial module and revenue tracking ensures accurate real-time data.

The automation of tenant billing reduces error, accelerates cash flow and ensures transparency.

Property Maintenance Services

Property management is not complete without maintenance. Dynamics 365 F&O improves the maintenance management process by:

Tracking and logging maintenance requests Tenants and property managers are able to easily track and log requests.

Schedule preventive maintenance : A regular maintenance schedule helps prevent expensive repairs and assure tenant satisfaction.

These features can help property managers maintain the value of their properties and increase tenant retention.

Portfolio Asset Management

Tracking performance for property managers who manage large portfolios is crucial. Dynamics 365 F&O offers:

Portfolio management A central dashboard provides insights on occupancy rates, revenues, and profitability.

Power BI Dashboards: Managers are able to visualize assets and data-driven decision.

The tools below can help managers maximize the performance of their assets and increase ROI.

Compliance with Financial and Regulatory Standards

Real estate companies must comply with all financial regulations. Dynamics 365 F&O provides:

Supports global accounting standards: Supports the compliance of IFRS 16, ASC 842, and other accounting standards.

Simple tax reporting and filing: Financial reports are automated to make compliance with regulatory requirements easier.

Compliance reduces risks and improves the credibility of stakeholders.

Analytics and reporting for advanced users

Real estate relies on data-driven decisions. Dynamics 365 F&O includes:

Powerful analytics: Property managers can create custom reports using Power BI and monitor key metrics.

Predictive Analytics: Helps in strategic planning by forecasting rental income and value of property.

This information allows property managers to be ahead of the market and increase profitability.

CRM Capabilities for Real Estate

In real estate, customer relationship management is essential. Dynamics 365 F&O uses CRM to:

Improve tenant engagement Track communications, manage inquires, and automate following-up.

Improve operational efficiency by automating workflows for property leasing and sales: Support the sale and lease of property.

By streamlining CRM, property managers can improve customer service and build better relationships.

The conclusion of the article is:

Dynamics 365 F&O has revolutionized the real estate industry. The software offers solutions from end to end that improve efficiency, accuracy and profitability. It addresses industry-specific challenges, including lease management and advanced analytics.

Are you ready to transform the way your property management operation is run? Learn more about Dynamics 365 Property Management or request a demonstration today.

0 notes

Text

Bookkeeping for property management companies

Bookkeeping for property management companies focuses on maintaining accurate financial records for rental properties, ensuring seamless accounting and compliance with tax regulations. These services include tracking rent payments, managing vendor invoices, reconciling accounts, and generating monthly financial statements. Professional bookkeeping helps property managers reduce errors, optimize cash flow, and make informed financial decisions. By using software like QuickBooks, Buildium, and AppFolio, property management companies can streamline operations and maintain financial transparency. Reliable bookkeeping services enable property managers to focus on growing their business while maintaining organized and efficient financial records.

1 note

·

View note

Text

"Revolutionizing Property Management: The Benefits and Features of Real Estate Software Solutions"

In today's ever-growing real estate industry, efficiency and accuracy are critical when the property manager handles several properties and numerous tasks. They can do everything, including managing tenants, monitoring finances, and coordinating maintenance work, which can be overwhelming. That's where property management software steps in to change the scenario from manual tasks to a neatly streamlined solution quite digitally.

Understanding Real Estate Property Management Software

Real estate property management software is designed for carrying out and streamlining all processes concerning property management. Centralized for property management, tenants, accounts, and maintenance, this software typically features the following topics:

· Tenant Management: Make tenant screening, lease agreements, rent collection, and communications simpler.

· Maintenance Management: Manage maintenance requests, work orders, and vendor interactions.

· Financial Management: Exact income and expense monitoring, with careful reporting.

· Document Management: The storing and organizing of all important documents like leases, rental agreements, and property records.

· Communication Tools: Includes communication between tenants, vendors, and property owners through the integrated messaging and email features.

Benefits of Using Real Estate Property Management Software

Property management systems provide many benefits to property managers in the real estate sector:

1. Effectiveness: Property management software automates routine tasks, enabling property managers to focus on the more strategic tasks that improve tenant satisfaction.

2. Perfection: The precision with which such software interacts with data minimizes the risk of error and guarantees that all accounting rules are followed.

3. Connectedness: The managing tenants or vendors using this kind of software utilize online centralized communication platforms for better coordination.

4. Better Decision-Making: Being privy to real-time data and analytical insights offers property managers a fighting chance: proper maintenance, rent modifications, property performance, and other operational hurdles can be tackled with some good calls thereafter.

5. Cost Savings: This means significant cost savings for streamlined processes and reduced administrative expenditure.

6. Increased Tenant Satisfaction: Considering the timely attention to maintenance requests, effective communication, and efficient property management, tenant experiences are generally wonderful.

Choosing the Right Software: Key Considerations

Choosing the appropriate real estate property management software will go with a lot of consideration. For example:

Features: Ensure software corresponds with your specific needs; it may be tenant management or maintenance tracking, including financial reporting and communication tools.

Scalability: Make sure the selected software can accommodate future growth of your portfolio.

Ease of use: Ideally, the software must have a very user-friendly interface, which minimizes the time of adoption and training.

Integration capabilities: The software should integrate efficiently with other important tools like accounting software or online payment gateways.

Customer support: The provision of reliable customer support will be imperative to deal with any technical eventualities and questions

Real Cube: A Leading Property Management Solution

Real Cube is one of the dominant players providing real estate property management software solutions.

Real Cube provides a very stable and wide-ranging solution for property managers of all sizes with its wide array of solutions, easy-to-use interface, and ample customer support.

Key features of Real Cube include:

Tenant Portal: Tenants can easily submit requests for maintenance, pay their rent online, and communicate with property managers directly.

Maintenance Tracking: Manage work orders, schedule vendors for services, or track costs in real time.

Reporting Finance: Generate complete financial reports like income statements, operating expense summaries, or ledgers for tenants.

Document Management: Store important documents securely and sort them as needed.

Access on Mobile: Handle properties while on the move through the Real Cube mobile app.

Conclusion

Property management depends on good organization, efficient functioning, and immediate follow-up on the work done by property managers. Real estate management software can bring about task automation, increase accuracy, and work on better communication. For effective property management, just like Real Cube, property managers run their day-to-day operations smoothly and creatively.

0 notes

Text

Why Landlords and Tenants Should Use Property Rental Management Software

Managing rental properties can be a complex and time-consuming task for landlords and property owners. From handling property rental booking to tenant onboarding and rent collection to property maintenance requests, property management software makes it easy to manage and monitor everything from mobile and desktop. Property rental management software provides a powerful solution by automating every task hassle-free.

Property rental software simplifies daily tasks, enhances tenant communication, and provides valuable insights through real-time reporting and analytics. Whether managing a single-room property or an extensive portfolio, with user-friendly and efficient management tools, property rental management software saves time, reduces costs, and improves tenant satisfaction

Why choose property rental management software in 2025?

Property rental management software in 2025 offers advanced features designed to meet modern landlords’ and property owners’ needs. With automated tenant screening, digital lease management, and real-time communication tools, rental management software streamlines daily operations and saves time. Online rent collection, customizable late fee policies, and detailed financial reporting ensure efficient cash flow management. Enhanced security features like data encryption and regulatory compliance protect sensitive information. Marketing tools, including virtual tours and social media integration, help reduce vacancies faster. With mobile and desktop accessibility, landlords can manage properties from anywhere, making property rental management software an indispensable tool for success in 2025.

Benefits of Property Rental Management Software for Landlords

Property Listings: Property rental software allows landlords to create professional listings of their residential and commercial rental properties with high-quality photos and detailed descriptions.

Tenant Screening & Onboarding: Property management software streamlines tenant screening by automating background checks and facilitating online lease signing. It also helps with efficient move-in inspections and documentation.

Online Rent Payments: Rental management software digital payment processing offers convenient online rent payment options like credit card processing and bank transfers.

Tenant Communication: Property rental software enhances communication with tenants through in-app messaging, announcements, and easy access to emergency contact information.

Lease Renewals & Rent Increases: The property rental app automates lease renewal reminders and facilitates online lease signing. Allows you to easily manage rent increases and track lease expiration dates.

Income & Expense Tracking: Property rental software allows you to track rent income, operation expenses, and other financial data in real-time.

Financial Reporting: gain valuable insights into property performance property rental software generates customizable financial reports for tax preparation, budgeting, and analysis.

Maintenance Requests: Rental management software enables tenants to submit and track maintenance requests online and effectively.

Tenant Portal: Property rental software mobile and desktop app empowers tenants by providing online access to account information, maintenance requests, and important documents.

Owner Portal: This provides owners with real-time access to financial reports, property performance data, and tenant communication tools.

Data Security & Encryption: Eventually property management software protects sensitive tenant and property data with robust security measures, including secure data storage and encryption.

User-Friendly Property Rental Management Software With Free Demo

Managing multiple residential and commercial rental properties can be overwhelming, but with RentAAA’s property rental management software application, available with a free demo, owners can simplify operations, enhance tenant satisfaction, and grow the rental business. RentAAA’s rental software provides everything you need to manage properties efficiently — from online listings to rent collection.

Simplify your rental operations with cloud-based property rental management software designed to handle residential, commercial, and single-room rentals from mobile and desktop applications. From listing the property to tracking tenant payments, RentAAA’s property management software is a perfect solution for landlords of all sizes, from single-property owners to large-scale.

#property rental software#property rental management software#property management software#property rental app#property rental management app#property management app#tenant management software#tenant management app#residential property management software#short term property management software#commercial property management software#property management software for landlords#property management software for owners

0 notes

Text

Streamline Your Finances with Advanced Accounting Software | Rentastic

In today’s fast-paced business world, managing finances efficiently is key to long-term success. Whether you’re a small business owner, a property investor, or an entrepreneur, having reliable accounting software can make all the difference. At Rentastic, we provide advanced accounting solutions designed to simplify financial management, save time, and reduce errors.

Why Choose Accounting Software?

Manual bookkeeping is time-consuming and prone to mistakes. With smart accounting Software, you can automate repetitive tasks, track income and expenses in real-time, and generate accurate financial reports effortlessly. Rentastic’s user-friendly interface ensures even non-experts can navigate complex financial data with ease.

Key Features of Rentastic’s Accounting Software

Real-Time Tracking: Monitor income and expenses instantly.

Automated Reporting: Generate professional financial reports with a click.

User-Friendly Dashboard: Access data effortlessly from a centralized platform.

Secure Cloud Storage: Keep your financial data safe and accessible anytime, anywhere.

Who Can Benefit?

Landlords & Property Investors: Track rental income and expenses efficiently.

Small Business Owners: Simplify day-to-day financial operations.

Freelancers: Manage invoices and expenses without hassle.

Why Rentastic?

At Rentastic, we go beyond traditional accounting tools by offering tailored solutions for real-world financial challenges. Our software is designed with flexibility and scalability in mind, ensuring it grows with your business needs.

Take control of your finances with confidence. Experience the future of financial management with Rentastic.

Visit Rentastic today to discover how our advanced accounting software can transform the way you manage your money. Simplify, automate, and grow smarter with Rentastic!

0 notes

Video

youtube

The Easy Way to Financial Freedom with One Simple Money Hack!

You know, stepping away from that 9-to-5 grind might feel like a distant dream for many of us, but let me tell you, it doesn’t have to be. The first thing you need to do is shift your mindset. It’s all about thinking long-term. Instead of chasing that next paycheck, start focusing on investments and strategies that actually grow over time. I mean, we’re talking about building real wealth here, not just making ends meet. And speaking of wealth, let’s talk about risk. I know it sounds scary, but embracing risk—calculated risk, mind you—is essential. You can’t avoid it entirely if you want to succeed. Learn to manage it, and you’ll find yourself making smarter moves. And don’t forget continuous learning! Invest in yourself. Read books, take courses, listen to podcasts. The more knowledge you have, the better equipped you’ll be to navigate this journey. Now, once your mindset is aligned, it’s time to build multiple income streams. You’ve probably heard that saying, “Don’t put all your eggs in one basket.” Well, it’s true! Consider real estate investing. Whether it’s rental properties, REITs, or even short-term rentals, this can provide you with a steady income. And let’s not overlook dividend stocks. Building a portfolio of high-yield dividend stocks can give you that sweet, sweet passive income. But that’s not all! Think about starting an online business. It could be a blog, an e-commerce store, or even a digital product business. The internet is a goldmine of opportunities. And if you have expertise in a high-demand field, freelancing or consulting can be a great way to leverage your skills for extra cash. Don’t forget about content creation! Platforms like YouTube, TikTok, or Instagram can turn your passions into profits. Once you’ve got those income streams flowing, it’s time to get smart about investing. The stock market is a great place to start. Think index funds, ETFs, or even individual stocks—just make sure you do your research first. Cryptocurrency? Sure, it’s high-risk and high-reward, but if you understand the market, it can be a game-changer. Peer-to-peer lending is another option; you can earn interest by lending money through platforms designed for just that. And let’s not ignore startups. Investing in innovative companies with growth potential can lead to massive returns if you choose wisely. Now, if you really want to escape that grind, consider creating a scalable business. Digital products like courses, eBooks, or templates can generate passive income. If you’re tech-savvy, think about developing software or apps that solve problems for specific audiences. And franchise ownership? That’s another avenue worth exploring. You get to operate proven business models under established brands, which can reduce your risk significantly. But here’s the thing—financial discipline is key. You need to minimize debt. Pay down those high-interest debts quickly. Automate your savings; set aside a portion of your income regularly, so you won’t even miss it. And live below your means. I know it’s tempting to upgrade your lifestyle, but investing those excess funds will pay off in the long run. Networking and collaboration are also crucial. Join communities focused on wealth-building. Partner strategically with others; sharing risks and rewards can lead to greater success. And don’t underestimate the power of mentorship. Learn from those who have already achieved financial freedom. Let’s not forget about leveraging tax advantages. Invest in retirement accounts like 401(k)s or IRAs. If you’re self-employed, use business deductions to your advantage. And if you’re into real estate, explore write-offs for depreciation, mortgage interest, and repairs. Finally, stay persistent and patient. Set milestones to break your goals into achievable steps, and be ready to adapt your strategies if something isn’t working. Celebrate your wins, no matter how small, to keep that motivation alive. So, are you ready to take the leap? It’s time to escape the grind and build the life you’ve always dreamed of.

1 note

·

View note

Text

Top Tax Tips for Australians: How to Maximize Deductions and Minimize Liabilities

Tax season often brings stress, but with the right strategies, it doesn't have to be overwhelming. Whether you're a freelancer, a small business owner, or just an individual looking to make the most of your tax return, understanding how to maximize your deductions and minimize your tax liabilities is essential.

In fact, a significant percentage of Australians over 70% rely on tax professionals to ensure they’re getting the most out of their tax returns. By partnering with a tax accountant in Narre Warren South, you can access expert advice tailored to your financial situation and ensure you’re making the most of the available tax-saving opportunities. Here’s how to optimize your tax strategy.

1. Track Your Work-Related Expenses

Many Australians miss out on claiming work-related expenses that could reduce their taxable income. Expenses such as uniforms, travel, and work-related training are all eligible for deductions. In fact, over 80% of Australians claim some form of work-related expenses on their tax returns.

If you drive for work, whether it's for meetings or site visits, you can deduct vehicle expenses like fuel, maintenance, and even depreciation. Similarly, if you work from home, a portion of your home office expenses, such as electricity and internet bills, may be deductible.

2. Maximize Self-Education Deductions

For individuals seeking to enhance their careers, self-education deductions are a valuable option. Whether you're taking a course, purchasing textbooks, or attending workshops, these expenses can be claimed as tax deductions.

To qualify, your studies need to directly relate to your current job or improve your work skills. If you’re an accountant, for example, taking an advanced course in tax laws would be deductible.

3. Contribute to Your Superannuation

Voluntary contributions to your superannuation are another great way to reduce your taxable income while securing your financial future. These contributions are taxed at just 15%, often a lower rate than your personal income tax rate. Additionally, the government matches contributions for eligible low-income earners.

More than 5.6 million Australians make voluntary contributions to their superannuation, taking advantage of the tax benefits these contributions offer. As a business owner, you can also contribute to your employees’ superannuation and potentially reduce your taxable income.

4. Take Advantage of Small Business Tax Concessions

Small business owners, in particular, have access to a range of tax concessions that can help lower their liabilities. For example, businesses with an annual turnover of less than $50 million are eligible for the instant asset write-off, allowing them to claim an immediate deduction for assets purchased for business use.

In fact, over 3 million small businesses in Australia benefit from these tax concessions. These businesses can claim deductions for equipment, software, and even vehicles used for business purposes.

Example: Jack, who owns a landscaping business, used the instant asset write-off to claim $12,000 for new equipment, significantly lowering his tax bill.

5. Leverage Tax-Efficient Investments

Investing in tax-efficient strategies is a smart way for Australians to reduce their taxable income. Negative gearing, for instance, allows you to claim deductions on the interest of an investment property loan if the cost of the loan exceeds the rental income it generates.

Additionally, investing in shares or managed funds can provide opportunities for franking credits tax already paid by the company on your dividend income. These credits can be used to offset your personal tax obligations.

Example: David, an investment property owner, leveraged negative gearing to reduce his taxable income and save $3,000 in taxes annually. He also invested in shares, benefiting from franking credits on his dividends.

Conclusion

Taking advantage of available deductions and tax-saving strategies can significantly reduce your tax liability, allowing you to keep more of your hard-earned income. Whether you’re an employee claiming work-related expenses, a freelancer maximizing self-education deductions, or a business owner utilizing small business tax concessions, there are numerous ways to lower your tax bill.

For small business owners, working with a tax accountant in Narre Warren South is a valuable investment. A tax professional can help identify additional savings, ensure compliance with ever-changing tax laws, and provide guidance on how to grow your business efficiently.

With careful planning and the right tax strategies, you can make the most of tax season and set yourself up for long-term financial success.

0 notes