#renewable methanol market

Explore tagged Tumblr posts

Link

#pioneering marketdigits consulting and advisory private limited#renewable methanol market#renewable methanol market size#biomass#multiple solid waste

0 notes

Text

Navigating Regulatory Frameworks in the Renewable Methanol Market

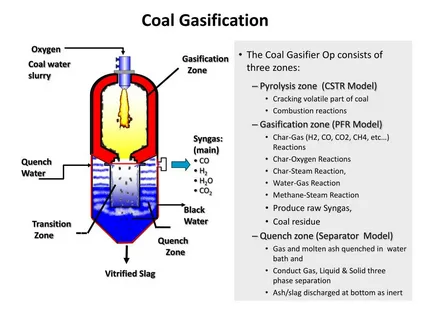

Renewable Methanol: A Promising Alternative Fuel for the Future Production of Renewable Methanol Renewable methanol can be produced from a variety of renewable resources such as biomass, biogas or directly from carbon dioxide and hydrogen. The most common production process starts with the conversion of biomass feedstocks like agricultural waste or organic municipal waste into syngas using a gasification process. The syngas obtained mainly contains carbon monoxide and hydrogen which are then converted into methanol through catalytic synthesis. Methanol synthesis from syngas is a well established industrial process. Similarly, biogas from the anaerobic digestion of organic waste can also be converted into syngas and then methanol. An emerging approach is to produce methanol directly from captured carbon dioxide and hydrogen. Electrolyzers powered by renewable electricity can produce hydrogen which is then combined with CO2 to synthesize methanol using specialized catalysts. Overall, these processes allow the production of liquid renewable methanol without consuming fossil fuels. Applications and Uses of Renewable Methanol Renewable methanol holds promising applications as a green alternative fuel and chemical feedstock if produced on a large scale commercially. Here are some of its key uses: One of the major applications of renewable methanol is in the transportation sector as an alternative vehicle fuel or fuel additive. It can be used directly in methanol-fueled vehicles or blended with gasoline or diesel. It allows vehicles to run cleaner with much fewer emissions. Renewable methanol can also replace fossil-based methanol used in manufacturing formaldehyde, acetic acid, methyl tert-butyl ether (MTBE), and other chemical products. As a chemical building block, it avoids the use of raw materials derived from non-renewable resources. Renewable methanol produced directly from captured CO2 also provides opportunities for carbon utilization at industrial scale. Advantages of Renewable Methanol Over Other Alternative Fuels Renewable methanol scores over other alternative fuels due to several advantages. Unlike hydrogen, it is a liquid at ambient conditions making it much easier to store and transport through the existing infrastructure. It has a higher energy density than other biofuels like ethanol, which means more energy can be packed into the same storage space. Methanol vehicles also do not require expensive new technologies and can use the existing internal combustion engines. Moreover, methanol produces less smog-causing emissions in tailpipes compared to gasoline, has lower toxicity than ethanol and is safer to handle than compressed natural gas. Barriers and Challenges Despite advantages, there are some barriers challenging large-scale production and use of renewable methanol. The production costs using biomass or captured carbon need to be reduced significantly for methanol to compete with gasoline and other petroleum fuels on price. Methanol vehicles also have limited infrastructure currently for fueling compared to gasoline vehicles limiting their adoption. Conclusion In conclusion, renewable methanol holds big promise as a future transportation and industrial fuel as well as chemical feedstock due to its various advantages over other substitutes. With further technological advancements aimed at reducing costs and expanding supporting infrastructure and vehicles, it could emerge as an important pillar helping achieve global decarbonization goals across multiple sectors of the economy. Many pilots and demonstration projects are already underway to validate deployment of renewable methanol on a wider scale. Overall, it presents exciting opportunities for establishing a truly sustainable bio-based methanol industry.

0 notes

Text

Renewable Methanol Market Is Estimated To Witness High Growth Owing To Increasing Focus on Clean Energy Sources

The global Renewable Methanol Market is estimated to be valued at US$ 196.8 million in 2022 and is expected to exhibit a CAGR of 7.9% over the forecast period of 2023-2030, as highlighted in a new report published by Coherent Market Insights. A) Market Overview: Renewable methanol is derived from sustainable feedstock such as biomass, municipal waste, and industrial waste gases. It offers various advantages such as reduced greenhouse gas emissions, lower toxic content, and compatibility with existing infrastructure. With the increasing focus on clean energy sources, there is a growing need for renewable methanol as an alternative to conventional methanol that is derived from fossil fuels. The market for renewable methanol is expected to witness significant growth as governments and industries strive to reduce their carbon footprint. B) Market Key Trends: One of the key trends driving the growth of the renewable methanol market is the increasing adoption of renewable energy sources in the transportation sector. Biofuels such as renewable methanol offer a cleaner and environmentally friendly alternative to fossil fuels in transportation fuel. For instance, the aviation industry has shown interest in using renewable methanol as a sustainable jet fuel. In 2019, Virgin Atlantic successfully operated a commercial flight using a blend of jet fuel and renewable methanol. This trend is expected to drive the demand for renewable methanol in the coming years. C) PEST Analysis:

Political: Governments around the world are implementing regulations and policies to promote the use of renewable energy sources and reduce greenhouse gas emissions. This is creating a favorable political environment for the growth of the renewable methanol market.

Economic: The increasing demand for renewable methanol is leading to investments in research and development activities and the establishment of production facilities. This is expected to contribute to economic growth and create job opportunities in the renewable energy sector.

Social: Society is becoming more aware of the environmental impact of fossil fuels and supporting the adoption of renewable energy sources. This is driving the demand for renewable methanol as a cleaner alternative.

Technological: Advancements in technology have made the production of renewable methanol more efficient and cost-effective. Technologies such as gasification, synthesis, and catalysis are being employed to convert various feedstocks into methanol.

D) Key Takeaways:

The global Renewable Methanol Market is expected to witness high growth, exhibiting a CAGR of 7.9% over the forecast period, due to increasing focus on clean energy sources. The need to reduce greenhouse gas emissions and shift towards sustainable alternatives is driving the demand for renewable methanol.

In terms of regional analysis, North America is anticipated to be the fastest-growing region in the renewable methanol market. The region has a strong emphasis on renewable energy sources and has implemented supportive policies and regulations. Additionally, Europe is expected to dominate the market, owing to its stringent emission standards and initiatives to promote renewable energy.

Key players operating in the global renewable methanol market are Methanex Corporation, Carbon Recycling International, BioMCN, Enerkem, Chemrec Inc., and Varmlands Methanol. These companies are focusing on expanding their production capacities and developing strategic partnerships to strengthen their market position.

In conclusion, the global market for renewable methanol is projected to witness significant growth in the coming years. The increasing adoption of renewable energy sources in the transportation sector and supportive government policies are driving the demand for renewable methanol. With advancements in technology and growing awareness about the environmental impact of fossil fuels, renewable methanol is expected to play a crucial role in achieving a cleaner and sustainable future.

#Renewable Methanol Market#Green Chemicals#Renewable Methanol Market Growth#Renewable Methanol Market Forecast#Renewable Methanol Market Overview

0 notes

Text

Renewable Methanol Market Segmented On The Basis Of Feedstock, Application, Region And Forecast To 2030: Grand View Research Inc.

San Francisco, 16 Aug 2023: The Report Renewable Methanol Market Size, Share & Trends Analysis Report By Feedstock (Renewable Energy, Agriculture Waste), By Application (Formaldehyde, MTBE), By Region, And Segment Forecasts, 2023 – 2030 The global renewable methanol market size is expected to reach USD 20.68 billion by 2030, as per the new report by Grand View Research, Inc., expanding at a CAGR…

View On WordPress

#Renewable Methanol Industry#Renewable Methanol Market#Renewable Methanol Market 2030#Renewable Methanol Market Revenue#Renewable Methanol Market Share#Renewable Methanol Market Size

0 notes

Text

Methanol Market: Current Trends and Future Outlook| MarketsandMarkets™

Methanol, also known as methyl alcohol, is an organic compound that is composed of one carbon atom, two hydrogen atoms, and one oxygen atom (CH3OH). It is a clear and colorless liquid that is highly flammable and has a distinctive odor. Methanol is used in the production of a variety of industrial and commercial products, including formaldehyde, acetic acid, methyl tert-butyl ether (MTBE), and…

View On WordPress

#Covid 19 Impact on Methanol Market#Fuel Cell#global methanol demand#Global Methanol Market#methanol commodity price#Methanol Industry#Methanol Market#Methanol Market Analysis#Methanol Market Demand#Methanol Market Forecast#Methanol Market Growth#methanol market outlook#methanol market price#methanol market report#Methanol Market Research#Methanol Market Share#Methanol Market Size#methanol spot price#Renewable Energy#renewable methanol market

0 notes

Text

#Green Methanol Ships Market#Renewable Energy Ships#Low-Emission Shipping#Methanol-Powered Vessels#Maritime Decarbonization

0 notes

Text

Renewable Methanol Market: Fuelling the Green Revolution

Introduction to Methanol Methanol, also known as wood alcohol, is a light, colorless, volatile and flammable liquid with the chemical formula CH3OH. It is the simplest alcohol and one of the commonly used light alcohols. Methanol is produced both from fossil fuels such as natural gas and coal as well as renewably through processes like biomass gasification. It is mainly used as a feedstock for producing other chemicals, solvents and as a fuel. Renewable Methanol Production Pathways There are several pathways for producing methanol renewably without using fossil fuels: Biomass Gasification: In this process, any type of biomass like agricultural waste, forest residues or energy crops are gasified at high temperature in the presence of steam and oxygen to produce syngas a mixture of carbon monoxide and hydrogen. This syngas is then catalytically converted to methanol. WastetoEnergy: Municipal solid waste, sewage sludge or other waste streams can be gasified or biologically broken down to produce syngas which is then converted to methanol. This helps produce a valuable fuel from waste. Direct Capture of CO2: Technologies are being developed to directly capture CO2 from ambient air or industrial sources. This captured CO2 can then be combined with green hydrogen produced from renewable power to synthesize methanol. Renewable Hydrogen: Electrolyzers powered by renewable electricity such as solar, wind or hydropower can produce green hydrogen by splitting water. Combining this hydrogen with CO2 yields renewable methanol. Building out Renewable Methanol Infrastructure For methanol to scale up significantly as a Carbon Neutral Fuel, dedicated production, storage, distribution and dispensing infrastructure needs to be developed: Production Facilities: Larger demonstration and commercial scale plants are being built worldwide using biomass, municipal waste or captured CO2 as feedstocks. Methanol Bunkering: Ports are installing bunkering facilities for providing methanol shiptoship or from storage tanks to vessels replacing marine fuel oil. Fuel Stations: More M85 compatible vehicles require retail fuel stations with methanol dispensers along with compatible nozzles, hoses and pumps. CrossCountry Pipelines: Methanol pipelines can transfer product from production sites to demand centers avoiding logistical challenges of road/rail transportation. Storage Infrastructure: Underground salt caverns or above ground tanks offer large scale, low cost storage options for methanol supply logistics. Standardization: Industry standards are being developed for methanol specifications, safety protocols, handling procedures and measurements units. Conclusion Renewable methanol holds promise as a versatile, carbon neutral fuel and chemical feedstock of the future. Continuous technological progress, supportive policies and infrastructure buildout can accelerate its adoption worldwide helping mitigate climate change and transition to a low carbon economy. Sustainable production pathways combined with growing applications puts methanol in a position to play an important long term role in energy markets.

0 notes

Text

/PRNewswire/ -- E-fuels Market is expected to reach USD 49.4 billion by 2030 from USD 6.2 billion in 2023 at a CAGR of 34.5% during the 2023–2028 period according to a new report by MarketsandMarkets™.

#E-fuels#E-fuels Market#E-fuel#energy#power#energia#utilities#utility#renewable resources#renewableenergy#renewable power#decarbonization#carbon neutral#energy supply#energy storage#e-methane#e-methanol#e-ammonia#e-diesel#e-gasoline

0 notes

Text

Renewable Methanol Market Growth and Global Demand, Research Factors, Top Leading Player with Business Revenues to 2030

The Renewable Methanol Market refers to the market for methanol produced from renewable sources, such as biomass, waste materials, or carbon dioxide (CO2) captured from industrial processes or the atmosphere. Renewable methanol is considered a sustainable alternative to conventional methanol, which is predominantly derived from fossil fuels.

Here is some comprehensive information about the Renewable Methanol Market:

Market Overview:

• Renewable methanol is primarily used as a fuel or fuel additive, as well as a raw material for the production of various chemicals and materials. • It offers several environmental benefits, including reduced greenhouse gas emissions and improved air quality. • The market for renewable methanol is driven by the increasing demand for clean fuels and the need to reduce carbon emissions in various industries.

Production Processes:

• Biomass-to-Methanol: Biomass, such as wood residues, agricultural waste, or dedicated energy crops, is converted into syngas through gasification or fermentation. The syngas is then converted into methanol through catalytic processes. • CO2-to-Methanol: Carbon dioxide captured from industrial emissions or the atmosphere is combined with hydrogen, typically derived from renewable sources, through a catalytic process known as methanol synthesis.

Market Drivers:

• Environmental Regulations: Stringent regulations to reduce carbon emissions, such as carbon pricing and renewable fuel mandates, are driving the demand for renewable methanol as a low-carbon fuel option. • Energy Transition: The shift towards renewable energy sources and the decarbonization of various sectors, including transportation and chemical industries, is creating opportunities for renewable methanol. • Circular Economy: The concept of converting waste materials and CO2 into valuable products aligns with the principles of the circular economy, driving the adoption of renewable methanol.

Market Applications:

• Transportation Fuel: Renewable methanol can be blended with gasoline or used as a standalone fuel in internal combustion engines or fuel cells, offering a cleaner alternative to conventional fossil fuels. • Chemicals and Materials: Renewable methanol serves as a feedstock for the production of formaldehyde, acetic acid, biodiesel, olefins, and other chemicals and materials. • Energy Storage: Methanol can be used as a hydrogen carrier for renewable energy storage and as a fuel in fuel cells or methanol reformers.

Market Challenges:

• Cost Competitiveness: Renewable methanol production is currently more expensive compared to conventional methanol due to higher feedstock costs and limited scale. However, as technology advances and economies of scale are achieved, costs are expected to decrease. • Infrastructure and Distribution: The existing infrastructure for methanol distribution and storage may require upgrades or modifications to accommodate renewable methanol. • Feedstock Availability: Ensuring a sustainable and sufficient supply of biomass or CO2 feedstocks for methanol production can be a challenge.

Market Outlook:

• The renewable methanol market is expected to witness significant growth in the coming years, driven by the increasing focus on decarbonization and the transition to renewable energy sources. • Technological advancements and innovation in production processes are expected to improve efficiency and reduce costs, making renewable methanol more competitive. Government policies and incentives supporting the use of renewable fuels and the circular economy will play a crucial role in shaping the market's growth.

It's important to note that market dynamics, regulations, and technological advancements can evolve over time, so staying updated with the latest industry developments is recommended.

0 notes

Text

Repsol’s Green Initiative: Investing in a Methanol Mega Plant

Repsol, a leading player in the European energy sector, has announced a substantial project in the northeast of Spain, earmarking over 800 million euros for the construction of a green methanol plant. This initiative underscores the company’s ambition to lead in sustainable technologies and carbon-neutral solutions.

The new facility is slated to commence operations in 2029, becoming one of the largest eco-plants in Europe by converting solid waste into renewable fuel.

Technological Features of the Eco-Plant

The location for this pioneering facility has been chosen in Tarragona. It will employ innovative technologies to process up to 400,000 tons of solid household waste annually, producing approximately 240,000 tons of clean fuel and circular economy products.

The company highlights several key benefits of the plant:

Addressing environmental challenges of waste disposal.

Providing the market with high-quality alternative fuels.

Optimizing the carbon footprint in sectors like shipping and aviation.

Additionally, the project will receive financial backing from the European Union through the EU Innovation Fund, highlighting its importance at the European policy level.

Financial Aspects of the Project

The total investment for realizing this project amounts to 800 million euros (approximately 834 million dollars). Repsol plans to attract external funding sources, such as the European Innovation Fund.

The project was announced shortly after the Spanish parliament’s decision not to extend the temporary windfall tax on major energy companies, a political stability that likely plays a crucial role in realizing the company’s recent decisions.

Long-Term Objectives of the Project

Repsol’s primary aim is to reduce its environmental impact while providing sustainable solutions for the European market. The project currently sets several priorities:

Supporting a Carbon-Neutral Economy: Shifting part of its production to renewable fuel sources.

Environmental Leadership: The new plant represents a leap towards zero-waste production.

Sustaining a Circular Economy: Focusing on utilizing and recycling waste instead of contributing to secondary environmental impacts.

The Repsol eco-plant will also bolster Spain’s position as a key player in Europe’s green energy transition

Our website: https://goldriders-robot.com/

Follow us on Facebook: https://www.facebook.com/groups/goldridersfb

Follow us on Pinterest: https://ru.pinterest.com/goldridersrobot/

Follow us on X: https://x.com/goldridersx?s=21

Follow us on Telegram: https://t.me/+QtMMmyyVhJExZThi

0 notes

Text

https://introspectivemarketresearch.com/reports/renewable-methanol-market/

0 notes

Text

India is leading a renewable energy revolution through its National Green *Hydrogen Mission,* with Andhra Pradesh set to become a key *Green Hydrogen Hub* .

Aiming to produce *5 million metric tonnes of green hydrogen* annually by 2030, the state is committed to reducing carbon emissions and enhancing energy security.

The ambitious *₹19,744 crore mission* promotes technological innovation and infrastructure development.

The Green Hydrogen Hub in *Visakhapatnam* , spanning 1,200 acres, aims to produce green ammonia, methanol, and sustainable aviation fuel, creating *57,000 jobs* .

With strategic investments and natural resources, Andhra Pradesh exemplifies sustainable development and positions India as a major player in the *global green hydrogen market.*

http://arjasrikanth.in/2025/01/15/hydrogen-havens-andhra-pradeshs-leap-into-a-green-energy-future/

0 notes

Text

Fuel Cell Market Size, Share, Trends And Industry Report, 2030

Fuel Cell Market Growth & Trends

The global fuel cell market size is expected to reach USD 36.98 billion by 2030, exhibiting a CAGR of 27.1% from 2024 to 2030, according to a new report published by Grand View Research, Inc. The rise in demand for unconventional energy sources is a key factor driving the growth.

North America accounted for a significant market share, due to the commercialization and adoption of electric vehicles. However, Asia Pacific emerged as a growing market in terms of shipments. Rising demand for combined heat and power systems in is projected to drive the demand for fuel cell in the region.

Power-based electricity generation is effective in minimizing emission of carbon dioxide or any other hazardous pollutants. Hence, fuel cell technology plays a vital role in dealing with environmental issues as well as encouraging the use of renewable carriers of energy. Ongoing product developments and innovation is expected to open new opportunities for emerging players.

Using fuel cells can minimize the dependency on non-renewable energy sources such as coal, natural gas, and petrochemical derivatives. Fuel cells employ electrochemical process for generation of energy and result in less combustion of fuels. Hybrid systems using conventional engines and fuel cells are deployed in most of electric vehicles.

Request a free sample copy or view report summary: https://www.grandviewresearch.com/industry-analysis/fuel-cell-market

Fuel Cell Market Report Highlights

Proton exchange membrane fuel cell (PEMFC) accounted for more than 60.0% of the global market in terms of revenue in 2023. PEMFC is widely used in applications such as forklifts, automobiles, telecommunications, primary systems, and backup power systems.

Based on Components, the fuel cell market has been segmented into stack and balance of plant. In 2023, the stack segment accounted for the largest share of more than 60.0% in the global fuel cell market.

The hydrocarbon segment accounted for the largest share of over 90.0% in 2023, owing to extensive infrastructure for production, transportation, and storage of hydrocarbons is already in place, making them readily available and affordable.

On the basis of size, the fuel cell market is categorized into small-scale and large-scale. The large-scale holds a share of about 70.0% in 2023 of the global fuel cell market.

Stationary fuel cells dominated the global market in terms of revenue, accounting for a market share of more than 69.0% in 2023, owing to the increasing demand for fuel cells from distributed generation facilities and backup power applications.

Based on End-use, the fuel cell market has been segmented into transportation, commercial & Industrial, residential, data center, military & defense, and utilities & government.

Asia Pacific held a significant revenue share of more than 65% in 2023 and is expected to grow at the fastest CAGR over the forecast period.

Fuel Cell Market Segmentation

Grand View Research has segmented the global fuel cell market report based on product, components, fuel, size, application, end-use, and region:

Fuel Cell Product Outlook (Volume, Units; Capacity, MW, Revenue, USD Million, 2018 - 2030)

PEMFC

PAFC

SOFC

MCFC

AFC

Others

Fuel Cell Components Outlook (Volume, Units; Capacity, MW, Revenue, USD Million, 2018 - 2030)

Stack

Balance of Plant

Fuel Cell Fuel Outlook (Volume, Units; Capacity, MW, Revenue, USD Million, 2018 - 2030)

Hydrogen

Ammonia

Methanol

Ethanol

Hydrocarbon

Fuel Cell Size Outlook (Volume, Units; Capacity, MW, Revenue, USD Million, 2018 - 2030)

Small-scale

Large-scale

Fuel Cell Application Outlook (Volume, Units; Capacity, MW, Revenue, USD Million, 2018 - 2030)

Stationary

Transportation

Portable

Fuel Cell End-use Outlook (Volume, Units; Capacity, MW, Revenue, USD Million, 2018 - 2030)

Residential

Commercial & Industrial

Transportation

Data Centers

Military & Defense

Utilities & Government

Fuel Cell Regional Outlook (Volume, Units; Capacity, MW, Revenue, USD Million, 2018 - 2030)

North America

Europe

Asia Pacific

Central & South America

Middle East & Africa

List of Key Players of Fuel Cell Market

Ballard Power Systems

Bloom Energy

Ceres Power Holdings PLC

Doosan Fuel Cell America, Inc.

FuelCell Energy, Inc.

Hydrogenics Corporation

Nedstack Fuel Cell Technology B.V.

Nuvera Fuel Cells LLC

Plug Power, Inc.

SFC Energy AG

Browse Full Report: https://www.grandviewresearch.com/industry-analysis/fuel-cell-market

#Fuel Cell Market#Fuel Cell Market Size#Fuel Cell Market Share#Fuel Cell Market Trends#Fuel Cell Market Growth

0 notes

Text

Global Coal Gasification Market 2024-2034: Technology, Feedstock & Growth

The Coal Gasification market report is predicted to develop at a compound annual growth rate (CAGR) of 5.4% from 2024 to 2034, when global Coal Gasification market forecast size is projected to reach USD 38.63 Billion in 2034, based on an average growth pattern. The global Coal Gasification market revenue is estimated to reach a value of USD 23.36 Billion in 2024

𝐂𝐥𝐚𝐢𝐦 𝐲𝐨𝐮𝐫 𝐬𝐚𝐦𝐩𝐥𝐞 𝐜𝐨𝐩𝐲 𝐨𝐟 𝐭𝐡𝐢𝐬 𝐫𝐞𝐩𝐨𝐫𝐭 𝐢𝐧𝐬𝐭𝐚𝐧𝐭𝐥𝐲:

https://wemarketresearch.com/reports/request-free-sample-pdf/coal-gasification-market/1624

Globally, and particularly in Asia Pacific, the coal gasification industry is producing excellent quantities of chemicals, fertilizers, and hydrogen. Future market expansion is also anticipated to be accelerated by the increasing number of methanol-infused fuels utilized in hybrid cars and aircraft. Traditional coal-fired power plants burn the majority of coal, but it can also be transformed into other energy products like gas, electricity, and hydrogen.

Market Drivers for Coal Gasification

Rising Energy Demand: As the global population grows and industrial activities expand, the demand for energy continues to increase. While renewable energy sources like wind and solar are gaining traction, they cannot yet meet the global energy demand on their own. Coal gasification offers a way to utilize the world’s vast coal reserves more efficiently and with lower emissions compared to traditional coal combustion.

Environmental Concerns: With increasing pressure to reduce greenhouse gas emissions and combat climate change, coal gasification presents a promising solution. By capturing carbon emissions and enabling the production of cleaner fuels, coal gasification can help achieve environmental goals while still utilizing existing coal resources. Governments and corporations are also investing in technologies like carbon capture and storage (CCS) to make coal gasification even more environmentally friendly.

Coal Gasification Market Growth Factors

The increase of coal reserves in developing nations encourages the market to expand throughout the ensuing years.

Growing emphasis on clean and efficient energy sources and decreasing dependency on natural gas and fossil fuels are the main factors propelling the coal gasification market's growth throughout the forecast period.

The demand for coal gasification is expected to increase during the forecast period due to the rising urbanization and industrialization.

Underground coal gasification (UCG), which turns coal into valuable gases without the need for mining, is being adopted quickly, which is expected to drive market growth.

Opportunity: Supportive government investment and initiatives

The market for coal gasification is expected to rise throughout the forecast period thanks to increased government initiatives and investment. The government is aggressively working to develop sustainable and environmentally friendly methods of producing electricity.

Coal Gasification Market Segmentation

By Technology

Fixed-Bed Gasifiers

Moving Bed

Dry Ash

Fluidized-Bed Gasifiers

Bubbling Fluidized Bed

Circulating Fluidized Bed

Entrained-Flow Gasifiers

Single-Stage

Multi-Stage

Plasma Gasification

High-Temperature Gasification

Plasma Arc Technology

Integrated Gasification Combined Cycle (IGCC)

By Feedstock

Sub-Bituminous Coal

Bituminous Coal

Anthracite

Petroleum Coke

Biomass/Coal Blends

Municipal Solid Waste (MSW)

Others

By Gas Output

Synthetic Gas (Syngas)

Methane-Rich Gas

Hydrogen-Rich Gas

By End-use Industry

Energy and Utilities

Chemicals and Petrochemicals

Oil and Gas

Metals and Mining

Transportation

Others

Key Market Players

General Electric (GE)

Royal Dutch Shell

Siemens Energy

ThyssenKrupp AG

Air Products and Chemicals, Inc.

KBR Inc.

Mitsubishi Heavy Industries

Synthesis Energy Systems

Huaneng Clean Energy Research Institute

China Coal Energy Group

Sasol Limited

Air Liquide

BHEL (Bharat Heavy Electricals Limited)

Key Benefits For Stakeholders

The report provides exclusive and comprehensive analysis of the global coal gasification market scope, trends along with the coal gasification market forecast.

The report elucidates the coal gasification market trends along with key drivers, and restraints of the market. It is a compilation of detailed information, inputs from industry participants and industry experts across the value chain, and quantitative and qualitative assessment by industry analysts.

Porter’s five forces analysis helps analyze the potential of the buyers & suppliers and the competitive scenario of the market for strategy building.

The report entailing the coal gasification market analysis maps the qualitative sway of various industry factors on market segments as well as geographies.

The data in this report aims on market dynamics, trends, and developments affecting the coal gasification market demand.

Conclusion

The coal gasification market is poised for growth as it offers a potential solution to the global energy crisis while addressing environmental concerns. With its ability to produce cleaner energy and enable carbon capture, this Technology Presents a way to utilize the world’s vast coal reserves in a more sustainable manner. While challenges remain, ongoing technological advancements and investments in research and development are likely to drive the evolution of coal gasification, making it a key player in the energy landscape for years to come.

0 notes

Text

Dimethyl Ether: A Versatile Fuel for a Sustainable Future

Dimethyl ether (DME) is emerging as a key player in the pursuit of sustainable energy solutions, offering versatile applications across various industries. This clean-burning compound holds promise as an alternative fuel and a critical component in transitioning away from conventional fossil fuels. In this article, we delve into the properties, production methods, applications, and environmental benefits of Dimethyl ether, exploring its potential to reshape the global energy landscape.

What is Dimethyl Ether?

Dimethyl ether, with the chemical formula CH3OCH3CH_3OCH_3CH3OCH3, is a colorless, odorless gas at standard temperature and pressure. Its molecular structure consists of two methyl groups connected by an oxygen atom, giving it a unique combination of chemical stability and reactivity. DME is highly flammable, liquefies under modest pressure, and possesses physical properties similar to liquefied petroleum gas (LPG).

Production of Dimethyl Ether

DME is synthesized primarily through two pathways: direct and indirect synthesis.

Direct Synthesis: This process involves reacting synthesis gas (syngas), a mixture of carbon monoxide and hydrogen, in the presence of a bifunctional catalyst. The reaction simultaneously forms methanol, which is then dehydrated to produce DME.

Indirect Synthesis: This involves a two-step process where methanol is first produced from syngas and subsequently dehydrated to form DME. This method is widely adopted due to its simplicity and existing infrastructure for methanol production.

Innovative technologies are now focusing on producing DME from renewable sources such as biomass and municipal waste, enhancing its sustainability profile.

Applications of Dimethyl Ether

DME's unique properties make it suitable for a range of applications:

Fuel Alternative:

Transportation: DME serves as a clean alternative to diesel fuel, offering high cetane numbers and eliminating soot emissions during combustion. Vehicles designed or retrofitted for DME are gaining traction in regions focusing on decarbonization.

Cooking and Heating: DME can replace LPG for domestic cooking and heating purposes, reducing greenhouse gas emissions.

Aerosol Propellant:As a non-toxic and ozone-friendly alternative to traditional propellants, DME is widely used in personal care products, paints, and pharmaceuticals.

Chemical Feedstock:DME acts as an intermediate in the production of valuable chemicals like olefins and dimethyl sulfate, contributing to the industrial sector.

Power Generation:In power plants, DME can serve as a substitute for natural gas or coal, reducing harmful emissions and supporting cleaner energy production.

Environmental and Economic Advantages

One of DME's standout features is its environmental friendliness. When burned, it produces minimal particulate matter and significantly lower levels of nitrogen oxides (NOx) compared to conventional fuels. Moreover, its sulfur-free nature ensures no formation of sulfur oxides (SOx), a major contributor to acid rain.

Economically, DME offers cost-effective benefits, especially when derived from abundant or waste-based feedstocks. Its adaptability to existing fuel infrastructure, such as LPG storage and distribution networks, further reduces implementation costs.

Challenges and Future Prospects

Despite its potential, widespread adoption of DME faces hurdles such as production scalability, storage, and transportation challenges. Investments in renewable DME production and government incentives for green energy adoption could accelerate its market penetration.

Conclusion

Dimethyl ether stands at the crossroads of innovation and sustainability, offering a cleaner, efficient, and versatile energy solution. As technological advancements refine its production and applications, DME has the potential to significantly reduce humanity’s carbon footprint, paving the way for a greener future. By embracing this promising compound, we can move closer to achieving global energy sustainability goals.

#Dimethyl ether#115-10-6#CH3OCH3#What is dimethyl ether used for?#Is dimethyl ether harmful?#What is the common name for CH3OCH3?#What is the common name of dimethyl ether?#CAS 115-10-6#China Dimethyl ether#Dimethyl ether price

1 note

·

View note