#register your business internationally

Explore tagged Tumblr posts

Text

"In the realm of infinite possibilities, formalizing your business ignites your entrepreneurial voyage. Embrace the adventure, leap forward, and watch dreams ascend. Challenges drive growth, setbacks foster resilience. Trust your vision, ignite determination, witness your business embody dedication. Registration isn't just a start; it's crafting an exceptional narrative. Seize this moment, register your business, empower dreams, script a remarkable journey.

🚀 #RegisterBusiness #EmbraceJourney #Entrepreneurship #DreamRealization #UnleashPotential #CarvePath #Kanakkupillai #TurningIdeasIntoReality"

#kanakkupillai#accounting#finance#entrepreneur#register your business internationally#register your business

1 note

·

View note

Text

Best Global entity registration and setup are easy and hassle-free with Ads247365. We can help you register your domain name and handle all the details of your local presence.

#international business registration and setup#international company formation#offshore business registration and setup#overseas business registration and setup#global entity registration and setup#register your business internationally

0 notes

Text

International Business Registration establishes a legal entity in a foreign country to conduct business operations. It means your company will have a physical presence in another country, allowing you to expand into new markets and reach potential customers worldwide.

#international business registration and setup#international company formation#offshore business registration and setup#overseas business registration and setup#global entity registration and setup#register your business internationally

0 notes

Text

Ads247365 offers comprehensive firm registration services to help you start your cross-border business. Our team of experts can assist you with all aspects of the registration process, including legal requirements, paperwork, and documentation. We provide personalized support to ensure the business meets all regulatory and compliance standards, giving you peace of mind and a foundation to build your international enterprise.

#international business registration and setup#international company formation#offshore business registration and setup#overseas business registration and setup#global entity registration and setup#register your business internationally

0 notes

Text

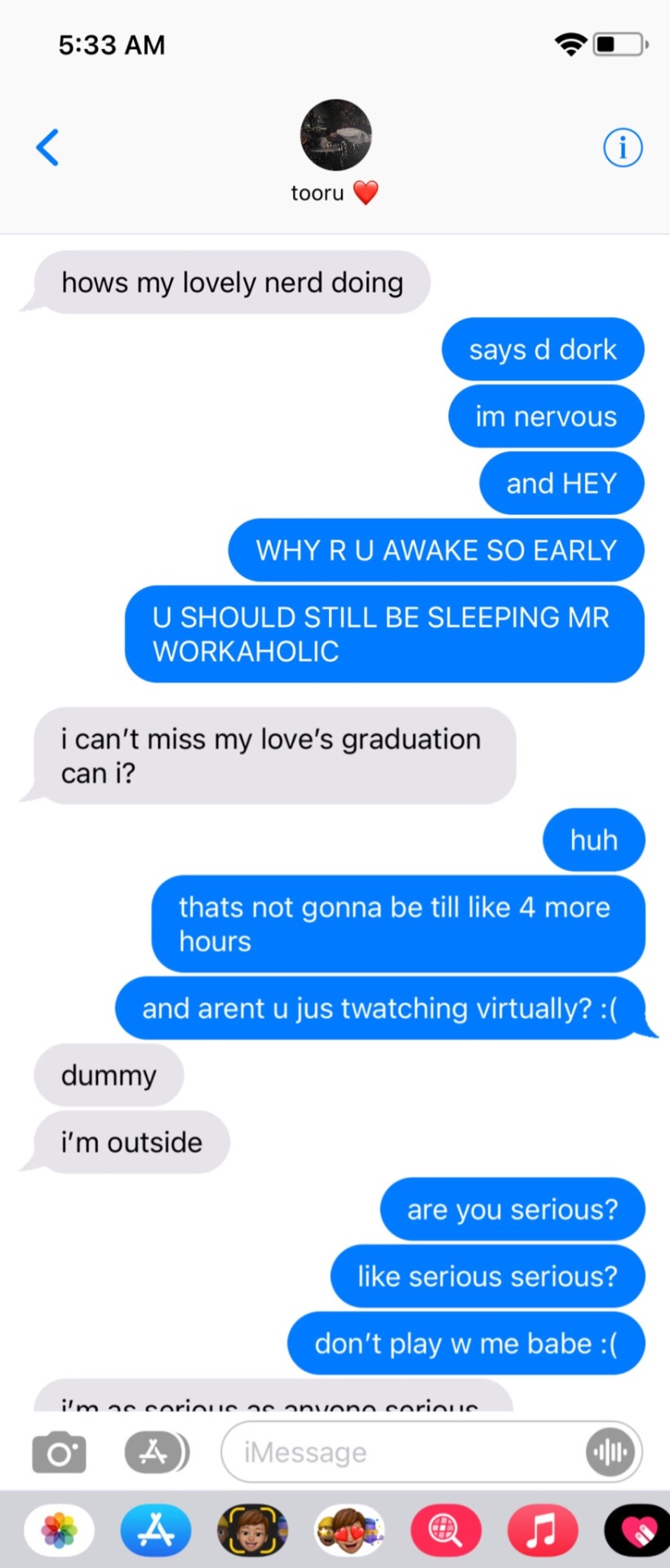

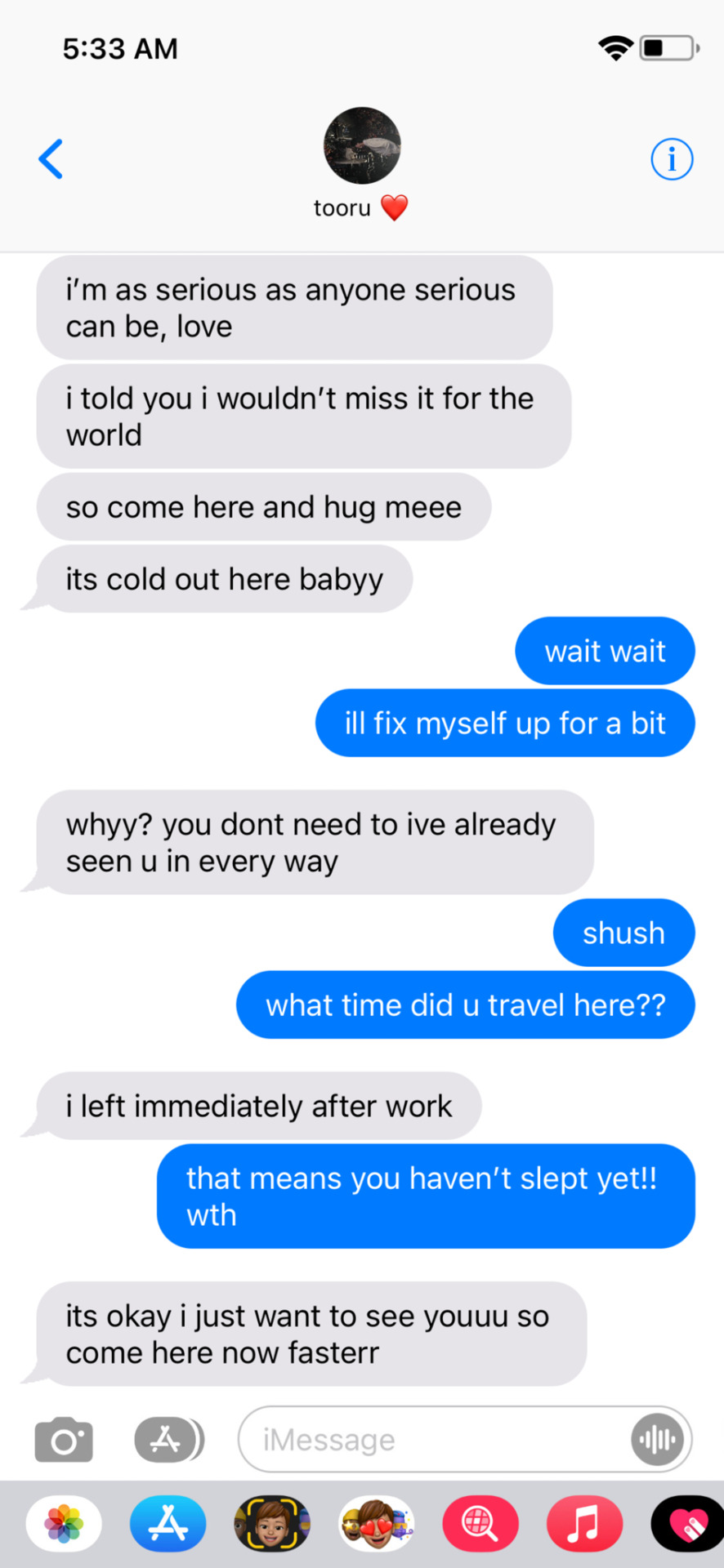

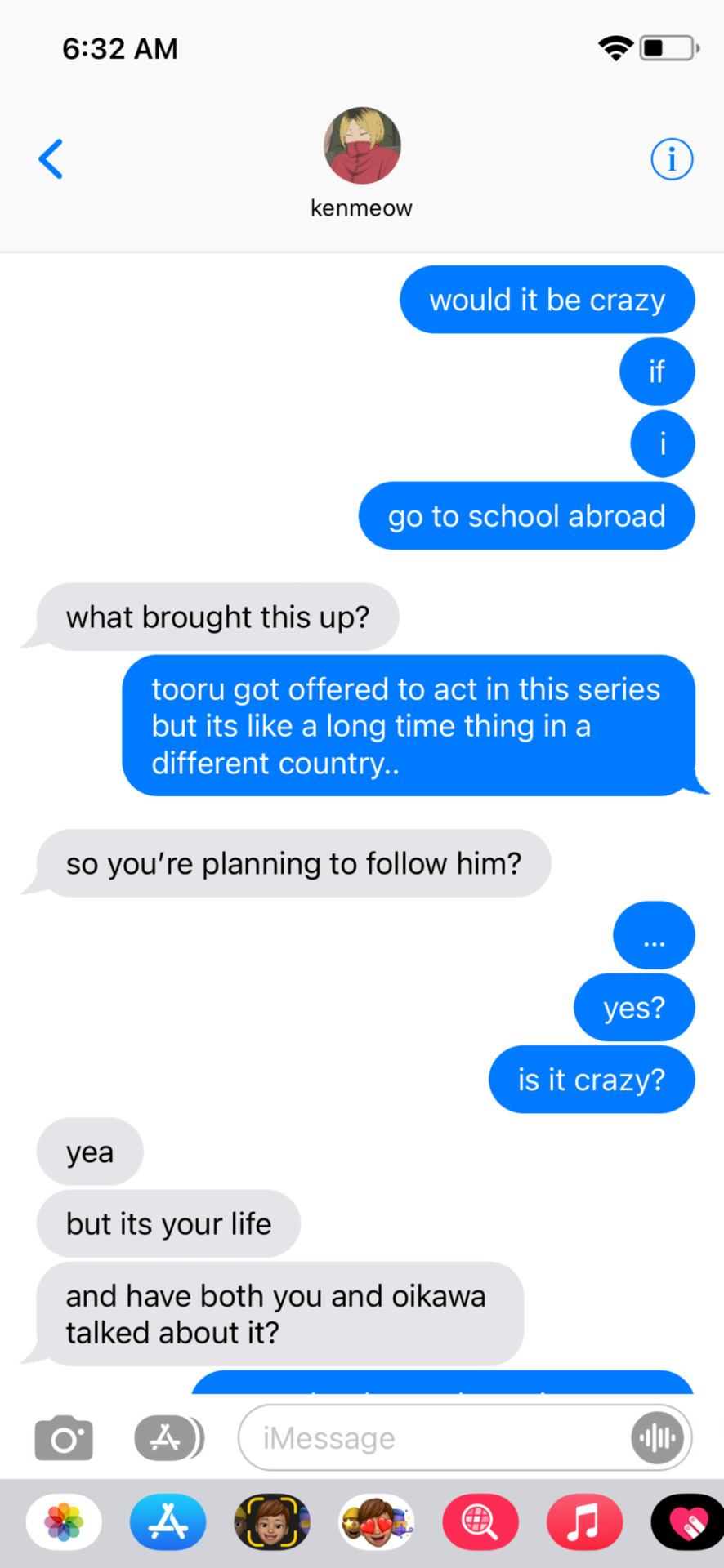

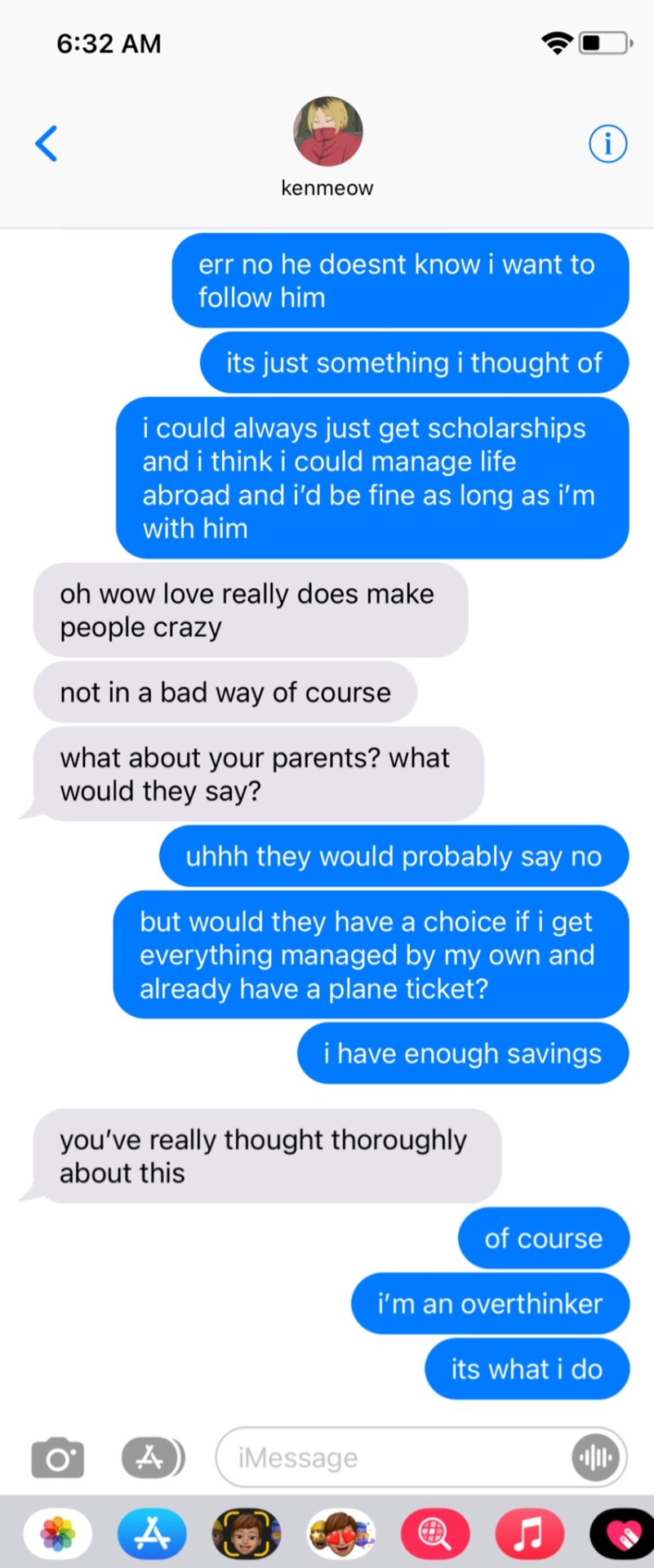

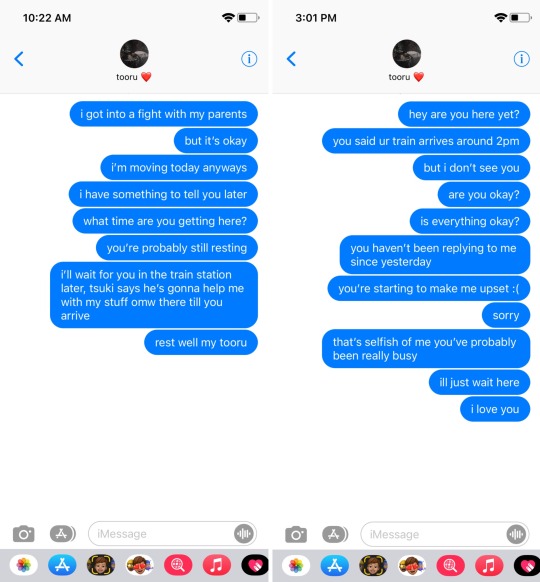

nonsense — 14. adulting and other important stuff

three and a half years ago,,

“i need to talk to you, tooru,” you take a deep breath as you fiddle with the petals of the flowers tooru surprised you with. you’ve been meaning to tell him about this but couldn’t find the perfect timing, it’s good that he could actually make it today, initially he had something scheduled for today, you were moping about him not being there when you finally get your high school diploma for the past week.

“about what?” your boyfriend hummed, reaching over to get a hold of your hand, clasping it and kissing the back of it, you smile softly, almost getting distracted, but no, you had something to say.

“iwa told me something the other day..” you say, brows furrowing, which made tooru worry something was the matter. “he told me that you got an offer to act internationally,” you finally say, biting your lower lip.

oikawa’s worried features immediately falter, in return a sheepish smile, “oh that.”

“what do you mean ‘oh that’!” you hit him on the shoulder with the hand he was holding a few seconds prior, “i can’t believe you didn’t tell me first!”

“i wanted to tell you in person, and it doesn’t matter anyway, i’m not going to take the offer,” oikawa explains, taking your hand to be clasped back in his.

“what?” you tilt your head to the side, confused, what is he talking about! it’s the opportunity of a lifetime, and he wasn’t going to take it? why?

“i was just thinking, it would mean i would be out of the country for long periods of time and i just, i was thinking about us..” oikawa says, leaning back on his car seat, not able to look at you in the eye, “we already planned to stay in tokyo together for our studies and this could change everything,” he lets out, “i’m already busy as is here with my work in japan, what more while im in another country?”

“if i accept it then we would have to do long distance again, an even longer distance, and you know how i want to be near you all the time so i don’t know how i would cope with wanting to be with you and you wouldn’t just be a couple of hours drive away,” he shields his eyes with his arm.

the both of you stayed in silence for a few moments, you thinking over what he said. he had a point of course, you think of all of your college life fantasies with him and how it wouldn’t exactly come true and get a little disappointed, but you wanting for him to achieve more of his dreams weighs bigger than your selfishness to keep him here with you.

“tooru.. i.. i still think you should take the offer,” you say, “this is a big opportunity and you can’t let me hold you back.”

he removed his arm on his face to look at you, with the look on his face you knew he was about to protest so you spoke quickly before he could, “if you’re worried about the long distance thing then it would be fine, i’m sure we can do it, we’d call and text all the time and it would be like we're right next to each other.. just please don’t make rash decisions, this is your dream,” you lean over to take his face between your hands, you place a delicate kiss on his lips, “i love you.”

oikawa was thinking it over, you can see it in his eyes that he was contemplating it, you give him another peck on the lips for extra convincing, “now..” he begins, “how am i supposed to not do what you want when you’re bribing me with kisses?”

“better just do as i say then?” you grin.

1 month later

you didn’t waste a second to answer his call, “where are you? i was so worried—”

“let’s break up,” he cut you off. his tone was so… cold, something you’ve never heard directed to you before. it made you pause before actually registering what he said. did you hear incorrectly? you probably did, it was quite busy here in the station, it could’ve muffled his voice and made you think he was actually breaking up with you, it was just because he was late that’s why you were overthinking, your scheduled ride was in 30 minutes after all and he still wasn’t here.

out of confusion, you just ask again, “what did you say?” it came out all too fragile.

“i said, we should break up,” he repeats in that same cold tone, but that can’t be, your tooru would never ask to break up, he was always the type to say you guys should talk it out whenever you two fought.

“nice joke, tooru,” you laugh— well, you try to laugh, it sounded awfully strained.

“i’m serious, let’s break up [name].”

“i…” you were clenching your phone, he spoke before you could make out another word.

“i don’t think we’re good for each other anymore,” he sighs, like he was exasperated.. like he was done with this.. done with you.

“did I do something wrong?” your voice wobbled, “if i did something wrong then just tell me, we can still fix this. has work been very stressful? have i been too clingy?” you started bombarding him with questions, "tell me what i did wrong so i can fix it," it was supposed to sound like you were put together and fine, instead it made you sound desperate, but right now you didn't care much.

"i just don't feel like being together anymore," he replies, sounding nonchalant.

"that's stupid!" you shout angrily at him through the phone, some passerbys looking your way when you did, "tell me the real reason," you demand, you have the right to know his reason at least, right? his reason for standing you up, his reason for not keeping his promise, his reason for why he's breaking your heart.

"i'm tired, [name], i realized i can't handle my career overseas while being in a relationship, i told you i think i couldn’t handle it, i’ve been thinking more about it and you always tell me to choose my career, right?" he says as your jaw clenches, all you were hearing is that he was tired of you.

at that moment, you couldn't believe you were planning to change your whole life for some guy, that you were willing to give up your dreams temporarily so you could be with him.

but then again, he wasn't just some guy to you. he was the one you love, the one who holds your hand just because he liked touching you, the one who would listen to you ramble about the most nonsensical things, the one who would always come to you whenever you were sad, it didn't matter if he was two hours away or that it was 2am, he would always come to make your tears stop, so why was he the one causing them now?

"fuck you," you say after a long while, too overcome with your emotions, a mixture of anger and hurt, "fine! let's break up," you guffaw.

"i'm glad you understand, [name]," was the final thing he said before hanging up.

understand? he thinks you understand? of course you don't understand! was your relationship just a joke to him? were the times you've spent with him really easy to let go of? were you really that easy to let go of?

you couldn't control your tears, you didn't even care what time it was now.

maybe he really did get tired of you, but then all of the sweet things he's said flash in your mind, did he mean any of those? did he mean it when he said he loved you? what were you to him? something to distract him from his busy and hectic life? a piece of entertainment?

why?

why?

why?

it hurts, it hurts so much. you sob, placing your hands on your face. it didn't help that you were already feeling awful since this morning because of your parents, the fact that oikawa didn't show up, and that he hasn't been replying to you for over a day, and even before that he was only replying shortly to your texts. maybe you should've seen it coming, but he was your loving boyfriend right? you were sure he had an explanation.

fuck him. fuck him. fuck him.

at that moment, you hated him so much, but for some reason, you hated yourself even more.

masterlist — previous | next

✦ fun facts !

tsukishima got into kpop when he was 13!

nonsense ! an oikawa tooru social media au

synopsis. you were oikawa tooru’s #1 fan, until you became his #1 hater. you hated him so much you went viral on twitter (accidentally) and literally became known as “the oikawa tooru hater”, doesn’t help that he keeps fueling the fire by subtweeting you. everyone is all in for this new drama. what isn’t known to the public, is that this particular drama’s been on hold for three years (him being your ex and all).

a/n — i think im gonna post my playlist of nonsense laterr

taglist is open ! + @kawaii-angelanne @ceneridiankaa @kittycasie @rukia-uchiha-98 @polish-cereal @kellesvt @rockleeisbaeeee @kashxyou @imsoluvly @jjulliette @tooruchiiscribs @littlefreakjulia @gomjohs @qualitygiantshoepsychic @mellowknightcolorfarm @konzumeken @migosple @kuroogguk @sangwooooo @katsu-shi @wolffmaiden @rijhi @2baddies-1porsche @yeehawcity @aishkaaa @crueldinasty @rintarousprincess @yyuiz @epeec28 @llamakenma @penguinlovestowrite @princelingperfect

#haikyuu smau#haikyuu#haikyuu x reader#hq x reader#oikawa tooru x reader#celebrity au#celebrity smau#actor au#model au#college au#haikyuu smau series#oikawa tooru x you#haikyuu oikawa tooru#exes to lovers#— nonsense.#— smaus.#haikyuu fluff#hq#oikawa tooru#haikyuu x you#hq smau

445 notes

·

View notes

Text

Creating an exit plan to become an expatriate (expat) from the United States involves a series of steps, from researching destinations to managing financial and legal obligations. Here’s a general outline to help guide you through the process:

1. Research Destination Countries

• Identify your criteria: Think about climate, cost of living, healthcare, quality of life, tax implications, and visa requirements. Consider how you want to spend your time abroad, like working, retiring, or starting a business.

• Narrow down options: Research countries that align with your criteria. For many Americans, countries in Europe, Central and South America, and parts of Asia are popular because of their expat-friendly environments.

2. Visit Potential Countries

• Plan exploratory trips: Spend a few weeks in each potential destination to experience the local lifestyle, cost of living, and culture firsthand. This can help confirm that a location fits your needs.

• Connect with local expats: Attend events or join expat communities to get insights into life in each country.

3. Understand Visa and Residency Requirements

• Research visa options: Each country has its own set of visa options, like work visas, retirement visas, digital nomad visas, and investment visas. Determine which one aligns with your goals.

• Plan for long-term residency: Many countries offer paths to permanent residency or citizenship. Find out the requirements and start the application process if your target country allows.

4. Prepare Financially

• Create a budget: Factor in moving costs, cost of living, healthcare, taxes, and emergency savings. Make sure your finances will support your lifestyle abroad.

• Understand tax obligations: U.S. citizens must file taxes regardless of where they live. Research your obligations and consider consulting an accountant with experience in expat tax law.

• Set up local bank accounts: Find out if you’ll need a local bank account and research how to transfer money internationally efficiently.

5. Secure Healthcare Coverage

• Look into healthcare options: Some countries offer affordable healthcare, while others may require private insurance. Explore local healthcare systems and check if your target country offers expat health insurance.

• Assess your U.S. healthcare: If you need continued U.S.-based healthcare coverage (like Medicare, which generally doesn’t cover you abroad), consider how you’ll handle medical needs.

6. Tie Up Loose Ends in the U.S.

• Handle legal and financial matters: Consider creating a will, assigning a power of attorney, and updating your legal documents.

• Manage property and assets: Decide whether you’ll rent out, sell, or keep your home and other properties.

• Notify institutions: Inform banks, creditors, insurance companies, and other relevant institutions about your move to avoid complications.

7. Learn the Language and Culture

• Study the local language: Even a basic understanding of the language will help with daily interactions, especially in less expat-heavy areas.

• Understand cultural norms: Adjusting to new customs and social norms will make integration smoother and more enjoyable.

8. Build a Support Network

• Join online communities: Many social media groups exist for expats in various countries. Being part of these groups can ease the transition.

• Stay connected to home: Plan regular calls with family and friends to help with homesickness and maintain relationships.

9. Make the Move

• Arrange for the physical move: Plan your relocation, including moving your belongings, storing items you’re leaving behind, and booking flights.

• Settle into your new home: Take time to get acquainted with your surroundings, set up essential services, and register with local authorities if required.

10. Maintain Flexibility

• Give yourself an adjustment period: The initial months can be a mix of excitement and culture shock. Allow time for adaptation.

• Have an exit strategy: Keep a backup plan in case you decide to return to the U.S. or move to another country in the future.

By planning each step carefully, you’ll create a smooth transition from the U.S. to your new country. Let me know if you’d like specific country recommendations or further details on any step!

2 notes

·

View notes

Text

Immigration Lawyer Townsville

Freeman Migration Services Australia provides advice on a commercial basis about Australia’s migration law and visa processes. When you use our skills select services you gain the benefit of our extensive knowledge of migration procedures, which makes us different from other less experienced providers of migration advice.

The principal, Alison Louise Twiname, is a Registered Migration Agent with the Office of the Migration Agents Registration Authority, and is a Member of the Migration Institute of Australia.

At Freeman Migration Services Australia we have handled many complex migration cases and can therefore provide you with expert advice about Australia’s migration law and procedures. Our 'hands on' knowledge of skills select procedures, and years of experience in processing and lodging visa applications, means that we can give your application the best possible chance of success.

Australia immigration laws are complex, and it is advisable to seek expert advice if you are considering migrating to Australia. When you use Freeman Migration Services Australia you can be assured that we have the depth of knowledge of skills select procedures to get you the best possible result.

Freeman Migration Services Australia assists many clients and businesses throughout Australia and internationally with their visa requirements. We respond as quickly as possible to our client’s many enquiries, and will take the worry out of your skills select experience.

We work closely with Australian businesses and skilled overseas employees, and can assist you with a range of other visa options such as partner visas. At Freeman Migration Services Australia, we gain a lot of satisfaction through helping people migrate to Australia.

We will not take on a case if we don’t believe that the application has a reasonable chance of success.

Freeman Migration Services Australia 155 Denham Street TOWNSVILLE QLD 4810 0747720100 Monday to Friday: 9:00am - 5:00pm https://www.freemanmigration.com.au

2 notes

·

View notes

Text

Unlocking Success: Understanding the Cost of Starting a Spice Business

The spice industry has long been a lucrative venture for entrepreneurs with a keen eye for quality and a passion for flavor. With spices being integral to cuisines worldwide, the market offers immense opportunities. However, before you dive into this vibrant industry, it’s crucial to understand the cost of starting a spice business.

Initial Investment Breakdown

Starting a spice business involves various costs, each playing a pivotal role in setting up a successful operation. These costs can be categorized into production, logistics, and marketing expenses.

1. Sourcing and Procurement: The quality of your spices will define your brand. Sourcing raw materials, whether domestically or internationally, is often the most significant initial expense. This includes costs associated with cultivating relationships with farmers, quality testing, and bulk purchasing.

2. Processing and Packaging: Once you’ve secured your raw materials, the next step involves cleaning, drying, grinding, and packaging the spices. Depending on the scale, you may need to invest in processing equipment or outsource to a third-party facility. Packaging plays a crucial role in branding and customer appeal, adding another layer to your costs.

3. Licensing and Legal Fees: Registering your business, obtaining food safety certifications, and securing trademarks for your brand will incur legal and administrative fees. These are essential to ensure compliance with local and international regulations.

4. Marketing and Branding: In a competitive market, creating a strong brand identity is indispensable. Expenses include designing logos, building a user-friendly e-commerce website, and running digital marketing campaigns to reach your target audience.

5. Distribution and Logistics: Whether you plan to sell online or distribute to retail stores, logistics costs such as warehousing, shipping, and supply chain management must be accounted for.

Hidden Costs You Might Overlook

While the obvious expenses are easy to identify, there are hidden costs that can significantly impact your budget. For instance, fluctuations in raw material prices due to seasonal variations or geopolitical issues can strain your finances. Moreover, investing in research and development to introduce unique spice blends may require additional funding.

Estimating Your Budget

The cost of starting a spice business can range from a few thousand dollars for small-scale, home-based operations to hundreds of thousands for large-scale, fully equipped ventures. It’s crucial to prepare a detailed business plan that outlines your expected expenses and potential revenue streams. This not only helps in managing your finances but also makes it easier to secure funding from investors or financial institutions.

Maximizing Profitability

While initial costs might seem daunting, the spice business offers high profit margins, especially if you focus on quality and branding. Establishing a loyal customer base, exploring export opportunities, and offering unique blends can further enhance profitability.

Final Thoughts

Understanding the cost of starting a spice business is the first step toward building a successful venture. By planning meticulously and staying adaptable, you can turn your passion for spices into a thriving enterprise. With the right strategy, your spice business can add flavor to kitchens worldwide while ensuring a steady stream of income.

0 notes

Text

Ensuring Compliance in Medical Hardware Imports with Expert IOR Services

The Importance of Compliance in Medical Hardware Imports

Ensuring that all procedures are being carried out legally and closely adhering to numerous rules and guidelines can make the importation of medical equipment a difficult task. In order to guarantee the effectiveness, safety, and quality of medical equipment as well as their optimal condition, compliance requires more than just checking a box. Product recalls steep fines, and reputational harm are just a few of the dire consequences that deviance may have.

The most significant parts of the customs process are paperwork, duties, and inspections. Importers must also manage these complex procedures in addition to adhering to legislation. These processes may be challenging and time-consuming, especially for businesses that have never imported medical supplies before.

Defining an IOR

An Importer of Record (IOR) is an entity that takes responsibility for importing goods from one place to another. In medical hardware imports, the IOR is a local business registered with the appropriate customs authorities.

Primary Responsibilities of an IOR in Medical Hardware Imports

The IOR has to make sure the medical stuff we bring in follows all the rules. This means checking if it's labeled right and packaged correctly. They also need to keep track of everything related to the import, like bills, customs papers, and any official approvals

Benefits of Using an IOR for Compliance Purposes

IORs are experts in the intricate world of customs regulations, import procedures, and medical device requirements. Their deep understanding of these complex areas allows them to provide invaluable guidance and support to businesses involved in medical hardware imports. By leveraging the expertise of an IOR, companies can significantly reduce their risk of non-compliance and avoid costly penalties. Additionally, IORs can streamline the import process, saving businesses valuable time and resources. Their efficient handling of customs clearance, regulatory compliance, and documentation ensures a smooth and efficient import experience, ultimately contributing to the overall success of the business.

Key IOR Responsibilities in Medical Hardware Imports

For medical hardware imports, the IOR is essential in alleviating customs clearance, ensuring regulatory compliance, and supervising proper labeling and packing. This includes providing all required documentation, knowing and complying with relevant regulations and standards, guaranteeing proper product labeling, and keeping complete documentation for

audits and compliance checks. The DAP Incoterm and Its Implications for IOR Services

Understanding the DAP Incoterm

Delivered at Place, or DAP is a sophisticated method of stating who bears what liability while transacting business internationally. In essence, it means that the seller is responsible for ensuring that the goods may be carried into the nation, transporting them to a designated location, and preparing everything needed for them to be removed from the ship or aircraft upon arrival.

Why Choose One Union Solutions as Your Importer and Exporter of Record?

The DAP Incoterm is often used in international trade, specializing in medical hardware imports. The seller is liable for paying the expense and liability of delivering the items to the specified region. Yet, the seller is not in a position to pass customs or transfer the goods from the delivery truck.

Implications for IOR Services

Under the DAP Incoterm, the IOR's responsibilities primarily begin after the goods have arrived at the destination. The IOR is typically responsible for:

Customs Clearance: Paperwork and procedures needed to deliver your goods and properly clear customs.

Regulatory Compliance: Assistance in staying out of trouble with the law, our staff stays up to date on the most recent changes.

One Union Solutions We aggressively control the risks associated with delivering your items, including the possibility of loss or damage while en route. Throughout the shipping procedure, you may feel secure knowing that your investment is protected thanks to our tactics.

Conclusion In summary, maintaining compliance with import laws is essential for both product quality and safety and to prevent fines from the law. With an importer-of-record-usa, the difficult process of navigating laws and customs requirements can be greatly simplified. Customs clearance, regulatory compliance, appropriate labeling and packing, and thorough documentation are among the main responsibilities of an IOR. The DAP Incoterm delegated particular tasks to the IOR upon the arrival of goods, highlighting the necessity of selecting an appropriate IOR for optimal compliance and risk minimization.

Importance of Using an IOR

Using an IOR for medical hardware imports offers numerous benefits, including:

Expertise: IORs are especially knowledgeable about rules and guidelines.

Decreased Risk: IORs can assist in lowering the chance of fines and non-compliance.

Time and Cost Savings: IORs can streamline the import process.

Compliance Assurance: IORs ensure adherence to all relevant regulations.

Contact One Union Solutions

For expert IOR services and support in medical hardware imports, contact One Union Solutions. Our team of experts assist you in streamlining your import procedures, reducing risks, and navigating the complexity of compliance.

0 notes

Text

offshore company setup

Guide to Offshore Company Setup: Everything You Need to Know

Setting up an offshore company is a strategic move for many entrepreneurs and businesses looking to expand their operations internationally. Whether it’s to access global markets, enjoy tax benefits, or secure a favorable legal environment, offshore companies provide numerous advantages. This guide covers the essential aspects of offshore company setup, helping you understand why and how to establish one.

1. What is an Offshore Company?

An offshore company is a business entity established in a country outside of the founder’s country of residence, often in jurisdictions that offer specific tax benefits, privacy, and ease of operation. Popular locations for offshore companies include the Cayman Islands, British Virgin Islands (BVI), Belize, and the UAE.

Key Features:

Operates outside the jurisdiction where it was established.

Commonly used for international trading, holding assets, and business structuring.

Often enjoys favorable tax treatment in the host country.

2. Benefits of Setting Up an Offshore Company

Offshore companies are attractive to various business owners due to several benefits, including:

Tax Efficiency: Many offshore jurisdictions offer tax exemptions or reduced tax rates, allowing businesses to legally minimize their tax obligations.

Asset Protection: Offshore structures can provide asset protection from legal claims and creditors, helping safeguard business assets.

Privacy and Confidentiality: Offshore jurisdictions often have strict laws that protect company and shareholder information, offering a level of privacy that is appealing to many investors.

Ease of International Operations: Offshore companies facilitate global expansion by enabling companies to transact internationally with minimal regulatory hurdles.

Flexibility in Management and Ownership: Offshore companies typically have fewer restrictions on the nationality of shareholders and directors, allowing international ownership and control.

3. Steps to Setting Up an Offshore Company

Setting up an offshore company requires careful planning and consideration of the specific jurisdiction and business goals. Here’s a step-by-step overview:

Step 1: Select the Right Jurisdiction

Each offshore jurisdiction offers unique benefits, so selecting the right one depends on your company’s needs. Factors to consider include tax regulations, political stability, reputation, and legal framework.

Step 2: Choose a Business Structure

Offshore companies can take various forms, such as International Business Companies (IBCs), Limited Liability Companies (LLCs), or corporations. Consult with a legal advisor to determine the best structure based on your business’s objectives.

Step 3: Register the Company Name

You’ll need to choose and register a unique company name in the offshore jurisdiction. Some jurisdictions may have naming restrictions, so research local regulations or seek help from a local agent.

Step 4: File Incorporation Documents

Prepare and submit the necessary documentation, such as the Articles of Incorporation and Memorandum of Association. Some jurisdictions may also require shareholder information, business plans, and identity documents.

Step 5: Open a Bank Account

Most offshore companies need an international bank account to conduct business efficiently. Ensure that your chosen bank supports offshore companies and meets your business’s banking needs, such as multi-currency accounts and online banking services.

Step 6: Maintain Compliance

After setup, stay compliant with the offshore jurisdiction’s regulatory requirements, including annual fees, company renewal, and financial reporting (if required).

4. Costs of Setting Up an Offshore Company

The costs of establishing an offshore company vary depending on the jurisdiction, business type, and professional services used. Typical expenses include:

Incorporation Fees: Government and administrative fees for registering the company.

Professional Fees: Costs for legal and accounting services.

Banking Fees: Fees for opening and maintaining an offshore bank account.

Annual Renewal Fees: Fees to keep the offshore company active in the jurisdiction.

5. Legal Considerations

It’s important to follow all legal requirements in both the offshore jurisdiction and the country of residence to avoid potential legal issues. Always consult with a legal expert to ensure compliance with international business laws, tax obligations, and anti-money laundering regulations.

6. Common Myths About Offshore Companies

Myth #1: Offshore Companies are Only for Tax Evasion While offshore companies offer tax benefits, they are also popular for asset protection, privacy, and international business expansion. Legal offshore structures operate in compliance with international laws.

Myth #2: Offshore Companies Lack Transparency Reputable offshore jurisdictions maintain high standards of compliance, requiring transparency and documentation, especially in financial matters.

7. Is Offshore Company Setup Right for You?

An offshore company can be an excellent choice for business owners who:

Operate internationally and want to streamline their operations.

Seek to diversify their asset holdings in a legally protected manner.

Desire tax benefits without evading legal obligations.

Final Thoughts

Offshore company setup can be a valuable tool for business growth, tax efficiency, and asset protection. By choosing the right jurisdiction and complying with local and international regulations, entrepreneurs can harness the benefits of an offshore structure. If you’re considering this path, consult with a professional to ensure that it aligns with your business goals and complies with all legal requirements.

0 notes

Text

Trademark Registration in Chennai

https://www.mangalamassociate.com/trademark-registration-in-chennai/

🔒 Protect Your Brand with Trademark Registration in Chennai 🔒

Trademark registration is key for businesses to safeguard their brand identity and intellectual property. Here's why you need it:

✅ Legal Protection: Exclusive rights to use your name, logo, or slogan. ✅ Brand Recognition: Build trust and loyalty among customers. ✅ Valuable Asset: Can be licensed, franchised, or sold. ✅ Global Reach: Protect your brand internationally with the Madrid Protocol.

Don’t let others profit from your hard work! Register your trademark today for long-term business success.

📞 Contact us now for professional trademark registration services in Chennai.

#TrademarkRegistration #BrandProtection #IntellectualProperty #ChennaiBusiness #LegalProtection #BusinessGrowth

0 notes

Text

How to Protect Your Work with Copyright in Coimbatore

Copyright registration in Coimbatore is essential for creators looking to protect their intellectual property rights. In Coimbatore, a city known for its thriving textile industry, educational institutions, and cultural diversity, copyright registration ensures that authors, artists, musicians, and other creators can safeguard their works and benefit from their creative endeavours. This article outlines the importance of copyright registration, the process involved, and the benefits it offers to creators in Coimbatore.

Understanding Copyright

Copyright is a legal right granted to creators of original works, including literary, dramatic, musical, and artistic works, films, sound recordings, and broadcasts. It gives the creator the exclusive right to reproduce, distribute, perform, and display their work. In India, copyright is governed by the Copyright Act 1957 and administered by the Copyright Office under the Ministry of Commerce and Industry.

Importance of Copyright Registration

Although copyright protection is automatic upon the creation of a work, registration provides several key advantages:

Legal Proof of Ownership: Registration serves as prima facie evidence in a court of law, proving the creator's ownership of the work.

Public Record: It creates a public record of the work, which can help deter potential infringers.

Eligibility for Statutory Damages: In case of infringement, registered works are eligible for statutory damages and attorney’s fees, which unregistered works are not.

International Protection: Registration can facilitate the protection of work internationally under various copyright treaties and agreements.

The Copyright Registration Process in Coimbatore

1. Preparation of the Application

The first step is to prepare the application for copyright registration. This involves:

Completing the Application Form: The applicant must complete the appropriate form (Form IV) available on the Copyright Office’s website. Each form is for a different type of work.

Providing Copies of the Work: Depending on the nature of the work, copies may need to be submitted. For instance, literary works require two copies of the manuscript.

Supporting Documents: Any other relevant documents, such as proof of ownership, must be attached.

2. Submission of the Application

The completed application, the required documents, and the fee must be submitted to the Copyright Office. The application can be filed online through the e-filing system on the Copyright Office’s website, or it can be submitted in person or by post to the Copyright Office.

3. Examination Process

After submission, the application undergoes an examination process:

Scrutiny: The Copyright Office scrutinizes the application to ensure all necessary documents and information have been provided.

Objections and Discrepancies: If any objections or discrepancies are found, the applicant is notified and given an opportunity to address them.

4. Registration and Certification

Once the examination is complete and any objections have been resolved, the Copyright Office registers the work and issues a certificate of registration. The details of the work are then entered into the Register of Copyrights.

Benefits of Copyright Registration in Coimbatore

1. Protection and Enforcement

Registered copyright helps creators enforce their rights and take legal action against unauthorized use or infringement. This is particularly important in Coimbatore, a city with a growing creative industry, including literature, music, and digital content.

2. Commercial Exploitation

With registered copyright, creators can license their work to others, opening up opportunities for commercial exploitation. This can include selling rights, creating adaptations, or collaborating with other artists and businesses.

3. Cultural Preservation

Coimbatore's rich cultural heritage is preserved through the protection of artistic works. Copyright registration ensures that traditional and contemporary works are documented and safeguarded for future generations.

4. International Reach

For creators aiming to reach an international audience, copyright registration provides a foundation for protecting their work globally. It simplifies the process of securing rights in other countries, facilitating cross-border collaborations and distribution.

Conclusion

Copyright registration in Coimbatore is a vital tool for protecting creators' intellectual property. It provides legal benefits and fosters a supportive environment for creativity and innovation. By understanding and utilizing the copyright registration process, creators in Coimbatore can ensure their works are protected, preserved, and valued both locally and internationally.

0 notes

Text

The business international business registration procedure in India and the United States are largely similar. Both countries have a similar legal framework, business registration procedures, and laws.

#international business registration and setup#international company formation#offshore business registration and setup#overseas business registration and setup#global entity registration and setup#register your business internationally#online international firm registration

0 notes

Text

Guide to Business Setup in Dubai: General Trade License, Mainland vs. Free Zone, and Company Formation

Dubai is a leading global hub for commerce, offering excellent infrastructure, a strategic location, and business-friendly policies that attract entrepreneurs from around the world. Whether you’re looking to establish a new business setup in Dubai mainland or a Dubai free zone, understanding the options for licenses, formation procedures, and regulatory frameworks is essential. This guide will walk you through the process of company formation in Dubai and provide insights into obtaining a general trade license.

1. Why Choose Dubai for Your Business Setup?

Dubai’s dynamic economy, political stability, and innovative policies make it an ideal location for setting up a business. The city offers two primary options for business setup: Dubai mainland and Dubai free zone, each with unique advantages that cater to different business needs.

Advantages of Setting Up a Business in Dubai

Tax Benefits: Dubai offers favorable tax regulations with no personal income tax and low or zero corporate tax for many industries.

100% Foreign Ownership: Certain free zones in Dubai allow 100% foreign ownership, which is attractive for international investors.

Strategic Location: Situated between Europe, Asia, and Africa, Dubai provides easy access to major global markets.

Advanced Infrastructure: Dubai’s high-quality infrastructure, including ports, airports, and logistics facilities, makes it a global trade powerhouse.

2. General Trade License in Dubai

A general trade license in Dubai is a versatile business license that allows companies to conduct a variety of trading activities under one license. With this license, a business can import, export, re-export, distribute, and store goods. It is ideal for businesses looking to trade in multiple product lines.

Key Benefits of a General Trade License

Broad Range of Activities: Allows trading in a wide variety of goods without requiring separate licenses for each item.

Flexible Trade Operations: Allows import and export with minimal restrictions.

Attractive to Investors: Simplifies the legal requirements, making it easier for businesses to operate and grow.

Steps to Obtain a General Trade License

Determine Your Business Activities: List the goods you plan to trade, as certain restricted items may require additional approval.

Choose a Location: Decide whether you will set up in a free zone or mainland.

Submit Application: Submit your application to the Dubai Department of Economic Development (DED) if you are setting up in the mainland, or to the relevant free zone authority.

Complete Legal Requirements: Fulfill all required documentation and pay the license fees.

3. Business Setup in Dubai Mainland

A business setup in Dubai mainland allows companies to operate anywhere in Dubai and across the UAE. This setup is ideal for companies that need flexibility and want to target the local market.

Key Benefits of a Mainland Business Setup

No Trade Restrictions: Mainland companies can trade freely within the UAE and internationally.

Eligibility for Government Contracts: Mainland companies are eligible to bid for lucrative government contracts.

Greater Business Flexibility: Ideal for businesses planning to expand operations within the UAE.

Steps for Mainland Business Setup

Decide on a Business Structure: Choose an appropriate legal structure, such as an LLC or branch office.

Reserve a Trade Name: Choose and register a unique trade name for your business.

Apply for a License: Submit your application to the DED along with necessary documents.

Rent an Office Space: A physical office is required for mainland companies.

Get Approvals and Start Operations: Complete all formalities, and you’re ready to launch.

4. Business Setup in Dubai Free Zone

Setting up a business in one of Dubai’s many free zones offers numerous advantages, particularly for international investors. Free zones are designed to attract foreign investment and are governed by their own regulatory bodies, allowing for 100% foreign ownership.

Key Benefits of Free Zone Business Setup

100% Foreign Ownership: Unlike mainland, free zone businesses can be fully owned by foreign nationals.

Exemptions on Customs Duty: Free zone businesses enjoy exemption from customs duties on imports and exports.

No Corporate Tax: Many free zones offer a corporate tax-free environment.

Tailored Infrastructure: Free zones often have industry-specific infrastructure, such as media hubs or technology centers.

Steps for Free Zone Business Setup

Choose a Free Zone: Dubai offers over 30 free zones, each catering to specific industries like tech, media, or logistics.

Determine Business Activities: Select your business activities based on the type of trade allowed within the chosen free zone.

Register the Company and Obtain a License: Submit your application to the free zone authority and complete the necessary formalities.

Rent Office Space (if required): Some free zones allow virtual office setups, while others require a physical presence.

5. Company Formation in Dubai

Company formation in Dubai involves establishing the legal structure, obtaining the necessary licenses, and completing all regulatory requirements. The process varies based on whether you are setting up in the mainland or a free zone.

Types of Legal Structures for Company Formation

Limited Liability Company (LLC): Most common for mainland setups, requiring a UAE local sponsor for some percentage of ownership.

Free Zone Company (FZC): Allows 100% foreign ownership in the respective free zone.

Branch Office: Suitable for foreign companies looking to establish a branch in Dubai.

Steps for Company Formation

Choose Business Structure and Location: Based on business goals and industry.

Get a Trade Name Approval: Obtain approval from the Department of Economic Development.

Submit Documents and Pay Fees: Complete all required paperwork and pay necessary fees for approval.

Secure Business Premises: Find a suitable location for your business, either in the mainland or a free zone.

Get Final Approvals: Receive final approval and collect your business license.

Conclusion

Setting up a business in Dubai can be a rewarding venture with the right guidance and planning. Deciding between a business setup in Dubai free zone or a Dubai Mainland, obtaining a general trade license, and completing the company formation process are essential steps. Each option offers unique benefits, whether you’re looking for a local presence with a mainland setup or complete foreign ownership with a free zone establishment. With Dubai’s favorable business environment, your company is well-positioned for growth and success.

Ready to start your business journey? With the right support and insights, Dubai’s vibrant business landscape can be yours to explore and excel in.

#Business setup in dubai#general trade license in dubai#business setup in dubai mainland#business setup in dubai free zone#company formation dubai

0 notes

Text

Ads247365 helps you with Global Entity Registration, which is a process to set up an organization's headquarters and its branches in different countries. The company offers a one-stop-shop solution to register your entity and provide customers with the information they need.

#international business registration and setup#international company formation#offshore business registration and setup#overseas business registration and setup#global entity registration and setup#register your business internationally#online international firm registration

0 notes

Text

How Company Formation in Hong Kong Can Open Doors to International Markets

Forming a company in Hong Kong offers numerous advantages for entrepreneurs seeking to expand their businesses globally. With its strategic location, access to international trade networks, and business-friendly environment, company formation HK can be the key to unlocking new growth opportunities worldwide. Here’s how setting up a business in Hong Kong can benefit your company’s international expansion.

1. Hong Kong’s Strategic Location

Hong Kong serves as one of the world’s most important global business hubs. Its geographical position at the crossroads of Asia provides businesses with easy access to major international markets, especially China. By choosing Hong Kong company formation, you position your business at the heart of one of the fastest-growing regions in the world. This prime location enables you to reach both the East and West with minimal barriers.

2. Access to Global Trade Networks

Hong Kong has a strong reputation for being a gateway to global markets, particularly through its international trade agreements and its status as a free trade port. By forming a company in Hong Kong, you gain access to a wide range of trade networks and business partnerships. The city has numerous free trade agreements (FTAs) and is an active member of global organizations like the World Trade Organization (WTO). This access allows businesses to operate with fewer customs duties, fewer trade barriers, and greater flexibility when entering new international markets.

3. Business-Friendly Environment

Hong Kong has long been known for its open economy and low tax rates, making it an attractive destination for international entrepreneurs. The city’s transparent legal framework and regulatory environment provide stability for foreign investors. Additionally, Hong Kong’s banking system is robust, and the financial sector is well-regulated, making it easy to open a business bank account and secure funding. With no restrictions on capital flows, setting up a business in Hong Kong gives you the freedom to expand internationally with ease.

4. Strong International Reputation

Hong Kong enjoys a strong international reputation, particularly as a financial and commercial center. This reputation opens doors to partnerships and funding opportunities from both local and international investors. Having your company registered in Hong Kong signals credibility, which can be crucial when expanding into new markets. Investors and customers alike trust Hong Kong’s regulatory environment, making it easier to establish your company’s presence worldwide.

5. Easy Access to Talent and Innovation

As a leading global business hub, Hong Kong attracts talented professionals from all over the world. Its highly skilled workforce, particularly in finance, technology, and international trade, gives you access to the talent you need to grow your business internationally. Additionally, Hong Kong is at the forefront of innovation, particularly in the fintech sector, making it an ideal base for businesses looking to leverage cutting-edge technologies for global expansion.

By choosing company formation in Hong Kong, your business gains unparalleled access to international markets. Hong Kong’s strategic location, global trade networks, business-friendly environment, and international reputation create the perfect foundation for global expansion. With AsiaBC’s expert guidance, you can smoothly navigate the company formation process and set your business up for international success. Explore our services today and take the first step towards expanding your global reach.

0 notes