#refund consulting industry

Explore tagged Tumblr posts

Note

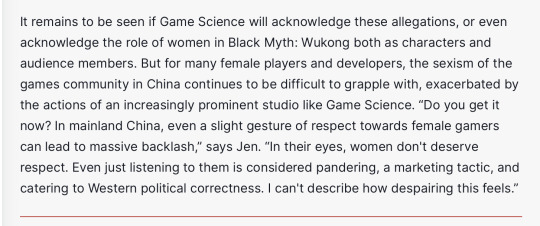

Not gacha but psa Black Myth Wukong is made by a bunch of incels. One of the key developers had publicly stated that he think women are dragging the game industry down and souls like games should be for men only. The company never acknowledge this behavior and uses sexual innuendos as hiring ads. Chinese incels spend a lot of time going around both weibo and twitter harassing women who express negative opinion on the game as well as threatened refund and review bomb when the studio censored one of its female character's design.

Don't give the studio ur money and if anyone you know decide they want to play even after knowing the studio doesn't see women as people be careful around them.

Here's some context for eng speaker

https://www.ign.com/articles/how-black-myth-wukong-developers-history-of-sexism-is-complicating-its-journey-to-the-west

Thank you, I would advise everyone read the article as it’s a good overview on the entire thing and gives the reader some information about feminism in China. There would be a lot for me to post everything here, I’ll post a couple screenshots and encourage everyone to give it a read. I hope everyone will not support these extremely misogynist men.

BEYOND parody. Like a lot of these kinds of guys, he sees men as fellow humans with emotions- depression, anger, pain. Manly emotions women cannot understand I guess. He sees the games that cater to these men as worthwhile. He sees women as not human- their personality is that they are girls. They will play the sellout crap you make and spend money frivolously to make their friends jealous. He thinks this is biological for some reason. I guess I should have consulted my uterus before playing “bloodbath” games like Bloodborne 😂 I swear inside of his head must be one of those toy aisles where every pink thing is on one side and blue on the other…

84 notes

·

View notes

Text

I got really bored and made my own Mineopoly board...

(all images from bing ai - no way I was wasting weeks doing all these myself!!)

And here's the Risk (Chance!) and Camphor Wood Chest (Community Chest Cards!)

Risk Cards

Advance to Go (Collect $£200) Advance to Titan. If you pass Go, collect $£200 Advance to Pluto Advance to Olympus Mons. If you pass Go, collect $£200 Advance to the nearest Space Service Station. If unowned, you may buy it from the Bank. If owned, pay owner twice the rental to which they are otherwise entitled Advance to the nearest Space Service Station. If unowned, you may buy it from the Bank. If owned, pay owner twice the rental to which they are otherwise entitled Advance to nearest Corporation. If unowned, you may buy it from the Bank. If owned, throw dice and pay owner a total ten times amount thrown. Bank of Callisto pays you dividend of $£50 Your life is saved! Get Out of Purgatory Free! Go Back 3 Spaces Industrial Accident. Go to Purgatory. Go directly to Purgatory, do not pass Go, do not collect $£200 Make general repairs on all your property. For each mining shaft pay $£25. For each complete mine pay $£100 Parking Fine $£15 Take a trip to Tebay Services. If you pass Go, collect $£200 You have been elected Chairman of JMC. Pay each player $£50 You receive a faulty merchandise refund from Diva Droid International after your mechanoid causes and industrial accident. Collect $£150

Camphor Wood Chest Cards

Advance to Go (Collect $£200) Bank of Callisto makes error in your favour. Collect $£200 Medibot Insurance fee. Pay $£50 From sale of mining stock you get $£50 You're a Hologram! Get Out of Purgatory Free! Industrial Accident. Go to Purgatory. Go directly to Purgatory, do not pass Go, do not collect $£200 Holiday fund matures. Receive $£100 Outland Revenue Refund. Collect $£20 It is your birthday. Collect $£10 from every player Hologramic insurance matures. Collect $£100 Pay medibot fees of $£100 Pay JMC training fees of $£50 Receive $£25 mining consultancy fee You are assessed for mine shaft repairs. $£40 per shaft. $£115 per mine You have won second prize in a GELF beauty contest. Collect $£10 You inherit $£100

#red dwarf#I know the board in the show isn't exactly like monopoly but that was only for copyright reasons.

14 notes

·

View notes

Text

To Manifest more money, get more specific.

Here are a FEW( there’s nearly infinite ways, don’t close yourself off!) ways one can receive money

Treat it like Pokémon and collect them all lol

1. Salary/wages: Regular income earned from employment self/employment.

2. Investment returns: Profits gained from investments such as stocks, bonds, or real estate.

3. Inheritance: Money or assets received from a relative or benefactor.

4. Grants: Funds awarded by organizations or institutions for specific purposes, such as research or education.

5. Loan repayment: Money received when someone pays back a loan that was previously provided.

6. Dividends: Payments made to shareholders from the profits of a corporation.

7. Royalties: Payments received by creators for the use of their intellectual property, such as books, music, or inventions.

8. Tips: Additional money given as appreciation for services rendered, typically in industries like hospitality or personal services.

9. Rebates: Refunds or discounts given after a purchase, often as an incentive or promotion.

10. Alimony/child support: Regular payments made to a former spouse or partner for financial support.

11. Found money: Money discovered unexpectedly, such as in lost or forgotten accounts, or on the ground.

12. Lottery winnings: Prizes won through games of chance like lotteries or scratch-off tickets.

13. Refunds: Money returned to a consumer after returning a product or canceling a service.

14. Sponsorship: Funds provided by companies or individuals to support a person or organization in exchange for advertising or promotion.

15. Crowdfunding: Money raised from a large number of people, typically through online platforms, to support a project, cause, or individual.

16. Cashback rewards: Money returned to a consumer as a percentage of their purchases, often offered by credit card companies or retailers.

17. Scholarships: Funds awarded to students to help cover the costs of education, typically based on academic achievement, financial need, or other criteria.

18. Patronage: Financial support given by individuals or organizations to artists, writers, or other creatives to fund their work or projects.

19. Rental income: Money earned from leasing or renting out property or assets, such as real estate, vehicles, or equipment.

20. Contest winnings: Prizes awarded for winning competitions or contests, which may include cash or other rewards.

21. Side hustle earnings: Additional income earned from part-time or freelance work outside of one's primary job.

22. Government benefits: Financial assistance provided by the government to eligible individuals or families, such as unemployment benefits, social security, or welfare.

23. Referral bonuses: Money received for referring new customers or clients to a business or service.

24. Stock options: Compensation provided to employees in the form of company stock, often as part of their overall compensation package.

25. Affiliate marketing commissions: Money earned through promoting and selling products or services for companies as an affiliate marketer.

26. Consulting fees: Payments received for providing expert advice or services to clients or businesses.

27. Trust distributions: Money distributed to beneficiaries from a trust fund, typically according to the terms outlined in the trust agreement.

28. Liquidation proceeds: Money received from selling off assets, such as stocks, bonds, or property.

29. Cash gifts: Money given by friends, family, or acquaintances as a gesture of goodwill, celebration, or support.

30. Insurance payouts: Money received from insurance companies to cover losses, damages, or expenses incurred due to accidents, disasters, or other covered events.

Focus on the ones that fits your self concept the best, for the best results.

5 notes

·

View notes

Text

2 Random Mega-corporations

2 Ferrets Exploration Labs Primary industries: exploration services and cartographic consulting Tax avoidance strategy: refund/incentive/credit leverage program Competition management approach: legal bombardment

Arek/Magnus/Domir Nutrient Primary industries: beverages and filtered water Tax avoidance strategy: military force Competition management approach: covert targeted violence

2 notes

·

View notes

Text

CBD Dr Oz Gummies Diabetes Reviews, Anxiety Benefits, 💢💥💖Safe Effective and Pain Relief!

╰┈➤✔️Product Name :- CBD Dr Oz Gummies Diabetes

╰┈➤✔️Benefits :-Reduces Chronic Pain,Stress & Anxiety.

╰┈➤✔️Dosage :- 1 gummy daily or As recommended by your doctor.

╰┈➤✔️Price :- Check Here

╰┈➤✔️Refund Policy :- 90-day money-back guarantee

╰┈➤✔️Side effects :- Users haven't report serious side effects so far.

╰┈➤✔️Where to Buy :- Order This Gummies From “OFFICIAL WEBSITE”

CBD Dr Oz Gummies Diabetes:- CBD Dr Oz Gummies Diabetes stand aside as a head choice for the ones searching out the remedial blessings of CBD. Their everyday corporation and a fulfillment equation supply a everyday approach for saddling the benefits. With top notch flavor, they assure that integrating health into every day life isn’t actually useful however additionally outstanding. The tenderfoots and enthusiasts of CBD devices will find out those chewy sweets overwhelming. Going to them ensures a stable, delectable, and whole way to address fitness and unwinding.

➲➲ Sale Is Live At Official Website ➧➧ Order Now! 🛒Order From Official Website:⇾ Click Here💙👀

Quality Assurance: Ensure CBD Dr Oz Gummies Diabetes Reviews undergo 0.33-celebration testing, verifying the accuracy of CBD content and confirming the absence of dangerous substances for a safe and dependable product.

Consistent Brand Choice: Stick to official brands like Sleep & Soothe to ensure the first-rate and purity of CBD. Reputable manufacturers prioritize transparency and cling to rigorous production standards.

Educational Resources: Stay knowledgeable about CBD and its ability consequences by using educational sources. Understanding CBD's mechanism of action can make contributions to a secure and informed utilization experience.

By adhering to those safety measures and precautions, individuals can expectantly contain CBD Dr Oz Gummies Diabetes into their well-being habitual, promoting a safe and enjoyable revel in with capacity sleep-enhancing benefits.

➲➲ Sale Is Live At Official Website ➧➧ Order Now! 🛒Order From Official Website:⇾ Click Here💙👀

Legal Compliance and Safety Measures

CBD Dr Oz Gummies Diabetes , sourced from industrial hemp, are typically criminal in lots of regions. However, users ought to be aware about nearby regulations regarding CBD products. While CBD is taken into consideration secure for most individuals, it is essential to monitor for potential aspect effects consisting of dry mouth or drowsiness. Adhering to recommended dosages, specially for people with underlying health conditions or taking medications, is essential. Pregnant or nursing people need to consult with healthcare experts earlier than incorporating CBD Dr Oz Gummies Diabetes into their routine.

Realizing the Dream: Consumer Experiences

Before embarking on the journey with CBD Dr Oz Gummies Diabetes , ability customers frequently are looking for insights from the reports of others. Customer evaluations and testimonials can offer precious statistics about flavor, effectiveness, and typical satisfaction. Reputable manufacturers, inclusive of Sleep & Soothe, may additionally exhibit customer feedback on their internet site or thru 0.33-birthday party structures, assisting ability customers in making knowledgeable selections.

Where can we buy it?

CBD Dr Oz Gummies Diabetes can be comfortably bought through numerous channels. The official Sleep & Soothe internet site is a dependable supply, supplying a person-pleasant platform to discover their product range, study consumer critiques, and make comfy purchases. Additionally, legitimate on-line retailers that specialize in wellness merchandise often bring

CBD Dr Oz Gummies Diabetes . Local brick-and-mortar shops with a focal point on fitness and wellbeing may inventory these gummies. To make sure authenticity and pleasant, it's advocated to buy immediately from the official internet site or authorized shops. Always check for promotions or discounts presented through Sleep & Soothe for a fee-effective buy.

➲➲ Sale Is Live At Official Website ➧➧ Order Now! 🛒Order From Official Website:⇾ Click Here💙👀

Conclusion:

In the pursuit of restful nights and rejuvenating sleep, CBD Dr Oz Gummies Diabetes offer a compelling pathway. Through the infusion of exquisite CBD, herbal flavors, and a dedication to purity, these gummies encapsulate the promise of a tranquil and soothing bedtime enjoy. As individuals explore the capability advantages of CBD Dr Oz Gummies Diabetes , they embark on a journey towards a more harmonious dating with sleep—one in which the wonders of CBD converge with the pleasure of a sweet and soothing treat.

➲➲OFFICIAL LINK—CHECK IT OUT:-

#CBDDrOzGummiesDiabetes#CBDDrOzGummiesDiabetesReviews#CBDDrOzGummiesDiabetesWheretobuy#CBDDrOzGummiesDiabetesUnitedStates#CBDDrOzGummiesDiabetesCost#CBDDrOzGummiesDiabetesPrice#CBDDrOzGummiesDiabetesPainRelief#CBDDrOzGummiesDiabetesIngredients#CBDDrOzGummiesDiabetesBenefits#CBDDrOzGummiesDiabetesShop

2 notes

·

View notes

Text

Just realized I’ve never actually shared the text from my top surgery fundraiser here, so:

Hi, my name is Ez Charlie Tadgh. (Mostly Charlie these days, but a lot of you still know me as Ez, which is fine, too!)

I’m writing today to ask for help in affording gender affirming top surgery.

To tell you a bit more about me: I’m a recent college graduate, a queer and autistic poet, an aspiring silversmith, hobbyist photographer, and an amateur chainmail weaver. In my free time I also enjoy playing video games and watching / talking about films. I'm currently raising a leopard gecko (her name is Poppy) and taking metalworking classes when life allows. My professional life is in the sex industry, as I am a customer service and sales representative for an online adult toy store.

Deciding to make this fundraiser has been a long time coming. Finally typing out the words feels surreal… For most of my life, even before having a name for my dysphoria, I’ve concealed the shape of my body in purposely ill-fitting shirts, and worn zip-up jackets even in dangerously hot weather to disguise the shape of my chest. I've spent years purposely manipulating my posture, intentionally hunching my shoulders to make my chest appear smaller. I've avoided hugs, kept my arms crossed over my front, practiced the exact way to stand in photos, all to try and make my chest seem flatter. Even wearing a binder has offered little relief- the compression of the traditional style does not agree with my asthma, and though TransTape allows me to breathe better (it feels like a literal weight off my shoulders!) it very easily triggers my sensory issues, and sometimes makes my psoriasis flair up under my breasts.

These practices aren't sustainable. They're damaging both my mental and physical health... This body IS the house I will live in for the rest of my life, y'know? I can't keep boarding up the walls, I can't keep fantasizing about moving. I need to make real renovations, so it can stop being just a place I live, and instead truly become my HOME.

So, yeah. I am finally at the point where I know I can't do this on my own anymore. Every day the need for this procedure becomes more clear and urgent in my mind.

Trans healthcare in this country is notoriously inaccessible, confusing, and expensive. I'm lucky to live within driving distance of Dr. Hope Sherie in Charlotte, NC, a surgeon who I have seen nothing but good reviews about, and who has been recommended to me by more than one trusted friend. However, my insurance will not cover this procedure, and I am regularly seeing $10,000 quoted as the amount for top surgery at Dr. Sherie's office. I have some money saved up towards that amount already, but it is only a small piece of the complete financial puzzle.

I have my first consultation with Dr. Sherie on May 1st, and plan to post an update with exact figures after that meeting. I have already paid $100 as deposit for this consultation, and will need to pay a non-refundable fee of $1,000 to reserve my surgery date, on the day it is selected. I will have to pay the rest of the surgery cost 3 weeks before the date of the surgery. (Should I need to reschedule during that final 3 weeks, I will have to pay a second, also non-refundable $1,000 deposit.) This is not even including the cost for any prescription medications, lab fees, post-op care materials, or other surgery-necessitated garments and binders for this procedure. Should I need any revisions after the initial procedure, the minimum fee would be $1,000.

I also need to consider the fact that I will have to take some time off of work for the surgery itself and the recovery period, thus losing at minimum 2 weeks pay (that's a full paycheck for me) and will need to buy extra food and health supplies for that period.

I don't want this surgery to feel like some sort of hardship I'm having to go through. I want it to be safe, I want to feel secure during this process, I want to know I'm not going to be stressed the entire time. That's what all of this is about, anyway:

Trying to achieve a state of comfort.

Anything you can do to help me towards this goal will receive my eternal gratitude and respect. I am constantly in awe of our community, and the level of support we can provide for one another. I feel grateful for even having the chance to ask for this sort of help. Thank you. I love y'all.

#diary#top surgery#transgender#trans#non-binary#ftm#gender#transition#ftnb#enby#please boost#lgbt#lgbtqia#lgbtq#queer#lgbt+#lgbtq+#lgbtqi+#lgbtqia+

15 notes

·

View notes

Text

Sitting here wondering how tf I managed to book $10k worth of photo work in 1 week. 2017 Kip is reeling. Two 5k weddings … of queer nerdy couples who love my work. Wild. And another consultation this week for another queer nerdy couple. People just … booked my most expensive package without batting an eye

(Keep in mind this is not 10k upfront… it’s 1k upfront per wedding and I’ll see the rest a year and a half from now when the weddings take place. In the meantime I should refrain from spending any of this money, in case, god forbid, something happens to me and I have to refund the deposit! Just a little fyi about the wedding industry … I’m not rolling in dough yet but damn, it’s nice to know I’ll have some fat wads of cash next summer and fall. I never thought I’d actually succeed at this… I just wanted to desperately.)

3 notes

·

View notes

Text

Top-Rated CBSE Home Tutors in Hyderabad | GrittyTech Academy

Introduction

Finding the right tutor for CBSE subjects in Hyderabad can be challenging. Every student deserves quality education, personalized attention, and a structured approach to learning. That's where GrittyTech Academy comes in! With Top-Rated CBSE Home Tutors in Hyderabad, we provide expert guidance to help students excel in their academics. Our Top-Rated CBSE Home Tutors in Hyderabad ensure a comprehensive learning experience tailored to student needs. For More...

Why Choose GrittyTech Academy Over Others?

Choosing the right home tutor is crucial for academic success. Here’s why Top-Rated CBSE Home Tutors in Hyderabad at GrittyTech Academy stand out:

Personalized Study Plans tailored to individual learning needs.

Real-Time Learning Experience with dedicated tutors.

Proven Track Record of student success.

Affordable Pricing without compromising quality.

Our Unique Approach

At GrittyTech Academy, we follow a student-centric teaching methodology that ensures effective learning. Our Top-Rated CBSE Home Tutors in Hyderabad focus on:

Concept-Based Learning: We focus on building a strong foundation.

Weekly Assessments: Regular tests to track progress.

Expert Guidance: Highly qualified professionals.

Interactive Sessions: Live Q&A and doubt-clearing sessions.

Different Ways of Learning at GrittyTech

We understand that every student has a unique learning style. That’s why we offer multiple learning modes with Top-Rated CBSE Home Tutors in Hyderabad:

One-on-One Tutoring – Personalized coaching for better understanding.

Group Sessions – Interactive learning with peers.

Online – Choose the format that suits you best.

Key Features of Our CBSE Home Tutoring Services

1. Step-by-Step Guidance

Our Top-Rated CBSE Home Tutors in Hyderabad break down complex topics into simple, easy-to-understand steps.

2. Live Sessions with Expert Tutors

Engage in real-time interactive classes with industry-experienced Top-Rated CBSE Home Tutors in Hyderabad.

3. Learn at Your Own Pace

Flexible learning schedules designed for students' convenience with Top-Rated CBSE Home Tutors in Hyderabad.

4. Mock Tests & Reviews

Regular tests to track progress and provide constructive feedback from Top-Rated CBSE Home Tutors in Hyderabad.

What Sets Us Apart?

Certified and Experienced Tutors

Regular Performance Analysis

Customized Study Materials

Support for All CBSE Subjects with Top-Rated CBSE Home Tutors in Hyderabad

Benefits of Choosing GrittyTech Academy

Boost Academic Performance with expert Top-Rated CBSE Home Tutors in Hyderabad.

Personalized Attention ensuring student success.

Time Management Skills through structured learning.

Stress-Free Learning Environment designed for student comfort with Top-Rated CBSE Home Tutors in Hyderabad.

Frequently Asked Questions (FAQs)

1. How do I enroll for CBSE home tutoring?

You can enroll by visiting our website or contacting us directly.

2. Do you provide trial sessions?

Yes! We offer a free consultation and demo class.

3. Are your tutors certified?

Yes, all our Top-Rated CBSE Home Tutors in Hyderabad are qualified professionals with extensive experience.

4. What subjects do you cover?

We cover all CBSE subjects from Class 1 to Class 12 with Top-Rated CBSE Home Tutors in Hyderabad.

5. How are the classes conducted?

We offer both online and offline tutoring sessions with Top-Rated CBSE Home Tutors in Hyderabad.

6. What is the fee structure?

Our pricing is affordable and varies based on the subject and grade level.

7. How do you track student progress?

We conduct weekly tests and assessments to monitor performance.

8. Do you offer flexible timings?

Yes! We provide customized class schedules based on student needs.

9. Is there a refund policy?

Yes, we have a transparent refund policy for valid cases.

10. How can I contact GrittyTech Academy?

You can reach us via our website, phone, or email for inquiries.

Testimonials

Ravi Sharma (Parent)

“My son’s grades have significantly improved since joining GrittyTech Academy. Highly recommend their Top-Rated CBSE Home Tutors in Hyderabad!”

Ananya Verma (Student)

“The tutors at GrittyTech are amazing! They explain concepts in a way that makes learning fun and easy.”

Enrollment Requirements

To enroll with GrittyTech Academy, students need to:

Be enrolled in a CBSE school.

Have a stable internet connection (for online classes).

Be ready to commit to structured learning with Top-Rated CBSE Home Tutors in Hyderabad.

Book Your Free Consultation

Ready to enhance your learning journey? Book a free consultation today and get started with the Top-Rated CBSE Home Tutors in Hyderabad at GrittyTech Academy.

0 notes

Text

Affordable Housing & Tax Benefits: What Real Estate Gained in Budget 2025?

Budget 2025 has eliminated all criteria by allowing two residences to be considered self-occupied, banning the tax burden for notional rental revenue.

The Union Budget 2025 has emerged as a game changer for homebuyers, providing numerous tax breaks and incentives. The government's actions, which range from easing tax policies to increasing affordable housing, are expected to have a long-term influence on the real estate business and homebuyers.

Finance Minister Nirmala Sitharaman made several important announcements on Saturday, including tax improvements under the new tax regime and the exemption of a second home from taxation for notional rental income. All homebuyers will receive from Budget 2025 is as follows:

Tax Reforms on Income: More Investments, More Savings A noteworthy outcome of the budget is the expansion of the tax refund under the new tax system. People with annual incomes up to Rs. 12 lakh (Rs 12.75 lakh for paid workers) are exempt from paying personal income tax. “This action greatly increases disposable income, enabling people to save more for housing investments," says Adhil Shetty, CEO of Bankbazaar.com. The middle class will have more money thanks to the streamlined tax system, which will boost household spending, savings, and real estate and equity investments.

Government announces SWAMIH Fund-2 to complete 1 lakh homes in stalled projects

In Budget 2025, an additional 1 lakh units will be allocated ₹15,000 crores to the new SWAMIH Fund 2, which would help lakhs of homeowners whose real estate projects have been delayed. The government's strong drive to address the housing problem is demonstrated by the completion of 50,000 dwelling units under the current SWAMIH project, with an additional 40,000 in the works, according to analysts.

The growth of the SWAMIH-2 Investment Fund stabilises the market, increases the number of ready-to-buy homes available to first-time purchasers, and may even lower the cost of housing. According to Grant Thornton Bharat Partner and Government Consulting Leader Ramendra Verma, the fund helps homebuyers, boosts trust in the real estate industry, and encourages the completion of stalled projects, all of which contribute to the sector's renaissance.

PropEquity reports that around 2000 housing projects totalling 5.08 lakh units in 42 locations are halted. There have been 345 projects totalling 76,256 units in 28 tier II cities and 1,636 projects totalling 4,31,946 units in 14 tier I cities that have stagnated.

The government wants to increase the yearly threshold for TDS on rent from the existing ₹2.4 lakh to ₹6 lakh. According to real estate experts, increasing the yearly TDS ceiling on rent from ₹2.40 lakh to ₹6 lakh will also greatly help landlords and small taxpayers by reducing the burden of compliance.

Govt. to set up ₹1 lakh Crore Urban Challenge Fund to ramp up urban infrastructure

The creation of an urban development fund will improve infrastructure, open up real estate opportunities, and turn cities into significant centres of growth.

"Incentivised urban reforms and the 1 lakh crore Urban Challenge Fund will improve city planning, municipal services, and governance—all of which are important drivers of long-term commercial growth," stated Ramesh Nair, CEO of Mindspace Business Parks REIT.

Support for Global Capability Centres (GCCs)

India would be bolstered as a global business hub by the introduction of a national guiding framework to assist states in luring and promoting GCCs. In light of India's growing economic clout, Puri predicted that this action will increase demand for office space in Tier-II and Tier-III cities as well as major metropolises like Bengaluru, Mumbai, Hyderabad, Pune, and Chennai.

Budget 2025 and affordable housing

No affordable housing policies were included in Budget 2025. The housing program would have benefited from a national policy for rental housing.

According to G Hari Babu, National President of NAREDCO, the Budget 2025 could have also addressed some important areas, especially the affordable housing segment. The government should prioritise revisions to the current housing cap, which has been stagnant for almost eight years, making it difficult for developers to deliver affordable homes within the set limits. Rising home loan interest rates and the antiquated definition of affordable housing have created barriers for many potential homeowners.

The Union Budget 2025 has undoubtedly set the stage for a transformative shift in the real estate sector, bringing relief to homebuyers and investors alike. From tax benefits and increased TDS thresholds to the expansion of the SWAMIH Fund and urban infrastructure development, these strategic reforms are expected to drive housing demand, boost market confidence, and accelerate stalled projects.

However, the absence of new affordable housing policies remains a missed opportunity, leaving many aspiring homeowners and developers seeking further government intervention. As India continues its journey toward urban expansion and economic growth, sustained policy support and adaptive reforms will be crucial in shaping a resilient and inclusive real estate ecosystem.

#realestate#investmentopportunities#realestategurgoan#realestatemarket#dwarka expressway#properties in gurgaon#Budget2025#Gurgaon#residential property#commercial property#real estate gurgaon

0 notes

Text

Powering Your Home with Savings: A 2024 Guide to Solar Panel Subsidies

The sun: it's a free, clean, and inexhaustible source of energy. Harnessing its power through solar panel installation is a smart move for homeowners and businesses looking to reduce their carbon footprint and save money on electricity bills. However, the upfront cost of going solar can be a concern. That's where solar panel subsidies come in, making the transition to clean energy more affordable than ever.

This comprehensive guide will walk you through everything you need to know about solar panel subsidies in 2024. We'll explore the different types of subsidies available, who qualifies, how to apply, and how these incentives can drastically reduce your solar panel installation costs. For expert advice and innovative solar solutions, visit Heliostrom, a trusted name in the solar energy industry.

What Exactly are Solar Panel Subsidies?

Solar panel subsidies are financial incentives offered by governments, local authorities, or other organizations to encourage the adoption of solar energy. These incentives help offset the initial investment costs associated with solar panel installation, making solar power a more accessible and attractive option. Subsidies can take various forms, including:

Direct Grants: A fixed sum of money provided to cover a portion of the installation costs.

Tax Credits and Rebates: Reductions in your tax liability or direct refunds after installation.

Net Metering: A program that allows you to sell excess solar energy back to the grid, earning credits on your electricity bill.

Low-Interest Loans: Financing options with lower interest rates, making solar panel installation more affordable.

For a detailed breakdown of available subsidy programs and how to maximize your savings, check out our comprehensive Solar Panel Subsidy Guide.

Types of Solar Panel Subsidies Explained

Understanding the different types of subsidies is crucial for making informed decisions about your solar investment. Here's a closer look:

Capital Cost Subsidies: These subsidies directly reduce the upfront cost of your solar panel system. A percentage of the total installation cost is covered by the government or a related agency.

Solar Tax Credits and Rebates: Tax credits allow you to deduct a percentage of your solar installation expenses from your taxable income, while rebates provide a direct cash payment after the system is installed.

Net Metering: This popular program allows you to connect your solar panels to the utility grid. When your system generates more electricity than you use, the excess is sent back to the grid, and you receive credit on your electricity bill.

Low-Interest Solar Loans: These loans offer lower interest rates than traditional financing options, making it easier to finance your solar project and reducing your overall borrowing costs.

Who is Eligible for Solar Panel Subsidies?

Eligibility criteria for solar panel subsidies vary depending on the specific program and your location. Common requirements often include:

Approved Equipment: Your solar panel system must meet certain technical standards and be approved by relevant authorities.

Permits and Inspections: Your installation must comply with all local building codes and regulations.

Grid Connection (for Net Metering): To participate in net metering programs, your system must be connected to the utility grid.

Property Ownership: You will generally need to be the owner of the property where the solar panels will be installed.

It's essential to research the specific requirements in your area and consult with a qualified solar installer like Heliostrom to determine your eligibility.

Top Solar Subsidy Programs Around the Globe

Many countries and regions offer attractive solar subsidy programs. Here are a few examples:

India: India's Rooftop Solar Programme Phase II and PM-KUSUM scheme provide significant incentives for residential and agricultural solar installations.

United States: The federal Investment Tax Credit (ITC) offers a substantial tax credit for solar projects, and many states offer additional rebates and incentives.

Europe: Several European countries have implemented Feed-in Tariffs (FiTs) and other support mechanisms to encourage solar energy adoption.

Australia: The Small-scale Renewable Energy Scheme (SRES) provides incentives for small-scale solar installations.

Applying for Solar Panel Subsidies: A Step-by-Step Guide

The application process for solar panel subsidies can vary depending on the program. However, it generally involves the following steps:

Choose a Qualified Installer: Select a reputable and experienced solar installer like Heliostrom who is familiar with the subsidy programs in your area.

Gather Necessary Documentation: Collect all required documents, such as proof of property ownership, system specifications, and permits.

Submit Your Application: Complete and submit the application form to the relevant authorities.

Await Approval: The review process may take some time, so be patient.

Install Your Solar System: Once approved, proceed with the solar panel installation. For a comprehensive guide on solar panels installation and its benefits, refer to our detailed article.

Claim Your Subsidy: After installation, submit proof of completion to receive your subsidy.

How Subsidies Impact Your Solar Investment

Solar panel subsidies can significantly reduce the overall cost of going solar. By taking advantage of these incentives, you can:

Lower Upfront Costs: Reduce the initial investment required for your solar panel system.

Accelerate Payback Period: Shorten the time it takes for your solar investment to pay for itself through energy savings.

Increase ROI: Improve the overall return on your solar investment.

Common Challenges and How to Overcome Them

While solar subsidies offer substantial benefits, there can be some challenges:

Complex Application Processes: The paperwork and procedures involved can be complex. Working with a qualified installer can help navigate this process.

Limited Funding: Some programs have limited funding, so it's important to apply early.

Policy Changes: Subsidy programs can be subject to change, so stay informed about any updates.

The Future of Solar Subsidies

As the world increasingly focuses on renewable energy, solar panel subsidies are expected to play a crucial role in driving the adoption of clean energy technologies. Continued innovation and decreasing costs are also making solar power an increasingly attractive option for homeowners and businesses.

Conclusion: Embrace the Sun and Save

Solar panel subsidies provide a fantastic opportunity to make the switch to clean, affordable energy. By understanding the different types of subsidies available and taking advantage of these incentives, you can significantly reduce your solar panel installation costs and contribute to a more sustainable future. Contact Heliostrom today to learn more about how you can benefit from solar panel subsidies and start your journey towards energy independence.

0 notes

Text

How to Spot Medical Tourism Scams and Avoid Fraud

Medical tourism has become a booming industry, offering patients access to affordable healthcare in different parts of the world. While many countries provide excellent medical services, there are risks involved, particularly in the form of scams and fraudulent activities. Unsuspecting medical tourists can fall victim to fake hospitals, unqualified doctors, and misleading treatment packages. To ensure a safe and successful medical journey, it is crucial to recognize the warning signs of medical tourism scams and take preventive measures.

Common Medical Tourism Scams

1. Fake or Unlicensed Hospitals

Some fraudulent medical facilities operate without proper licensing or accreditation. These establishments may appear legitimate online but lack the necessary credentials for safe and effective treatments. Red Flags:

No accreditation from recognized international healthcare organizations (e.g., JCI, NABH, or ISO)

Limited or no online presence beyond their own website

Lack of verifiable patient reviews or testimonials

2. Unqualified or Impostor Doctors

Certain medical tourism scams involve doctors who lack proper qualifications or experience. Fake doctors may use fraudulent degrees to lure in unsuspecting patients. Red Flags:

No visible professional credentials or certifications

Refusal to provide a detailed medical history or references

Lack of verifiable professional affiliations with reputed medical boards

3. Overpromised and Misleading Treatment Packages

Scammers often promote "too-good-to-be-true" packages that guarantee unrealistic results at extremely low prices. Red Flags:

Guaranteed success rates with no risks mentioned

Incredibly cheap treatment costs compared to international standards

No clear breakdown of costs or hidden fees appearing later

4. Unnecessary Procedures or Treatments

Some fraudsters trick patients into undergoing unnecessary surgeries or treatments to increase their profits. Red Flags:

Sudden recommendations for expensive or additional procedures without proper diagnosis

Doctors pressuring patients into making immediate decisions

Lack of detailed explanation about the necessity of the treatment

5. Fake Travel and Accommodation Packages

Medical tourism scams are not limited to healthcare providers; travel agencies and facilitators can also deceive patients with fake accommodation and transport arrangements. Red Flags:

Demands for full advance payment with no refund policy

Last-minute changes to hotel or clinic location

Vague or non-existent customer support

How to Avoid Medical Tourism Scams

1. Verify Hospital and Doctor Credentials

Before committing to any treatment, research the medical facility and the doctor's credentials. Look for internationally recognized accreditations, such as:

Joint Commission International (JCI)

National Accreditation Board for Hospitals & Healthcare Providers (NABH)

Medical councils of the respective country

2. Read Patient Reviews and Testimonials

Genuine patient experiences provide insights into the quality of care. Look for:

Reviews on independent platforms like Google, Trustpilot, or medical forums

Video testimonials with real patient feedback

Negative reviews that indicate potential issues

3. Get a Second Medical Opinion

Before undergoing treatment, consult a trusted medical professional in your home country to confirm the diagnosis and treatment plan.

4. Request a Detailed Treatment Plan and Cost Breakdown

Ensure you receive a comprehensive treatment plan, including:

Estimated total cost with no hidden charges

Detailed procedure breakdown with pre-and post-treatment care

Information on potential risks and side effects

5. Work with Reputable Medical Tourism Agencies

Choose well-established medical tourism facilitators who have a proven track record and partnerships with accredited hospitals. Verify their credibility through:

Official websites with verifiable contact details

Transparency about their partnerships and services

Positive customer feedback and ratings

6. Use Secure Payment Methods

Avoid making full advance payments unless necessary. Opt for secure payment methods such as:

Credit cards with fraud protection

PayPal or other trusted third-party payment services

Direct payments to hospitals rather than intermediaries

While medical tourism offers affordable and quality healthcare options, it also carries risks of scams and fraud. By staying informed, verifying credentials, and working with reputable healthcare providers, you can protect yourself from fraudulent activities. Always prioritize safety over cost, conduct thorough research, and take necessary precautions to ensure a successful medical journey abroad.

0 notes

Text

CANDIDTAX: Revolutionizing Tax Filing & Planning Services with Personal CA Assistance & Maximum Refund

In the ever-evolving landscape of taxation in India, CANDIDTAX has emerged as a game-changer. As one of the country’s leading tax startups, it redefines tax services by combining innovation with a customer-centric approach. Going beyond mere tax filing, CANDIDTAX takes a holistic view of an individual’s financial situation, ensuring maximum benefits while simplifying the process (https://www.candidtax.in/)

A New Standard in Tax Filing Services: Traditional tax filing can be tedious, complex, and overwhelming. However, CANDIDTAX has set a new benchmark by integrating expert tax knowledge with user-friendly technology. Their platform ensures seamless, error-free tax filing while maximizing refunds and eliminating costly mistakes.

Key Innovations by CANDIDTAX: CA- Assisted ITR Filing with CANDIDTAX, users are never alone in their tax journey. Every return is assisted by a Chartered Accountant near their location, providing a professional and meticulous approach to tax filing. This ensures accuracy and compliance, avoiding the risks of being penny wise, pound foolish.

Handling Notices: Notices from the Tax Department can be stressful, but CANDIDTAX offers free consultation with experienced CAs, guiding users on how to respond effectively and ensuring peace of mind.

Driving Economic Growth and Empowering Individuals: CANDIDTAX is not just a tax service—it is an economic enabler. By fostering self-reliance and employment generation, the startup actively contributes to Aatma Nirbhar Bharat. It encourages entrepreneurship among freelancers, retirees, homemakers, and anyone aspiring to be their own boss.

Commitment to Social Responsibility & Free ITR Filing for Special Categories: In a commendable initiative, CANDIDTAX offers free tax filing for senior citizens, military personnel, and other deserving categories, demonstrating its commitment to social welfare.

Educational Seminars and Webinars: Understanding taxes should not be reserved for experts alone. CANDIDTAX regularly conducts free seminars and webinars, empowering individuals and businesses with valuable financial knowledge, setting a new industry standard in education and awareness.

The Future of Tax Services in India

With a perfect blend of technology, personal expert assistance, and social responsibility, CANDIDTAX is setting a precedent for the future of tax services in India. Their commitment to innovation, personalized CA support, and financial education makes tax filing stress-free and more beneficial than ever before.

For those looking for a smarter, more efficient, and hassle-free tax solution, CANDIDTAX is the answer.

Visit or call CANDIDTAX today and GET maximum refunds in ITR. (https://www.candidtax.in/)

0 notes

Text

Top Highest Paying Jobs in Canada: Lucrative Careers to Pursue in 2025

Canada is known for its strong job market and numerous opportunities for professionals seeking high salaries. Whether you’re a skilled worker, an experienced professional, or an immigrant looking for opportunities, understanding the highest paying jobs in Canada can help you make an informed career choice. In this article, we will explore the highest paying jobs, industries with lucrative salaries, and important factors such as the Canada Workers Benefit and Canada visa processing time.

Also Read:- best streaming service canada

warmest place in canada

pr card renewal

Top High-Paying Jobs in Canada

If you are looking for a well-paying career in Canada, here are some of the best options:

1. Medical Professionals

Surgeons & Physicians – One of the highest paying jobs in Canada, earning between $250,000 - $500,000 annually.

Dentists – With growing healthcare needs, dentists earn around $150,000 - $300,000 per year.

Pharmacists – A stable and well-paid profession, pharmacists earn between $100,000 - $140,000 annually.

2. Technology & IT Jobs

Software Engineers & Developers – The tech industry continues to boom, with salaries ranging from $90,000 - $150,000.

Data Scientists & AI Specialists – Experts in data analytics and artificial intelligence can earn upwards of $100,000 - $180,000.

Cybersecurity Specialists – Due to the rise in cyber threats, professionals in this field earn between $90,000 - $160,000.

3. Engineering Jobs

Petroleum Engineers – With Canada’s strong energy sector, petroleum engineers can earn between $110,000 - $200,000.

Civil & Mechanical Engineers – Salaries range from $85,000 - $130,000, depending on experience and industry.

Electrical Engineers – Well-paid professionals, earning between $90,000 - $140,000.

4. Finance & Management

Investment Bankers & Financial Analysts – High-paying roles in banking and finance range from $100,000 - $250,000.

Management Consultants – Helping businesses improve efficiency, they earn between $90,000 - $180,000.

Actuaries – Experts in financial risk assessment earn $100,000 - $170,000.

5. Aviation & Skilled Trades

Pilots & Air Traffic Controllers – Salaries range from $80,000 - $200,000.

Electricians & Plumbers – In-demand trade jobs that pay $70,000 - $120,000.

Construction Managers – Managing large-scale projects, they earn between $90,000 - $150,000.

Canada Workers Benefit (CWB) & Eligibility

The Canada Workers Benefit (CWB) is a refundable tax credit designed to support low-income workers. If you meet the Canada Workers Benefit eligibility criteria, you may qualify for financial assistance to supplement your income. The eligibility depends on factors such as income level, employment status, and residency.

Canada Visa Processing Time

If you are planning to move to Canada for a high-paying job, understanding the Canada visa processing time is crucial. The processing time varies depending on the visa type:

Express Entry: 6-12 months

Work Permits: 2-6 months

Provincial Nominee Program (PNP): 6-18 months

Conclusion

Canada offers numerous opportunities for professionals seeking high paying jobs across various industries. Whether you are in the medical field, IT sector, finance, or skilled trades, there are several career paths that offer lucrative salaries. Additionally, understanding the Canada Workers Benefit and visa processing time can help you plan your move effectively. If you are looking for career growth and financial stability, Canada remains one of the best destinations to explore.

0 notes

Text

Is Your Life Insurance Policy Right for You? How to Spot Mis-selling

Life insurance is meant to provide financial security and peace of mind; act as a safety net against adversity but unfortunately, life insurance mis-selling is something that is far too common these days. This malpractice can turn your safety net into a source of stress and financial loss. With increasing reports of insurance fraud and mis-selling, it's important that you understand how to identify and protect yourself from deceptive sales practices.

Understanding Insurance Mis-selling

Insurance mis-selling occurs when an agent or broker deliberately misleads a customer into purchasing a policy through false promises or misrepresentation of facts. This unethical practice often targets vulnerable individuals, particularly senior citizens, who may not fully understand the complexities of insurance products.

Common Signs of Insurance Mis-selling

1. Pressure Tactics and Rush Decisions

If an agent pressures you to make an immediate decision or claims an offer is "limited time only," this should raise red flags. Legitimate insurance decisions require careful consideration and shouldn't be rushed.

2. Unclear Terms and Conditions

Watch out for situations where:

The agent glosses over important policy details

Documentation is not provided in your preferred language

Key terms are explained verbally but differ from written documents

Premium payment terms and duration are not clearly specified

3. False Promises and Misrepresentation

Be wary of agents who:

Promise guaranteed returns that seem too good to be true

Claim the policy is a short-term investment when it's actually long-term

Assure loans or additional benefits not mentioned in the policy document

Present insurance as a fixed deposit or savings scheme

How to Protect Yourself from Mis-selling

1. Thorough Documentation Review

Always read the policy documents carefully

Pay special attention to the fine print

Request clarification for any terms you don't understand

Never sign blank forms or documents

2. Ask Critical Questions

Before purchasing any policy, make sure you ask the important questions and get clear answers for them:

What is the premium payment term?

What are the exact returns or benefits?

What are the conditions for claim settlement?

What are the exclusions and waiting periods?

What happens if you miss a premium payment?

3. Utilise the Free Look Period

All insurance policies come with a free look period (typically 15-30 days) during which you can:

Review the policy thoroughly

Verify if the features match what was promised

Cancel the policy and get a refund if unsatisfied

Red Flags That Warrant Immediate Attention

Unrealistic Returns: Be sceptical of promises of exceptionally high returns or guaranteed benefits that seem improbable.

Bundled Products: Watch out for situations where multiple policies are bundled together without clear explanation of the individual components.

Hidden Charges: Be alert to any fees or charges not explicitly mentioned during the initial discussion.

Lack of Documentation: Always insist on proper documentation and avoid verbal assurances without written proof.

How Insurance Samadhan Helps You Fight Mis-selling

Insurance Samadhan stands as your trusted partner in tackling life insurance mis-selling complaints. This is how they support their clients:

1. Expert Consultation

The team brings over 100 years of combined insurance industry experience, providing:

Professional policy analysis

Expert evaluation of mis-selling cases

Customised solutions for each unique situation

Clear guidance on available options

2. Transparent Process

With complete transparency, they offer:

Refundable fee structure with INR 500 returned if the case remains unresolved

Clear communication at every stage

Regular updates on case progress

No hidden charges or surprise fees

3. Technology-Driven Solutions

Through Insurance Samadhan’s very own Polifyx App, you get:

Real-time case tracking

Interactive dashboard for case management

Easy document submission

Instant access to case updates

4. Comprehensive Support

Their services include:

Complete case documentation

Direct liaison with insurance companies

Representation at various forums

Post-resolution support

Steps to Take If You've Been Mis-sold a Policy

Gather Evidence:

Collect all policy documents

Note down conversations with agents

Save all communication records

Document any promises made during the sale

File a Complaint:

First approach the insurance company's grievance cell

If unsatisfied, escalate to the Insurance Ombudsman

Seek assistance from consumer protection organisations

Consider professional help from organisations specialising in insurance disputes

Take Preventive Action:

Report fraudulent agents to the insurance company and regulatory authorities

Share your experience to warn others

Stay informed about your rights as a policyholder

Conclusion

Insurance mis-selling can have serious financial consequences, but being well-informed and aware can help you avoid becoming a victim. Remember that a genuine insurance policy should align with your financial goals, risk appetite, and long-term needs. If something doesn't feel right, trust your instincts and seek professional advice.

Don't hesitate to reach out to expert organisations that specialise in resolving insurance disputes. InSa are experts in tackling life insurance mis-selling complaints and can provide valuable guidance and support in addressing the issues and making sure that your rights as a policyholder are protected.

By staying informed and taking appropriate precautions, you can make the right decisions about your insurance needs and protect yourself from fraudulent practices in the insurance market.

0 notes

Text

Service Marketplace Development: Elevating Experiences with Tailored Solutions

In today’s fast-evolving digital landscape, businesses are shifting to online platforms to offer enhanced convenience and seamless interactions. A key driver in this transformation is service marketplace development, a solution designed to connect service providers and customers in a dynamic, efficient, and user-friendly environment. Whether it's hiring a professional cleaner or scheduling a medical consultation, service marketplaces are redefining the way we access and provide services.

The Core Features of Service Marketplaces

Building a robust and functional service marketplace requires incorporating essential features that address both the providers’ and customers’ needs. Let’s explore some of the core aspects:

1. Booking Systems

An intuitive and efficient booking system is the backbone of any service marketplace. It enables customers to schedule services quickly, while providers can manage appointments seamlessly. Advanced booking systems often come with features like calendar integrations, reminders, and availability tracking, ensuring smooth communication between both parties.

2. Payment Management

Seamless transactions are crucial for maintaining user trust and satisfaction. Modern service marketplaces include secure payment management systems that support multiple payment methods, ensuring convenience for users across various regions. These systems also handle invoicing and refunds, offering a complete financial solution.

3. Provider Ratings and Reviews

Transparency is key to building trust in a service marketplace. A robust provider ratings feature allows users to review and rate their experiences. This fosters accountability among service providers while helping customers make informed decisions.

4. Tailored Service Solutions

One size doesn’t fit all when it comes to service marketplaces. Businesses that offer tailored service solutions can address the specific needs of their audience, whether it’s a niche industry or a unique geographical market. This customization enhances user satisfaction and sets the platform apart from competitors.

Why Service Marketplace Development Matters

The rise of the gig economy and on-demand services has made marketplaces a vital part of modern business strategies. Here’s why service marketplace development is essential:

Improved Accessibility: Connects service providers with customers effortlessly.

Scalability: A well-designed marketplace can scale to accommodate growing user demands.

Operational Efficiency: Features like automated booking systems and payment management reduce manual intervention.

Enhanced Customer Experience: Tailored solutions and provider ratings ensure users find what they need with ease.

Choosing the Right Development Partner

Developing a service marketplace requires technical expertise and a deep understanding of user behavior. Collaborating with an experienced development partner ensures that your platform is equipped with cutting-edge technologies, a secure payment gateway, and user-centric features.

Conclusion

As the demand for convenient and reliable services grows, investing in service marketplace development becomes a strategic move for businesses aiming to stay competitive. By integrating advanced features like booking systems, payment management, and provider ratings, along with offering tailored service solutions, companies can create a marketplace that resonates with their audience and drives success.

Ready to embark on your marketplace development journey? Get started today to transform your business into a hub of seamless service delivery.

0 notes

Text

Unlocking Innovation: The Power of SR&ED Consulting in Brampton

In today’s competitive business environment, innovation is the key to staying ahead of the curve. Companies are constantly looking for ways to enhance their products, streamline operations, and develop new technologies. One of the most effective ways to support this innovation is by taking advantage of the SR&ED Consulting in Brampton. The Scientific Research and Experimental Development (SR&ED) program offers financial incentives for Canadian businesses conducting research and development activities. With the right consulting support, companies in Brampton can maximize their SR&ED claims and secure valuable funding to fuel their growth.

What is SR&ED and Why Does it Matter?

The SR&ED program is a federal tax incentive program designed to encourage Canadian businesses to invest in R&D. It provides funding and tax credits to companies that are engaged in eligible scientific research and experimental development activities. For many businesses, especially those in technology, manufacturing, and engineering, this program is an untapped resource that can significantly offset the costs associated with innovation.

The program encompasses a wide range of activities, from basic research to experimental development, and covers costs related to labor, materials, overhead, and even some capital expenditures. However, to make a successful claim, businesses need to properly document their activities and demonstrate that their work meets the program’s criteria.

Benefit

Navigating the SR&ED program can be complex, and many businesses struggle to understand what qualifies for a claim. SR&ED consultants in Brampton are experts who can guide you through the entire process, ensuring that your claim is not only accurate but also maximized for potential tax refunds. Here are some key benefits of working with this:

Maximize Your Claim This consultants are skilled at identifying all eligible activities and expenditures, even those that may not be immediately apparent. They will help you track and document your R&D activities effectively, ensuring that you capture all potential claims, which can often result in a larger refund.

Ensure Compliance The SR&ED program has strict eligibility criteria and documentation requirements. Failing to meet these requirements can result in rejected claims or audits. With the assistance of a consultant, your business can ensure full compliance with the program’s rules, minimizing the risk of audit and delays in receiving funding.

Save Time and Resources Claiming SR&ED credits can be time-consuming, especially if your business is unfamiliar with the intricacies of the program. By outsourcing this responsibility to SR&ED consultants, your team can focus on core business operations while experts handle the claim process efficiently.

Access to Industry Expertise SR&ED consultants bring deep knowledge of the R&D landscape and how to structure claims across various industries. Whether you're developing new software, improving manufacturing processes, or experimenting with novel engineering techniques, consultants will ensure your R&D activities align with the program’s eligibility criteria.

Why Choose SR&ED Consulting in Brampton?

Brampton is home to a growing number of small and medium-sized enterprises (SMEs), as well as larger corporations involved in research and development. For businesses in this dynamic city, leveraging SR&ED incentives is an important strategy to support innovation. With local consultants who understand the unique needs of Brampton businesses, you can receive personalized guidance and support to make the most of the SR&ED program.

Additionally, this consultants based in Brampton are well-versed in the nuances of regional and industry-specific research, which can further streamline the claims process. They also have established relationships with tax authorities, which can facilitate smoother communication and claim submission.

For businesses in Brampton looking to stay competitive and accelerate their growth through R&D, this Consulting offers a powerful way to unlock funding and tax credits. The program is an invaluable resource that can significantly reduce the financial burden of innovation, but only if it’s managed correctly. With the help of an experienced SR&ED consultant, your business can confidently navigate the program, ensuring that your R&D efforts are rewarded with the financial support they deserve.

By tapping into this powerful program, you not only benefit from immediate financial relief but also reinforce your commitment to continuous innovation. So, if you're looking to optimize your R&D activities and maximize your tax incentives, reach out to this consulting firm in Brampton today. Find us here

0 notes