#real estate degree australia

Explore tagged Tumblr posts

Text

Lisa Myers nee San Mei Tan (left) with a loved 1 circa 1973-75

Born November 20 1959 in Jakarta, Indonesia

Renton, Washington

#Lisa Myers#Lisa Tan Myer#San Mei Tan#Jakarta#Indonesia#Renton#Washington#Australia#San Angelo#Texas#Pittsburgh#Pennsylvania#Gresham#Oregon#electrical engineer#interior designer#biomedical engineering researcher#real estate#fashion modeling#dress design school#oil painter#Structural Test Team worker#at The Boeing Company#Boeing Test Laboratories#University of Pittsburgh Medical School#Associate degree in Mathematics#Associate degree in Science and Physics#mother#beloved aunt and sister#beloved friend

10 notes

·

View notes

Text

The crown princess is now the first Australian-born Denmark Queen consort, from the Commonwealth with Scottish roots 🏴

Australia’s Mary Donaldson went from commoner to Danish Queen 🇩🇰

An unconventional journey from Australia’s middle class to European royalty began in an unremarkable bar in Sydney in 2000. Twenty-three years later, in what has been called a “real-life fairytale”, Mary Donaldson, becomes the queen of Denmark 🇩🇰 Queen Mary, not only of Denmark, but of the Inuit in Greenland and the Faroe Islands.

Mary Donaldson was born in Tasmania an island state of Australia in a Hobart’s Hospital in 1972 to Scottish parents. John Dalgleish Donaldson, and Henrietta Donaldson (Henrietta Clark Horne). The daughter of a mathematics professor and an executive assistant who had emigrated to Australia from Scotland 🏴

Her father was born in the town of Cockenzie and Port Seton - (Scots: Cockennie [koˈkɪni]; Scottish Gaelic: Cùil Choinnich, meaning "cove of Kenneth") is a unified town in East Lothian, Scotland. It is on the coast of the Firth of Forth, four miles east of Musselburgh, and her mother was born in Edinburgh.

Mary grew up in a middle-class suburban home alongside her siblings, Jane, Patricia and John. After her graduating with a degree in law and commerce from the University of Tasmania, She moved to Melbourne and Sydney, Mary had a high-flying career in advertising and then worked in luxury real estate. She worked during three months in Edinburgh as an account manager at an advertising agency.

But it was a chance encounter in a busy pub that would ultimately turn her life upside down. The Crown Prince sat alongside his cousin, Prince Nikolaos of Greece, his brother, Prince Prince Joachim, and Princess Martha of Norway at the “Slip Inn” in Sussex Street in Sidney as Australia celebrated Ian Thorpe's first Olympic gold.

Princess Mary and her father John Dalgleish Donaldson at her wedding in Copenhagen Cathedral on 14th May 2004.

The wedding of Frederik, Crown Prince of Denmark, and Mary Donaldson took place on 14 May 2004 in the Copenhagen Cathedral. Mary’s mother Henrietta ‘Etta’ Donaldson died from a heart condition two years before Mary married into royalty.

The Danish Folketing (parliament) passed a special law (Mary's Law) giving Donaldson Danish citizenship upon her marriage, a standard procedure for new foreign members of the royal family. She was previously a dual citizen of Australia and the United Kingdom. Ahead of the wedding, Mary had to give up her Australian citizenship and join Denmark's Lutheran Evangelical Church.

The new Danish queen consort is of Scottish descent. Scotland's and Scandinavia's histories have long been intertwined with smatterings of Old Norse in the language, Viking and Norse settlement in Scotland 🏴

Her father, John Dalgliesh Donaldson, stressed her Scottish roots in his speech at her wedding — and claimed his own clan had once helped eject the Norse from the Hebrides.

Check out the video below and listen her father's speech: “In the 12th century, after much savage fighting, the marauding Vikings were driven out of Scotland by a band of men led by the grandfather of the first Donald, the founder of the clan MacDonald. And for those of you who are not aware, I’m wearing tonight, the dress MacDonald tartan, which is the ancient MacDonald”.

“Donald’s great-grandfather would have wondered why he went to such trouble when, some eight centuries later, we take account of today’s union between the Viking Frederick and Mary of the MacDonald clan.”

Loving words from Mary's father.

youtube

Margrethe II reigned as Queen of Denmark from 1972 until her abdication in 2024. Having reigned for 52 years, she is the longest-serving female monarch in Danish history.

The Queen of Denmark made the announcement in her New Year's Eve speech. She formally hand over the throne in a Council of State today 14th January, 2024 at 2:00 p.m., when she signed the Declaration of Abdication. From that moment on, her son became King Frederick X.

The Crown Princess Mary was crowned Queen consort alongside her husband, the new King Frederik of Denmark. It was a historic moment, for which she wore a historic outfit by the Danish designer Soeren Le Schmidt.

youtube

🎥 credit #dnk.royalty.with.dominik

#MaryDonaldson #Australia #commoner #DanishQueenMary #Queen#Scottishroots #Scotland #Hobart #CockenzieandPortSeton #HenriettaDonaldson #John Dalgleish Donaldson #VikingandNorse #Denmark #Greenland #FaroeIslands #Frederik #KingFrederikX #Tasmania #islandstate

8 notes

·

View notes

Text

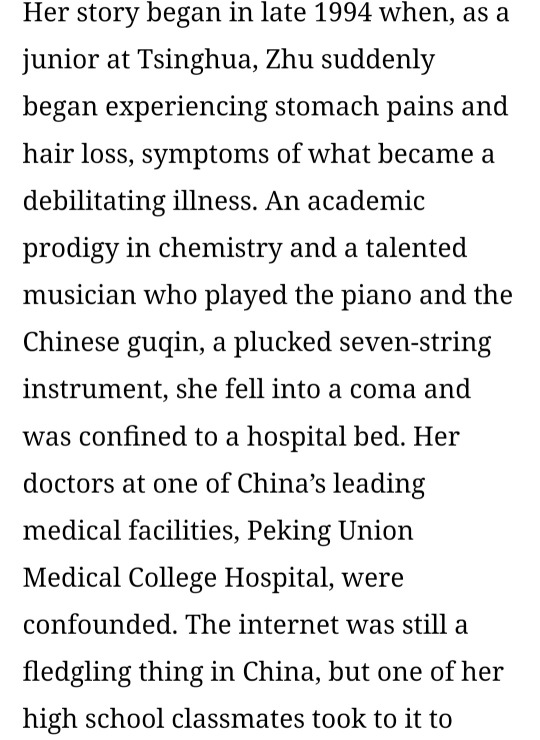

Social media to write a plea in what he acknowledged was sloppy English, asking for assistance in diagnosing her illness. It was one of China's first attempts at crowdsourcing, written on one of the few wired computer terminals then available in the country.

The accomplished student who could play the Guqin (Chinese classical music) and showed so much promise in life was now rapidly deteriorating into someone unrecognizable to her friends.

required round-the-clock care from her aging parents.

has never been released in China.

Though no one has ever been arrested in the case, Zhu's parents are convinced they know the culprit's identity. During the initial police investigation, a classmate and roommate of Zhu's, a woman named Sun Wei, emerged as a prime suspect. Sun held authorized access to thallium compounds at her chemistry lab and had ample opportunities to poison Zhu in their dorm room. Sun was ultimately released due to a lack of definitive evidence, according to law enforcement officials, and Sun has denied any involvement in Zhu's illness.

However, Zhu Ling's supporters are convinced that Sun had plausible motives. They allege that she was jealous of Zhu's academic success, musical talent, and physical attractiveness. Zhu's father also alleges that the police were unwilling to pursue Sun because her family had powerful political connections: Her grandfather, Sun Yueqi, was a high-ranking Chinese official, and one of Sun's father's cousins, Sun Fuling, was a former vice mayor of Beijing.

Incidents of poisoning involving thallium and other rare chemicals occurred in several of China's most esteemed universities in the years after Zhu fell ill. But most of these cases were solved swiftly and the culprits brought to justice. Zhu's mother couldn't help noticing that none of those suspects came from politically well-connected families like Sun's.

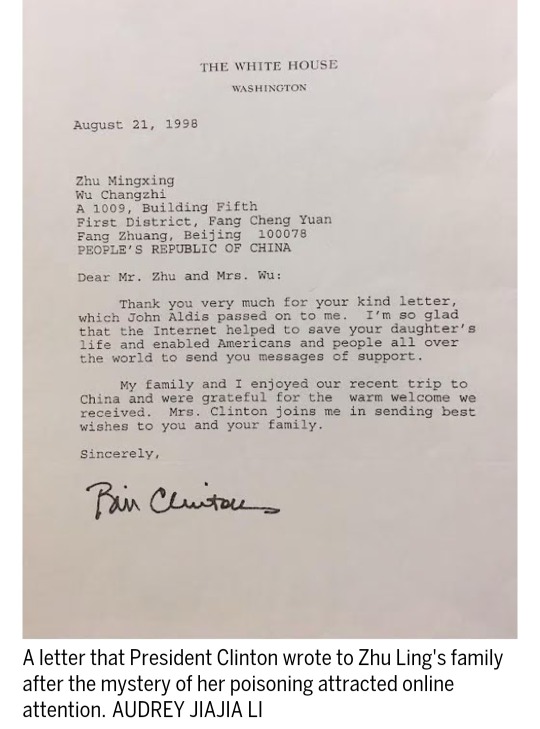

Zhu's case was one of the earliest in China in which the internet played a major role in motivating people to come to the assistance of a stranger. Calls for justice for Zhu have surged from time to time, mirroring a hopeful belief that the internet and free-flowing information could turn China into a transparent civic society. In August 1998, even President Bill Clinton extended solace to Zhu's parents. "I'm so glad that the Internet helped to save your daughter's life and enabled Americans and people all over the world to send you messages of support," he wrote in a letter to Zhu Ling's parents.

At the time, Clinton believed that online media would transform China into a more open and democratic place, arguing that attempting to control the internet would be like "trying to nail Jell-O to the wall."

But today, it seems the Jell-O has been stuck securely to the wall as the Chinese authorities exert tight control over the internet. Updates about Zhu's family still captivate the nation on occasion, igniting public outcry and demands for accountability. But those expressions of support for her family or calls for justice typically fade away quickly due to censorship. In the weeks after her death, some social media posts about it were deleted, accounts devoted to her case were temporarily suspended, and search results on her name were restricted.

*Sun Wei was the only one with access to the poison. It's reported that Sun Wei has moved to either the U.S. or Australia and changed her name to Shiyan Sun/Sun Shiyan, or Jasmine Kosloski (her second husband's family name)/Jasmine Sun.

The reports are that she lives in Australia.

Also that she does real estate work and she and her husband (Feiyu Xle) are property developers.

Zhu Ling had three other roommates and alleged accomplices to the crime:

Jin Ya - one of the roommates, after earning a bachelor's degree from Tsinghua University, later worked at the university founded by Sun Wei's grandfather.

Wang Qi/Gang Xue - immigrated to the U.S. Now works at Amgen Pharmaceutical in Boston.

Hanlin Li - immigrated to the U.S. Now works at Vertex Pharmaceutical, Boston.

3 notes

·

View notes

Text

LETTERS FROM AN AMERICAN

November 16, 2023

HEATHER COX RICHARDSON

NOV 17, 2023

The summit of the leaders of the Asia-Pacific Economic Cooperation (APEC) economies continued today in San Francisco, California.

Formed in 1989, APEC is made up of the economies of 21 nations around the Pacific Rim: Australia, Brunei, Canada, Indonesia, Japan, South Korea, Malaysia, New Zealand, Philippines, Singapore, Thailand, Taiwan, Hong Kong, China, Mexico, Papua New Guinea, Chile, Peru, Russia, Vietnam, and the United States. Together, these economies make up about 62% of global gross domestic product and almost half of global trade.

David Sanger of the New York Times today noted an apparent shift in the power dynamic between President Joe Biden and Chinese president Xi Jinping, who met yesterday for a four-hour conversation. Earlier in his presidency, Xi was riding on a strong economy that overshadowed that of the U.S. and looked as if it would continue to do so. Then, Xi favored what was known as “wolf warrior” diplomacy: the aggressive defense of China’s national interests against what Chinese envoys portrayed as foreign hostility, especially that of the U.S.

Under that diplomatic regime, Xi emphasized that liberal democracy was too weak to face the twenty-first century. The speed and momentous questions of the new era called for strong leaders, he said. In early February 2022, Russia and China held a summit after which they pledged that the “[f]riendship between the two States has no limits.”

Things have changed.

The U.S. has emerged from the coronavirus pandemic with a historically strong economy, while China’s economy is reeling from a real estate bubble and deflation at the same time that government crackdowns have made foreign capital flee. This summer, Xi quietly sidelined Qin Gang, the foreign minister associated with wolf warrior diplomacy, and in October, he replaced Defense Minister General Li Shangfu, who is under U.S. sanctions for overseeing weapon purchases from Russia.

Indeed, China has also been quietly pushing back from its close embrace of Russia. Just weeks after their February 2022 declaration, Russia invaded Ukraine in an operation that Russian president Vladimir Putin almost certainly expected would be quick and successful, permitting Russia to seize key Ukrainian ports and land. Such a victory would have strengthened both Russia and China at the same time it weakened Europe, the United States, and their allies and partners.

Instead, Ukraine stood firm, and the North Atlantic Treaty Organization (NATO) and allies and partners have stood behind the embattled country. As the war has stretched on, sanctions have cut into the Russian economy and Putin has had to cede power to Xi, accepting the Chinese yuan in exchange for Russian commodities, for example. This week, Alberto Nardelli of Bloomberg reported that the European Union is considering another round of sanctions, including a ban on the export of machine tools and machinery parts that enable Russia to make ammunition.

In a piece at the Center for European Policy Analysis today, Julia Davis, who monitors Russian media, noted that Russia lost an extraordinary 997,000 people between October 2020 and September 2021, even before the war began. Now it is so desperate to increase its population that its leadership claims to have stolen as many as 700,000 Ukrainian children and is urging women to have as many children as possible.

Holly Ellyatt of CNBC noted that to the degree they even mentioned it, Russian media sniped at the Biden-Xi summit, but it was hard to miss that although Russian president Putin was not welcome to attend, Xi came and engaged in several high-level meetings, assuring potential investors that China wants to be friends with the U.S. Also hard to miss was Xi’s pointed comment that the China-U.S. relationship “is the most important bilateral relationship in the world.”

Going into this summit, then, the U.S. had the leverage to get agreements from China to crack down on the precursor chemicals that Chinese producers have been shipping to Latin America to make illegal fentanyl, restore military communications between the two countries now that Li has been replaced, and make promises about addressing climate change. Other large issues of trade and the independence of Taiwan will not be resolved so easily.

Still, it was a high point for President Biden, whose economic policies and careful investment in diplomatic alliances have helped to shift the power dynamic between the U.S. and two countries that were key geopolitical rivals when he took office. Now, both the U.S. and China appear to be making an effort to move forward on better terms. Indeed, Chinese media has shifted its tone about the U.S. and the APEC summit so quickly readers have expressed surprise.

Today, Biden emphasized “the unlimited potential of our partnerships…to realize a future that will benefit people not only in the Asia-Pacific region but the whole world,… [a] future where our prosperity is shared and is inclusive, where workers are empowered and their rights are respected, where our economies are sustainable and resilient.”

Biden and administration officials noted that companies from across the Asia-Pacific world have invested nearly $200 billion in the U.S. since Biden took office, creating tens of thousands of good jobs, while the U.S. has elevated its engagement with the region, holding bilateral talks, creating new initiatives and deepening economic partnerships.

Today, Biden and Commerce Secretary Gina Raimondo announced that the Indo-Pacific Economic Framework, an economic forum established last year as a nonbinding replacement for the Trans-Pacific Partnership former president Trump abruptly pulled out of, had agreed on terms to set up an early warning system for disruptions to supply chains, cooperation on clean energy, and fighting corruption and tax evasion.

In a very different event in San Francisco today, a federal jury convicted David DePape, 43, of attempted kidnapping and assault on account of a federal official’s performance of official duties for his attack on former House Speaker Nancy Pelosi’s husband Paul with a hammer on October 28 of last year, fracturing his skull.

DePape’s lawyers did not contest the extensive evidence against him but tried to convince the jury that DePape did not commit a federal crime because he did not attack Pelosi on account of Representative Pelosi’s official position. Instead, they said, DePape had embraced the language of right-wing lawmakers and pundits and believed in a conspiracy theory that pedophile elites had taken over the country and were spreading lies about former president Donald Trump.

DePape told jurors he had come to conspiracy theories through Gamergate, a 2014–2015 misogynistic online campaign of harassment against women in the video game industry, which turned into attacks on feminism, diversity, and progressive ideas. Trump ally Steve Bannon talked of pulling together the Gamergate participants behind Trump and his politics.

Also today, a subcommittee of the House Ethics Committee set up to investigate allegations against Representative George Santos (R-NY) issued its report. The Republican-dominated committee found that Santos had lied about his background during his campaign and, furthermore, that he appears to be a serial liar. Those lies also “include numerous misrepresentations to the government and the public about his and his campaign’s financial activities.”

That is, the committee found, Santos defrauded his campaign donors, falsified his financial records, and used campaign money on beauty products, rent, luxury items from Hermes and Ferragamo, and purchases at the website Only Fans. The subcommittee recommended the Ethics Committee refer Santos to the Department of Justice, and “publicly condemn Representative Santos, whose conduct [is] beneath the dignity of the office” and who has “brought severe discredit upon the House.”

Santos says he will not run for reelection.

—

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Letters From An American#Heather Cox Richardson#Ethics#Santos#Xi#China US relations#Asia-Pacific Economic Cooperation (APEC)#gamergate#Pelosi

5 notes

·

View notes

Text

How The World Works

This is how the world works in the West these days, economically speaking. A group of influential conservatives ushered in something called neoliberal economics back in the 1980s around the time of Thatcher and Reagan. Indeed, Ronald Reagan famously said, “government is not the solution but the problem,” or words to that effect. What was meant by this is an economic and government policy which reduced the involvement of government in how citizens and countries made money. The mantra was that business is more efficient than government in running operations and producing stuff, therefore, it should be unimpeded in getting on with the job of being profitable. What followed was a huge transfer of assets from the public to the private sector. Utilities like water and power companies were privatised. What had been shared state wealth was sold into private hands. This happened with national airlines, banks, telecommunication carriers, insurance companies and a plethora of large businesses once owned by governments and their citizens. Thus, we witnessed the rise and expansion of the oligarch class, many of the billionaires we see today benefitted from these neoliberal economic policies.

Economics In The West

Of course, when we the voters were presented with these plans we were assured of the savings we would make on our energy bills, phone charges, transport costs, financial transactions and other expenditures. Unfortunately, for us, in most cases these savings did not eventuate. What did happen was a select group of insiders got very rich from buying assets at what turned out to be a very modest level of investment. The promised efficiencies of privatisation saw job losses for workers but consumers were not the main beneficiary. Shareholders became the prime concern of these companies, with consumers and their workers well down the ladder of importance going forward. In many of these privatisation stories these new companies inherited duopolistic market shares, where competition was limited and, therefore, price setting enabled them to raise their prices to customers.

President Joe Biden and Russian by The White House Baiden-Harris is licensed under CC-CC0 1.0

Neoliberalism How It Works

Neoliberalism has seen inequality sharply rise over the last 40 years. There have been a smaller group of winners, the CEOs and those who invested in these privatised corporations have in many instances made vast capital profits. But there have been plenty more losers across the board, with workers at a lot of these companies losing their jobs to offshore labour sources in countries where wages are much lower. The continuing financialization of every aspect of life has meant that private equity has gobbled up swathes of homes in real estate moves, farms are likewise heading into corporate hands, hospitals and healthcare have gone for profit, retail has been shaken up by this private equity invasion, and it seems that no realm is immune. In America, this fierce dog eat dog attitude to human wealth acquisition means that if you are not intensely competing you are dead meat. Higher education in the US is very expensive and the expectation of a college degree among employers means that most young folk end up with tens of thousands of dollars of interest bearing debt hanging over their heads. Happiness and inequality are not great bedfellows or sisters. The extreme capitalism that exists in America is making life a shit show for many millions of people. Australia follows the US in many of these trends and inequality here has exploded over the last 15 years or so.

How Deregulation Favours The Rich Deregulation is a favoured frontier to be pushed back by those in the neoliberal camp. The deregulation of the banks and financial institutions has seen a motza period for the big 4 banks downunder. The Commonwealth Bank’s shares are currently valued at: 134.97+0.20(+0.15%) - (https://finance.yahoo.com/quote/CBA.AX/) https://www.abc.net.au/news/2023-08-09/wednesday-finance-with-alan-kohler/102709880 Shareholders have been the big winners in the economy over the last decade or two. Consumers and workers the big losers, as the cost of living crisis meets the housing crisis to make living in Australia increasingly unaffordable for younger Australians and the working poor. Australia taxes income to the detriment of workers, whereas it leaves capital gains largely alone. This means poorer folk bear the brunt of paying taxes. Things like the Capital Gains Tax Discount (CGTD) and Negative Gearing (NG) allow rich folk to minimise their taxes. Former PM John Howard was a real estate agent before entering politics full time and it was he who made these changes to our tax system. These changes have resulted in a driving up of property prices, as people stash their wealth in these tax free boltholes. The economist and ABC presenter Alan Kohler has charted the effects of these tax changes on the Australian property market over the last couple of decades. It cost around 6 times an average yearly income to buy a house in Australia at the time Howard became PM and that has now risen to around 12 times in 2024. Millionaires were once though of as rich and now it costs around that much to buy an average house in Sydney. The banks have made a motza from people borrowing vast amounts of money to buy homes in Australia. Despite this a Royal Commission into the banks found them charging dead people bank fees long after they had died, laundering money in the tens of millions for all sorts of nefarious groups, and ripping off consumers via a variety of immoral and illegal practices. Multi-billion dollar profits year after year are just not enough for the Big 4 banks downunder.

Photo by iam hogir on Pexels.com Aussie Property Market A Ponzi Scheme The Australian property market has been described by a number of commentators as a Ponzi scheme. “They’re operating something I’ll describe in a very nice way as a Ponzi scheme. But it is actually worse than a Ponzi scheme. It’s a Ponzi scheme because there’s no economic utility in residential houses at this point in time because the yield generated from rent is way below anything to be able to generate a return. We, for years, have run a Ponzi scheme in this country because the politicians don’t really know how to grow the economy and really grow industry or do anything other than dig up raw materials out of the ground to ship overseas.” - (Matt Barrie in https://www.macrobusiness.com.au/2024/10/australian-housing-is-a-ponzi-scheme/) People, generally, like to lay blame upon their leaders, but we get the kind of leaders we deserve in democracies. The horse called self-interest usually wins most races. Neoliberalism has seen a concerted shift in attitudes among Australians. The narratives have been more about individual wealth enhancement and the public good has been shelved as obsolete. At the same time, sensationalist media outlets run alarmist click bait campaigns about youth crime epidemics. State politicians, seizing on this, run on law and order in a bid to get votes, as if locking everybody up is any kind of real solution. Short termism, knee jerk stuff that will continue to fail to address the underlying problems. Politicians pandering to lazy thinking will only end up creating career criminals trained in our houses of corrections. Australian lives are centred around overly inflated house prices to the detriment of families. Of course, many Australians are negatively impacted by today’s economics full stop. Robert Sudha Hamilton is the author of America Matters: Pre-apocalyptic Posts & Essays in the Shadow of Trump. ©HouseTherapy

Read the full article

0 notes

Text

Best and Most Effective CRM Platform: DDS4U Leading the Way in Australia

In the ever-evolving business landscape, managing customer relationships effectively is key to long-term success. For businesses in Australia, choosing the right Customer Relationship Management (CRM) platform can make all the difference. With the best CRM platform in Australia, DDS4U stands out as a game-changer for organizations looking to streamline their customer interactions, boost engagement, and enhance overall business performance.

Why Choose DDS4U as Your CRM Platform?

As the best CRM platform in Australia, DDS4U has been designed with business growth and customer satisfaction in mind. DDS4U helps businesses maintain strong, personalized relationships with their customers while improving operational efficiency through a suite of automated tools. Here's why DDS4U has become the go-to solution for businesses looking to elevate their customer relationship management:

Centralized Customer Data: One of the biggest challenges businesses face is managing scattered customer data. DDS4U provides a centralized platform that consolidates all customer information in one place. This allows businesses to have a 360-degree view of their customers, improving communication and enabling personalized interactions.

Automation for Efficiency: In today’s fast-paced business environment, efficiency is crucial. DDS4U automates key business processes, including task management, lead tracking, and customer support workflows. This ensures that teams can focus on what really matters—delivering excellent service and driving growth.

Customizable Solutions: Every business is unique, and DDS4U understands that. The platform offers customizable features that cater to different industries, ensuring that the solution fits the specific needs of your business. Whether you're in retail, real estate, or consulting, DDS4U adapts to your requirements.

Seamless Integration: DDS4U integrates seamlessly with existing business tools and platforms, providing a cohesive digital ecosystem for your operations. This ensures that you don’t have to overhaul your current systems but instead enhance them with powerful CRM capabilities.

Real-Time Analytics and Insights: DDS4U empowers businesses with real-time analytics and insights. By tracking customer behavior, sales trends, and performance metrics, businesses can make data-driven decisions that lead to better customer outcomes and improved ROI.

Key Features of DDS4U's CRM Platform

Customer Support Automation: DDS4U helps businesses deliver top-notch customer support by automating service tickets, tracking customer interactions, and managing queries seamlessly.

Lead Management: Automatically capture, track, and manage leads throughout their lifecycle. With DDS4U, turning prospects into loyal customers has never been easier.

Task and Workflow Automation: Streamline repetitive tasks and workflows to boost team productivity and efficiency, allowing for more focus on strategic initiatives.

Data Security: DDS4U prioritizes the security of your customer data, ensuring that all information is stored securely and is accessible only to authorized users.

Scalability: Whether you’re a small business or a large enterprise, DDS4U grows with your needs, offering scalability without compromising performance.

Why DDS4U is the Best CRM Platform in Australia

DDS4U’s CRM platform has emerged as the best CRM platform in Australia because of its dedication to helping businesses improve their customer relationships while driving growth and efficiency. The platform’s powerful features, combined with its user-friendly interface, make it an ideal choice for businesses across various industries. Plus, with the ability to customize and scale, DDS4U provides businesses with a future-proof CRM solution that evolves with them.

Conclusion

For businesses in Australia, finding the best CRM platform that delivers consistent results can be a challenge. However, DDS4U has positioned itself as a leader by offering a comprehensive, feature-rich CRM solution that simplifies customer relationship management and accelerates business growth. Whether you’re a startup looking to establish a strong foundation or an established company wanting to optimize customer engagement, DDS4U is the answer to your CRM needs.

Embrace the future of CRM with DDS4U—the most effective and reliable CRM platform for businesses across Australia.

#Business efficiency tools#Automation software#Streamline operations#Automate business processes#Productivity solutions#Business process automation#Top automation platform

1 note

·

View note

Text

Do You Need a Degree to Become a Professional Realtor!

Becoming a professional realtor is a dream for many who are passionate about real estate and eager to help others find their perfect homes. Whether or not a degree is necessary to become a professional realtor is a topic of ongoing debate. This blog explores the necessity and value of a degree in real estate.

The Role of a Professional Realtor

A professional realtor, a member of the National Association of Realtors (NAR), follows a strict code of ethics and standards. Key responsibilities include market analysis, negotiation, transaction processing, and advising clients on property transactions. While a degree in business, finance, or marketing can be advantageous, it is not always required. Some countries are increasingly making formal education in real estate a norm for those looking to become a professional realtor.

Education and Licensing Requirements in the US and Canada

In the United States and Canada, becoming a professional realtorS generally requires obtaining a license, which depends on the specific state or province. The typical process includes:

Age and Residence: Applicants must be at least 18 or 19 years old and legal residents of their state or province.

Pre-Licensing Education: Prospective realtors must complete a pre-licensing course, ranging from 60 to 120 hours depending on jurisdiction.

Passing the Licensing Exam: Both state/provincial and national real estate license exams must be passed.

Background Check: Some states and provinces require background checks and fingerprinting.

Continuing Education: Realtors must complete ongoing education to renew their licenses and stay updated on industry changes.

Do You Need a Degree in Real Estate?

In the US and Canada, a degree in real estate or a related field is not always required to become a professional realtor, but it can significantly enhance career prospects. A degree provides a deeper understanding of market trends, legal issues, and financial principles, making candidates more competitive. Additionally, some brokerages may prefer or even require formal education for those looking to become a professional realtor.

Examples from Other Countries

Requirements vary widely in other countries:

Australia: A Certificate IV in Real Estate Practice is required to practice as a professional realtor.

United Kingdom: While a degree is not mandatory, passing exams from organizations like the National Federation of Property Professionals (NFoPP) is beneficial.

Singapore: A degree is preferred for career advancement, and passing the Real Estate Salesperson (RES) exam is required.

How a Degree Can Enhance a Real Estate Career

Gaining Practical Experience: While pursuing a degree, internships with real estate professionals offer valuable hands-on experience. This practical exposure complements theoretical knowledge and provides insight into real estate deals and client interactions.

Pursuing Advanced Certifications: A degree can facilitate obtaining higher certifications and designations, such as the Accredited Buyer’s Representative (ABR) or Certified Residential Specialist (CRS) from the NAR. These certifications demonstrate expertise and can be advantageous in a competitive market.

Utilizing Online Courses and Training: Lifelong learning through online courses and training programs is crucial, regardless of having a degree. These resources cover advanced topics in real estate principles, marketing, and legal issues, offering flexibility to fit a professional’s schedule.

Conclusion

While a degree is not mandatory to become a professional realtor, it offers valuable knowledge, recognition, and job opportunities. In the US, Canada, and many other countries, there are various paths to a successful real estate career, whether through formal education or gaining experience and certifications. Ultimately, success in real estate requires a combination of knowledge, skills, and adaptability. Whether you pursue a degree or an alternative path, dedication and ongoing learning will lead to success for those aiming to become a professional realtor.

0 notes

Text

Real Estate Photography Prices Melbourne Australia

The cost of real estate photography can vary depending on several factors, including the location of the property, the photographer's experience, the size and type of property, the number of photos required, and any additional services such as drone photos

Mini Blog by Aspect Property Photograpy. We produce the best value for real estate photography in Melbourne

1. Day Time Photography

Price Range: $160 - $240

Includes: 8-12 high-quality photos of the property’s interior and exterior. Additional photos $12-$15 ea

Typical Use: Smaller homes, condos, or apartments where a basic photo package is sufficient to showcase the property.

2. Twilight Photography:

Price Range: $220 - $350

Includes: Photos taken during the twilight hours (just after sunset) to create a dramatic and appealing effect, showcasing the property in a different light.

Typical Use: Luxury homes, homes with extensive outdoor lighting, or homes in scenic locations.

3. 4. Aerial/Drone Photography:

Price Range: $150 - $240 (as an add-on service)

Includes: Aerial shots of the property and surrounding area, which provide a unique perspective and can highlight the property's exterior features, lot size, and location.

Typical Use: Properties with significant land, luxury homes, or homes with unique or scenic surroundings.

5. Virtual Tours/3D Photography:

Price Range: $200 - $400 (depending on the size of the property)

Includes: 360-degree virtual tours, Matterport 3D scans, or interactive floor plans that allow potential buyers to navigate through the property online.

Typical Use: High-end properties, homes in out-of-state or international markets, or properties where remote viewing is critical.

6. 7. Video Walkthroughs:

Price Range: $250 - $600

Includes: A professionally shot and edited video walkthrough of the property, often including background music, voiceover, or on-screen text.

Typical Use: Larger or luxury properties, or homes in markets where video marketing is particularly effective.

8. Additional Services:

Virtual Staging: $25 - $50 per room. Digital staging of furniture and decor in empty rooms to show the property’s potential.

Floor Plans: $120 - $300 for creating detailed floor plans of the property.

Photo Editing: Often included in the package, but additional charges may apply for extensive retouching or specialized editing.

Factors Influencing Cost:

Location: Real estate photography prices tend to be higher in large cities or high-cost-of-living areas. There might be a travel free for properties outside the metro area

Experience and Reputation: More experienced photographers with a strong portfolio or specialized skills (e.g., drone photography) may charge more.

Property Size and Complexity: Larger or more complex properties require more time and effort to photograph, leading to higher costs.

For specific prices for the Melbourne Reel Estate Market contact Aspect Property Photography

Reall Estate Photography Melbourne Prices

Conclusion:

The cost of real estate photography can vary based on your specific needs and the market you're in. While basic photography might be sufficient for some listings, investing in premium services like drone photography, virtual tours, or twilight photos can significantly enhance the appeal of a property, potentially leading to a quicker sale at a higher price. It's important to assess the value of these services in relation to your overall marketing strategy for the property.

0 notes

Text

GOLDEN VISA

This form of visa is also for long-term foreign residency. It is ideal for those who want to invest in a business in the UAE. It has a validity of up to 5 to 10 years, depending on the eligibility of the foreign national. Golden Visa offers long-term residency to foreign national entrepreneurs and investors who want to start a business or invest in the UAE. As a UAE Golden Visa holder, you can easily travel, study, work, and even sponsor your family members. The Golden Visa system has further boosted the UAE’s position as one of the world’s most advanced hubs for global business and lifestyle, attracting people from around the globe to the UAE. The Golden Visa offers long-term residency (10 years) to people with a salary of over AED 30,000 per month, an investment of AED 2 million or above, or own off-plan property valued at AED 2 million and above. Aura Vision Advisors will assist you at every step in your application and ensure all requirements are complete and your profile is approved. Advantages of Having a UAE Golden Visa ü You can work, reside, travel, and invest in the UAE ü You will hold a long-term renewable visa valid for 10 years ü You can sponsor yourself and your family members regardless of their ages ü You can sponsor unlimited number of domestic helpers ü You will be allowed for multiple entries followed by the issuance of residency permits ü You can stay outside of the UAE for any duration without having to nullify your Golden Visa. ü Allows your family to stay within the UAE until the end of the duration of the Golden Visa even in the event of the primary visa holder’s death. ü All foreign nationals holding a Golden Visa and having driving license from their home country can now take driver’s test without extra lessons ü Additionally, if the Golden Visa holders have a license from one of 32 approved countries, including the US, UK, Australia, Italy, Saudi Arabia, South Africa, Spain, New Zealand, Qatar, Kuwait, and Ireland, they will automatically be eligible for a UAE driver’s license ü You can have 100% ownership of any business started and operated in the UAE. ü All Golden Visa holders will be gifted the coveted Esaad Privilege Card for FREE 10-Year Golden Visa Categories ü Golden Visa for Professionals Skilled workers and professionals qualify for a Golden Visa if they meet specific criteria. It includes holding a valid employment contract within the UAE, with the job falling under occupational level 1 or 2 as defined by the Ministry of Human Resources and Emiratisation. Additionally, applicants should have a bachelor’s degree and draw a minimum salary of not less than AED 30,000 per month. ü Golden Visa for Real Estate Owners Any individual who has purchased a property worth no less than AED 2 million or more, regardless of whether it’s off-plan, completed, mortgaged or not mortgaged. The UAE has cancelled the AED 1 million minimum down payment required for people to qualify for a golden visa through real estate investment. ü Golden Visa for Investors One must possess a minimum of AED 2 million worth of public investment, which can be in the form of an organization or an investment fund. Additionally, at least 60% of the total investment should not be acquired as a loan and should not be tied to real estate. For other types of assets, investors should expect to have complete possession.

0 notes

Text

Day 27 I ate a Dom Rodrigo and I liked it!

Today I had so many options. I really wanted to go find those flamingos in the Rio Formosa Lagoon, as it was beyond where I was headed today, to meet Esther in Vilamoura. I was excited to see Vilamoura, apparently a little more expensive to live than other places I've seen. Esther is one of four women who responded to my FB post earlier this year, seeking travellers / expats to catch up with. I've now met three of them (Crystal from the US, Rosie from Canada and Esther from South Africa), I'm not sure what's happened to the fourth!

I decided this morning it was a bit too ambitious to head out to Vilamoura at 10.30am, a one hour drive, catch up with Esther, then potentially drive another hour, then go on a flamingo hunt in an area that I'm not familiar with on my own. There were so many other options I'd thought about asking Esther’s opinion on instead.

Esther, like the waiter I'd met in the first week, left South Africa five years ago with her Portuguese husband and two children because of safety concerns. Esther mentioned her father had been murdered there, her mother had been attacked (she said luckily not raped), she had been involved in a car hijack and her husband I think an armed robbery, bloody hell, no wonder she's taken to liking cocktails, after 20 years of not drinking. They arrived and her husband became an Uber driver and then COVID hit and they were eating into their savings. He now does Uber driving and is a real estate agent, but that sounds very competitive here. Esther has started to do cleaning and gets paid €12 per hour. She was so surprised when I told her I pay $40 per hour and that's cheap in Australia. Esther mentions the more exclusive areas, where the footballers and other famous people live is not that far, in Quinta do Lago and Vale do Lobo. I was keen to visit.

After one coffee and a pastel de nata, then another coffee, I asked Esther if she wanted to join me wandering around the marina at Vilamoura. We were headed to lunch at an Indian restaurant she'd recommended but sadly it was closed. We ate pizza and drank a glass of wine instead and she was keen for me to try a cocktail, rattling off how yummy Sex on the Beach and a few others were. I think she assumed I might not have drunk cocktails before! She rang her husband for a bar recommendation and we ended up at an Irish Pub called Northwoods. It was pretty empty apart from five guys and a rather grumpy woman who said there'd be no cocktails until the real bartender arrived. We said we'd wait. We got talking to Stewart, from Glasgow I think. He moves between Scotland and Vilamoura. We then couldn't help but engage with the other four guys who were singing about three lines of some song quite loudly and badly. Well that then gave them licence to join us. Four pissed Scottish dudes from Fife, over for a few days of golf. It was like they'd never met an Australian woman in Portugal before, in fact they pretty much said so. They asked if I played golf! I said the game was a bit too boring for me and I got them quite worked up when I knowingly called the clubs "sticks"! They were all talking over each other to me, it was quite chaotic for a while. I challenged them to a push up competition, one dude took me on and lost! The one wearing my sunglasses in the picture below. Luckily they needed food and I declined their offer to join them for a Chinese buffet! They departed quoting from Crocodile Dundee about the knife!

I then carefully drove the one hour home, knowing that I'd be adding another degree of difficulty, driving at night! Stewart told me driving on the N125 was dangerous and I should take the toll road. I'll be checking out turning the tag on for the two remaining days I have the car. The Portuguese don't seem to obey roundabout etiquette and I've checked my understanding of what lane I'm supposed to be in to go straight. I now realise I've been driving in the overtaking lane, and I need to check that what I'm assuming is the give way sign onto a highway might be a merge sign!

I made it home! Cooked myself a late dinner and ate the Dom Rodrigo I purchased in Lagos yesterday. It's interesting the woman at Casa da Isabel didn't think I'd like it, but it tastes pretty good, like a much softer baklava. It's a local sweet made with egg strands, ovos moles, almond kernels, sugar and cinnamon, having been served throughout its history in three different ways. The first was in the form of a candy, the second was served in a porcelain bowl, so it could be eaten with a spoon and the third is served wrapped in coloured aluminium foil, in order to draw more attention to it, but still needs to be eaten with a spoon!

In case anyone is curious about my Netflix, I've moved from Baby Reindeer (what a head fuck that series was) to Nyad (great movie) and now about to watch Derry Girls! It’s ok Leigh Sales has only just started watching it too!

0 notes

Text

Top Master in Finance Programs Around the World

Are you ready to take the next step in your finance career and elevate your expertise to new heights? Pursuing a Master's in Finance (MiF) program could be your gateway to success in the dynamic world of finance. With numerous prestigious institutions offering top-notch MiF programs worldwide, choosing the right one can be a daunting task. Let's explore the top Masters in Finance colleges in World to help you make an informed decision.

What is a Master in Finance (MiF)?

A Master in Finance program is a specialized postgraduate degree designed to equip students with advanced knowledge and skills in the field of finance. Whether you're interested in corporate finance, investment banking, financial analysis, or asset management, an MiF program provides a comprehensive understanding of financial markets, strategies, and theories.

Top Masters in Finance Colleges in World

1. MIT MFin Program

- Duration: 12-18 Months

- Fees: $87,600 - $120,400

- Average Salary: $110,000

- Specializations: Corporate Finance, Investment Management, Financial Technology (FinTech), Quantitative Finance, Risk Management, Entrepreneurial Finance

2. University of Illinois MFin Program

- Duration: 15 Months

- Fees: $24,321

- Average Salary: $72,000

- Specializations: Asset Management, Corporate Finance, Data Analytics and Fintech, Quantitative Finance, Real Estate, Finance Research (PhD.)

3. HEC Paris MFin Program

- Duration: 10 Months

- Fees: €40,900

- Average Salary: €78,000

- Specializations: Corporate Finance, Capital Markets

4. ESCP Europe MFin Program

- Duration: 15 Months

- Fees: €29,100

- Average Salary: €97,000

- Specializations: Corporate Finance, Investment Management, Financial Markets and Banking, Financial Regulation and Risk Management, Sustainable Finance

5. EDHEC MFin Program

- Duration: 15-24 Months

- Fees: €28,950

- Average Salary: €105,354

- Specializations: Financial Markets, Corporate Finance, Financial Economics, Risk and Investment Management, Data Science for Finance

6. RMIT University MFin Program

- Duration: 2 Years

- Fees: AUD$42,240

- Average Salary: AUD$75,000

- Specializations: Not specified

7. University of Sydney MFin Program

- Duration: 15 Months

- Fees: AU$54,000

- Average Salary: $65,000

- Specializations: Corporate Valuation, Derivative Securities, Risk Management, Mergers and Acquisitions, Portfolio Theory, Asset Pricing, Banking

Top Master in Finance Programs: Country-wise

USA

- MIT (Cambridge, USA)

- University of Illinois (Illinois, USA)

- University of Maryland (College Park, Maryland)

Europe

- HEC Paris (France)

- ESCP Europe (Paris, France)

- EDHEC (Paris and London)

- SKEMA (Paris and Brazil)

- ESSEC (Cergy, France)

Australia

- RMIT University (Melbourne)

- University of Sydney (Sydney)

- Australian National University (Canberra)

Jobs & Career After MiF

Embarking on a Master in Finance program opens doors to a plethora of exciting career opportunities. Here are some lucrative roles and their average salary ranges:

1. Investment Banker: €60,000 - €150,000

2. Financial Analyst: €40,000 - €80,000

3. Risk Manager: €50,000 - €100,000

4. Financial Consultant: €40,000 - €100,000

Process of Admission in Master in Finance Programs

Securing admission to a top Masters in Finance colleges in World involves several steps, including meeting eligibility criteria, submitting standardized test scores (GMAT/GRE), providing academic transcripts, letters of recommendation, statement of purpose or essays, resume/CV, and possibly an interview.

Conclusion

Choosing the top Masters in Finance colleges in World is crucial for your future success in the finance industry. Whether you aspire to work in investment banking, corporate finance, or financial analysis, these top MiF programs around the world provide the knowledge, skills, and opportunities to achieve your career goals. Take the first step towards unlocking your financial future by enrolling in one of these prestigious programs today!

0 notes

Text

MA UPDATE - what we know now for sure and breadcrumbs to follow... (I might be a tad obsessed) by u/yabberyabberblabla

MA UPDATE - what we know now for sure and breadcrumbs to follow... (I might be a tad obsessed) This is the info I gleaned from his yearbooks combined with the info suddenly offered up here (thanks to narcwatchkiwi) and all sorted into a chronology of sorts: https://ift.tt/FhOaWeG July 20 (according to the Twig), 1977.Grew up in Peterborough where he attended Highland Heights Public School and Peterborough Collegiate and Vocational School.Has one brother two years older than him.Mother worked at a kindergarten and father was a real estate agent.Graduated from PCVS in June of 1996.Moved to Montreal to study Art History at McGill (my alma mater!).Because he graduated in Ontario with an Ontario Academic Credit year, he likely received advanced standing on admission to McGill. This could cut a program down by a full year. So, let's assume his BA in Arts History could have been completed in three years (six semesters) of full-time study.Goes to Sydney, Australia on an exchange program through McGill. This exchange is only one semester long and requires at least a 3.0 average on a 4.0 point scale system.He would only have been able to do this in the first or second semester of his second year at McGill at the earliest. Assuming he went to Montreal in September of 1996, he could have been in Sydney in Semester 1 (starting Fall, 1977) or Semester 2 (starting Winter, 1998) at the earliest.He could have taken his exchange in his 5th semester (starting Fall, 1998) of study at McGill but he would not have been able to take his graduating semester at an exchange University.Looks like he decided to quit McGill and stay in Sydney to work at Hugo's Lounge in King's Cross because there is no mention of him actually attaining a degree and I think if he had one, he would say so.Returned (not clear when) to Canada from Australia and waited tables in Toronto (not clear for how long).Moved to London (not clear when) and waited tables (not clear for how long).At 26, in 2003, responded to ad for SoHo house and started there that very night.Regularly served Nick Jones and was promoted to membership team.Is now 46.EDITED TO ADD: I find it mysterious that all of a sudden we are offered so much back story on mister mystery! Someone lurks here... post link: https://ift.tt/Gql1DtW author: yabberyabberblabla submitted: December 05, 2023 at 01:07AM via SaintMeghanMarkle on Reddit

#SaintMeghanMarkle#harry and meghan#meghan markle#prince harry#voetsek meghan#sussexes#markled#archewell#megxit#duke and duchess of sussex#duchess of sussex#duchess meghan#duke of sussex#harry and meghan smollett#walmart wallis#harkles#megain#spare by prince harry#fucking grifters#meghan and harry#Heart Of Invictus#Invictus Games#finding freedom#doria ragland#WAAAGH#yabberyabberblabla

1 note

·

View note

Text

The Benefits of Owning SMSF Property

Self-Managed Superannuation Funds (SMSFs) have gained popularity as a vehicle for retirement savings in Australia. While SMSFs offer various investment options, one particularly appealing avenue is property investment. Owning SMSF Property can provide several benefits that make it an attractive choice for those looking to secure their financial future. In this article, we will explore the advantages of investing in property through an SMSF and how it can contribute to a more secure retirement.

Diversification of Investments: Diversification is a fundamental principle of investment. Owning SMSF property allows you to diversify your superannuation investments, reducing risk by spreading your assets across different classes. Real estate can be a stable and long-term investment that complements other assets in your SMSF portfolio, such as shares and cash.

Tax Benefits: SMSFs enjoy several tax benefits, and owning property is no exception. Rental income received from SMSF property investments is generally taxed at a concessional rate of 15%. Additionally, if the property is held for at least 12 months, any capital gains upon its sale may be eligible for a one-third discount on the applicable capital gains tax.

Control and Flexibility: SMSF trustees have a high degree of control over their investments, including property. This control allows you to make investment decisions that align with your retirement goals and risk tolerance. You can select the type of property, location, and even the financing structure.

Steady Income Stream: Owning an investment property can provide a regular rental income stream, which can be an important source of revenue for your SMSF in retirement. This income can be used to fund your retirement lifestyle or reinvested to grow your superannuation savings.

Long-Term Growth Potential: Historically, property has shown long-term capital growth potential. While the property market can experience fluctuations, owning property within your SMSF may provide a stable and potentially appreciating asset that can enhance your retirement savings over time.

Asset Protection: Assets held within an SMSF are generally protected from creditors in the event of bankruptcy or legal claims against individual members. This added layer of security can help safeguard your retirement savings.

Estate Planning: SMSF property can be a valuable part of your estate planning strategy. Upon your passing, the property held within your SMSF can be distributed to your beneficiaries in accordance with your wishes, providing a seamless and tax-efficient inheritance.

Retirement Income Stream: SMSFs also offer the option to convert your superannuation savings, including property, into a retirement income stream. This provides a regular income during your retirement years, allowing you to enjoy the lifestyle you desire.

Borrowing for Investment: SMSFs can leverage the power of borrowing to invest in property through Limited Recourse Borrowing Arrangements (LRBAs). This allows your SMSF to access capital to acquire property, increasing your potential returns and diversification opportunities.

Capital Growth and Leverage: Property investments have the potential for capital growth, which can lead to increased wealth over time. Leveraging your SMSF to purchase property through an LRBA can amplify these growth prospects.

Conclusion

Owning SMSF property offers an array of advantages that can enhance your retirement savings and financial security. By diversifying your SMSF portfolio with property, you can benefit from long-term capital growth, a steady rental income stream, and various tax advantages. The control, flexibility, and asset protection provided by SMSFs make them a compelling choice for retirement planning.

However, it's essential to remember that property investments come with responsibilities and considerations. Property management, maintenance, and compliance with SMSF regulations are crucial aspects to address. It is advisable to seek professional guidance from financial advisors, accountants, and legal experts to ensure that your SMSF property investments align with your retirement goals and comply with current regulations.

In conclusion, SMSF property ownership is a powerful tool that, when managed effectively, can contribute significantly to your retirement nest egg and help you achieve your desired financial future.

For more details, visit us :

Self managed super fund bitcoin

Smsf property investments

0 notes

Text

Nashville Coin Gallery Reviews

What is Nashville Coin Gallery?Nashville Coin Gallery Locations, Timings, Email, Phone, Services

Nashville Coin Gallery, founded in 2002 by Pete Dodgea, is a nationally known and highly respected dealer in rare coins, paper money, and precious metals bullion products, with annual revenue in the millions of dollars.

Nashville Coin Gallery, according to the company, lives on word-of-mouth referrals and online reviews from its many satisfied clients, many of whom are repeat customers. This reciprocity of loyalty is met with the highest respect and gratitude from the gallery's end. Nashville Coin Gallery's foundation has been founded in the pursuit of a unique blend of top-tier customer service and outstanding pricing, setting a standard unmatched in the coin and precious metals industry. The Brentwood location has evolved into an exclusive appointment-only engagement in which the gallery works directly with customers to provide a more personalised experience. The gallery's strategic position, around 10 miles from downtown Nashville and 8 miles from Franklin, demonstrates the gallery's commitment to accessibility. - Address: 500 Wilson Pike Circle, Ste. 227, Brentwood, TN 37027 - Phone: (615) 764-0331 - Email: [email protected] - Website: https://nashvillecoingallery.com/

People Behind Nashville Coin Gallery: CEO, Owner, Co-Founders & MoreWho owns Nashville Coin Gallery? What is the management team behind Nashville Coin Gallery?

The company's website mentions the following team members: Pete Dodge: Founder

Pete is the owner and founder of Nashville Coin Gallery. He is a lifelong coin collector from Brockton, Massachusetts, who was first exposed to the hobby as a child while in the Cub Scouts. After working as a computer programmer/analyst for many years, including in the United States Air Force from 1980 to 1984, Pete decided to make his lifelong hobby a full-time business and founded Nashville Coin Gallery in 2002. Pete is our Head Numismatist, and he is the primary buyer and seller of coins, paper money, and precious metals bullion products at Nashville Coin Gallery. Pete enjoys travelling, creating music, and playing guitar and piano in his spare time. Jonah Nestadt: Coin & Bullion Buyer

Jonah was born in Sydney, Australia, where he got a bachelor's degree in International Business from Macquarie University. He then worked at a coin store in New Jersey for four years before joining Nashville Coin Gallery as a coin and bullion buyer in February 2022. Jonah enjoys hiking, mountain biking, and listening to live music in his spare time, and he has backpacked in several countries across the world. Jackson Taylor: Accounting / Finance / Marketing

Jackson is another Nashville Coin Gallery employee who has been with the company since February 2016. He attended Mississippi State University and majored in economics and accounting. His responsibilities at Nashville Coin Gallery mostly include marketing, bookkeeping, online SEO, and data analytics. He's also been known to help out the Shipping Department when they're in need. Jackson enjoys golf, basketball, and powerlifting. Brian Roan: Shipping & Receiving Specialist

Brian was born in Illinois but grew up in the Dallas area, graduating from high school in Richardson, Texas, just outside of Dallas. He moved to Tennessee in 1990 after spending time in Virginia and Oklahoma and started working at Nashville Coin Gallery in May 2022. Brian is an avid amateur photographer who enjoys photographing birds, flowers, and other animals when he is not performing shipping and receiving chores for Nashville Coin Gallery. He also enjoys travelling with his wife. Sylvia McMillan: Accounting / Payroll / Human Resources

Sylvia moved to the Nashville, Tennessee area in 2020 and was still working part-time from home for a company in Washington doing real estate work when she became interested in investing in precious metals, so she came to Nashville Coin Gallery numerous times to buy gold and silver. She showed interest in joining their team after becoming fascinated by the firm itself, like the way the company conduct business. Sylvia joined the Nashville Coin Gallery team in November 2022 and working in the Accounting & HR department, where she is responsible for accounting functions, payroll, and human resources. Sam Mizell: Photography & Videography

Sam joined the Nashville Coin Gallery team in November of 2020 as a Shipping and Receiving Specialist. He manages all things related to shipping and receiving for a year and a half, from assembling boxes to packing and securing the contents, from ensuring every box is adequately insured to generating shipping labels, from ordering shipping supplies to videotaping all shipping and receiving activities. During his time, Sam also became highly skilled at coin photography and website video production. However, he quit the organization in early May 2022 after taking another full-time position in the music industry.

Nashville Coin Gallery Products: Bullion Coins, Bars, And Rare CoinsAll products offered by Nashville Coin Gallery

Nashville Coin Gallery offers a diverse range of numismatic products and precious metals. Here's a list of the product categories they provide: Gold:

- Gold Coins (Various denominations and historical periods) - Gold Bullion Bars (Assorted weights and refineries) - Gold American Eagles - Gold Canadian Maple Leafs - Gold Krugerrands - Gold Austrian Philharmonics - Gold Chinese Pandas - Gold Australian Kangaroos Silver:

- Silver Coins (Different designs, eras, and countries) - Silver Bullion Bars (Various sizes and manufacturers) - Silver American Eagles - Silver Canadian Maple Leafs - Silver Britannias - Silver Austrian Philharmonics - Silver Chinese Pandas - Silver Australian Koalas Platinum: - Platinum Coins (Assorted designs and origins) - Platinum Bullion Bars (Various weights and brands) - Platinum American Eagles - Platinum Canadian Maple Leafs Palladium: - Palladium Coins - Palladium Bullion Bars Rare Coins: - Collectible U.S. Coins (Historical coins, key dates, and unique varieties) - World Coins (Coins from various countries and time periods) - Certified Coins (Graded and authenticated by professional grading services) Paper Money: - U.S. Paper Currency (Banknotes of different denominations and historical significance) - World Paper Currency (Currency notes from around the globe) Other Precious Metals: - Other Bullion (Such as bars and coins in various metals) - Coin Supplies (Albums, holders, and accessories for coin storage and display) Special Collections and Sets: - Commemorative Coin Sets - Limited Edition Releases It's important to note that the availability of specific products may vary over time, and it's recommended to visit their official website or contact them directly for the most up-to-date information on their product offerings.

Can You Invest in Nashville Coin Gallery IRA?Do They Offer A Precious Metals IRA?

To invest in a precious metals IRA through Nashville Coin Gallery are the general steps: Open a Self-Directed IRA Select an IRA company that handles opening precious metals IRA accounts and fill out an application. You can work with Nashville Coin Gallery to recommend an IRA company and provide the necessary paperwork. However, I don't recommend doing so. Fund Your IRA Once you have selected an IRA company, you can move your funds into your new IRA account. You can work with the IRA company representative to transfer or rollover funds into the new account. Select a Precious Metals Dealer One of the forms you need to fill out along the way is typically called a Buy Direction Letter. This is where you list the precious metals dealer you have selected, such as Nashville Coin Gallery. Decide Which Precious Metals to Purchase You can choose to invest in gold, silver, platinum, or palladium for your IRA. There are some restrictions regarding fineness requirements and allowable coin types, so it's important to get guidance from Nashville Coin Gallery in this area. Place Your Order Once the funds are available in your IRA account, you can call them to place your order for the desired precious metals. However, I don't recommend opening an IRA with Nashville Coin Gallery. Why? Because there are plenty of better options available for you. Opening a precious metals IRA is a major decision. That's why I suggest checking out our top gold IRA providers list. There, you can find the best precious metals dealer in your state and choose accordingly. Also, the list will help you understand what the industry's best has to offer and what you might miss out on.

Nashville Coin Gallery Fees and Charges: Do they overcharge?What are their fees? Do they have hidden fees?

It's important for people to know about fees and charges when they're thinking about investing in things like coins and precious metals. However, Nashville Coin Gallery's website doesn't give clear information about these fees, and that might make potential customers and investors feel disappointed.

When you're thinking about investing your money, it's really helpful to have all the details about how much things will cost. Not having this information on the website can make people uncertain about whether to invest or not. It's like not knowing all the costs before you buy something – you might end up surprised by extra expenses you didn't expect. Even though Nashville Coin Gallery has a good reputation and happy customers, not knowing the fees upfront can create doubts for those who want to understand everything before making a decision. This could also lead to worries about hidden fees that nobody likes. Transparency is Important

Nashville Coin Gallery Reviews and Complaints: BBB, Yelp, GoogleRead all the Nashville Coin Gallery reviews & complaints

Better Business Bureau (BBB) Based on two customer reviews, Nashville Coin Gallery has an A+ rating and a 3/5 rating on the Better Business Bureau website. The company has been in business for 20 years and has been accredited since 2007. One of their customers posted a negative review saying they should be arrested for robbing people, while another customer praised the company.

Nashville Coin Gallery has received #6 complaints on Google The company has received several unresolved complaints from customers. There are also several unresolved negative reviews on different platforms. Our #1 rated gold IRA company has ZERO unanswered complaints on BBB. Yelp Nashville Coin Gallery has a 4.8/5 star rating on the Yelp platform, based on 10 customer reviews. Customers have mostly posted positive reviews, appreciating the company for providing excellent customer service and being open and honest with them.

Google Reviews On Google, the company has received many reviews from customers, both positive and negative; however, the majority of customers have left positive reviews saying that the owner, Pete Dodge, responds professionally and is transparent and helpful to them. It is important to remember, however, that customers have also posted negative reviews.

Overall, the company has an insufficient online presence, and there are no client ratings and reviews on Trustpilot, which could be cause for concern for potential customers. Having a solid internet presence is essential for client trust and Nashville Coin Gallery's online visibility is not so good. Positive Reviews #1. Linda, a customer, described her great experience with the company, stating that the owner Pete was a wonderful guy to work with. It was her first time, and Pete helped set her at ease by explaining value, and condition, and answering all of her questions. Linda further stated that the company gave her more than she expected in return for her collection. Lastly, she said she would recommend this company to anyone looking to sell or purchase coins.

#2. Another customer, Ammon S., also shared his experience, adding that the drive to the company was worthy. Pete was kind and quick in handling the coins he sold. Lastly, he added, he got better deals than he could have received anywhere else.

#3. Mary stated that she liked her overall experience with the company and its owner, Pete. Pete was really polite and accommodating on the phone, she stated, and in person, he was happy to share his expertise on the coins he had. At last, she added, surely would recommend this company.

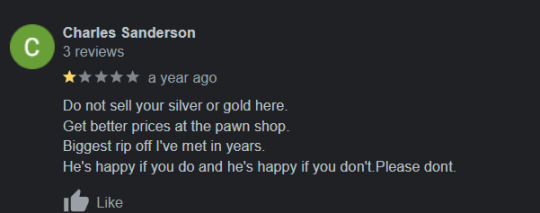

Negative Reviews #1. A customer, Charles advised that you should not sell your silver and gold here since you will get a higher price elsewhere. He described it as the biggest rip-off he has encountered in years. Lastly, he recommended avoiding doing business with this company.

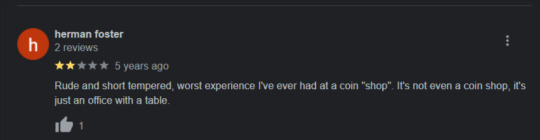

#2. Another customer, Herman, stated that his experience was terrible and that the staff was rude and short-tempered. He also stated that it is not a coin company, but rather a little office with a table.

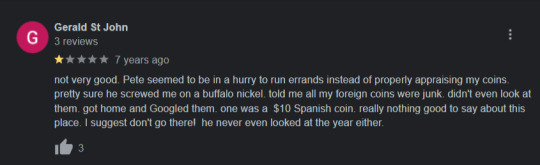

#3. Gerald, a customer, explained his terrible experience with the company, starting with its owner Pete, who appeared to be in a hurry to run errands rather than carefully evaluating customer's coins. He also added that he is sure Pete cheated him on his coin. Pete told the customer that his foreign coins were worthless and he did not even look at them. When the customer returned home, he looked up the coins and discovered that it was a $10 Spanish coin. At last, he advised everyone not to do business with this company.

Is Nashville Coin Gallery Legit? Should You Invest With Them?Is Nashville Coin Gallery a scam or legit? Are they worth it?

No, I don't recommend investing with them. Pros: - A+ rating on BBB Cons: - Risk of hidden fees and charges - Lack of transparency - Limited online presence - No Trustpilot rating I believe you have numerous better options available for you. Nashville Coin Gallery has been in the precious metals business for 20 years. On the Better Business Bureau, they have an A+ rating with 3 stars. However, little information on fees and charges has been revealed by the company, and there are few customer reviews. Before you make any final decision, I recommend checking out our top gold IRA providers. There, you will find out what the industry's best has to offer. Also, it will ensure you make an informed decision. Or, you can check out the best gold dealer in your state below: Each state has its regulations and rules, so we've sorted and found the best Gold IRA company for each state. Find the best Gold IRA company in your state Read the full article

0 notes

Text

Types of Construction Videography Services Available in Parramatta

In Parramatta, a bustling city in New South Wales, Australia, you'll find a range of construction videography services catering to the construction industry's diverse needs. One prominent provider of construction videography services in Parramatta is Sensor Studios. Let's take a closer look at the types of construction videography services available in Parramatta, with a specific focus on the offerings from Sensor Studios:

Construction Progress Videos:Documenting construction progress is a crucial aspect of the industry. Construction videographers capture regular updates, showcasing the transformation of a construction project from its early stages to completion. These videos are valuable for project management, stakeholder communication, and marketing purposes.

Time-Lapse Videos:Time-lapse videos condense the entire construction process into a shorter, engaging video. Sensor Studios in Parramatta offers time-lapse services that capture a project's evolution, highlighting significant milestones and changes in a visually appealing and concise format.

Drone Videography:Aerial videography is increasingly popular for construction projects. Drones equipped with high-resolution cameras capture stunning aerial footage, offering a unique perspective on the construction site. Sensor Studios may provide drone services to capture sweeping views of the project area and offer valuable data for site assessment and progress tracking.

Construction Safety Videos:Safety is a top priority in the construction industry. Videography services can help create safety training videos, toolbox talks, and incident reports to ensure that construction workers are aware of safety protocols and that best practices are followed on-site.

Promotional and Marketing Videos:Construction videography is not limited to documenting the process; it also includes creating promotional and marketing content. These videos showcase completed projects, highlighting the features and quality of the construction work. Sensor Studios may offer services to help construction companies market their achievements effectively.

Virtual Tours and 360-Degree Videos:To provide clients and stakeholders with immersive experiences, 360-degree videos and virtual tours are a fantastic option. These videos allow viewers to explore a construction project or completed building from different angles and can be valuable for real estate development and sales.

Documentation and Archival Videos:Construction videographers can create comprehensive documentation videos, recording important details of a project for archival purposes. These videos serve as a historical record of the construction process and can be useful for legal and reference purposes.

Expert Interviews and Testimonials:To enhance credibility and showcase the expertise of the construction team, videography services can capture expert interviews and testimonials. Sensor Studios may offer services to conduct interviews with key project stakeholders and professionals involved in the construction.

Educational and Training Videos:Construction videography services may include educational and training videos for construction workers and staff. These videos can cover a range of topics, including equipment operation, safety protocols, and industry best practices.

Site Analysis and Inspection Videos:Construction videography can assist in site analysis and inspection by providing a detailed visual record of construction sites. Sensor Studios may offer services to document site conditions before, during, and after construction for assessment and quality control.

Sensor Studios in Parramatta is a reputable provider of construction videography services. They offer a range of these services to meet the specific needs of construction companies and stakeholders. Whether you require progress videos, time-lapse footage, aerial views, or promotional content, Sensor Studios can help you achieve your construction videography goals.

In conclusion, Parramatta offers a diverse range of construction videography services, with Sensor Studios playing a significant role in providing these services. Construction videography is invaluable for documenting progress, enhancing safety, marketing, training, and much more in the construction industry, ensuring that projects are efficiently managed and communicated to various stakeholders.

0 notes

Text

What's Asset Based Lending? Business Overview

In Operations Research and Financial Engineering from Princeton University. InterNex Capital is an online lender that gives enterprise traces of credit which would possibly be secured by a borrower’s accounts receivable. With InterNex, you can use your accounts receivable to safe a loan between $250,000 and $10 million with a maximum asset based financing 12-month term and annual interest rates beneath 18%. Overall, you’ll usually discover that rates of interest are greater than what you’ll discover with financial institution merchandise since most asset-based lenders are various lenders.

By region, Asia-Pacific attained the very best asset-based lending market dimension in 2021. This is attributed to the truth that the exceptional growth of digital banking has led to declining usage of physical bank branches with an rising asset based lending menace of digital players capturing a considerable market share. Further, the rising of new age fintech firms have additionally now began venturing out from the standard funds and transactions.

Asset-based loans are quick, flexible, and provide access to more funds than conventional financing choices. So take advantage of the opportunity to unlock your organization's true potential. Private credit score has become a permanent asset based loans feature of the lending landscape and continues to serve as a dependable various to banks as a supply of capital. Yet many buyers remain under-allocated to essential segments of private credit score.