#profitable defi investments

Explore tagged Tumblr posts

Text

The DeFi Projects That Could Make You Rich in 2023

Discover the potential for wealth in 2023 with the best DeFi projects to invest in. Uncover a world of decentralized finance innovations that could propel your financial success. From lending platforms to yield farming protocols, these carefully selected DeFi projects offer promising opportunities. Stay ahead of the curve and explore projects with transformative potential in the ever-evolving DeFi landscape. With cutting-edge technology and a focus on user empowerment, these projects aim to revolutionize traditional finance. Embrace the future of wealth creation and dive into the exciting world of DeFi projects that could make you rich in 2023.

#defi projects 2023#best defi investments#top defi projects#defi investment opportunities#lucrative defi projects#profitable defi investments#high-growth defi projects#promising defi investments#wealth-generating defi projects#defi projects with potential returns

0 notes

Text

ATTENTION - Affiliate and network professionals beware!!

The fastest growing network in the crypto industry is starting - don't miss your chance and come with your team -

Start for free, more information in the back office 👉 https://app.robex-ai.com/join/crypto-united/right 👈 YOUR big opportunity 23/24

#bitcoin#wallet#network#cryptocurrency#blockchain#trader#invest#defi#earn money online#profit#income#make money online#trading infra#crypto trading#cryptocurreny trading#trading view#robex#robexai#robex ai

9 notes

·

View notes

Text

Halo semua!

Aku baru saja memulai blog ini untuk berbagi pengalaman dan pengetahuan seputar studi crypto. Meskipun aku hanya seorang investor kelas shrimp, aku percaya bahwa pembelajaran adalah kunci kesuksesan di dunia ini.

2021 menjadi momentum penting bagi saya dalam memasuki dunia crypto. Saat semuanya naik karena bullrun, saya memulai perjalanan ini dengan semangat belajar yang tak terbatas. Saya berharap bisa berbagi insight, tips, dan mungkin juga kebingungan saya sepanjang perjalanan ini.

Mari kita terus belajar dan tumbuh bersama dalam dunia crypto yang penuh dengan potensi!

Terima kasih telah bergabung dan semoga kita bisa saling mendukung!

Salam.

#crypto#blockchain#binance#bybit#bitget#investment#cryptoexchange#defi#bitfinex#changpengzhao#okex#business#financial freedom#profit#bullrun#shibainu#shiba inu

0 notes

Text

Top 5 Reasons to invest in DeFi Staking Platforms

What are DeFi Staking Platforms?

DeFi staking platforms enable cryptocurrency holders to earn rewards by locking up their digital assets in a smart contract. Fungible tokens and non-fungible tokens (NFTs) are the types of cryptocurrency assets that may be staked; the benefits often equate to obtaining more of the same.

Top 5 Reasons to invest in DeFi staking platforms

Claim: This activity entails compensating users for locking their assets on your site for a specified period. The rewards are determined based on the assets that are locked - larger locked-in assets result in higher rewards that are directly delivered to the users' wallets.

Security: Strong security mechanisms, including SSL encryption, two-factor authentication, and smart contract audits, are in place on the platform.

High Liquidity: Its high liquidity makes it simple and quick for users to stake and unstake their assets. It guarantees that users will have no trouble buying and selling tokens.

Rewards: Users may earn attractive incentives from the platform by staking their tokens. Staking fees, governance tokens, or other incentives are some ways these benefits are given out.

User-Friendly Interface: The platform's user-friendly interface makes an easy way for users to navigate and understand the staking process.

Make Huge Profit by Creating Your Own DeFi Staking Platform!

The process of locking cryptocurrency assets inside a smart contract in exchange for rewards and passive income is known as DeFi staking.

Fungible tokens and non-fungible tokens (NFTs) are the types of cryptocurrency assets that may be staked; the rewards are usually set to earning more of the same thing.

Joining staking pools enables users to raise staking earnings along with other cryptocurrency users. After storing any number of tokens in a staking pool, users can start earning passive income based on the value of their holdings.

Before investing in DeFi Platforms: If you are interested in DeFi Staking Platforms, Don’t fall for the fake stuff around the internet. Before investing your money you should know about how to get passive income in DeFi Staking Platforms, Feel free to get a free consultation with DeFi experts via Telegram - @ BeleafTech

Start Your Own DeFi Staking Platform with a leading blockchain development company:-

#defi#defi staking#defi staking platform#crypto#blockchain#bitcoin#cryptocurrencies#investment#earn money online#how to earn money#profit#financial#earnonline#earnings

1 note

·

View note

Text

Uranus Awakens: How the Rebellious Bull Shakes Up Business and Finance in 2024

Prepare for disruption, fellow stargazers! As the revolutionary planet Uranus stations direct in the grounded sign of Taurus on January 27, 2024, a cosmic earthquake ripples through the world of business and finance. Get ready for unexpected twists, innovative breakthroughs, and a complete reshaping of the economic landscape. Buckle up, entrepreneurs, investors, and everyone in between — Uranus is here to shake things up!

The Cosmic Cocktail:

Imagine the stoic, earth-loving Taurus as a well-established bank, steeped in tradition and conservative practices. Now, picture the rebellious Uranus, bursting in with a briefcase full of digital currency and blockchain ideas. That’s the essence of this transit — a clash between old and new, stability and revolution, practicality and radical transformation.

Impacts to Expect:

Technological Disruption: Brace yourself for a wave of innovation in finance and business. Cryptocurrency, blockchain, and decentralized finance (DeFi) will take center stage, challenging traditional banking systems and pushing the boundaries of what’s possible.

Prepare for a digital gold rush as Uranus throws open the vault of financial innovation! Cryptocurrency will erupt into mainstream commerce, blockchain will become the new ledger, and DeFi will democratize finance like never before. Traditional banks better dust off their abacus and learn to code, because digital cowboys are charging onto the financial frontier, redefining how we value, exchange, and invest. From peer-to-peer microloans to fractionalized real estate ownership, the possibilities are as limitless as your imagination. Buckle up, because the tectonic plates of finance are shifting, and the digital revolution is rewriting the rules of the game!

Shifting Market Dynamics: Expect volatility and unexpected shifts in established industries. Old guard companies might scramble to adapt, while nimble startups with innovative ideas flourish. Think green energy disrupting fossil fuels, or AI revolutionizing the service industry.

Be prepared for market earthquakes! Uranus, the cosmic trickster, will send shockwaves through established industries, causing titans to tremble and upstarts to dance. Picture fossil fuels choking on the dust of solar panels, brick-and-mortar stores gasping as virtual bazaars boom, and customer service bots replacing flustered clerks. AI will infiltrate every corner, from crafting personalized shopping experiences to streamlining logistics, while sustainable solutions crack open resource-hungry giants. It’s a Darwinian playground for businesses — adapt or face extinction. This isn’t just a market shuffle, it’s a complete reshuffle of the deck, and the cards are dealt anew. Get ready for the thrill of the unexpected, because the only constant in this dynamic landscape is change itself!

Evolving Values: Sustainability, ethical practices, and social responsibility will become increasingly important for consumers and investors alike. Businesses that prioritize these values will thrive, while those stuck in outdated models might struggle.

Get ready for a values revolution! Consumers and investors will turn from price tags to purpose tags, demanding businesses that go beyond profit and prioritize sustainability, ethical sourcing, and social responsibility. Imagine carbon-neutral factories replacing smog-belching behemoths, fair-trade coffee beans eclipsing exploitative practices, and employee well-being becoming a non-negotiable bottom line. Businesses that cling to outdated models will find themselves gasping for air as ethical alternatives steal the oxygen. It’s not just a trend, it’s a tidal wave of conscious consumerism sweeping away the tide of greed. So, businesses, listen up: embrace responsible practices, champion inclusivity, and weave sustainability into your very fabric, or risk being swept away by the rising tide of conscious capitalism. The future belongs to those who do good, not just those who do well!

Collaborative Entrepreneurship: Collaboration and community-driven ventures will rise in prominence. Shared workspaces, cooperatives, and peer-to-peer platforms will gain traction, challenging the traditional top-down corporate structure.

Picture the corporate pyramid crumbling as the cosmic crane hoists the collaborative flag! Uranus, the revolutionary, encourages a seismic shift: from isolated silos to thriving beehives. Shared workspaces buzz with creative collisions, cooperatives blossom out of shared passions, and peer-to-peer platforms become the new marketplace, fueled by trust and mutual aid. The top-down hierarchy shivers as horizontal networks rise, blurring the lines between boss and worker, replacing command with consensus. Collaboration takes center stage, not competition, as communities band together to tackle challenges and build innovative solutions. So, entrepreneurs, shed your solopreneur capes and embrace the power of the collective! In this new social business ecosystem, where synergy triumphs over supremacy, the future belongs to those who share, empower, and co-create a brighter tomorrow. Let the collaborative revolution begin!

Focus on Personal Values: Individuals will increasingly prioritize work that aligns with their personal values and passions. Entrepreneurship fueled by purpose and authenticity will flourish, shaping a more diverse and fulfilling business landscape.

Prepare for a workplace metamorphosis! Uranus, the cosmic butterfly, flutters wings of purpose, urging individuals to shed the career chrysalis and soar towards fulfilling their true potential. Gone are the days of soul-sucking jobs; now, personal values take center stage as the compass guiding career choices. Imagine passionate bakers opening community cafes, eco-conscious designers launching upcycled fashion lines, and tech whizzes crafting apps that tackle social issues. Authenticity becomes the new currency, with entrepreneurs weaving their passions into the fabric of their ventures, creating a mosaic of purpose-driven businesses that cater to every corner of the human experience. This isn’t just a career shift, it’s a heart shift, transforming the business landscape into a vibrant tapestry of diverse talents and fulfilled souls. So, listen to your inner compass, embrace your unique spark, and let your passion ignite the world — the future of work belongs to those who dare to be true to themselves!

Tips for Navigating the Cosmic Chaos:

Embrace innovation: Don’t cling to the old ways. Stay open to new technologies, trends, and business models. Be curious, explore, and experiment.

Adapt and evolve: Be prepared to change course quickly. Agility and responsiveness will be key to success in this dynamic environment.

Prioritize sustainability and ethics: Integrate environmental and social responsibility into your business practices. Consumers and investors are increasingly drawn to values-driven companies.

Collaborate and connect: Build partnerships, join communities, and leverage the power of collective action. Collaboration will be crucial for navigating the changing landscape.

Follow your passion: Don’t be afraid to pursue your entrepreneurial dreams. Uranus encourages authenticity and purpose-driven ventures.

Remember, Uranus isn’t about chaos for chaos’ sake. It’s about dismantling outdated structures and paving the way for a more progressive, sustainable, and fulfilling economic future. By embracing the change, staying adaptable, and aligning your business with your values, you can not only survive this cosmic revolution but thrive in the exciting new world it creates. So, let your inner rebel loose, embrace the disruption, and ride the wave of innovation — the economic future is bright for those who dare to dream big!

#uranus in taurus#taurus uranus#business astrology#astrology business#astrology finance#finance astrology#astrology updates#astro#astrology facts#astro notes#astrology#astro girlies#astro posts#astrology community#astrology observations#astropost#astro community#astrology notes

14 notes

·

View notes

Text

How to Make Money with Binance

In the ever-evolving world of cryptocurrency, Binance has emerged as one of the most popular and user-friendly platforms for trading digital assets. Whether you’re a seasoned trader or a complete beginner, Binance offers a plethora of opportunities to make money. From trading and staking to earning interest on your crypto holdings, the possibilities are virtually endless. In this comprehensive guide, we’ll explore various strategies to help you make money with Binance, ensuring you have the knowledge and tools to maximize your earnings.

1. Trading Cryptocurrencies

One of the most straightforward ways to make money on Binance is through trading cryptocurrencies. Binance offers a wide range of trading pairs, allowing you to buy and sell digital assets with ease. Here are some key strategies to consider:

Spot Trading: This is the most basic form of trading, where you buy cryptocurrencies at the current market price and sell them when the price increases. Binance offers a user-friendly interface, making it easy for beginners to get started.

Margin Trading: For more experienced traders, Binance offers margin trading, which allows you to borrow funds to increase your trading position. This can amplify your profits, but it also comes with higher risks.

Futures Trading: Binance Futures allows you to trade cryptocurrency contracts with leverage. This means you can open larger positions with a smaller amount of capital, potentially leading to higher profits. However, it’s essential to manage your risk carefully.

To make money through trading, it’s crucial to stay informed about market trends, use technical analysis tools, and develop a solid trading strategy. Binance provides a wealth of resources, including charts, indicators, and educational materials, to help you make informed decisions.

2. Staking and Earning Interest

Another excellent way to make money on Binance is through staking and earning interest on your crypto holdings. Binance offers several options for earning passive income:

Staking: By staking certain cryptocurrencies, you can earn rewards for participating in the network’s consensus mechanism. Binance supports a variety of staking options, including Proof of Stake (PoS) coins like Ethereum 2.0, Cardano, and Polkadot.

Savings: Binance Savings allows you to earn interest on your idle crypto assets. You can choose between flexible savings, where you can withdraw your funds at any time, or locked savings, which offers higher interest rates for fixed terms.

DeFi Staking: Binance also offers DeFi staking, where you can earn high yields by providing liquidity to decentralized finance protocols. This is a more advanced option but can be highly profitable if done correctly.

Staking and earning interest are excellent ways to make money with minimal effort. By simply holding your cryptocurrencies on Binance, you can generate a steady stream of passive income.

3. Participating in Binance Launchpad and Launchpool

Binance Launchpad and Launchpool are innovative platforms that allow users to invest in new cryptocurrency projects before they hit the mainstream market. These platforms offer unique opportunities to make money by getting in early on promising projects.

Binance Launchpad: Launchpad is a token sale platform where Binance users can purchase tokens from new projects at a discounted price. These tokens often appreciate significantly once they are listed on the exchange, providing substantial returns for early investors.

Binance Launchpool: Launchpool allows users to stake their existing cryptocurrencies to earn new tokens from upcoming projects. This is a great way to diversify your portfolio and make money by earning tokens with high growth potential.

Participating in Launchpad and Launchpool requires some research and due diligence, as not all projects will be successful. However, by carefully selecting promising projects, you can significantly increase your chances of earning substantial profits.

4. Referral Program and Affiliate Marketing

Binance offers a lucrative referral program that allows you to make money by inviting others to join the platform. Here’s how it works:

Referral Program: When you refer a friend to Binance using your unique referral link, you earn a commission on their trading fees. The more people you refer, the more you can earn. Binance offers a tiered commission structure, allowing you to earn up to 40% of your referrals’ trading fees.

Affiliate Marketing: For those with a larger audience, Binance’s affiliate marketing program offers even greater earning potential. By promoting Binance on your blog, social media, or YouTube channel, you can earn substantial commissions based on the trading volume generated by your referrals.

The referral program and affiliate marketing are excellent ways to make money with Binance, especially if you have a network of crypto enthusiasts or a strong online presence. By leveraging your connections and promoting Binance, you can generate a steady stream of passive income.

Conclusion

Binance is a versatile platform that offers numerous opportunities to make money, whether you’re a trader, investor, or content creator. From trading cryptocurrencies and staking to participating in Launchpad and earning referral commissions, the possibilities are vast. By leveraging the tools and resources provided by Binance, you can maximize your earnings and achieve your financial goals.

If you’re ready to start your journey and make money with Binance, don’t wait any longer. Click on the link below to sign up and take advantage of the incredible opportunities that Binance has to offer.

Ready to make money with Binance? Sign up today using this link and claim your 100 USD Trading Fee Credit. Start exploring the various ways to grow your crypto portfolio. Don’t miss out on the chance to earn passive income, trade with confidence, and invest in the future of finance. Join Binance now and take the first step towards financial freedom!

3 notes

·

View notes

Text

Liquidity Pools Simplified: What They Are and Why They Matter

If you're new to cryptocurrency, you’ve probably heard the term “liquidity pool” tossed around. But what is it, really? And why is it such a big deal in the world of decentralized finance (DeFi)? Let me explain this in a way that’s relatable, simple, and easy to understand—like having a conversation with a friend over coffee.

What Exactly is a Liquidity Pool

Imagine walking into a small village market where people barter goods. You’ve got apples and want oranges, but there’s a catch: you need to find someone with oranges who also wants apples. This process can be slow and frustrating.

Now imagine there’s a stall in the market that always has apples and oranges in stock. You can trade your apples for oranges instantly, without waiting for someone else to show up. That stall? That’s essentially what a liquidity pool is in the crypto world.

A liquidity pool is a digital reserve of two different cryptocurrencies, or tokens, that are paired together and available for trading at any time. It’s like a constantly stocked shelf, ensuring that trades happen quickly and smoothly without delays.

Who Provides the Tokens in Liquidity Pools

Now you might ask, “Where does this steady supply of tokens come from?” The answer is simple: people like you and me—called liquidity providers.

Liquidity providers deposit equal amounts of two tokens into the pool. For example, if you’re contributing to a pool with ETH (Ethereum) and USDT (Tether), you’ll need to provide both tokens in equal value.

Why would someone do this? Because it’s profitable. Whenever someone makes a trade using the pool, a small transaction fee is charged. That fee is shared among all liquidity providers based on their contribution. Think of it as earning rent on property you’ve invested in.

How Do Liquidity Providers Earn

Let’s say you provide liquidity on a platform like STON.fi. Every time someone trades in the pool you’re part of, a fee of 0.2% is collected. That fee is then distributed among all liquidity providers based on their share in the pool.

For example, if you contributed 10% of the total liquidity, you’d earn 10% of the fees. It’s like owning a share of a vending machine—every time someone buys a snack, you get a cut of the profits.

Why Are Liquidity Pools Important

Without liquidity pools, decentralized exchanges (DEXs) wouldn’t work. They enable instant trades without needing a buyer or seller on the other side of the transaction.

Think of them as the engine of a car. Without the engine, the car doesn’t move, no matter how shiny it looks. Liquidity pools ensure that trades happen efficiently and that markets run smoothly.

How to Join a Liquidity Pool

If this sounds appealing, you might be wondering how to get started. Here’s a simple roadmap:

1. Choose a Pool: Look for a liquidity pool that matches your goals. Popular pairs like ETH/USDT or BTC/ETH are often good starting points.

2. Deposit Tokens: You’ll need to provide equal value of both tokens in the pair. For example, if you’re adding $500 worth of Token A, you’ll also need $500 worth of Token B.

3. Start Earning Fees: Once your tokens are in the pool, you’ll start earning a share of the transaction fees based on your contribution.

Key Metrics to Consider

Before jumping into a pool, it’s important to evaluate a few things:

APR (Annual Percentage Rate): This shows how much you could potentially earn in a year, based on recent trading activity. It’s like checking the interest rate on a savings account.

TVL (Total Value Locked): This is the total value of tokens in the pool. Higher TVL usually means more stability and less risk of price swings.

24h Volume: This shows the trading activity over the past day. Higher volume means more transactions and potentially more earnings for liquidity providers.

Risks to Be Aware Of

Liquidity pools are not without risks. The biggest one is something called impermanent loss.

Let’s use another analogy. Imagine you own a lemonade stand and sell lemonade for $1 per cup. One day, the price of lemons triples, but you’re locked into selling your lemonade at the old price. You’ve lost potential profit.

In liquidity pools, if one token’s price changes significantly compared to the other, you might end up with fewer valuable tokens than you started with. This is called impermanent loss because it only becomes a real loss if you withdraw your tokens while the prices are still unbalanced.

A Win-Win Situation

Despite the risks, liquidity pools remain a cornerstone of the DeFi ecosystem. They benefit both traders and liquidity providers:

Traders enjoy instant transactions without delays.

Liquidity providers earn passive income from fees.

It’s a win-win, like a farmer’s market where both buyers and sellers benefit from the community’s participation.

Liquidity pools might sound intimidating at first, but they’re a simple and effective way to earn passive income while contributing to the crypto ecosystem. Whether you’re a seasoned trader or a curious beginner, understanding how these pools work can open up new opportunities for you.

Remember, like any investment, it’s important to do your homework. Start small, choose reputable platforms, and evaluate the risks carefully. Over time, you’ll see how liquidity pools can be a powerful tool in your crypto journey.

So, are you ready to dive into the world of liquidity pools? Let me know your thoughts or questions—let’s grow together in this exciting space!.

3 notes

·

View notes

Text

Mastering Farming Withdrawals on STON.fi: A Simple and Relatable Guide

When it comes to farming on STON.fi, the process of withdrawing your funds can feel a bit daunting, especially if you're new to DeFi. But don't worry—this guide will break it down for you in a simple and relatable way. Think of it like harvesting crops after nurturing your garden. There are rewards to gather, tools to reclaim, and soil to prepare for the next planting season. Let’s dive in!

Step 1: Harvesting Your Rewards (The Fruits of Your Labor)

Imagine you’ve been growing apples in your garden. The first step is to pick the apples, leaving the tree intact. In farming terms, these apples are your rewards.

Go to the Pools page on STON.fi.

Toggle the ‘My Pools’ option to find your active farm.

Scroll to the ‘Farm Positions’ section and click ‘My Positions’ to see your rewards.

Hit ‘Claim Rewards’ and confirm the transaction in your wallet.

Now, your earned rewards are safely in your wallet. But your tree (LP tokens) and the soil (locked liquidity) remain untouched. Let’s move to the next step.

Step 2: Reclaiming Your LP Tokens (Getting Back Your Tools)

Think of LP tokens as the tools you lent out to help grow your farm. When you're done farming, you’ll want these tools back.

Head back to the ‘Farm Positions’ section.

Look for the minus button (‘—’). If it’s inactive, your LP tokens are still locked, and you’ll need to wait until the unlocking period is over.

Once available, click the minus button, confirm the transaction in your wallet, and reclaim your LP tokens.

Congratulations! You’ve now retrieved your tools. However, the funds you initially provided to the pool are still locked in the soil. Let’s dig them out.

Step 3: Withdrawing Liquidity (Recovering Your Investment)

Your initial investment in the liquidity pool is like the fertile soil you used to plant your crops. Now it’s time to scoop it back into your wallet.

Navigate to the Pools tab and toggle ‘My Pools.’

Select the pool where you’ve provided liquidity.

Scroll to the section showing your liquidity details and click ‘Withdraw.’

Choose how much you want to withdraw. For the full amount, select MAX.

Confirm the transaction in your wallet.

Voila! Your original funds, along with any remaining rewards, are now back in your hands.

Explore more farms

A Quick Note on Gas Fees (The Price of Transportation)

Just like you’d need fuel to transport your harvest to the market, blockchain transactions require gas fees. On STON.fi, these fees are paid in TON. Always ensure you have a little TON in your wallet to cover these fees and avoid delays.

Why Mastering Withdrawals Matters

Withdrawing from farming isn’t just about collecting rewards—it’s about taking control of your financial assets. Whether you’re cashing out or reinvesting elsewhere, understanding each step strengthens your confidence in navigating DeFi.

Think of this process as managing a small business:

Your rewards are your profits.

LP tokens are the business tools you need to keep things running.

The liquidity you provided is your startup capital.

By mastering this, you’re not just earning in DeFi—you’re also building the knowledge to make smarter financial decisions.

Final Thoughts: Simplifying DeFi One Step at a Time

DeFi might seem complex at first, but it’s really about breaking things down into manageable steps. Farming is just one of the many ways you can participate and grow in this ecosystem. And while the terminology might sound technical, the process itself is straightforward when you understand the flow.

I hope this guide has made farming withdrawals on STON.fi feel less intimidating. If you still have questions or want to share your experience, let’s discuss in the comments below. After all, the beauty of DeFi is that we’re all learning and growing together.

2 notes

·

View notes

Text

How to Withdraw Funds from Farming on STON.fi: A Simple Guide for Everyone

If you’ve been farming on STON.fi, you might be wondering how to safely withdraw your rewards and funds when it’s time to wrap things up. Don’t worry—I’ve got you covered. Let’s break this process into simple, easy-to-follow steps so you can feel confident every step of the way.

Think of farming as planting seeds in a garden. Over time, these seeds grow into crops (your rewards), and when the time comes, you’ll need to harvest them while making sure the garden is still intact. Let’s walk through this “harvest” process.

Step 1: Claim Your Rewards (Harvest Your Crops)

The first thing you’ll want to do is claim the rewards you’ve earned. These are like the fruits of your labor—yours to enjoy.

1. Head to the Pools Page: Log in to STON.fi and navigate to the ‘Pools’ section.

2. Find Your Farm: Toggle ‘My Pools’ to display the farms where you’ve been staking your assets.

3. Check Your Positions: Scroll down to the ‘Farm Positions’ menu and select ‘My Positions.’ This will show your farming details, including the rewards you’ve earned.

4. Claim Your Rewards: Click ‘Claim Rewards,’ then confirm the transaction in your wallet.

At this point, you’ve harvested your crops (rewards), but your farmland (LP tokens) and soil (locked funds) are still intact in the system.

Step 2: Retrieve Your LP Tokens (Reclaim Your Land)

LP tokens are your proof of ownership in the liquidity pool. When you’re ready to stop farming, you’ll need to withdraw these tokens.

1. Check the Lock-Up Period: In the ‘Farm Positions’ section, look for the minus button next to your position. If it’s inactive, it means your LP tokens are still locked, and the tooltip will tell you when they’ll be available.

2. Unlock Your Tokens: Once the lock-up period ends, click the minus button and confirm the transaction in your wallet. Your LP tokens will be released.

This step ensures that you’re reclaiming your land (ownership), but the crops you planted (liquidity) are still in the pool.

Step 3: Withdraw Your Liquidity (Harvest the Remaining Crops)

Now it’s time to withdraw your original investment—the liquidity you provided.

1. Navigate to ‘My Pools’: Go back to the ‘Pools’ tab and toggle ‘My Pools.’

2. Select the Pool: Choose the specific pool where you provided liquidity.

3. View Your Liquidity Details: Scroll to the section displaying your liquidity information.

4. Withdraw Your Funds: Click ‘Withdraw,’ select the percentage you want to withdraw (or choose MAX for the full amount), and confirm the transaction in your wallet.

Once this is done, all your funds, including any remaining rewards, will be safely back in your wallet.

A Quick Note About Gas Fees

Just like a car needs fuel to run, blockchain transactions require gas fees. These fees are paid in TON on the STON.fi platform. Before you start withdrawing, make sure you have some TON in your wallet to cover these costs.

Breaking It Down: Why This Matters

Farming in DeFi is all about managing your resources wisely. Withdrawing your funds is the final step in this journey. By understanding each step—claiming rewards, unlocking tokens, and withdrawing liquidity—you’re not just securing your profits but also building confidence in navigating decentralized platforms like STON.fi.

Imagine you’re running a small business. Your crops (rewards) are like the profits, your LP tokens are the business itself, and the liquidity you provided is the capital. When it’s time to move on, you’ll want to take everything in a way that keeps your operations organized and your finances intact.

Final Thoughts

DeFi might seem complex at first, but once you break it down into relatable steps, it’s as straightforward as managing a garden or running a small business. Withdrawing your funds from STON.fi is part of the learning curve, and the more you practice, the more natural it becomes.

Whether you’re withdrawing to reinvest, save, or just take a break, remember that each step you take brings you closer to mastering the world of decentralized finance. You’ve got this!

5 notes

·

View notes

Text

How to Withdraw Liquidity From a Pool: A Step-by-Step Guide for Beginners and Enthusiasts

Let’s talk about withdrawing liquidity from a pool. At first glance, this might sound like some obscure, technical operation best left to the experts, but trust me, it’s not. If you’ve ever transferred money between your savings and checking accounts, or even cashed out a joint investment, you’ve already grasped the essence of what it means to withdraw liquidity.

Now, let me guide you through this process in a way that feels personal, relatable, and empowering. Whether you're new to the world of DeFi or just need some clarity, this guide is for you.

The Basics: What Is Liquidity Withdrawal

Think of a liquidity pool as a communal fund where participants like you and me deposit assets to facilitate trading on decentralized platforms. You’re essentially lending your assets to the pool, and in return, you earn a share of the fees generated from trades that happen in the pool.

Now, when you decide it’s time to retrieve your share—your initial deposit plus any accrued earnings—you “withdraw liquidity.” It’s that simple. It’s like owning a vending machine with others, collecting a cut of the profits, and deciding when to cash out your share.

The Step-by-Step Process

Step 1: Locate Your Liquidity Pool

Start by navigating to the "Pools" section of the platform you’re using. Once there, switch to the "My Pools" tab. This section is your personal ledger, listing all the pools you’ve contributed to.

Imagine logging into your online portfolio and seeing all the stocks or mutual funds you own. Each pool is like an individual investment account, showing you exactly where your assets are working for you.

Step 2: Select the Desired Pool

From the list, select the pool you want to withdraw from. Scroll to the bottom of the pool’s page, and you’ll find a button labeled Withdraw. This is your starting point for taking back your funds.

Think of this as walking into a bank and telling the teller which specific account you’d like to withdraw from. Simple, right?

Step 3: Decide How Much to Withdraw

Clicking Withdraw opens a window where you’ll specify how much liquidity you want to withdraw. If you’re ready to take it all, select the MAX option.

This step is like deciding how much cash to withdraw from an ATM. You might want to take only what you need and leave the rest to grow, or you might be ready to take it all out—it’s entirely up to your financial strategy and goals.

Step 4: Confirm the Transaction

After selecting the amount, click Withdraw Liquidity and confirm the transaction using your wallet. Remember, this step requires a small amount of TON (or the platform’s native token) to cover blockchain transaction fees.

Think of these fees as gas for your car. Just as you can’t drive without fuel, you can’t complete a blockchain transaction without covering the cost of its operation. Always ensure you’ve got enough TON in your wallet to keep things running smoothly.

Things to Keep in Mind

Transaction Rewards

When you withdraw liquidity, you’re not just taking back your initial deposit—you’re also collecting the rewards generated from trading fees in the pool. It’s like reinvesting dividends from a stock portfolio. Over time, these earnings can significantly boost your total return.

Impermanent Loss

This concept might sound intimidating, but let me break it down. Impermanent loss occurs when the value of the tokens you’ve contributed to the pool changes relative to holding them individually.

Imagine you own equal amounts of gold and silver. If gold's price doubles while silver's remains stagnant, your combined portfolio value in the pool might not reflect the full increase you’d get from holding gold alone. However, this "loss" becomes less relevant if the trading fees and rewards outweigh it.

A Personal Take on Liquidity Withdrawal

When I first ventured into liquidity pools, I was cautious, like anyone dipping their toes into a new financial venture. I double-checked every step, making sure I wasn’t leaving anything behind or exposing myself to unnecessary risks.

Over time, I realized that withdrawing liquidity is less about technical steps and more about understanding the underlying principles. Each withdrawal felt like cashing out a successful investment—rewarding and motivating.

Why It Matters

Learning how to withdraw liquidity isn’t just about reclaiming your funds; it’s about understanding how decentralized finance works, making informed decisions, and taking control of your financial future.

If you’ve ever wondered whether you could navigate the complexities of DeFi, let me reassure you: you absolutely can. It’s no different from learning to manage your personal finances—just with a digital twist. And as you gain confidence, you’ll find that the possibilities in this space are virtually limitless.

So, are you ready to take the next step in your DeFi journey? If you have questions or need clarification, let’s discuss them below. After all, in the world of crypto, shared knowledge is the most valuable currency of all.

6 notes

·

View notes

Text

On Thursday, Democratic Rep. Jamie Raskin, ranking member of the Committee on Oversight and Accountability, urged the committee’s chairman, James Comer, to “compel Jared Kushner to comply with document requests he has ignored and defied for over a year.” Those requests came in 2022 from the House Committee on Oversight and Reform when Democratic representatives were using the committee to investigate the very real “appearance of a quid pro quo for your foreign policy work during the Trump Administration.” The billions (with a “B”) that Kushner’s investment firm, Affinity Partners, has received from various Gulf monarchies, as well as the $2 billion (with a “B”!) he got from Saudi Arabia is orders of magnitude more than what Comer’s unsubstantiated claims against Hunter Biden are.

Raskin’s letter to Comer comes just weeks after the House committee chairman went on CNN and acknowledged when pressed, “I think that what Kushner did crossed the line of ethics.” Raskin writes that with Comer’s “recent acknowledgement” of Kushner’s ethical failures, along with the chairman’s “repeated assertions that our Committee is ‘investigating foreign nationals’ attempts to target and coerce high-ranking U.S. officials’ family members by providing money or other benefits in exchange for certain actions,’” Raskin thought it was a good time to ask Comer to put his money where his mouth is.

Comer, a man whose ethical standards seem to lie somewhere between a dungeon and a hole in the ground, responded through a spokesperson, saying, “Ranking Member Raskin’s letter to Chairman Comer is nothing more than an attempt to distract from the mounting evidence of Joe Biden’s involvement in his family’s influence peddling schemes.” What is that evidence? Nobody knows.

RELATED STORY: House Republican admits he can't find any Biden crimes

To put things into perspective, the circumstantial evidence of corruption on the part of Jared Kushner—who unlike Hunter Biden was literally a top adviser to the president of the United States—is mountainous. Meanwhile, after subpoenas and the full power of his committee, Comer has not been able to produce any evidence that Hunter Biden did anything wrong. In fact, the only evidence Comer has provided seems to prove that then-Vice President Joe Biden, with all of his responsibilities, was trying very hard to be a supportive father to his son.

On the other hand:

Jared Kushner received his top-secret clearance over the objections of two White House security specialists because of how dubious his connections with foreign money were.

Back in 2018, Saudi Crown Prince Mohammed bin Salman (MBS) reportedly bragged that Kushner was “in his pocket.”

The more details that come out about Kushner’s Affinity Partner fund, the more obvious it becomes that it is an entirely Saudi investment fund that manages “roughly $3 billion.” Committee Democrats say “99% of [that] was ‘attributable to clients who are non-United States persons.’”

Every accusation is a confession with the conservative movement. While Comer, Rep. Jim Jordan, and others hold three-ring-circus-style investigations into Hunter Biden and Joe Biden, the real organized swamp, including Jared Kushner and Donald Trump, continues to profit off of their corrupt behavior.

Sign the petition: Demand transparency about Jared Kushner’s Saudi business dealings.

Trump’s continuing legal problems, the car crash of a Republican debate, and the polling numbers defy the traditional media’s narrative that the Republican Party is even above water with voters.

28 notes

·

View notes

Text

Over 1 Million New Crypto Tokens Have Been Launched Since April: What It Means for the Market and How You Can Join the Trend

The world of cryptocurrency is evolving at an unprecedented pace. Since April, over 1 million new crypto tokens have been launched, marking a significant surge in the creation of digital assets. This explosion of new tokens highlights both the growing interest in decentralized finance (DeFi) and the increasing accessibility of blockchain technology to everyday users. Whether you're a seasoned investor or a newcomer to the crypto space, this trend presents exciting opportunities for innovation and profit. In this blog, we'll explore the reasons behind this surge in new tokens, what it means for the market, and how you can create your own memecoin on the Solana blockchain.

The Explosion of New Crypto Tokens

The creation of over 1 million new crypto tokens since April is a testament to the democratization of blockchain technology. A few years ago, launching a new cryptocurrency required extensive technical knowledge, significant financial resources, and access to a network of developers. Today, however, tools like token generators and blockchain platforms have made it possible for anyone with an idea to create and launch their own token.

This surge in new tokens is driven by several factors:

Accessibility of Token Creation Tools: Platforms like the Solana token generator have simplified the process of creating and launching new tokens. These tools are user-friendly and require little to no coding knowledge, making them accessible to a wide audience.

Rise of Decentralized Finance (DeFi): DeFi has opened up new possibilities for token creation, as developers and entrepreneurs seek to create tokens that serve specific purposes within decentralized ecosystems. From governance tokens to yield farming tokens, DeFi has fueled the demand for new crypto assets.

Popularity of Memecoins: The success of memecoins like Dogecoin and Shiba Inu has inspired countless imitators, leading to a flood of new memecoins entering the market. These tokens often go viral due to their cultural relevance and the power of community-driven marketing.

Increased Investor Interest: As more people become interested in cryptocurrency, there is a growing demand for new and unique investment opportunities. New tokens provide investors with a chance to get in on the ground floor of potentially lucrative projects.

What Does This Mean for the Crypto Market?

The launch of over 1 million new crypto tokens in just a few months is a significant development that will have lasting implications for the cryptocurrency market. Here are some of the key trends and impacts to watch:

1. Diversification of the Market

The influx of new tokens has led to a more diverse cryptocurrency market. While Bitcoin and Ethereum still dominate, the rise of new tokens has created a more fragmented market with a wide range of investment opportunities. This diversification is beneficial for investors who are looking to spread their risk across different assets and for developers who want to innovate in niche areas of the market.

2. Increased Competition

With so many new tokens being launched, competition in the crypto space has intensified. Only the most innovative and well-executed projects will stand out in a crowded market. This increased competition is driving developers to create more sophisticated and user-friendly tokens that offer real value to users.

3. Regulatory Scrutiny

The surge in new tokens has also caught the attention of regulators. As the number of tokens grows, so does the potential for scams and fraudulent projects. Regulators around the world are taking a closer look at the cryptocurrency market, which could lead to stricter regulations and oversight. This scrutiny is a double-edged sword; while it may weed out bad actors, it could also slow down innovation in the space.

4. Opportunities for Innovation

The creation of new tokens is driving innovation in the blockchain space. Developers are experimenting with new use cases, from decentralized finance and gaming to social tokens and NFTs. This wave of innovation is expanding the possibilities of what blockchain technology can achieve and is creating new opportunities for users and investors alike.

How to Create Your Own Memecoin on Solana

If you’ve been inspired by the surge in new tokens and are considering creating your own, now is the perfect time to get started. The Solana blockchain, known for its speed, low fees, and scalability, is an excellent platform for launching a new token, particularly a memecoin. Here’s how you can create your own memecoin on Solana:

1. Define Your Concept

The first step in creating a memecoin is to define your concept. What will your token represent? What is the meme or cultural reference that will make it stand out? The more relatable and viral your concept, the more likely it is to attract attention and build a community.

2. Use the Solana Token Generator

The Solana token generator is a powerful tool that simplifies the process of creating a token on the Solana blockchain. With this tool, you can easily define the characteristics of your token, such as its name, symbol, and total supply. The token generator takes care of the technical details, allowing you to focus on building your brand and community.

3. Launch Your Token

Once your token is created, it’s time to launch it on the Solana blockchain. This step involves deploying your token to the network, making it available for trading and distribution. The Solana blockchain’s high transaction speed and low fees make it an ideal platform for launching a new token, ensuring that your memecoin can be traded quickly and efficiently.

4. Build Your Community

The success of a memecoin largely depends on its community. Use social media platforms like Twitter, Reddit, and Discord to promote your token, engage with potential investors, and build a loyal following. The more people who support your memecoin, the greater its chances of going viral and achieving significant growth.

5. List Your Token on Exchanges

To increase the visibility and liquidity of your token, consider listing it on cryptocurrency exchanges that support Solana-based tokens. This step will make it easier for people to buy, sell, and trade your memecoin, increasing its potential for growth.

Why Solana Is the Best Platform for Your Memecoin

While there are several blockchain platforms available, Solana stands out as one of the best options for creating and launching a memecoin. Here’s why:

1. High-Speed Transactions

Solana can process up to 65,000 transactions per second, making it one of the fastest blockchain platforms in the world. This speed is crucial for memecoins, which often experience high trading volumes due to their viral nature. Faster transactions mean that your memecoin can be traded more efficiently, reducing the risk of missed opportunities.

2. Low Transaction Fees

Transaction fees on the Solana blockchain are a fraction of a cent, making it an affordable platform for both developers and users. This low cost is particularly important for memecoins, which often rely on a large number of small transactions.

3. Scalability

Solana’s innovative Proof of History (PoH) consensus mechanism allows the network to scale efficiently without compromising on speed or security. This scalability ensures that your memecoin can handle increasing demand as more users join your community.

4. Developer-Friendly Tools

The Solana ecosystem includes a range of tools and resources designed to make token creation and deployment as easy as possible. The Solana token generator is just one example of the user-friendly tools available to developers on the platform.

Conclusion: Join the Token Creation Revolution

The launch of over 1 million new crypto tokens since April marks a significant moment in the evolution of the cryptocurrency market. This surge in token creation is driving innovation, increasing competition, and creating new opportunities for investors and developers alike.

If you’ve been thinking about creating your own crypto token, there’s never been a better time to get started. The Solana blockchain offers the speed, scalability, and low fees you need to launch a successful memecoin. With tools like the Solana token generator, you can create your own token quickly and easily, allowing you to capitalize on the growing interest in new digital assets.

Don’t miss out on the opportunity to be part of this exciting trend. Whether you’re looking to invest in new tokens or create your own, the time to act is now. Join the token creation revolution and take your place in the future of finance.

3 notes

·

View notes

Text

Issue 4, 5/10/2023 - The Overseer

Issue Masterpost About the Overseer

This week’s news is once again accompanied by a PDF version of your latest news brought to us once again by the lovely Cheer! Pick it up right here for your viewing pleasure!

The Incident and What it Means for You

By Virtual

News of The Incident has been making its rounds around the Hermitcraft server this week, and citizens have been left wondering what carnage will be wrought as a result.

To those concerned about a second (third if you count the Mycelium resistance) civil war, rest easy. It is likely that the two perpetrators will be the only ones Doc targets. For those not affiliated with Grian or Scar, congratulations! You have free tickets to the show of a century. To those unlucky citizens affiliated with the troublemakers, it is likely The Horrors will be unrelenting. The last time Grian touched DocM77’s redstone, the Hermitcraft server experienced a civil war unlike any it had ever known. Since then, Doc has acquired new weaponry and game-breaking mechanics. The serverwide anvil launcher, goat mech, and living, breathing ender dragon have the potential to make any coming wars very bad for Grian and Scar specifically.

Sources from within the Perimeter say that Doc’s strategies will be psychological until he prepares his heavy weaponry for launch. Efforts currently seem to be focused on Grian, making his base a very dangerous place to be. The charged creeper launcher is once again an active threat, and citizens can expect everything to start breaking in ways that defy physics, reality, and all common sense. Those working for or living near the affected area may want to take shelter within Grumbot for the time being. Though Scarland is yet to be targeted, workers are already beginning to post evacuation routes and vacate the theme park, demonstrating a collective survival instinct far greater than that of their boss. This is an advisable course of action.

All citizens will be watching the events following The Incident with rapt attention. Though the consequences coming towards Grian and Scar will be fun and games, citizens should still be on the lookout to keep themselves safe. To those citizens who want to avoid all possibility of being caught in the crossfire, the safest option will be to change your identity and begin working for Joe Hills.

Now onto other news below the cut!

Astrology Corner

By Winter

Have you been feeling without guidance? Do you look at your birthday and look up your star sign and wonder, “Will the market fall, and due to my investments, I will become broke????” “Am I the capitalist?” Don’t worry, here at The Overseer, we can help you.*

Aries: Do not invest in the button, it may blow up in your face.

Taurus: I wager that you will need to invest in your local newspaper.

Gemini: Due to the rise of Etho heads across the market, you will be paid in Etho heads this week. Make room on your counter.

Cancer: Due to the rise in your boss's anger, you will take out a loan.

Leo: Your life insurance just went up due to your affiliation with GTWS/Grian.

Virgo: You will cash out on the prediction on how the TCG matches worked out.

Libra: You should invest in Redstone as it will increase rather soon.

Scorpio: You will start to see a decline in profits. Pray to the button.

Sagittarius: It will become profitable to become a ghost hunting agency.

Capricorn: You will be tipped a diamond to convince your boss to take part in the war.

Aquarius: You are advised to invest in a protection shield.

Pisces: No one will notice if you sit in front of the button all day.

All star signs: Don’t worry, you are not being watched… yet.

*Ignore how blatantly specific these are. Nothing bad will happen to you.

From the Sidelines

By StarryFelix Scar, Grian, Bdubs and Doc affiliates+

The last week on the server was chaotic to say the least. With the recent happenings on the server, several of the affiliate guilds are either in shambles or laughing about the shenanigans of their employers. Bdubs’ guild is wondering if dearest Scar’s comment section will ever recover.

The Stress affiliates are happy that she has finally returned to the Hermitcraft server, and Iskall is welcomed back with massive warmth as well. Beside some of the chaos there are most definitely some good and heartwarming moments.

Now… Grian and Scar’s little accident, which I assume people have written about already, is making the citizens in Scarland question the extent of their safety. While they are celebrating all the beautiful new visitors throughout the park (courtesy of Cleo’s amazing armour stand work) and the rising of the absolutely stunning castle, the tensions are visible.

After the intervention for Grian and the back of his base, the people in the area are questioning whether he will even get to finish it. The affiliates do not seem to be too concerned about their own safety, but this might be mainly because so many of them live underground, close to The Rift. Perhaps they’re more used to dangerous situations? The ever unexpectedly weird Grumbot might have influenced their way of looking at the world, and we may never know if this is the truth. This is, for the most part, speculation.

Generally, there still seems to be peace. The question is for how long because last time, “It all started when Grian touched my redstone,” so we don’t know what will happen. The citizens are following all of the events, the rise of tensions, the Tweets, and Youtube Comments of their affiliated Hermits on foot to partially ensure their own safety.

On a happier note, the Beef affiliates are happy that there is finally a solid base instead of just the TCG area or the starter base. It has been both a busy and calm week, and it seems that soon there might be more interesting stuff happening to report about.

For now, it seems most citizens are waiting in anticipation for what might happen next. The speculations of war are ever more present than they usually are on the Hermitcraft server… many affairs and mishaps this week.

I will be heading off and will be keeping an eye on how the citizens take all the sudden commotion that is going on. For now, this was From the Sidelines and I hope to see you in the next column!

Museum Opening!

By Ilea

This week on Hermitcraft we were able to witness an opening of a museum. Of course all of the artifacts in it were ethically sourced and through some serious convincing (and sneaking into it through the back door) we managed to prepare a short guide to it.

Starting with none other than the TCG cards, that have been taking the server by storm. The exhibit was of course donated by VintageBeef himself and we absolutely want to shine more light on it as the TCG tournament is coming to an end.

Then we can see quite a collection of artifacts that are connected to the King's Rules on the server, which includes things like the infamous "No No No No" disc and an invite to the party at which it was played. From the same collection we may find heads of both evil and good King Ren as well as multiple King's Banners and even a shield with it. Probably our favorite artifact from this collection is the "You speak when spoken to!" horn, that over the months has brought a lot of joy and earplugs to many of us.

In a carefully secured glass box we can see the "Begin?" button that opened the Rift and had us connect with the Empires. Right next to it positioned is "King Sausages Diamond of Peace" to remind us about our Empires friends. For now the button is unclickable and we can safely say that this is an actual Grianproof casing.

What is not Grianproofed are Mumbo's vaults and right next to the button we see the first vault key of the season. We are sure that he is not using it anymore, but if anyone would ever feel like trying to get into it, then copying this exhibit should work.

Right opposite we can see a mysterious creeper that had us run away scared not to break something, but then we read the label. As it turned out this was Scar's prized creeper costume that managed to scare the life out of many people. We are really glad that it is safe in the museum now and no longer in his hands.

Speaking of Scar, in this museum we can look at the Scarland VIP pass, which we all can only dream about. What lies close to it is a Zedvancement trophy that had us wondering about what it was for and an old stream day torch, that quite honestly is a blast from the past.

Upstairs we firstly can see the giant dragon head of a Dragonbro that was given to Cubfan by Bdubs. Through the great Hermit Vine we have managed to find out that it was a prize for Cub completing a quest and later used by him as his Royal Magician attire.

After that we are greeted with an array of heads, starting with the ultra rare Baldubs(Bald Bdubs) head from his head shop. Quite honestly upon seeing this we were too stunned to speak. Right next to it there is an awful lot of hair provided by a dwarven beard. We absolutely love the style of it, the braids on this thing are incredibly intricate, but we do not recommend making pictures with it.

Lastly there hangs a sad proof of how washed up our old, but still beloved Etho is. Once again we give our condolences to his pvp skill and wish him a swift recovery.

That is all of the exhibits that we managed to find, hopefully it will grow over the next months, and who knows, maybe we will have a chance to visit it again.

Lost and Found

By Virtual

The following items were collected from across the server over the past week. If you would like to report an item missing, or if you recognize any of the below items as your own, please contact us at [email protected]* *not a real email address

Item 1: A green shulker box, found on top of Zedaph’s netherite beacon. Though Zedaph seemed reluctant to give up the box, one of his affiliates delivered it to the Overseer offices last week. When opened, the box contained twelve anvils, a pair of green leather trousers, and three goat horns, all renamed to some variation of DocM77’s username. The purpose of these items is unknown, and their existence raises some concerning implications. If this box belongs to you, collect it at the Overseer offices as soon as possible.

Item 2: A nether portal without corners, found in the lagoons below Scarland Castle. The nether portal was found completely submerged yet still functioning. The portal was originally suspected to belong to DocM77; However, the goat has denied responsibility for it. When swam through, the portal dropped citizens into a strange, dark corner of the nether disconnected from any visible nether hub, despite its proximity to Scar’s portal. If this anomaly belongs to you, consider relocating the portal or putting up a sign.

Item 3: An unusable ender pearl, found in Cub’s TCG arena. When thrown, this ender pearl will not teleport the player. Instead, it returns to the user’s inventory in the same hand it was thrown from, regardless if a player is already holding something different. The ender pearl also puts out a constant stream of End ambiance no matter what biome it is in. If this item belongs to you, pick it up before next Friday. Cub has plans to begin experimenting on it.

Ask the Seers

By Seers Jester, S, Vi, and Nes

Has your favourite little guy been put into a situation they can’t get out of? Do you have questions about how a mountain appeared on top of your house last night? Question no more, for The Seers are here to help! Questions can be submitted through the ask box and are collected throughout the week.

—————————————————

Dear Seers, Today, I was just doing my usual shift at Scarland, and then BOOM!! I got Hotguyed!! And also died!! This is a near daily occurrence. My back is killing me from all the repeated injuries. Send help/advice, please. I can’t keep doing this! - Porcupine of a Popcorn Vendor

While I'm aware of a pamphlet of advice produced by the associated Scarland staff, I presume you're needing more than that. While it's not exactly feasible to never be Hotguy'd again, there are some tricks that could make things easier for you.

Option number one, actually, is to complain to your boss. While OSHA doesn't really apply here vis-a-vis entitlement to a safe working environment, he'd probably be willing to move you to a position working indoors if this is really affecting you. I heard once that he was actually able to pull some strings and ask Hotguy himself to stop bothering a particular staff member after they mentioned all the sharpness arrows were, respawn or no, making their chronic back pain flare up really bad.

Another option, if you wouldn't like to talk to your boss about it (understandable), is to get your hands on a mascot suit. Hotguy has never shot someone in a Jellie costume (I suspect some sort of deal with Scar?) and you can use that to your advantage. I'm at least ninety percent sure all employees of Scarland are entitled to wear a Jellie fursuit if they can stand it in this weather, but policies could have changed, I don't know. Maybe enough merch would be close enough?

Final option - desperate option - is to try and wear camouflage with your environment. This means being out of uniform, but also not being an obvious target for aerial attacks (or at least less obvious than someone else). This might mean breaking dress code a bit, but… Well, if someone talks to you about it you get the opportunity to explain yourself and how the Hotguy attacks have been a genuine problem for you lately, which routes back to "complain to your boss" option, minus the part where you start the confrontation. If no one bothers you about being out of uniform/in a dyed-light-maroon uniform, you're now less of a target for random velocitay attacks.

Best of luck! If this advice can't help you avoid Hotguy attacks entirely, I hope it at least lessens them!

- The Seers

_______________________________

Dear Seers, Back at it again, I used your advice on the shriekers! But I kept the TNT a bit, tested it out, and your advice worked! Now I have a tiny problem. I got a Warden chasing me around and I don't wanna kill him. I've grown attached to Bobby the Warden.. but he scares my cats and I don't have any place to keep him. Any suggestions? - Crazier Than The Beast Wranglers

Hello, Crazier Than The Beast Wranglers!

So glad our previous advice helped. Hopefully the receiver of your prank appreciated it as much as you did!

As for Bobby, I suggest asking your local beast wrangler about appropriate care tips for a Warden of his size and age. You can typically find them in or around Decked Out 2! They can also provide you with advice on housing, or you can refer to how other citizens and Hermits are housing their Wardens - such as Scars pet Warden in the tower.

The cats are an entirely different issue. You could try desensitizing them to Bobby by having them in rooms next to one another, sort of like how you’d introduce a new cat by having the new one and one room and the old cat can smell them and get used to their scent before meeting them.

Side note: keep Bobby away from fishing rods

- The Seers

ADVERTISEMENTS

By Jamie

—————————————————

Come by Tango's Citadel today to get some of the best baked goods on the server! Fellow Citizen, Azelea, has opened up a bakery and shall be catering the Hermitcitizen Masquerade Ball later this year. Don't miss the first week’s sale!

—————————————————

Watcher issues? Hello, there! I have experience avoiding Watchers and having them not be able to actually convert me. If any researchers, scientists, or people struggling with the Watchers want to come by, please do! I'll try my best to pass along what makes me unable to be converted. Location: The small house in the birch forest near Grian's base Owner: Fleur

—————————————————

Calling out to all book lovers! This Friday we shall be meeting at Bdubs’ Moss Cafe to discuss our favourite books and give out any and all recommendations! Personally, I’m looking forward to ‘The Secret Life of Sunflowers’.

—————————————————

Fun and Games

This week's fun and games are brought to you by Snuffy!

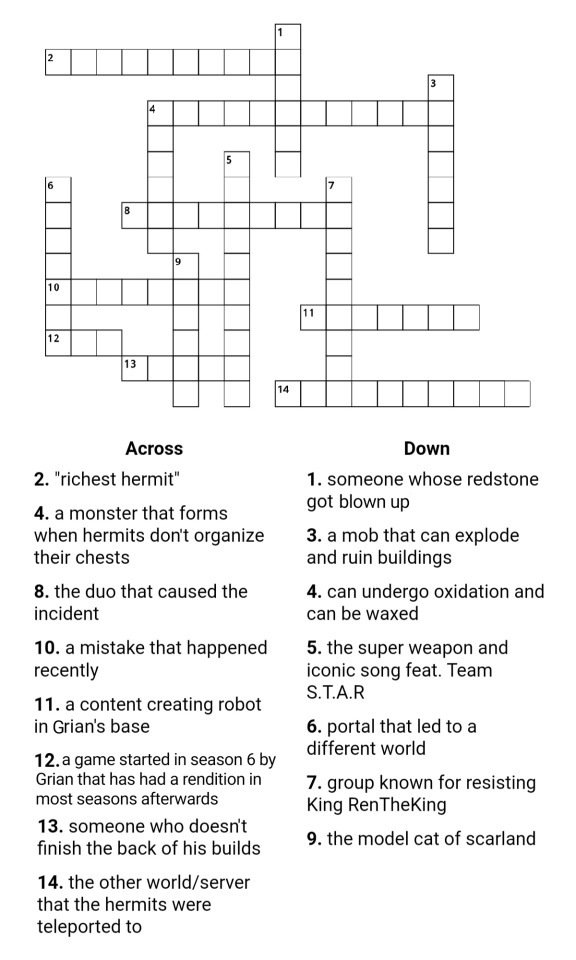

Crossword

Brain Teasers

In this game, there are four images of some sort and you need to figure out what each Brain Teaser is trying to say! For example, a brain teaser could be the word READ with lines above and below, and it would mean ‘read between the lines’. Have fun!

And that’s all for this issue folks! Thank you so much for reading, and have a wonderful week!

#issue#hermitcitizen#pdf edition#hccn astrology corner#hccn lost and found#hccn ask the seers#hccn advertisements#hccn fun and games

37 notes

·

View notes

Text

Discussion on the rationality of BitPower mechanism

Introduction With the development of blockchain technology, decentralized finance (DeFi) as a new financial model has gradually attracted widespread attention. As a member of the DeFi field, BitPower has demonstrated the potential of decentralized finance through its unique smart contract mechanism, income structure and security measures. This article will explore the rationality of BitPower mechanism and analyze its advantages in security, profitability and sustainability.

Security of smart contracts The core of BitPower lies in its smart contracts, which are deployed on the Ethereum Virtual Machine (EVM) and based on TRC20 and ERC20 standards. The code of these smart contracts is open source, ensuring the transparency and credibility of the system. Due to the immutability of smart contracts, they cannot be modified or deleted once deployed, which greatly improves the security and stability of the system. In addition, BitPower Loop adopts a completely decentralized operation mode, without centralized administrators or owners, which means that no one can unilaterally change the system rules, thus avoiding human intervention and operational risks.

Rationality of income structure BitPower's income structure is cleverly designed to encourage users to get returns by providing liquidity. Users can provide liquidity according to different time periods and obtain corresponding yields. For example, the annualized yields of 1 day, 7 days, 14 days and 28 days are 429%, 773%, 1065% and 1638% respectively. This structure not only encourages users to participate in short-term investment, but also provides considerable returns for long-term investment. At the same time, the introduction of the compound interest mechanism further enhances the observability of the returns, so that the user's investment returns can grow significantly over time.

Sustainability of the promotion mechanism BitPower's promotion mechanism aims to expand the user base by inviting new users to join, thereby enhancing the liquidity and stability of the system. Each user can become a project initiator, invite new users to join through an invitation link, and receive corresponding referral rewards. The referral reward varies according to the level of the referral, ranging from 20% of the first-generation friends to 1% of the 17th-generation friends. This hierarchical referral reward mechanism not only encourages users to actively promote, but also ensures the long-term sustainable development of the system.

Decentralized governance structure BitPower's decentralized governance structure is another important manifestation of the rationality of its mechanism. The system has no centralized manager, and all participants are equal in rules and mechanisms. This decentralized governance structure ensures the fairness and transparency of the system and avoids possible corruption and injustice in the centralized system. At the same time, decentralized governance also enhances the resilience of the system, enabling it to better cope with external attacks and internal problems.

Rationality of the economic model BitPower's economic model is reasonably designed and can effectively balance the benefits and risks of the system. Users' benefits mainly come from liquidity provision and recommendation rewards. This income structure avoids high-risk models such as Ponzi schemes while maintaining high returns. In addition, BitPower also automatically executes reward distribution through smart contracts, reducing the risks and errors of human operations and improving the efficiency and reliability of the system.

Summary Through the analysis of the BitPower mechanism, it can be seen that it has significant advantages in security, profitability and sustainability. The immutability of smart contracts and the decentralized governance structure ensure the security and fairness of the system; the reasonable income structure and promotion mechanism provide users with considerable returns while enhancing the liquidity and stability of the system; the design of the economic model effectively balances benefits and risks. In summary, BitPower's mechanism is highly reasonable and feasible in the current DeFi field, providing a powerful example for the development of decentralized finance.

Future Outlook With the continuous development of blockchain technology and DeFi ecology, BitPower is expected to play a greater role in the future. By continuously optimizing smart contracts and improving user experience, BitPower can attract more users to join and further expand its influence and market share. At the same time, with the introduction of more innovative mechanisms, BitPower is expected to make more breakthroughs in the field of decentralized finance and provide users with richer and more diverse financial services.

In short, as a decentralized financial platform, BitPower's reasonable mechanism design not only ensures the security and stability of the system, but also provides users with generous returns and continuous incentives. It is an important case worthy of attention and research in the DeFi field.

5 notes

·

View notes

Text

Impermanent Loss: What It Is and How to Navigate It in DeFi

When diving into the world of decentralized finance (DeFi), it’s easy to get excited about the potential for earning through liquidity pools. But as with any investment opportunity, there are risks involved, and one that often confuses newcomers is impermanent loss.

Let’s take a step back and talk about what impermanent loss really is, why it matters, and how you can minimize its impact while participating in DeFi platforms like STON.fi DEX. I’ll keep this simple and relatable, so by the end, you’ll feel more confident about navigating this part of the DeFi journey.

What Is Impermanent Loss

Imagine you’re running a small fruit stand. You start the day with an equal amount of apples and oranges, each priced at $1. A customer comes along and trades some apples for oranges because they like apples better. By the end of the day, oranges have doubled in price to $2 each, while apples are still $1.

If you decide to count your earnings, you’ll notice that even though you made some trades, your total value in the fruit stand might be less than if you had just held onto the apples and oranges without trading them.

That’s impermanent loss in a nutshell. In DeFi, it happens when you provide liquidity to a pool—let’s say a pair of ETH and USDT—and the price of one token changes compared to the other. Since the pool automatically balances the ratio of the two tokens, your final holdings may not reflect the profit you’d have made by simply holding onto the tokens.

Why Does This Matter in DeFi

Providing liquidity is one of the ways DeFi platforms like STON.fi DEX work. When you deposit tokens into a liquidity pool, you’re enabling other users to trade those tokens seamlessly. In return, you earn trading fees.

But here’s the catch: if one of the tokens in the pool experiences significant price changes, the automatic balancing mechanism of the pool could leave you with fewer high-value tokens and more low-value ones when you decide to withdraw your funds. This is why impermanent loss can feel like a hidden cost.

How to Think About Impermanent Loss

Impermanent loss isn’t always a deal-breaker. It’s only a loss if you decide to withdraw your funds while the token prices are imbalanced. If the prices stabilize or return to their original levels, the “loss” disappears.

Think of it like parking your car in a metered spot. You might spend a few dollars on parking, but if you made more money from what you accomplished while parked, the cost becomes negligible.

Ways to Minimize Impermanent Loss

Here’s the good news: impermanent loss can be managed, and sometimes, the rewards from providing liquidity outweigh the potential loss. Let’s talk about some strategies:

1. Use Stablecoin Pools

Stablecoins like USDT, USDC, and DAI are pegged to fiat currencies, meaning their value doesn’t fluctuate much. When you provide liquidity in pools that include stablecoins, you significantly reduce the risk of impermanent loss because the token prices stay relatively stable.

2. Choose Tokens with Similar Price Movements

If you’re providing liquidity for two tokens, look for pairs that tend to move in the same direction price-wise. For example, ETH and WETH (wrapped ETH) often have synchronized price changes, minimizing imbalance in the pool.

3. Diversify Your Liquidity Investments

Just as you wouldn’t put all your eggs in one basket, don’t put all your funds into a single pool. Diversify across different pools to spread the risk.

4. Leverage Incentives

Platforms like STON.fi DEX often provide additional incentives, such as staking rewards or bonus tokens, to offset impermanent loss. These rewards can make a significant difference, turning what looks like a loss into an overall gain.

How STON.fi DEX Makes This Easier

STON.fi DEX is a prime example of a platform that supports liquidity providers with resources and rewards to navigate these challenges. By participating in STON.fi’s liquidity pools, especially stablecoin pools, you can reduce your exposure to impermanent loss while earning competitive rewards.

Additionally, the platform’s clear design and educational tools make it easier for both beginners and experienced users to understand the risks and benefits involved. Think of it as having a map while exploring new territory—it helps you avoid unnecessary detours.

Final Thoughts: Balance Risk with Reward

Impermanent loss might sound intimidating, but it’s just one piece of the larger DeFi puzzle. By understanding it and applying strategies to manage it, you can confidently take advantage of the earning opportunities that DeFi platforms like STON.fi DEX offer.

As with any investment, it’s about balancing risk with reward. If you’re earning enough from trading fees or platform incentives, the potential impermanent loss may not matter as much.

So, the next time you hear the term "impermanent loss," think of it as a learning curve rather than a roadblock. With the right tools, strategies, and platforms, you’re well on your way to making the most of what DeFi has to offer.

3 notes

·

View notes

Text

Discussion on the rationality of BitPower mechanism