#pre-settlement loans

Explore tagged Tumblr posts

Text

California Lawsuit Loans: A Lifeline for Plaintiffs Seeking Justice

Struggling Financially While Fighting a Legal Battle? Here’s Your Solution

Imagine you’re in the middle of a legal case—perhaps a personal injury lawsuit or an employment dispute. Your case is strong, but the process is dragging on for months, even years. Bills are piling up, medical expenses are overwhelming, and your daily cost of living hasn’t paused just because you’re waiting for justice. What if you had a way to ease this financial burden and give yourself the power to fight for the compensation you truly deserve? This is where California Lawsuit Loans come in.

What Are California Lawsuit Loans?

California Lawsuit Loans are a form of pre-settlement funding that provides plaintiffs with cash advances while they wait for their cases to settle. Unlike traditional loans, these advances are non-recourse, meaning you only repay them if you win your case. This makes them a valuable financial tool for individuals struggling with financial instability during long legal battles.

Who Can Benefit From California Lawsuit Loans?

These loans are designed for plaintiffs who:

Have pending personal injury, employment, medical malpractice, or civil rights lawsuits.

Are facing financial difficulties due to medical bills, rent, or daily expenses.

Want to avoid settling for a lowball offer from insurance companies due to urgent financial needs.

Need financial stability to continue their legal fight without stress.

How California Lawsuit Loans Can Help You Win Your Case

1. Financial Stability to Fight for Maximum Compensation

Insurance companies often use delay tactics, hoping plaintiffs will become financially desperate and accept a lower settlement. With California Lawsuit Loans, you can afford to wait for a fair offer without compromising due to financial pressure.

2. No Risk – Repay Only If You Win

Unlike traditional bank loans, lawsuit loans are risk-free because they are non-recourse. If you don’t win your case, you don’t have to repay the loan. This ensures that you are not burdened with additional debt in case of an unfavorable outcome.

3. Covers Urgent Expenses

Many plaintiffs find themselves drowning in medical bills, rent payments, and daily expenses while their lawsuit drags on. A lawsuit loan helps cover these essential costs, allowing you to focus on recovery and legal proceedings rather than worrying about finances.

4. Quick and Hassle-Free Process

Getting approved for a California Lawsuit Loan is much easier than securing a traditional loan. There are no credit checks, no employment verification, and minimal paperwork involved. The loan approval is based solely on the strength of your case.

5. Levels the Playing Field Against Insurance Companies

Insurance companies have extensive legal resources and financial backing to drag out cases. Plaintiffs often settle early out of financial desperation. Lawsuit loans give you the financial backing needed to hold out for a just settlement.

The Application Process: How to Get a California Lawsuit Loan

Applying for a lawsuit loan is a simple and straightforward process:

Apply Online – Fill out a quick online application on this website.

Case Evaluation – The funding company reviews your case details with your attorney.

Approval & Offer – If approved, you receive a funding offer based on the expected settlement amount.

Get Cash Fast – Upon agreement, funds are transferred to your account within 24-48 hours.

Repay Only If You Win – You repay the loan from your settlement, and if you lose, you owe nothing.

Common Misconceptions About California Lawsuit Loans

Myth 1: “Lawsuit Loans Are Like Traditional Loans”

Truth: Unlike bank loans, these are non-recourse advances, meaning repayment is contingent on case success.

Myth 2: “Only People With Good Credit Qualify”

Truth: Your credit score and employment status don’t matter – approval is based on your case’s strength.

Myth 3: “Lawsuit Loans Are Expensive”

Truth: While there are fees, they are structured fairly, and a lawsuit loan prevents you from settling for less than you deserve.

Real-Life Example: How a Lawsuit Loan Changed a Plaintiff’s Life

Sarah, a California resident, was injured in a car accident due to another driver’s negligence. She had mounting medical bills, was unable to work, and was on the verge of accepting a low settlement. However, she secured a lawsuit loan that allowed her to cover her expenses and hold out for a fair settlement. In the end, she won a much larger compensation amount, ensuring her financial security.

Don’t Let Financial Stress Force You to Settle – Take Control Now

If you're struggling financially while waiting for your legal case to settle, California Lawsuit Loans can provide the financial relief you need. Don’t let insurance companies take advantage of your desperation—get the support you need to win your case.

Apply Now and Secure Your Future

Ready to take control of your financial situation and fight for the justice you deserve? Apply for a California Lawsuit Loan today! Visit USA Settlement Loan to get started and receive your funds in as little as 24 hours.

#California Lawsuit Loans#lawsuit funding#pre-settlement loans#legal funding California#lawsuit cash advance

0 notes

Text

Pre Settlement Loans | Lawsuit Loans

Get Relief While You Wait for Your Case to Settle!

Need financial support during your legal battle?

Loans4Lawsuits offers Pre-settlement loans, providing you with the cash you need to cover expenses while awaiting your settlement.

Get peace of mind and focus on your case with us! Let us be your ally in the legal battle.

#Settlement Loans#Lawsuit Settlement Loans#Lawsuit Loans#Pre-Settlement Loans#Loans 4 Lawsuits#Settlement Funding

1 note

·

View note

Text

Navigating Pedestrian Accident Settlement Loans

Pedestrian accidents can change your life in an instant, affecting both your physical well-being and financial stability. Coping with the aftermath of such an incident often means dealing with medical bills and lost wages that can pile up. In such challenging times, a pedestrian accident settlement loan can provide essential financial relief.

Read more about it here: https://certifiedlegalfunding.com/navigating-pedestrian-accident-settlement-loans-a-comprehensive-guide/

Check out more contents: https://certifiedlegalfunding.com/blogs/page/3/

#pre settlement funding#legal funding#certified legal funding#settlement funding#loan services#online loans#funding#lawsuit loans#settlement loans

0 notes

Text

Guide To Pre-Settlement Funding

0 notes

Text

Waquis Mortgage Quality Control offers comprehensive pre-settlement loan reviews as part of their mortgage quality control services. Their pre-funding reviews, priced at $60, include a customizable checklist and a rapid one-day turnaround, ensuring seamless business operations. This service is designed to meet clients' specifications and facilitate thorough audits before loan closing, enhancing quality control and compliance.

0 notes

Text

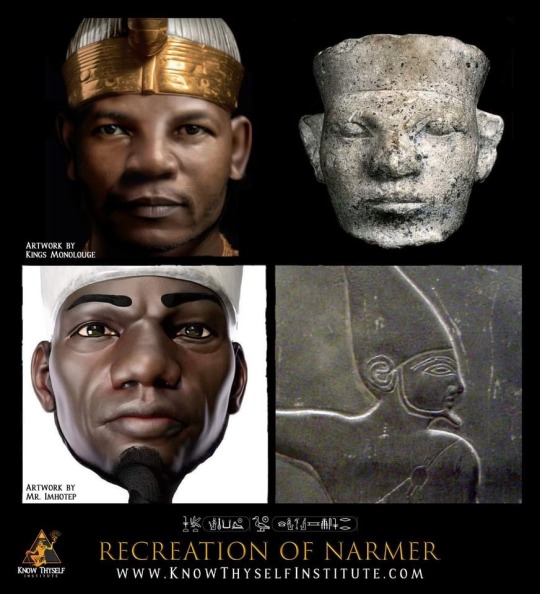

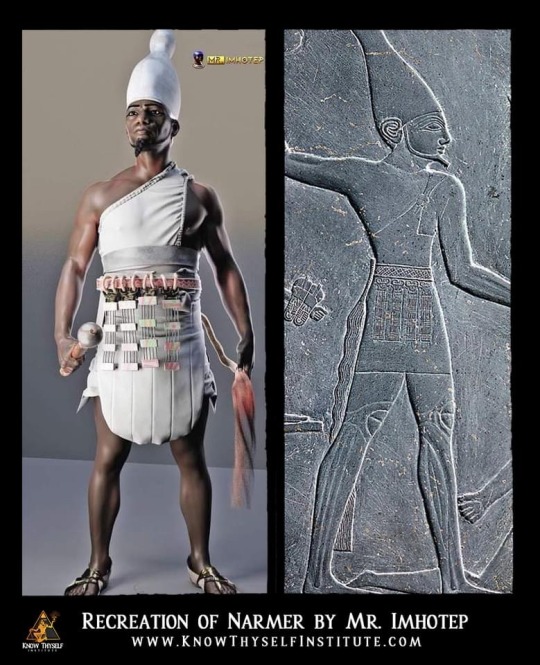

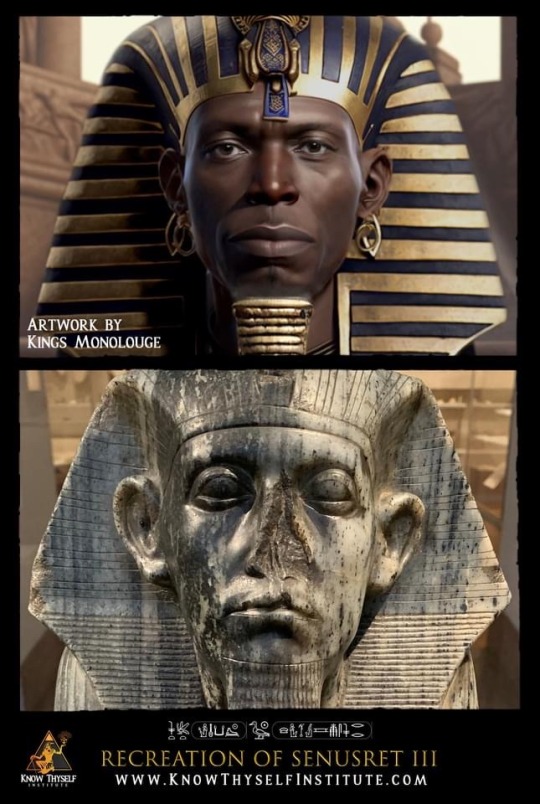

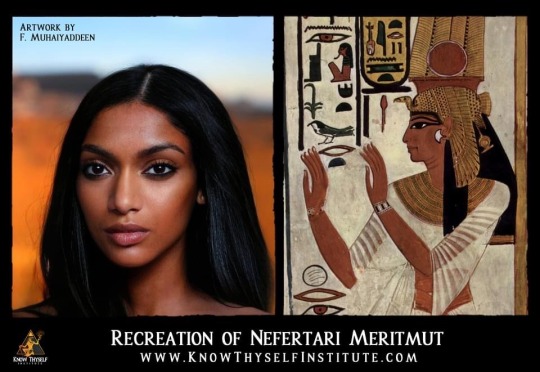

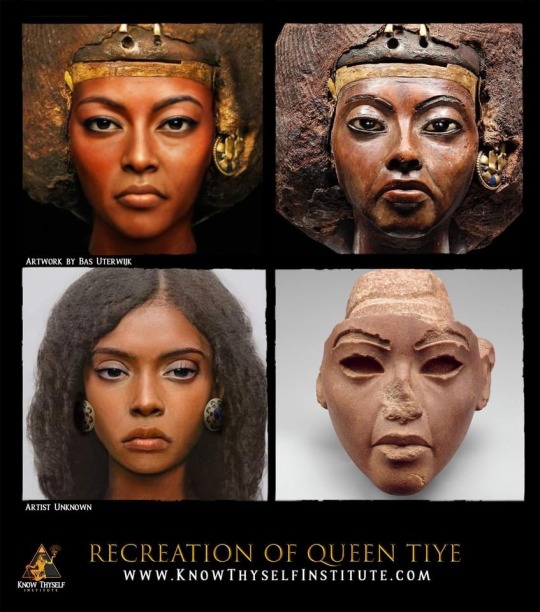

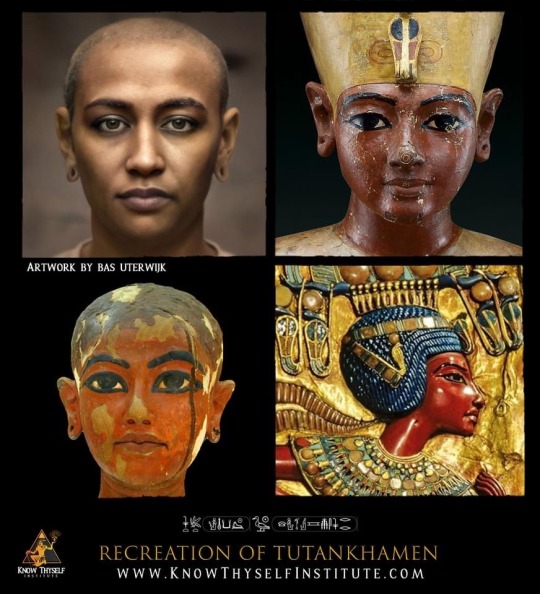

ORIGINS OF HAPI (NILE) VALLEY CIVILIZATION

The progenitors of the Nile Valley civilization were Nilo-Saharan peoples who migrated to the Hapi (Nile) Valley from the Green Sahara, Nubia and Northeast Africa. The cattle cults of Het-Heru (Hathor), spiritual beliefs, iconography and cultural motifs associated with the old Kingdom can be traced to these regions prior to the unification of the two lands. The science of mummification began in Libya with the 5600 year old Tashwinat Mummy, known as the “Black Mummy of the Green Sahara''. The Black Mummy predates the oldest Kemetic mummy by over 1000 years. Astronomy and the study of the procession of the equinox began in South Africa at the site of the Adams Calendar Stone Circle and continued at the Napta Playa Stone circle located in modern day Sudan. This 7000 year old ceremonial center dried out around 3400 BC and they transferred their knowledge into the Nile Valley. The earliest images of Pharaonic Kingship were found in Nubia at the site of Qustul were the oldest depiction of Pharaonic Kingship is shown on the Qustul incense Burner. The original populations of the Nile Valley were no different than modern Sudanese, Ethiopian, Eritrean and Somali populations of today with a mixture of western Eurasians via the Levant whom for the most part settled in the Delta region. The cultural overlap of Kush and Kemet existed from the very dawn of Hapi Valley civilization and the cultural fusion was expressed in the customs and spiritual beliefs of its early inhabitants. These ancient traditions are continually practiced in Africa to this day.

Below are the results from a genome project conducted by Dr. Shomarka Keita, a Research Affiliate and Biological Anthropologist in the Department of Anthropology at the Smithsonian Institution and Dr. A. J. Boyce, who works at the Institute of Biological Anthropology and St. John's College

Oxford University.

PROJECT MUSE

Genetics, Egypt, and History: Interpreting Geographical Patterns of Y Chromosome Variation

IV, XI, V=Nilotic African

VII, VIII=Near Eastern

235 S.O.Y. Keita and A. J. Boyce

Early speakers of Nilosaharan and Afroasiatic apparently interacted based on the evidence of loan words (Ehret, personal communication). Nilosaharan’s current range is roughly congruent with the so-called Saharo-Sudanese or Aqualithic culture associated with the less arid period (Wendorf and Schild 1980), and therefore cannot be seen as intrusive. Its speakers are found from the Nile to the Niger rivers in the Sahara and Sahel, and south into Kenya. The eastern Sahara was likely a micro-evolutionary processor and pump of populations, who may have developed various specific sociocultural (and linguistic) identities, but were genealogically “mixed” in terms of origins.

These identities may have further crystallized on the Nile, or fused with those of resident populations that were already differentiated. The genetic profile of the Nile Valley via the fusion of the Saharans and the indigenous peoples were likely established in the main, long before the Middle Kingdom. Post-neolithic/predynastic population growth, as based on extrapolations from settlement patterns (Butzer 1976) would have led to relative genetic stability. The population of Egypt at the end of the pre-dynastic is estimated to have been greater than 800,000, but was not evenly distributed along the valley corridor, being most concentrated in locales of important settlements (Butzer 1976). Nubia, as noted, was less densely populated.

Interactions between Nubia and Egypt (and the Sahara as well) occurred in the period between 4000 and 3000 BCE (the predynastic). There is evidence for sharing of some cultural traits between Sudan and Egypt in the neolithic (Kroeper 1996). Some items of “material” culture were also shared in the phase called Naqada I between the Nubian A-Group and upper Egypt (~3900-3650 BCE). There is good evidence for a zone of cultural overlap versus an absolute boundary (Wilkinson 1999 after Hoffman 1982, and citing evidence from Needler 1984 and Adams 1996). Hoffman (1982) noted cattle burials in Hierakonpolis, the most important of predynastic upper Egyptian cities in the later predynastic. This custom might reflect Nubian cultural impact, a common cultural background, or the presence of Nubians.

Whatever the case, there was some cultural and economic bases for all levels of social intercourse, as well as geographical proximity. There was some shared iconography in the kingdoms that emerged in Nubia and upper Egypt around 3300 BCE (Williams 1986). Although disputed, there is evidence that Nubia may have even militarily engaged upper Egypt before Dynasty I, and contributed leadership in the unification of Egypt (Williams 1986). The point of reviewing these data is to illustrate that the evidence suggests a basis for social interaction, and gene exchange.

236 S.O.Y. Keita and A. J. Boyce

There is a caveat for lower Egypt. If neolithic/predynastic northern Egyptian populations were characterized at one time by higher frequencies of VII and VIII (from Near Eastern migration), then immigration from Saharan sources could have brought more V and XI (Nilo-Saharan) in the later northern neolithic. It should further be noted that the ancient Egyptians interpreted their unifying king, Narmer (either the last of Dynasty 0, or the first of Dynasty I), as having been upper Egyptian and moving from south to north with victorious armies (Gardiner 1961, Wilkinson 1999). However, this may only be the heraldic “fixation” of an achieved politi- cal and cultural status quo (Hassan 1988), with little or no actual troup/population movements. Nevertheless, it is upper Egyptian (predy- nastic) culture that comes to dominate the country and emerges as the basis of dynastic civilization. Northern graves over the latter part of the predynastic do become like those in the south (see Bard 1994); some migration to the north may have occurred—of people as well as ideas.

238-239 S.O.Y. Keita and A. J. Boyce

After the early late pleistocene/holocene establishment of Afroasiatic-speaking populations in the Nile valley and Sahara, who can be inferred to have been predominantly, but not only V (and XI), and of Nilosaharan folk in Nubia, Sudan, and Sahara (mainly XI and IV?), mid- holocene climatic-driven migrations led to a major settlement of the valley in upper Egypt and Nubia, but less so in lower Egypt, by diverse Saharans having haplotypes IV, XI, and V in proportions that would significantly influence the Nile valley-dwelling populations.

These mid-Holocene Saharans are postulated to have been part of a process that led to a diverse but connected metapopulation. These peoples fused with the indigenous valley peoples, as did Near Easterners with VII and VIII, but perhaps also some V. With population growth the genetic profiles would become stabilized. Nubian and upper Egyptian proximity and on some level, shared culture, Nubia’s possible participation in Egyptian state-building, and later partial political absorption in Dynasty I, would have reinforced biological overlap (and been further “stabilized” by ongoing population growth).

Source:

https://muse.jhu.edu/article/187884

HEAD to HEAD: Ancient Egypt Reconstructions COMPARED (Bas Uterwijk vs TKM): https://www.youtube.com/watch?v=E8iN6EFVTbQ&t=35s

Visit A Virtual Museum:

https://www.knowthyselfinstitute.com/museum

"I have not spoken angrily or arrogantly. I have not cursed anyone in thought, word or deeds." ~35th & 36th Principals of Ma'at

146 notes

·

View notes

Text

Unknown ancient languages in the area of modern day Finland

Before the arrival of Western Uralic languages, which eventually developed into the Sámi languages and Finnish, there were already earlier languages being spoken in the area of modern day Finland. These ancient languages are completely unknown to us; after all, their cultures did not write. However, some names and words from those languages still live on as they were loaned into Sámi and Finnish and are still in use.

The prevalence of these loan words is higher in Sámi than in Finnish: as much as third of the words in Sámi languages are of unknown origin. The Sámi linguist Ante Aikio has been able to find at least two different ancient languages which the Sámi languages loaned words from in the area. The southern language he has dubbed Paleo-Lakelandic, the northern one Paleo-Laplandic. Before the arrival of Western Uralic languages, there had already been human settlements in Finland for nearly 10 millenia.

The first wave of Western Uralic languages came from the group whose Western Uralic dialect eventually developed into the Proto-Sámic language. As established, they loaned a lot of words from these ancient languages in Finland. The Finnish language has a more complicated origin, geographically. I'll write it with a smaller font as it is kind of off-topic but if you're interested:

The sister of Proto-Sámic is Proto-Baltic Finnic, which was born when Western Uralic dialects west of modern day Central Russia split into Proto-Finnic and Mordvinic lanugages. At this state, they loaned words from the ancient language of the Comb-Ceramic culture. Some of Proto-Finnics started living together with the Indo-European Baltic speakers, resulting in the birth of the Proto-Baltic Finnic language. This community was bilingual; possibly even for a thousand years. This explains the massive amount of Baltic loan words in Finnish. This community also loaned words from the earlier languages of the Baltic (before the arrival of Baltic or Proto-Baltic Finnic languages), mainly names of different kinds of fish.

After this, the Proto-Baltic Finnic language spread over the gulf to Southern Finland and encountered ancient languages of Finland it borrowed words from. Eventually, it encountered (and mixed with) Proto-Sámic. This mixing resulted in the birth of Finnish (or rather, its different dialects) as its separate language. Similarly, in the more northern areas, the Proto-Sámic language split into the different Sámi languages of modern day.

This process was slow. In the 17th century, there were still the last speakers of a Sámi language in Kainuu, for example. However, they mixed with and switched to Finnish centuries ago. And similarly, there were possibly still pre-Sámi languages spoken in the north of Fennoscandia during the Medieval times. They switched to speaking Sámi, much like Sámi-speakers in more southern areas switched to speaking Finnish.

Some words (note these are educated guesses):

The words "kontio" (bear) and "nuotio" (campfire) possibly came to Finnish through Sámi, originally from Old Lakelandic. Also through Sámi, from Old Laplandic, are the words "mursu" (walrus), "norppa" (ringed seal), and "kiiruna" (rock ptarmigan).

Some words that were loaned from ancient languages directly to Proto-Finnish without the Sámi middleman include "niemi" (small peninsula), "saari" (island), and "vuori" (mountain, hill).

Many place names in Finland have names that seem to originate from ancient languages as well, such as Saimaa, Inari and Päijänne.

The text is translated and condensed from Ennen suomea ja saamea Suomen alueella puhuttiin lukuisia kadonneita kieliä — kielitieteilijät ovat löytäneet niistä jäänteitä (Prior to Finnish and Sámi, multiple lost languages were spoken in the area of Finland — linguists have found relicts of them).

19 notes

·

View notes

Text

My grandmother wanted me to call about this loan offer I got to see about paying off her loan, because she isn't able to pay it since she lost her VA so I've been paying it and we were hoping to get a lower rate.

I am pre-qualified for a loan of $18,500, but I'm already approved for this other thing. It's a like debt consolidation program. So they would take my previous debt consolidation loan, my PayPal credit line and my PayPal credit card. I'd pay them $302 a month I think it was for 36 months and they would work with those companies to get settlements so they would all be paid off within the timeframe. That would save me $250 a month and pay off two more of my bills.

So I'm looking into the company but I think I'm going to do it? That sounds like a smart idea. I want to talk to my grandmother about it since I was supposed to do this for her loan, so I want to make sure she's not upset about that and she's on the phone right now. But an extra $250 a month would be a pretty big shift in my finances, which kind of sucks that little bit would help but it would lmao.

3 notes

·

View notes

Text

President Joe Biden’s Student Loan Forgiveness Plan Struck Down

By Tannu Punn, The State University of New York Cortland, Class of 2025

July 13, 2023

President Joe Biden lost a Supreme Court case on June 30th, but so did all the millions of student loan borrowers that would have saved thousands in debt. In August 2022, the Biden-Harris Administration introduced the student loan forgiveness plan to help working and middle-class federal student loan borrowers transition back into regular payment after COVID-19-related support ended. This plan included up to $20,000. To be eligible for this forgiveness, Pell Grant recipients could receive up to $20,000, while non-Pell Grant recipients could receive up to $10,000 if their individual income is less than $125,000 or $250,000 for households. [1]

The challengers of the student loan forgiveness plan in Biden v. Nebraska were six states with Republican attorney generals who argued that the loan forgiveness plan violated several federal laws and the HEROES Act. However, to successfully strike down this lawsuit, the plaintiffs had to prove that the policy injured a party or multiple parties; it is not enough to say that the plaintiffs disagreed with the policy. Chief Justice Roberts claimed that the student loan forgiveness plan did not follow through with the Heroes Act because the Act gives the secretary of education the right to modify and waive laws governing student loans and not completely "transform them." Roberts also mentioned how in previous years, laws were waived for a legal requirement, but in the case of this student loan forgiveness program, there was no such thing. [2] If Congress wanted to give the secretary of education the power to "make vast economic and political significance decisions," it must say it in clear words and the HEROES Act did not say such a thing. Justice Barret joined the majority's opinion with a concurring opinion stating that the Biden administration went beyond what Congress could have reasonably understood to be granted in the HEROES Act.

Shortly after Biden lost the case, he announced how the administration may be able to continue to support relief for student loan borrowers with the use of the Higher Education Act of 1965. The Department of Education issued a notice on July 18th, which is the first step in issuing regulations and following this public hearing, the Department will finalize the issues to be addressed through rulemaking. As this Act allows "compromise and settlement authority," the Administration finalized the SAVE program (Saving on Valuable Education) which will cut borrower's monthly payments in half. [3] More specifically, the SAVE program will allow:

· For undergraduate loans, the amount that borrowers have to pay will be cut in half from 10% to 5% of discretionary income

· Forgive loan balances after 10 years and not 20 years for loan borrowers with $12,000 or less

· If borrowers make their monthly payments, there will be no charge for unpaid interest rates -- even if the monthly payment is $0.

In addition to the SAVE program, there is also an "on-ramp" program for repayment starting October 1st. During this period, borrowers will not face the threat of default or harm to their credit score if they miss monthly payments. [4]

Although this new plan is going to longer to officially start, as it must go through various rule-making federal hearings, Biden is confident that it will not face any legal issues like his previous plan under the HEROES Act did.

______________________________________________________________

[1] https://studentaid.gov/debt-relief-announcement

[2] https://www.scotusblog.com/2023/06/supreme-court-strikes-down-biden-student-loan-forgiveness-program/#:~:text=Supreme%20Court%20strikes%20down%20Biden%20student%2Dloan%20forgiveness%20program,-By%20Amy%20Howe&text=By%20a%20vote%20of%206,%24400%20billion%20in%20student%20loans.

[3] https://www.whitehouse.gov/briefing-room/statements-releases/2023/06/30/fact-sheet-president-biden-announces-new-actions-to-provide-debt-relief-and-support-for-student-loan-borrowers/

[4] https://www.boston.com/news/politics/2023/07/10/biden-has-a-plan-b-for-student-loan-forgiveness-heres-how-it-works/

2 notes

·

View notes

Text

Ohio Lawsuit Loans: A Lifeline for Plaintiffs in Financial Need

Facing a Legal Battle? What If You Didn’t Have to Struggle Financially?

Imagine this: You’ve been injured in an accident, wrongfully terminated from your job, or involved in a legal dispute that isn’t your fault. Your case is strong, but the legal process is dragging on for months or even years. Meanwhile, medical bills, rent, and daily expenses keep piling up. Your savings are running dry, and the settlement that could change your life is still far away. How do you survive financially while waiting for justice?

This is where Ohio lawsuit loans come in. They are designed to help plaintiffs like you stay afloat, covering essential expenses until your case is settled. But how do they work, and are they the right choice for you? Let’s dive deep and explore how Ohio lawsuit loans can be the financial relief you need during these trying times.

What Are Ohio Lawsuit Loans?

Ohio lawsuit loans (also known as pre-settlement funding) provide financial support to plaintiffs awaiting settlement payouts. These loans are not traditional loans. Instead, they are non-recourse advances, meaning you only repay the funds if you win your case. If you lose, you owe nothing.

Unlike bank loans or payday advances, lawsuit funding is based on the strength of your legal claim, not your credit score or employment history. This makes it an excellent option for those who need financial help but may not qualify for traditional lending options.

The Pain Points: Why Do Plaintiffs Need Financial Help?

When you’re involved in a legal battle, financial strain can hit hard. Here are some of the common challenges plaintiffs face:

1. Medical Bills Keep Piling Up

A personal injury case often means hefty medical expenses. Treatments, surgeries, medications, and therapy costs can quickly become overwhelming, especially if you’re unable to work.

2. Lost Wages and Income

Legal battles can prevent you from working, making it difficult to cover basic needs like rent, mortgage, and utilities. Without a steady income, many plaintiffs struggle to keep up with monthly expenses.

3. Pressure to Settle for Less

Insurance companies and defendants often take advantage of plaintiffs’ financial struggles, offering lowball settlements in hopes that they’ll accept out of desperation. Ohio lawsuit loans allow you to hold out for a fair settlement rather than settling for less due to financial pressure.

4. Everyday Living Expenses Don’t Stop

Whether it’s groceries, child care, or transportation, daily expenses don’t pause just because you’re in a lawsuit. Having financial support ensures that your quality of life isn’t completely disrupted.

How Do Ohio Lawsuit Loans Work?

Applying for Ohio lawsuit loans is simple and involves just a few steps:

Step 1: Apply Online

Fill out a quick and easy application form on a trusted lawsuit funding website like USA Settlement Loan. You won’t need a credit check or employment verification.

Step 2: Case Review

The lender works with your attorney to evaluate the merits of your case. If your case has a high likelihood of success, you’ll receive a funding offer.

Step 3: Receive Funds

Once approved, you’ll get cash in as little as 24-48 hours. You can use this money to pay medical bills, rent, utilities, or any other essential expenses.

Step 4: Repay Only If You Win

If your case settles successfully, the repayment comes directly from your settlement. If you lose the case, you owe nothing. There’s no risk of financial burden beyond what you receive in your settlement.

Benefits of Choosing Ohio Lawsuit Loans

Risk-Free Funding: Since it’s a non-recourse loan, you don’t have to worry about repayment if you lose your case.

No Credit Checks or Employment Verification: Approval is based on your case strength, not your financial history.

Quick Access to Cash: Get funds in as little as 24-48 hours after approval.

Freedom to Fight for a Fair Settlement: No need to accept lowball offers due to financial pressure.

Covers Essential Expenses: Use the money for medical bills, rent, food, or any urgent needs.

Who Qualifies for Ohio Lawsuit Loans?

If you’re involved in any of the following cases, you may qualify:

Personal Injury (Car Accidents, Slip & Fall, Medical Malpractice)

Workers’ Compensation Claims

Wrongful Termination

Product Liability Cases

Civil Rights Lawsuits

Even if your case isn’t listed, you can still apply and see if you qualify.

Make the Right Choice: Get Financial Relief Today

Legal battles are stressful enough without financial hardship adding to your burden. Ohio lawsuit loans provide the breathing room you need to stay financially stable while waiting for your settlement. Don’t let financial struggles force you into an unfair settlement—get the support you need to fight for the compensation you deserve.

If you’re struggling financially while your case is ongoing, apply now at USA Settlement Loan and get the cash you need to stay afloat. Your case is strong—don’t let financial stress weaken your fight for justice!

#Ohio lawsuit loans#pre-settlement funding#lawsuit cash advance#legal funding Ohio#financial help for plaintiffs

0 notes

Text

Lawsuit Funding Solutions | Loans 4 Lawsuits

Get the Financial Support You Need at the Time!

Loans4Lawsuits provides lawsuit funding solutions, including lawsuit loans and settlement loans, to individuals involved in legal proceedings.

With our quick and hassle-free process, we offer financial assistance to help cover legal expenses while awaiting a settlement.

Trust Loans4Lawsuits for reliable funding in times of legal need.

#Lawsuit Funding#Settlement Loans#Lawsuit Loans#Loans 4 Lawsuits#Financial Support#Pre Settlement Funding

1 note

·

View note

Text

Navigating Pedestrian Accident Settlement Loans

Pedestrian accidents can change your life in an instant, affecting both your physical well-being and financial stability. Coping with the aftermath of such an incident often means dealing with medical bills and lost wages that can pile up. In such challenging times, a pedestrian accident settlement loan can provide essential financial relief.

youtube

Read more about it here: https://certifiedlegalfunding.com/navigating-pedestrian-accident-settlement-loans-a-comprehensive-guide/

Check out more contents: https://certifiedlegalfunding.com/blogs/page/3/

#pre settlement funding#legal funding#certified legal funding#settlement funding#loan services#online loans#funding#lawsuit loans#settlement loans#Youtube

0 notes

Text

Why Choosing a Mortgage Broker in South Yarra Can Save You Thousands

When it comes to securing a home loan, making the right choice can mean the difference between saving thousands of dollars or paying more than necessary. A mortgage broker in South Yarra provides access to a broad range of lenders, negotiates competitive rates, and helps you find the most suitable loan for your financial situation.

What Does a Mortgage Broker Do? A mortgage broker acts as an intermediary between borrowers and lenders, offering expert guidance throughout the loan process. Unlike banks, which only promote their own products, brokers compare multiple lenders to find options that best suit your needs. This personalised approach ensures you secure a loan with favourable terms, competitive interest rates, and flexible repayment options.

The South Yarra Property Market South Yarra is known for its vibrant real estate market, making it crucial to work with a broker who understands the local landscape. Whether you’re purchasing a home or investing in property, a mortgage broker can help you navigate the competitive market, ensuring you secure financing tailored to your circumstances.

How a Mortgage Broker Saves You Money Working with a mortgage broker in South Yarra can lead to substantial financial savings in several ways:

• Lower Interest Rates: Brokers have access to exclusive loan products that aren’t always available directly to borrowers. • Fee Reductions: Brokers negotiate on your behalf to minimise hidden fees and unnecessary costs. • Loan Structuring: They ensure your loan is set up to align with your long-term financial goals, potentially saving you thousands over time. • Time Savings: Instead of comparing lenders yourself, a broker does the legwork for you, ensuring a hassle-free experience. • Commercial Finance in Melbourne: How a Broker Helps If you’re seeking commercial finance in Melbourne, a mortgage broker can provide invaluable assistance. Whether you're a business owner, investor, or developer, brokers offer access to commercial loan options that suit various needs. They help structure loans efficiently, ensuring you obtain the best possible deal while maintaining financial stability.

The Mortgage Application Process Brokers streamline the mortgage application process by:

• Assessing your financial situation and goals. • Researching and comparing multiple loan options. • Assisting with documentation and pre-approvals. • Negotiating with lenders for favourable terms. • Guiding you through settlement and beyond.

Mistakes to Avoid When Choosing a Mortgage Broker

Not Checking Credentials: Always ensure your broker is licensed and experienced. Overlooking Loan Terms: Understand all fees and conditions before signing any agreement. Ignoring Market Comparisons: A good broker will compare multiple lenders, so don’t settle for just one offer.

Final Thoughts

Choosing a mortgage broker in South Yarra can be a game-changer when securing a home or commercial loan. With access to multiple lenders, expert negotiation skills, and tailored financial advice, brokers help you save money and find the right loan for your needs. Whether you’re a first-time buyer or an experienced investor, working with a trusted broker can simplify the process and ensure you make the best financial decisions.

1 note

·

View note

Text

Simplifying the Home Loan Process with Expert Guidance

Securing a home loan in Australia involves key steps, from consulting a mortgage broker to final settlement. For first-time buyers, exploring first home buyer loan offers can make the process smoother. Additionally, consolidating debt into a home loan may offer a more manageable repayment plan, helping you achieve homeownership with ease.

The first step in the home loan process is consulting a mortgage broker. They assess your eligibility, explain loan features like interest rates and fees, and explore options like consolidating debt into a home loan. Brokers also present first home buyer loan offers and guide you through the process to ensure you’re confident moving forward.

Once you've reviewed your eligibility and chosen a suitable loan, you'll need to submit your application. This includes providing basic details like your name, address, employment history, income, and liabilities, along with supporting documents for a thorough assessment.

After receiving your application, the broker conducts a preliminary assessment, verifying your details, calculating borrowing capacity, and evaluating options like consolidating debt into a home loan. They compare lenders, including first home buyer loan offers, and may request additional info. Once verified, the broker prepares the final documentation for your review and signature.

After you sign the final application documents, your mortgage broker submits them to the lender. The lender will assess your application based on their criteria and may request additional documents. This process can take a few weeks, depending on the loan's complexity and the lender’s requirement.

Once your application is submitted, the lender will assess it against their guidelines, conduct a credit check, and arrange a property valuation. If your application meets the criteria, you will receive conditional or pre-approval, valid for up to three months. If all checks are satisfactory, the lender will issue unconditional approval, confirming your loan approval. After formal approval, the lender sends a loan offer and contract for review. You can consult a solicitor before signing. Once signed, the loan is settled. For purchases, the solicitor manages ownership transfer; for refinancing, including consolidating debt into a home loan, the new lender pays off the existing loan. First-time buyers should explore first home buyer loan offers. After the loan is advanced, you’ll be notified, and ownership is complete.

As your mortgage broker, our support continues beyond settlement. Our customer care team offers annual reviews to ensure your mortgage stays on track. We assist with adjustments like switching loan products or modifying repayment frequencies. We also monitor your property’s value to help you make informed decisions about your equity, whether you're considering an investment property or moving to a new home.

The home loan application process can be straightforward with the right guidance. By working with a mortgage broker like us, providing the necessary documentation, and understanding each stage, you can secure a loan that aligns with your financial goals, whether you're consolidating debt into a home loan or exploring first home buyer loan offers.

0 notes

Text

Mortgage Brokers: Your Shortcut to the Best Home Loan

Buying a home is one of the most significant financial decisions ever, and finding the right mortgage can be overwhelming. With countless lenders, interest rates, and loan options available, navigating the mortgage market can feel like a maze. This is where mortgage brokers come in—as a top rated Mortgage Broker in South Jordan, Utah, your ultimate shortcut to securing the best home loan.

What is a Mortgage Broker?

A licensed professional mortgage broker acts as a middleman between borrowers and lenders. Unlike banks, which only offer loan products, mortgage brokers can access a wide range of loan options from multiple lenders. They aim to help you find the best loan terms based on your financial situation and homeownership goals. By assessing your economic status, credit history, and loan preferences, a mortgage broker works to match you with a lender that meets your needs.

Mortgage brokers also stay updated with industry trends and changes in lending regulations, ensuring you receive the most relevant advice.

Whether you are a first-time homebuyer or an experienced property investor, a mortgage broker can provide insights into loan structures, fixed and variable interest rates, and repayment options that suit your financial outlook.

Benefits of Using a Mortgage Broker

Access to More Loan Options

Mortgage brokers work with multiple lenders, giving you access to loan products you might not find independently. Some lenders exclusively work with brokers, meaning you could access better deals than those publicly available.

Saves You Time and Effort

Instead of researching and comparing loans, a broker does the heavy lifting—gathering loan offers, negotiating terms, and handling paperwork. This allows you to focus on other aspects of the home-buying process, such as house hunting and financial planning.

Expert Advice and Guidance

Brokers understand the complexities of the mortgage market and can help you navigate tricky financial situations, such as self-employment income or low credit scores. They analyze your financial health and recommend options that align with your long-term goals, ensuring you make an informed decision.

Better Interest Rates and Terms

Because brokers have established relationships with lenders, they can often secure better interest rates and terms than you might get by going directly to a bank. They negotiate on your behalf to find a mortgage with favorable conditions, potentially saving you thousands of dollars over the loan term.

Smooth Application Process

A broker assists with all the documentation and ensures the process runs smoothly, reducing stress and potential delays. They guide you through pre-approval, application, and final settlement, making the process more efficient and less daunting.

How to Choose the Right Mortgage Broker

Not all mortgage brokers are the same, so it's essential to do your research. Here are a few key things to look for:

Experience and Reputation: Check online reviews and ask for recommendations. An experienced broker with a solid reputation is more likely to secure better loan deals and provide reliable advice.

Licensing and Credentials: Ensure they are properly licensed and accredited. Mortgage brokers should hold the necessary certifications and be part of recognized industry bodies.

Transparency: A good broker should clearly explain fees, commissions, and loan options. Be wary of brokers who are not upfront about their fees or seem to push specific lenders without explanation.

Communication: Choose someone responsive and willing to answer your questions. A mortgage broker should proactively keep you informed throughout the process and address any concerns you have.

A mortgage broker can be a game-changer when finding the right home loan. Providing access to more lenders, better rates, and expert guidance makes the mortgage process easier and more efficient. Whether you're a first-time homebuyer or looking to refinance, working with a mortgage broker is a smart move that can save you time, money, and stress.

If you're in the market for a home loan, consider partnering with a trusted mortgage broker—your shortcut to the best home loan! Their expertise and industry knowledge will give you a competitive edge, ensuring you secure a loan that aligns with your financial goals and sets you on the path to successful homeownership.

0 notes