#pre seed funding

Explore tagged Tumblr posts

Text

Kickstart Your Startup with Pre-Seed Funding

Secure essential early-stage capital with Pre-seed Funding. This initial investment helps turn your innovative idea into a viable business. Use the funds to develop your product, conduct market research, and build a strong foundation, setting the stage for future growth and success.

1 note

·

View note

Text

#startup investment process#investment process#start up funding process#pre seed startup funding#startup pitch#investment funding

0 notes

Text

A 2025 Guide: Raising Seed Funding for Your UAE Startup

Starting a business is exciting but challenging, especially when securing the necessary funds to get your idea off the ground. Many startups struggle in their early years due to a lack of funding, making seed funding essential for their survival and growth. The UAE has emerged as a thriving hub for startups, offering various funding opportunities. But how do you raise seed funding for your UAE startup? This guide will walk you through the essential steps and strategies to secure early-stage funding and kickstart your business.

Where to Find Seed Funding for Your UAE Startup

Securing seed funding requires knowing the right sources to approach. Here are some key avenues for raising funds in the UAE:

Angel Investors

Angel investors are high-net-worth individuals (HNIs) who invest in startups in exchange for equity. They not only provide funding but also mentorship and networking opportunities. Some renowned angel investment networks in the UAE include Dubai Angel Investors and Falcon Group.

Early-Stage Venture Capital (VC) Firms

Early-stage VCs specialize in high-risk investments and can provide significant capital for startups with growth potential. Some well-known early-stage VC firms in the UAE are Global Ventures, Wamda Capital, and BECO Capital.

Incubators & Accelerators

Startup incubators and accelerators in the UAE offer not only funding but also mentorship, office space, and resources. Programs like Hub71 and Dubai Future Accelerators help startups refine their business models and scale efficiently.

Government Grants & Initiatives

The UAE government actively supports startups with various funding programs that don’t require equity dilution. Programs like the Mohammed Bin Rashid Innovation Fund (MBRIF) and the Abu Dhabi Investment Office (ADIO) provide financial aid to innovative businesses.

Crowdfunding Platforms

Startups with a strong community presence can leverage crowdfunding platforms to raise funds from a large pool of investors. Platforms like Eureeca and Beehive have helped numerous startups in the UAE raise capital.

Corporate Funding & Strategic Partnerships

Large corporations and industry-specific accelerators offer funding, resources, and market access to promising startups. Companies often invest in startups aligned with their strategic goals, making corporate funding a valuable option.

How to Secure Seed Funding for Your UAE Startup

Raising seed funding requires a strategic approach. Here are some key steps to improve your chances of securing investment:

Develop a Scalable Business Model

Investors look for startups with a clear path to scalability and profitability. Your business model should outline your revenue streams, target market, and long-term growth strategy.

Create a Compelling Pitch Deck

A strong pitch deck is crucial to attracting investors. Since investors spend only a few minutes reviewing a pitch, your presentation should be concise, engaging, and informative. Include key elements such as:

The problem you are solving

Your unique value proposition

Market opportunity and target audience

Business model and revenue strategy

Market traction and achievements

Funding request and proposed equity dilution

Leverage Market Research & Data

Investors prefer data-driven decisions. Conduct thorough market research to showcase demand for your product or service. Present key metrics like competitor analysis, customer traction, and potential market expansion opportunities.

Participate in Pitching Competitions

Pitching competitions provide an excellent opportunity to secure funding, gain industry recognition, and receive valuable feedback from experts. Popular startup pitching competitions in the UAE include:

Make It In The Emirates (MIITE)

GITEX Future Stars

Supernova Challenge

Green Shoots Startup Pitch Competition

Network at Startup & Investment Events

Networking is essential for raising seed funding. Attend events like the International Investor Summit (IIS) and Dubai Startup Networking Event to connect with potential investors and industry leaders.

Build Relationships with Investors

Before pitching for funding, engage with investors through social media, industry panels, and investment forums. Understanding their interests and investment criteria allows you to tailor your pitch for better chances of success.

Conclusion

Raising seed funding for your UAE startup requires a well-defined strategy, extensive networking, and a compelling business case. With various funding sources available, including angel investors, VCs, government grants, and crowdfunding platforms, startups in the UAE have multiple opportunities to secure early-stage capital. By refining your pitch, participating in startup events, and building investor relationships, you can increase your chances of success and take your business to new heights.

FAQs

1. What is seed funding, and why is it important? Seed funding helps startups develop their product, conduct market research, and launch operations. It plays a crucial role in transforming an idea into a viable business.

2. What’s the difference between pre-seed and seed funding? Pre-seed funding is used for validating ideas and creating prototypes, while seed funding supports business operations, product development, and market expansion.

3. How can a startup qualify for seed funding in the UAE? Startups must demonstrate market demand, scalability, and a strong value proposition. A compelling pitch deck, solid business model, and networking efforts can improve chances of securing funding.

4. Can international startups raise seed funding in the UAE? Yes, international startups can secure funding in the UAE if they comply with local business regulations and set up a legal entity. Joining incubators and attending startup networking events can increase funding opportunities.

0 notes

Text

Looking to scale your business efficiently? Mulligan Valley Partners offers expert Startup advisoring services tailored to your needs. From strategic planning to securing funding, we guide startups toward success. Trust our experienced advisors to help you navigate challenges and achieve growth. Visit Mulligan Valley Partners today to elevate your startup’s potential and thrive in a competitive market!

1 note

·

View note

Text

Master Startup Funding: Pre-Seed to IPO Explained

Funding is the lifeblood of any startup. Without it, businesses can stall, unable to move forward or achieve their growth potential. Securing the right funding at the right time is crucial for survival and scaling. In fact, lack of funds is the second most common reason for startup failure, affecting 29% of failed ventures. To avoid becoming part of this statistic, understanding the different stages of startup funding from pre-seed to IPO is essential. This blog will guide you through each funding stage, providing a roadmap for raising capital effectively.

What is Startup Funding?

Startup funding involves raising capital to transform an idea into a viable business and sustain its operations. It’s critical for startups to secure funding not just for survival, but for growth in a competitive market. Funding can come from individual investors, such as angel investors, or institutions like venture capital firms. Timing is key; raising funds too early or too late can both have detrimental effects. This blog outlines the steps to help you navigate the timing and methods of raising funds effectively.

Stages of Startup Funding

Startups typically follow a sequential process to secure funding, although some may skip stages based on their growth trajectory.

1. Pre-Seed Funding

Objective: Validate the startup idea, conduct primary market research, and develop a prototype.

Pre-seed funding helps entrepreneurs move from an idea to a tangible business concept. This stage often involves bootstrapping, using personal savings, or seeking support from friends and family. Occasionally, early-stage angel investors may contribute. It’s crucial to keep equity dilution below 15% when seeking external funding.

2. Seed Funding

Objective: Test market traction by building a Minimum Viable Product (MVP) and hiring a core team.

Seed funding is the first major external investment stage. It nurtures the startup idea by providing the resources needed to test the market. Angel investors, early-stage venture capitalists, and crowdfunding are common sources. Ideally, equity dilution at this stage should be between 10% and 20%.

3. Early-Stage Funding

Objective: Refine product-market fit through R&D and expand the team.

Early-stage funding supports further market research and solidifies the product-market fit. This stage often involves revenue generation and is funded by angel investors and early-stage venture capitalists. Events like the Global Startup Summit by 21By72 provide platforms for startups to secure early-stage funds.

4. Series A Funding

Objective: Grow market presence and target customer segments.

Series A funding focuses on scaling operations and enhancing brand presence. It helps startups optimize their operations to meet market demands. Venture capital firms and corporate funds are primary sources, with equity dilution ranging from 15% to 25%.

5. Series B Funding

Objective: Expand offerings and scale operations by hiring skilled team members.

Series B funding supports startups that have established market presence and need to scale further. This stage often involves increased investment from existing investors and venture capital firms, with equity dilution up to 15%.

6. Series C Funding

Objective: Enter global markets and diversify product lines.

Series C funding is aimed at global expansion and market dominance. Startups use these funds to develop new product lines or acquire other companies. Late-stage venture capital and private equity investors are typical funders, with equity dilution between 10% and 15%.

7. Mezzanine Financing/Bridge Funding

Objective: Maintain operations before raising significant capital.

Bridge funding helps startups sustain operations while preparing for major funding rounds. This stage is critical for maintaining momentum and boosting valuation. Venture capital and private equity investors often provide these funds.

8. IPO Funding

Objective: Expand the business and provide liquidity to early investors.

An Initial Public Offering (IPO) transforms a private company into a public one, allowing it to raise significant capital. This stage involves rigorous financial audits and regulatory compliance. An IPO provides liquidity to early investors and founders while enhancing brand visibility.

Conclusion

Understanding the various stages of startup funding, from pre-seed to IPO, is crucial for entrepreneurs. Each stage—pre-seed, seed, early-stage, Series A, Series B, Series C, bridge funding, and IPO—serves a specific purpose in the growth trajectory of a startup. By mastering these stages, startups can strategically raise capital, scale operations, and achieve long-term success.

FAQs

1. What are the stages of startup financing entrepreneurs must know? Startups typically progress through pre-seed, seed, early-stage, Series A, Series B, Series C, mezzanine/bridge funding, and IPO stages, each aligning with their growth and operational needs.

2. What’s the difference between pre-seed and seed funding? Pre-seed funding focuses on idea validation and market research, often sourced from personal savings or angel investors. Seed funding develops an MVP and involves external investors for market testing.

3. What’s the role of venture capital for startups? Venture capital is crucial for scaling operations during Series A, B, and C funding stages. Besides financial backing, venture capitalists offer mentorship, strategic advice, and industry connections.

4. When should a startup prepare for an IPO? Startups should prepare for an IPO when they have a strong market position, consistent revenue, and proven scalability, ideally during favorable market conditions to maximize returns.

#startup funding#Angel investors#Early-stage funding#IPO process#pre-seed funding#Pre-seed to IPO#seed funding#Series A funding#Series B funding#Series C funding#Startup funding process#Venture capital for startups#Venture capital Funding

1 note

·

View note

Text

Pre-Seed Funding Landscape: A Comprehensive Guide

Dive into the intricate world of pre-seed funding with this comprehensive guide. Whether you're a budding entrepreneur or an investor looking to explore early-stage opportunities, this resource provides invaluable insights into the prelude to startup financing. From understanding the fundamentals of pre-seed funding to identifying key stakeholders and crafting compelling pitches, embark on a journey that demystifies the process and equips you with the knowledge to navigate the complexities of securing initial capital for your venture.

0 notes

Text

what is seed funding for startups

In the vast landscape of entrepreneurship, seed funding serves as the initial spark that ignites the journey of a startup. It’s the crucial injection of capital that propels innovative ideas from conception to reality. Seed funding is often the first formal investment a startup receives, providing the necessary resources to validate its concept, develop a minimum viable product (MVP), and take the initial steps toward growth. In this comprehensive guide, we’ll delve into the intricacies of seed funding, exploring its significance, process, sources, and challenges.

What is Seed Funding?

Seed funding, also known as seed capital or seed money, refers to the initial investment made in a startup during its early stages of development. This funding typically occurs in the pre-seed or seed stage, where the startup is still refining its business model, conducting market research, and building its founding team. Seed funding is crucial for startups as it enables them to transition from the ideation phase to the execution phase, laying the foundation for future growth and attracting further investment.

Significance of Seed Funding

Validation of Concept: Seed funding provides startups with the financial resources needed to validate their business concept and test its feasibility in the market. This validation is essential for attracting subsequent rounds of funding and gaining the confidence of investors.

Product Development: With seed funding, startups can develop a prototype or MVP that demonstrates the value proposition of their product or service. This allows them to gather feedback from early adopters and iterate on their offering to better meet the needs of their target audience.

Team Building: Seed funding enables startups to assemble a core team of talented individuals who share the vision and passion for the venture. These initial hires are instrumental in driving the startup’s growth and executing its strategic objectives.

Market Traction: Securing seed funding enables startups to acquire their first customers, generate initial revenue, and demonstrate traction in the market. This traction not only validates the startup’s business model but also attracts further investment from venture capitalists and angel investors.

The Seed Funding Process

Preparation: Before seeking seed funding, startups need to prepare a compelling business plan or pitch deck that outlines their value proposition, target market, competitive landscape, and financial projections. This document serves as a roadmap for investors to understand the startup’s vision and potential for growth.

Identifying Investors: Startups can seek seed funding from a variety of sources, including angel investors, venture capital firms, accelerators, and crowdfunding platforms. It’s essential to identify investors who have a track record of investing in startups within the relevant industry or sector.

Pitching: Once potential investors have been identified, startups pitch their business idea and investment opportunity to them. This pitch may take place in formal settings such as investor meetings, pitch competitions, or demo days, where startups have the opportunity to showcase their product or prototype.

Due Diligence: Investors conduct due diligence to evaluate the startup’s business model, market opportunity, team, and financial projections. This process helps investors assess the risk and potential return on investment (ROI) associated with the startup.

Negotiation and Term Sheet: If investors are interested in funding the startup, they will present a term sheet outlining the terms and conditions of the investment, including the amount of funding, equity stake, valuation, and rights of the investors. Startups negotiate these terms to ensure they align with their long-term goals and objectives.

Closing the Deal: Once the terms have been agreed upon, the seed funding round is closed, and the investors provide the agreed-upon capital to the startup. This funding is typically disbursed in multiple tranches based on the achievement of predetermined milestones.

Sources of Seed Funding

Angel Investors: Angel investors are affluent individuals who provide capital to startups in exchange for equity ownership. They often invest in startups within their industry or sector of expertise and play a hands-on role in mentoring and advising the founding team.

2. Venture Capital Firms: Venture capital firms invest in startups with high growth potential in exchange for equity ownership. They typically participate in later-stage funding rounds but may also provide seed funding to promising startups with a compelling business model and market opportunity.

3. Accelerators and Incubators: Accelerators and incubators are programs designed to support early-stage startups by providing funding, mentorship, and resources in exchange for equity or a small investment. These programs often culminate in a demo day where startups pitch their ideas to a room of investors.

4. Crowdfunding Platforms: Crowdfunding platforms such as Kickstarter, Indiegogo, and Seedrs enable startups to raise capital from a large number of individual investors in exchange for rewards, pre-orders, or equity. Crowdfunding allows startups to validate their idea and generate initial traction while accessing capital from a diverse pool of investors.

5. Government Grants and Programs: Some governments offer grants, subsidies, or tax incentives to support innovation and entrepreneurship. These programs provide non-dilutive funding to startups to help them develop new technologies, create jobs, and stimulate economic growth.

Challenges of Seed Funding

Limited Resources: Startups often face resource constraints, including limited funding, manpower, and expertise, during the seed stage. This requires them to prioritize their activities and make strategic decisions to maximize the impact of their available resources.

Valuation and Dilution: Determining the valuation of a startup in the early stages can be challenging, leading to negotiations between founders and investors. Additionally, raising seed funding often requires startups to give up equity, resulting in dilution of ownership and control.

Market Validation: Validating the market demand for a product or service is essential for the success of a startup. However, achieving market validation can be difficult and time-consuming, especially in industries with long sales cycles or complex customer acquisition processes.

Competition: Startups face competition not only from existing players in the market but also from other startups vying for the same customers and resources. To stand out in a crowded market, startups must differentiate themselves through innovation, quality, and customer experience.

Execution Risks: Even with seed funding, startups face execution risks related to product development, market penetration, and scalability. It’s essential for startups to execute their business plan effectively and adapt to changing market conditions to achieve sustainable growth.

Want Seed Funding for your start up busines

Website: https://www.unicornivc.com/

Contact Us : https://www.unicornivc.com/contact.php

Conclusion

Seed funding plays a pivotal role in the startup ecosystem, providing entrepreneurs with the financial resources, mentorship, and support needed to turn their ideas into successful businesses. By understanding the significance, process, sources, and challenges of seed funding, startups can navigate the early stages of development more effectively and increase their chances of long-term success. As the lifeblood of innovation and entrepreneurship, seed funding continues to fuel the growth of groundbreaking ideas and shape the future of industries worldwide.

0 notes

Text

hey kid...

want a free ttrpg?

Dog and background by @b-marsollier

The demo version of A Fool's Errand is available for free on itch!

A Fool's Errand is a tarot-fueled science fantasy roleplaying game about playing the Fool, keeping the gods in check, flirting with godhood yourself, and preventing the next Big Oops.

4-6 Players (including GMs)

Play with a deck of tarot cards in lieu of dice

Session 0 mechanics heavily baked in

~2-4 hours per session

Great for campaigns (4+ sessions)

Modular and replayable with tons of GM support to pick up & play

Interested? A Fool's Errand is funding starting October 22nd. Pre-save so you don't miss it!

The Game

A Fool’s Errand uses tarot cards to tell an expansive science fantasy story over several phases.

First, the group collaborates on the Big Oops - the biggest calamity in this world’s history. Players pinpoint what the world lost when the previous Fools reached their journey’s zenith, and which Major Arcana consorted or clashed with each other along the way.

Then, players create their Fools - Android or Human characters who become intertwined with the Major Arcana gods (including those who had a hand in the Big Oops), and whose journeys are led by unique tarot decks built with choices made in character creation.

Finally, the player’s characters play in the post-calamity, exploring both the waking world, and the Dream & Digital Networks - the surrealistic subconscious realm of Humans & Androids, respectively. Both are places of heightened power and quantum knowledge accessible to the Fools.

Players’ unique decks determine success, failure, and when a Major Arcana can’t help itself but to intervene in the adventure. Characters always have the option to accept the obligations from the Gods, or deny them.

Can they keep the Gods in check, contend with calamity, and spare the world another Big Oops?

Character Creation

Players build their Fools by selecting three motivations, each tied to a different Major Arcana. Included among these choices are the key Major Arcana who involved themselves in the previous Big Oops.

Each Major Arcana has a list of motivations to choose from. These three selected motivations provide a springboard for players to conceptualize their character. The three chosen Major Arcana are then inserted into the player’s play decks.

Players then expand upon their character builds by selecting their Lineage (Human or Android), Archetypes (Influencer, Inquirer, Operator, Outlaw, Protector, and/or Virtuoso), Skills, and Power Trees (a list of abilities themed after the Minor Arcana and branching into either Magic or Tech).

Characters pursue their motivations by exploring both the post-calamitous waking world and the Dream and Digital Networks. All the while, the Major Arcana intervene, planting seeds for players to clarify and satisfy their requests, or “Obligations”. As the Obligation Tracks fill up, the Fools flirt with godhood and draw closer to the advent of their own Big Oops.

Get This Game!

Head here to help us fund a physical print of the game!

#ttrpg#freettrpg#tarot#new ttrpg#androids#science fantasy#major arcana#tarot cards#final fantasy 7#metropolis

85 notes

·

View notes

Text

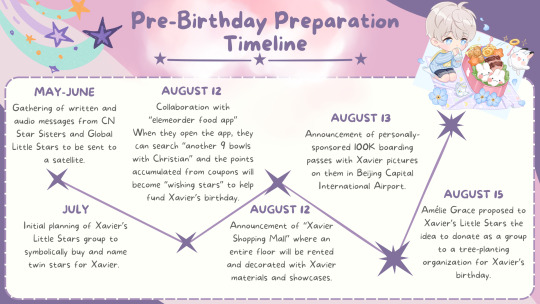

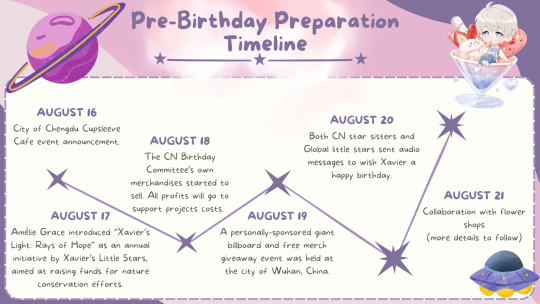

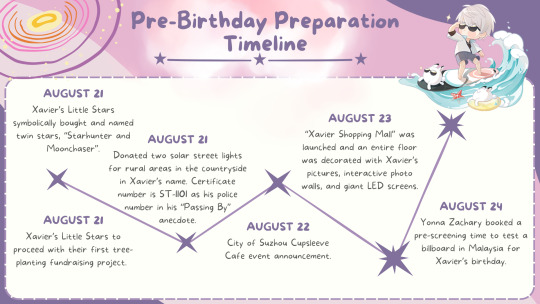

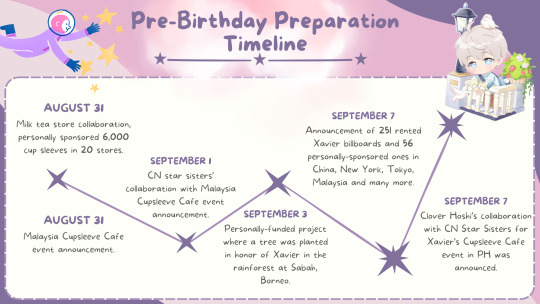

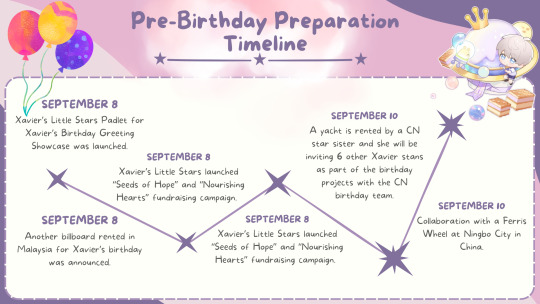

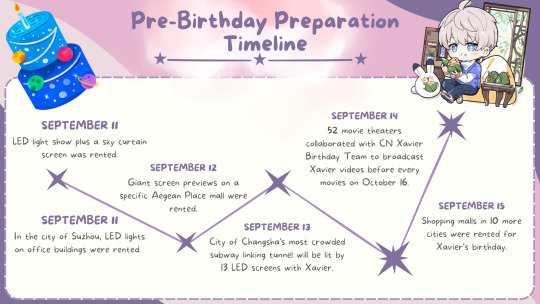

✨ Pre-Birthday Preparations Timeline for Xavier: A Global Celebration of Our Star Prince ✨

As Xavier's birthday draws near, the fandom is buzzing with excitement across the globe! Our community has been hard at work since May, creating memorable ways to celebrate our beloved Prince of Philos. From our CN Star Sisters to Xavier’s Little Stars, the love for our Light has transcended borders, uniting us in preparing for his special day.

Aside from our international cupsleeve events, here’s a sneak peek of some of the highlights of our preparations:

⭐️CN Star Sisters and Global Little Stars gathered heartfelt written and audio messages to be sent to a satellite in honor of Xavier.

⭐️Collaboration with the elemeo food app, where fans could collect points (wishing stars) to help fund Xavier’s birthday.

⭐️Announcement of personally-sponsored 100K boarding passes with Xavier’s image at Beijing Capital International Airport.

⭐️Donation of 2 solar street lights to rural areas.

⭐️Xavier’s Little Stars symbolically purchased and named twin stars in the sky “Starhunter and Moonchaser” in Xavier’s honor.

⭐️Another symbolic buying and naming of a star in the sky "Xavier-Lumiere" with its own star website and virtual reality access (personal project).

⭐️10+ shopping malls were rented for Xavier's birthday with giant LED screens, interactive photo walls, and decorations.

⭐️The Stellaris fan site was launched to unite Xavier’s global fanbase.

⭐️Milk tea collaboration kicked off, distributing 6,000 custom cup sleeves across 20 stores.

⭐️A personally-funded tree-planting project in Sabah, Borneo.

⭐️300+ Xavier billboards across the globe, including LED light shows, giant screen previews, sky curtain screens, LED office buildings, and LED screens on one of the most crowded subway tunnels in China.

⭐️The “Seeds of Hope” (tree-planting) and “Nourishing Hearts” (food for the needy) fundraising campaigns were launched by Xavier's Little Stars.

⭐️A personally-rented yacht where 6 other Xavier stans were invited to celebrate.

⭐️Ferris Wheel collaboration

⭐️52 movie theaters to broadcast Xavier videos before every movie on October 16th.

…and more!

This celebration is more than just a birthday party— it’s a symbol of the unity, passion, and light that Xavier has brought to all of us. Swipe through the supporting graphics for a full timeline of events and stay tuned for even more projects, events, and surprises that will make this celebration truly unforgettable! Let’s keep shining our light for Xavier. 🌟

The real countdown starts on September 16, leading up to Xavier’s birthday on October 16. Celebrate with us!

Thank you to every Star Sister, Little Star, and Global Stan for making this celebration shine as bright as Xavier himself! 🌟

Disclaimer: these projects and events are fan-hosted and not affiliated with the official Love and Deepspace game.

#xavier love and deepspace#lumiere love and deepspace#love and deepspace#zayne love and deepspace#rafayel love and deepspace#lnds xavier#lnds sylus#sylus#lnds zayne#lnds rafayel#lnds#love and deepspace smut#lads xavier#lads rafayel#lads sylus#lads zayne#love and deepspace fanart#lads mc#misty invasion#sylus love and deepspace#lads

54 notes

·

View notes

Text

Pre-Seed Startup Funding: Your First Step Toward Success with SGC Angels

Pre-seed startup funding is the first step in turning your idea into a real business. SGC Angels helps by giving money to new businesses to get started. This funding can cover things like making your product, learning about the market, and building your team. SGC Angels understands that starting a business is hard, so they give more than just money—they offer advice, guidance, and help you connect with investors. If you are a founder looking for funding, SGC Angels is here to help you get your business started and make your idea successful.

#early stage funding for startups#pre seed startup funding#investment funding#startup pitch#start up funding process#investment process#startup investment process

0 notes

Text

Guarantee that this one is worth a deep dig:

U.S. International Development Finance Corporation grant (2024)

Recipient: Kamay Ventures I L.P. Amount: $4,000,000

Purpose: KVILP is a seed/pre-s a multi-corporate fund covering LATAM, focusing on digitalization of the complete value chain from the farm to the consumer

Country: Brazil

https://usaspending.gov/award/ASST_NON_9000116450_7700/

6 notes

·

View notes

Text

Bite the Hand that Starves You: Chapter Four

Fic as of this chapter contains: discussion of abortion, references to drug use, intersex and trans characters, torture/graphic violence, colonialism and its aftermath, implied sexual violence, disassociation

Kardasi: Peikirvi - would translate to something like "concubine", specifically refers to an individual that socially presents as male, and was assigned such at birth, but can carry children (and often could impregnate someone else), who is legally bound to someone. Usually this is done with a pre-existing couple who has fertility issues.

---

It wasn't a baby. In terminating it, you were admitting that- it wasn't a baby. It never breathed, thought, or spoke.

Garak wished there was something physical that made sense. He knows if he asked, they'd show him some vial, or petri dish, with an unidentifiable clump, and that didn't feel right. It didn't feel like something worth funding over. In terminating it, you were admitting that it wasn't.

It wasn't a baby, so of course it didn't look like one, and it wasn't worth fussing over. Not once it was gone, anyway.

“Everything checks out.” Dr. Ammshah said. “I also talked over a few options for your care going forward with Dr. Bashir. First, I know you said you wished to keep all your organs, but we still can do a tubal detachment-"

“No.”

“I thought you might say that.” Dr. Ammshah looked away- purposely a display of deference. “In that case, there are implants available which don’t need to be replaced more than once every kashmim. It’s a lot longer lasting than the shots preferred in the Federation, and if you ever want to have children, it’s not too difficult to remove. I know you’ve had issues with an implant before, so let me reassure you: this implant has no electrical components. The worst it can do is move somewhere it shouldn’t.” She's rolled her sleeves up- most likely a nervous habit. It reveals inked scars on her forearms.

Garak thought for a moment. “Doctor Bashir.” The observation of her arms is distant and evokes no feeling in him. He knew from the moment Julian said her name why she had been eager to help him in particular.

His head turned to Garak quickly- he hadn't stopped paying attention, but hadn't expected to be called upon. “Yes?”

“If I were to do shots, would I be allowed to keep the doses on hand and self administer them, or would I have to come to the infirmary every time?” His own arms are unmarked. It was too dangerous, given who would see his bare skin, for Tolan to give into that form of sentiment- to permanently have Garak carry evidence with him.

“Normally I give patients a few doses and they self administer. I see no reason why you'd be different.” It was not said with anything but pure neutrality.

“I wanted to be sure. I'd rather use the shots, in that case.” His name would have become fetid in her mouth if she knew of Garak outside the boundaries of this room and those marks.

“Would you like me to go ahead and give you the first dose?”

Garak nodded. No more incidents like this. At last.

The first time he sees Kel, the stripes of her childhood have faded, and he assumes she is Barkan’s. So did everyone else. As her age of emergence approached, its clear to everyone they'd assumed wrong. One time at Bamarren, in the garden, and Barkan a week late coming back for Palandine's cycle-

It must've been embarrassing, when Barkan realized. Most peikirvi fucked the wife too, at least once. Historically, it was thought all they did was transfer the husband's seed, with a little of themselves- ultimately, they were not recorded as the father in that case. They knew better now.

Barkan never allows the two of them in the same bed without him as a physical barrier. They went back to Prime a few times- Garak has his own room in the historic Lokar home after the ceremony.

Dr. Bashir put the hypospray down next to his hand. “I'll go ahead and have the pharmacy retrieve a few more doses for you so they're ready when you leave.”

Garak’s hand curled around the handle. “Thank you, doctor.”

The round circle of metal (always cold) went a half inch past the end of his neck ridges, under the chin, like always.

He never sleeps well there. He kept remembering- one time he'd been helping prepare guest rooms, and fell asleep on top of an heirloom silk quilt. Mila never locked him in a closet, but she'd roll out a mat of rough sticks and make him kneel on it in front of the estate cenotaphs for hours.

He'd lived decently on his own as an Order agent, but never that decently.

“Do you have any questions for me?” Dr. Ammshah asked.

“No.” He'd already dismissed the one from earlier. Except- “If this happens again, will Dr. Bashir need to call on you?”

She turned to him. Like with now, and the examination, she'd had Dr. Bashir take careful watch. “I think that may be something at his discretion. Normally, I would have someone observe quite a few procedures before trying to undertake one. But usually I'm dealing with residencies, not a full fledged doctor. Most likely, I'd still end up supervising over video at least.”

Dr. Bashir inclined his head. “I do think I’d be able to handle it, but yes, I would most likely call you just in case.”

The Lokars have silk quilts too- they'd been very fashionable, six to eight generations ago. Barkan has him on top of one once. The whole time Garak is thinking about the launderer, a quiet young thing, and wondering how the hell he was going to clean it.

The Garak cenotaph on Tain’s estate was blank in his childhood (Tolan is on it now), but the message was clear- you will die here.

Garak nodded and leaned back. “I don't plan on this happening again.”

It was better if it wasn't a baby. If it was, where would he bury it? Where you buried your dead was your home. What name would be put on the cenotaph he did not have, on a station with no soil deeper than his knee?

---

Jabara sat next to him, jarring him out of his thoughts. “You're three hours into overtime today.”

Julian wished he could say he hadn't noticed, but he had. Perfect internal clock and everything.

Dr. Ammshah would be leaving in a few days. A check up after a day, a few days of buffer in case of a last minute emergency, then she'd be on her way back to Vulcan. Which left him with one less pair of hands soon.

“I'm just trying to make sure everything goes smoothly.” Julian rubbed a hand over his face. “How's setting up the storage bay going?”

“It's going fine. It hasn't really been used since the last time we needed it, so it didn't need to be cleared out.”

He had been to send his earliest cases home with a minder. That freed up eight beds, with more flagged as being viable to go home under the same conditions. However, he still had more patients coming in- both newly ill and those who'd tried to tough out what they'd assumed was a bad dining choice at first. The surgical suite had a few beds in it now.

Calculations in his head guessed that at least they'd seen a slowdown starting the day Dr. Ammshah left. “That's good. Are any beds ready yet?”

“A few. Yaatare wants to move the first patient over in the next hour or so.”

“I'll want to look things over first.”

“I know. And I was hoping I'd have to comm you to tell you instead of finding you still here.” Jabara stared scalpels in the side of his head.

“Everyone's doing overtime right now.”

“When was your last day off?”

Julian sighed. “Jabara-”

“You're comfortable telling off the rest of the medical staff and any Starfleet officer you see for poor work habits like too much overtime, but you set a poor example.” Jabara leaned back. “You asked me to be blunt with you from the beginning sir, so- it gives the impression that you're a hypocrite, or that you don't trust your staff.”

Julian flinched. It wasn't the first time Jabara told him that- the fact that she fully took him up fully on the request to be blunt was why he preferred working with her. “You want me to check on the storage bay and go back to my quarters.”

“At least. I also frankly don't want to hear you came back here any sooner than eight hours from now. Ten would be better.”

Julian put his hands up. “Alright. I'll go.”

---

Quark’s was perhaps not the best place to unwind if your stress came from how busy you were. Normally the sights- bright lights, Dabo attendants covered in glitter and rhinestones, flashes of brilliant color everywhere- sounds- shrieks of delight and anger, the wheels turning, glass clinking, conversations- smells- all kinds of food, astringent alcohol, a bit of sweat, cleaner (Quark never allowed vomit to sit the way he never let a paying customer's glass sit empty)- made it exciting.

Right now, Julian was just regretting his choices, holed up in a corner alone. Quark had taken one look at him and mixed something without even asking what he was in the mood for- it was vaguely reminiscent of a hot toddy. Julian found he didn't mind it.

He wiped the red foam from the corner of his mouth and sighed.

“I don't usually see you here by yourself.”

Julian managed a smile as Jadzia slid into the seat across from him. “Well I'm not by myself now, am I?”

“Mm. Is this how it usually works for you?”

“How what works?”

“Dates. You sit alone, looking sad and pretty, and someone eventually walks over.”

“Ah, so I'm pretty.” Julian said, sipping his drink. “And no, usually I'm here for fun and enjoying myself.”

Jadzia peered at his mug. “Oh, Quark gave you a Sweet Howler.” She grimaced a bit. “I heard kunowaat was going around. I didn't realize it was this bad.”

How badly was this going to hit him in the morning? Julian sighed. “It's not the worst thing to deal with. A steady, high, clean water intake, and a constant drip of diozaine, and basically anyone who catches it will live. It's just resource intensive and… annoying."

“I can imagine. I'm glad I'm vaccinated.”

“We've been working on that.” Julian muttered. “I told other Starfleet Medical doctors on Bajor to make it a top priority, but the problem with Bajorans and vaccines…”

“We still haven't built up everyone's trust after the Occupation.”

“No. Especially not in rural areas, like where it started this time.” Julian looked up at her. “Enough about work. How have you been? Any interesting holosuite programs you've discovered?”

Are you alright after the Joining Council almost let you die to save themselves some face?

“I've been okay. And no, no new interesting programs have made their way into my clutches.”

I've been okay, often meant something very different, Julian found.

“And which ones does the major like?” Julian asked.

“I don't think she has a preference yet.”

“Really?”

Jadzia shrugged. “She likes a little of everything, and nothing in its entirety out of what I've introduced her to. We've been trying out more programs recently…” she cocked her head. “Some people are just a bit picky. That makes it all the more special when you do find what they like.”

Interesting.

“How has Bareil been?”

Jadzia gave him a puzzled look. “Why would I know?”

Julian tapped his fingers on the side of his mug. “You just mentioned you've been with the major a lot lately. I thought she might’ve mentioned something.”

Jadzia doesn't quite buy it, still giving him an odd look. “She hasn't, really. Since when are you interested in what vedeks are doing, Julian?”

“Well, he's not just any vedek. If I'm to live right next to Bajor I ought to know what's going on with… politics.”

Jadzia squinted at him. “Do you know something I don't?”

“About Bareil? No.”

“Hm.” Jadzia leaned back.

“Are you going to report me to Odo?” Julian said lightly.

Jadzia softened a bit, not that she was especially hardened in the first place. “For all I know, he put you up to asking me.” She looked around, then peeked under the table. “Doesn't look like he's nearby, though.”

“You can't tell.”

“Well, not anymore.” Jadzia admitted. “It used to be something was a little off about whatever form he took. He's gotten better recently. A spare jacket in one of the labs turned out to be him and made me jump half a Quark into the air a few days ago.”

Julian snickered. “Half a Quark… I'll have to remember that one.”

---

Garak sat on the floor.

His holding cell was now an apartment. A ransacked apartment- Garak had accidentally slept in his shop last night, and Dukat hadn’t hesitated to seize the opportunity to target him in his tantrum- but just. An apartment.

He wondered if he'd be pushing his luck to request different quarters now.

He looked around, taking stock, and halted on an ajar wall panel. He yanked at it, heart pounding, and the metal bent- the red box was still there. Garak cradled it in his lap for a moment.

The recitation mask stared up at him. And kept staring.

Garak picked it up and threw it at the wall.

It only bounced off. The mask was lightweight, but the stone was strong and resilient.

Garak let out an angry sigh- bordering on a growl, really- as he got up off the floor. He picked up a chair leg that had broken off.

The mask gave him no more satisfaction than a clunk.

Garak tried, all night- throwing it, stomping on it, putting it under a table leg and then pushing down with all he had- the mask did not break.

25 notes

·

View notes

Text

Researchers develop AI tool to transform MS monitoring through rapid brain MRI analysis

- By InnoNurse Staff -

University College London researchers have developed an advanced AI tool called MindGlide to analyze brain MRI scans of multiple sclerosis (MS) patients.

MindGlide can rapidly (in 5–10 seconds) detect key brain changes like lesions and shrinkage, even from routine or lower-quality scans that previously couldn't be used effectively.

The AI tool outperformed existing methods (SAMSEG and WMH-SynthSeg) in identifying brain abnormalities, showing up to 60% improved accuracy. It also successfully tracked treatment effects using real-world images, not just clinical trial data.

Tested on nearly 15,000 MRI images from over 1,000 patients, MindGlide proved reliable across time points and scan types, including those not designed for MS analysis. Researchers hope it will unlock insights from millions of archived hospital scans, helping both research and future clinical care.

Currently, MindGlide analyzes only brain images—not the spinal cord, which is also crucial in MS—so future development aims to expand its scope.

Ultimately, MindGlide could transform MS monitoring and treatment evaluation by providing fast, accurate, and wide-reaching AI-powered insights.

Read more at University College London/Medical Xpress

///

Other recent news and insights

Canada: Healthtech startup Vopemed secures $2.29 million in pre-seed funding for AI-enhanced surgical imaging (BetaKit)

#ms#multiple sclerosis#medtech#health tech#ai#imaging#radiology#mri#neuroscience#brain#health informatics

2 notes

·

View notes

Text

( CALLUM KERR, BROMOSEXUAL, CISMALE HE/HIM ) — by the grace of the gods, old and new, i present to you LORD ELYJAH HARDYNG of MARZOLL within the lands of BERGIA. the gods have blessed us with their presence for 34 years. many know them to be DARING, AGREEABLE, OPTIMISTIC, and while it is not always shown, it is said they can also be AIR-HEADED, BRUTAL, & EASY. what will their tale in the story of metia be? only they can write it, so let’s see how their legend unfolds.

once merely a knighted house, the HARDYING line has been reliable fodder for years, throughout the war. never as commanders, only as storied soldiers of grand gestures of heroism, sacrifice, and love. it could almost be believed that was a hardying curse that, upon fathering one's first son, a hardying would immediately die in the next battle. as was the tale with elyjah's father's father's father, and elyjah's father's father, and elyjah's father. one of the first hardyings to hold the name in a time of peace for decades if not centuries, and the house finally being recognized for their heroism (potentially by one too many stories being ended with 'and what house was this solider from?' 'none of note, sir, just a hardying') that they were granted leave and funds to construct a castle along the valtolian border, joining along with other keeps and houses in maintaining the line of defense between the two kingdoms. holding the ridge near the strip of land connected to the uncharted lands, the newly constructed MARZOLL BURG utilized newer technologies and architectural techniques than a lot of long-standing ancient bergian strongholds. built with local stone, marzoll burg appears as much a part of the mountain as it jutted off from it, with steep walls and supports plunging into the valley below, and numerous balconies from which to enjoy the crips bergian air, and countless views over valtolia -- and into those uncharted lands, peeked over the wall. with a castle built as much for guardianship as well as observation, marzoll serves as a break point for messenger birds and messengers themselves, a freshly established market hub enabling new routes, and an observation point for those more aligned with surveillance.

- - - - - - -

as his father before him, elyjah was made fatherless by the time the next battle occurred after his birth. likely inspired by having continued his line, the late bryden hardying threw himself into an outnumbered bout, holding the line for an incredible amount of time before being left pinned to the ground by far too many swords for one to count. as a young lord of the house, under the stewardship of his mother, elyjah trained and fought -- but never married. he assumed, and believed, that, if he didn't settle down and put a kid in someone, then the curse would never take hold -- and thus, he'd be immortal in battle. having lasted longer than his father and his father's father before him, the theory almost seemed to carry weight. but then, the peace was signed. houses were uplifted for their service, and seeds needed to be planted for roots to take hold. only now, with no war to enforce it, was the hardyng curse still in effect? were elyjah to wed, and father a child of his own, would he then be doomed to die immediately after? having nothing but hope, duty, and a full pair to prove himself with, lord elyjah harding was prepared to find out.

yes:

topping, oral (both), roughhousing, public/semi-public, somnophilia (pre-agreed), rimming (both), breeding, marathon, post-combat/battle high, outdoors

maybe:

bottoming (for the Right One), exhibition

no:

any degree of feminization (either side), femme pronouns (either side), infantilization (either side), humiliation (either side), feet, scat

5 notes

·

View notes

Note

How are your current economic/political relationships with your fellow Sols?

Politically? We get on well, as we must for a prosperous New Kunlun. Economically? Well, that's a more involved answer.

You see, when Yi proposed the creation of New Kunlun and the Eternal Cauldron project, he made something very clear to us: we weren't going to another planet, not long-term. For the energy needs of every part of the project, we would need to be stationed next to a star. That meant there was never going to be any mining, or any new seeds for foodstuffs beyond what Goumang could engineer herself, or any extra-societal trade, nothing like that. Once New Kunlun left Penglai... that would be it. Nothing new was really coming into the pot, aside from Apeman brains (and other biomatter).

All of the Jin, and pre-Kunlun rations, and art, and fineries of Penglai that could be here with us right now came with us at launch. We brought vast amounts of these resources, as much as we could feasibly manage, so that we had something to fall back on when all this got solved, but vast doesn't mean infinite. Because this was the case, every Sol's... department, for lack of a better term, received their funding up-front.

We technically are still the presiding Sols over the budget, and perform reviews of spenditure to advise the Sols in their projects using raw materials, but... let's be real. It's not like we could cut anybody's funding if they did something we didn't like. That part's no longer really enforceable (which is the reason why we primarily stick to trying to keep our district the best place it can be, as our primary duty).

Suffice to say, our faith and investment in the Eternal Cauldron project was a very up front matter.

5 notes

·

View notes

Text

* ◟ : 〔 RICKY WHITTLE, CIS MAN, HE / HIM 〕 ATLAS COSMATOS , some say you’re a FORTY FIVE YEAR OLD lost soul among the neon lights. known for being both CHAMELEONIC and BRUTAL, one can’t help but think of SYMPATHY FOR THE DEVIL by THE ROLLING STONES when you walk by. are you still the VULTURE, LEADER, ACTIVIST SHAREHOLDER for THE NEON PARIAHS, ARGUS MANAGEMENT, even with your reputation as THE VULTURE? i think we’ll be seeing more of you and GROTESQUE SCARS AND BURNS HIDDEN BENEATH PRESSED THREE PIECE SUITS, HOLDING BACK BILE AT EVERY INHALE OF UNFAMILIAR POLLUTED AIR, SEAMLESSLY SWITCHING BETWEEN BRUTAL AND BIDDABLE; AMENABLE AND CRUEL, although we can’t help but think of TOM RIPLEY ( THE TALENTED MR. RIPLEY ) + THOMAS SHELBY ( PEAKY BLINDERS ) + MAD MAX ( MAD MAX: FURY ROAD ) whenever we see you down these rainy streets.

Name: Atlas Cosmatos Age: 45 Gender: Cismale Pronouns: He/his Orientation: Bisexual Affiliation: The Vulture, Neon Pariahs Civilian Occupation: Activist Shareholder at Argus Management History (TLDR below): tw - mentions of violence

Life in the wastelands, a harsh and treacherous sculptor, whittles existence to its barest form. Here, in this unforgiving expanse, what starvation and desperation do not erode into oblivion, mutates, sprouting teeth and thorns. His memories do not stretch beyond this barren theater; recollections of boyhood, tenderness, or a family that should have been, are as elusive as shadows at dusk. He is a child of the brutal winds and the cruel landscape, claimed wholly by their merciless embrace; hunger, too, stakes its relentless claim on him. In this desolate realm, survivors cluster like moths to the faint glow of hope. They glimpse the neon shimmer of a distant city, a beacon in the darkness. Yet, to their discerning eyes, these luminescent promises are but harbingers of a more insidious demise—luring them into a complacency that whispers of a slow, unnoticed death. In this seductive embrace, their hard-won teeth and thorns are dulled, their very essence smothered in a deadly ambrosia, filling their lungs and dreams with a sweet, suffocating fragrance. In the wasteland's crucible, one among them is shaped into a leader, his voice the loudest in denouncing this illusory Eden. The replicants, mirroring man's form yet surpassing him in lethal prowess, become the fallen angels of this dystopia. Anunnaki, the purveyor of this numbing nectar, weaves dreams laced with poppy seeds, its CEO a mere idol of false salvation. Their scornful laughter soon transforms into rallying cries of freedom and revolution. Survival—collective, unyielding survival—demands the dethroning of these deceptive beacons. Navigating the city's labyrinth, they adapt with a predator's grace. To blend into this urban jungle, to mimic its inhabitants, is a lesser challenge for those sculpted by hardship. They are artisans of survival, wearing many guises. Atlas, among them, embodies this adaptability. Armed with fabricated credentials and a magnetic charisma, he infiltrates a hedge fund as an activist shareholder. His mission: to wield his stake like a weapon, pressuring corporations to sever ties with Anunnaki. His tactics are manifold: proxy wars, media blitzes, resolutions, legal battles, and negotiations. His shadowy work extends beyond the boardroom—sabotaging Anunnaki's supply lines under the cloak of night. His next stratagem looms: to amass a significant share in Anunnaki itself. But Stoneage, a privately owned company, a fortress impervious to his financial arsenal, presents a more formidable challenge. Here, the Neon Pariahs must innovate anew. Their directive is clear: to dismantle the replicants by any means necessary, a relentless war against the shadowy figures of this new world order.

Wanted Connections

Any and all replicants for him and the pariahs to hunt. He's made sure to equip all pariahs with tasers hehe

Enemies of the Neon Pariahs - aka those loyal to Anunnaki and Stoneage

Companies he has pressured with shareholder activism

Detectives who may be suspicious of his records and sudden appearance - careful of what you may find. Perhaps those hired or working with Anunnaki/Stoneage?

5 notes

·

View notes