#peo payroll service

Explore tagged Tumblr posts

Text

India's Booming Economy: Is Now the Time to Launch Your Company?

India's economic landscape is undergoing a remarkable transformation. Projected to be the world's third-largest economy by 2030, the country. India's booming economy presents a compelling opportunity for entrepreneurs.

Capitalizing on the Indian Opportunity:

If you're considering launching your company in India, here are some key sectors to explore:

Technology: From software development to e-commerce, India is a hub for tech innovation.

Manufacturing: The push for domestic manufacturing creates opportunities in sectors like automobiles, textiles, and pharmaceuticals.

Healthcare: With a growing population and rising healthcare needs, India's healthcare sector presents promising potential.

Education: India's young population requires a robust education system. Edtech solutions and skill development initiatives hold significant promise.

Challenges to Consider:

Despite the exciting prospects, launching a business in India comes with its own set of challenges:

Navigating Regulations: India's regulatory environment can be complex. It's crucial to seek guidance to ensure compliance.

Infrastructure Development: While infrastructure is improving, logistical bottlenecks can sometimes hinder operations.

Competition: The Indian market is increasingly competitive. A strong value proposition and well-defined target audience are essential for success.

SetMyCompany will carefully evaluating your business model, understanding the market landscape, and partnering with experienced advisors, you can leverage the country's growth potential and position your company for success.

Ready to Explore Further with SetMyCompany?

We Conduct In-Depth Market Research: Understand the specific needs and preferences of your target audience.

Network with Industry Experts and Potential Partners: Gain valuable insights and forge strategic connections.

We will handle all your End-to-End Legal and Financial Professionals:

#Rigistering the firm, #Bookkeeping,#Payrollservice,#HR Operation's, Auditing and Taxation services.

With a well-defined strategy and a commitment to long-term success, India's economic boom could be the perfect springboard for your next big venture.

#tax#payroll#accounting#business#finance#employer of record services#peo payroll service#eor service#register a business in india

2 notes

·

View notes

Text

Why do companies use a PEO?

Companies use a Professional Employer Organization (PEO) for several key reasons:

Cost Savings: PEOs negotiate better rates for benefits due to their larger employee base, reducing overall HR costs.

Compliance and Risk Management: PEOs ensure companies stay compliant with employment laws, minimizing the risk of fines and legal issues.

Employee Benefits: Access to comprehensive benefits packages helps attract and retain top talent.

HR Expertise: Companies gain access to experienced HR professionals for payroll, recruitment, and employee management.

Improved Efficiency: Partnering with the best PEO companies streamlines operations, allowing businesses to focus on growth.

Scalability: PEOs provide scalable solutions that grow with the business.

Employee Training and Development: PEOs offer training programs to enhance employee skills and productivity.

Using a PEO enables companies to focus on their core activities while benefiting from professional HR management and robust employee benefits.

#best peo service#peo service#payroll#human resources#best peo service provider#peo firm#peo solutions#peo solution#peo payroll service#PEO companies near me

0 notes

Text

PEO Payroll Service for Agriculture Businesses

Streamline your payroll with Cornerstone's PEO payroll service tailored for agriculture. Simplify payroll management and focus on growing your farm business.

0 notes

Text

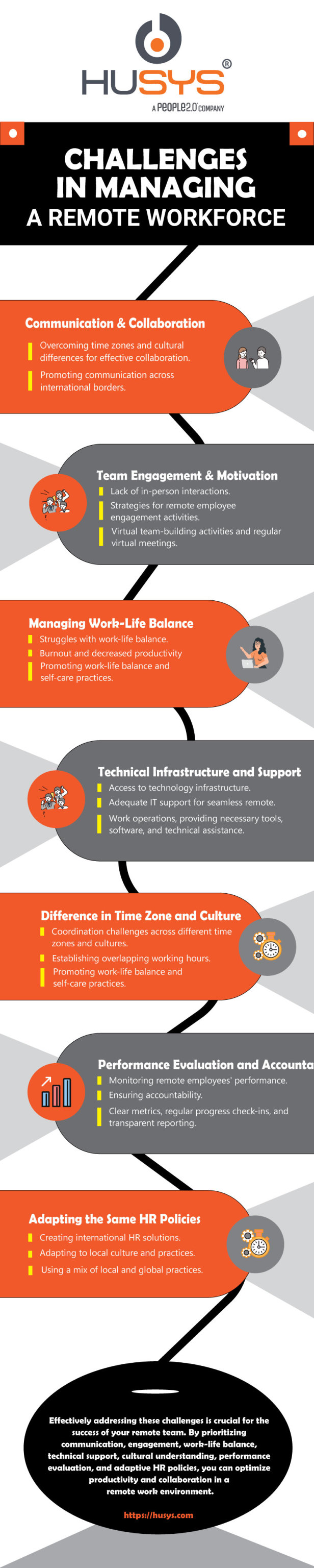

Managing a remote workforce brings unique challenges that can affect productivity and collaboration. To ensure your remote team's success, it's essential to tackle these challenges head-on. Check out my latest post to discover the common hurdles faced when managing a remote workforce and strategies for overcoming them. Let's thrive in the world of remote work! 💼🌍✨

#peo services in india#employer of record#peo services#payroll#payroll outsourcing#globalpayroll#business expansion#eor services india#remote work#remote workforce

2 notes

·

View notes

Text

Manufacturing Payroll Processing - Hybrid Payroll

Streamlining Manufacturing Payroll Processing: A Guide to Efficiency and Compliance

In the manufacturing industry, payroll processing is more complex than in many other sectors due to factors like multiple shifts, overtime, union regulations, and compliance requirements. Efficient payroll processing ensures employees are paid accurately and on time while keeping the organization compliant with labor laws. This blog explores the key aspects of payroll processing in the manufacturing industry and how businesses can streamline their payroll operations.

Key Challenges in Manufacturing Payroll Processing

Shift Differentials and Overtime Pay: Many manufacturing employees work in multiple shifts, with different pay rates for night shifts or overtime hours. Ensuring correct calculations for these differentials is critical to payroll accuracy.

Compliance with Labor Laws: Manufacturers must comply with labor laws, including the Fair Labor Standards Act (FLSA), Occupational Safety and Health Administration (OSHA) regulations, and state labor laws governing minimum wage, overtime, and break periods.

Union and Contractual Agreements: Many manufacturing workers are part of labor unions, requiring adherence to collective bargaining agreements that dictate wages, benefits, and overtime pay.

Employee Classification: Manufacturers often employ a mix of full-time, part-time, temporary, and contract workers. Misclassification can lead to compliance issues and penalties.

Tracking Work Hours Accurately: The use of manual timesheets or outdated tracking systems can result in errors, leading to payroll discrepancies and employee dissatisfaction.

Best Practices for Efficient Payroll Processing

Automate Payroll with Software Solutions: Investing in payroll software specifically designed for manufacturing can automate calculations for overtime, shift differentials, and deductions, reducing errors and improving efficiency.

Integrate Time Tracking Systems: Using biometric scanners, digital time clocks, or cloud-based attendance systems ensures accurate tracking of employee hours, reducing discrepancies and manual interventions.

Ensure Compliance with Labor Laws: Staying updated on federal, state, and local labor laws helps manufacturers avoid legal penalties. Regular audits of payroll records can also help in maintaining compliance.

Streamline Union and Employee Agreements: Payroll systems should be configured to align with union contracts and company policies. Automating benefits, bonuses, and wage increases based on agreements ensures compliance and fairness.

Use Direct Deposit and Digital Pay Stubs: Digital payroll processing eliminates paper checks, ensuring timely payments and reducing administrative work. Employees also benefit from easy access to their pay records.

Regular Payroll Audits and Reconciliation: Conducting periodic payroll audits helps identify errors before they escalate into compliance issues or disputes. Reconciling payroll with financial records ensures transparency and accuracy.

Final Thoughts

Manufacturing payroll processing can be complex, but with the right technology and best practices, businesses can streamline operations, reduce errors, and ensure compliance with labor laws. By automating payroll, integrating time-tracking systems, and staying informed on regulatory requirements, manufacturers can enhance efficiency and keep their workforce satisfied. Investing in modern payroll solutions is not just a convenience—it’s a necessity for sustainable business growth in the manufacturing sector.

#construction payroll processing#hospitality payroll management#premier payroll services#payroll outsourcing in denver#payroll services denver#small business payroll processing#peo hr solutions#hospitality payroll solutions

0 notes

Text

Employer of Record Services - Streamlining Workforce Management

Explore the advantages of Employer of Record (EOR) services as a comprehensive solution for managing your workforce. Learn how EOR services streamline the complexities of payroll, compliance, and HR administration, allowing businesses to focus on core objectives while ensuring legal and regulatory adherence. Discover the strategic benefits of partnering with an EOR to expand your global reach, enhance flexibility, and mitigate risks associated with international employment. Stay ahead in the evolving landscape of workforce management with our insightful guide to Employer of Record Services

#Employer of Record#EOR services#payroll solutions#HR administration#peo services#payroll services in europe#international eor & peo services#netherlands

0 notes

Text

Unveiling Top-rated PEOs and Their Impact on Businesses

In the complex world of human resources and business management, Professional Employer Organizations (PEOs) have emerged as valuable partners for companies of all sizes. They offer comprehensive HR solutions, allowing businesses to focus on their core operations and growth. In this blog, we will discuss what PEOs are and introduce you to some top-rated PEOs that are leading the industry.

What Is a PEO?

A Professional Employer Organization, or PEO, is a third-party outsourcing firm that partners with businesses to manage a range of HR-related functions. When a company engages a PEO, they enter into a co-employment relationship, where the PEO becomes the employer of record for certain aspects of the workforce, such as payroll, benefits administration, and HR compliance.

PEOs offer a wide array of services, including:

Payroll Processing: PEOs handle payroll, ensuring accurate and timely paychecks while managing tax compliance and reporting.

Benefits Administration: PEOs provide access to employee benefits, such as healthcare, retirement plans, and more. This helps businesses attract and retain top talent.

HR Compliance: PEOs keep businesses up to date with changing labor laws and ensure they remain compliant with state and federal regulations.

Risk Management: PEOs share liability for employment-related issues, offering businesses protection against legal claims and disputes.

Employee Training and Development: PEOs often provide training programs to improve employee skills and engagement.

Recruitment and Onboarding: PEOs assist with finding, hiring, and onboarding new talent, streamlining the hiring process.

Top-Rated PEOs:

ADP TotalSource: ADP TotalSource is one of the largest and most well-known PEOs. They offer a wide range of services and have a strong reputation for reliability and efficiency.

TriNet: TriNet is recognized for its technology-driven solutions and robust benefits packages, making them an attractive option for businesses of all sizes.

Insperity: Insperity is known for its focus on customer service and tailored HR solutions, providing a personalized approach to each client.

Oasis, a Paychex Company: Oasis, now part of Paychex, offers a comprehensive suite of HR services, and their size and experience make them a trusted choice in the PEO industry.

Justworks: Justworks is a more modern PEO, known for its user-friendly technology platform and emphasis on small to mid-sized businesses.

Choosing the Right PEO:

Selecting the right PEO for your business is crucial. Consider factors such as the provider's reputation, experience, range of services, and industry expertise. Your choice should align with your specific business needs and growth goals.

In conclusion, Professional Employer Organizations play a significant role in helping businesses streamline HR processes, reduce costs, and enhance their overall operations. The top-rated PEOs mentioned above are just a few examples of the many reputable options available. As the business world continues to evolve, PEOs will remain vital partners for companies looking to focus on their core competencies and succeed in an ever-competitive marketplace.

#business#finance#peo broker#investment#hr consultant#payroll service#consulting#investments#consultant

0 notes

Text

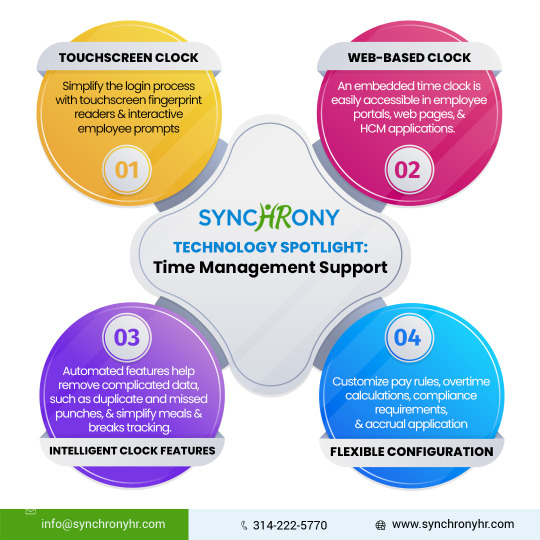

Technology Spotlight: Time Management Support

As an HR outsourcing (HRO) organization, SynchronyHR offers clients a one-stop shop for leading payroll, benefits, and HR technology.

https://www.synchronyhr.com/post/technology-spotlight-time-management-support

#hr outsourcing#payroll outsourcing#workers compensation insurance#businessgrowth#employee benefits for small business#professional employer organization#employee benefits#risk management services#synchronyhr#peo companies

0 notes

Video

youtube

Streamline Payroll Processing with PEO Services

0 notes

Text

Streamline your payroll process with our global payroll services in UAE. Get accurate and efficient payroll management today

0 notes

Text

#tax#payroll#accounting#business#finance#Global Payroll#Payroll#HR#Global Expansion#EOR#India Payroll#UK Payroll#Outsourcing#company registration#eor services#poe hr#poe employer#poe employment#payroll poe#global peo#eor providers#payroll processing#payroll services#payroll software#online payroll#outsourced payroll#tax filing for payroll#payroll tax compliance#direct deposit#pay stubs

0 notes

Text

What are the two types of PEO?

There are two main types of Professional Employer Organizations (PEOs): Full-Service PEOs and Administrative Services Only (ASO) PEOs.

Full-Service PEO: This type handles comprehensive HR functions, including employee benefits, risk management, compliance, and peo payroll. A full-service PEO essentially becomes a co-employer, sharing legal responsibilities with the client company.

ASO PEO: In contrast, an ASO model provides only specific HR administrative services like payroll management and benefits without assuming co-employment responsibilities. The company retains more control over its employees while benefiting from external expertise.

0 notes

Text

What Advantages Does a Payroll Service Offer Your Company?

When you're just starting out, it's crucial that every part of your firm functions efficiently and successfully. You also want it to run with as little of your involvement and oversight as possible. Your time is precious, and you should make the most of it by eliminating unnecessary steps and handing off or automating repetitive tasks whenever possible.

Payroll solutions for small businesses are often used interchangeably by business owners. Contractor payroll services, on the other hand, can aid in a great many business processes. Investing in payroll services in advance helps you handle any issues that may emerge and keeps your business running smoothly.

Savings on Costs

If a company decides to use a third-party contractor payroll provider, it will be responsible for any costs associated with that arrangement. All applicable payroll-related taxes, penalties, and fines, as well as other administrative expenses, will be factored into this sum. If you pay multiple employees or have a particularly complicated payroll system, you can save a tonne of money by using a payroll outsourcing service. A big number of people are usually involved in this kind of system. When you outsource your payroll processing, you won't have to pay employees to deal with administrative tasks related to processing payroll. Furthermore, you no longer have to worry about fulfilling this prerequisite.

Major Functions

Using a contractor PEO payroll service is more than just "delegating" a time-consuming task to a third party. It also helps the company prioritize core business functions without neglecting operational demands. That is to say, the corporation can gain a strategic advantage by focusing more on value-adding and money-making endeavors and less on those that are peripheral to its core objective.

Keep up Your Good Behavior

Government payroll tax regulations are undergoing rapid modification at the present. Wages, employee benefits, PF percentages, taxes, and other relevant matters are subject to a number of complex regulations. These elements, taken collectively, make payroll administration more challenging. You should try to avoid audit irregularities and penalties by following these guidelines and not deviating from them.

0 notes

Text

Unlock the Power of EOR Service (Employer of Record) and discover the game-changing features! This serves as a catalyst for global expansion, enabling companies to reach new horizons effortlessly. When planning your next international expansion, consider asking the pivotal question, Can I leverage EOR service in that particular country? This simple inquiry will not only save valuable time but also reduce costs significantly. Join us on this informative journey as we delve into the benefits of our EOR solution.

#employer of record#payroll#peo services#globalpayroll#peo services in india#business expansion#business launch#hr outsourcing#payroll outsourcing#statutory compliance services#eor service provider#eor services india

1 note

·

View note

Text

Construction Onboarding Services - Hybrid Payroll

What is the 4 step onboarding process?

Construction onboarding is the process of integrating new employees, contractors, or subcontractors into a construction project or company. Due to the unique and often hazardous nature of construction work, onboarding in this industry focuses heavily on safety protocols, site-specific procedures, and regulatory compliance. Here's what construction onboarding typically includes:

The 4-step onboarding process generally follows this structure:

Pre-boarding: This step occurs before the new hire’s first day. It includes sending necessary paperwork, setting up workspaces, and providing information about what to expect on day one. It helps ease anxiety and create excitement for the role.

Orientation: The formal introduction to the company, covering company policies, benefits, systems, and a general overview of the organization. This is where new hires meet key people, learn about the company's mission, and get acquainted with the tools they'll be using.

Training: This step focuses on teaching the new hire the specific skills, tools, and processes they need to perform their role. Depending on the complexity of the job, this could range from a few days to several months.

Integration: The final step is ongoing support to ensure the new hire feels fully integrated into the company culture and their team. This could involve mentorship, regular check-ins, and continued learning opportunities to solidify their role within the organization.

Following this process helps ensure a smooth transition and sets the employee up for long-term success.

#retail industry hr services#workforce ancillary management#small business payroll outsource#peo management software#finance industry payroll solutions#enpense management services#hospitality workforce scheduling#real time payroll processing

0 notes

Text

International PEO Service Provider in India: Why BrooksPayroll is Your Best Choice

Expanding a business into India is an exciting opportunity, but it comes with its own set of challenges, especially when it comes to managing employees. This is where an International Professional Employer Organization (PEO) like BrooksPayroll comes into play. As a leading PEO service provider in India, BrooksPayroll offers a seamless solution to handle your HR, payroll, compliance, and other administrative tasks, allowing you to focus on growing your business.

What is a PEO and Why Do You Need One? A Professional Employer Organization (PEO) is a company that provides comprehensive HR services to businesses. When you engage with a PEO, you enter into a co-employment relationship where the PEO becomes the employer of record for your employees. This means that the PEO takes on many of the responsibilities of employment, such as payroll, taxes, and compliance, while you retain control over the day-to-day management of your employees.

For international businesses looking to expand into India, a PEO like BrooksPayroll is invaluable. It simplifies the complexities of Indian labor laws, ensures compliance with local regulations, and manages employee benefits—all without the need for you to establish a legal entity in India.

Why Choose BrooksPayroll as Your PEO Service Provider in India? Expertise in Indian Labor Laws: BrooksPayroll has deep knowledge of the Indian regulatory landscape. They stay updated with the latest changes in labor laws and ensure that your business remains compliant at all times.

Cost-Effective Solution: Setting up a subsidiary in India can be expensive and time-consuming. BrooksPayroll offers a cost-effective alternative by handling all employment-related functions, allowing you to enter the Indian market quickly and efficiently.

Comprehensive HR Services: From recruitment and onboarding to payroll processing and employee benefits management, BrooksPayroll offers a full suite of HR services. This ensures that your employees are well taken care of, which in turn boosts productivity and retention.

Localized Payroll Management: Payroll in India can be complex, with various statutory requirements and tax regulations. BrooksPayroll’s localized payroll management ensures accuracy and compliance, reducing the risk of penalties and fines.

Scalability: Whether you’re starting with a small team or planning a large-scale expansion, BrooksPayroll’s services are scalable to meet your needs. They can quickly adapt to your changing business requirements.

Dedicated Support: BrooksPayroll provides dedicated support to ensure that your business operations run smoothly. Their team of experts is always available to assist with any HR-related issues that may arise.

How BrooksPayroll Simplifies Your Expansion into India Expanding into a new country is a significant step, and BrooksPayroll makes it easier by taking care of the complexities involved in hiring and managing employees in India. Here’s how they can help:

Quick Market Entry: By handling all HR and compliance matters, BrooksPayroll enables you to enter the Indian market faster, without the need for lengthy legal processes.

Risk Mitigation: Navigating the legal and regulatory environment in India can be risky without the right expertise. BrooksPayroll mitigates this risk by ensuring full compliance with local laws and regulations.

Focus on Core Business: With BrooksPayroll managing the administrative burden, you can focus on what you do best—growing your business and achieving your strategic goals.

Conclusion Choosing the right PEO service provider is crucial to the success of your expansion into India. BrooksPayroll, with its extensive experience and comprehensive service offerings, stands out as a top choice for international businesses. By partnering with BrooksPayroll, you can streamline your operations, ensure compliance, and focus on driving your business forward in the Indian market.

Ready to expand your business into India? Contact BrooksPayroll today and discover how their International PEO service provider in India can make your expansion seamless and successful.

#top eor providers in india#best payroll services provider in delhi & ncr#consultant payroll services in india#posh training in india

3 notes

·

View notes