#payroll hong kong

Explore tagged Tumblr posts

Text

Looking for reliable payroll software in Hong Kong? Manage employee salaries, taxes, and compliance effortlessly with advanced payroll solutions tailored for businesses of all sizes. Choose the best payroll software in Hong Kong to simplify operations and enhance accuracy in payroll processing.

1 note

·

View note

Text

Reliable Payroll Software Hong Kong

Our Payroll Software is designed to simplify payroll management for businesses in Hong Kong. Automate salary calculations, MPF contributions, and tax deductions while ensuring compliance with local regulations. With seamless integration into your HR systems, you can streamline your payroll process, reduce errors, and save time.

#payroll software Hong Kong#hr payroll software#payroll software#payroll system#payroll software for sme#payroll software for small business#best payroll software Hong Kong

0 notes

Text

Part 1 of AAA IG AU

in this au alice and jen are married and living in hong kong, they moved there when lorna got sick and decided to move back home about a year after lorna's passing. jen started her skincare/cosmetics company while in hong kong and is going to expand it into the us. alice runs a cybersecurity company (Gulliver Solutions) that focuses on protecting payroll companies from cyber attacks. it used to be her dad's business and it used to focus on traditional security but when he stepped down, she took over and moved them into the digital sphere. alice and jen have been married for nine years at this point. it's set in 2024 because i forgot that its actually 2026 in the mcu

here is everyone's ig handles:

alice - always_alicewg

agatha - shadesofharkness

jen - the.kale.effect

lilia - seer.in.silks

rio - greenswitch

billy - billy.goatkid

eddie - eddie.bear

sharon - sharondavis❤️

jen's brand - KaleKareCosmetics

#AAA ig au#AAA#agatha all along#instagram au#pigeon posts#Alice Wu-Gulliver#Jennifer Kale#bloodpotions

49 notes

·

View notes

Text

Finding: Lackluster Oversight Resulted in Transnational Criminal Organizations and Fraudsters Stealing U.S. Taxpayer Money from Pandemic Relief Funds

International criminal organizations and foreign government-affiliated actors exploited the urgency of relief programs and orchestrated sophisticated fraud schemes that span multiple countries.

Chinese government-linked hackers stole at least $20 million in U.S. Government COVID-19 relief funds

An USSS investigation revealed that hackers affiliated with the Chinese government, specifically identified as APT41, were implicated in theft of $20 million of U.S. Government COVID-19 relief funds

APT41 has a history of fraudulent activity in the past, specifically traditional unemployment insurance fraud against SBA across dozens of states

APT41 also has a history of espionage activities on behalf of the Chinese government, including attacks on pro-democracy politicians in Hong Kong and data breaches affecting more than 100 organizations

A Nigerian fraud ring stole $10 million in pandemic relief funds

Mr. Abemdemi Rufai, a Nigerian government official, organized a large-scale cyberfraud scheme—named Scattered Canary—targeting COVID-19 relief funds

Scattered Canary, a business email compromise operation, filed at least 174 fraudulent unemployment claims in Washington state and 17 in Massachusetts that were all accepted, all with an expected payout of $5.4 million

An Indian national stole $8 million in a COVID-19 relief fraud scheme

A federal grand jury in Newark, New Jersey indicted an Indian national for submitting fraudulent PPP loan applications totaling more than $8.2 million

The defendant submitted at least 17 applications on behalf non-existent companies, using false information about employees and payroll

He also fabricated tax filings on behalf of a non-existent business to receive more relief payments

He reportedly received $3.3 million in loan proceeds which he then laundered

Domestic and International Fraudsters that Stole from Pandemic Relief Programs were also Connected to Other Organized Crimes

Fraudsters involved with stealing millions of dollars were also involved in other federal crimes including wire fraud and drug smuggling

DOL IG has continued to connect abuse of UI relief funds to organized criminal groups

The National UI Fraud Task Force was created to combat fraud of UI perpetrated by domestic and international criminal organizations, many of which include street-level criminal organizations with ties to illegal guns and drugs

The U.S. Attorney's Office charged six individuals, including two Maryland State Department of Labor subcontractors, with participating in a conspiracy to fraudulently obtain $3.5 million in UI benefits

The lead defendant now faces separate narcotics and firearms charges, including allegations that he unlawfully possessed a machine gun in furtherance of a drug trafficking crime

Another convicted felon charged with CARES Act fraud also committed firearm offenses and possession with the intent to distribute fentanyl

The U.S. Attorney's Office for the District of Maryland targeted cases with connections between COVID-19 fraud and individuals involved with violent crime, organized criminal networks, business email compromise schemes, and narcotics distribution

2 notes

·

View notes

Text

I was curious about lgbt rights in china and came across this absolute gem

Wikipedia wtf do you mean by “unknown” under the header of military. You can’t just like ask? Somebody knows the answer to this it’s not like some undiscovered part of science. Why doesn’t “not explicitly prohibited by law” qualify as an answer? If there’s some complication or nuance you can just link to that or try to explain it wtf is ‘unknown’ supposed to mean?

I swear getting basic information on China on the anglophone internet is the most wild process in the world. You’ll find ten articles being like “the evil inscrutable machinations of the eternal enemy are impossible to decipher but I, the China whisperer, have uncovered the duplicitous plot behind why they* do incredibly mundane thing or fucked up thing that every other government also does” and one article that talks about how its actually a utopia and then veers off on a wild tangent about how those Hong Kong protestors had it coming and every single one of them was on the CIA’s payroll.

*’They’ will be used in a really vague way that the author can pretend means “the Chinese government” when called out but really seems to imply a sweeping statement about all Chinese people given that the author will justify their analysis with various references to Chinese culture I learned in 3rd grade as if that makes them an expert.

English speaking internet treat China like a real place that exists and not a mysterious fantasy land to project onto challenge (impossible).

48 notes

·

View notes

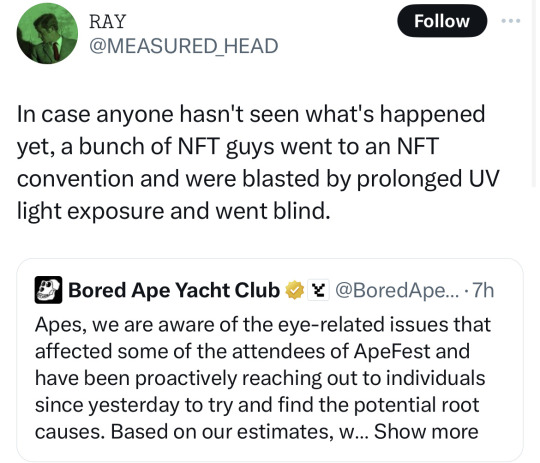

Text

Let's all remember that despite the temptation, this isn't actually funny. These people went to a concert, and were blinded en masse.

This is horrific.

The organizers of this concert need to be held accountable for maiming an entire audience, as well as possibly the performers.

I don't know literally anything about Hong Kong law, but if it is in any way possible, this needs to be pursued as what it is: negligence leading to a mass maiming.

After all, this is a known risk that concert organizers are supposed to be aware of. It has happened before.

However, as of this time, the "lab grade UV-C lamp" thing seems to be a rumour. The only lab which has investigated this incident (on the event organizer's payroll), says this was caused by a malfunctioning UV-A lamp.

It is unknown if the blindness will be permanent or temporary at this time.

66K notes

·

View notes

Note

Shut the fuck up about China unless you're gonna acknowledge Hong Kong, Nepal, Tibet and the Uyghurs. Idgaf if you think it should be ignored in favor of white ppl's war crimes it's deranged to care more about hating the right perpetrators than championing ALL victims.

Also kill yourself if you actually think the USSR was good/don't know or care about the holodomor. There's no redeeming monsters like you.

China: Hong Kong is China, stolen by British. Cope harder. Nepal, --Were you dropped on as a child? Tibet -- always was part of China, or you like it to be under a pedophile under CIA payroll.? Uyghurs -- You hate chinese, you hate muslims, you care about chinese muslims, why? USSR -- Let's see you industrialize and defeat nazis in 40 years bitch. Holodomor - "holod" (hunger) and "moryty" (to kill). It's the term was invented by the Ukrainian immigrants in Czechoslovakia (who lost to the Soviets in the Civil War and who fled after the defeat) and later picked by CIA to use in cold war propaganda. It's a famine not genocide you dumb fuck as opposed to countless intentional genocidal famines by British.

0 notes

Text

Senior HR Officer (C&B/ Payroll Exp.)

Established in 1990 and is one of the leading staff recruitment services company in Hong Kong. As the registered Employment Agency under the Employment Ordinance, our services includes all levels of employment on a permanent, contract and t… Apply Now

0 notes

Text

How to Integrate Your Business Account in Hong Kong with Financial Software

Integrating your business account Hong Kong with financial software is a game-changer for entrepreneurs looking to streamline their operations. This integration not only automates financial tasks but also enhances accuracy and decision-making. Integrating your business account with financial software allows for automation of financial processes such as invoicing, payroll, and expense tracking, saving valuable time. It provides real-time access to updated financial data, enabling better business decisions. Additionally, it minimizes errors in financial records by syncing your business account Hong Kong with reliable software and ensures regulatory compliance with Hong Kong’s tax and regulatory requirements through automated reporting features.

Steps to Integrate Your HK Business Account

To integrate your HK business account effectively, start by choosing the right financial software that supports multi-currency transactions, connects seamlessly with your business account online, and meets your business needs. Contact your bank to ensure your HK business account provider offers integration support or APIs compatible with the financial software you plan to use. Follow the software’s integration instructions or seek assistance from your provider to connect your business account service Hong Kong to the platform. Before going live, test the integration to ensure that all financial data flows correctly and securely, and train your team on how to use the integrated system for maximum efficiency.

Benefits of Integration

Integration benefits include enhanced productivity, better financial oversight, and cost efficiency, which collectively simplify operations and minimize errors.

Popular Financial Software for Hong Kong Businesses

Popular financial software options for Hong Kong businesses include QuickBooks Online, known for its user-friendly interface and robust features, Xero, which is excellent for small businesses seeking cloud-based solutions, and SAP, ideal for large enterprises with complex financial operations.

Modernize Your Financial Operations

Integrating your business account in Hong Kong with financial software is a vital step towards modernizing your financial operations. By choosing the right tools and implementing them effectively, you can unlock your business’s full potential. Ready to simplify your business finances? Check us out at AsiaBC to learn more or to explore how we can assist you. As a trusted business account service provider Hong Kong businesses rely on, we’re here to guide you through the process. Modernize your financial operations today and stay ahead in Hong Kong’s competitive business landscape. Choose the best business account service in Hong Kong to support your journey to success.

0 notes

Text

How KGH Consultancy Empowers Businesses to Achieve Their Goals?

In today’s ever-changing corporate market, meeting organizational goals might feel like navigating a maze. From start-ups looking for their footing to established organizations looking to expand, having the right partner can make all the difference. This is where KGH Consultancy comes in as a reliable advisor and enabler. With offices in Hong Kong and the United Arab Emirates (UAE), KGH Consultancy is at the forefront of providing personalized business solutions that promote success across industries. In this detailed guide, we’ll look at how KGH Consultancy’s range of services, industry experience, and client-focused approach help organizations achieve and surpass their goals.

A Vision for Empowerment and Success

KGH Consultancy was established with a clear mission: to empower businesses by offering world-class consulting solutions. Whether you’re looking to streamline operations, expand globally, or ensure compliance with regulations, KGH Consultancy’s team of experts is dedicated to providing personalized strategies that align with your objectives.

The consultancy believes that no business challenge is too big or small, and this mind-set is reflected in their commitment to delivering results-driven solutions.

Tailored Services for Diverse Business Needs

KGH Consultancy takes pride in offering a wide array of services that cater to different aspects of business management. Here’s a closer look at how these services contribute to achieving business goals:

A. Business Setup and Expansion Starting a business in competitive markets like Hong Kong and the UAE might be difficult, but KGH Consultancy makes the process easier. Their business setup services include everything from corporate registration to legal documentation and compliance. KGH advises organizations wishing to grow globally on market entry strategy, licensing, and operational setup. This ensures a smooth transition into new markets, allowing businesses to meet growth ambitions without undue delays.

B. Corporate Governance and Compliance

In an era of stringent regulations, ensuring compliance is crucial for avoiding penalties and safeguarding reputation. KGH Consultancy specializes in corporate governance and compliance services, offering solutions such as statutory filings, company secretarial support, and corporate governance frameworks.

Their expertise in regulatory compliance ensures that businesses operate within the legal framework, freeing up valuable time and resources for core activities.

C. Financial and Tax Advisory

Effective financial and tax management is crucial for long-term profitability and sustainability. KGH Consultancy offers customized financial advisory services, such as:

• Tax planning and optimization

• VAT and GST compliance

• Financial reporting and audits

These services assist organizations in reducing financial risks, optimizing costs, and maintaining healthy cash flow, ensuring they remain on pace to fulfil their objectives.

D. HR and Payroll Solutions

A dedicated and well-compensated workforce is critical to corporate success. KGH Consultancy provides HR and payroll administration services that make it easier to onboard employees, process payroll, and comply with labor laws.

By automating HR operations and ensuring timely payments, businesses can concentrate on developing a productive team that drives growth.

E. Strategic Business Consulting

KGH Consultancy focuses on strategic business consulting services, including market research and analysis.

• Formulating growth strategies

• Risk mitigation plans

These services are intended to assist firms in identifying opportunities, mitigating risks, and implementing strategies that promote long-term success.

Expertise Across Key Markets

Hong Kong: A Gateway to Asia

Hong Kong is known for its business-friendly atmosphere, strong financial system, and strategic position. KGH Consultancy uses its extensive knowledge of the Hong Kong market to help firms manage its unique difficulties and possibilities.

From aiding with company incorporation to delivering tax-efficient solutions, KGH ensures that Hong Kong firms are well-positioned to achieve their goals.

UAE: A Hub for Global Business

The UAE provides an exceptional opportunity for enterprises seeking to build a presence in the Middle East. KGH Consultancy assists clients in establishing and expanding their activities in free zones, mainland areas, and offshore jurisdictions, leveraging its experience in the region’s regulatory framework.

KGH helps businesses survive in this dynamic industry by providing end-to-end support such as visa processing, office setup, and compliance services.

Client-Centric Approach: The Key to Success

One of KGH Consultancy’s distinguishing characteristics is its continuous commitment to client satisfaction. The firm has a client-centric approach, which includes:

• KGH prioritizes understanding each client’s unique needs and concerns.

• KGH offers personalized solutions that correspond with the client’s goal.

• Provide ongoing support to ensure success beyond installation.

KGH provides ongoing support to help clients stay on course and adjust to changing situations. This individualized approach has helped KGH Consultancy establish a reputation for excellence and dependability in the consulting sector.

5. Empowering Startups and SMEs

Startups and small-to-medium enterprises (SMEs) face unique challenges, from limited resources to fierce competition. KGH Consultancy plays a pivotal role in empowering these businesses by offering affordable, scalable solutions that address their pain points.

How KGH Helps Startups

Feasibility studies to evaluate business ideas

Assistance with funding and investment strategies

Support in building robust operational frameworks

How KGH Supports SMEs

Cost-effective compliance and tax solutions

Growth strategies for scaling operations

Technology integration for improved efficiency

By addressing the specific needs of startups and SMEs, KGH helps them build a strong foundation for success.

Focus on Innovation and Technology

Utilizing technology is crucial for maintaining competitiveness in the current digital world. KGH Consultancy promotes the use of cutting-edge solutions by companies, including: cloud-based financial management systems; digital marketing tactics to increase brand awareness; and AI-powered tools for consumer insights and market analysis.

Businesses may increase productivity, make better decisions, and accomplish their objectives more quickly by incorporating these technologies.

Why Choose KGH Consultancy?

Partnering with KGH Consultancy has many benefits, such as: • All-inclusive Services: KGH offers business consulting services for every stage, from setup to scaling. • Market Knowledge: KGH is well-versed in the specifics of the UAE and Hong Kong markets, having established a significant presence in both. • Track Record of Success: A list of happy customers says a lot about KGH’s talents. • Dedication to Excellence: KGH goes above and beyond to guarantee the success of its clients.

Steps to Get Started with KGH Consultancy

Partnering with KGH Consultancy is easy:

Initial Consultation: Discuss your business goals and challenges.

Customized Strategy: Receive a tailored action plan designed for your success.

Implementation: Let KGH handle the execution while you focus on your business.

Ongoing Support: Stay on track with regular updates and expert guidance.

Conclusion: Empowering Businesses, Driving Success

KGH Consultancy is a partner on your path to success, not merely a supplier of services. KGH has become a well-known brand in business consulting thanks to its client-focused strategy, extensive service offering, and industry knowledge. KGH Consultancy can help you reach your objectives, whether you’re an established company trying to reach new heights or a startup hoping to make an impression. Are you prepared to empower your company? To start your journey to success, stop by KGH Consultancy Hong Kong or KGH Consultancy UAE right now!

Other Links:

Company Formation in Mainland & Freezones

Business Structuring

Funding Assistance

1 note

·

View note

Text

3E Accounting Limited: Your Trusted Partner for Business Success in Hong Kong

Introduction

3E Accounting Limited, Hong Kong, is a premier accounting firm committed to providing tailored financial solutions to businesses of all sizes. As a company incorporation specialist in Hong Kong, we have become a trusted name for seamless company formation, SME support, and professional accounting services. Our mission is to empower businesses with financial clarity and compliance, fostering growth and success in the dynamic Hong Kong business landscape.

Your Trusted Accounting Firm in Hong Kong

At 3E Accounting Limited, we pride ourselves on being a one-stop solution for all accounting needs. Whether you are searching for an accounting firm near me or require specialized guidance, our experienced professionals are equipped to deliver excellence.

Comprehensive Accounting Services

Our services include bookkeeping, financial reporting, tax compliance, payroll management, and more. We utilize state-of-the-art technology to ensure precision, efficiency, and confidentiality in all financial processes.

Why Choose Us?

Expertise: Our team comprises certified accountants with extensive experience.

Personalized Solutions: We tailor our services to match the unique requirements of each client.

Cost-Effectiveness: High-quality services at competitive rates.

Commitment to Compliance: We stay abreast of Hong Kong’s regulatory requirements, ensuring that your business remains compliant.

Hong Kong Company Formation Made Simple

Establishing a business in Hong Kong is a strategic decision due to its robust economy, favorable tax policies, and global connectivity. At 3E Accounting Limited, we simplify this process, making us the go-to company incorporation specialist in Hong Kong.

Our Company Incorporation Services

Company Name Search and Registration We assist in selecting and registering your company name, ensuring adherence to Hong Kong’s regulations.

Documentation Preparation We handle all required documents, including the Articles of Association and business registration forms.

Bank Account Setup We facilitate smooth and hassle-free bank account opening for your new business.

Post-Incorporation Compliance Our team ensures that your company complies with statutory requirements such as annual returns and tax filings.

Empowering SMEs in Hong Kong

As a recognized Hong Kong SME support specialist, 3E Accounting Limited understands the challenges small and medium enterprises face. We provide bespoke solutions to help SMEs thrive in a competitive environment.

Tailored Support for SMEs

Financial Planning and Analysis: We help SMEs create sustainable financial strategies.

Tax Optimization: Our tax experts guide SMEs in leveraging Hong Kong’s tax benefits.

Corporate Secretarial Services: Ensuring regulatory compliance while letting you focus on core operations.

Grants and Funding Assistance: We assist SMEs in identifying and applying for government grants and subsidies.

Why SMEs Choose Us?

Our comprehensive approach, combined with our deep understanding of SME challenges, makes us an indispensable partner for growing businesses.

The Role of a Hong Kong Company Formation Specialist

Selecting the right partner for company formation is crucial for long-term success. As a leading Hong Kong company formation specialist, we provide unmatched expertise, making the process efficient and worry-free.

Our Edge in Company Formation

Local Expertise: Profound knowledge of Hong Kong’s legal and economic framework.

Streamlined Processes: End-to-end support, minimizing delays and errors.

Support Beyond Formation: From compliance to financial planning, we are with you every step of the way.

Accounting Solutions for Every Business Need

From startups to established corporations, 3E Accounting Limited caters to diverse industries and business types.

Customized Services for Various Sectors

E-commerce Businesses: Inventory management, tax compliance, and financial reporting.

Professional Services: Expense tracking, payroll solutions, and regulatory compliance.

Retail and Hospitality: Cash flow management, financial forecasting, and bookkeeping.

Our tailored approach ensures that each business gets the financial support it needs to succeed.

Why Location Matters: "Accounting Firm Near Me"

Finding an accounting firm near me is crucial for personalized and prompt service. With a central location in Hong Kong, 3E Accounting Limited offers accessibility and efficiency to local businesses.

Benefits of Choosing a Local Accounting Firm

Face-to-Face Consultations: Personalized discussions to better understand your needs.

Quick Response Times: Immediate support when you need it.

Local Market Insights: Expertise in navigating Hong Kong’s unique business environment.

Our Commitment to Excellence

At 3E Accounting Limited, we believe that our success lies in the success of our clients. Our commitment to quality and innovation drives us to continually refine our services.

Technology-Driven Solutions

We leverage the latest accounting software and tools to deliver real-time insights and streamline processes.

Professional Development

Our team undergoes continuous training to stay updated with industry trends and regulatory changes.

Transparent Communication

We prioritize clear and open communication, ensuring that our clients are always informed.

Partnering with 3E Accounting Limited

As your trusted partner, we are dedicated to providing reliable, efficient, and innovative solutions. Whether you need a dependable accounting firm or a specialist for Hong Kong SME support, we are here to guide you at every step.

#accounting firm#accounting firm near me#company incorporation specialist hong kong#hong kong company formation specialist

0 notes

Text

#payroll software Hong Kong#hr payroll software#payroll software#payroll system#payroll software for sme#payroll software for small business#best payroll software Hong Kong#payroll and leave management

0 notes

Text

Part 2 of of AAA IG AU

(Part 1) Alice's posts

in this au alice and jen are married and living in hong kong, they moved there when lorna got sick and decided to move back home about a year after lorna's passing. jen started her skincare/cosmetics company while in hong kong and is going to expand it into the us. alice runs a cybersecurity company (Gulliver Solutions) that focuses on protecting payroll companies from cyber attacks. it used to be her dad's business and it used to focus on traditional security but when he stepped down, she took over and moved them into the digital sphere. alice and jen have been married for nine years at this point. it's set in 2024 because i forgot that its actually 2026 in the mcu

here is everyone's ig handles:

alice - always_alicewg

agatha - shadesofharkness

jen - the.kale.effect

lilia - seer.in.silks

rio - greenswitch

billy - billy.goatkid

eddie - eddie.bear

sharon - sharondavis❤️

jen's brand - KaleKareCosmetics

#AAA ig au#AAA#agatha all along#instagram au#pigeon posts#Alice Wu-Gulliver#Jennifer Kale#bloodpotions

23 notes

·

View notes

Text

The Hang Seng Index opened 163 points lower at 19,578 points and then remained soft. The decline once extended to 275 points and hit a low of 19,466 points. It fell 182 points or 0.92% for the whole day to 19,560 points. The Technology Index fell 33 points or 0.76% to 4,370 points. . Main board transaction volume was HK$109.3 billion.

The U.S. "small non-farm payrolls" ADP private employment growth in November was weaker than expected, reinforcing market expectations for the Federal Reserve to raise interest rates. The three major U.S. stock indexes all hit record highs overnight. However, the positive external atmosphere has limited stimulating effect on Hong Kong stocks. The US dollar continues to be strong, and investors are worried about the impact of RMB depreciation on Chinese stocks. In addition, the market is also waiting to see whether the Mainland's Central Economic Work Conference to be held next Wednesday will introduce further economic stimulus policies. Since the Hang Seng Index can still hold the 10-DMA (19,453) after adjustment, the market outlook is still expected to break through the resistance of the 20-DMA (19,638) and challenge the 20,000 level.

European stock markets stabilized, with British stocks closing slightly higher by 0.16%, French stocks and German stocks rising by 0.37% and 0.63%.

Before the U.S. employment data for November was released on Friday, U.S. stocks repeatedly consolidated at historical highs on Thursday. After opening 24 points higher, the Dow Jones Industrial Average turned around and fell back up to 266 points, reaching a low of 44,747 points. It once rose 0.13% to a high of 6,094 points; the Nasdaq, which is dominated by technology stocks, rose 0.28% to a high of 19,790 points. The S&P 500 and Nasdaq fell back after breaking through the top.

At the close of U.S. stocks, the Dow Jones Industrial Average fell 248 points, or 0.55%, to 44,765 points; the S&P Index retreated 11 points, or 0.19%, to 6,075 points; and the Nasdaq fell 34 points, or 0.18%, to 19,700 points.

The U.S. exchange rate index once fell 0.58% to 105.75, the euro rose as much as 0.76% to $1.0592, and the yen once rebounded 0.62% to 149.66 per dollar. Bitcoin rose above the US$100,000 mark for the first time, soaring 6.05% to a high of US$103,800.

0 notes

Text

Tokyo leads Asian stocks rally

Asian stock indexes rose and the dollar hit a new seven-week high against the yen on Monday after unexpected US labour market data dispelled fears of recession and spurred a sharp rate cut.

US Treasury yields hit two-month highs, extending their gains after a closely watched non-farm payrolls report on Friday showed the economy unexpectedly added the most jobs in six months in September.

Crude oil prices fell from a one-month peak even as Israel bombed targets in Lebanon and Gaza. Monday marked the one-year anniversary of the Hamas attack that sparked the war.

Japan’s Nikkei (.N225) index, open new tab, led gains in regional shares, up 2.28 per cent as of 05:15 GMT, helped by a weaker yen.

Hong Kong’s Hang Seng (.HSI), open new tab rose 1.45 per cent, Australia’s stock benchmark (.AXJO), open new tab added 0.68 per cent and South Korea’s Kospi (.KS11), open new tab gained 1.53 per cent. Mainland Chinese stocks remain closed until Tuesday due to the Golden Week holiday.

MSCI’s broadest index of Asia-Pacific shares (.MIAP00000PUS), open new tab, climbed more than 1 per cent.

US Dow futures were slightly lower after the money index closed at a record high on Friday following the release of payrolls data.

On Monday, the yield on 10-year US Treasuries hit 3.992% for the first time since August 7. Two-year bond yields rose to 3.965%, a level last seen on August 22. That sent regional bond yields higher, while the yield on 10-year Japanese government bonds hit its highest level since August 6 at 0.915%.

Gold fell 0.35% to $2,643 an ounce amid the dollar’s recovery, although it remained not far from last month’s record peak of $2,685.42.

Brent crude futures fell 35 cents to $77.70 a barrel after hitting $79.30 on Friday, the highest since 30 August. US West Texas Intermediate crude futures fell 25 cents to $74.13. They rose to $75.57 on Friday, the highest level since August 29.

Analysts believe that many of the factors that pressured the US dollar over the summer have changed. In particular, recession fears are waning, and price dynamics show that the limits of the dovish reaction function pricing have been reached with this data.

MUFG noted that this is the second time the dollar index has pulled back to the 100.00 support level in recent years. The last time in July 2023, the dollar index tested that level but failed to break below it before posting a strong 7.8 per cent bounce.

The yen fell slightly to 149.10 per dollar, its lowest level since August 16. It then trimmed losses and is trading around 148.40. This followed last week’s more than 4% decline, the biggest weekly percentage drop since early 2009.

Read more HERE

#world news#news#world politics#japan#japan news#japanese economy#stock market#investing stocks#oil prices#gold

0 notes