#outsourced tax accounting services

Explore tagged Tumblr posts

Text

Explore expert Outsourcing Accounting Services and tailored Accounting Solutions Australia to streamline your finances and boost business efficiency across Australia

2 notes

·

View notes

Text

Optimize Your Firm’s Financial Management with White Bull! Accounting and CPA firms: Discover the efficiency of outsourced financial solutions. From bookkeeping and payroll to tax preparation, White Bull provides seamless support tailored to the unique needs of professional firms. Let us handle the details so you can focus on what matters most—serving your clients!

👉 Visit us: white-bull.com

#accounting#bookkeeping#payroll#tax returns#outsourced accounting services#AccountingFirms#CPAFirms#OutsourcedAccounting#BookkeepingServices#PayrollSolutions

2 notes

·

View notes

Text

Top Audit Firm in Qatar | Accounting and Bookkeeping

Discover GSPU, your trusted audit and accounting firm in Qatar! Our experienced professionals offer tailored financial solutions, innovative strategies, and expert guidance to help your business thrive. Get in touch today to streamline your financial processes and drive growth with confidence.

#accounting#taxes#success#startup#tax#tax accountant#property taxes#audit#taxation#taxcompliance#bookkeeping#accounting services#business growth#services#finance#business consulting#outsourced cfo services#corporatefinance#cybersecurity#excise tax

3 notes

·

View notes

Text

Payroll outsourcing in UK

Breathe Easy, Business Owners: Why Payroll outsourcing in UK with MAS LLP is Your Secret Weapon Running a business in the UK is exhilarating, but managing payroll? Not so much. Between HMRC deadlines, complex calculations, and ever-changing regulations, payroll can quickly become a time-consuming headache. That's where MAS LLP comes in, your one-stop shop for Payroll outsourcing in UK that takes the weight off your shoulders and lets you focus on what matters most: growing your business.

Why Choose MAS LLP for Payroll outsourcing in UK?

Expertise You Can Trust: Our team of qualified and experienced payroll professionals are the best in the business. They stay up-to-date on the latest HMRC regulations, ensuring your business remains compliant and avoids costly penalties. Accuracy Guaranteed: Say goodbye to manual calculations and spreadsheets. We leverage cutting-edge technology and robust processes to deliver error-free payroll every time. Time is Money: Free yourself and your team from the payroll burden. Outsourcing allows you to dedicate your valuable time and resources to core business activities that drive growth. Peace of Mind: Rest assured knowing your employees are paid accurately and on time, every time. We handle everything from deductions and taxes to payslips and reports, giving you complete peace of mind. Personalized Service: You're not just a number with MAS LLP. We believe in building strong relationships with our clients, providing you with a dedicated account manager who understands your unique needs and is always available to answer your questions. Beyond Payroll: The MAS LLP Advantage

MAS LLP goes beyond just processing payroll. We offer a comprehensive suite of accounting outsourcing services designed to streamline your finances and give you a clear picture of your business health.

Bookkeeping: From daily transactions to account reconciliation, we keep your books meticulously organized and error-free. VAT Compliance: Navigate the complexities of VAT regulations with our expert guidance and minimize risks. Management Reporting: Gain valuable insights into your finances with customized reports and analysis that help you make informed decisions. Cloud-Based Solutions: Access your financial data securely anytime, anywhere, with our user-friendly cloud platform. Partner with MAS LLP and Reclaim Your Time and Focus

Payroll outsourcing in UK with MAS LLP isn't just about ticking boxes; it's about investing in the future of your business. We empower you to focus on what you do best, while we handle the nitty-gritty of payroll with accuracy, efficiency, and a personal touch.

Ready to ditch the payroll headaches and get back to business? Contact MAS LLP today for a free consultation and discover how we can help you breathe easy and achieve your business goals.

Note: This blog post is just a starting point. Feel free to adapt it to include specific details about MAS LLP's services, testimonials from satisfied clients, or special offers to attract potential customers.

#audit#accounting & bookkeeping services in india#ajsh#income tax#auditor#businessregistration#chartered accountant#foreign companies registration in india#taxation#ap management services#Payroll outsourcing in UK

4 notes

·

View notes

Text

How to Make Sure You're Withholding and Reporting Your Taxes Correctly

Taxes are an inevitable part of life for most individuals and businesses. Whether you're a salaried employee, a freelancer, or a business owner, understanding how to withhold and report your taxes correctly is crucial to avoid potential legal troubles and financial headaches down the road. In this article, we will explore the key steps and considerations to ensure that you're handling your taxes in a responsible and compliant manner.

Know Your Tax Obligations

The first and most critical step in ensuring you're withholding and Outsource Management Reporting your taxes correctly is to understand your tax obligations. These obligations vary depending on your employment status and the type of income you earn. Here are some common categories of taxpayers:

1. Salaried Employees

If you're a salaried employee, your employer typically withholds income taxes from your paycheck based on your Form W-4, which you fill out when you start your job. It's essential to review and update your W-4 regularly to ensure that your withholding accurately reflects your current financial situation. Major life events like marriage, having children, or significant changes in your income should prompt you to revisit your W-4.

2. Freelancers and Self-Employed Individuals

Freelancers and self-employed individuals often have more complex tax obligations. You are responsible for estimating and paying your taxes quarterly using Form 1040-ES. Keep detailed records of your income and expenses, including receipts and invoices, to accurately report your earnings and deductions.

3. Small Business Owners

If you own a small business, your sales tax responsibilities extend beyond your personal income. You must separate your business and personal finances, keep meticulous records of all business transactions, and file the appropriate business tax returns. The structure of your business entity (e.g., sole proprietorship, partnership, corporation) will determine the specific tax forms you need to file.

4. Investors and Property Owners

Investors and property owners may have to report income from dividends, interest, capital gains, or rental properties. These income sources have their specific tax reporting requirements, and it's essential to understand and comply with them.

Keep Accurate Records

Regardless of your tax situation, maintaining accurate financial records is essential. Detailed records make it easier to report your income and deductions correctly, substantiate any claims you make on your tax return, and provide documentation in case of an audit. Here are some record-keeping tips:

Organize Your Documents: Create a system to store your financial documents, including receipts, invoices, bank statements, and tax forms. Consider using digital tools for easier record keeping.

Track Income and Expenses: Keep a ledger or use accounting software to record all income and expenses related to your financial activities. Categorize expenses correctly to maximize deductions and credits.

Retain Documents for Several Years: The IRS typically has a statute of limitations for auditing tax returns, which is generally three years. However, in some cases, it can extend to six years or indefinitely if fraud is suspected. To be safe, keep your tax records for at least seven years.

Understand Deductions and Credits

Deductions and credits can significantly reduce your tax liability. Deductions reduce your taxable income, while credits provide a dollar-for-dollar reduction of your tax bill. Familiarize yourself with common deductions and credits that may apply to your situation:

Standard Deduction vs. Itemized Deductions: Depending on your filing status and financial situation, you can choose between taking the standard deduction or itemizing your deductions. Itemizing requires more documentation but can result in greater tax savings.

Tax Credits: Explore available tax credits, such as the Earned Income Tax Credit (EITC), Child Tax Credit, and Education Credits. These credits can provide substantial savings, especially for low- to moderate-income individuals and families.

Business Expenses: If you're self-employed or a small business owner, be aware of deductible business expenses, including office supplies, travel expenses, and home office deductions.

Seek Professional Assistance

Tax laws are complex and subject to change. Seeking professional assistance from a certified tax professional or CPA (Certified Public Accountant) can be a wise investment. Tax professionals can help you:

Maximize Deductions: They are well-versed in the intricacies of tax law and can identify deductions and credits you might overlook.

Ensure Compliance: Tax professionals can ensure that you are complying with current tax laws and regulations, reducing the risk of costly errors or audits.

Provide Tax Planning: They can help you create a tax-efficient strategy to minimize your tax liability in the long term.

Represent You in Audits: If you face an audit, a tax professional can represent you and help navigate the process.

File Your Taxes on Time

Filing your taxes on time is crucial to avoid penalties and interest charges. The tax filing deadline for most individuals is April 15th. However, if you need more time, you can file for an extension, which typically gives you until October 15th to submit your return. Keep in mind that an extension to file is not an extension to pay any taxes owed, so pay as much as you can by the original deadline to minimize interest and penalties.

Consider Electronic Filing

Electronic filing (e-filing) is a secure and convenient way to submit your tax return to the IRS. It reduces the risk of errors and ensures faster processing and quicker refunds, if applicable. Many tax software programs offer e-filing options, making it easy for individuals and businesses to submit their returns electronically.

Stay Informed and Adapt

Tax laws can change from year to year, so staying informed is essential. Follow updates from the IRS and consult outsourcing sales tax services professionals or resources to understand how changes in tax laws may affect you. Be proactive in adapting your tax strategies to maximize savings and remain compliant with current regulations.

In conclusion, withholding and reporting your taxes correctly is a responsibility that should not be taken lightly. Understanding your tax obligations, keeping accurate records, leveraging deductions and credits, seeking professional assistance when needed, and filing on time are essential steps to ensure a smooth and compliant tax-filing experience. By following these guidelines, you can navigate the complexities of the outsourcing sales tax services system with confidence and peace of mind. Remember that taxes are a fundamental part of our society, and paying them correctly ensures that essential public services and infrastructure are funded for the benefit of all.

2 notes

·

View notes

Text

9 Ways You Can Invest Using SMSF :-

A self-managed super fund is great for individuals who want to be more hands-on when investing in their future and building generational wealth.

#quick smsf accountants#smsf accountant#smsf tax return service#smsf outsourcing#smsf tax return#smsf accounting and taxation#retirementplanning#melbourne#australia#smsf solution

0 notes

Text

#outsource accounting#outsourced bookkeeping#bookkeeping services#online bookkeeping services#accounting and bookkeeping services#bookkeeping#small business accounting#bookkeeping services for small business#bookkeeping and tax services#accounting#bookkeeping services near me

0 notes

Text

Expert Accounting and Bookkeeping Services Since 2004

Professional Accounting Services for Over 20 Years

Outsourced Bookkeeping is your premium business partner for accounting and bookkeeping services. We render services to individuals, small and large companies, and CPAs across the US. Hospitality and real estate sectors are our specialization.

For real estate, we manage property accounts, leases, and customer accounts. In the hospitality industry, we assist restaurant owners with accounts payable, cash flow, inventory management, and customer accounts.

Our team is equipped with advanced professional knowledge and tools to ensure compliance with state and federal regulations. We provide top-notch accounting and bookkeeping solutions tailored to your specific needs.

Accounting & Bookkeeping Services We Offer

Tracking Business Transactions

Preparation of Financial Statements

Performing Bank Reconciliations

Accounts Payable & Receivable Service

Customized Business Reporting & Periodic Reviews

Preparation of Cash Flow Management

Managing Cash and Subsidiary Ledgers

Tax Filing Process

#bookkeeping services#bookkeeping services near me#outsourcing accounting and bookkeeping services#bookkeeping services for small business#online bookkeeping services#accounting and bookkeeping services#online accounting and bookkeeping services#online business bookkeeping services#bookkeeping and tax services#quickbooks bookkeeping services#professional bookkeeping services#virtual bookkeeping services

0 notes

Text

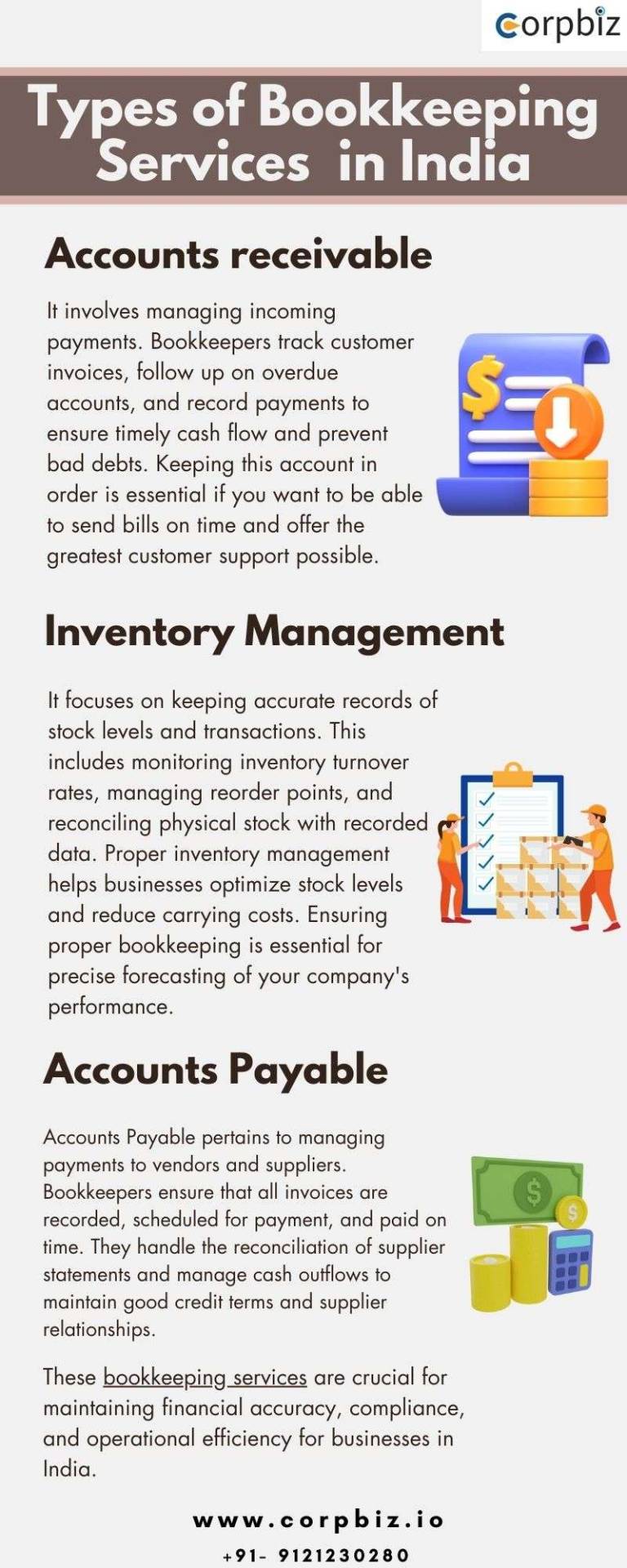

Expert Bookkeeping Services for Accurate Records

Expert bookkeeping services ensure accurate financial records, helping businesses maintain compliance and efficiency. Outsourced bookkeeping services provide cost-effective solutions by handling financial transactions, reconciliations, and tax preparations. Companies can choose from various types of bookkeeping services, including single-entry and double-entry bookkeeping, cash-based or accrual-based accounting, and virtual bookkeeping. These services help businesses track expenses, manage payroll, and accurately generate financial reports.

#legal services#legal#tax#bookkeeping services#online bookkeeping services#accounting and bookkeeping services#outsourced bookkeeping services#bookkeeping#businesses

0 notes

Text

Top Reasons to Choose Accounting Advisory Services

Accounting Advisory Services capitalize on the unique insight of the accounting firm in order to make profitable shirt from serving clients to a year-round strategic business advisor. Well, all accounting firms are looking for different ways to keep themselves ahead of the competition. From advising on mergers to specializing accounting and advisory – there are various ways to take advantage of the unique opportunities.

#Accounting Advisory Services#Outsourced Bookkeeping Services#Arkansas Accounting Services#Personal Tax Preparation#Fractional CFO Kansas City

0 notes

Text

Streamline Your Business with Year-End Accounts Outsourcing

Simplify your year-end accounts preparation with professional outsourcing services from SAS KPO. We offer efficient, accurate, and timely year-end accounts preparation to ensure your business remains compliant and financially organized. Trust our expert team to handle the complexities of financial reporting, so you can focus on growing your business. Visit: https://saskpo.co.uk/year-end-accounts-outsourcing/

#Year-End Accounts Outsourcing Services#Year-End Accounts#Year-End Accounts Services#Accounting Services#Financial Reporting#Business Compliance#Tax Preparation

0 notes

Text

Collab Accounting UK offers Outsource Bookkeeping Services to help businesses manage their finances with ease. Our expert team handles all aspects of bookkeeping, from tracking expenses to ensuring tax compliance, allowing you to focus on growing your business. Trust us to provide accurate and efficient financial management. Visit us at 128 City Road, London, EC1V 2NX, or learn more at www.collabaccounting.co.uk.

0 notes

Text

Cash Flow Forecasting and Management, by Jones Advisory LLC

Cash flow forecasting is an integral part of financial management, providing businesses with valuable insights into their future cash flow projections and allowing them to make informed decisions about resource allocation, investment opportunities, and strategic planning.

#business & individual tax planning#certified public accountants#outsourced cfo services#accounting#finance#investing

0 notes

Text

Accounting outsourcing in US

We Provides the best Accounting outsourcing services in US and MAS is the top of outsourcing and Bookkeeping service Companies in India and US

Accounting outsourcing in US | Accounting Services in India | Bookkeeping | Outsourcing Company

#audit#accounting & bookkeeping services in india#ajsh#income tax#auditor#businessregistration#chartered accountant#foreign companies registration in india#taxation#Accounting outsourcing in US

3 notes

·

View notes

Text

Solution for your 100% SMSF tax reporting needs!

Quick SMSF Accountants:- www.quicksmsfaccountants.com.au

Personalized accounting services specifically designed for SMSF trustees, administrators, financial planners, auditors and tax agents. Let us handle your tax return preparation and SMSF auditing with our expertise. Ongoing support from our dedicated SMSF accounting team and tax experts. Stay compliant. Stay up-to-date with your financials. Lodge your fund return seamlessly. Work with Best SMSF Accountant & Tax Return Services. ANNUAL FEE $990

#quick smsf accountants#smsf accountant#smsf tax return service#smsf outsourcing#melbourne#smsf tax return#australia#smsf accounting and taxation#smsf solution#retirementplanning

0 notes

Text

Expert Accounting and Bookkeeping Services Since 2004

Professional Accounting Services for Over 20 Years

Outsourced Bookkeeping is your premium business partner for accounting and bookkeeping services. We render services to individuals, small and large companies, and CPAs across the US. Hospitality and real estate sectors are our specialization.

For real estate, we manage property accounts, leases, and customer accounts. In the hospitality industry, we assist restaurant owners with accounts payable, cash flow, inventory management, and customer accounts.

Our team is equipped with advanced professional knowledge and tools to ensure compliance with state and federal regulations. We provide top-notch accounting and bookkeeping solutions tailored to your specific needs.

Accounting & Bookkeeping Services We Offer

Tracking Business Transactions

Preparation of Financial Statements

Performing Bank Reconciliations

Accounts Payable & Receivable Service

Customized Business Reporting & Periodic Reviews

Preparation of Cash Flow Management

Managing Cash and Subsidiary Ledgers

Tax Filing Process

To know more: https://www.outsourcedbookeeping.com/contact-us/

#bookkeeping services#bookkeeping services near me#outsourcing accounting and bookkeeping services#bookkeeping services for small business#online bookkeeping services#accounting and bookkeeping services#online accounting and bookkeeping services#online business bookkeeping services#bookkeeping and tax services#quickbooks bookkeeping services#professional bookkeeping services#virtual bookkeeping services

0 notes