#online 2290 tax preparation

Explore tagged Tumblr posts

Text

How to E-file Form 2290 Without Breaking the Bank

Being the owner of a trucking company, most of the time, these things give an irritating feeling to do taxes, especially with something like Heavy Vehicle Use Tax (HVUT). However, you will be surprised to know that you can file Form 2290 electronically and pay it without burning too much of a hole in your pocket. Here is a step-by-step guide on how to do it effectively and save money. 1. What is Form 2290? It is a tax form truckers must file to the IRS if their vehicle exceeds 55,000 pounds. You will be required to file this form to the IRS yearly and helps funds for road maintenance. 2. Why File Form 2290 Online? E-filing of Form 2290 online is quick, convenient, and sometime cheaper than mailing it. You can do it from anywhere, at any time, and get your quick confirmation from the IRS. Also, you will not fear delays with postal services. 3. How to E-file Without Breaking the Bank Here is how to e-file Form 2290 without breaking the bank: Compare E-file Providers: There are many Form 2290 online services. Some are cheaper than others. Check their prices and see if they have deals on them. Watch for Discounts: Some e-file providers give discounts during tax season and/or first filers. Look for these types of savings to shave some more off. Use Free Trials or Low-cost Providers: Some providers allow you to try their service free or at low cost, especially if you file for only one truck. 4. How to E-file Form 2290 Online There is a simple step-by-step guide on how to e-file: Select an E-file Provider: Choose a reliable and affordable provider to file Form 2290 online. Sign up and input your information- including the information relating to the vehicle (in this case, your truck) and your Employer Identification Number. Form 2290 Filing: You can prepare your Form 2290 online. The website will automatically forward it to the IRS. Schedule 1: Once your form is processed, you'll receive Schedule 1, which becomes proof of payment. 5. Why Affordable E-filing Matters An independent trucker works tough to run a business, and every dollar saved helps. An economical way of e-filing Form 2290 online saves precious money while aiding you to stay compliant with the IRS. The lesser amount spent on filing means the more amount you can invest in your business or truck maintenance. Conclusion E-filing the Form 2290 online is not only simple but also inexpensive if you choose the right provider. And following the above makes it quite possible to file your taxes without breaking the bank, and that's what you do best: drive!

0 notes

Text

Empowering Logistics Companies | Form 2290

Welcome to the 2024 Key Tax Deadline and Strategies Season!

As we approach January 29th, the begin of the e-filing season, it’s time to center on proficient and stress-free assess filing.

We are committed to directing you through this prepare, guaranteeing a smooth involvement. Our group is here to oversee your monetary obligations with mastery and care, making assess recording direct and worry-free.

Forms to Anticipate by the Conclusion of January or the Starting of February Form W-2G: For detailing betting winnings. Form 1099-C: For announcing obligation of $600 or more canceled by certain monetary substances counting monetary teach, credit unions, and government government agencies. Form 1099-DIV: For announcing profits and selling distributions. Form 1099-G: For announcing certain government installments, counting unemployment recompense and state and nearby charge discounts of $10 or more.

Form 1099-INT: For detailing intrigued, counting intrigued on conveyor certificates of deposit. Form 1099-K: For announcing installments gotten from a third-party settlement entity. Form 1099-LS: For detailing reportable approach deals of life insurance. Form 1099-LTC: For announcing long-term care and quickened passing benefits. Form 1099-MISC: For detailing eminence installments of $10 or more, lease or other commerce installments of $600 or more, prizes and grants of $600 or more, edit protections continues of $600 or more, angling pontoon continues, restorative and wellbeing care installments of $600 or more.

Form 1099-NEC: For announcing nonemployee compensation. Form 1099-OID: For announcing unique issue discount. Form 1099-PATR: For announcing assessable disseminations gotten from cooperatives. Form 1099-Q: For detailing conveyances from 529 plans and Coverdell ESAs. Form 1099-QA: For detailing disseminations from ABLE accounts. Form 1099-R: For detailing conveyances from retirement or profit-sharing plans, IRAs, SEPs, or protections contracts. Form 1099-SA: For announcing conveyances from HSAs, Toxophilite MSAs, or Medicare Advantage MSAs. Form 1098: For announcing $600 or more of contract interest. Form 1098-E: For detailing $600 or more of understudy advance interest. Form 1098-MA: For announcing contract help payments. Form 1098-T: For announcing qualified educational cost and expenses. Form 8300: For announcing exchanges of more than $10,000 in cash (counting computerized resources such as virtual cash, cryptocurrency, or other advanced tokens speaking to value).

Form 8308: For detailing trades of a organization intrigued in 2023 that included unrealized receivables or significantly acknowledged stock items. Form 5498: For announcing IRA commitments, counting conventional, Roth, SEPs, and SIMPLEs, and giving the December 31, 2023, reasonable advertise esteem of the account and required least dispersion (RMD) if applicable. For proficient handling of your assess return, it is fundamental that we accumulate all essential data. It would be ideal if you fill out the brief Admissions Sheet.

Your precise reactions on the Admissions Sheet will empower us to give you with the best conceivable benefit and guarantee compliance with charge regulations. Convenient Arrangements and Custom fitted Assistance: Tax Deadline Understanding the complexities of assess season, G&S Bookkeeping offers helpful arrangements for record accommodation.

If you’re in the Rancho Cucamonga range, feel free to drop off your printed material at our office. Alternatively, secure online transfers are accessible. Our objective is to make your assess due date encounter as consistent as conceivable. For organizations with financial year plans, we give custom-made bolster to help in recognizing and assembly particular assess due date, guaranteeing prompt compliance. Conclusion: Set out on a Smooth Charge Journey: As the charge season unfurls, let us at G&S Bookkeeping ease your travel. With our mastery and personalized approach, we’re committed to guaranteeing a smooth and effective charge recording involvement for you.

Ready to begin? Provide us a call, and take the to begin with step towards a worry-free charge season.

0 notes

Text

Get smooth Form 2290 online tax preparation and instant Schedule 1 copy delivery, only at TaxExcise.com.

0 notes

Text

Direct Financial and Tax Services LLC

Address

Hiram, GA

30141

Phone:

470-474-1240

Website

http://www.directaxpro.com/

Description:

We provide outstanding service to our clients and we are committed to professionalism, responsiveness and quality. We have been in the industry for more than 10 years, and our reputation is everything to us. Our firm is staffed with only the most experienced financial professionals with the ability to meet your needs. Our well-trained and organized staff will bend over backwards to meet and exceed your expectations.

Keywords

Tax preparation, tax preparation services, tax preparation near me, Tax prep, tax prep service, Health insurance, Life insurance, dental insurance, income tax, 8862, 1040, online tax preparation, virtual tax services, online tax prep, earned income credit, IRS, professional tax service, tax software, free tax service, affordable, low cost, no cost, self employed, truck driver, 2290, dat loadboard, ch robinson, TQL, pilot, love's, truckstop, truckers taxes, mhc kenworth, TA, tax planning, atlanta tax preparer, hiram tax service, dallas tax service

Hours

Monday-Friday

9am-8pm est

Saturday 10am-9pm est

Sunday: Closed

1 note

·

View note

Text

Form 2290 prefile is now available in Tax2290.com

Form 2290 prefile is now available in Tax2290.com

Prefile Form 2290 for the Tax Year 2019 – 2020, This is the same time of the year to report or renew your Form 2290 heavy motor vehicle use tax with the IRS and to receive the stamped Schedule -1 proof to renew and register your vehicles with the states authorities.

Why you wait till July or August to report your Heavy Vehicle Use Tax Form 2290 for Tax year 2019 – 2020, Tax2290.com has made it…

View On WordPress

#efile tax 2290 software#form 2290#form 2290 efile#form 2290 online#online 2290 tax preparation#tax 2290 efile website#tax 2290 electronic filing website#tax 2290 federal software#tax 2290 online website#tax 2290 preparation#tax 2290 preparation website#tax 2290 reporting#tax 2290 reporting software#tax 2290 reporting website#tax 2290 software#tax form 2290#tax form 2290 online#tax2290 online software

0 notes

Text

Heavy Vehicle Use Tax Form 2290 Electronic Filing for New Vehicels Added in October

Heavy Vehicle Use Tax Form 2290 Electronic Filing for New Vehicels Added in October

The Federal Vehicle Use Tax Form 2290 is an annual tax and due by August 31 for vehicle first used from July for 2018-19 tax period. However form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period. The current period begins July 1, 2018, and ends June 30, 2019. Form 2290 must be filed by the last day of the month following the month of…

View On WordPress

#2290 due date#2290 tax dues#2290 tax efile#2290 truck tax dues#efile 2290#efile tax 2290 software#federal 2290 vehicle use tax#form 2290 online#hvut 2290 online#online 2290 efile#online 2290 tax preparation#online tax 2290 payment#online tax 2290 preparation#renewal 2290#tax 2290#tax 2290 bill#tax 2290 efile#tax 2290 efile website#tax 2290 electronic filing#tax 2290 electronic filing website#tax 2290 federal software#tax 2290 federal tax#tax 2290 filing#tax 2290 online filing#tax 2290 online website#tax 2290 preparation#tax 2290 preparation website#tax 2290 reporting#tax 2290 reporting software#tax 2290 reporting website

0 notes

Photo

Why you need to choose @tax2290.com to complete your HVUT Form 2290 online for 2022 - 23.

· The Most Experienced Form 2290 E-file Service Provider

· Handpicked, Industry’s Best Customer Service via Phone, Chat & Email

· Instant Alert for all the actions via Email & Text

· Import Vehicle Information from Previous years Filings

· Bulk vehicle upload using excel spreadsheet

· E-file from Desktop, Laptop, Tablet or Mobile phones

· Mobile App for both Android & iOS

· Stamped Schedule 1 Copy by Fax

· Option to E-file Pro-Rated Tax Returns

· Flexible Pricing Plan for Business Owners & Trucking Companies

· Seasonal Pricing Plan for Frequent Filers

· Special Pricing Plans for Accountants, CPA’s & Book Keepers

· Easy & Simple IFTA Return Preparation

· Certified by the IRS to Claim Refunds through Form 8849

· E-file 2290 Amendments to Correct your Mistakes on Form 2290

· Resubmit Rejected Returns for FREE

· Handle Multiple Businesses under a Single Login

· McAfee Secure certificate for safe website usage, free from malware and malicious links

· BBB accreditation with an A+ rating.

#2290 truck tax e file for 2022#form 2290 e file for 2022#hvut form 2290 e file for 2022#form 2290 for 2022#hvut for 2022#irs tax 2290 e file for 2022

0 notes

Text

Recession in the Trucking Industry

The COVID-19 pandemic has contributed to a significant decline in the employment situation in the trucking industry. The industry observed a slight decline in May this year; however, it is still a tad better than the end of last year (1). Trucking employment observed a drop of 1,500 jobs after an increase of 600 jobs in April. The employment data for the month of April and May are preliminary. In 2020, the trucking subsector faced 42,500 job loss. Compared to the largest annual decrease in 2009, when the trucking company lost over 100,000 trucking jobs, this number is far better. Job employment in the industry again fell by 76,500 jobs during the Great Recession in 2008. Another recession year occurred in 2001 when we lost over 49,000 jobs The trucking industry is up less than 1,000 jobs when compared to the end of 2020. Around mid-2020, there was a drop of over 92,000 jobs as the trucking subsector endured its largest monthly loss ever since the subsector tracking began in 1990. The pandemic and subsequent lockdown restrictions, including stay-at-home orders, had a massive impact on business operations, with April 2020 being the hardest hit month. It caused several businesses to shut down and modify operations, causing massive job losses and erasing over 5 years of employment growth in the industry. However, things began picking up from May 2020, which was the beginning of a nine-month positive streak.

Some Reason for Hope

The employment report submitted by Convoy, an online freight network, shows some improvement in the trucking industry, despite the ongoing concern about labor shortages (2). Convoy focuses on three data points in its analysis that show the labor market in a positive light.

This year April saw the average work hours rise after hitting an all-time high in March.

Young and Hispanic drivers were the most responsive to the job positions that recently opened up in the trucking industry, as per the household survey data.

There was a keen interest in online CDL training, but this interest was not backed up as states ended their emergency Unemployment Insurance benefits.

According to Aaron Terrazas, Convoy’s director of economic research, June will provide better insight into the efforts of onboarding drivers and policymakers’ support to the economy. It is yet to be seen how the COVID-19 era policies and broader reopening will impact the latest labor market ideas whether it will yield job gains or fail to shape up as intended. According to the US Bureau of Labor Statistics, material-moving and transportation jobs showed a slight increase to 8.9% from 8.8% in April (3). This shows a huge improvement from last year's data when the employment rate in the transport industry was greater than 18% as a result of the pandemic. The economy gained 55,000 jobs in May, with the employment rate dropping to 5.8% from 6.1%. However, there was a drop of 9% in employment since April 2020.

Final Thoughts

The pandemic has surely caused some setbacks in the economy and trucking industry. However, this is not the first time the industry has faced such unprecedented turmoil. Now is the time to stay at the top of your game more than ever and prepare for any expected downturn. Assuming another wave of unemployment won’t hit us as strongly as last year, the rest of this year could play out much better. While panicking won’t help, it is smart to stay tax compliant by filing form 2290 using e-file service providers such as eform2290.com. You could also double-check on your processes, protect cash flow, and implement better techniques and supply chains for greater efficiency.

1 note

·

View note

Text

How to Easily File Form 2290 for Your Trucking Business

Filing Form 2290 online is a simple and efficient way to meet your Heavy Vehicle Use Tax obligations for your trucking business. No more paperwork and long wait times; you can file online in a few easy steps.

Here's what you do:

Gather information about your EIN, VIN, and vehicle weight Select an IRS-approved e-filing service to prepare and submit your Form 2290 online Fill it out, review it carefully, and then submit it to the IRS. Enjoy fast delivery to your email in minutes of your stamped Schedule 1 as proof of payment. Optimise saving time apart from faster processing, also reducing the chances of error. Keep filing into the habit every year, and you're rolling!

0 notes

Text

Online 2290 Filing and IFTA Reporting on iTrucker

Those in the trucking business know the burden of filing 2290 form each year. There are serpentine queues to stand in and lots of paperwork to fill out. This can be super annoying, especially when you have big rigs that need to be driver, offices that have to be managed, and employees who require constant supervision.

Time is a precious element in a trucker’s life. It is because if you cannot meet delivery schedules, then you will have to deal with irate customers as soon as you reach the destination. With iTrucker’s 2290 software, it is now easy to fulfill your yearly obligation as a truck driver.

iTrucker 2290 is online software that makes 2290 tax filings simpler and easier for the clients. It is the most convenient and affordable E-filing tax 2290 services on the web. It charges a minimal amount as the service fee. However, you need to make the necessary payment before filing the process to transmit the prepared return to the IRS. You can view the complete 2290 PRICING on our official website.

2290 Key Services Offered at iTrucker

IRS 2290 Schedule 1

IRS 2290 Amendments

Form 8849 Schedule 6

IRS 2290 VIN Corrections

The IFTA Reporting is equally necessary and important as well. If your business employs the use of commercial motor vehicles, you need to file quarterly fuel tax reports that include the total of mileage traveled and the amount of fuel purchased in each state.

Earlier, this required endless paperwork. But today, with the iTrucker’s online IFTA software, it has become very convenient to generate reports and submit them to base jurisdiction. Not only is this software convenient but also affordable. Visit our official website and choose the most appropriate pricing model for yourself. Hurry!! What are you waiting for?

#IFTA Reporting#IFTA PRICING#ifta fuel tax report#ifta tax rates#2290 PRICING#2290 Online Filings#2290 Key Services#AOBRD#HVUT#fmcsa services#trucking industry#Trucking tech news

0 notes

Text

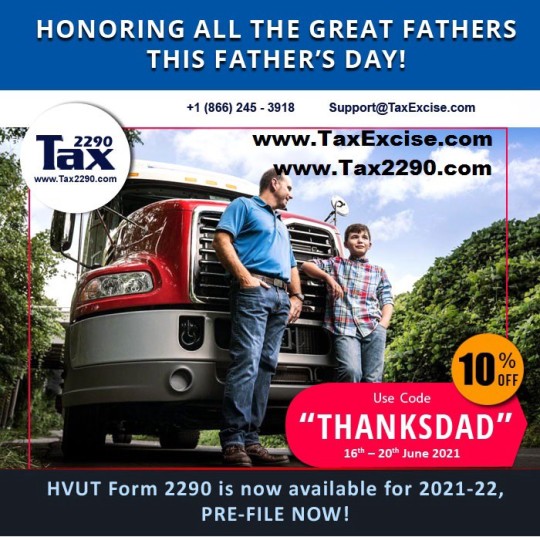

A Special Gift for a Trucker Father this Fathers Day

A Special Gift for a Trucker Father this #FathersDay. Honoring All The Great Fathers offering discounts on the 2290 filing fee which you could avail on the annual renewal filing for the tax period 2021-22, use the promo code “THANKSDAD” for a 10% off.

HVUT Form 2290 is now available for 2021–22, PRE-FILE NOW! “Dads are most ordinary men turned by love into heroes, adventurers, storytellers, and singers of song.” Fathers are always special to their son’s and daughter’s. Every year, Father’s Day is celebrated by families all around the world. Fathers everywhere receive new socks, bizarre flavors of barbecue sauce, or something he actually…

View On WordPress

#2020 express form tax 2290#2020 express tax form 2290#2020 green tax form 2290#2020 hvut form 2290#2020 road tax form 2290#2020 tax form 2290#2020 Tax Form 2290 Preparation#2020 Tax2290#2020 Truck Tax 2290#2020 truck tax form#2290 form 2020#2290 online#2290 road tax form#2290 tax#2290 Tax Online 2020#efile 2290 online#efile 2290 taxes#express truck tax form 2290#Form 2290#form 2290 efile#form 2290 efiling#form 2290 electronic filing#form 2290 for 2020#form 2290 instructions#form 2290 online filing#form 2290 online reporting#Form 2290 online tax#form 2290 online tax reporting#form 2290 tax#Heavy Truck Tax 2020

0 notes

Text

Last few hours to report Federal Quarterly Excise Taxes online for 2nd Quarter 2018

Last few hours to report Federal Quarterly Excise Taxes online for 2nd Quarter 2018 | #PCORIfee #IndoorTanning can also be reported at @taxexcise, efile is $49.99. HVUT 2290 is also due now and IFTA Fuel Tax for 2nd Quarter too due now...

The Federal Excise Taxes for 2nd Quarter of 2018 is now DUE, you have less than 12 hours to report it with the IRS. Act fast and do it online at TaxExcise.com to avoid paying more as late fee, interest and other charges…

Expert Tax Preparation & e-Filing Advantages

TaxExcise.com has better ways to handle your Federal Excise Tax filing worries, being an expert and the most experience e-file…

View On WordPress

#720 Excise Tax#720 online#deadline for PCORI Fee#e file excise tax#E-File Excise Tax Return#E-File Form 2290#E-File Form 720#E-File Form 8849#E-file PCORI Fee#Efile Excise tax form 720#efile form 720#efile indoor tanning excise taxes#efile PCORI#electronic filing excise tax#Excise Tax Form 720#Excise Tax on PCORI#excise tax online#Excise Tax Preparation website#Excise tax return online#Excise taxes online#federal excise tax efile#Federal Excise tax Form 2290#Federal Excise Tax returns online#first quarter federal excise tax#Form 2290#Form 2290 online#Form 720#Form 720 Dead Line#Form 720 Due Date#Form 720 excise tax returns online

0 notes

Photo

Added new truck in October then November 30 is the deadline to report HVUT on it Truckers must keep one thing in mind that if you mail the completed form 2290 and the payment, it may possibly take the IRS 4-6 weeks to return your stamped receipt that is the Schedule 1 copy to you.

#2290 due date#2290 tax dues#2290 tax efile#2290 truck tax dues#efile 2290#efile tax 2290 software#federal 2290 vehicle use tax#form 2290 online#hvut 2290 online#online 2290 efile#online 2290 tax preparation#online tax 2290 payment#online tax 2290 preparation#renewal 2290#tax 2290#tax 2290 bill#tax 2290 efile#tax 2290 efile website#tax 2290 electronic filing#tax 2290 electronic filing website#tax 2290 federal software#tax 2290 federal tax#tax 2290 filing#tax 2290 online filing#tax 2290 online website#tax 2290 preparation#tax 2290 preparation website#tax 2290 reporting#tax 2290 reporting software#tax 2290 reporting website

0 notes

Text

10% flat off to e-File 2290 Truck Tax Returns

10% flat off to e-File 2290 Truck Tax Returns

Form 2290 must be filed for the month the taxable vehicle is first used on public highways during the current period. The current period begins July 1, and ends June 30. Form 2290 must be filed by the last day of the month following the month of first use, and if any due date falls on a Saturday, Sunday, or legal holiday, file by the next business day.

If you first use multiple vehicles in more…

View On WordPress

#2017 tax 2290 payment#2290 tax for 2017#2290 tax preparation#2290 tax returns online#pay 2290 online#pay 2290 online for 2017#tax 2290 online#tax 2290 preparation#Tax Year 2017 filing for HVUT

0 notes

Link

IRS Form 2290 Onilne | Pay 2290 Online | 2290 Schedule 1 Proof | Form 2290 Online Filing

IRS Form 2290 Online Filing to report heavy vehicles with 55,000 pounds or more gross weight. Pay HVUT 2290 in minutes. IRS Form 2290 Efile Provider at +1-316-869-0948

0 notes

Text

Benefits of e-filing a Form 2290 online at www.form2290.com

Simple, Quick, Safe and Secure -

Filing a Form 2290 was a big hassle in old days, printing too many pages of form and fill out complicated questions, going to the IRS office, stand in a long queue and then it would be done. If was sent in the mail then it was time-consuming too. Now E-filing technology has made filing process easy and convenient. When it is to enter personal information online using the internet, the first thing a person would think is about his/her data safety. And that is correct, one should think about it. At www.form2290.com we have high-level SSL encryption (Secure Socket Layer). That protects users information from the data hackers. In this way, the data entered on our website by the users remain safe and secure. We NEVER sell or share customers data, like others do. We designed our website in a very simple way that helps users to understand and complete the form 2290 without any hardship. Tax return filer on our site, who does not use a computer regularly, he or she can submit the form easily without facing any challenges. Once a form 2290 has been submitted online, it takes just minutes to get schedule 1 back from the IRS. Schedule 1 is a proof of e-filing as well as proof of payment for form 2290. The biggest advantage to use of www.form2290.com to e-file a form 2290 is you can get a schedule 1 within minutes

Get E-filing Assistance - Pre or Post E-filing Assistance -

Tax filers are always in a lot of confusions about filing a form 2290 online. You can always contact us or get help from us for any query or question pertaining to online filing. We have a dedicated team of experts to assist you through calls, chat or emails. They will help you with various scenarios such as below;

How to e-file,

Walk through to complete online filing,

How much to pay IRS tax or how to file as tax-exempt,

Claiming tax credit on mileage did not exceed or Sold, Destroyed and Stolen trucks

Help to calculate prorated tax amount,

Amendments assistance (such as VIN correction, Mileage Exceeded or Gross Weight Amendment),

Help in rejected form corrections,

And many more

We are well known among trucking companies, tax giants, sole proprietors, tax professionals, owner-operators and CPAs it is due to we provide high standard and professional services to our clients.

Get Schedule 1 within Minutes -

Normally Form 2290 paper filing takes a longer time in comparison to online filing. Once you send Form 2290 in the mail to the IRS it might take 4 to 6 weeks to receive schedule 1 back. When online filing is just like magic, once you submit the form online and on the next moment schedule 1 would beep to your inbox.

Convenient and Time Saving Idea -

Online filing of Form 2290 is a very good idea in comparison to do it the manual way by sending in the mail to the IRS. The number of advantages are more, such as below;

Tax filer does not need to go to tax professionals, tax consultants or agents,

No need to do a lot of research on how to file – just follow the steps online to complete it,

No need to wait till the tax preparers will complete the form and approve it – easy way to enter information online instead and submit.

One can prepare online filing from his/her own home and submit without travelling to the IRS office, tax professionals office or somewhere to file.

Can file at any time, anywhere and using any device (mobile phone, tablet or computer).

Do not need to send any documents in the mail (except if selected to pay tax by sending a check in mail or money order).

Get automatic tax due dates reminders through email.

Instant Amendments or Corrections on Rejected forms -

It is common that mistakes happens while filing a tax return. We often get customers who made mistakes on their Form 2290 and they would be happy when they will find easy solutions for that. At www.form2290.com customers will have the option to correct their rejected forms easily. Regardless of rejection reason, they would get help from us to get it corrected within minutes. Common rejection reason is wrong EIN or Business name, which does not match with the IRS record. Also incorrect routing number and Duplicate filing.

If an incorrect VIN number entered on the accepted form then VIN correction option takes place to fix it. Also, Gross weight amendment to correct incorrect gross weight and if mileage limit crossed more than 5000 miles in a tax year (7500 miles if a farm heavy highway motor vehicle) then it requires mileage exceeded amendment. Amendment filing takes just minutes to get amended schedule 1 back from the IRS.

Easy and Handy option to keep Record of Every year Filings online-

We often hear from the tax filers about missing or misplacing their watermarked schedule 1. Generally, when we need something we cannot find it. In the case of paper filing, if someone loses the stamped schedule 1 then it would be a bit tough to get a new copy and obviously, it would be time-consuming. When comparatively it would be much easy, handy and straight forward option to get a new copy of schedule 1 if it was filed electronically. You can keep the record of online filing at www.form2290.com for many years and get a copy of any years to schedule 1 any time you need. Regardless of timing, online filing is available 24 hours a day and 7 days a week.

0 notes