#oil & gas pumps market

Explore tagged Tumblr posts

Text

The global Artificial Lift Market is projected to reach USD 9.0 billion in 2028 from USD 7.3 billion in 2023 at a CAGR of 4.4% according to a new report by MarketsandMarkets™. Artificial lift comprises techniques in the oil and gas sector to boost hydrocarbon production from wells with insufficient natural pressure. Employed when reservoir pressure is inadequate, methods like rod lift systems, electric submersible pumps, gas lift, and hydraulic pumping enhance flow rates. These mechanisms enable more efficient recovery, compensating for declining reservoir pressure and optimizing production in mature wells. The growing requirement to maximize the production potential of mature fields is one of the leading factors driving the growth of the artificial lift market, as the demand for oil and gas is constantly growing. Digitalization and automation to enable better analysis of good conditions present promising opportunities for the artificial lift market.

#oil rig#oil and gas#oil and gas companies#oil industry#oil#artificial life#energy#energia#Artificial lift#Artificial lift market#drilling tools#oil and gas drilling#offshore drilling#offshore oil and gas#oil and gas production#oil and gas industry#oil and gas pump#oil pump#oil pulling

0 notes

Text

"The man who has called climate change a “hoax” also can be expected to wreak havoc on federal agencies central to understanding, and combating, climate change. But plenty of climate action would be very difficult for a second Trump administration to unravel, and the 47th president won’t be able to stop the inevitable economy-wide shift from fossil fuels to renewables.

“This is bad for the climate, full stop,” said Gernot Wagner, a climate economist at the Columbia Business School. “That said, this will be yet another wall that never gets built. Fundamental market forces are at play.”

A core irony of climate change is that markets incentivized the wide-scale burning of fossil fuels beginning in the Industrial Revolution, creating the mess humanity is mired in, and now those markets are driving a renewables revolution that will help fix it. Coal, oil, and gas are commodities whose prices fluctuate. As natural resources that humans pull from the ground, there’s really no improving on them — engineers can’t engineer new versions of coal.

By contrast, solar panels, wind turbines, and appliances like induction stoves only get better — more efficient and cheaper — with time. Energy experts believe solar power, the price of which fell 90 percent between 2010 and 2020, will continue to proliferate across the landscape. (Last year, the United States added three times as much solar capacity as natural gas.) Heat pumps now outsell gas furnaces in the U.S., due in part to government incentives. Last year, Maine announced it had reached its goal of installing 100,000 heat pumps two years ahead of schedule, in part thanks to state rebates. So if the Trump administration cut off the funding for heat pumps that the IRA provides, states could pick up the slack.

Local utilities are also finding novel ways to use heat pumps. Over in Massachusetts, for example, the utility Eversource Energy is experimenting with “networked geothermal,” in which the homes within a given neighborhood tap into water pumped from underground. Heat pumps use that water to heat or cool a space, which is vastly more efficient than burning natural gas. Eversource and two dozen other utilities, representing about half of the country’s natural gas customers, have formed a coalition to deploy more networked geothermal systems.

Beyond being more efficient, green tech is simply cheaper to adopt. Consider Texas, which long ago divorced its electrical grid from the national grid so it could skirt federal regulation. The Lone Star State is the nation’s biggest oil and gas producer, but it gets 40 percent of its total energy from carbon-free sources. “Texas has the most solar and wind of any state, not because Republicans in Texas love renewables, but because it’s the cheapest form of electricity there,” said Zeke Hausfather, a research scientist at Berkeley Earth, a climate research nonprofit. The next top three states for producing wind power — Iowa, Oklahoma, and Kansas — are red, too.

State regulators are also pressuring utilities to slash emissions, further driving the adoption of wind and solar power. As part of California’s goal of decarbonizing its power by 2045, the state increased battery storage by 757 percent between 2019 and 2023. Even electric cars and electric school buses can provide backup power for the grid. That allows utilities to load up on bountiful solar energy during the day, then drain those batteries at night — essential for weaning off fossil fuel power plants. Trump could slap tariffs on imported solar panels and thereby increase their price, but that would likely boost domestic manufacturing of those panels, helping the fledgling photovoltaic manufacturing industry in red states like Georgia and Texas.

The irony of Biden’s signature climate bill is states that overwhelmingly support Trump are some of the largest recipients of its funding. That means tampering with the IRA could land a Trump administration in political peril even with Republican control of the Senate, if not Congress. In addition to providing incentives to households (last year alone, 3.4 million American families claimed more than $8 billion in tax credits for home energy improvements), the legislation has so far resulted in $150 billion of new investment in the green economy since it was passed in 2022, boosting the manufacturing of technologies like batteries and solar panels. According to Atlas Public Policy, a research group, that could eventually create 160,000 jobs. “Something like 66 percent of all of the spending in the IRA has gone to red states,” Hausfather said. “There certainly is a contingency in the Republican party now that’s going to support keeping some of those subsidies around.”

Before Biden’s climate legislation passed, much more progress was happening at a state and local level. New York, for instance, set a goal to reduce its greenhouse gas emissions from 1990 levels by 40 percent by 2030, and 85 percent by 2050. Colorado, too, is aiming to slash emissions by at least 90 percent by 2050. The automaker Stellantis has signed an agreement with the state of California promising to meet the state’s zero-emissions vehicle mandate even if a judicial or federal action overturns it. It then sells those same cars in other states.

“State governments are going to be the clearest counterbalance to the direction that Donald Trump will take the country on environmental policy,” said Thad Kousser, co-director of the Yankelovich Center for Social Science Research at the University of California, San Diego. “California and the states that ally with it are going to try to adhere to tighter standards if the Trump administration lowers national standards.”

[Note: One of the obscure but great things about how emissions regulations/markets work in the US is that automakers generally all follow California's emissions standards, and those standards are substantially higher than federal standards. Source]

Last week, 62 percent of Washington state voters soundly rejected a ballot initiative seeking to repeal a landmark law that raised funds to fight climate change. “Donald Trump’s going to learn something that our opponents in our initiative battle learned: Once people have a benefit, you can’t take it away,” Washington Governor Jay Inslee said in a press call Friday. “He is going to lose in his efforts to repeal the Inflation Reduction Act, because governors, mayors of both parties, are going to say, ‘This belongs to me, and you’re not going to get your grubby hands on it.’”

Even without federal funding, states regularly embark on their own large-scale projects to adapt to climate change. California voters, for instance, just overwhelmingly approved a $10 billion bond to fund water, climate, and wildfire prevention projects. “That will be an example,” said Saharnaz Mirzazad, executive director of the U.S. branch of ICLEI-Local Governments for Sustainability. “You can use that on a state level or local level to have [more of] these types of bonds. You can help build some infrastructure that is more resilient.”

Urban areas, too, have been major drivers of climate action: In 2021, 130 U.S. cities signed a U.N.-backed pledge to accelerate their decarbonization. “Having an unsupportive federal government, to say the least, will be not helpful,” said David Miller, managing director at the Centre for Urban Climate Policy and Economy at C40, a global network of mayors fighting climate change. “It doesn’t mean at all that climate action will stop. It won’t, and we’ve already seen that twice in recent U.S. history, when Republican administrations pulled out of international agreements. Cities step to the fore.”

And not in isolation, because mayors talk: Cities share information about how to write legislation, such as laws that reduce carbon emissions in buildings and ensure that new developments are connected to public transportation. They transform their food systems to grow more crops locally, providing jobs and reducing emissions associated with shipping produce from afar. “If anything,” Miller said, “having to push against an administration, like that we imagine is coming, will redouble the efforts to push at the local level.”

Federal funding — like how the U.S. Forest Service has been handing out $1.5 billion for planting trees in urban areas, made possible by the IRA — might dry up for many local projects, but city governments, community groups, and philanthropies will still be there. “You picture a web, and we’re taking scissors or a machete or something, and chopping one part of that web out,” said Elizabeth Sawin, the director of the Multisolving Institute, a Washington, D.C.-based nonprofit that promotes climate solutions. “There’s this resilience of having all these layers of partners.”

All told, climate progress has been unfolding on so many fronts for so many years — often without enough support from the federal government — that it will persist regardless of who occupies the White House. “This too shall pass, and hopefully we will be in a more favorable policy environment in four years,” Hausfather said. “In the meantime, we’ll have to keep trying to make clean energy cheap and hope that it wins on its merits.”"

-via Grist, November 11, 2024. A timely reminder.

#climate change#climate action#climate anxiety#climate hope#united states#us politics#donald trump#fuck trump#inflation reduction act#clean energy#solar power#wind power#renewables#good news#hope

2K notes

·

View notes

Link

#adroit market research#oil and gas pumps market#oil and gas pumps market 2020#oil and gas pumps market size#oil and gas pumps market share

0 notes

Text

The global Artificial Lift Market is projected to reach USD 9.0 billion in 2028 from USD 7.3 billion in 2023 at a CAGR of 4.4% according to a new report by MarketsandMarkets™.

#Artificial Lift#Artificial Lift Market#artificial lift systems market#energy#oil and gas#oil and gas industry#oil production#offshore oil and gas#oil and gas exploration#oil and gas companies#oil and gas drilling#oil and gas sector#oil and gas production#oil and gas equipment#oil and gas prices#oil and gas reserves#oil exploration#exploration#production#oil pump#oil prices#oil#gas#shale gas#shale oil#upstream#oilfield#oilfields#drilling rig#drilling rigs

0 notes

Link

#adroit market research#oil and gas pumps market#oil and gas pumps market 2020#oil and gas pumps market size#oil and gas pumps market share

0 notes

Text

On Trump cutting help to everyone but Israel and Egypt... He fucked up. As in, he literally just caused one of the things he said he would prevent, and I actually expected him to keep his word on this because doing otherwise would be immensely STUPID and successfully unite a large chunk of world, INCLUDING Israel, to be pissed at him. What I'm referring top is the impending increase in oil and fuel prices.

When Russia started its full scale invasion of Ukraine in 2022, a regime of sanctions was put in place with a precise goal: to keep Russia from making money out of its refined oil exports without removing said products from the market, thus increasing immensely the oil products worldwide including the US (a state with abundant exports, but the global market means that if oil prices go up they go up EVERYWHERE). This scheme worked, but had a very clear weak spot, namely Ukraine's increasing ability to forcibly stop the exports by targeting the pipelines, refineries (mostly on the Black Sea coast, as most of the exports were historically aimed to Europe and the initial oil fields were closer), and the so-called "shadow fleet" of poorly maintained tankers that allows the buyers to import Russian oil products and gas at higher prices than the price cap established by the sanctions (but still well below the market price).

Ukraine so far hadn't seriously tackled the Russia energy export ability because the US and Europe had a deal with them, weapons and help in exchange for not skyrocketing oil prices worldwide, a deal Ukraine mostly kept to... And then THIS IDIOT decided to give a "show of force" by cutting off help to Ukraine for ninety days. To which Ukraine, to whom defeat would mean genocide and knows better than stop fighting without solid guarantees, has already answered via an ACTUAL show of force by hitting the Ryazan Oil Refinery (the largest oil refinery in Russia, 196 km from Moscow thus making it a visible target). Twice. And at least the second attack caused secondary fires, with consequent "bonus" damage.

I don't have a car so I don't really notice this stuff unless I look at the oil pumps... But I expect gasoline and diesel prices to spike soon if they already haven't, leading a large chunk of America's allies, including Israel (oil IMPORTER nation, as they have no oil deposit) to tell this idiot to make a waiver for Ukraine YESTERDAY, all the while OPEC laughs and makes money after this long term decrease of the offer of oil products around the world.

He decided to show the world he had it by the balls, but it was the world that squeezed.

20 notes

·

View notes

Text

Trump’s Oil and Gas Donors Don’t Really Want to ‘Drill, Baby, Drill’. (Wall Street Journal)

Excerpt from this Wall Street Journal story:

Donald Trump wants oil companies to “drill, baby, drill” on the first day of his presidency, but his fossil-fuel benefactors have a different agenda.

Many of the tycoons who backed the Republican’s victorious campaign say what they need help with is shoring up demand for their products—not pumping more fossil fuels, which they have little incentive to do.

They are pushing for policies that would lock in fossil-fuel use, such as easier permitting for pipelines and terminals to shuttle fossil fuels to new markets. They also favor eliminating Biden administration policies meant to put more electric vehicles on the road.

Under President Biden, shale companies produced record amounts of oil and natural gas as crude prices rebounded from the pandemic’s depths and then soared after Russia’s invasion of Ukraine. But the industry is also confronting the early stages of a long-term shift away from fossil fuels, as well as concerns that gasoline consumption has peaked in the U.S.

Trump handed shale donors their first big return on investment by nominating Liberty Energy Chief Executive Chris Wright, a fracking booster and fossil-fuels champion, to lead the president-elect’s Energy Department.

When Dan Eberhart, the CEO of oil-field services firm Canary, met with Trump during a fundraiser at his Mar-a-Lago club in Florida this summer, Eberhart had a unique request. He asked Trump to push back on the International Energy Agency, the influential, Paris-based energy forecaster. The agency has predicted global oil demand will peak by the end of the decade, earning scorn from GOP lawmakers who dubbed the group an “energy transition cheerleader.”

“You need to stop acting like fossil fuels are the devil,” Eberhart said in an interview, referring to the IEA’s stance.

A spokesperson for the IEA said it remains “focused on its key missions of energy security and energy transitions, based on the mandates from our member governments.”

Many of Trump’s oil and natural-gas supporters favor easing regulations that govern drilling. The changes would include scrapping rules targeting methane emissions, getting new permits to frack on federal land and eliminating climate disclosure rules.

But some donors grimace when they hear Trump promise that under his watch, crude-oil producers would open the floodgates. He has also promised to cut Americans’ energy costs by 50% or more.

Oil backers’ skepticism stems from the fact that Wall Street has successfully pressured chronically indebted frackers to stop burning through cash, and return it to shareholders via buybacks and dividends instead of reinvesting it to frack more wells.

15 notes

·

View notes

Text

President Joe Biden is prepared to release more oil from the country’s strategic reserves if gas prices increase during the summer. This is the latest plan by the Biden administration to counter higher prices at the pumps and the more expensive prices on various goods due to inflation.

A Biden administration energy adviser suggested gas prices are “still too high” for many in the country and said he favors taking action to “cut them down a little bit further.”

“We will do everything we can to make sure that the market is supplied well enough to ensure as low [a] price as possible for American consumers,” Special Presidential Coordinator for Global Infrastructure and Energy Security Amos Hochstein told the Financial Times. “I think that we have enough in the SPR if it’s necessary.”

17 notes

·

View notes

Text

Gas Station Stream of Consciousness Post

Gas Stations as Liminal Spaces

I've had quite a few hyperfixations in my day - ATMs, laundry detergents, credit cards - so my current one pertaining to gas stations is fitting considering my affinity for liminal spaces and the dedication of this blog to them. Liminal spaces are transitory in nature, hence their portrayal in online circles through photos of carpeted hallways, illuminated stairwells, dark roads, and backrooms, among other transitional points.

Gas stations are posted online as well; images of their fuel pumps or neon signage photographed through a rainy car window communicate their liminality and the universal experiences they provide to all of society. Perhaps they are the ultimate specimen of a liminal space. The machines they are created for, automobiles and tractor trailers alike, themselves are tools for motion, vestibules that enable travel and shipment across long distances at high speeds. Cars and roads are liminal spaces, albeit in different formats, and gas stations serve as their lighthouses. Vehicles at filling stations, therefore, are in a sense liminal spaces within liminal spaces within liminal spaces.

The uniqueness of a gas station as a liminal space, however, is its intersection with the economics and aesthetics of capitalism. Gasoline (and diesel fuel) is a commodity, downstream from crude oil, merely differentiated by octane ratings. Some argue that minute distinctions between agents, detergents, and additives make some brands better than others. Indeed, fuels that are approved by the Top Tier program, sponsored by automakers, have been shown to improve engine cleanliness and performance, but this classification does not prefer specific refiners over others; it is simply a standard. To a consumer, Top Tier fuels are themselves still interchangeable commodities within the wider gasoline commodity market.

The Economics of Gas Stations

The market that gas stations serve is characterized by inelastic demand, with customers who reckon with prices that fluctuate day in and day out. This is not to say that consumer behavior does not change with fuel prices. It has been observed that as prices rise, consumers are more eager to find the cheapest gas, but when prices fall, drivers are less selective with where they pump and are just happy to fill up at a lower price than last week. In response, gas stations lower their prices at a slower rate than when increasing prices, allowing for higher profit margins when wholesale prices fall. This has been dubbed the "rockets and feathers" phenomenon.

When portrayed as liminal spaces, gas stations are most often depicted at night, places of solitude where one may also enter the adjacent convenience store and encounter a fellow individual who isn't asleep, the modern day lightkeeper. The mart that resides at the backcourt of a gas station is known to sell goods at higher prices than a supermarket, simultaneously taking advantage of a captive customer, convenient location, and making up for the inefficiencies of a smaller operation. It may come as no surprise, then, that gas stations barely make any money from fuel sales and earn their bulk through C-store sales. This is a gripe I have with our economic system. Business is gamified, and in many cases the trade of certain goods and services, called loss leaders, is not an independent operation and is subsidized by the success of another division of a business, a strategy inherently more feasible for larger companies that have greater scale to execute it.

Nevertheless, most gas station owners, whether they have just one or hundreds of sites, find this method fruitful. Even though most gas stations in the US sell one of a handful of national brands, they operate on a branded reseller, or dealer, model, with oil companies themselves generally not taking part in the operations of stations that sell their fuels. The giants do still often have the most leverage and margin in the business, with the ability to set the wholesale price for the distributor, which sells at a markup to the station owner, which in turn will normally make the least profit in the chain when selling to the end customer at the pump. This kind of horizontal integration that involves many parties lacks the synergies and efficiencies of vertical integration that are so applauded by capitalists, but ends up being the most profitable for firms like ExxonMobil, who only extract and refine oil, and on the other end of the chain merely license their recognizable brands to the resellers through purchasing agreements. Furthermore, in recent years, independent dealers have sold their businesses to larger branded resellers, in many cases the ones from whom they had been buying their fuel.

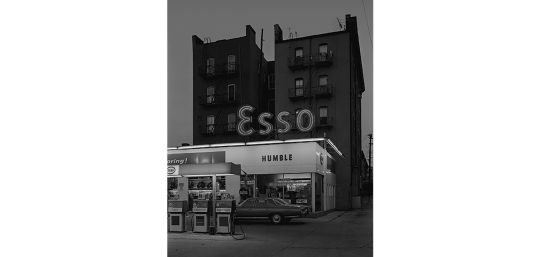

A Word on ExxonMobil's Branding Potential

The largest publicly traded oil company in the world is Exxon Mobil Corporation. It is a direct descendent of the Rockefeller monopoly, Standard Oil, which was broken up in 1911 into 34 companies, the largest of which was Jersey Standard, which became Exxon in 1973. This title was generated by a computer as the most appealing replacement name to be used nationwide to unify the Humble, Enco, and Esso brands, decades before AI was spoken of. The latter brand is still used outside of the United States for marketing, arising from the phonetic pronunciation of the initials of Standard Oil. In 1999, Exxon and Mobil merged, and the combined company to this day markets under separate brands. Exxon is more narrowly used, to brand fuel in the United States, while Mobil has remained a motor oil and industrial lubricant brand, as well as a fuel brand in multiple countries.

Mobil originated in 1866 as the Vacuum Oil Company, which first used the current brand name for Mobiloil, and later Mobilgas and Mobilubricant products, with the prefix simply short for "automobile". Over time, Mobil became the corporation's primary identity, with its official name change to Mobil Oil Corporation taking place in 1966. Its updated wordmark with a signature red O was designed by the agency Chermayeff & Geismar, and the company's image for service stations was conceived by architect Eliot Noyes. New gas stations featured distinctive circular canopies over the pumps, and the company's recognizable pegasus logo was prominently on display for motorists.

I take issue with the deyassification of the brand's image over time. As costs were cut and uniformity took over, rectangular canopies were constructed in place of the special ones designed by Noyes that resembled large mushrooms. The pegasus remained a prominent brand icon, but the Mobil wordmark took precedence, which I personally believe to be an error in judgement. This disregard for the pegasus paved the way for its complete erasure in 2016 with the introduction of ExxonMobil's "Synergy" brand for its fuel. The mythical creature is now much smaller and appears only at the top right corner of pumps at Mobil gas stations, if at all.

Even into the 90s and the 21st century the Pegasus had its place in Mobil's marketing. In 1997, the company introduced its Speedpass keytag, which was revolutionary for its time and used RFID technology, akin to mobile payments today, to allow drivers to get gas without entering the store or swiping a card. When a Speedpass would be successfully processed, the pegasus on the gas pump would light up red.

When Exxon and Mobil merged in 1999, the former adopted the payment method too, with Exxon's less iconic tiger in place of the pegasus.

The program was discontinued in 2019 in favor of ExxonMobil's app, which is more secure since it processes payments through the internet rather than at the pump.

What Shell has done with its brand identity is what Mobil should've done for itself. The European company's logo was designed in 1969 by Raymond Loewy, and is a worth contender for the "And Yet a Trace of the True Self Exists in the False Self" meme. In recent years, Shell went all in on its graphic, while Mobil's pegasus flew away. I choose to believe that the company chose to rebrand its stations in order to prevent the malfunction in the above image from happening.

ExxonMobil should have also discontinued the use of the less storied Exxon brand altogether, and simplifying its consumer-facing identity to just the global Mobil mark. Whatever, neither of the names are actual words. As a bonus, here is a Google map I put together of all 62 gas stations in Springfield, MA. This is my idea of fun. Thanks for reading to the end!

#exxonmobil#exxon#mobil#gas station#gas stations#liminal space#liminal spaces#liminal#liminalcore#liminal aesthetic#justice for pegasus#shell#corporations#capitalism#branding#marketing#standard oil#economics#gas#gasoline#fuel#oil companies

110 notes

·

View notes

Text

Recent events in the State of Washington pit environmentalists against the voting public.

Doomberg

Nov 13, 2024

“Don't pay any attention to the critics—don't even ignore them.” – Samuel Goldwyn

By nearly all the measures that matter, the State of Washington’s energy mix is about as green as it gets. Leveraging the powerful flows of the Columbia River, Washington generates approximately 60% of its electricity from hydroelectric dams. The Grand Coulee Dam is by far the largest hydroelectricity producer in the US and ranks among the top ten globally, generating more than 20 billion kilowatt hours (kWh) per year. The state is also home to the Northwest’s only commercial nuclear energy facility—the Columbia Generating Station—which provides a further 8% of annual supply to the grid, about as much as is currently delivered by wind turbines. The balance of Washington’s generation comes from clean-burning natural gas, and the last of its large coal furnaces is set to close in 2025. Set it and forget it | Getty

A similar story emerges when analyzing how residents in Washington heat their homes. More than 58% use electricity, and state leaders are actively pushing heat pumps as a replacement for traditional resistive heating options. Only a third of households rely on natural gas, while the remaining 9% rely on a mix of propane, wood, and other sources.

Although Washington produces almost no oil or natural gas within its borders, it has positioned itself shrewdly in both markets. The state is home to five refineries, ranks fifth in the US by total refining capacity, and is a net exporter of petroleum products. Washington is also a major conduit of natural gas produced in British Columbia and Alberta, home to some of the lowest-cost supply in the world. The Gas Transmission Northwest pipeline is capable of flowing 2.7 billion cubic feet per day (bcf/d) as it passes into the state from Idaho on its way to Oregon. The Northwest Pipeline has a peak capacity of 3.8 bcf/d and enters Washington in Sumas, southeast of Vancouver, facilitating gas supply for Oregon, Idaho, Wyoming, Utah, and Colorado.

5 notes

·

View notes

Text

Coiled Tubing Insights: A Deep Dive into Services, Operations, and Applications

Coiled Tubing Market Overview:

Request Sample

Inquiry Before Buying

Coiled Tubing Market Report Coverage

The “Coiled Tubing Market Report — Forecast (2024–2030)” by IndustryARC, covers an in-depth analysis of the following segments in the Coiled Tubing Industry. By Service: Well Intervention & Production, Drilling, Perforating, Fracturing, Engineering Services, Milling Services, Nitrogen services and others. By Operations: Circulation, Pumping, Logging, Perforation, Milling and Others. By Technology/Services: Software Solutions, Hardware By Location: On-Shore, Off-Shore By Application: Wellbore Cleanouts, Electrical Submersible Pump Cable Conduit, Fracturing, Pipeline Cleanout, Fishing, Cementing, Nitrogen Jetting and others. By End Use Industry: Oil and gas Industry, Engineering Procurement and Construction Industry, Others By Geography: North America (U.S, Canada, Mexico), South America (Brazil, Argentina, and others), Europe (Germany, UK, France, Italy, Spain, and Others), APAC (China, Japan India, SK, Australia and Others), and RoW (Middle East and Africa)

Schedule a Call

Key Takeaways

North America dominates the Coiled Tubing Market share of 46.6% in 2023, owing to its advanced oil and gas industry, technological innovation, and substantial investments in exploration and production activities.

The development of unconventional resources, such as shale oil and gas, has increased the demand for coiled tubing services. Coiled tubing is often employed in hydraulic fracturing (fracking) operations in these unconventional reservoirs.

Well intervention services, including well cleaning, stimulation, and logging, are major applications of coiled tubing. As older wells require maintenance and newer wells require optimization, as a result growing the Demand for Well Intervention Services using coiled tubing continues to increase.

Buy Now

Coiled Tubing Market Drivers

Increased Exploration and Production Activities

The surge in oil and gas exploration, notably in unconventional resources such as shale, tight gas, and heavy oil, is fueling the demand for coiled tubing services. Integral to well intervention and stimulation procedures, coiled tubing plays a pivotal role in sustaining and augmenting production rates. This heightened exploration and production activity underscores the significance of coiled tubing services in maintaining operational efficiency and maximizing output in the energy sector.

Increasing Energy Demand

The escalating global energy demand propels the coiled tubing market forward. With an ever-growing need for energy resources, particularly in oil and gas sectors, there’s a heightened requirement for efficient extraction methods. Coiled tubing technology offers a versatile and cost-effective solution for various well intervention and drilling operations, catering to the increasing complexities of resource extraction. Its flexibility, mobility, and ability to access challenging environments make it indispensable in meeting the surging energy demands worldwide. As industries strive to optimize production and enhance operational efficiency, coiled tubing emerges as a crucial component in the quest for sustainable energy solutions.

3 notes

·

View notes

Link

#adroit market research#oil and gas pumps market#oil and gas pumps market 2020#oil and gas pumps market size#oil and gas pumps market share

0 notes

Text

The global Artificial Lift Market is projected to reach USD 9.0 billion in 2028 from USD 7.3 billion in 2023 at a CAGR of 4.4% according to a new report by MarketsandMarkets™.

#Artificial lift#artificial lift systems market#Artificial lift market#oil and gas#oil production#oil pump#oil prices#oil#oil rig#oil and gas exploration#oil and gas industry#oil and gas companies#offshore oil and gas#energy#oil and gas drilling#oil and gas equipment#oil and gas production#oil and gas prices#oil exploration#exploration#production#drilling rig#drilling rigs#oil drilling#offshore drilling#oil and gas news

0 notes

Link

#adroit market research#oil and gas pumps market#oil and gas pumps market 2020#oil and gas pumps market size#oil and gas pumps market share

0 notes

Text

Buy MS Flange ISI 1538 at Lowest Price in Delhi NCR

If you're in the market for MS Flange ISI 1538, you've come to the right place! At Udhhyog, we pride ourselves on offering high-quality MS flanges at competitive prices, ensuring you get the best value for your money.

What is MS Flange ISI 1538?

MS Flange ISI 1538 is a mild steel flange that meets the Indian Standards Institute specifications, making it suitable for various industrial applications. These flanges are essential for connecting pipes, valves, pumps, and other equipment in piping systems. The ISI 1538 standard ensures that these flanges have the necessary strength and durability to withstand high-pressure conditions and corrosive environments.

Key Features of MS Flange ISI 1538

Durability: Made from high-quality mild steel, these flanges are designed to resist wear and tear, providing long-lasting performance.

Standards Compliance: Being ISI certified, they meet strict quality standards, ensuring safety and reliability in all applications.

Versatile Applications: MS Flanges are commonly used in various sectors, including construction, manufacturing, and oil and gas industries, making them a versatile choice for any project.

Easy Installation: The design of these flanges allows for straightforward installation, minimizing downtime and labor costs.

Why Buy from Udhhyog?

Lowest Prices: We offer the lowest price for MS Flange ISI 1538 in Delhi NCR, making it easier for you to stick to your budget without sacrificing quality.

Quality Assurance: At Udhhyog, we believe in providing only the best. Each flange undergoes rigorous quality checks to ensure that it meets our high standards.

Fast Delivery: We understand the urgency of your projects, which is why we offer prompt delivery services to ensure you get your flanges when you need them.

Expert Guidance: Our experienced team is ready to assist you with product selection and any technical inquiries, ensuring you find the perfect flanges for your specific needs.

How to Purchase

Buying MS Flange ISI 1538 from Udhhyog is simple and hassle-free. Visit our website or contact our sales team for a quick quote. We provide a user-friendly platform that allows you to browse our extensive inventory and make informed purchasing decisions.

Don’t compromise on quality—choose Udhhyog for your MS Flange ISI 1538 needs and enjoy the best prices in Delhi NCR. Start your order today and experience the Udhhyog difference!

#MSFlange#ISI1538#FlangeSupplier#DelhiNCR#IndustrialSupplies#AffordableFlanges#Udhhyog#MildSteelFlange#ConstructionMaterials#EngineeringSolutions

5 notes

·

View notes

Text

"Stick an aircraft engine in it" part 1 - Boeing Jetfoil

In the late 60s and early 70s, all branches of transport were hoping for an increase in performance similar to what the jet airliner brought to aviation, and the solution was invariably to use similar gas turbine technology, with invariably identical career trajectories when the oil crises hit, as, apart from in aviation, far more economical engine options were available. So I was very surprised to see this still active in Japan last summer:

This is a hydrofoil which uses gas turbines to power a pump-jet. Once it is going fast enough, it takes off and runs on foils, greatly reducing water resistance and achieving speeds up to 45 knots, over 80 km/h (which, on water, is very fast). I remember seeing exactly this type of vessel in ferry brochures when I was a child; Oostende Lines operated some between England and Belgium. The advent of the SeaCat, a class of huge Diesel-powered car-carrying catamarans, got the better of the hydrofoils and the hovercraft, which was incidentally another case of "stick an aircraft engine in it".

This specific class of hydrofoil takes the mantra to another level, as it was designed by Boeing, which named it the 929 Jetfoil. Production was licensed to Kawasaki Heavy Industries in Japan, which made boats for the domestic market. The Rainbow Jet is one of these, running between Sakaiminato on the San'in coast and the Oki Islands. I saw more of them at Atami in Eastern Shizuoka, providing transport to the Izu Islands. So, despite the astronomical 2150 L/h consumption (though to be fair, I can't find consumption numbers for equivalent foot passenger-only catamarans), Japan still runs them...

#Japan#Shimane-ken#Mihonoseki#島根県#美保関#隠岐フェリー#レインボージェット#Rainbow Jet#Jetfoil#gas turbine#the Seventies' Solution for Speed#2023-07

3 notes

·

View notes