#nirmala sitharaman new tax

Explore tagged Tumblr posts

Text

Tax Nirmala Sitharaman: "I Want to Do More"

Finance Minister Nirmala Sitharaman recently addressed the pressing concerns of middle-class taxpayers, offering both reassurance and a candid acknowledgment of the limitations in delivering sweeping reforms. In an interview with Times Now, she outlined key tax adjustments introduced in the last Union Budget, aimed at providing relief to salaried individuals without compromising the government’s…

0 notes

Text

New Income Tax Bill 2025: Simplified Taxation, Reduced Litigation, and Economic Impact

The New Income Tax Bill is now available and will be presented to the Lok Sabha by Union Finance Minister Nirmala Sitharaman. The decades-old Income Tax Act of 1961 will be replaced by this. With 536 sections and 16 (XVI) schedules, the bill is expected to become the Income Tax Act of 2025. Read also: “Income Tax” Slightly Over ₹12 Lakh Salary? Do You Pay Full Tax? During the Budget 2025 Speech,…

View On WordPress

0 notes

Text

0 notes

Text

India’s coalition government has unveiled its first full-year budget, focusing on tax relief, infrastructure, and economic reforms. Finance Minister Nirmala Sitharaman announced tax cuts for the middle class, raising the exemption limit to ₹1.2 million, aiming to boost urban consumption.

The government has increased infrastructure spending to ₹11.2 trillion, while also pushing for nuclear energy expansion and allowing 100% FDI in insurance. Support for small industries and regulatory reforms aims to drive private investment.

Despite growth concerns, the government remains committed to fiscal discipline, targeting a deficit reduction to 4.4% by 2026

#general knowledge#affairsmastery#generalknowledge#current events#current news#upscaspirants#india#upsc#generalknowledgeindia#world news#india news#indian#taxes#modi#narendra modi#pm modi#bharat#minister#nirmala sitharaman#cabinet#infrastructure#finance minister#breaking news#news#political news#public news#upsccoaching#upsc current affairs#upscpreparation#upsc2025

0 notes

Text

Income Tax Budget 2025 : 12 लाख करमुक्त उत्पन्न आणि त्यापेक्षा जास्त उत्पन्न असल्यास कर कसा मोजला जातो?

#**Income Tax Budget 2025 : 12 ला�� करमुक्त उत्पन्न आणि त्यापेक्षा जास्त उत्पन्न असल्यास कर कसा मोजला जातो?**#Income-Tax-Budget-2025#new-tax-regime-2025#tax-slab-2025#new-tax-regime#income-tax-calculator#income-tax-slab#budget-live#income-tax#nirmala-sitharaman#income-tax-slab-for-ay-2025-26#income-tax-budget-2025#new-tax-slab#new-tax-regime-slabs#new-income-tax-slab#tax-slab#budget-2025-live#new-tax-regime-calculator#moneycontrol#new-tax-slab-2025#old-tax-regime-slabs#tax-calculator#new-budget-2025#tax-calculator-2025#old-tax-regime#union-budget#2025-budget#tax#zee-business-live#budget-news

0 notes

Video

youtube

Rs 12 Lakh Tax Exemption Explained

#youtube#In the Union Budget 2024-25 Finance Minister Nirmala Sitharaman announced significant changes to the income tax structure under the new tax

0 notes

Text

India New Income Tax Slabs for FY 2025-26: Comprehensive Analysis and Impact

The Union Budget for the fiscal year 2025-26 has introduced significant changes to India’s income tax structure. One of the most notable updates is the introduction of a 25% tax rate for incomes ranging from Rs 20 lakh to Rs 24 lakh, along with a shift in the 30% tax bracket to incomes exceeding Rs 24 lakh. These changes aim to rationalize tax liabilities while ensuring a fair distribution of tax…

#budget 2025 income tax slab#income tax#income tax slab#india budget 2025#live nirmala sitharaman#nifty latest news updates#nifty live trading#nifty today latest news updates#nirmala sitaraman#nirmala sitharaman budget speech#nirmala sitharaman live today#nirmala sitharaman speech#nirmala sitharaman today#nirmala sitharaman today budget#nirmala sitharaman today speech#sensex latest news updates#sensex today latest news updates

0 notes

Text

Budget 2024 Highlights, New Tax Regime Slabs, Income Tax & More

This is the Interim budget 2024 which is presented by Finance Minister Nirmala Sitharaman. Nirmala Sitharaman presented her 7th budget in parliament.

In the budget 2024, which came just after the election results, the government has also paid the price for the ‘support’ of the allies. Special packages were given to the Bihar government and the Andhra Pradesh government.

At the same time, new employment opportunities have been opened to address the discontent among the youth who expressed their dissatisfaction in the Lok Sabha elections.

However, by increasing the capital gains tax on stock market investors, the burden on the middle class, already suffering from inflation, has been increased further.

In the new tax system, a slight relief has been provided by increasing the standard deduction from ₹50,000 to ₹75,000. Additionally, changes have been made to the income tax slab.

READ MORE: Budget 2024 Highlights, New Tax Regime Slabs, Income Tax & More

#Budget 2024#budget highlights#Budget 2024 highlights#New tax regime#union budget 2024#Nirmala Sitharaman#new tax regime slabs#old tax regime#income tax slab#new regime tax slab#new income tax slab#Budget 2024 Highlights in English#India Budget 2024#income tax budget 2024#Union Budget 2024-25#tax#Union budget 2024 highlights new tax regime slabs income tax & more#Budget 2024 highlights income tax#Income tax slab Budget 2024#Union Budget 2024-25 Highlights#Budget 2024 Highlights in Hindi#Budget 2024 Highlights PDF#Union Budget 2024-25 date#budget 2024 income tax#new tax slab 2024#budget 2024 tax slab#old regime tax slab#India Budget#union budget 2024 highlights#new income tax regime

1 note

·

View note

Text

0 notes

Text

অনলাইন গেমিং-র উপর এবার ২৮% জিএসটি! ঘোষণা কেন্দ্রীয় অর্থমন্ত্রীর

নিউ দিল্লি: অনলাইন গেমিং-র উপর এবার ২৮ শতাংশ জিএসটি বসানোর সিদ্ধান্ত নেওয়া হয়েছে। কেন্দ্রীয় অর্থমন্ত্রী নির্মলা সীতারামনের সভাপতিত্বে সম্প্রতি জিএসটি কাউন্সিলের ৫১তম বৈঠক হয়। এই বৈঠকে অনলাইন গেমিং, ক্যাসিনো এবং ঘোড়ার রেসের মতো খেলাগুলিতে ২৮ শতাংশ জিএসটি প্রযোজ্য রাখার সিদ্ধান্ত নেওয়া হয়েছে। সংবাদ সম্মেলনে অর্থমন্ত্রী বৈঠকে গৃহীত সিদ্ধান্তের কথা জানান। তিনি বলেন, অনলাইন গেমিংয়ের উপর ২৮ শতাংশ…

View On WordPress

#finance minister nirmala sitharaman#GST#GST On Online Gaming#nirmala sitharaman#Tax#tax news#অনলাইন গেমিং#অর্থমন্ত্রী#কর#কেন্দ্রীয় সরকার#জিএসটি#নির্মলা সীতারামন

0 notes

Text

youtube

GST Benefits in Budget 2023 - Cheer to some | Mint Primer | Mint

North-eastern states have recorded a compounded annual GST revenue growth rate of 27.5% so far since the implementation of the GST as against 14.8% for all states, making them the biggest gainers of the new indirect tax regime. The north-eastern states have been the biggest beneficiaries of the five-year-old goods and services tax (GST) regime, according to the Reserve Bank of India (RBI) report on State Finances.

#budget 2023#gst#union budget 2023#budget 2023 news#budget 2023 india#gst return#nirmala sitharaman#gst news#gst benefit#gst benefits for business#fm nirmala sitharaman#revenue growth#goods and services tax#mint#mint primer#igst#budget 2023 income tax#tax saving#union budget 2023-24#2023 budget#income tax#tax#how to save tax#india budget 2023#union budget#national budget 2023#gst 2023#Youtube

0 notes

Text

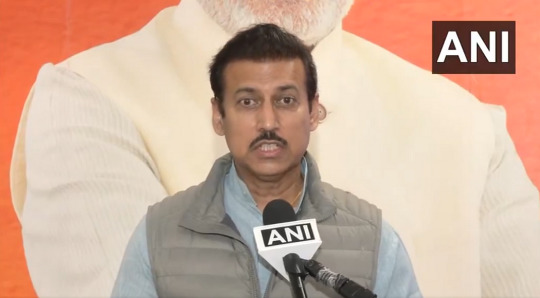

Union Budget 2025: Rajasthan Minister Col Rajyavardhan Rathore Highlights Boost for MSMEs & Startups

The Union Budget 2025, presented by Finance Minister Nirmala Sitharaman, has placed a strong emphasis on fostering entrepreneurship, innovation, and economic self-reliance. Rajasthan’s Minister Rajyavardhan Singh Rathore has lauded the budget’s focus on Micro, Small & Medium Enterprises (MSMEs) and Startups, calling it a game-changer for India’s business ecosystem.

This budget introduces bold incentives, funding support, and digital transformation initiatives to empower small businesses and young entrepreneurs, ensuring that they remain the backbone of India’s growing economy.

Key Announcements for MSMEs & Startups

1. Enhanced Credit Support for MSMEs

✅ ₹50,000 Crore Expansion in Credit Guarantee Scheme — Making loans easily accessible for small businesses. ✅ Interest Subvention for MSMEs — Lower borrowing costs to promote business expansion. ✅ Tax Relief for MSMEs — Increased turnover threshold for tax exemptions.

2. Startup India 3.0 — A New Era of Entrepreneurship

✅ ₹25,000 Crore Startup Growth Fund — Supporting early-stage and high-impact startups. ✅ Easier Compliance & Single Window Clearance for business registrations. ✅ Tax Holiday Extension for eligible startups, reducing financial stress.

3. Technology & Digital Transformation

✅ AI, Blockchain & Cloud Support for MSMEs — Helping businesses adopt advanced technology. ✅ Digital Payment Incentives — Encouraging a cashless economy and financial inclusion. ✅ Boost for FinTech & E-commerce Startups — Simplified regulations and incentives.

4. Skill Development & Job Creation

✅ New Entrepreneurship Hubs in Tier-2 & Tier-3 Cities to nurture local talent. ✅ ₹10,000 Crore Allocation for Digital Skilling & AI Training — Preparing the youth for high-growth industries. ✅ Expansion of Production-Linked Incentive (PLI) Scheme to generate employment in key sectors.

Rajasthan’s Gains: A Thriving Hub for MSMEs & Startups

Minister Rajyavardhan Singh Rathore highlighted how Rajasthan stands to benefit immensely from these policies, stating:

“This budget reflects the Modi government’s unwavering commitment to empowering MSMEs and startups. Rajasthan, with its strong entrepreneurial spirit, will see a surge in new businesses, innovation hubs, and employment opportunities.”

He emphasized three major gains for Rajasthan’s business ecosystem:

Tourism & Handicrafts MSMEs will receive enhanced support for global market expansion.

Renewable Energy Startups in Rajasthan will gain access to Green Funds.

Agritech & Rural Startups will benefit from new funding and digital infrastructure.

A Vision for Aatmanirbhar Bharat

The Union Budget 2025 ensures that India’s MSMEs and startups thrive in a competitive global economy. With tax incentives, credit support, and technology integration, this budget paves the way for a self-reliant and prosperous India.

Col. Rajyavardhan Rathore’s message to entrepreneurs:

“This is the best time to be an entrepreneur in India. With government support and strong policies, MSMEs and startups are set to become the driving force behind ‘Viksit Bharat’.”

🚀 A New Era of Business Begins! Jai Hind! Jai Rajasthan! 🇮🇳

4 notes

·

View notes

Text

2 notes

·

View notes

Text

New Income Tax Bill 2025: This may still undergo several changes sooner than later

Union Finance Minister Nirmala Sitharaman to Present New Income Tax Bill in Parliament on Thursday Union Finance Minister Nirmala Sitharaman is set to present the new income tax bill in the Parliament on Thursday. The bill, which is already being circulated on social media, is receiving reactions from taxpayers and experts alike. However, it’s important to note that the current bill is expected…

0 notes

Text

'Not at all': FM Sitharaman dismisses GST rise concerns

New Delhi: Finance minister Nirmala Sitharaman dismissed concerns over any rise in Goods and Services Tax (GST) rates, claiming that not even one item has seen an increase since the introduction of the GST regime.Speaking during question hour in the Rajya Sabha on Tuesday, she highlighted that the GST rates have instead been reduced, bringing the average rate down from 15.8 per cent at the time…

0 notes