#nevada factoring company

Explore tagged Tumblr posts

Text

Factoring in California: What You Need to Know Before Choosing a Company

Need cash flow solutions? Factoring in California helps businesses thrive. Learn how to choose the right company for your needs and get the best rates.

#factoring company California#invoice financing for small business in Nevada#california factoring companies#california factoring company#california invoice factoring#factoring companies in California#factoring companies in Nevada#invoice factoring California#nevada factoring companies#nevada factoring company#nevada invoice factoring

0 notes

Text

The original Fallout had one group of raiders. That was the name the game map gave to them - 'Raiders' - but they were in fact known as the Khans. They were a relatively minor faction, being tied to quests in the first town the player is likely to visit, but we learn a lot about them in their brief appearance.

Many of the Khans are given names and dialogue, and will tell the player about their history - including how they came from the same place as the people of Shady Sands, Vault 15, and feel entitled to share in the town's wealth. Some see their raiding life as a way to claim control of the post-war world - ruling through strength and fear, believing that old ideas of morality died with the rest of the world. Others treat it as just another job - they support their group by trading, maintaining equipment, preparing food, and other everyday tasks.

In short, the Khans are a fully-realised community, as much a part of the story as any other. We learn that their brutal leader, Garl Death-Hand, took command after killing his abusive father. The player can kill him, or negotiate with him, or impress him with acts of cruelty, or even challenge his nihilistic views by convincing him that they're his father, back from the dead. Killing Garl and destroying his compound is treated as the best choice for the region as a whole, and is confirmed to have happened in the next game in the series, but it's certainly not the only option.

Fallout 2 has two groups of raiders. One - again marked 'Raiders' on the map - turn out not to be raiders at all, in that they're not attacking towns to steal their wealth. Instead, they're a mercenary company, hired by a disreputable businessman from one town (New Reno) on behalf of another town (Shady Sands again, now the capital of the New California Republic) to harass a third town (Vault City) to convince them that they need outside help in maintaining their defences. It's part of the game's major subplot about the three societies competing for control of northern California and western Nevada.

The other group are the New Khans, founded by Garl's son Darion after the original Khans' defeat. These Khans aren't nearly so fearsome as their predecessors - they mostly operate in secret, hiding behind a group of squatters who have moved into the ruins of Vault 15 and pretending to help them restore it for use. Darion is wracked with resentment over what happened to his father's crew and guilt for having survived, and his gang ultimately present little real threat to the outside world.

What I'm getting at here is that, in the world of Fallout as it existed in those early games, 'raiders' were not a major factor. There was one group who conducted raids as part of their regular economic activity, but only against particular communities - Shady Sands saw them as raiders, but to the Hub, they were just traders. Raiders only existed in a particular context - they had particular interests, beliefs and opportunities that would not always be possible or applicable.

Most of the games' conflict came not from the existence of raiders but from bilateral political and economic competition between groups with overlapping but not identical interests, which was reflected in their respective ideologies. We see this in Killian and Gizmo fighting to control the future of Junktown, and in the Master's attempt to reshape the world with the Unity while the different groups of New California try to retain their independence.

We particularly see it in Fallout 2, with its three-way battle for economic domination between the constitutional democracy of the New California Republic, the mafia-ruled narco-state of New Reno, and the elitist technocratic slave state of Vault City. Which of these groups continue to rule and expand, and which crumble, is what ultimately shapes the region's future - with control of Redding and its gold supply as the linchpin.

While the Enclave are the story's primary antagonists, they're chiefly characterised by their refusal to engage with this new socio-economic order - they believe that all outside authorities are illegitimate, and all outsiders non-human, and their only plan is to release a bioweapon into the atmosphere and kill literally everyone on Earth but themselves. The Enclave's defeat is necessary for New California's survival, but, otherwise, they change very little about how people live their lives. They're like Darion's New Khans on a larger scale - relics of a fallen order, robbed of their purpose, hiding in an old bunker and driven by nothing but resentment of having been left behind.

I might, in future, talk about the contrasting depiction of raiders in Fallouts 3, 4 and 76, and about New Vegas's use of raider and bandit groups like the Khans, the Legion, the Fiends and the White Legs. For now, I think I've made my point - that raiders are not a fact of life but a product of a particular place and time, and much less relevant to the universe of Fallout than other forms of competition and violence.

160 notes

·

View notes

Text

Here we are, folks. After 5 years, Madness Combat 12 is finally out. Now, let’s deconstruct it.

Spoilers for MadCom 12 below (duh)

The opening. Now, there are some things I would like to highlight.

ONE: Nevada is labelled as “The Occurant”. This will be important later.

TWO: The text on the side.

“THE PLACE THAT WAS NEVER MEANT TO BE” “THE INFINITE ENTROPY AT ALL BORDERS TAX THE HIGHER POWERS THAT GOVERN IT”

Entropy means “lack of order or predictability”. The sheer amount of chaos is literally tearing reality apart.

I just like this shot. The depth in it, vast, but empty. Eerily beautiful.

“TRACKER DATA ACTIVE” “HANK.” “DISSONANT;” “0.01%”

On Doc’s computer. Why is 2BDamned doing this? We’ll find out soon enough. It should be noted that the “Dissonance Triggers” almost look like X, Y, and Z coordinates.

“HANK’S CHARTER HAS BEEN REVOKED” “Fix Nevada.” “DO NOT WAIVER”

A charter is defined as “a written grant by a country's legislative or sovereign power, by which a body such as a company, college, or city is founded and its rights and privileges defined.”

Perhaps the “charter” here is Hank’s soul? His being? We don’t know for sure.

Waiver means “refrain from applying or enforcing”.

The Auditor, in this scene, is basically saying “Hank is not active, and I need to make sure it stays that way.”

This graffiti probably means nothing, but I think it might be describing Sanford. So far, he has not died once in the entire series.

Agony. The text to the right mentions the Auditor, “recovery”, and “suppliment”. I have no idea what this could mean, maybe our red-and-black boy is trying to copy what 2BD does, but in the opposite direction?

Auditor, but without the fiery parts.

Mind fuckery. Note that he tries a ��CONVERT”, as well as doing multipe return commands. It also points out, again, how Sanford is NOT DEAD, NOR HAS HE DIED BEFORE.

No hope for those trapped, I suppose.

This looks like the tree from MadCom 1. Nice callback.

I’ll let this speak for itself (refer back to TRACKER DATA ACTIVE).

The text says:

“KILL THEM”

And this is where we see Sanford lose his eyes, although he can still apparently see somehow.

A better look at Sanford overall. He still has that iconic lip, but he is missing parts of his body and his eyes to a mysterious black spot that also functions like a hole in some cases.

This is one of the defining moments of the episode (to me, at least). Sanford, seemingly overtaken by rage, randomly gains the strength to tear a half-MAG agent’s head off their body.

This might be just there for the cool factor, or maybe some other power acted on Sanford in that moment. With the info we have, we can’t really tell.

Here we see an anchor, like the one used on Dedmos in the Dedmos mini-series.

“Employic”, according to my research, is not a word in the English language.

Substrata is “an underlying layer or substance, in particular a layer of rock or soil beneath the surface of the ground.”

This purgatory is apparently underground, which would make sense given that we only see passages to it connected to walls or floors.

The Auditor looking shocked as he is trapped in a capsule of rock. With context clues, we could make a conclusion that this is the same type of “purgatory rock” that now makes up Deimos’s lower jaw.

Hank is connected to a machine.

Sanford has somehow been resurrected, even though he still HAS NOT BEEN KILLED.

The Auditor specifically calls out 2BD. He’s onto Doc’s shit.

Another picture of the tablet screen, shortly after Deimos drops it. We can be certain that “AUD” is referring to the Auditor.

Love wins. What else can I really mention if even Krinkels said it himself.

Deimos was “compensated”. Surprised anything still even has value around Nevada anymore. Maybe bullets do, actually.

Sanford has to return as soon as possible for a “deathless resurrection evaluation”. Wonder what that would even look like.

Hank’s icon, showing up for quite a short period of time before the screen fills with “ERROR” messages. He looks distressed.

Whatever could “OCCURANT LINES ARE CONVERGING” mean?

Well, we know that Nevada was labelled as “The Occurant” earlier.

(You might not be able to read this text in this screenshot with Tumblr image compression, I don’t know.)

————————————————————————

Finally, I have some info that isn’t necessarily what happened in the animation, but could help with understanding it. As this is already getting long enough, I’ll leave it with a short blurb.

The definition of the title word.

The description of the episode on the Newgrounds site.

————————————————————————

Even without looking at it in-depth, Madness Combat: Contravention was a masterpiece of animation. It was fluid, the characters were expressive, and the visuals were stunning. Big props to Krinkels, Cheshyre, Cturix (did the sound effects), and Tarkade (made the backgrounds) for creating the most entertaining 8 minutes of my life.

————————————————————————

Thoughts? Theories? Something I missed? Share it in the reblogs! After all, what is this fandom without the community we’ve formed!

58 notes

·

View notes

Text

California is facing a record $68 billion budget deficit.

This is largely attributed to a “severe revenue decline,” according to the state's Legislative Analyst's Office (LAO).

While it’s not the largest deficit the state has ever faced as a percentage of overall spending, it’s the largest in terms of real dollars — and could have a big impact on California taxpayers in the coming years.

Here’s what has eaten into the Golden State’s coffers.

Unprecedented drop in revenue

California is dealing with a revenue shortfall partly due to a delay in 2022-2023 tax collection. The IRS postponed 2022 tax payment deadlines for individuals and businesses in 55 of the 58 California counties to provide relief after a series of natural weather disasters, including severe winter storms, flooding, landslides and mudslides.

Tax payments were originally postponed until Oct. 16, 2023, but hours before the deadline they were further postponed until Nov. 16, 2023. In line with the federal action, California also extended its due date for state tax returns to the same date.

These delays meant California had to adopt its 2023-24 budget before collections began, “without a clear picture of the impact of recent economic weakness on state revenues,” according to the LAO.

Total income tax collections were down 25% in 2022-23, according to the LAO — a decline compared to those seen during the Great Recession and dot-com bust.

“Federal delays in tax collection forced California to pass a budget based on projections instead of actual tax receipts," Erin Mellon, communications director for California Gov. Gavin Newsom, told Fox News. "Now that we have a clearer picture of the state’s finances, we must now solve what would have been last year’s problem in this year’s budget.”

The exodus

California has also lost residents and businesses — and therefore, tax revenue — in recent years.

The Golden State’s population declined for the first time in 2021, as it lost around 281,000 residents, according to the Public Policy Institute of California (PPIC). In 2022, the population dropped again by around 211,000 residents — with many moving to other states like Texas, Oregon, Nevada, and Arizona.

Read more: 'It's not taxed at all': Warren Buffett shares the 'best investment' you can make when battling inflation

“Housing costs loom large in this dynamic,” according to the PPIC, which found through a survey that 34% of Californians are considering moving out of the state due to housing costs.

Other factors such as the post-pandemic remote work trend — which has resulted in empty office towers in California’s downtown cores — have also played a role in migration out of the state.

Poor economic conditions

In an effort to tame inflation in the U.S., the Federal Reserve has hiked interest rates 11 times — from 0.25% to 5.5% — since March 2022. These actions have made borrowing more expensive and have reduced the amount of money available for investment.

This has cooled California’s economy in a number of ways. Home sales in the state are down by about 50%, according to the LAO, which it largely attributes to the surge in mortgage rates. The monthly mortgage to buy a typical California home has gone from $3,500 to $5,400 over the course of the Fed’s rate hikes the LAO says.

The Fed’s rate hikes have “hit segments of the economy that have an outsized importance to California,” according to the LAO, including startups and technology companies. Investment in the state’s tech economy has “dropped significantly” due to the financial conditions — evidenced by the number of California companies that went public in 2022 and 2023 being down by over 80% from 2021, the LAO says.

One result of this is that California businesses have had less funding to be able to expand their operations or hire new workers. The LAO pointed out that the number of unemployed workers in the Golden State has risen by nearly 200,000 people since the summer of 2022, lifting the percentage from 3.8% to 4.8%.

Fixing the budget crunch

The LAO suggests that California has various options to address its $68 billion budget deficit — including declaring a budget emergency and then withdrawing around $24 billion in cash reserves.

California also has the option to lower school spending to the constitutional minimum — a move that could save around $16.7 billion over three years. It could also cut back on at least $8 billion of temporary or one-time spending in 2024-25.

However, these are just short-term solutions and may not address the state’s longer term budget issues. In the past, the state has cut back on business tax credits and deductions and increased broad-based taxes to generate more revenue.

Mellon did not reveal any specifics behind the state’s recovery plan in her comments to Fox News. She simply said: “In January, the Governor will introduce a balanced budget proposal that addresses our challenges, protects vital services and public safety and brings increased focus on how the state’s investments are being implemented, while ensuring accountability and judicious use of taxpayer money.”

13 notes

·

View notes

Text

Metafog cast

About Aston Morris

Aston Morris was born in Nevada to a single mom in 1966. He grew up without a father due to his biological father being a married man who didn't want anything to do with him and his mom.

Growing up, Aston wanted to become an astronaut after seeing the moon landing. In his teens, he started working at a poorly ran waterpark, where an incident broke his nose and left him with a brain injury.

While he recovered mostly physically, this still left him being denied a spot in an astronaut training program.

While his outburst left him getting arrested, he was approached by the MantiCorp with a job offer to work as an enforcer. While the pay alone was nice, 19 year old Aston accepted the offer just to be able to see space.

Aston was going to start working for the company fulltime, but after a vacation in Los Angeles, he auditioned for an acting job he found, which led him getting a leading role in a sitcom that became a hit and started his acting career.

Despite gaining stardom, Aston still continued working for MantiCorp, thought his work for the corporation became less frequent.

As the most successful one from their high school class, Aston was tasked with hosting and arranging their high school reunion, leading him to reconnect and then start a romantic relationship with his high school friend, Juliet Barker, now going by Juliet Heartwood

About the STARMAN: The STARMAN project was a hybrid experiment by the MantiCorp to test out combat ready humanoid robots and using robots to replace or "resurrect" dead individuals. The STARMAN failed with the first goal, due to the fine motors and materials raising the price of production being too expensive compared to other more crude robots which could be mass produced for cheaper. Even in more delicate cases like assassinations or espionage, it would be more convenient to simply train a non-robot individual. As for the second goal, it was meant to rival cyborgs, which had been popular for a while to extend one's life, or use it to recover from fatal bodily injuries. Cyborgs, however, required the brain of the customer to stay intact and alive till the process was complete, and the STARMAN project broke new ground by instead of requiring the brain, a simple scan of the subject's mind was sufficient enough to let them live on in a robot body. Despite it's success, this was deemed not worthy to follow through due to ethic's concerns, the possibility of copy being inaccurate to the original person and the price range leaving a very limited customer base. Due to these factors, the STARMAN project was shut down, but the "Aston Morris"-model was kept around due to the request of the current CEO, Midge Mantis, citing "convenience".

3 notes

·

View notes

Text

Navigating the Legal Landscape: Understanding the Burden of Proof in Car Accident Lawsuits

Car accidents can be life-altering events, leaving victims with physical injuries, emotional trauma, and financial burdens. When seeking compensation for damages resulting from a car accident, understanding the legal intricacies is crucial. One key aspect that shapes the outcome of car accident lawsuits is the burden of proof. In this article, we'll delve into what the burden of proof entails, its significance in car accident cases, and shed light on how hiring a car accident lawyer, like those in Las Vegas, Nevada, can make a difference.

The Burden of Proof Unveiled

The burden of proof in a legal context refers to the responsibility placed on a party to prove the truth of their claims or assertions. In car accident lawsuits, the burden typically lies with the party seeking compensation, often the plaintiff. Establishing a solid case requires presenting evidence that convincingly demonstrates the other party's negligence or fault in causing the accident.

Car Accident Lawyer in Las Vegas, Nevada

When faced with the aftermath of a car accident, engaging the services of a skilled car accident lawyer becomes paramount. In Las Vegas, Nevada, where traffic is bustling and accidents are unfortunately common, having a legal professional by your side can significantly enhance your chances of a favorable outcome. A seasoned car accident lawyer Las Vegas, Nevada, possesses the expertise to navigate the local legal landscape and can guide you through the complexities of your case.

A Beacon of Legal Support

In the realm of car accident lawsuits, Corena Law stands out as a beacon of legal support. Car accident lawyer las vegas nevada. Specializing in personal injury cases, including those arising from car accidents, Corena Law boasts a track record of successfully representing clients in Las Vegas, Nevada. The dedicated team at Corena Law understands the intricacies of the legal system and strives to alleviate the burden on victims by fighting for their rights and just compensation.

The Role of Evidence in Car Accident Lawsuits

In any legal proceeding, evidence is the linchpin that can make or break a case. In car accident lawsuits, evidence is crucial for establishing liability and proving the extent of damages. This can include but is not limited to:

Photographs and Videos: Visual evidence such as photos or videos from the accident scene can provide a clear depiction of the circumstances surrounding the collision.

Eyewitness Testimonies: Statements from individuals who witnessed the accident can serve as powerful evidence, offering an unbiased account of what transpired.

Police Reports: Official police reports filed at the scene of the accident can provide a comprehensive overview, detailing factors like weather conditions, traffic violations, and officer observations.

Medical Records: To substantiate claims of injuries and medical expenses, comprehensive medical records are indispensable.

Expert Opinions: In some cases, expert opinions, such as accident reconstruction specialists, can be enlisted to provide a professional assessment of the events leading to the accident.

FAQs

Q1: What should I do immediately after a car accident? A: Seek medical attention first, then document the scene by taking photos, collecting contact information from witnesses, and obtaining the other party's details. Report the accident to the police and contact your insurance company. It is advisable to consult with a car accident lawyer for guidance on the next steps.

Q2: How long do I have to file a car accident lawsuit? A: The statute of limitations for filing a car accident lawsuit varies by jurisdiction. In Nevada, for instance, the general time limit is two years from the date of the accident. However, it is recommended to consult with a car accident lawyer promptly, as delays can impact the strength of your case.

Q3: Can I handle a car accident case without a lawyer? A: While it is possible to handle a car accident case without a lawyer, having legal representation significantly improves your chances of a favorable outcome. A car accident lawyer can navigate legal complexities, negotiate with insurance companies, and ensure your rights are protected.

Conclusion

In the aftermath of a car accident, understanding the burden of proof is crucial for building a robust legal case. With the support of a skilled car accident lawyer in Las Vegas, Nevada, such as Corena Law, victims can navigate the legal landscape with confidence. Remember, evidence is the key to success in car accident lawsuits, and seeking professional legal assistance ensures that your rights are safeguarded. By being proactive and informed, you can increase your chances of obtaining the compensation you rightfully deserve.

2 notes

·

View notes

Text

How Much Does Cannabis Oil Cost?

Whether you’re a new or experienced cannabis consumer, you’ve likely wondered, “how much does cannabis oil cost?” This new therapeutic product has earned high praise from medical and recreational users. Each bottle of cannabis oil, also known as a tincture, comes with varying ratios of cannabinoids at relatively steep prices compared to other health- and wellness-related products. Despite the high markup for cannabis oil, many consumers regularly use this delivery method to reap all of the mental and physical benefits of two major cannabinoids: cannabidiol (CBD) and delta-9-tetrahydrocannabinol (THC). A number of factors affect the price of the oil. You can expect to pay anywhere from $30 to up to $200 for a single bottle. Here’s what you need to know about shopping smart for cannabis oil.

How Much Does CBD Oil Cost?

CBD oil has become widely accessible to the entire nation. It’s revered for its non-psychoactive and therapeutic effects on pain, anxiety, inflammation, seizures, and other debilitating symptoms. The health and wellness aspect of CBD oil commands a premium price for its symptomatic relief. Apart from its medical applications, there are plenty of other factors that determine how much consumers pay for cannabis oil in general. Katie Stem of Peak Extracts told Weedmaps, “When examining a cost analysis from a production perspective, you look at labor, materials, packaging, labels, potency/purity testing, marketing, and shipping distribution.” For manufacturers, bulk CBD can range from $3 to $15 per gram, which works out to be less than one cent to 1.5 cents per milligram. Consumers end up paying about $50 to $60 per 1,000 mg bottle, or about 5 to 20 cents per milligram.

Why Are People Paying Premium Prices for CBD Oil?

CBD oil products, in particular, offer many potential health benefits for medical and recreational consumers. People generally buy CBD oil to help them with inflammation, pain, anxiety, stress, depression, muscle spasms, fatigue, sleep disorders, and plenty of other symptoms. Furthermore, CBD doesn’t produce the negative side effects, especially if you take the appropriate dosage. Despite the popularity of CBD oil products, their efficacy has not been approved by the Food and Drug Administration. Only the CBD-based drug, Epidiolex, has been approved for medical use. In fact, many hemp companies have received warning letters from the FDA for claiming unproven health benefits on its packaging and advertising. While CBD oil can help supplement a conventional treatment plan, it’s important to consult with your physician before starting a cannabis oil regimen.

How Much Does Cannabis Oil Cost?

Cannabis oil varies in price based on cannabinoid content, as well as the region where it’s sold. Seattle-based Headset published a report detailing pricing data for a variety of marijuana products in Washington State, California, Nevada, and Colorado. The price of THC oil varied by state. For example, Colorado had the highest price at 41 cents per milligram, which was 64 percent higher than Nevada’s 25 cents per milligram. California and Washington both had a 30 cent per milligram average price for THC oil. Here are just a few examples of THC oil prices in the Southern California market: - Mary’s Medicinals The Remedy THC has 1,000 mg of THC priced at $56, about 6 cents per milligram. - Raw 1:20 THC:CBD Focus tincture has 1,000 mg priced at $87, about 9 cents per milligram. - Select 1:1 Peppermint oil has 1,000 mg priced at $68, about 7 cents per milligram. - Care by Design 8:1 CBD-rich sublingual drops has about 240 mg priced at $40, about 16 cents per milligram. - Humboldt Apothecary Relax CBD 3:1 tincture has 250 mg priced at $65, about 26 cents per milligram. - Releaf 1:1 CBD:THCa tincture has 900 mg priced at $99.62, about 11 cents per milligram.

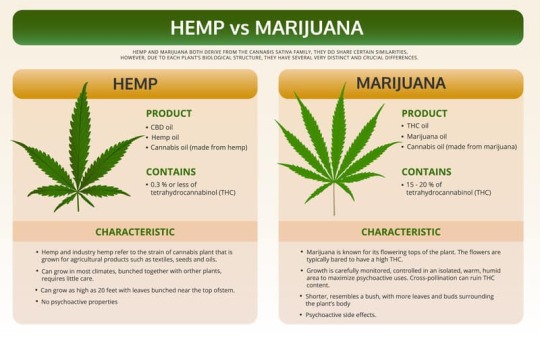

Marijuana vs. Hemp-Derived Cannabis Oil

Cannabis oil products can be derived from either marijuana or hemp plants. Both belong to the same Cannabis sativaplant species. Marijuana plants are primarily bred for a THC-rich resin, while hemp plants produce high-CBD resin with only trace amounts of THC. Hemp-derived oil tends to be more affordable than marijuana-derived oil. When shopping for cannabis oil, consumers may run across terms such as full-spectrum, broad-spectrum, or distillate. Each comes with varying price points depending on many factors, including its source. Full-spectrum products contain the original chemical profile of a strain, including THC, CBD, and terpenes. Broad-spectrum contains everything in the plant but the THC, for a non-intoxicating experience. Distillates only contain one cannabinoid, either CBDA or THCA. The compounds in full-spectrum and broad-spectrum cannabis oil not only add to the aroma, but also the effects and the price. Research into cannabinoids indicate that the interaction between different cannabinoids and terpenes produces an “entourage effect.” This synergistic effect of the plant’s compounds is thought to enhance the therapeutic benefits of a cannabis product. For this reason, many medical consumers look for full- or broad-spectrum cannabis oil. However, someone who doesn’t want the aroma of intoxication of cannabis, may stick with a CBD isolate. Hemp-derived CBD oil is more widely available than cannabis-derived tinctures. Ever since the 2018 Farm Bill passed, hemp-derived CBD is legal all over the country. If you’re hoping to buy cannabis-derived tinctures, you must live in a state that allows medical cannabis (at the very least). In these states, cannabis-derived tinctures tend to be pricier because hemp isn’t as expensive to produce.

Factors Affecting Cannabis Oil Costs

A bottle of cannabis oil can vary in price based on an assortment of factors from production to marketing costs. For example, cannabis oil made from organically grown hemp from Colorado will have a higher price than oil made from a plant grown in a state with a newer market. Besides quality, potency also affects the price of a product. Cannabis oil with 1,000 mg of cannabinoids will be more expensive than oil with fewer cannabinoids per milliliter. The cannabis industry has unique costs and challenges that can drive up the price of cannabis oil. For example, lab testing requirements can force companies to spend hundreds of thousands of dollars testing their oil for contaminants. Lab testing can range from $100 to $400 per sample tested. In many cases, cannabis must be tested various times throughout the supply-chain process. Furthermore, the cannabis industry can’t write off business expenses because according to the US federal government, the marijuana plant is a Schedule I drug with no medicinal value. Dispensaries and producers may hike up their prices to offset some of these overhead costs. Industry experts believe that full legalization will help build a stronger regulatory framework for the industry to benefit both companies and consumers.

Is Cannabis Oil Lab Tested?

Certified laboratories can provide a complete analysis of licensed cannabis product samples. Third-party labs can test for potency including its cannabinoid and terpene profile. Labs also test for pesticides, microbial contamination, residual solvents, and other harmful chemicals that can remain after the extraction process. Essentially, lab testing ensures the product you are buying has the potency listed on the label. More importantly, lab testing ensures the product you are consuming has no harmful contaminants that can offset its therapeutic effects. Lab testing can significantly increase the price of cannabis oil products. However, it’s up to you to make sure your product is actually lab tested. Most companies who lab test provide a certificate of analysis (COA) on its website. Simply type in the batch number found on the packaging into their lab results page. Buying from a licensed cannabis retailer is one of the only ways to ensure you are getting a product tested by a third-party lab. While buying hemp-derived CBD oil online without lab testing may be cheaper, we recommend you spring the extra few bucks for peace of mind and security.

How to Find Reliable and Cost-Effective Cannabis Oil

Finding the right cannabis oil at the right price point can seem like an impossible task. Luckily, there are a few ways you make sure you get the most for your dollar based on your desired results. It can take a few hours, days, or weeks of research to find the right cannabis oil. While price matters, some affordable cannabis oils can be just as effective as the most expensive cannabis oils. Here are a few ways to save money on cannabis oil. - Buy cannabis oil in bulk. Larger quantities mean more upfront costs, but the product often comes with considerable savings of up to 40 percent per milligram. Manufacturers pass their savings on packaging onto you. Buying in bulk can also earn you free shipping with most hemp-derived oil companies. - Follow your favorite cannabis oil companies or retailers on their social media channels to scope out special discounts, promotions, and giveaways. - Sign up for low-income, veteran, or other financial assistance programs if you qualify. Not every company offers this perk, but the ones that do may give you a discount of more than half off if you can send qualifying proof or apply for a spot in their program. - Buy based on price-per-milligram. In order to calculate the price per milligram of a cannabis oil bottle, divide the total price of the product by the milligrams of cannabinoids in the product. - When searching for bargains, always make sure you buy cannabis oil that has a certificate of analysis (COA) from an accredited third-party laboratory ensuring you have a safe and pure products.

Will CBD Prices Ever Come Down?

Industry insiders believe the price of cannabis oil will eventually go down, but not anytime soon. The industry’s strict regulations place an enormous burden on cannabis companies in terms of testing, taxes, and other rules on the plant’s production. A variety of factors serve to limit the amount of cannabis production possible. Whether it’s commercial cannabis bans in your town or excessive licensing costs, it takes a lot of money to start up a cannabis company. Cannabis oil may never be the most affordable natural medicine available, at least compared to pharmaceutical or herbal supplement products. However, prices are expected to go down as lawmakers become more supportive of the industry. Once they remove the harsh limits imposed on weed companies, maybe then will the prices become accessible for those who truly need it. As you can see, the price of cannabis oil varies widely based on the source, quality, potency, location, size, and other manufacturing and marketing costs associated with the product. The novelty of the industry and a lack of regulation have contributed to cannabis oil’s high prices, but consumers are hopeful that one-day cannabis oil can reach an accessible price point for everyone that needs it. Stay tuned to the Cannabis Training University blog for updates on: - price of cannabis oil - THC oil cost - how much does CBD oil cost - Colorado cannabis oil cost - THC oil price per gram - how to ingest cannabis oil - cost of CBD oil products - cheapest full-spectrum CBD oil

Learn to Grow High CBD Cannabis

There's never been a better time to learn to grow with legalization efforts ramping up worldwide! Enroll in Cannabis Training University to learn how to grow your own medicine so you can control your budget. Become the next great cannabis grower with online cannabis training from the #1 rated marijuana school.

Read the full article

9 notes

·

View notes

Text

Best SEO Experts

When looking for SEO experts, it's important to consider factors such as their experience, expertise, track record, and client testimonials. You can start by researching online and reading reviews, blogs, and articles about SEO experts and their work. Here are some tips on finding reliable resources:

Follow reputable SEO blogs and websites: There are several blogs and websites dedicated to SEO and digital marketing, which provide up-to-date information, insights, and best practices. Some of the popular ones include Moz, Search Engine Land, Search Engine Journal, Ahrefs, and Backlinko.

Attend SEO conferences and events: Attending industry events, conferences, and workshops is a great way to connect with SEO experts and learn about the latest trends and best practices in the field. Some of the popular SEO events include BrightonSEO, Pubcon, SMX, and MozCon.

Read books on SEO: There are several books on SEO and digital marketing written by experts in the field, which provide in-depth knowledge and insights on the subject. Some of the popular books include "The Art of SEO" by Eric Enge, "SEO for Growth" by John Jantsch and Phil Singleton, and "The Ultimate Guide to Link Building" by Eric Ward and Garrett French.

Join online communities and forums: Joining online communities and forums dedicated to SEO and digital marketing can provide you with a wealth of knowledge and insights from experts in the field. Some of the popular communities include Moz Community, Warrior Forum, and Black Hat World.

Now, let's take a closer look at some of the top SEO experts in the field:

Sandy Rowley: Sandy Rowley is an experienced SEO expert based in Reno, Nevada, in the United States. She is the founder and owner of Reno SEO, Marketing & Web Design, a digital marketing agency that specializes in search engine optimization, web design, and social media marketing. Sandy is known for her results-driven approach to SEO, focusing on developing customized strategies that meet the specific needs of her clients.

Neil Patel: Neil Patel is a well-known digital marketing expert and entrepreneur, who is the co-founder of several marketing and analytics tools, including Crazy Egg and Hello Bar. He is also the founder of Neil Patel Digital, a leading digital marketing agency that provides SEO, content marketing, and social media services to businesses of all sizes. Neil is known for his expertise in SEO, content marketing, and online advertising, and has been featured in several publications, including Forbes and The Wall Street Journal.

Brian Dean: Brian Dean is the founder of Backlinko, a popular blog and resource for SEO and digital marketing. He is known for his expertise in link building, on-page SEO, and content marketing, and has published several guides and tutorials on these topics. Brian is also a frequent speaker at industry events and has been featured in publications such as Forbes, Entrepreneur, and Inc.

Rand Fishkin: Rand Fishkin is the founder and former CEO of Moz, a leading SEO software company. He is also the founder of SparkToro, a market research and audience intelligence tool for digital marketers. Rand is known for his expertise in all aspects of search engine optimization, including technical SEO, keyword research, and link building. He has authored several books on SEO and is a well-known speaker in the industry.

2 notes

·

View notes

Text

Nevada Business Lawyer

You're considering launching a business in Nevada, and you know that maneuvering the state's complex laws and regulations can be overwhelming. As you start to build your venture, you'll need to make key decisions that can have a lasting impact on your company's success. A Nevada business lawyer can provide essential guidance on everything from choosing the right business structure to negotiating contracts. But what specific benefits can you expect from hiring an attorney, and how do you find the right one for your unique needs?

Key Takeaways

• A Nevada business lawyer can provide expert guidance on complex business laws and regulations in the state. • They can help navigate business formation and structure, including selecting the right entity type and obtaining necessary licenses. • A business lawyer in Nevada can assist with contract negotiation and review, ensuring key provisions protect business interests. • They can also aid in resolving business disputes through alternative methods, such as mediation and arbitration, or litigation. • Regular consultation with a Nevada business lawyer helps ensure compliance with state and federal laws, minimizing the risk of penalties.

Benefits of Hiring a Business Lawyer

By hiring a Nevada business lawyer, you gain access to expert guidance and counsel that can help you navigate complex business laws and regulations, minimize risks, and make informed decisions.

You'll be able to tap into their in-depth knowledge of Nevada's specific business compliance requirements, ensuring your company remains compliant and avoids costly fines or penalties. A skilled business lawyer will help you develop a sound legal strategy, tailored to your business's unique needs and goals.

With a Nevada business lawyer on your side, you'll be well-equipped to handle any legal challenges that arise, from contract disputes to regulatory issues.

They'll help you stay up-to-date on changes in Nevada business laws and regulations, ensuring you're always in compliance. By leveraging their expertise, you'll be able to focus on running your business, confident that your legal affairs are in good hands.

Business Formation and Setup Options

When setting up your Nevada business, you'll need to choose a business structure that suits your needs, such as a corporation, limited liability company (LLC), or partnership.

You'll also need to navigate the entity formation process, which involves filing necessary documents with the state and obtaining required licenses and permits.

As you consider your options, you'll want to take into account startup tax considerations to guarantee you're taking advantage of available tax benefits and minimizing your liability.

Business Structure Options

Forming a business in Nevada requires selecting a suitable structure from various options, including sole proprietorships, partnerships, limited liability companies (LLCs), and corporations, each offering distinct advantages and disadvantages. You'll want to take into account factors such as liability protection, tax implications, and corporate compliance requirements when making your decision.

When evaluating business structure options, reflect on the following key aspects:

Liability Protection: Will your personal assets be protected in case of business debts or lawsuits? LLCs and corporations offer liability protection, while sole proprietorships and partnerships do not.

Tax Implications: How will your business income be taxed? Sole proprietorships and partnerships are pass-through entities, while LLCs and corporations may be subject to double taxation.

Corporate Compliance: What ongoing filing and reporting requirements will you need to meet? Corporations and LLCs are subject to more stringent corporate compliance requirements than sole proprietorships and partnerships.

Ultimately, the business structure you choose will depend on your unique circumstances, goals, and priorities. It's crucial to consult with a qualified Nevada business lawyer to determine the best structure for your business.

Entity Formation Process

How do you formally establish a business entity in Nevada, and what steps must you take to guarantee compliance with state regulations?

To start, you'll need to choose from the various entity types available in Nevada, such as corporations, limited liability companies (LLCs), and partnerships. Each entity type has its own advantages and disadvantages, so it's important to consult with a Nevada business lawyer to determine which one best suits your business needs.

Once you've selected an entity type, you can begin the incorporation process. This typically involves filing the necessary documents with the Nevada Secretary of State's office, such as articles of incorporation or articles of organization. You'll also need to obtain any necessary business licenses and permits, and register for taxes with the state and federal government.

To ensure adherence to state regulations, you'll need to draft bylaws or an operating agreement, depending on your entity type. These documents outline the governance structure and operational procedures for your business.

Startup Tax Considerations

As you establish your business in Nevada, understanding the tax implications of various formation and setup options is crucial to minimize liabilities and maximize benefits.

You'll want to reflect on how different structures, such as sole proprietorship, partnership, or corporation, impact your tax obligations. A Nevada business lawyer can help you navigate these complexities.

When it comes to startup tax considerations, you should be aware of the following key points:

Tax Incentives: Nevada offers various tax incentives to encourage business growth, such as the Nevada New Markets Tax Credit program.

Startup Deductions: Familiarize yourself with deductions available to startups, including research and development expenses, business use of your home, and start-up costs.

Business Tax Registration: Verify you register your business with the Nevada Department of Taxation and obtain necessary licenses and permits to avoid penalties.

Contract Negotiation and Review

As you navigate contract negotiation and review, you'll want to pay close attention to key contract provisions that can impact your business's success.

You'll need to carefully consider terms such as payment structures, liability clauses, and termination conditions to guarantee they align with your company's goals and interests.

Key Contract Provisions

When negotiating or reviewing a contract, identifying and understanding key contract provisions is essential to protect your interests and guarantee that the agreement aligns with your business goals and objectives.

As a Nevada business owner, you'll want to ascertain that your contracts are thorough and clear to avoid potential disputes or contract breaches. In the event of a contract breach, having well-defined provisions can aid in contract enforcement and minimize potential losses.

Here are three key contract provisions to focus on:

Scope of Work: Clearly outline the responsibilities and obligations of all parties involved, including specific tasks, timelines, and deliverables.

Payment Terms: Define payment schedules, amounts, and methods to prevent misunderstandings and ascertain timely payments.

Termination and Dispute Resolution: Establish procedures for terminating the contract and resolving disputes, including mediation, arbitration, or litigation.

Negotiation Strategy Tips

Negotiating a contract requires a well-planned strategy that prioritizes your business objectives, protects your interests, and adapts to the dynamics of the negotiation process.

You'll need to employ effective negotiation tactics to achieve your goals. Start by clearly defining your objectives and identifying potential areas of contention. This will help you focus your efforts and make strategic decisions during the negotiation.

Effective communication is essential in contract negotiation. You must articulate your needs and concerns clearly, while also listening actively to the other party's perspective. This will help build trust and facilitate creative problem-solving.

Be open to compromise, but don't concede on critical issues. Instead, seek mutually beneficial solutions that satisfy both parties' interests. Remember to maintain a professional demeanor, even in the face of disagreement.

Resolving Business Disputes and Litigation

Disputes can arise in even the most well-managed businesses, and it's essential that you understand the options available for resolving them in a timely and cost-effective manner. When you're facing a dispute, you'll want to evaluate alternative dispute resolution methods, such as mediation techniques and arbitration processes, before heading to court.

Here are three options you should evaluate:

Mediation: A neutral third-party facilitates a discussion between you and the other party to reach a mutually acceptable solution.

Arbitration: A neutral third-party makes a binding decision after hearing evidence and arguments from both sides.

Litigation: Taking your dispute to court, where a judge or jury will make a decision.

You'll want to consult with a Nevada business lawyer to determine the best approach for your specific situation. They can help you navigate the process and represent your interests.

Nevada Business Laws and Regulations

Numerous state and federal laws govern businesses in Nevada, and it's your responsibility as a business owner to comply with these regulations to avoid costly fines, penalties, and reputational damage.

You must familiarize yourself with Nevada's licensing requirements, which vary depending on the type of business you operate. For instance, you may need to obtain a general business license, as well as specialized licenses or permits specific to your industry.

Additionally, you must comply with Nevada's employment regulations, which cover matters such as minimum wage, overtime, and workers' compensation. You're also subject to federal laws, including the Fair Labor Standards Act and the Americans with Disabilities Act.

Failure to comply with these regulations can result in legal action, fines, and damage to your business's reputation. To guarantee compliance, it's essential to regularly review and update your business practices and policies to reflect changes in Nevada's business laws and regulations.

Finding the Right Business Lawyer

When steering through the complexities of Nevada's business laws and regulations, you need to secure the expertise of a seasoned business lawyer who can provide counsel tailored to your specific business needs.

In your search, consider the following key factors to guarantee you find the right business lawyer for your organization:

Define your legal needs: Determine the specific areas of law that your business requires assistance with, such as corporate law, intellectual property, or employment law.

Evaluate their experience and qualifications: Look for a lawyer with extensive experience in handling business law cases and a proven track record of success in their specific legal specialties.

Understand their fee structure: Clarify their attorney fees, payment terms, and billing procedures to assure you're comfortable with the arrangement and can budget accordingly.

Frequently Asked Questions

How Much Does a Nevada Business Lawyer Typically Charge per Hour?

You're likely wondering about the hourly charge of a business lawyer.

Typically, you'll encounter various legal fee structures, with hourly billing rates being the most common. Expect to pay anywhere from $200 to over $600 per hour, depending on the lawyer's experience, location, and type of law practiced.

You should also consider asking about package deals or flat fees for specific services, as these can be more cost-effective.

Can I Use an Out-Of-State Lawyer for My Nevada-Based Business?

You're drowning in a sea of legalese, frantically searching for a lifeline – but can an out-of-state lawyer be your savior?

Technically, yes, you can use an out-of-state lawyer, but beware: they may not be familiar with Nevada's unique laws.

Out-of-state representation can be a gamble, as the lawyer may not be admitted to practice in Nevada's legal jurisdiction.

Tread carefully, or you may find yourself lost in a labyrinth of jurisdictional issues.

What Is the Difference Between a Business Lawyer and a Corporate Lawyer?

When considering legal counsel for your business, you may wonder about the difference between a business lawyer and a corporate lawyer.

While often used interchangeably, the distinction lies in their focus areas.

A business lawyer advises on various business structures and guarantees legal compliance across all aspects of your business.

A corporate lawyer, on the other hand, typically focuses on more complex corporate issues, such as mergers and acquisitions.

Can a Business Lawyer Help With My Company's Intellectual Property Needs?

You're safeguarding your company's innovative edge, just as Thomas Edison protected his groundbreaking light bulb design.

A business lawyer can indeed help with your intellectual property needs. They can guide you through trademark registration, ensuring your brand's distinctiveness is secured.

Additionally, they can assist with copyright protection, shielding your original works from unauthorized use.

How Often Should I Meet With My Business Lawyer for Routine Matters?

You should meet with your business lawyer regularly for routine consultations to guarantee your company remains compliant with relevant laws and regulations.

Schedule quarterly or bi-annual legal check-ins to review contracts, discuss potential disputes, and address any ongoing concerns.

Don't wait for issues to arise; proactive communication helps prevent costly mistakes.

Areas We Serve in Nevada

We serve individuals and businesses in the following locations:

Alamo Nevada Amargosa Valley Nevada Austin Nevada Baker Nevada Battle Mountain Nevada Beatty Nevada Beaverdam Nevada Bennett Springs Nevada Blue Diamond Nevada Boulder City Nevada Bunkerville Nevada Cal-Nev-Ari Nevada Caliente Nevada Carlin Nevada Carson City Nevada Carter Springs Nevada Cold Springs Nevada Crescent Valley Nevada Crystal Bay Nevada Dayton Nevada Denio Nevada Double Spring Nevada Dry Valley Nevada Dyer Nevada East Valley Nevada Elko City Nevada Ely City Nevada Empire Nevada Enterprise Nevada Eureka Nevada Fallon Station Nevada Fallon Nevada Fernley Nevada Fish Springs Nevada Fort McDermitt Nevada Gabbs Nevada Gardnerville Nevada Gardnerville Ranchos Nevada Genoa Nevada Gerlach Nevada Glenbrook Nevada Golconda Nevada Golden Valley Nevada Goldfield Nevada Goodsprings Nevada Grass Valley Nevada Hawthorne Nevada Henderson Nevada Hiko Nevada Humboldt River Ranch Nevada Imlay Nevada Incline Village Nevada Indian Hills Nevada Indian Springs Nevada Jackpot Nevada Johnson Lane Nevada Kingsbury Nevada Kingston Nevada Lakeridge Nevada Lamoille Nevada Las Vegas Nevada Laughlin Nevada Lemmon Valley Nevada Logan Creek Nevada Lovelock Nevada Lund Nevada McDermitt Nevada McGill Nevada Mesquite Nevada Mina Nevada Minden Nevada Moapa Town Nevada Moapa Valley Nevada Mogul Nevada Montello Nevada Mount Charleston Nevada Mount Wilson Nevada Mountain City Nevada Nellis AFB Nevada Nelson Nevada Nixon Nevada North Las Vegas Nevada Oasis Nevada Orovada Nevada Osino Nevada Owyhee Nevada Pahrump Nevada Panaca Nevada Paradise Nevada Paradise Valley Nevada Pioche Nevada Preston Nevada Rachel Nevada Reno Nevada Round Hill Village Nevada Ruhenstroth Nevada Ruth Nevada Sandy Valley Nevada Schurz Nevada Searchlight Nevada Silver City Nevada Silver Peak Nevada Silver Springs Nevada Skyland Nevada Smith Valley Nevada Spanish Springs Nevada Sparks Nevada Spring Creek Nevada Spring Valley Nevada Stagecoach Nevada Stateline Nevada Summerlin South Nevada Sun Valley Nevada Sunrise Manor Nevada Sutcliffe Nevada Tonopah Nevada Topaz Lake Nevada Topaz Ranch Estates Nevada Unionville Nevada Ursine Nevada Valmy Nevada Verdi Nevada Virginia City Nevada Wadsworth Nevada Walker Lake Nevada Washoe Valley Nevada Wells Nevada West Wendover Nevada Whitney Nevada Winchester Nevada Winnemucca Nevada Yerington Nevada Zephyr Cove Nevada

Nevada Lawyer Consultation

When you need help from an Attorney in Nevada, call Jeremy D. Eveland, MBA, JD (702) 302-4757 for a consultation.

Jeremy Eveland 17 North State Street Lindon UT 84042 (801) 613-1472

Home

Related Posts

Preventing Cybersecurity Breaches

Piercing the Corporate Veil

Franchise Disclosure Laws

Mastering Business Law: Key Essentials For Success

Tax Status and LLC Types

Estate Planning For Protecting Family Privacy

Estate Planning For Estate Distribution Disputes

Social Media Claims Compliance For Digital Marketing

Family Trusts

Nevada

Read more here https://jeremyeveland.com/nevada-business-lawyer/

0 notes

Text

Nevada Business Lawyer

You're considering launching a business in Nevada, and you know that maneuvering the state's complex laws and regulations can be overwhelming. As you start to build your venture, you'll need to make key decisions that can have a lasting impact on your company's success. A Nevada business lawyer can provide essential guidance on everything from choosing the right business structure to negotiating contracts. But what specific benefits can you expect from hiring an attorney, and how do you find the right one for your unique needs?

Key Takeaways

• A Nevada business lawyer can provide expert guidance on complex business laws and regulations in the state. • They can help navigate business formation and structure, including selecting the right entity type and obtaining necessary licenses. • A business lawyer in Nevada can assist with contract negotiation and review, ensuring key provisions protect business interests. • They can also aid in resolving business disputes through alternative methods, such as mediation and arbitration, or litigation. • Regular consultation with a Nevada business lawyer helps ensure compliance with state and federal laws, minimizing the risk of penalties.

Benefits of Hiring a Business Lawyer

By hiring a Nevada business lawyer, you gain access to expert guidance and counsel that can help you navigate complex business laws and regulations, minimize risks, and make informed decisions.

You'll be able to tap into their in-depth knowledge of Nevada's specific business compliance requirements, ensuring your company remains compliant and avoids costly fines or penalties. A skilled business lawyer will help you develop a sound legal strategy, tailored to your business's unique needs and goals.

With a Nevada business lawyer on your side, you'll be well-equipped to handle any legal challenges that arise, from contract disputes to regulatory issues.

They'll help you stay up-to-date on changes in Nevada business laws and regulations, ensuring you're always in compliance. By leveraging their expertise, you'll be able to focus on running your business, confident that your legal affairs are in good hands.

Business Formation and Setup Options

When setting up your Nevada business, you'll need to choose a business structure that suits your needs, such as a corporation, limited liability company (LLC), or partnership.

You'll also need to navigate the entity formation process, which involves filing necessary documents with the state and obtaining required licenses and permits.

As you consider your options, you'll want to take into account startup tax considerations to guarantee you're taking advantage of available tax benefits and minimizing your liability.

Business Structure Options

Forming a business in Nevada requires selecting a suitable structure from various options, including sole proprietorships, partnerships, limited liability companies (LLCs), and corporations, each offering distinct advantages and disadvantages. You'll want to take into account factors such as liability protection, tax implications, and corporate compliance requirements when making your decision.

When evaluating business structure options, reflect on the following key aspects:

Liability Protection: Will your personal assets be protected in case of business debts or lawsuits? LLCs and corporations offer liability protection, while sole proprietorships and partnerships do not.

Tax Implications: How will your business income be taxed? Sole proprietorships and partnerships are pass-through entities, while LLCs and corporations may be subject to double taxation.

Corporate Compliance: What ongoing filing and reporting requirements will you need to meet? Corporations and LLCs are subject to more stringent corporate compliance requirements than sole proprietorships and partnerships.

Ultimately, the business structure you choose will depend on your unique circumstances, goals, and priorities. It's crucial to consult with a qualified Nevada business lawyer to determine the best structure for your business.

Entity Formation Process

How do you formally establish a business entity in Nevada, and what steps must you take to guarantee compliance with state regulations?

To start, you'll need to choose from the various entity types available in Nevada, such as corporations, limited liability companies (LLCs), and partnerships. Each entity type has its own advantages and disadvantages, so it's important to consult with a Nevada business lawyer to determine which one best suits your business needs.

Once you've selected an entity type, you can begin the incorporation process. This typically involves filing the necessary documents with the Nevada Secretary of State's office, such as articles of incorporation or articles of organization. You'll also need to obtain any necessary business licenses and permits, and register for taxes with the state and federal government.

To ensure adherence to state regulations, you'll need to draft bylaws or an operating agreement, depending on your entity type. These documents outline the governance structure and operational procedures for your business.

Startup Tax Considerations

As you establish your business in Nevada, understanding the tax implications of various formation and setup options is crucial to minimize liabilities and maximize benefits.

You'll want to reflect on how different structures, such as sole proprietorship, partnership, or corporation, impact your tax obligations. A Nevada business lawyer can help you navigate these complexities.

When it comes to startup tax considerations, you should be aware of the following key points:

Tax Incentives: Nevada offers various tax incentives to encourage business growth, such as the Nevada New Markets Tax Credit program.

Startup Deductions: Familiarize yourself with deductions available to startups, including research and development expenses, business use of your home, and start-up costs.

Business Tax Registration: Verify you register your business with the Nevada Department of Taxation and obtain necessary licenses and permits to avoid penalties.

Contract Negotiation and Review

As you navigate contract negotiation and review, you'll want to pay close attention to key contract provisions that can impact your business's success.

You'll need to carefully consider terms such as payment structures, liability clauses, and termination conditions to guarantee they align with your company's goals and interests.

Key Contract Provisions

When negotiating or reviewing a contract, identifying and understanding key contract provisions is essential to protect your interests and guarantee that the agreement aligns with your business goals and objectives.

As a Nevada business owner, you'll want to ascertain that your contracts are thorough and clear to avoid potential disputes or contract breaches. In the event of a contract breach, having well-defined provisions can aid in contract enforcement and minimize potential losses.

Here are three key contract provisions to focus on:

Scope of Work: Clearly outline the responsibilities and obligations of all parties involved, including specific tasks, timelines, and deliverables.

Payment Terms: Define payment schedules, amounts, and methods to prevent misunderstandings and ascertain timely payments.

Termination and Dispute Resolution: Establish procedures for terminating the contract and resolving disputes, including mediation, arbitration, or litigation.

Negotiation Strategy Tips

Negotiating a contract requires a well-planned strategy that prioritizes your business objectives, protects your interests, and adapts to the dynamics of the negotiation process.

You'll need to employ effective negotiation tactics to achieve your goals. Start by clearly defining your objectives and identifying potential areas of contention. This will help you focus your efforts and make strategic decisions during the negotiation.

Effective communication is essential in contract negotiation. You must articulate your needs and concerns clearly, while also listening actively to the other party's perspective. This will help build trust and facilitate creative problem-solving.

Be open to compromise, but don't concede on critical issues. Instead, seek mutually beneficial solutions that satisfy both parties' interests. Remember to maintain a professional demeanor, even in the face of disagreement.

Resolving Business Disputes and Litigation

Disputes can arise in even the most well-managed businesses, and it's essential that you understand the options available for resolving them in a timely and cost-effective manner. When you're facing a dispute, you'll want to evaluate alternative dispute resolution methods, such as mediation techniques and arbitration processes, before heading to court.

Here are three options you should evaluate:

Mediation: A neutral third-party facilitates a discussion between you and the other party to reach a mutually acceptable solution.

Arbitration: A neutral third-party makes a binding decision after hearing evidence and arguments from both sides.

Litigation: Taking your dispute to court, where a judge or jury will make a decision.

You'll want to consult with a Nevada business lawyer to determine the best approach for your specific situation. They can help you navigate the process and represent your interests.

Nevada Business Laws and Regulations

Numerous state and federal laws govern businesses in Nevada, and it's your responsibility as a business owner to comply with these regulations to avoid costly fines, penalties, and reputational damage.

You must familiarize yourself with Nevada's licensing requirements, which vary depending on the type of business you operate. For instance, you may need to obtain a general business license, as well as specialized licenses or permits specific to your industry.

Additionally, you must comply with Nevada's employment regulations, which cover matters such as minimum wage, overtime, and workers' compensation. You're also subject to federal laws, including the Fair Labor Standards Act and the Americans with Disabilities Act.

Failure to comply with these regulations can result in legal action, fines, and damage to your business's reputation. To guarantee compliance, it's essential to regularly review and update your business practices and policies to reflect changes in Nevada's business laws and regulations.

Finding the Right Business Lawyer

When steering through the complexities of Nevada's business laws and regulations, you need to secure the expertise of a seasoned business lawyer who can provide counsel tailored to your specific business needs.

In your search, consider the following key factors to guarantee you find the right business lawyer for your organization:

Define your legal needs: Determine the specific areas of law that your business requires assistance with, such as corporate law, intellectual property, or employment law.

Evaluate their experience and qualifications: Look for a lawyer with extensive experience in handling business law cases and a proven track record of success in their specific legal specialties.

Understand their fee structure: Clarify their attorney fees, payment terms, and billing procedures to assure you're comfortable with the arrangement and can budget accordingly.

Frequently Asked Questions

How Much Does a Nevada Business Lawyer Typically Charge per Hour?

You're likely wondering about the hourly charge of a business lawyer.

Typically, you'll encounter various legal fee structures, with hourly billing rates being the most common. Expect to pay anywhere from $200 to over $600 per hour, depending on the lawyer's experience, location, and type of law practiced.

You should also consider asking about package deals or flat fees for specific services, as these can be more cost-effective.

Can I Use an Out-Of-State Lawyer for My Nevada-Based Business?

You're drowning in a sea of legalese, frantically searching for a lifeline – but can an out-of-state lawyer be your savior?

Technically, yes, you can use an out-of-state lawyer, but beware: they may not be familiar with Nevada's unique laws.

Out-of-state representation can be a gamble, as the lawyer may not be admitted to practice in Nevada's legal jurisdiction.

Tread carefully, or you may find yourself lost in a labyrinth of jurisdictional issues.

What Is the Difference Between a Business Lawyer and a Corporate Lawyer?

When considering legal counsel for your business, you may wonder about the difference between a business lawyer and a corporate lawyer.

While often used interchangeably, the distinction lies in their focus areas.

A business lawyer advises on various business structures and guarantees legal compliance across all aspects of your business.

A corporate lawyer, on the other hand, typically focuses on more complex corporate issues, such as mergers and acquisitions.

Can a Business Lawyer Help With My Company's Intellectual Property Needs?

You're safeguarding your company's innovative edge, just as Thomas Edison protected his groundbreaking light bulb design.

A business lawyer can indeed help with your intellectual property needs. They can guide you through trademark registration, ensuring your brand's distinctiveness is secured.

Additionally, they can assist with copyright protection, shielding your original works from unauthorized use.

How Often Should I Meet With My Business Lawyer for Routine Matters?

You should meet with your business lawyer regularly for routine consultations to guarantee your company remains compliant with relevant laws and regulations.

Schedule quarterly or bi-annual legal check-ins to review contracts, discuss potential disputes, and address any ongoing concerns.

Don't wait for issues to arise; proactive communication helps prevent costly mistakes.

Areas We Serve in Nevada

We serve individuals and businesses in the following locations:

Alamo Nevada Amargosa Valley Nevada Austin Nevada Baker Nevada Battle Mountain Nevada Beatty Nevada Beaverdam Nevada Bennett Springs Nevada Blue Diamond Nevada Boulder City Nevada Bunkerville Nevada Cal-Nev-Ari Nevada Caliente Nevada Carlin Nevada Carson City Nevada Carter Springs Nevada Cold Springs Nevada Crescent Valley Nevada Crystal Bay Nevada Dayton Nevada Denio Nevada Double Spring Nevada Dry Valley Nevada Dyer Nevada East Valley Nevada Elko City Nevada Ely City Nevada Empire Nevada Enterprise Nevada Eureka Nevada Fallon Station Nevada Fallon Nevada Fernley Nevada Fish Springs Nevada Fort McDermitt Nevada Gabbs Nevada Gardnerville Nevada Gardnerville Ranchos Nevada Genoa Nevada Gerlach Nevada Glenbrook Nevada Golconda Nevada Golden Valley Nevada Goldfield Nevada Goodsprings Nevada Grass Valley Nevada Hawthorne Nevada Henderson Nevada Hiko Nevada Humboldt River Ranch Nevada Imlay Nevada Incline Village Nevada Indian Hills Nevada Indian Springs Nevada Jackpot Nevada Johnson Lane Nevada Kingsbury Nevada Kingston Nevada Lakeridge Nevada Lamoille Nevada Las Vegas Nevada Laughlin Nevada Lemmon Valley Nevada Logan Creek Nevada Lovelock Nevada Lund Nevada McDermitt Nevada McGill Nevada Mesquite Nevada Mina Nevada Minden Nevada Moapa Town Nevada Moapa Valley Nevada Mogul Nevada Montello Nevada Mount Charleston Nevada Mount Wilson Nevada Mountain City Nevada Nellis AFB Nevada Nelson Nevada Nixon Nevada North Las Vegas Nevada Oasis Nevada Orovada Nevada Osino Nevada Owyhee Nevada Pahrump Nevada Panaca Nevada Paradise Nevada Paradise Valley Nevada Pioche Nevada Preston Nevada Rachel Nevada Reno Nevada Round Hill Village Nevada Ruhenstroth Nevada Ruth Nevada Sandy Valley Nevada Schurz Nevada Searchlight Nevada Silver City Nevada Silver Peak Nevada Silver Springs Nevada Skyland Nevada Smith Valley Nevada Spanish Springs Nevada Sparks Nevada Spring Creek Nevada Spring Valley Nevada Stagecoach Nevada Stateline Nevada Summerlin South Nevada Sun Valley Nevada Sunrise Manor Nevada Sutcliffe Nevada Tonopah Nevada Topaz Lake Nevada Topaz Ranch Estates Nevada Unionville Nevada Ursine Nevada Valmy Nevada Verdi Nevada Virginia City Nevada Wadsworth Nevada Walker Lake Nevada Washoe Valley Nevada Wells Nevada West Wendover Nevada Whitney Nevada Winchester Nevada Winnemucca Nevada Yerington Nevada Zephyr Cove Nevada

Nevada Lawyer Consultation

When you need help from an Attorney in Nevada, call Jeremy D. Eveland, MBA, JD (702) 302-4757 for a consultation.

Jeremy Eveland 17 North State Street Lindon UT 84042 (801) 613-1472

Home

Related Posts

Preventing Cybersecurity Breaches

Piercing the Corporate Veil

Franchise Disclosure Laws

Mastering Business Law: Key Essentials For Success

Tax Status and LLC Types

Estate Planning For Protecting Family Privacy

Estate Planning For Estate Distribution Disputes

Social Media Claims Compliance For Digital Marketing

Family Trusts

Nevada

Read more here https://jeremyeveland.com/nevada-business-lawyer/

0 notes

Text

Best Nevada Invoice Factoring Company - Invoice Factoring Services

Need immediate cash flow? Our Nevada invoice factoring company helps businesses like yours get paid faster. Sell your unpaid invoices for quick funding with our invoice factoring services. No long-term contracts, just fast, flexible financing!

#accounts receivable financing company#best nevada invoice factoring company#invoice factoring companies Nevada#invoice factoring company#invoice factoring company in Nevada#Invoice factoring for startups#invoice factoring services#invoice factoring services in Nevada#invoice factoring services Nevada#nevada invoice factoring#same-day invoice factoring#small business factoring

0 notes

Text

Nevada Business Lawyer

You're considering launching a business in Nevada, and you know that maneuvering the state's complex laws and regulations can be overwhelming. As you start to build your venture, you'll need to make key decisions that can have a lasting impact on your company's success. A Nevada business lawyer can provide essential guidance on everything from choosing the right business structure to negotiating contracts. But what specific benefits can you expect from hiring an attorney, and how do you find the right one for your unique needs?

Key Takeaways

• A Nevada business lawyer can provide expert guidance on complex business laws and regulations in the state. • They can help navigate business formation and structure, including selecting the right entity type and obtaining necessary licenses. • A business lawyer in Nevada can assist with contract negotiation and review, ensuring key provisions protect business interests. • They can also aid in resolving business disputes through alternative methods, such as mediation and arbitration, or litigation. • Regular consultation with a Nevada business lawyer helps ensure compliance with state and federal laws, minimizing the risk of penalties.

Benefits of Hiring a Business Lawyer

By hiring a Nevada business lawyer, you gain access to expert guidance and counsel that can help you navigate complex business laws and regulations, minimize risks, and make informed decisions.

You'll be able to tap into their in-depth knowledge of Nevada's specific business compliance requirements, ensuring your company remains compliant and avoids costly fines or penalties. A skilled business lawyer will help you develop a sound legal strategy, tailored to your business's unique needs and goals.

With a Nevada business lawyer on your side, you'll be well-equipped to handle any legal challenges that arise, from contract disputes to regulatory issues.

They'll help you stay up-to-date on changes in Nevada business laws and regulations, ensuring you're always in compliance. By leveraging their expertise, you'll be able to focus on running your business, confident that your legal affairs are in good hands.

Business Formation and Setup Options

When setting up your Nevada business, you'll need to choose a business structure that suits your needs, such as a corporation, limited liability company (LLC), or partnership.

You'll also need to navigate the entity formation process, which involves filing necessary documents with the state and obtaining required licenses and permits.

As you consider your options, you'll want to take into account startup tax considerations to guarantee you're taking advantage of available tax benefits and minimizing your liability.

Business Structure Options

Forming a business in Nevada requires selecting a suitable structure from various options, including sole proprietorships, partnerships, limited liability companies (LLCs), and corporations, each offering distinct advantages and disadvantages. You'll want to take into account factors such as liability protection, tax implications, and corporate compliance requirements when making your decision.

When evaluating business structure options, reflect on the following key aspects:

Liability Protection: Will your personal assets be protected in case of business debts or lawsuits? LLCs and corporations offer liability protection, while sole proprietorships and partnerships do not.

Tax Implications: How will your business income be taxed? Sole proprietorships and partnerships are pass-through entities, while LLCs and corporations may be subject to double taxation.

Corporate Compliance: What ongoing filing and reporting requirements will you need to meet? Corporations and LLCs are subject to more stringent corporate compliance requirements than sole proprietorships and partnerships.

Ultimately, the business structure you choose will depend on your unique circumstances, goals, and priorities. It's crucial to consult with a qualified Nevada business lawyer to determine the best structure for your business.

Entity Formation Process

How do you formally establish a business entity in Nevada, and what steps must you take to guarantee compliance with state regulations?