#net wrap market outlook

Explore tagged Tumblr posts

Text

Net Wrap Market: A Comprehensive Overview of Growth, Trends, and Players

The net wrap market is a significant sector in the crop protection industry, playing a pivotal role in contemporary agricultural practices. This blog delves into the global net wrap market, providing insights into its current size, growth drivers, key players, and future trends. We explore the net wrap market in depth, highlighting its growth prospects and the factors that are driving its expansion.

Current Market Size and Growth Trends

As of 2022, the global net wrap market stands at an estimated value of around USD 900 million. This figure is projected to expand at a consistent compound annual growth rate (CAGR) of 4% from 2022 to 2027, reaching a projected value of USD 1.2 billion by the conclusion of the forecast period. The growth in this market can be attributed to the expanding use of modern farming techniques, the escalating demand for superior forage preservation solutions, and the agriculture sector's expansion in developing economies.

Key Players in the Market

A number of prominent companies dominate the global net wrap market. Among these are Tama Group, Berry Global, RKW Group, John Deere, and Silawrap. These industry leaders are at the forefront of innovation, providing a diverse range of net wrap products to cater to the varying requirements of farmers worldwide. Strategic collaborations, product launches, and acquisitions are common strategies employed by these key players to maintain their competitive edge and broaden their market reach.

Regional Analysis

The net wrap market displays regional disparities in demand and consumption patterns. North America and Europe continue to be the leading markets for net wrap due to the widespread adoption of mechanized farming practices and the existence of large-scale commercial farms. In contrast, the Asia-Pacific region is undergoing swift growth, fueled by agricultural mechanization and the growing awareness of forage conservation techniques among smallholder farmers.

Market Dynamics and Growth Drivers

Numerous factors contribute to the expansion of the net wrap market. These include the automation of agricultural practices, the necessity for efficient forage preservation methods, and the rising demand for high-quality silage. Furthermore, government initiatives promoting sustainable agriculture and environmental conservation bolster market growth by encouraging the adoption of eco-friendly net wrap materials and practices.

Emerging Trends and Future Outlook

The net wrap market is witnessing several emerging trends that are set to influence its future direction. These include the development of biodegradable and compostable net wrap alternatives to address environmental concerns, the integration of smart technologies for real-time monitoring and optimization of baling processes, and the increasing adoption of round bales in livestock farming.

Market Challenges

Despite the growth prospects, the net wrap market faces several challenges. Massive product costs can hinder global industry expansion by 2030. Changing government laws leading to fluctuations in raw material costs can further impede global industry expansion.

Conclusion The global net wrap market is poised for continuous growth, driven by technological advancements, evolving agricultural practices, and the growing recognition of the importance of forage conservation. Key players in the market are anticipated to capitalize on these trends by investing in research and development, expanding their product offerings, and strengthening their distribution networks to cater to the evolving needs of farmers worldwide. As the agriculture sector continues to evolve, the net wrap market will remain a crucial component of modern farming practices, enabling efficient forage conservation and contributing to global food security.

#net wrap industry research reports#net wrap market forecast#net wrap market outlook#net wrap market research reports#net wrap market growth#net wrap market revenue#net wrap industry

0 notes

Text

Insights into the Evolving Net Wrap Market

Introduction

In the realm of global economic stability, the agricultural industry plays a pivotal role, continuously advancing towards efficiency and sustainability. Within this landscape, the Net Wrap Market emerges as a vital player, offering solutions to enhance baling efficiency while addressing environmental concerns. Let's delve into the dynamic world of the Net Wrap Market, exploring its growth trajectory, technological innovations, and sustainability initiatives.

Understanding Market Dynamics

The Net Wrap Market is experiencing steady growth, with a projected Compound Annual Growth Rate CAGR of 5.8%. This growth is fueled by the modernization of agriculture, increasing demand for efficient baling materials, and continuous technological advancements in net wrap technology. Farmers increasingly recognize the benefits of net wrap in optimizing operations and preserving hay quality.

Insights from Market Research Reports

Valuable insights from market research reports forecast the Net Wrap Market to reach USD 1.2 billion by 2027. These reports provide comprehensive analyses of market trends, competition, and emerging opportunities, empowering stakeholders to make informed decisions and navigate market complexities effectively.

Addressing Agricultural Challenges

With the global population projected to reach 9 billion by 2050, agricultural production must rise to meet growing food demands. Net wrap plays a pivotal role in ensuring hay quality preservation, reducing spoilage, and improving labor efficiency. As cities expand and dietary habits shift, the demand for high-quality forage supported by efficient baling methods like net wrap continues to rise.

Asia-Pacific: A Region of Growth

The Asia-Pacific region emerges as a key driver of net wrap market growth, fueled by rapid urbanization, changing consumer preferences, and government initiatives to modernize agriculture. With a focus on efficiency and sustainability, farmers in this region increasingly adopt net wrap solutions to meet evolving agricultural needs.

Innovations Shaping the Industry

Advancements in net wrap materials revolutionize the industry, with UV-stabilized polymers offering enhanced durability and biodegradable alternatives gaining traction among eco-conscious farmers. Manufacturers invest in research and development to develop innovative net wrap solutions that cater to the evolving needs of farmers worldwide.

Embracing Sustainability

Sustainability takes center stage in the Net Wrap Market, with growing demand for eco-friendly products and increasing regulatory influence driving industry-wide transformations. As environmental concerns mount, stakeholders prioritize sustainable practices to ensure the long-term viability of the industry.

Market Expansion and Competitive Landscape

Market revenue is poised to exceed USD 900 million by the forecast period's end, driven by increased investments in agriculture and market expansion efforts by key players. While North America holds a dominant position, regions like Europe and Asia-Pacific experience significant growth, fueled by expanding agricultural activities and modernization efforts.

Trends Shaping the Future

Several trends reshape the future of the Net Wrap Market, including IoT technology integration, advanced material development, and collaborative partnerships between manufacturers and technology providers. By embracing innovation, sustainability, and data-driven decisions, stakeholders contribute to a thriving agricultural future supported by efficient baling solutions like net wrap.

Conclusion

The Net Wrap Market offers promising opportunities for stakeholders to navigate market dynamics, capitalize on emerging trends, and drive sustainable growth in the agricultural industry. By embracing innovation and sustainability, stakeholders pave the way for a more efficient and environmentally conscious future for baling operations worldwide Top of Form.

#Net Wrap Market#Net Wrap Market Analysis#Net Wrap Market Demand#Net Wrap Market Forecast#Net Wrap Market Growth#Net Wrap Market Outlook#Net Wrap Market Revenue#Net Wrap Market Size#Net Wrap Market Trends#Net Wrap Market Research reports

0 notes

Text

Glassine Papers Market Segments, Potential Applications and Analysis 2031

The Insight Partners market research Glassine Papers Market Size and Share Report | 2031 is now available for purchase. This report offers an exclusive evaluation of a range of business environment factors impacting market participants. The market information included in this report is assimilated and reliant on a few strategies, for example, PESTLE, Porter's Five, SWOT examination, and market dynamics

Glassine Papers market is evaluated based on current scenarios and future projections are added keeping the projected period in consideration. This report integrates the valuation of Glassine Papers market size for esteem (million USD) and volume (K Units). Research analysts have used top-down, bottom-up, primary, and secondary research approaches to evaluate and approve the Glassine Papers market estimation.

Detailed scrutiny of market shares, optional sources, and basic essential sources has been done to integrate only valid facts. This research further reveals strategies to help companies grow in the Glassine Papers market.

Key objectives of this research are:

To contemporary market dynamics including drivers, challenges, threats, and opportunities in the Glassine Papers market.

To analyze the sum and market estimation of the worldwide Glassine Papers market

Based on key facets, market segments are added.

The competitive analysis covers key market players and their business strategies.

To examine the Glassine Papers Market for business probable and strategic outlook.

To review the Glassine Papers Market size, key regions and countries, end-users, and statistical details.

To offer strategic recommendations based on the latest market developments, and Glassine Papers market trends.

Perks of The Insight Partners’ Glassine Papers Market Research

Market Trends: Our report reveals developing Glassine Papers market trends that are poised to reshape the market preparing businesses with the foresight to retain their competitive edge. This Market research report presents market trends, supply chain analysis, leading participants, and business growth strategies. This research covers technological progress and key developments covering various aspects of the inclusive market. It is valuable market research for existing key players as well as new entrants in the Glassine Papers Market. Through inputs derived from experts, this research attempts to guide future investors about market details and potential returns on investment.

Competitive Landscape: This research reveals key market players, their strategies, and possible areas for differentiation.

Analysts Viewpoint: We have industry-specific experts who add credibility to this report with their exclusive viewpoints based on market understanding and expertise. This report goes further into details of entire business processes and doesn’t restrict to only operational aspects. These insights cover venture economics and include tactics for capital investment, investor funding, and projections of ROIs. Net income and profit loss financial stats are crucial metrics of this Glassine Papers market report. With these meticulous insights companies can reduce their risks and increase the success rate in the coming decade.

Glassine Papers Market Report Coverage:

Report Attributes

Details

Segmental Coverage

Product Type

Bleached Glassine Paper

Unbleached Glassine Paper

Application

Food Packaging

Soap Wrapping

Labels

Envelopes

Flower Wrapping

End-Use Industry

Food Industry

Consumer Goods Industry

Chemical Industry

Pharmaceutical Industry

Regional and Country Coverage

North America (US, Canada, Mexico)

Europe (UK, Germany, France, Russia, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, Australia, Rest of APAC)

South / South & Central America (Brazil, Argentina, Rest of South/South & Central America)

Middle East & Africa (South Africa, Saudi Arabia, UAE, Rest of MEA)

Market Leaders and Key Company Profiles

Glatfelter Ober-Schmitten GmbH

Guilin Qifeng Paper Co., Ltd

HERMA Material

HUHTAMAKI GROUP

Innovia Films

Legion Paper Corp.

Norman A Peroni Ltd

Paper World Co., Ltd.

Shandong Mingda Packing Product Co., Ltd.

Valmet

Other key companies

What all adds up to the credibility of this research?

A comprehensive summary of the contemporary Glassine Papers market scenario

Precise estimations on market revenue forecasts and CAGR to rationalize resources

Regional coverage to uncover new markets for business

Rivalry analysis aims to help corporations at a modest edge

Facts-based crystal-clear insights for business success

The research can be customized as per business necessities

Access to PDF, and PPT formats of this research

About Us:

The Insight Partners is a one-stop industry research provider of actionable intelligence. We help our clients in getting solutions to their research requirements through our syndicated and consulting research services. We specialize in industries such as Semiconductor and Electronics, Aerospace and Defense, Automotive and Transportation, Biotechnology, Healthcare IT, Manufacturing and Construction, Medical Devices, Technology, Media and Telecommunications, Chemicals and Materials.

Contact Us: www.theinsightpartners.com

0 notes

Text

Canned Foods Market Outlook by Industry Growth, Future Trends, Analysis by Type, Application and Business Opportunities to 2033

The global canned foods market net worth is estimated to be around US$ 17 Bn in 2023 and is anticipated to register a CAGR of 4.2% from 2023 to 2033. The research report on the global canned foods market reveals that the valuation of the market would reach up to US$ 25.6 Bn by 2033.

During the course of the forecast years, advancement in the canned foods industry is anticipated to be fuelled by changes in lifestyles, improved distribution networks, and rising demand for ready-to-eat food items. The world’s expanding cross-cultural cuisine trend has had a favourable effect on the market expansion. Exotic dishes offered by local retailers and eateries, such as Sushi and other seafood products, have increased the demand for canned food in the last few years.

Get Sample Copy@ https://www.futuremarketinsights.com/reports/sample/rep-gb-15971

Due to the ease of cooking using canned food ingredients, which also last longer without being contaminated or spoiling, many restaurant and hotel businesses and restaurants use them extensively. Moreover, as N the fruits in cans are clean and yet maintain all of their nutritious value the demand for canned foods is projected to grow more in tandem with the growth of the hotel and hospitality industry.

Key Takeaways from the Canned Foods Market Study

Supermarkets or hypermarkets are the major distribution channels for all types of canned food items and contribute more than 40% of the revenue generated globally.

In contrast, canned foods available over online retail channels are getting popular more rapidly and are penetrating new markets at a faster rate.

Only in the United States, the market for canned foods is anticipated to reach US$ 16 Bn by 2025 while growing at a rate of 3.8% during the forecast years.

China is predicted to be the fastest-growing nation in terms of production and consumption of canned food items and would register an impressive CAGR of 6% through 2033.

Preview Full Report@ https://www.futuremarketinsights.com/reports/canned-foods-market

Competitive Landscape for the Canned Foods Market

Some of the major canned food market participants are Campbell Soup Company, Danish Crown AmbA, Del Monte Foods, Inc., JBS USA Holdings, Inc., Ayam Brand, Holyland Marketing Private Limited, The Kraft Heinz Company, Bolton Group S.r.l., Inc., Nestlé, Danish Crown Amba., Conagra Brands, Inc., Universal Canning Inc., StarKist Co., Bumble Bee Seafoods, Wild Planet Foods, Inc., Connors Bros Ltd., and LDH (La Doria) Ltd. Among others.

Renowned canned foods market key players are constantly implementing innovative tactics like launching new products and increasing their production capacity in order to better serve the market and retain their growing consumer base. In this way, it aids in boosting their market position and increasing their manufacturing capacity to penetrate new markets. Providing consumers with high-quality goods is another benefit.

Recent Developments in the Canned Foods Industry

The Campbell Soup Company introduced a new tinned container for its spicy chicken noodle soup with a new flavor in July 2021.

A minimal supply version of popular canned tuna with wrapping inspired by the popular Japanese manga series Doraemon was introduced by Thai Union’s canned tuna-related brand SEALECT in March 2021.

To diversify its business into canned snacks, the possession of the Del Monte processed fruit and vegetable packaging business in Canada of Conagra Brands was finalized in July 2018 by Bonduelle SA, which is a French company that offers different types of frozen, and fresh vegetables in cans.

Key Segments

By Product:

Canned fruits and Vegetables

Canned Meat and Seafood

Canned Ready Meals

Others

By Type:

Organic

Conventional

By Distribution Channels:

Supermarket or Hypermarket

Convenience Stores

E-commerce or Online Retail Channels

Others

About FMI

Future Market Insights (ESOMAR certified market research organization and a member of Greater New York Chamber of Commerce) provides in-depth insights into governing factors elevating the demand in the market. It discloses opportunities that will favor the market growth in various segments on the basis of Source, Application, Sales Channel and End Use over the next 10-years.

0 notes

Note

Ciao :D You imagine: Bilbo is the owner of a small bookshop in a delightful little town square. Every day Bofur, a street artist playing his flute, stands in front of his shop. Bofur is always very nice and kind to Bilbo, but the latter does not want him in front of his shop and treats him as if he were a dog to be chased away. But one day Bofur notices that Bilbo hasn't gone to work, and worriedly starts looking for him. And finally Bofur finds him! What's happened?

The proprietor of the lovely bookshop (Baggins Books) just on the corner of the market square balled his hands into fists at the sound coming through the window. The dwarf was back playing his blasted flute.

He wouldn’t have minded (the dwarf wasn’t bad at it! He even had a lovely singing voice!), but some people tended to give the dwarf a wide berth, and as a result, Bilbo’s business was also given the same.

He sighed to himself and decided he needed to ask the musician to move to another place. He smoothed out his waistcoat and opened the door.

The dwarf was happily dancing away and playing a upbeat sounding ditty when Bilbo pointedly cleared his throat behind him.

“I’m sorry...Bofur, is it?”

Bofur turned and nodded. “Are you enjoying the music, Mister Baggins?”

“Well, see, that’s the problem. It doesn’t matter if I enjoy it because my customers don’t seem to and they’ve been avoiding the shop. I really do wish...(the hobbit sighed with exasperation) you’d find another street corner to play on!” Bilbo’s hands were on his hips now and he was scowling.

Bofur savoured the way Bilbo’s little brow furrowed in annoyance, even if his words were harsh. The dwarf smiled warmly He’d heard worse, often on a daily basis.

“Why Mister Baggins, it’s almost as if you’re saying you don’t like my company.”

Bofur watched the hobbit’s eyes widen and the hair on his feet practically bristle. “I don’t...that’s not what I mean...I...”

Oh, this was hilarious. Bofur loved watching the smaller male become flustered by being torn between the urge to be honest and the urge to be polite. Bofur saw no such divide. He always said what he meant. It was sometimes hard for him to understand that other folk didn’t. But it also afforded him the outlook that people who appeared rude were sometimes trying to hide other feelings. He squashed the part of himself that whispered inwardly that it was only wishful thinking on his part.

“Look,” the hobbit was saying. “I just need you to leave. I’m losing customers. So, um...go on, shoo.”

Bofur raised an eyebrow. “Shoo? I’m not a pigeon.”

Bilbo managed to convey a look somewhere between annoyance and pleading and the dwarf sighed. He leaned down and picked his hat up off the ground. There was very little coin in it today.

“As you wish, Mister Baggins.”

------------------------------------------------------------------------------------------

Despite moving to another corner of the market as Bilbo had requested, Bofur still walked by the bookshop in the morning hoping to catch a glance at Bilbo. If the hobbit happened to glance up from his book of Fairy Tales and Mythology at the moment the dwarf was passing by, Bofur would wave cheerfully, secretly savouring the way Bilbo’s face would turn scarlet and his eyes would dart back down towards his book before the dwarf walked on.

It became the part of the day he most looked forward to, even if he still wasn’t getting much coin. His cousin was almost finished making some new toys to sell in the market square though, so he could help Bifur with that when the time came and it would no doubt net them a better profit.

He was walking by one morning, like any other when he realized the shop was not open. The lights were dimmed and Bofur counted on his fingers. No, it was definitely a day when the hobbit should be in. He leaned against the window and peered in just in case he could spot Bilbo in the dim light.

And that was when he saw it: there was glass all over the floor. Panic flooded the dwarf as he realized someone must have broken in. Had they hurt Bilbo? Where was he?

He frantically ran down the alley to the back of the shop and his heart skipped a beat when he saw the door hanging off its hinges and the broken windows. Wasting no time, he hurled himself into the shop, calling for the hobbit.

“Bofur?”

Bilbo’s voice was weak, barely audible. “Is that you?”

“It’s me! Where are you?”

Bilbo appeared from behind one of the bookshelves, looking wide eyed and disheveled, which immediately brought out Bofur’s protective instincts. “Did someone hurt you?"

“No, no, I’m fine. Just a little shaken. I heard them talking when they robbed the store and I hid. I don’t know what they would have done if they’d found me, but I hid and I’m safe.”

Bofur’s concern was palpable. “Do you need anything? Do you want me to stay until you’re sure everything’s safe?” He sounded fretful.

“Funny you should say that. One of the things I overheard them say was: ‘the dwarf isn’t around much now so it’ll be easier to rob the store.’.”

“Oh...”

“I owe you my deepest apologies. It was wrong of me to say those things to you the other day when you’ve shown me nothing but kindness.”

Bofur began to protest but Bilbo cut him off. “I know what you’re going to say, but it was wrong of me.”

“I’ve heard worse, really.”

“Well you shouldn’t have to. It’s wrong and my mother didn’t raise me the way I’d acted. I’m so sorry, Bofur. You were just trying to make a living, like me.”

The dwarf patted Bilbo’s shoulder. “Apology accepted, then,” he smiled, and his heart lashed against its cage at the tentative smile that Bilbo gave in return.

Suddenly the hobbit turned pale and dropped to the floor.

“Bilbo! Bilbo, are you alright?” Bofur was at his side in a second, trying to help him off the floor by wrapping him up in his arms. The hobbit was trembling.

“Sorry, just swooned, it was a bit of a delayed shock.” He squeaked a little as he was lifted up in the dwarf’s strong arms, then he felt a bit swoony for an entirely different reason. He leaned against Bofur’s chest, burrowing closer for comfort. Bofur didn’t smell the way he’d thought. He smelt of pipeweed and cedar. A comforting, homey smell.

“I can take you home if you need me to. If you have family or something...”

“I am home,” replied the hobbit. “I live alone upstairs.”

The reality that Bilbo not only had had his business broken into, but also the place he was meant to feel safest hit Bofur.

“Then, I’ll stay, if you want me to.”

The hobbit burrowed closer. He felt safe with the dwarf.

“Only if you at least let me make you a cup of tea to make up for how rotten I was.”

He smiled up at the grin that elicited. “In that case, Mister Baggins, you’d better put the kettle on.”

40 notes

·

View notes

Text

The Sellout, chapter two

two: the big reveal

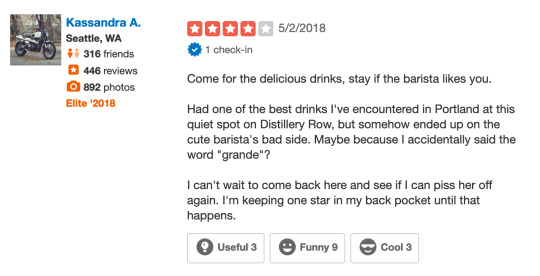

Kassandra sipped her coffee and surveyed the Portland skyline: the muddy river far below, Mount Hood backlit by sunrise skies as soft and pink as a kitten's tongue, and the laughably light traffic skating along I5. Roofs and trees, then trees in greater and greater numbers until they made a velvety green carpet all the way to the mountains. Portland had to be the smallest big city she'd ever lived in.

She sipped again, letting the coffee's warmth ward off the chill from the polished concrete floor beneath her feet, and she wandered away from the unbroken expanse of floor-to-ceiling windows that formed the eastern wall of her condo, back to the table where her laptop waited for her to put the finishing touches on the Yelp review she'd been dying to write since yesterday afternoon.

After visiting fifty — no, closer to a hundred — coffee shops in the month she'd lived here so far, she'd never experienced one quite like Cliffhanger Coffee. The latte she'd ordered was damn near perfect, but the coffee snob capital of the US was full of near-perfect lattes. It wasn't full of beautiful, dark-haired women with fire in their eyes who could pull espresso shots while throwing volleys of sharp, sharp words at the first sign of a threat.

Despite turning up the dials on her charm and attentiveness, Kassandra had gotten skewered almost as soon as she'd opened her mouth. After two years of living with Pacific Northwest passive aggressiveness, the woman's flat-out, in-your-face aggressiveness had hit Kassandra like the first taste of a sea breeze after years in the desert.

She'd savored every sip of that latte while walking up Belmont back to her car, and later on, she'd fallen asleep thinking about the woman's sharp words, the muscled lines of her forearms, and how they'd disappeared into blackwork tattoos that ran under the rolled-up sleeves of her flannel shirt. Trees on one arm and plants on the other, ferns giving way to some kind of vine, twisting in intricate lines on her skin...

Kassandra shook the thought away and focused on the text she'd written. Come for the delicious drinks, stay if the barista likes you... She tapped a finger against her chin in thought, then typed out one final sentence before she clicked "Post Review."

She examined her handiwork with a satisfied grin, then finished off the last of her coffee. Maybe she could squeeze in a visit to the other side of the river after her one o'clock planning meeting downtown. She picked up her phone.

Dessa answered in the middle of the first ring. "Good morning, Kassandra." She'd been Kassandra's assistant long enough to know her working hours went from seven a.m. to seven p.m. and often beyond.

"Dessa. Good morning. How's my two to four looking this afternoon?"

Quiet click-clicks as Dessa brought up her calendar. "You've got a one-on-one with Trevor Adams from two-thirty to three-thirty."

"Reschedule him to early next week."

"Consider it done."

"Any messages for me?"

"Kevin would like you to call, but he says it's not urgent."

Kassandra snorted. A CEO's not urgent merely meant right now instead of yesterday. "Coordinate a call with Lisa so I can talk to him at his earliest convenience." Lisa, his long-suffering admin assistant, who'd followed him from Microsoft to Juniper and every other stop along the way.

"It'll probably be around eight-thirty."

"That works." She drummed her fingers on the tabletop. "How're things back at the ranch?"

A sigh. "Markos has been looking for you."

Kassandra rolled her eyes. "He can make a calendar request like everyone else."

"I told him that, but you know how he is."

She did, all too well. He liked his meetings with her to be in person and off the record, like he was some big-shot politician instead of a middling marketing executive. "I'll be on site tomorrow morning. If he weasels by again, tell him he can buy me lunch."

"Will do. Anything else you need?"

"That's it for now. Thanks, Dessa."

She gave one last smirking glance at Yelp, then closed the browser tab and pulled up Outlook. The number of messages in her inbox had reached quadruple digits, and she made a mental note to spend some time cleaning it up later. She scrolled around until she found the email she wanted, then picked up her phone again. "Hi, Evelyn. It's Kassandra. Ready to start crunching those square footage numbers on the southeast flagship?"

.oOo.

A little after two o'clock, Kassandra turned her Audi R8 onto the looping ramp that led up to the Morrison Bridge, and just past the apex of the curve, she punched the gas and grinned as the big V10 began to howl. The acceleration shoved her hard into her seat, and it was like sitting in a recliner strapped to a rocket, more than making up for the fact that the car only came with an automatic transmission. No matter. If she wanted to shift gears herself, she had motorcycles for that.

She found a place to park on a side street off Belmont, slung her laptop bag over her shoulder, then backtracked a couple of blocks to the building that housed Cliffanger Coffee. The neighborhood wore its light industrial roots proudly: lots of brick and corrugated metal, and the coffeeshop's building was no exception. The ground floor units had lofted ceilings, but there were two more floors above them that looked like they'd been converted into apartments sometime in the last forty years. Likely rent controlled. Probably what had kept the owner from tearing it all down and putting up a mixed use development in its place.

A development on a street corner like this could net tens of millions.

The corner unit was occupied by a store selling overpriced furniture, and she scanned the price tags through the windows as she passed: five-hundred-dollar end tables and six-thousand-dollar couches. The store had probably been open for less than a year. She wondered what had been in its place a decade ago, when the coffee shop next door had moved in and nudged this neighborhood a little further down the path of gentrification.

A slate-colored sign bearing the words "Cliffhanger Coffee" hung over the door, the bold white lettering in a font that was clean and timeless rather than trendy, set over an angular slash that was more suggestive of a cliff than explicit.

Kassandra pushed the door open and stepped inside. Busier today, with customers dotting the interior tables, and the same three people from yesterday seated at the couches, deep in conversation. The woman — the owner, Kassandra reminded herself — was at the register, smiling as she handed a cup to a customer. At the sound of the door opening, her gaze slid from the man, to Kassandra, then back again.

The woman's smile faded as soon as the customer turned his back to her. She wore a blue and white plaid button-down with the sleeves rolled up to her elbows, and tight black jeans. The buckle of her belt glinted silver under the menu board's lights. "What do you want?" she asked as Kassandra walked up to the counter, her gaze as opaque as smoked glass, and Kassandra knew she wasn't really asking about a drink.

"I'll take a double shot, bone dry cappuccino, please."

The woman's eyes narrowed a fraction as Kassandra's weaponized order hit its mark. "Four dollars and thirty cents," she said flatly, slamming her fingertip into the register's touchscreen so hard its plastic casing creaked. This time, Kassandra took a good look at the woman's hands: long and slender, implying fine bones within, but her fingers were wrapped with muscles, as were her wrists and forearms, powerful lines disappearing into black foliage and vines that climbed up her arm.

That kind of muscle didn't come from pulling shots at an espresso machine — it came from training and effort. Kassandra knew it well; she wore it herself from her neck to her calves, earned it in the weight room and on the pitch, and, once everyone figured out she'd grow up to be tall instead of fast, on the basketball court. The woman had probably started young at whatever sport it was, but she was too tall and lean to be a gymnast, and no soccer player who wasn't a goalkeeper had wrists like that, and she wasn't tall enough to be a keeper anyway...

Kassandra realized she was staring, and her fingers fumbled at her wallet inside her suit jacket's pocket. It took her two tries to pull a twenty from the cash in her money clip, and she made herself take a slow breath before she pushed it across the counter. "Can you make that drink for here, please?" she asked once she'd regained her poise.

The woman tilted her head and eyed the twenty. Her look could have shattered concrete. Then the twenty disappeared into the cash drawer and a stack of coins and bills took its place. "You might as well have a seat," she said, tossing the words over her shoulder as she moved to the espresso machine.

And just like the day before, the woman's shroud of irritation fell away as soon as she focused her full attention on making the drink, her eyes lighting up with a clean, unburdened joy. This woman was the one Kassandra wanted to talk to. She wanted to ask, Does it feel the same way for you too? It was beating everyone in the paint to a rebound, or hitting a holeshot on the racetrack, that flowing perfection where everything is just so and all is right in the world. Kassandra had spent a lifetime chasing it.

One espresso shot and two full pitchers of steamed milkfoam later, the drink slid across the counter. "Bone dry," the woman said in a voice to match.

Kassandra picked up the cup, murmuring her thanks before she drifted around the perimeter of the shop. Lots of brick and exposed metal, softened by green plants. Real ones. This place would Instagram well. She sipped the drink, the hot espresso tunneling through a thick layer of fluffy foam, completely free of milk and its diluting effects. Yesterday's latte had been near-perfect, but this drink was perfection in every way, its components correctly proportioned, the shot ecstatically good. She needed to find out who the woman's coffee roaster was.

A set of shelves crammed with books occupied much of the back wall, under a small, hand-lettered sign reading take one, leave one. Past the shelves, a bulletin board hung over a small self-service bar that held carafes of cream and a variety of sweeteners. Kassandra's eye lingered on a line of brightly colored stickers running along the edge of the board: Best of Portland 2010, Best of Portland 2011, 2012, 2013... all the way to last year, 2017.

She chose a table against the wall that was mostly hidden from the counter's line of sight, pulled her laptop from her bag, sat down, and pretended to get to work.

A steady stream of customers passed through the doors of the shop, despite the doldrums of the mid-afternoon, and the thread of tension wound tight around the woman's voice began to loosen as she filled orders and chatted with customers. Once, she even laughed, low and round and rich, the sound fuming in the air like a good bourbon. Until that moment, Kassandra wasn't sure the woman was capable of it.

The shop began to empty out as the clock swept past three. Kassandra packed her laptop away and carefully set the empty cup into the bus tub under the self-service bar. She strolled over to the counter, ignoring the hostile glances from the regulars at the couches. There was a jar full of business cards next to the register she hadn't noticed before. Enter to win a ten-pack of drinks written in strong, angular lettering.

The woman turned to her and crossed her arms.

"The drink was perfect," Kassandra said.

Silence.

"I didn't catch your name."

"I didn't give it to you."

Not this way, Kassandra wanted to say. Let's not do it like this. Let's just talk. Tell me about your coffee: who grew it, where it came from, and what drew you to doing this? Because she wanted to see that bright joy return to the woman's eyes instead of the anger living there now. "You don't like me at all, do you?"

"Have you given me a reason to like you?"

"Have I given you a reason not to?" Her brows knit with real confusion. "If I've caused any offense, I'm sorry."

"You seem to think that I have to give you the time of day because you're dropping twenties on drinks."

That stung. "Consider it compensation for wasting your precious time, then." She had tried to be nice from several angles, but had bounced off the mirror finish of the woman's anger every time. Nice didn't work on everyone. She'd keep her interest professional then, and run a different play from the playbook. "I guess you really wanted that fifth star," she said, and then she reached into her laptop bag and fished out one of her business cards, and she smirked as she caught a glimpse of a siren's enigmatic smile looking out from a familiar green circle. She locked eyes with the woman and threw the card into the jar by the till. "See you later."

As she walked out the door and onto the sidewalk, she couldn't help but grin. She would have loved to see the woman's face as she read the words on the card:

Kassandra Agiadis Vice President of International Real Estate Development Starbucks Coffee Company

Chapter two of The Sellout. Continued in chapter three...

29 notes

·

View notes

Text

Don’t be Swayed by “Sell in May and Go Away!”

Are you a trader or an investor? Ask Warren Buffett, the greatest investor of our lifetime, why he believes in buying and holding as do we unless there is a reason to change course as we did last October. We know many rich investors but few wealthy traders.

We understand the virtues of compounding and the negative impact of paying taxes on long term performance. Of course, always sell a stock if you believe that it’s fully valued. You may even consider writing covered calls or selling some market protection on a short-term basis if you are worried about near-term fundamental risks. We utilize both tools at times.

We are tired of hearing the pundits last week recommending taking profits just because we were entering May only to moderate their views on Friday after the sensational labor report.

We have rarely seen an environment so conducive to risk taking:

The economy is expanding above trend

Unemployment is at 3.6%, a fifty-year low

Non-farm productivity increased 3.6% in the first quarter pulling unit labor costs below 0 despite accelerating wage gains;

Inflation is well below the 2% Fed threshold

The Fed is accommodative/on hold for a year

Bank liquidity and capital ratios are at all-time highs

Earnings/cash flow are better than expected

The market multiple is around 17 times prospective 2019 earnings with 10-year treasuries hovering around 2.5%

Prospects for trade deals look better and better.

Yes, we have had a meteoric gain this year, but we are only back to where we were a year ago. The market is fundamentally undervalued today so why sell, pay taxes and alter your holding period? Fund performance should be valued net of taxes as it is what is left in the bank after all that counts, not gross performance.

We fully recognize that markets can correct at any time without reason, but it rarely happens when everyone expects it to occur, like now. The simple truth is that this is one of the most unloved markets that we have ever seen with participants anxious to go home protecting gains made to date. The market has been bipolar running with the winners and punishing beyond reason any company that falters even if by a penny. Herein lies great opportunities for the investor with a multi-year time horizon.

While there is no place like home, we are also investing in China as the government has successfully navigated through a rough patch and appears to be negotiating in good faith with the U.S. to reach a trade deal soon. We are also getting more optimistic on Japan as it appears that we could reach a trade deal with them sooner than we initially thought. While we believe that these deals will be good for Europe and the Emerging Markets, we also find them with more risk than other markets if no trade deals are reached so we’d rather hold off for now.

Let’s look at the recent data points that support or detract from our current view:

There is very little bad that we could say about the recent data points in the United States: private payrolls surged by 263,000 jobs in April with average hourly earnings increasing 3.2% year over year vs 2.8% the prior month; worker productivity increased 3.6% in the first quarter; consumer spending rose 0.9% in March, the strongest gain in a decade; the PCE inflation index was flat in March and up only 1.6% year over year; factory orders rose a seasonally adjusted 1.9% in March with new orders, excluding transportation up 0.8%; pending home sales surged 3.8% in March although down 1.2% over the last year; and consumer confidence jumped to 129.2 in April with the present situation index at 168.3 and future expectations now up to 103, both decade highs.

However, the Manufacturers Supply Side index slipped to 52.7 in April while the ISM Services Index declined slightly to 55.5. Readings above 50 are considered expansionary.

The Fed held rates steady as expected continuing to pledge patience and data dependent on any future moves. Market participants got upset when Chairman Powell mentioned in the follow up news conference that he felt that low inflation was transitory and would return to higher levels down the road. It seems that Buffett agrees, questioning the consequences of a lack of fiscal constraint on future inflation. As you know, we have long held the opinion that future inflation would remain surprisingly low held down by global competition, major technological advancements, and the rise of disruptors in all sorts of industries.

Finally, comments from the administration support our view that trade deals with China and Japan are on the horizon. While we would not expect to see any immediate impact to global growth, it will favorably improve growth prospects in 2020 and 2021. The financial markets will anticipate the improvements in growth well before it happens. We expect U.S. agriculture to be major beneficiaries of any trade deals and have invested accordingly.

By the way, while Trump and the Democrats appear to have agreed on the framework for a $2 trillion-dollar infrastructure program, don’t expect one any time soon.

The bottom line is that the U.S. economy is on track to have another above trend year and could be even better next year, an election year, if trade deals are reached and passed in Congress.

We remain optimistic about the prospects for China this year and beyond, especially if trade deals are reached. The official manufacturers purchasing index fell slightly in April to 50.1 with some weakness reported in production and new orders too. All three readings remain above 50 signaling continued expansion. We continue to expect growth near 6.4% for the year boosted by accelerating fiscal spending, lower taxes and a sharp increase in the monetary aggregates. A trade deal, once reached, will do wonders for business/consumer sentiment and growth.

We were pleasantly surprised that first-quarter growth exceeded expectations in the Eurozone but don’t go wild as it was only 0.4% compared to the abysmal fourth quarter of 2018. Inflation was also higher than expected rising 1.2% in April excluding food and energy. Growth prospects in the region remain bleak until there is substantial fiscal, regulatory and trade policy changes to better compete globally.

Japan prospects rest entirely on trade deals being reached. It does look better than we earlier envisioned.

Let’s wrap this up.

Stay the course and don’t be swayed by the slogan “Sell in May and Go Away” as the fundamentals just don’t warrant it at all. Could there be a correction? Of course, but continue to look over the valley as the outlook remains positive for risk assets, especially here.

Our portfolios continue to evolve as opportunities to sell and buy pop up. Our portfolios include some healthcare stocks that reached attractive buy points; technology including semis that we added to recently on this pullback; global capital goods and industrials; some agricultural stocks that should benefit from trade deals; low cost industrial commodity companies; housing related names like HD; large U.S. global banks like BAC and C; and many special situations. The common thread throughout out portfolios is excellent management, strong business plans to globally compete and win; strong financials with huge free cash flow; above market yields; and selling below intrinsic value. We are flat the dollar expecting it to weaken on trade deals and own no bonds expecting the yield curve to steepen as global growth improves over the next eighteen months.

Remember to review all the facts; pause, reflect and consider mindset shifts; always look at your asset mix and risk controls; do independent research and …

Invest Accordingly!

Bill Ehrman

Paix et Prospérité LLC

4 notes

·

View notes

Text

The period between 2017 - 2025 to see the Agricultural Films And Bonding Market getting enhanced by green development

Introduction

Agricultural Films and bonding’s are films which are used specifically for agriculture purposes. Agricultural Films is a polyethylene film or made from other compounds are widely used in various types of agricultural practices. As compared to traditional methods of growing crops, use of agricultural films is much advanced and eliminates the rotting of plants. Agricultural films can be used in various ways such as mulching, greenhouse covering, netting, Silage and much more.

Mulching is the most common application of these films which require sophisticated systems, but once installed can last for many seasons and helps in better yields with almost zero destruction of crop or waste of land. The Agricultural films are a basic necessity for starting a horticulture, hydroponic or greenhouse system for the production of crops, where these films provide an outer covering to the whole area and provide a syndicate atmosphere for the production. The films help the plants to grow with minimum water, soil, and nutrition. Materials used to produce Agricultural Films, and bondings are PE, LLDPE, PVC, PET, Laminated Materials and others. Agricultural films are mostly opaque while some farmers also use transparent or translucent films for specific purposes. Due to its versatile features and vast usage, Agricultural Films and Bonding market is expected to witness an escalating demand among the industries.

To remain ‘ahead’ of your competitors, request for a samples@

https://www.persistencemarketresearch.com/samples/14548

Agricultural Films And Bonding Market: Dynamics

Agricultural Films and Bonding market is driven due to the increasing usage in the greenhouse industry. Despite the growth of large greenhouses, small greenhouses with the limited area are getting traction globally and creating a robust demand for Agricultural Films and Bonding market. Agricultural Films provide temperature and moisture control, protection from frost and low temperature, reduces energy consumption for heating, increases crop yield and helps in achieving a better quality of plants.

Bonding is used to join two or more films and helps in providing shape and stability to a structure. Manufacturing companies are focusing on providing films which give high-quality finish on flat or cylindrical surfaces. Most of the manufacturers of Agricultural Films and Bonding are located in China and South Asian countries which are exporting Agricultural Films and Bonding to North America, Europe, and other regions. However, Agricultural Films and Bonding is not 100% efficient. In the case of heavy rain or extremely low temperatures or extreme frost, these films don’t even work. The Agricultural Films come at a higher cost than planting in bare soil. Most of the cost in establishing Agricultural Films structure bears to films, equipment’s, transplanters designed for plastic beds and additional labor. Removal of Agricultural Films is also costly and require a lot of efforts.

Agricultural Films And Bonding Market: Segmentation

type of material

Agricultural films

Twine

Netting

PE

LLDPE

PVC

PET

Laminated Materials

BOPP

CPP

EVA

Sisal

Polypropylene

LDPE

Others

HDPE

LDPE

Polypropylene

Others

type of colour

Opaque

Transparent

Translucent

type of feature

Moisture proof

Water Soluble

type of films

Stretch film

Shrink film

Metallized film

Release film

Twist film

type of process

Blow molding

Casting

Multiple Extrusion

Injection molding

type of application

Covering of Greenhouse, horticulture, etc.

Mulching (Ground Covers & Crop Covers)

Silage

Twine

Netting

Stretch wrap

Bags

Sheets

Bale

Others

Shade

Anti-hail

Anti-insect

Others

For critical insights on this market, request for methodology here @

https://www.persistencemarketresearch.com/methodology/14548

Agricultural Films And Bonding Market: Regional Outlook

Regional coverage for Agricultural Films and Bonding market includes North America, Latin America, Eastern Europe, Western Europe, Asia Pacific Excluding Japan (APEJ), Middle East and Africa (MEA) and Japan. Agricultural Films and Bonding market will witnesses a high demand in APEJ due to the high investments in the region and its manufacturing units. Market in India and China is still at growth stage which will fuel the market for next ten years in the region.

Agricultural Films And Bonding Market: Key Players

The market players in Agricultural Films and Bonding market are Dai Nippon Printing Co., Ltd., PLASTIKA KRITIS S.A., and NOVAMONT S.P.A., BASF SE, Berry Plastics Corporation, Exxon Mobil Corporation, Industrial Development Company (INDEVCO) sal, POLYPAK AMERICA INC. and many more

For in-depth competitive analysis, buy now@

https://www.persistencemarketresearch.com/checkout/14548

About us

Persistence Market Research is here to provide companies a one-stop solution with regards to bettering customer experience. It does engage in gathering appropriate feedback after getting through personalized customer interactions for adding value to customers’ experience by acting as the “missing” link between “customer relationships” and “business outcomes’. The best possible returns are assured therein.

Contact us:

Persistence Market Research Address – 305 Broadway, 7th Floor, New York City, NY 10007 United States U.S. Ph. – +1-646-568-7751 USA-Canada Toll-free – +1 800-961-0353 Sales – [email protected]

0 notes

Text

Fruit Packaging Market Size, Share, Outlook, and Opportunity Analysis, 2019 – 2027

Fruit packaging is of utmost importance, which ensures that fruits are protected from mechanical damages and adverse climatic conditions during the process of handling and distribution. Packaging of fruits is not beneficial in delaying or preventing spoilage of fresh fruits. Improper packaging of fresh fruits could accelerate spoilage. However, packaging of fruits offers protection against moisture loss, contamination, and damage.

Market Dynamics:

The fruit packaging market is expected to witness significant growth over the forecast period, owing to increasing demand for innovative packaging solutions for both soft fruits and hard fruits. Soft fruits such as grapes are highly perishable and can be crushed easily thereby leading to rotting of fruits. Thus, soft fruits are usually packed in semi-rigid containers or polyethylene bags with adequate ventilation holes. Moreover, hard fruits such as apples are comparatively less perishable and have higher shelf life. Therefore, most common type of packaging used for hard fruits include open trays or the plastic film over trays. Hard fruits are also packaged in nets or perforated polyethylene films.

Market Outlook:

Based on packaging type, the global fruit packaging market is segmented into flexible and rigid packaging. Amongst these, rigid packaging segment is expected to account for significant market share over the forecast period. This can be attributed to increasing usage of corrugated fiberboard boxes as a major container in food industry, owing to low cost to strength & weight ratio. This also has a non-abrasive and smooth surface, which offers good cushioning factor. The corrugated fiberboard boxes are also reusable and recyclable, which makes it capable for use in fruit packaging.

Key players:

Key players operating in the global fruit packaging market include Smurfit Kappa Group Plc, Sonoco Products Company, Mondi Group Plc, Bemis Company, Inc., International Paper Company, Linpac Packaging Limited, Sealed Air Corporation, and Amcor Limited among others.

Request Copy Of This Business Report: https://www.coherentmarketinsights.com/market-insight/fruit-packaging-market-3647

Market Taxonomy:

On the basis of packaging type, the global fruit packaging market is segmented into:

Flexible Packaging

Bags & Sacks

Pouches

Wraps

Rigid Packaging

Boxes

Folding Cartons

Trays

Crates

Others

On the basis of material type, the global fruit packaging market is segmented into:

Plastic

Polyethylene (PE)

Polypropylene (PP)

Polyvinyl Chloride (PVC)

Polyvinylidene Chloride (PVDC)

Others (PLA, EVA, and Others)

Paper & Paperboard

Wood

Others

About Us:

Coherent Market Insights is a global market intelligence and consulting organization that provides syndicated research reports, customized research reports, and consulting services. We are known for our actionable insights and authentic reports in various domains including aerospace and defense, agriculture, food and beverages, automotive, chemicals and materials, and virtually all domains and an exhaustive list of sub-domains under the sun. We create value for clients through our highly reliable and accurate reports. We are also committed in playing a leading role in offering insights in various sectors post-COVID-19 and continue to deliver measurable, sustainable results for our clients.

Contact:

Coherent Market Insights 1001 4th Ave, #3200 Seattle, WA 98154, U.S. Email: [email protected] United States of America: +1-206-701-6702 United Kingdom: +44-020-8133-4027 Japan: +050-5539-1737 India: +91-848-285-0837

0 notes

Text

Exploring the Dynamics of the Net Wrap Market

Introduction:

The net wrap market serves as a vital component of modern agriculture, offering efficient solutions for bundling and preserving forage materials. In this blog, we delve deeper into the dynamics of the net wrap industry, examining key market drivers, challenges, opportunities, and future prospects backed by statistical insights and market analysis.

Market Dynamics:

1. Market Growth Trajectory:

The Net Wrap Market has been witnessing a steady growth trajectory, propelled by the increasing adoption of mechanized harvesting techniques and the rising demand for high-quality forage preservation solutions across various agricultural sectors.

Statistical insights reveal a compound annual growth rate CAGR of approximately 4% in the global net wrap market over the past five years, with further growth projections in the forecast period.

2. Key Market Drivers:

Mechanization in Agriculture: The ongoing trend towards mechanization in agriculture, particularly in developed regions, is a primary driver of demand for net wrap products. Mechanized baling and wrapping processes offer increased efficiency and labor savings for farmers.

Expansion of Livestock Farming: The expansion of the livestock farming sector, driven by growing global demand for meat and dairy products, fuels the need for efficient forage preservation methods, thereby boosting the demand for net wrap.

Technological Advancements: Continuous advancements in net wrap materials and manufacturing processes, aimed at enhancing product durability, UV resistance, and bale wrapping efficiency, contribute to market growth.

3. Market Challenges:

Environmental Concerns: The non-biodegradable nature of traditional net wrap materials raises environmental concerns related to waste accumulation and disposal. This has led to increased scrutiny and calls for sustainable alternatives within the industry.

Pricing Pressures: Intense competition among market players and fluctuating raw material prices pose challenges in maintaining competitive pricing strategies, impacting profit margins and market stability.

4. Emerging Trends and Opportunities:

Sustainable Alternatives: The growing focus on sustainability and environmental stewardship is driving research and development efforts towards the development of biodegradable and recyclable net wrap materials, presenting opportunities for market innovation.

Expansion in Developing Markets: Emerging economies, particularly in Asia-Pacific and Latin America, present untapped opportunities for market expansion due to increasing adoption of modern agricultural practices and rising mechanization levels.

Product Diversification: Market players are increasingly focusing on diversifying their product portfolios to cater to specific customer needs and preferences, such as specialized net wrap solutions for different crop types and baling equipment.

Conclusion:

The Net Wrap Industry continues to evolve in response to changing agricultural landscapes, technological advancements, and environmental considerations. By addressing key challenges, capitalizing on emerging trends, and embracing opportunities for innovation and market expansion, stakeholders can navigate the dynamic landscape of the net wrap industry and drive sustainable growth in the years to come.

#Net Wrap Market#Net Wrap Market Analysis#Net Wrap Market Demand#Net Wrap Market Forecast#Net Wrap Market Growth#Net Wrap Market Outlook#Net Wrap Market Revenue#Net Wrap Market Size#Net Wrap Market Trends#Net Wrap Market Research reports

0 notes

Text

They’re pale, they say, you know, the poets, and with hair like this, you know, and a look in their eyes .

Thank you, Brooks. "What we noticed in the last 10 or 15 years, is the patients are now better at advocating for themselves. Apart from being world class medical centres offering the latest healthcare amenities, all these hospitals boast facilities that pamper patients and their attendants.. Wolfsburg will relish the opportunity to capture just their second ever domestic trophy in club history, to cap off what was a remarkable season for Dieter Hecking's squad. The city watch is looking for a certain ugly girl, known to

oakley m frame ice iridium

frequent the Purple Harbor, so best you have a new face as

pantofi sport cu scai barbati

well.” He cupped her chin, turned sandalias doradas gioseppoher head this way and that, nodded. The report, undertakenby Kijiji in partnership with researchers from the University of Victoria and the Observatoire de la Consommation Responsable in Montreal, reveals the kind of positive data points that mirror similar studies put out by others such as Facebook.The apparent aim is to show that technology companies aren't just disrupting old industries and eliminating jobs they're also creating new jobs and wealth.The report says the average reseller earns $883 from posting ads for items such as clothing, shoes and accessories the three most popular categories on Kijiji. Once Duck had caught a glimpse of a hull that he insisted belonged to Urho the Unwashed. However the chambers themselves work together . They’re pale, they say, you know, the poets, and with hair like this, you know, and a look in their eyes . He seems to dream of nothing but me.. Boeing has booked 321 net orders in 2016, as updated today on the Boeing Orders Deliveries website. You wouldn?t want to accidentally let a ?wicked? slip during conversation when ?deck? is the appropriate term. Area since 1980. Four, with a bit of scrimping. We will be analyzing the new data and updating our forecast on NBC Action News. We run through the rules and announce the first matchups. You will discover market forecasts, technological trends, predictions and expert opinion providing you with independent analysis derived from our extensive primary and secondary research. That was a good answer, and an honest one. One crack, and we all drown. Allergy levels will remain high again tomorrow and until we get a good rain it looks like allergy sufferers may be sneezing more than normal. You know it was not my fault that I am here. The more the company grew, the less stable it became.. Another cool feature of the HyperDunk is that the shoe is introduced with Flywire cables inside, that contract and retract in accordance with your foot movement. Some will look at this moment and say it fell short of expectations, others will look at it and say it exceed some expectations. JW: Oh yeah I like this shirt a lot. The Converse EB2 also come with a durable rubber sole that provides an outstanding traction. “I am no butcher queen.”. “We looked for you at Winterfell, but

galeb spodnjice

found only Crowfood Umber beating drums and blowing horns. Let us again look at the statute-book of Louisiana... Ostomel and then Steven p. He shunned the lamprey pie and tried only one Mens ADIDAS ORIGINALS small spoonful of the stew. Move of the Village Wen captures a comprehensive account of the countryside represented in 31 foot long surrealist episodes. Under the new deal, a Cathay Pacific 747 8F would leave Hong Kong laden with high end goods such as phones, fashion apparel and perishable produce. To be a married man is a serious thing. After dark the brother came on board, and, instead of taking his sister away, began to appeal to the humanity of the captain in the most moving terms. The eight Republicans and seven Democrats on the Senate Intelligence committee each get their moments as they take turns questioning the former FBI chief who was fired last month by President Donald Trump.The panel members represent right, left and center of the political spectrum, including liberal Democrats who attacked Trump relentlessly, and conservative Republicans who defended him unreservedly. Depressing the brake pedal energizes the controller. The underlying LED also illuminates a narrow strip that just cuts into the top of the door. Once at the top for good, I was left speechless at what I saw.. M. Does anyone have any feedback or thoughts on this. While the writer was travelling in Kentucky, many years ago, she attended church in a small country town. Note: I am an ultra distance runner so I wear shoes that are a half size larger than what I typically cizme vara cu toc wear. When the poor screw up, their slip ups are held over their heads as proof that they not only caused their situation, but adidas retro schuhe männercontinue to perpetuate it.. Even if I could slip these chains, I’d need to climb over him to reach his sword belt. Mason scampered 45 yards. The note was from Masloboev. An enclosed wagon groaned along behind him, drawn by six heavy draft horses and defended

зимни обувки adidas 2016

by crossbowmen, front and rear. One source of almost constant annoyance to my feelings is the profanity and vulgarity, and the bad, disagreeable temper, of two or three fellow-prisoners of my cell. Looking more carefully one began to suspect behind the invariable mask something spiteful, cunning, and intensely egoistic. Guy Balensi reprend la gestion du Trianon. Carina says her good byes, trying once again to seduce Chuck, but only because she loves taking what Sarah wants. The stewards began to bring out the first dish, an onion broth flavored with bits of goat and carrot. This is because the hip flexors work hard along with your abs to hold your legs just off the floor and kick.. He bathed thrice a day and wore flowers in his hair as if he were a maiden. If you're referencing the Greek delicacy of meat and chips wrapped in flatbread, please see above.. First released in 1997, the Nike Air Foamposite Pro has long been a collector's favourite. Last year, extent trended relatively low as well, but a surge in the middle of March made for a late max on March 19th. I don’t know what those are. Yes the Bertuzzi crime went unpunished. And it was on national television that Sedochenkoff, 18, shined along with AcroArmy an acrobatic gymnastic group made up of 19 gymnasts as they made it into millions of viewers homes and all the way to the finals on evro kalkulator Season 9 of the reality show Got Talent. Some shouted obscene proposals, others insults. Oui, calça kickboxing il est possible de faire des films de genres et des films audacieux au Qubec. Hodor walked with one eye frozen shut, his thick brown beard a tangle of hoarfrost, icicles drooping from the ends of his bushy mustache. Brosowsky interest is in urban agriculture cities, reducing the heat island effect (covering all that concrete and asphalt with parks and gardens) and getting local food to people who need it through community gardens and other projects. 83): “The Rev. It is going to be windy as well and that will certainly add to the chill. And, as Ryan Cooper observedFriday, Trump is largely justified in that outlook.

0 notes

Text

Where Do We Go From Here?

The US financial markets rose to a new high last week while overseas markets rallied as well. The global tug of war is all about the impact of tariffs on growth. Despite all of the pessimistic rhetoric and fear in the marketplace, the OECB only lowered its global economic growth projections for 2018 and 2019 by 0.1% and 0.2% respectively to 3.7% which is pretty darn good. So, what’s all the worry about?

The media is misinforming you about the real magnitude and impact of tariffs. For instance, a 10% tariff on $200 billion of Chinese goods is a $20 billion surcharge when the US economy is nearly $20 trillion dollars. Just think that the estimated damage from Hurricane Florence is between $38 and $50 billion which will be recovered and spent over the next few years. Also, consumer net worth increased by a whopping $107 trillion in the second quarter alone. Do you really believe that $20 billion in additional tariffs will make a dent our economy? Let’s assume that Trump raises the ante and imposes 10% tariffs on all $500+ billions of Chinese imports. That’s $50 billion or less than 0.003% of our GNP assuming that no goods are sourced elsewhere at lower prices. Really, how worried can you be as tax cuts alone dwarf tariffs?

It is clear that there will be supply chain challenges/disruptions as corporations shift supply lines to China and from China to other regions in the world. Rather than view this as a problem, there will be new winners as China loses global market share. Herein lies China’s dilemma. Don’t believe the Chinese government rhetoric that they can fully offset the loss in exports/production by moving up the supply chain to higher valued goods and/or increase domestic infrastructure spending sufficiently to fully offset the loss of exports to other regions.

We have shifted our portfolio to benefit from these new emerging trends. Demand for industrial commodities and equipment will actually increase which goes against the general belief. We’ve invested accordingly.

The US economy is humming along, and it now appears that third-quarter GNP growth may exceed 3.5% as both businesses and consumers are in great shape. We expect a strong fourth quarter too, with excellent Christmas sales. We expect the Fed to raise rates Wednesday and most likely once again after November elections. But here again don’t worry as the real rate will still be negative which means that it is still stimulative. The Fed should pause as we enter 2019 to see if trade conflict does impact growth and also to see if productivity gains continue to accelerate which will hold down inflationary pressures. We continue to expect the Fed to remain one step behind fearing a slowdown more than an accelerating economy. The US economy will remain strong next year with growth currently projected slightly below 3% led by a further hike in business investment along with continued gains in consumer spending. Normalized inflation will be less than 2% as productivity gains offset wage increases and one-time tariff hikes. S&P earnings are likely to exceed $170 per share in 2019 and the 10-year treasury will breach 3.25% as the yield curve steepens.

China is really caught between a rock and a hard place. While the government wants to exude confidence that their economy can withstand Trump’s trade tariffs/tactics, the truth is that Trump has shone a light for all to see on the inequities in dealing with China and how IP has been stolen by them. Their standing in the world has suffered despite all the money that they are throwing around to other countries to work with them. China 2025 is in jeopardy. Don't believe the rhetoric that China can win a trade war as they have much more to lose than us. Corporations are looking to at least partially shift production from China to supply from elsewhere. There will be new winners as China loses if this trade battle gets extended way beyond our elections. China’s move to reduce import tariffs from other countries won’t do much to stimulate consumer demand if employment growth and wages increase more slowly than currently projected. We do expect a deal to be reached after elections as it is in the self-interest of China both near and longer term. Without a deal, we expect China to grow less than 6.4% for the remainder of this year and even less rapidly next year.

The big news out of the Eurozone last week was that the Brexit talks were failing. Clearly no deal would undermine the single market objective but the long-term impact would be minimal for the rest of the world. The sharp move down in the pound clearly indicates that England would be the near-term loser without a deal. It is far more important the Eurozone strikes a trade deal with the US than resolving Brexit. Without a deal, the European economies will go nowhere and the ECB will not able to begin a path toward normalization as so stated. Here again, the US is holding all the cards.

It appears that the US and Canada are still not able to reach a new trade deal as politics over farm subsidies are overwhelming the positives of a new NAFTA. Canada is the loser here. Notwithstanding, we do expect a deal to be reached after fall elections. Nonetheless, the US will move forward with its deal with Mexico

We were pleased to see that Prime Minister Abe was elected to a new three-year term as ruling party President. Don’t believe that Japan will get closer to China at our expense as that is all about negotiating tactics. The BOJ met last week and reaffirmed extremely low rates and accommodative ease for an extended time. We expect Japan and the US to strike a trade deal within the next few months. Don’t forget that our negotiations with North Korea is one of Trump’s bargaining chips here.

Let’s wrap this up.

Despite impeding tariffs, the outlook for global economic growth for the remainder of this year and next is pretty good. The US will stand out at the margin as Trump’s economic agenda continues to positively impact our economy. While we do not agree with Trump’s tactics, we agree that there is no better time to focus on trade policy inequities than now - as well as protecting our IP. If all tariffs and subsides are reduced, the entire world will benefit. We expect trade deals to be reached with our counterparts over the next three to nine months which will lead to a reacceleration in growth and increases in business/consumer confidence in those areas.

Continue to invest as you look over the valley and take advantage of periodic sharp moves down in the market caused by over-reactions to news snippets or Trump’s foolish tweets. We still believe that the Republicans will lose the House this fall but keep the Senate. Also, we expect Jude Kavanaugh to be appointed to the Supreme Court.

Our portfolios continue to emphasize the financials, capital goods and industrials, technology at a fair price to growth without the government in your face, health care, cable, transportation and special situations where management strategic moves enhance shareholder value. Focus on the best management teams with strategic plans to succeed generating huge cash and free cash flow.

Remember to review all the facts; pause, reflect and consider mindset shifts; look at your asset composition and risk controls; do first hand research and…

Invest Accordingly!

Bill Ehrman Paix et Prospérité LLC

2 notes

·

View notes

Text

Spunbond Nonwoven Market: Size, Share, Trends, Demand, Key Player profile and Regional Outlook by 2027

Global spunbond nonwoven market is segmented on the basis of the function, method, polymer type, application, and region.

On the basis of the function, the global spundbond nonwoven market is bifurcated into disposable and non-disposable. The disposable spunbond nonwoven is leading the market due to the environment concerns associated with non-disposable products.

Access Report @ https://www.marketresearchfuture.com/reports/spunbond-nonwoven-market-5960

Spunbonding is achieved through a sequence of three processes: heating, flowing, and cooling. The different heating methods are used while manufacturing spunbond nonwoven include conduction, convection, and radiation. The conduction is used for calendar bonding, convection for bonding medium and heavyweight nonwovens, whereas radiant heating systems are used for various applications where instant heating and concentrated heating zones are required.

Spunbonding is carried out of various types of polymers such as polypropylene, polyester, nylon, polyethylene, polyurethane, and rayons. The polypropylene is the dominating type due to its high yield (fiber per kilogram) and low cost. The polypropylene scrap is readily recycled in spunbonding manufacturing. However, the polyester offers better quality products at higher cost.

The global spunbond nonwoven market is also segmented on the basis of its application into medical & personal care, automotive, agriculture, geo-textiles, industrial, packaging, and others. The medical & personal care segment is holding the major share of the global market owing to the use in manufacturing wet wipes, absorbent hygiene products, surgical masks, gowns, sanitary napkins, and drapes. The product is extensively consumed in the manufacturing of interiors, seating components, door trim panels, airbag covers, carpets, and insulation in the automotive. It is also used in crop cover, fruit net, shade net, and others, which are expected to drive the product demand in the agriculture sector. The increasing demand for polyester felts, filtration, and separators in geo-textiles is likely to fuel the market growth. Similarly, the market is expected to experience high demand from the electronics sector for industrial insulation, protective applications, and cable wrapping.

Regional Analysis

The global spunbond nonwoven market is segmented into five regions: Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa.

Asia Pacific accounted for the major share of the global spunbond nonwoven market in 2016 due to high demand from major end-use industries such as personal care, automotive, agriculture, and others in the region.

The high demand from the healthcare and automotive industries in the U.S. and Canada is expected to drive the North American market over the forecast period 2018-2023.

The growth of the European market is attributed to the increased product demand from the healthcare and automotive sector in the Western European region.

The Latin American market is expected to witness a high growth owing to the high demand for spunbond nonwoven from the personal care and automotive sector.

The increasing infrastructural and construction activities in the GCC countries is likely to fuel the product demand in the manufacturing of geo-textiles.

Get a Free Sample@ https://www.marketresearchfuture.com/sample_request/5960

Competitive Analysis

Some of the manufacturers operating in the global spunbond nonwoven market are PEGAS NONWOVENS Czech s.r.o. (Luxembourg), DuPont (U.S.), Mitsui Chemicals, Inc. (Japan), Asahi Kasei Corporation (Japan), Schouw & Co. (Denmark), TORAY INDUSTRIES, INC. (U.S.), Mogul Co., Ltd. (Turkey), KURARAY CO., LTD. (Japan), Kolon Industries, Inc. (South Korea), Berry Global Inc. (U.S.), Radici Partecipazioni SpA (Italy), KCWW (U.S.), Avgol Ltd. (Israel), Fitesa S.A. (Brazil), and Sunshine Nonwoven Fabric Co., Ltd. (China)

0 notes

Text