#multifamily construction company

Explore tagged Tumblr posts

Text

Upgrade Living Spaces with a Trusted Apartment Renovation Company

Renu is a leading apartment renovation company specializing in transforming living spaces with high-quality upgrades and modern design solutions. Whether you're looking to renovate a single unit or update an entire apartment complex, Renu delivers expert craftsmanship, streamlined project management, and tailored renovation strategies to meet your goals. From kitchens and bathrooms to flooring and finishes, this apartment renovation company ensures every detail reflects style, functionality, and value, making it the ideal partner for property owners and managers seeking impactful results.

#apartment renovations#multifamily renovation#renovation services#general contractors#apartment renovators#multifamily construction company#renovation contractors#apartment renovation company#Renu

0 notes

Text

Greython Construction - Premier Commercial & Residential Builders

Greython Construction offers top-tier commercial and residential building services across the U.S. With expertise in custom home construction, hospitality renovation, and multifamily developments, we deliver quality, innovation, and sustainable solutions. Our team ensures projects are completed on time and within budget. Discover why Greython is a trusted name in construction excellence. Contact us for your next project!

#hotel renovation company mystic ct#commercial general company mystic ct#general building contractor near me#construction company san diego#general contractors near me#multifamily contractors orange county

0 notes

Text

How Construction Managers Keep Projects on Track and Within Budget

Construction projects are complex undertakings that require meticulous planning, coordination, and management. At the heart of successful projects is the construction manager, a professional tasked with ensuring that projects are completed on time and within budget. Here's a closer look at the strategies construction managers use to achieve these critical objectives.

1. Comprehensive Project Planning

Before breaking ground, construction managers develop a comprehensive project plan that includes timelines, resource allocation, and cost estimates. This planning phase is crucial for identifying potential challenges and developing strategies to mitigate risks. A well-thought-out plan serves as a roadmap for the project, guiding the team through each phase and ensuring that all activities are aligned with the project's goals.

2. Detailed Budgeting and Cost Control

One of the primary responsibilities of a construction manager is to develop and manage the project budget. This involves estimating costs for materials, labor, equipment, and other expenses. Construction managers use their expertise to create realistic budgets that include contingencies for unexpected costs. Throughout the project, they monitor expenditures closely, making adjustments as needed to prevent cost overruns.

3. Effective Resource Management

Managing resources efficiently is key to keeping a project on track. Construction managers oversee the allocation of labor, materials, and equipment, ensuring that everything is available when needed. They coordinate with suppliers, subcontractors, and other stakeholders to avoid delays and disruptions. By optimizing resource use, construction managers help to streamline workflows and maintain the project's schedule.

4. Regular Monitoring and Reporting

To keep projects on track, construction managers implement regular monitoring and reporting processes. They conduct site inspections, review progress reports, and hold meetings with the project team to assess the project's status. This proactive approach allows them to identify and address issues promptly, minimizing their impact on the project's timeline and budget.

5. Risk Management and Problem-Solving

Construction projects are inherently unpredictable, with potential risks ranging from weather delays to supply chain disruptions. Construction managers are skilled in risk management, identifying potential threats early and developing contingency plans. When problems arise, they use their problem-solving skills to find quick and effective solutions, ensuring that the project continues to move forward.

6. Communication and Collaboration

Effective communication is essential for keeping all stakeholders informed and aligned. Construction managers facilitate communication between the project owner, architects, engineers, contractors, and other parties. They ensure that everyone understands their roles and responsibilities and that any changes to the project plan are communicated promptly. This collaborative approach helps to prevent misunderstandings and keeps the project on track.

7. Leveraging Technology

Modern construction managers leverage technology to enhance project management. They use software tools for scheduling, budgeting, and collaboration, which provide real-time data and analytics. This technology enables construction managers to make informed decisions quickly and to manage the project more efficiently.

Conclusion

Construction managers play a vital role in the success of construction projects, ensuring that they are completed on time and within budget. By combining detailed planning, effective resource management, risk mitigation, and strong communication, the construction management company helps to navigate the complexities of construction projects. Their expertise not only ensures project success but also delivers value to all stakeholders involved.

#construction management company#construction management firm#construction managers#multifamily construction managers#certified construction manager#construction management service#SD-Cap#construction management#construction management contract

0 notes

Text

The Healing Power of Community: How Joining a Wellness Community Can Improve Your Mental Health | HugeCount

Mental health is a crucial aspect of our overall well-being, and it has become an increasingly important topic in today’s society. As more people become aware of the importance of taking care of their mental well-being, they are turning to various tools and techniques to support their mental health. One powerful tool that has been […]

Source: https://hugecount.com/real-estate-and-construction/the-healing-power-of-community-how-joining-a-wellness-community-can-improve-your-mental-health/

#homz#integrated communities#multifamily housing#national housing company#wellness communities#Real estate and Construction

0 notes

Text

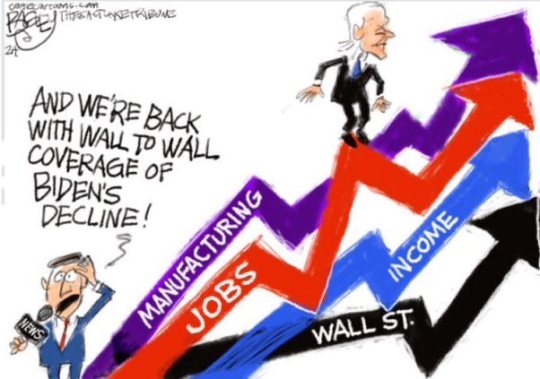

Bagley

* * * *

LETTERS FROM AN AMERICAN

August 14, 2024

Heather Cox Richardson

Aug 15, 2024

The July report for consumer prices from the Bureau of Labor Statistics, which came out today, showed that prices rose less than 3% in the previous twelve months. Core inflation has fallen to its lowest rate since April 2021. For well over a year, wages have grown faster than inflation.

President Joe Biden cheered the news but added in a statement, “Prices are still too high. Large corporations are sitting on record profits and not doing enough to lower prices. That’s why we are taking on Big Pharma to lower prescription drug prices. We’re cutting red tape to build more homes while taking on corporate landlords that unfairly increase rent. And we’re taking on price gouging and junk fees to lower everyday costs from groceries to air travel.”

When a reporter asked Biden if the U.S. has beaten inflation, Biden answered: “Yes, Yes, Yes. I told you we were going to have a soft landing…. My policies are working. Start writing that way.”

Just yesterday, the administration announced $100 million worth of investments in new housing in the form of grants to state and local governments to spur the production of new housing. Kriston Capps of Bloomberg reports that “more housing units are under construction now than at any point in half a century—some 60,000 multifamily units were completed in June alone—and rents are stabilizing in some areas as a result.”

Single-family home construction is slower, and with Senate Republicans having blocked a $78 billion tax deal that would support housing tax credits that promote the construction of housing, the White House is finding other ways to spur housing construction.

On Monday the White House continued its attempt to protect the interests of consumers after years in which they lost ground. Continuing to combat junk fees, it proposed rules to fight back against “all the ways that corporations—through excessive paperwork, hold times, and general aggravation—add unnecessary headaches and hassles to people’s days and degrade their quality of life.”

Companies deliberately design processes to be burdensome in order to deter people from getting a refund or a rebate, or canceling a membership or a subscription. Those frustrations waste money and time, the administration said, and after listing some of its own proposals for making it easier to navigate ending subscriptions or activating insurance coverage, it invited Americans to submit their own on a public portal.

In a speech on Friday in North Carolina, Vice President Kamala Harris is expected to take on the issue of price gouging by large corporations. Researchers for U.K. think tanks Institute for Public Policy Research and Common Wealth found in late 2023 that profiteering, or “greedflation,” “significantly” boosted prices, leading to increases of 30% or more in corporate profits. “Excessive profits were even larger in the US, where many important sections of the economy are dominated by a few powerful companies,” wrote Phillip Inman of The Guardian.

Responding to today’s news that inflation is coming down, the stock market ticked up in expectation that the Fed will now be more likely to cut interest rates in September.

The White House took notice today of the fact that applications for small businesses continue to boom across the country, with 19 million new business applications since Vice President Harris and President Biden took office, an annual growth rate 90% higher than prepandemic averages. The White House also noted that congressional Republicans are trying to cut the Small Business Administration and to cut taxes for big corporations.

Politico greeted today’s economic news with a headline saying, “Inflation is easing. Now, Harris has an even bigger problem with the economy.” And the New York Times reported that in a speech in North Carolina, “Harris Is Set to Lay Out an Economic Message Light on Details,” adding that she is expected to tweak Biden administration themes “in a bid to turn the Democratic economic agenda into an asset.”

The United States economy under Biden and Harris has been the strongest in the world, and now that inflation seems to be under control as well, Harris needs to turn that record “into an asset”? Political journalist James Fallows wrote: “Now they are all just trolling us.”

The Biden-Harris administration has changed the orientation of the United States government from relying on markets to order society and protecting the interests of wealthy Americans in the expectation that they would invest in the economy more efficiently than they could if the government interfered by protecting workers and consumers. Biden and Harris, along with the cabinet officers and staff of the executive branch, revived an older ideology calling for the government to promote the interests of the American people as a whole. This means regulating business and providing government services and oversight to make sure no interest can run the table.

What the two different worldviews look like was on display earlier this month, when Republicans and a few Democrats in the Senate killed a bipartisan expansion of the child tax credit, a tax break for parents with dependent children. A hike in that credit during the pandemic cut child poverty dramatically, only for that rate to bounce back when the pandemic relief expired and dropped five million U.S. children back into poverty in 2022. The Center on Budget and Policy Priorities noted that the change “underscores the fact that the number of children living in poverty is a policy choice.”

On January 31, 2024, the House passed an expansion of the child tax credit that was smaller than the one in place during the pandemic, and Republican vice presidential hopeful Ohio senator J.D. Vance, who has been criticized for comments about “childless cat ladies,” seemed to support the measure when he said, “If you’re raising children in this country, we should make it easier, not harder. And unfortunately it’s way too expensive and way too difficult.” He then falsely accused Democratic presidential candidate Kamala Harris of calling for ending the child tax credit (she has actually called for expanding it).

But Vance missed the vote, and before it, Senator Thom Tillis (R-NC) told colleagues that passing the bill would “give Harris a win before the election.” According to Chabeli Carranzana of The 19th, Tillis “printed out fake checks made out to ‘millions of American voters’ with the memo: ‘Don’t forget to vote for Kamala!’”

The two different worldviews were also on display Monday night when Republican presidential candidate Donald Trump complimented X owner Elon Musk for firing workers who threatened to strike. The right to strike is protected under federal labor law, and the Biden-Harris administration has stood firmly for workers’ rights.

On Tuesday the United Auto Workers union filed charges against Trump and Musk with the National Labor Relations Board for threatening and intimidating workers. “When we say Trump stands against everything our union stands for, this is what we mean,” said UAW president Shawn Fain.

Tonight, Trump gave a speech in Asheville, North Carolina, that was supposed to be about the economy. Before he could appear, Trump had to pay the city $82,247.60 in advance, with city officials apparently concerned about the candidate’s habit of skipping out on costs associated with his rallies. Once on stage, he tossed economic issues overboard and concentrated on personal attacks on Biden and Harris, along with stream-of-consciousness musings on tampons and socialism. Apparently speaking of his campaign aides, he said: They wanted to do a speech on the economy. They say it’s the most important subject. I’m not sure it is.”

The era of unfettered markets and the concentration of wealth may be coming to an end. In late July, the finance leaders of the Group of 20 (G20), a forum of the world’s major economies, agreed to cooperate on fair taxation of "ultra-high-net-worth individuals,” although they did not agree as to whichinternational body should lead.

But yesterday, Joe Perticone of The Bulwark noted that MAGA Republicans appear to have figured out a way to use the struggle over the nation’s economic ideology to elect Trump.

The House recessed in late July having failed to pass a single one of the 12 appropriations bills the government needs to stay in operation because, although the appropriations bills are traditionally kept “clean” of anything extraneous, extremist members of the House Freedom Caucus insist on making extreme cuts and adding their culture war items to the bills. Congress doesn’t reconvene until early September, and the new fiscal year starts on October 1, leaving the House very little time to pass the necessary bills.

Yesterday, members of the House Freedom Caucus called for Republicans to return to Washington, D.C., to pass the bills “to cut spending and advance our policy priorities.” If they can’t pass the bills—and they failed all spring—the extremists want a short-term fix just into “President Trump’s second term.” But they also want the fix to include the SAVE Act, “as called for by President Trump—to prevent noncitizens from voting [and] to preserve free and fair elections in light of the millions of illegal aliens imported by the Biden-Harris administration over the last four years.”

It is already illegal for noncitizens to vote in federal elections. As Perticone notes, Trump’s own 2017 commission to find evidence that undocumented immigrants voted in 2016 disbanded without finding any, and another audit, led by Georgia Republicans before the 2022 midterms, found not a single successful attempt of noncitizens to vote in the previous five years.

Perticone reports that the measure is designed to suppress legitimate Democratic voting and, if Trump still loses, by claiming that Trump lost, again, because the election was stolen by illegal voters.

Trump continues to insist that Biden’s replacement at the top of the Democratic ticket was a “coup,” partly because he wants to face off against Biden, rather than Harris. But he also is priming his supporters to believe that those Americans who want the government to work for them rather than the very wealthy are illegitimate.

LETTERS FROM AN AMERICAN

HEATHER COX RICHARDSON

#Letters From An American#Heather Cox Richardson#economic news#the economy#immigration#unions#working people#real estate market#child tax credit

10 notes

·

View notes

Text

The Peebles Corporation

Website: https://peeblescorp.com/ Address: 1691 Michigan Avenue, Miami Beach, FL 33139 The Peebles Corporation is one of the largest hotel developers and land development companies. With a portfolio of over 10 million square feet and $8 billion in active and completed projects across major cities, their success through public and private partnerships is unmatched. As one of the largest multifamily developers, they prioritize construction excellence, sustainability, historic preservation, and innovative design for transformative outcomes. Recognized as one of the most acclaimed black-owned property management companies, The Peebles Corporation has become one of the largest multifamily developers in the US. #Real Estate Development#hotel developers#hotel development#land development companies#property developer LinkedIn: https://www.linkedin.com/company/the-peebles-corporation

#Real Estate Development#hotel developers#hotel development#land development companies#property developer

2 notes

·

View notes

Text

The Peebles Corporation

Website: https://peeblescorp.com/ Address: 1691 Michigan Avenue, Miami Beach, FL 33139 The Peebles Corporation is one of the largest hotel developers and land development companies. With a portfolio of over 10 million square feet and $8 billion in active and completed projects across major cities, their success through public and private partnerships is unmatched. As one of the largest multifamily developers, they prioritize construction excellence, sustainability, historic preservation, and innovative design for transformative outcomes. Recognized as one of the most acclaimed black-owned property management companies, The Peebles Corporation has become one of the largest multifamily developers in the US. #Real Estate Development#hotel developers#hotel development#land development companies#property developer#commercial property development LinkedIn: https://www.linkedin.com/company/the-peebles-corporation

#Real Estate Development#hotel developers#hotel development#land development companies#property developer#commercial property development

2 notes

·

View notes

Text

The Peebles Corporation

Website: https://peeblescorp.com/ Address: 1691 Michigan Avenue, Miami Beach, FL 33139 The Peebles Corporation is one of the largest multifamily developers with offices in New York City, Miami, and Washington D.C. With a portfolio of over 10 million square feet and $8 billion in active and completed projects across major cities, their success through public and private partnerships is unmatched. As one of the largest multifamily developers, they prioritize construction excellence, sustainability, historic preservation, and innovative design for transformative outcomes. Recognized as one of the most acclaimed black-owned property management companies, The Peebles Corporation has become one of the largest multifamily developers in the US. #Real Estate Development#commercial property development#commercial real estate developers#commercial real estate development LinkedIn: https://www.linkedin.com/company/the-peebles-corporation

#Real Estate Development#commercial property development#commercial real estate developers#commercial real estate development

2 notes

·

View notes

Text

The Peebles Corporation

Address: 1691 Michigan Avenue, Miami Beach, FL 33139 The Peebles Corporation is one of the largest multifamily developers with offices in New York City, Miami, and Washington D.C. With a portfolio of over 10 million square feet and $8 billion in active and completed projects across major cities, their success through public and private partnerships is unmatched. As one of the largest multifamily developers, they prioritize construction excellence, sustainability, historic preservation, and innovative design for transformative outcomes. Recognized as one of the most acclaimed black-owned property management companies, The Peebles Corporation has become one of the largest multifamily developers in the US.

4 notes

·

View notes

Text

Expert Apartment Renovation Company | Multifamily Remodeling Specialists – Renu

Looking for a trusted apartment renovation company? Renu specializes in multifamily renovations, offering expert interior and exterior upgrades to enhance property value and tenant satisfaction. From unit remodels to amenity enhancements, we deliver high-quality, cost-effective solutions tailored to your community's needs. Our experienced team ensures minimal disruption while maximizing efficiency, helping property owners achieve modern, market-ready spaces. With a commitment to quality and on-time delivery, Renu is your go-to partner for transforming multifamily properties. Contact us today!

#multifamily renovation#renovation services#apartment renovations#general contractors#apartment renovators#multifamily construction company#renovation contractors#apartment renovation company#renu

0 notes

Text

BEST INVESTMENT IN REAL ESTATE INVESTMENT

Investing in real estate can be very challenging to the freshers of the market. What challenges the most is to choose the type of property to invest in. This article aims to educate you about the potential investing opportunities when real estate investing is concerned –

1. COMMERCIAL REAL ESTATE

The best commercial properties to invest in include industrial, office, retail, hospitality and multifamily projects. It is considered one of the best type of real estate investment potential for higher cash flow. Investor who opt for commercial properties may find they represent higher income potential, longer leases and lower vacancy rates than other forms of real estate.

2. RAW LAND INVESTING & NEW CONSTRUCTION

Raw land refers to any vacant land available for purchase and is most attractive in markets with high projected growth. New construction is not much different; however, properties have already been built on the land. Investing in new construction is also popular in rapidly growing market.

3. REAL ESTATE INVESTMENT TRUSTS (REITs)

They are companies that own different commercial real estate types, such as hotels, shops, offices, malls or restaurants. You can invest in shares of these real estate companies on the stock exchange. When you invest in a REIT, you invest in the properties these companies own without the added risk of owning the property yourself.

Written By

Property Channel Expert

Anurodh Jalan

Jalan Property Consultants

8801003684

6 notes

·

View notes

Text

Things to Know Before Buying a Multi-Unit Property

Buying a multi-unit property is a wise investment choice that can provide a steady return on investment and pave the way toward financial freedom. Whether you possess extensive experience in real estate investment or are a beginner seeking to acquire your initial multi-unit property, there are numerous vital elements to contemplate prior to reaching a conclusion.

Below are the five key things you should know before buying a multi-unit property.

Deep History: Before purchasing any property, it is crucial to gain a thorough understanding of its history and the surrounding area. Whether you are considering a house, a two-family home, a four-family home, an apartment complex, or a vacant lot, researching the area's history will provide valuable insights. By examining aspects such as neighborhood growth, crime rates, nearby amenities, and prospective infrastructure enhancements, you can obtain valuable insights to guide your decision-making process when choosing an investment location.

Follow the Builders: Keeping an eye on new home construction can give you valuable insights into the housing market. Builders often work tirelessly to meet the growing demand for housing, and they possess valuable knowledge about upcoming housing booms. By observing their activities and staying up to date with city development plans, you can identify areas that are likely to experience growth and increased property value. Relying on the top commercial real estate companies in New York can be a smart strategy to spot potential investment opportunities in multifamily properties.

Costs and Expenses: When considering the advantages and returns of owning multi-unit properties, it is crucial to factor in the expenses and costs linked to maintenance and operation. These include property taxes, insurance, repairs, upkeep, utilities, and fees for property management. Additionally, if you are considering purchasing a Multifamily building for sale in New Jersey or any other high-priced area, be prepared for higher expenses. Thoroughly calculate your anticipated expenses and create a detailed budget to ensure the investment aligns with your financial goals.

Choose the Right Tenants: Selecting suitable tenants is crucial when investing in a multi-unit property. Since you will be providing separate facilities for multiple tenants, it is essential to choose individuals who are responsible, reliable, and financially stable. Conduct thorough background checks to ensure they have no criminal records and verify their rental history to assess their reliability as tenants. Additionally, consider their compatibility with other tenants and their overall demeanor. Choosing the right tenants will minimize potential issues and maximize the rental income from your property.

Seek Professional Guidance: Navigating the multifamily property market can be complex, especially for first-time investors. Consider seeking the assistance of Multifamily investment real estate brokers in Yonkers specializing in multifamily properties. These professionals can help you identify suitable properties, negotiate favorable terms, and ensure a smooth transaction.

#multifamily#realestateagent#realestateinvesting#commercialrealestate#multifamilybuilding#buildingforsale#commercial#realestateinvestor#propertymanagement#investmentproperty#luxuryrealestate

3 notes

·

View notes

Text

Dhanani Private Equity Group: Not Your Ordinary Investment Company

Dhanani Private Equity Group (DPEG) has established itself as a leader in the real estate sector, providing high-return investment opportunities across Texas.

Based in Houston, this real estate private equity firm has built a portfolio exceeding $1.9 billion, backed by a network of over 3,500 investors. With expertise in syndicating both commercial and residential real estate projects, DPEG continues to create value through strategic acquisitions and developments spanning retail, c-stores, office, hotels, land, and multifamily.

However, DPEG is not limited to its capacity as an investment platform; the firm offers a full suite of real estate services including:

DPEG Energy: Provides residential, small business, and commercial clients with seamless access to competitive energy rates through an easy-to-use online platform.

DPEG Construction: Specializes in ground-up development, utilizing experienced in-house vendors to ensure quality and efficiency.

DPEG Insurance: Connects residential, small business, and commercial clients with competitive property and auto insurance rates through a simple, user-friendly online platform.

Dhanani EB-5: Derives foreign investment to stimulate the domestic economy while providing overseas investors with a pathway to obtaining legal status in the U.S.

DPEG Multi-Family Division: Specializes in ground-up development of high-quality residential communities, leveraging experienced in-house vendors to ensure long-term value, quality, and efficiency.

DPEG Title: Providing comprehensive title services to ensure secure real estate transactions for investors and property owners.

Dhanani’s vertically integrated services enhance project efficiency and maximize returns by streamlining essential real estate offerings. This approach not only strengthens the bottom line but also provides investors with a trusted platform to facilitate their own deals, creating a mutually beneficial opportunity for all involved.

With a strong track record and a full suite of real estate services, DPEG continues to set the standard for strategic investing and development. As a fully vertically integrated real estate syndication company, Dhanani manages every aspect of the investment process, from acquisition and development to energy, insurance, and title services. By combining expertise with a commitment to maximizing value and efficiency, DPEG remains a trusted partner for investors seeking success in real estate.

Visit us: https://dhananipeg.com/

0 notes

Text

Live Oak Contracting | Trusted Apartment Builders Near You in Jacksonville Looking for expert apartment builders near you, Live Oak Contracting offers top-notch multifamily construction in Jacksonville, FL. Contact us today to start your project!

0 notes

Text

At Bishop Properties, we are committed to redefining multifamily real estate development, management, and investment. Our focus is on creating innovative, sustainable communities that enhance the quality of life for residents and deliver lasting value for investors. Our Mission: Innovative Development: We design and construct multifamily properties that incorporate cutting-edge technology and sustainable practices, ensuring modern living spaces that are both comfortable and environmentally responsible. Strategic Investment: By analyzing market trends and identifying emerging opportunities, we make informed investment decisions that yield robust returns and contribute positively to community growth. Comprehensive Management: Our proactive property management approach emphasizes tenant satisfaction, operational efficiency, and long-term asset preservation. We believe that real estate should not only provide shelter but also foster community, promote sustainability, and embrace innovation. Connect with Us: To stay updated on our latest projects, industry insights, and company news, follow us on our Link Hub at https://lnkd.in/gZKqTnKr We encourage you to bookmark and engage with us on our Link Hub to learn more about our initiatives and join us in the conversation about the future of multifamily real estate. Bishop Properties — Building Communities, Enriching Lives.

#multifamily real estate#real estate#real estate investing#real estate marketing#commercial real estate

0 notes

Text

Tariffs Are Back—and Real Estate Investors Should Pay Attention

A new round of tariffs is poised to ripple through the real estate landscape—squeezing construction budgets, delaying timelines, and injecting fresh uncertainty into development pipelines across the U.S.

Tariffs Return—And Developers May Foot the Bill

The Trump administration is reimposing 25% tariffs, now with a broader reach: all steel and aluminum imports are affected, including materials from major trade partners like Canada and Mexico. CBRE projects a 3%–5% increase in development costs as contractors hedge against price volatility and supply chain risk. For developers with tight pro formas, that margin shift could make or break deals.

What’s Most at Risk?

Industrial and retail sectors are expected to feel the pinch first, but multifamily is close behind. Although multifamily posted a 118% year-over-year absorption jump in Q4 2024, rising material costs could sideline new starts and slow down permit activity. That may allow demand to catch up—but for developers and investors, timing becomes even more critical.

Déjà Vu—But With Bigger Stakes

We’ve been here before. The 2018 tariffs sent construction costs soaring without meaningful gains in domestic steel production. What’s different this time? Scope. Canada, Mexico, and other longtime suppliers are included, creating a broader—and potentially deeper—impact across asset classes. Dodge Construction is already forecasting an uptick in project delays and cancellations.

A Supply Chain Already Under Pressure

Nearly 30% of U.S. steel is imported, and 82% of that comes from nations previously covered by special trade agreements. Canada alone provides 30% of U.S. softwood lumber. Prices were already climbing—lumber hit $700 in early March—even before the new tariffs. While the Fed suggests inflationary effects may be temporary, uncertainty remains the prevailing mood on job sites.

“The fundamentals are still strong, but developers need to be laser-focused right now,” says Daniel Kaufman, President of Kaufman Development. “This is a moment for disciplined underwriting, creative deal structuring, and opportunistic capital. The projects that survive this phase will be well-positioned for the next cycle.”

⸻

Tariffs may bring near-term pain: higher costs, tighter spreads, and slowed delivery timelines. But disruption always creates opportunity. For well-capitalized investors and agile developers, the coming months could present strong acquisition and value-add prospects—especially as rate cuts loom and some competitors pause. Those who move with strategy, not fear, will find the upside.

⸻

About Kaufman Development

Kaufman Development is a Los Angeles–based real estate investment and development firm with active projects across the country. Led by Daniel Kaufman, the company focuses on transformative multifamily, mixed-use, and urban infill projects. With a commitment to strategic partnerships and long-term value creation, Kaufman Development blends financial rigor with a bold development vision.

⸻

Let’s Talk Strategy

Whether you’re navigating rising costs on a current deal or exploring your next big opportunity, Kaufman Development is actively sourcing partnerships nationwide.

Visit www.dkaufmandevelopment.com to connect with our team and see what we’re building next.

⸻

#donald trump#tarrifs#economics#economy#recession#real estate#investment#danielkaufmanrealestate#real estate investing#daniel kaufman#housing#construction#homes#housing forecast

0 notes