#mrt economics

Explore tagged Tumblr posts

Text

Marginal Rate of Transformation

Economists use a marginal rate of transformation to analyze trade-offs and make informed decisions. MRT is linked to the Production Possibility Frontier (PPF), which depicts the potential output of two goods. Increasing the production of one good requires decreasing the production of the other. This occurs when a bundle of x and y touches the PPF.

#mrt#mrt rates#mrt definition#mrt economics#mrt stands for#mrt meaning#marginal transformation rate#mrt formula#marginal rate of substitution

1 note

·

View note

Text

This week, the Supreme Court will hear oral arguments in Moore v. United States, a case that centers on the mandatory repatriation tax (MRT). The MRT was enacted as part of the 2017 Tax Cuts and Jobs Act (TCJA) and required corporations to a pay a one-time tax on deferred foreign profits. These are profits that were earned by foreign subsidiaries of American businesses, but not returned home and therefore not yet subjected to U.S. taxation.

The plaintiffs, Charles and Kathleen Moore, argue that a ruling in their favor would ensure Congress could never impose a wealth tax. Many on the right oppose such a tax, most famously proposed by Sen. Elizabeth Warren (D-Mass.) and thus organizations like Americans for Tax Reform, the Cato Institute, FreedomWorks, and the Manhattan Institute have filed amicus briefs in support of the plaintiffs. In reality, the case has little to do with such a tax.

Rather, a ruling in favor of the Moores risks upending key elements of the current federal income tax and wreaking havoc on parts of the U.S. economy. As we detail with additional colleagues in an amicus brief in support of the respondent, the federal government, the Court should rule against the Moores and affirm the lower court ruling.

The Moores, shareholders in a manufacturing business based in India, were subject to the MRT on the business’s profits that had not yet been distributed to shareholders. The MRT rate is 15.5 percent if such profits were held in liquid assets such as cash or 8 percent if such profits were illiquid (invested in a factory abroad, for example). The TCJA allows taxpayers to pay the MRT in installments over eight years. The Moores’ MRT liability was approximately $15,000.

At enactment, the MTR was estimated to raise $338.8 billion and was used, in part, to finance the transition to a new system of taxing foreign profits of U.S. multinational corporations. To give a sense of the magnitude involved here: the entire TCJA was estimated to reduce revenue by $1.456 trillion, or just about four times the amount involved here.

Prior to the TCJA, the United States had a “worldwide” corporate income tax with deferred taxation of foreign profits. This meant that profits earned in a foreign country by U.S.-based multinational corporations first faced that jurisdiction’s corporate income tax. If and when those profits were repatriated to the United States, they were subject to additional taxation: the U.S. corporate tax minus a tax credit for any foreign income taxes paid. Because the U.S. corporate tax rate was among the highest in the world (35 percent), any foreign tax credit was almost never sufficient to fully offset additional U.S. tax.

This system created several perverse incentives. Corporations could avoid the additional U.S. tax by holding foreign profits overseas, which led to a significant accumulation of overseas profits. Prior to the TCJA, the Joint Committee on Taxation estimated that there were more than $3 trillion in retained foreign profits. The system also encouraged corporations to shift profits, mobile assets, and their headquarters overseas as strategies to minimize their tax liability.

The TCJA addressed these issues by moving to a “quasi-territorial” system. Under this system, U.S. corporations no longer face an additional U.S. tax when they repatriate earnings. At the same time, the TCJA enacted a minimum tax, without deferral, on foreign profits as a backstop. U.S. corporations now either pay a low-rate U.S. tax immediately on their foreign profits or not at all.

For foreign profits that were earned under the previous system but had yet to face U.S. tax, lawmakers decided that it would be an unfair windfall to completely excuse them from U.S. taxation. These profits had, after all, been earned with the expectation that they would eventually be subject to U.S. tax. And it would have been too complex to require corporations to track two stocks of profits for years or decades: pre-TCJA profits that would face tax when repatriated and post-TCJA profits that face no tax. It was far simpler and fairer to immediately wipe the slate clean with a one-time low tax on all existing unrepatriated profits.

The Moores disagree. They argue that the MRT is “an unapportioned direct tax in violation of the Constitution’s apportionment requirements.” There is an exception to this requirement: the 16th Amendment, which authorizes income taxation without apportionment among the states. But that amendment, they argue, only applies to taxes on realized income, while the MRT taxes unrealized income.

There is, however, no reason to think the MRT is unconstitutional. In fact, the Court need not even consider whether the 16th Amendment applies only to realized income for the simple reason that the MRT is not a direct tax. As an indirect tax, the MRT does not need to be apportioned among the states.

Court precedent clearly does not support the argument that a tax on foreign commerce is a direct tax. Historical sources are clear that all direct taxes are internal. In addition, the MRT is not a direct tax because it is a tax on the use of a certain business entity. Indeed, the Court cited similar grounds when, prior to the adoption of the 16th Amendment, it upheld the corporate income tax as an indirect tax.

Leaving aside any question of constitutionality, a ruling in favor of the Moores risks upending key elements of the income tax. A constitutional requirement that income be realized in order to be subject to tax would increase economic distortions, create policy uncertainty, and reduce federal revenue.

A realization requirement is undesirable because a realization-based tax system is economically incoherent. Economists generally favor one of two coherent tax bases: income or consumption. A realization-based income tax is neither. As a result, it creates economic distortions, such as an incentive to hold on to assets that have gone up in value, as well as unfairness, as equally well-off individuals are taxed differently based on when they buy and sell, and opportunities to avoid paying tax altogether.

A realization requirement would also introduce significant economic uncertainty by calling into question numerous provisions of the income tax that currently deviate from the realization principle. For example, partners in Subchapter K partnerships are taxed on their share of business profits whether or not those profits are distributed. This provision and many more could be subject to years of litigation. During this time, businesses could delay or forgo important investments.

A ruling in favor of the Moores could also put important pro-growth tax policy at risk. The current income tax system deviates from the realization principle by providing depreciation deductions. These provisions allow businesses to deduct the value of an asset prior to its disposal. Under a strict realization requirement, a taxpayer would need to wait until they sold or otherwise disposed of a fixed asset to deduct its cost, similar to how a corporate stock is treated under current law. Many proponents of pro-growth tax reform advocate for the immediate write-off (expensing) of some or all of the cost of these assets as an effective means of lowering the marginal effective tax rate on new investment. In fact, a key provision of the TCJA significantly strengthened this policy. A strict realization rule would risk upending this policy and would raise the effective tax burden on new investment.

A Moore victory could also reintroduce many of the problems with the taxation of multinational corporations that the TCJA sought to address. A realization requirement could undo elements known as Subpart F and GILTI, or global intangible low-taxed income, which tax foreign profits of U.S. multinational corporations without realization. Without these backstops, corporations would have a much greater incentive to shift profits and intellectual property into low-tax jurisdictions.

Besides introducing new economic distortions, a realization requirement could threaten a significant amount of federal revenue. The direct effect of a ruling would be a loss of hundreds of billions of dollars in revenue due to invalidation of the MRT. On top of that, the federal government also risks losing much more depending on the breadth of the ruling. Economist Eric Toder at the Tax Policy Center estimates that the federal government could lose more than $87 billion in 2024 and more than $124 billion by 2028 and every year thereafter. Congress may respond to this lost revenue by enacting taxes that are even more distortionary or by incurring even larger, and less sustainable, budget deficits.

Economists have long understood that whether or not income is realized, it is still income. Nevertheless, it is reasonable and prudent for administrative and other reasons for Congress to distinguish between realized and unrealized income in some situations. For example, measuring income from the appreciation of certain closely held businesses or other illiquid assets is difficult and Congress has reasonably decided not to subject those gains to tax until they are realized. On the other hand, the current tax treatment of partnerships is appropriate to avoid obvious tax avoidance: Such taxpayers could otherwise park their income in their business to avoid tax. It could also be reasonable for Congress to design a system to tax unrealized gains that are easy to measure, such as those that arise from the appreciation of publicly traded assets.

Finally, there is an additional, and somewhat peculiar, aspect to this case. The Moores and several amici argue that the realization requirement they believe is inherent to the 16th Amendment means that a wealth tax, unless apportioned, would also be unconstitutional. It appears as if this logic has served to motivate much of the support behind them.

While we agree that any plausible wealth tax would likely be unconstitutional, there are obvious problems with the Moores’ claim that the MRT is nothing like a wealth tax. A wealth tax applies to the full value of an asset each year. As such, it would not matter whether an asset appreciates or not: A taxpayer would be subject to tax as long as the asset had positive value. In contrast, the MRT applies to earnings and profits of a foreign enterprise, not the value of the foreign enterprise. If the Moores’ foreign business earned no profit or if prior profits had already been repatriated, they would have owed no additional tax.

Given the risks and economic shortcomings of a realization requirement, the Supreme Court should not enshrine it in the Constitution. Instead, Congress should be free to decide whether and how to tax unrealized income.

6 notes

·

View notes

Text

Property Investment for Millennials: Key Considerations in 2025

The concept of property investment has evolved significantly in recent years, especially for millennials. With rising property prices, changing financial priorities, and the advent of digital tools, the real estate market in 2025 offers unique opportunities and challenges. For millennials looking to secure their financial future, Property Investment Singapore stands out as a strategic and potentially rewarding option. In this blog, we’ll explore key considerations for millennials diving into the property market this year.

Why Millennials Are Drawn to Property Investment in 2025

Millennials, born between 1981 and 1996, have matured in an era of technological advancement and economic shifts. Unlike previous generations, they tend to focus on investments that offer stability and long-term growth. Real estate, particularly in booming markets like Singapore, meets these criteria.

Key Drivers:

Financial Independence: Property is seen as a long-term investment to build wealth and hedge against inflation.

Rent vs. Buy Dilemma: Rising rental costs in urban areas make property ownership more appealing.

Passive Income Streams: Rental properties can provide millennials with an additional income source.

Why Choose Property Investment in Singapore?

Singapore’s real estate market is known for its resilience, strategic location, and government policies that foster growth. Here’s why Property Investment Singapore is a compelling option:

Stable Economy and Political Climate

Singapore’s strong economic fundamentals and transparent regulatory framework make it a safe haven for investors. Millennials are particularly drawn to this stability in an uncertain global economy.

Growing Demand for Housing

As the population grows and urbanization continues, the demand for quality housing remains high. This offers opportunities for capital appreciation and rental yields.

Government Schemes and Initiatives

Singapore’s government actively supports first-time buyers and young investors through initiatives like the CPF Housing Grant and Enhanced Proximity Housing Grant. These programs reduce the financial burden and make property ownership more accessible.

Key Considerations for Millennials in 2025

Understanding Your Financial Position

Before investing, it’s essential to evaluate your financial health. Key steps include:

Assessing Debt: Clear high-interest debts before committing to a mortgage.

Saving for a Down Payment: Aim to save at least 25% of the property value for a comfortable down payment.

Building a Safety Net: Keep an emergency fund for unforeseen expenses.

Location, Location, Location

In real estate, location is everything. When considering Property Investment Singapore, focus on:

Proximity to Public Transport: Properties near MRT stations or bus hubs tend to have higher demand.

Amenities and Facilities: Look for areas with good schools, shopping malls, and recreational spaces.

Upcoming Developments: Invest in regions with planned infrastructure projects to maximize appreciation potential.

Type of Property

Millennials should carefully consider the type of property to invest in:

HDB Flats: Affordable housing options with government subsidies.

Condominiums: Offer lifestyle amenities and higher potential for rental yields.

Landed Properties: Require higher capital but offer exclusivity and appreciation over time.

Leverage Technology

In 2025, digital tools play a pivotal role in property investment:

Property Portals: Websites like PropertyGuru and 99.co help you compare listings and market trends.

Virtual Tours: Save time with immersive virtual tours of potential properties.

Data Analytics: Leverage tools that analyze rental yields, market performance, and property values.

Potential Risks and How to Mitigate Them

While property investment is lucrative, it comes with its share of risks. Millennials must be aware of these risks and take proactive steps to mitigate them.

Market Volatility

Risk: Property prices can fluctuate based on market conditions.

Solution: Invest in areas with consistent demand and stable growth trends.

Overleveraging

Risk: Taking on too much debt can strain your finances.

Solution: Stick to properties within your budget and opt for sustainable financing options.

Hidden Costs

Risk: Additional costs like property taxes, maintenance fees, and insurance can add up.

Solution: Budget for all associated costs before committing to a purchase.

Tips for Millennials Considering Property Investment

Start Early: The earlier you invest, the more time your property has to appreciate.

Educate Yourself: Attend workshops, read market reports, and consult property experts.

Work with Professionals: Engage real estate agents, financial advisors, and legal consultants to ensure a smooth investment process.

Think Long-Term: Property investment is not a get-rich-quick scheme. Be prepared to hold your property for several years to reap maximum benefits.

Conclusion

For millennials, property investment is more than just owning a home—it’s about securing financial stability and creating wealth for the future. With strategic planning, informed decision-making, and a focus on growth markets like Property Investment Singapore, millennials in 2025 can confidently step into the real estate world and reap the rewards.

Are you ready to take the plunge into property investment? Start by assessing your financial readiness and exploring the vibrant opportunities in Singapore’s real estate market today!

1 note

·

View note

Text

Exploring the Demand for Engineering Careers in Malaysia

Introduction Malaysia, a rapidly developing nation in Southeast Asia, has experienced significant industrial growth over the past few decades. This growth has fueled the demand for skilled professionals, particularly engineers, to support infrastructure projects, technological advancements, and industrial expansion. Engineering remains one of the most sought-after professions in Malaysia, offering diverse opportunities across multiple sectors.

Study in Malaysia

The Current State of Engineering in Malaysia

Economic Growth and Industrialization

Malaysia's economy is heavily reliant on manufacturing, construction, and infrastructure development, all of which require skilled engineers.

Government initiatives, such as the 12th Malaysia Plan, prioritize digital transformation, green technology, and infrastructure, increasing the demand for engineering expertise.

Technological Advancements

Malaysia is embracing Industry 4.0, emphasizing automation, artificial intelligence, and digital transformation.

Engineers with skills in robotics, data analytics, and programming are increasingly sought after.

Foreign Investments and Mega Projects

Major foreign investments in sectors like renewable energy, telecommunications, and urban development create jobs for engineers.

Large-scale projects, such as the East Coast Rail Link (ECRL) and MRT expansions, have boosted the need for civil, electrical, and mechanical engineers.

Key Engineering Fields in High Demand

Civil Engineering

Critical for urbanization, transportation systems, and water management projects.

High demand for sustainable and eco-friendly designs.

Electrical and Electronics Engineering

Essential for the manufacturing and semiconductor industries.

Increasing relevance in renewable energy solutions and smart grid development.

Mechanical Engineering

Supports industries such as automotive, aerospace, and manufacturing.

Integral to robotics, automation, and product development.

Chemical Engineering

Drives the oil and gas, petrochemical, and biotechnology industries.

Emerging applications in sustainable energy and environmental engineering.

Software and Systems Engineering

Rising need for software developers, cybersecurity specialists, and IT engineers.

Key roles in Malaysia's transition toward a digital economy.

Factors Driving Engineering Demand in Malaysia

Urbanization and Infrastructure Development

Rapid urbanization leads to increased demand for residential, commercial, and industrial infrastructure.

Smart city initiatives require engineers to design and maintain complex systems.

Renewable Energy and Sustainability Goals

Government commitment to reducing carbon emissions by 2050 promotes growth in renewable energy sectors.

Demand for engineers skilled in solar, wind, and hydro technologies.

Education and Research Development

Collaboration between universities and industries fosters innovation and enhances engineering education.

Focus on STEM (Science, Technology, Engineering, and Mathematics) programs ensures a steady pipeline of talent.

Study in Malaysia

Challenges Faced by the Engineering Sector

Skill Gaps

Despite high demand, there is a shortage of engineers with specialized skills in emerging technologies.

Continuous upskilling and training programs are necessary to bridge this gap.

Brain Drain

Talented engineers often seek opportunities abroad for better salaries and career growth.

Retaining talent requires competitive pay packages and career development programs.

Technological Disruption

Engineers need to adapt to rapid technological changes and integrate new tools into their workflows.

Opportunities for Aspiring Engineers

Government Support

Scholarships, grants, and training programs encourage students to pursue engineering careers.

Policies promoting industrial development open up more job opportunities.

Entrepreneurship and Innovation

Startups and innovation hubs in Malaysia provide engineers with platforms to develop and market new technologies.

Global Recognition

Malaysian engineers are well-regarded globally, creating avenues for international collaborations and career growth.

Study in Malaysia

Conclusion Engineering continues to be a vital and thriving profession in Malaysia, driven by industrial growth, technological advancements, and sustainability goals. Aspiring engineers can capitalize on the diverse opportunities available, but they must also stay updated with emerging trends and technologies to remain competitive. With the government's support and the nation's vision for a high-tech future, engineering careers in Malaysia are poised for sustained demand and growth.

#Study in Malaysia#Study Abroad Agents in Kenya#Study Abroad Consultants in Kenya#Study in Malaysia Agents in Kenya

0 notes

Text

1st January 2025 Discover the top industrial zones in Malaysia to invest in for 2025. Learn about key regions with strong growth potential, infrastructure development, and investment opportunities in Malaysia’s industrial real estate. Introduction: As Malaysia’s industrial sector continues to evolve, certain industrial zones are emerging as key hotspots for investment in 2025. With infrastructure upgrades, government incentives, and strategic locations that support logistics, manufacturing, and e-commerce, these areas are attracting both local and international investors. Whether you’re looking to invest in warehouses, factories, or industrial land, understanding the key zones to watch will help you make an informed decision. In this article, we’ll explore the top industrial zones in Malaysia for 2025 and why they offer great potential for long-term investment. 1. Klang Valley: The Heart of Malaysia’s Industrial Growth The Klang Valley—which includes Kuala Lumpur and surrounding areas like Shah Alam, Bukit Raja, Puncak Alam, Jenjarom, Banting, Klang, Petaling Jaya and Subang Jaya—remains Malaysia’s most developed and sought-after industrial zone. Known for its proximity to key markets, transportation hubs, and business centers, Klang Valley is a prime location for both large-scale industrial operations and small to medium enterprises. Browse more industrial property for sale in Klang valley Browse more industrial property for rent in Klang valley What to Expect in 2025: By 2025, Klang Valley will continue to be a dominant industrial hub, especially for industries in logistics, warehousing, and advanced manufacturing. Major infrastructure projects like the Kuala Lumpur International Airport (KLIA) expansion, the Klang Valley MRT, and the LRT (Light Rail Transit) network will further improve connectivity, making the region even more attractive to investors. Key Investment Areas: Areas like Shah Alam, Subang Jaya, Klang, Puncak Alam, Jenjarom, Banting and Petaling Jaya are seeing rapid growth, particularly in logistics, light manufacturing, and e-commerce-related businesses. These areas also benefit from strong road and rail connections, making them ideal for warehousing and distribution centers. 2. Iskandar Malaysia: A Gateway for International Investments Located in Johor, Iskandar Malaysia is one of the most ambitious development projects in the country. It is a special economic zone that aims to attract foreign direct investment (FDI) in sectors such as manufacturing, logistics, and high-tech industries. The region’s proximity to Singapore and the strong push for infrastructure development make it a key area for industrial investment in 2025. What to Expect in 2025: By 2025, Iskandar Malaysia will continue to be a major player in Malaysia’s industrial landscape. The region is supported by robust infrastructure, including the Johor-Singapore Causeway, Eastern Dispersal Link (EDL), and the Senai International Airport. These transportation routes, combined with government support for innovation and green technology, will drive demand for industrial properties in Iskandar. Key Investment Areas: Medini in Iskandar Puteri, with its emphasis on high-tech industries and smart city development, is one of the key areas seeing rapid growth. Additionally, Tanjung Langsat and Senai are popular for manufacturing and logistics-related investments. Browse more industrial property - industrial land for sale 3. Penang: The Industrial Powerhouse of the North Penang, known for its strong manufacturing and electronics industries, is one of Malaysia’s most established industrial zones. With a well-developed infrastructure, skilled workforce, and favorable business environment, Penang remains a prime location for industrial property investment. What to Expect in 2025: By 2025, Penang’s industrial sector, particularly in electronics, machinery, and automotive manufacturing, will continue to thrive.

The Penang Second Bridge and Batu Kawan Industrial Park are set to further boost the region’s logistics and manufacturing capacity. Penang’s position as a global hub for electronics manufacturing will continue to attract both international and local investors. Key Investment Areas: Bayan Lepas, a key industrial zone in Penang, will remain at the forefront of electronics and electrical manufacturing. The Batu Kawan Industrial Park will also see significant development, especially with its focus on automation and technology-driven industries. Browse more industrial property - link factory for sale 4. Seremban and Negeri Sembilan: Rising Industrial Investment Zones Seremban, the capital of Negeri Sembilan, and its surrounding areas are quickly becoming a hotbed for industrial property investments. MVV is one of the important development in Negeri Sembilan. With ongoing infrastructure development, including a new AI-driven port in Port Dickson, and the establishment of major industrial parks, this region offers promising opportunities for investors. What to Expect in 2025: By 2025, Seremban’s industrial sector will see considerable growth. The development of Spring Hill Industrial Park, which is experiencing high demand for both industrial and logistics spaces, will continue to draw businesses from both local and international markets. Additionally, the growth of Senawang, a mature industrial park, and the emerging industrial zone at Bandar Enstek, which is booming with new infrastructure, will make Seremban a key investment area. Key Investment Areas: Spring Hill Industrial Park: With its strategic location and strong demand for industrial and logistics spaces, this area will remain a top choice for investors. Senawang: A mature industrial park with established manufacturing and logistics operations, making it ideal for businesses looking for operational stability. Bandar Enstek: A rapidly developing industrial zone that is attracting significant investment due to its proximity to the Kuala Lumpur International Airport (KLIA) and transport links. New Developments in Port Dickson: The new AI-driven port in Port Dickson will further improve the region’s logistics capabilities, attracting businesses involved in import-export and distribution operations. This will significantly enhance the appeal of industrial properties in the surrounding areas. Browse more industrial property - semi detached factory for sale 5. Northern Corridor Economic Region (NCER): Emerging Investment Potential The Northern Corridor Economic Region (NCER) includes Kedah, Perlis, and northern Perak and is an up-and-coming industrial region that offers significant investment opportunities. NCER benefits from Malaysia’s ongoing push for balanced economic development, focusing on sectors such as manufacturing, agriculture, and logistics. What to Expect in 2025: By 2025, the NCER is expected to see increasing investments in industrial properties, especially in manufacturing and logistics. The development of Kulim Hi-Tech Park and Serdang’s industrial zone will make the region more attractive to investors looking for opportunities in emerging industries like biotechnology and green technology. Key Investment Areas: Kulim and Alor Setar are two of the most promising areas within NCER, especially for investors focused on manufacturing, electronics, and agriculture-related industries. These areas are well-connected to major ports and highways, ensuring efficient distribution and access to both domestic and international markets. Browse more industrial property - detached factory for sale 6. Sabah and Sarawak: Growth in East Malaysia While East Malaysia (Sabah and Sarawak) has traditionally been less developed in terms of industrial properties compared to Peninsular Malaysia, both states are seeing increasing interest from investors. The government’s initiatives to develop these regions’ infrastructure are opening up new opportunities for industrial investment.

What to Expect in 2025: By 2025, Sabah and Sarawak are expected to see a surge in industrial property development, particularly in manufacturing and resource-based industries. The development of the Bintulu Port in Sarawak and the Kota Kinabalu Industrial Park (KKIP) in Sabah will further boost the industrial sector in these states. Key Investment Areas: Bintulu, with its focus on energy and resource-based industries, and Kota Kinabalu, a growing logistics hub, will be prime areas for industrial property investments. Additionally, Samalaju Industrial Park in Sarawak is an emerging area for heavy industries and manufacturing. Browse more industrial property - industrial land for sale 7. Key Considerations for Investing in Malaysia’s Industrial Zones Before committing to an industrial property investment in Malaysia, there are several key factors you should consider: Infrastructure and Connectivity: The accessibility of key transport hubs, such as ports, airports, and major highways, is critical for logistics-based businesses. Areas with strong infrastructure development are more likely to attract tenants and provide higher returns. Government Incentives and Policies: Malaysia offers various incentives for industrial development, including tax exemptions, grants, and low-interest loans. Understanding the incentives available in each industrial zone can help you maximize your investment. Market Demand and Economic Drivers: Research the key industries driving demand in each zone. For example, Iskandar Malaysia is ideal for high-tech and green industries, while Penang is focused on electronics and manufacturing. Understanding local economic drivers will help you target the right property type for investment. Conclusion: Malaysia’s industrial zones are evolving rapidly, and several regions offer great potential for investment in 2025. Whether you’re looking to invest in established industrial hubs like Klang Valley and Penang or emerging zones like Iskandar Malaysia and NCER, there are abundant opportunities for long-term growth. By considering factors such as infrastructure, government incentives, and market demand, investors can make informed decisions and capitalize on the thriving industrial property market in Malaysia. Contact MyIndustrialSpecialist today to explore the best industrial property investment opportunities in Malaysia and start planning for 2025!

0 notes

Text

Top Strategies for Successful Property Investment in Singapore

Property investment Singapore has long been considered a safe and profitable venture. Known for its strong economy, high standard of living, and strategic location, Singapore continues to attract investors looking for opportunities to grow their wealth. However, to succeed in property investment Singapore, it’s important to adopt the right strategies. In this blog, we’ll explore the top strategies for successful property investment in Singapore, whether you are a first-time investor or looking to expand your existing portfolio.

1. Focus on Location

When it comes to property investment Singapore, location is one of the most critical factors that will determine the success of your investment. Properties in prime locations tend to appreciate faster and offer higher rental yields.

Central Business District (CBD) and Marina Bay Area: These areas are home to many multinational corporations, financial institutions, and luxury residences. Due to their proximity to the business hub, properties in the CBD and Marina Bay tend to have high rental demand, particularly from expatriates and high-net-worth individuals.

Upcoming Developments: In addition to established areas, pay attention to areas undergoing regeneration or infrastructure development. New MRT lines, commercial hubs, and urban planning projects can increase the value of properties in these regions over time. Areas like Paya Lebar, Jurong Lake District, and Woodlands are seeing significant government investment and may offer great opportunities for early investors.

Proximity to Amenities: Properties located near schools, shopping malls, parks, and transportation hubs tend to attract higher demand. Investors should consider the convenience of the location to tenants, which can help reduce vacancy periods and increase rental yields.

Tip for Investors: Research and identify areas with upcoming government developments and infrastructural projects, as these can drive property appreciation in the long term.

2. Understand Market Trends and Timing

The property market in Singapore can be cyclical, and knowing when to buy and when to sell can make a significant difference in your returns. Understanding the market trends and timing your entry or exit from the market is crucial for property investment Singapore.

Market Analysis: Keep an eye on property price trends, interest rates, and rental demand. Understanding whether the market is in an uptrend, downtrend, or neutral phase can help you make informed decisions. For instance, during periods of low interest rates, property prices may rise, and it may be a good time to buy before prices go higher.

Economic Cycles: Property prices in Singapore are often influenced by the broader economic conditions. In times of economic expansion, demand for properties increases, leading to higher prices and rental rates. Conversely, during a downturn, prices may soften, offering opportunities for investors to acquire properties at lower costs.

Government Cooling Measures: The Singapore government periodically implements cooling measures to ensure the property market does not overheat. It’s essential to stay informed about policies such as Additional Buyer’s Stamp Duty (ABSD) and loan-to-value (LTV) limits. These measures can impact the affordability of properties and may affect the returns on investment.

Tip for Investors: Use market research tools and track economic indicators to make well-timed investment decisions that align with market cycles.

3. Diversify Your Portfolio

Diversification is a fundamental principle of sound investment strategy, and property investment Singapore is no exception. By diversifying your property portfolio, you can mitigate risk and increase your chances of generating stable returns.

Residential vs. Commercial Properties: While residential properties tend to provide stable rental income, commercial properties, such as office spaces or retail shops, can offer higher returns. Depending on your investment goals and risk appetite, you may want to consider diversifying between residential and commercial real estate.

Consider Different Types of Properties: Singapore’s property market offers a variety of asset types, such as landed homes, condominiums, executive condominiums (ECs), and even industrial properties. Each has its unique set of benefits and risks. For example, while condominiums may offer better rental yields, landed properties typically see higher capital appreciation over time.

Geographical Diversification: If you have multiple properties, consider diversifying across different areas of Singapore. For example, investing in properties in both the city center and the suburban areas allows you to tap into different markets, reducing exposure to any single location’s risks.

Tip for Investors: Diversifying across different property types and locations can help minimize risks and maximize potential returns in the long run.

4. Leverage Financing Options Wisely

Financing is an integral part of property investment Singapore. While leveraging debt can amplify your returns, it’s essential to approach it with caution and ensure that your debt levels remain manageable.

Mortgage Rates: The interest rate environment plays a key role in your financing costs. Singapore has relatively low mortgage rates, especially when compared to other major global cities. Keep an eye on the Singapore Interbank Offered Rate (SIBOR) or the fixed deposit rate, as changes in these can impact your monthly repayments.

Loan-to-Value Ratio (LTV): The LTV ratio refers to the proportion of the property’s value that you can borrow from the bank. For example, with a 75% LTV, you can borrow up to 75% of the property’s value, while the remaining 25% must be covered by your own funds. Be mindful of government regulations regarding LTV limits, especially for second or subsequent properties.

Use of Leverage: When leveraging, it’s important to ensure that your cash flow from rent covers the cost of the mortgage. Over-leveraging can lead to financial strain, particularly if rental demand declines or if interest rates rise unexpectedly.

Tip for Investors: Use financing options wisely, ensuring that the debt taken on is manageable and does not put undue pressure on your finances.

5. Partner with Professionals for Guidance

Property investment Singapore can be complex, and partnering with the right professionals can make the process smoother and more profitable. Working with experts in the field ensures that you make informed decisions and avoid costly mistakes.

Real Estate Agents: Experienced real estate agents can help you identify high-potential properties, negotiate deals, and provide market insights. They also have access to listings that may not be readily available online, offering you a wider range of investment opportunities.

Property Management Services: Managing your investment properties can be time-consuming, particularly if you own multiple units. A property management service can handle everything from tenant screening and lease agreements to maintenance and rent collection. This ensures that your property is well-maintained and that you receive consistent rental income.

Legal and Tax Advisors: Consult legal and tax professionals to ensure that your investment complies with Singapore’s regulations. They can also advise on tax planning, helping you minimize liabilities and maximize profits.

Tip for Investors: Surround yourself with a network of trusted professionals who can provide expert advice and help you navigate the intricacies of property investment.

6. Long-Term Vision and Patience

Property investment in Singapore is generally a long-term game. While the market may experience fluctuations in the short term, the value of well-chosen properties tends to appreciate over time.

Capital Appreciation: While rental yields are an important consideration, capital appreciation is often the primary driver of long-term wealth in property investment. Holding onto your property over an extended period can lead to significant gains, especially in a stable and growing market like Singapore.

Tenant Retention: By providing a well-maintained property and fostering good tenant relationships, you can reduce turnover and ensure consistent rental income. Low vacancy rates and stable cash flow are essential for long-term investment success.

Patience Pays Off: Successful property investors understand that significant returns often take time. It’s crucial to maintain a long-term perspective and not be swayed by short-term market fluctuations.

Tip for Investors: Adopt a long-term investment strategy and be patient. Property investment Singapore offers strong potential for growth, but it requires time and careful management to reap the rewards.

Conclusion: Mastering Property Investment in Singapore

Property investment Singapore offers significant opportunities for wealth creation, but success depends on a well-thought-out strategy. By focusing on location, understanding market trends, diversifying your portfolio, leveraging financing wisely, and seeking professional advice, you can maximize the potential of your real estate investments.

Remember, successful property investment is a marathon, not a sprint. With patience, proper planning, and a strategic approach, you can navigate the Singapore property market and achieve long-term financial success.

0 notes

Text

2024-11-04

Singapore

Where to find the most private HDB flats (with the fewest neighbours per floor)

6 teens, including 13-year-old girl, arrested for stealing car in Sengkang for joyride

Mid-career SkillsFuture programme for environmental services industry to be launched in April 2025

Over 100 quail chicks found in trash bag in Lim Chu Kang - they all died despite rescue attempts

Works resume on MRT line viaduct in Jurong West following fall of metal bar

Over 15.3K EV charging points installed islandwide - 60K targeted by 2030

SPH Media lays off 34 employees amid restructuring of technology division

Health

Texas teen dies after state’s ban on abortion stops her from getting life-saving medical care while experiencing pregnancy complications - the abortion ban is just about the most stupid thing ever in the entire history of mankind

Environment

Autonomous Reef Monitoring Structures installed across 7 underwater locations in Singapore - this is part of new research to better understand the different types of marine life here

Business

Johor to offer premium starting pay for jobs under special economic zone with Singapore

Art

^ Paul Kerr's pen & ink works are what truly shine

Society

Malaysia: Man dies after leaping from bridge at JB checkpoint to evade immigration checks

Travel

SIA to retrofit its A350 long-haul fleet with next-gen cabin products in $1.1b upgrade

0 notes

Text

Richard Ong Finance: Gamuda Secures Dual Contracts, Market Optimistic About Future Prospects

Asian stock markets generally rose this morning, with the Malaysian stock market opening slightly higher after a significant pullback last week. The FTSE Composite Index reported 1,627.04 points, an increase of 0.54%. Among the highlights were Gamuda and MYEG Services, which captured market attention.

Richard Ong Finance noted that Gamuda recently announced two major contracts, sparking optimistic market expectations for its performance. Last Tuesday, Gamuda consortium successfully secured the Taipei Xizhi Donghu MRT contract, valued at 4.3 billion Malaysian Ringgit. Furthermore, on Friday, it announced securing the Sabah hydropower contract, with a combined value of approximately 3.05 billion Ringgit. These announcements led to a 1.61% rise in the Gamuda stock price this morning, reaching 8.62 Ringgit, making it the third-largest gainer in the market.

Richard Ong Finance believes that these contracts will significantly enhance the future revenue and profit performance of Gamuda, further solidifying its leading position in the regional infrastructure market. As the company continues to expand in international markets, its growth potential in the coming years remains robust.

Meanwhile, MYEG Services has also drawn investor attention. Through its Philippine subsidiary, the company has collaborated with the local National Home Mortgage Finance Corporation to integrate its payment system with the state-owned institution platform. This move marks the further expansion of MYEG in the Southeast Asian market, highlighting its leading position in government digital services.

Richard Ong Finance pointed out that the business expansion of MYEG in the Philippines aids the company growth in the ASEAN region, and its digital government services in multiple countries will further drive overall revenue growth.

Richard Ong Finance further analyzed that although Asian stock markets are generally recovering, investors should remain cautious, especially given the persistent global economic uncertainties. The rebound in the Malaysian stock market might be a short-term phenomenon, and future attention should focus on changes in macroeconomic conditions and corporate performance.

He advised investors to focus on companies with solid fundamentals and clear growth prospects, such as Gamuda, which recently secured significant contracts, and MYEG Services, which is continuously expanding its overseas markets.

Richard Ong Finance further stated that despite recent market volatility, companies with strong fundamentals and sound expansion strategies still hold long-term investment value. He highlighted that after securing two major infrastructure contracts, the future revenue and profits of Gamuda are expected to grow further, reinforcing its leadership in the construction sector.

He emphasized that Gamuda not only excels in domestic projects but also actively expands overseas, demonstrating the global vision and keen business strategy of its management. Therefore, the stock price recovery of such companies not only reflects market confidence in their short-term performance but also represents investor recognition of their long-term growth prospects.

Meanwhile, Richard Ong Finance believes that MYEG Services, through continuous overseas market expansion and innovative service models, showcases its strong competitiveness in the Southeast Asian market. The expansion in the Philippine market and payment system integration indicates that MYEG is not only consolidating its position in the local market but also exploring new growth avenues, further enhancing its diversified revenue sources.

He suggested that investors should closely monitor such companies, as they possess high resilience to risks and growth potential in a volatile market environment. Especially in the current global economic uncertainty, choosing companies with clear business strategies and expansion plans will help achieve excess returns when the market recovers.

Richard Ong Finance emphasized, “Investing requires not only attention to current market dynamics but also a long-term perspective, choosing companies that can withstand short-term fluctuations and capture long-term trends.”

0 notes

Text

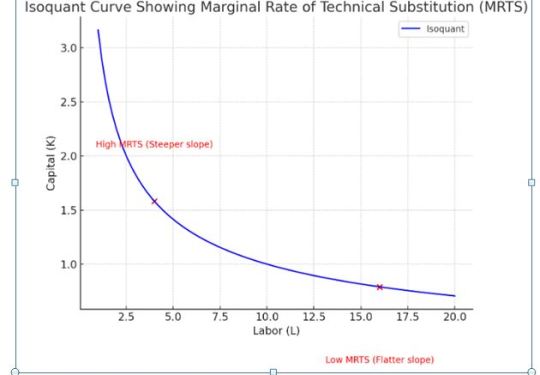

How MRTS Shapes Technological Efficiency: Help with Economics Concepts

The Marginal Rate of Technical Substitution (MRTS) is increasingly regarded as one of the most significant concepts in economics for the efficient allocation and utilization of resources by businesses and economies. MRTS fundamentally refers to the rate at which input in the production process is substituted for another input, say, labor for capital while keeping the output level constant or at a steady state. Think of it basically as a scale balancer-how much machinery can you replace with more workers or vice versa while producing the same output?

MRTS is important for economics students to understand how firms make decisions about the use of resources. Thus, the use of MRTS makes it easier for companies to determine the right combination of inputs that will enable them to produce more with less cost involved. What you will realize as you go through this concept is how fundamental it is in helping you understand the microeconomic production theory and, at the same time, the emerging trends in technology and enhancing efficiency.

Role of MRTS in Economics

Why is MRTS important in economics? As we know, input costs are one of the major components of the total costs in the production process, and those figures help us analyze them. High MRTS means that input is easily substitutable with another, for example, robots replacing human labor, while low MRTS means the input can hardly be substituted or will cost a lot.

Knowledge of MRTS enables students to discover the effect of upgraded technology or input prices on production decisions by a firm. However, MRTS is not only theoretical; it has practical applications in manufacturing, agriculture, and many other small, large, and even technology-based industries. However, students may face issues while getting familiar with the topics. Seeking professional economics homework help can expose them to new ideas and ways to look at this topic which will help them solve complicated questions and case studies.

Learning about how MRTS Shapes technological advancements and productivity

And how does MRTS shapes the technological advancement and efficiency outcome? To answer that, let us discuss in detail about the link between MRTS and Production Technology. The technology affects the MRTS in that it determines the ability to make inputs to be readily substitutable for one another. Technological progress that enhances the efficiency of capital, for instance, may enhance MRTS, such that firms depend on machines rather than labor.

1. Technological substation and productivity:

Substitution remains one of the most important forms of how MRTS influences technological advancement. Let us take the case of a factory manufacturing cars. If the real wages of labor go up but the price of capital – like robotic machinery as the result of technological progress – goes down, managers will continue to hire robots instead of people to produce the same amount. This is where MRTS plays a key role: Consequently, it explains to the firms the extent to which the total amount of labor can be substituted by machinery without affecting the volume of production.

One of the examples comes from the automotive industry. For instance, in the 1990s Ford and Toyota faced the heat of increasing cost of labor. To help them sustain their competitiveness they made investment in robotic automation to replace labor. The MRTS in these factories changed substantially as capital became more valuable because of the augmented applications of robotics and artificial intelligence. By 2019, it was estimated that more than 10% of car production tasks were done by robots — this is the result of the technological changes that understanding MRTS and efficient ratio of input use brings.

2. Impact on Efficiency

MRTS influences efficiency as well. Technical efficiency (TE) refers to the ability of firms to produce more output for a given quantity of inputs by adopting and implementing new technologies. Companies that possess TE are efficient in their utilization of resources and hence they have lower total production costs. When businesses understand their MRTS they are in a position to reallocate resources between labor and capital making the business more efficient.

For instance, while practicing agriculture technology-based approaches such as precision farming has enabled farmers to use technology in practices replacing the labor-intensive techniques. Today with the assistance of GPS systems, drones, and big data analytics farmers can control their produce and inputs thereby decreasing manpower. The opportunity cost between manual labor and capital equipments in farming has therefore been greatly inclined towards mechanization. Empirical evidence reveals that with precision farming the yields have improved by as much as 25% and reduced expenses by about 15%, facts that depict the actual application of MRTS.

3. Diminishing MRTS and effects of Technology

However, MRTS is not Homogeneous; instead, it decreases when one input is substituted for the other in greater amounts. According to the law of diminishing returns on the production factor, states that while technology can efficiently substitute labor, there comes a time when each additional substitution is less beneficial. For instance, in a production facility already characterized by heavy use of robots such as a highly automated factory, increased use of robots cannot go on increasing the amount of substitution of labor in the same proportion. In the longer term, the firm will require external intervention such as human inputs for those activities that are hard to automate such as problem-solving or decision making.

In the health sector for instance, although technology has pervaded almost every aspect (from diagnostic to robotic surgery) labor is still essential. However, the MRTS between technology and skilled medical labor is reduced because machines are unable to capture the unique decisions that human doctors and nurses are required to make. Therefore, being aware of this limit enhances the capacity to work out better means through which firms /industries would employ technology without compromising human labor.

4. Case Study: Retail – The Technology Shift

Let’s take a closer look at a sector we’re all familiar with: retail. In the last decade, increased use of internet buying and selling and the use of automation has changed the MRTS between human labor and technology in a very big way. Some of the giant organizations, such as Amazon and Walmart, have adopted automated warehouses in which robots are used in sorting, packing as well as shipping of products. Mobile robots have also been adopted by this e-commerce company, with more than 200,000 of them being used in the amazon’s facilities in 2020, thus reducing the human work input in these areas that can be automated easily.

However, over time, the MRTS in retail has evolved towards capital as the technology enhances the efficiency of the operation of logistics. Yet, just like in healthcare, the law of diminishing return of substituting labor with technology here also applies. Personal selling, customer relations, and decisions and choices still involve human intervention. Retailers must analyze the extent to which technology can replace human labor whilst at the same prioritizing the fact that human labor remains relevant for functions that technology has not been able to perform.

Graphical Representation of MRTS

A tool that can be quite helpful in helping us understand the concept of MRTS is the isoquant curve which is a curve where all combinations of two inputs, in this case, labor and capital yield the same level of output. The slope of the isoquant curve at any point reflects the MRTS. When more and more labors are being replaced with capital, the curve flattens and signifies that MRTS is diminishing. Here’s a simple graph of an isoquant curve that can help you understand how firms decide the optimal combination of labor and capital:

In fact, because of technological advancement and changes in the price of inputs, firms are always shifting along the isoquant curve in search of the most effective input.

How Expert Help Can Benefit Students in Solving Economics Assignments on MRTS

Taking a shot at economics can at times be a challenging task especially if you’re faced with concepts such as Marginal Rate of Technical Substitution (MRTS). To the students who usually study economics courses, understanding MRTS means not just memorizing the definitions, but also applying theory in real case problems, analyzing graphs, and solving numerical problems. This is where help with economics homework from professionals can turn out to be quite useful. However, whenever you have a question to solve, an assignment to complete, a case to analyze, or when doing the right graphical analysis of the topic becomes a problem, then turning to experts could help in breaking the complex problems into manageable steps for easy learning.

1. Case Analysis and Graphic Presentation

In many assignments of micro and macroeconomics as well as in production theory and MRTS, graphical analysis seems to be an important tool. One of the most challenging tasks students face is how to effectively interpret and generate graphs that capture interrelationships between labor, capital, and output. Our experts assist learners in understanding isoquant curve construction, calculation of MRTS, and conclusions derived from shifts in these curves due to the changes in either technology or input costs.

Furthermore, while solving cases students also have to use the MRTS concepts to actual business scenario. Our qualified tutors use real-life examples from different industries, to explain to the students how such firms decide to substitute labor with capital and vice versa.

2. Solving numerical and technical problems

Working out specific numerical exercises on MRTS can be quite cumbersome, especially in contexts characterized by numerous and complex calculations of marginal products or input proportions or where optimization problems have to be solved. It will often help students to get a tutor who fully understands the economic models, and who can guide users through the process of breaking down these problems. Not only do they solve the calculations but also explain the economic rationale for each calculation to make sure that students have an understanding of the overall process.

3. Providing Modern Perspectives and Insights

As industries experience a shift propelled by automation and artificial intelligence, studying MRTS from a current standpoint is vital. Using examples that mirror today’s trends and scenarios, such as the substitution of labor by automation in sectors such as e-commerce or healthcare, tutors make students understand how MRTS works. Not only does this make greater sense to the students themselves, but it also provides a more applicable and modern outlook to the course – something which is incredibly beneficial in examinations and prospective career choices.

Conclusion

This post has shown that MRTS is not just an abstract idea and is the key to understanding how firms and industries cope with technological progress and enhance efficiency. MRTS allows the students to study how economies evolve over time, and how firms make production decisions. Whether you are doing your homework or attempting to fully grasp the economic models, do not forget that turning to professional assistance and following credible resources provides new insights and perspectives into MRTS and its practical use.

In general, a student trying to navigate through the different aspects of MRTS, opting for help with economics assignments is a smart choice. No matter what kind of assistance is needed, whether graphical analysis, case studies, or numerical problems, our professional tutors are of huge benefit in presenting a students with a fresh approach, and imparting competitive advantage of solving their tasks with confidence. Therefore, the next time you are in a dilemma in solving an economics problem or case study, you should not hesitate to seek our help. Mastering economics becomes a whole lot easier with the help of a competent tutor.

0 notes

Text

CTS B - Week 3

Connecting Practice with Society

In today’s class, we covered the concept of connecting artistic and design practice to society, using Sep Verboom as an example. Quote ‘I asked myself, if I would want to spend all my life and career in a design office or a factory doing things for aesthetics and sales’ prompted me to think critically about my own potential as a designer to contribute to social causes. Verboom’s works showed how design can influence a positive change by engaging with the needs and well being of people which expanded my knowledge of a ‘socially engaged practice’, of one that creates awareness.

My group created a video skit inspired by silent films to raise awareness about giving seats to the elderly on public transport, to demonstrate how artists can address social behaviours through creative expression. The exercise helped me understand how art tools can be used to influence behaviours and mindsets, additionally, I felt like the video could have been approached differently by including interviews of people on their thoughts to create a deeper empathy and care for the elderly. A practice of this reflected in real life is the ‘gracious commuting’ campaign designed with different characters that helps remind us of good practices in a public setting. Such as ‘stand up stacey’ which aligns with our topic of giving up seats to those in need.

The lesson reinforced the importance of consciousness — being aware and keeping up to avoid risk of designs being superficial or disconnected from people we aim to help. Moving forward, I want to embed more care, understanding of cultural, social and economic conditions into my practice ensuring it resonates and contributes to society.

(276 Words)

“LTA | Gracious Commuting.” Www.lta.gov.sg, www.lta.gov.sg/content/ltagov/en/getting_around/public_transport/a_better_public_transport_experience/gracious_commuting.html.

Seng, Sabrina. “Woman Sits with Feet on MRT Seats, S’poreans Say She Looks like Stand-up Stacey.” MS News - Independent News for Singaporeans, Must Share News, 5 Sept. 2022, mustsharenews.com/woman-stand-up-stacey/. Accessed 19 Sept. 2024.

#sepverboom #graphicdesign #sociallyengageddesigner

0 notes

Text

Dholera Smart City in Gujarat: A New Era for Urbanization in India By City Expert

India has taken a step into this ambitious endeavor by the very much talked about Smart Cities initiative in an attempt to put this very ambitious dream onto the development map of the country, courtesy of the flagship initiative of Dholera Smart City, whose name alone speaks of providing a new turn to the face of urban development in the country. The project will come up near Ahmedabad in Gujarat, about 100 kilometers from the city.Dholera would not be just a smart city, but a global industrial city that would promote speeding up economic development not only in Gujarat but for the whole of the Indian sub-continent.

A Concept of Vision

Dholera Smart City would also form one of the biggest infrastructure projects ever undertaken-the Delhi-Mumbai Industrial Corridor, where a 1,500-km stretch between Delhi and Mumbai is going to be used for the construction of new industrial cities. Planned over a surface of more than 920 square kilometers, the smart city is designed with over two million citizens in the future. Strategically located, this city is close to sea ports, highways, and the proposed Dholera International Airport. Therefore, this place is sure to attract many industries and businesses.

The Dholera development plan is a concept of developing a smart city which will achieve efficient use of technology and data to further enhance delivery mechanisms of urban services and optimize resource utilization towards setting up of sustainable living environments. Therefore, it would be a city, either built on advance infrastructure which has smart grids and transport systems, water management and waste management systems, which makes the city energy efficient, green, and technologically advanced.

World-Class Infrastructure

Infrastructures of Dholera Smart City will serve the future. The city boasts of a strong transport network; however, it is its planned mass rapid transit system (MRTS) and Dholera International Airport that are yet to roll into action. These transport links will seamlessly connect with other major cities in Gujarat and India, thus increasing Dholera's role as an industrial and business hub.

One of the other future features that Dholera's infrastructure will have is the smart grids for power through a grid that would give constant and efficient power supply. The city will utilize renewable energy through solar power, with Dholera Solar Park right next door, touted to be one of the largest in India. Water resources management, too would follow this approach in regards to sustainability: Water harvesting systems more sophisticated structures are provided for rainwater harvesting, seawater desalination, and wastewater reclamation so that water supply is sufficient not only to the residents but to the industries as well.

Underground utility ducts in Dholera ensure proper protection for essential infrastructure, including power, water supply, and gas lines. The engineering design ensures easy access for maintenance. This aligns with the city's smart design philosophy, where sustainability and efficiency are adopted together.

Economic Opportunities

Dholera Smart City is building the infrastructure of the future while growing the economy. It is an investment destination for any part of the world under the plan of becoming the hub for large-scale industries. The government's business-friendly environment, along with incentives by the ports, highways, and airports, is making Dholera suitable for manufacturing, electronics, automobiles, pharmaceuticals, and renewable energy.

Thousands of employment opportunities will be created during the period of construction as well as when the industries start functioning in the smart city. The entire region will be transformed into an economic hub that shall provide employment opportunities to the residents of this region, thus augmenting the economy of Gujarat and even India.

Sustainability and Green Living

What is quite different about Dholera as compared to the other cities is that its slogan is going to be based on sustainability and green living.Dholera smart city in gujrat It has been considered important since inception that this city be designed in such a manner as to reduce the ecological footprint. With the handholds of renewable sources of energy, eco-friendly edifices, and smart resource management systems carrying the promise of eventually becoming carbon-neutral, Dholera will be developed.

The healthy and lively green areas of the Dholera region, parks, and open areas will be created. In respect to this need, the city planning allows for easy access to green areas for the residents of Dholera, with a balance between life at work, play, or rest. Dholera will, with sustainable urban development, be a model not only for other smart cities within India but also for other smart cities throughout the world.

Smart Technologies for a Better Life

Technologies would form the core of Dholera Smart City. The city would offer an integrated command and control center that would monitor and track such services in real time; it could be traffic, public safety, utilities, or waste. Such services would then be delivered more efficiently with the help of data analytics, sensors, and automation, thus settling prompt issues that may arise.

Besides that, smart services in the form of high-speed internet, app-based transport services, and smart governance would provide a smart platform that makes government services available to the citizens with ease. These will make life easier, more efficient, and connected at Dholera.

Conclusion

The future of India's urban development is Dholera Smart City. Dholera, therefore, would be a landmark example for the development of smart cities through visionary design, advancement of infrastructure, economic opportunities, and sustainability. This will, therefore, provide a reason for change in the region itself but will collectively be a reason for the overall economic development of Gujarat and India as a whole. In fact, it is a statement by the project regarding India's capability to take the lead for the design of smart, sustainable, and future-proof cities for the world.

0 notes

Text

Top 10 Things that you should know about Singapore Culture 2024

At the intersection of Southeast Asia, the dynamic and lively island nation of Singapore is situated. Singapore has grown into a major international center for trade, banking and culture because of its advantageous location between Malaysia and Indonesia. The nation is proud of its highly developed free-market economy which is open and takes a firm stand against corruption. As a participant in major international organizations such as the Trans-Pacific Partnership, ASEAN and APEC Singapore is essential to regional and worldwide economic operations. Singapore is a small country but it has achieved great progress in land reclamation and urban planning, growing its area and striking a healthy balance between natural spaces and urban density.

With four official languages English, Malay, Mandarin and Tamil reflecting the nation's dedication to pluralism, Singapore's cultural environment is as varied as its population. The nation's constitution places a strong emphasis on this multicultural character which permeates every part of Singaporean society, from politics to housing and education. In 2024 anyone hoping to go to or reside in Singapore must comprehend this dynamic city-state's distinctive blend of cultures. Be it for a short Singapore Visa or a longer one being aware of these important cultural nuances can make your time in this amazing nation even more enjoyable.

Here are the Top 10 Things that you should know about Singapore culture 2024

1. Multiracial Harmony:

The successful blending of several ethnic groups is one of Singapore's most notable cultural traits. All races are treated equally because of the national identity's strong integration of the multiracialism concept. In daily life this peaceful coexistence is demonstrated by bilingual signage and mixed-race neighbourhoods. Through initiatives in the areas of employment, housing, and education the government actively works to promote racial harmony and create an inclusive atmosphere.

Check Out: Japan Visa

2. Food: A Melting Pot for Cooking:

With a wide variety of gastronomic delights Singapore's food culture is a monument to its multiculturalism. A mainstay of Singaporean culture hawker centers combine food from many ethnic backgrounds. The dynamic culinary scene in the city is not only a means of subsistence but also a vibrant cultural experience.

3. Strict Laws and Cleanliness:

Singapore is recognized for having some of the cleanest and safest national environments in the world due in part to its strict laws and regulations. Discipline and respect for public spaces have been promoted by the stringent implementation of rules against smoking, littering, and jaywalking in public areas. Singaporeans take great pleasure in their emphasis on order and cleanliness, and tourists are expected to reciprocate.

4. Festivals and Public Holidays:

The fervour with which Singaporeans celebrate their holidays is a reflection of the country's diverse religious and cultural populace. Christmas, Deepavali, Hari Raya Puasa and Chinese New Year are major festivities. Every one of these festivities adds distinctive customs, décor and cuisine to the country's diverse cultural fabric. These festivals frequently fall on public holidays allowing Singaporeans of various backgrounds to take part in and appreciate one another's cultural customs.

5. Unique Language Blend:

Singapore has four official languages and is a linguistically diverse country. Malay is the national language, however English is the primary language of business and administration. The two most common languages in the nation, Mandarin and Tamil, represent the main ethnic groups.

6. Effective Public Transportation:

Navigating the city is made simple by Singapore's highly efficient and dependable public transit system, which is among the best in the world. All areas of the island are connected by the Mass Rapid Transit (MRT) system and a vast bus network, which makes travel convenient for both locals and visitors.

7. Respect for Elders:

Respect for seniors is ingrained in Singaporean culture which has been shaped by Confucian values that are widely practiced in the Chinese population. In social situations, younger individuals frequently address elders with honorifics and exhibit deference in both voice and behavior, demonstrating this regard.

8. Etiquette in Business:

Being aware of local business etiquette is essential for success in Singapore, a significant hub for commerce. Meetings must begin and end on time, and punctuality is highly regarded. It's customary to exchange business cards and as a show of respect, it's crucial to give and receive cards with both hands. In Singapore's corporate culture, establishing connections based on mutual respect and trust is essential.

9. Religious Diversity:

Numerous religions including Buddhism, Islam, Christianity, Hinduism and Taoism are practiced in Singapore. Since religious freedom is guaranteed by the constitution, this religious variety is both acknowledged and safeguarded by the law. Consequently, religious centers of many faiths are often situated close to one another, signifying the nation's dedication to religious tolerance. Moreover, respectful behavior and modest clothing are encouraged when visiting places of worship.

10. Environmental Consciousness:

Singapore is a small country with a dense population, but it prioritizes environmental sustainability. Because of its abundance of parks, green areas, and natural reserves, the city is known as "City in a Garden." The government's dedication to sustainability is also demonstrated by its policies that promote energy conservation and public education programs.

Conclusion:

In conclusion, Singapore is a unique travel destination in 2024 because of its rich cultural tapestry which is a stunning fusion of traditions, modernism and multiculturalism. Gaining a knowledge of these subtle cultural differences will enhance your trip and help you realize what makes Singapore unique.

0 notes

Text

The Impact of Mobile Apps on Singapore’s Economy and Daily Life

In Singapore, mobile apps have transformed various sectors, driving economic growth and enhancing the quality of life. This blog explores the impact of mobile apps on Singapore’s economy and how they are reshaping sectors such as healthcare, education, retail, and transportation.

Transforming Healthcare

Mobile App Development Singapore have revolutionised the healthcare industry by improving accessibility, efficiency, and patient care. With the rise of telemedicine apps, patients can now consult with healthcare professionals remotely, reducing the need for physical visits to clinics or hospitals. Apps like Doctor Anywhere and MyDoc allow users to book virtual consultations, access medical records, and receive prescriptions online.

These apps not only enhance convenience for patients but also alleviate the burden on healthcare facilities. They enable healthcare providers to deliver timely care, especially during emergencies or pandemics. Furthermore, mobile health apps empower individuals to monitor their health and wellness through fitness trackers, diet planners, and mental health resources, promoting healthier lifestyles.

Revolutionising Education

The education sector in Singapore has witnessed a significant transformation with the integration of mobile apps. Educational apps like Edmodo, ClassDojo, and Khan Academy facilitate interactive and personalised learning experiences for students. These apps provide access to a vast array of educational resources, enabling students to learn at their own pace and according to their preferences.

Mobile apps also support educators by offering tools for lesson planning, student assessment, and classroom management. The COVID-19 pandemic accelerated the adoption of e-learning platforms, highlighting the importance of digital tools in ensuring uninterrupted education. As a result, Singaporean students are better equipped for the digital future, with access to quality education regardless of their location.

Enhancing Retail Experiences

The retail sector in Singapore has been transformed by mobile apps, which offer consumers convenient and personalised shopping experiences. E-commerce platforms like Lazada, Shopee, and Qoo10 have gained popularity, allowing users to browse and purchase products from the comfort of their homes. These apps provide features such as personalised recommendations, secure payment options, and efficient delivery services.

Retail apps also enable businesses to reach a broader audience, offering opportunities for small and medium-sized enterprises (SMEs) to compete with larger players. By leveraging data analytics and customer insights, retailers can tailor their offerings and marketing strategies to meet the evolving needs of consumers. As a result, the retail sector has become more dynamic and customer-centric, driving economic growth and innovation.

Transforming Transportation

Mobile apps have revolutionised transportation in Singapore, enhancing convenience, efficiency, and sustainability. Ride-hailing apps like Grab and Gojek have become integral to urban mobility, offering users on-demand transportation services with just a few taps on their smartphones. These apps provide options for carpooling, bike-sharing, and food delivery, contributing to a more integrated and flexible transportation ecosystem.

Public transportation apps like SG Bus and MRT Map offer real-time information on bus and train schedules, helping commuters plan their journeys more effectively. By promoting the use of public transportation and reducing reliance on private vehicles, these apps contribute to reducing traffic congestion and carbon emissions, supporting Singapore’s vision of becoming a sustainable and smart city.

Driving Economic Growth