#mortgage company hawaii

Explore tagged Tumblr posts

Text

Sorry, parents: The American dream is only for DINKS

Homebuyers with kids will likely spend 66% of their income on a mortgage and childcare this year.

Parents in Los Angeles and San Diego can expect to spend as much as 121% and 113%, respectively.

Some Californians have moved across the country to afford to buy a home.

Thinking about buying a home this year with kids already in the picture? Get ready to dig deep.

A recent study from Zillow found that potential homebuyers with children are likely to spend 66% of their income on mortgage payments and childcare expenses — an increase of nearly 50% from 2019.

The real-estate company estimated city- and state-level childcare costs from 2009 to 2022 for the typical American family with 1.94 children by analyzing data from the Women’s Bureau of the US Department of Labor and advocacy group Child Care Aware.

According to Zillow’s analysis, in 31 of the largest 50 US metropolitan areas with available childcare cost data, families looking to buy a home can expect to spend more than 60% of their income on mortgage and childcare costs.

Some areas are even costlier, with parents in cities like Los Angeles and San Diego needing to dedicate as much as 121% and 113%, respectively. (In those areas, the cost of buying a typical home and childcare is so big relative to the median income that Zillow's calculation results in figures over 100%.)

Zillow determined that a family earning a median household income of $6,640 per month can expect to allocate $1,984 of that to childcare. If the family purchased a house at a 6.61% interest rate — the rate in early January, when the US Department of Labor released its latest data on childcare costs — and made a 10% down payment, their monthly mortgage would amount to $1,973.

That leaves just $2,683 for additional expenses like food, transportation, and healthcare. This means many households with kids are financially strained; they're likely spending more than 30% of their income on housing, well above what experts recommend.

It all adds up to a costly reality that's making the American dream of homeownership seem farther out of reach for parents than ever before.

Parents can blame a yearslong battle with inflation, as well as stubbornly high home prices and mortgage rates, for contributing to their predicament.

Based on the study, a new buyer household in the United States, making the median income, would spend 30% of it on housing. It's paying for childcare, then, that adds so much on top of the housing budget.

The upshot: Another group, less encumbered financially, appears better poised to realize the dream of homeownership: "DINKS," an acronym that stands for "dual income, no kids."

Some child-free DINKS — who boast a median net worth above $200,000 according to the Federal Reserve's Survey of Consumer Finances — devote their disposable income to luxuries like boats and expensive cars.

Without the financial obligations of raising children, such as covering medical expenses or enrolling them in daycare or private school, DINKS can save thousands of dollars a year and build greater long-term wealth.

Some DINKS use their savings to finance vacations and travel the world, like Elizabeth Johnson and her husband, who, over the past couple of years, have hiked in the Swiss Alps, snorkeled in Hawaii, and enjoyed leaf peeping in Canada.

"We hang out with other people's kids every once in a while," Johnson previously told Business Insider's Bartie Scott and Juliana Kaplan, "but then we happily just give them back to their parents."

Some Americans with kids move to places where their money goes further

One solution to the high cost of both buying a home and raising a family?

Move.

In recent years, young Americans in higher-cost states have decided to move to places that offer them a cheaper cost of living.

Janelle Crossan moved to New Braunfels, Texas, from Costa Mesa, California, in 2020 following a divorce.

She was able to become a first-time homebuyer and found a safe community to raise her son.

"I paid $1,750 for rent in a crappy little apartment in California," Crossan told BI earlier this year. "Now, three years later, my whole payment, including mortgage and property taxes, is $1,800 a month for my three-bedroom house."

Pengyu Cheng, a program manager for a tech company, told BI in 2023 that moving from California to Texas allowed him and his wife to afford their first home, giving them the confidence and security to have their first child.

"Living in California has always been expensive," Cheng said. "I knew that when my wife and I eventually expanded our family, we wouldn't be able to afford San Francisco or the Bay Area in general — even though we both earn good salaries."

8 notes

·

View notes

Text

Good point! Not just renters but anyone not on the deed.

Yeah I cannot invite you in even though this is my home. You see I live with my brother, kids, best friend, polycule, and it's their name on the paperwork.

Deeds can burn up in flames but it's all about intent/vibes which has made vampires invaluable in property disputes. There's that famous case in Hawaii where the billionaire couldn't invite people to most of "their property" because it was stolen.

Missing cases can be put to bed when the next of kin can invite vampires into the house. Devastating but also allows people to grieve properly.

Neighbors gossip about murder because so and so has been inviting vamps over and everyone thought her abusive husband had skipped town but honestly good riddance.

There's a rampant crime spree and now the FBI are involved because a mortgage company is getting kickbacks inviting vampires into everyone's homes. Worse yet insurance companies are in on the scam and jack rates on home owners insurance premiums in at-risk areas. What are you gonna do, dude can turn into smoke.

look i don’t know how reliable a source of information this website is but the idea that you can easily get rid of vampires in your home just by telling them they’re not welcome anymore is extremely funny to me

152K notes

·

View notes

Text

What is Supported Independent Living?

Supported Independent living is senior housing that focuses on self-sufficiency. If your loved one needs a little help with daily tasks but not significant hands-on care, this could be the right choice for them.

You can access SIL through your NDIS plan. This article will explore what this means for you, including how to find and engage a service provider.

What is a CCRC?

Continuing Care Retirement Communities, or CCRCs (also called Life Plan Communities) offer seniors the option to live independently, then access care services as their needs change. Typically, residents begin their CCRC residency in independent living and can later transition to other levels of care—including assisted living and skilled nursing—while still living on the same campus.

Generally, a CCRC offers a wide variety of amenities and programs designed to keep its residents active. These can include fitness classes, art workshops and happy hours, and many CCRCs feature on-site healthcare facilities.

Most CCRCs charge a one-time entrance fee and monthly service fees. Depending on the contract type, some build the cost of future care into those fees while others offer a refundable entrance fee or refundable portion of the one-time entry fee to help protect your assets. Download our free CCRC Insider's Guide Workbook to learn more about this senior living option. It is a useful resource for financial or legal advisors as well as individual consumers.

What is an ILC?

ILCs are state-chartered institutions (currently operating in California, Colorado, Hawaii, Indiana, Minnesota, Nevada, and Utah) that under certain circumstances do not qualify as “banks” under the Bank Holding Company Act. This means that a nonfinancial company may control an ILC, and it would not be subject to the same regulatory oversight and supervision as a BHCA-registered bank.

ILCs provide property line estimates to help mortgage and title companies verify that new fences or other improvements don’t encroach on neighboring properties. They are also commonly used by municipalities for construction permitting.

In a sense, an ILC is a less comprehensive version of a land survey. For example, it doesn’t examine all boundary lines or locate all utilities. For this reason, we recommend seeking a full survey to get accurate property deed dimensions before beginning any construction project. That said, our team has decades of experience supplying ILCs that satisfy mortgage and title companies. We can also recommend the best way to solve any issues that an ILC uncovers.

What is a SIL?

SIL provides NDIS participants with support services to live in their own home or share accommodation, such as a supported living arrangement, community residence, or a host family. SIL providers work with individuals and their families to develop a personalised support plan that meets their needs, goals and preferences.

The NDIS’s SIL funding covers the cost of support workers who can help with daily activities, including cooking and washing. The funds can also help with accommodation costs.

SIL stands for Safety Integrity Level and is used in functional safety standards like IEC 61508. The term SIL has become commonplace in Request for Proposals (RFPs) and purchase requirements in many industries. Nevertheless, many engineering managers don’t have a full understanding of SIL’s meaning and how to apply it in their work. This course, AN INTRODUCTION TO FUNCTIONAL SAFETY, breaks down the basics and gives attendees a clear framework to follow. SIL can be calculated from the risk assessment methodologies PHA and LOPA, using probability of failure on demand or per hour (PFD/PFH) to meet a target SIL level defined during the allocation process.

What is a CIL?

Generally speaking CIL is a way to fund paid support to help you learn new skills and live independently in the community. Usually participants will receive this funding through the National Disability Insurance Scheme (the NDIS).

Development that may be liable for CIL includes new homes and buildings such as extensions, self-build houses and annexes. The levy is payable on any new building with a gross internal floor area of over 100 square metres, but there are some types of development that can be exempt or qualify for relief from the levy – see the CIL Guidance section for more details.

A key feature of CILs is consumer control – meaning that a person with a disability is assumed to be the expert in their own needs and circumstances, and should be at the centre of decision making about how they are supported. This is why all CILs are governed by a board of directors composed of people with disabilities, as well as other community members.

0 notes

Text

FOR IMMEDIATE RELEASE:

October 17, 2023

Media Contact:

Danny Wimmer

Michigan Joins Settlements to Resolve Data Security Errors with ACI Worldwide and Inmediata

LANSING – Michigan Attorney General Dana Nessel announced two settlements today involving financial and healthcare technology companies ACI Worldwide and Inmediata. ACI Worldwide is a large-scale payment processing company, Inmediata a healthcare clearinghouse that facilitates financial and clinical transactions between healthcare providers and insurers.

“We must rely on organizations such as these to secure our financial and personal data to a reasonable and robust standard,” said Nessel. “I am happy to join my colleagues in protecting consumers and holding corporations accountable when they violate that trust.”

ACI Worldwide Settlement

Michigan joined a coalition of 48 states, the District of Columbia, and Puerto Rico in announcing a $10 million settlement with payment processor ACI Worldwide over a 2021 testing error that led to the attempted unauthorized withdrawal of $2.3 billion from the accounts of mortgage holders. Michigan will receive $246,258.97 from the settlement. A private class action settlement is providing restitution to persons affected by the testing error. Affected Michigan residents who may wish to submit claim forms must do so by November 13th, and more information on the class action settlement is available here.

ACI Worldwide is a payment processor for Nationstar Mortgage, known publicly as Mr. Cooper. On April 23, 2021, ACI was testing its Speedpay platform. Due to significant defects in ACI’s privacy and data security procedures and its technical infrastructure related to the Speedpay platform, live Mr. Cooper consumer data was entered into the system. This resulted in ACI erroneously attempting to withdraw mortgage payments from hundreds of thousands of Mr. Cooper customers on a day that was not authorized or expected. The error impacted 477,000 customers, some of whom were forced to incur overdraft or insufficient funds fees.

State regulators, including Michigan’s Department of Insurance and Financial Services, have entered into a separate agreement with ACI for an additional $10 million. The regulators’ settlement also orders ACI to take steps to avoid any future incidents, including requiring the company to use artificially created data rather than real consumer data when testing systems or software and to segregate testing or development work from its consumer payment systems.

Along with Michigan, the settlement was joined by the attorneys general of Alabama, Alaska, Arizona, Arkansas, California, Colorado, Connecticut, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Minnesota, Mississippi, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, Washington, Wisconsin, Wyoming, the District of Columbia, and Puerto Rico.

Inmediata Settlement

AG Nessel also announced that Michigan, along with 32 other state attorneys general, has reached a settlement with Inmediata, a healthcare clearinghouse that facilitates transactions between healthcare providers and insurers across the U.S. The settlement is in response to a coding issue that exposed patient information of approximately 1.5 million consumers for almost three years.

On January 15, 2019, the U.S. Department of Health & Human Services Office of Civil Rights alerted Inmediata that personal information maintained by Inmediata was available online and had been indexed by search engines, potentially allowing sensitive patient information to be viewed and downloaded by anyone with an internet connection.

Although Inmediata was alerted to the breach on January 15, 2019, the company delayed notification to impacted consumers for over three months and then sent misaddressed and unclear notices.

The settlement resolves allegations of the attorneys general that Inmediata violated state consumer protection laws, breach notification laws, and HIPAA by failing to implement reasonable data security.

Under the settlement, Inmediata has agreed to make a $1.4 million payment to the states. Michigan will receive $217,049 from the settlement. Inmediata has also agreed to overhaul its data security and breach notification practices going forward, including:

implementation of a comprehensive information security program with specific security requirements, including code review and crawling controls;

development of an incident response plan with specific policies and procedures regarding consumer notification letters; and

annual third-party security assessments for five years.

Indiana led the multistate Inmediata investigation, assisted by the Executive Committee consisting of Connecticut, Michigan, and Tennessee, and joined by Alabama, Arizona, Arkansas, Colorado, Delaware, Georgia, Iowa, Kansas, Kentucky, Louisiana, Maryland, Massachusetts, Minnesota, Mississippi, Montana, Nebraska, New Hampshire, North Carolina, Ohio, Oklahoma, Oregon, Pennsylvania, Puerto Rico, Rhode Island, South Carolina, Utah, Washington, West Virginia, and Wisconsin.

##

0 notes

Text

Best Commercial Mortgage Real Estate Loans Hawaii

Securing the right financing is pivotal when venturing into the realm of commercial real estate. At our mortgage brokerage company, we specialize in facilitating Commercial Loans — financial instruments that empower borrowers to acquire, develop, or refinance commercial properties such as office spaces, retail centers, industrial complexes, and more. These loans offer tailored solutions for businesses and investors seeking to capitalize on property opportunities while effectively managing their capital. Navigating the intricate landscape of commercial loans can be daunting, which is why partnering with us offers distinct advantages. Our seasoned experts possess an in-depth understanding of the market and lending dynamics, enabling us to tailor loan solutions that align with your objectives. We’re committed to simplifying the application process, securing competitive rates, and ensuring seamless funding. Our reputation for transparency, customer-centricity, and a track record of successful loan closures make us the ideal choice to navigate the complexities of commercial lending. For More Info Call Now — 951–963–9699 or Click Here : https://happyinvestmentsinc.com/best-commercial-mortgage-real-estate-loans-hawaii/

Achieving approval for a commercial loan requires a strategic approach. Begin by collating your financial documents, including business and personal tax returns, financial statements, and property details. Engage with our team for a consultation, allowing us to assess your needs and financial standing. Our experts will guide you in selecting the right loan type, term, and interest structure. Upon submission of your application, we initiate a thorough review process, evaluating factors such as property value, cash flow, and creditworthiness. With our assistance, you’re poised to fulfill the lender’s requirements and secure the coveted loan approval.

1 note

·

View note

Text

Are you running behind your mortgage payments or experiencing repossession of your home? Our company helps homeowners navigate all challenges and avoid foreclosure in Hawaii. We have devised a multisectoral approach that allows all clients to adopt the best method to avoid losing their homes. If you are facing a foreclosure Oahu or in Hawaii, we will assist with a practical, achievable, and well-integrated approach to help you avoid foreclosure.

1 note

·

View note

Text

Glossary of Common Terms Used During the Mortgage Process

Annual Percentage Rate (APR) is the abbreviation for the term. When comparing the mortgage's total cost, this tool is invaluable. In addition to the interest rate, the total cost of a mortgage includes both the initial and recurring charges. It's possible to compare the cost of different mortgages because the APR formula is predetermined by government regulations.

If you have a capital and interest mortgage, a portion of your monthly payment goes toward paying off the principal balance of your loan as well as the interest accrued on it. As the term progresses, you'll be making payments that will pay off your mortgage in full. As a result, a Repayment Mortgage is another name for this sort of loan.

The interest rate on a capped-rate mortgage is agreed to by both the borrower and the lender and is never allowed to rise above a predetermined percentage. There is an agreed-upon time frame for this agreement. The rate normally returns to the lender's standard variable rate after the predetermined time period. A lender's interest rate can rise and fall during the time when interest charges are capped, but they can never go higher than the capped rate.

You can choose to get a fixed or a percentage of your mortgage's total value in the form of cashback when you pay off your loan. This money could be recouped by the lender through an increase in interest rates.

Fair Charges, Easy Access, and Decent Terms are all abbreviations for the CAT marks/standards. For the purpose of making simple financial instruments with straightforward terms available to the general public, the government founded these institutions to that end. A CAT mortgage has no setup fees, no redemption fees, and interest is calculated daily. In addition, it will have a loan amount of no less than £5,000, allow you to choose your own repayment schedule, and be transferable if you ever decide to move. Finally, if you fall behind on your payments but are able to make up the difference, you won't be penalised for not purchasing the lender's insurance.

This is the end of the house-buying process, when the money is transferred and the keys are given to the new owner. Moving can be stressful, but it can also be exciting!

Buyer and seller get into a legally binding contract. Contracts for the purchase of a house are exchanged between the buyer and seller's solicitors once both parties sign the agreement. Both parties are bound by the contract at this stage.

Conveyancing is the legal procedure used to purchase and sell real estate. This is something you may accomplish on your own or have done for you by a lawyer or specialist in the field of conveyancing. A freehold purchase is a lot easier than a leasehold purchase.

It's a type of fixed-rate loan where the lender promises to lower the regular variable rate for an agreed amount of time. After the discount period expires, the best mortgage broker near me typically moves to the ordinary variable rate of the lender. Keep an eye on penalties that extend beyond the initial discount time period.

Redemption is when the borrower pays off both capital and interest and so owns their property outright. Early Redemption charges apply. When you pay off your mortgage early, whether to buy the house entirely, move, or re-mortgage, you'll have to pay early redemption fees. Before agreeing to a mortgage, always inquire about early redemption fees.

With an endowment, you'll be guaranteed to pay off your interest-only mortgage with a life insurance policy and a portion of your savings. Many forms of endowments exist, including those that are 'with profits', 'unitized with profits', and 'unit-linked.' When these policies were sold in the 1980s, they were marketed as "guaranteed" to pay off a mortgage at the end of the term. There has been a decline in investment returns on these insurance, which was formerly considered normal. A large number of mortgages may not be fully repaid at the conclusion of their terms because many policies are not worth what they were predicted to be.

Ownership equity is the difference between what a property is actually worth and how much money the owner owes on that property. There is equity of £50,000 if the home is valued at £200,000 and you owe £150,000 on the mortgage. If you were to sell right now, you would get £50,000 in cash. Negative equity occurs if the home's worth is less than the amount owed on the mortgage.

As a result of owning a freehold, you have full ownership of both the property itself and the land on which it stands.

Higher Lending Charge (HLC) - (it was previously known as a Mortgage Indemnity Guarantee). It is imposed by around three-quarters of all lenders on borrowers who are unable to put down a 10% deposit on a home. If the value of your home falls below the amount of money you borrowed, the lender will be protected by this sort of insurance. Only the lender is covered by the insurance, which usually costs £1,500.

This is a property survey designed to provide more information than a mortgage valuation, but less information than a full structural survey, for the purpose of helping potential buyers make informed decisions. It will assist both the borrower and the lender in deciding whether or not to acquire.

Monthly payments are solely used to pay the interest on a loan, not the principal. As a result, you will still owe the whole amount of money you borrowed at the conclusion of the mortgage term. If you want to pay off your mortgage at the end of the term, you should create a separate investing account into which you may put your monthly contributions. The most common types of investment vehicles are individual savings accounts (ISAs), pension plans, and endowment policies.

Independent financial advisors are known as IFAs. The Financial Services Authority is in charge of overseeing and enforcing these professionals. Having the ability to provide you with products from all financial service providers is a need for being labelled as "independent" by these firms. When only a limited number of financial institutions are available, they cannot claim to be "independent." A financial advisor might be a solo act or part of a larger organisation. In order to provide a recommendation, an IFA must do a thorough investigation of your financial situation. Then they can tailor their suggestions to your specific needs.

ISA stands for Individual Savings Account, and it is a tax-free way to hold stocks, save money, or buy life insurance. To pay off an interest-only loan, you can use the money you save in an ISA.

When a leasehold property is purchased, the Freeholder retains possession of the property until a predetermined point in the future. For many properties, the Freeholder has the right to take ownership of the property 999 years after the first date of Leasehold. Condominiums and other multiple-occupancy properties like apartments are always sold on leasehold, and they often have a shorter leasehold tenure (between 100 and 125 years). The leaseholds of individual apartments are often owned by the apartment owners themselves, while the freehold is owned by a management company in which the unit owners have a stake. Leaseholders who live in the property have the legal right to purchase their freehold under the terms of UK law, on the condition that they meet certain conditions.

The term "Life Insurance" can also refer to Term Insurance, or "Mortgage Protection Insurance," when it is expressly tied to the acquisition of real estate. Your mortgage will be reimbursed in full if you die, thanks to a tax-free lump sum payment. Level Term Life Insurance and Decreasing Term Life Insurance are only two of the many options. A mortgage insurance policy is one that covers you and your lender for as many years as you agreed to when you signed the loan documents. There is no value in these insurance policies that can be invested in or surrendered. Your age, health, and how long you want your coverage to last all have a role in how much you'll pay in premiums.

A period of time during which you have decided to keep your loan with the lender is known as a "lock-in period. It can range from six months to the entire period, depending on the arrangement. During the lock-in term, you will almost always be subject to redemption penalties if you decide to pay off your mortgage or refinance. If you have a mortgage, make sure you know how long it will take to pay it off.

Means "Loan to Value," or LTV. An assessment of how much you owe on your mortgage compared to how much your home is worth. Taking up a £157,500 mortgage on a property that costs £175,000 would have a loan-to-value (LTV) of 90%. Mortgage Indemnity Premiums are often charged on mortgages with a loan-to-value ratio of 75 percent or below. Some people don't, and it's natural to wonder why.

#mortgage hawaii#mortgage oahu#mortgage lenders near me#mortgage brokers hawaii#mortgage companies hawaii#mortgage company hawaii#mortgage companies oahu#mortgage home loans hawaii

0 notes

Photo

Are you planning to have a full search for your title in Hawaii? Call Indus Abstract Services!

https://www.ias.us/title-search-services-hawaii/

0 notes

Text

The Financial Freedom #1 | 2022

This story originally appeared on LearnVest.

Each July 4 we celebrate the nation’s freedom with fireworks, barbecues and parades.

Yet for many Americans, personal freedom can be more sobering—because it’s often tied to the less-than-stellar state of their finances.

“My husband and I took out a 30-year mortgage, and it felt like having a rock tied around my neck,” says Paige Hunter, referring to the feeling of hopelessness that motivated the couple to rework their budget and aggressively pay down their mortgage. As a result, the Hunters are now “reaping some serious happy rewards.”

That’s just one of several feel-good stories we sourced from people across the U.S. who’ve taken control of their money and achieved true financial freedom—whether by padding a retirement account, building and then selling a business, or paying off student loans.

So here’s hoping their liberating experiences inspire you this Independence Day.

“I Paid Off $30K of Debt Before Saying ‘I Do’”

Christina Yumul, 33, public relations executive, Maui, Hawaii

“When I moved from San Diego to Maui at 26, I was about $50,000 in debt due to college loans, overspending on vacations, and living the single life with my girlfriends.

Ironically, even though Maui has a higher cost of living, the lifestyle is more affordable. Nightly cocktails, expensive dinners, and weekend road trips to Palm Springs and Vegas became a thing of the past. Instead, my free time is spent hiking, at the beach, and at friends’ houses—all of which provides the same emotional satisfaction but without the high cost.

Very slowly, I started paying more than the monthly minimums on my debt, and in a couple of years, I paid off my car. My original plan was to buy a new car, but then I got engaged. My fiancé was very good with his money and never had debt. I was embarrassed by the $30,000 of debt I was bringing to the marriage, so I made a decision to buckle down and pay it off before our wedding in two years.

I signed up for automatic transfers from my paychecks to my loans. When I went to the grocery store, I only shopped for what I needed that day. I carried only my debit card in my wallet. And a couple months before our wedding, I made the last payment.

Although my initial motivation was to feel financially confident going into my marriage, going debt-free has meant so much more. I have changed my spending habits, and I now have my own company.

My husband and I save, so that we have money allocated for goals and don’t have to worry about paying it off after. Up next? We’re budgeting for a trip to New Zealand.

♦♦♦ "So do you also want financial freedom?

♦♦♦ Do you also want to get rid of your debt?

♦♦♦ Do you also want to fulfill your dreams?

So my #1 recommendation is to work here everyday and earn money without any investment or without leaving your home?

My #1 recommendation >>> https://bit.ly/3sKh3KC

You can do this as a part time, working for your own time?

And yes, if you want to live a millionaire life and become a millionaire from time to time and earn millions of dollars, then you can subscribe to the channel on telegram by visiting the link for the country ...

SUBSCRIBE on Telegram >>> https://linktr.ee/profitchannel

#financial#financial freedom#sucessstory#sucessc#make money online#work from home#millionaremindset#millionaire lifestyle

9 notes

·

View notes

Text

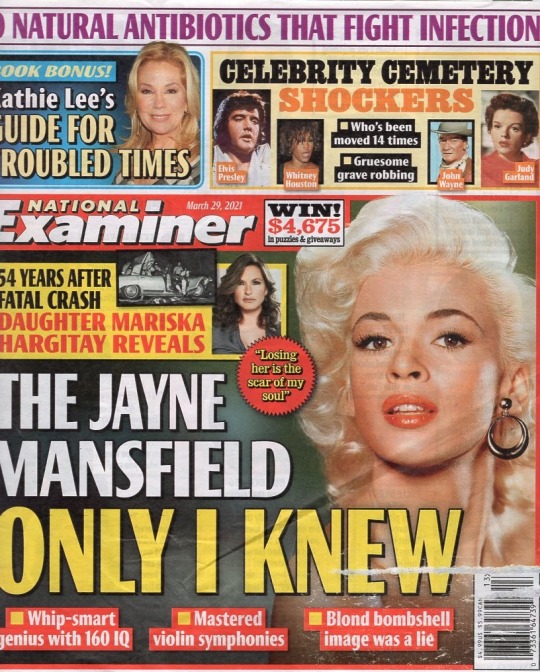

National Examiner, March 29

You can buy a copy of this issue for your very own at my eBay store: https://www.ebay.com/str/bradentonbooks

Cover: The Jayne Mansfield only her daughter Mariska Hargitay knew

Page 2: They're Aging Like Fine Wine -- celebs reflect on the wonders of getting older -- Candice Bergen, Anthony Hopkins, Halle Berry, Diane Keaton, Jennifer Lopez, Sandra Bullock, Bette Davis, Reese Witherspoon, Sally Field

Page 3: Helen Mirren, Jamie Lee Curtis, Madonna, Sigourney Weaver, Michael Caine, Jennifer Aniston, Goldie Hawn, Diane Lane

Page 4: Warren Beatty's roles and costumes

Page 6: Since her 2016 split from Brad Pitt, Angelina Jolie has had to keep calm and carry on with six growing kids to think about and she admits the past few years have been pretty hard and she's been focusing on healing her family -- the six kids she shares with Brad, who range in age from 12 to 19, have been looking out for her too -- the 45-year-old is looking forward to her 50s and she feels that she's going to hit her stride in her 50s

Page 7: Canine Cuisine -- simple home-cooked fare for Fido

Page 9: Reach for at-home antibiotics

Page 10: When a Texas grocery store lost power during the devastating recent storm, they did something unimaginably generous -- they allowed all the customers to leave with whatever was in the shopping carts without paying for anything -- the shoppers at an H-E-B supermarket in Leander didn't even have to cough up a dime as they proceeded through the checkout lanes, even if they had hundreds of dollars' worth of food and supplies weighing down their wagons

Page 11: Your Health -- crying is healthy

* If you suffer from insomnia, try wearing socks to bed

Page 12: Hollywood Cemetery Shockers -- Elvis Presley, Marilyn Monroe, Whitney Houston, John Wayne

Page 13: James Brown, Michael Todd, Princess Diana, Sammy Davis Jr., Judy Garland, Steve Irwin

Page 14: Dear Tony, America's Top Psychic Healer -- the secret of life is so simple and attainable -- Tony predicts movie and TV star Robin Wright's move to being a director will be very successful and there will be many more films to come

Page 15: A Florida man just received the biggest surprise of his long life at the party to celebrate his 100th birthday -- someone had found and returned his wedding ring that he lost five years earlier while shopping at an Aldi's in Minnesota

Page 16: Kathie Lee Gifford: It's never too late to go after your dreams

Page 18: Happy Days mom Marion Ross is 92 now, but she still holds a memory about the legendary Cary Grant close to her heart -- back in 1959, when she was married to Freeman Meskimen, the actress was working on a film with the handsome star when she discovered she might be pregnant but she wasn't absolutely sure and so she didn't share her suspicions with anyone until one day, when a scene called for her to do something she wasn't sure a possibly pregnant woman should be doing, she revealed her secret to Cary Grant -- he sat down next to her, put his arm around her and said sweetly You're pregnant! and when she looked up at him, he had tears in his eyes; he was so excited for her and they had this marvelous moment together -- Marion said her husband was less than thrilled when her pregnancy was confirmed and they divorced a few years later

Page 19: An Indiana middle-school principal made the cut when he helped a kid out of a hairy situation -- when an eighth-grader at Stonybrook in Warren Township confided in Jason Smith he couldn't take his hat off because he was embarrassed about his uneven haircut, Jason offered to really straighten things out if he promised to return to class -- Jason has been cutting hair most of his life and he played college basketball and cut his teammates' hair before games, and he's been cutting his son's hair for 17 years and he had professional clippers and edgers at home, so he said if he went home and got his clippers and lined the student up, would he go back to class? and the student said yes, so Jason gave the kid a buzz and the happy student went back to class -- Jason says he knows a bad haircut may sound like a small thing, but to a boy that age, grappling with peer pressure, a bad 'do is a real don't

Page 20: Cover Story -- My mom Jayne Mansfield -- Mariska Hargitay reveals bombshell truths about the beloved sex symbol

Page 22: Use your noodle -- pool toy swims to the rescue

Page 24: Back when Calvin Tyler was in college in the early 1960s, he had such a hard time scraping together tuition money that he had to drop out before finishing his senior year and take a job as a UPS driver -- fast-forward a few decades: Calvin has just donated $20 million to Morgan State University in Baltimore, his alma mater

Page 25: A wounded veteran in Temecula, California, got the surprise of his life when he received a mortgage-free home courtesy of the Gary Sinise Foundation -- Josue Barron, who had joined the Marines at age 17, lost both his left leg and his left eye while serving in Afghanistan in 2010

Page 26: Dreamy hunk Patrick Swayze fell for one of his co-stars while filming the romantic movie Ghost, but the object of his affection wasn't on-screen love Demi Moore; it was Whoopi Goldberg

Page 28: 20 things you didn't know about James Bond actor Daniel Craig

Page 30: Spunky Hayley Arceneaux won a battle with bone cancer when she was 10 years old, and grew up to become a physician assistant in child oncology at St. Jude's Children's Hospital, where she was treated and if that wasn't enough, Hayley is going to blast off on a space flight -- the super survivor, who's now 29, was selected by the St. Jude's staff from hundreds of other employees to represent the famous hospital on the first-ever civilian spaceflight, arranged by the company SpaceX, to take place at the closing of 2021

Page 40: It's crystal clear -- the healing starts here -- crystals are very effective when it comes to healing, especially with one's emotion and they have special energies in different ways

Page 42: How to lower your COVID risk -- with new variants of the virus documented in the U.S., it's important to stay vigilant

Page 44: Eyes on the Stars -- Rebecca Holden of Knight Rider (picture), Lou Diamond Phillips of Prodigal Son in NYC (picture), Katharine McPhee admitted she was concerned with what people would think early on during her romance with 71-year-old David Foster, the daughter of John Travolta and Kelly Preston named Ella Blue Travolta is following in the footsteps of her actor parents by starring in Get Lost which is a modern-day retelling of Alice in Wonderland, Sarah Silverman recently apologized for mocking Paris Hilton at the 2007 MTV Awards, Nicolas Cage has tied the knot for the fifth time to Riko Shibata, Metallica have donated $75,000 to Feeding America via their All Within My Hands nonprofit and the funds are earmarked to aid folks in Texas who were affected by deadly winter storms

Page 45: Orlando Bloom running on the beach while vacationing in Hawaii (picture), Antonio Banderas (picture), Tom Jones takes the stage in the U.K. (picture), Robin Roberts near ABC's NYC studio (picture), Aaron Carter and fiancee Melanie Martin say they have a baby on the way nearly 10 months after she'd suffered a miscarriage, Dustin Diamond was never married to his galpal Jennifer Misner according to his death certificate, Liam Neeson attended a NYC screening of his new movie to thank viewers for coming to the theater on the first day Big Apple cinemas reopened after being shuttered by COVID-19 last year

Page 46: A single mom of three was struggling to do everything on her own, but there was one problem she lacked the skills and money to handle -- her house in Sudbury, Massachusetts was falling apart and that's when some kindly Good Samaritans stepped in with their toolbelts and performed the extensive home repairs she need at no charge

Page 47: Parenting Advice From the Stars -- Reese Witherspoon, Busy Philipps, Mark Consuelos and Kelly Ripa, Ryan Reynolds and Blake Lively, Jada Pinkett Smith and Will Smith, Sarah Michelle Gellar, Jennifer Garner

#tabloid#tabloid toc#tabloidtoc#jayne mansfield#mariska hargitay#warren beatty#angelina jolie#angelina jolie's kids#kathie lee gifford#cary grant#marion ross#gary sinise#ghost#patrick swayze#demi moore#whoopi goldberg#daniel craig#rebecca holden#lou diamond phillips#orlando bloom#antonio banderas#tom jones#robin roberts#katharine mcphee#david foster#john travolta#kelly preston#ella blue travolta#sarah silverman#paris hilton

7 notes

·

View notes

Text

Heating and cooling companies chapel hill nc

Mortgage brokers play a needed and natural part upon economy. Nowadays, mortgage broker cary nc bond becomes giving her a very bond and is also required with the who find themselves engaged available of mortgage broker business, mortgage lending business. Mortgage brokers or lenders or dealers should obtain license and permit of your licensing department. This mortgage broker license is called for with the mortgage brokers who're engaged available of mortgage in state. To have this mortgage broker license, drug abuse is needed to obtain mortgage broker bond from the best state. Mortgage broker bonds are issued down to the statutes and ordinance of the state of Hawaii and federal jurisdiction.

Mortgage broker bond ensures proper performance of mortgage business without the default act belonging to the mortgage broker or lender. Mortgage broker bonds are issued upon various areas of the states and many of the industries analysed the demand for mortgage broker bond while in the state. Mortgage broker bond protects the oblige with the non-performance of contract by the key in the state of Hawaii and enforce the mortgage broker to grant a performance. Today, trend was changed and the general public enforce to issue mortgage broker bonds down to the state of Hawaii ordinance. Mortgage broker bond also forms component of different varieties of surety bonds this type of mortgage broker bond are issued in separate forms and various bond amounts.

Mortgage broker bonds play a highly effective role while in the economy and the only thing most every place in the world mortgage broker bonds are required. Mortgage broker bond are issued down to the regulations of the state of Hawaii statutes and ordinance. All mortgage brokers of the state of Hawaii need to have a mortgage broker bond from the best surety bonding company. Nowadays, more amount of surety Bonding Company comes toward issue mortgage broker surety bond to folks down to their requirement and needs. This mortgage broker bonds are issued to folks down to their requirement and various premiums.

When folks recognize the aim and employ of surety bond, then it can probably be said that non-performance and default act belonging to the contract will likely be avoided and prevented. After the mortgage broker or lender or dealer fails to execute the contract, then an oblige can sue the mortgage broker or lender or dealer for non-performance of contract. The oblige has every right court action both mortgage broker and surety with the non-performance of contract. When all requirements are satisfied and legally published by drug abuse, mortgage broker bond will likely be issued in to the applicant. Mortgage broker bond and mortgage broker license are an excellent requirements want for the mortgage broker or lender or dealer.

1 note

·

View note

Text

Everything You Need To Know About Refinancing

Refinancing is the process of paying off your existing home loan by taking out a new loan on it. This allows you to get a low-interest rate, better repayment options, or access the equity of your home to get access to cash. If you are considering this as an option, the next step is to choose the right mortgage lender. Infinite Financial LLC, a mortgage company in Hawaii, not only offers refinancing options but also assists you well throughout the process.

Refinancing a home loan may offer many advantages, from lower monthly payments to cashing out on equity for home improvements. Furthermore, 2021 might be perhaps be the best year to think about refinancing. Interest rates are extremely low, and with the best refinance rates in Hawaii, property owners can secure these low rates.

Here are a few important reasons that will have you consider refinancing your home:

Reduce your monthly payments with refinancing

Get a reduced rate of interest compared to your existing rate.

Increase the term and decrease the interest rate of your loan, which will reduce your monthly burden. Let's assume you have 10 years left on a 15 year mortgage. With refinancing you can get a lower interest rate, and cash out some of your equity. Remember that as a rule of thumb, you'll have to pay between 1-3% of your loan amount for closing costs, so consider that before refinancing.

Cut down the total cost of your loan

In the case you are fine with the existing scheduled installment, refinancing your home loan with a shorter term and low-interest rate can conceivably save you a lot of cash in monthly installments. This can be an appealing alternative if your monetary circumstance has improved since you originally purchased your home—the more you are ready to pay every month now, the bigger the savings you will see once your home loan is cleared.

Pay for Home Renovation or other Projects

If you have been paying your home loan for a couple of years, you have probably developed a considerable value for your home, particularly given Hawaii's unshakable real estate market, prices are likely to go higher. You can use this value by taking out another home loan that is bigger than your present home loan balance, paying it off, and utilizing the excess money for your needs. Home renovation and redesigning are typical needs to utilize cast-out refinance.

Pay off Debt Faster

Speaking of credit card dues and personal loans, if you have any debt that you are carrying balances on, then you can pay this off with your cash out refinance. The idea here is to refinance your mortgage slightly higher than your existing balance and use that extra amount to clear your debt that is chargeable at a higher rate of interest.

Refinancing a mortgage can either be used to lower existing monthly payments to something more manageable, or to get some cash out on the value of equity of your house, which can be further used to pay your other bills. Ian Ho of Infinite Financial LLC is a renowned Mortgage Lender in refinancing, if you wish to consider your options then he is available to help.

1 note

·

View note

Text

Improve your credit score in Anchorage, AK

Mistakes on your credit report are common. Working with a credit repair service can help you fix those errors. We researched the best credit repair in Anchorage, AK. Those who need help restoring their credit should look for reputable companies willing to customize their plans to match individual needs.

Here is the Best 8 Credit Repair Companies in Anchorage, AK

1. CreditRepairEase.com: Overall Best Credit Repair firm in Anchorage, AK

Credit Repair Ease makes it easy for people looking for the best local credit repair services provider. We are available in 51 states of the United States and committed to offering you the best credit repair service. Whether you live in Alabama, California or New York, or any other state of United States, we help you from your location and you don't have to take much burden.

2. Go Clean Credit

Go Clean Credit is one of the top credit repair companies in Anchorage, offering personalized credit correction services since 2003. Because restoring your credit can be daunting, Go Clean Credit makes it a hands-on process specified for your needs. You may be dealing with mortgage correction, judgments, bankruptcies, student loans or identity theft. Go Clean Credit provides a trusted source for credit repair companies in Hawaii. Their client-cantered approach pairs credit restoration with credit education to keep you on the right track.

3. Lexington Law Firm

Lexington Law has worked to help thousands of clients in Alaska with our credit repair services. We are eager to continue fighting for a fair and accurate credit report for all. Across the country, Lexington Law clients have seen millions of unfair, inaccurate and unsubstantiated negative items removed from their credit reports. As trusted leaders in credit repair, we've helped clients challenge nearly every credit problem, including bankruptcies, tax liens, late payments, collections and more.

4. CRE Credit Services

CRE Credit Services has become the proven and trusted leader in the nation for credit repair and credit education services. Many banks, lenders, mortgage brokers, real estate professionals, and insurance companies send their clients to CRE so that they can become qualified or more qualified for a mortgage, vehicle, better insurance rates, or better interest rates. We have saved clients tens of millions of dollars in interest by improving their credit and making them more well qualified buyers and more financially secure. We offer a completely free credit analysis and consultation from one of our credit experts. We are the industry leaders when it comes to credit repair results and education and offer a full money back guarantee to our clients!

5. THE CREDIT PROS

THE CREDIT PROS Credit Repair offers help to improve your credit history whether you have, late payments, charge-offs, collections, inquiries, bankruptcies, repossessions, debt validation, or judgments. We aim at restoring and correcting a poor credit score in Acampo. Although there are number of credit repair companies in Acampo but professionals at Top Rank Credit Repair takes personal interest in your situation. Our team remains in touch with the clients to discuss progress, questions or concerns. We believe that there should not be any communication gap between the clients and the company, so we stick to this rule determinately. We, Top Rank Credit Repair, are there in Acampo to undo the effects of bad credit history on your life and reroute it to a better path.

6. The Credit Xperts

The Credit Xperts is a reputable credit repair company that can legally and ethically remove negative items from your credit report, and thereby improve your credit score. Information that is contained in your credit file must be reported according to a law called the Fair Credit Reporting Act (FCRA). If the information isn’t 100% accurate or 100% verifiable then it must be corrected or removed. With less negative information on your credit profile, the result is most often a nice increase in your credit score.

7. My Credit Focus

Here at My Credit Focus, we take pride in being a leader in the credit repair industry and it is our commitment for excellence that has helped us to nurture a successful network of satisfied customers over the years. Stressing on a personalized work approach, we treat every credit repair case with complete urgency and this has helped us to evolve as a one top destination for people who are looking for convenient and timely credit repair services. We have the much-needed endorsements and recommendations from the major financial institutions, banks and mortgage providers and as such it is easier for us to take necessary actions that are required to make your credit report glitch free. Professional services backed by competitive price rates make My Credit Focus a commendable choice to opt for during adverse credit issues.

To learn more about the top Credit repair companies in Anchorage, AK, contact Credit Repair Ease! We can help you in Repair and enhance your credit that help you in building a good financial solution. What are you waiting for? Call on (888) 803-7889 now to schedule a free consultation!

1 note

·

View note

Video

youtube

How to Build a Passive Rental Portfolio with Lane Kawaoka

https://www.jayconner.com/how-to-build-a-passive-rental-portfolio-with-lane-kawaoka/

Jay Conner (00:09): Well hello and welcome back to another exciting episode of Real Estate Investing with Jay Conner. I'm Jay Conner, your host and The Private Money Authority. And if this is your first time to the show, I want to give you a special welcome here on the show. We talk about everything related to real estate investing. We talk about all kinds of deals, we talk about single family houses, apartments, commercial land, sell storage and on and on and on. And if you've been following and listening in for a little while, you know I've had just some amazing guests and experts here on the show and today is no exception. But before I bring on my special guests today, I've got a free gift for everybody and that is if you are looking for more funding for your deals, regardless of what your mortgage broker or your hard money lender or such my site, I've got a free on demand online class that gives you the 5 steps that shows you exactly how I went from having no funding to over $2 million in funding in less than 90 days.

Jay Conner (01:12): So you can check it out and get right on over to www.JayConner.com/MoneyPodcast. So with that, I am so excited to have as my guest today, a good friend of mine also, we're in a mastermind group. His name is Lane Kawaoka and he currently owns 2,600 units as in apartments and et cetera across the United States. What you're going to love about listening to Lane today is that he is truly a virtual investor, meaning he lives in Hawaii, but all of his investments are in elsewhere in the United States. So we recently quit his day job as a professional engineer and he is now enjoying the wealth and the freedom that I know all of you all are looking for.

Jay Conner (02:11): So what Lane does is he partners with investors who want to build a portfolio but are too busy to mess with the tenants and the toilets and the termites, et cetera, by curating opportunities. And his company, which was called the HUI Deal Pipeline Club. Whereas investors have personal access to him and know that Lane is perfectly putting his money on the line too as well. Well, his pipeline club has acquired over $155 million of real estate and it's acquired by syndicating over $15 million of private equity just since 2016 so he's also another great connection as I am in this world of private money. So what Lane does is he reverse engineers the wealth building strategies that the rich use to the middle class via the 50 investing podcast, which you can check out. It's SimplePassiveCashflow.com and Lane's mission is to help hardworking professionals out of the rat race one free strategy call at a time. So with that, Lane welcome to the show!

Lane Kawaoka (03:15): Hey, thanks for having me, Jay. Aloha!

Jay Conner (03:17): Aloha. I love it. I love it. Like what's that thing you call when you put them around the neck and they welcome you to Hawaii, a lei. There you go. There you go. Yeah, well, as I said about Lane and I are in a high end mastermind group and we've gotten to know each other and in fact we were in the same focus group at our last mastermind meeting and I was just very, very intrigued with Lane and what he's got going on and it's therefore invited him here to the show. So whether you are a investor with capital or if you are a real estate investor and you're just sort of tired of going to the local REIA club, hanging around some broke people and you actually want to change what that looks like, you're definitely going to want to tune in today closely and learn how to connect with Lane. So Lane, give us your background story. How did you get, well, first of all, before you give us your background story, give us an overview of what you've got going on in this world of real estate investing. I mean, you've got over 2,600 units. What does that look like?

Lane Kawaoka (04:23): Yeah. So I'm kind of more evolved buy and hold investor instead of buying one of single family homes these days, I get sent apartment deals that get syndicated and I get to know the operators and sponsors and I do my due diligence, run the numbers, get the PNLs and rent rolls. Then I see if I want to invest and to bring along my investors with me.

Jay Conner (04:45): I got you. So you just said through syndication, just to make sure everybody understands what we're talking about. What do you mean when you say syndication?

Lane Kawaoka (04:56): Yeah, so a lot of these properties that, you know, say you're buying a hundred unit building, you know, you're going to need a couple of million dollars with down payment and you know, potentially funding from someone like yourself. But you know, you're going to get that private equity raise to get the big loan with the bank who controls 80% of it and you're going to pick up a $5 million property. Most people don't have $2 million lying around, nor is it very smart to you know, most of my investors, we go by this principle, we don't put any more than 5% of our net worth and to any one deal, [right?] So we diversify it over multitude of these types of syndications.

Jay Conner (05:38): So really what we're saying, when you say syndication, what we're talking about is using other people's money, private money, and having them invest into the deals with you. Right?

Lane Kawaoka (05:46): Right, right. So we create a couple of asset classes for general partners and limited partners, you know, limit partners, very little liability. They don't do anything other than bring your money in and check some monthly statements and hopefully we all get to the destination. Right?

Jay Conner (06:05): Exactly. Exactly. So you're living in Hawaii, none of your investments are there. All of your commercial properties are elsewhere in the United States. So how do you decide where you want to invest and where to go look for deals?

Lane Kawaoka (06:23): Yeah, I mean, my first criteria is cash flow. So the rent to value ratio is kind of what governs where I even start looking. So just like when I was buying single family homes, you know, I'm looking for a hundred thousand dollar house that rents for at least a thousand dollars a month. Because at that point I know I can pay all my expenses, all my mortgage expenses, and have a little bit buffer there to be able to cash flow because let's face it, I think over sessions coming up in the future and you know, even if the price goes down a little bit, I still want to be able to cash flow

Jay Conner (06:59): sure. That makes sense. So is there any particular area of the country or cities that you are focusing on or not focusing on?

Lane Kawaoka (07:09): Yeah, I mean most of the deals that I kind of look at are in the Southeast. More of the red States with very landlord friendly and a lot of blue color job force growth out there. A lot of manufacturing. Some of these places might be more tertiary market settlers. People hear less about, you know, like a Huntsville, Alabama, Birmingham, Alabama, Gulf port, Mississippi, Lake Charles, Louisiana. You know, those are typical markets that we like to target as emerging markets.

Jay Conner (07:43): I got ya. So let's say you know, you've determined a particular city or area or the Southeast that you want to focus on. So where do you go find the deals? I mean there's other websites that you use. Do you use direct mail campaigns? I mean, if somebody is starting out, where do they go to look?

Lane Kawaoka (08:01): Yeah, I mean if you're starting out, I mean, I hate to say this, but you don't have a shot. I mean, I think in single family homes, we can all agree, most deals, 80% of them are found off market in the commercial realm, over 50 units, 80% of deals are controlled by brokers. Unless you close a hundred or 200 units before, he ain't going to get a shot at closing. This next one, people are saying, well, what about the other 20% that are out there? It's like, yeah, you can direct market a sophisticated seller who owns an apartment, but unless that property is some huge issues and you know, I target properties that are 90% occupied or more, so I can get that qualified for them. Fannie Mae, Freddie Mac, non-recourse Monday, I won't really want to deal with those 20% problem property even though they're out there. So it's an unfair game.

Jay Conner (08:54): Yeah. So you

Jay Conner (08:56): say if you've never done one of these deals is going to be very hard for you to break in. So how does somebody start?

Lane Kawaoka (09:04): Well, I mean that's where most of our investors, they've done a bunch of single family homes. They fill up their net worth to be half a million dollars or more. They've gotten sophisticated in terms of they know the risks of real estate and they know how it works. But then they come into deals as a passive investor and they invest anywhere from $30,000 to $50,000 into a deal. And it's kind of buying your way into a big company. But it's, you know, you know the operators,

Jay Conner (09:36): right? So in other words, to really get started in this game, you need to be partnering up someone starting out. It needs to be like partnering up with someone like you that's already got the relationships that already knows the ropes that already knows how to do the workings of the deal. Right?

Lane Kawaoka (09:52): Right! And because we follow, we follow SPC protocol and there's a big thing about mass smart it being out there. So a lot of it, is you have to have a preexisting relationship with the sponsor you're going to work with. [Right] Most deals out there, 90 to 97% of deals are for non-acute investors, but you need to have a preexisting relationship.

Jay Conner (10:18): Exactly. I got you. So what's a realistic ride-over return that people can anticipate to get in these types of deals?

Lane Kawaoka (10:26): You know, from the get go, a lot of these properties with prudent leverage on it, your cash line, you know, high single digits, you know, maybe 8% that's usually, but these properties along of course cap rate compression has kind of taken over and it's hard to find these properties, which is why you've got to get about a thousand properties to find one that actually works. But the kind of deals that we kind of folk it's on or actually today, but there's some kind of value add opportunity. For example, putting about $4,000 into every unit with new paint, new flooring. And then it's just like on a pig. So they, we can raise those rents. 50 a hundred dollars if you get that bump in net operating income, which in commercial real estate, that's your operating income divided by your cap rate equals your, market place.

Jay Conner (11:22): Okay. So lane, you know, we hear people in your space and apartments talking about primary, you know, secondary, you know, other types of markets. So what's your comment and thought about, you know, should you invest in particular kinds of markets or not invest in particular kinds of markets?

Lane Kawaoka (11:42): Yeah, so I mean just to kind of define it for folks who don't know what primary, secondary, tertiary markets are. Primary markets are your top tier markets like Los Angeles, Hawaii, York, San Francisco, Seattle. You're not going to find the rent to value ratios out there to be able to cash flow. Now you know, I'm not going to knock anybody strategy in terms of investing, but my strategy is I want to cash flow on the property because my number one was not to lose money. You know, [that's a good rule.] You know that whole, you know, investing in those kinds of markets. Yeah. Everybody wants to live in a place like Seattle or San Francisco and generally the prices are going to be going up. But you know, we all seen what happened in the past and there's always going to be another recession where the prices kind of tank.

Lane Kawaoka (12:36): Again, I would rather skew my portfolio to more of, Hey, the property creates more rental income than it has an expenses and it can support itself. You regardless of what the market price is and when I can do that, I can sell at the right time whenever I want, at my price I want to be in. So to do that you need to go to a little bit off the beaten path to secondary markets like Birmingham, Atlanta, Indianapolis, Kansas City, Memphis, Little Rock or tertiary markets, which are about 50 a hundred thousand in population. Like you know, I guess El Paso is probably a larger Trisha market, but a Lake, Charles, Louisiana, Huntsville, Alabama would be good examples of tertiary markets.

Jay Conner (13:24): All right, I got you now. So that's the markets. So let's talk about for a moment the different kinds of properties or assets. So you know, in the commercial world you hear people talking about class A, assets class B, assets, class C assets. First of all, define for everybody what are these different types of classes of assets and what should you invest in?

Lane Kawaoka (13:48): Yeah, so the A-class or your brand new properties, these are the luxury assets that you know are usually brand new builds built anywhere from the last 20 years till now. The class B assets are kind of your 1980s 1990s vintage, a little bit older. And then the class C assets are like your 1950s to 1970s it doesn't go by age. There's no hard and fast rule, but you know, you talk to a broker, of course they're gonna bump up the rating on you for one grade, right? But you know, investors, you know, kinda know this lingo and they can kind of know what kind of class of building it is. But you know, just like how I said you don't invest in primary markets, you don't really want to be investing for class a luxury. We kind of target class B and C because that's where we can get a bargain. And we're not competing with unsophisticated investors just looking for a choppy asset. Right.

Jay Conner (14:45): That makes sense. Now you've mentioned a couple of times, you know there's another recession coming and of there always is. Nobody knows when for sure, but I know that you practice what you preach and you invest in what you would call recession proof assets. So other than say apartments or rentals, I have you got any other, of course nothing's guaranteed, but anything, any other what you would refer to as recession? Proof of assets?

Lane Kawaoka (15:15): Yeah, I mean another option are like mobile home parks. You know, I think when you talk about mobile home parks, people think about trailer homes, which that scares a lot of people off and that's a good sign. When people are scared on sophisticated, dumb money doesn't follow. So mobile home parks in a recession, if what you're thinking is people are going to the A class, people are going to move to the Bs, the Bs, they're going to move to the Cs and move into mobile home parks. It's an asset class that they aren't going to build any more of because of late on, no politician wants the responsible for permitting a mobile home park and also mobile home parks. Don't generate revenue for the city. So cities and counties don't want them, so they're, you know, most people in America believe it or not make under $30,000 and they need good housing like mobile home parks. That's one form. I'm, you know, I'm kind of getting into that a little bit. I know apartments the best, but I understand it's smart to invest in different asset classes. It's still sort of impacted by the economy. If you want to really go to the deep end and get totally non for later with the economy, I would say like settlement investing would be another good one. You know, investing off people's life insurances when they die, you get paid. Is that Saint out there? Nothing guaranteed more than death and taxes. Right?

Jay Conner (16:38): Right! Interesting. Interesting. Now I heard you mentioned this a few minutes ago, but I want to drill down on it. You referred to the rent to value ratio and that's you know, a common phrase in the broader commercial. So first of all, explain to everybody what do you mean by rent to value ratio and then what is your rule of thumb on what the ratio needs to be for the deal to make sense?

Lane Kawaoka (17:00): Yeah, so you know, just a quick example, some of the first properties when I was purchasing rental properties was a hundred thousand dollar house that rented for a thousand dollars a month. Threats evaluation. As you take the monthly rent divided by the purchase price, and that's the rent to value ratio, you're looking for something 1% or higher, 2% awesome. But it's sort of hard to find good areas. That's not a war zone, but you know, you're going to have to put it into the spreadsheet and go down. But line by line and every expense and income, but from a quick and dirty way of doing this, that the rent to value ratio above 1% is a good indicator that shows good cash flow, now I invest off cash flow. That may not be your, your listeners personal strategy. But when I'm investing off cash, I look for that 1% indicator. You know, like here in Hawaii, you know, this million dollar house rents for $3,000 a month. That's a 0.3%

Jay Conner (18:04): that works doesn't fit your formula, does it?

Lane Kawaoka (18:06): Yeah. Yeah. You know, it's the California will say no one all, you know, that doesn't work.

Jay Conner (18:12): Right. I got you. And you know I know this about you Lane, and that is, you know, it wasn't too long ago that you retired from your day job as an engineer, but you've been building this empire of real estate assets while doing a day job. How in the world do you do that? How do you find the time to do the, you know, actionable items that you gotta do in order to build this kind of investment company while you're working full time?

Lane Kawaoka (18:45): Yeah, I mean when I was just picking up single family homes my first five, seven years, you know, I use property management companies, you know, they're well worth, but 10% of your income that you bring in. Someone told me that you know, you don't do things unless you can scale it to seven acres and a single family homes are a great way to get started. Especially turnkey rentals. You know, like my first 20 podcasts were all about turnkey rentals, how I started. But as your network grows, you kind of drift into more syndications and private placements like all I have. And yes we use property managers, but there's also asset managers who are another layer of managers who kind of make sure we're doing the right thing with the asset and they are partners aligned with the passive investors. So everybody has skin in the game. And that's a key component that I don't invest without.

Jay Conner (19:40): Well that makes sense. That makes sense. Well, Lane, I know we put together a special URL for my listeners, which is www.jayconner.com/Lane, and tell our audience what is that URL address and why would they want to go there?

Lane Kawaoka (20:01): Yeah, so one thing that I've kind of, pretty much the only product I've made is, you know, your network is your net worth is what they say. And I work with high paid professionals who have money, most of which are accredited and you know, to get access to these deals, you've got to build up your network. Unfortunately, the worst place to go is these pre internet forums and the local real estate club because let's face it, they're just a bunch of broke people, you know, how do you prefer, you know they're not going out to be skiing scrapyard or whatnot. Use my podcast, which attracts passive investors and created this little mastermind.

Jay Conner (20:45): Excellent. So folks go to www.JayConner.com/Lane, and that will get you in contact with Lane and have a strategy session with them and have the opportunity to work together with him on commercial projects and invest if you like, and get connected and truly learn what passive income is about. So Lane, parting comments? Last piece of advice for our listeners and audience.

Lane Kawaoka (21:15): Yeah, I mean if people want to book a call, my email is lane@simplepassivecashflow. Just to make sure you tell me that Jay sent you because, and I think that's a big thing. That's why you and I joined these different masterminds, right? Jay like it's all about like it's a small world out there and you know, you never really want to work with some random person, so at least know they came from you. You know, I know that they're, you know, I can kind of follow the breadcrumbs, what kind of, what they're all about.

Jay Conner (21:45): You know, so our viewers have definitely heard me say this before, but I don't know who came up with the phrase that opposites attract. That's stupid. I mean, I want to hang around people that are like me, right? So yes, birds of the same feather do flock together. So anyway, Lane, I'm sure you'll be hearing from a good number of our, audience members Lane. Thank you so much, man, for taking the time to come here on the show and tell folks what you got going on.

Lane Kawaoka (22:12): Yeah, yeah, we'll catch up in a couple months there in San Diego. Good to see you again.

Jay Conner (22:17): You got it. Lane, thank you so much for coming on and I'll see you soon. Well there you have it folks. Thank you for joining in for another episode. I'm Jay Conner, The Private Money Authority, wishing you all the best and here's to taking your real estate investing business to the next level. We'll see you on the next show. Bye for now.

20 notes

·

View notes