#mobile and dth recharge api

Explore tagged Tumblr posts

Text

API Service Providers

#money transfer api#recharge exchange api#utility bill payments api#bus ticket booking solution api#electricitybillpaymentapi#top fintech api companies#mobile and dth recharge api#pan card api#api service providers

0 notes

Text

Fintech and Software Service Provider

All Type Fintech services like: AEPS, DMT, recharge, Bill Payment, Loan, Insurance, b2B Service, Whitelabel, reseller panel, Bbps, UPI/QR, Software & Application Development services result in tailored and easy-to-evolve solutions for automated financial service delivery. https://rrfinco.com/

#dmt software#loan service#gst services#account opening#aeps software#api integration#api solution#recharge software#b2c services#b2b service#whitelabel software development#writers on tumblr#white label solution#white label services#white label agency#whitelabel service#bill payment software#black and white#b2b lead generation#best aeps service provider#bill payment#rrfinco#rrfinpay#dth recharge#mobile recharge#fintech software#fintech industry#food#fintech service#fintech company

0 notes

Text

API Service provider

India's Largest Multi-Recharge Platform Offering Money Transfers, Prepaid/DTH Recharges, Bill Payment, Flight & Hotel Bookings, PAN-Mini ATM, AEPS etc

0 notes

Text

Recharge Solutions with RC Panel's Free Recharge API

In today's fast-paced world, staying connected and managing your mobile balances efficiently is more important than ever. Whether you're a business owner, developer, or an entrepreneur looking to provide added value to your customers, the ability to offer easy and quick recharge solutions is a game-changer. This is where RC Panel's Free Recharge API comes into play.

What is RC Panel’s Free Recharge API?

RC Panel’s Free Recharge API is a robust and efficient tool designed to allow businesses and developers to integrate recharge services into their applications, websites, or platforms with minimal effort. This API service enables seamless mobile and DTH recharges, and it’s completely free, making it an ideal choice for startups and businesses looking to scale quickly without worrying about high integration costs.

Key Features of RC Panel’s Free Recharge API

Multi-Operator Support: RC Panel’s Free Recharge API supports a wide range of telecom operators and service providers. Whether it’s prepaid or postpaid mobile recharges, DTH, or data cards, our API offers diverse recharge options that can be integrated effortlessly into your platform.

Real-Time Recharge Processing: The API is designed for high-speed, real-time transaction processing, ensuring that customers receive instant recharges. This eliminates any delays or issues that might arise, improving the user experience and trust in your service.

Easy Integration: The RC Panel Free Recharge API comes with easy-to-follow documentation that makes it simple to integrate into your existing platform. You don’t need to be an expert developer to start providing recharge services on your website or mobile app. It’s a plug-and-play solution!

Secure and Reliable: With a focus on data privacy and security, the RC Panel Free Recharge API ensures that all transactions are safe and secure. The encryption protocols safeguard sensitive user data and transaction details, so both you and your customers can have peace of mind.

No Hidden Fees or Charges: One of the standout features of the RC Panel Free Recharge API is its zero-cost service. You get access to top-quality recharge solutions without having to pay for the API access. This is ideal for businesses that want to provide a wide range of services without breaking the bank.

Comprehensive Support: RC Panel offers excellent customer support to help you with any technical issues or questions. Whether you need help during the integration process or after your service is live, our team is always available to assist you.

Why Choose RC Panel’s Free Recharge API?

Cost-Effective: For businesses looking to provide recharge services without huge upfront costs, the Free Recharge API from RC Panel is an unbeatable option. You get all the functionality of a premium API at no charge.

Improved Customer Retention: Offering value-added services like mobile recharges can significantly boost customer loyalty. By integrating RC Panel's API into your platform, you create an additional revenue stream while keeping your users engaged.

Scalability: Whether you're a small startup or an established enterprise, RC Panel's API can scale with your business needs. From basic recharge services to more advanced features, our API can grow with you.

How to Get Started

Getting started with RC Panel’s Free Recharge API is simple. Just follow these steps:

Sign Up: Register for a free account on the RC Panel website.

Access API Documentation: Once logged in, you'll have access to the comprehensive API documentation.

Integration: Use the provided API keys to integrate the recharge services into your website, app, or platform.

Start Offering Recharge Services: Once integrated, you can start offering recharge services to your customers immediately!

#mobile recharge software#money transfer software#rc panel#pan card agency#mobile recharge#multi recharge company#advertising#biology#business#cars#free recharge api#recharge api#rcpanal#freerechargeapi#bigrechargeb2bplatform#multirechargesoftwareprovider#rechargeadminportal#bestmobilerechargeportal#fintech#mobilerecharge#rechargeapi#infotech#freerechargesoftware#rcpanel#moneytransfersoftware

0 notes

Text

High Commission Multi Recharge Software

In the ever-evolving landscape of online services, Multi Recharge Software stands out as a game-changer for mobile recharge businesses across India. Designed to be classic, reliable, user-friendly, and LAPU-friendly, our Multi Recharge App offers an all-in-one solution for distributors and retailers to grow their mobile recharge business effectively. Additionally, with our High Commission Multi Recharge Software, distributors and retailers can maximize their earnings, ensuring that every transaction brings in the highest possible returns. Whether you’re a small reseller or a large distributor, our software empowers you to scale your business while benefiting from high commission rates on every recharge.

SERVICES:- Multi Recharge Software | White Label Recharge Software | all in one recharge | multi recharge website | multi recharge portal | multi recharge app | multi recharge business Software | Mobile Recharge Services | Mobile Recharge Software | Lapu Sim Recharge Software | white label recharge portal | multi recharge service provider | Mobile Recharge API | Multi Recharge Api | Utility Bill Payment API | White Label Recharge API | Dth Recharge Api | Mobile Recharge Software | Mobile Recharge RetailersSingle Sim Multi Recharge Software | White Label Recharge SoftwareRecharge | Lapu Software | Reseller Recharge Software| Mobile Recharge Website | B2B Recharge Software | high commission multi recharge | multi recharge software provider |multi recharge company | multi recharge software | mobile recharge software development | recharge software provider | recharge software development | Recharge software development | High Commission Multi recharge Software

Multi recharge Software available in Andhra Pradesh | Assam | Arunachal Pradesh | Bihar | Chhattisgarh | Goa | Gujarat | Haryana | Himachal Pradesh | Jharkhand | Karnataka | Kerala | Madhya Pradesh | Maharashtra | Manipur | Meghalaya | Mizoram | Nagaland | Odisha| Punjab | Rajasthan | Sikkim| Tamil Nadu | Telangana | Tripura| Uttarakhand | Uttar Pradesh | West Bengal

Contact us - +917230882222

0 notes

Text

The In-Building Wireless Market is projected to grow from USD 14772.25 million in 2024 to an estimated USD 24448 million by 2032, with a compound annual growth rate (CAGR) of 6.5% from 2024 to 2032.The global Master Recharge API (Application Programming Interface) market is rapidly evolving, driven by the growing demand for seamless and efficient digital payment solutions. With the increasing penetration of smartphones and the surge in digital financial services, this market is witnessing a significant boost. Businesses across various sectors, from telecom to e-commerce, are leveraging these APIs to provide recharge and utility payment services to their customers. A Master Recharge API serves as an intermediary that connects service providers with end users. It allows businesses to integrate recharge services for mobile, DTH (Direct-to-Home), data cards, utility bill payments, and more into their platforms. Through a single API integration, companies can access multiple service providers, ensuring a seamless user experience.

Browse the full report https://www.credenceresearch.com/report/in-building-wireless-market

Market Drivers

Growing Smartphone Penetration: With billions of smartphone users worldwide, there is a surging demand for digital payment and recharge services. Mobile recharges, bill payments, and subscription renewals are now a part of everyday life, creating a robust demand for Master Recharge APIs.

Digital Transformation: Governments and organizations are promoting cashless transactions and digital ecosystems, further fueling the need for APIs that streamline payment processes.

E-commerce Growth: E-commerce platforms often integrate recharge and bill payment services to enhance customer retention and engagement. Master Recharge APIs enable them to offer these services efficiently.

Rising Demand for White-Label Solutions: Businesses, especially startups, prefer white-label recharge platforms powered by Master Recharge APIs to reduce development costs and accelerate time-to-market.

Challenges in the Master Recharge API Market

Despite its growth, the Master Recharge API market faces some challenges:

Security Concerns: As digital transactions increase, so does the risk of cyberattacks and fraud. Ensuring robust security measures is a priority.

Market Saturation: The entry of numerous players has led to fierce competition, making differentiation a challenge for API providers.

Regulatory Compliance: Adhering to varying regulations across regions can be complex, especially in cross-border operations.

Technological Integration: Businesses need to ensure that APIs are compatible with their existing systems, which can sometimes pose difficulties.

Emerging Trends

The Master Recharge API market is adapting to changing consumer behavior and technological advancements. Notable trends include:

Blockchain Integration: Blockchain technology is being explored to enhance transparency, security, and efficiency in transactions.

AI-Powered Insights: Artificial Intelligence (AI) is being used to provide data-driven insights, helping businesses improve customer experience.

Expansion into Rural Areas: With increasing internet penetration, API providers are targeting underserved regions to broaden their customer base.

Personalized Offerings: Companies are focusing on tailored solutions to meet the unique needs of businesses and consumers.

Future Outlook

The Master Recharge API market is expected to grow exponentially in the coming years. With advancements in technology and the increasing reliance on digital payment systems, this sector presents immense opportunities for innovation and expansion. Industry players must focus on improving API security, scalability, and user experience to stay competitive.

Key Player Analysis:

Airspan Networks

Cobham Limited

CommScope, Inc.

Corning Incorporated

Huawei Technologies Co., Ltd.

JMA Wireless

Nokia

Samsung Electronics Co., Ltd.

TE Connectivity

Telefonaktiebolaget LM Ericsson

Segmentation:

By Solutions:

System Components

Hardware

Software

Services

By System Components:

Antennas

Cabling

Distributed Antenna System

Repeaters

Small Cells

By Business Type:

Existing

New

By Building Size:

Large and Medium Buildings

Small Buildings

By Business Models:

Carrier

Enterprise

Host

By Application:

Commercials

Residential

Government

Hospitals

Industrial Uses

Defense

Retail

By Region

North America

U.S.

Canada

Mexico

Europe

Germany

France

U.K.

Italy

Spain

Rest of Europe

Asia Pacific

China

Japan

India

South Korea

South-east Asia

Rest of Asia Pacific

Latin America

Brazil

Argentina

Rest of Latin America

Middle East & Africa

GCC Countries

South Africa

Rest of the Middle East and Africa

Browse the full report https://www.credenceresearch.com/report/in-building-wireless-market

Contact:

Credence Research

Please contact us at +91 6232 49 3207

Email: [email protected]: www.credenceresearch.com

0 notes

Text

Venus Recharge & BBPS API Integration by Infinity Webinfo Pvt Ltd

Venus Recharge is a platform offering comprehensive services related to mobile recharges, DTH recharges, and bill payments. With the integration of Bharat Bill Payment System (BBPS), Venus Recharge expands its services to include a wide range of utility payments, all through a single API. Infinity Webinfo Pvt Ltd facilitates the integration of these services, providing businesses with a seamless and unified payment experience.

VENUS API INTEGRATION BY INFINITY WEBINFO PVT LTD

What is Venus Recharge?

Venus Recharge is a platform designed to provide quick and efficient mobile recharge services. It acts as an aggregator, allowing businesses and users to recharge prepaid mobiles, pay postpaid bills, and manage DTH services. Venus Recharge's services are built to simplify day-to-day transactions for end-users by offering an all-in-one solution.

The platform partners with multiple service providers to ensure that users have access to a variety of telecom operators and service providers, thus increasing the scope of services they can offer.

What is Venus BBPS?

Venus BBPS refers to the service provided by Venus Recharge, where they have integrated the BBPS system into their platform. This integration allows users to access a wide range of bill payment options, including utility payments, mobile and DTH recharges, and more, directly through the Venus Recharge platform.

Key Features of Venus BBPS:

Unified Bill Payments: Users can pay for multiple types of bills (electricity, water, gas, broadband, etc.) through a single interface.

Secure Transactions: All payments are processed securely with compliance to BBPS and NPCI standards.

Real-Time Processing: Payments made through Venus BBPS are processed in real-time, ensuring instant updates and confirmations.

Multiple Payment Channels: Venus BBPS supports payments through various methods, including internet banking, UPI, wallets, and debit/credit cards.

Wide Range of Billers: BBPS connects a large number of billers, ensuring that users can pay bills from different service providers across India.

API Integration of Venus Recharge & BBPS by Infinity Webinfo Pvt Ltd

Infinity Webinfo Pvt Ltd specializes in API integrations that allow businesses to leverage Venus Recharge and BBPS services through a single API. By integrating these services, businesses can offer an enhanced user experience, streamlining the payment process for their customers.

Features of the Integration:

Unified Access to Multiple Services: The integration of both Venus Recharge and BBPS provides access to a range of services:

Prepaid & postpaid mobile recharges

DTH service recharges

Utility bill payments (electricity, water, gas, broadband, etc.)

Single API Solution: Businesses only need to interact with one API that can manage multiple services. This simplifies the development process, as there's no need to integrate different APIs for each service separately.

Secure Payment Processing: Infinity Webinfo Pvt Ltd ensures that all transactions, whether for recharges or bill payments, are handled securely. They implement token-based authentication, encryption, and error handling to prevent fraud and enhance transaction reliability.

Real-Time Transaction Updates: The integration supports real-time transaction updates, meaning users get instant confirmation once a payment is made, contributing to a better user experience.

Customization: Infinity Webinfo Pvt Ltd offers flexibility in how businesses can customize the API to suit their platforms. Whether it's a website, mobile app, or third-party software, the API can be easily integrated and tailored to fit specific needs.

Multi-Biller Support: Through BBPS, the API supports multiple billers, giving users access to various service providers, which increases the range of services offered.

Transaction History & Analytics: The API integration enables businesses to keep track of transaction history and provides analytics to monitor usage patterns, service demand, and other key metrics.

Benefits of Venus Recharge & BBPS API Integration

Expanded Service Offerings: By integrating with Venus Recharge and BBPS, businesses can offer their customers a wide variety of services under one roof, including telecom recharges and utility bill payments.

Increased Customer Retention: Providing multiple services through a single interface can lead to greater customer satisfaction and retention, as users are more likely to return to a platform that simplifies their payment needs.

Streamlined Operations: Businesses can handle multiple services using a single API, reducing development overhead and simplifying back-end operations.

Revenue Generation: Each transaction processed through Venus Recharge and BBPS can generate additional revenue for businesses, as they can charge convenience fees or benefit from commissions.

Compliance and Security: Integration with BBPS ensures that all transactions comply with NPCI's guidelines and security standards, offering businesses and their customers peace of mind.

Conclusion

Integrating Venus Recharge and BBPS through Infinity Webinfo Pvt Ltd's API solution is a powerful way for businesses to expand their service offerings and streamline operations. This integration provides users with a one-stop solution for all their recharge and bill payment needs, while ensuring secure and efficient transactions. With a single API, businesses can tap into a vast market of prepaid recharges, postpaid bill payments, and utility services, enhancing their revenue potential and customer engagement.

Let me know if you'd like further details or assistance on any specific aspect of the integration.

Mobile: - +91 9711090237

#venus API Integration#VENUS Recharge and BBPS API Integration#Recharge & BBPS API Integration#Payment Gateway API Integration#Venus#API Integration#infinity webinfo pvt ltd

1 note

·

View note

Text

Cyrus Recharge is the recharge API integration provider in India. We provide white lable mobile recharge API, Robotics Recharge API, DTH Recharge API, money transfer API,Utilities Bill Payments API, White Label Applications.

0 notes

Text

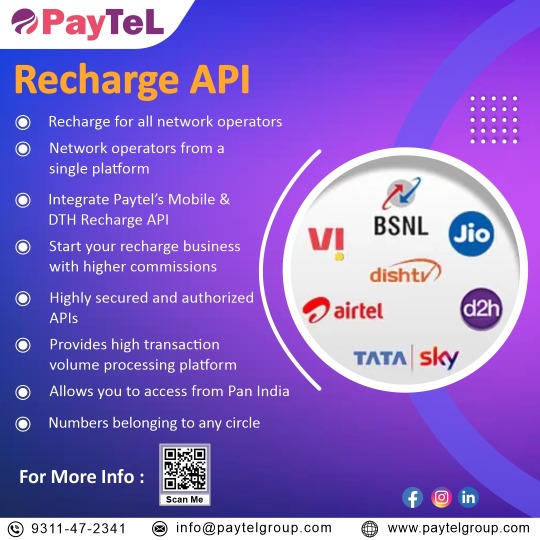

Recharge API

✅ Recharge for all network operators ✅ Network operators from a single platform ✅ Integrate Paytel’s Mobile & DTH Recharge API ✅ Start your recharge business with higher commissions ✅ Highly secured and authorized APIs ✅ Provides high transaction volume processing platform ✅ Allows you to access from Pan India ✅ Numbers belonging to any circle

For inquiries, reach out to us! 🌐 www.paytelgroup.com 📞 +91 9311472341

rechargeapi #mobilerechargeapi #mobilerecharge #dthrechargeonline #recharge

mobile #mobileonlinerecharge #paytelgroup #paytel #api #dthrecharge #onlinemobilerecharge #jio #mobilerecharge #india #airtel #digitalindia #paymentgateway #apibanking #verificationAPI #onlinemobilerechargeservice #onlinemobilerecharge #paytel #paytelgroup

0 notes

Text

multi recharge software in sikar

Multi recharge software

Multi Recharge Software has revolutionised the concept of an online recharge platform. Presenting to the users: "Multi Recharge App: A Classic, Reliable, User Friendly, High Quality and Lapu Friendly Online Mobile Recharge System in India". Just look at our features; we focus on providing our clients with a high-quality multi-recharge software system that includes an Android app and a web-based platform for distributors/retailers to help them grow their mobile recharge business online.

The Multi Recharges software is devised to be a business class product for distributors/retailers to run their mobile recharge business on digital platforms. This Lapu-friendly multi-recharge app is designed for distributors/retailers to manage products, customers.

SERVICES:- Multi Recharge Software | White Label Recharge Software | all in one recharge | multi recharge website | multi recharge portal | multi recharge app | multi recharge business Software | Mobile Recharge Services | Mobile Recharge Software | Lapu Sim Recharge Software | white label recharge portal | multi recharge service provider | Mobile Recharge API | Multi Recharge Api | Utility Bill Payment API | White Label Recharge API | Dth Recharge Api | Mobile Recharge Software | Mobile Recharge RetailersSingle Sim Multi Recharge Software | White Label Recharge SoftwareRecharge | Lapu Software | Reseller Recharge Software| Mobile Recharge Website | B2B Recharge Software | high commission multi recharge | multi recharge software provider |multi recharge company | multi recharge software in sikar | mobile recharge software development | recharge software provider | recharge software development | Recharge software development | High Commission Multi recharge Software

Multi recharge Software available in Andhra Pradesh | Assam | Arunachal Pradesh | Bihar | Chhattisgarh | Goa | Gujarat | Haryana | Himachal Pradesh | Jharkhand | Karnataka | Kerala | Madhya Pradesh | Maharashtra | Manipur | Meghalaya | Mizoram | Nagaland | Odisha| Punjab | Rajasthan | Sikkim| Tamil Nadu | Telangana | Tripura| Uttarakhand | Uttar Pradesh | West Bengal

Contact us - +917230882222

0 notes

Text

Recharge Exchange Api services

ApiBox: Recharge Exchange API Service is a cutting-edge software solution that revolutionizes the way recharge services are conducted. This powerful API enables seamless and secure exchange of recharging data between service providers, empowering businesses to offer their customers a wide range of prepaid mobile, DTH, and data card recharges effortlessly. With its user-friendly interface and robust functionality, ApiBox streamlines the recharge process, ensuring rapid and accurate transactions. It also supports multiple payment gateways for enhanced convenience. Built with the latest technology, this API ensures data privacy and reliability, making it the go-to choice for businesses seeking to elevate their recharge services and deliver exceptional user experiences.

0 notes

Text

https://rrfinco.com/aeps.php

Aeps Service Provider

The RRFinCo top 10 AEPS service providers are NSDL Payment Banks, Fino Bank, Spice Money, Paynearby, Paytm AEPS, NPCI, TATA SKY, L&T Finance, IRCTC, FINO, ICICI BANK .

#dmt software#recharge software#api integration#gst services#account opening#aeps software#b2b service#loan service#api solution#b2c services#aeps service provider#best aeps service provider#fintech servi#fintech solutions#fintech software#fintech app development company#fintech industry#fintech innovations#gamming software#e commerce software#mlm software#software company#app development company#aeps#dth recharge#mobile recharge#personal loans#business loan#home loan#loans

0 notes

Text

high commission multi recharge software in india

Multi Recharge Software has revolutionized the concept of an online recharge platform. Presenting to the users: “Multi Recharge App: A Classic, Reliable, User Friendly, High Quality and Lapu Friendly Online Mobile Recharge System in India”. Just look at our features; we focus on providing our clients with a high-quality multi-recharge software system that includes an Android app and a web-based platform for distributors/retailers to help them grow their mobile recharge business online.

The Multi Recharges software is devised to be a business class product for distributors/retailers to run their mobile recharge business on digital platforms. This Lapu-friendly multi-recharge app is designed for distributors/retailers to manage products, customers.

SERVICES:- Multi Recharge Software | White Label Recharge Software | all in one recharge | multi recharge website | multi recharge portal | multi recharge app | multi recharge business Software | high commission multi recharge software in india | Mobile Recharge Software | Lapu Sim Recharge Software | white label recharge portal | multi recharge service provider | Mobile Recharge API | Multi Recharge Api | Utility Bill Payment API | White Label Recharge API | Dth Recharge Api | Mobile Recharge Software | Mobile Recharge Retailers Single Sim Multi Recharge Software | White Label Recharge Software Recharge | Lapu Software | Reseller Recharge Software| Mobile Recharge Website | B2B Recharge Software | high commission multi recharge | multi recharge software provider |multi recharge company | multi recharge software | mobile recharge software development | recharge software provider | recharge software development | Recharge software development | High Commission Multi recharge Software |

Multi recharge Software available in Andhra Pradesh | Assam | Arunachal Pradesh | Bihar | Chhattisgarh | Goa | Gujarat | Haryana | Himachal Pradesh | Jharkhand | Karnataka | Kerala | Madhya Pradesh | Maharashtra | Manipur | Meghalaya | Mizoram | Nagaland | Odisha| Punjab | Rajasthan | Sikkim| Tamil Nadu | Telangana | Tripura| Uttarakhand | Uttar Pradesh | West Bengal

Contact us — +917230882222

0 notes

Text

Seamless Recharges, Limitless Possibilities: Exploring Payniko Payment Gateway's Transformative Recharge API

Embark on a journey of digital empowerment with Payniko Payment Gateway's cutting-edge Recharge API. In this blog post, we uncover the dynamic features and functionalities that define Payniko's Recharge API, reshaping the landscape of mobile, DTH, and data card recharges. From speed and reliability to customization options, discover how Payniko is redefining the recharge experience for users and businesses alike.

Effortless Recharge Experience: Delve into the unmatched efficiency of Payniko's Recharge API, designed to simplify and expedite the recharge process. Users can effortlessly top up their mobile phones, renew DTH subscriptions, and recharge data cards with unparalleled ease.

Versatility in Operator Support: Highlight the flexibility of Payniko's Recharge API with its extensive support for diverse operators. Users enjoy the freedom to recharge with their preferred mobile service providers, DTH operators, and data card services, enhancing the overall user experience.

Real-Time Transaction Transparency: Emphasize the importance of real-time transaction updates integrated into Payniko's Recharge API. Users receive instant notifications, fostering transparency and trust throughout the entire recharge process.

Tailored Solutions for Businesses: Illustrate the customizable options available for businesses integrating Payniko's Recharge API. From branded interfaces to personalized features, Payniko empowers businesses to create a recharge experience that seamlessly aligns with their unique brand identity.

Security at Its Core: Assure users of Payniko's unwavering commitment to security, fortified by robust encryption and authentication protocols. Payniko's Recharge API ensures the highest standards of protection for sensitive information, creating a secure environment for all transactions.

Comprehensive Integration Guidance: Showcase the user-friendly documentation and integration guides provided by Payniko. Businesses and developers can effortlessly navigate the integration process, unlocking the full potential of Payniko's Recharge API without unnecessary complexities.

User-Centric Design and Accessibility: Explore how Payniko places user-friendliness at the forefront of its Recharge API. Whether users are tech-savvy enthusiasts or newcomers to digital transactions, Payniko guarantees a seamless experience, fostering accessibility and convenience for all.

Success Stories and Empowered Experiences: Conclude the blog post by sharing success stories or testimonials from businesses that have harnessed the power of Payniko's Recharge API. Illustrate real-world examples of how the API has transformed and elevated the recharge experience for diverse enterprises.

By unveiling the features and impact of Payniko Payment Gateway's Recharge API, this blog post aims to inform and inspire businesses and users alike, showcasing how Payniko is at the forefront of reshaping the recharge landscape within the digital era.

1 note

·

View note

Text

Revolutionizing Refills: Yumype Payment Gateway's Recharge API for Seamless Digital Transactions

Step into the future of digital convenience with Yumype Payment Gateway's groundbreaking Recharge API. In this blog post, we explore the dynamic capabilities and user-centric features that define Yumype's Recharge API, reshaping the landscape of mobile, DTH, and data card recharges. From speed and reliability to customization options, discover how Yumype is redefining the recharge experience.

Effortless Recharge Journey: Delve into the unmatched efficiency of Yumype's Recharge API, designed to simplify and expedite the recharge process. Users can effortlessly top up their mobile phones, renew DTH subscriptions, and recharge data cards with unparalleled ease.

Multi-Operator Harmony: Highlight the versatility of Yumype's Recharge API with its support for a myriad of operators. Users enjoy the flexibility to recharge with their preferred mobile service providers, DTH operators, and data card services, creating a truly personalized experience.

Real-Time Transaction Transparency: Emphasize the importance of real-time transaction updates integrated into Yumype's Recharge API. Users receive instant notifications, fostering transparency and trust throughout the entire recharge process.

Customization for Unique Brands: Illustrate the customizable options available for businesses integrating Yumype's Recharge API. From branded interfaces to personalized features, Yumype empowers businesses to create a recharge experience that seamlessly aligns with their unique brand identity.

Security Reinforced: Assure users of Yumype's unwavering commitment to security, fortified by robust encryption and authentication protocols. Yumype's Recharge API ensures the highest standards of protection for sensitive information, creating a secure environment for all transactions.

Comprehensive Integration Guidance: Showcase the user-friendly documentation and integration guides provided by Yumype. Businesses and developers can effortlessly navigate the integration process, unlocking the full potential of Yumype's Recharge API without unnecessary complexities.

User-Centric Design for Accessibility: Explore how Yumype prioritizes user-friendliness in its Recharge API. Whether users are tech-savvy enthusiasts or newcomers to digital transactions, Yumype guarantees a seamless experience, fostering accessibility and convenience for all.

Success Stories and Empowered Experiences: Conclude the blog post by sharing success stories or testimonials from businesses that have harnessed the power of Yumype's Recharge API. Illustrate real-world examples of how the API has transformed and elevated the recharge experience for diverse enterprises.

By unveiling the features and impact of Yumype Payment Gateway's Recharge API, this blog post aims to inform and inspire businesses and users alike, showcasing how Yumype is leading the way in reshaping the recharge landscape within the digital era.

0 notes

Text

Multi Recharge Software In Rajasthan

Multi Recharge Software has redefined the way mobile recharge businesses operate in India. With its classic, reliable, and user-friendly system, this platform is designed to cater to distributors and retailers in rajasthan who want to expand their recharge business. Offering a high-quality multi-recharge software system, our solution includes both an Android app and a web-based platform, making it easier than ever for entrepreneurs in rajasthan to grow their business online.

The Multi Recharges software is devised to be a business class product for distributors/retailers to run their mobile recharge business on digital platforms. This Lapu-friendly multi-recharge app is designed for distributors/retailers to manage products, customers.

SERVICES:- Multi Recharge Software | White Label Recharge Software | all in one recharge | multi recharge website | multi recharge portal | multi recharge app | multi recharge business Software | Mobile Recharge Services | Mobile Recharge Software | Lapu Sim Recharge Software | white label recharge portal | multi recharge service provider | Mobile Recharge API | Multi Recharge Api | Utility Bill Payment API | White Label Recharge API | Dth Recharge Api | Mobile Recharge Software | Mobile Recharge RetailersSingle Sim Multi Recharge Software | White Label Recharge SoftwareRecharge | Lapu Software | Reseller Recharge Software| Mobile Recharge Website | B2B Recharge Software | high commission multi recharge | multi recharge software provider |multi recharge company | multi recharge software | mobile recharge software development | recharge software provider | recharge software development | Recharge software development | High Commission Multi recharge Software

Multi recharge Software available in Andhra Pradesh | Assam | Arunachal Pradesh | Bihar | Chhattisgarh | Goa | Gujarat | Haryana | Himachal Pradesh | Jharkhand | Karnataka | Kerala | Madhya Pradesh | Maharashtra | Manipur | Meghalaya | Mizoram | Nagaland | Odisha| Punjab | Rajasthan | Sikkim| Tamil Nadu | Telangana | Tripura| Uttarakhand | Uttar Pradesh | West Bengal

Contact us - +917230882222

0 notes